A Credit Card Authorization Form is a document containing a cardholder’s credit card information, typically issued by a business owner or a third party, which registers a cardholder’s consent to a future charge on their credit card for a period specified on the document.

The form permits businesses to carry out a one-time charge or a recurring charge, as the case may be, on a cardholder’s credit card.

Free Templates

Common Uses

Any business owner or service provider that accepts credit cards as a mode of payment can use a credit card authorization form. The form functions as evidence that the cardholder is financially capable of covering the cost of the transaction they are about to initiate. It also functions as protection for businesses against chargebacks.

Chargebacks

Chargebacks allow cardholders to contest a charge on their account and make requests to the card issuer to enforce a reversal. The idea behind chargebacks is to have a system in place that serves as protection to cardholders against unauthorized transactions. However, chargebacks can be detrimental to a business. A business’s payment processor will begin to question the operational ethics of a business when the dispute ratio of such a business exceeds the allowed rate (usually 3%).

To avoid a high dispute ratio, businesses tend to cut their losses in chargeback situations and make unfair refunds to customers. Since the credit card authorization form is a signed document expressing the cardholder’s consent to a business to charge a card, adopting its use can be helpful to a business experiencing high rates of dispute.

Recurring payments

A credit card authorization form can also help set up a recurring or ongoing payment. It is a way of getting authorization to charge a card over an agreed-upon period continuously. These types of transactions, for example, a monthly subscription plan, are known as “card on file” transactions. The automation of these sorts of transactions saves both parties the time they would otherwise use to make manual payments.

Postpaid Payments

Another use for a credit card authorization form is to authorise a credit card billing that will take place later. A charge will not register on the credit card upon collecting the information; instead, a pending status will reflect on the cardholder’s account. Transactions like this are called “authorization only” transactions and are common with car rental companies and hotels. Another case of this type of transaction is a customer making a booking for an item that is not in stock.

CNP

Card-not-present (CNP) transactions are also situations that necessitate the use of credit card authorization forms. This occurs when the cardholder and credit card are not physically present at the place of the transaction. Due to this, such transactions are more prone to deceit, and a credit card authorization form functions as additional evidence if the situation arises. It is particularly helpful for businesses that do not operate physical stores and take orders online or over email or phone.

How does a Credit Card Authorization Form Works

A business that wishes to start using credit card authorization forms simply needs to incorporate them into its payment system. A credit card authorization form essentially keeps card information on file so a business can process transactions without repeatedly needing the cardholder’s permission. The form can be hard copy or digital.

The following information describes the steps involved in executing a credit card authorization form:

