Keeping track of income and expenses is a requirement in most households to make sure money stretches from paycheck to paycheck. While budgets are good for everyone, if you’re one of many that are finding that your financial situation is in dire straits because of an economic recession or a change in your employment, this is the perfect time to start a personal monthly budget and get control of your finances. Creating such a template can give you the peace of mind that things will be alright in the long run, no matter the current circumstances.

Personal Monthly Budget is a plan that categorises and allocates income towards expenses, savings, and debts.

Budgets are financial plans made to plan for and categorise all of your expenses for a period of time, usually a month, making sure they don’t exceed your sources of income for that time. A budget’s expenses include required bills like insurance and utilities and discretionary spendings like entertainment or personal care.

Budgets can be used to help you achieve a major goal, such as saving for a house, or for smaller goals, like making all of your payments on time. People often associate the word “budget” with restriction, but budgets don’t have to be restrictive to be effective for you or to help you achieve your goals.

More than a plan, a budget is also an itemised list. Seeing your expenses laid out in a budget helps you to find and define spending patterns, overspending, surpluses, and to get an accurate picture of your spending.

Listing all of your income for a month against all of your spending, either for required or discretionary expenses, will help you see your personal cash flow so you can make better decisions and understand what you can and cannot afford.

Free Monthly Budget Templates

Start with Categorizing

A solid budget accounts for every kind of spending you’ll probably undertake during the month. Ineffective budgets often don’t have enough categories, and therefore, money just “goes missing,” or the categories are specific and spending becomes impossible to keep track of.

Making your monthly budget account for each necessity, under a category like utilities, and each discretionary purchase, under a category like personal care, helps you to manage your spending.

Budget categories

Budget Categories, when properly implemented, help you to achieve your financial goals. For example, if you establish the goal at the beginning of the month, “I want to spend only 100 dollars on entertainment,” then you can easily allocate money for movies and games and not spend over that amount. The budget category in this scenario is, “entertainment.”

The categories listed below will cover nearly all of your financial needs throughout the month, but these categories are meant to be personalised to your lifestyle, so feel free to add or take away categories as you see fit.

- Rent/mortgage – Money from this category keeps the roof over your head.

- Utilities – Bills such as water, gas, electricity, sewer, trash, and recycling.

- Phone/Internet – Amounts in this category may be variable if you often go over data limits or pay on a “pay for what you use” plan.

- Automotive – Car payments, detailing, and maintenance. If you don’t own a car, this could be the cost of transportation.

- Groceries/food – For some, it may be a good idea to split this category into two, one for your at-home groceries, another for eating out. Whether you include non-food items like shampoo and toilet paper in this category is up to you.

- Entertainment – Movies, books, games, and recreation.

- Savings – Money that is not to be spent but set aside for your financial goals. A savings of three months of your income is a safe bubble to aim for in case the worst happens, and you need to live off your savings.

- Medical/healthcare – check-ups, appointments, medicine.

- Insurance – Car insurance and health insurance.

- Education – Current semester payments, books and supplies, housing, fees for trips or subscriptions, or tutors.

- Clothing – As an essential but often expensive item, clothing may not be a monthly expense for all, but maybe a bi-monthly or bi-annual expense.

- Personal Care – Taking care of yourself looks different for every household, but this category could include expenses like gym memberships, salon visits, cosmetics, or babysitting when you need a night out.

- Debt – This category may be set in stone, such as if you’re paying off a car, house, or loan, or it may be ever-changing, such as if you’re accruing different credit card amounts each month. It is essential to budget this money to avoid credit score dips or wage garnishment.

- Donations – For many, charitable donations are a regular expense, such as with church tithes. If they’re not, and you’d like to become a regular supporter of an organisation, deciding this could be a fulfilling addition to your expenses.

How to Make a Personal Monthly Budget Template

Before being able to set financial goals, you must have an idea of what you’re currently making and spending. Running through the following steps will help you establish a baseline of income versus spending, hopefully establishing that you have a surplus and not a deficit, and help you create a financial goal, like cutting entertainment costs, increasing donations, or doubling your savings.

Gather your financial paperwork

Whether through your online portals or through the mail, you’ll need to establish your current bills and sources of income, and this will come in the form of your financial paperwork. This paperwork might include bank statements, investment accounts, utility bills, pay stubs, W-2s or 1099s, credit card bills, grocery or clothing receipts, rent receipts or mortgage statements, and school or car loan statements.

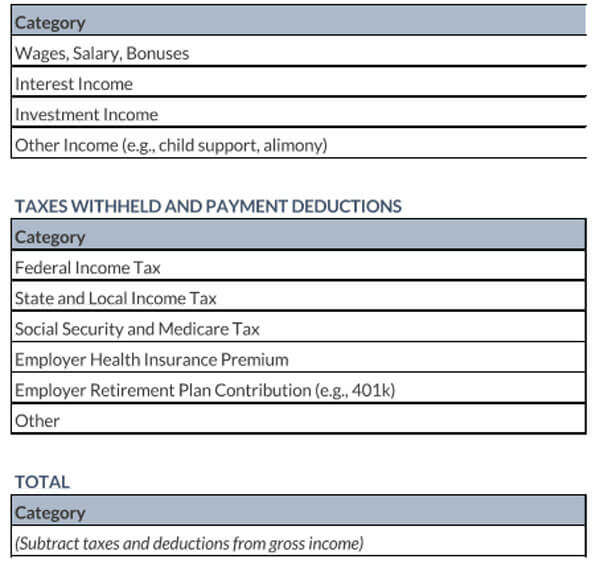

Calculate your income

Depending on your line of work, paychecks may come in a monthly, bi-monthly, or weekly sum. If you’re self-employed or reliant on government checks, any money you take in should be included. Record the total amount for the month in this category. This is where you should use your bank statements and pay stubs to establish your baseline.

