An employer uses a proof of income letter to verify an employee’s payment history and employment details (previous or current). In many cases, a proof of income letter is written as a backing to support loans or mortgage payments from a financial institution, house rent verification, and government agencies.

The letter details where an employee works, salary, the post held, income regularity, and income source. This helps businesses verify prospective applicants’ identities and their ability to handle the position of interest.

A proof of income letter can also be used by a current employer or landlord to conduct a background check on a tenant or new employee. It helps them build trust for security purposes.

It can also be called an employment verification letter, proof of employment letter, employment confirmation letter, salary verification letter, or work verification letter.

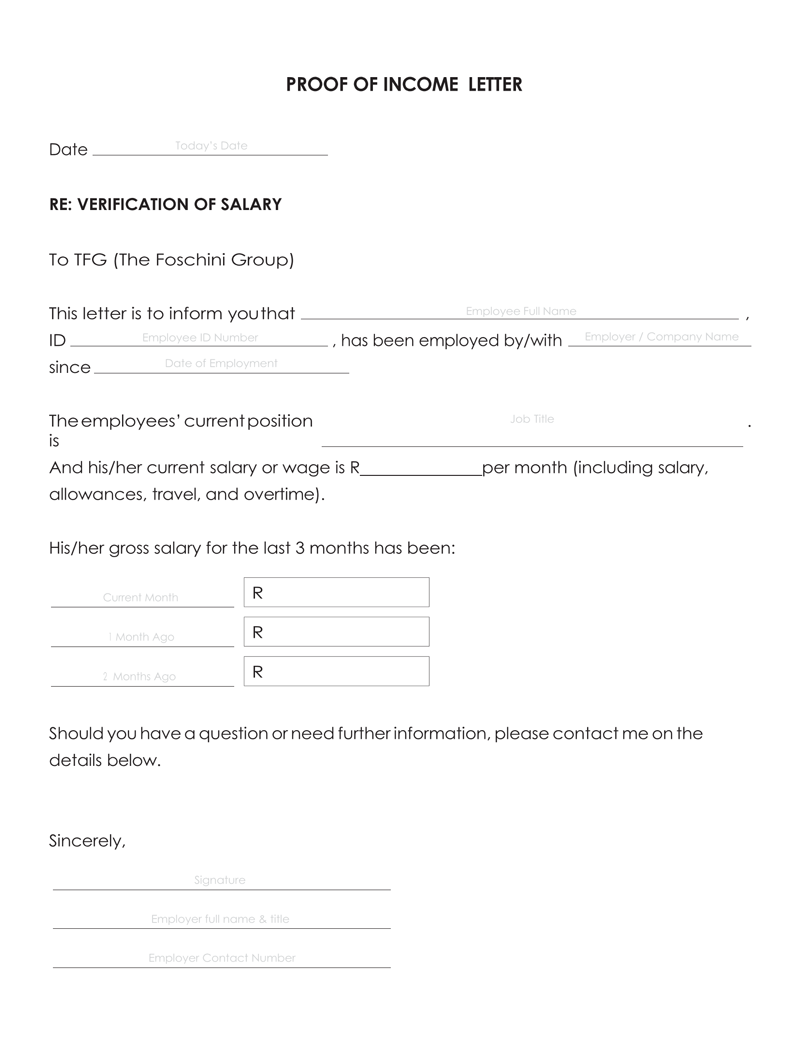

