Prior to entering and assuming occupancy of a building or accommodation facility, a would-be tenant will often have to deposit a sum of money to the account of the landlord. This is called a security deposit. It is later on used to care for damages and other issues that may arise in times of occupancy.

Upon depositing this money into the account of the landlord, a receipt is often issued. This is the security deposit receipt. This receipt is issued out by the bank or financing institution and is further transmitted to the landlord for record keeping and future reference.

Free Templates

Security Deposit Receipts and Laws

As is the norm with almost every other business transaction documents, this receipt too, is subject to some laws and provisions. Below are some of the things that set the rules through which it operates and gives off the desired end results:

Purpose

To the landlord, this document acts as proof that the landlord has indeed received the security deposit in his account. To the tenant, it is proof that you have indeed remitted the security deposit as agreed upon before the entry into the premises.

Statutory requirements

Some states require that this deposit be made public and declared for the purposes of tax exemptions and other financial responsibilities. As such, the deposit and the associated acknowledgment serves as a supplementary notice if and when the need for such a notice arises.

Time-frame

All business documents have validity. This is simply a duration of time in which it is active and considered legally valid. Many jurisdictions demand that you send out this notice to the parties within a 30-day period. Be sure to familiarize yourself with the needs and requirements of your jurisdiction.

Interest obligations

In some instances, these deposits do attract some interests which are to be shared out between the landlord and the tenant. Yet again, it is up to you to know the prevailing interest laws and how they may impact your stay in the area. This is a piece of information you will accrue from your state offices.

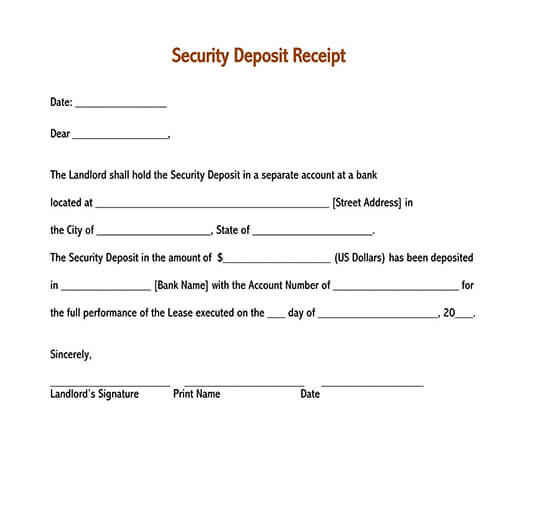

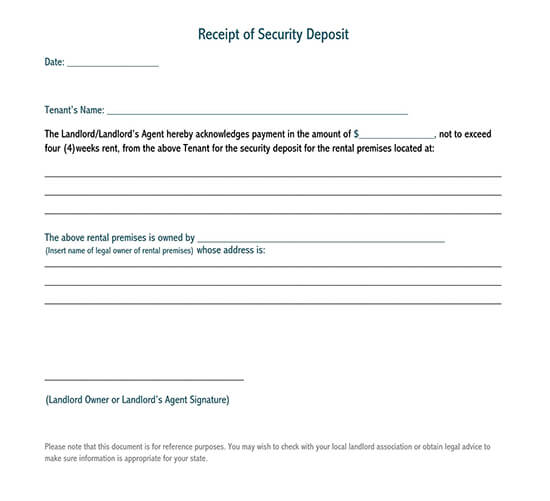

What to Include in a Security Deposit Receipt?

Tenant particulars

You should start off with the particulars of the tenant. These include:

- The name of the tenant and his address

- The date in which the receipt is drafted for future responses (mm/dd/yyyy)

Location of the funds

Where exactly are the funds held or are they to be remitted? To furnish this information, you have to incorporate:

- The identity of the banking institution that handles such funds

- The physical address of the bank i.e. the streets, state, zip code, and the other vital metrics

Bank Details

After specifying the bank wherein the security deposits have been remitted, you now have to specify the bank details themselves.

These are:

- The amount of money you have deposited in the account

- The account number

- The name of the banking institution

- The date when the amount disclosed above was deposited (mm/dd/yyyy)

Landlord’s signature

Append the relevant signatures at this stage.

These include:

- Landlord’s signature

- The printed name of the landlord

- Dates when the signature was appended (mm/dd/yyyy)