Create a list of monthly expenses

Using your paperwork, establish the necessary and recurring expenses for your budget.

This could include information from your bank statements, utility bills, credit card bills, groceries, receipts, housing costs, and loans. Pay close attention to things like subscriptions that are easy to overlook, but might add up.

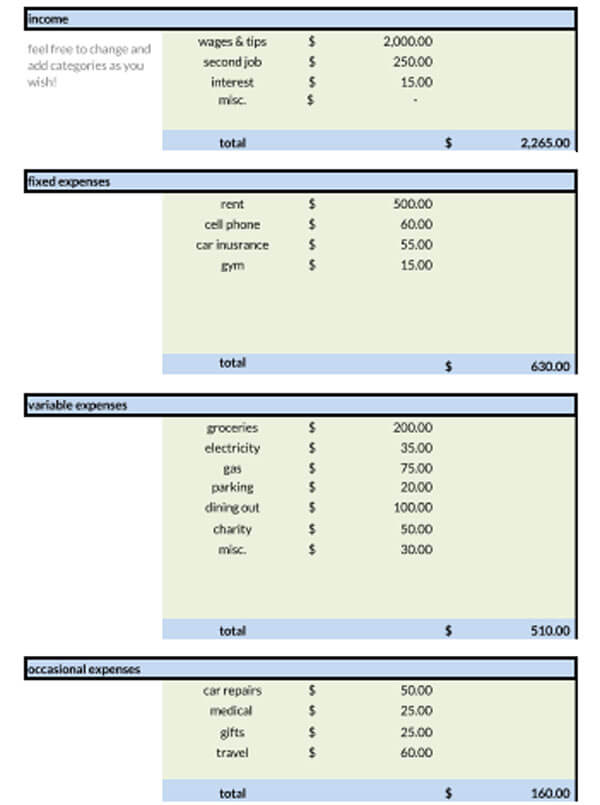

Determine fixed and variable expenses

Fixed expenses do not change from month to month. You know exactly what you expect to pay each time. Variable expenses are not set in stone. These could be birthday gifts, gasoline, credit card balances, electricity bills, etc. Look over your paperwork to determine a rough estimate or an average for your variable expenses.

Total your income and expenses

With all the information you’ve already gathered, determine the sum of all your monthly income and all your monthly expenses. If you’re making more money than you’re spending, you’re off to a good start. If you’re spending more money than you’re making, then you’ll need to make adjustments in the next step.

Make adjustments to expenses

This is the point where you set a financial goal (spend less, save more, pay off debt). If you discover at the end of the previous step that you’re in the red, don’t despair. You may feel like giving up, but you have an opportunity to fix the problem before you’re in too deep.

As you make adjustments, you’ll need to pay close attention to where you’re spending and see where you can cut back. As you look through your receipts and bank statements, ask yourself these questions:

- Is this item or service a necessity?/Do I need it?

- How can I cut this expense down without eliminating it entirely? Can I find a lower rate or negotiate for a lower price?

- Is it possible to cut this expense completely? If so, I can add it back when my money is in better shape.

If you’re hesitant to cut your personal expenses, look into ways to cut regular payments like car insurance. Look hard, and you might find a lower rate through another company. The aim at the end of the adjustment stage depends on the type of budget. If you want to have a balanced budget, the goal is not to have a surplus; it’s to have your income and expenses equal.

