All businesses and organizations including non-profit firms are liable to tax compliance, meaning they should provide transparent and accurate accounts and documentation of their transactions. The Internal Revenue Service (IRS) provides a section referred to as the Itemized Deductions that allows the exception of gifts and donations obtained from charitable contributions. Qualified organizations that receive tax-deductible charities are expected to provide proof of how they received their contribution by documenting receipts.

A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors.

Donations are mostly tax-deductible, but taxpayers are not let off with just their word, they need to provide proof that a particular amount of property was acquired. Hence, the purpose of receipt is to assist in filing taxes in compliance with the Internal Revenue Service (IRS).

Free Templates

How Much Tax- Deduction Can a Donor Claim?

Under the IRS Itemized Deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to renowned organizations. Therefore, organizations are expected to send the receipts to their donors to serve as proof that they made the donation and are liable for tax deductions. IRS permits donors to deduct or exempt a maximum of 50% of their total Adjusted Gross Income (AGI) of the period the donation was made.

What IRS Considers as Charity

The Internal Revenue Service (IRS) defines a charitable organization as one that exists for more than one charitable purpose in society. Donors should first confirm with 501(c)(3) Charity list to verify if the charity is eligible for tax deductions under the IRS guidelines.

The IRS gives high priority to the following as being part of the charity:

- Religious Organizations are considered as a charity by the IRS, which include churches, mosques, and temples among other religious institutions.

- The IRS considers non-profit educational centers as charitable organizations.

- Non-profit medical facilities also qualify as charity organizations according to IRS

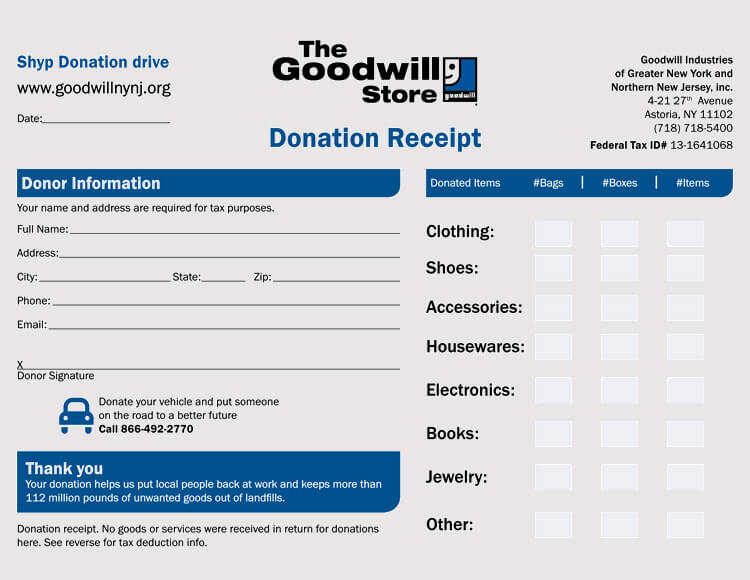

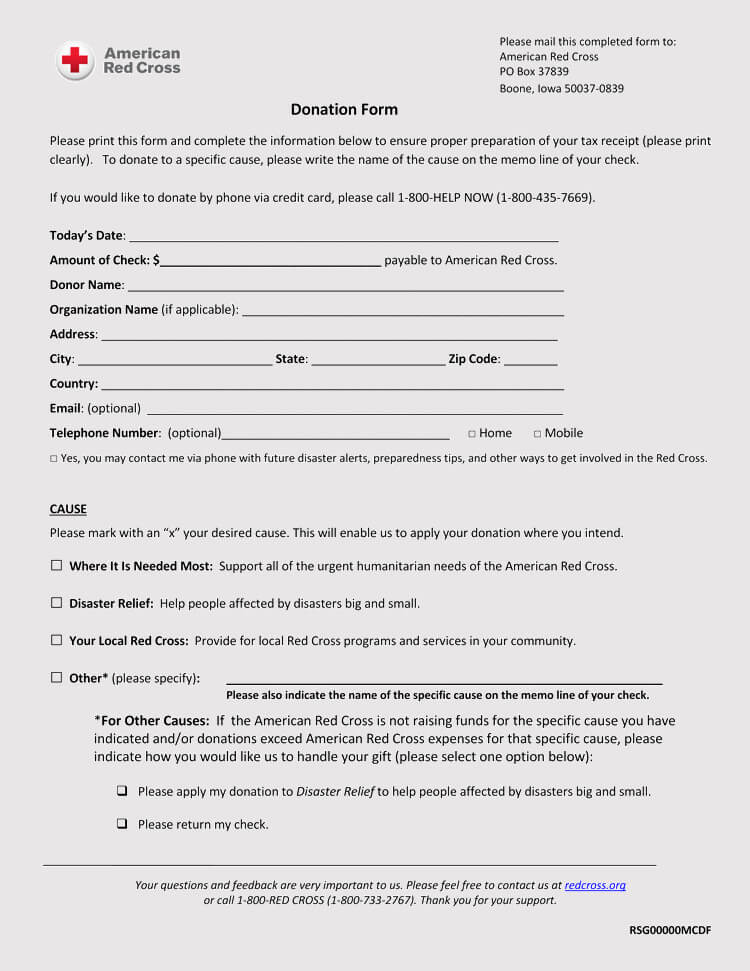

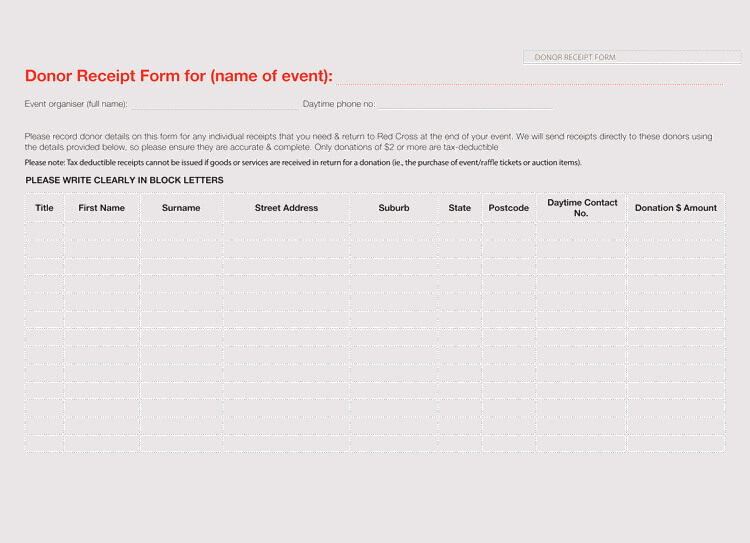

- Red cross and goodwill organizations are recognized by the IRS as charitable organizations.

- Children orphanages and animal orphanages as well are part of charity organizations identified by the IRS.

Non- charity organizations

However, some organizations do not qualify as part of charity based on IRS analysis. Such organizations include:

