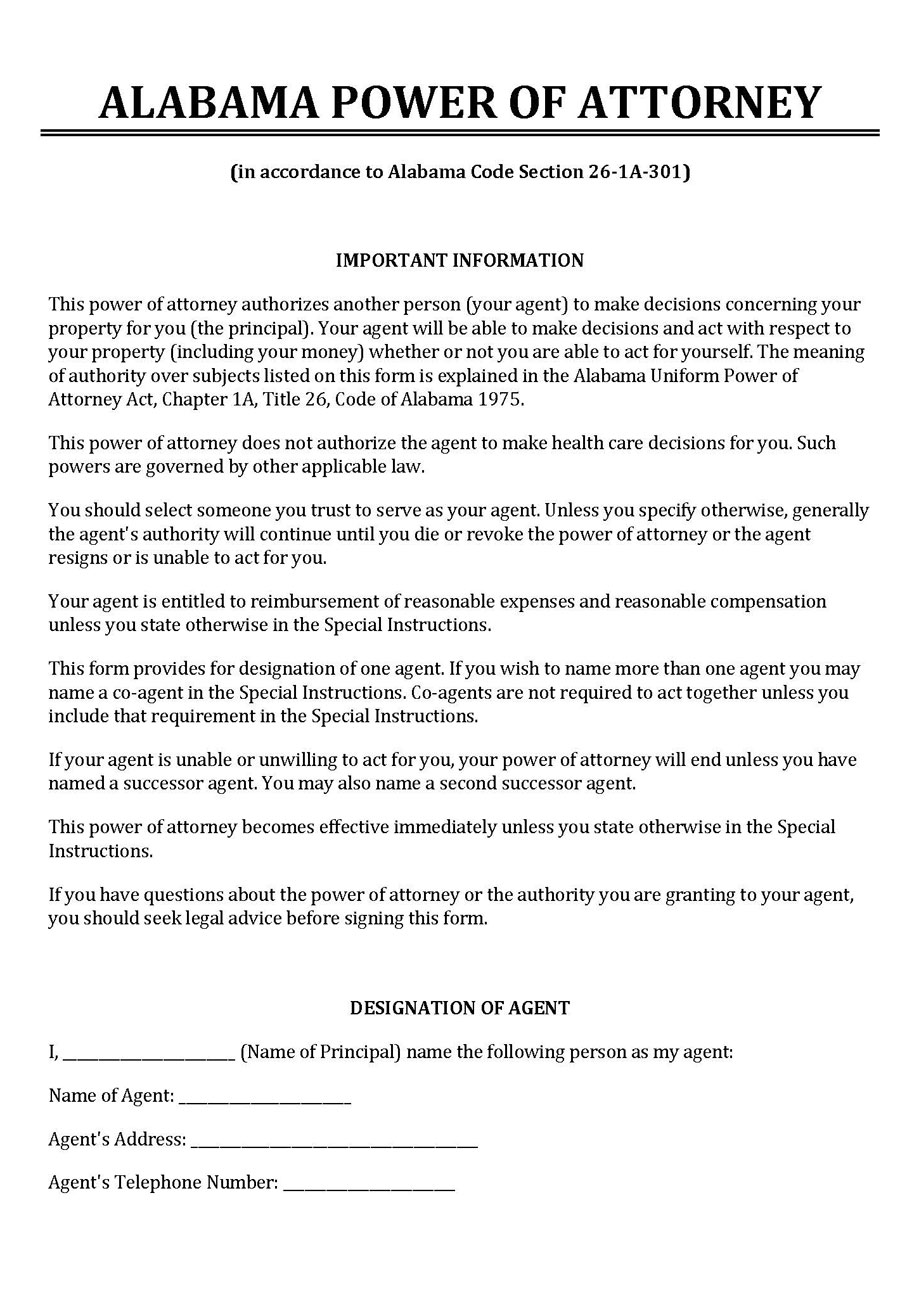

A Power of Attorney for Alabama is a legal document giving someone the right to make decisions for another person.

These decisions may be financial, medical, or family-based. Many types of these forms can be used, and they can be tailored to suit your specific circumstances and for a more extended time.

There are several reasons to have it. First, anyone over the age of 18 should think about getting one in case of emergencies. For example, if the principal requires financial assistance, they may appoint a representative (also known as the agent). They may be appointed for the short or the long term. If the principal sees a medical need, they can appoint someone to take care of their medical decisions if necessary. Also, if they choose to live abroad or have any circumstances that may incapacitate them, such as declining health, a POA is incredibly helpful.

This document, in short, is used to make sure that an agent can take thoughtful actions for the benefit of the principal who is not able to. This article will cover its all types available and pertinent laws and procedures in Alabama.

Free Forms

Types of Power of Attorney

A power of attorney is not a specific term. Many forms can be used to make specific decisions for the appointed agent. This is to protect all parties involved in the process. The agent cannot assume all life decisions in every circumstance. Instead, they can only make the specifically authorized decisions in it.

This article will cover the ten most commonly used POA forms in Alabama. This article can also find the supporting laws and statutes describing them.

Following enlisted are the types that are most commonly used:

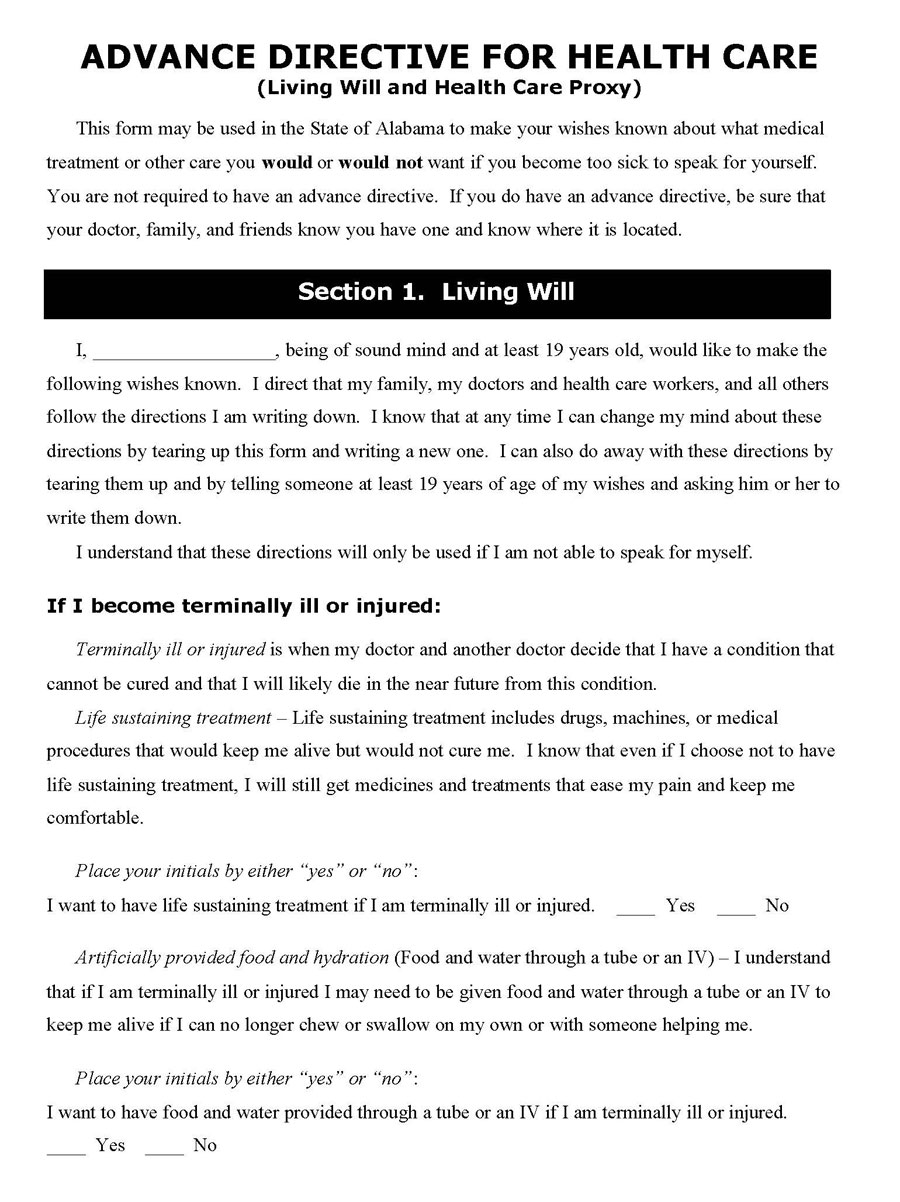

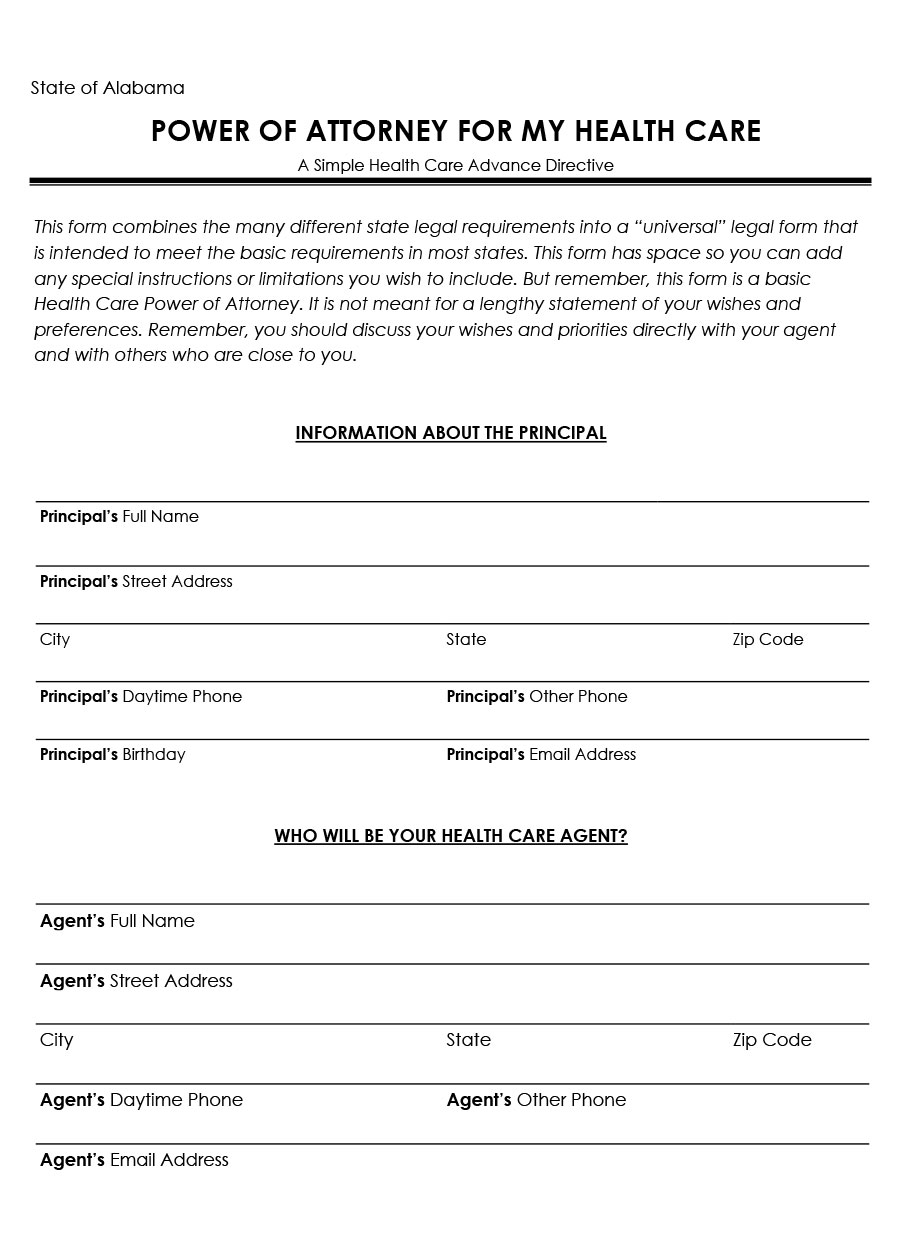

Advance Directive Power of Attorney Sample

Download: Microsoft Word (.docx)

