A Rent Receipt is a payment document issued by the landlord of a rental property to a tenant whenever the tenant makes a rent payment.

On the other hand, a rent receipt template is a standard receipt that allows the landlord to create multiple receipts by customizing them to suit his requirements. Thus, it serves as a starting point for the receipt creation.

Alternatively, a rent receipt may also be referred to as:

- Rent remittance voucher

- Rent fee invoice

- Rent proof of payment slip

A landlord may use these receipts if they own a residential unit that they have rented out to tenants who make monthly payments. Similarly, they may also use a rental receipt to document a one-time rental charge, for example, when a person leases a private home for a holiday.

You may opt to retain copies of the receipts you issue to your tenants for record-keeping or to enter receipt details in the rent tracking system.

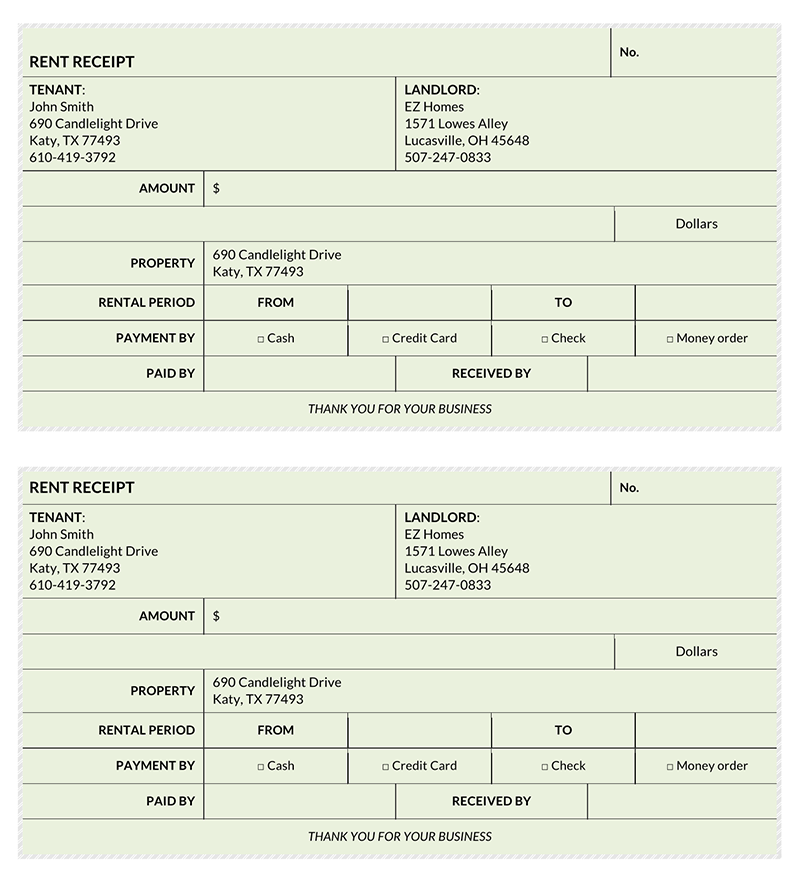

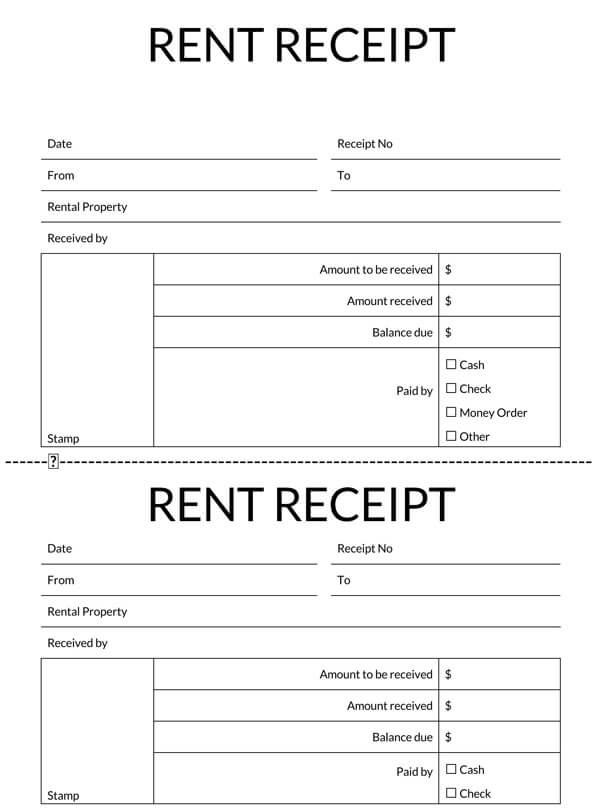

