A Single-member LLC Operating Agreement documents specify how an LLC company owned by one member operates and affirms the separation between the LLC and the owner’s personal property.

A single-member LLC ensures the owner is not liable for the LLC’s financial and legal liabilities. Additionally, it benefits the sole owner as the company’s net revenue can be taxed at the same rate as the owner’s income, meaning the LLC does not pay applicable taxes as an entity.

The operating agreement also defines the roles and responsibilities of everyone involved in running the company, from the owner, manager(s), registered agent, officer(s), or any other person at the key position.

The IRS stipulates that a single-member LLC or “disregarded entity” is not separate from the owner’s income for tax purposes unless it files Form 8832 and explicitly declares to be deemed as a corporation. However, the single-member LLC is a separate entity regarding employment tax and certain excise taxes.

A single-member LLC operating agreement is alternatively known as a sole-member LLC operating agreement.

Note: Since a single-member LLC operating agreement has only one signatory, it is advocated that the document be notarized to be stamped for authentication.

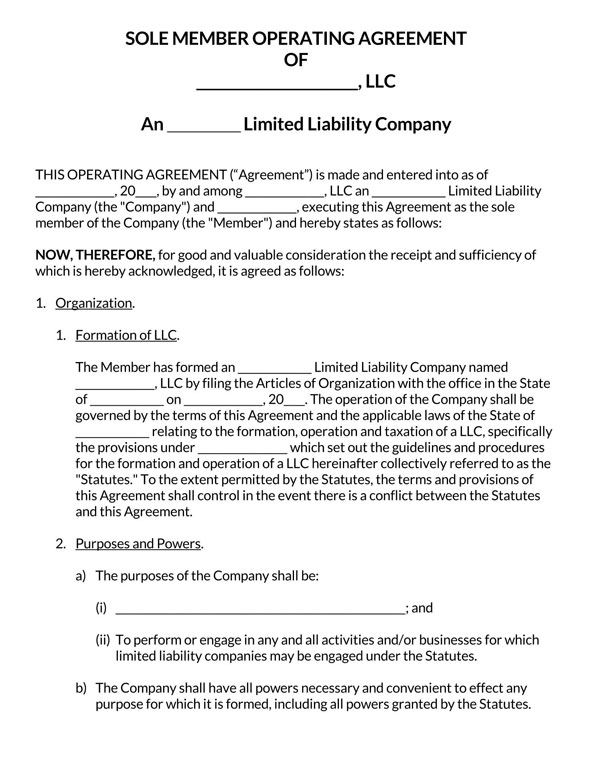

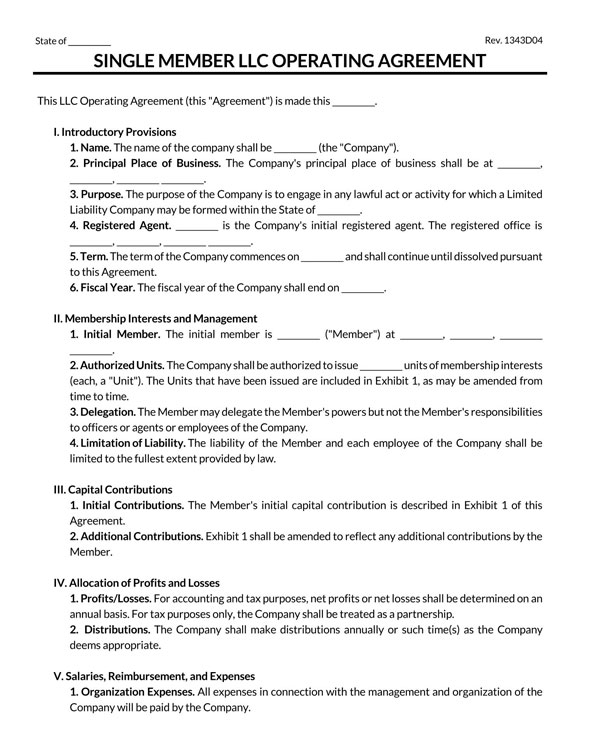

Operating Agreement Template

Single-member LLC vs. Sole Proprietor

A single-member LLC and a sole proprietorship are similar in that they are both ownership structures where one person owns the company.

