In its simplest explanation, a Sales Receipt is a document that acknowledges the existence or conclusion of a transaction.

It is usually a document that records the sale and shows that money has been paid for the goods or services rendered. In a transaction, the seller has the duty to issue a sale receipt to the buyer once the transaction has been completed and the buyer has made full payment for the service or goods. However, there are cases where the sales receipt indicates partial payment of the goods sold or the services rendered. This often occurs when there is an agreement for an installment payment for the goods bought or services rendered. In this case, the receipt issued would always indicate the partial payment and the balance for the subsisting transaction.

Free Templates

Sales receipts (Word format)

Sales receipts (Excel format)

Sales receipts (PDF format)

Why are Sales Receipts Important

Retail businesses must provide their customers with sales receipts after the completion of a transaction. Though this paper that document sales may look small and carry little information, there are reasons why they are important.

Some of these reasons are:

They serve as evidence of sale for customers

Customers may not necessarily have to keep records of all the sales they did in a period except circumstances demand. But if they have to do so, sales receipts would serve as evidence of the transactions they initiated for a period. What’s more important is that a sales receipt helps them track down the seller. This would help them in case they want to purchase more of the earlier goods. It can also help them if they notice that the goods they bought are bad and they need to return them.

They serve to prevent scams

Retail businesses would have noticed that there are situations where people would try to scam them by returning goods that were not bought at their store. In situations like this, a shoplifter might return goods stolen to convert them into cash. Where there is no sales receipt, this would have been the end. But this is not usually the case because a receipt can tell whether goods were bought or stolen from a store.

Uses of a Sales Receipt

These receipts are as useful as some of the goods they were issued on behalf of. The sales receipt are more than documents issued after a transaction and thrown away later by the customer.

Some of the uses of these sales receipts include:

Record sales

Every business owner set out to grow and succeed would know the importance of keeping sales records for all transactions. The sales receipt offers an effective opportunity to record the sales made in the business. Keeping receipts makes the business of recording sales easier. In this light, what needs to be done is merely cumulating the receipts and the sales amount on them. This would give the business owner the total of the sales that have been made within the period that the receipt has covered.

In doing this, the receipt is one way that ensures the proper documentation of financial transactions for a period. There is hardly any bookkeeping strategy that would discard the habit of keeping receipts. So, for all that matters,receipts serve as a record for the business and help them make their financial tracking easier to do.

CRA’s financial record-keeping requirements

Many businesses are required to pay taxes to the authorities where they operate their businesses. In order to do this, the business must first comply with CRA’s financial record-keeping requirements. These requirements demand the existence of sales receipts because they help you keep a proper trail, audit, and prove your sales and tax numbers.

Other uses

There are also other uses of sales receipts. For example, these receipts are helpful if your customers need to track their transaction costs or prove deductible expenses. They may also come in handy to keep a record of the taxes that have been paid so far.

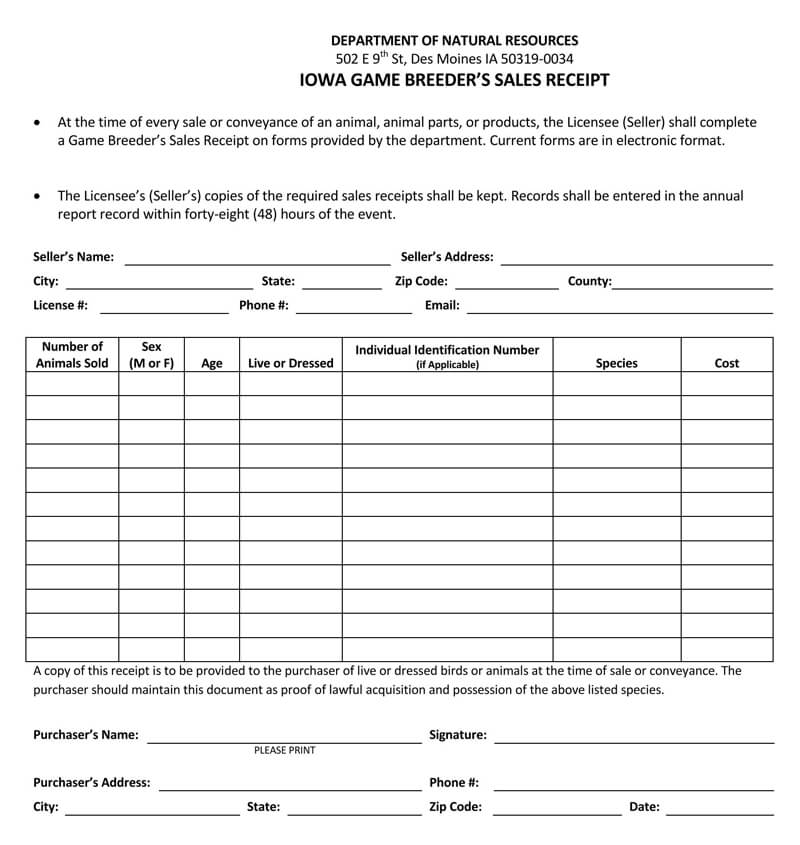

Types of Sales Receipts

Sales receipts are not of a uniform type. They vary according to items of transactions and purpose.

The following are the kind of popular sales receipts:

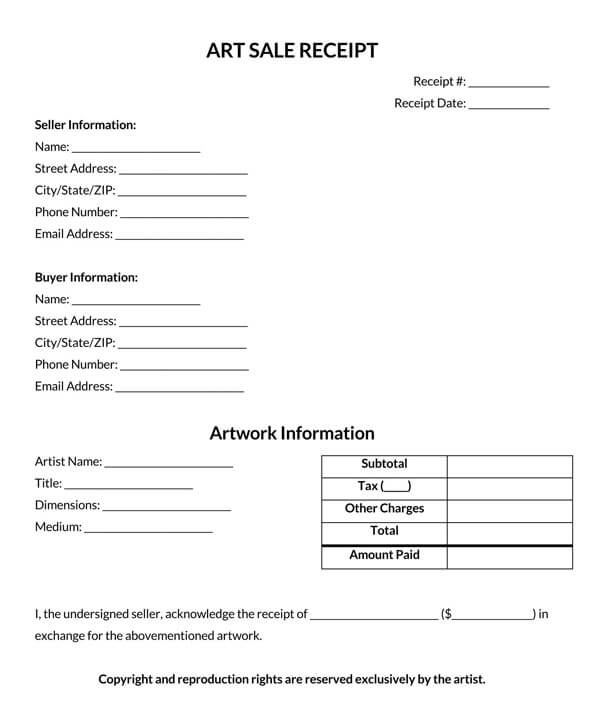

Art

These are sales receipts issued to the buyer of a piece of art after the art has been delivered. These receipts usually describe the artwork and the contact information of the buyer and seller.

Download: Microsoft Word (.docx)

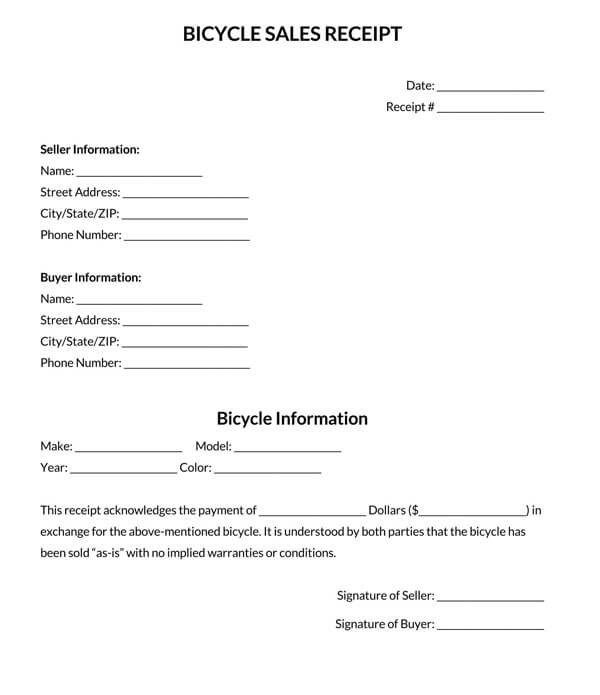

Bike

These receipts are issued to confirm the purchase of a bicycle. The receipts describe the bicycle bought and the cost. It often also contains a note on the nature of the agreement and the possibility of a warranty.