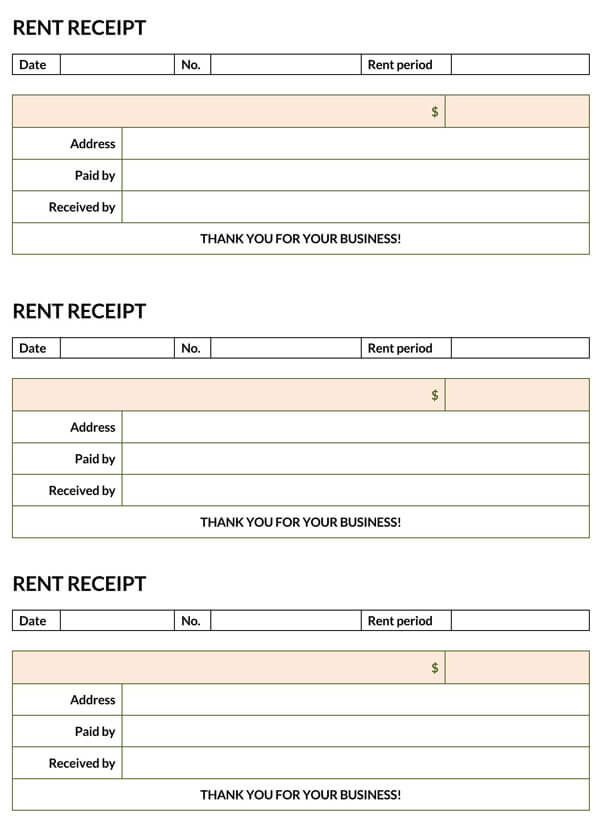

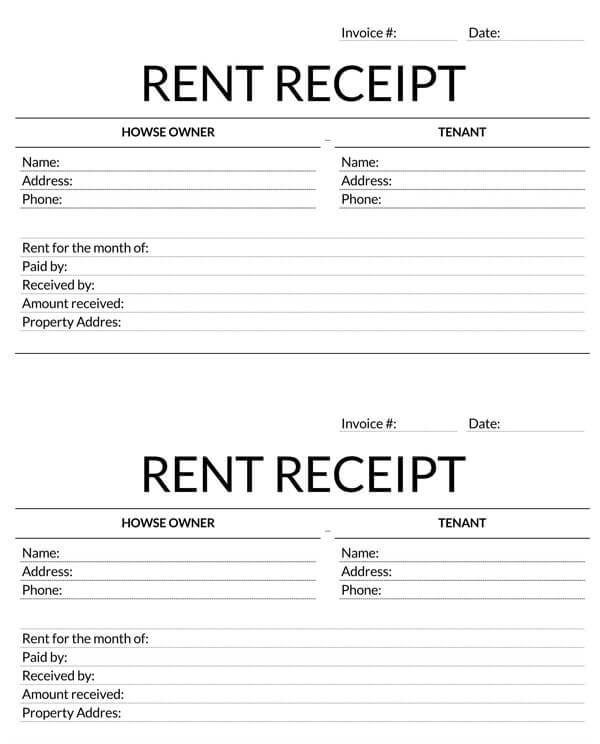

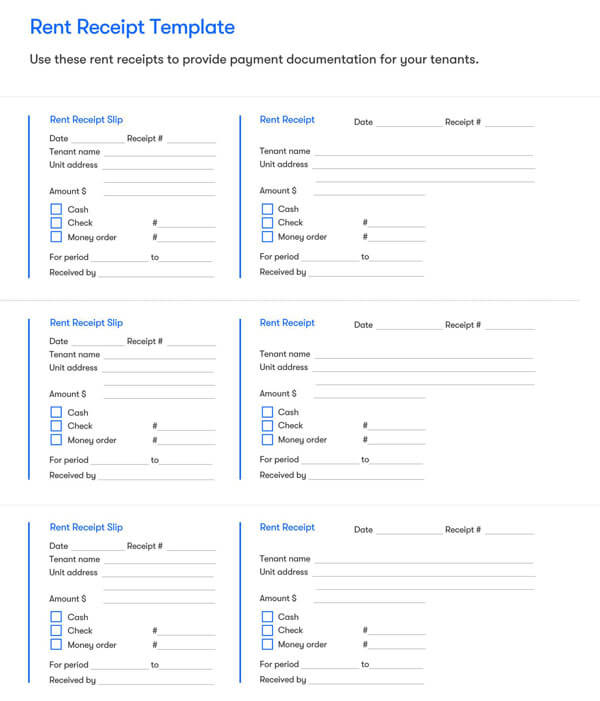

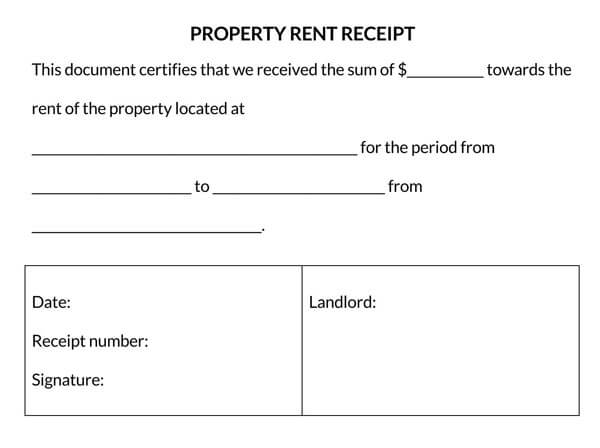

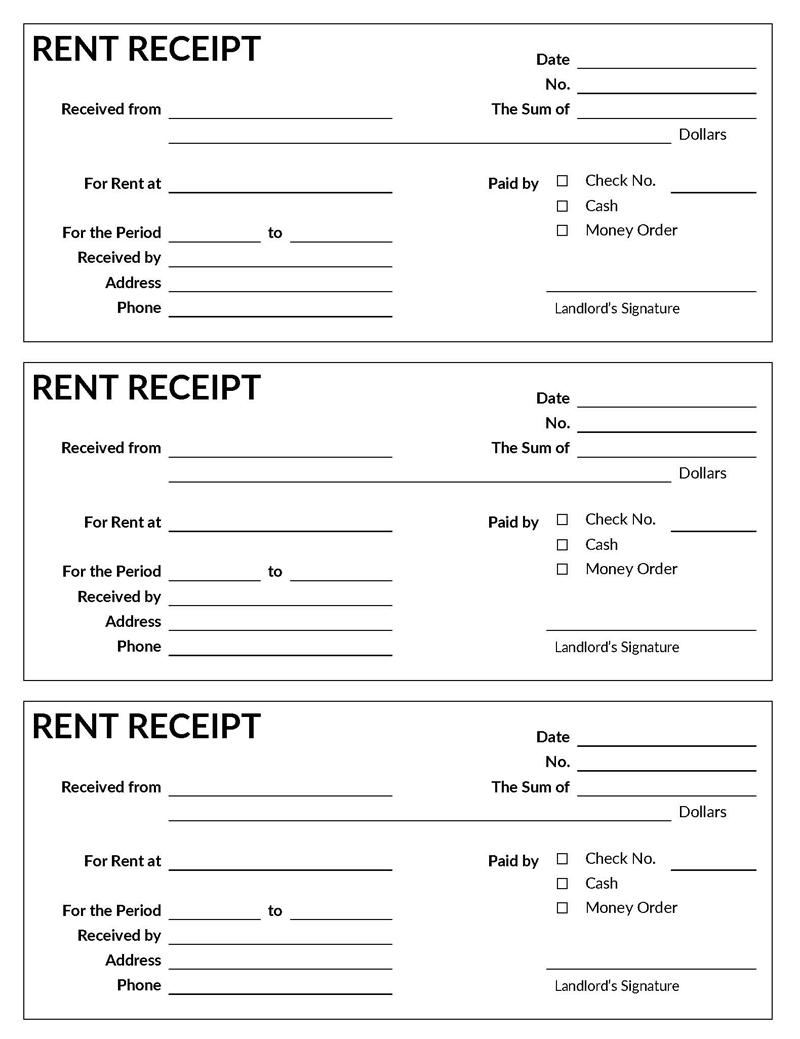

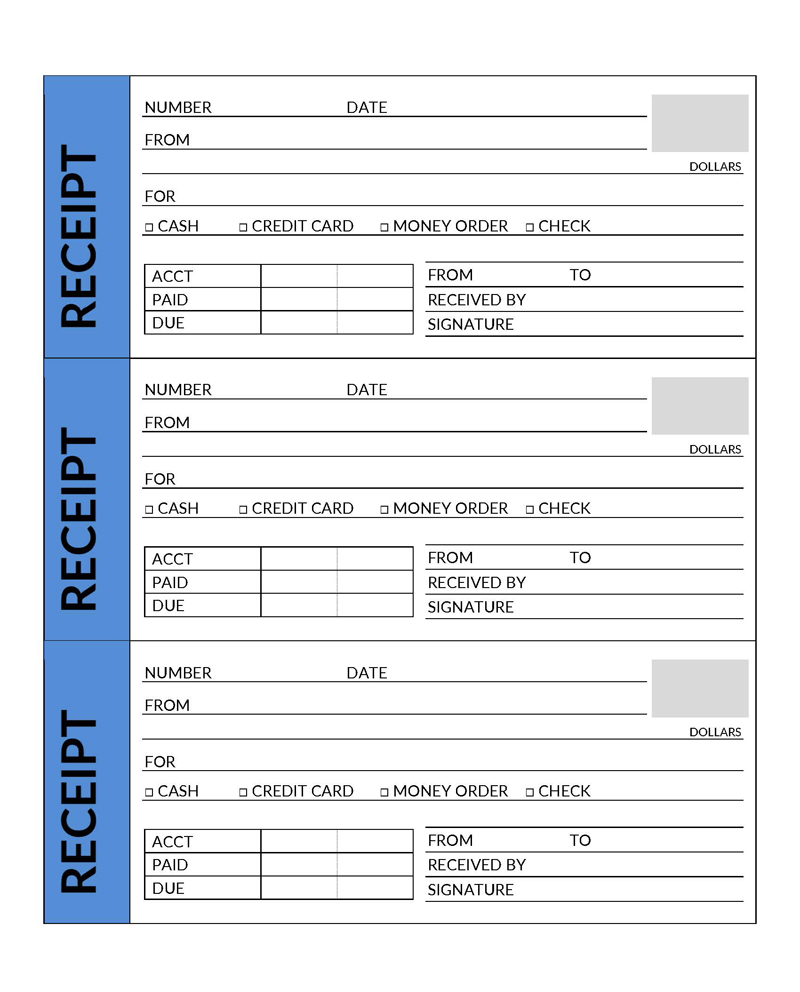

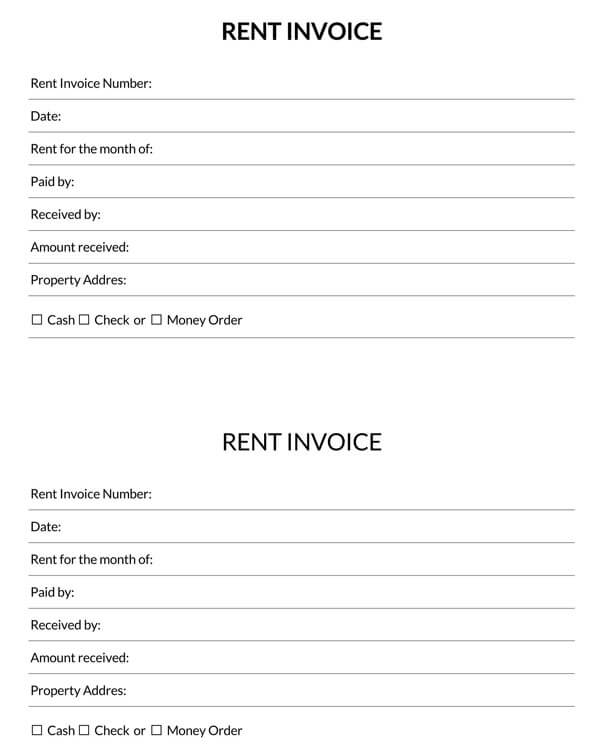

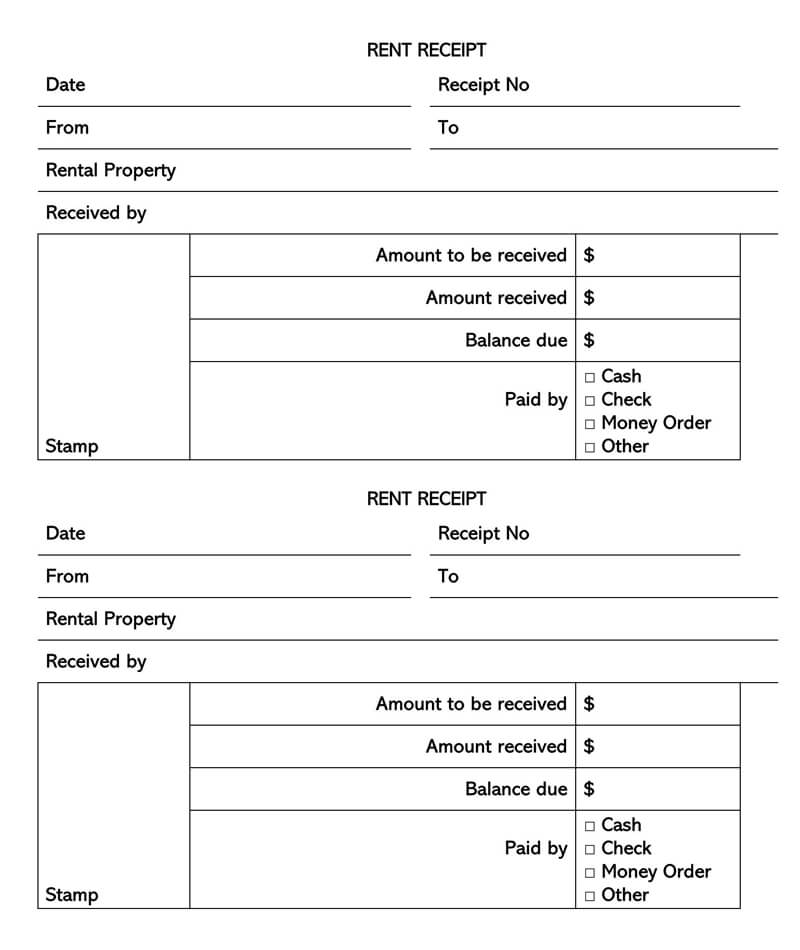

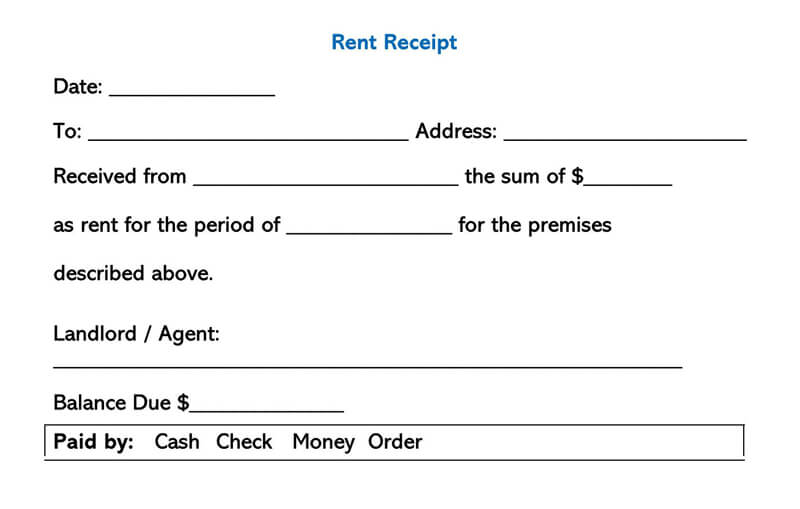

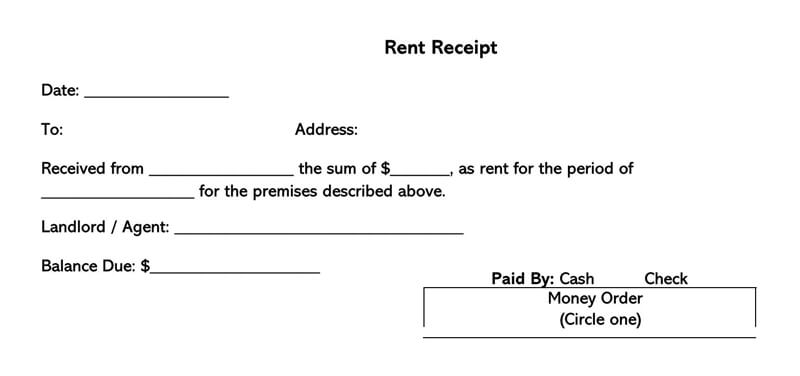

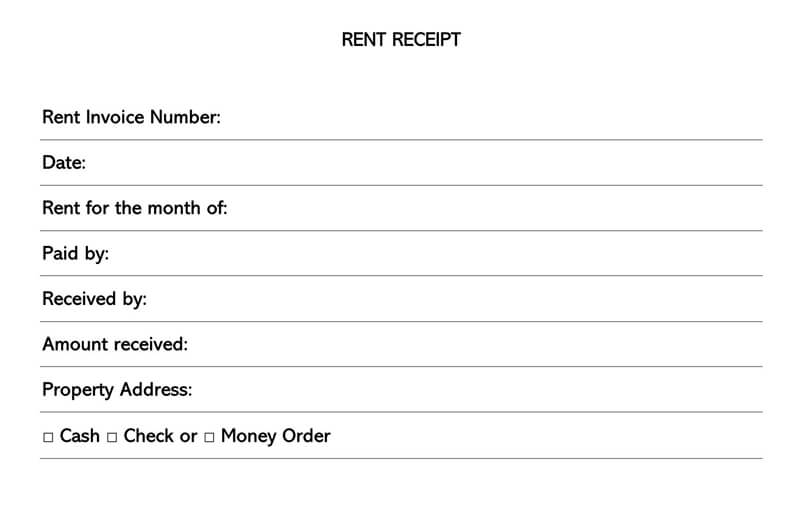

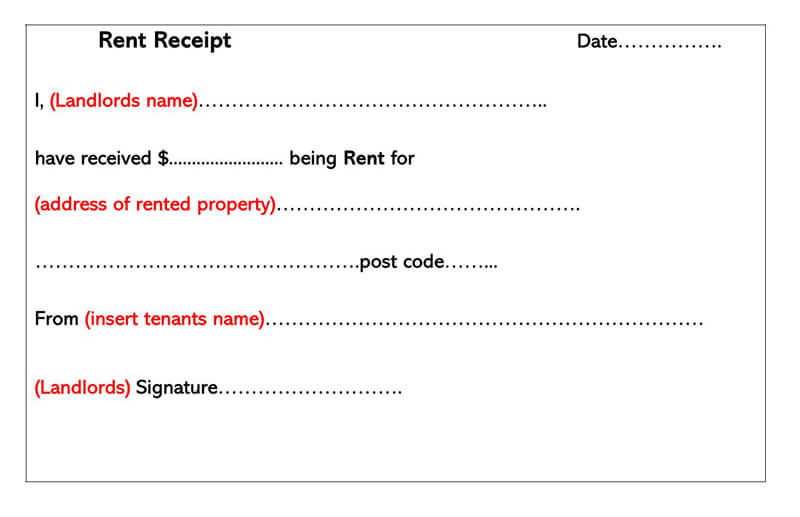

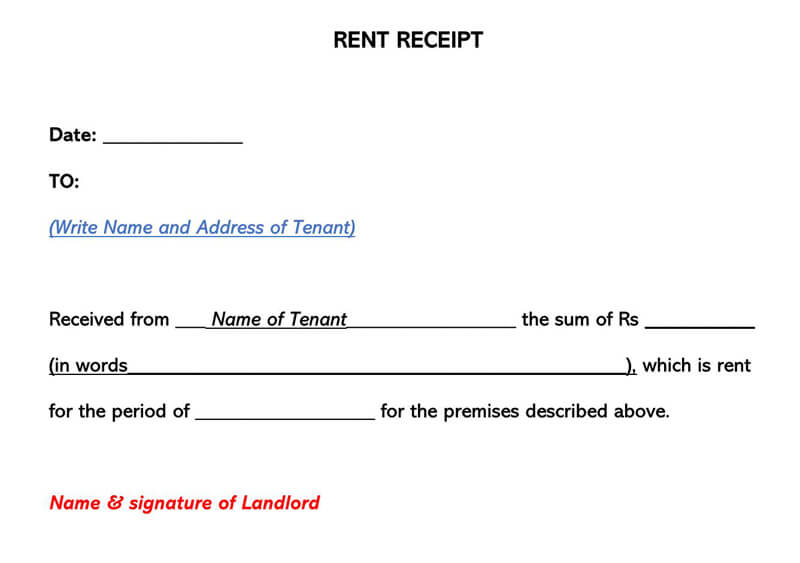

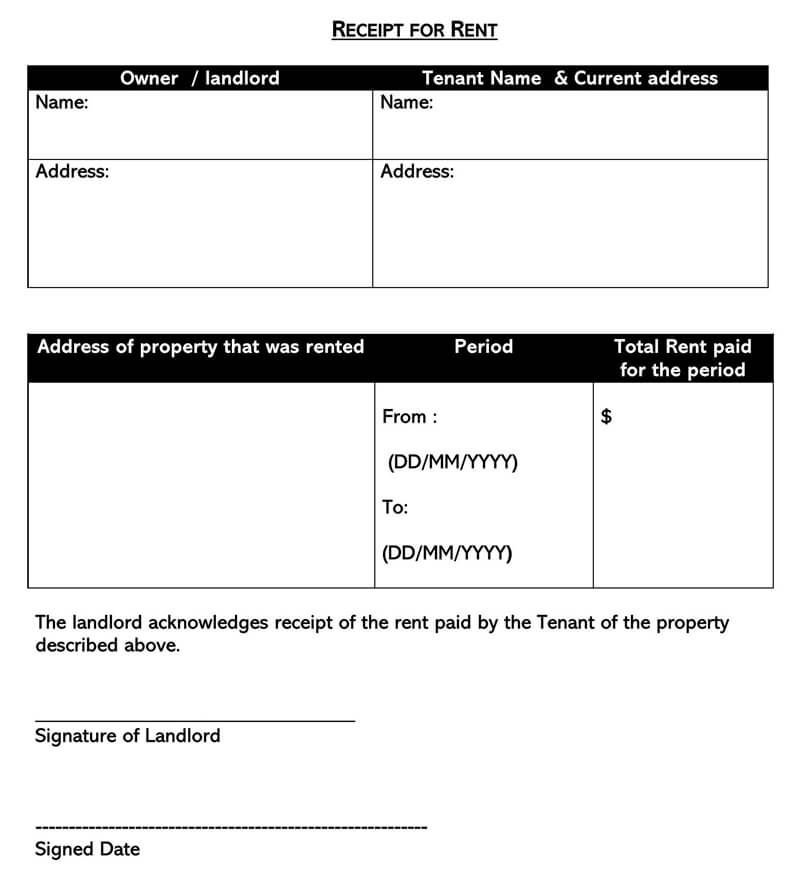

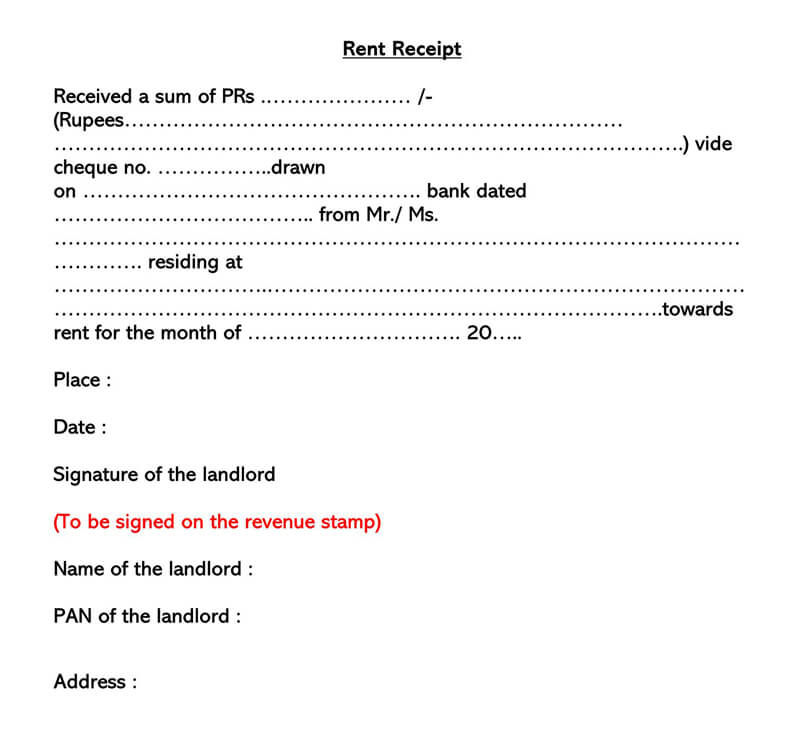

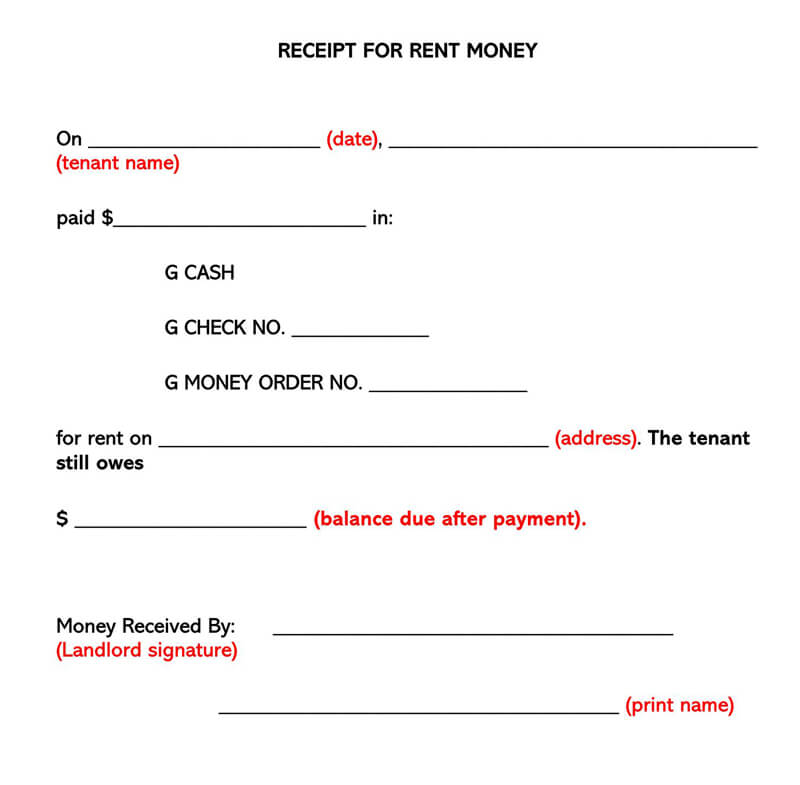

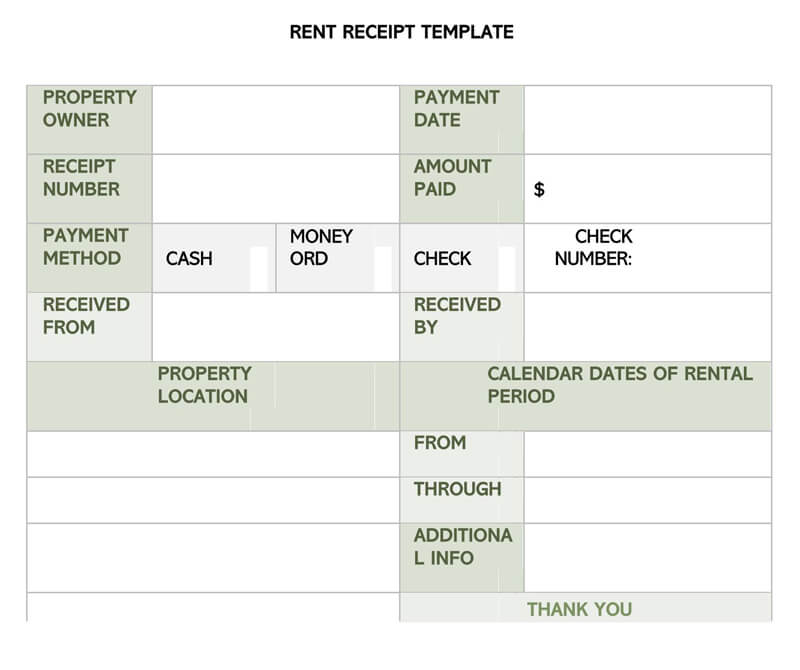

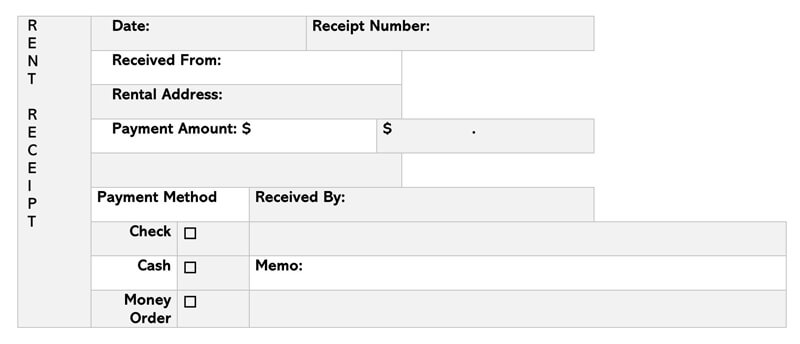

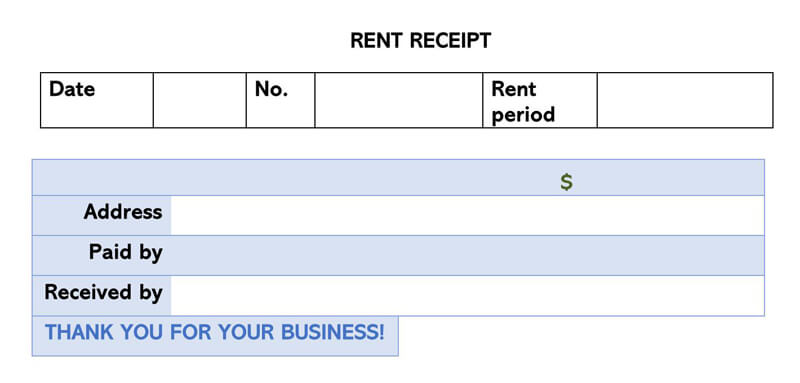

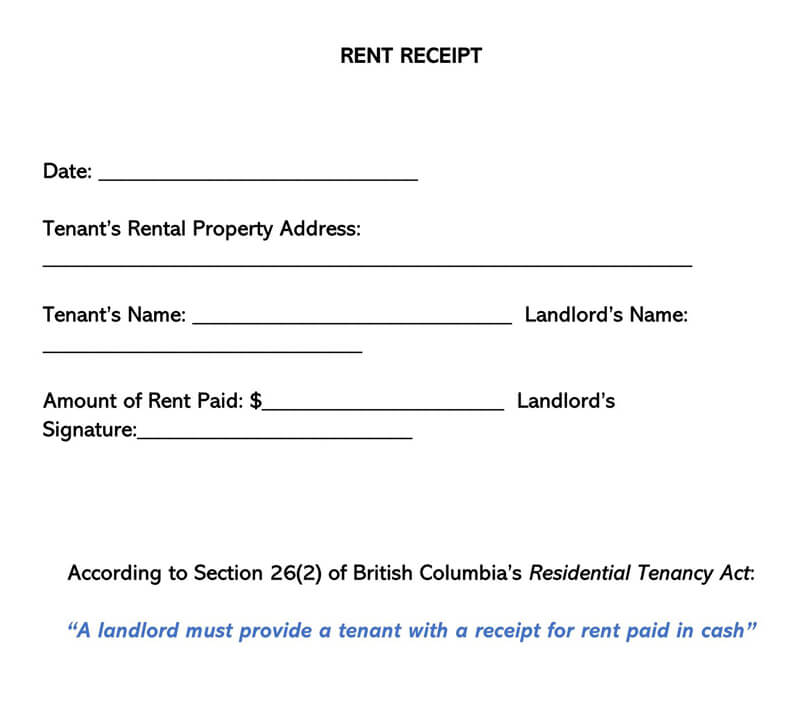

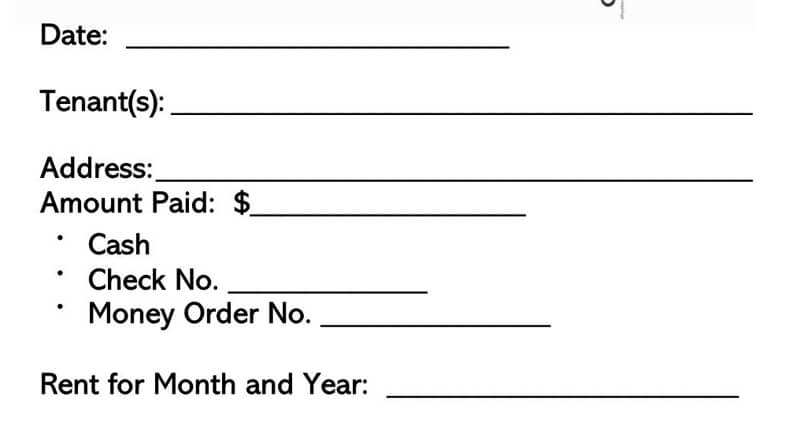

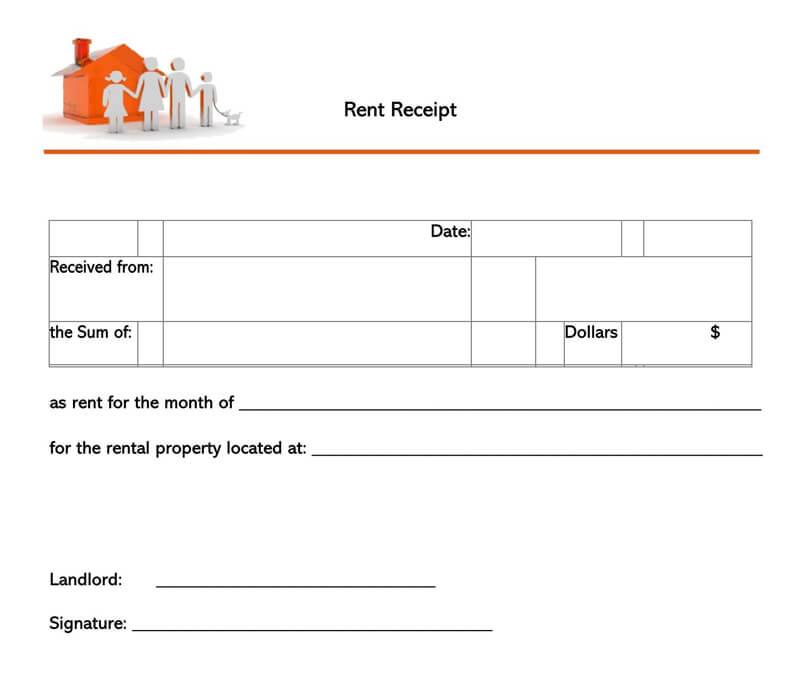

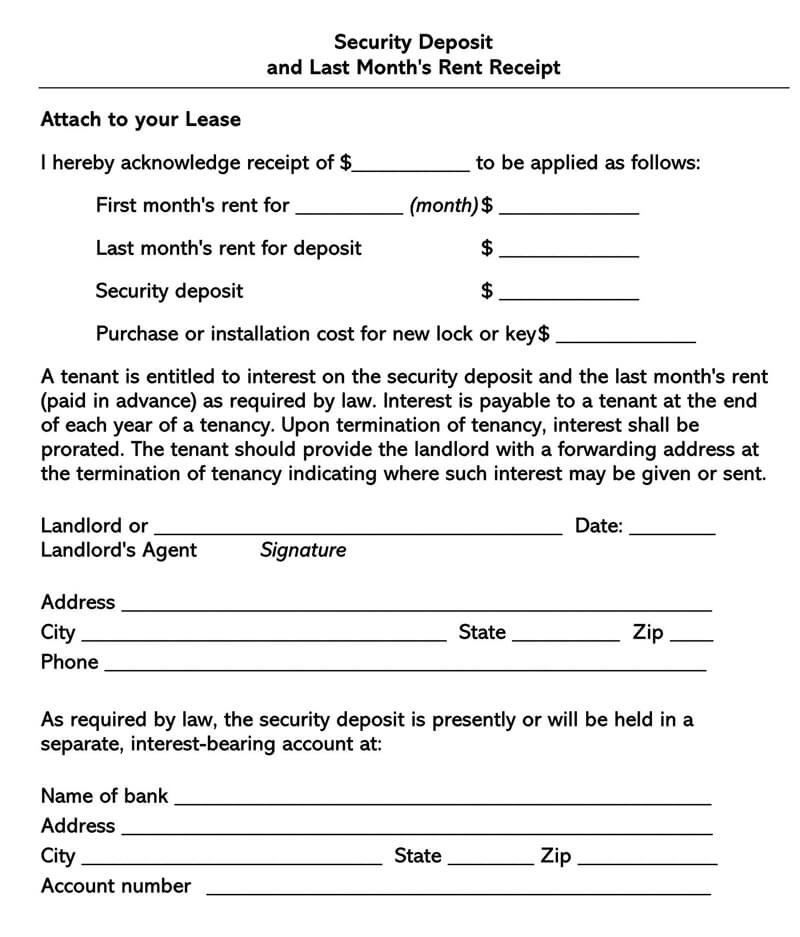