Free Downloads

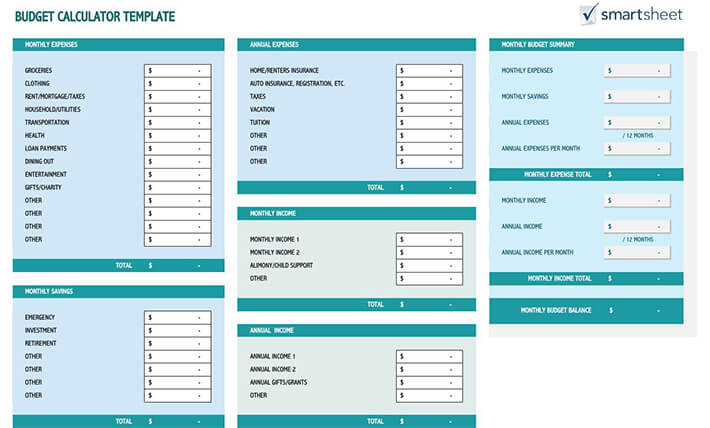

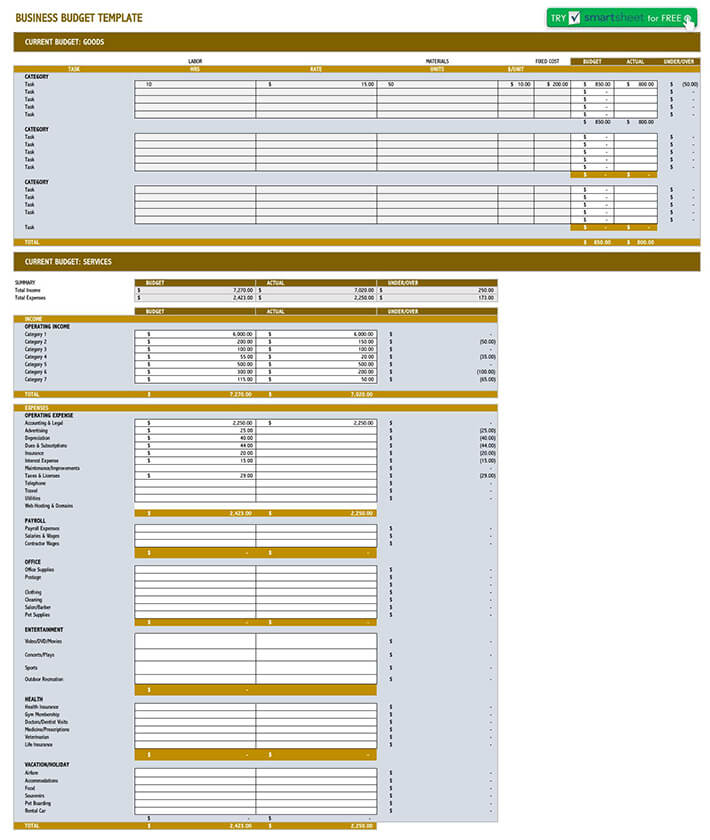

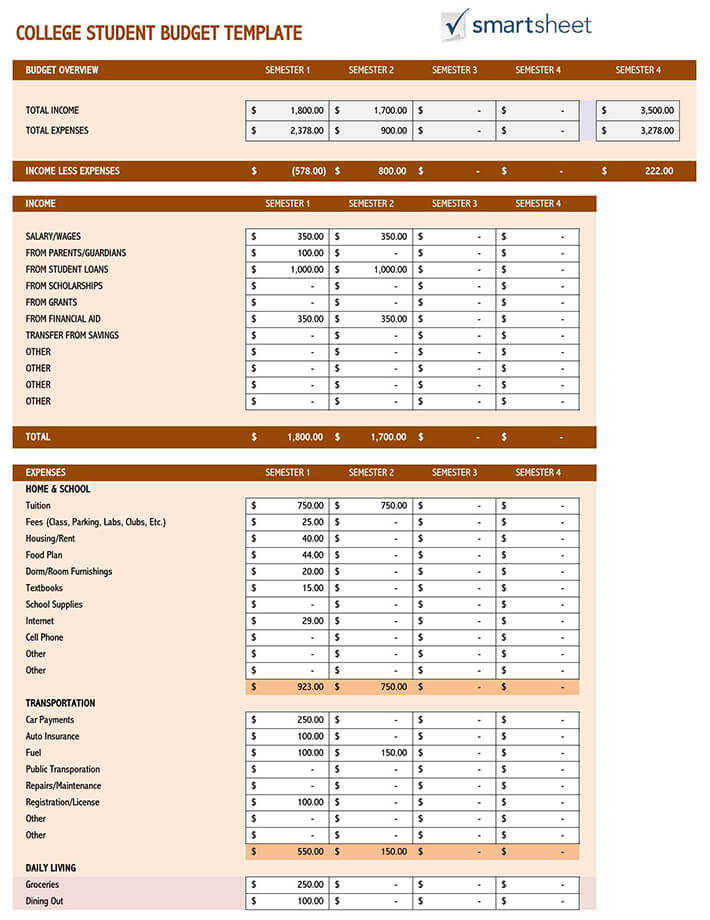

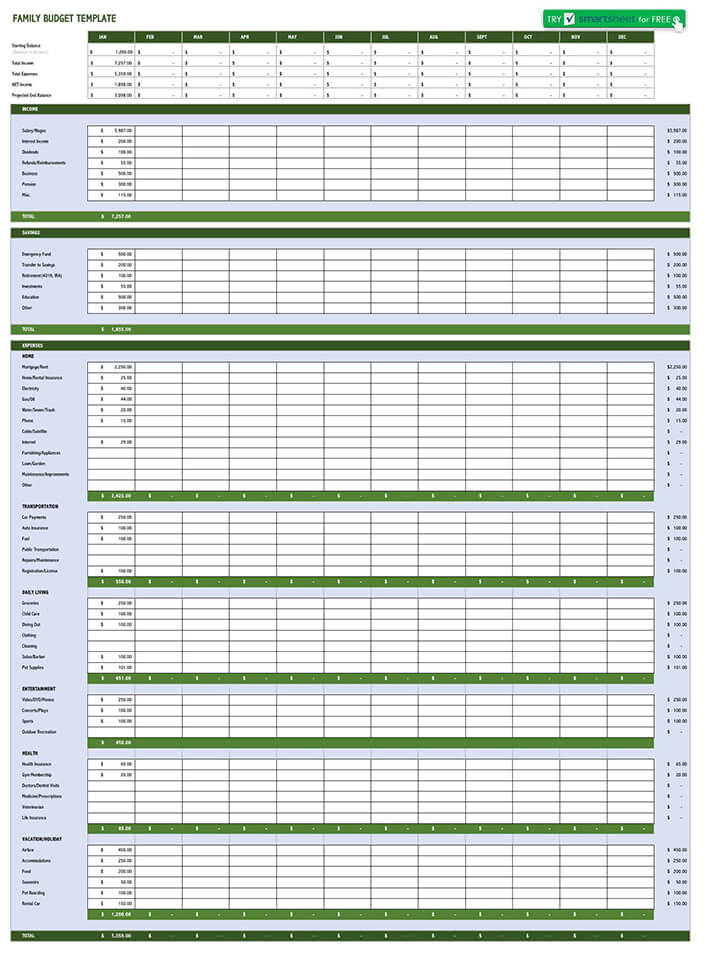

Monthly Budget Templates and Worksheets