Download: Microsoft Word (.docx)

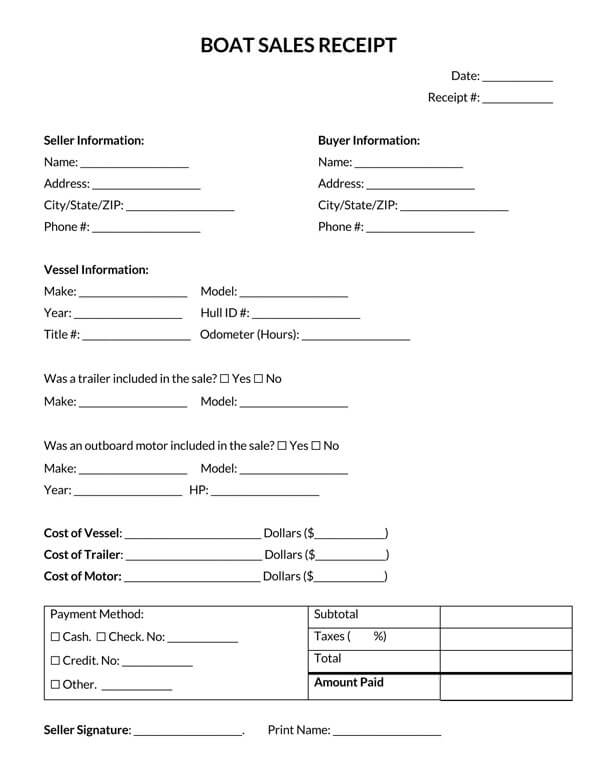

Boat

These receipts are issued to document that there has been a successful transfer of a sea vessel (boat) from the owner to the purchaser. The receipt also includes other additional information relating to the vessel.

Download: Microsoft Word (.docx)

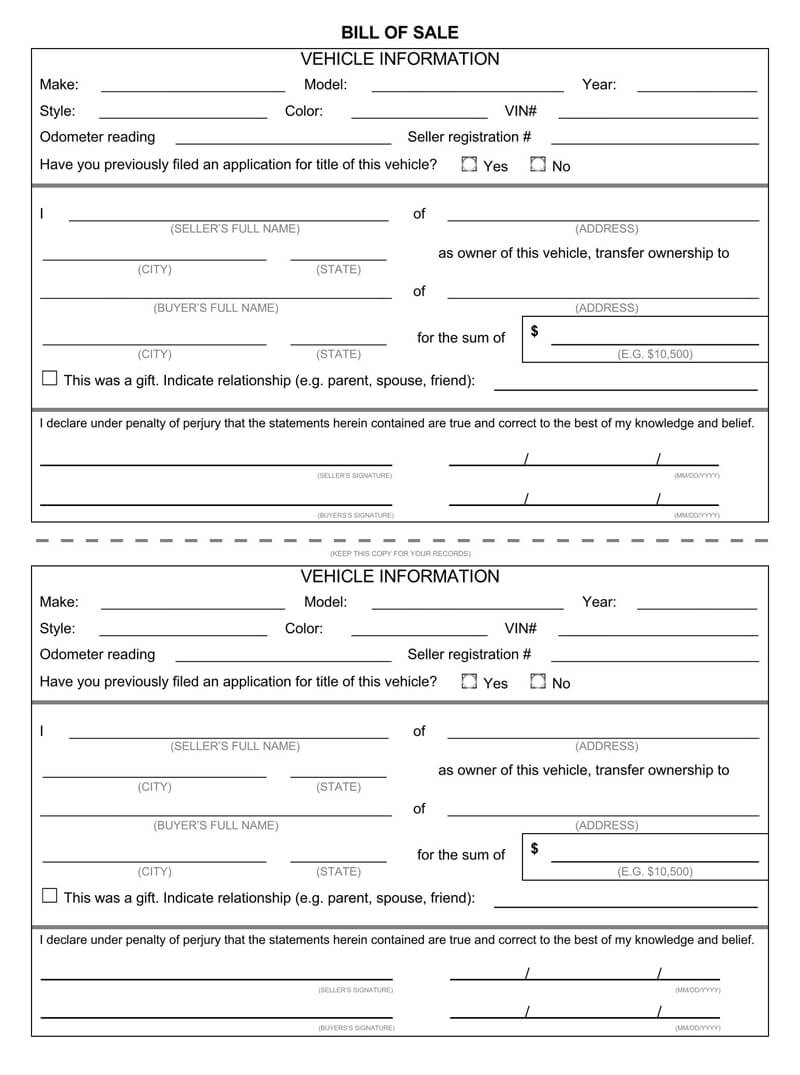

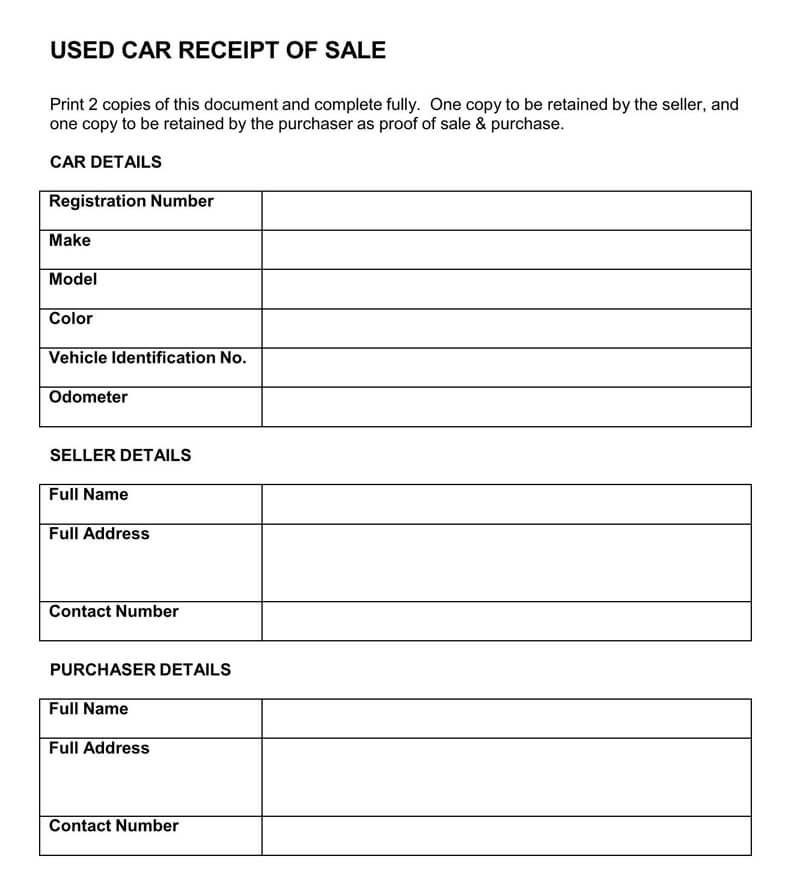

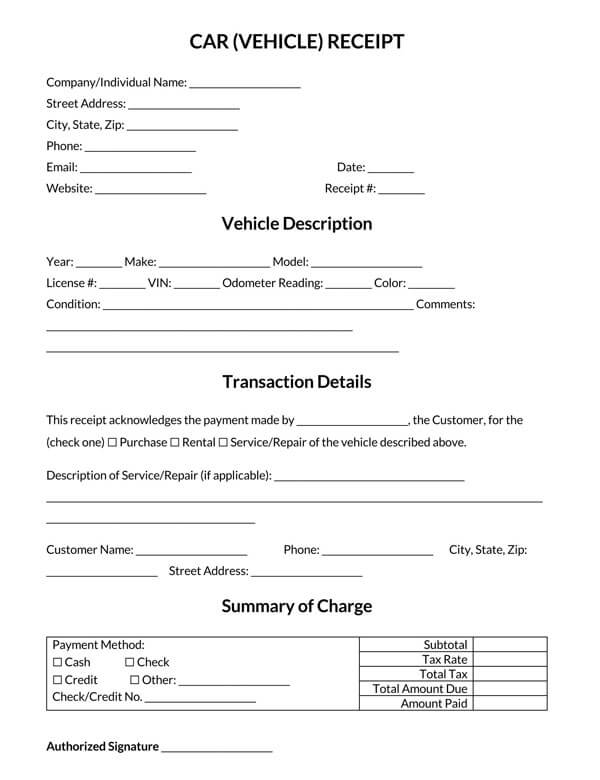

Car Vehicle Receipt Template

These receipts are used to show the completion of a sale of cars. They usually contain car lists, related add-ons, and information on relevant taxes.

