A Personal Property Bill of Sale Form is a document that establishes the legal transfer of ownership of any personal property from a seller to a buyer.

The seller generally prepares a bill of sale form, and the current state of the property is reflected on the bill. It becomes a legal document only after the sale has been completed and full payment has been made. Therefore, it is best used for items sold in “as is” condition and paid for in full.

A bill of sale and a receipt serve almost the same purpose, but while a bill of sale contains detailed information about the transaction, a receipt only shows proof of payment. This means that a bill of sale may serve as a receipt, but a receipt cannot serve as a bill of sale.

In many states, property ownership does not depend on the property’s physical possession. Instead, a personal property bill of sale form can suffice to prove the ownership of the property. All the information of the transaction must be contained in the form. This is to protect both the buyer and seller in the case of any dispute concerning the item(s).

Free Templates

Standard template

By state

Who Uses a Personal Property Bill of Sale Form

A bill of sale form is required by anyone who is looking to buy or sell personal property. This document serves as legal proof of such a transaction and helps protect the seller or buyer from future disputes arising from the deal.

This form is important and useful to people purchasing or selling items in private, purchasing or selling expensive & high-value property, purchasing or selling pre-owned items, conducting online trades, and those who live in states where the form is required as proof of ownership.

In some cases, people will also need a bill of sale to prove ownership of an item even when a sale has not occurred. For instance, if a friend gifts their motorcycle to their friend, they will need the form for the registration and insurance of the bike and show ownership of that motorcycle.

Alternatively, some transactions which involve the transfer of property do not require you to have a property bill of sale form.

Some such transactions include:

Real estate

A bill of sale cannot be used for this transfer because it requires more forms from both the state and local governments, and the transactions are usually more complicated than the transfer of a vehicle, for instance.

Small-scale sales

You do not require a bill of sale to buy or sell inexpensive items or property. Therefore, though it is a personal decision to use the document, it is not necessary.

Performance of services

Providing or obtaining services such as counseling, hairdressing, appliance repairs, etc., a bill of sale is not required because there is no transfer of ownership of any tangible item.

It is recommended that you consult an attorney if you’re unsure as to whether you need a bill of sale or not.

The Need for a Bill of Sale

A bill of sale is very important if you intend to buy or sell a piece of personal property. In many cases, people end up in trouble paying for damages, buying stolen property, or losing ownership of their property because they cannot provide a bill of sale. If you purchase any item that may require proof in the future, you should use a bill of sale.

It is essential for both buyer and seller, and it protects their interests in case any issue regarding the exchange arises. If there is no bill of sale or some receipt, it is almost impossible to prove that a transaction ever occurred.

Therefore, states like California in the US require a written bill of sale for purchase or sale of items worth more than $500. This is the legal proof of such a transaction, and it is also required for tax purposes.

Furthermore, this document also becomes vital in times when you need to ensure an item. The bill of sale will be required to prove that you’re, in fact, the owner of the item that is to be insured. The importance of using this document for transactions cannot be overemphasized.

Asides from the fact that it serves as proof of sale, it also becomes a legal document used when transferring title to vehicles and other personal property:

- A well-prepared bill of sale guarantees protection for buyers and sellers of property alike. It is a requirement in many states if you must insure an item.

- Some of the key benefits of having a bill of sale form for the buyer include proof of ownership, information on warranty, and the date of transfer of ownership.

- For the seller, the “As-is” terms offer protection from refund or warranty, easy tax reporting, and date of transfer of ownership.

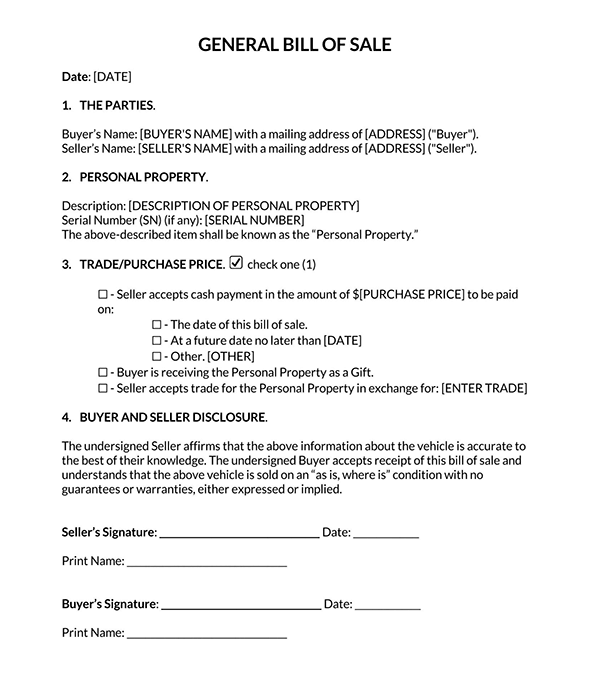

Components of a Personal Property Bill of Sale Form

The bill of sale stores information about your sale or purchase of a property. This document serves as legal proof of ownership for the buyer and a protective document for the seller in case of any issues.