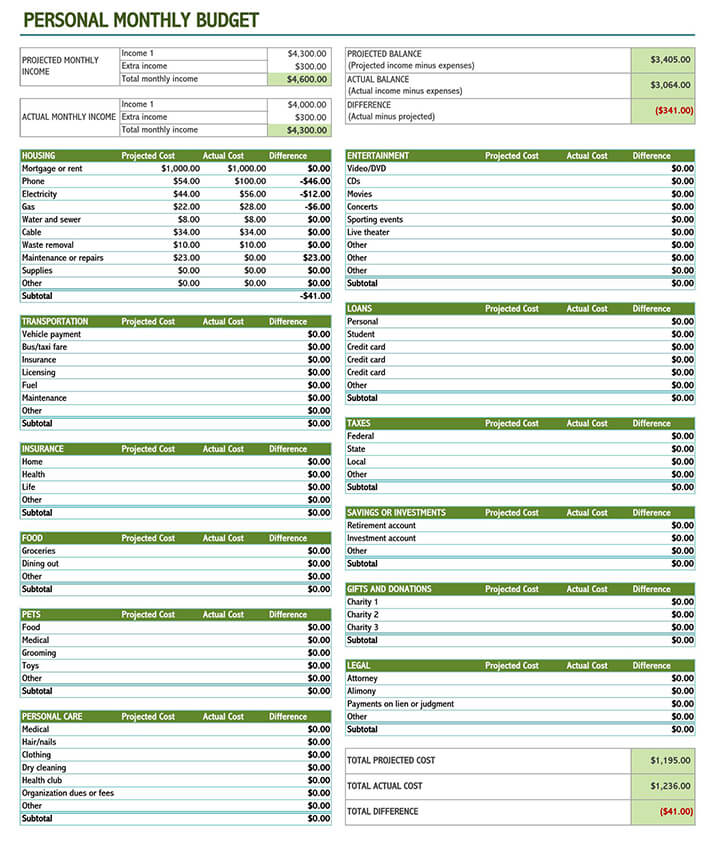

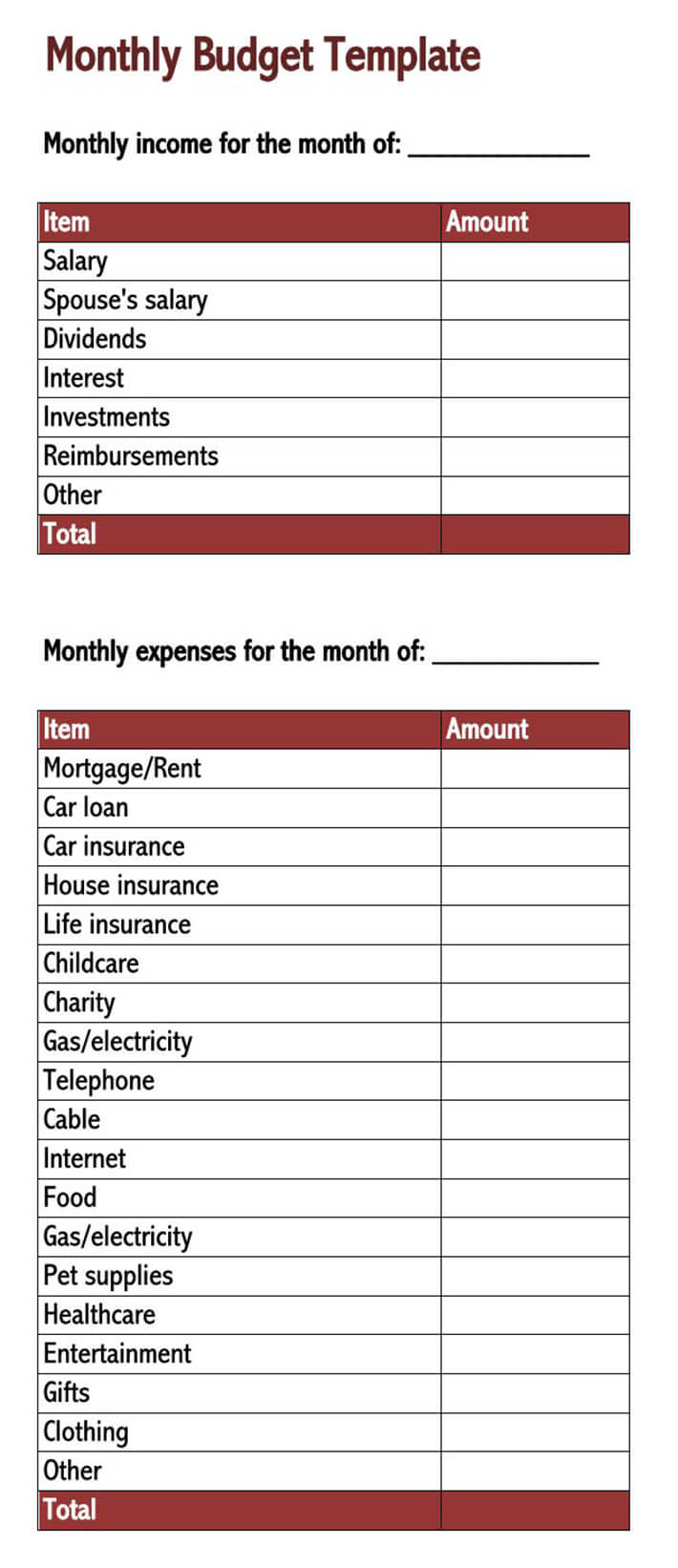

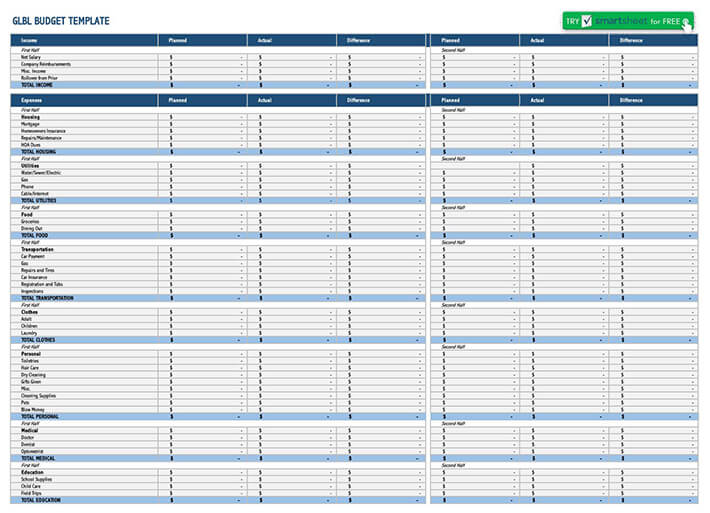

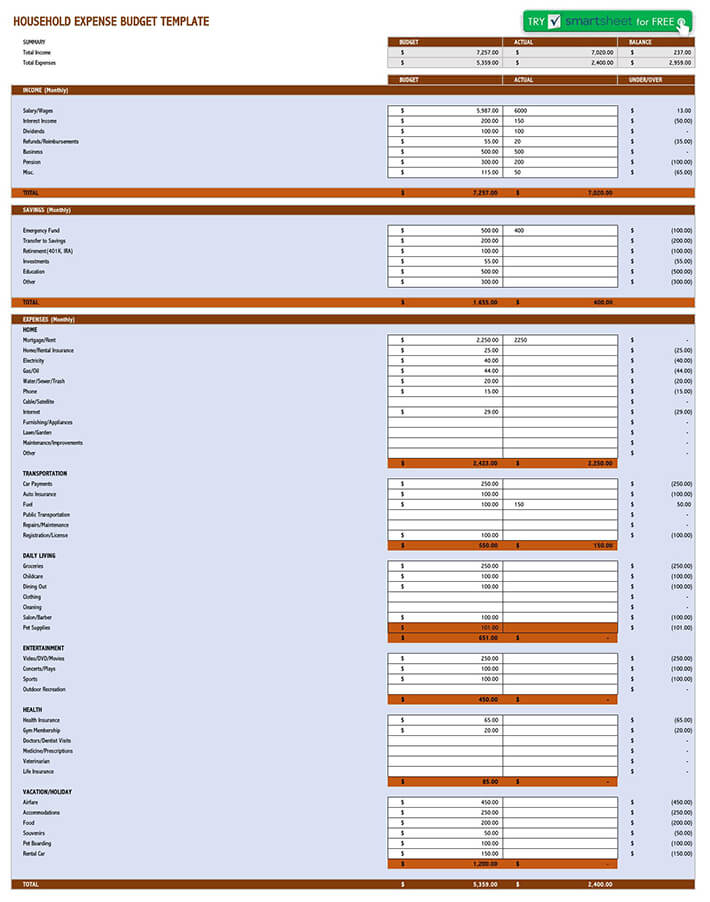

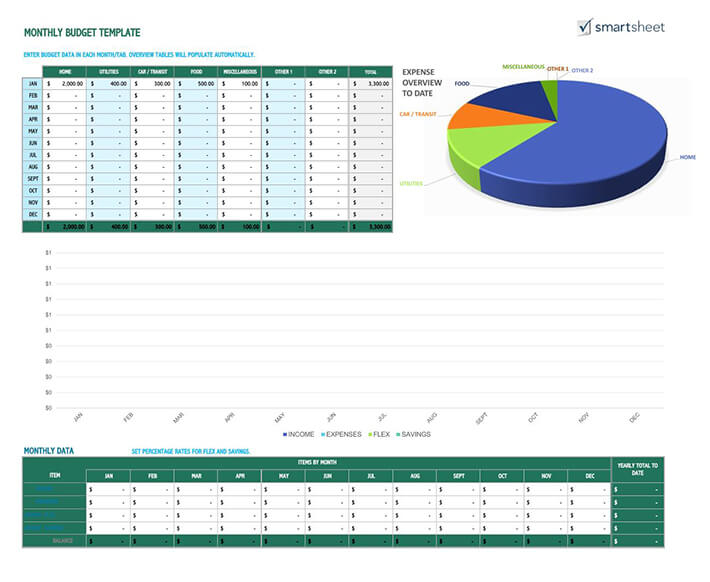

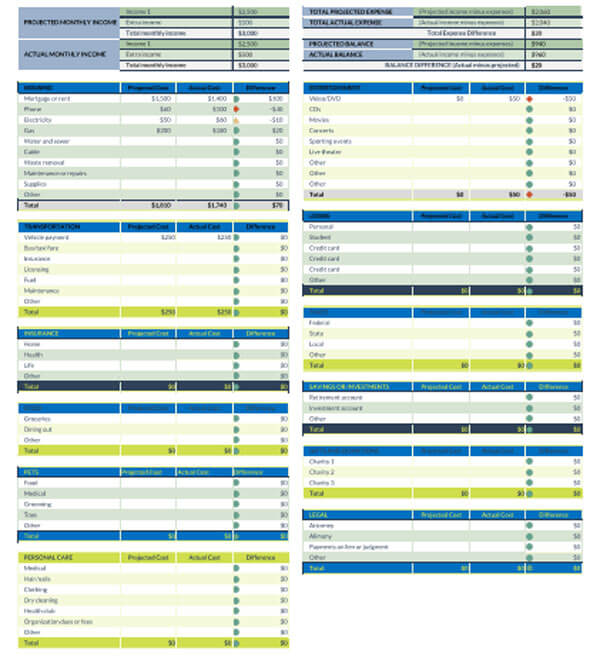