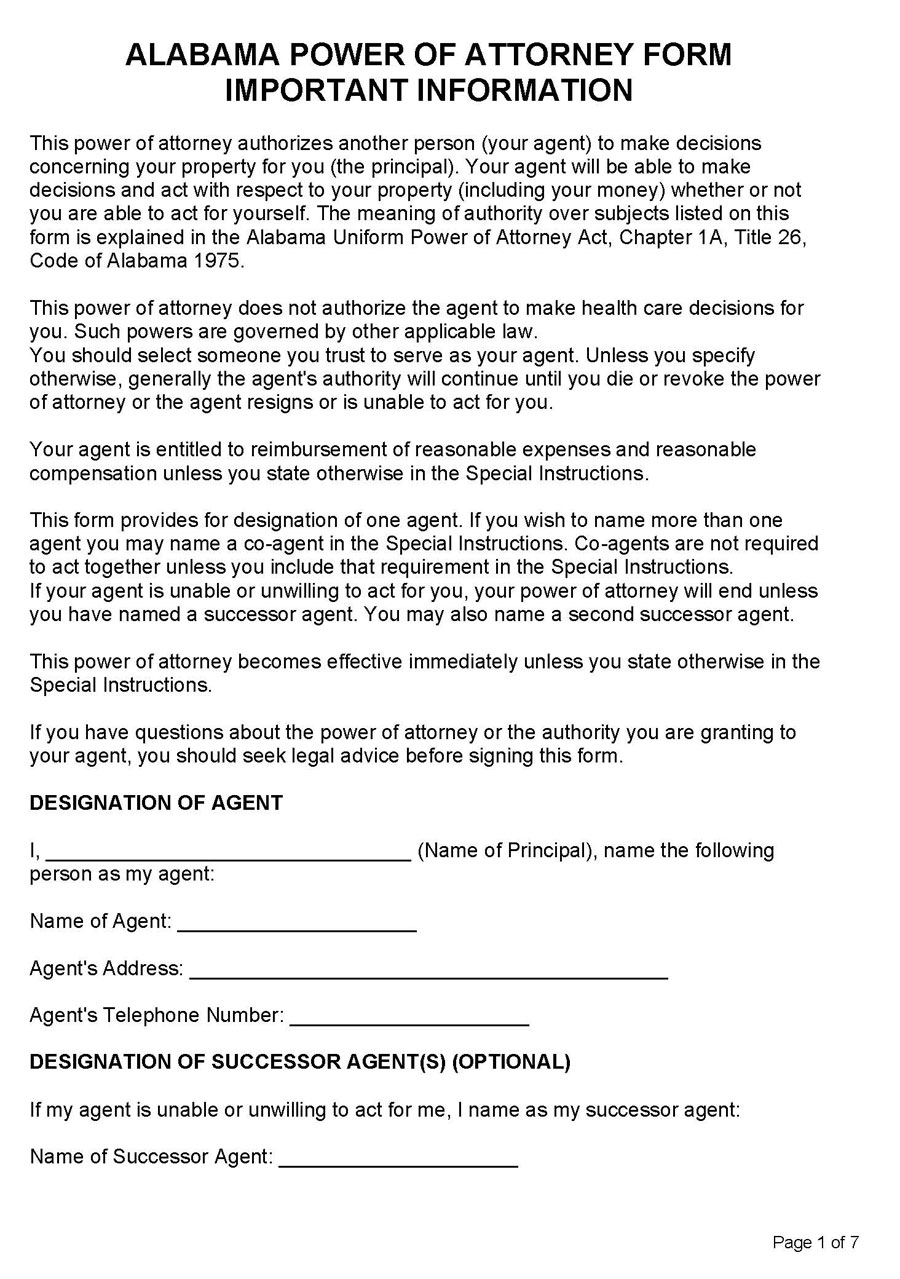

Durable Power of Attorney Form

Download: Microsoft Word (.docx)

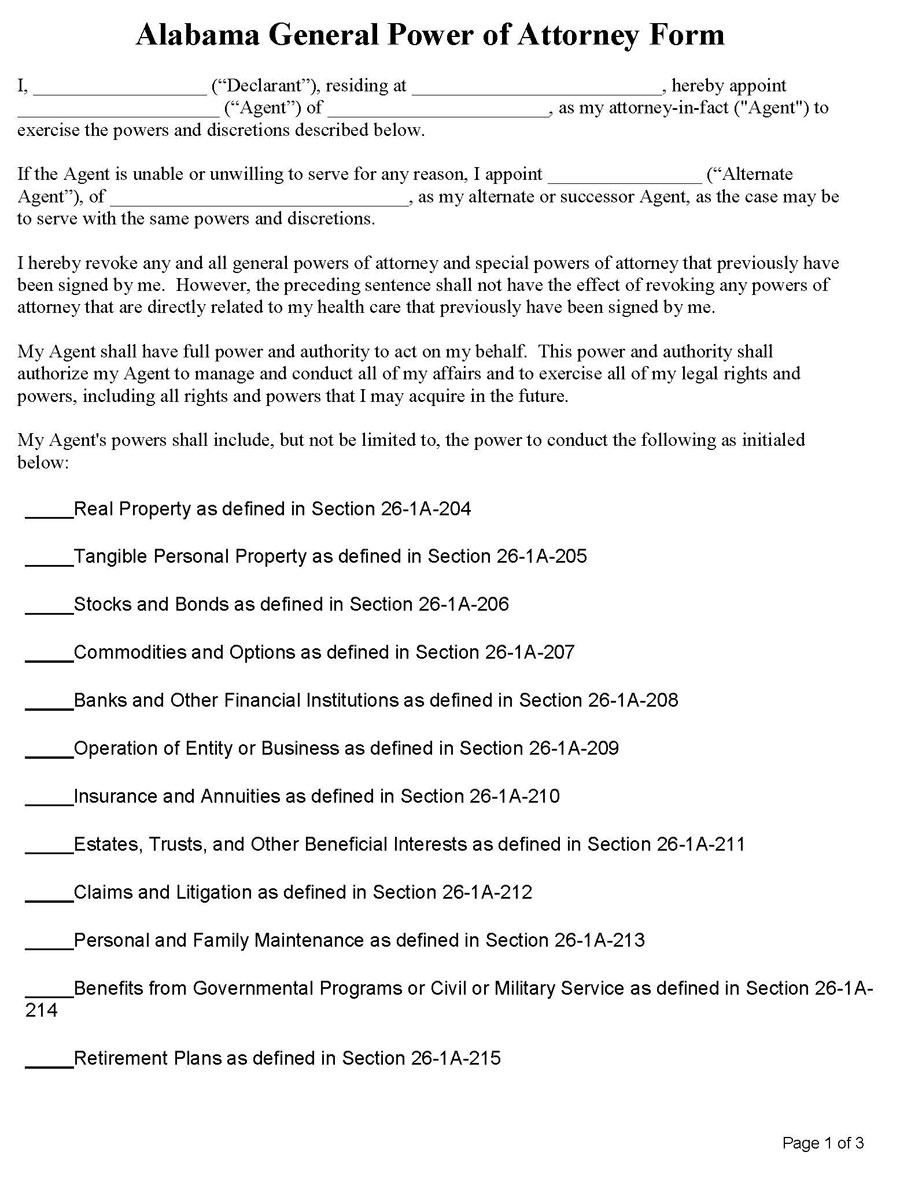

General Power of Attorney Form

Download: Microsoft Word (.docx)