For your bill of sale to be well equipped, the following information must be included:

Transaction date

The form must include the date the sale was conducted, and both parties must sign it. A bill of sale is not legal if it does not specify the accurate date, including the day, month, and year the trade was conducted. It is required in the document for the sake of reference.

Seller details

This section of the document contains information about the seller of the property, including their full names, contact, and address. If there are additional sellers, this section must also provide information about them. This is necessary for the buyer to know exactly who they are doing business with and to foster credibility.

Buyer details

The name, address, and contact information about the buyer must also be fully stated, including that of any additional buyers.

Description of the item being sold

The bill of sale must contain complete information about the item being sold. The color, condition, appearance, missing components, age, size, model, and every detail about the item must be highlighted. This measure is put in place to ensure that both parties are fully aware of the item being sold.

If the item is a car, information about the VIN, odometer, body type, manufacturer information, etc., must be included in this section. This creates transparency and reduces the risks of future issues between the seller and buyer of the item.

Location of the sale

The specific location of the item being sold must be stated in this section of the bill. Along with a brief description of the item, location information like city, country, state, and zip code must also be provided in this section.

Price

A bill of sale must contain the total cost a buyer will have to pay to get the item sold.

EXAMPLE

If there are tax fees to be paid on the item, this section of the bill provides the total price the buyer will have to pay and no subtotal.

The total price should be written in words and numerals.

Sales tax

Information about the tax on the item, if any, and how the tax will affect the pricing of the item must be highlighted in the bill. The information provided on the bill of sale will indicate how much sales tax you may pay. The tax may be added to the price of the item. However, if the item is exempt from tax or the tax has been fully paid, it should also be stated in the bill.

Inspection

In cases where an item is sold “As-is” and not under any form of warranty, the buyer will have a chance to inspect the item to be sure they are satisfied with its current state before paying. This section of the bill makes provisions for that.

Payment method

You can use the typical payment options like cash, online transfer, bank draft, check, and trade with another item of equal value. Ensure that the money enters your account before transferring the item to the buyer in the case of electronic transfers.

Encumbrance

This section allows the seller to warrant that there are no encumbrances, restrictions, or other claims of ownership on the item that will prevent the sale. If there are encumbrances on the item, the seller must indicate this. The seller should also clearly state who will be responsible for paying off the encumbrance.

This provision is necessary on the bill to protect the buyer’s interests from future issues and to ensure that the buyer is aware of such encumbrances.

Any loans or liens on the item

Liens refer to a record placed on an asset that ensures proceeds from selling such assets will go to a lienholder. If a property is placed on a lien or used in exchange for a loan, the seller must indicate it in the bill of sale.

The loan must be fully paid off and the lien removed before the item can be legally sold to a buyer. In some cases, the buyer may agree to pay off the loans. This ensures the buyer’s protection from cases of having the item seized by the lienholder or creditor.

History of ownership

Accurate ownership information of the item should be included in the bill of sale. This includes information about who sold the item to the seller, along with a statement that the seller is the sole owner of the item and that nobody else can claim it. This is necessary to avoid ownership issues in the future and to guarantee the legality of the seller’s claims of ownership.

As-is

The “As-is” clause in the bill of sale is proof that the buyer of the property has agreed to buy the property as it is, in its current state, form, shape, or otherwise. By making full payment and receiving the property, this clause stipulates that the buyer is satisfied with the state of the property, and it protects the seller from any liabilities or warranty obligations in the future.

VIN

In the sale of a vehicle, a vehicle information number (VIN) must be included in the bill of sale form. The VIN must tally with the model of the car, where it was assembled, the year it was made, and other information.

Gift

In many cases, friends, colleagues, or relatives can gift property to one another, and proof of ownership may be required to prove that the person in possession of the property is the legal owner. A bill of sale contains a provision indicating that the property was gifted and not sold or bought.

