A cash receipt is a printed statement of the cash or cash equivalent amount received in a cash sale transaction.

The cash sale receipt is usually generated when a vendor accepts cash or its equivalent from another party, usually a customer, an investor, or a bank. The cash sale receipt is usually acknowledged when money is taken from the customer to adjust the outstanding accounts receivable balance generated when a credit sale transaction occurs. A copy of the cash sale receipt is usually given to the customer, and a copy is retained to track the sales and/or services offered. If the cash payment qualifies as a tax-deductible purchase, the customer could need the receipt when listing such deductibles on their income tax returns.

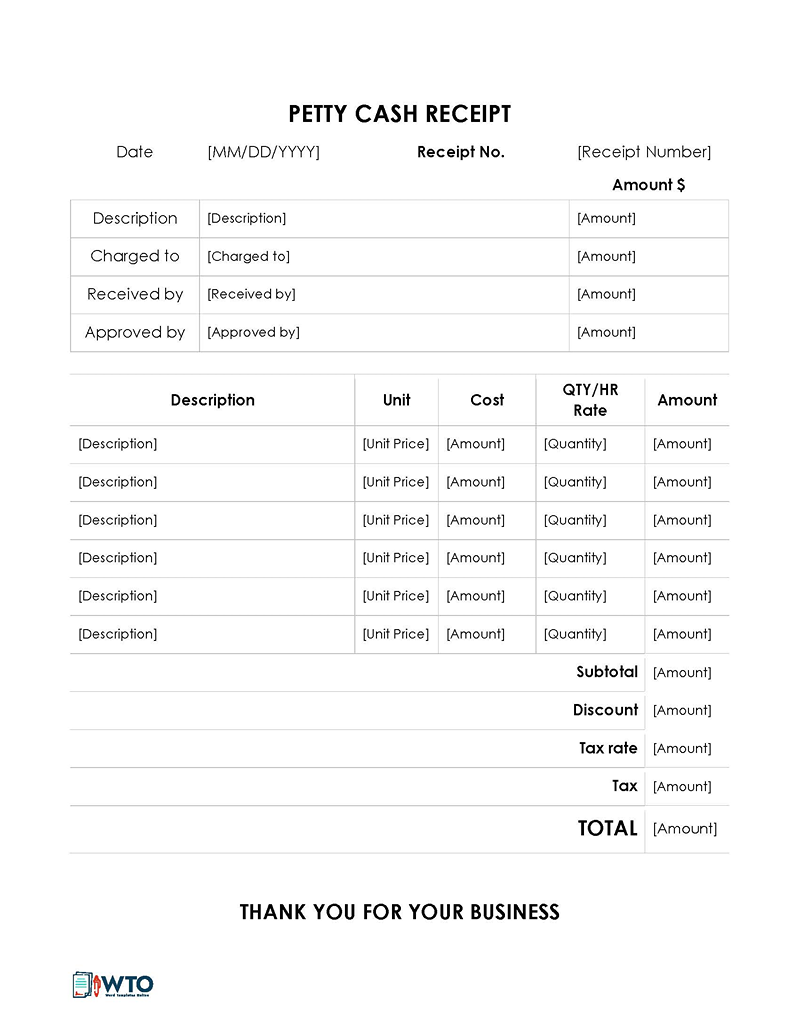

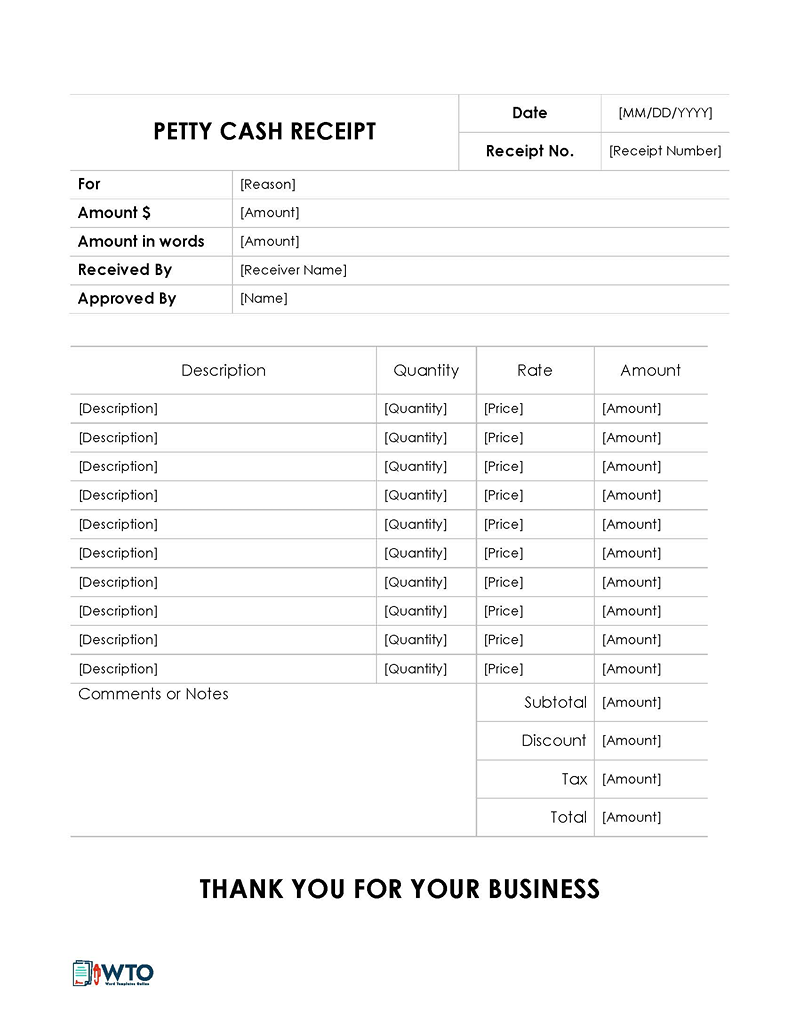

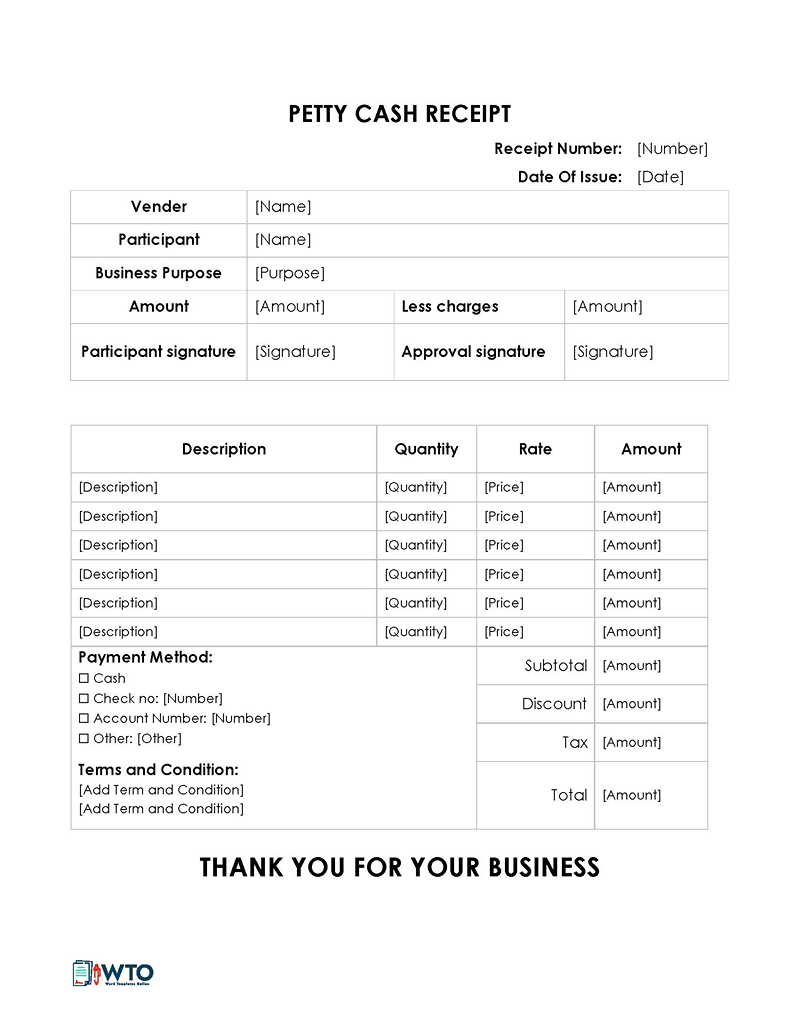

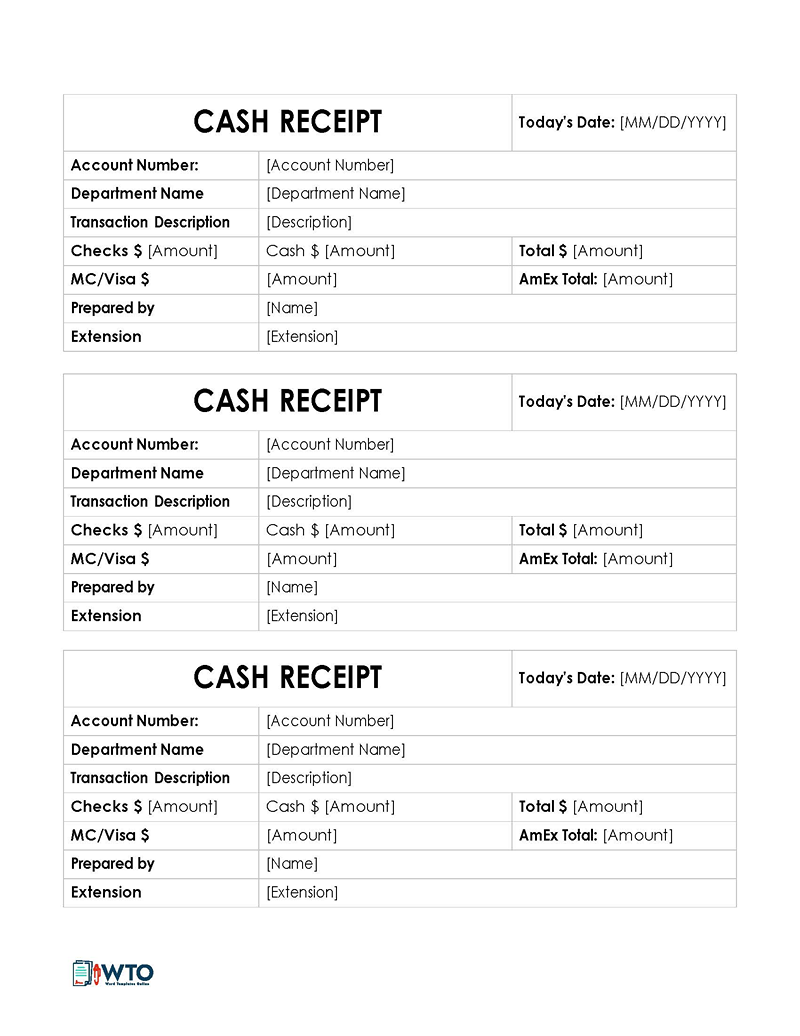

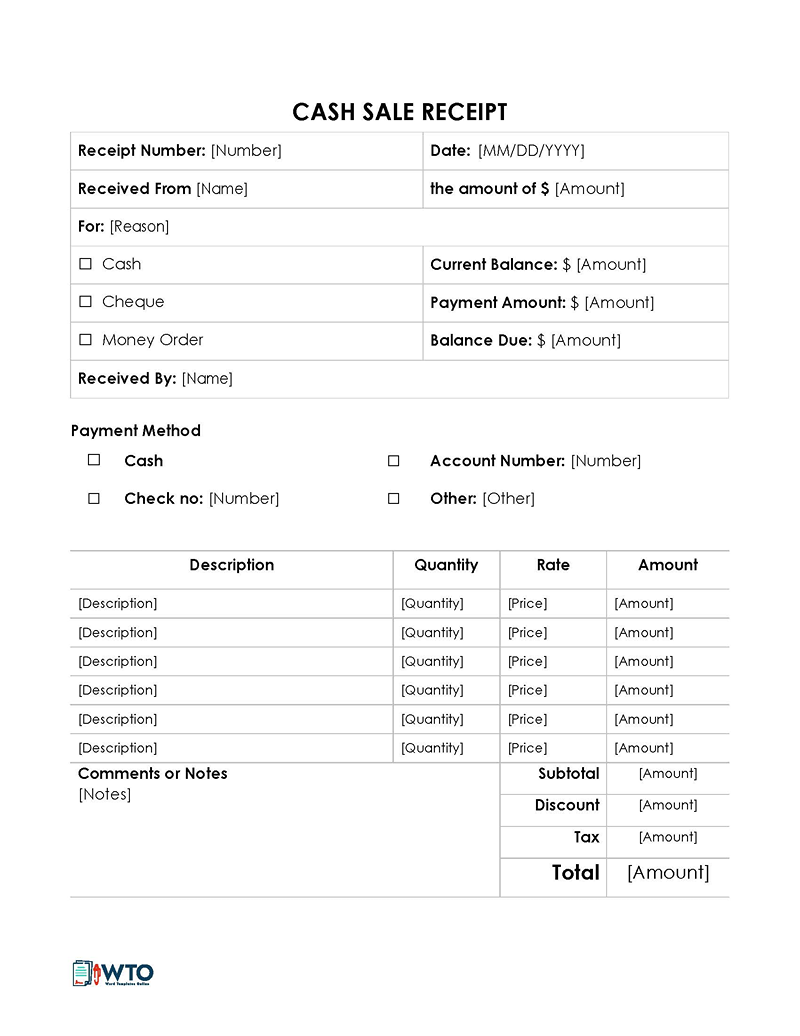

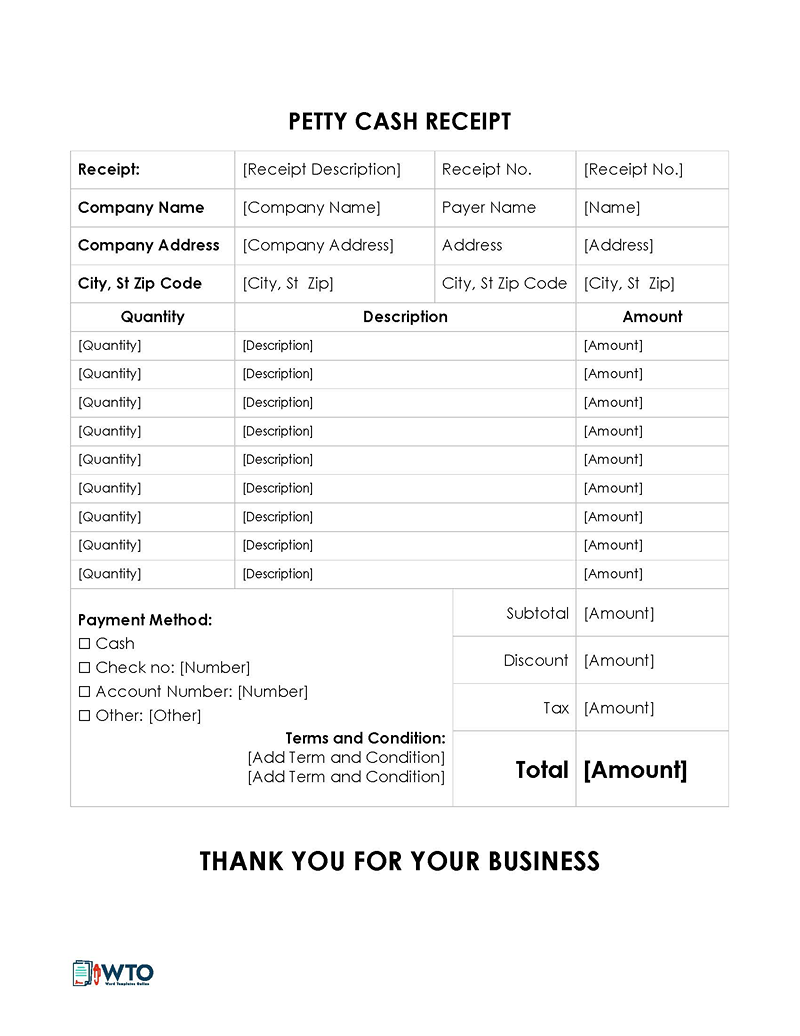

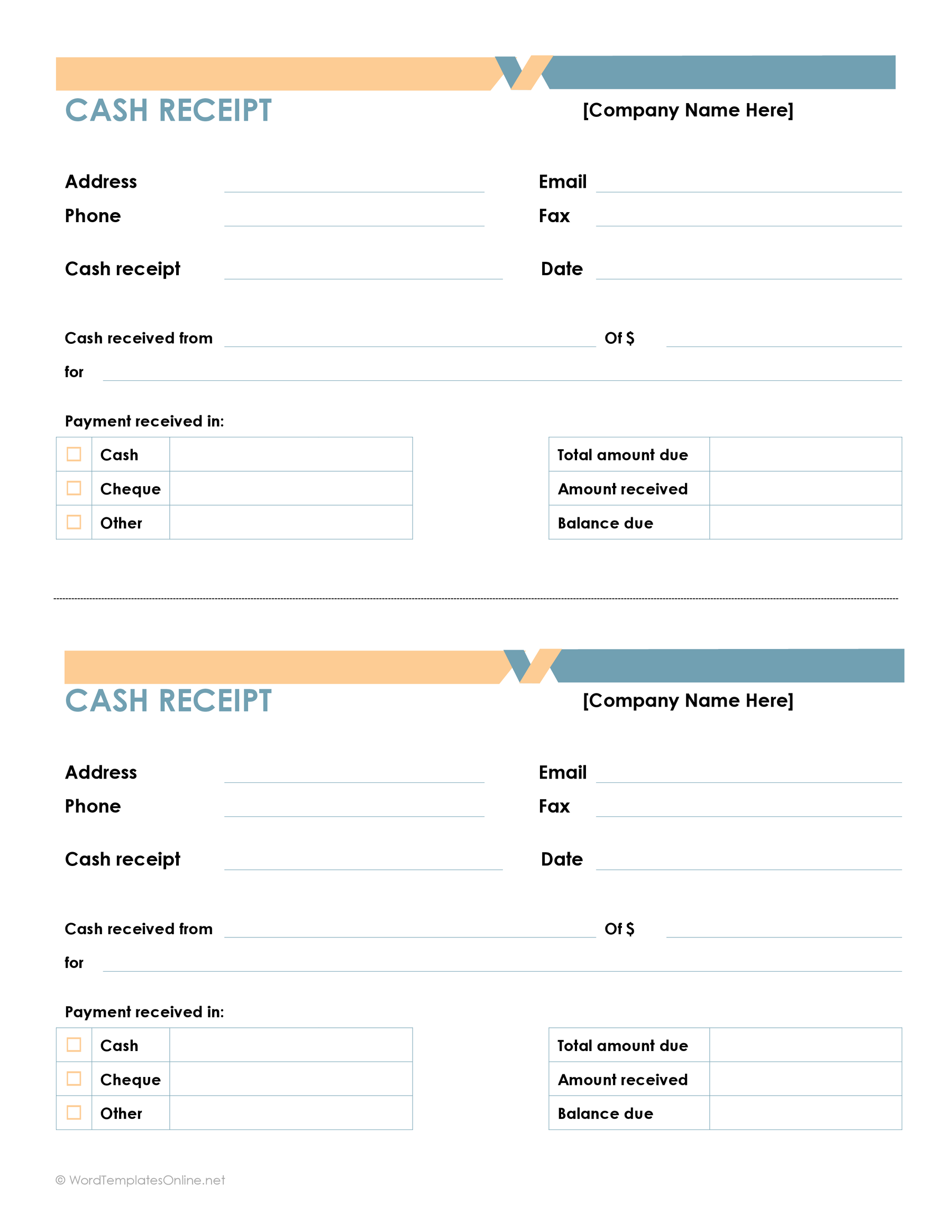

