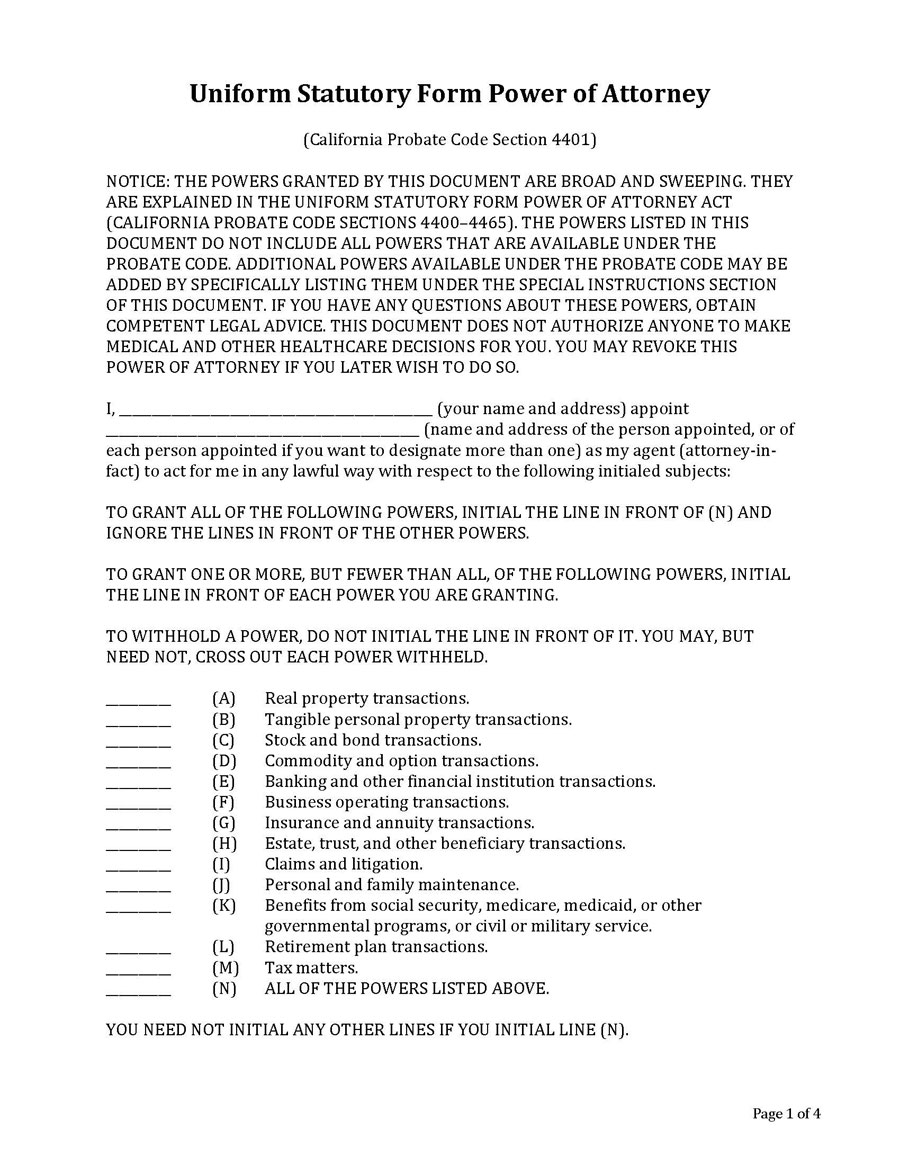

A California Power of Attorney(POA) allows an individual (a principal) to legally appoint another person (an agent) to make financial, medical, and property decisions on their behalf.

The agent is granted exclusive powers to handle affairs specified in the document. The agent may be a close friend or relative and must make decisions in the principal’s best interest. The principal can opt to grant a few or a broad range of powers to be exercised for a long or short period.

There are a number of tasks that the agent may perform on the principal’s behalf, including financial transactions, negotiation, and signing of contracts, bill payments, hiring and firing of employees, and the purchase and sale of stocks, bonds, and other securities. A POA can only be exercised while the principal is still alive and should not be mistaken for a will.

Free Forms

Who Needs It?

California’s POA form is used by anyone with money or assets that need to be protected. It ensures that a trusted agent handles the principal’s financial affairs. Homeowners or individuals with multiple properties can also use a POA to ensure the agent acts on matters such as the estate’s maintenance or sale. In addition, a POA in California is used when the principal is incapacitated due to illness or in the event the person is unavailable due to activities such as travel.

It also helps to give an individual’s spouse or family the ability to take over their affairs as they are not automatically authorized based solely on their relation to the principal. The principal can outline how powers will be exercised if they opt to appoint more than one agent. The principal must only sign a POA in California while competent to ensure they are fully aware of the powers they are appointing to the other party.

Types of Power of Attorney

There are numerous kinds of POA in California. The tasks or transactions to be performed will determine what POA is used. Understanding the various types will help ensure that the correct details are included in the document. It will also ensure to clarify California state laws related to the selected POA.