Point of sale

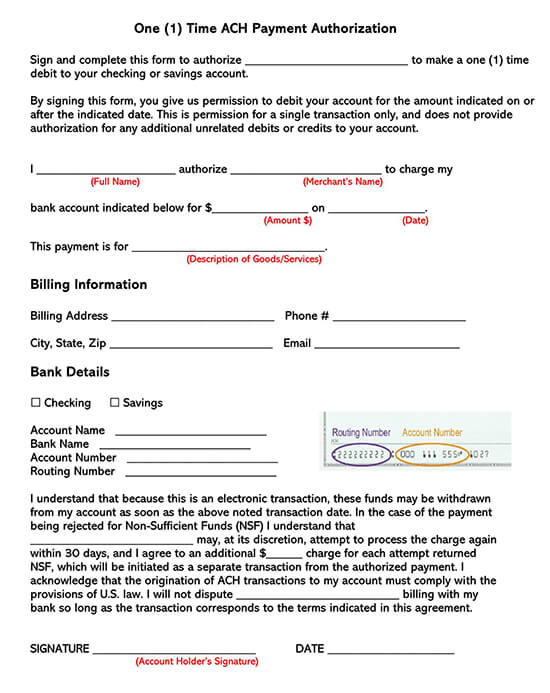

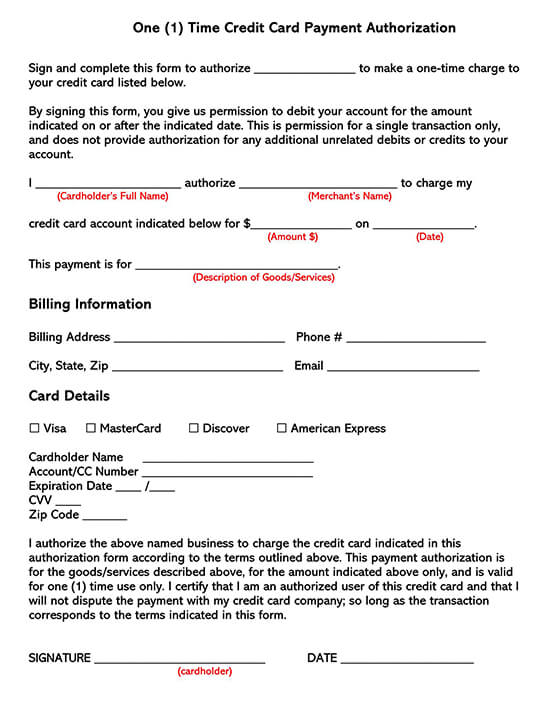

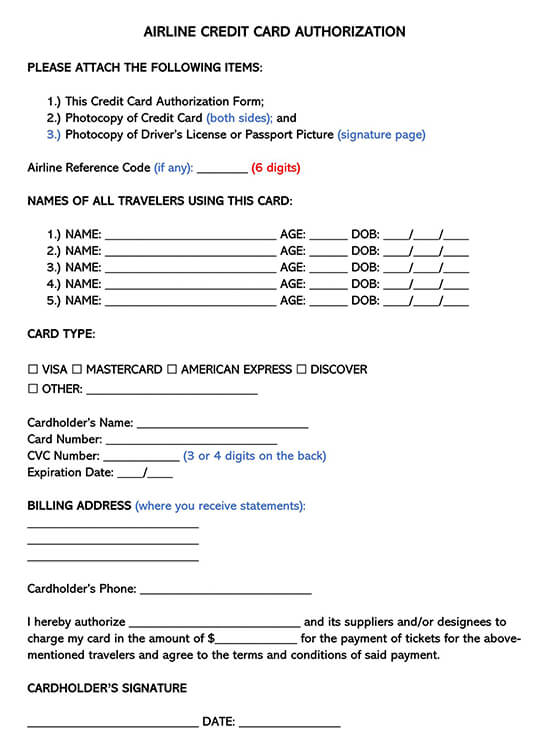

After the parties have reached an agreement on a purchase, filling in the form can begin. For credit/debit cards, the form should require the cardholder to supply their name, the card number, card expiration date, and billing address. For a bank account (ACH), the account holder should supply their name, address, routing number, and account number.

Frequency of payment (One-time charging or recurring)

The business should specify if the transaction is a one-time payment or a recurring one. If it is recurring, the business should note the frequency of the charge, and if the charge amount may differ on each payment, the business may choose to specify an amount range rather than an actual amount.

Cardholder signs the form

The authorization form only becomes valid after the cardholder signs and dates it. The cardholder’s signature indicates that they accept the provisions of the form and that they acknowledge the information they have supplied to be true.