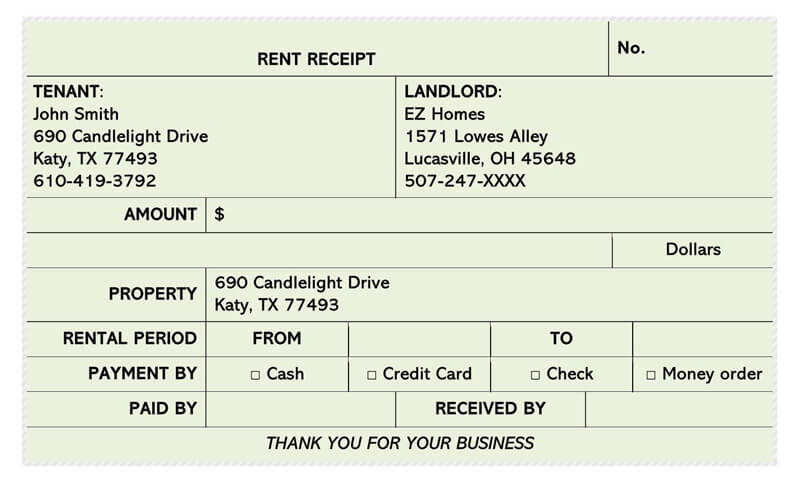

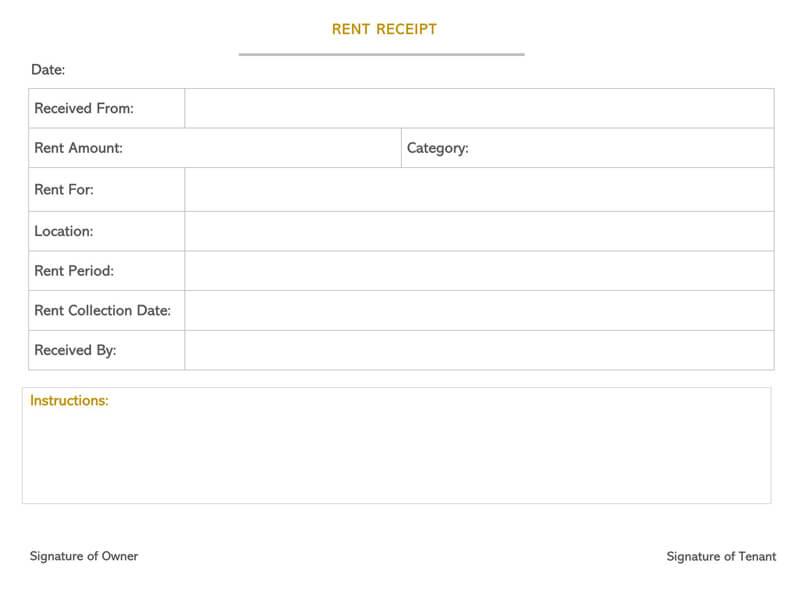

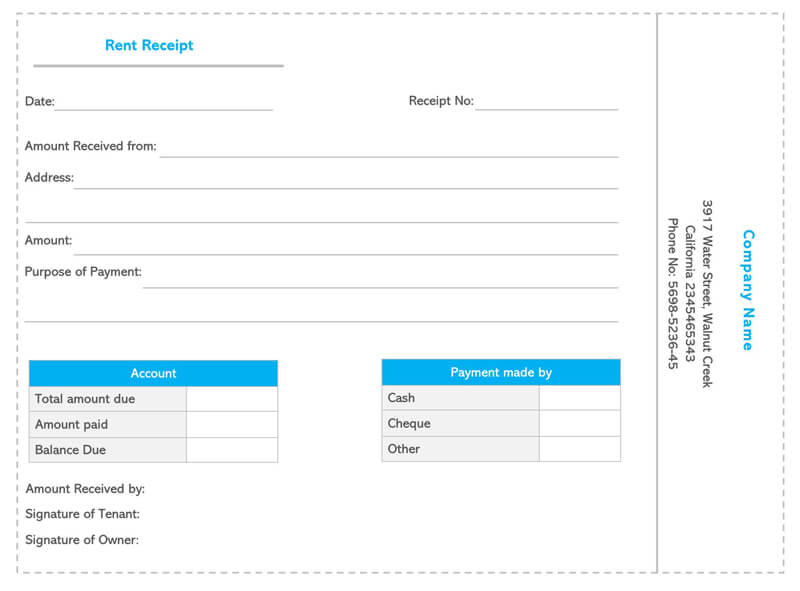

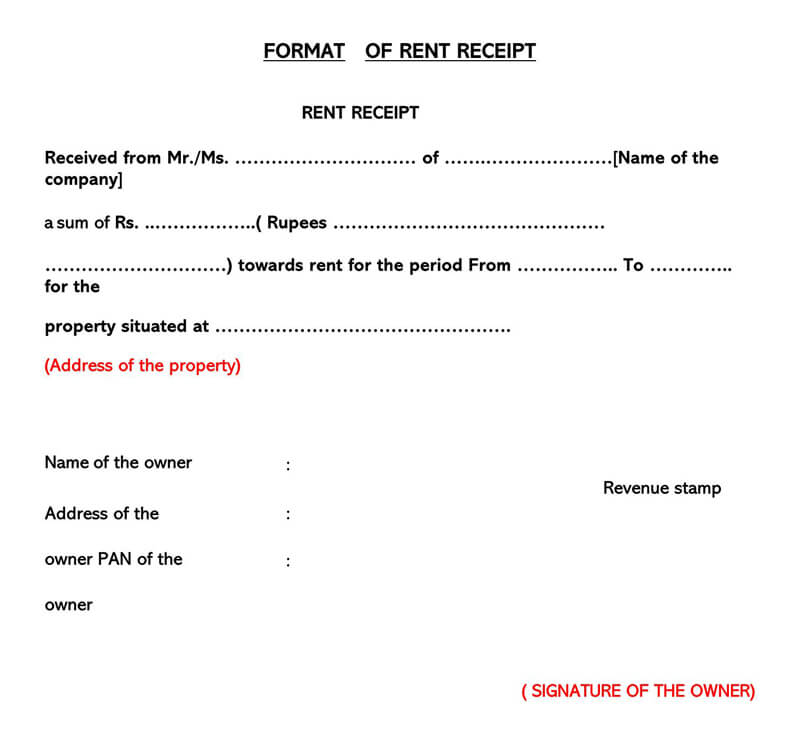

Free Rent Receipt Templates

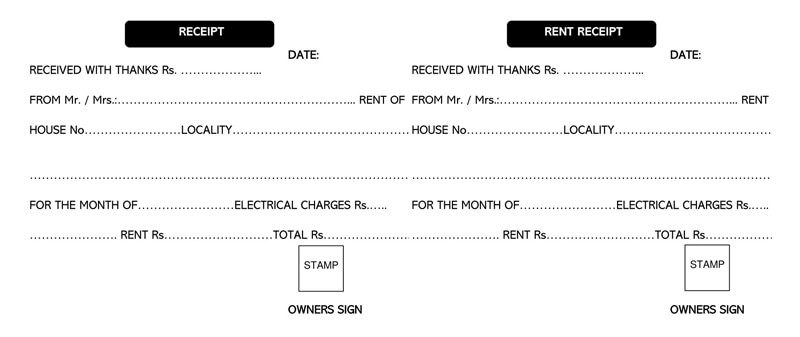

Rent Receipt Books VS. Rent Receipt Template

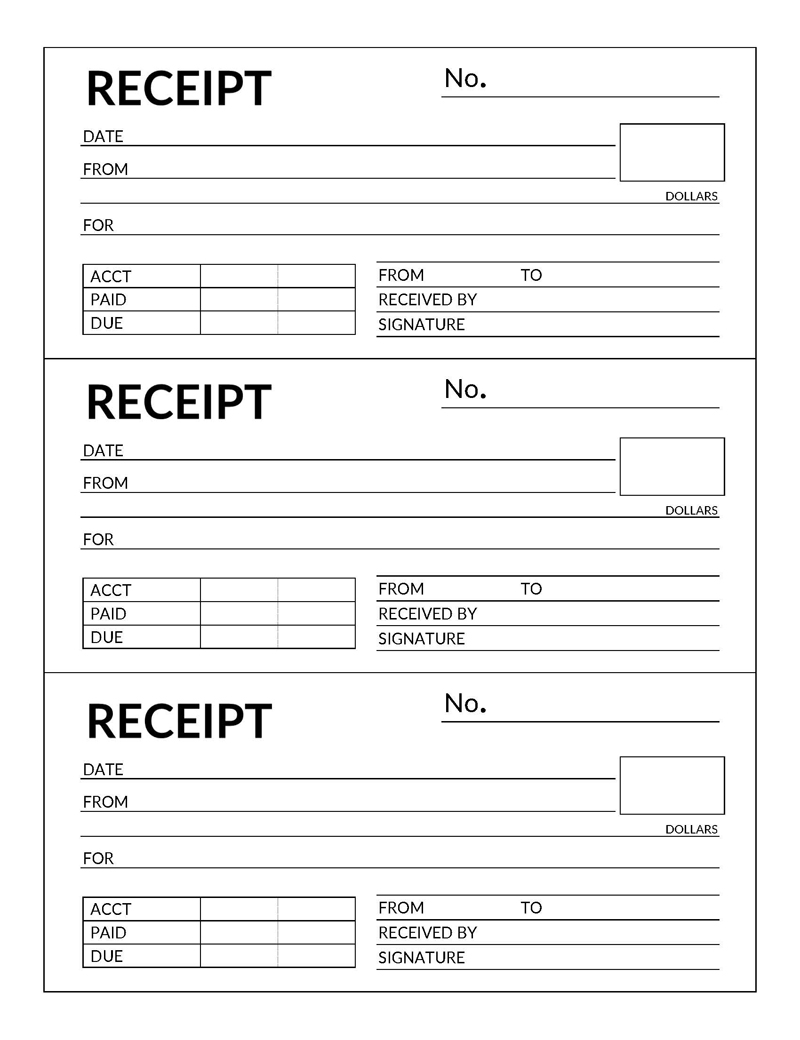

A rent receipt book refers to a book containing sheets/ forms that can be purchased, filled, and then issued to tenants upon rent payment, while a rent receipt template is a form that allows the landlord to create receipts by customizing the template to suit their requirements.

Pros and Cons of a rent receipt book

Following are the pros and cons of a rent receipt book:

Pros

The use of a rent receipt book offers several advantages to the user, the landlord. Among them is its ease of accessibility. The receipt books can be purchased from retail shops all over, at average prices. The receipt books do not demand any special expertise to use since they are