An Asset is anything owned or controlled by an entity such as a corporation, the government, or a person that is positively valuable economically.

When valuable assets that are legally owned by a business entity are categorized on a sheet or document according to their individual usages and contribution or involvement in revenue-generation procedures of that business entity, a List of Assets is made.

It has economic value that can be converted into revenue or cash, now or in the future. These can be physical or non-physical.

Below mention are some of the properties of assets that can be included in the list;

- Ownership can be converted into cash or cash equivalents

- Economic value that can be sold or exchanged

- Resource which can be converted to economic benefits in the future

Importantly:

A company’s assets are listed on its balance sheet and equity and liabilities due to the financial benefit they bring to a company. They can be listed on the list based on each asset’s liquidity or historical cost.

Free Templates

Importance of Classification

These are considered part of a company’s cash flow. It is therefore imperative that companies classify them on the list to determine how each one financially benefits them. Assets can be classified based on type, liquidity, and other criteria.

Through such classification, a company identifies which asset brings in how much money and when.

EXAMPLE

By classifying which ones are tangible and intangible, companies in a high-risk and volatile industry can understand the company’s solvency and risk of operating.

Also, by identifying the ones that are readily convertible, a company can plan on how to raise capital in case of emergencies.

Free Downloads

Types of Assets

It has been established that assets for management and accounting purposes have to be categorized. Therefore there are different specific types of classifications that are commonly part of a list.

The most common classifications for companies are as follows:

Current assets

Current assets are the ones on the list that have been sold or are expected to be used up or sold soon, ordinarily one fiscal year or one business cycle – whichever is longer. They can be readily converted into cash and cash equivalents within a year; therefore, their financial benefit can be realized in the immediate future. Also, their financial value is typically dependent on time. These are the ones that are already in cash.

EXAMPLE

- Cash

- Accounts receivables

- Products ready for sale

- Bank drafts

- Short term investments

- Debt securities

- Credit to be paid in the immediate future

- Treasury bills

- Raw materials

- Work-in-progress

- Certificates of deposit

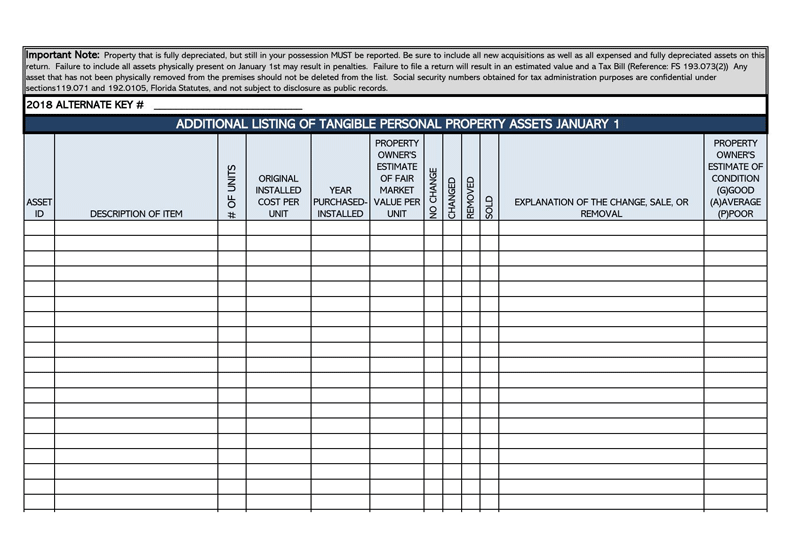

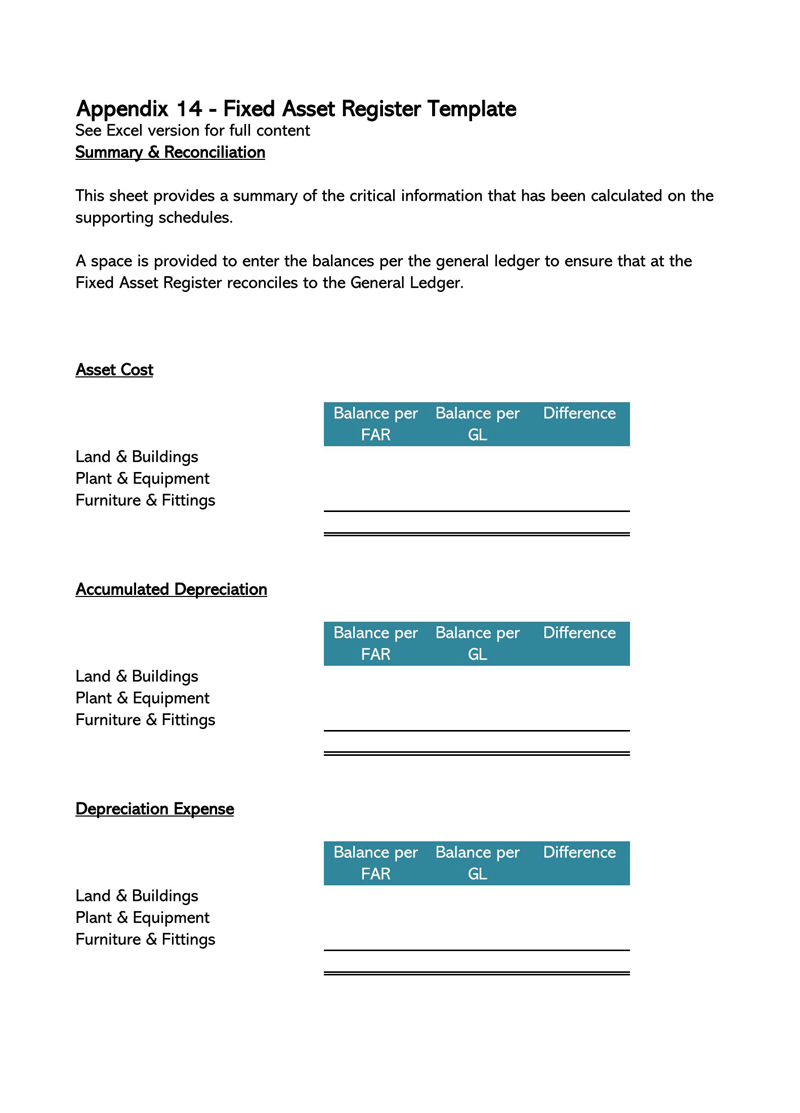

Fixed or tangible assets

A fixed asset is also termed as a non-current asset. This is the one that cannot be easily or readily converted into cash. Their financial benefit is realized in the future (more than a year) – thus also referred to as long-term assets.