Download: Microsoft Word (.docx)

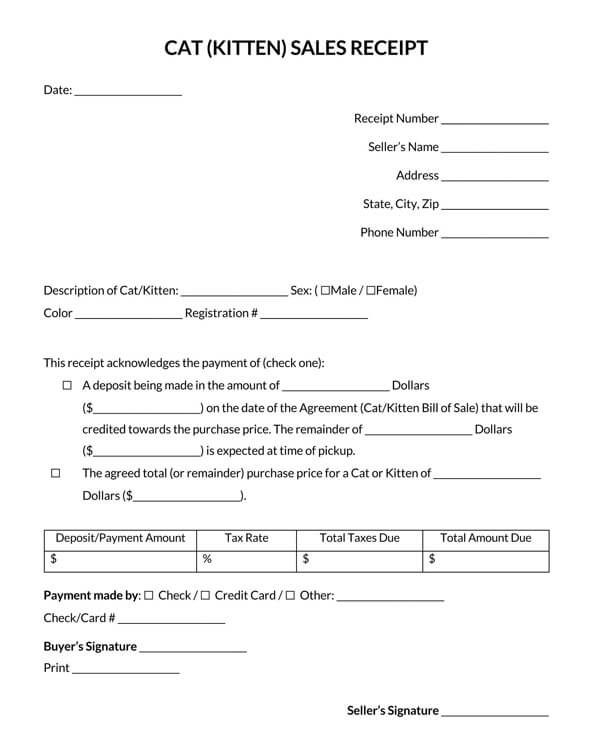

Cat Kitten Sales Receipt Template

When anyone purchases a cat or kitten, the receipt given is a cat sales receipt. These receipts reflect the transfer of the cat from the breeder or owner to the buyer. Before this receipt is issued, there is often an agreement for the buyer's security called the Cat Bill of Sale.

Download: Microsoft Word (.docx)

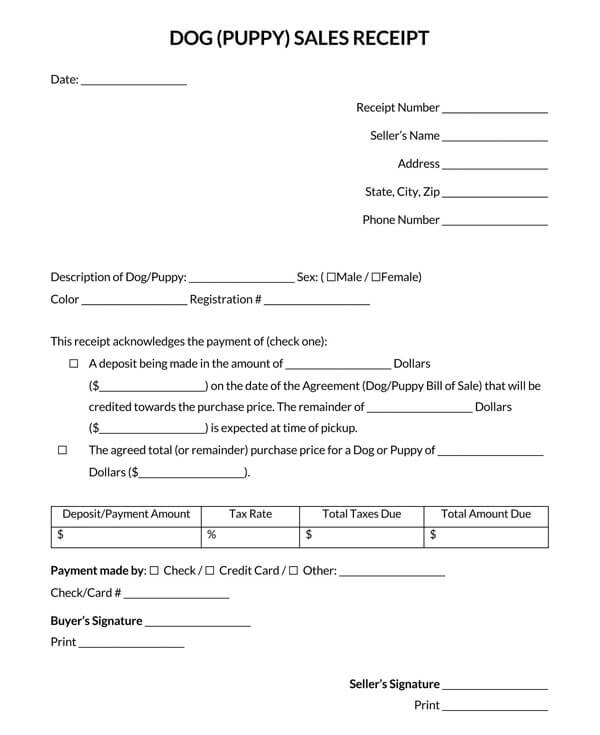

Dog Puppy Sales Receipt Template

This is just like the cat sales receipt. It is used to serve as proof of full or partial payment towards purchasing a dog or puppy.

Download: Microsoft Word (.docx)

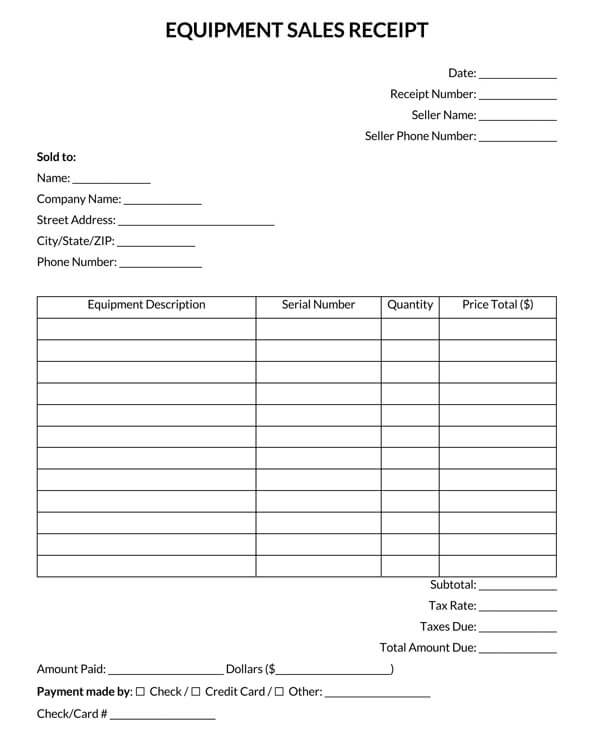

Equipment

This receipt shows that the transaction for the purchase of any kind of equipment has been completed. It usually reflects the transfer of title of the equipment from the seller to the buyer, especially where it concerns large equipment.

Download: Microsoft Word (.docx)

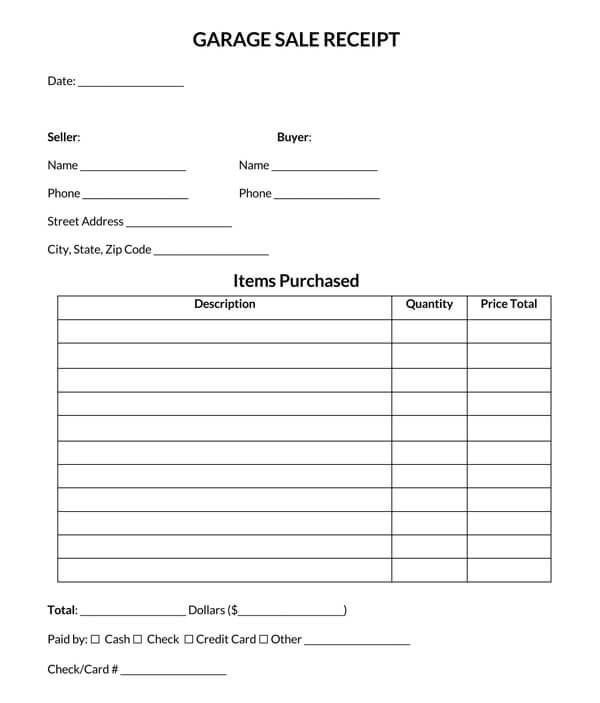

Garage sale

If you want to buy a garage, you will be issued a garage sale receipt. This receipt will reflect the price and description of the garage sold.

Download: Microsoft Word (.docx)

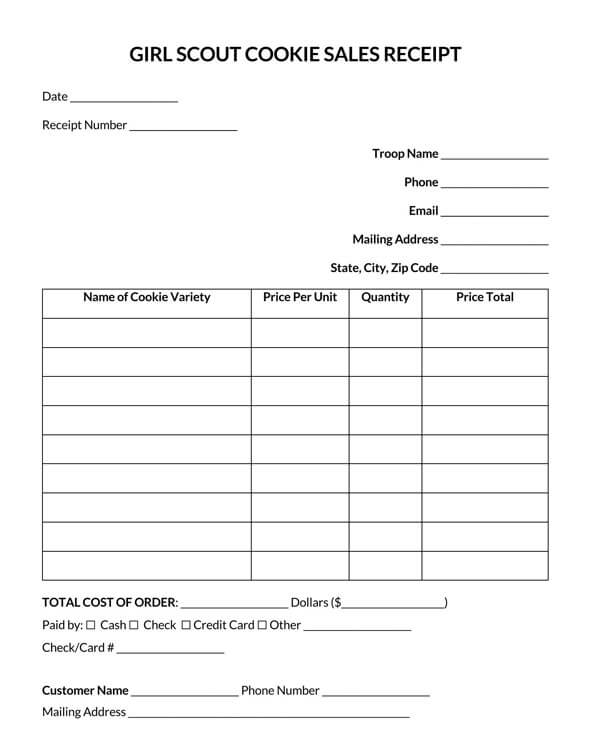

Girl scout cookie

As a part of the girls' scout troops, this receipt is given to customers as evidence of their purchase. It usually includes the contact information of the troops. This is mostly so that there can be an avenue for further contact.