The following are the various types of California POA:

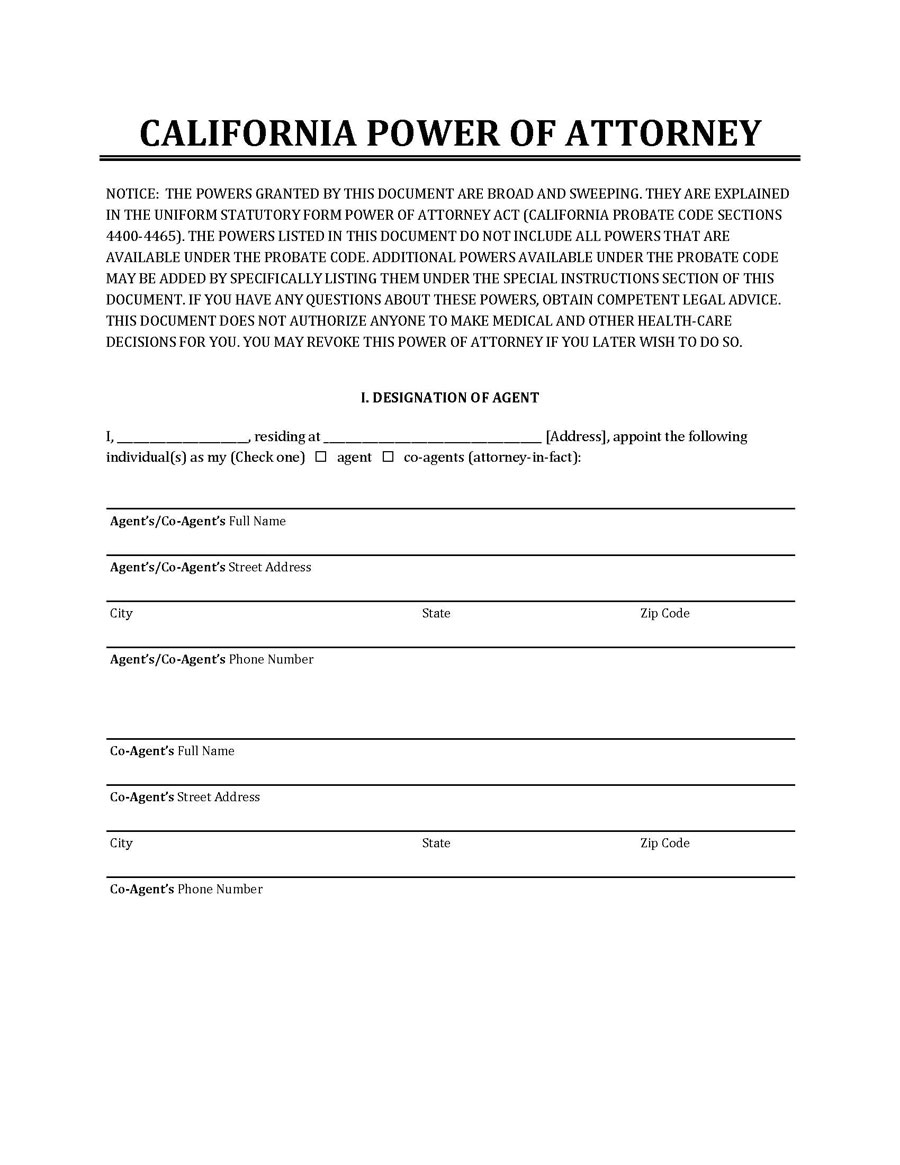

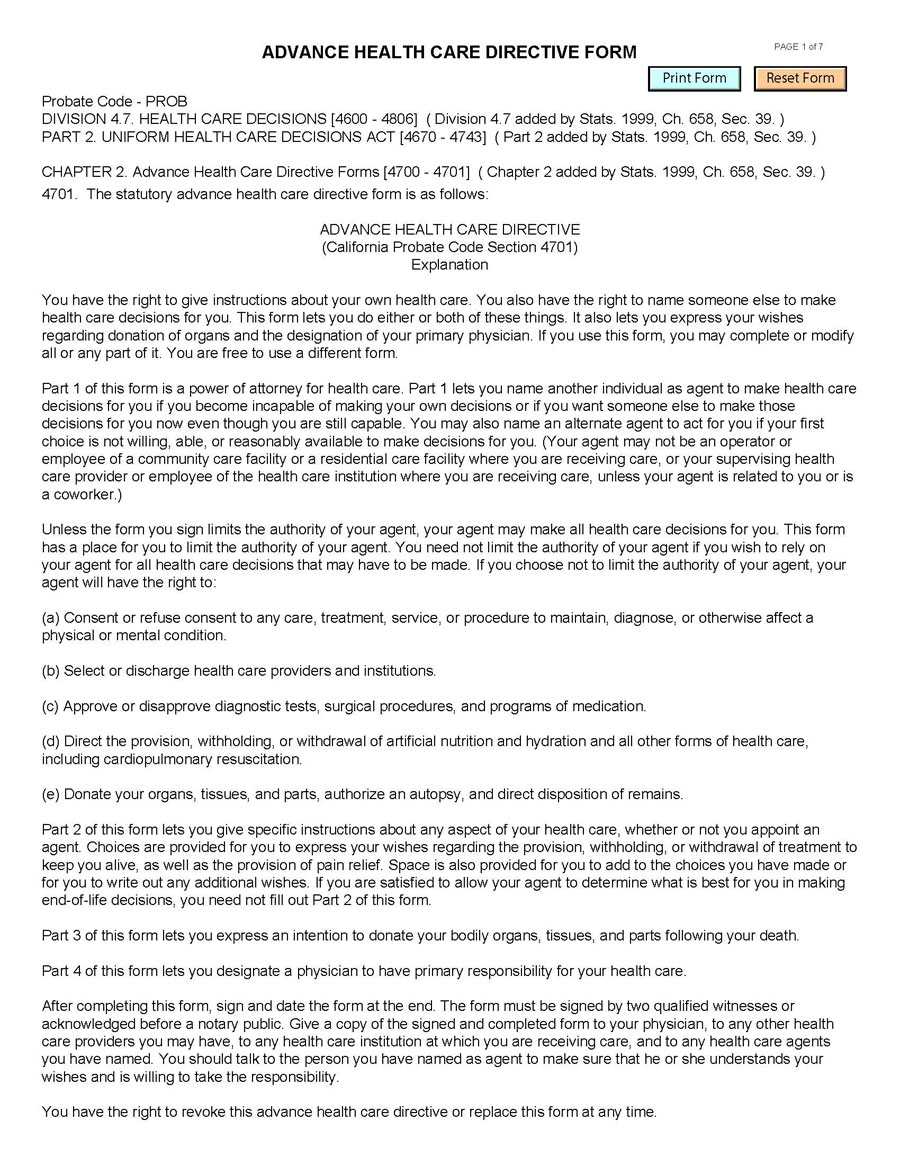

Advance Health Care Directive POA Sample

Download: Microsoft Word (.docx)