EXAMPLE

- Tangible fixed (long term) assets such as PPE (property plant and equipment), company-owned vehicles, office furniture, etc

- Assets such as patents, trademarks, copyrights

- Goodwill

- Long term investments

Financial assets

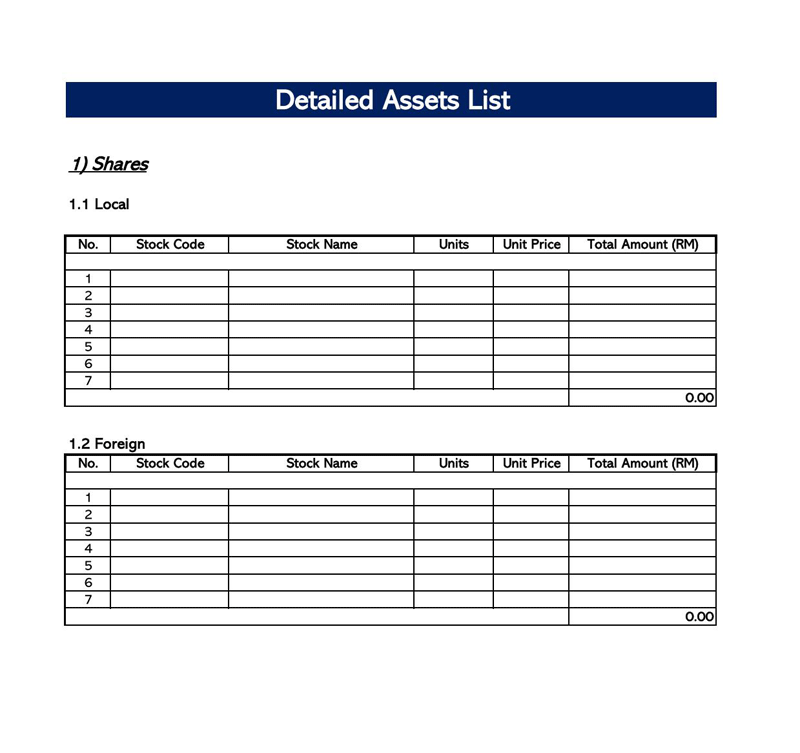

Financial assets are primarily investments made by a company in other companies. Therefore, their financial value can vary depending on the value of the company invested and the amount of money invested. They are acquired for growth or as a defensive strategy.

- Growth assets – Equity securities, rental property, antiques, appreciation, dividends, corporate bonds, company stocks

- Defensive assets – Savings account, certificates of deposit, debt securities, interest

Intangible or intellectual property assets

Intangible assets, unlike tangible ones, lack physical substance (they cannot be touched). Intangible ones do not directly benefit the company cash flows, but they increase the company’s overall value.

EXAMPLE

The brand KFC is an intangible asset that plays a vital role in sales. If anyone buys the brand, they will automatically have a vast customer base of customers loyal to the KFC brand, a customer base that would take a long time to build if they were to open a new business with a new brand.

Since these are difficult, if not impossible, to liquidate, they are not listed in the company’s balance sheet.

