A Proforma Invoice is a preliminary bill of sale sent to a customer/buyer in advance of delivery of goods or a shipment, i.e., before work is completed or a required action is completed.

Such invoice typically contains the date of issue, the quantity and description of the goods and or services being sold, shipment weight, shipment/transportation charges (if any), any taxes or fees, and finally the total amount payable.

A proforma invoice, also referred to as a pre-estimate or an off-set quote, is simply a document that accurately states the goods or services to be provided and the agreed-upon price for such goods or services. These are usually used in international transactions, majorly for customs and imports purposes. Although they are binding in nature, the terms of the sale included are usually subject to change.

Proforma invoices are very important as they help ensure a smooth sales process by eliminating any queries that may arise as the terms of the sale are set and agreed upon upfront. For example, an institution may decide to send this invoice before shipping a product. Although it contains the exact cost associated with the product’s shipping (s), it is not usually considered a demand for payment. The charges included are usually subject to change.

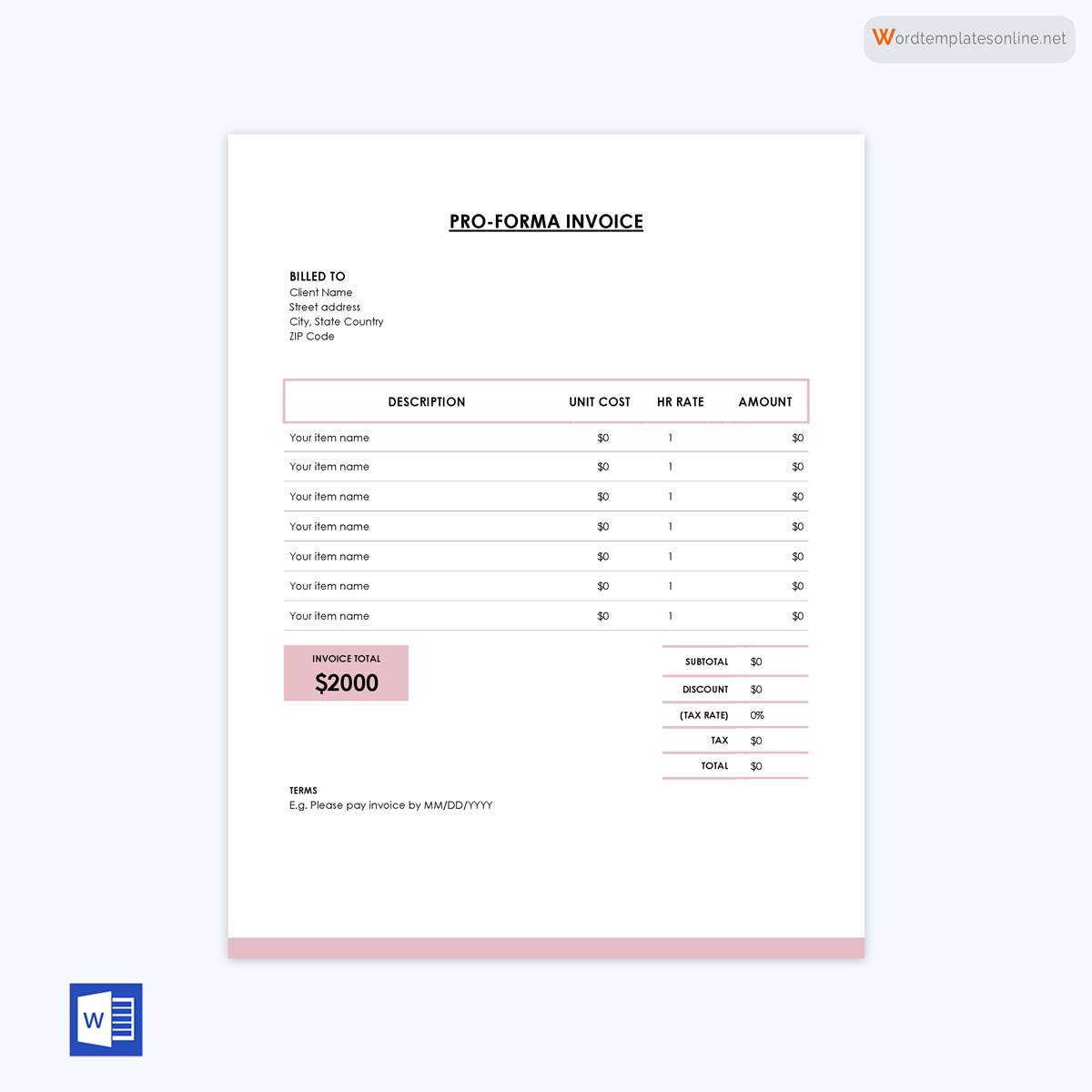

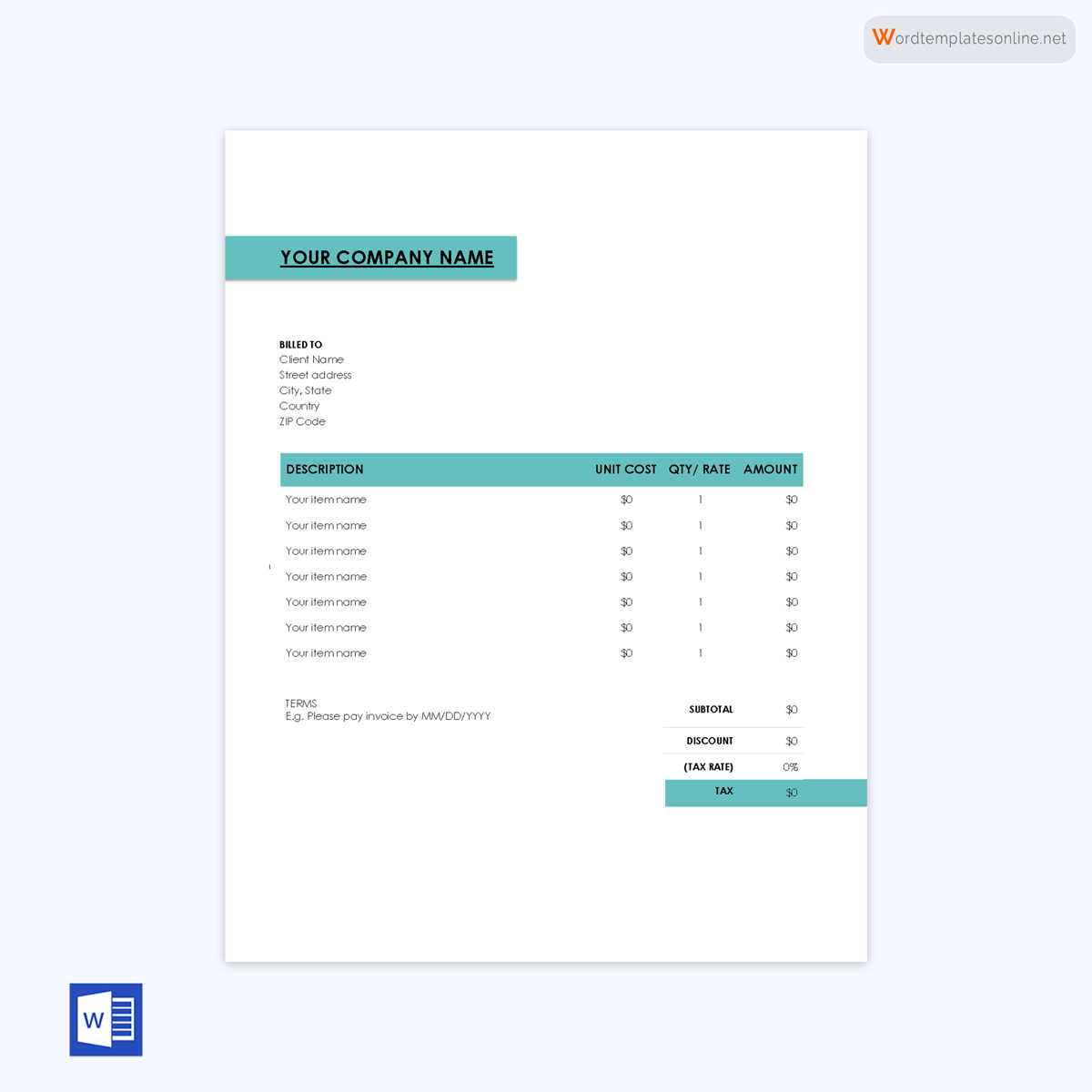

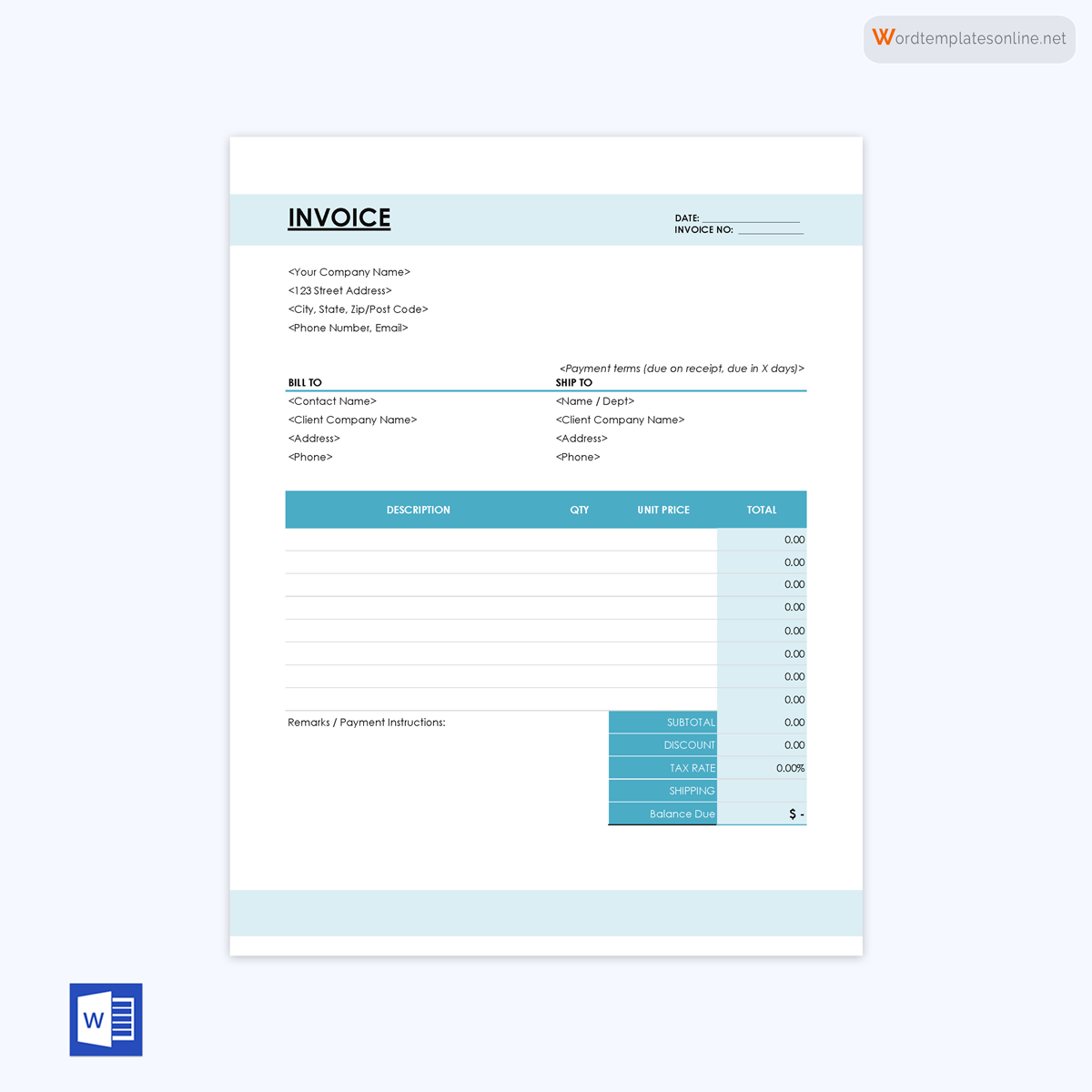

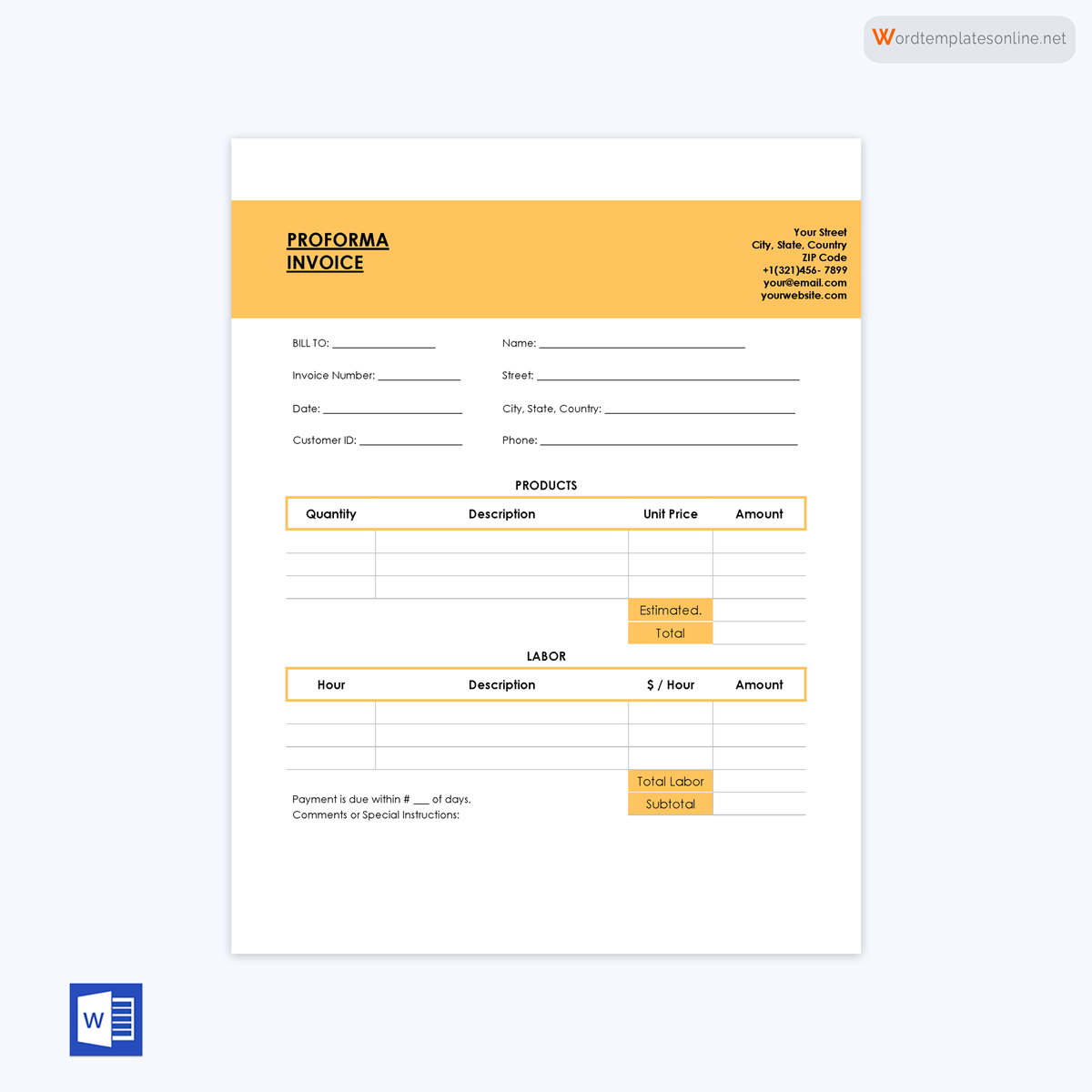

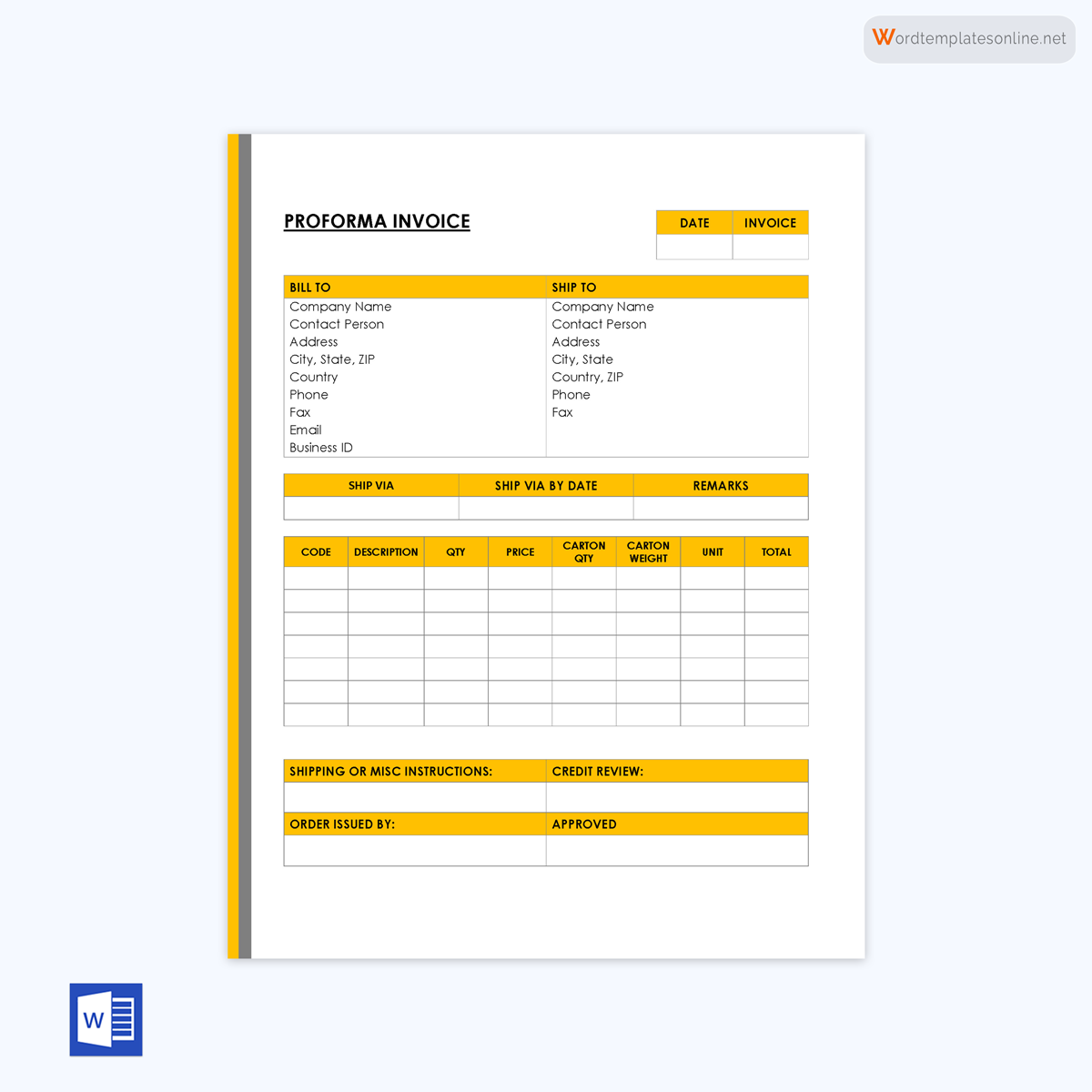

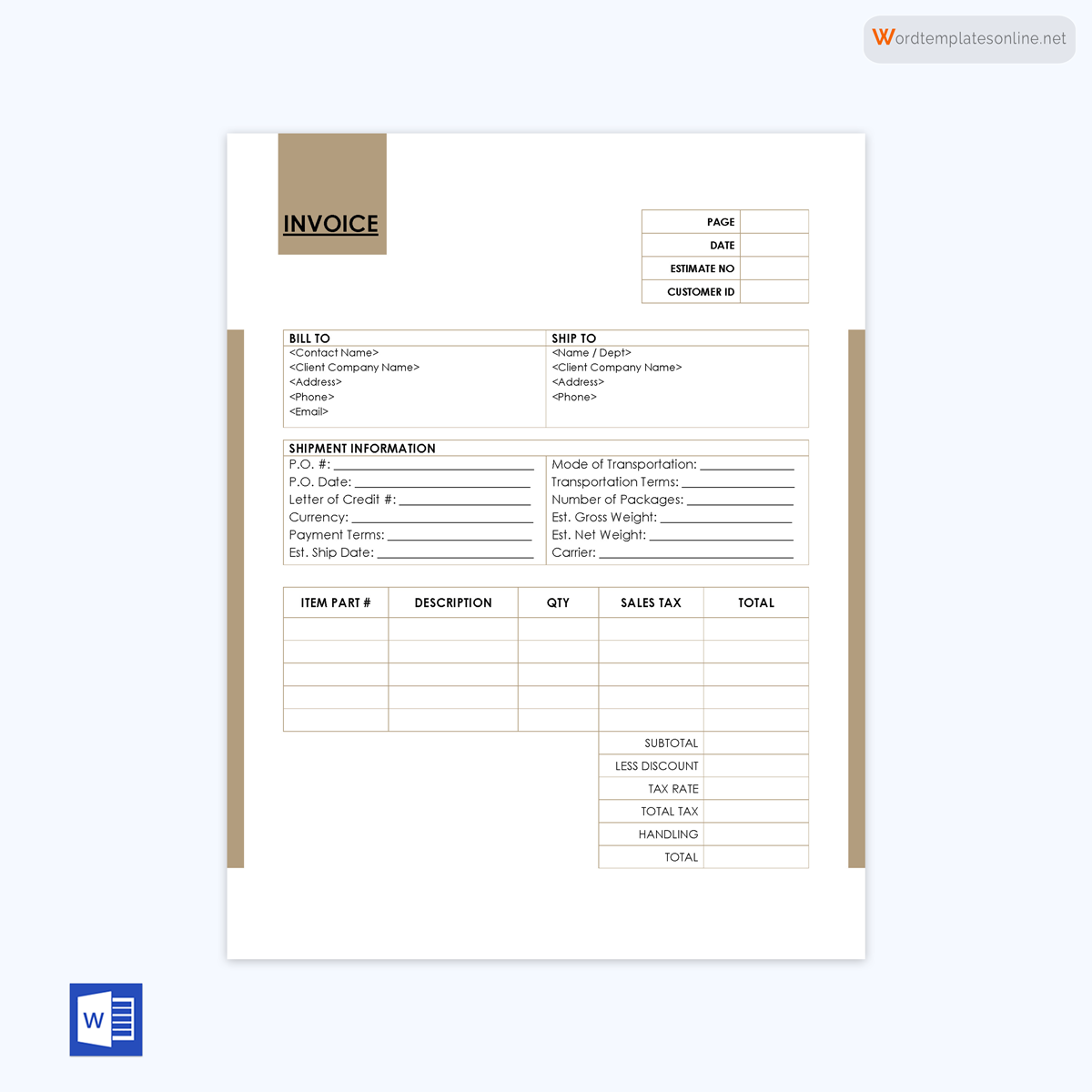

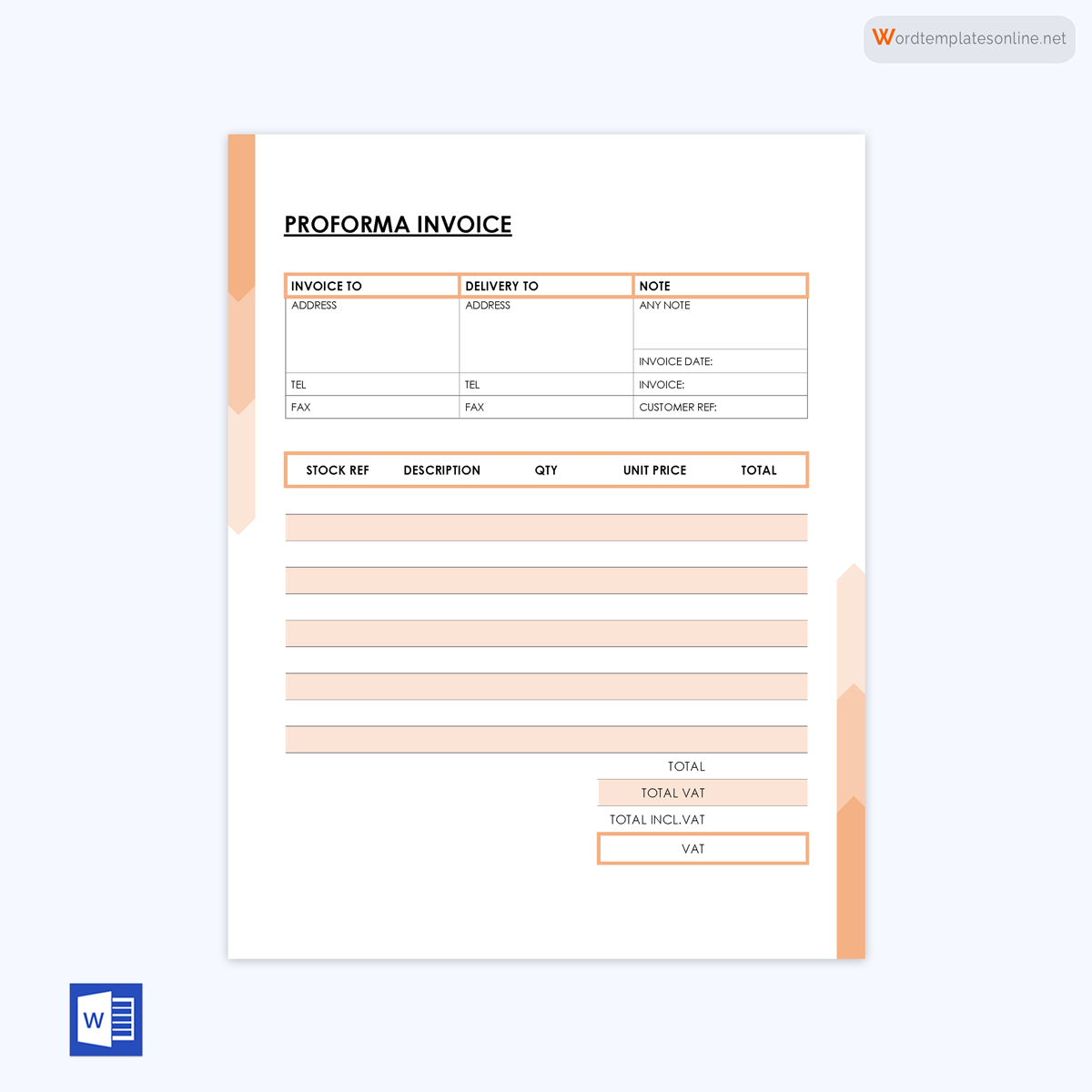

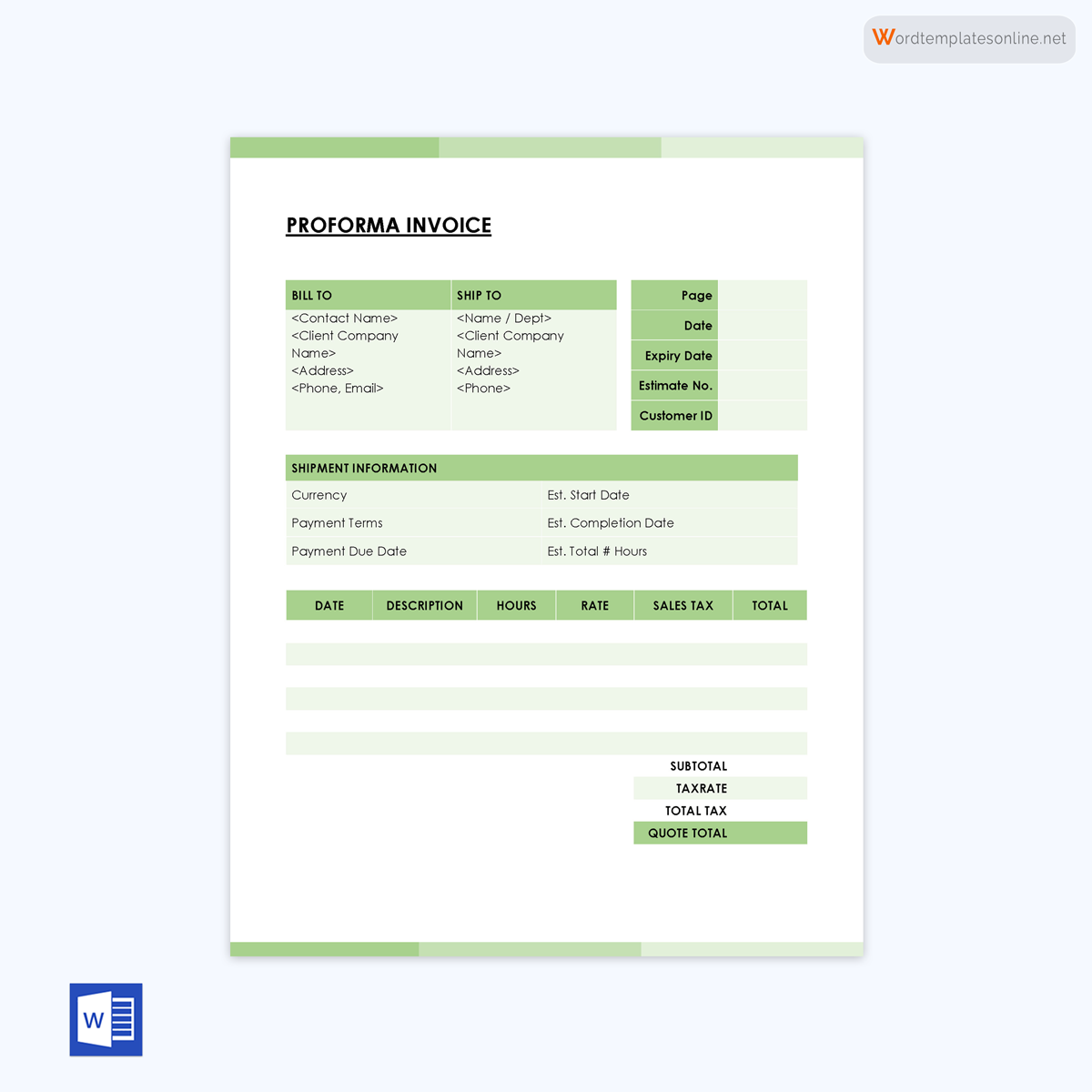

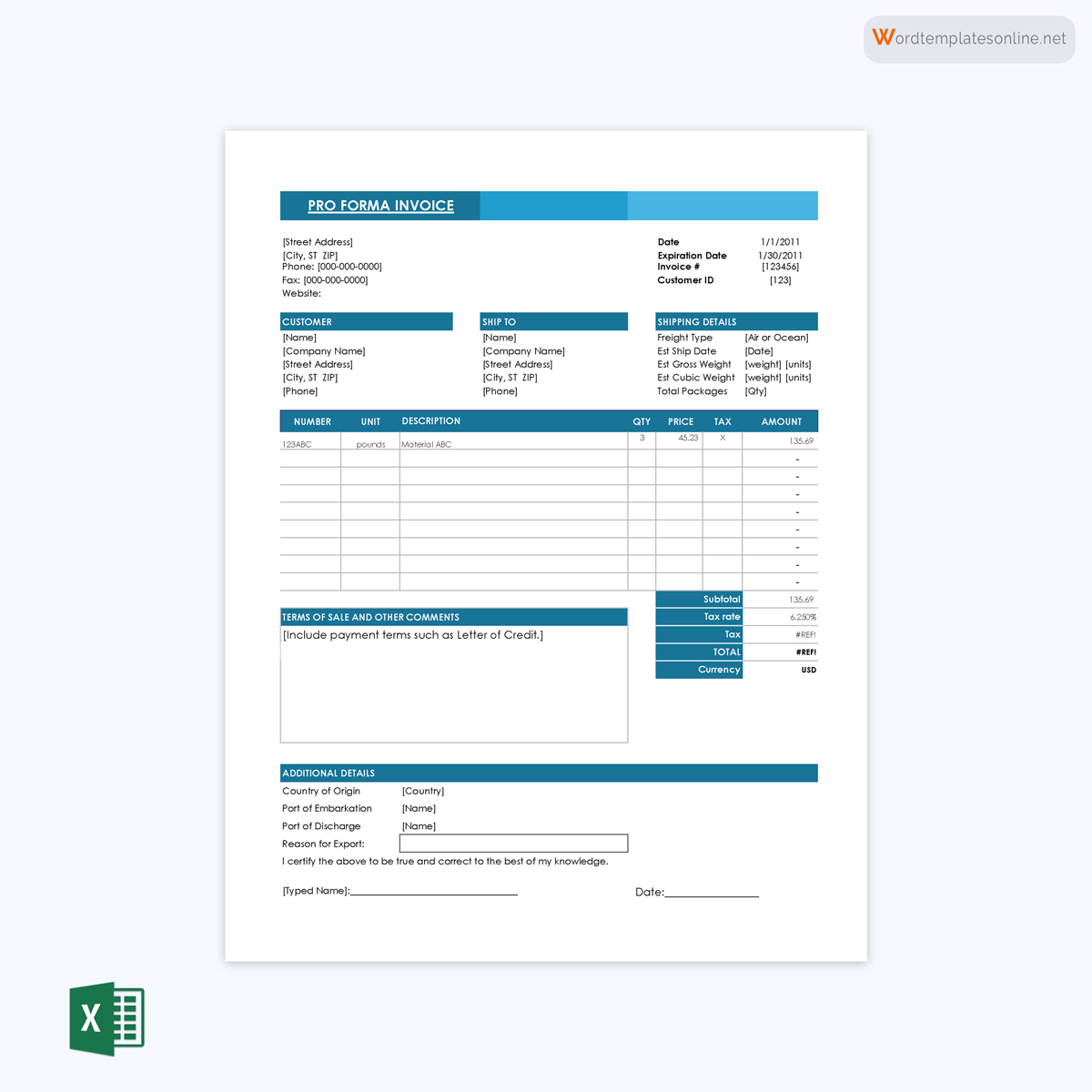

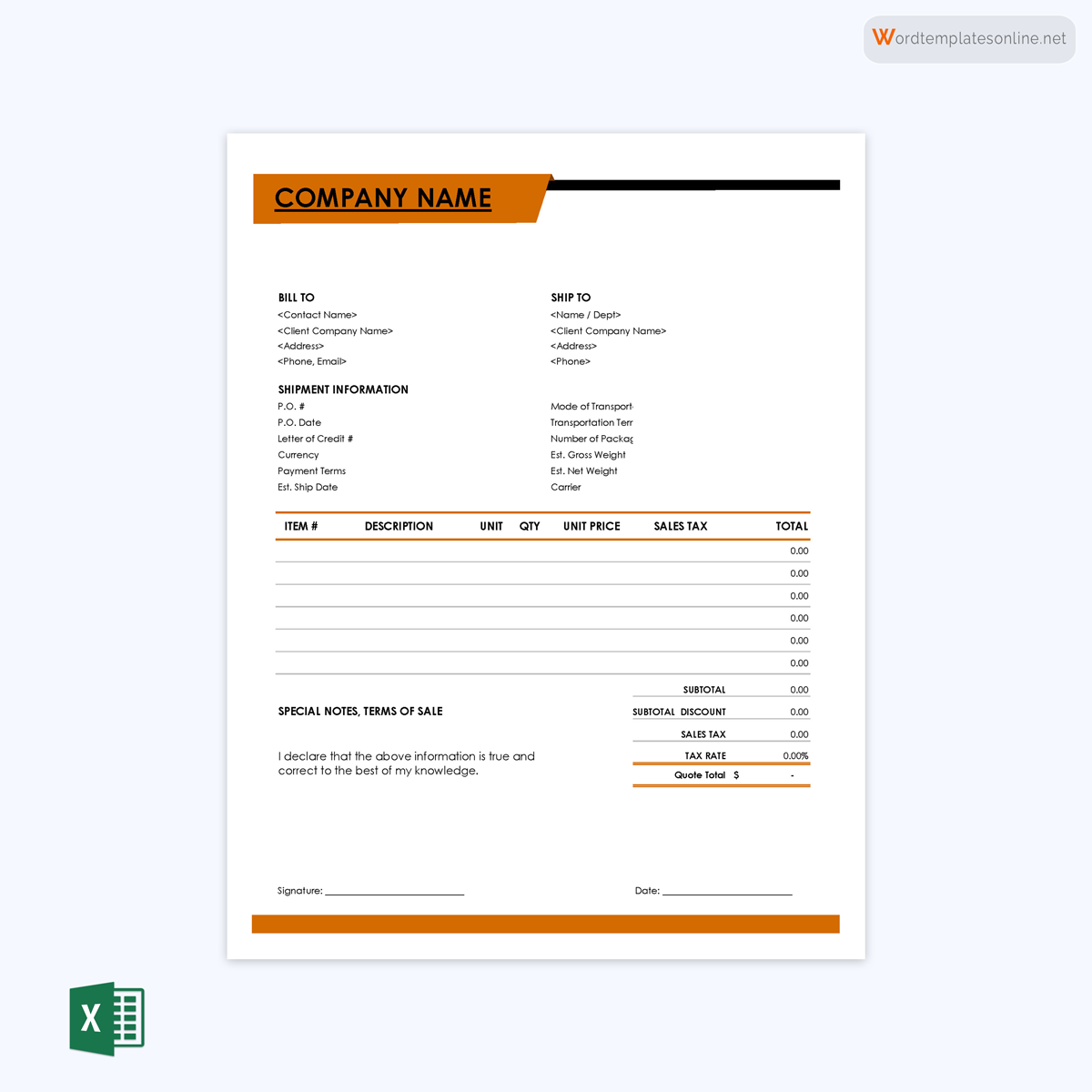

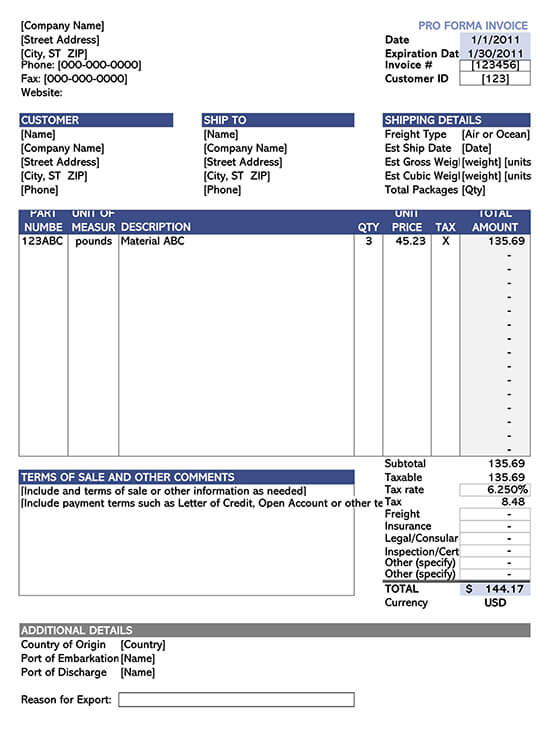

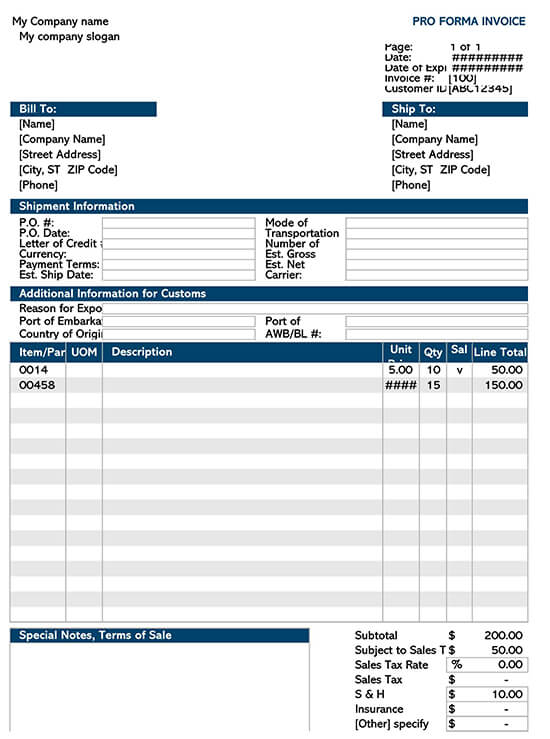

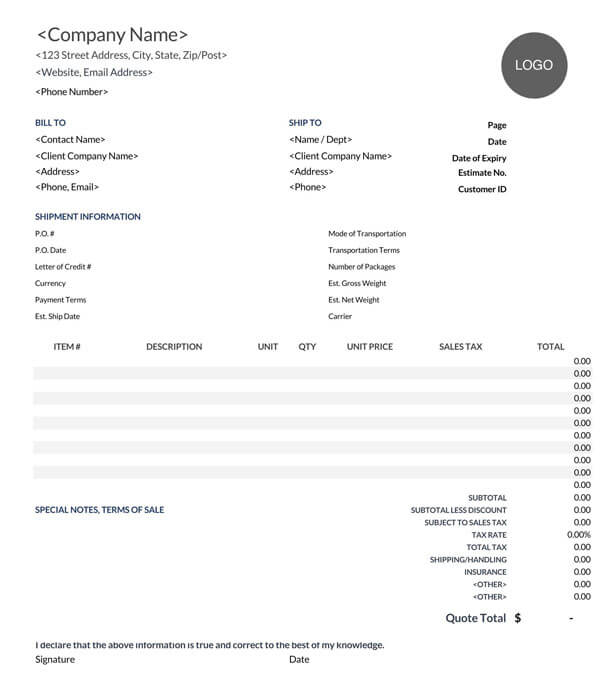

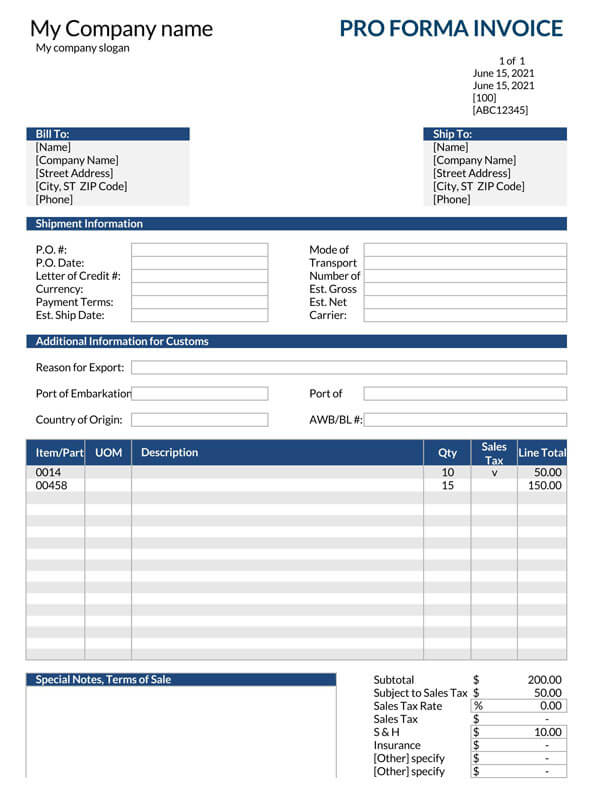

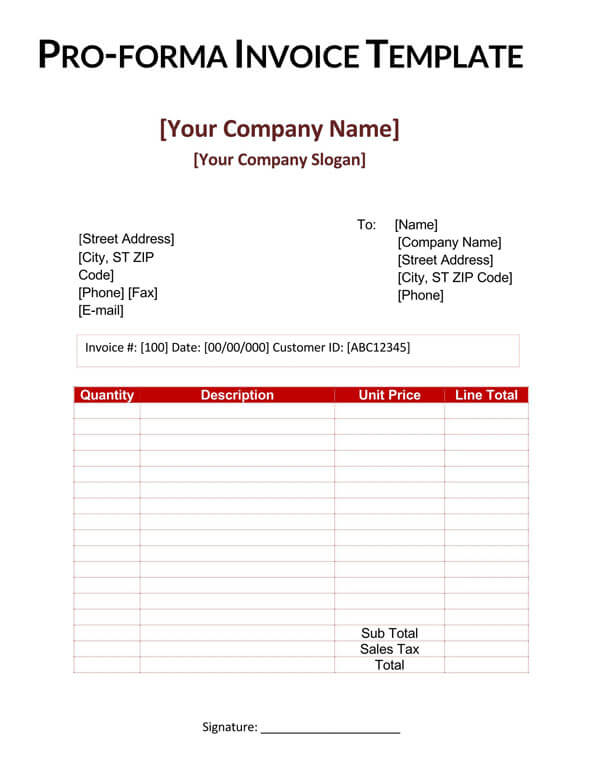

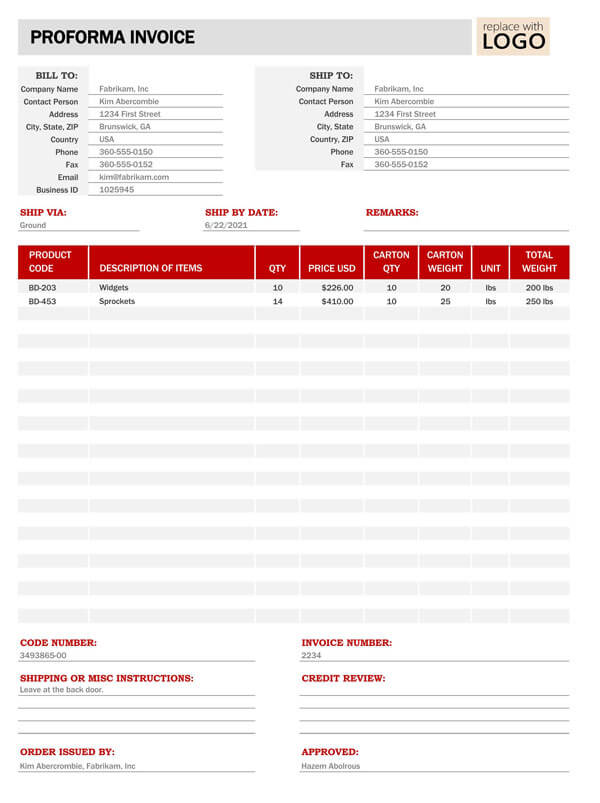

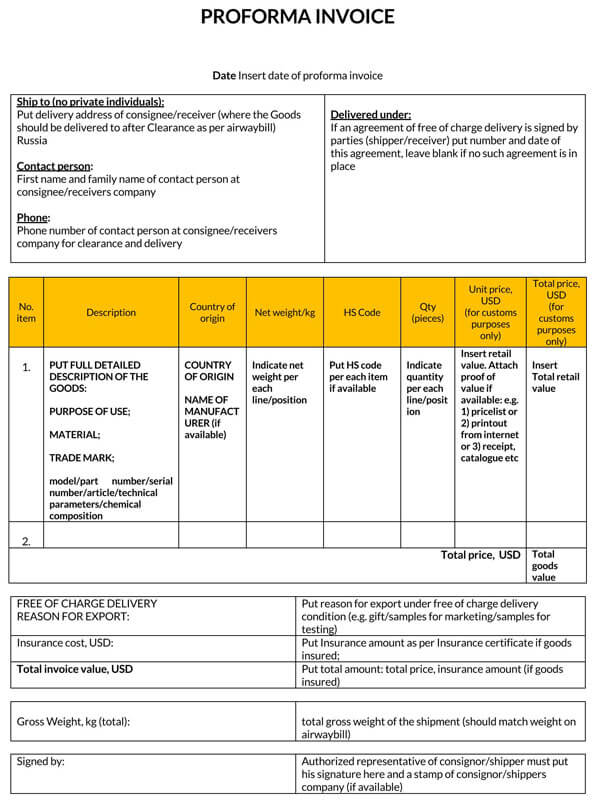

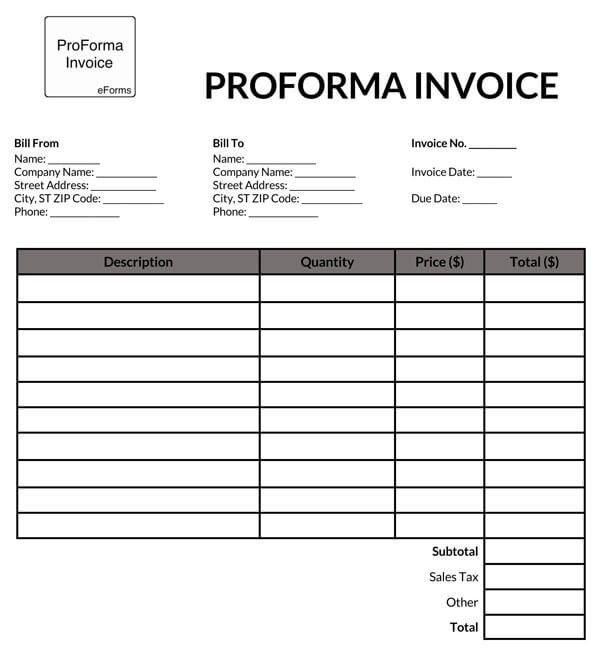

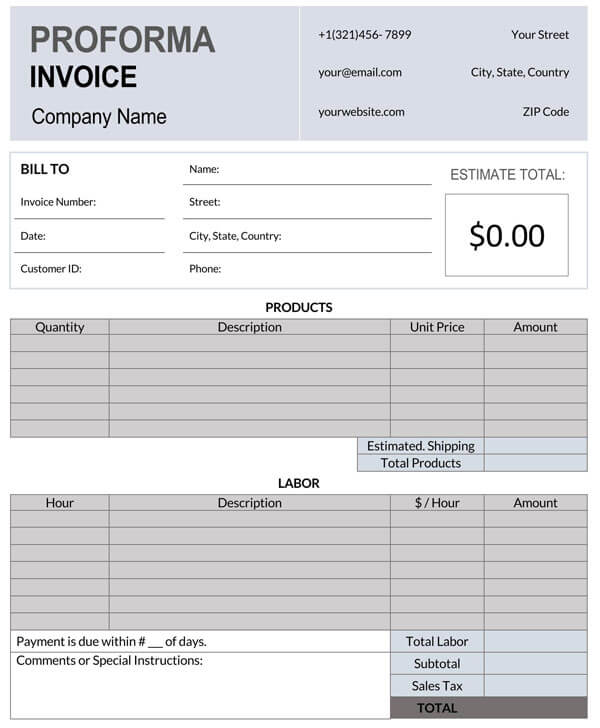

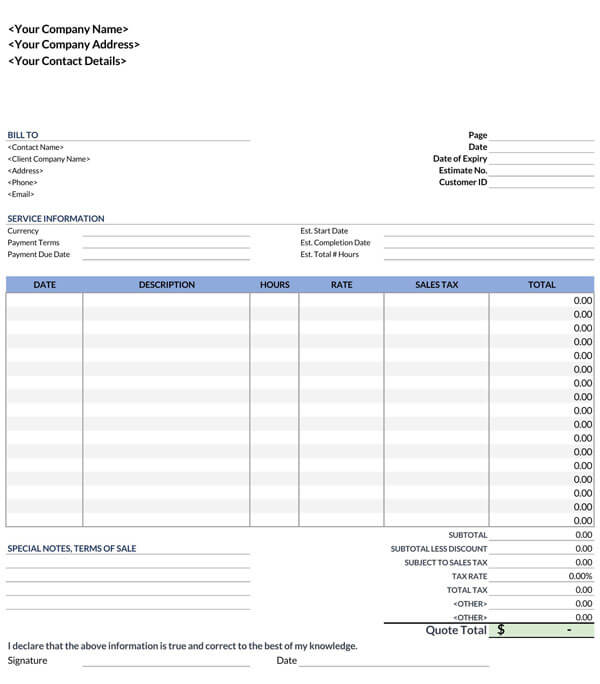

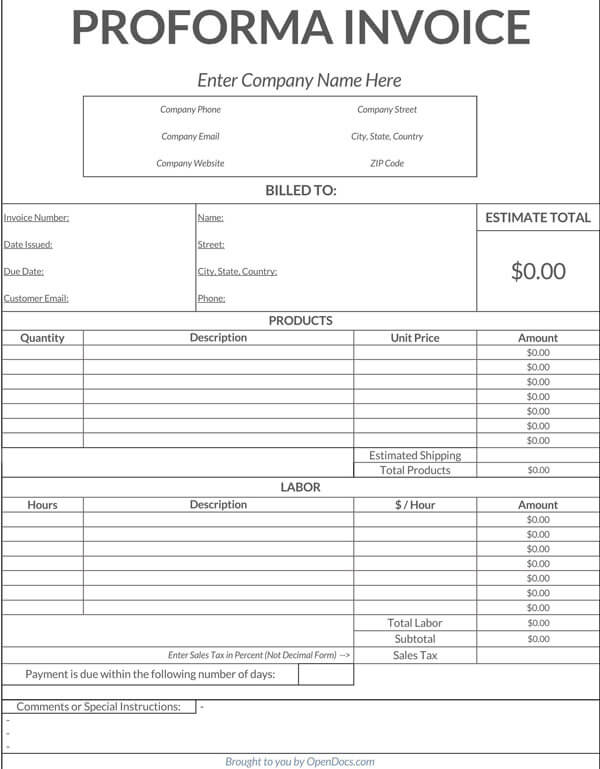

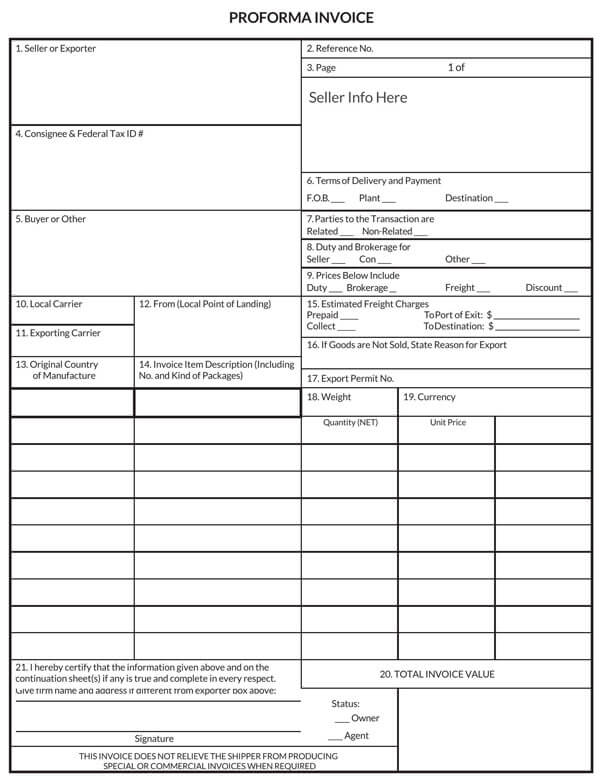

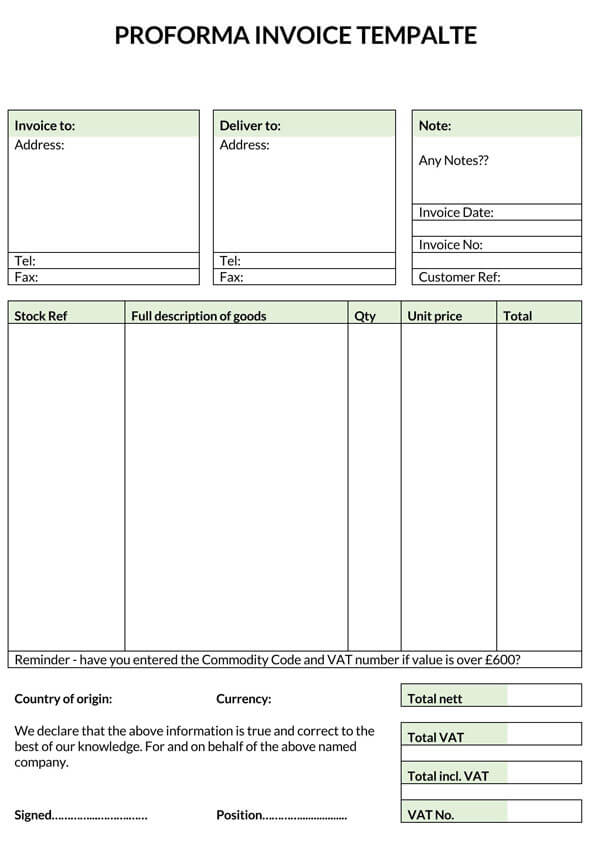

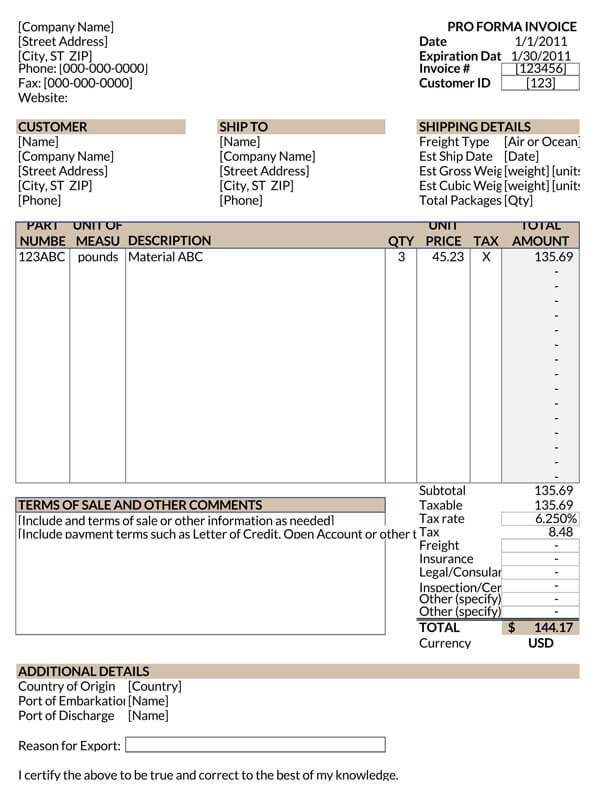

Free Proforma Invoice Templates

Uses of a Proforma Invoice