Types of Credit Card Authorization Forms

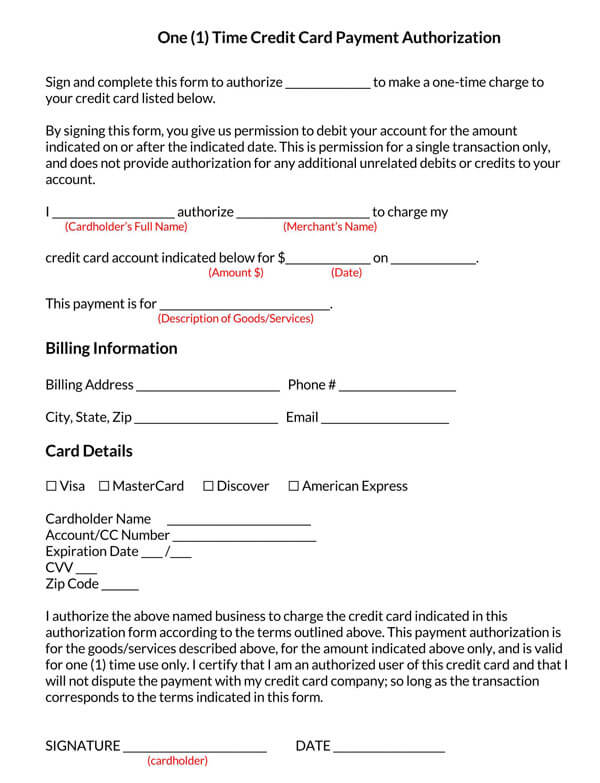

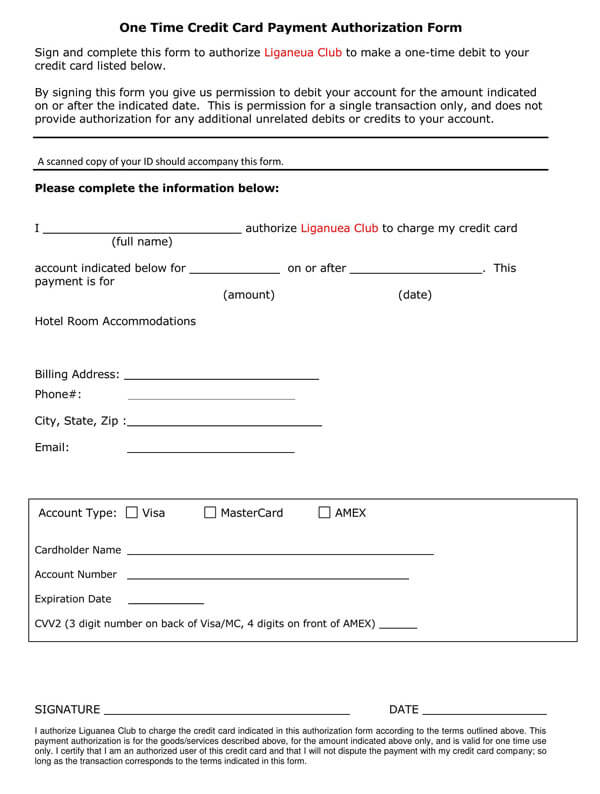

1-time credit card authorization

This is a simple template and does not need a lot of information. The one-time credit card authorization form allows a business to process a single transaction without a physical card. When a cardholder signs this form, it becomes invalid after one transaction.

Download: Microsoft Word (.docx)

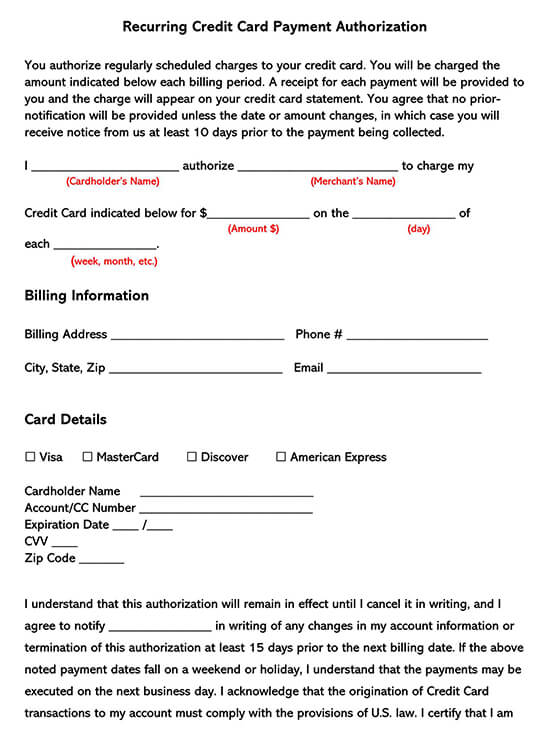

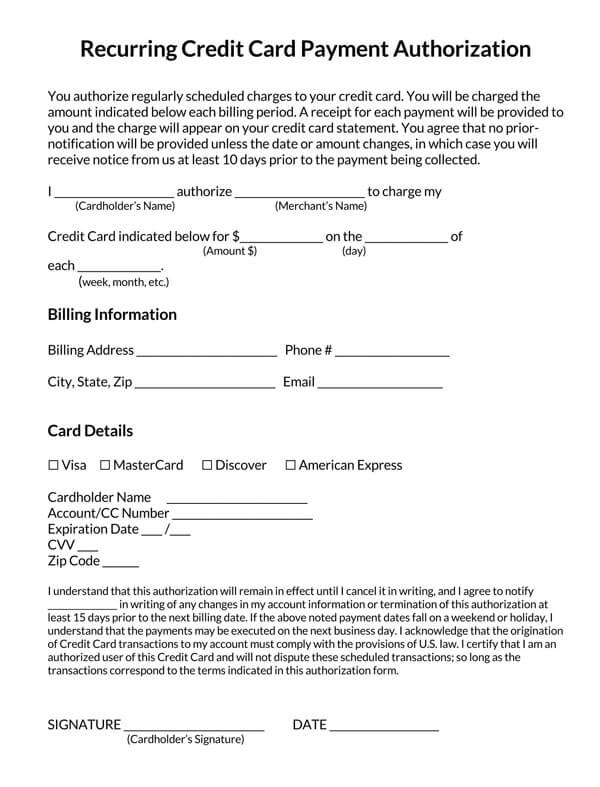

Recurring credit card authorization

This is a form specifically for recurring payments. The form features payment details like the amount and frequency of charges.