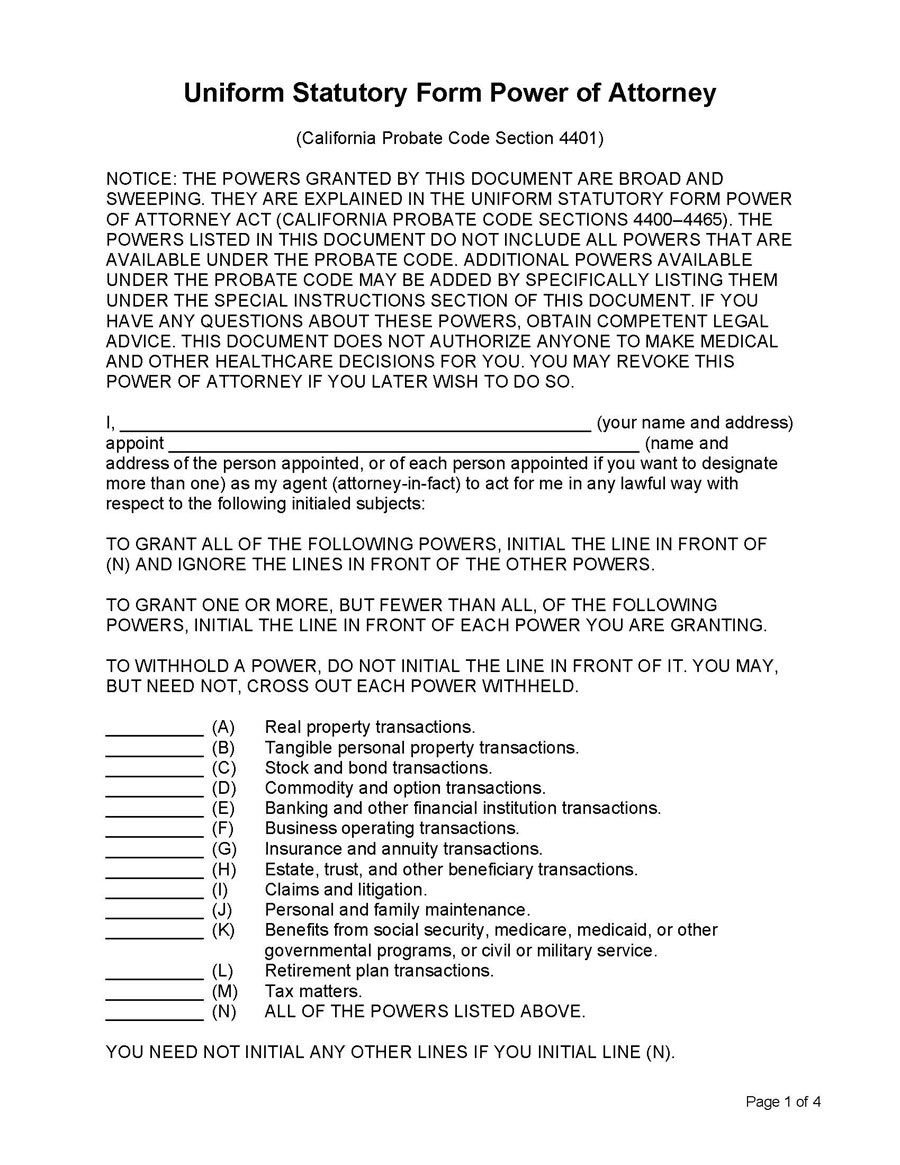

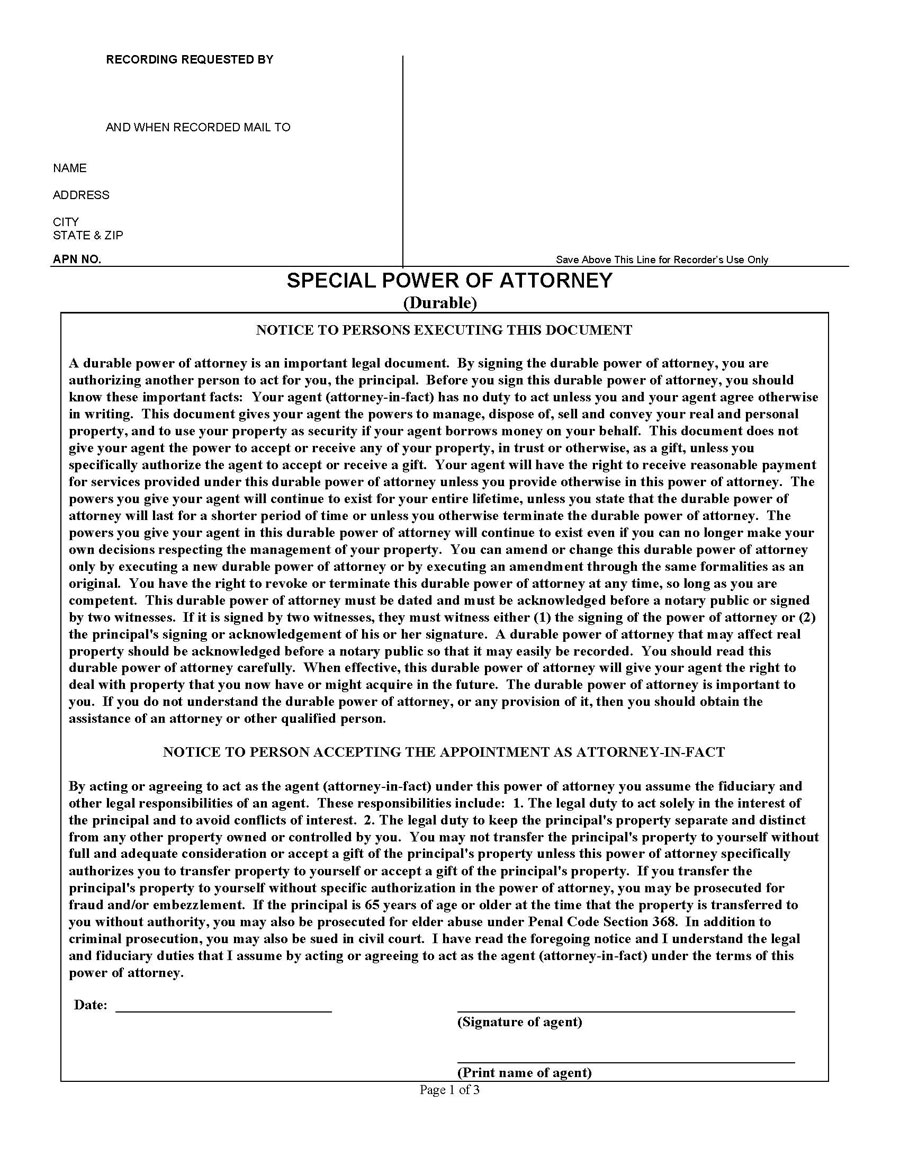

Durable Power of Attorney Form