EXAMPLE include

- Patents

- Trademarks

- Copyrights

- Logos

- Industry knowledge

- Company inventions

- Goodwill

- Any trade secrets

- Franchises

- Company knowledge

- Company reputation

- Company brand

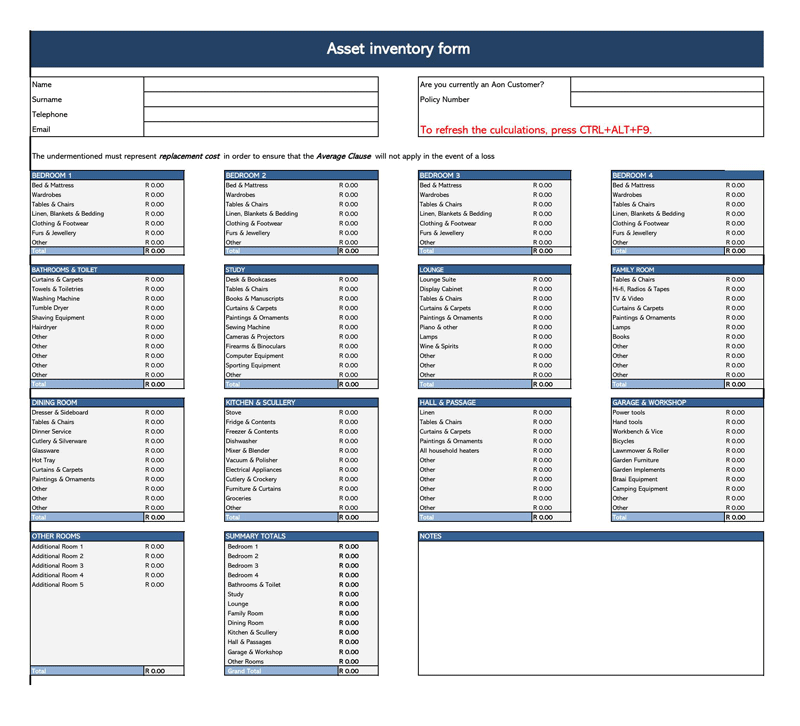

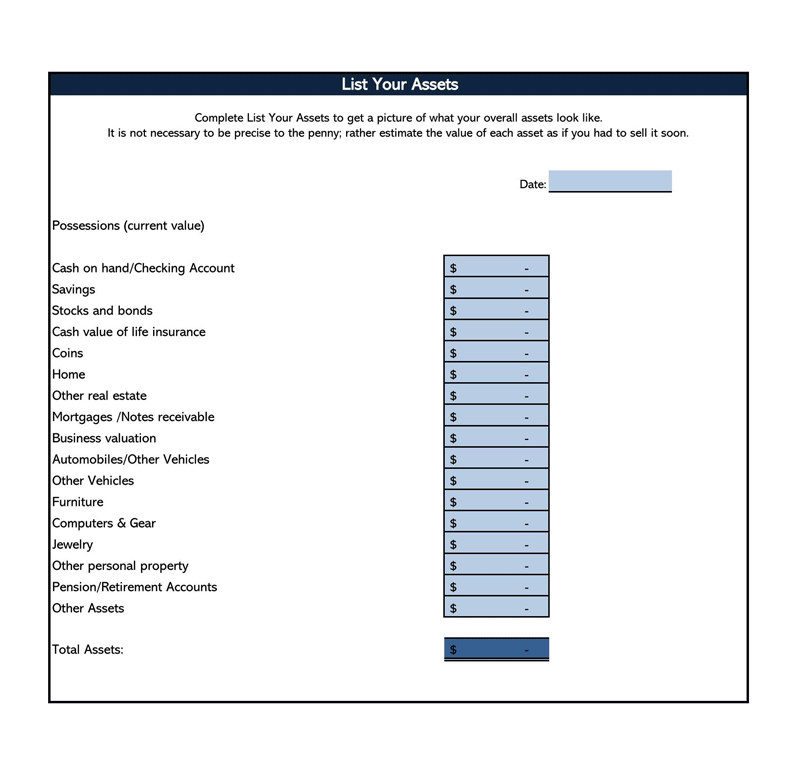

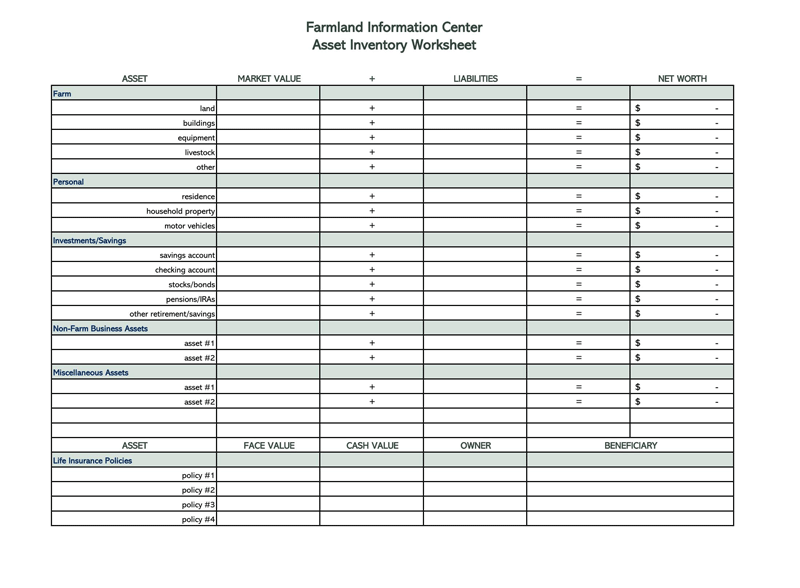

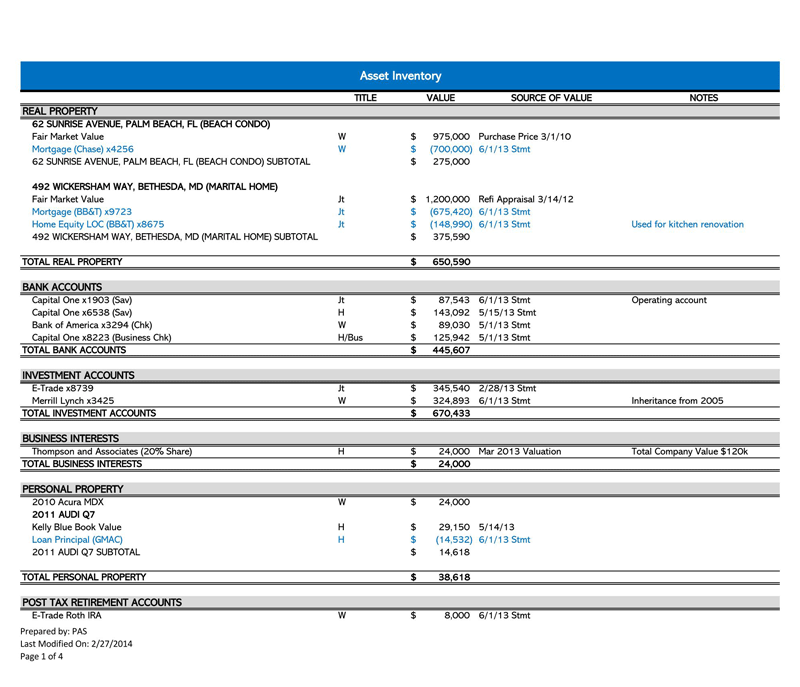

Personal assets

Personal assets are the ones by an individual. They can be listed if you’d like to list your personal property or put it up for collateral. This can help you eventually provide financial benefit to your company if needed. They contribute to the company’s net worth.

EXAMPLE

- Jewelry

- Household furniture

- Land or other property you own

- Money in your checking account

- Money market accounts

- Valuable collectibles

- Life insurance policies

- Bonds

- Annuities

- Stocks

- Pensions

- Retirement plans

- Mutual funds

Operating assets

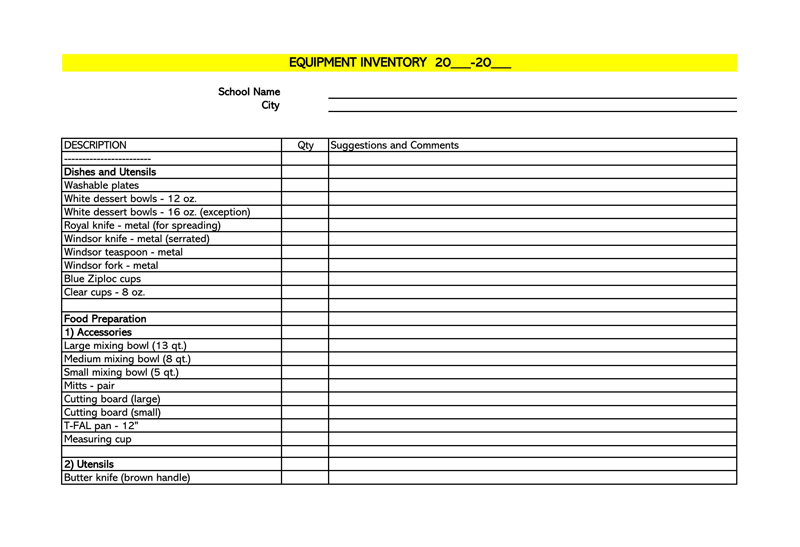

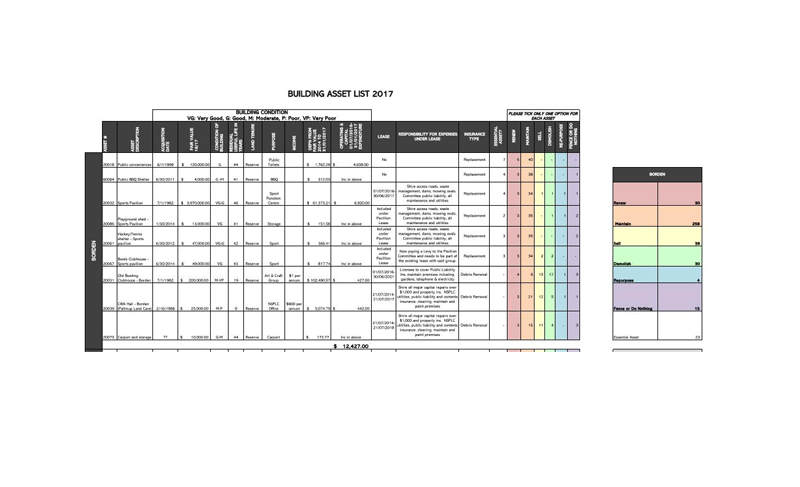

Operating assets are the ones used daily to run the company. They make up the consumables that the company uses to generate income.

EXAMPLE

- Cash

- Accounts receivable

- Inventory

- Building

- Machinery

- Equipment

Non-Operating assets

Non-operating assets are revenue-generating resources belonging to the company but are not used daily.

The following represent non-operating ones:

- Short-term investments

- Marketable securities

- Vacant land

- Interest income from a fixed deposit

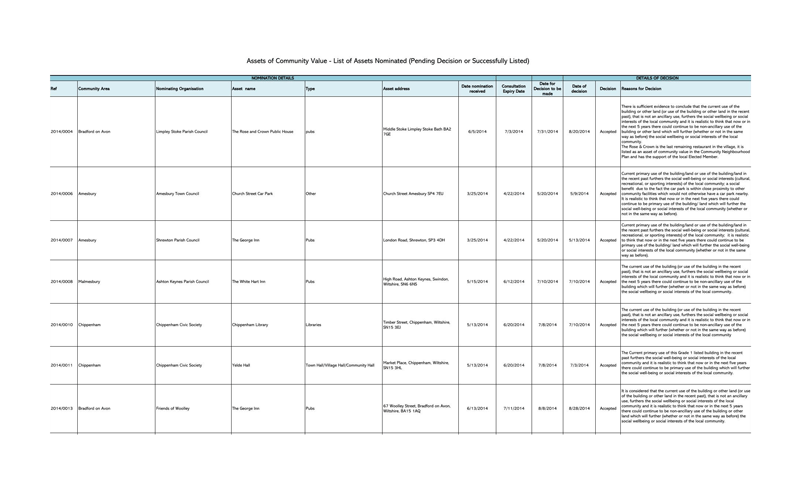

Corporate asset

Corporate assets are the ones such as subsidiaries, brand names, and other companies owned by the company. Corporations will usually have a long list of the ones they own.