Download: Microsoft Word (.docx)

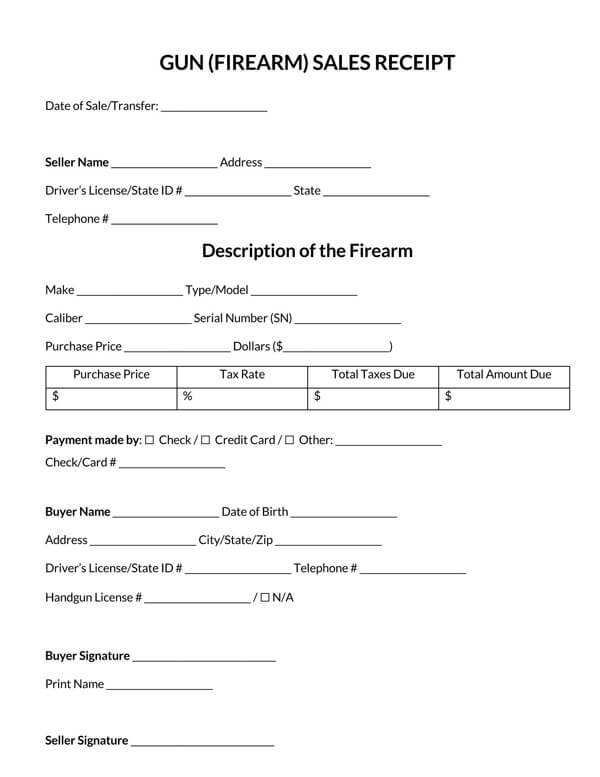

Gun (Firearm)

This receipt is used to show proof of the purchase of firearms. This receipt reflects the names, signature, and contact information of the buyer and seller. It also contains the serial number and description of the firearm.

Download: Microsoft Word (.docx)

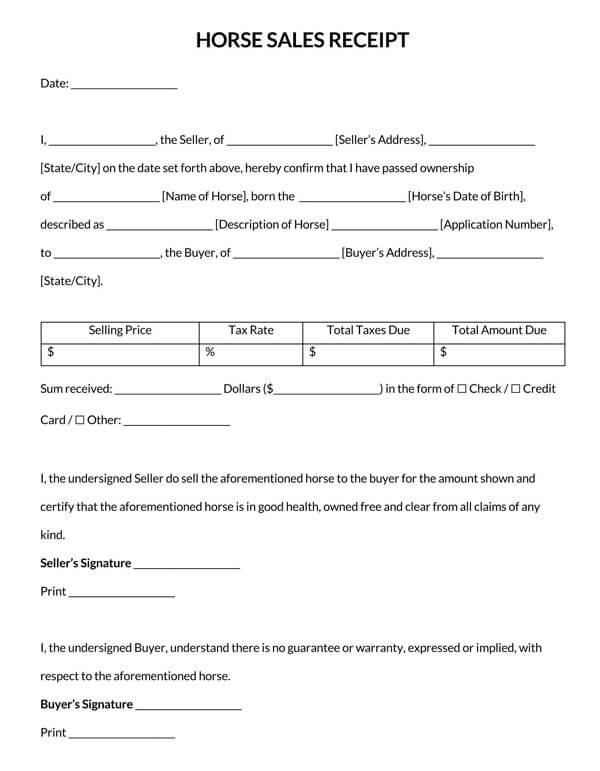

Horse

This receipt is issued after the payment for the purchase of a horse. The receipt reflects the transfer of ownership, the amount paid, and applicable warranties on the horse.

Download: Microsoft Word (.docx)

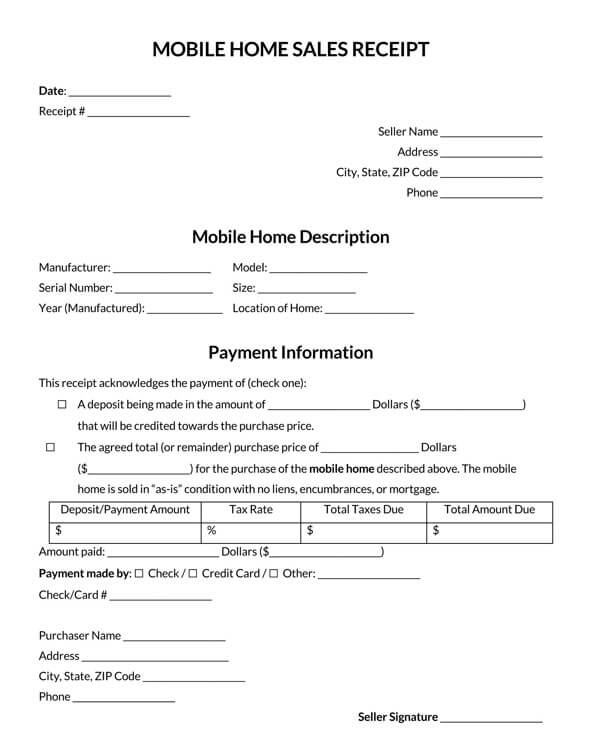

Mobile Home

Where a transaction is for the purchase of a mobile home, the receipt that will be issued will be a mobile home receipt. Like another receipt, it usually reflects the purchase details and an indication of a successful transfer.

Download: Microsoft Word (.docx)