Download: Microsoft Word (.docx)

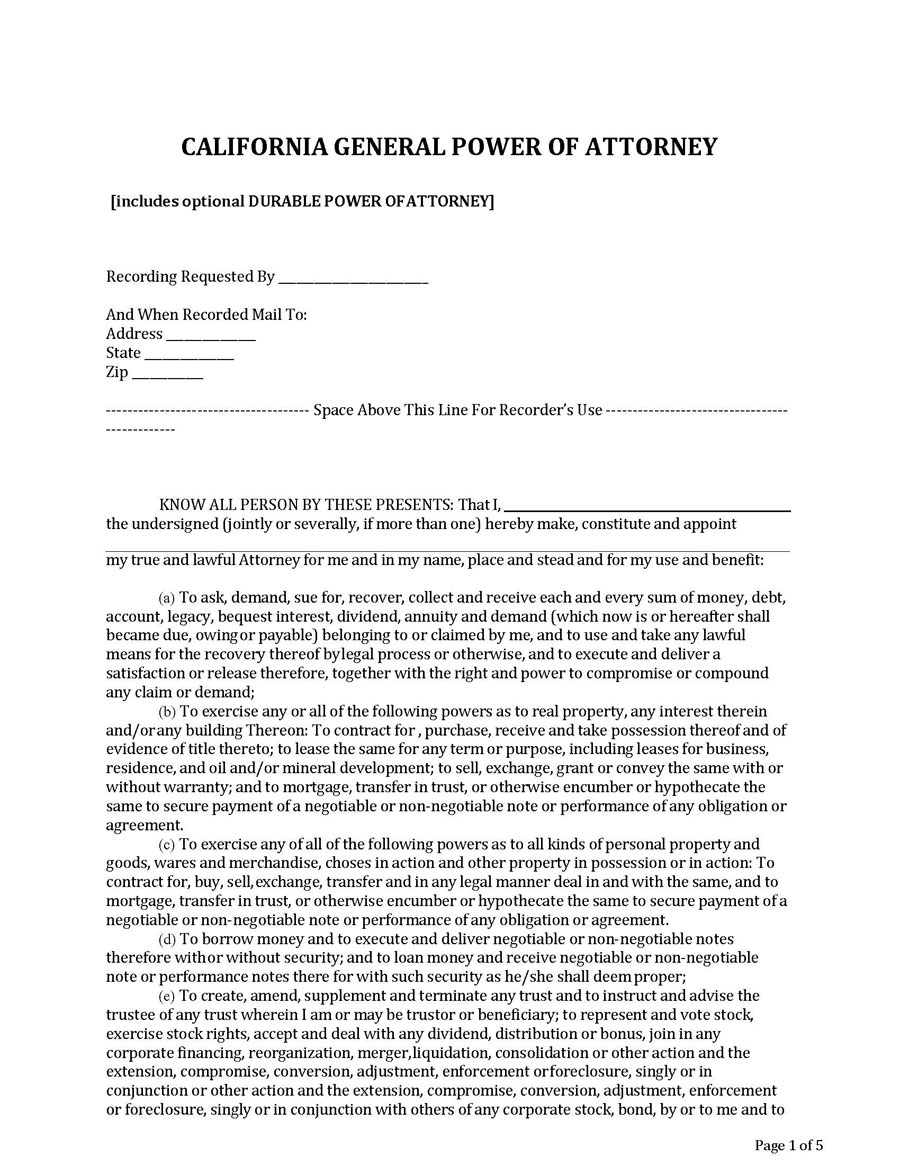

General Power of Attorney Form

Download: Microsoft Word (.docx)