Download: Microsoft Word (.docx)

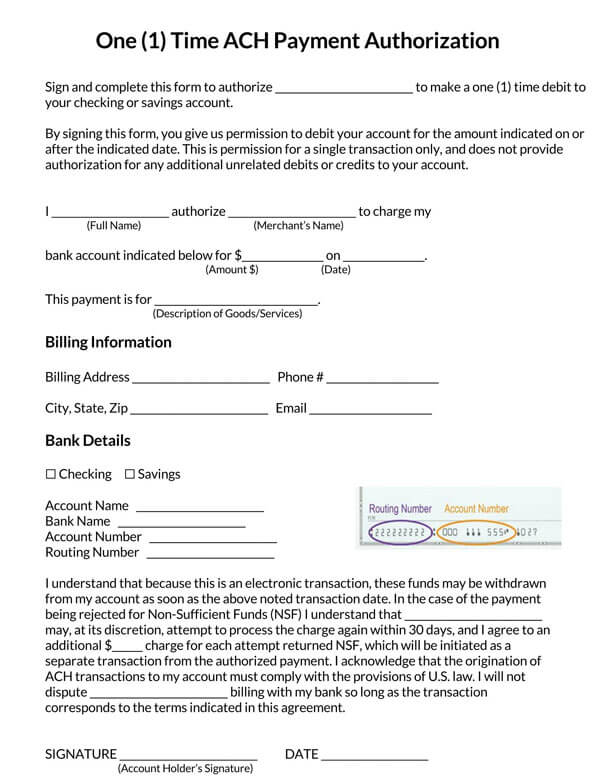

1-time ACH authorization

The one-time ACH authorization specifies that the account owner has given their consent to the business to take a one-time specified amount out of their bank account.

Download: Microsoft Word (.docx)