These invoices are usually sent out to help in the sales process. Once the proforma has been sent and the customer/buyer agrees on the price, the goods and/or services can then be sent or performed. It is reasonable faith estimates that help the customer/buyers understand what they are paying for.

Other uses of a proforma invoice include:

To declare the value of goods

The purpose of such an invoice is to ensure that both you and the customer/buyer agree on the terms and conditions of the sale/purchase, including the total cost of the products/services. It helps declare the value of the product(s) being shipped so that it can pass through customs swiftly and be delivered to the customer/buyers on time.

For international shipping

Proforma invoices are also used in international shipping, especially for customs purposes on imports. It usually includes details about shipping, packaging, delivery fees, and any tax and related shipping costs.

For internal purchase approval

The proforma invoice is sent to inform the customer/buyer of the value of the products and/or services they purchase to ensure a smooth delivery. Most customers/buyers use these for the internal purchase approval process. By having all the information, they need to make the purchase, including the total price, estimated delivery dates, etc., the customer/buyer can justify whether to make the purchase or not.

Difference between an Invoice, a Proforma Invoice, and a Quotation

It is important to understand the primary differences between an invoice, a proforma invoice, and a quotation when selling your products and/or services. By understanding these differences, you will be able to send out the right invoice or quotation and look more professional to your customer/buyers.

Proforma and an invoice

The main difference between a proforma and an invoice is that a proforma is a declaration you make to the buyer agreeing to provide them with some goods and/or services on a specific time and date and is usually sent before billing. In contrast, an invoice is a legal notice that demands payment in exchange for goods or services rendered under contract law. It is the document that the seller sends to the buyer (customer) at the time of sale.

Proforma and a quotation

A quotation is a price estimate sent out by a seller to potential customers who have expressed their interest in purchasing a product and/or a service from their business. A quotation is usually created during the