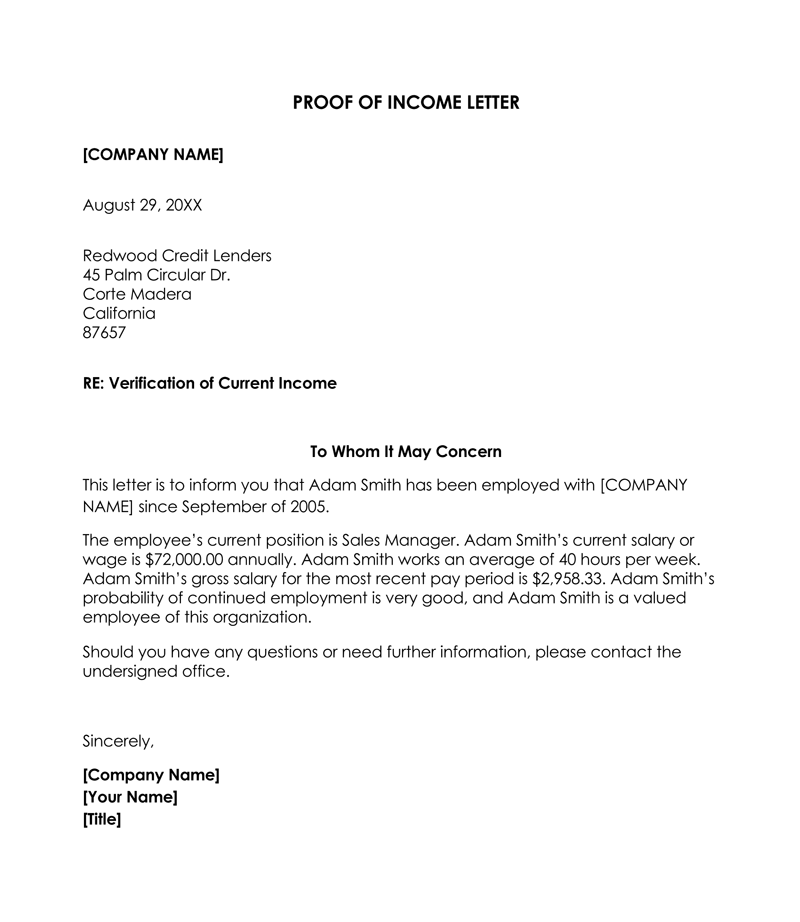

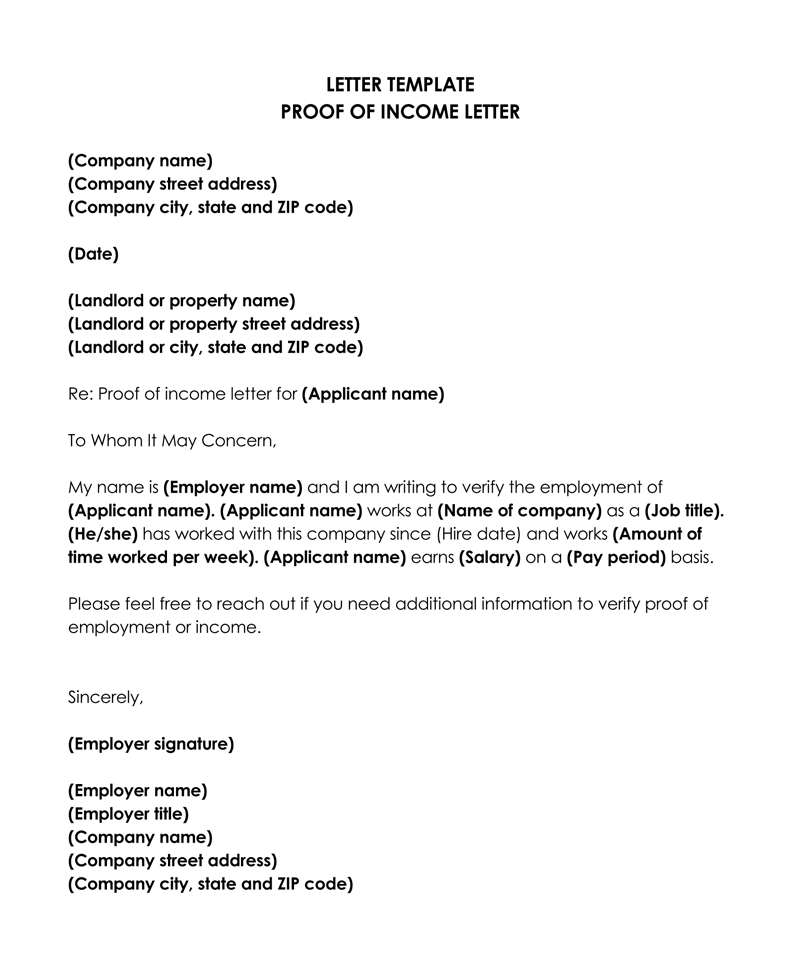

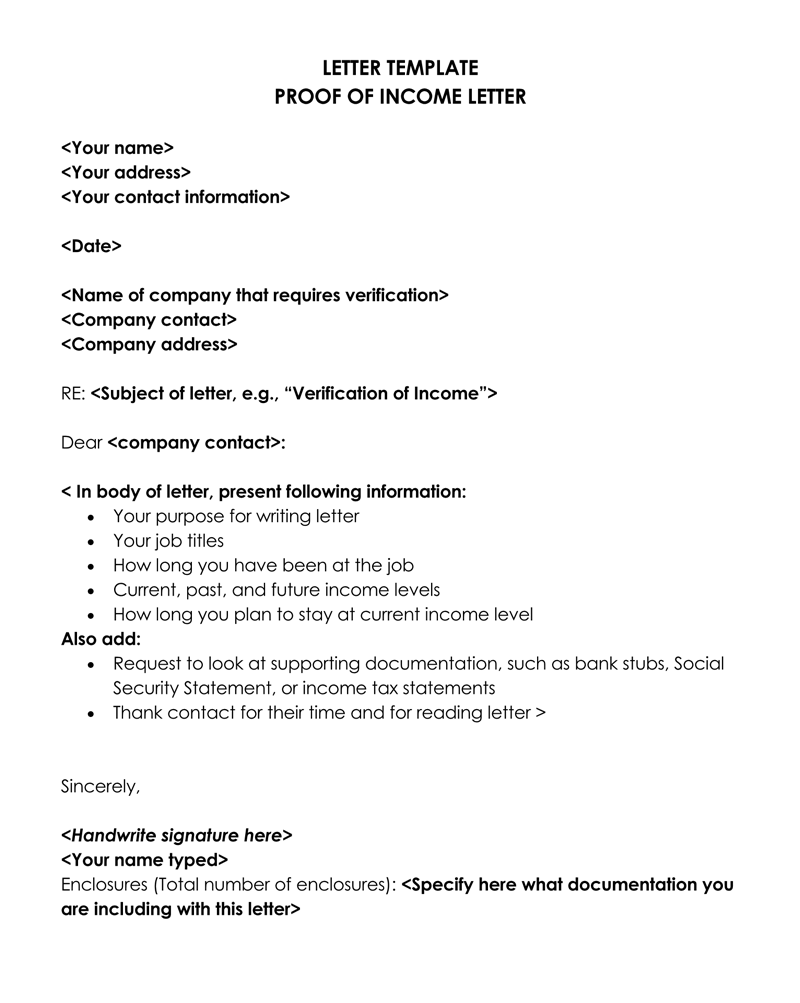

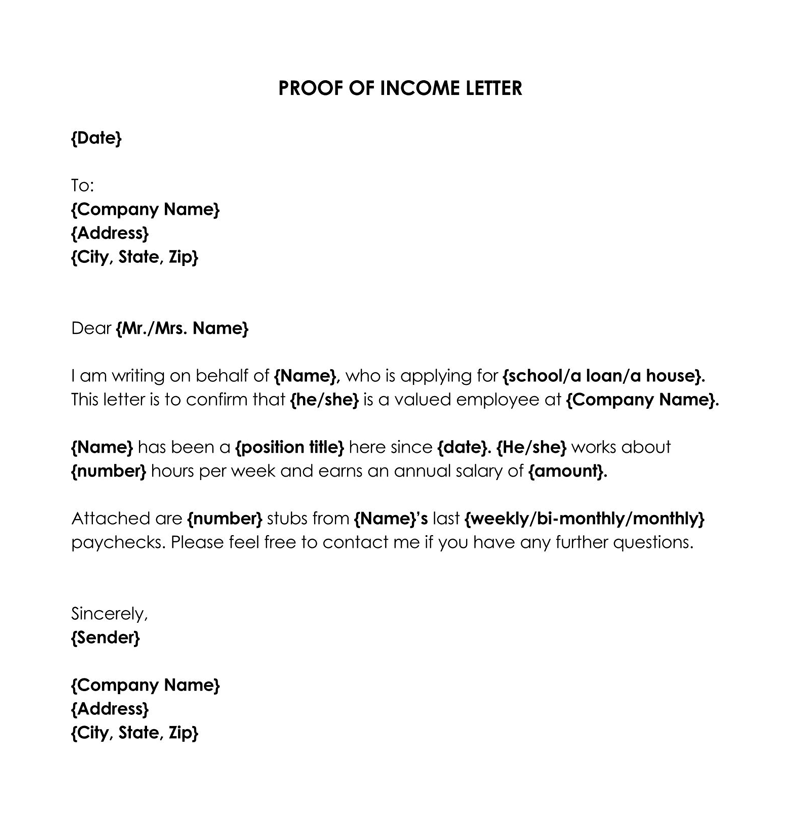

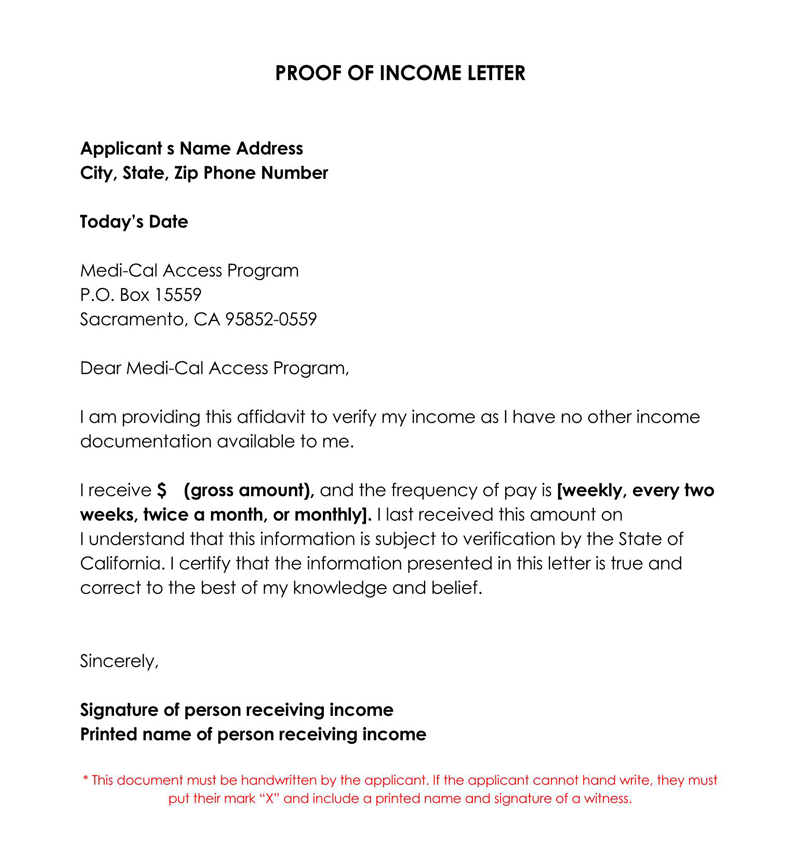

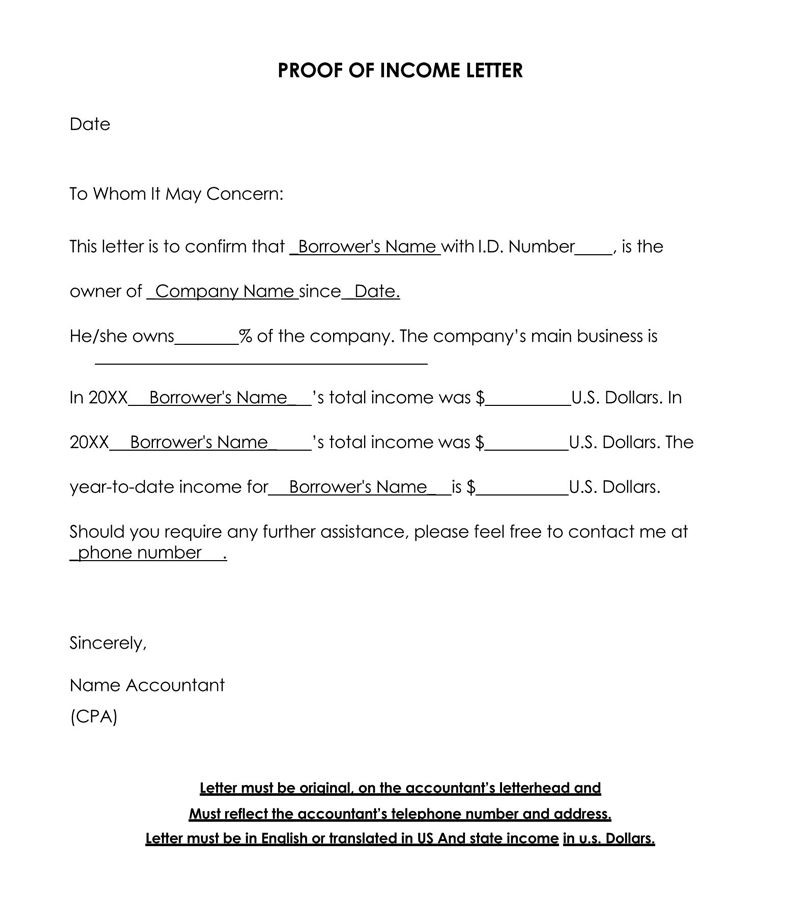

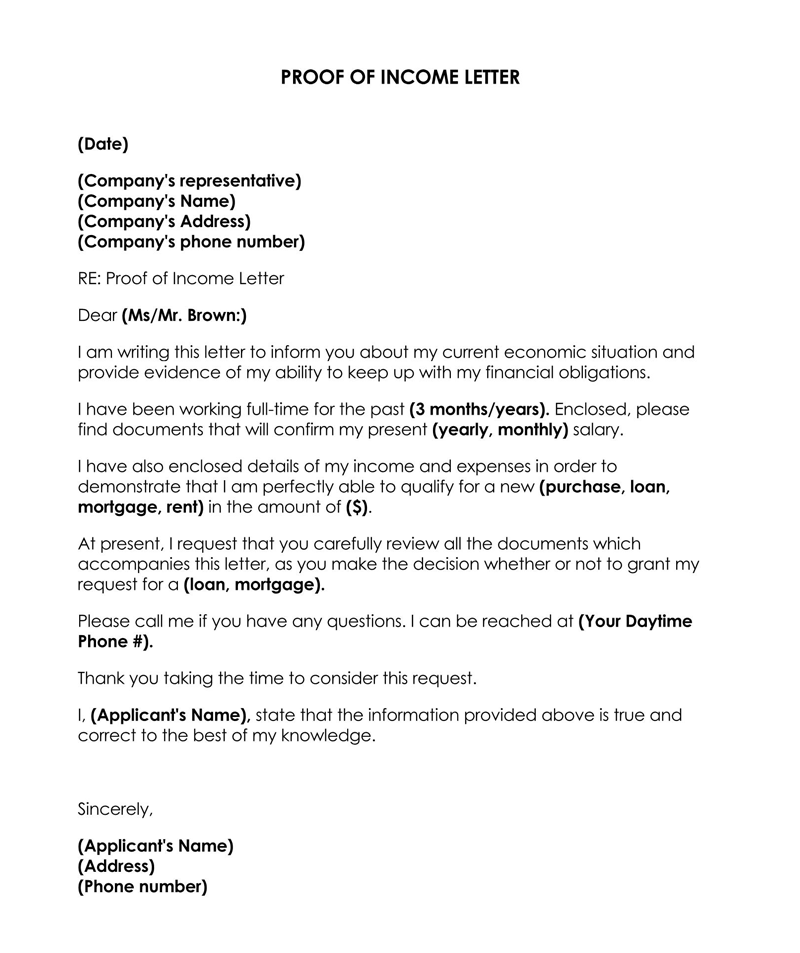

Salary Verification Letter Examples

Who Can Request It and Why?

A proof of income letter request provides security to the requestor. It helps them analyze the person’s personality they want to deal with in different situations.

The letter may be requested by the following:

Employers

Potential applicants often lie about their job description, place of work, and income. Therefore, this letter helps the new employer determine the claim’s authenticity. It provides both parties with maximum security.

Landlords

A landlord can determine the ability of a prospective tenant to maintain a housing application. With this letter, it is easy to confirm if the income of prospective tenants matches the rent service charges of the house under consideration. Thus, it saves many landlords from dubious tenants.

Financial institutions

A lender or a financial institution should request proof of income from the borrower to determine the genuineness of the payment source, their credibility, and their financial performance. It is significant to verify every piece of information before funds are released to borrowers.