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

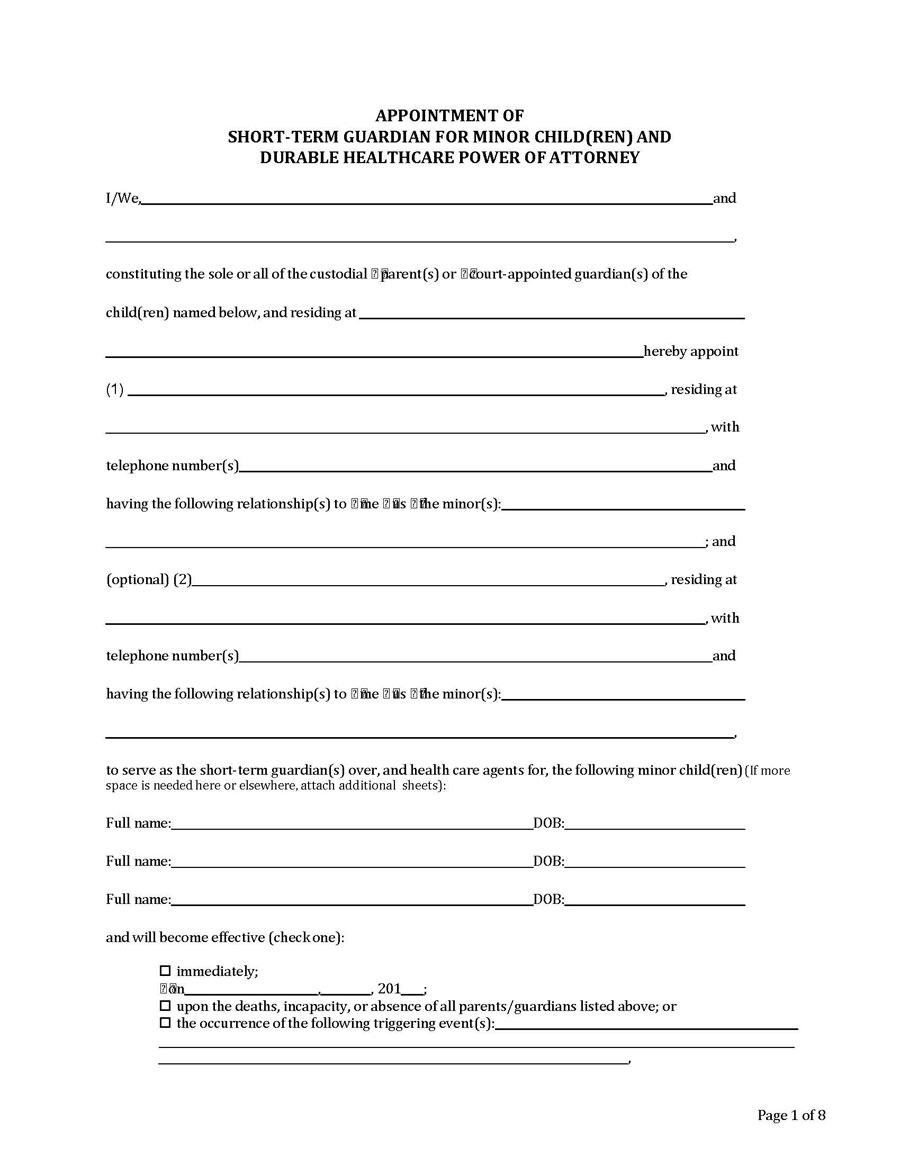

Parental Power of Attorney Form

Download: Microsoft Word (.docx)