Free Downloads

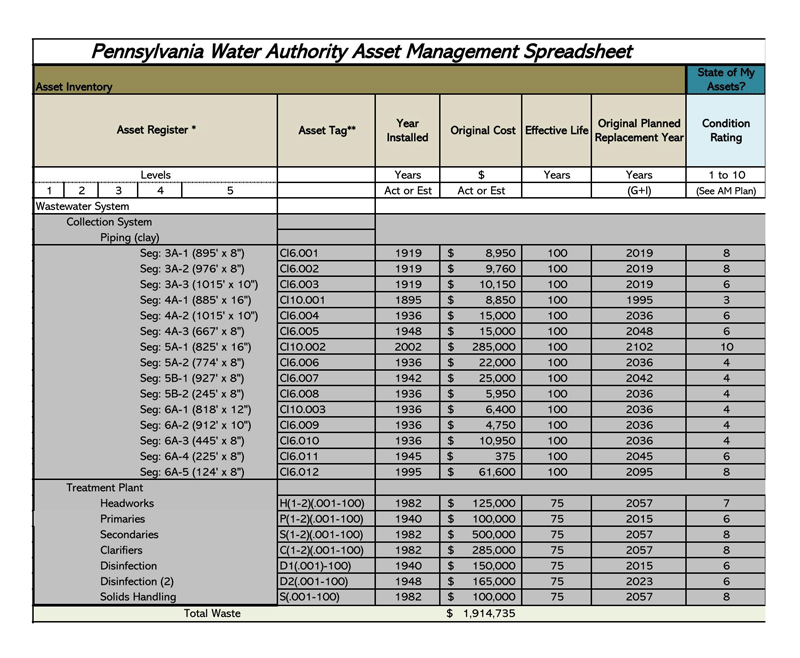

Making a List

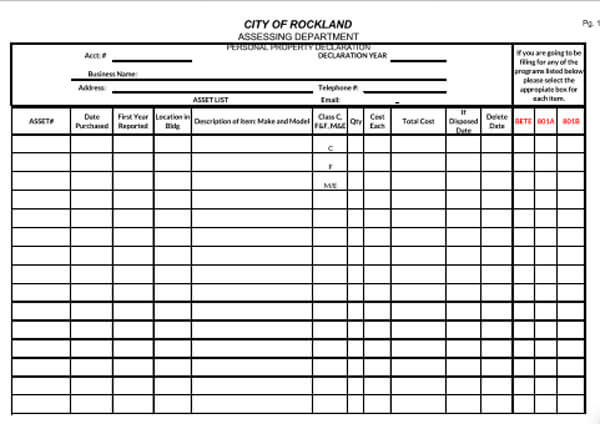

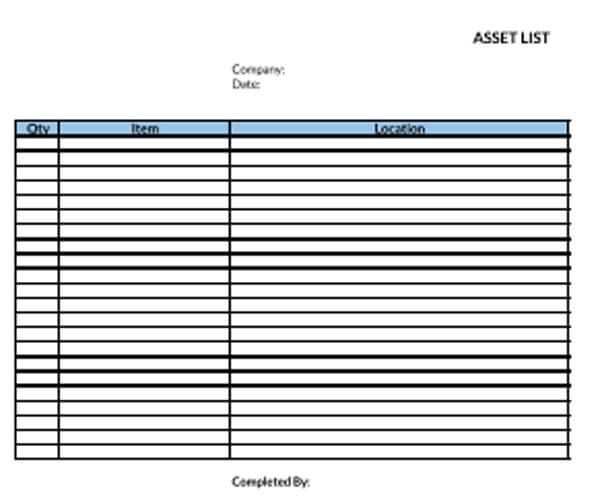

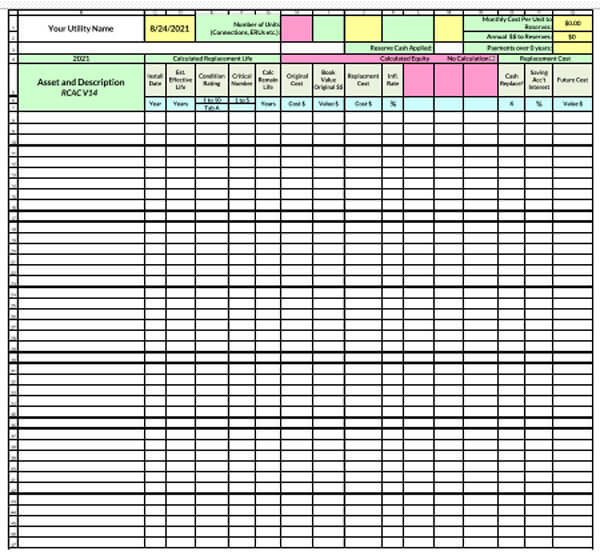

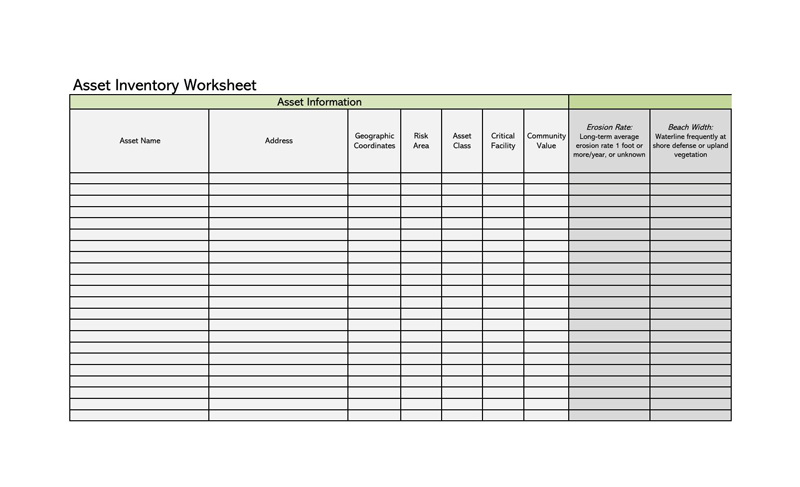

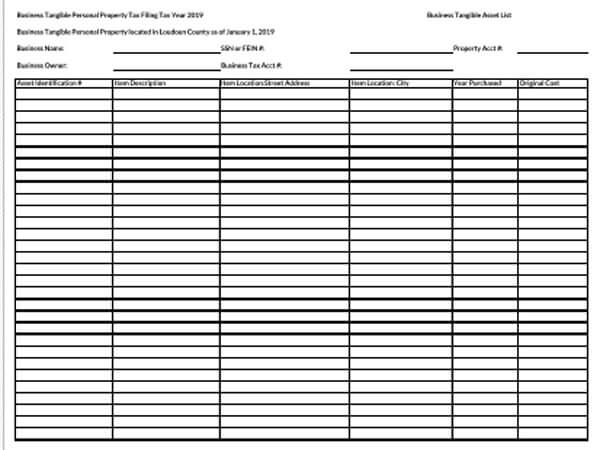

