Whether you are planning for your new project, business, or any other major event, a budget summary provides you with the whole context of allocating resources and managing other expenses. A budget summary acts as a shortening tool, making it easier for you to understand the entire budgeting of your project. In most cases, tracking specific expenses over a period of time can be tiresome work. However, in order to avoid such problems, a budget summary can help you simplify the task.

What is the Budget Summary

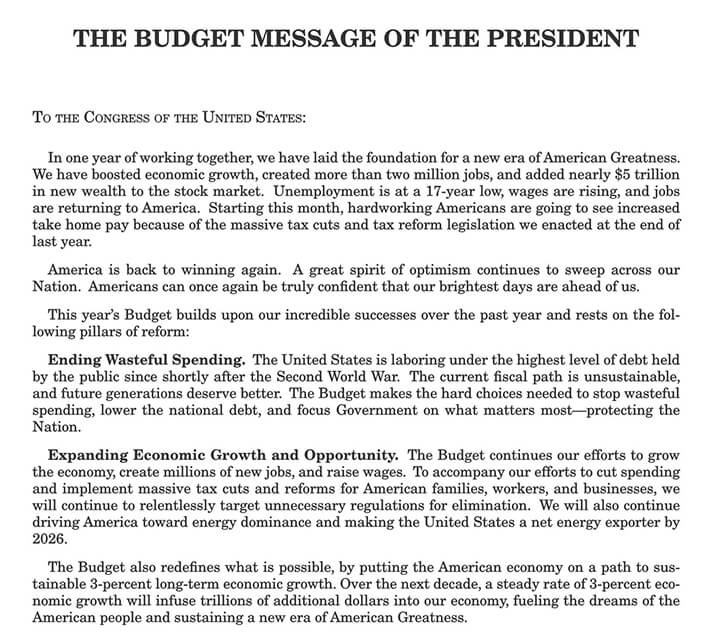

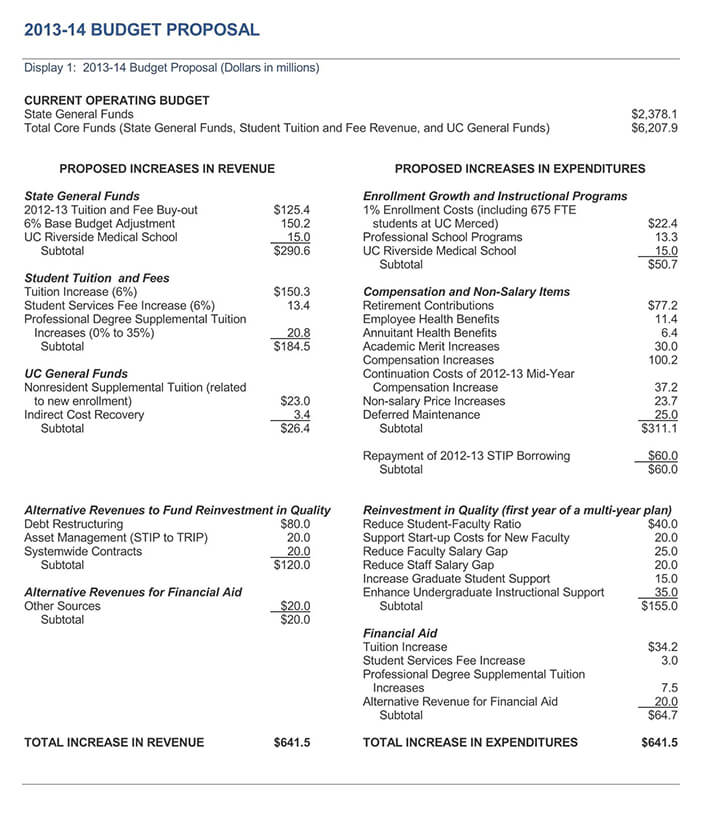

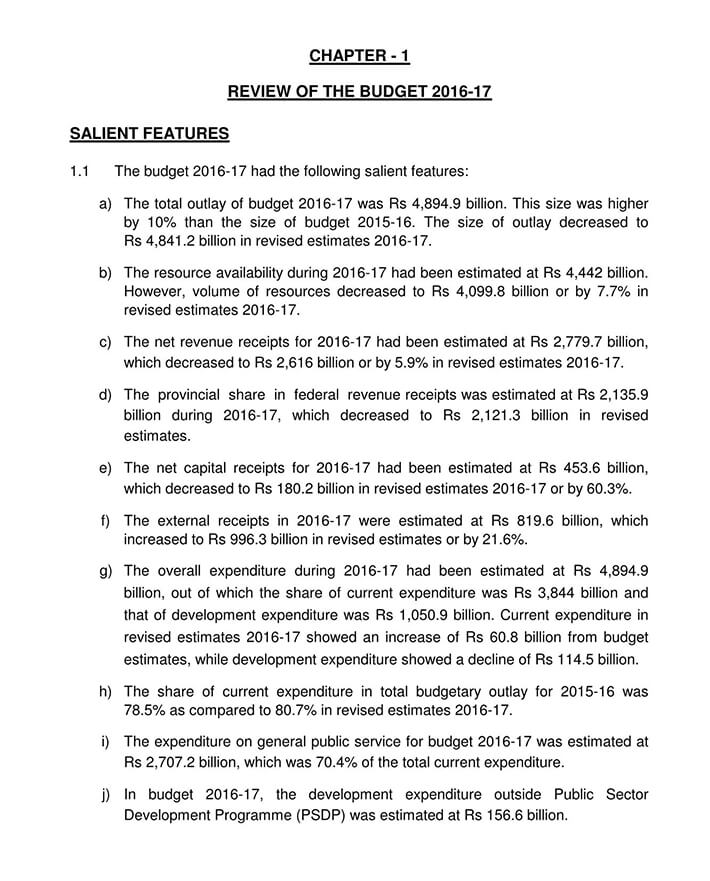

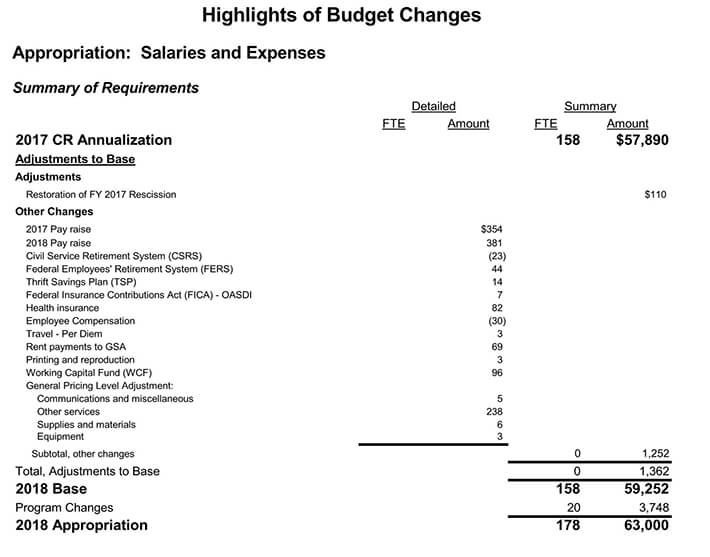

In its simplest definition, a budget summary refers to an itemized summary of expected revenue as well as expenditure of a given project, business, or company. Usually, a budget summary often highlights some essential information that is related to the significant revenues and expenses of an organization.