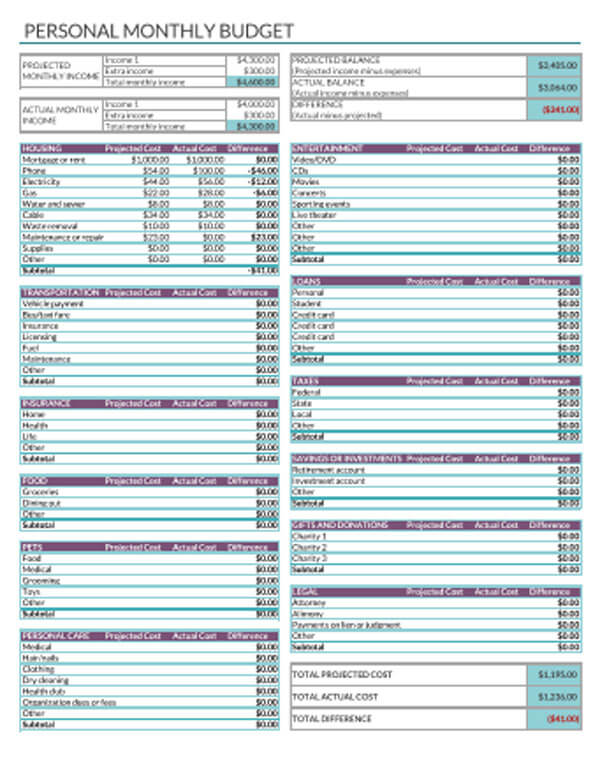

Do you want to take 100% control of your monthly finances? Well, using a monthly budget template is the way to go. It helps you have a better grasp of your monthly money flow. Plus, this helps in allocating the budget for various expenses and monitoring their difference against the actual budget.

What’s more, the model does record both income and expenses for the whole month. This helps you be in a better position to manage your finances sustainably.