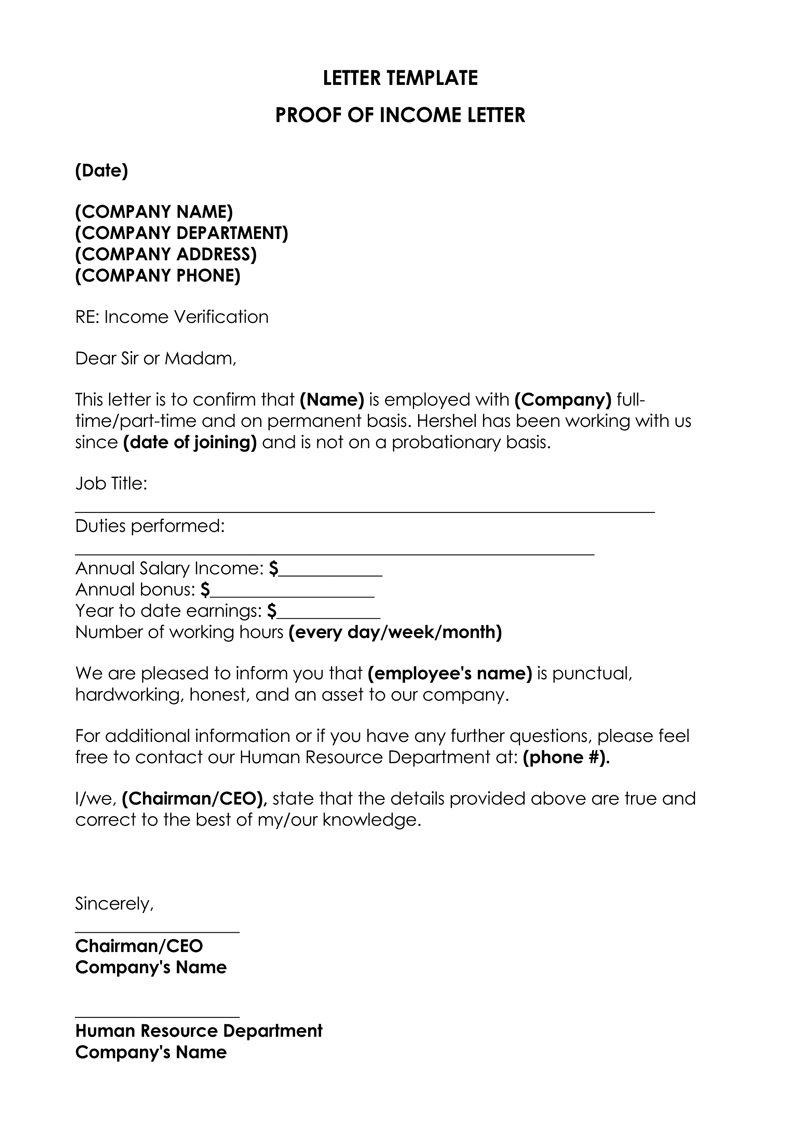

How to Write a Perfect Proof of Income Letter

Letters of this nature should be written formally. It should follow all the formal letter writing conventions, avoiding familiarization and a less business-like approach. The format of the letter is provided below:

Date

The date is one of the essential features of a verification letter. The letter has to carry a specific date on which it is written. The date can be written on the appropriate section of the letter-headed paper.

Personal information

The verifier’s name must be included in the letter to provide a form of identity for the inquirer. The details also help the inquirer know the individual who represents the company.

It usually includes the verifier’s company identity (name), address, city, state, zip code, phone number, and email address. These details are necessary to show an inquirer that the income verification letter comes from an authentic source.

Requester’s details

Next in the letter should be the party’s name requesting the letter of employment. It should be written atop the body of the email but beneath the address section of the letter-headed paper. It should contain the address and role of the person being addressed, as it helps to personalize the letter.

Employee’s details

Writing the body of the letter requires the following details that are necessary to determine an employee’s employment status:

Name of employee

The employee’s name must be included in the letter’s body along with the other employment details. When writing an email, the employee’s name can be inserted in the body of the email. It should be written in the first entry field, while it must be mentioned in the second field. The first section is the subject line of the email.

EXAMPLE

John Doe

Title of employee

This aspect details the description of the employee’s job details. This includes his duties and level of work.

EXAMPLE

Branch Manager at KFC, Colorado.

Supervision and maintenance.

Employment details

Employment details reveal all pieces of information about an individual’s work history. It details the employment type, job description, total number of commitments to the job, employment type, and job expiration.

EXAMPLE

He works a full-time shift in this position and runs 8 hours per day, MondayTypes through Friday. His contract will expire on the 21st of June, 2050.

Type of employment

Details of the duties of the individual involve a full-time or part-time commitment.

Employment start date

This part of the letter should come after the job description narration. It helps the verifier determine the security of the job the person holds at the organization.

EXAMPLE

Employment start date: December 1st, 2020.

Hours worked per week

It is determined by the type of employment the person holds at the institution. This could be full-time or part-time employment.

EXAMPLE

8-hours per week, Monday through Friday

Salary

It is necessary to help the inquirer decide if the person is worthy of the obligation. This can be paid hourly, daily, weekly, biweekly, monthly, quarterly, and annually.

Payment frequency

Details, when the salary is paid A regular payment frequency, would be a good fit when writing a letter.

EXAMPLE

His salary plan takes off on Monday of every week, and he is paid $35 per hour.

Bonuses

It depends on whether the company pays bonuses as a separate financial reward. If the company doesn’t pay its staff any bonuses, then there is no need to include bonuses in the letter.

Bonuses include maternity leave, health insurance, thirteenth month, and annual leave bonuses.

Employment end date

This is particularly good for contract workers. Contract work always has a marked end date for each job description. Because of this, the end date should be included in the letter for a contract worker.

