In the state of Kansas, when selling or buying a vehicle that is 35 years or older in a private sale, the seller must provide a Kansas Vehicle bill of sale (Form TR-312). A car bill of sale in Kansas acts as a legal document, sales receipt, and will be needed for registering a vehicle to a new owner with Kansas’s department of revenue – vehicle division.

A Kansas vehicle bill of sale is also used in determining the correct amount of sales tax that the person registering the vehicle must pay.

Other requirements for transferring ownership of a vehicle are a Form TR-59 (Odometer Disclosure), and Form TR-41 (Power of Attorney) if you will be registering the vehicle on behalf of the owner.

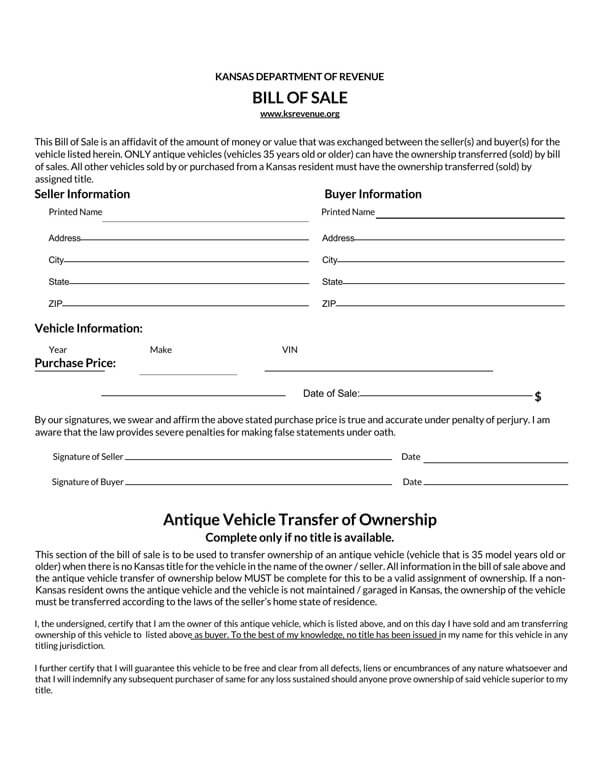

Free Kansas Vehicle (Car) Bill of Sale Form

Signing and Language Requirements

Any vehicle documents that are submitted to the KDRVD must be in English. Translators are not provided by the State, so you will need to have someone translate the documents into English for you.

Both parties are required to sign the Kansas vehicle bill of sale in front of a notary public that is recognized by the state of Kansas.

If the vehicle being purchased has a lien on it, the state requires:

- A notarized release of lien document

- A completed consent form from the state lien holder

- Form TR-42 – the lien holder’s section will be needed from this form, (request & consent for Kansas title to be issued with lien)

While the state of Kansas doesn’t require you to have a car bill of sale for Kansas for all vehicle transactions, it is beneficial to the seller and buyer as it gives both a written record of the sale. This can be helpful should there be any legal dispute around the sale of the vehicle because it protects both parties from liability.

For example, if the person selling the vehicle has been involved in a hit and run before the vehicle was sold, the Kansas vehicle bill of sale can be used by the buyer as proof that they did not own the vehicle at the time of the accident. The same goes for situations in which the buyer is involved in an accident or is given a traffic ticket close to the date of sale. The seller can prove they were not in possession of the vehicle at the time.

Key Details Needed on a the Bill of Sale

The state of Kansas does provide a downloadable Form TR-312 for your convenience. Alternatively, you may create your own bill of sale form.

You will need to have the following details on it in order for it to be accepted by the state of Kansas:

- The full names and contact details for both the buyer and the seller.

- Details about the vehicle, which should include the make, model, year, color, VIN, and condition of the vehicle at the time of sale.

- The amount that the vehicle was sold for.

- The date on which the vehicle was sold.

- The bill of sale needs to be signed by both parties.

Titling and Registering a Vehicle in Kansas

Once a sale has been completed, it is up to the buyer to have the vehicle titled and registered in their name. Vehicle registrations are required to be renewed every year. The expiration date for your vehicle is determined by the last name of the registered owner. For vehicles that have already been registered, you may renew the vehicle online using Kansas’ official web app, iKan.

All vehicle types, including antique vehicles, must be titled and registered within 60 days from the date of sale. This can be done by visiting your local county treasurer’s office – the motor vehicle division. Vehicles must be registered in the county they are being stored or located in. If you do not get your vehicle registered and titled within the 60-day time frame, you will be subject to a penalty.

Antique and Out-of-State Vehicles

Vehicles that go back to 1950 or newer, as well as out-of-state motor vehicles, are required to have a motor vehicle examination (MVE-1). This is done by the Kansas Highway Patrol or a location that has been designated by KHP.

For vehicles being titled and registered for the first time by the new owner, you will need to have the following documentation:

- A current and valid Kansas driver’s license

- A completed Kansas vehicle bill of sale (Form TR-312)

- A completed Form TR-59 (odometer disclosure form)

- The original Certificate of Title, which must be signed. If the title has been lost or damaged, you can apply for a replacement from the DMV

- A Certificate of Origin from the manufacturer

- A completed Form TR-212a (title and registration manual application)

- Funds to cover the appropriate registration fees

- If the vehicle was registered and titled in another state or was bought from out of state, you will need to have a completed Form MVE-1 (motor vehicle examination certificate)

- If you are registering and titling the vehicle on behalf of the owner, you will need to complete Form TR-41 (Kansas motor vehicle power of attorney)

- Proof of motor vehicle insurance, which must include the policy number, name of the insurance provider, name of the owner, the dates that the coverage begins and ends, and the VIN, make, model, and year of the vehicle. You can find more information on vehicle insurance requirements on the Kansas DMV website.

Where to Register a Vehicle in Kansas

If you are registering your vehicle for the first time, you will need to do so in person at your nearest treasurer’s office for your county.

Kansas sales tax

Sales Tax must be paid when registering a vehicle, which includes private sales and wrecked/damaged vehicle sales. The amount that you pay is determined by how much the vehicle was purchased. This must be paid to the county in which the owner resides. For instances where the sale price has not been recorded on the title, a Kansas vehicle bill of sale will be needed.

Conclusion

Kansas vehicle bill of sale is a very essential document that requires to be prepared and used with great properness. This article serves as a guide for anybody who has questions regarding this form or its uses.