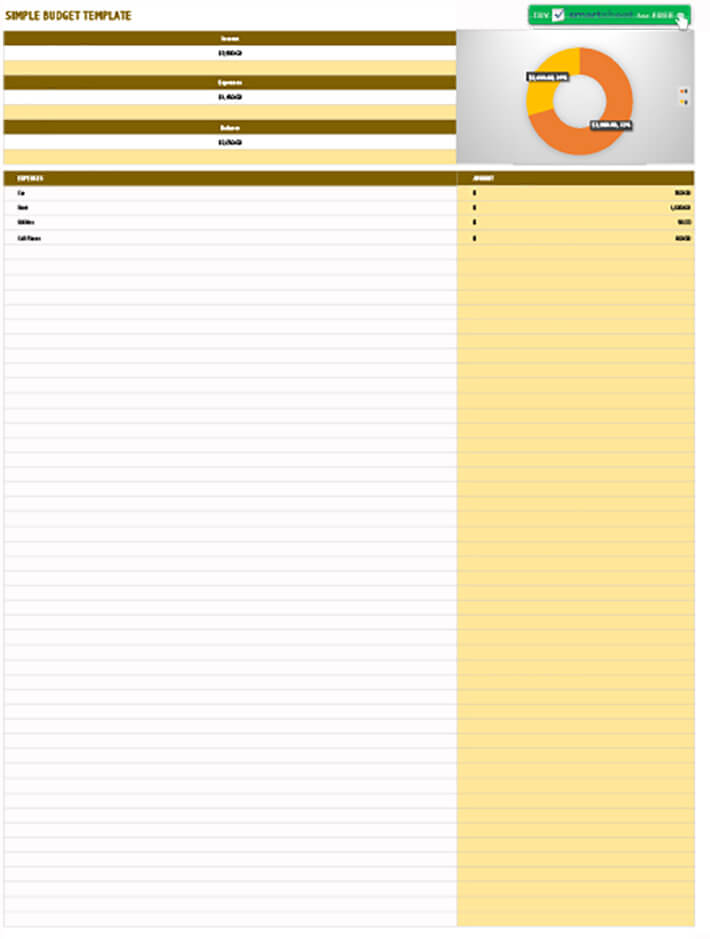

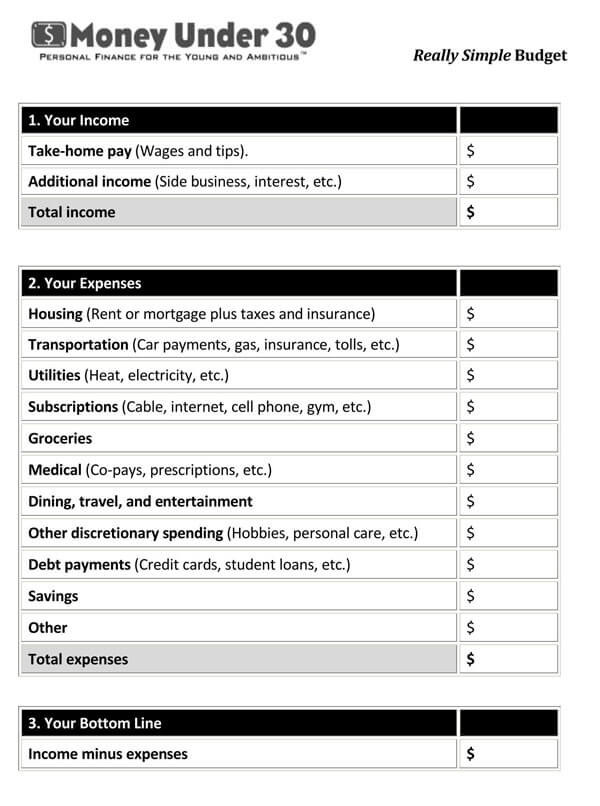

In its simplest explanation, a personal monthly budget template is a categorised document that focuses on how your money is allocated each month. These templates have been proven to ease the management of your money better. Additionally, you can know precisely where your money goes each month. Usually, these templates are either in electronic or printable forms.

Old-fashioned pen and paper may be your go-to, but using a digital option like a spreadsheet, template, or budgeting app may just be more efficient and save you a lot of time and hair-pulling. These will have fields pre-designated for your income and expenses, creating categories to better see your spending, and including built-in formulas to help you get your budget to a surplus or zeroed-out.

How to use

When using a worksheet, you’ll need to track every form of income on a monthly basis. If you get paid twice a month or on a variable schedule, add it all up to be a monthly sum. The same applies to expenses. Divide expenses that aren’t monthly to get the monthly rate and put each expense in the appropriate category column.

How to complete

Just like when you’re building a monthly budget on your own, you’ll need to gather financial documents like statements, bills, and paystubs. For the upcoming month, you’ll write out all of the expenses you’re expecting. Create a column entitled “Monthly Budget Amount” in which you calculate your expenses for the next month. Organise your expenses according to the available categories.

At the end of that month, you’ll fill in the “Monthly Actual Amount” in which you total up the true amount that you’ve spent on those categories. Ideally, these estimates are equal, or you’ve spent less than you expected. Anywhere there’s a difference in totals, record that difference.

Outcome

After you’ve recorded differences, you’ll need to closely analyse areas where you’re spending more than you expected. It may be time to adjust spending in those areas. If you’ve constantly got a surplus at the end of the month, however, you might need to create a category to decide what to do with that money, for example, vacation savings, faster debt repayment, or an emergency fund.

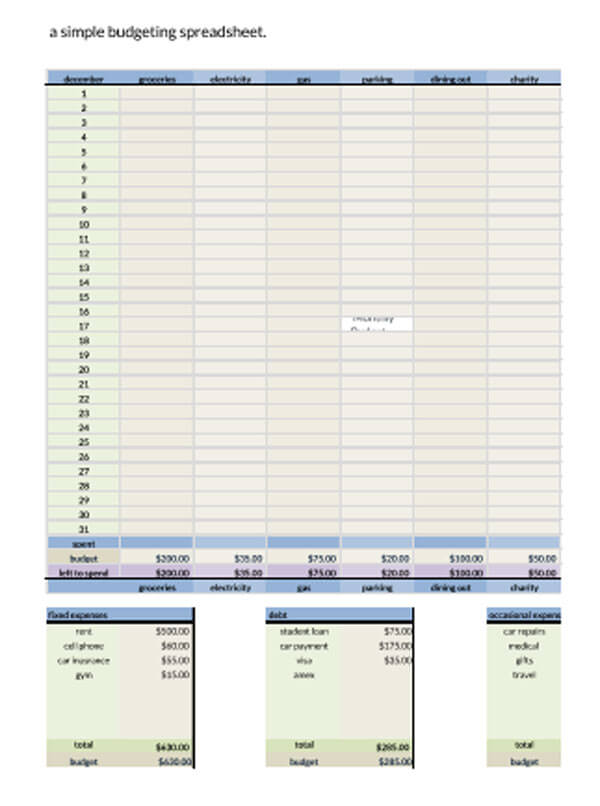

Track Your Expenses

Tracking what you spend should ideally be done on a daily basis and not at the end of the month. Recording what you spend every day will help you make adjustments to keep from overspending and might help you see areas where you’re spending too much or developing a pattern.