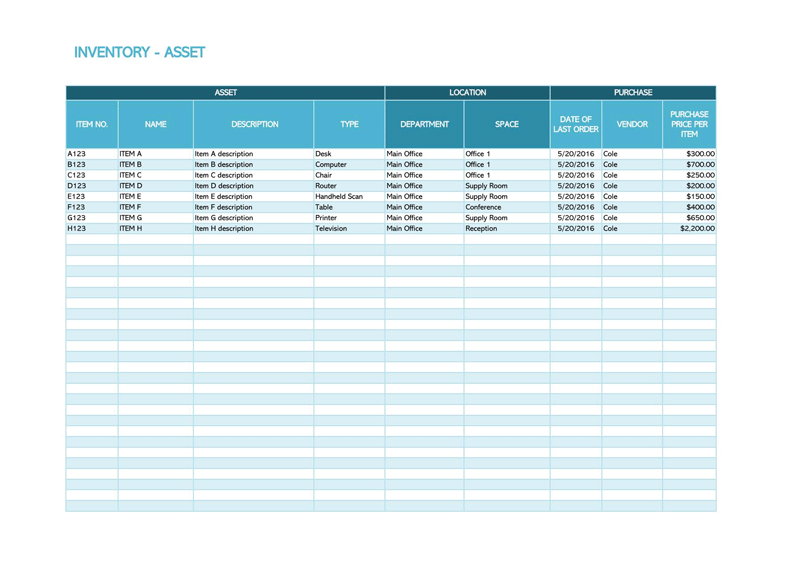

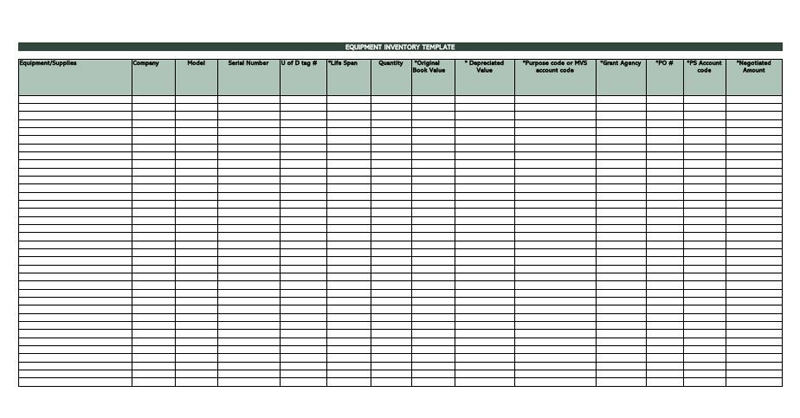

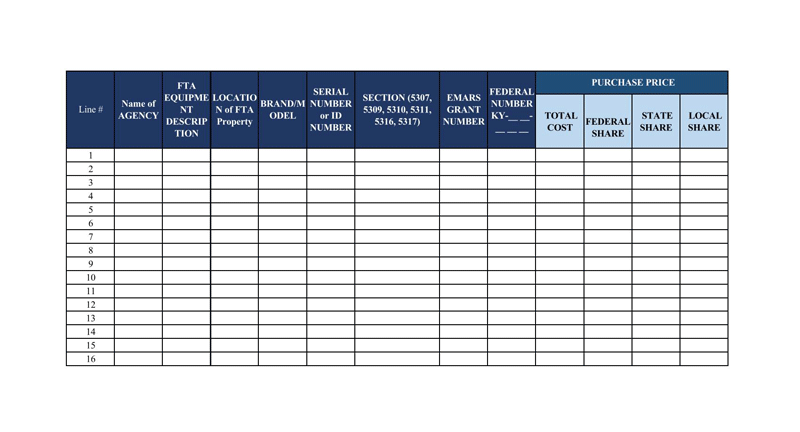

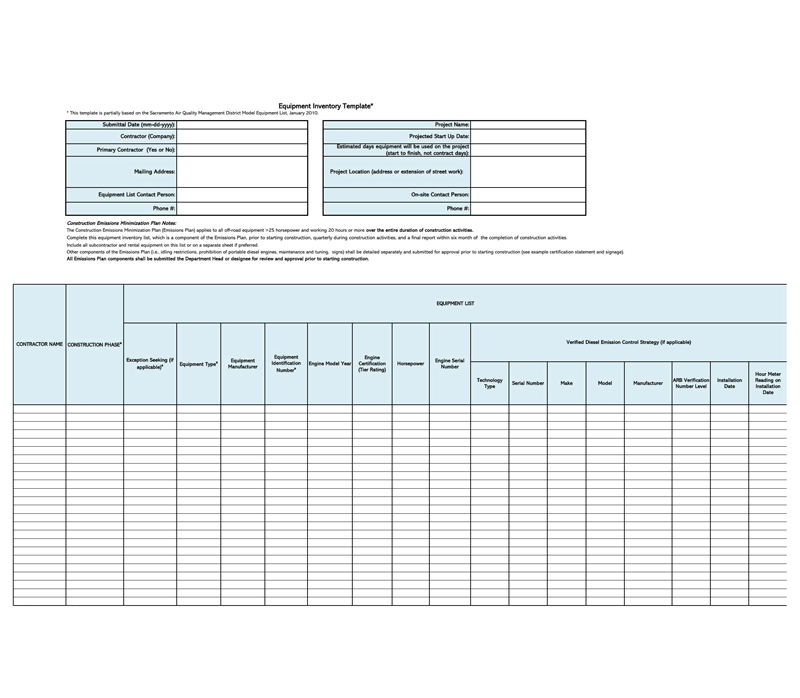

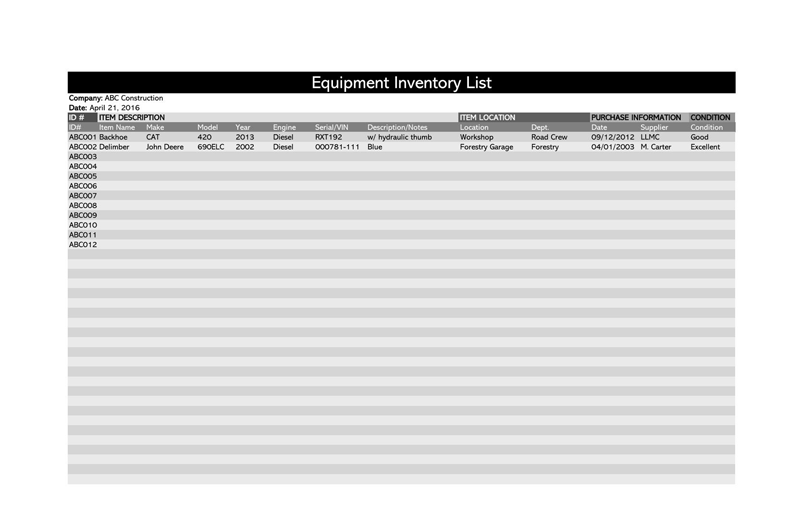

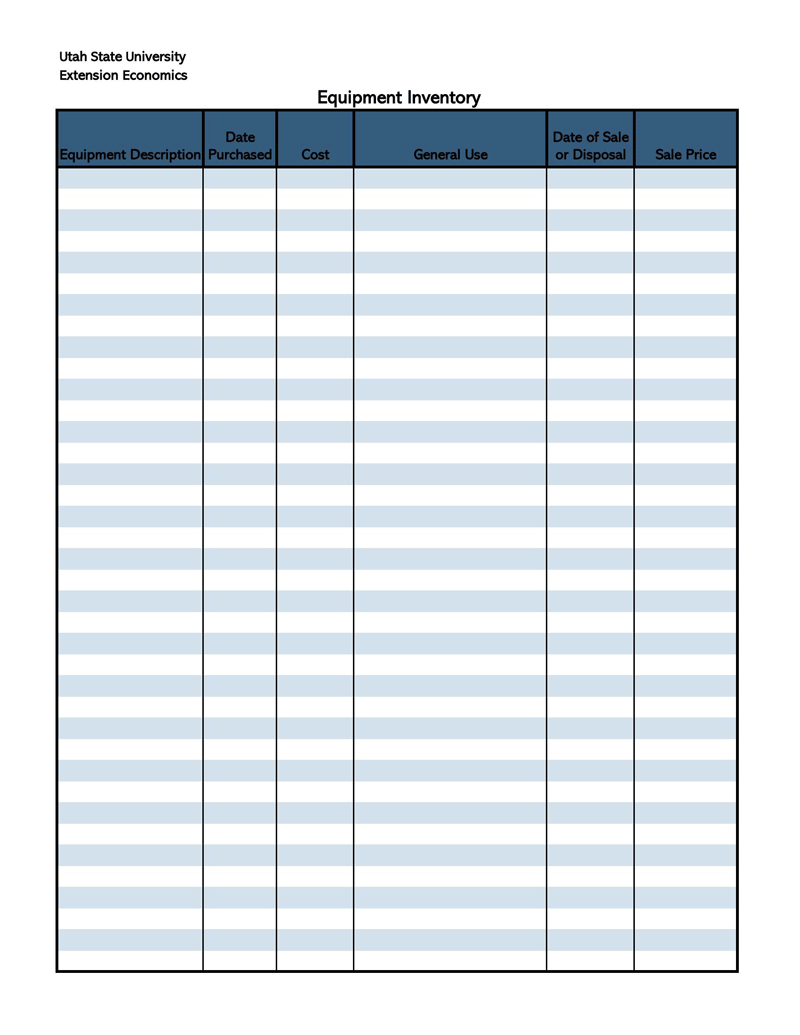