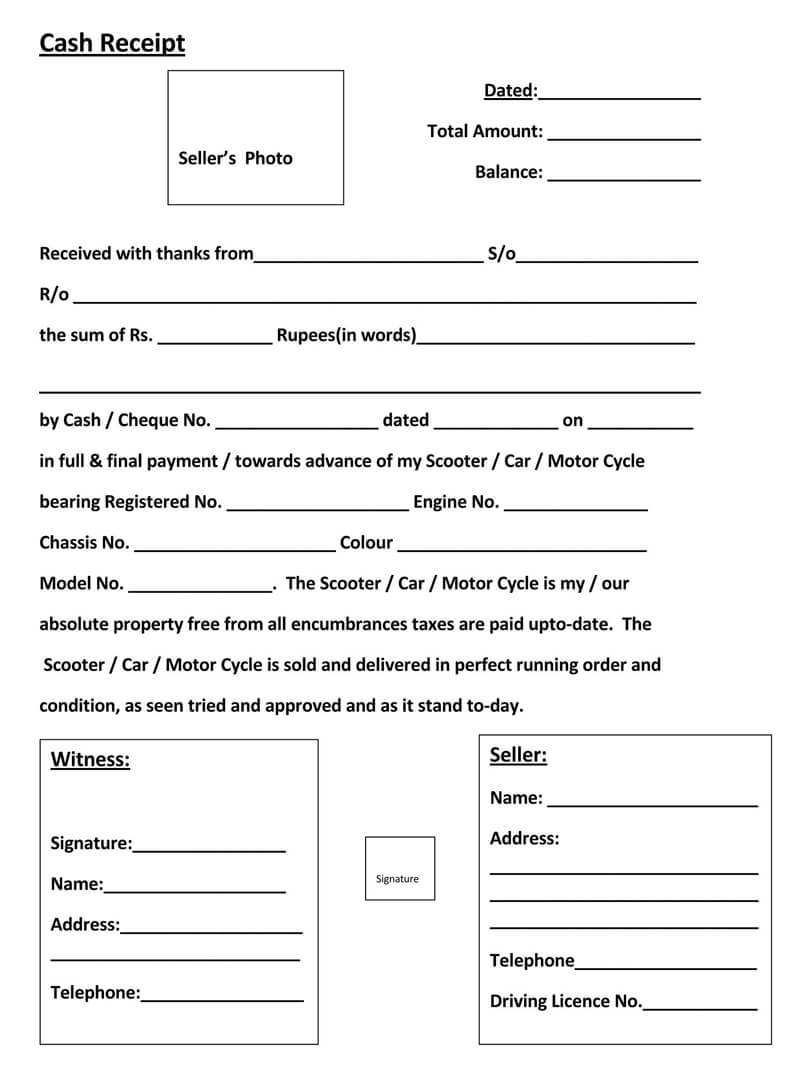

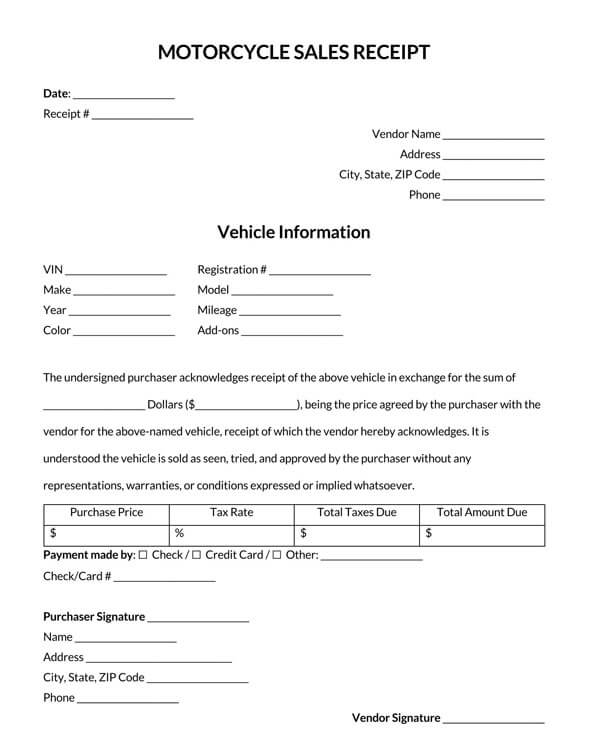

Motorcycle Sales Receipt Template

This receipt is usually used to show that there has been a purchase of a motorcycle. It reflects information like price, registration number, and mode of payment.

Download: Microsoft Word (.docx)

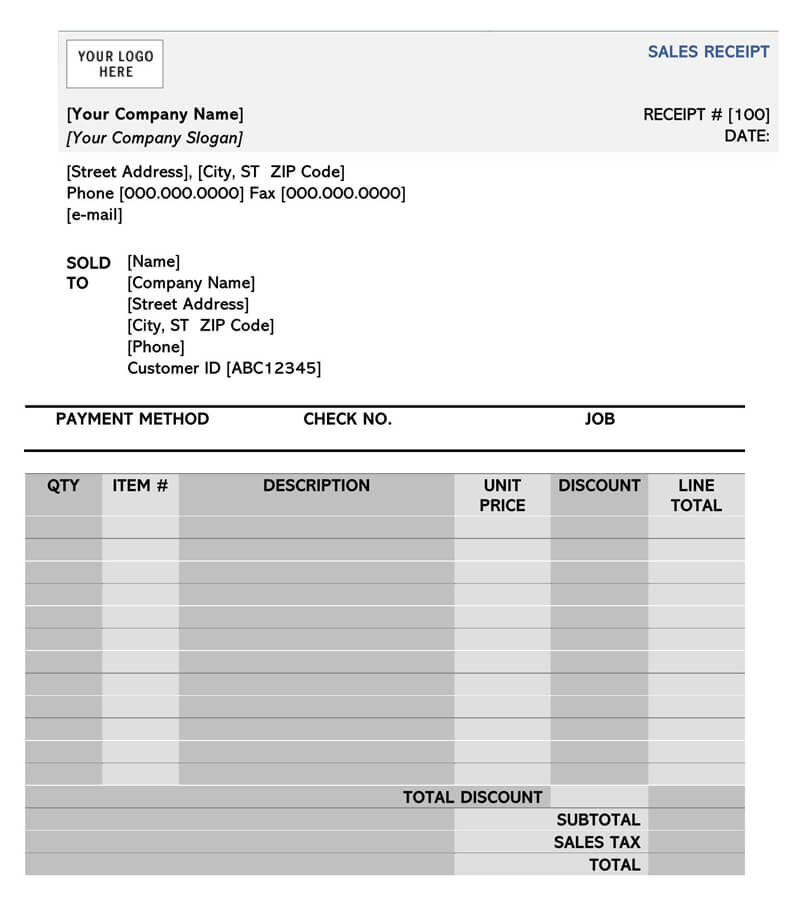

Invoice VS Sales Receipt

It is possible for anyone to easily confuse invoices with sales receipts because they look alike and are mainly used for documenting transactions. However, there are still some differences between them. An invoice is a document given to a customer in a request for payment for the goods supplied or services rendered. On the other hand, sales receipts are issued to prove that the customer has paid for the goods supplied or services rendered.

From this, one can see that there is a difference in the time each is issued. While the invoice is issued after sales but before payment, a receipt is issued after the sales and payment has been made.

The invoice is important to give the customer an overview of what items have been purchased or rendered. It also gives a breakdown of the cost of each and the total expenses that have been incurred. The sales receipt is important because it serves as proof of payment for the goods or services rendered.

Methods of Making Sales Receipt

Making this receipt can be as simple as you are willing to make the effort. There are different methods, and they depend on how willingly you want to personalize them. However, one thing you have to know is that the things you include in your receipt can affect your business.

The following are the methods for making sales receipts:

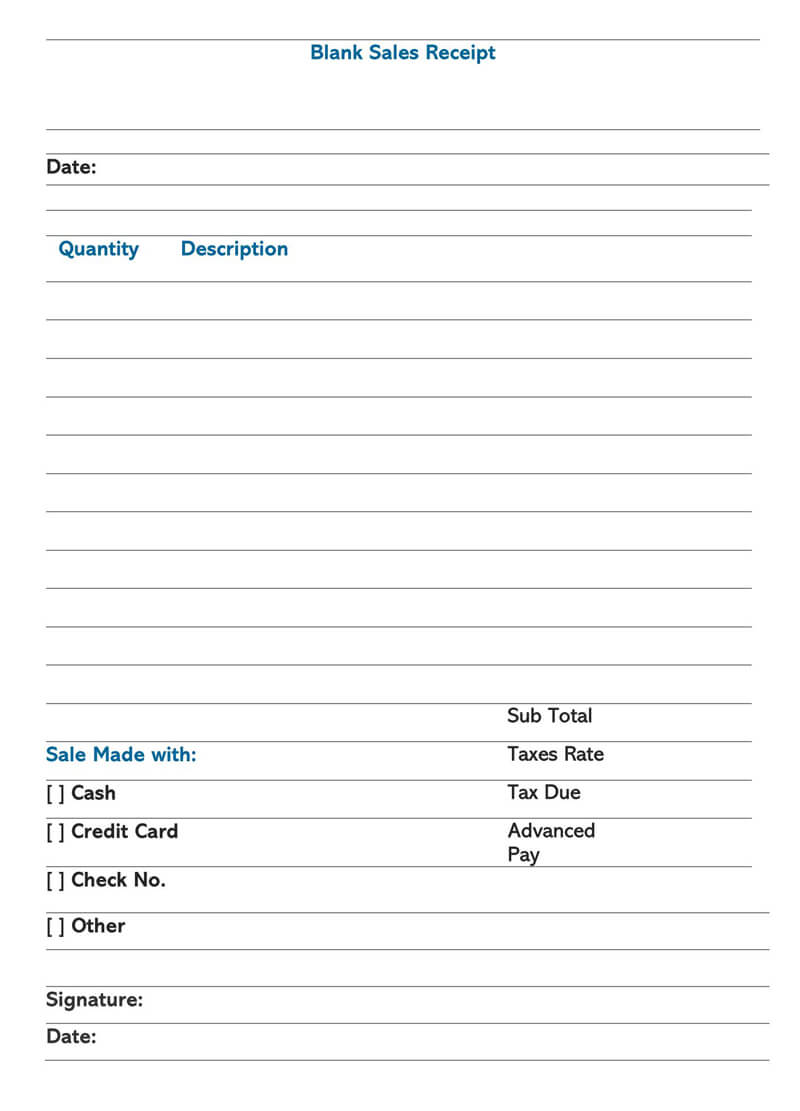

Handwritten

This is advisable if your business has a sales associate in charge of the products or services. These receipts are often pre-printed, and the blank spaces are filled with the necessary information by the sales associate. However, to be more convenient, it is advisable you make a personalized pre-printed receipt for your business.