Trade-in

If the item is being traded for another item, the trade-in bill of sale will show the values of both items to ensure that both seller and buyer get value for their items.

Witnesses and notarization

If the seller can have witnesses’ signatures, it will be proof that both parties (seller and buyer) duly agreed to the transaction, if the matter goes to court in the future. It is required in some states that a public notarize your document. This also increases the legitimacy of the bill and is helpful in case of a future dispute.

Warranties

A bill of sale usually includes the “as-is” language to prevent future liability for the seller. This means there are no warranties on the item, and the buyer has agreed to pay for it in its current condition. The seller must not hide information about the item’s condition and if there are liens on said property.

Signatures

Though ideally, the bill of sale can only be signed by the seller. However, the buyer is also required to sign it in some jurisdictions. So, before completing your bill of sale, find out if local and state laws require the buyer to sign the form too.

State laws

Different laws apply according to states when it comes to the bill of sale. For instance, in states like California, a bill of sale is recommended when buying or selling items worth more than $500. While some states may not require it for tax or insurance purposes, other states will require one.

Also, while it is compulsory in states like Louisiana, Nebraska, Maryland, Montana, and West Virginia for a notary public to witness the signing of the bill of sale by both parties, it is not compulsory in other states.

Find out the state laws guiding bill of sale forms in your state before consummating one. You can also consult an attorney to help you with the necessary information.

Tips for Creating the Bill of Sale Form

A bill of sale protects you from liabilities and future disputes with the buyer of your personal property. This document can also be used in determining your sales tax and serve as proof of ownership and a receipt for the buyer.

While this document may not be required in your state, it is still very important that you have one. You can handwrite a bill of sale form yourself; so long as it meets all the aspects of the form and both parties agree to it, it becomes legal.

Here are a few tips for creating your form:

Collect information

The first step when preparing a bill of sale is collecting all the information required, such as the names of the buyer and seller, condition of the item, price, and all other related info about the item. This information will be used to create the document.

Review and sign

Before signing, all the information must be carefully reviewed to be sure there are no errors. Edits can be made by downloading the document in Microsoft Word or other related editing platforms. In some states, a notary public must witness the signing of the document by both parties.

Distribute and store copies

After signing the document, copies should be made and distributed to both parties. If witnesses are involved in the document, it should be given to them too. You can make digital copies of the document to keep it safe and secure.

All related documents should be completed in sealing the transaction. This puts both the buyer and seller at ease. You can use a sale of goods agreement to document the terms of the deal, details of delivery, shipping information, and receipt of the goods. This way, both the buyer and seller are aware of their responsibilities to ensure seamless transfer of ownership.

Frequently Asked Questions

The “as-is” condition means that the buyer has agreed to buy the property in its current state, and the seller gives no warranty on the property. This protects the seller from having to pay the buyer for any damages or issues after the buyer has agreed to pay for the property as it is.

This document is typically used for the sales of vehicles, motorcycles, aircraft, and other automobiles. Other personal items like:

• Furniture

• Gadgets

• Animals

• Livestock

• Jewelry

• Pets

• Tools

Etc can also be sold and bought with this document serving as legal evidence of the transfer of ownership.

You can customize your own bill of sale if you intend to sell an item without fearing future issues. However, it is recommended that you have an attorney present when making your bill of sale if you don’t want them to draft it for you. When preparing the statement, make sure you provide detailed information about an item, including its present condition, appearance, and age.

Relevant identification numbers like the VIN, HIN, or serial number should be included in a vehicle bill to make it more credible and easily identifiable in theft cases.

A bill of sale form is only typically required to transfer ownership of tangible or physical goods. Documents like Service Agreement is more suited for the receipt or provision of services.

Once you have received the full payment for the sale, you can proceed to deliver a copy of the document to the buyer.

No, they are different. A sales contract refers to all the details of the transaction, including information about the item, date of the transfer of ownership, payment terms, delivery information, and all the logistics involved. A bill of sale, on the other hand, only talks about the transaction itself.

Because of the nature of the bill of sale, a seller cannot use it to sell a property they do not own. Alternatively, a seller can only sell movable personal property using this document. Property such as real estate cannot be sold using a bill of sale form. You can use a warranty deed or quitclaim for this.

You cannot use a bill of sale as a receipt for services because the document is only used when transacting physical goods. For services, you can make use of a consulting agreement.