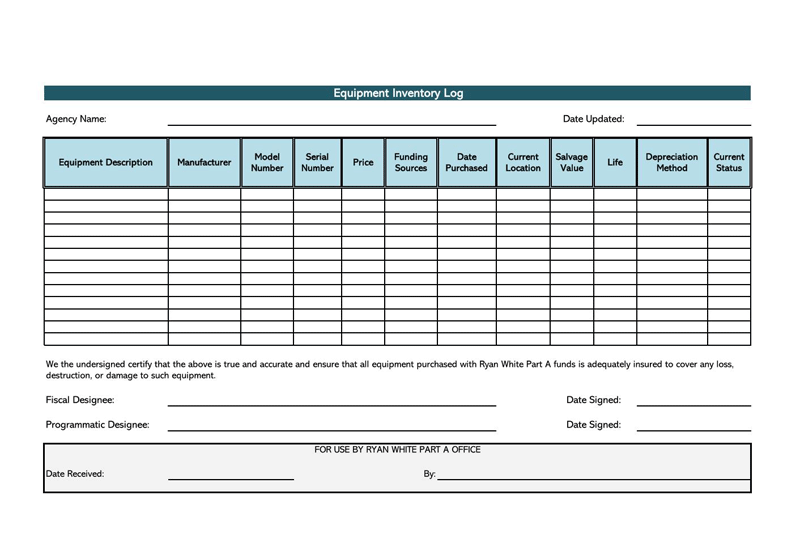

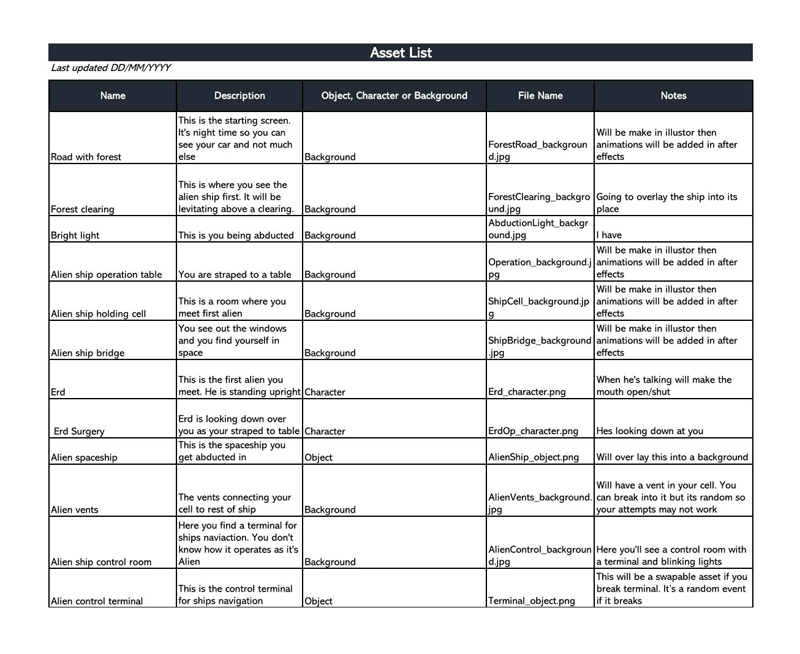

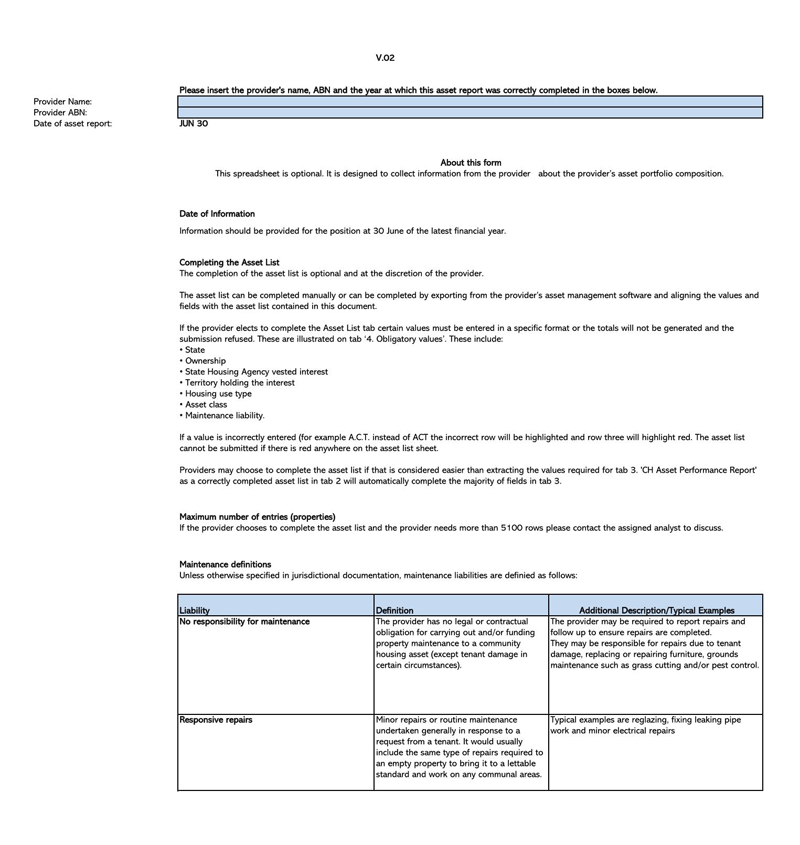

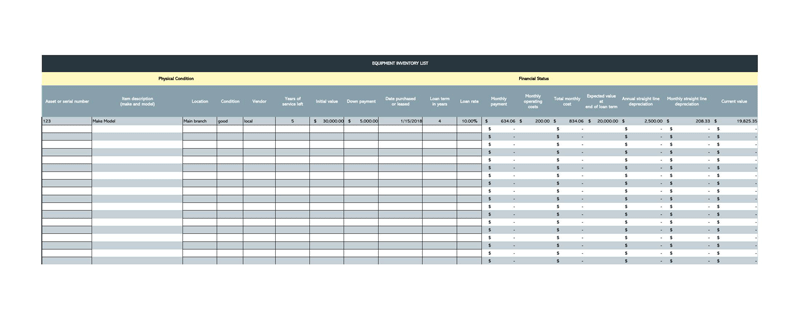

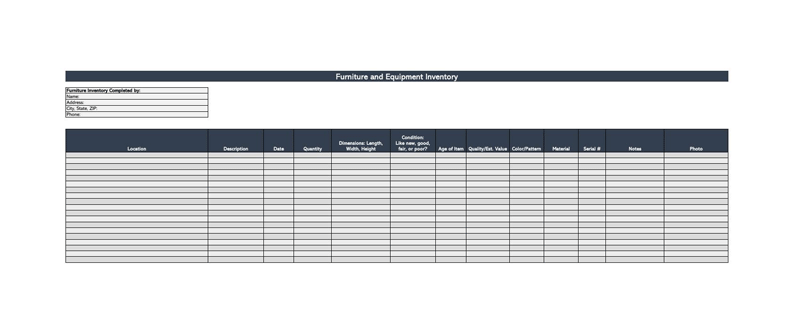

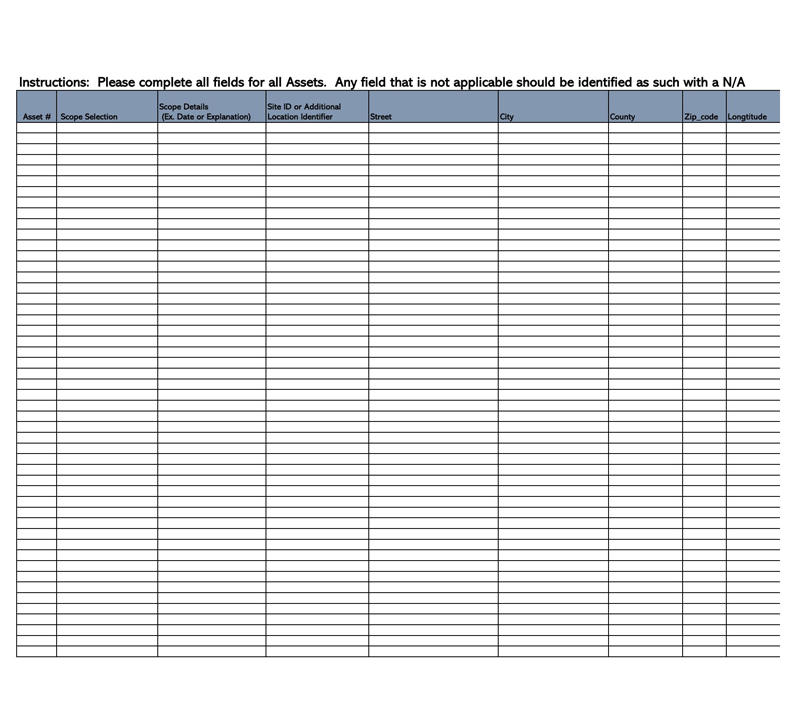

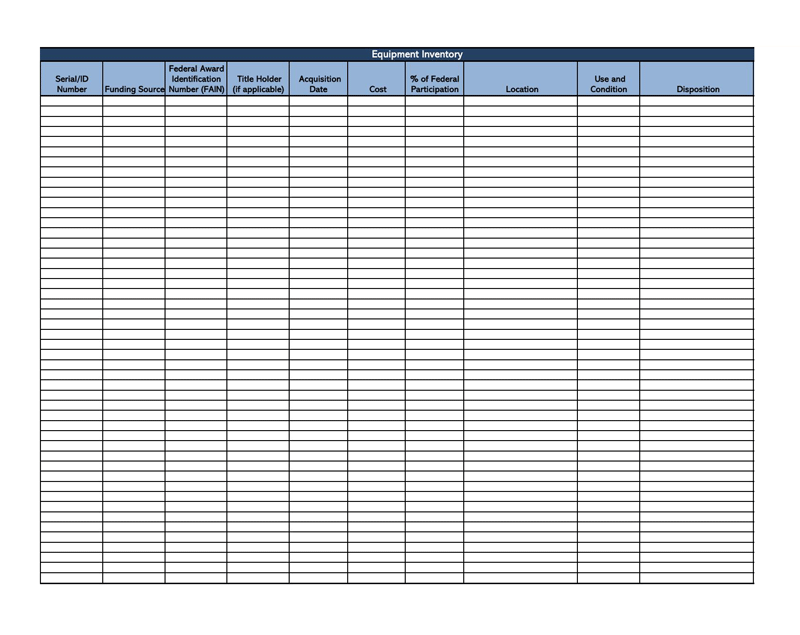