induction or negotiation phase when a customer enquiries about the seller’s product/service price. Unlike a legally binding proforma, a quotation is not legally binding and holds no financial value, and the customer can decide to accept or reject the sale without any consequences.

What to Include in Proforma Invoice Template?

Before goods can be allowed to pass through customs in the United States, they must be accompanied by special documentation. A standard commercial invoice must be issued within 120 days and provide all the required information, including information about the buyer and the seller. The invoice must also contain a description of the goods, the quantity, the location of the purchase, and the total value of the goods, including the taxes.

Although there is no standard format to use when creating such a template, several things must be included to make it complete and ensure that the customer understands what the document is all about.

Some of the things that must be included are:

- Date of issue: The date of issue is when the invoice was created and sent out to the client. The date of issue is important as it helps determine the warranty duration, if any, the expected delivery date, and in tracking invoices sent and received.

- Contact details: The contact details of both the seller and the customer should be included in the proforma. This is to enable either party to contact the other should they have queries or questions regarding it.

- Details of the goods or services: A simple description of the goods and/or services to be offered should be included in the proforma invoice to help the client understand what they are paying for. The description can include the weight, duration, dimensions, colour, etc.

- Agreed prices: The total price of the goods and/or services to be rendered must also be included in the invoice. This is to help the customer decide on whether to approve the purchase or decline it depending on their budget.

- VAT and other applicable taxes: The proforma invoice should include a total breakdown of the VAT and other applicable taxes to help the client understand the total amount before purchasing the product/service.

- Shipping costs: If the product(s) will be shipped to the customer, the invoice should include the total shipping cost they stand to incur.