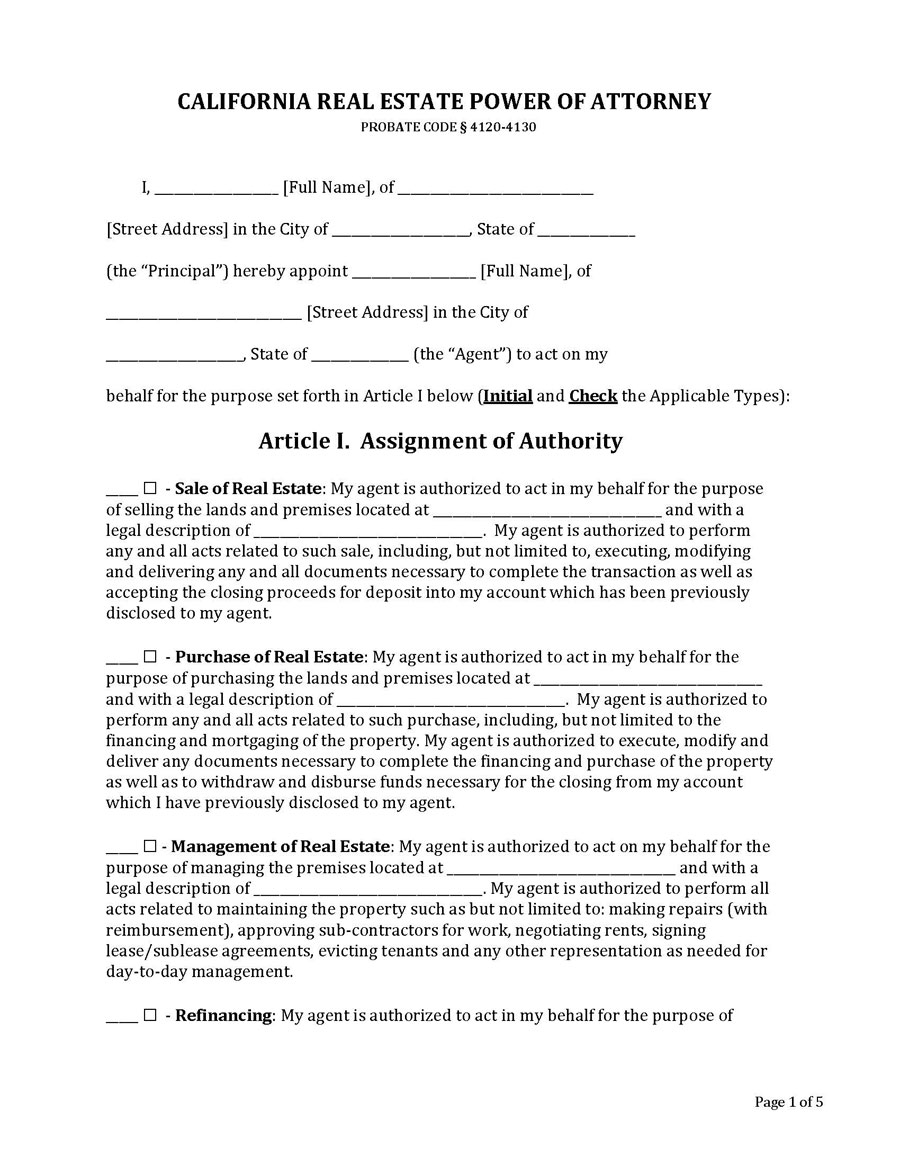

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

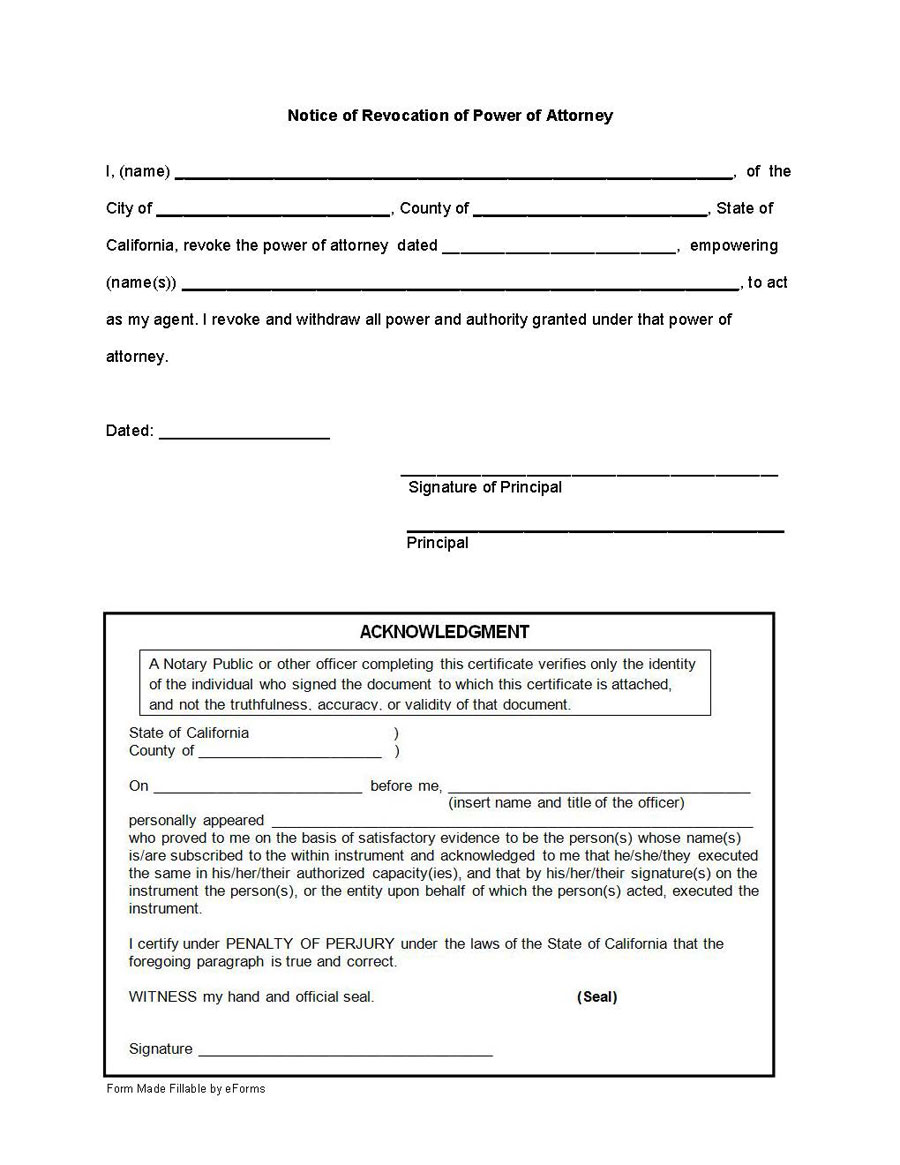

Revocation Power of Attorney Form

Download: Microsoft Word (.docx)