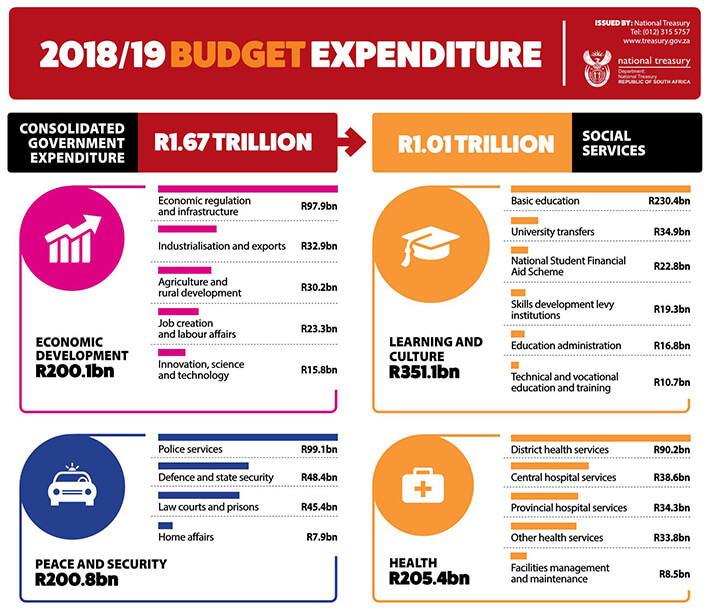

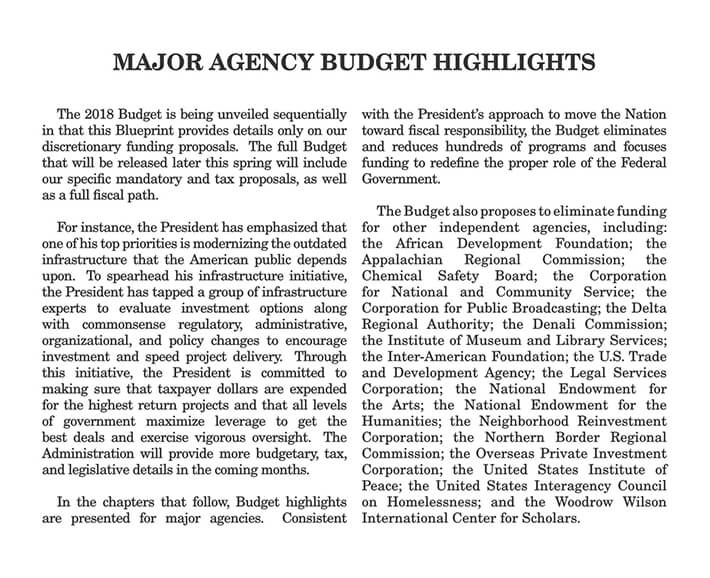

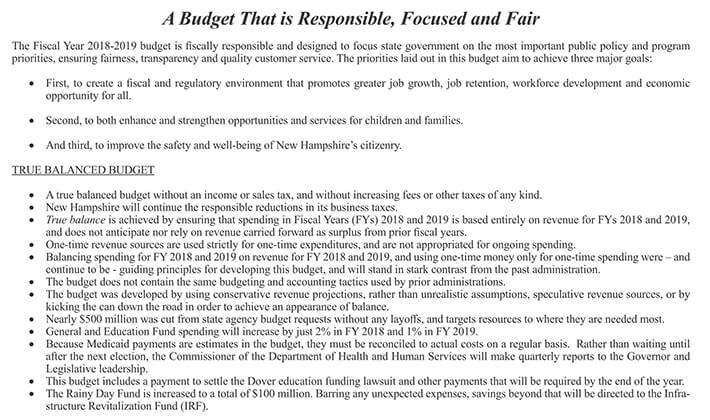

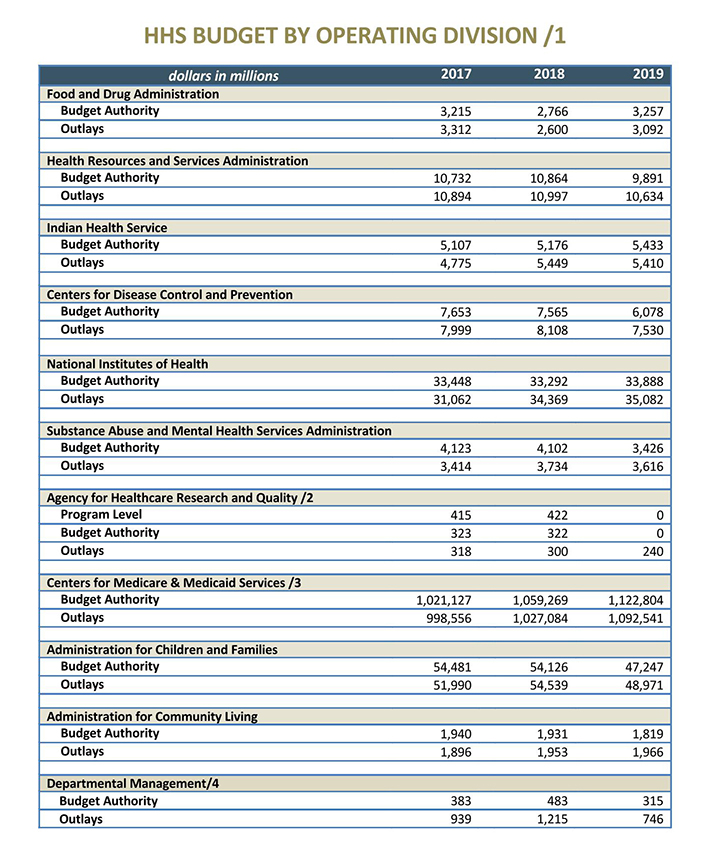

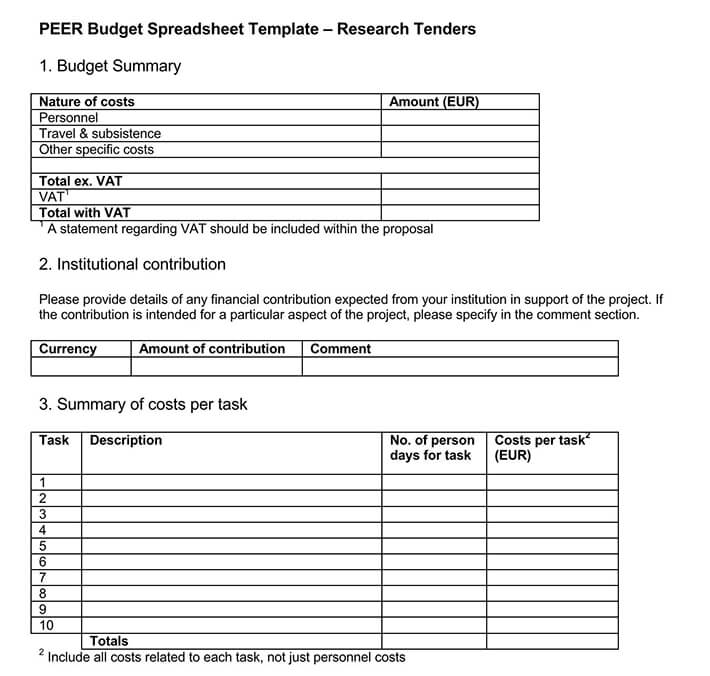

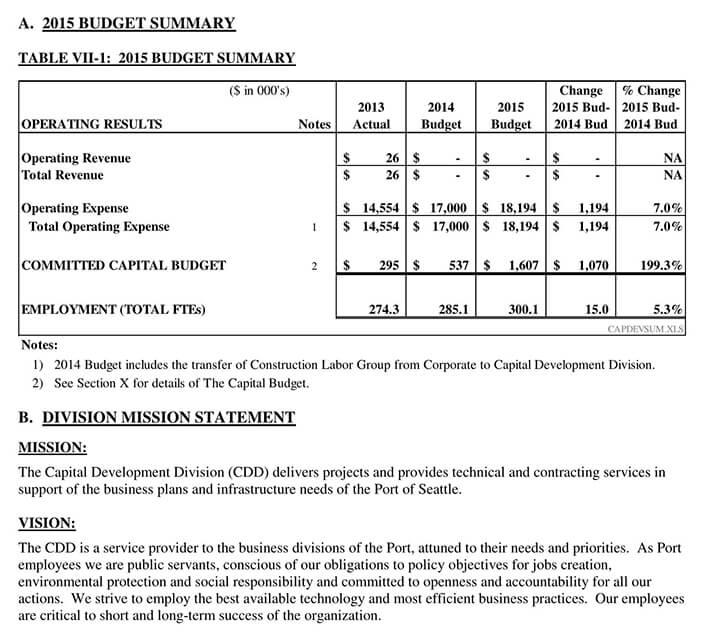

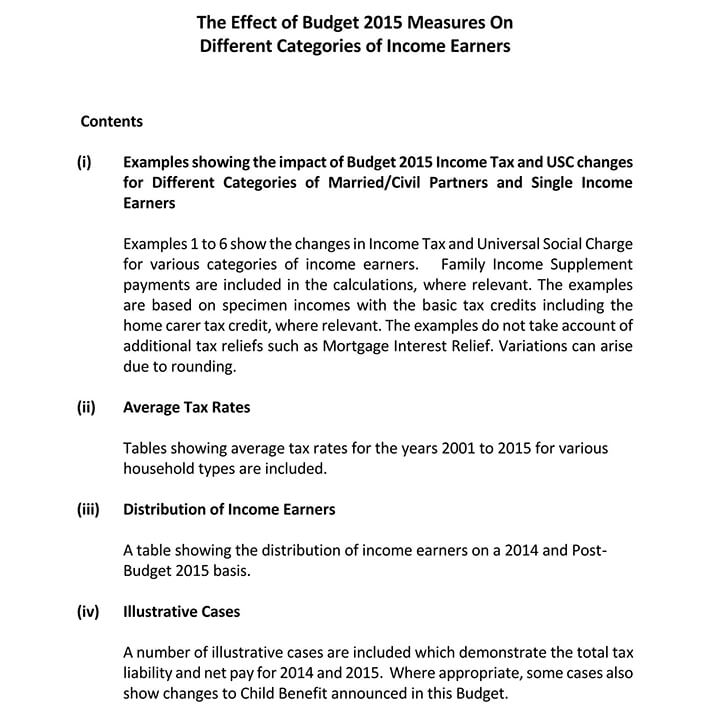

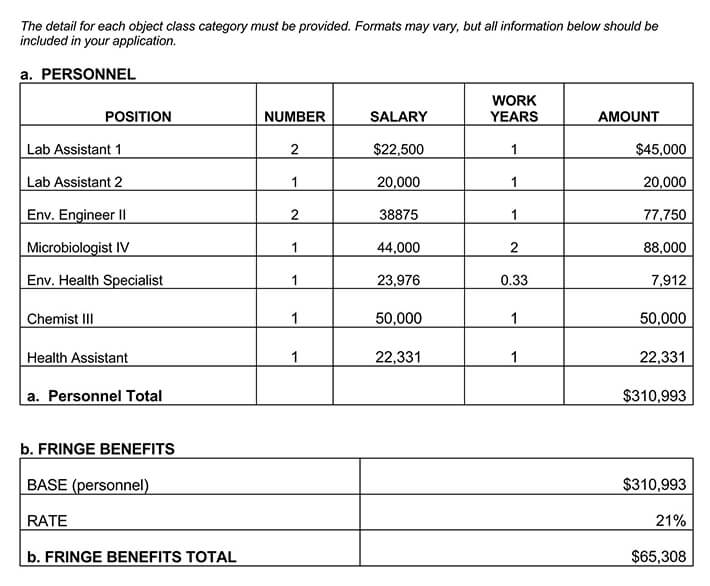

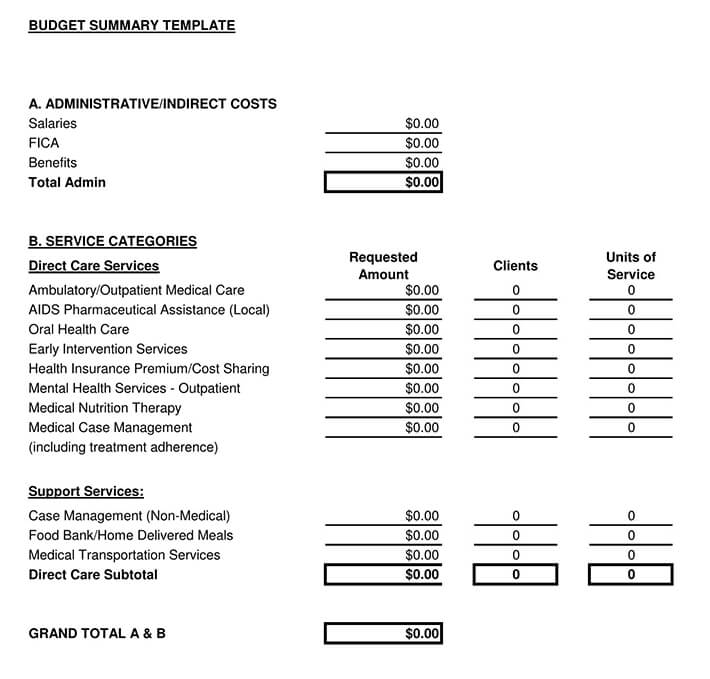

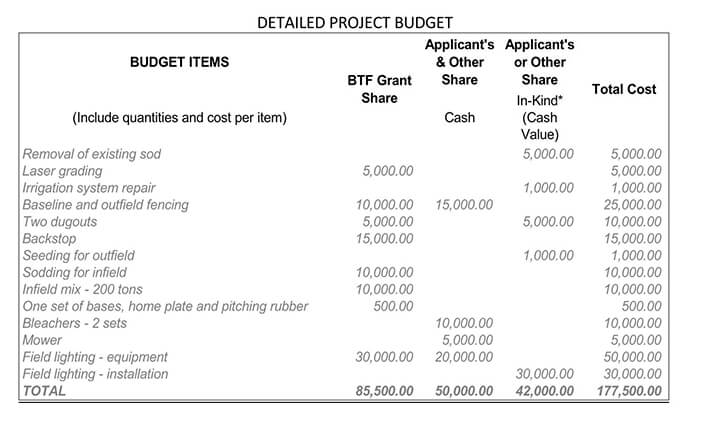

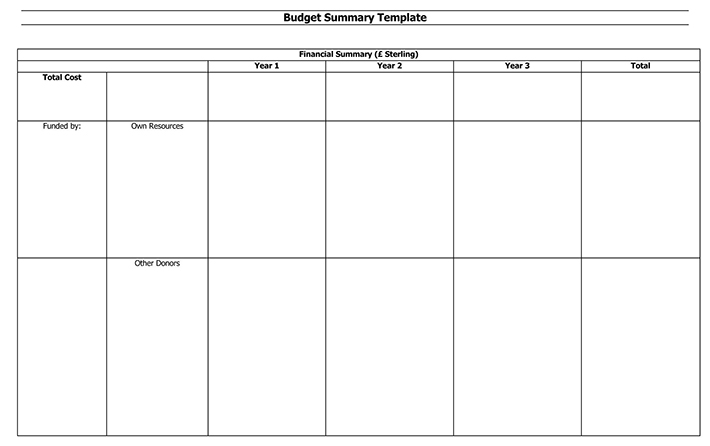

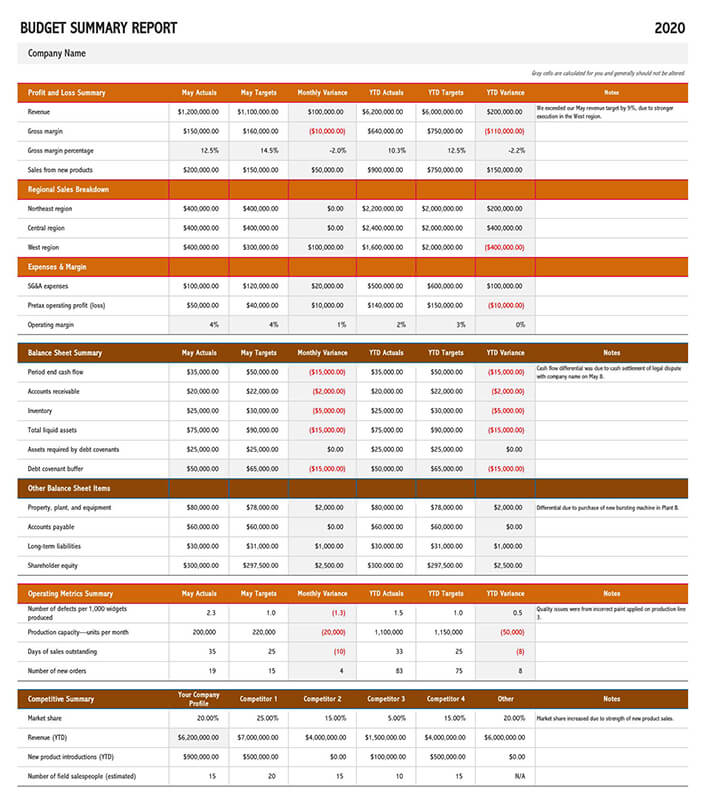

Free Budget Summary Templates

Budget Summary Effects

Well, according to the economist, a budget summary can impact differently on the overall process of your development plans. Here are some ways on how to budget summary can affect the development of the budgeting process and other future prospect plans.