- Total amount due: The total amount due is calculated by adding all the costs associated with delivering the product/services to the customer. The total cost should be included in the invoice to help the customer decide whether to continue with the purchase or not, depending on their budget.

note

When preparing this invoice template, make sure to include a bold and clear title “PROFORMA” and do not include an invoice number, a payment due date, or the exact date of delivery since it is not an acknowledgment of purchase and the terms of sale are subject to change.

More Free Templates

Following are some more free downloadable templates for you, in case you require additional of these. We have already provided you with ample choices of these free forms in this article above.

Frequently Asked Questions

A proforma invoice is a document that accurately states the goods or services to be provided and an agreed-upon price for such goods or services.

Such invoices are usually used in international transactions, especially for custom purposes on imports. They help businesses in all sectors satisfy their internal purchase approval process by streamlining the sales process and eliminating confusion or queries that may arise since the sale’s terms are agreed upon upfront.

A seller can send a such invoice to a buyer once they have agreed upon the deliverables or the product(s) to be shipped.

A commercial invoice differs from invoice in that it must contain all the details required for the acknowledgment of sale/purchase, i.e., the name of both the buyer and the seller, a description of the goods, the quantity, the location of the purchase and the value of the shipped items while a proforma invoice only must have enough details to enable customs to determine the duties required from an examination of the items included.

Although not recommended, customers can at times choose to make an initial deposit against the actual document and keep the payment receipt. After the product(s) have been shipped, the seller may reference the receipt number on the standard invoice to avoid billing the customer twice.

A preliminary invoice is created for internally checking invoices or enabling customers to check their invoices. They are usually not included in the accounts receivables and accounts payables. An example of a preliminary invoice is the proforma invoice which is sent to customers to inform them about the terms of the sale and is not a demand for payment.