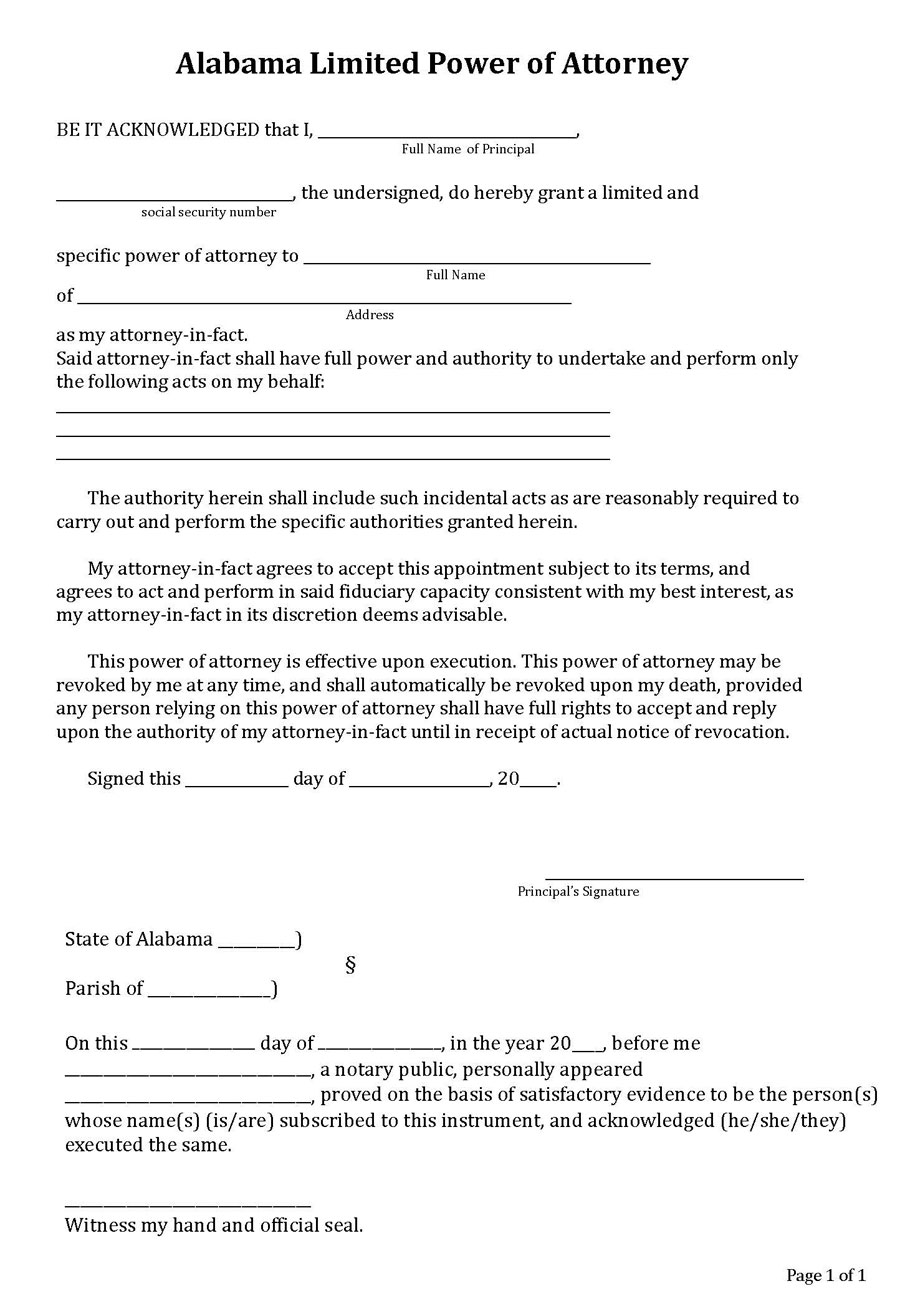

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

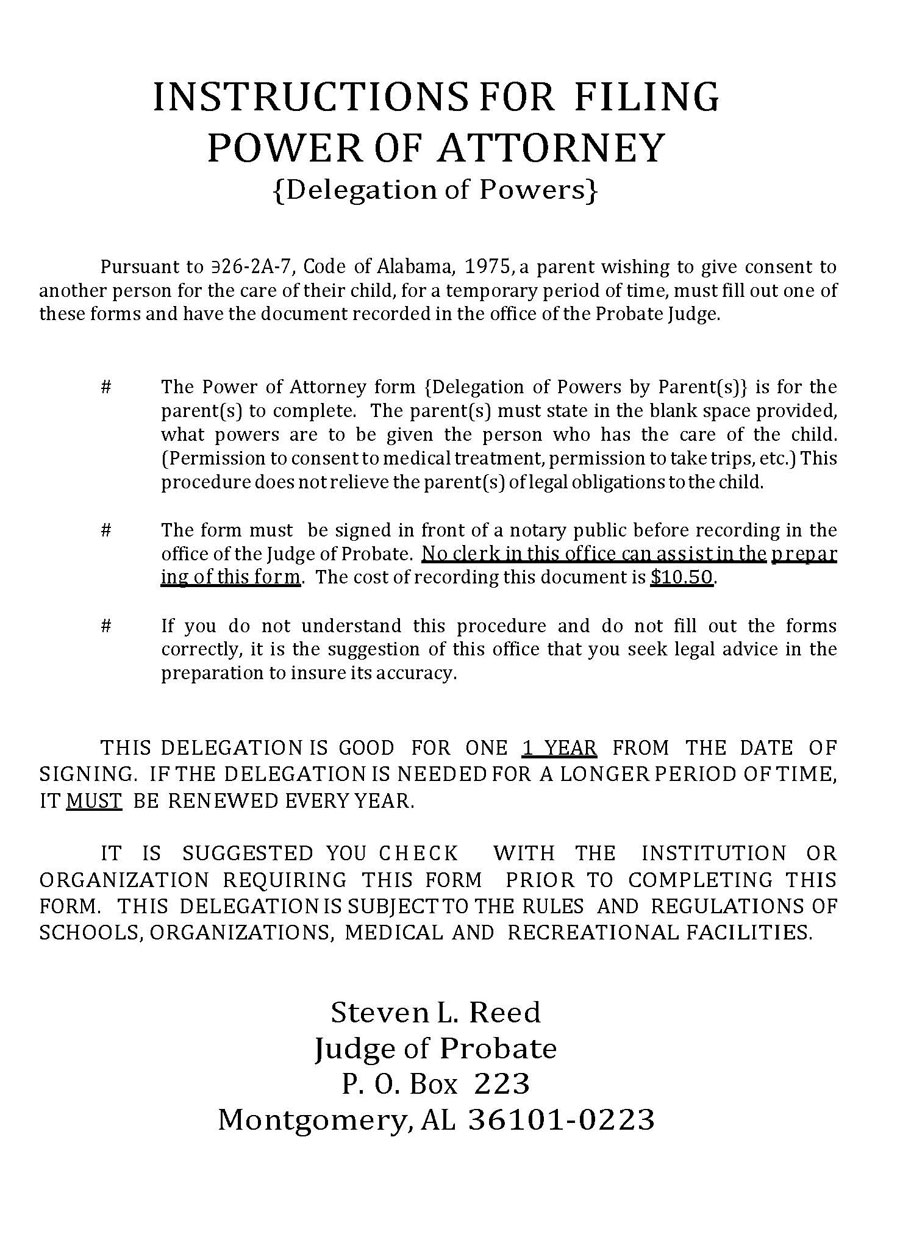

Minor Power of Attorney Form

Download: Microsoft Word (.docx)