Whatever app, worksheet, monthly budget template, or spreadsheet you’re using should allow you to keep track of this. For a few minutes a day, you can be more responsible with your spending.

Notice as you track when you run out of money in one category. The only two options when this happens are to stop spending for that category or move money around to adjust. Using the envelope system may help you to get a grasp on this. Whatever money is in the envelope for that category is all there is.

Once the cash is gone, you’ll have to actively take money from another envelope to keep spending in that category. Using cash may help you to avoid some impulsive decisions to take money from a necessity to fill a void for a non-necessity.

Remember as you track that your goal is to keep your expenses equal to or lower than your income.

Tips to Use a Monthly Budget Template

On frequent occasions, creating a monthly budget template is not only a tiresome process but a daunting one, especially for new users. Therefore, to simplify everything for you, we have provided tips that will guide you through:

Know your income

The first step towards creating a useful monthly budget template has a grasp of all your monthly income. This shouldn’t be restricted only to your salaries and wages. Instead, you should also include other sources of income, including side businesses, tokens, and sales, to mention a few. Also, the salary/wage should be the take-home, i.e., the amount you are left with after accounting for income tax and other deductions.

Identify your expenses

Here, you need to take stock of your monthly expenses. Usually, there are different types of costs, i.e., fixed expenses and variable expenses. Fixed expenses are those that are relatively constant and don’t change whatsoever. They include loan repayment, car payment, utilities, and so on.

On the other hand, variable expenses are those that come once, fluctuate, or pop up unexpectedly. They include entertainment, groceries, and transport, among others.

Focus on your savings

According to financial experts, it’s essential that you set aside some savings for your monthly operations. This will help supplement your monthly income whenever the need arises. Who knows, sometimes the variable expenses might exceed your income, rendering you a financial crisis or debt. I guess you wouldn’t want to go that way. Therefore, to stay financially stable, a little saving is necessary.

Analyse your spending habits

Taking a keen analysis and comparison of your income versus your expenses helps you weigh or determine how much you’re spending every month. However, you should be consistent in your analysis, let’s say for three months to have a good idea of your average amount that should go for various expenses. Also, analysis helps you determine whether or not you need to cut back your spending.

Monthly budget software

Just as mentioned above, you can either use printable or electronic templates. However, if paperwork isn’t your thing, you can still opt for the electronic templates. There are different software that can help you create electronic personal monthly budget templates without much sweat. This software includes YouNeedABudget.com, MoneySavingExpert.com, and BudgetPlanner. Alternatively, you can use Microsoft Excel for a simple budget.

Budgeting Tips

- After a month has been completed, each member of the family should scan over their spending to get an idea of what their wants and priorities are and how much they tend to spend on them. This will help establish a baseline that can be learned from to make smarter decisions and small changes over time.

- Remember that budgets can change for a variety of reasons. Review your spending and needs and tweak as needed. Perhaps your circumstances have changed with your job, housing, children, or goals. Because things change, it’s important to sit down every once and a while and assess what your needs and goals are. If they’ve changed, it may be time to adjust your budget. If you’re working with an app or program, add categories as needed, adjust your prioritised categories, or make cuts to expand one. Your budget should be working for you, and you should not be working for your budget.

- If you pay credit card bills in full every month, list your expenses under their appropriate categories, not under debt. If you maintain a balance that is accruing interest, and you make monthly payments, your expenses should be listed as more than the monthly payment under your debt repayment category.

- Be open to changing your budget categories as you need to. Your budget should be fluid and adjustable.

- For big expenses that you expect, make a category to save up for overtime. For example, if you know you’ve got to get new tires, you can save up over time instead of pulling money around to afford it when the time comes. The same goes for Christmas presents. These are called sinking funds and accounting for them will save you stress later on.

- Use autopay for your necessities. This feature will not only ensure that your bills get paid, but it’s quick and makes it easy to record on your budget sheet. Make sure, though, that if these expenses are variable, that you’ve got the funds to pay those bills by the time the payment goes through.

Frequently Asked Questions

Financial goals like remodelling, vacation, or other big expenses will fit into your savings category. Establish how much you’re hoping to save at the end of a time period, and divide that total amount into monthly savings. If, for example, you’re hoping to put a downpayment on a car in six months at $3,000 dollars, then divide the total amount (3,000) by the number of months, (6). You’ll need to save $500 a month to achieve that goal.

With a balanced budget, income and expenses “zero out.” They are equal. This means there’s neither a surplus nor a deficit.

Using a worksheet can save you time and effort when forming a budget. Keeping close track of the expenses on the worksheet can give you more control over your money and your life. It will also help you to become aware of spending patterns, deficits, surpluses, and expenses that you didn’t account for.

If you find that you’re spending more than you make, you need to make adjustments to bring your budget back to zero or to a surplus. If you have money left over, you may want to put it back into the budget by adding money for a specific category or upping your savings or retirement.