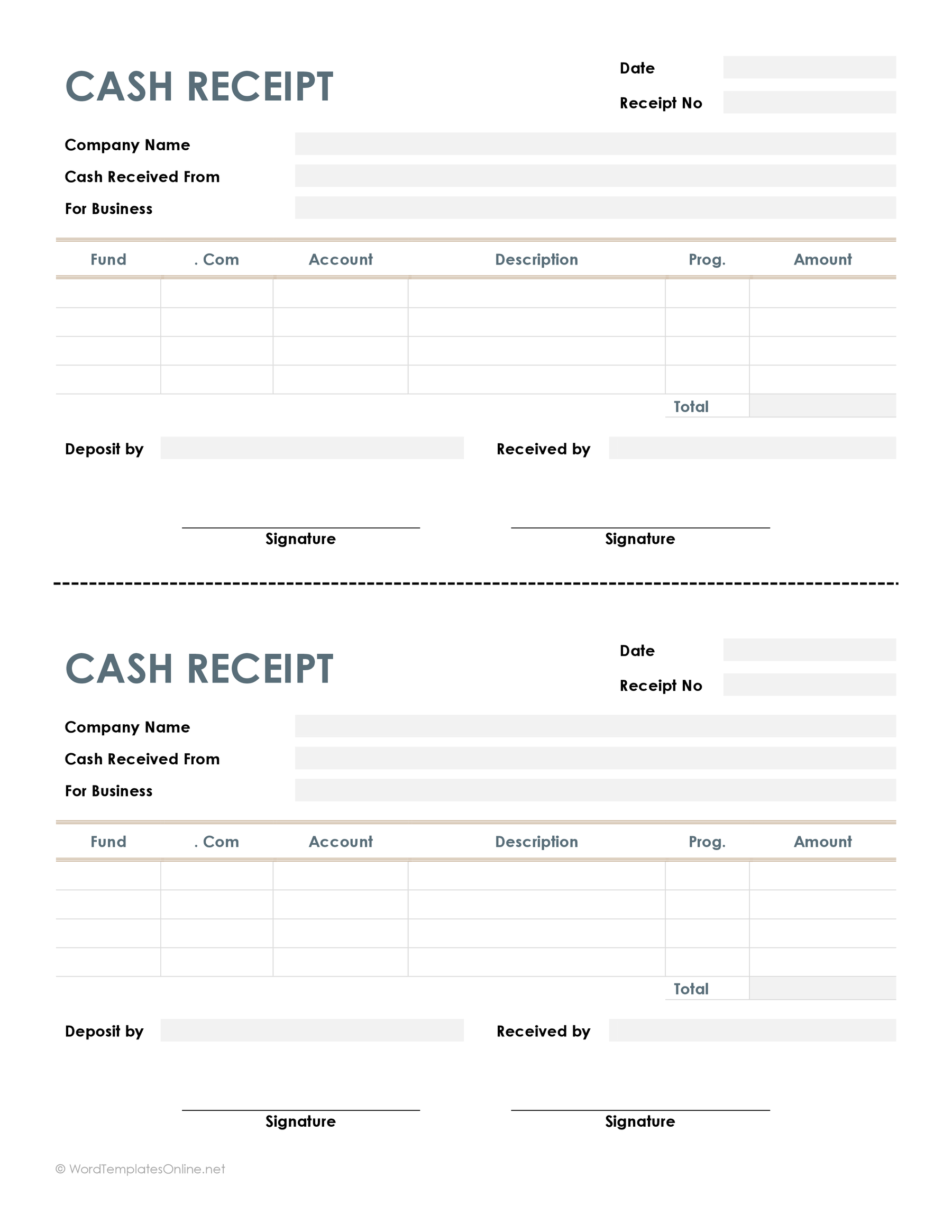

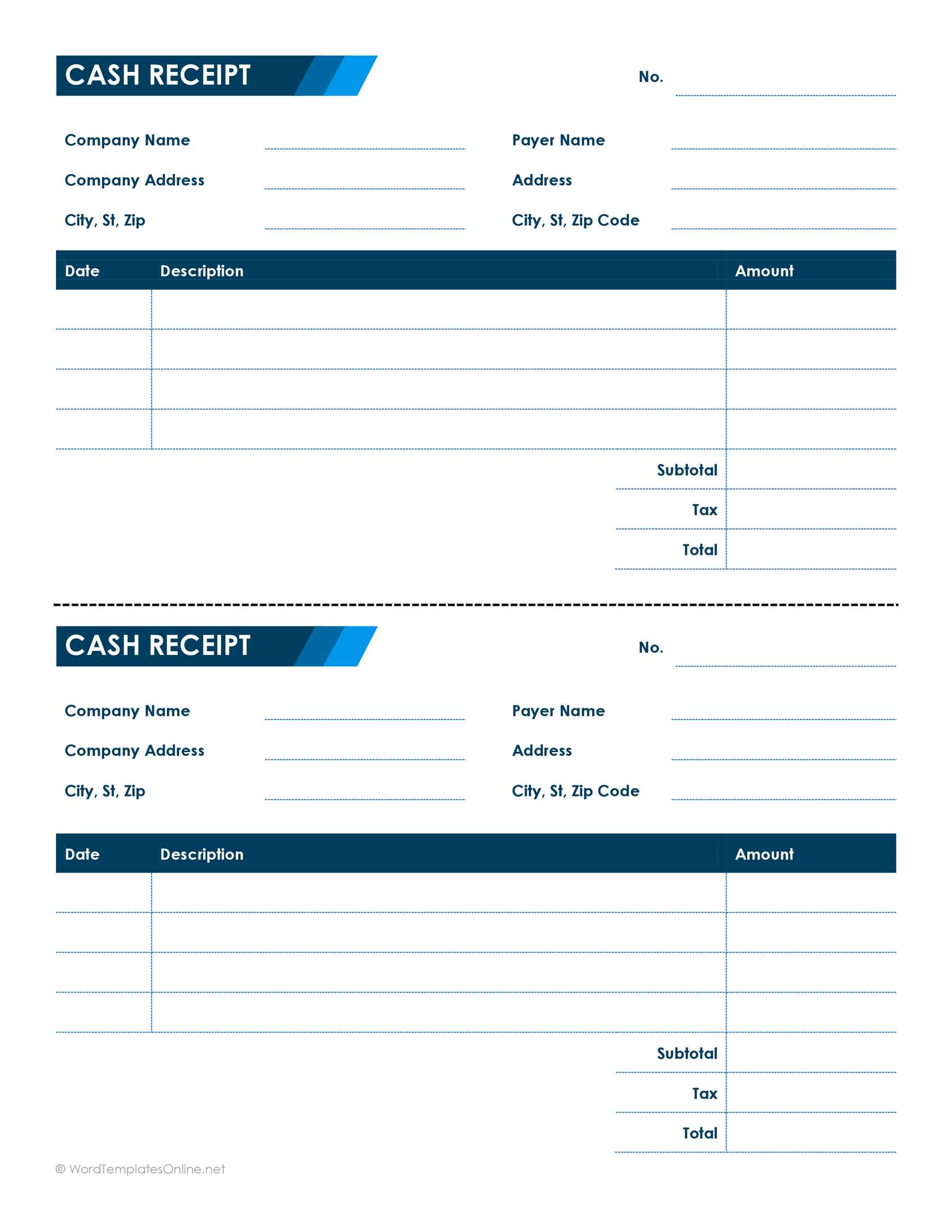

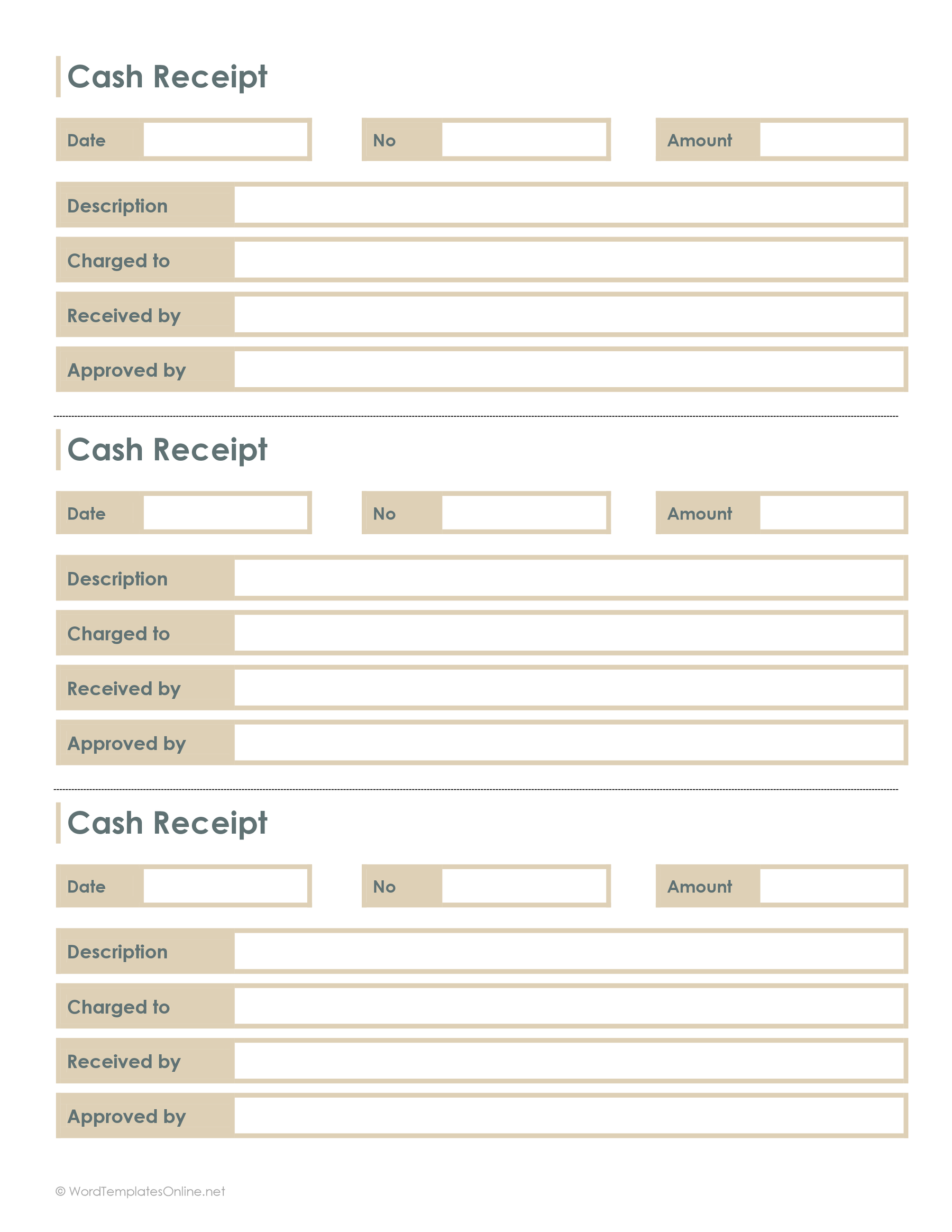

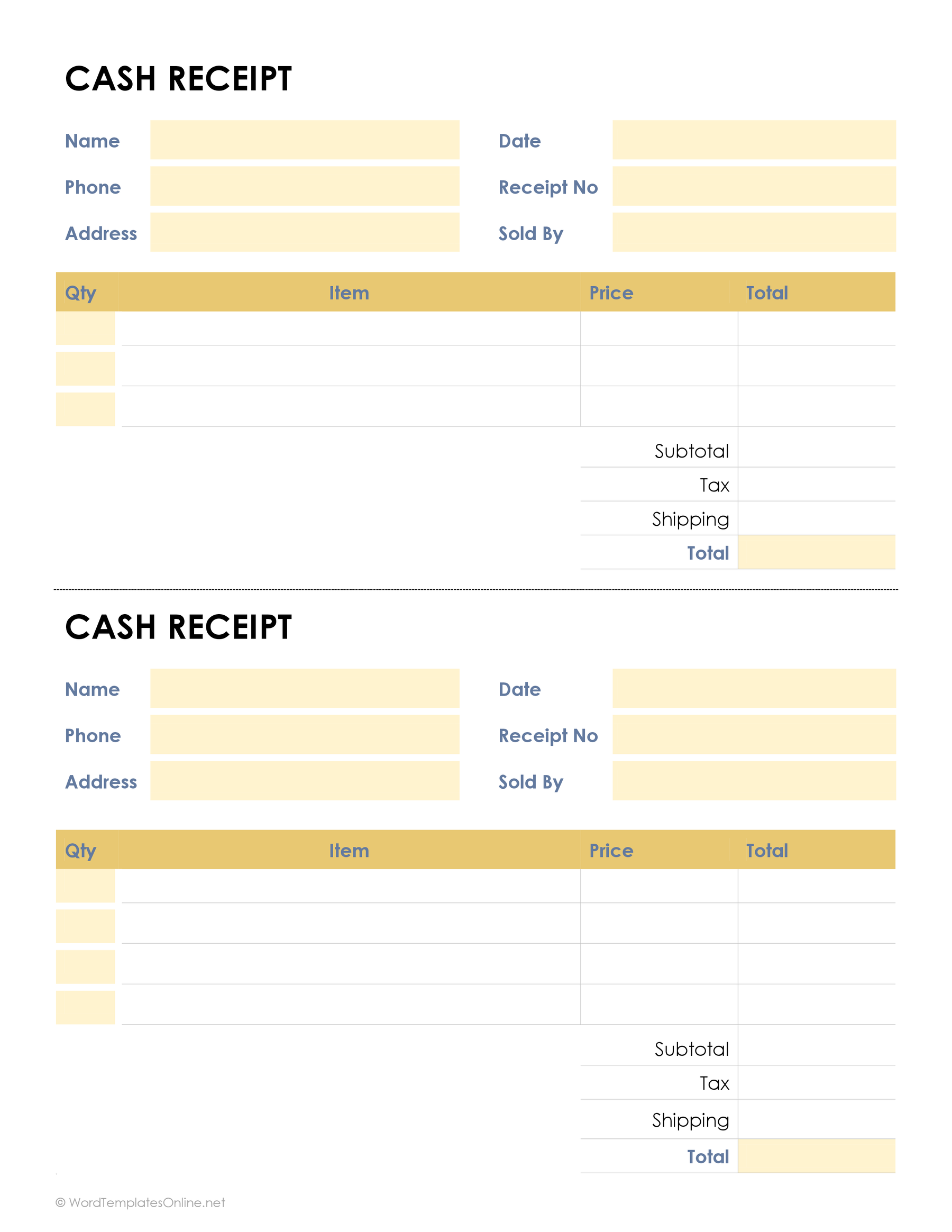

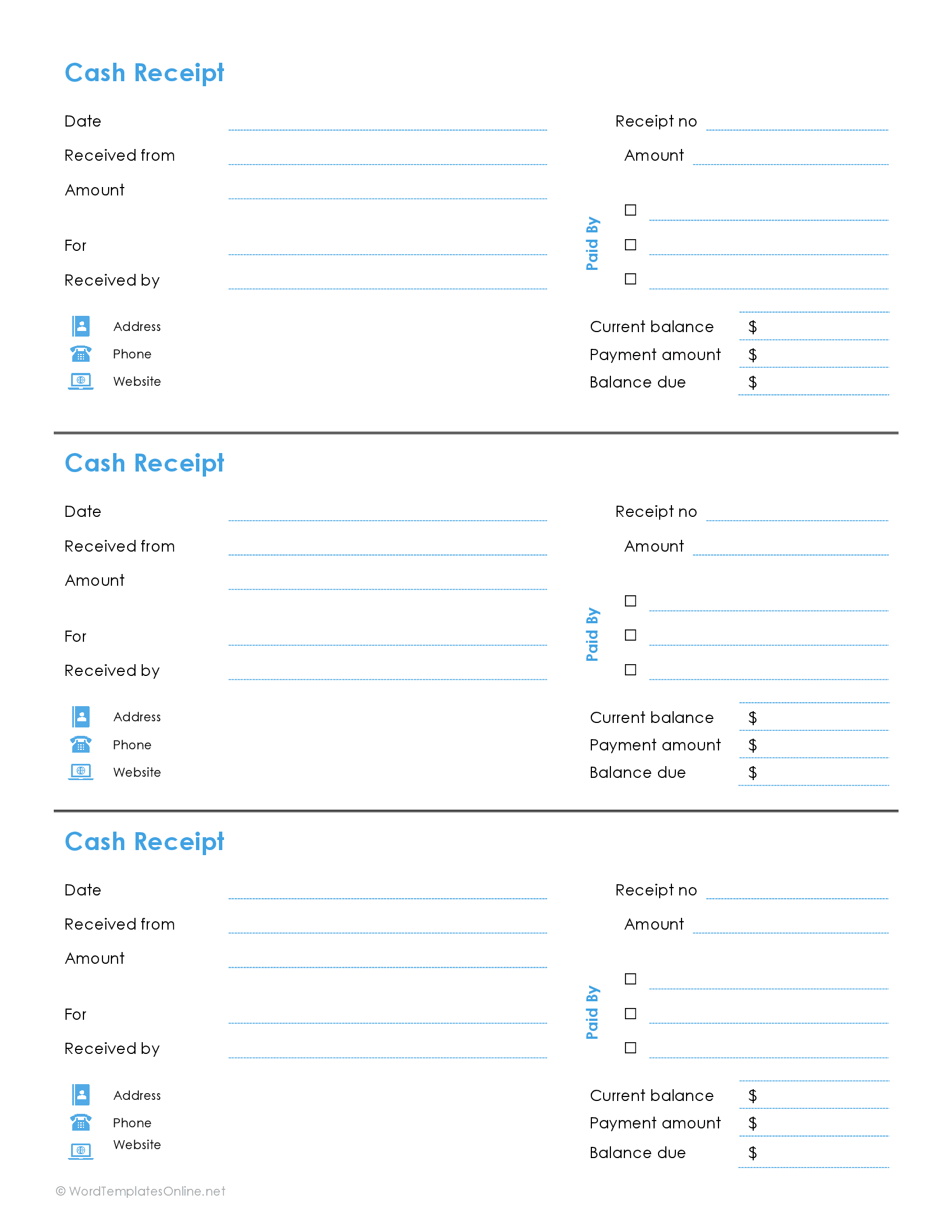

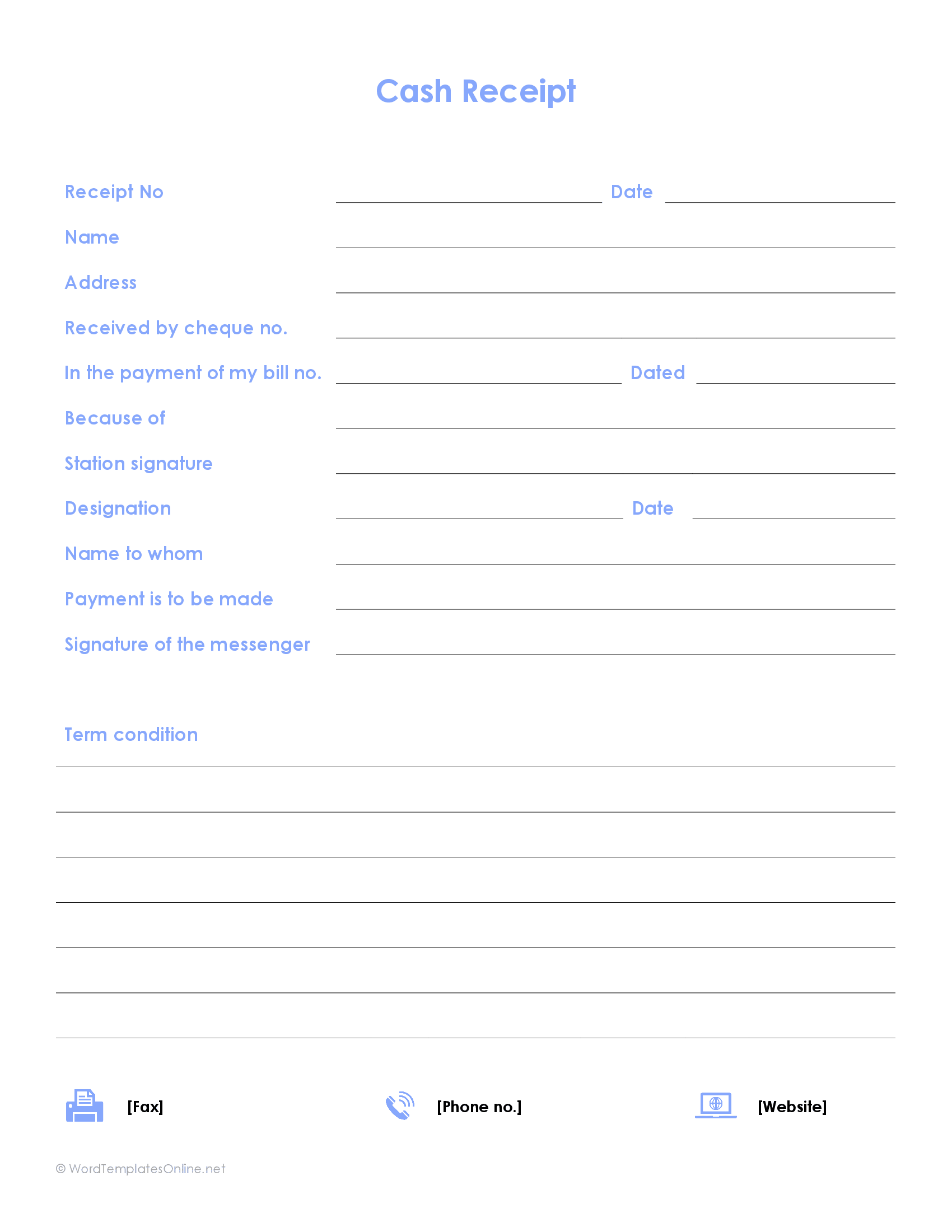

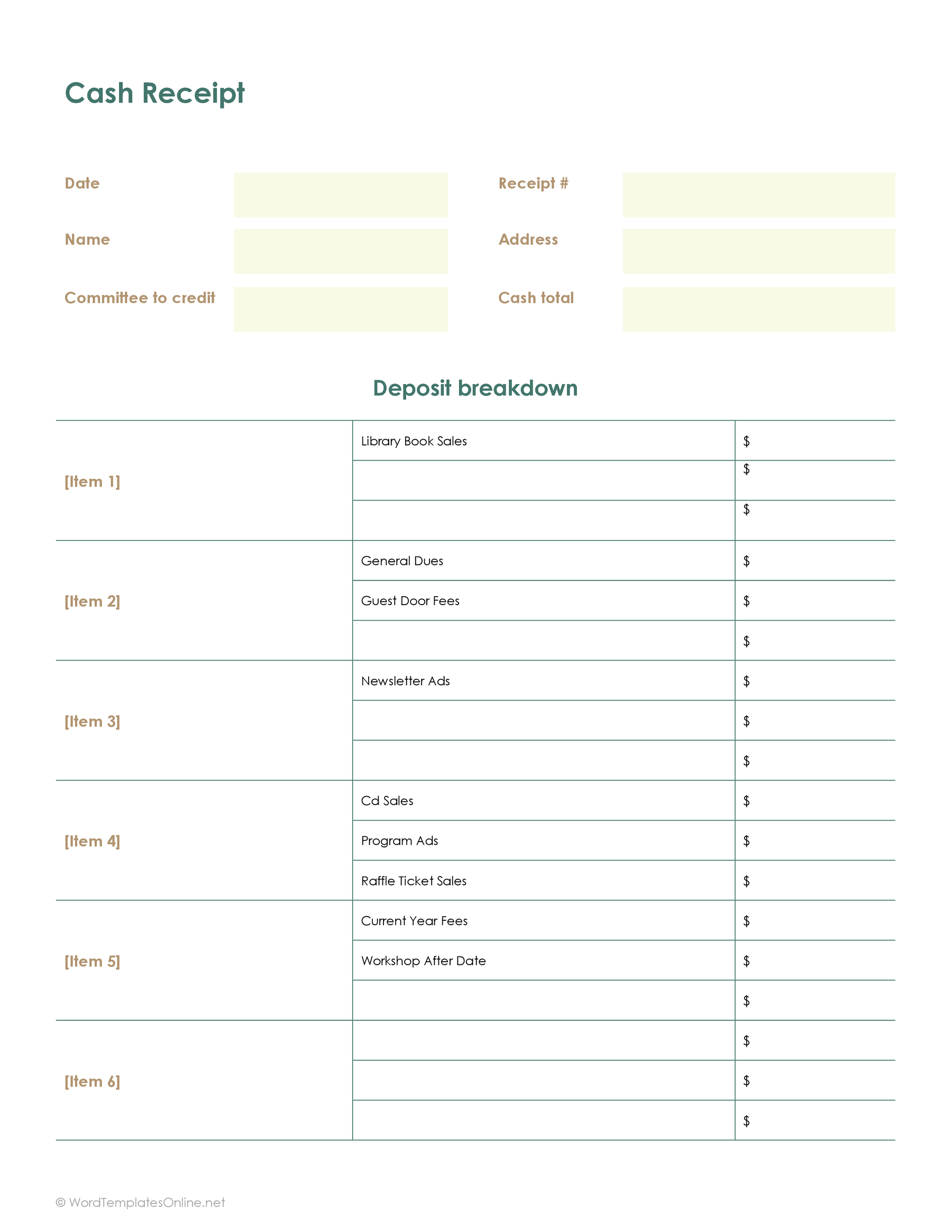

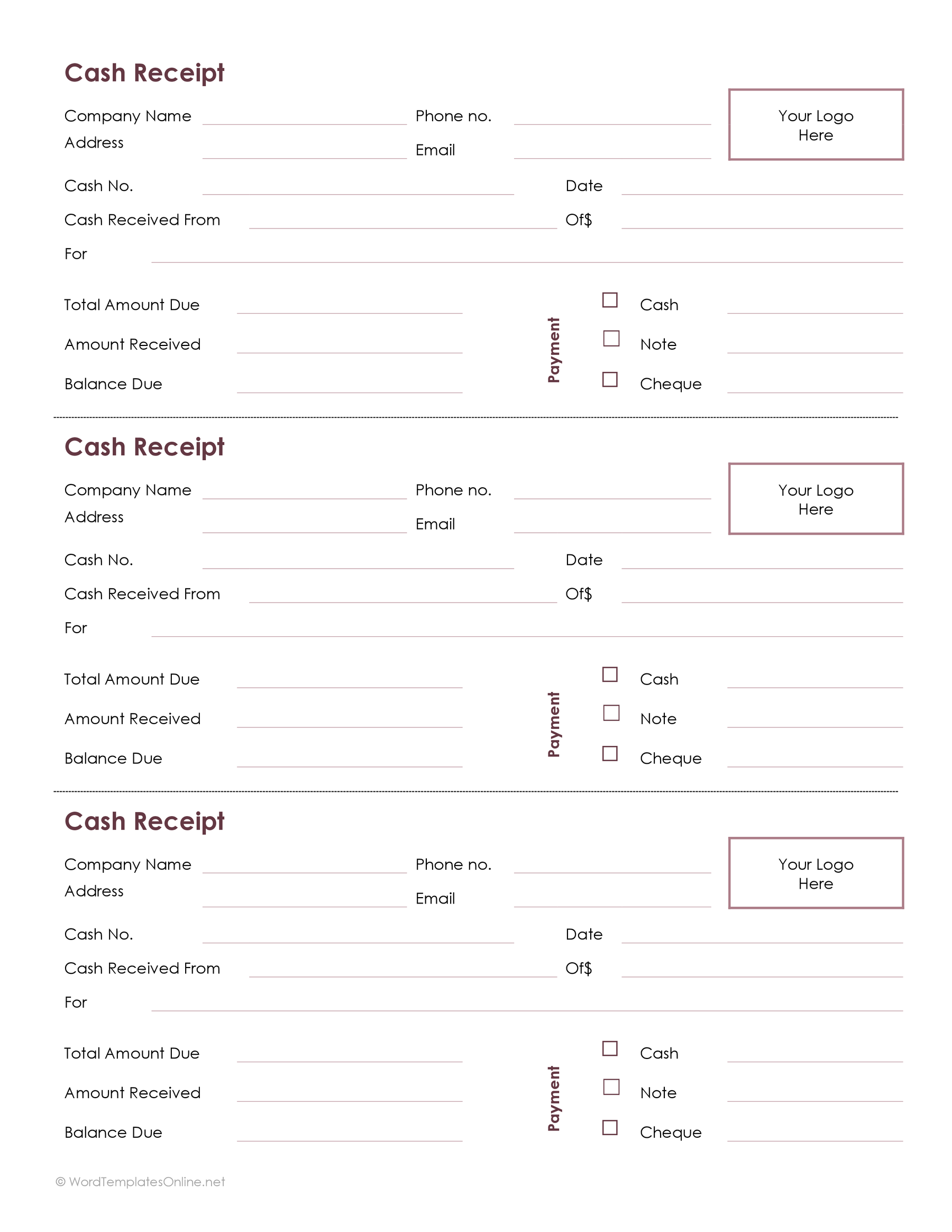

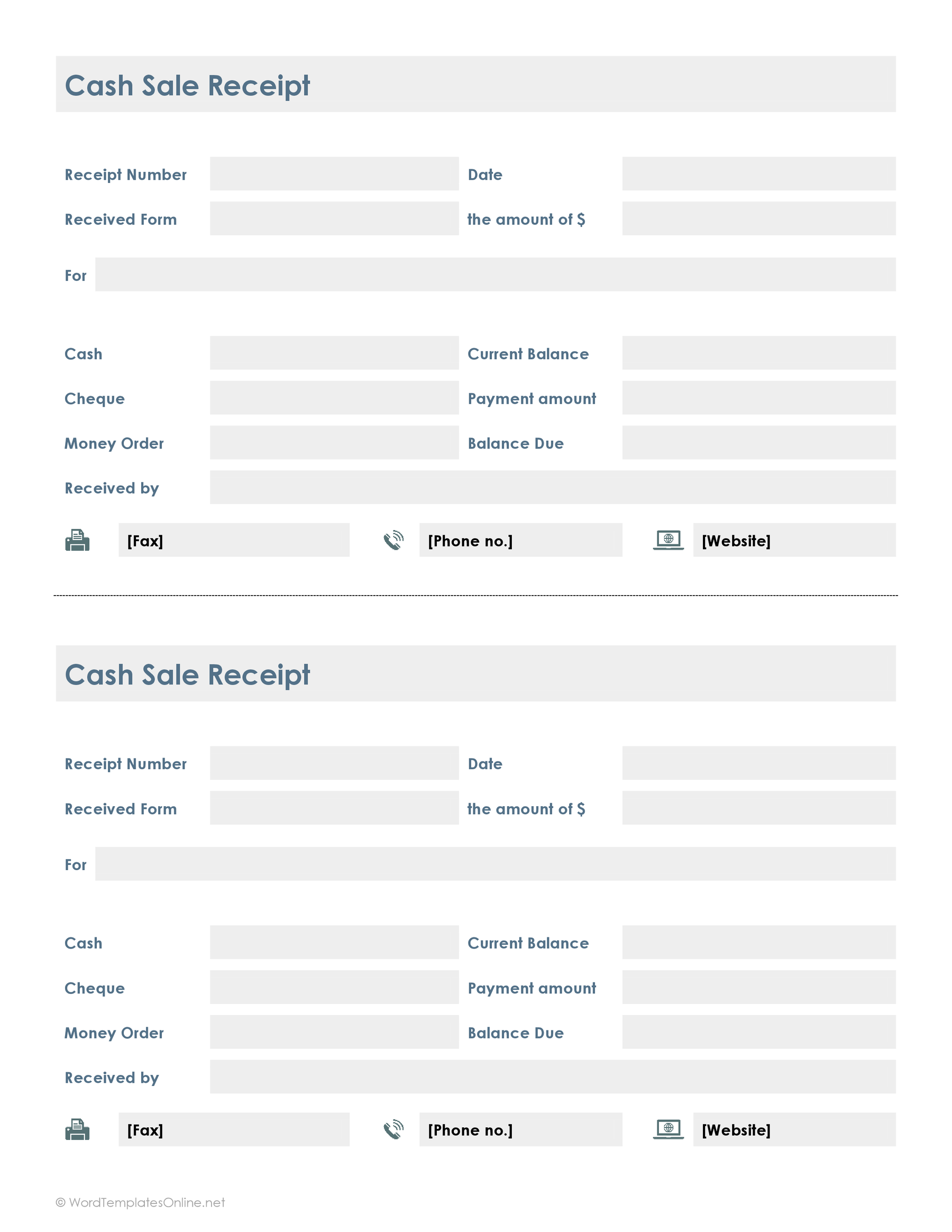

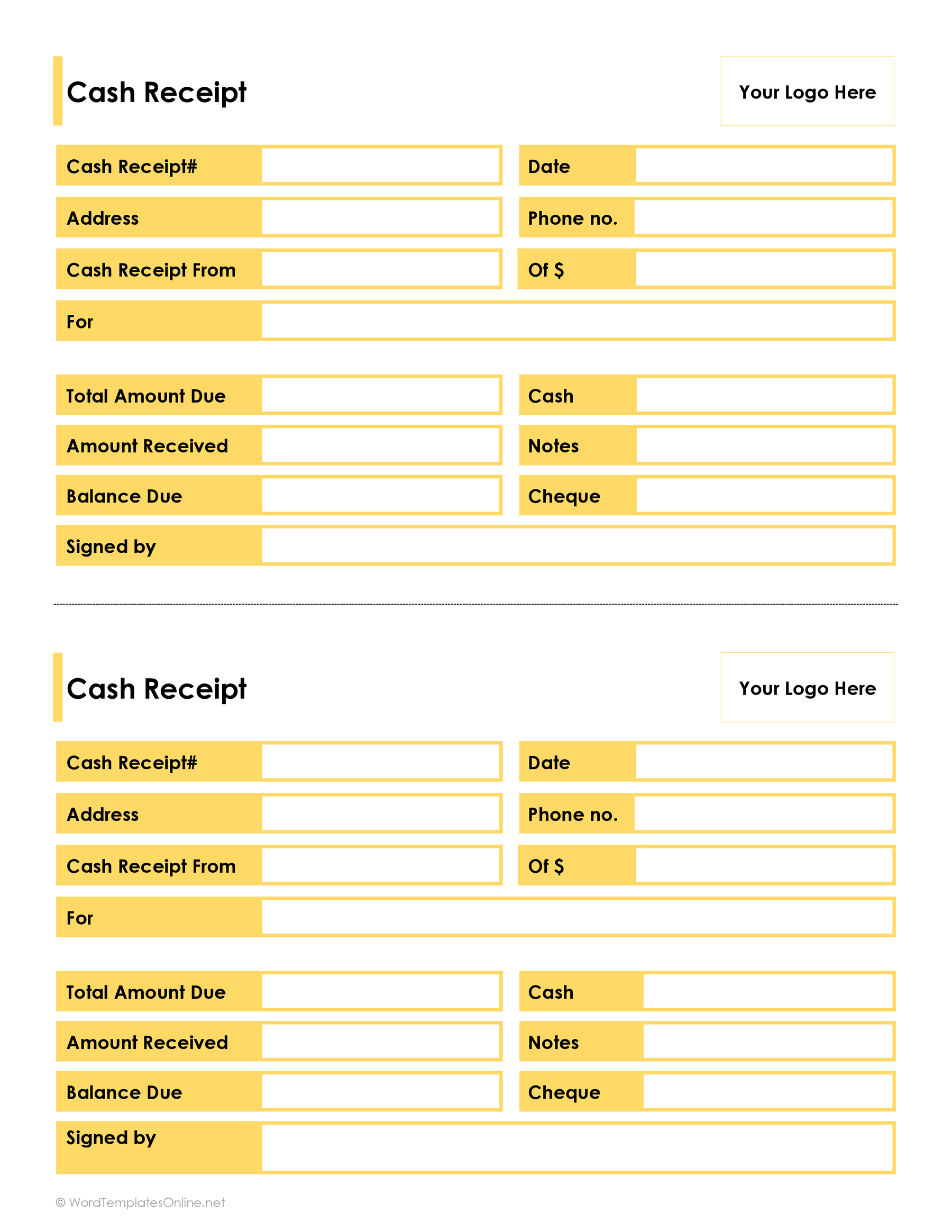

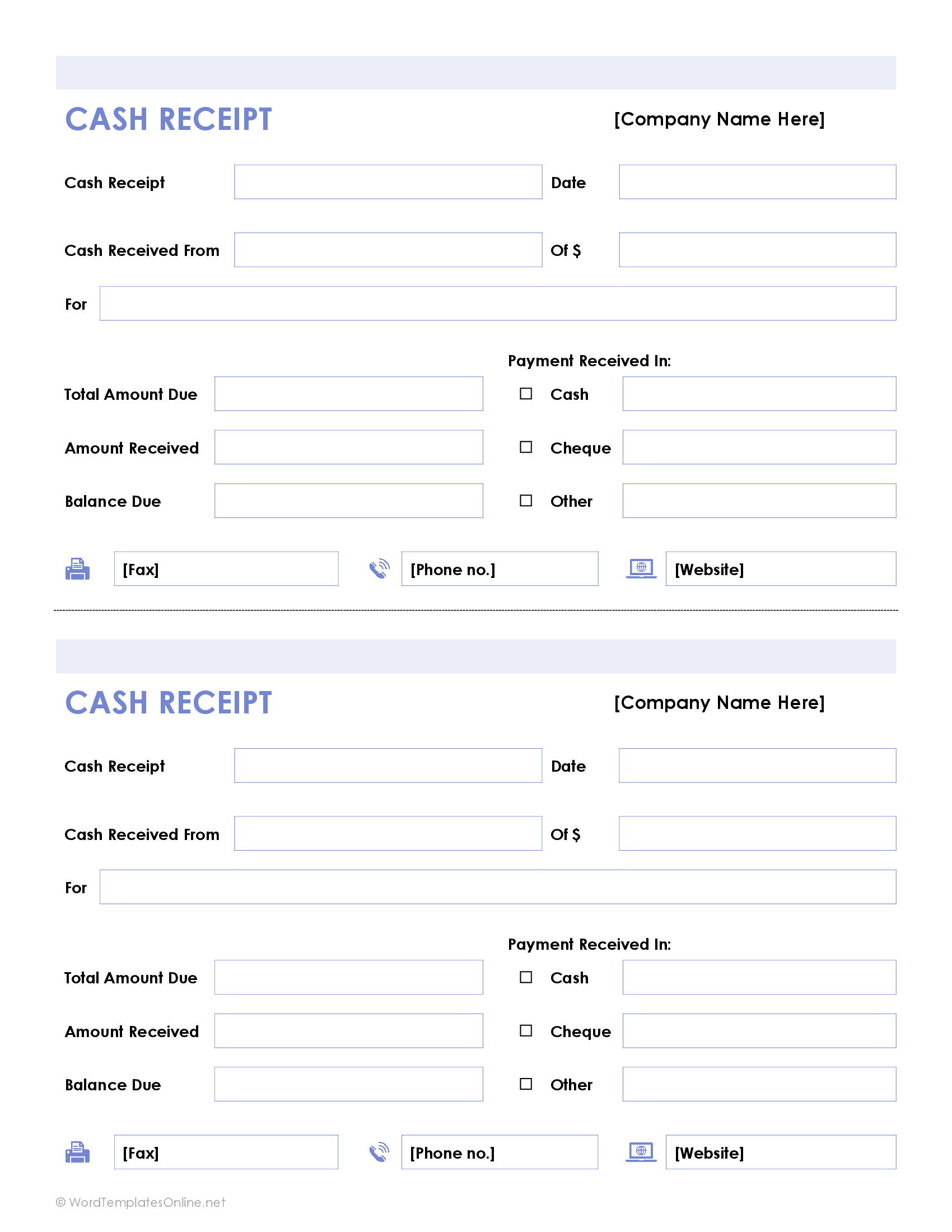

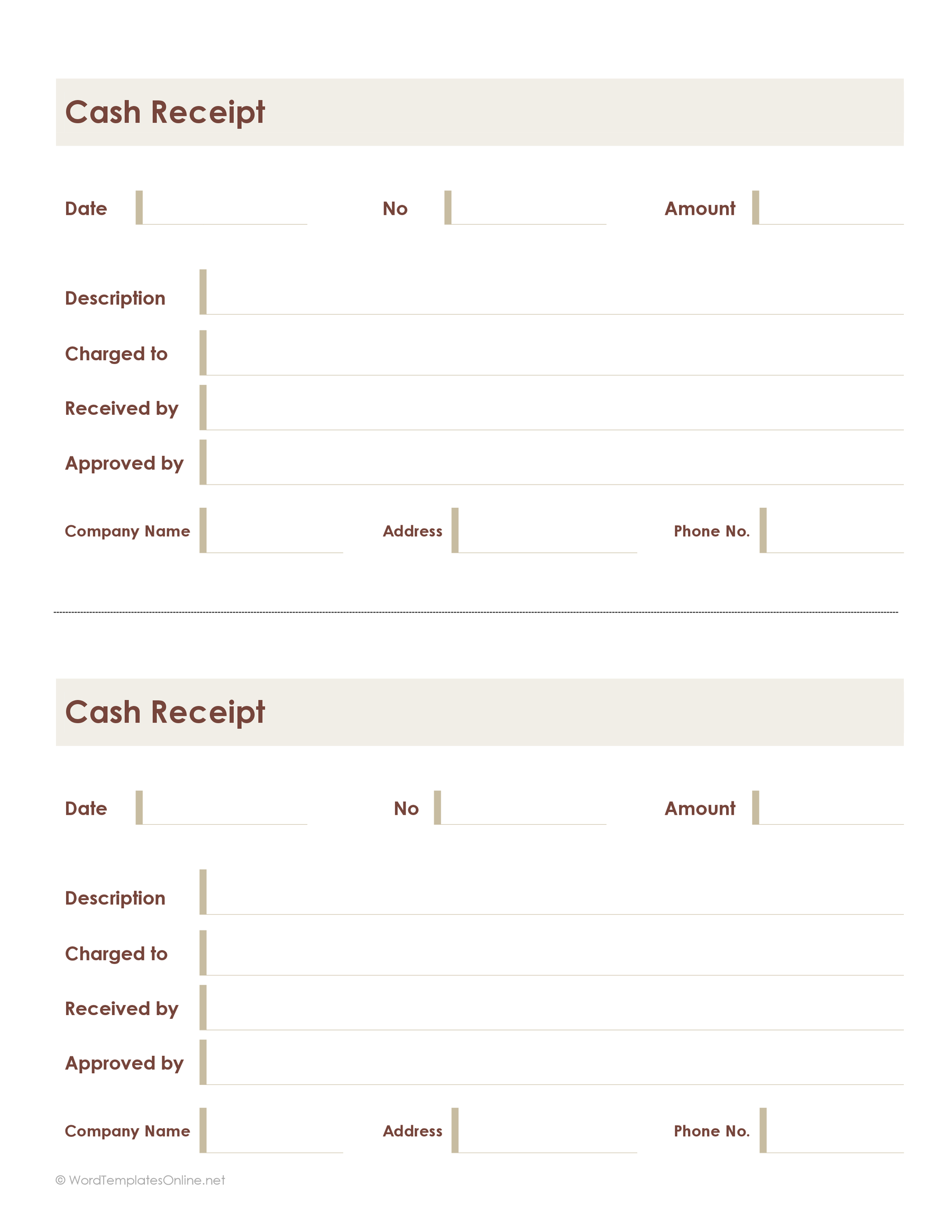

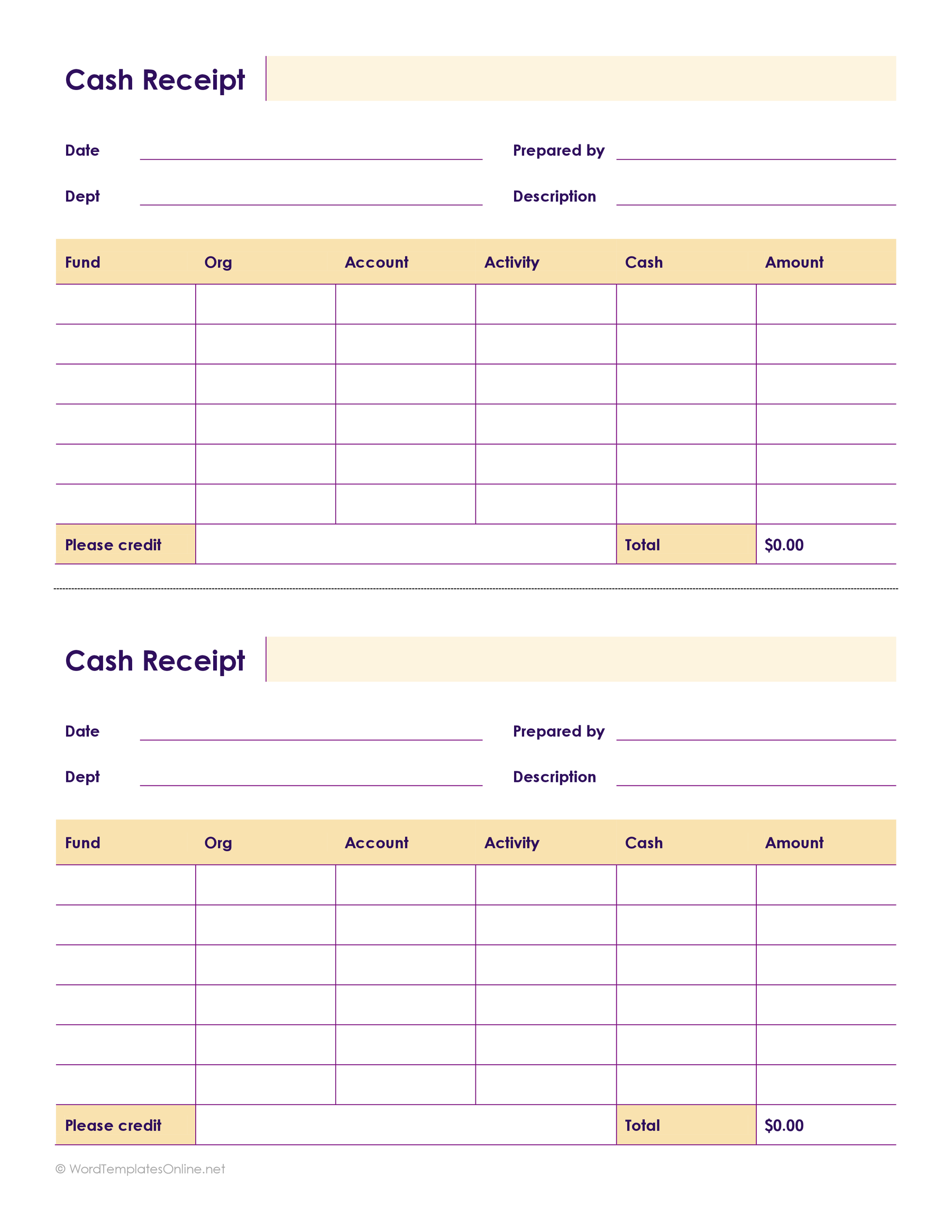

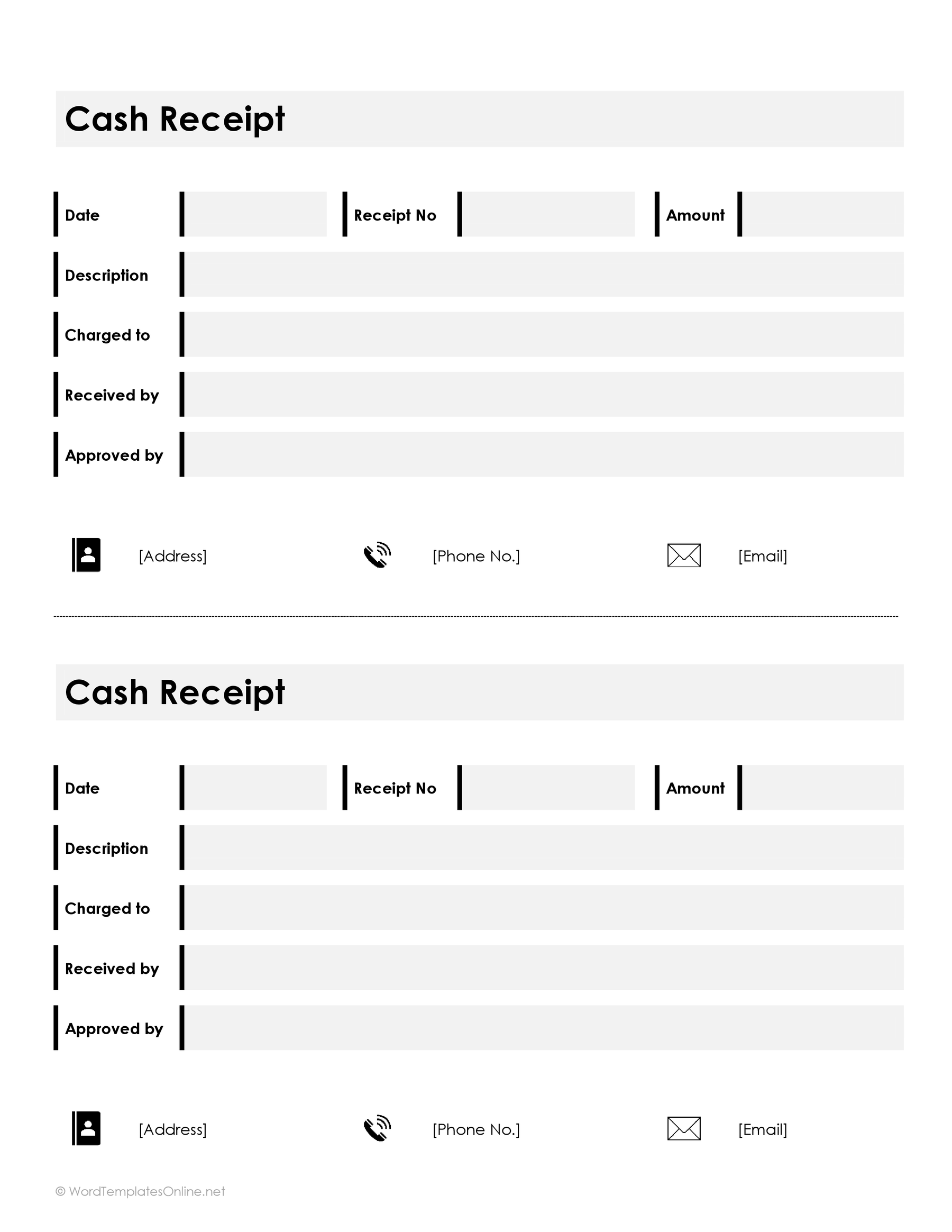

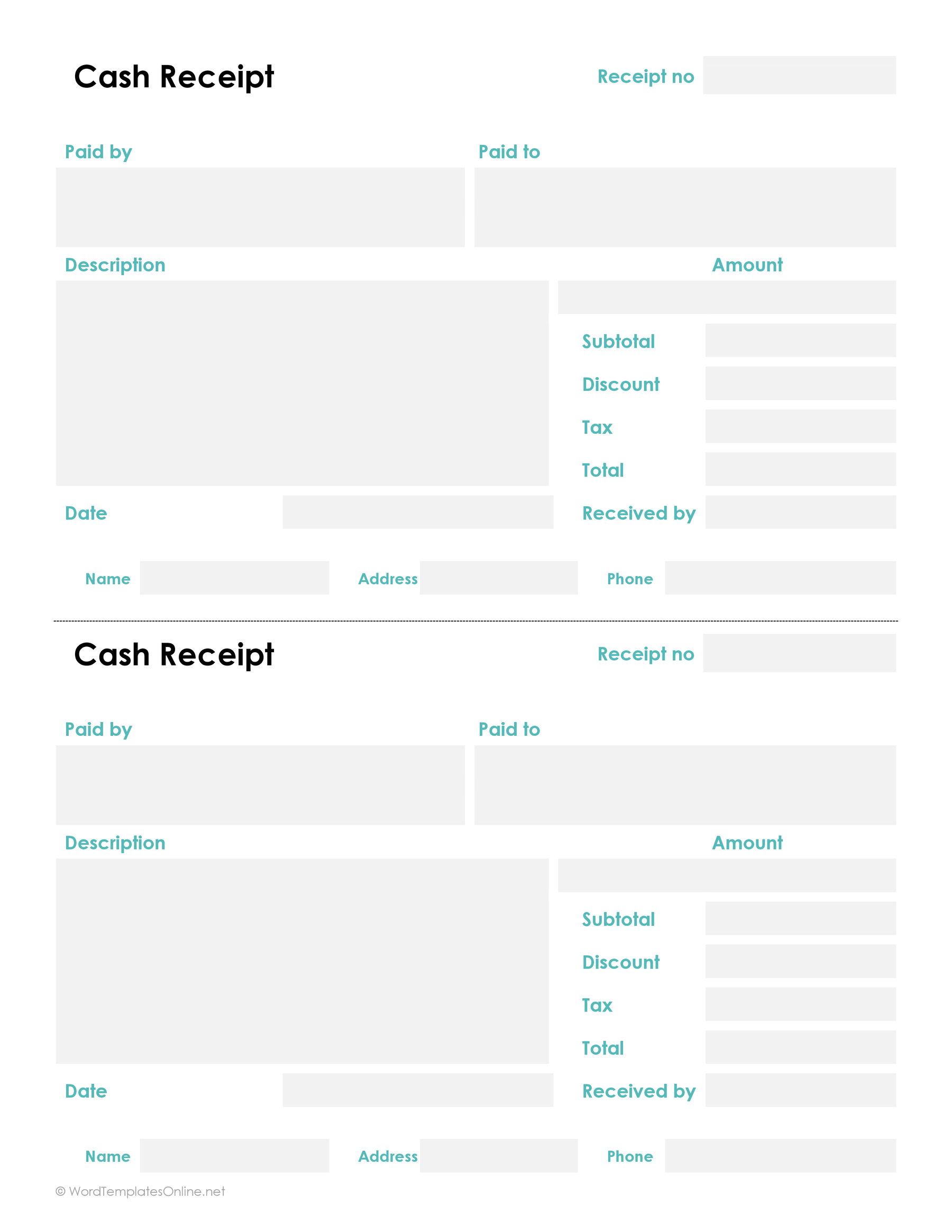

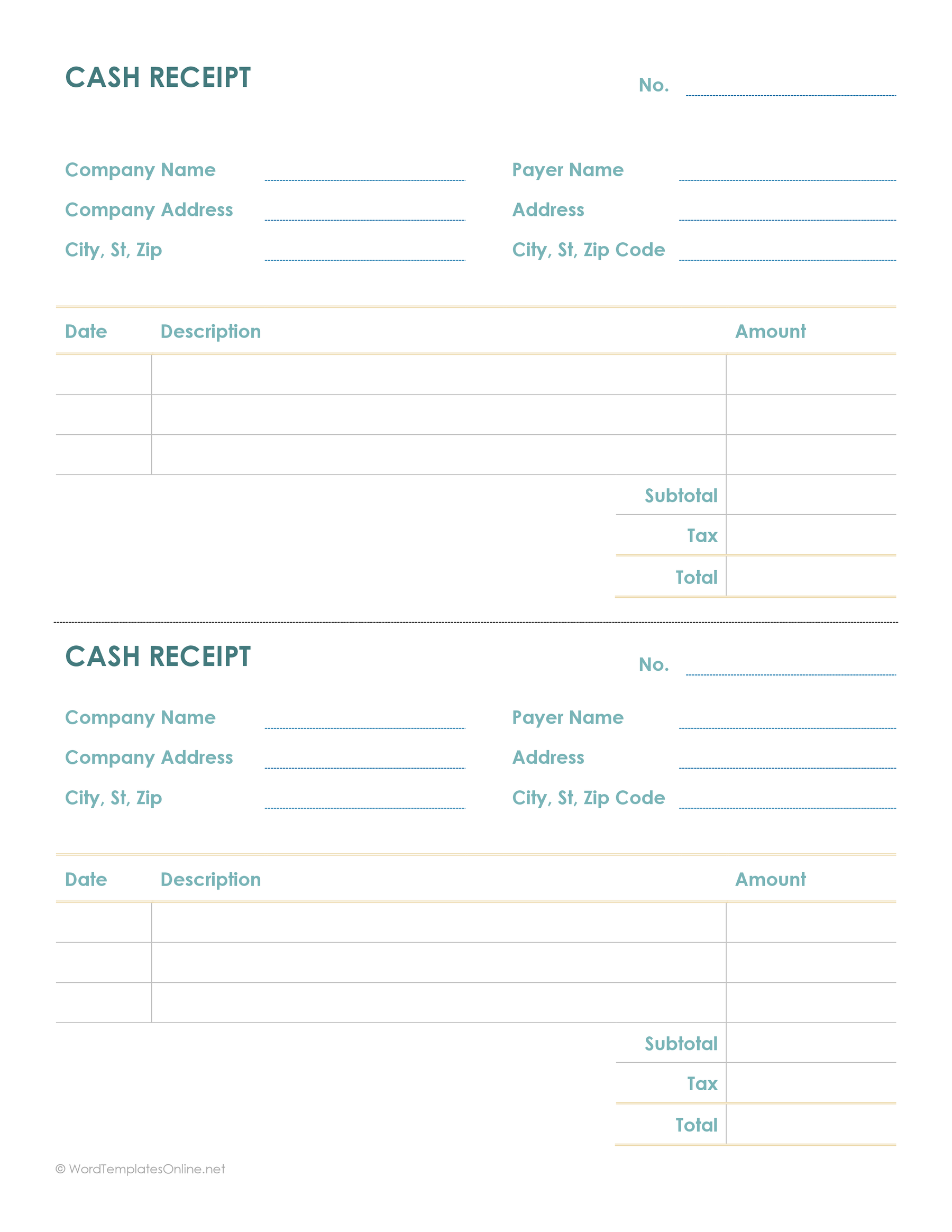

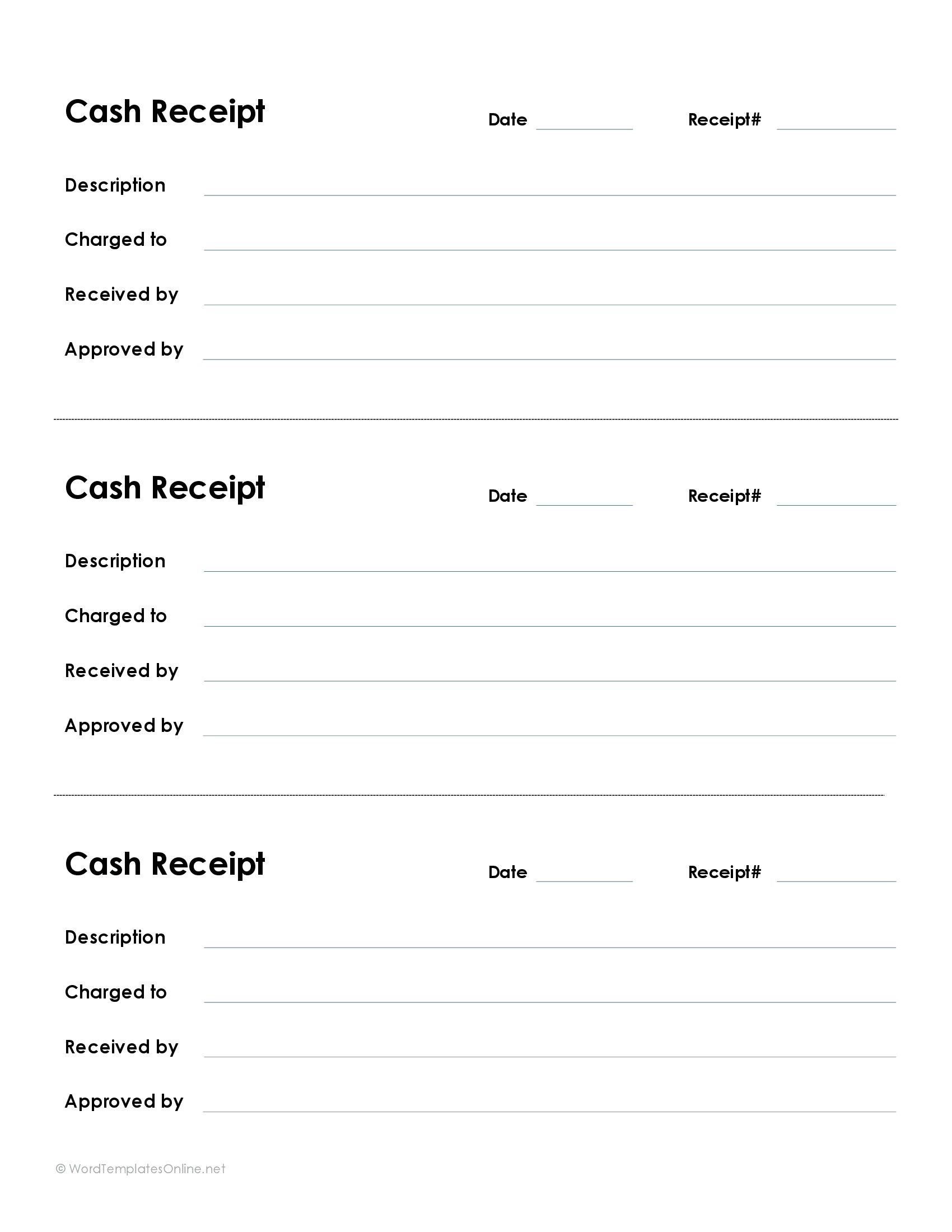

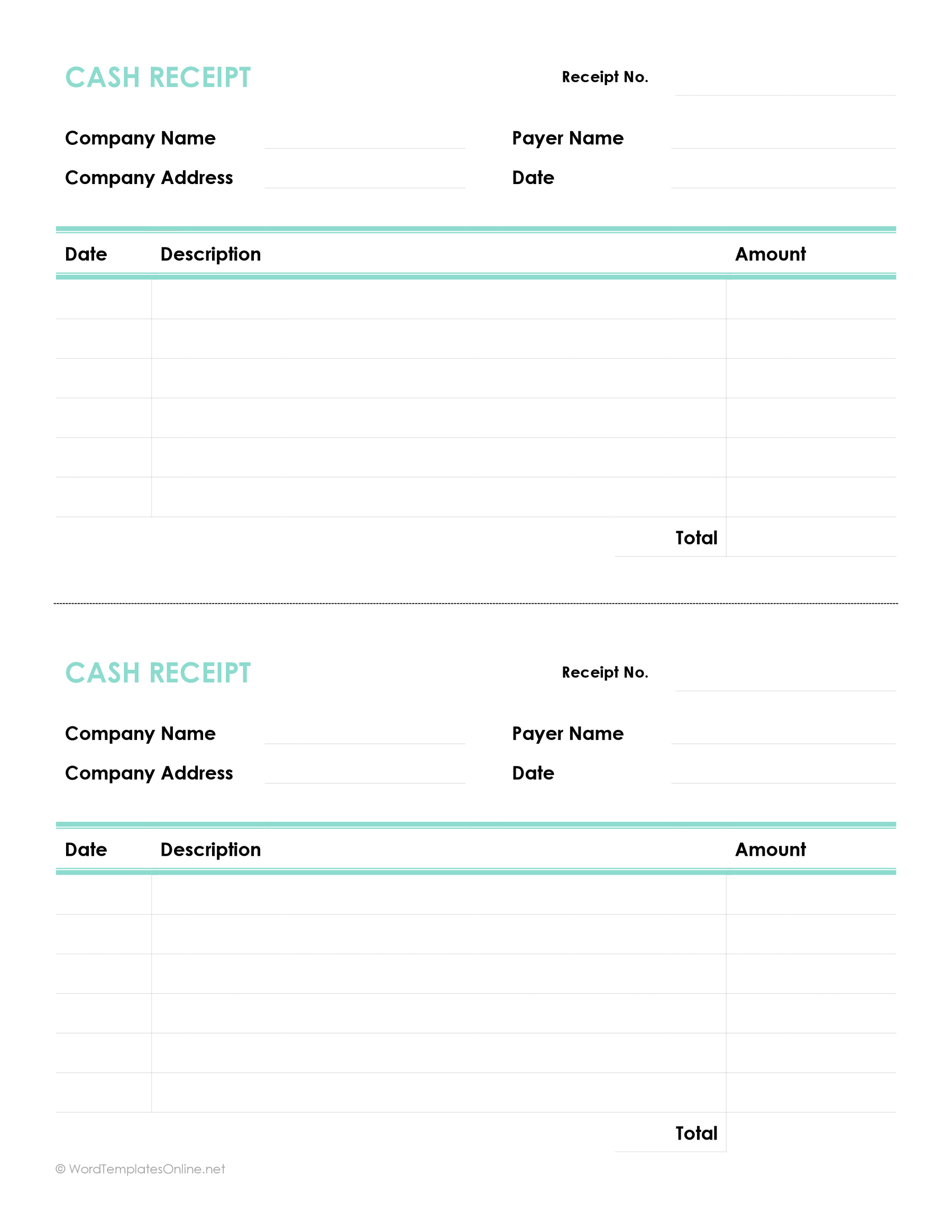

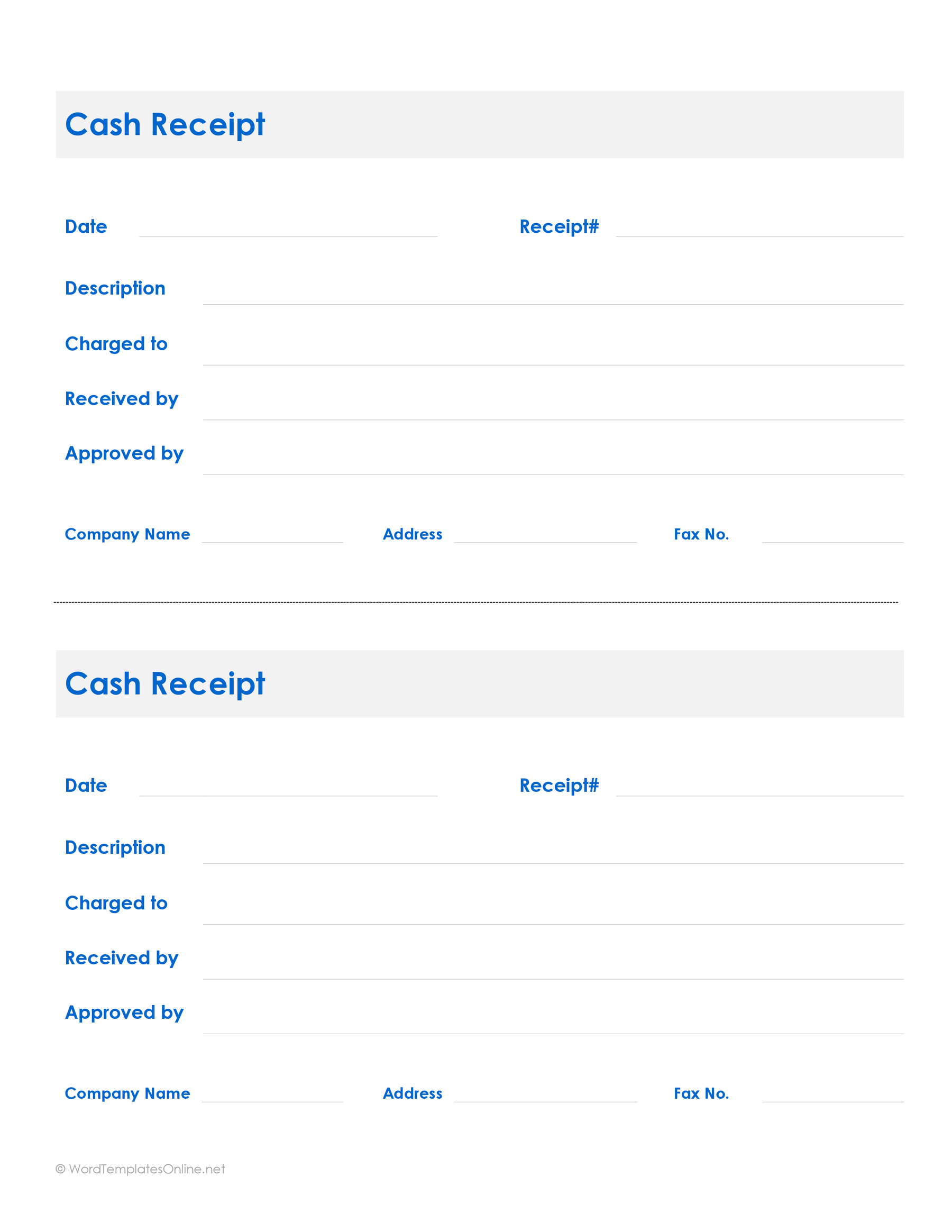

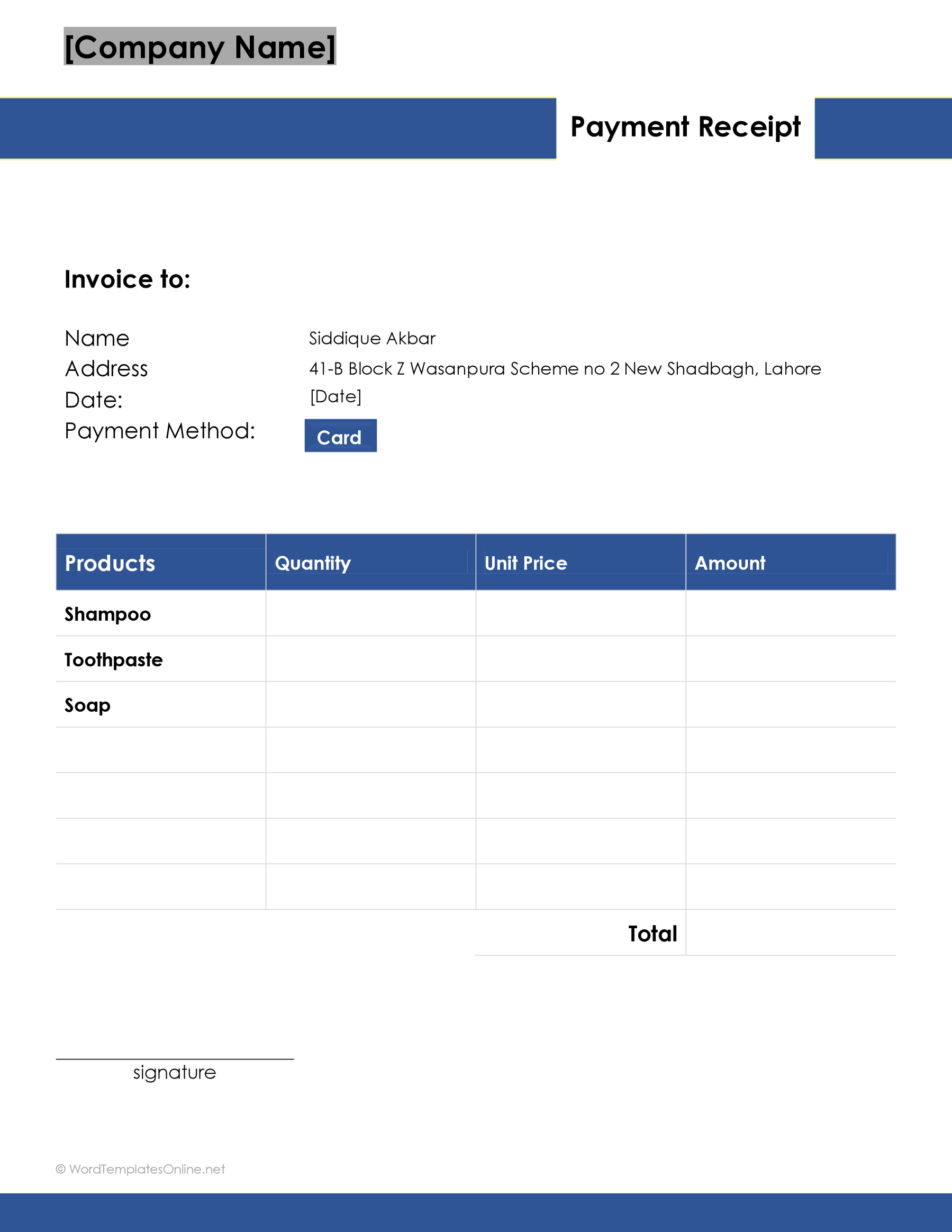

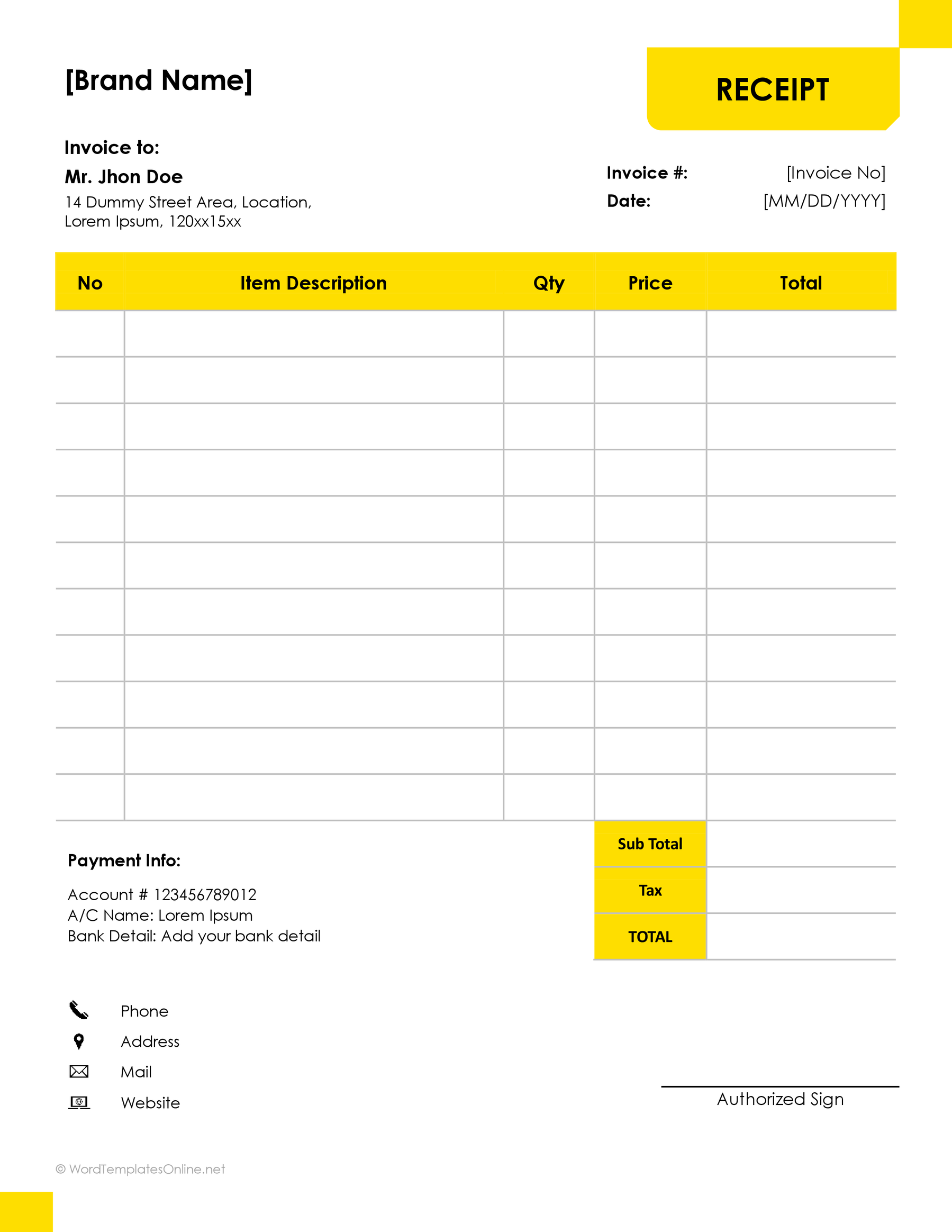

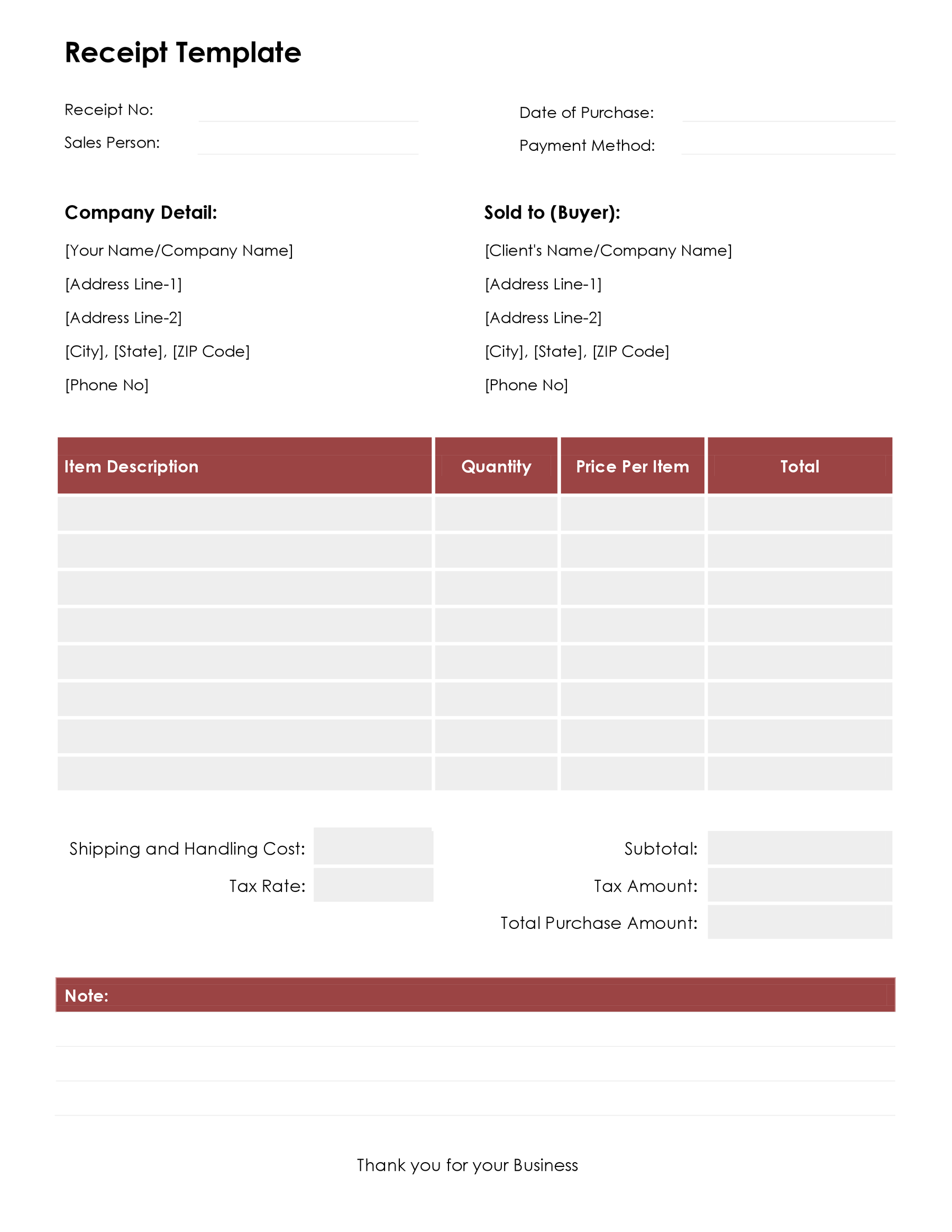

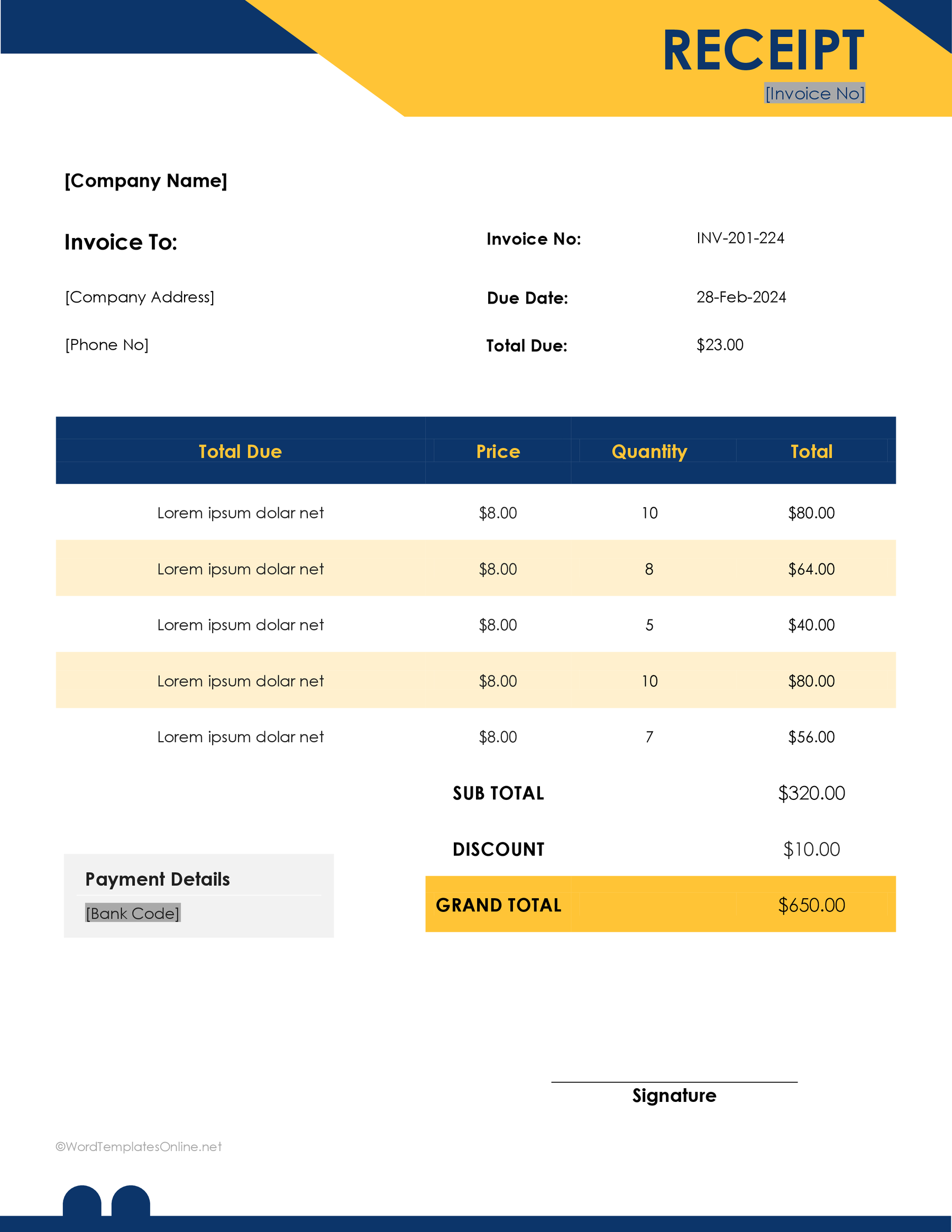

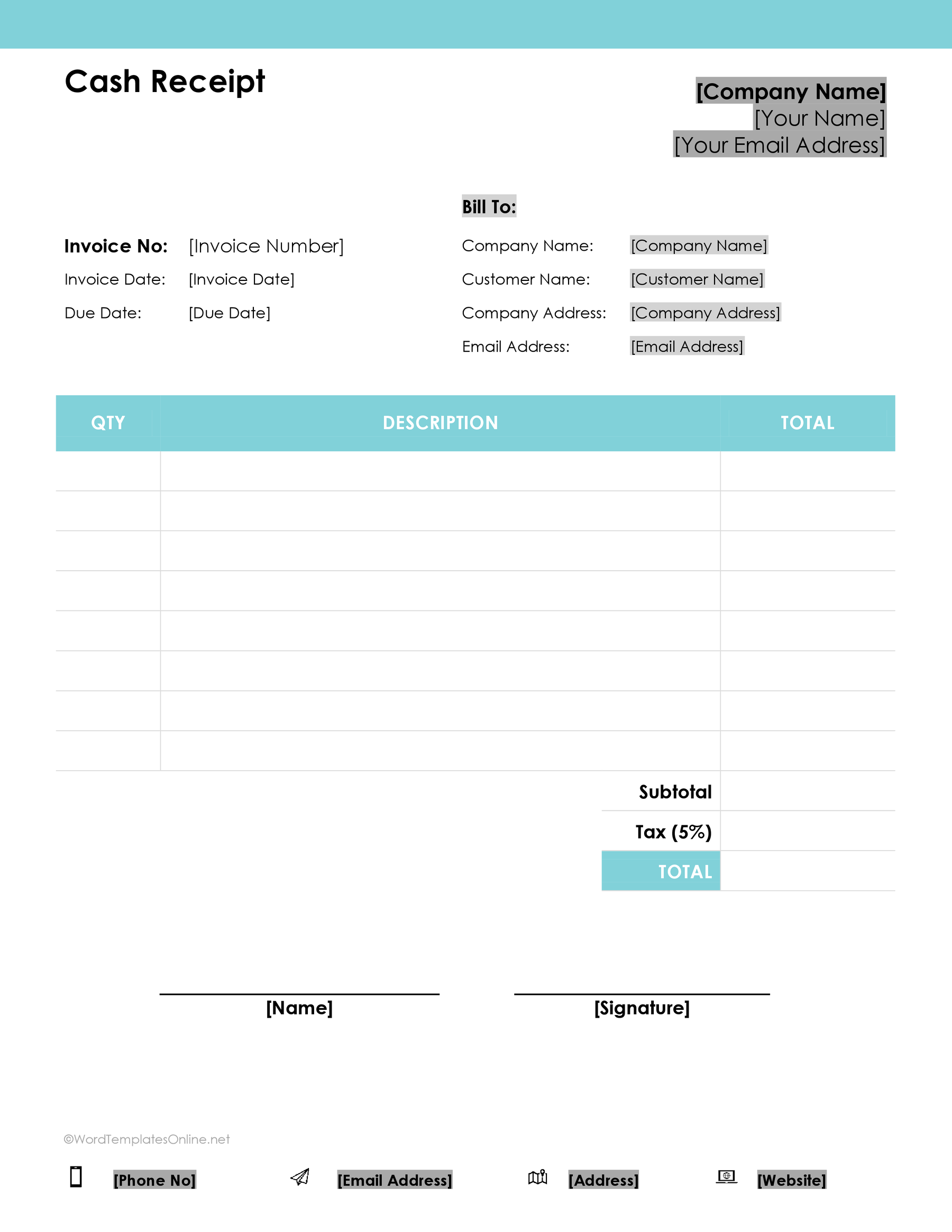

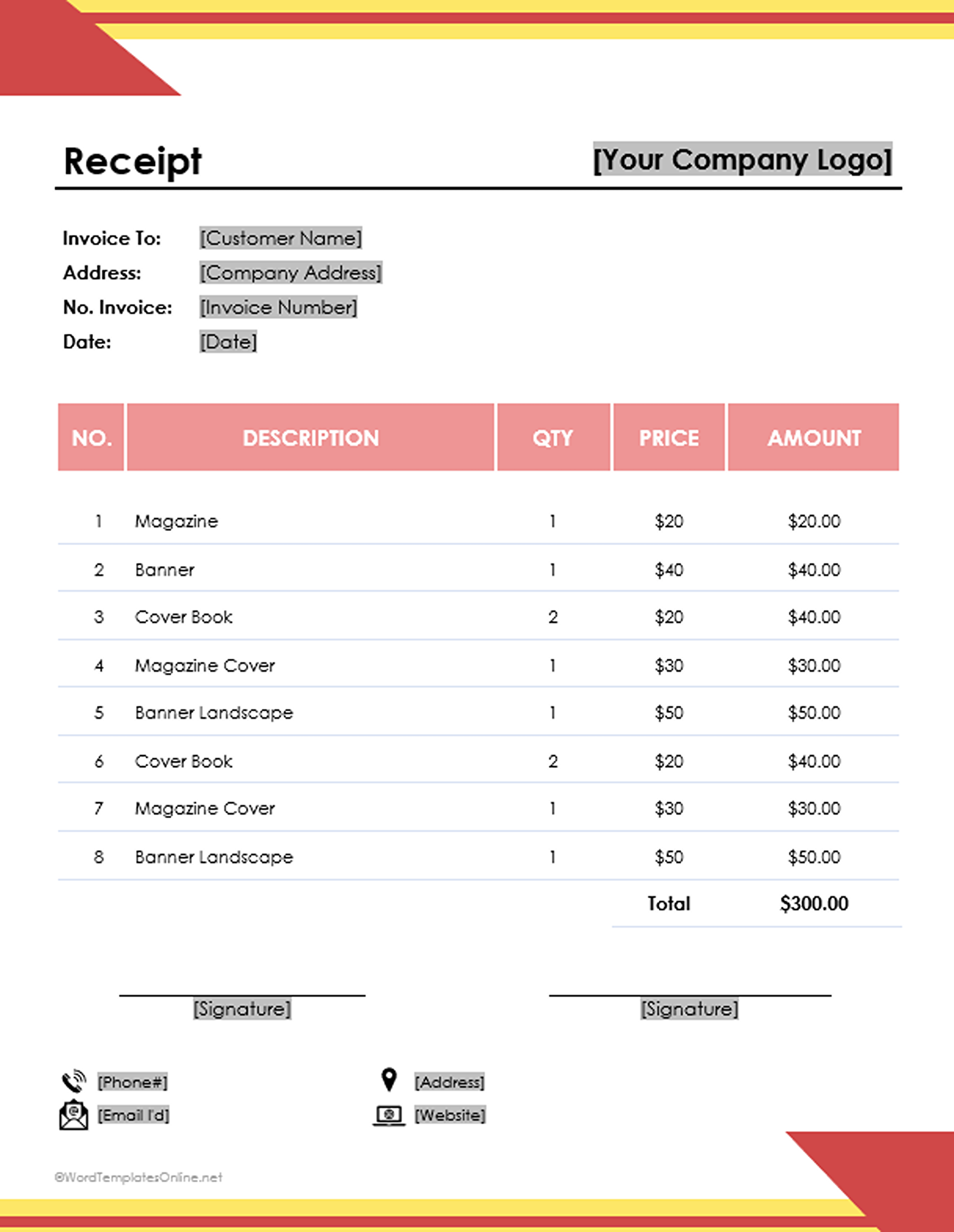

Free Receipt Templates