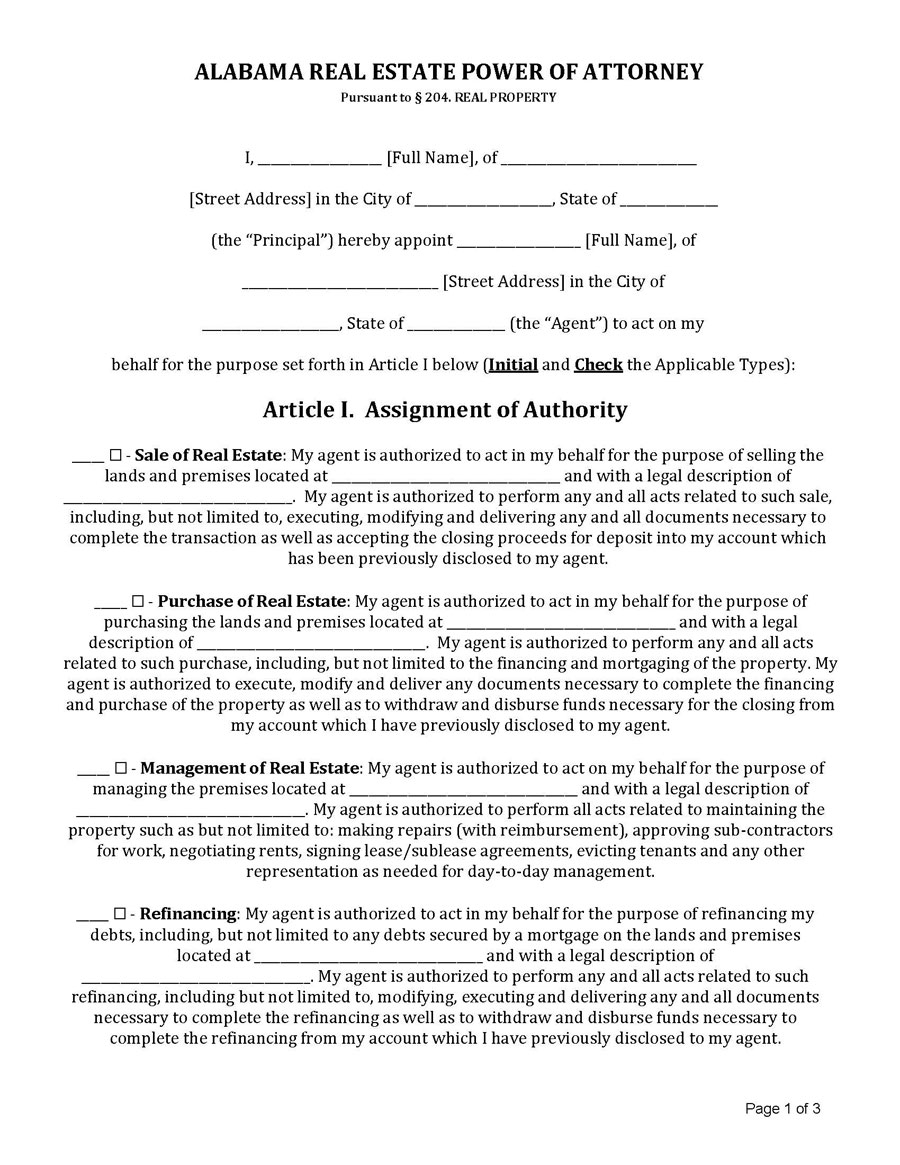

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

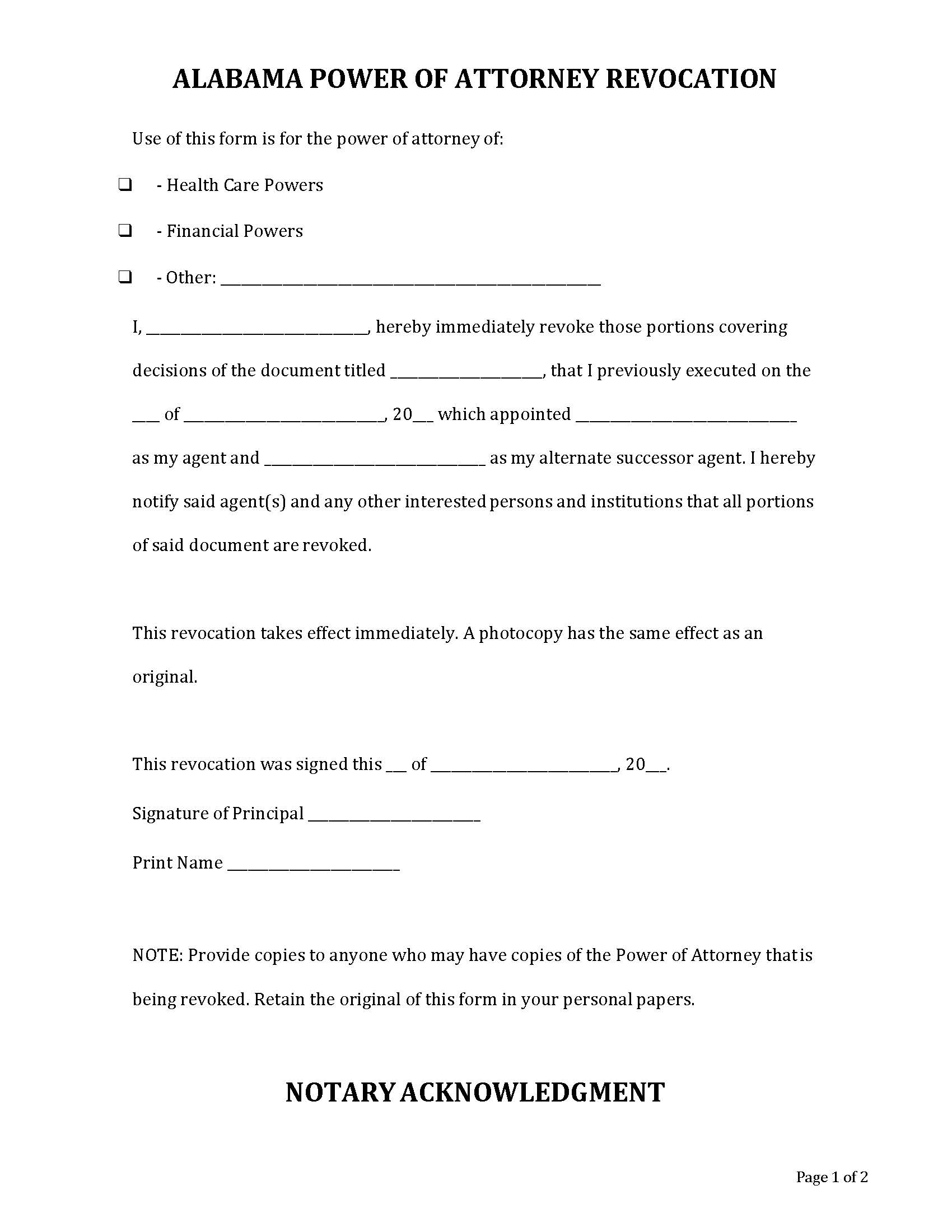

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