- Sports club

- A voluntary gift is given to another person

- Contributions from political leaders

- Civil and local groups

- SACCOS and trade unions

Types of Donations Recognized by the IRS

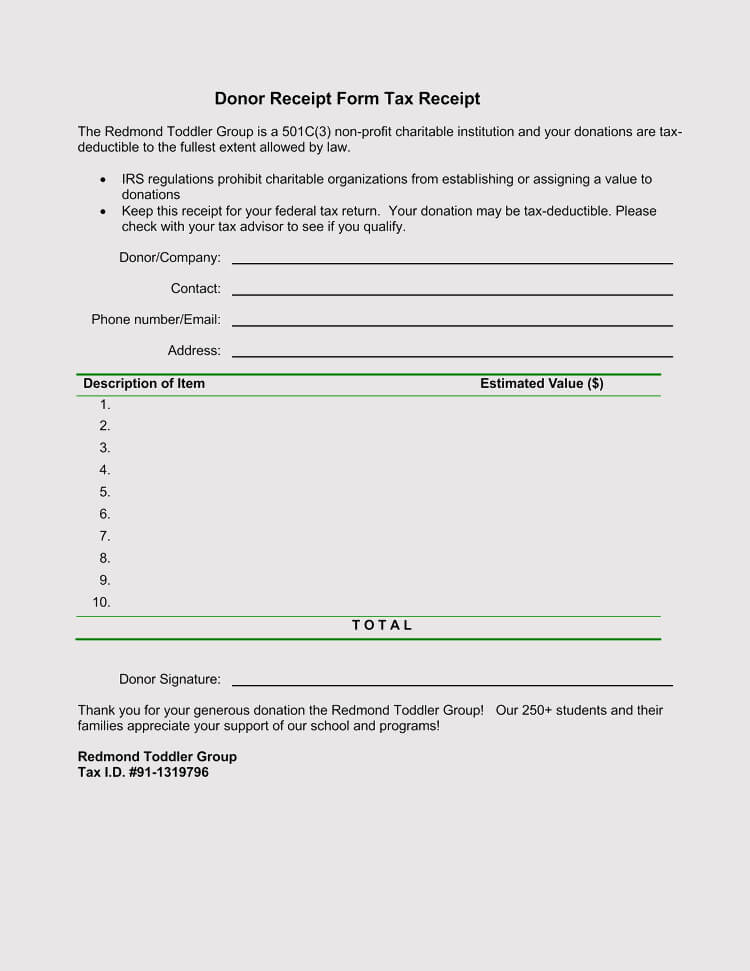

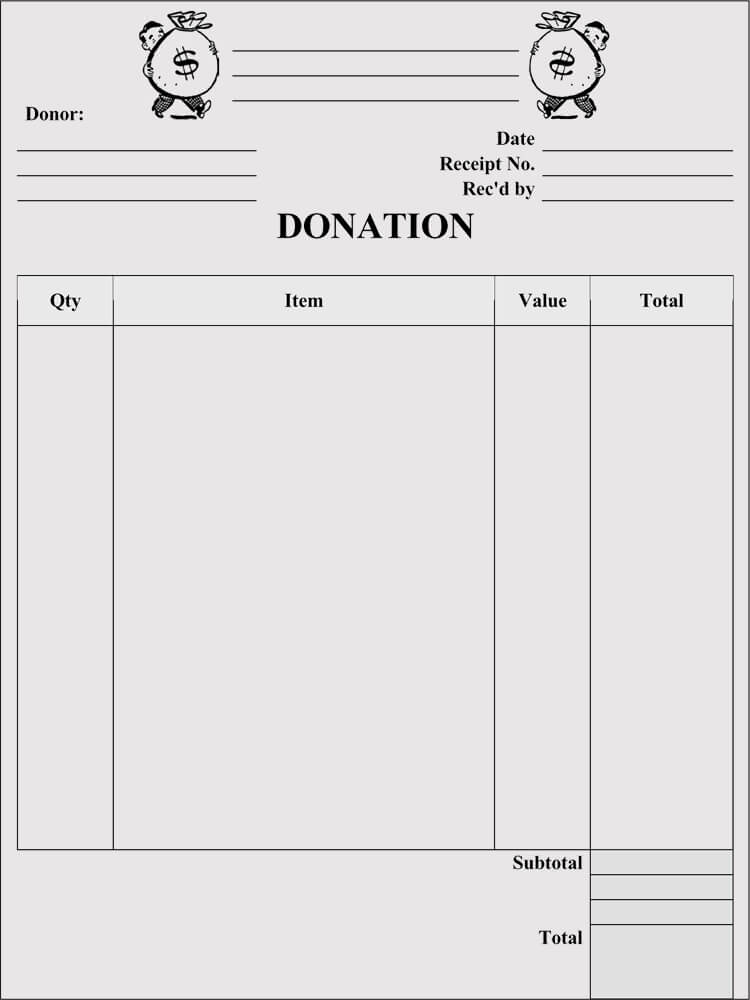

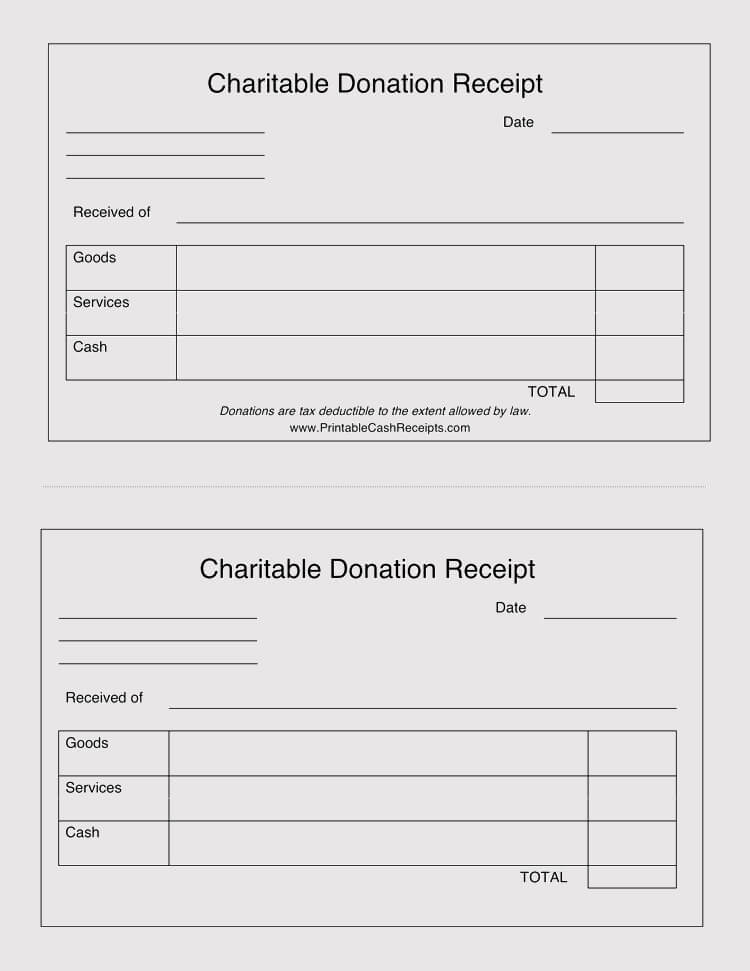

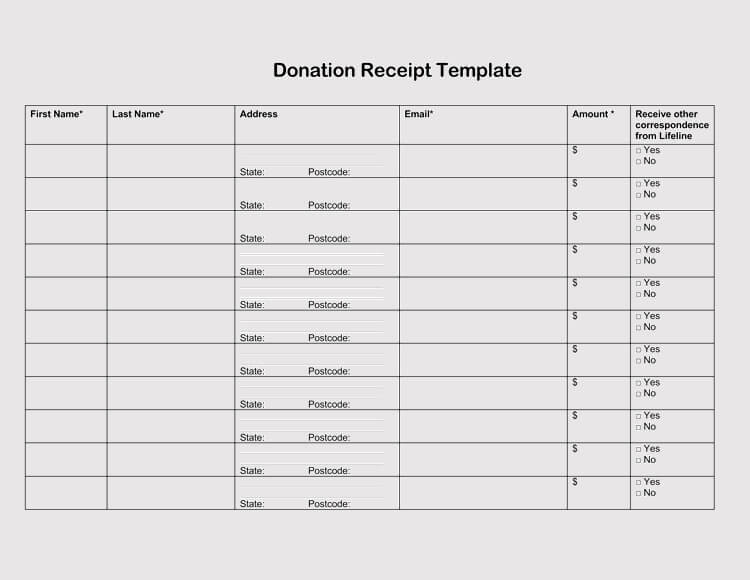

Donations given to charity may take many forms depending on the purpose or mission the charity organization seeks to achieve. Cash is the most common type, however, other forms may include non-cash ones also known as donations in kind, and may include; clothing, food, property among others. A receipt should be issued to donors indicating the type of donation offered, the date it was made, the name of the organization that received the donation and the donor, and the value.