Accepting Cash Payment

When selling or buying an item with a cash sale transaction, security is very important. It is recommended that both the buyer and seller meet in a clear and secure location, especially when the cash in question and the item being sold is expensive. Also, both the transfer of goods and/or services and the cash should be made simultaneously unless agreed otherwise.

note

It is important to note that handling cash increases the risk of theft and may not be as convenient as accepting only credit cards or cheques from customers. Consequently, a cash-only policy might alienate customers who don’t like to carry many bills, but it also means that one doesn’t have to risk bounced cheques and doesn’t have to pay credit card fees.

Here is how to properly accept cash payments:

Make a deal

When doing any type of sale/purchase, both the seller and the buyer must strike a mutually benefiting deal. The product/type of service to be offered must be agreed upon, and the dates on which the transaction shall be done should also be agreed on. In most cases, cash sale transactions are usually done instantly, and the cash receipt is given upon completion of the transaction by both parties involved.

Exchange of goods and cash

For a cash sale to be completed successfully, both the buyer and seller must do their part, i.e., the seller must bring the item/offer the services required, and the buyer must bring the cash with them. Suppose the seller offers a service (depending on the type of service to be offered). In that case, the cash is usually transferred either in full or partially before or after the service is offered, depending on the agreement made between the two parties involved.

Issue the cash receipt

After the product/service is offered to the buyer and the seller is given the cash, the seller must then issue the buyer with a receipt outlining the transaction details, i.e., the amount paid and a description of the item/service rendered. The seller must also retain a copy of the receipt if they need to prove the transfer of ownership if requested to do so.