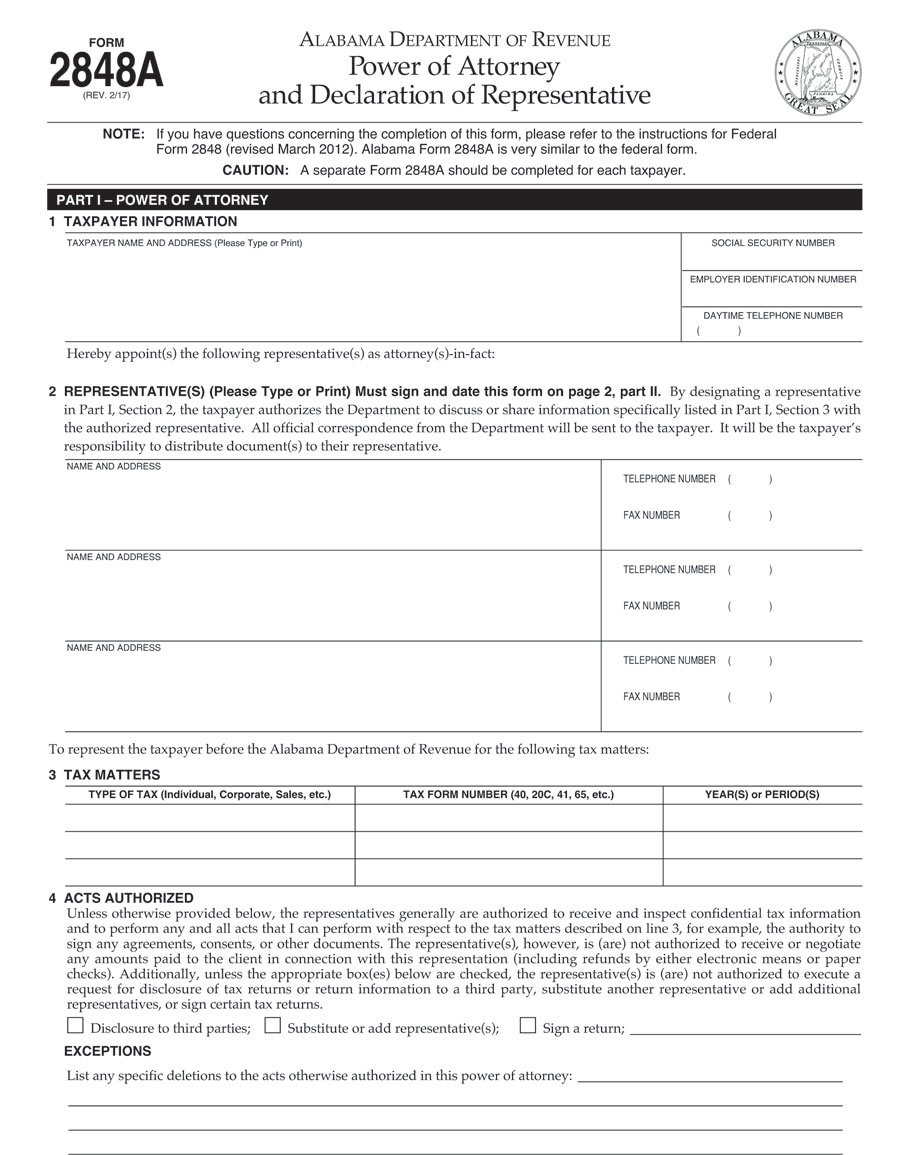

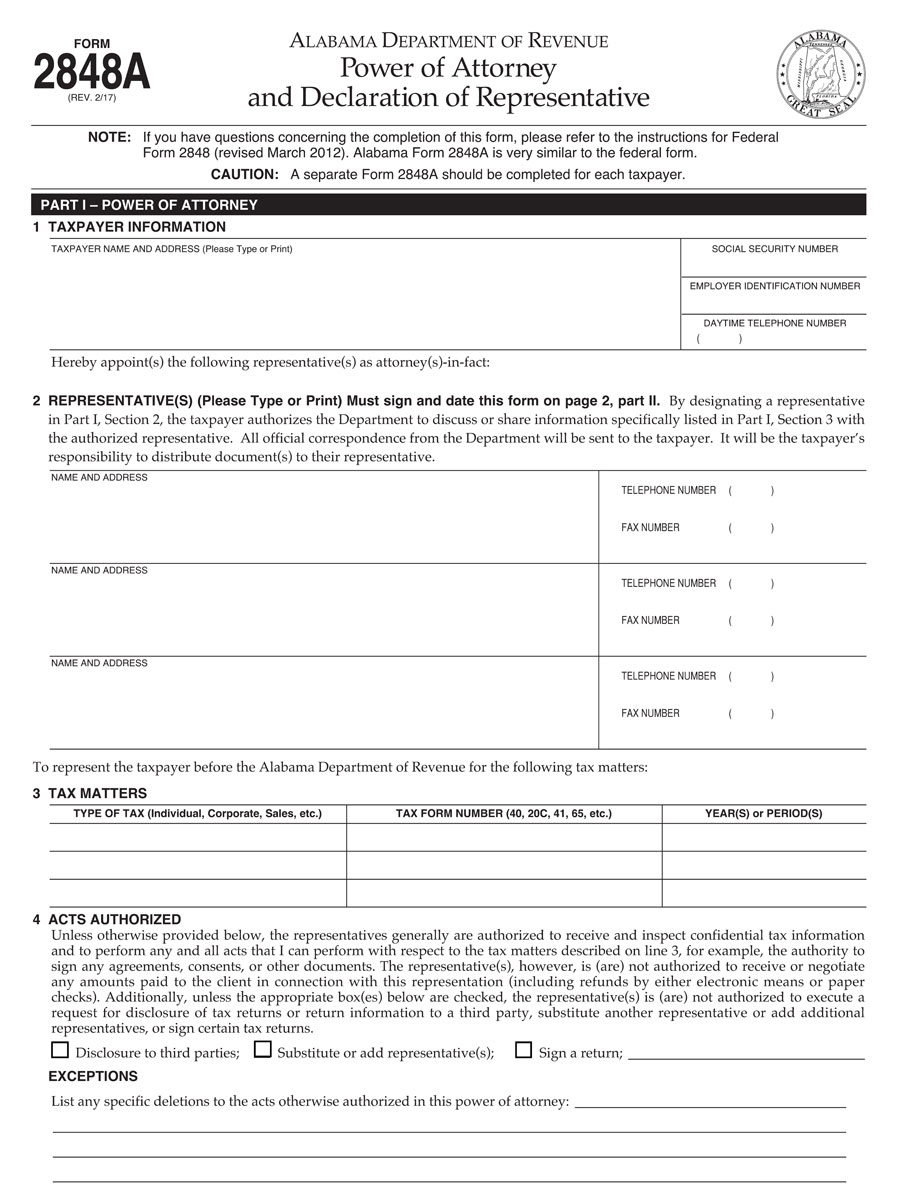

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