very straightforward when it comes to filling out the rent payment details. Another advantage is that the rent receipt book does not require access to the internet since they are manually filled.

Cons

The usage of receipt books has a variety of drawbacks. Receipt books are sold in the form of already printed hard copies, which make it difficult to customize them. The landlords are therefore limited to using them in their original state, even when they do not suit all the intended needs. For instance, you may have to use a slip that does not have the logo since it might not be included during the designing of the receipt book. Additionally, the landlord risks using all the receipt copies if the receipt book is lost or destroyed. The landlord may also find it difficult to organize the receipt slips, especially if they are detached from the receipt book.

Pros and Cons of a rent receipt template

Following are the pros and cons of a rent receipt template:

Pros

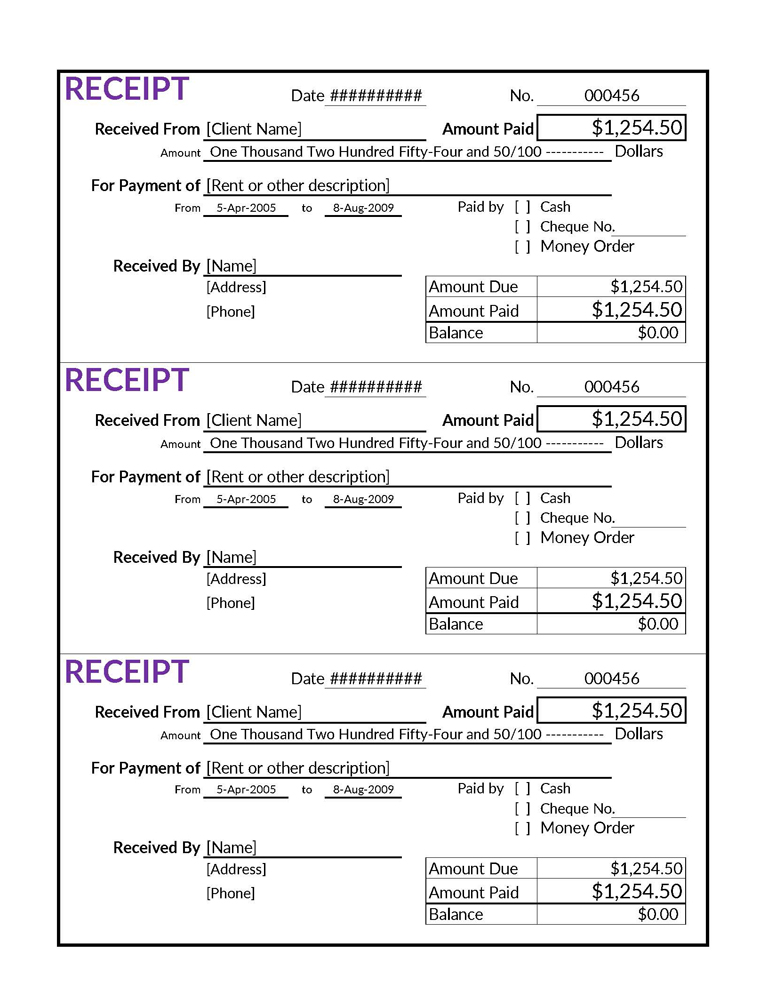

A rent receipt template is easy to customise, update and replicate. The landlord has the privilege to tailor the receipt template into any design that he finds appealing and also include all the information that he finds fit and necessary. Receipt templates exist in electronic form, which makes it easier to save the files online or on other storage gadgets. Additionally, the availability and accessibility of these templates have been made easy by the current technology, and therefore, landlords can easily download these templates for use in their business.

Cons

Some of the drawbacks of using a rental receipt template include difficulties in transitioning from one rental receipt software package to another. This could be due to regulatory requirements, difficulties in data transfers, and a high initial cost of software purchases. Additionally, full implementation of the rental software requires high technical knowledge, as well as internet access by both the landlord and the tenant; hence the software cannot be used if the two parties have no access to an internet connection.