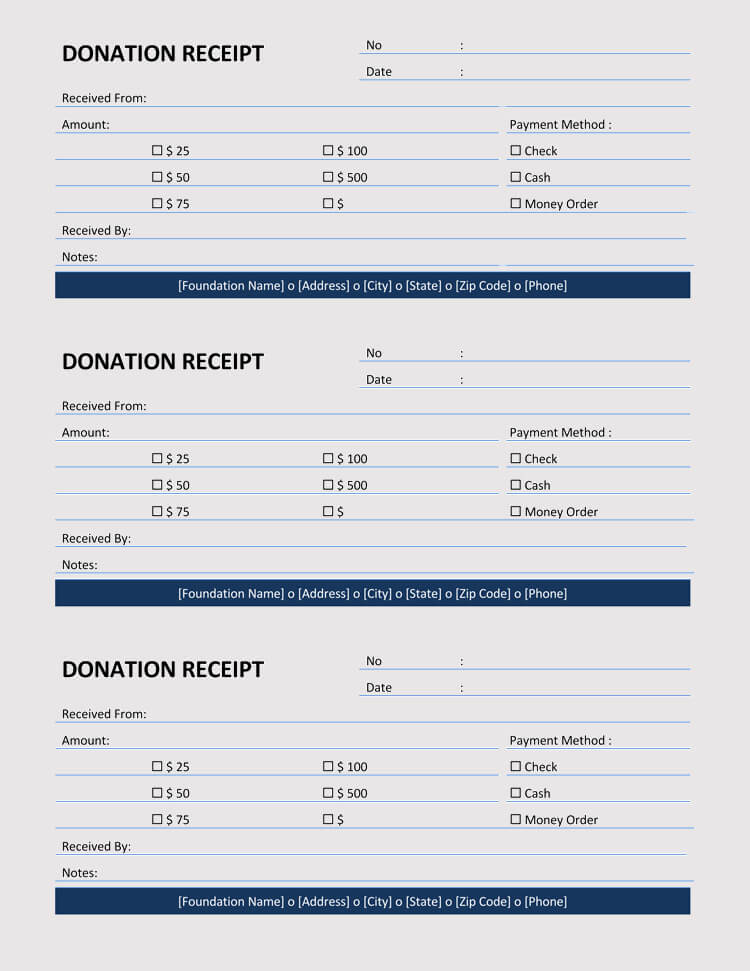

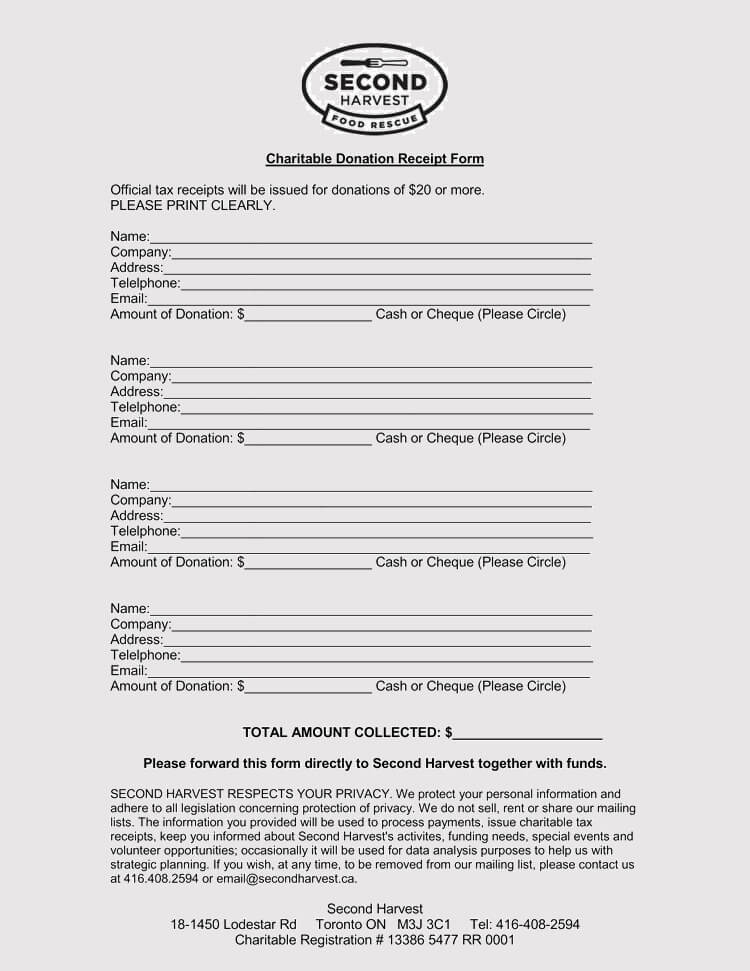

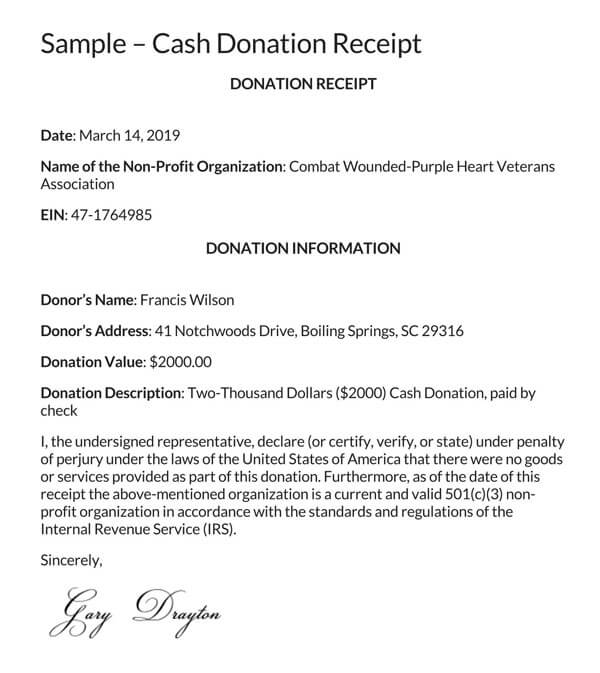

Cash payments

Cash payments are donations contributed by donors to charity in the form of cash. A template contains the date, the name of the donor, the organization that will receive it, and the amount being donated.

cash donation template

First Name: ____________________

Last Name: ____________________

Address: ____________________

City/State/Zip: ____________________

Home Phone: ____________________

Cell Phone: ____________________

Email: ____________________

Enclosed is my tax-deductible gift of

$ ____________________

I would like my donation applied toward:

__________________________________________________________

__________________________________________________________

__________________________________________________________

__________________________________________________________

__________________________________________________________

Please make checks, corporate matches, and other donations payable to:

Gift will be matched by: ____________________

Organization Name: ____________________

Branding/Logo

Please keep my donation confidential

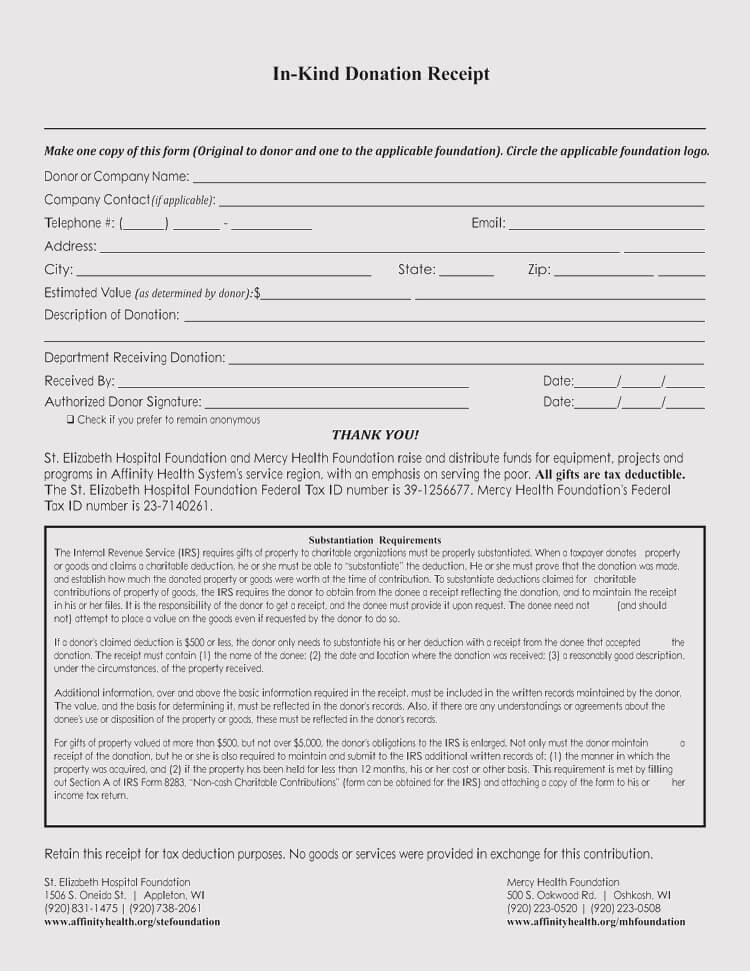

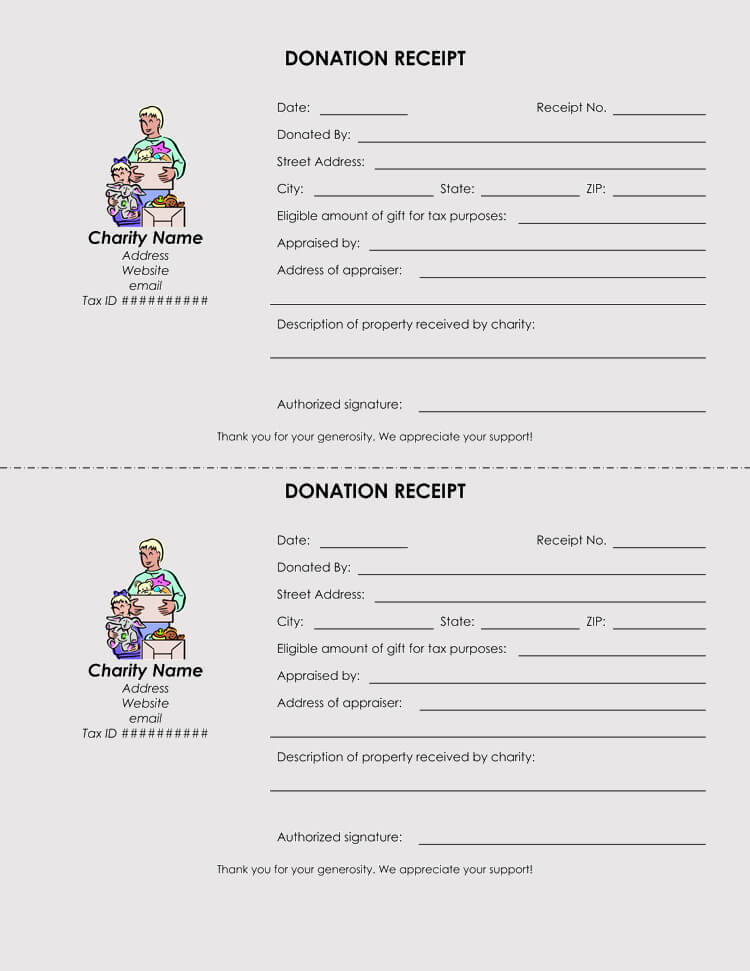

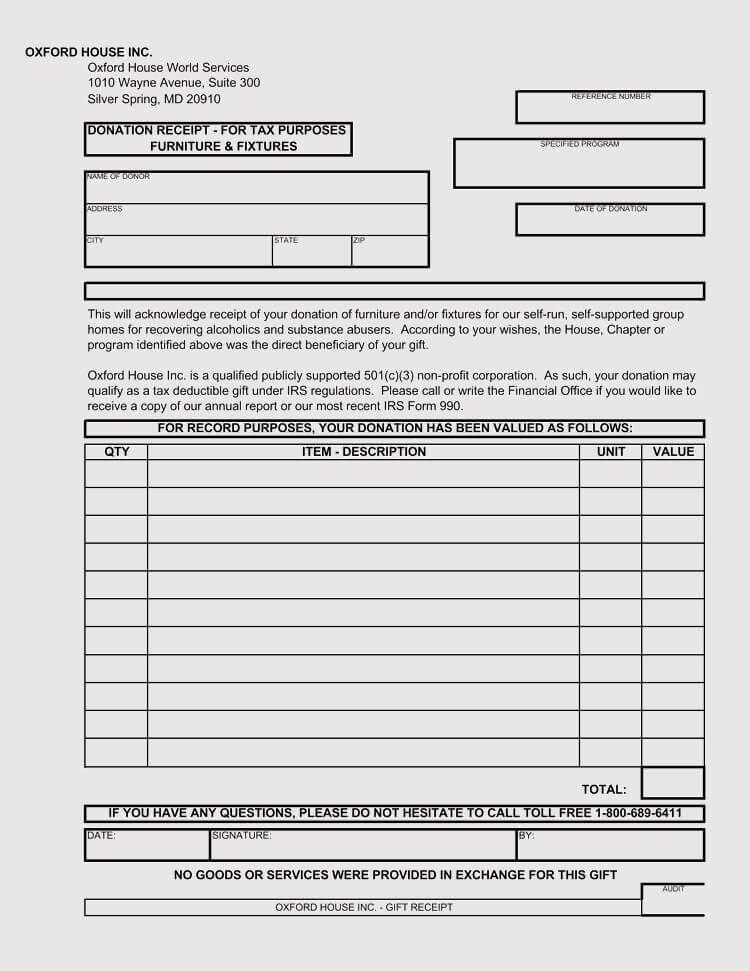

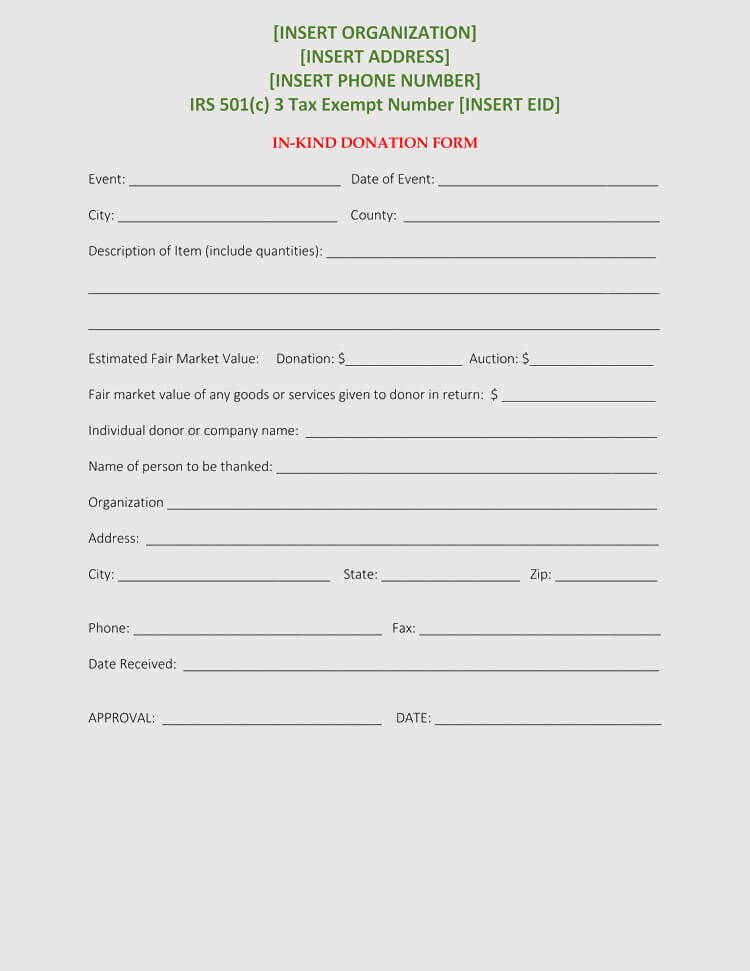

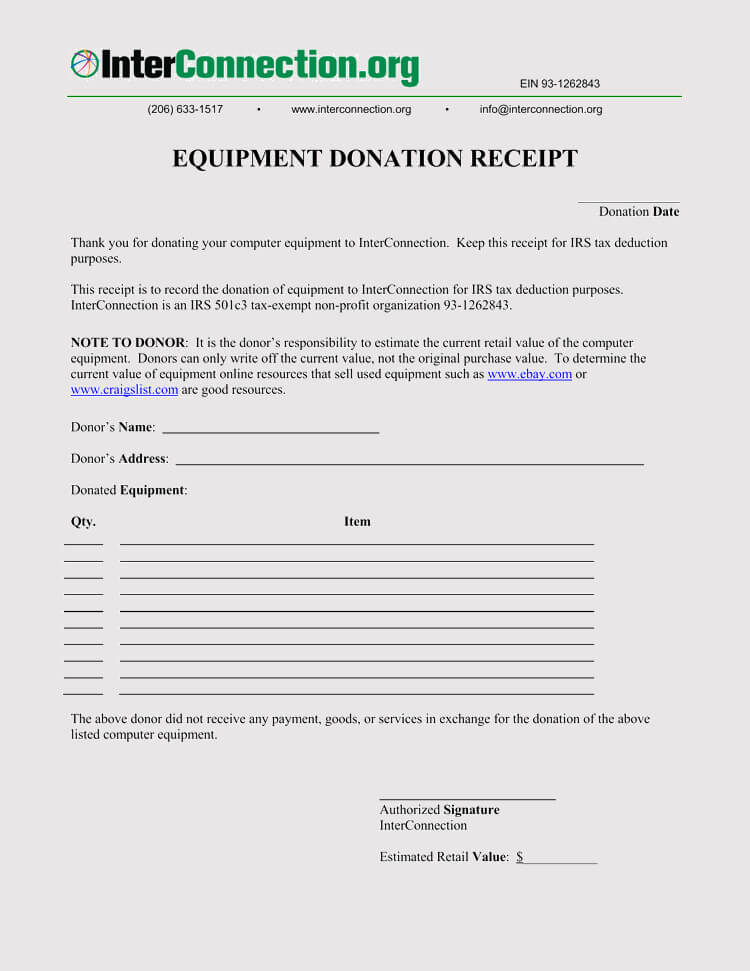

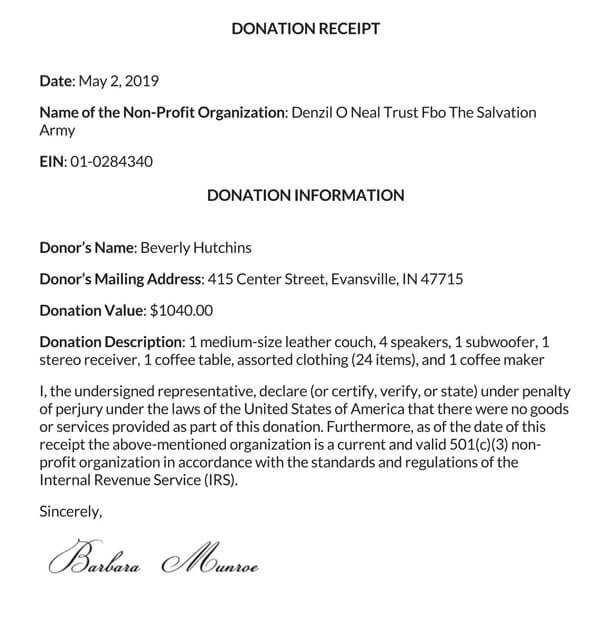

Personal property (in-kind) donation

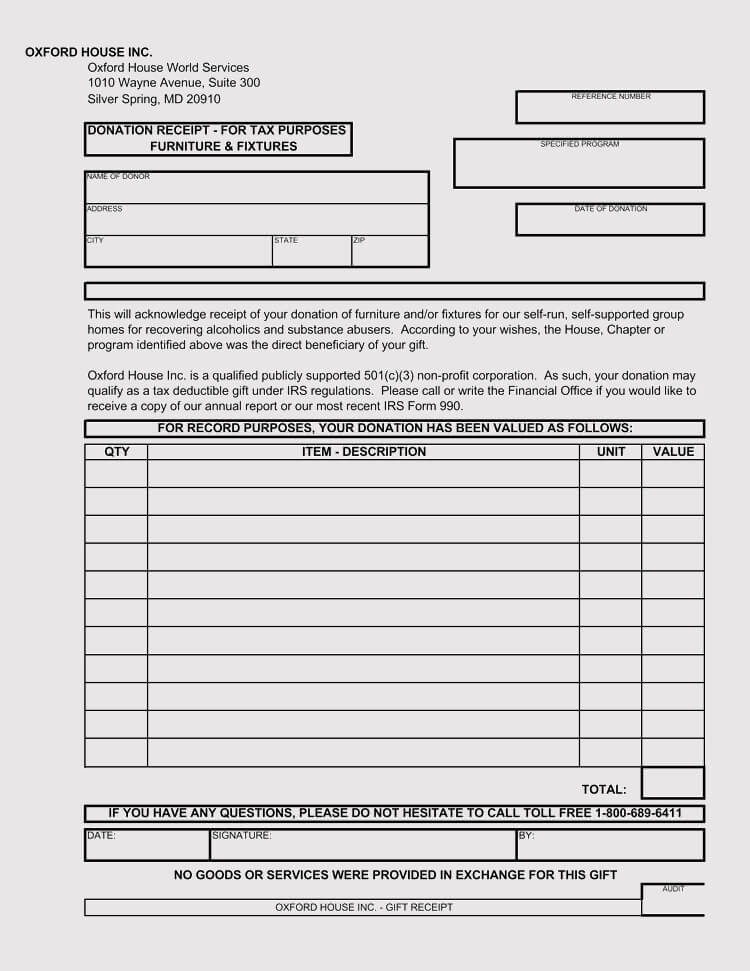

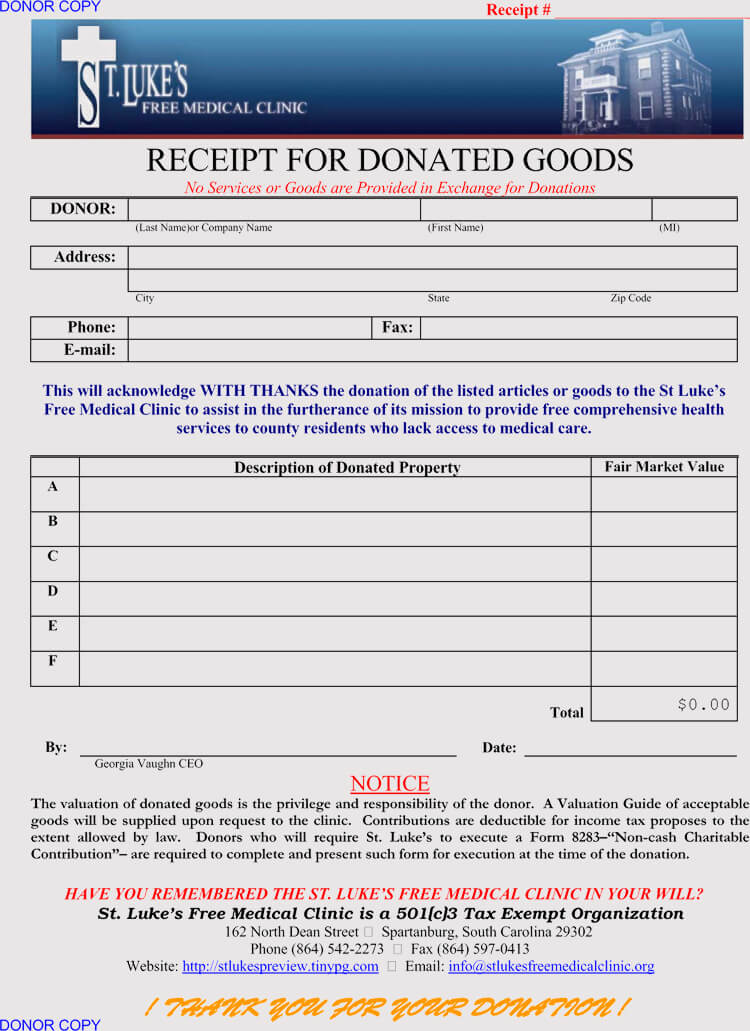

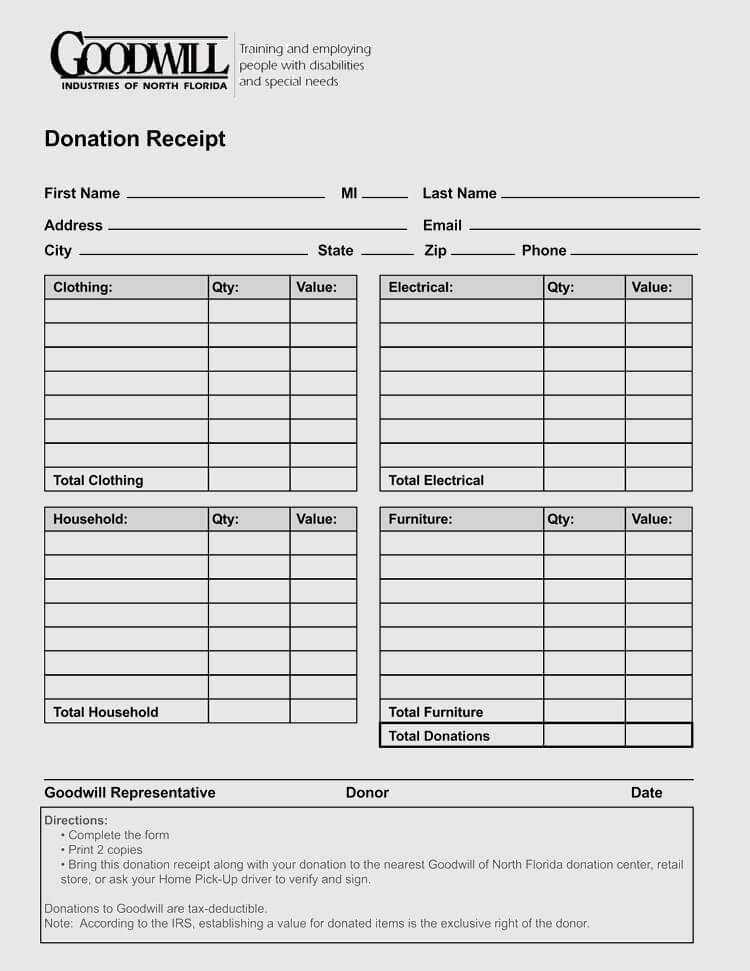

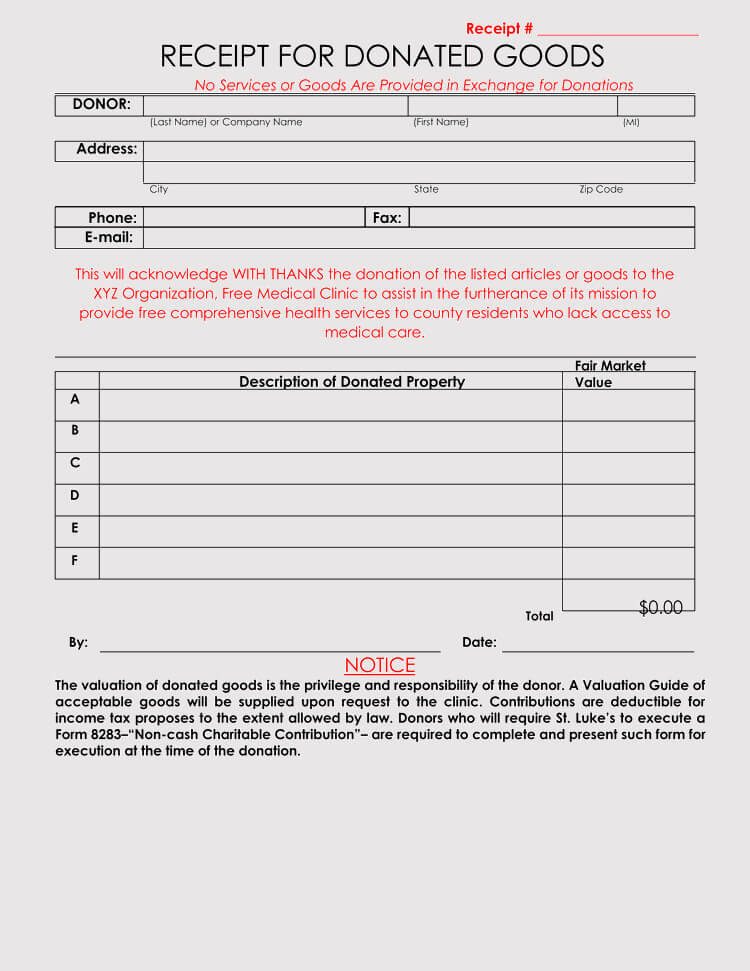

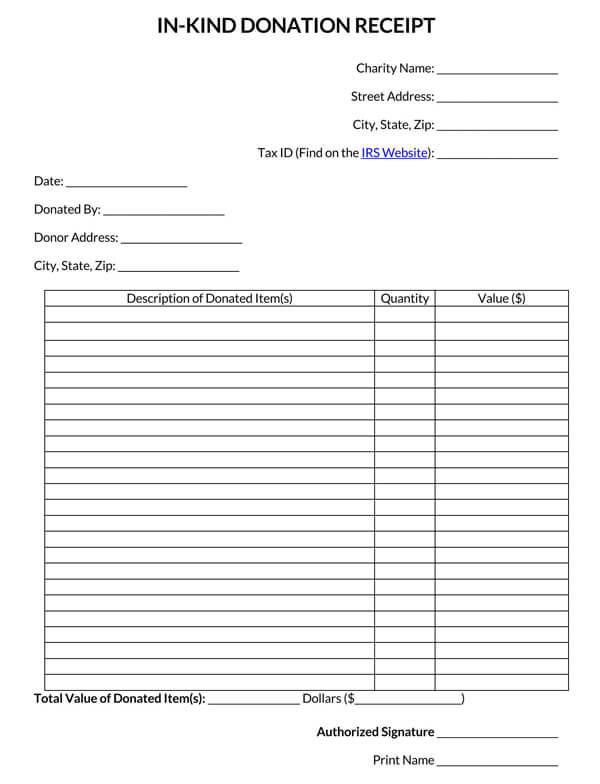

Personal Property donations include giving contributions in terms of clothing, furniture, art, household items, among other necessities required by the charity. The receipt that captures personal property donations should consist of the name of the item being contributed, the value of the item, and a brief description of the item. Other considered factors in such a receipt could be; the date when the transaction was carried out, the name of the donor, and the charity receiving the contribution.

The IRS allows a donor to claim tax deductions on personal property donated to charity worth more than $500 but not more than $5000. In such situations, the IRS stipulates that the property be professionally appraised to qualify for a tax deduction.

The appraisal has to be completed in sixty days and the appraiser should authorize IRS form 8283 section-A IRS Form 8283 – Section A. indicating these donations. For the ones that exceed $5000, a special appraisal is required to be recognized by the IRS needs to be completed IRS Form 8283 – Section B