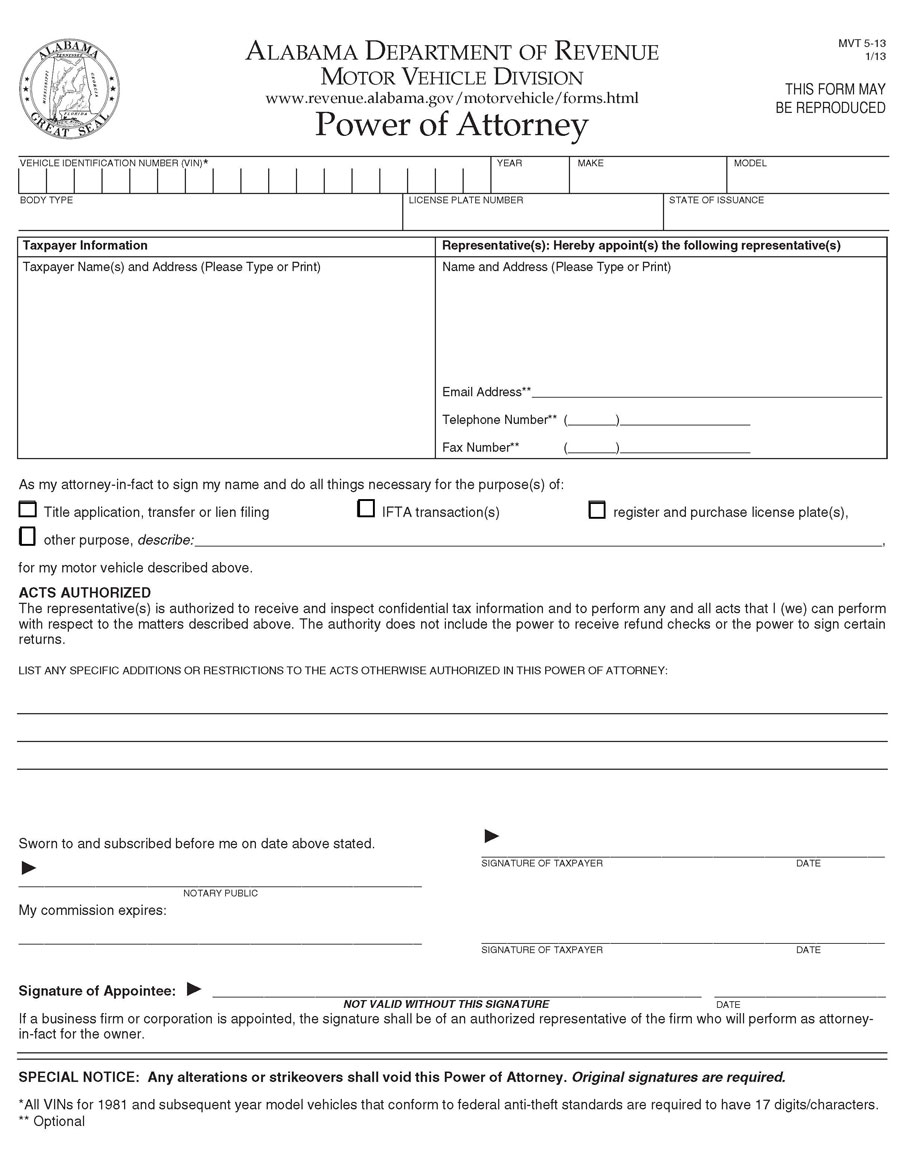

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

Medical Durable Power of Attorney Form

Download: Microsoft Word (.docx)