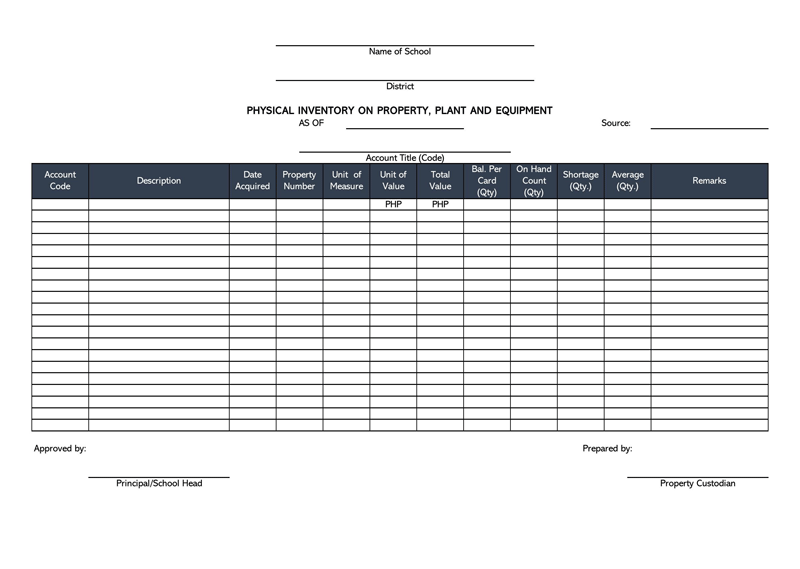

Creating a list can be time-consuming. Since this is usually a part of the periodic reconciliation of company resources, it is best to use a template. These can then be appropriately placed in their respective classifications.