Signature

You should include your signatures at the end of the letter to attest to the validity of every piece of information that you have provided in the letter.

EXAMPLE

Sincerely,

John Doe,

Branch Manager

Supervision and Maintenance

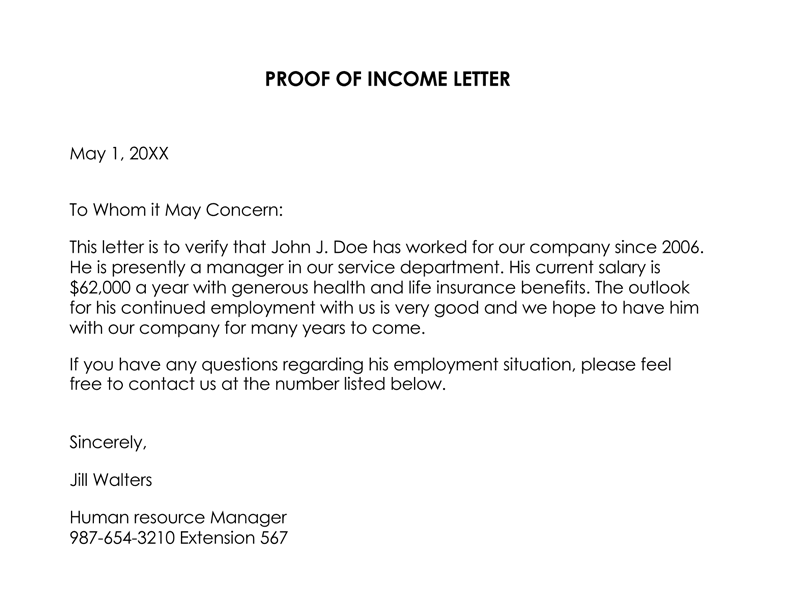

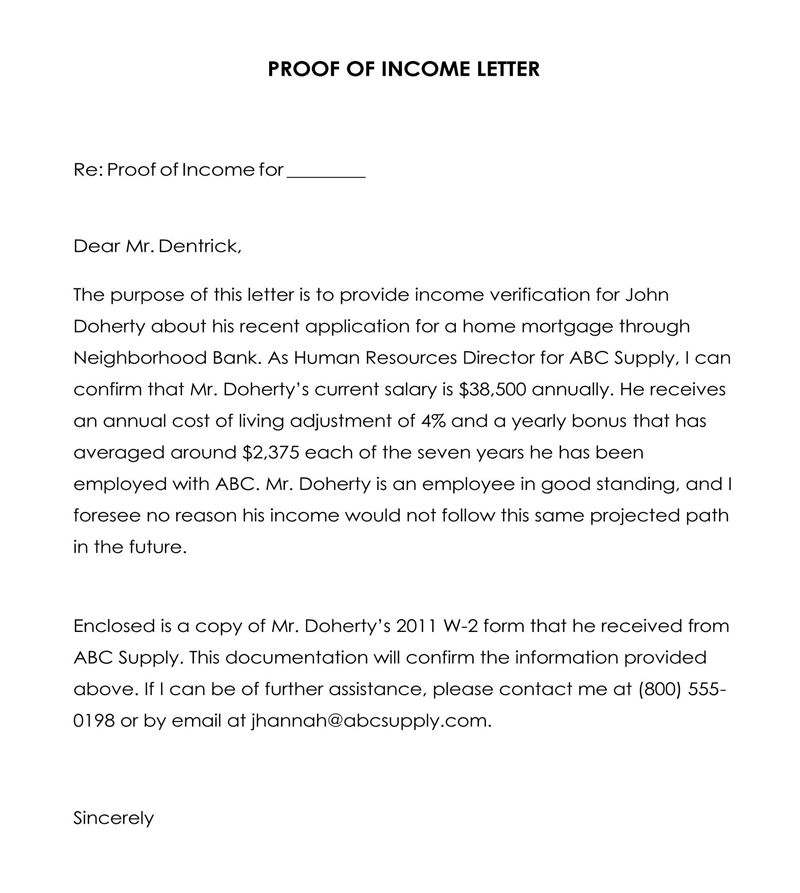

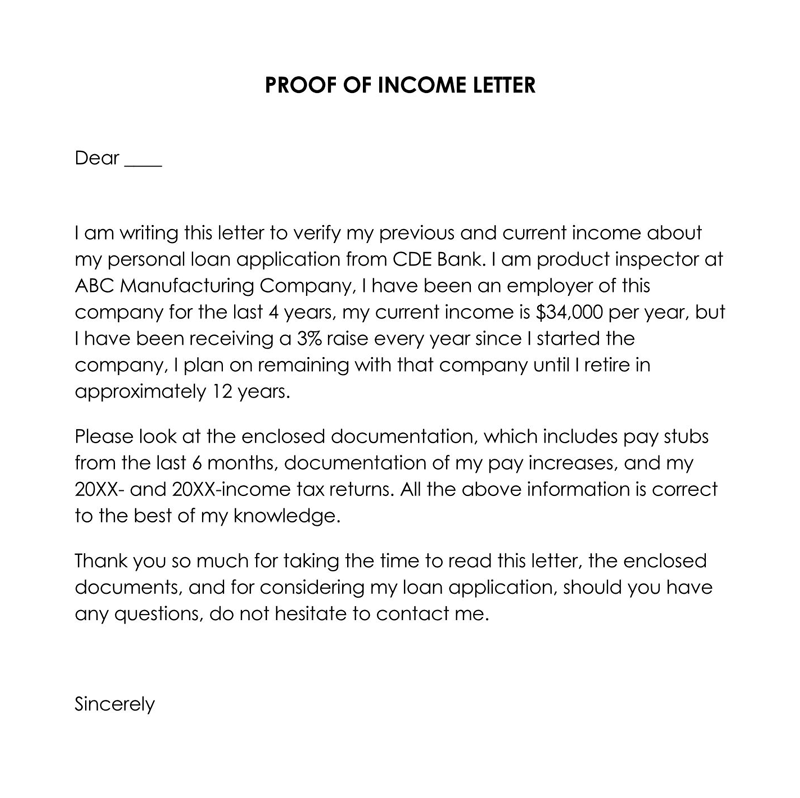

Sample Letter

Date: December 6, 20XX

To Whom It May Concern,

I am writing to confirm the employment details and income of Mr. John Doe, who has been an employee at SolarTech Innovations, located at 123 Solar Way, Sunnyville, TX, since January 3, 20XX. Mr. Doe is currently working as a Senior Systems Analyst and has been a dedicated and valuable member of our team.

Mr. Doe’s current annual salary is $75,000, paid biweekly. In addition to his base salary, he is eligible for an annual performance bonus of up to 10% of his salary based on company and individual performance metrics. His employment with us is full-time, and we expect his position to continue for the foreseeable future.

Please note that Mr. Doe’s income has been consistent and reliable during his tenure with us. There have been no significant changes in his salary in the past year, and he has fulfilled all his job responsibilities satisfactorily. His financial stability, as reflected in his income, is a testament to his commitment and performance at SolarTech Innovations.

Should you require any additional information or verification regarding Mr. Doe’s employment or income, please feel free to contact our HR department at (555) 123-4567 or hr@solar-tech.com. We are happy to provide any further assistance needed.

Sincerely,

Jane Smith

Human Resources Manager

SolarTech Innovations

(555) 123-4567

hr@solar-tech.com

Analysis