Security Deposit Receipt Templates

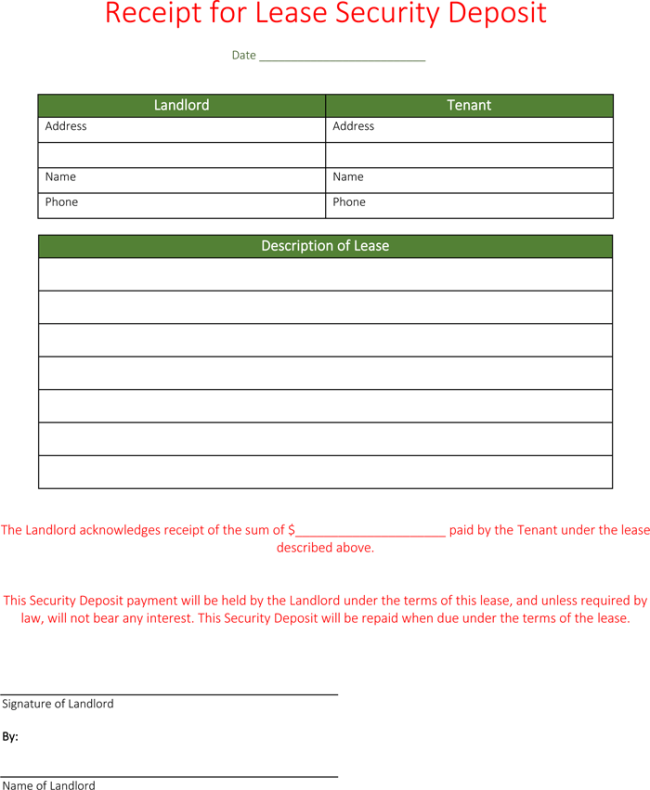

Security deposit receipt 01

Lease security deposit receipt template

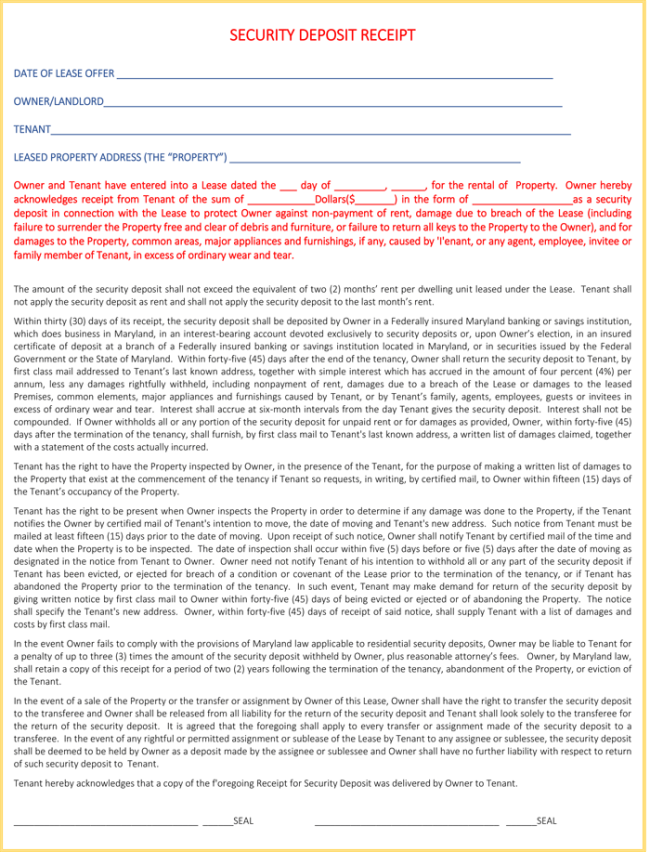

Security deposit receipt (with terms)

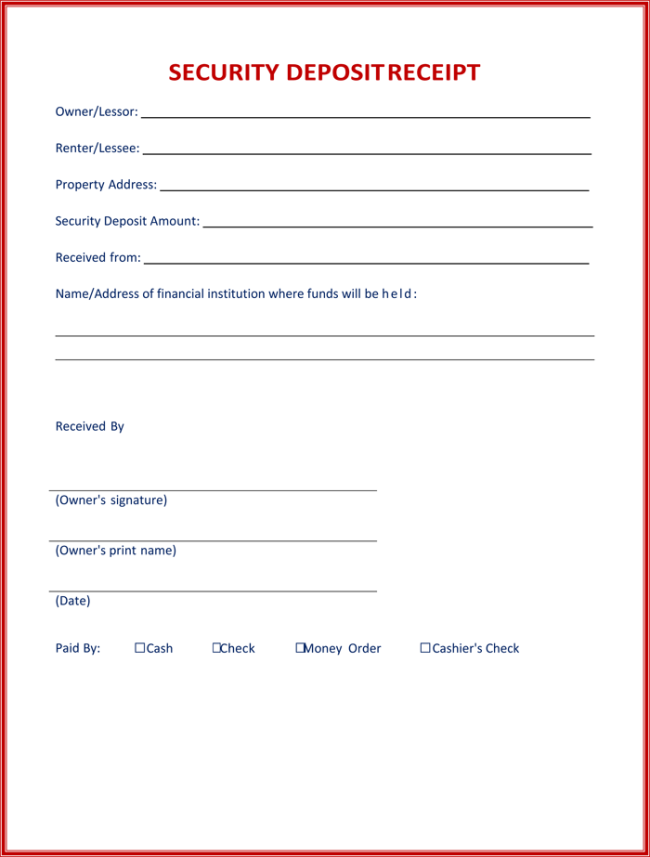

Security deposit receipt template (Word)

Importance of Security Deposit Receipts

The security deposit receipt is important to all the stakeholders in the real estate sector. In this segment of our discussions, we examine the importance or salient benefits that the document confers to the various stakeholders.

For landlords

In some states, landlords are required to notify their tenants of the existence of some money in an escrow account. Under such a circumstance, the document serves to protect the landlord from any unnecessary litigations that may come about.

For tenants

To a tenant, the document serves as proof that you have indeed remitted the security deposits as is required of you. It further serves to confer some peace of mind knowing that you have indeed complied with all the relevant requirements.

For prospective buyers

A buyer definitely wants to know whether the security deposit for the building in dispute has been remitted as expected. How can he possibly know this save for some security deposit receipt being shown or displayed to him?

General

Generally, the security deposit serves to imbue a sense of confidence to the landlord. He is assured that regardless of the damages and other dangers that arise in occupancy, he will still recoup his money. That is not to mention that the document may be used to facilitate litigation and other disputes.

Conclusion

The benefits of a security deposit are too many and critical to be handled lightly. Thus, you have to pay some in-depth attention to this wonderful document as you go about lending or renting out your premise. What are you waiting for now? Is it not proper for you to now implement the findings?