The following steps can be followed when filling the template:

1. Writing your list

The first step in creating a list is coming up with a wholesome list of the company’s assets.

The following steps can be used to achieve this:

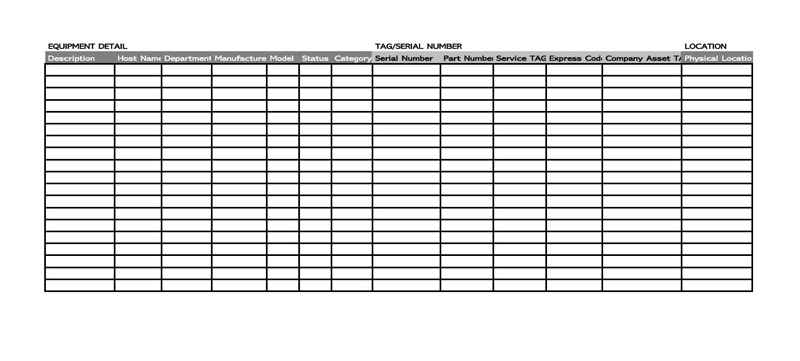

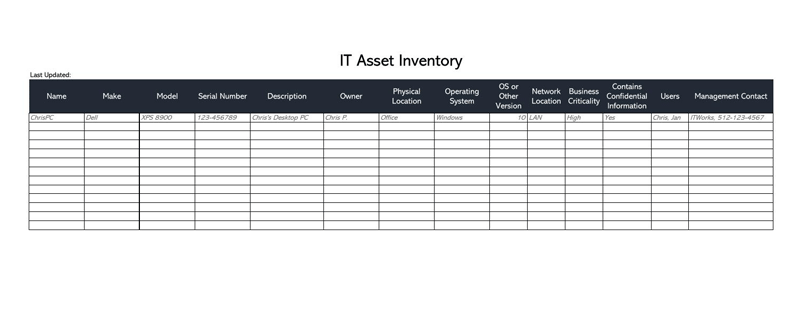

Select a record-keeping system

First and foremost, select the most convenient method. The two common ways of listing assets are manual or electronic listing. Therefore, once you have selected the most suitable template for your company, you can either download the template and print it out or personalize it using MS Word or Excel. The latter is, however, recommended as it allows for digital storage.

Separate your physical assets

Once the template is ready, start by identifying physical ones first. These are the tangible assets – those you can feel and see. Next, the company must be able to prove their ownership.

Distinguish your financial assets

Next, list the intangible ones of the company. These resources cannot be touched or seen but generate revenue and contribute to the overall company valuation. This includes stocks and bonds.

note

It can sometimes be difficult to distinguish the tangible and intangible ones because some tend to cross over. For example, the insurance on artwork can be challenging to categorize as it can fall under both categories. It is thus advised for one to place them in the category they believe that is more suited.

Document personal information

The company should then provide company information that can be used for identification purposes. This information includes company name, owner, CEO, income tax number, location, and any other information that can be used to attach those listed in the document to the owner.

Describe the items

Provide a comprehensive description of each item listed in the document. Include as much information as possible for specifics. You can further subdivide the two major categories into subcategories such as land, buildings, automobiles, valuable collections, etc.

EXAMPLE

Automobiles can be described by type, brand name, model, year, CC, etc.

Add pictures and the dates when the pictures were taken for clarification. Valuable collections can be valued as a unit instead of separately. If they have been appraised, the appraiser should be identified by indicating their name, contact information, and critical details about the appraisal.

Provide evidence of ownership

Afterward, you need to give evidence of intangible assets such as insurance policies, title deeds, certificates, and financial accounts. Intangible ones should be identified by their account numbers, owners, and signatories to those accounts. The signatories should be identified by name, address, SSN. Add details about anyone authorized to manage, sell or access any of the financial assets.

Provide acquisition details when necessary

The acquisition details of precious assets should be provided. Indicate the method of acquisition, price, and place of acquisition. Identify the seller by their name, address, and other contact information. The list should also declare the type of ownership of significant ones.

Include location information

The document should then state the location of the items mentioned. The location of tangible assets can be given by declaring the physical address where they exist or are stored (for example, security deposit boxes). Their location, such as deeds, mortgages, etc., can be identified by giving the name of the custodian, legal firm, attorney, insurance company, or bank where financial accounts were opened. All signatories or parties authorized to access accounts should be noted together with the date when the account was opened.

Note special conditions for certain items

Afterward, the document should note down special conditions that apply to specific ones.

EXAMPLE

If the company’s ownership is a partnership with survivorship, it should be stated who the beneficiaries are.

Provide the names, addresses, and terms of ownership transfer.

Finish your inventory list

Lastly, add company assets that do not fit in any of the categories outlined in the list above. Finally, indicate when the list was created because valuations are bound to change with time; therefore, it is essential to declare when the listed ones were valued at the said amount.

2. Protecting your list of assets

It is a document with legal and managerial significance in a company. Therefore, it is important to ensure its contents are protected by providing a legal cushion and physical protection to the document.

Follow the steps below to achieve this:

A list of legal representatives or authorized agents

Create a list of the company and non-company (attorneys) representatives authorized to attend to affairs related to those mentioned in the list in the absence of the principal figures in the company. The document should state the representatives’ names, addresses, phone numbers, and email addresses. In addition, these representatives must have been given the authorization to access them through other documentation and should be notified of the existence of the list.

Scan or photocopy all of your receipts

Next, add receipts of valuable assets or any receipts at hand to the list. If filling the template electronically, scan the receipts and add the electronic copies to the document. Photocopy the receipts if you are creating a physical list. You can also add other documentation that can be used to prove the company’s ownership.

Create copies of inventory and securely store

Then, once the list has been fully completed, create copies of the document and store them separately. Electronic lists should be stored in two USB drives, encrypted, and stored with an attorney or bank. A physical copy should also be printed and stored in a fireproof safe such as a safety deposit box.

3. Keep your information up to date

Finally, the company should commit to updating the list periodically. Changes are bound to happen; they should be incorporated in the list after some time – add newly bought assets and delete that no longer the company’s ownership. Acquisition or liquidation of principal should be declared in the list as soon as possible. Ensure to note down significant details about the transaction.

EXAMPLE

Date, involved parties, etc.

Previous lists should be replaced with the amended lists to avoid confusion.

Free Templates

Conclusion

Listing is an important process in the valuation of a company, as the value of its assets will typically determine its worth. These are any physical or intangible resources under the company ownership. Those listed in the document should be outlined in their respective categories. A company can use templates to create the list as they are fast and equally as efficient. Finally, the list should be updated periodically. Hence, an ideal list ought to incorporate all the attributes mentioned above.