In the provided proof of income letter, the writer has adeptly incorporated several key technical features that make it a useful example for readers. First and foremost, the structure is clear and formal, adhering to standard business letter formats. This includes the inclusion of a date, a standard salutation, and a proper closing with contact details, all of which are essential for formal correspondence. The language used by the writer is professional yet simple, making it accessible to a wide audience without sacrificing formality.

Furthermore, the writer ensures the letter is comprehensive by including all necessary details: the employee’s name, position, employment start date, salary information, and the nature of the employment (full-time, with an expectation of continuity). The inclusion of additional compensation details, like bonuses, enhances the letter’s thoroughness. By providing contact information for further verification, the writer adds an element of credibility and openness, which are crucial in official documents. These elements collectively make the letter a reliable and practical guide for readers needing to draft a similar document.

Frequently Asked Questions

A current or past employer writes proof of income letters to confirm an employee’s or former employee’s work claims. The request can come from a government agency, private entity, prospective landlords, mortgage lenders, collection agencies, or employers to establish employment claims and salary streams.

Yes. In many cases, the salary is the ultimate decision to confirm a person’s claim to a position of interest. It should include an employee’s hire date, position within the company, and current wage or salary. For former employees, it should explain the reason for termination (voluntary or involuntary) and the end date.

The government, mortgage provider, prospective landlord, prospective employer, or collection agency requires an employment verification letter. It is an avenue to establish the truth of an individual’s job history, salary or wage scale, and the worthiness of their interest.