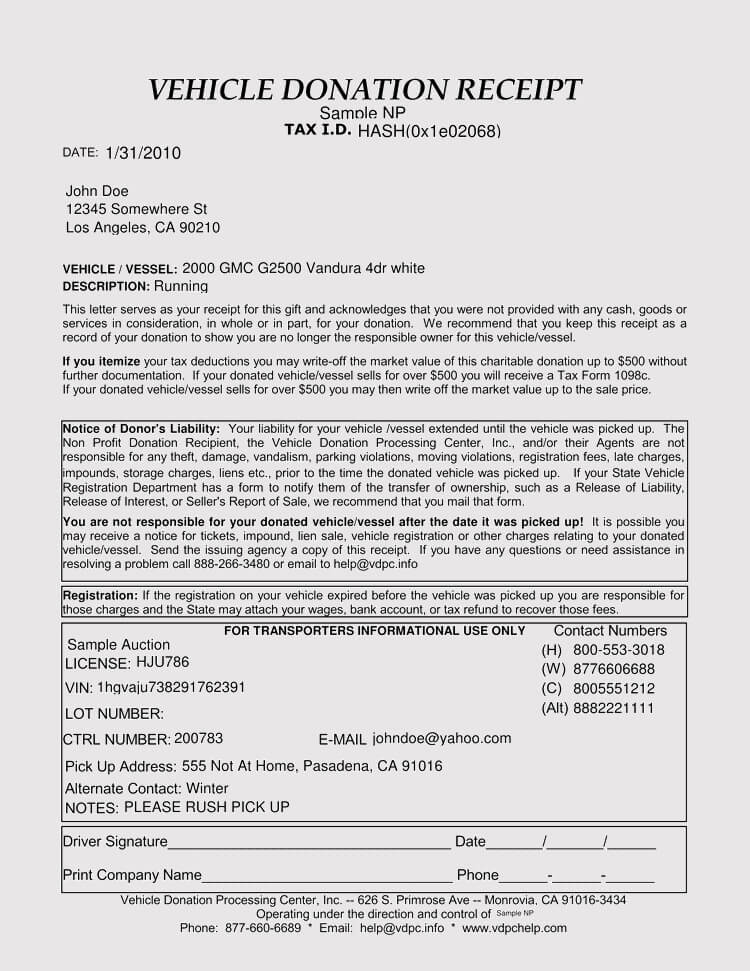

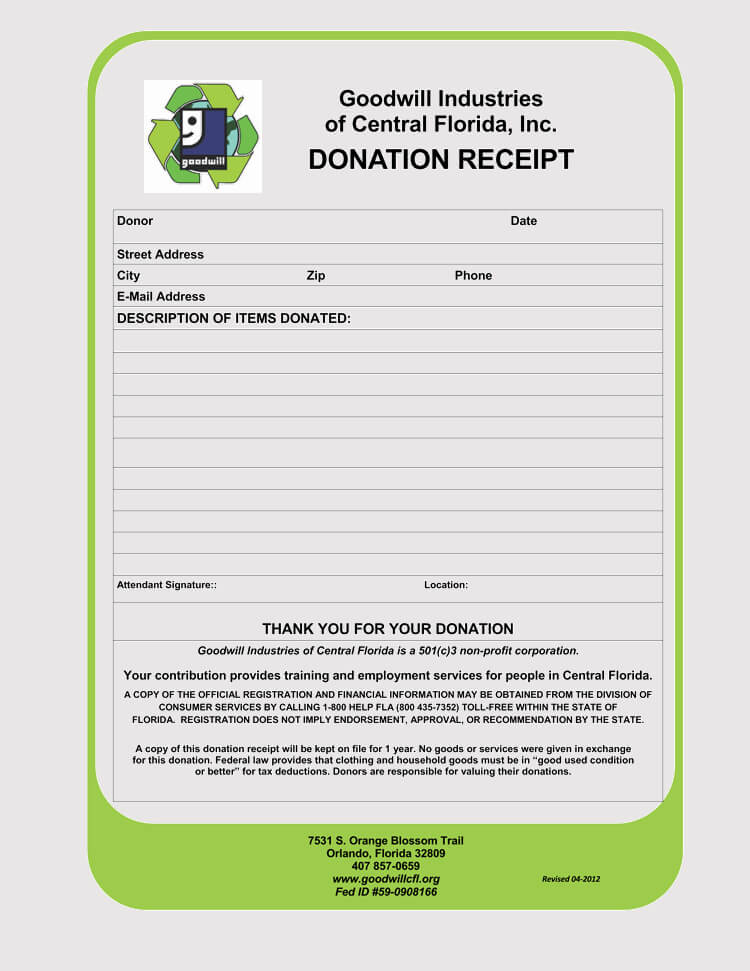

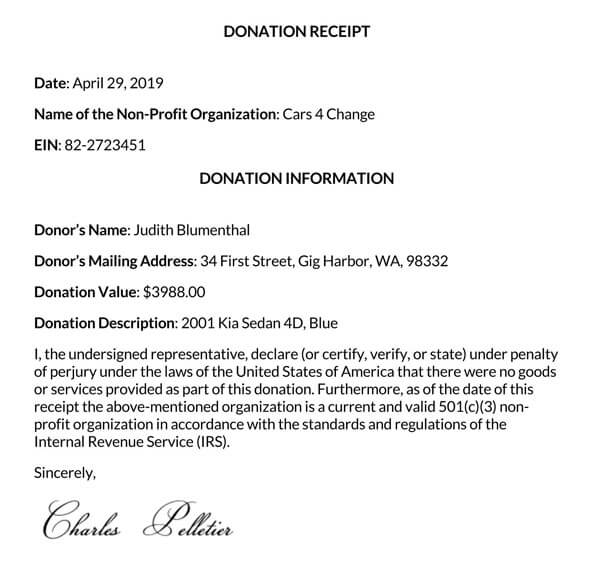

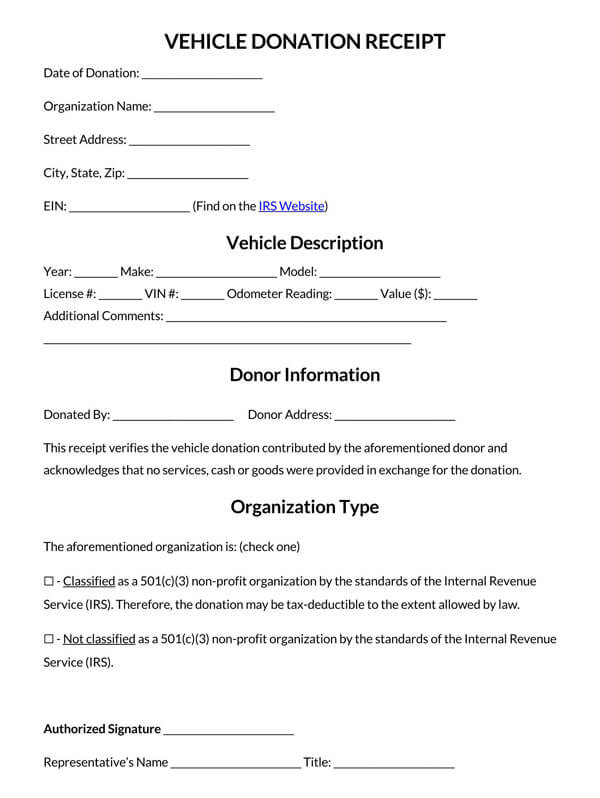

Vehicle donation

These receipts are viable for applying for tax deductions if the worth of the vehicle donated exceeds $500. To receive tax deductions, donors and charities must fill the forms below according to the IRS guidelines at the end of the year.

- For Charities: the IRS expects charities to fill IRS Form 1096 attached together with IRS Form 1098-C. The charity is also expected to provide their donors a written receipt in compliance with IRS Publication 4302.

- For donors: the IRS expects them to fill Schedule A of the IRS 1040. Donors are required to present the receipt obtained from the charity organization they donated to.

The written receipt should capture the following details:

- Donor’s Name

- Charity’s Tax ID Number

- 17-character Vehicle Identification Number (VIN)

- Vehicle’s Odometer Reading

- Description of Vehicle

- Year

- Make

- Model

- Color

- Body Type

- Date of the Contribution

- *If sold, gross proceeds from the sale.