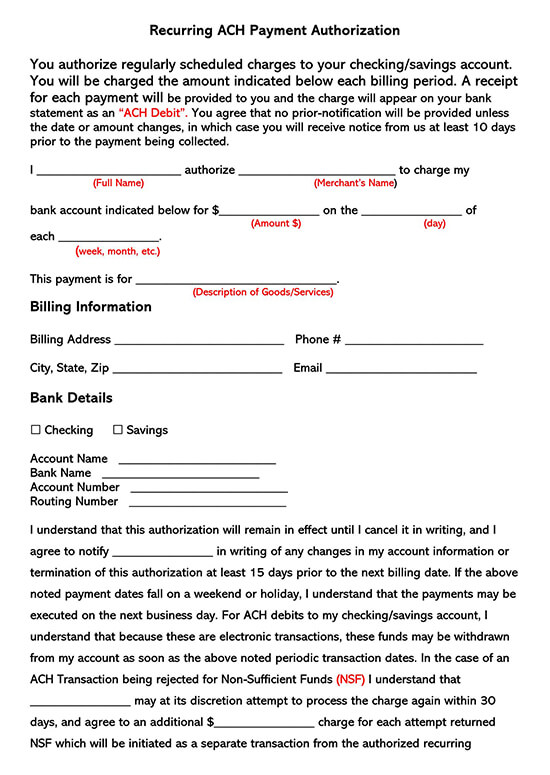

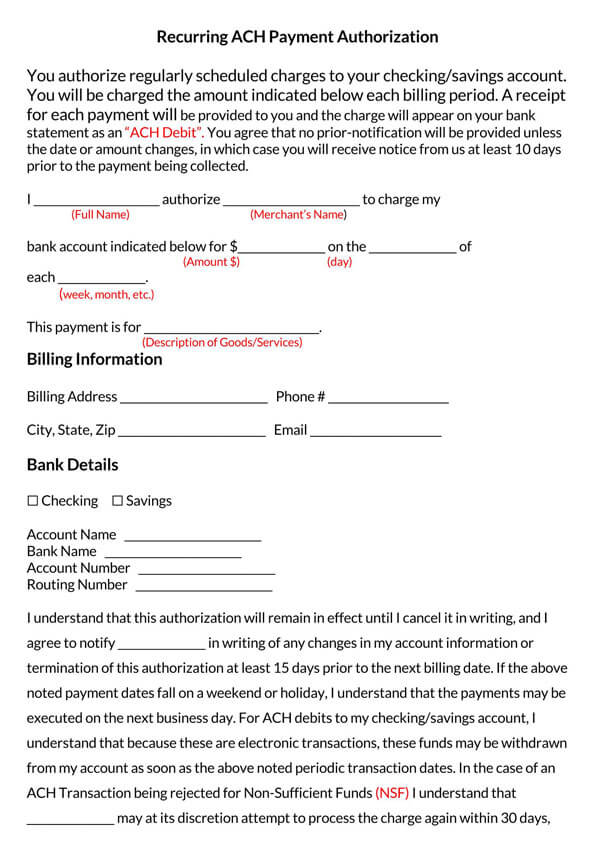

Recurring ACH authorization

This type of ACH authorization form permits a business to charge a specified amount from a client's bank account on a regular basis.

Download: Microsoft Word (.docx)

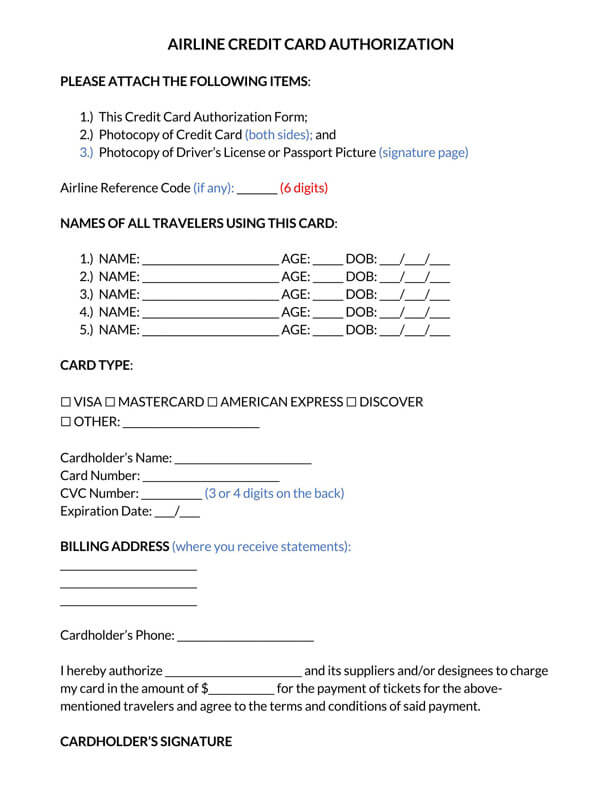

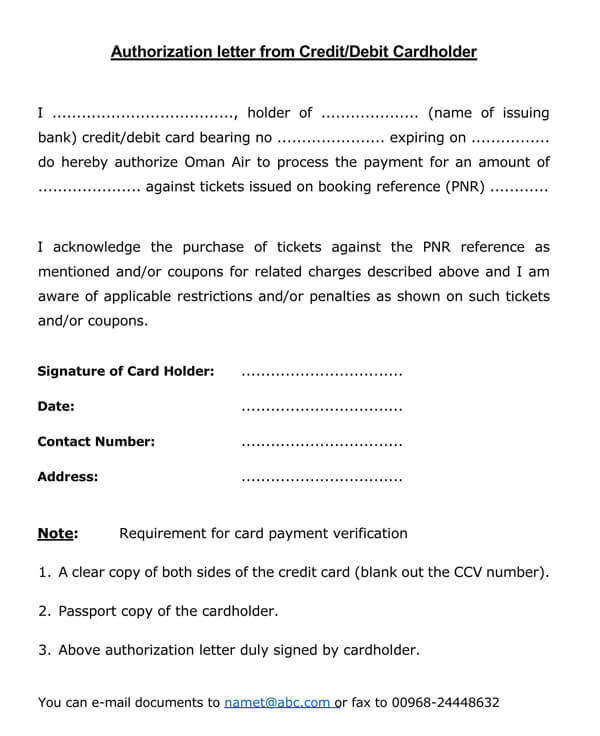

Airline credit card authorization

An airline credit card authorization form gives permission to an airline to charge a cardholder's credit card for a ticket. In this case, the individual purchasing the ticket is not necessarily the card owner. Businesses or third parties purchasing a ticket on someone's behalf commonly use this type of authorization form.