Sending money electronically

A cash sale doesn’t have to be necessarily made using physical cash. It can be made using electronic cash transfer using available cash transfer methods online. Some of the most popular methods of transferring cash electronically for free include the use of PayPal, Venmo, and Cash App, which involve sending cash to the recipient’s email address even if they do not have an account yet. The cash will be stored under the account matching the email address provided, and once they open an account, they will be able to make withdrawals and transfers.

How to Write a Cash Receipt

Knowing how to write a cash sale receipt is one key process that any seller should know about doing a cash sale transaction. Cash sale receipts usually vary in content and style, and there is no set standard for crafting one. However, there are key components that must be maintained in cash sale receipts.

They include:

The seller’s information

The first item to be included in the cash sale receipt is information on the seller, i.e., their/company name, street address, phone number, email address, website, and any other key information that can help identify them easily.

EXAMPLE

The information should follow the following format:

Company/Seller’s Name

Company Registration Number

Street Address

City, State, Zip

Phone

Fax

Email

Website

Documentation

A cash sale receipt must have a clear and informative description of the item/service offered. This is because the receipt can be used as proof of payment and transfer of ownership at the same time.

The information captured in this section should include:

- The date of the transaction: The date on which the transaction was completed should be included in the cash sale receipt to help establish when the transaction took place, which may come in handy in situations where a warranty is given for the product and/or services offered

- Product/service details: A clear and definitive product/service description should be included in the cash sale receipt to help distinguish the product and/or services