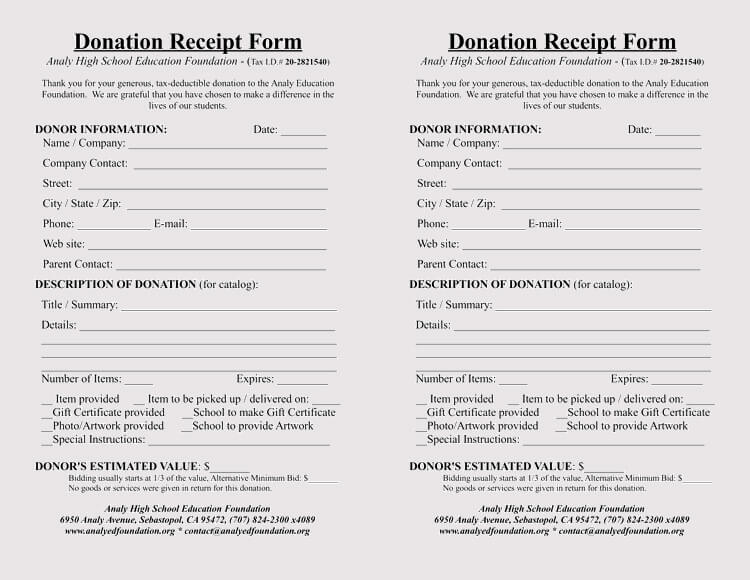

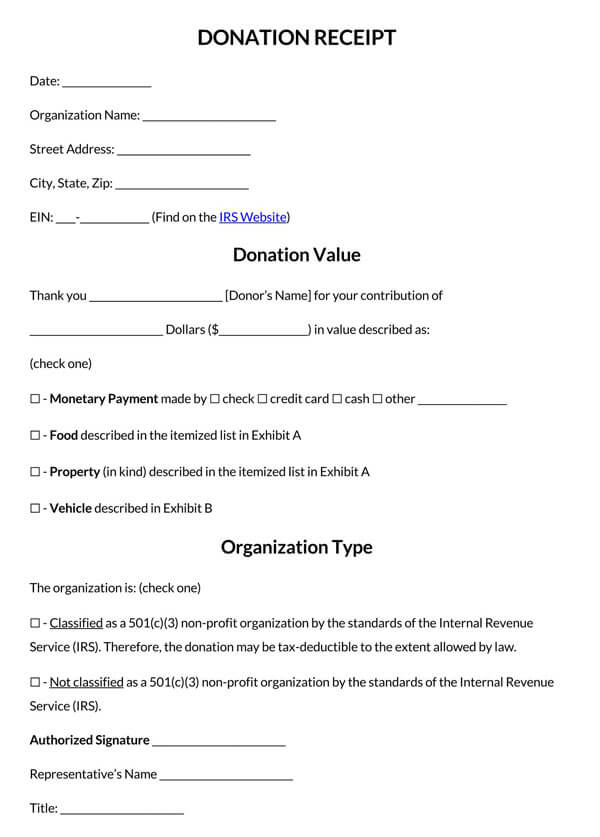

Types of Receipts

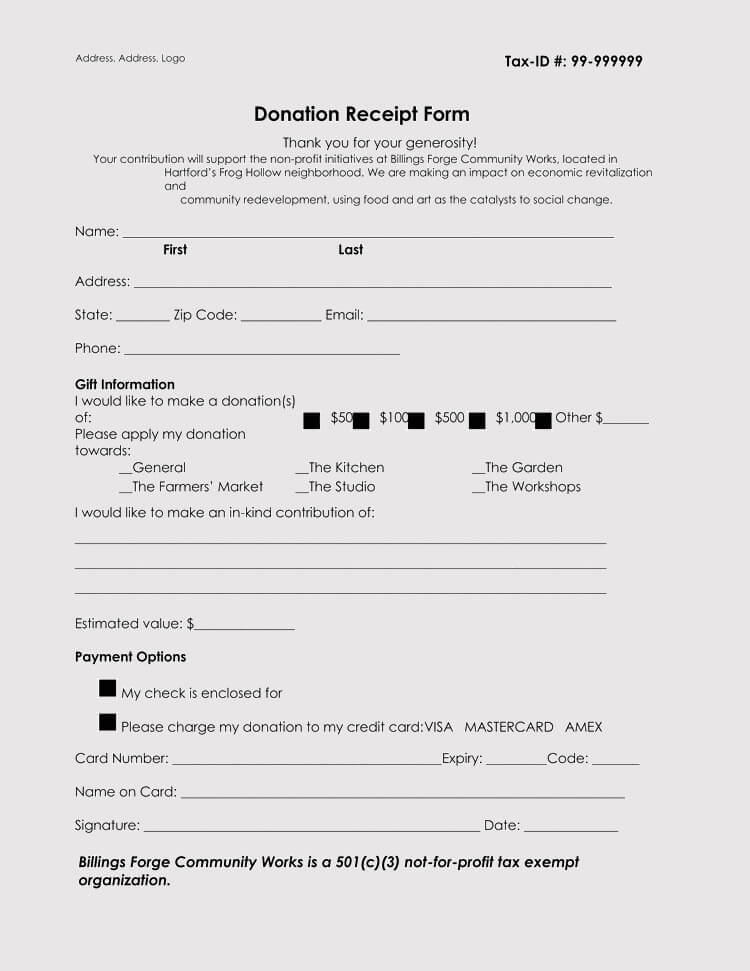

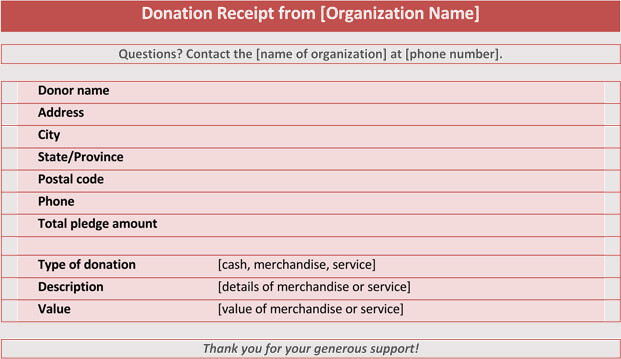

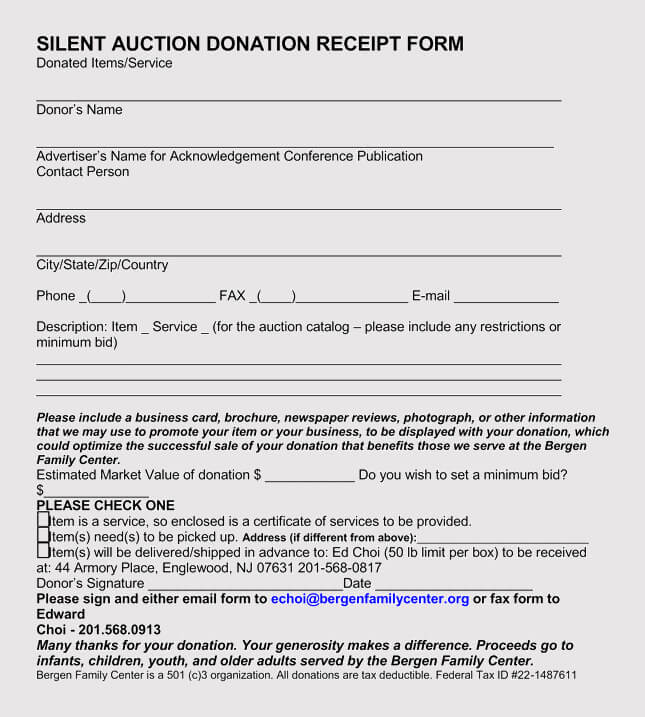

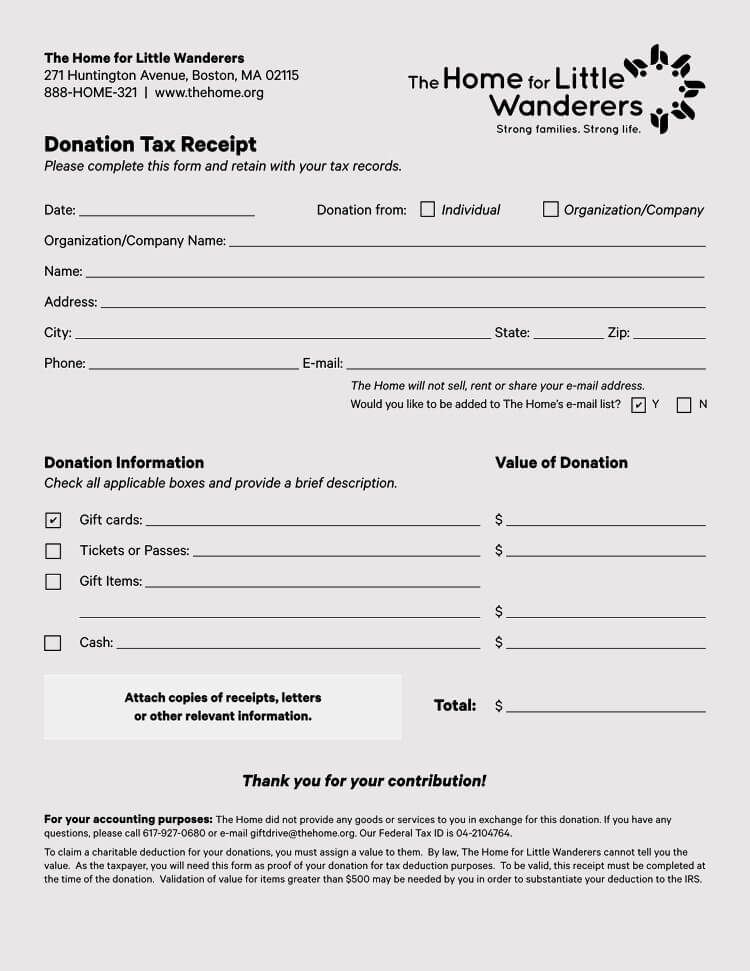

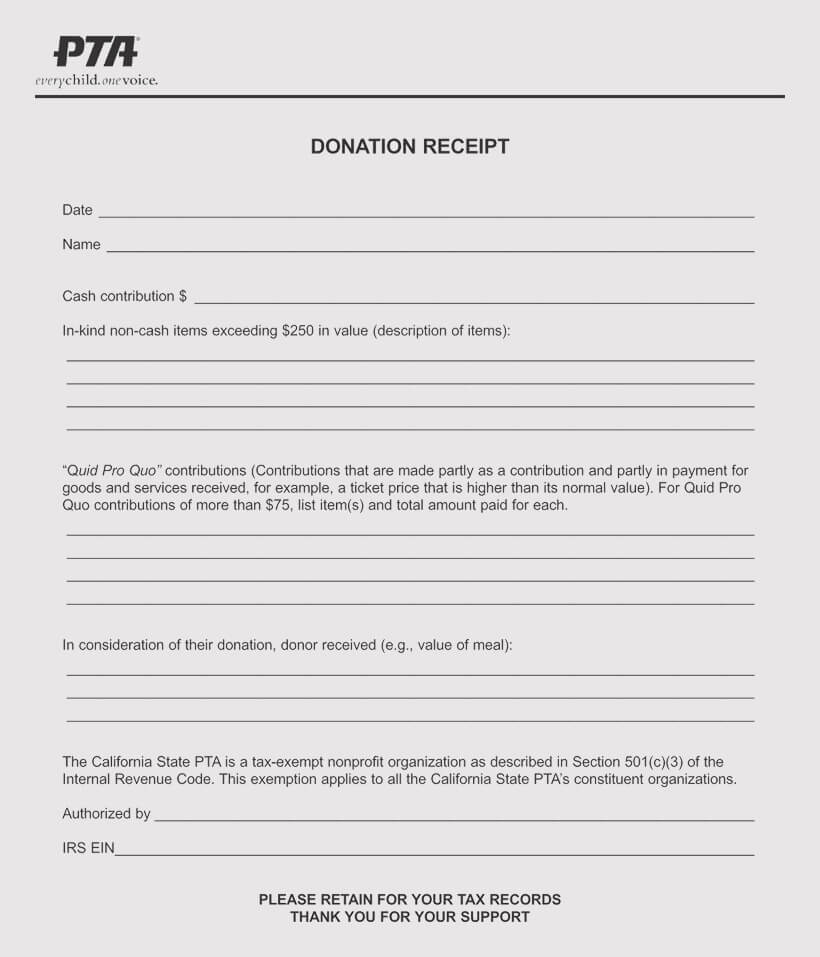