Download: Microsoft Word (.docx)

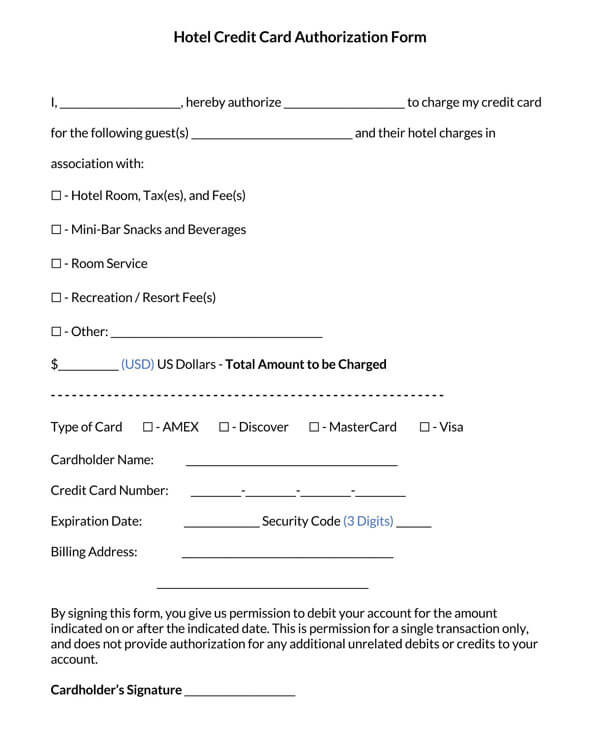

Hotel credit card authorization

This type of credit card authorization form allows a hotel guest to use an authorized credit card belonging to a third party to pay for a hotel's lodging. The card owner may place a limit on extra charges that the card can cover, e.g., food or minibar, and any outstanding incurred due to these have to be paid by the guest.

Download: Microsoft Word (.docx)

What is a Credit Card Authorization Hold

A credit card authorization hold works by temporarily freezing the value of an initiated transaction in a cardholder’s account. It takes effect after the cardholder authorizes a transaction and usually remains in place until the merchant receives the funds from the bank. The authorization hold essentially stops a customer from spending the payment money elsewhere while ensuring the merchant gets the agreed payment.

When a credit or debit card transaction is initiated, a request goes through the credit card processor to the issuer to review the account, verify the card’s validity, and confirm whether the account has enough funds to complete the transaction. If the card issuer confirms that the funds are sufficient to cover the cost of the transaction, they place an authorization hold on the account, reducing the credit line by the amount of the transaction.

Authorization holds help to protect businesses from fraud and chargebacks. Authorization holds are removed after the business captures the charge or after it has exceeded the maximum number of days designated by the issuer.