- Payment details: This includes the name of the buyer, the amount paid, and a description of what the payment is made for

EXAMPLE

Paid By: _______________ [The name of the Buyer]

Amount Paid: ______________ [Dollar amount paid]

For payment of: ______________ [Description of the item]

Payment breakdown

The cash sale receipt must include a section showing a breakdown of the payment made, i.e.,

- The subtotal,

- Tax rate,

- Total amount due,

- Amount paid and the

- The remaining balance, if any.

This information helps in calculating income tax returns as well as keeping track of installment payments.

Payment method

The mode of payment should also be included in the cash sale receipt. Since not all cash sales are made by exchanging physical cash for an item/service, the mode of payment helps one keep their finances. The mode of payment can be cash, electronic cash transfer, etc.

Signatures

A cash sale receipt should have a section where the seller affixes their signature to acknowledge that they gave out the goods/service and payment duly made. The seller or their representative must print their name and sign against their name at the bottom of the receipt.

EXAMPLE

Received by: ____________ [Name of the seller]

Authorized signature: ____________ [Seller’s signature]

Frequently Asked Questions

A cash sale receipt must contain the seller’s/company’s information, the date of transaction, a description of the items/services offered, the amount of the transaction with the total amount broken down to show the net amount, value-added tax and any discounts offered, and the mode of payment.

It is advisable to send a cash sale receipt immediately after a sale has been completed.

There are different options to issue the cash receipt. One can issue these electronically while the other option is to provide a handwritten cash receipt to the buyer. There are different tools available nowadays and some people use built-in printers for producing cash receipts as well. One can also email the receipt to the clients. It is very important to issue the cash receipts on receiving payment.