Reasons for Using Rent Receipts

The following are various reasons why a landlord should always issue a rent receipt:

Create a paper trail for cash payments

A rental receipt gives evidence of payment for the money that cannot be tracked, as some rental payments may be made using cash. You will need a means of recording your rental payments if you are usually audited. This can be achieved by using receipts.

Mandatory in some states

Some states compel landlords to give a receipt when requested. There are different laws in different states, with some states requiring receipts for every payment method while others only ask for receipts for money orders or cash payments.

To simplify record-keeping

Landlords should use rent receipts to record financial transactions like any other business owners and managers. Therefore, you need to store copies of receipts after each payment by the tenants.

They help to minimise disputes

If by any chance a tenant alleges that their rent has been paid, the allegations can be answered by a rent receipt or lack of one. If any rental concerns grow, a comprehensive record of payments received may increase your confidence and support your argument in solving the dispute.

If you are worried that a tenant may use a rent receipt to proclaim that the rent was paid when a check bounces off, don’t worry because these receipts cannot protect an individual whose check bounced, and you will still be able to follow up to get the payment. Also, a returned check is sufficient evidence of the non-validity of the payment.

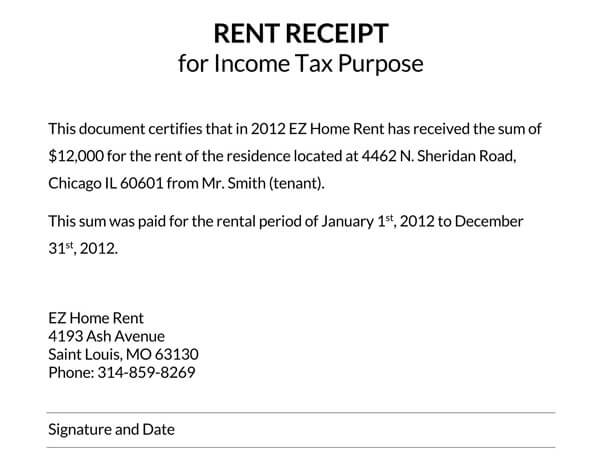

Makes tax credit easier to claim

Some countries offer tenants tax subsidies. Renting receipts guarantees that your tenant can prove that the payments have been paid to facilitate their claim for a tax credit if extra proof is required.