Related: Hotel Credit Card Authorization Forms

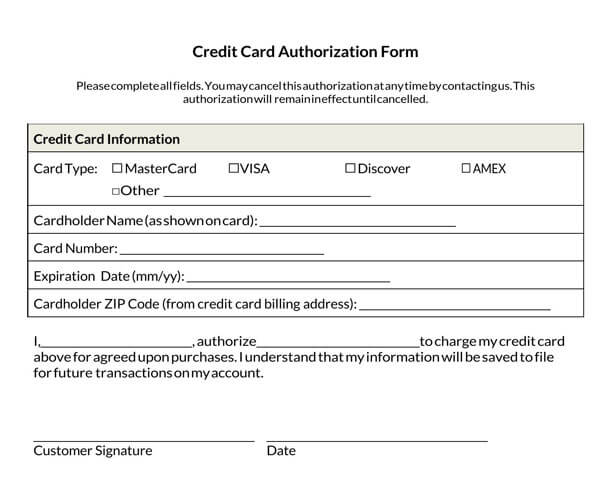

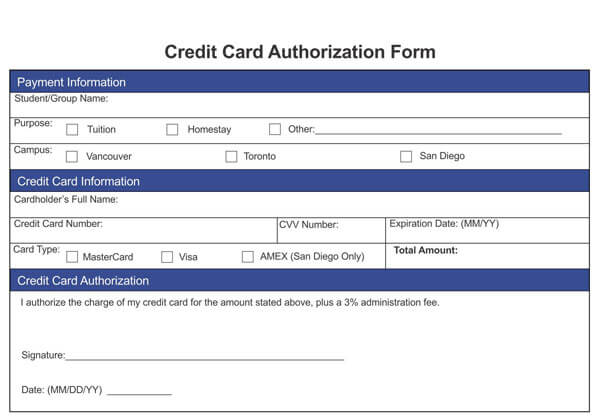

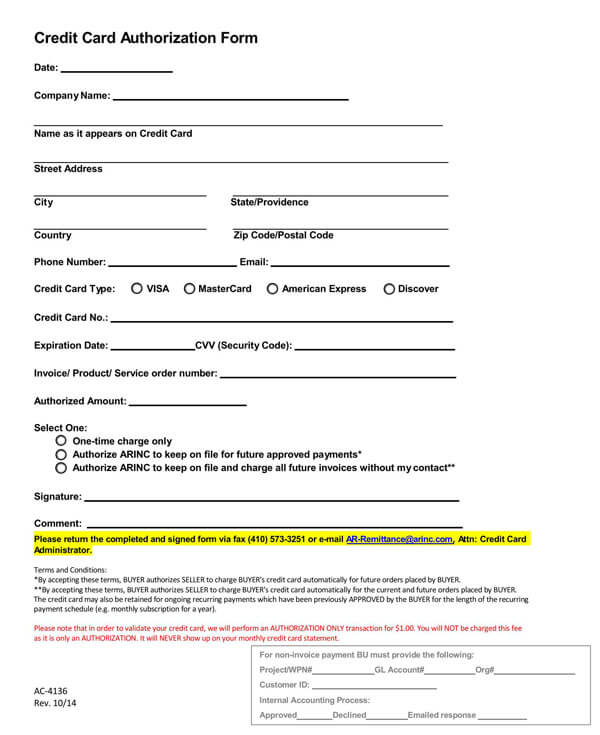

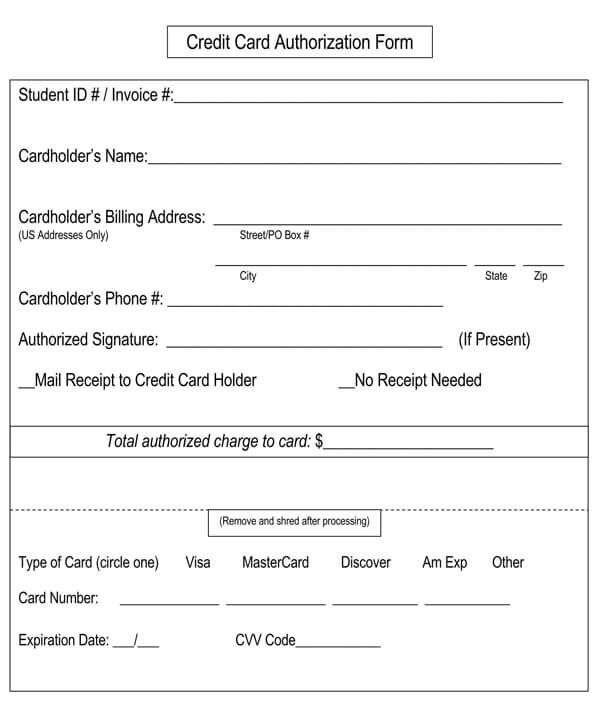

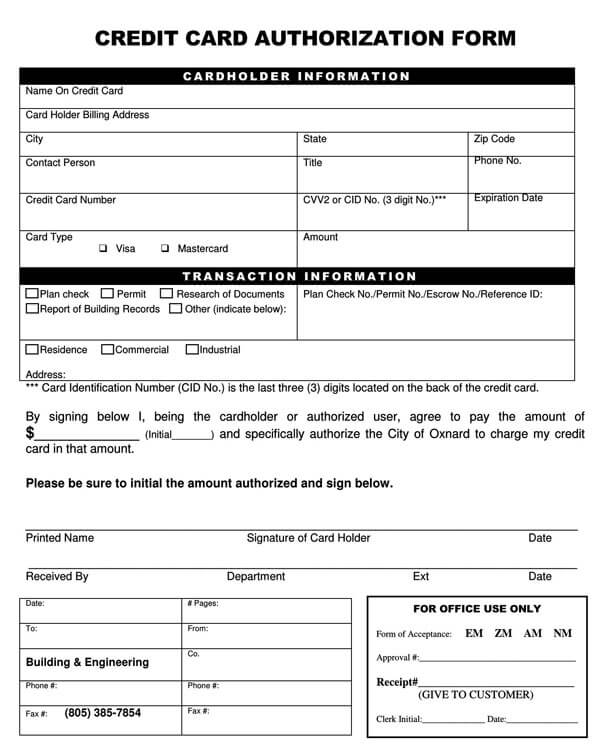

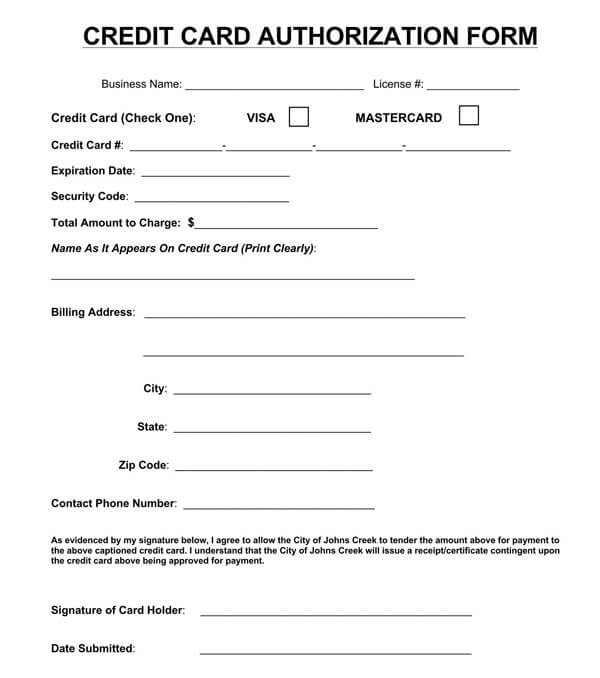

Basic Components of a Credit Card Authorization Form

A merchant looking to create a credit card authorization form for their business should make sure to include certain basic components.

These basic components include:

Recurring charge or one-time charge

This component allows the customer to grant permission to the merchant to charge a specified amount to their card. It further allows the cardholder to specify the nature of the payment – if it is a one-time charge or a recurring one. If it is a one-time charge, the merchant cannot initiate another payment again using the same authorization.

Parties’ details

The authorization form must properly capture the details of both parties (buyer and seller). The required information includes the full names of the cardholder and merchant, the specific amount payable, a description of the goods or services that the customer is paying for, and the business information of the merchant.

Billing information

The credit card authorization form should have a section titled “Billing Information,” where basic cardholder information like billing address, contact number, and email address should be included.

This section of the form should have two subsections titled “Credit Card” and “Bank”. Only one of these subsections should be completed per payment authorization. At this point, the customer will need to decide which mode of payment they want to use.

The customer can choose between the following modes of payment:

- Bank (ACH): This is an authorization to take payment directly from the customer’s bank account. The customer will have to indicate whether they make payments through a savings account or a checking account. Other information needed in this section includes the name of the banking institution where the account is located, account number, name on the given account, and routing number.

- Credit card: This section requires the input of the customer’s credit card details, like credit card type, cardholder’s name, card expiration date, and account number must be supplied. Financial regulations do not permit the storage of a customer’s CVV. Therefore, if the merchant collects this information through the authorization form, that information should not remain on the form before it is stored.