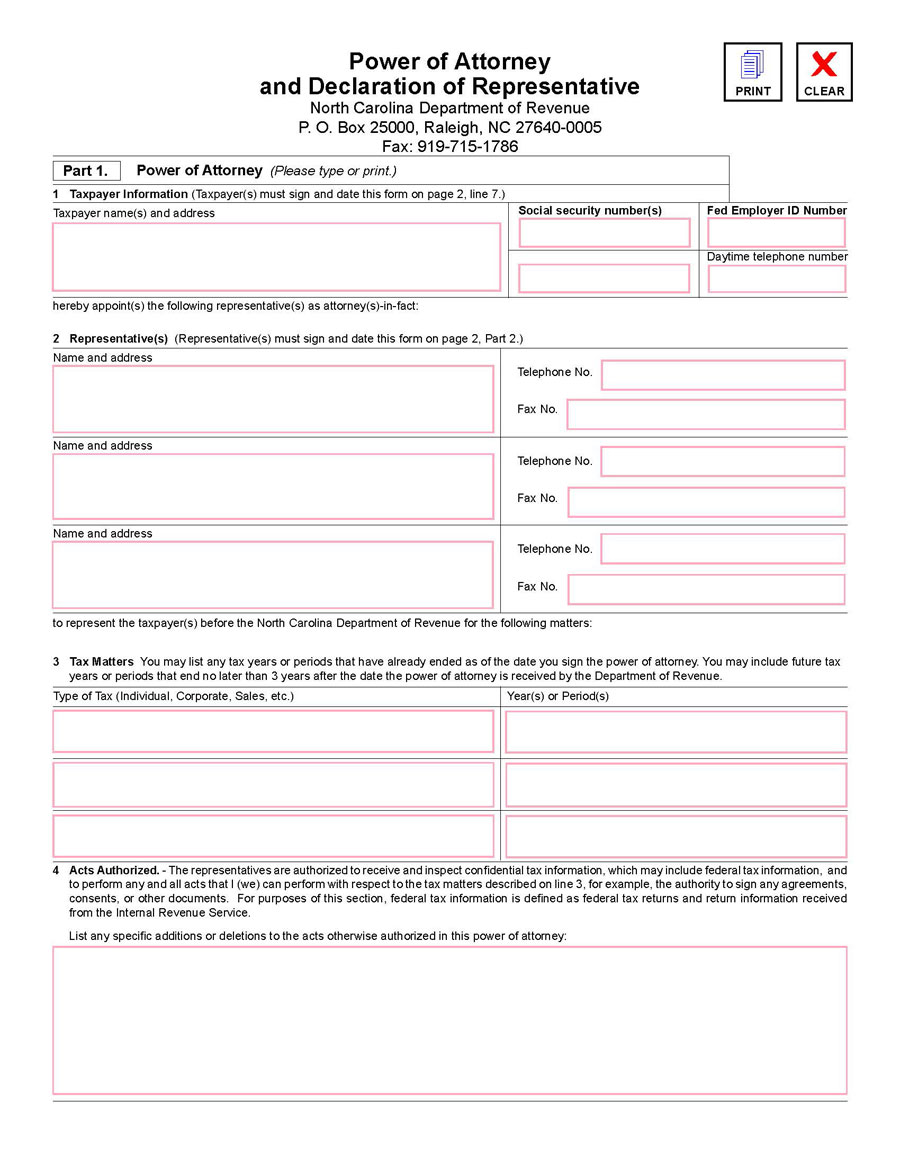

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

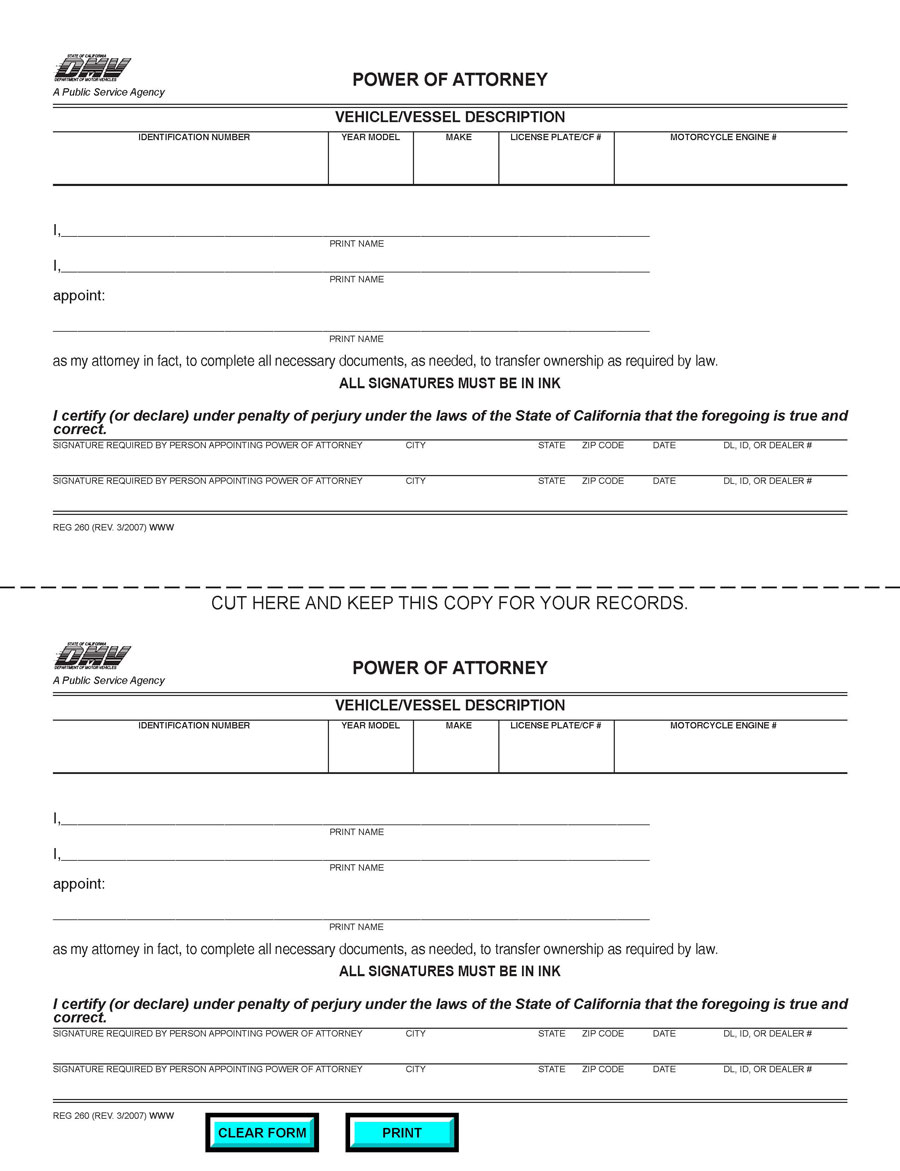

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

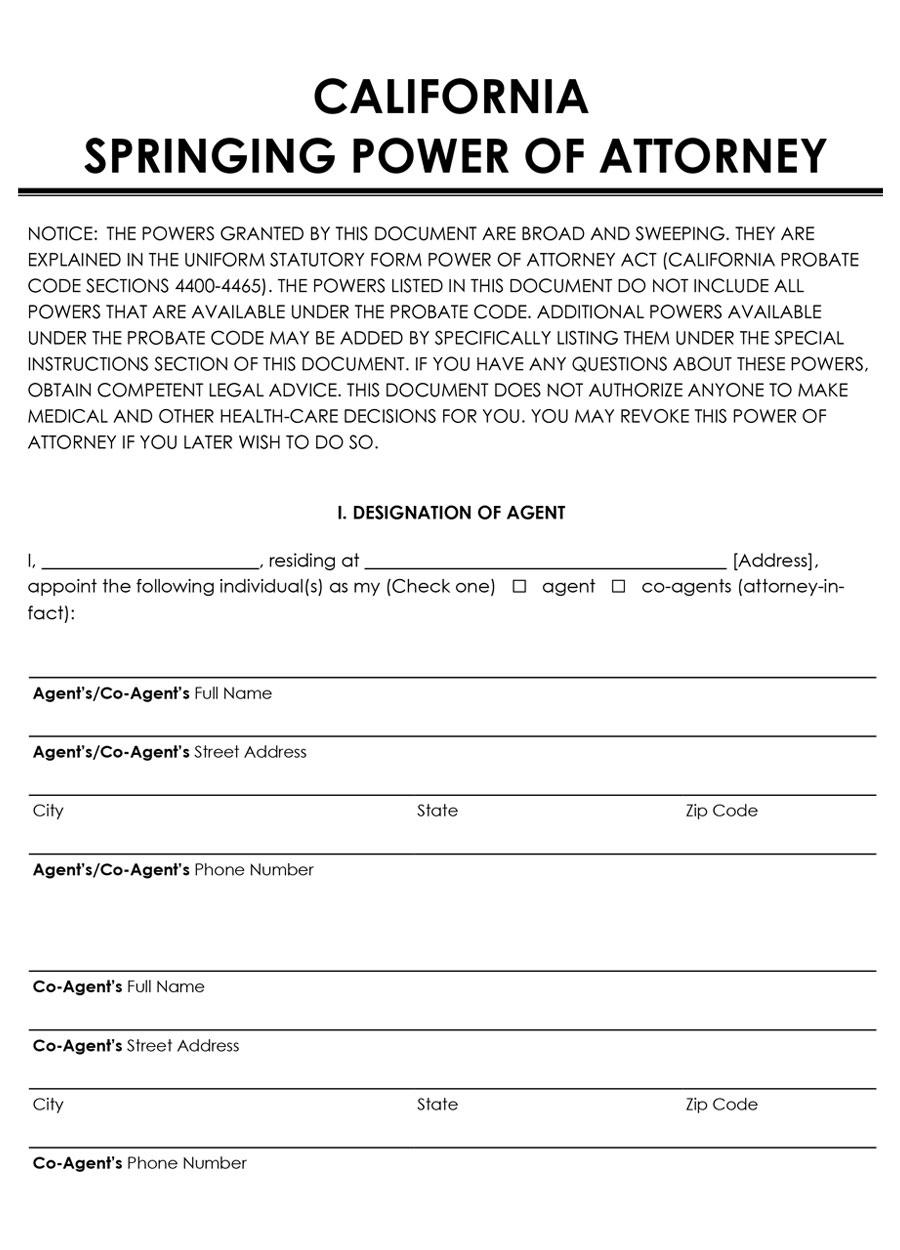

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

Legal Requirements

For a power of attorney in California to be used, it must meet specific requirements.

EXAMPLE

For a practical document to be created, the principal must be 18 years and above, of sound mind, and able to read and understand the agreement.

Other requirements outlined in the California Probate Code section [4000-4465] include ensuring that the indication of the date of execution, the principal’s signature or representative, and the document must be notarized or signed in the presence of two witnesses. The witnesses must be adults, and the agent cannot be a witness. The witnesses may either witness the actual signing of the agreement or an acknowledgment by the principle that affirms the signature indicated in the document.

How to Obtain a Power of Attorney in California?

To get a power of attorney, the principal and agent should be identified. A power of attorney specific to the state of California should then be obtained and filled. It should be customized to the agreement between the principal and agent while also clearly outlining what tasks must be performed. Finally, it should be signed by the principal and agents in the preference of a notary public or two witnesses. If the principal dies, a power of attorney becomes void as it is only effective while they are still alive.

How to execute it?

A California power of attorney should only be signed once to meet the state’s legal requirements. Once it is signed, it can be executed. A copy of the document should be provided to the agent and any other relevant parties, such as the principal’s doctor, bank, or relevant authority.

disclaimer

The principal should consider getting legal advice before signing a power of attorney document. Seeking legal advice can help the principal or rights holder decide on the type of power of attorney that best meets their needs and circumstances.

Frequently Asked Questions

Yes. A California POA can be revoked. A revoked POA means that the agent will no longer be able to act on the principal’s behalf. The principal does not need the agent’s approval to revoke POA.

A principal can name more than one POA in California. Then, they must assign powers to the agents selected. The principle will determine how much power to grant each agent.

The type of POA will determine when it becomes effective. For instance, the durable POA comes into effect upon signing it and only becomes void if revoked by the principal or invalidated by a court that determines that the principal was not of sound mind when it was created. The California springing POA becomes effective at a specific time or upon a specific event like incapacitation. A health POA comes into effect when the principal cannot make their own medical decisions.

Signing a POA does not take away the principal’s rights to make decisions on their own accord. Instead, it aims or ensures that the agents only act in the principal’s best interests, making it a convenient document. But, of course, the principal can still override the agent’s decisions or revoke a in writing.