Also, taxes of both a single-member LLC and a sole proprietorship can be passed to the owner. The owner is consequently required to declare any “passed through” income tax through a Schedule C tax form attached to the owner’s tax return. Single-member LLC owners have the flexibility to be taxed as a C or an S corporation if they qualify as one. This provision does not apply to sole proprietors.

A sole proprietorship business structure does not have the limited liability protection offered by single-member LLCs to owners. A sole proprietorship has no legal separation from its owner, meaning the owner assumes any financial or legal liability of the business.

An owner additionally, a sole proprietorship has limited guidelines of governance than an LLC because the business and the owner are deemed to be one entity. On the other hand, An LLC has to be operated as an LLC, separating the business from the owner. An annual report should be sent to the state to ensure the business is not abusing its limited liability powers.

Lastly, a single-member LLC has more restrictions and regulations imposed on the owner and the business than a sole proprietorship. A single-member LLC owner must file an annual report and separate the business activities from personal activities, unlike a sole-proprietorship where they are treated as a single entity. Single-member LLC owners must also run the LLC following state-specific restrictions for it to remain a limited liability company.

Why Single-member Agreement?

There are multiple incentives for single-member LLC owners to adopt an operating agreement to facilitate the governance of their LLC.

This article will look into some of these reasons why an operating agreement is a crucial document:

To prove separation

A business can face debts, lawsuits, claims, or any other liabilities. These liabilities can easily be directed towards the owners of the business. An LLC ensures this does not happen by ensuring that the owner’s assets are separated from the business. An operating agreement solidifies this “limited liability” accorded by an LLC business structure.

Define succession

An operating agreement ensures that an owner defines how assets and liabilities of the business should be distributed, how the business should be dissolved, or the LLC owner needs to transfer ownership to a beneficiary, etc.

High rate of credibility

The credibility of single-member LLCs with an operating agreement is held in high regard by external parties such as investors, banks, creditors, etc. Therefore, an operating agreement is an indication of proper governance in an LLC.

Define your rules

An LLC operating agreement gives an owner more control over their business by defining their policies, management structure, and rules and regulations.

Tip: An operating agreement can be a state requirement or not, depending on state laws. Single-member LLCs formed in California, New York, Maine, Missouri, and Delaware must have an operating agreement, whereas, in the other states, it is highly recommended.

How to Write Operating Agreement?

Owners of single-member LLCs can write their operating agreements if they do not want their company to be governed by default LLC state laws. Therefore, knowing what to include in the document is essential if they want to have complete independence.

Below is a definitive step-by-step guide on how to achieve this:

Company details

Company details such as the effective date (first day of operation), name of the LLC, principal location of operation, and the type and purpose of the LLC are the first items to be noted on a single-member LLC operating agreement.

Registered agent

The appointed registered agent and office is then identified by providing their name and address as stated in the Articles of Organization. Contact details are also added for clarity.

Ownership

A single-member LLC operating agreement needs to clarify that the owner possesses 100% ownership of the LLC. The sole owner’s voting rights, powers, and obligations are also indicated in this section of the operating agreement.

Management

Next, the operating agreement indicates the management structure adopted by the sole owner. For example, Single-member LLC can either be managed by the owner or appointed manager(s). For a manager-managed LLC, it should clarify the roles, responsibilities, and compensation of each manager.

New numbers

With a single-member LLC, there is always a likelihood that a new member will join in the future. As a result, the single-member LLC will have to be converted to a multi-member LLC, which ultimately means the operating agreement must be modified to accommodate the new member. Therefore, a straightforward laid-out procedure of adding new members should be spelled out in the document.

Capital contributions

The subsequent section needs to indicate the capital investment made by the sole owner towards the LLC. Any tangible or intangible assets like cash, promissory note, real estate, etc., contributed towards starting the LLC should be declared. The required capital contributions of incoming members are also discussed in this section.