Acknowledgment statement

The acknowledgment section of the form is a statement that explicitly describes to the customer what they are consenting to. It is an essential part of the credit card authorization form, and its absence might render the entire form invalid. In addition to the statement describing the payment authorization, the acknowledgment statement should include the applicable penalty amount for any rejected charges due to insufficient funds in the card or account. This helps to clarify any future penalty charges to the customer.

Cardholder’s signature and date

The credit card authorization form is not valid until the cardholder appends their signature and the document is dated. Therefore, the form should feature a section for signature and date.

More Templates

Frequently Asked Questions

While it is not legally mandatory, credit card authorization forms have widespread use among merchants and prove to be highly effective in curbing payment issues, like chargebacks, that merchants experience.

While PCI regulations do not prohibit collecting a customer’s CVV before authorization, it specifically forbids its storage after first use. For recurring charges, merchants only require the CVV for the first transaction and subsequently do not need it for use in later transactions. Recording CVV on stored authorization forms is a significant financial risk, as a data leak can lead to identity theft.

Card on File is payment credentials that merchants store with permission to help facilitate future transactions. The stored information includes the card number, card expiration date, cardholder’s name, account number, and billing address. Either the merchant or the customer can initiate a Card on File transaction.

To remain compliant with PCI standards, merchants should provide a secure, encrypted email connection through which customers can send signed forms. Merchants can also set up an encrypted private client portal by using a secure file transfer app. Although not advised, if the merchant wishes to provide a copy of the form to the customer, he may send a password-protected PDF file through a secure and encrypted email. If the merchant has the hard copy of the signed authorization form, he or she should store it in a secure cabinet or room, and restrict access to it to only essential personnel.