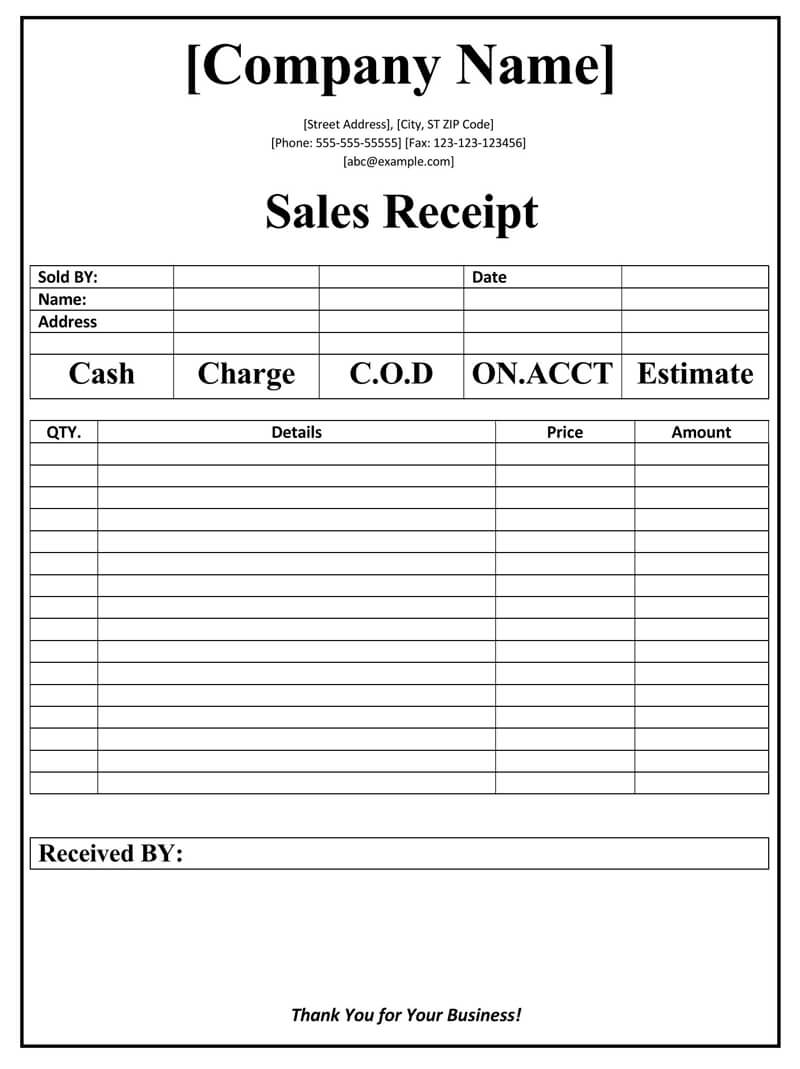

Sales receipt templates

Some services are carried out with extra efforts or necessarily require going beyond what would normally be expected. For example, running lawns might be the service, but it might extend to edging and weeding. A lot of flexibility is required for this kind of service, and for the receipts, you can use our blank sales receipt templates. These receipts would allow you to input additional service descriptions and their cost. You can make your own blank sales receipts templates by using your word processor and following the programmed template. You can also decide to pick things up from scratch.

Buy blank receipt books from a bookstore

Alternatively, you can buy a blank receipt that fits into the kind of industry you are in a bookstore. Before you do this, ensure you check for the content and see that you have all the things required to input in a sales receipt for your business.

CRA’s Rules for Sales Receipts

CRA is the Canadian Revenue Agency. These are compliance rules for businesses operating in Canada. These rules are required to be complied with in all situations.

They involve including the following things:

- The GST/HST registration number of the seller

- The name of the business

- The information about the sale, such as the date, time, and address of the sale