- A budget summary helps ensure that your budget stays in line with what is included within the written documents. In other words, it ensures proper assessment and evaluation of financial resources, making you stay within your budget limit.

- A budget summary also helps provide a detailed overview of how an organization used the allocated resources in a particular developmental process. This also helps determine the effectiveness of the development process in question.

- A budget summary identifies the impacts of budget usage on the management and operation of the business/organization.

Tips for Creating a Budget Summary

Creating a budget summary can be difficult and tiresome. However, with the following steps, you can develop a compelling and effective budget summary with lots of ease.

- Define the objective and purpose of the budget brief. Usually, it is important that you start the process by defining your objectives and the purpose of the budget summary. This will help set the rightful tone and direction that will help you get necessary and relevant information.

- Understand the activities and processes that should be included in the scope of the budget summary. Ensure that you are particular with the activities or processes you include in the summary.

- Clarify the scope and limitations of the budget summary. In order to avoid confusion with your audience, it’s important that you give an idea of the scope of your budget. This will also tell you how much money you will be handling.

- Ensure you collect all the necessary information that will be relevant to your project. You can achieve this by consulting various stakeholders such as financial officers, auditors, accountants, etc.

- Discuss the organization’s revenues and other sources of income. In necessary, you can record the amount of money the company has received within the past periods.

- Discusses the budget reallocations that happened within the process described in the budget summary.

Benefits of Creating a Budget Summary

- A budget summary helps you focus on your financial goals

- It gives you the power to control your finances.

- It helps you organize your spending habits and savings

- It enables you to plan for the expected and unexpected costs.