Payment

A single-member LLC operating agreement needs to indicate how the owner will be compensated. For example, details such as whether the payment will be salary-based or periodic lump-sum payments, etc., can be indicated. This information is necessary for tax purposes; tax agencies must see that the LLC is separate from its owner.

Succession and dissolution

Single-member LLC owners need to plan for the dissolution and succession of the LLC in case of events like death, legal or physical incapacitation, resignation, bankruptcy, etc. The operating agreement should state the beneficiary or heir to assume ownership of the LLC if need be. Sometimes, the LLC may have to be dissolved; therefore, a well-laid out plan of dissolutions should be written.

Governing laws

Next, is the jurisdiction under which single-member LLC will be operated. Note that, in some states, all LLCs ought to have an operating agreement. However, in states where an operating agreement is not compulsory, it is essential to declare the governing laws. This is done by indicating the name of the particular state.

Notarized signature

To finalize the writing process, single-member LLC owners have to sign the operating agreement in the presence of a notary public. The notary provides an official stamp and signs to validate when the operating agreement came into effect.

How to Form Single-member LLC?

Forming a single-member LLC is straightforward and must be duly followed to ensure the LLC is compliant. Key steps followed in this regard are as indicated below:

Determine the entity’s name

The business must first be assigned an official name. This will involve conducting a name search with the state’s department of corporations or in the USPTO Trademark Database to check if the preferred name is available for use. Look out for terms restricted for use in naming business entities.

The name must contain a designator that identifies it as an LLC. The name can be reserved at a certain period fee, which varies from state to state until the LLC is formed.

Search for an agent

Once then the name has been selected, a registered agent should then be appointed. The agent must have a residence or operate in the state where the LLC will be based. The agent can be an individual or an entity but must be available during business hours to receive essential documents such as notices for the single-member LLC.

Article of Organization

Next, the Articles of Organization should be prepared for filing with the state. A comprehensive Articles of Organization will indicate the LLC name, the effective date of the LLC, a primary address, a list of managers, purpose of business, the registered agent, and other details. The file can be submitted online or mailed depending on the application procedure in the respective state.

Filing fee

A filing fee will typically be required to finalize the registration of the LLC. The filing fee ranges from $50 to $800, depending on the particular state. The application is processed and can be finalized in 5 to 30 days. If an operating agreement is mandatory in the state, it can be prepared and signed at this point.

EIN

Lastly, a single-member LLC operating agreement will require an Employer Identification Number to open a business account or hire employees. The EIN can be acquired from the IRS website at no cost. However, online applications can take as fast as 15 minutes, and mail applications take longer.

Frequently Asked Questions

This is dependent on the state where the LLC is located. An operating agreement for single-member LLCs is compulsory in some states, whereas in others, it is not. However, it is always advised that one should be used regardless.

A single-member LLC is not taxed as an entity. Instead, it is taxed as a sole proprietorship where the owner has to file its returns as personal income through the Schedule C form attached to the owner’s Form 1040.

Yes. Married couples can form an LLC treated as a single-member LLC in any state, Arizona, California, Idaho, New Mexico, Texas, Louisiana, Nevada, Washington, or Wisconsin. This is because property obtained by a married individual in these states is taken to be owned in common with their spouse. Note that only one spouse’s name appears in the owner’s list; after all, it is a single-member LLC.

Not necessarily. An EIN is needed by a single-member LLC only if the company will have employees and has an excise tax liability.

No. In terms of liability, single-member LLC separates the owner’s assets from the company’s financial and legal liability, unlike a sole proprietorship. However, a single-member LLC is considered a “disregarded entity” for tax purposes, meaning it is taxed as a sole proprietorship.

A single-member LLC can hire as many employees as deemed necessary, both full-time and independent contractors.

Yes. This is as long as the owner owns 100% of the rental property. The two businesses (LLC and rental property) can be grouped as one entity such that rent can be offset as a self-rental loss against the single-member LLC’s income.