- The business’ contact information

- The name of the sales associate in charge of the sale

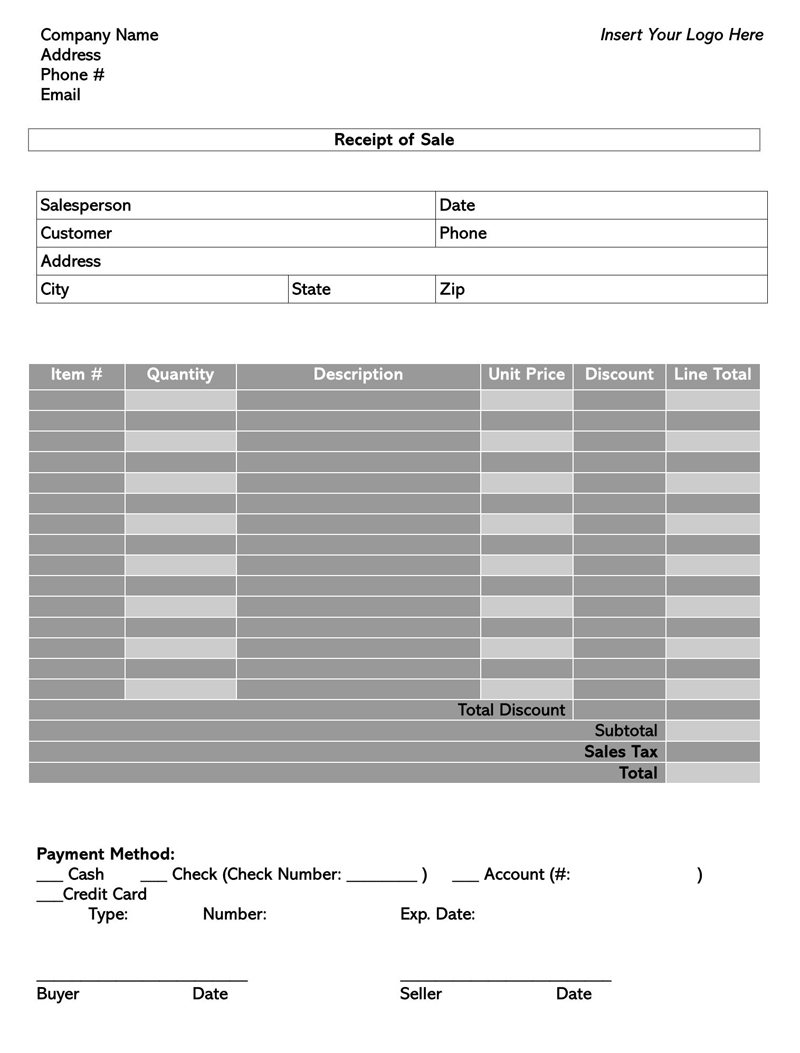

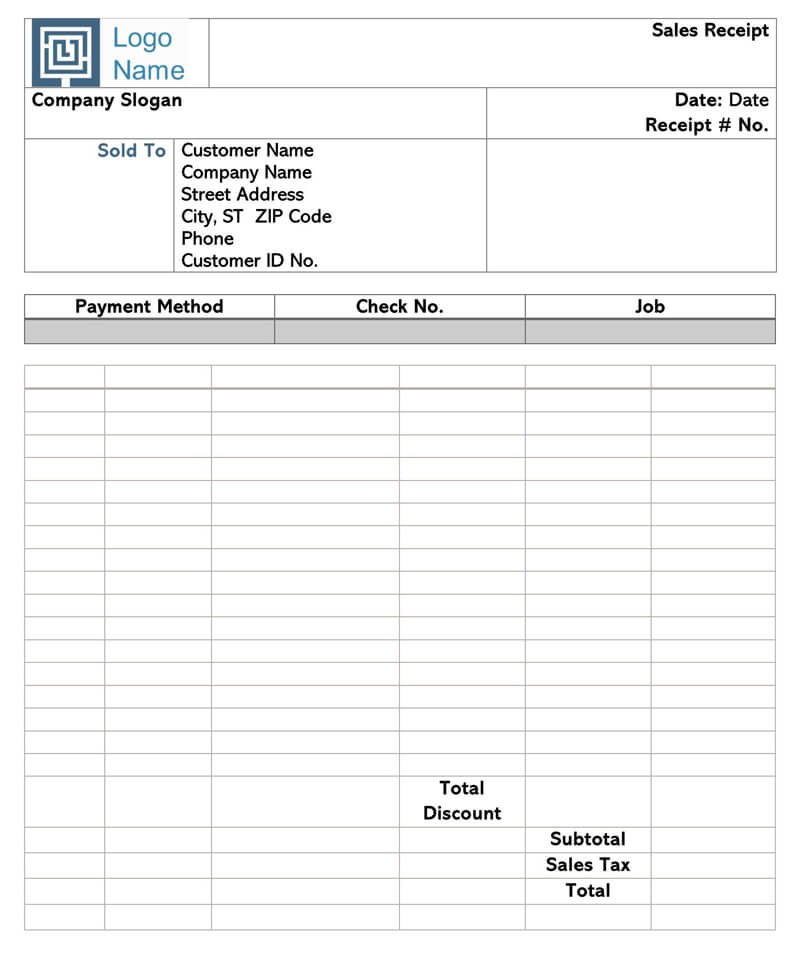

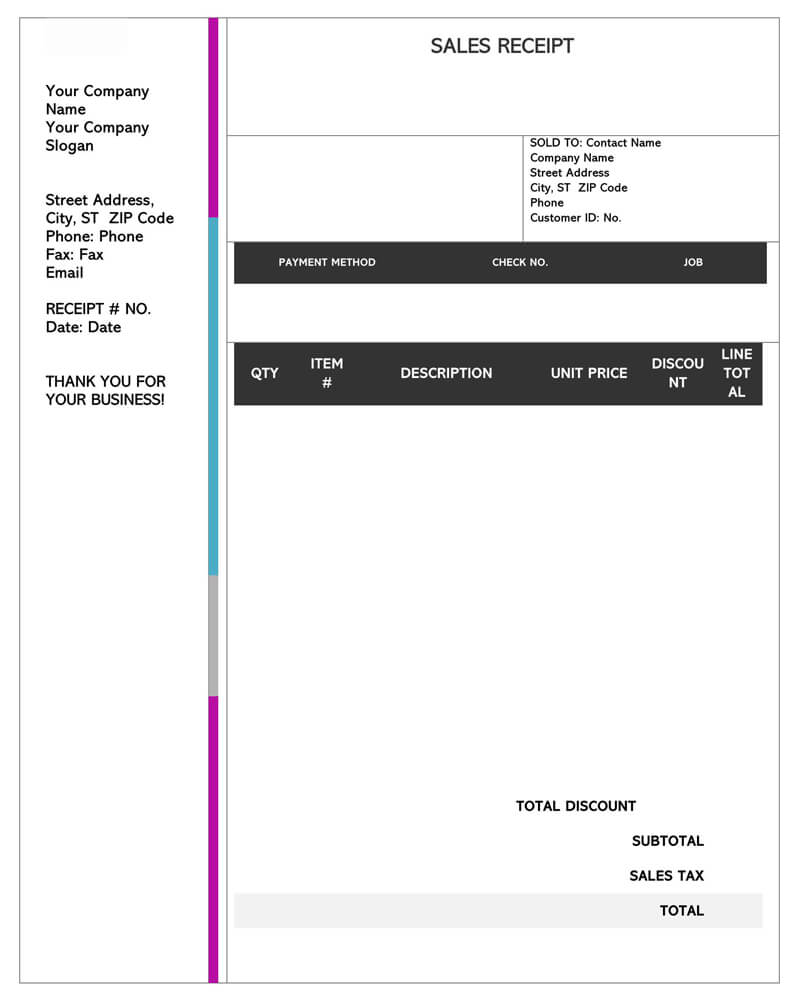

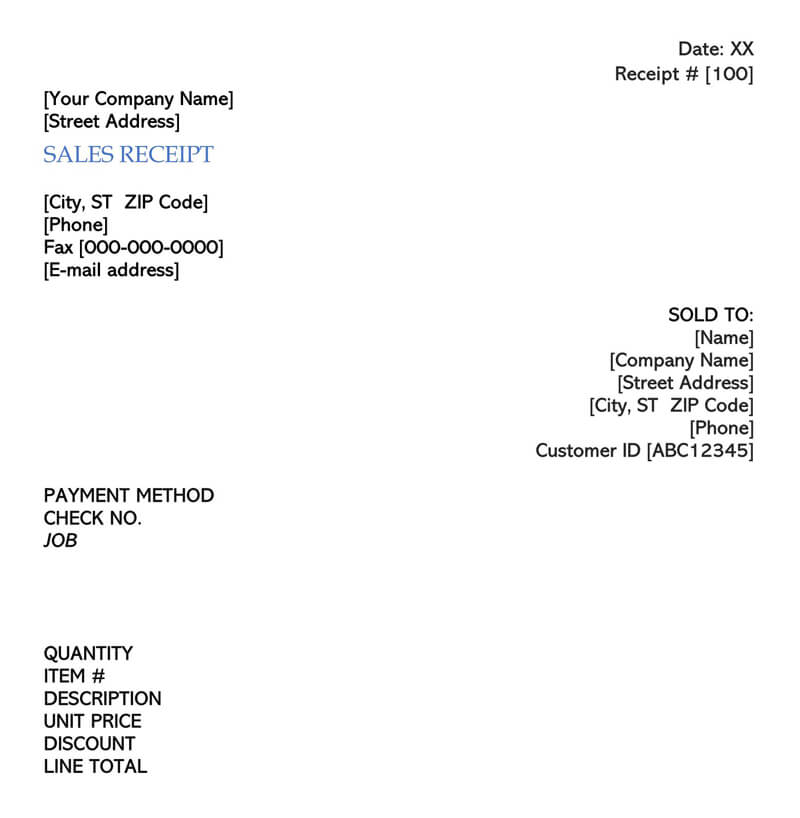

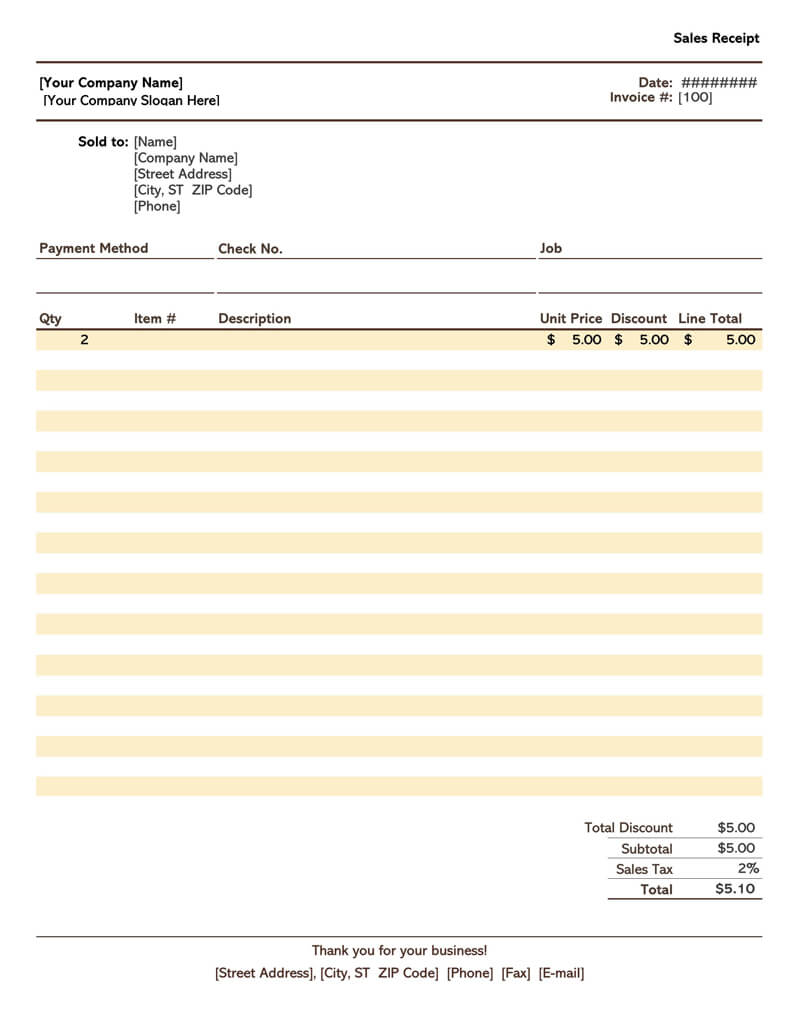

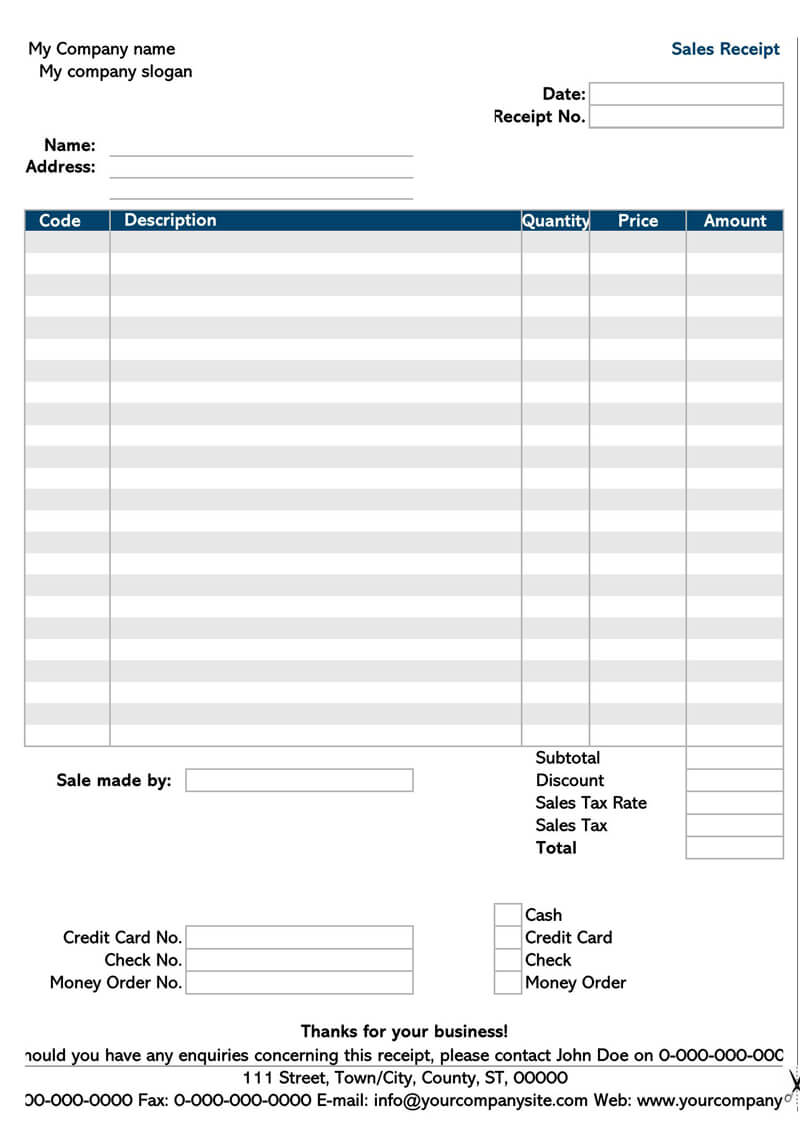

What to Include in a Sales Receipt Template

Sales receipts are important because of the purpose they serve. In many situations, making a sales receipt template allows a business to personalize the details and cover the essential components of the receipts. As a business owner, there are some components that you should not miss out on. Essentially, there are two sections that your receipts should have.

They include:

Section 1: Header

This section of the sales receipt template contains essential information about the receipt and the issuer that can be traced to the business. It is what gives you a hint about the originality of the receipts being issued. They are mostly expected to be filled by the sales associates of the business.

The information template includes:

Receipt number

This is the unique identification number of your receipt. It is only your receipt that can carry this number in the stack of receipts issued. This number makes it easier for the sellers to validate that a receipt was issued by their store.

Date

Receipts are not completely filled without a timestamp. The timestamp is the date of the issuance of the receipt or the date of purchase of the goods.

Merchant’s information

The merchant information is the personal and contact information of the business owner. It necessarily does not have to be your private address. It could be your business address, but it has to be filled as it is essential. The things often expected in this section are the name of the business or the owner’s name, official contact number and email, and complete official business address.

Section 2: “Sold to”

This equally important section is for the buyer’s information. It contains information about the buyer and the description of the goods bought or the services rendered.

Some of the things included in this section of sales receipt template are:

Buyer’s details

Buyers’ details are essential in this section because they identify the legal owner of the goods the receipt reflects. Information imputed here has to be verifiable if there is an issue with the product or service rendered. Therefore, the buyer’s name, full and legal names of the companies, and the official address of the buyer as stated here.

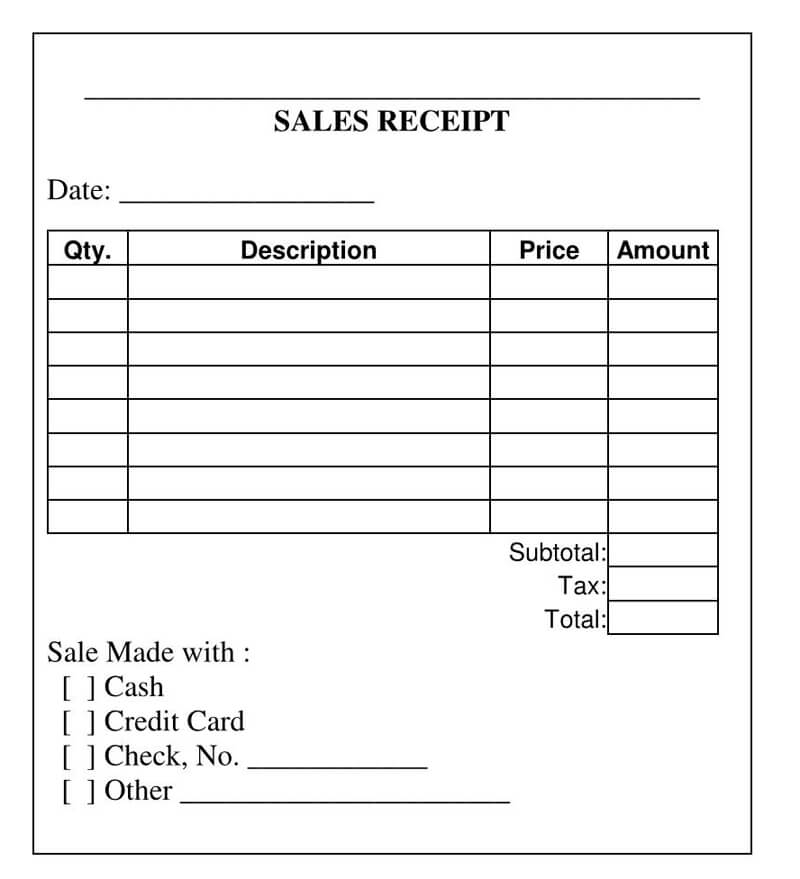

Purchased item(s)