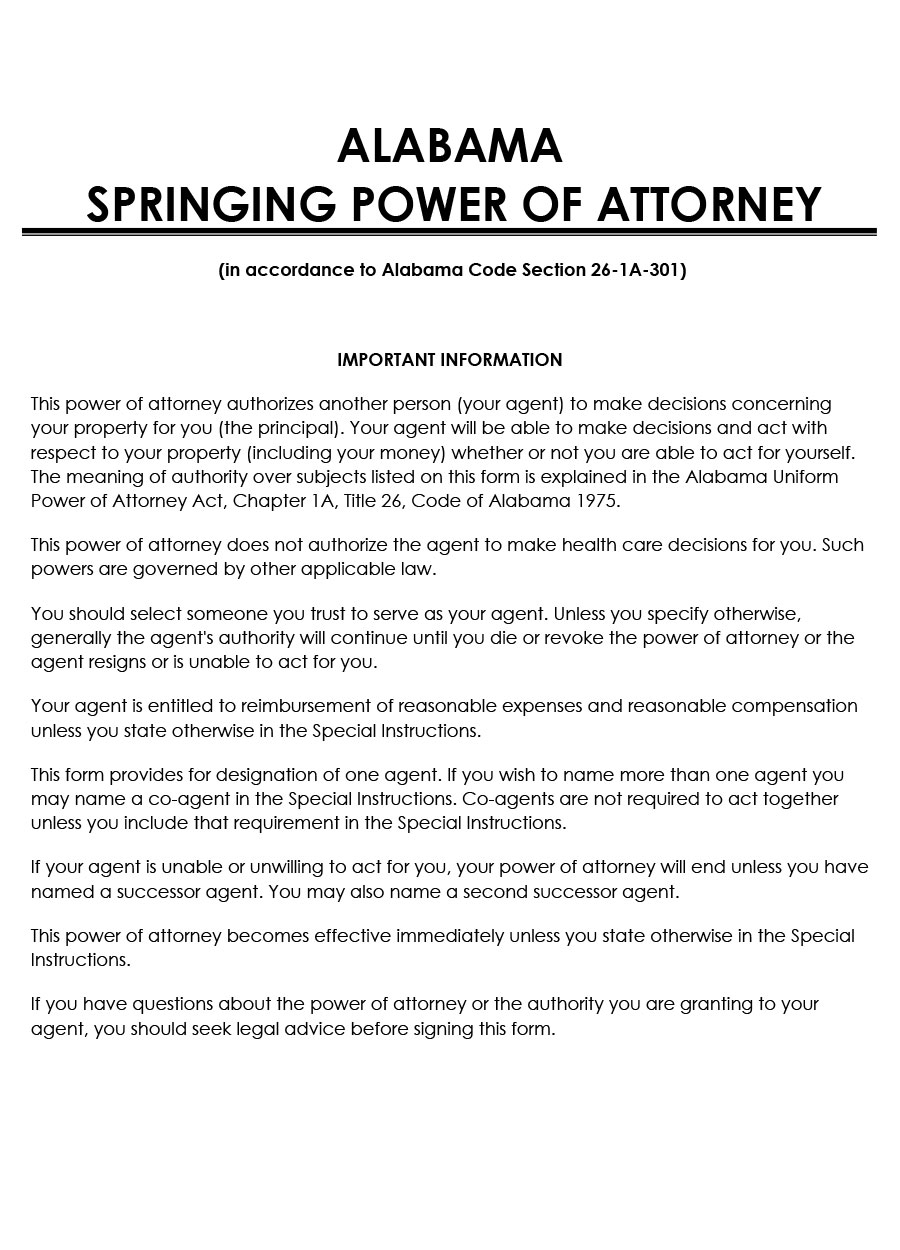

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

Governing Laws

The laws governing a durable POA are found in Alabama Code Section 26-1-2. This code is broken down into several parts.

The agent’s power is described along with the authority granted to them to provide or withhold treatments while acting within good faith. For it, the agent remains in power, even in the event of the principal’s incapacitation.

The form must use particular language laid out within the law. For example, the POA must state: “This POA shall not be affected by disability, incompetency, or incapacity of the principal.”

The durable POA can be revoked by having the principal sign and date in a written document designating the intent. Likewise, if the principal chooses to deface or destroy the original POA in any way, that is also interpreted as a revocation of its authority.

All other durable health care directives from other states are also valid within Alabama. However, the State of Alabama will not recognize the administration or prevention of prohibited services in-state.

Finally, physicians and health care providers cannot be charged with any civil or criminal liability when relying on the good faith of an agent.

Alabama POA Requirements

Although an Alabama POA document is valid, it must meet several requirements to be legally binding. A conservatorship court proceeding will be necessary if these requirements are not met. This can be costly and time-consuming. The requirements for the form may be found in Chapter 26, Title 1A of the Code of Alabama.

Alabama law requires all POAs to be very specific. It should clearly state who is granted authority and what it is. After signing, the document should be validated by a notary public in most cases.

Each of it should be customized to give specific powers to the agent. For example, a financial POA does not grant the agent authority to make all financial transactions. In addition, the form must specify whether the principal wishes the agent to change beneficiaries or trusts.

The date should also be included along with the date at which the agreement was signed. It also needs to include a date acknowledging when the powers were in effect.

How to Get Power of Attorney in Alabama?

It can only be obtained if both the agent and the principal are present. Therefore, it is a good idea to have a lawyer review the details of the form to ensure that it is sound.

If a POA is not signed before the principal becomes incapacitated, a court proceeding must be held to determine if a conservatorship is necessary. In these cases, the court will make the final determination about who gets it.

Frequently Asked Questions

In most cases, it is a simple document to complete and hiring an attorney can be an expensive endeavor. However, if you have a complicated situation or need advice, it may be wise to consider working with a legal professional.

Typically, meeting and hiring an attorney to draw up a power of attorney costs between $200-$500. However, this can vary depending on the needs of the form and the location.

It’s crucial that your agent and any relevant financial institutions receive a copy of the final power of attorney. This guarantees that there are no issues in case the POA becomes necessary.

In almost all cases, a POA needs to be notarized in the State of Alabama. However, when it comes to the real estate ones, the form should also be filed with the corresponding county.

A POA can specify the types of authority a given agent has. Especially with limited forms, the principal will list all the agent’s powers. These could be pretty general, such as typical banking transactions.

It automatically ends when the principal dies, when the POA is revoked, or specified expiration date is reached. Alternatively, it can also terminate when the specific purpose for the document is achieved or if the agent dies or becomes incapacitated.