Rental history

Various factors are essential to landlords during the screening of tenant applications, including the rental history of the potential tenants.Rent receipts might be useful to establish a solid history of payment for a tenant.

Receipt Templates (Word)

How Rent Receipts Work

Below is the procedure that you should follow when issuing these receipts:

Accept the rent

Collect the rent payments by your payment agreement with the tenant. The payment may be collected in cash or transferred electronically.

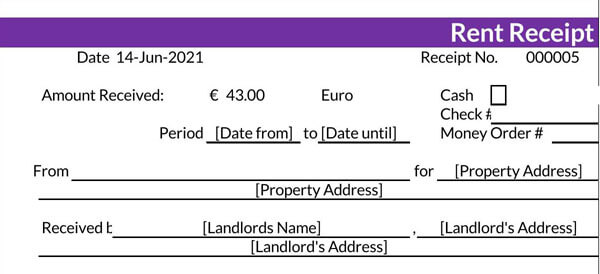

Write and sign the receipt

On this receipt, write the tenant’s name, indicate the amount paid, the payment date, and the rental period. Then sign the receipt.

Keep the original and send a copy

Hand over a copy of the receipt to the tenant and retain the original copy. Here are several ways for sending a rent receipt to the tenant:

- Send a PDF copy of the this receipt to the tenant via email

- Print and mail a copy of the rent receipt to the tenant

- Print it out and personally hand it over to the tenant

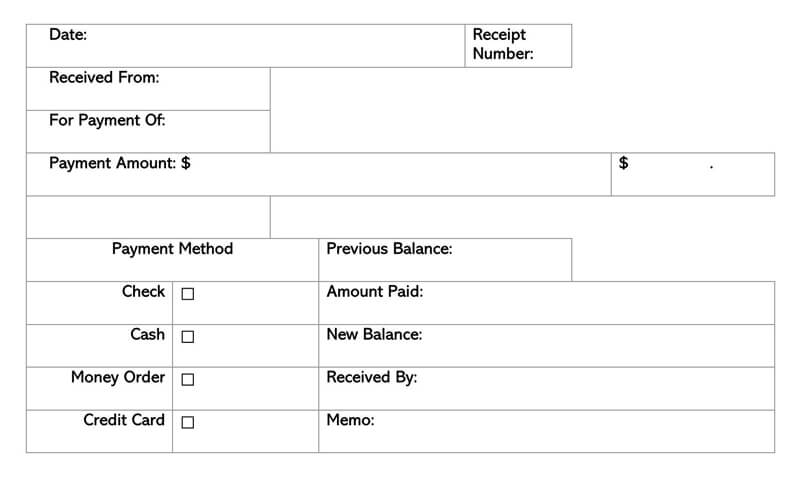

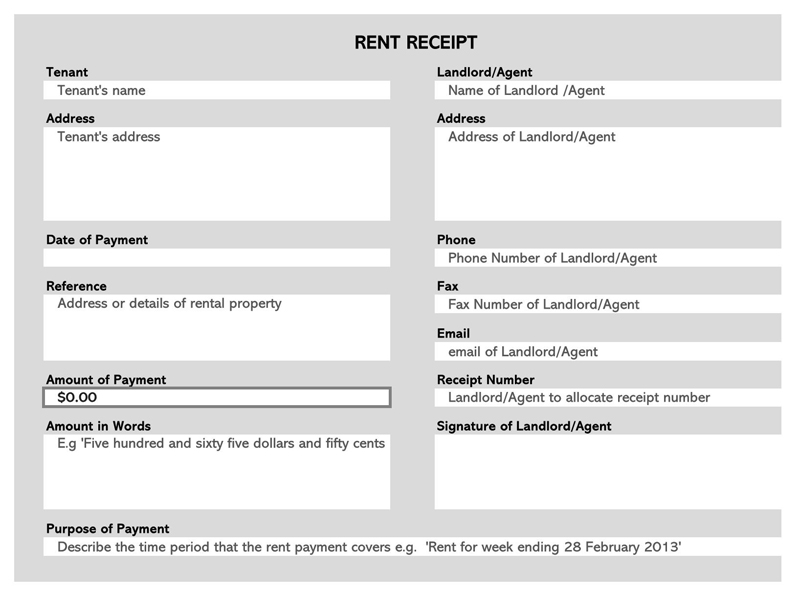

What to Include in a Rent Receipt

The following are the essential components that you should include in a rent receipt:

Date of payment

It is important to indicate the date when you received the rental payment from the tenant. Enter the date in mm/dd/yyyy format.

Receipt number

Assign each rent receipt a unique number to give each of them a unique identity. This will help differentiate rent receipts collected from different tenants.

The total amount paid

Write the sum of the amount paid. This will serve as proof of what was paid in case a dispute regarding the amount paid arises.

Name of the landlord

Write your full name. This will help resolve any rent payment issues with ease since it affirms that you are the individual who wrote the receipt.

Address of the rental

Indicate the property address on your receipt. This gives the receipt a clear identity of its source. Include street address, city, state, and ZIP code.

Tenant’s details

It is necessary to write essential details of the tenant, including their full name, address, and phone number. This helps to identify the tenant with rented property.

Details of the person who made the payment

It is very important to add details of the person who made the payment on behalf of the tenant. This will make it easy to resolve any issues that may arise concerning the transaction made.

Rental period

Indicate the accurate period for which the payment was made by the tenant. For example, May 1-31, 2021)

The remaining balance and late fees

The landlord should also indicate the remaining balance and late fee on the rental receipt, when necessary.

Other terms

Other terms that should also be added at the end of the rent receipt include the following:

- Payment method- Indicate whether the payment was made using cash, e-wallets, bank transaction, check, etc.

- Other fees or services- When necessary, state other fees or services other than the rent that the payment might be associated with.

- “Received by”- Indicate that you are the person who received the payment. In instances when another party or individual (e.g., a caretaker, manager, or agent) receives the rent payment on your behalf, they should indicate their names.

- “Paid by”- Write the name of the individual who makes the payment, regardless of whether it was the tenant or any other person who transacts on their behalf.

Signature of the landlord or manager

Whoever writes the receipt should add their signature at the end of the receipt to verify that the rent has been paid and collected by the tenant and the landlord, respectively.

More Templates

Receipt templates (excel)

Dos and Don’ts for Providing Rent Receipts

Below is a summary of dos and don’ts for issuing receipts to your tenants:

Dos for providing rental receipts

- You should provide rent receipts if you are compelled to do so by the laws of your country or state or when requested to do so. Rules surrounding receipts vary in different nations and states. In some jurisdictions, failure to provide rent receipts may attract heavy fines. For this reason, it would be wise that you issue the receipt after every rent payment, regardless of whether the law compels you to do so or not.

- Maintain every receipt for your records and, if possible, in a secure location.

- Use a rent receipt template to ensure that you cover all the relevant details when preparing the receipts.

Don’ts for providing rental receipts

- Do not issue rental receipts before the tenant makes the payment

- Do not fail to sign or add the official stamp on the rent receipt

- Do not leave out the outstanding balance owed by a tenant when generating a receipt for recurring payments

Consequences of Not Using a Rent Receipt

The failure to use these receipts might attract dire consequences. Below are some of those:

Defaults

If and when the tenants discover that the landlord does not keep an accurate record of the receipts, they may take advantage and skip a payment altogether. Alternatively, they may also lie that they have indeed remitted payments yet in reality they have not.

Poor litigation

In case any dispute touching on rental payments spills over to the courtroom, the landlord may be at a disadvantage with regards to defending himself. He may not produce the exhibits to showcase that indeed the tenant was paying his dues as required or not paying at all.

Insecure tenants

For any business to blossom and flourish in the long run, there has to be some trust and security among the key players. Failing to maintain the records will eat away some trust and sense of security from the tenants. This may, in turn, harm the rapport between the landlord and the tenant that eventually diminishes the revenue inflow.

Reduced revenue inflows

Just in the case, the issue persists for an extended duration of time, the affected landlord may suffer reduced revenue inflows. Considering that the landlord exists primarily to make a profit, such a reduction may severely harm his standing and stay in business.

Conclusion

This article gives details about rent receipts, including the reasons for their use, the procedure for issuing these receipts, the essentials of receipts, and also offers guidelines on the usage of the same. The details of this article have been well-researched and consolidated to assist landlords in issues concerning the use of rental receipts.