The items you bought, too, need to be recorded. This aspect is where the information on your goods or service is documented.

The information usually included here are:

- Description: The information about what you bought will be imputed. How it

- Quantity: This usually contains the number of goods that has been bought

- Price/unit: This is the price of a each of the good that has been bought

- Line total: This is the amount that is gotten from the calculation of the quantity and the unit of the goods bought

Totals involved with the payment

Here, information about the amount due for payment is given:

- Subtotal: This is the total of the goods so far but does not represent all the money that is payable.

- Discount: If a discount applies, the percentage or the amount of discount is stated here.

- Sales tax: The sales tax is the tax deducted from the product you bought. They are usually VAT or GST on the product. The sales tax in your receipt is, however, dependent on the goods bought and the location

- The total amount paid: Information about the whole amount paid is usually written here. It is written in figures and words.

- Payment method: This contains information about what method is adopted for payment

- Card/check number: Depending on the method adopted for payment, this contains the identifier for the card or check issued.

Bank details/ payment terms

This could contain details about how the due money will be paid and the terms guiding the payment.

Other information

There might also be a need to add some other information to your receipt. This essentially depends on you and the product or services rendered. The other information you can include may be the availability of coupons for a returning customer. You might also include branding materials and any marketing details that can help your business.

Frequently Asked Questions

Gift receipts are like the normal sales receipt you get, just that there is no information about the price of the gifts. This makes it easier for the buyer to exchange the gifts without the receiver seeing their cost. Some gift receipts might only include the bar codes or just the name of the items bought.

You can use word processors to make your receipt conveniently. With a word processor, you can easily create a manual sales receipt. You can also link your sales database to your receipt document using a word processor. This will allow you to get information when you need it automatically. What would then be left would be to print your receipts. What’s more interesting is that you can use a word processor to share the pdf format of your receipts to your customers via email.