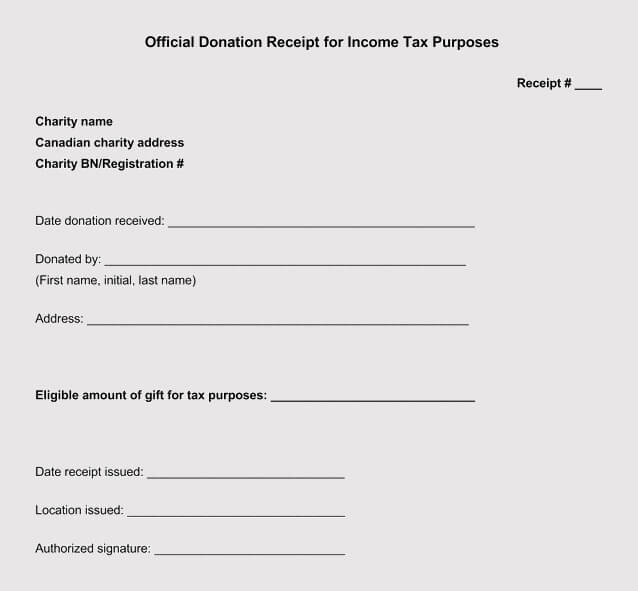

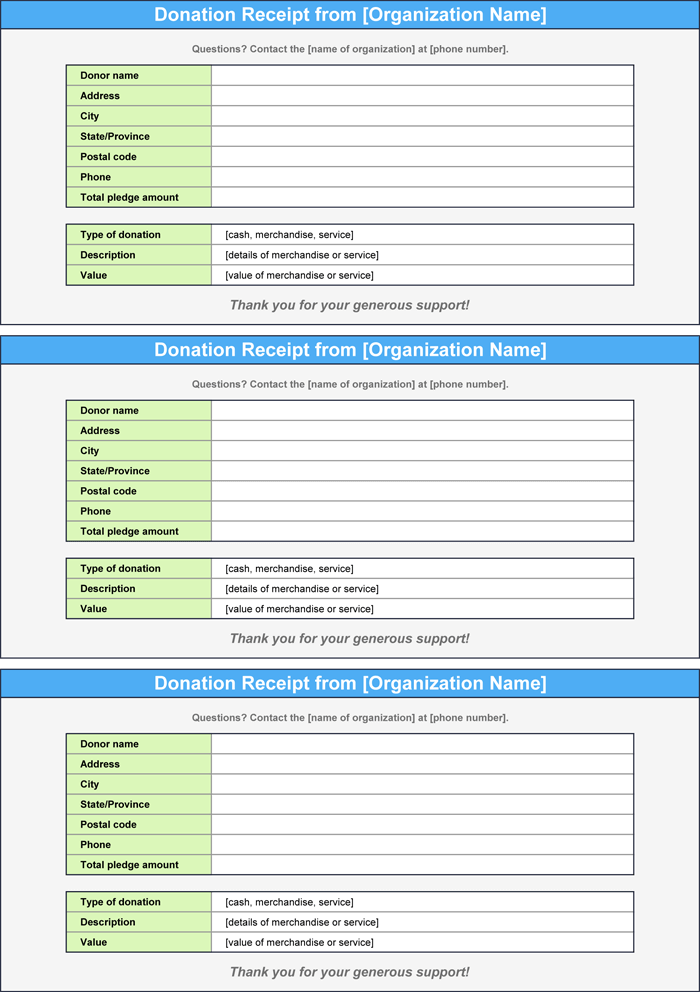

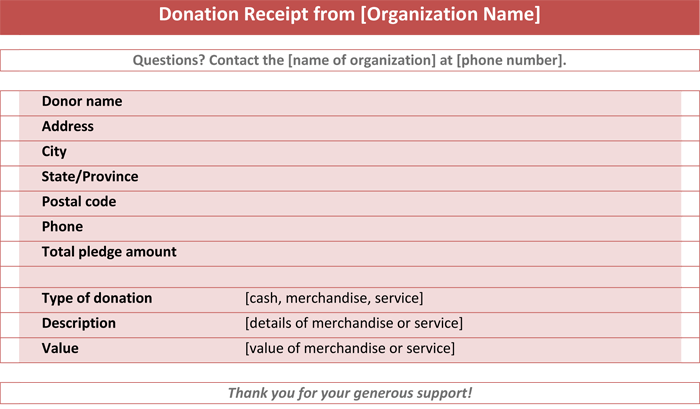

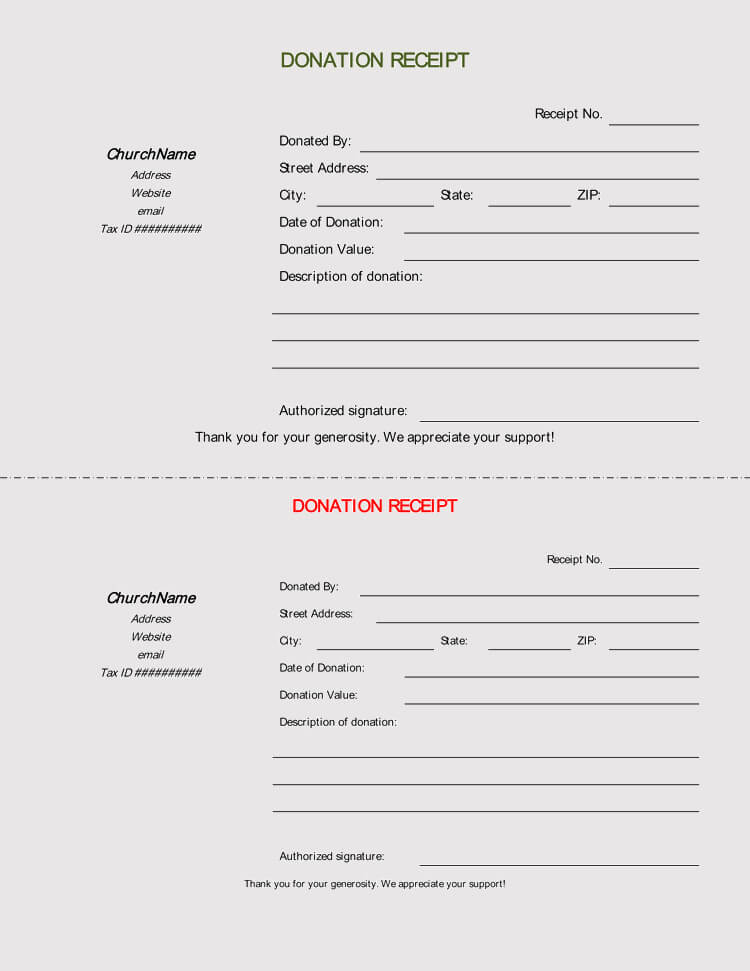

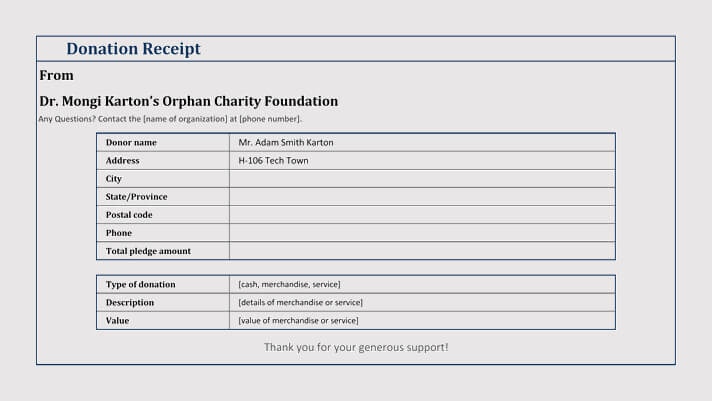

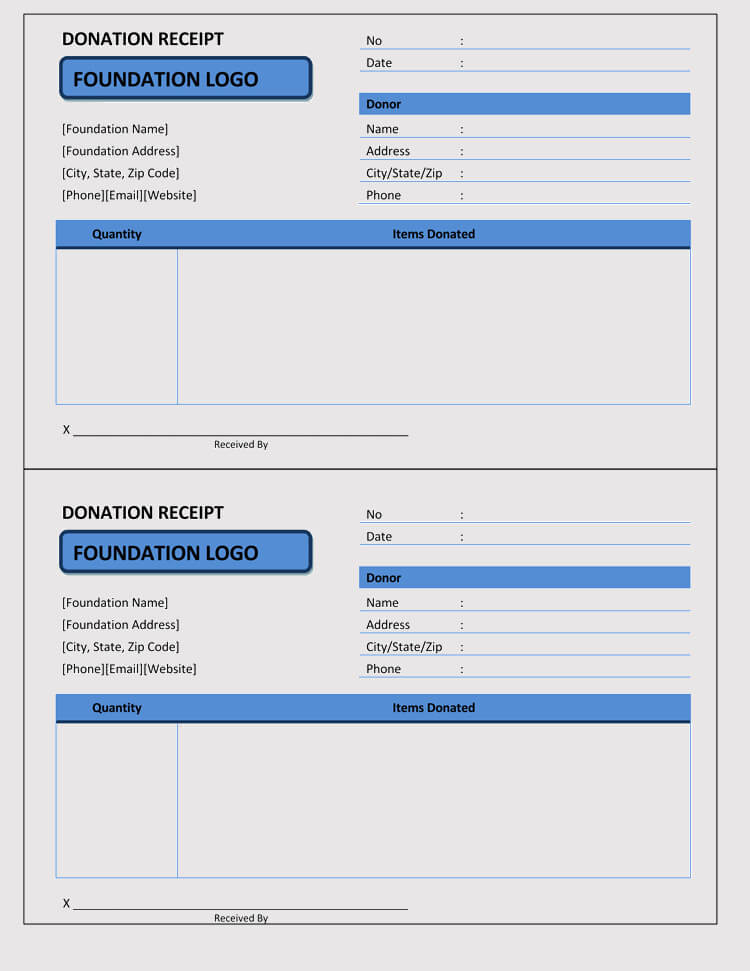

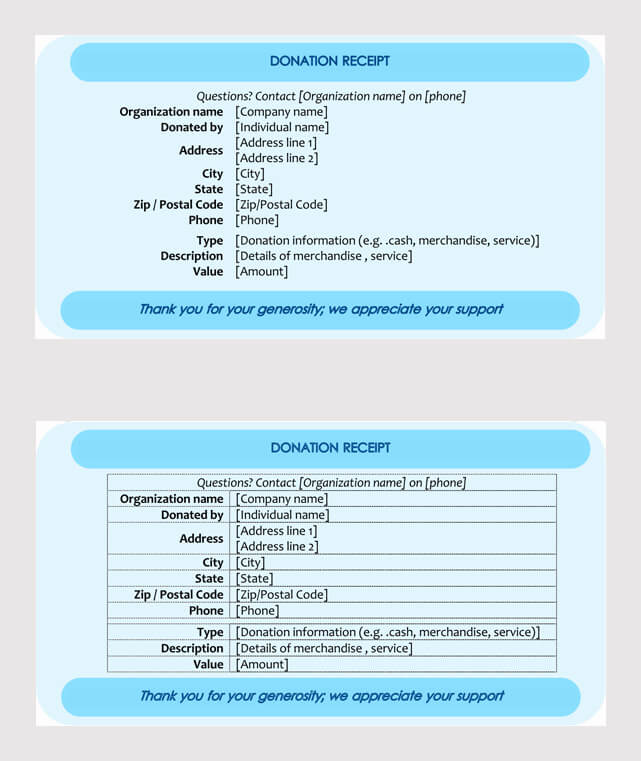

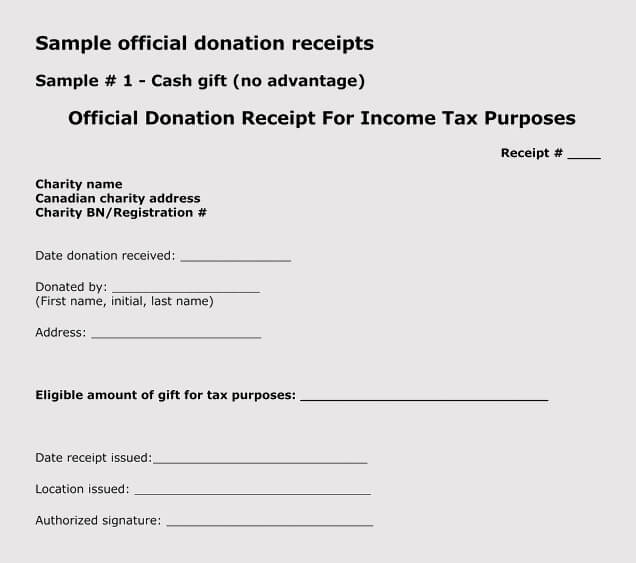

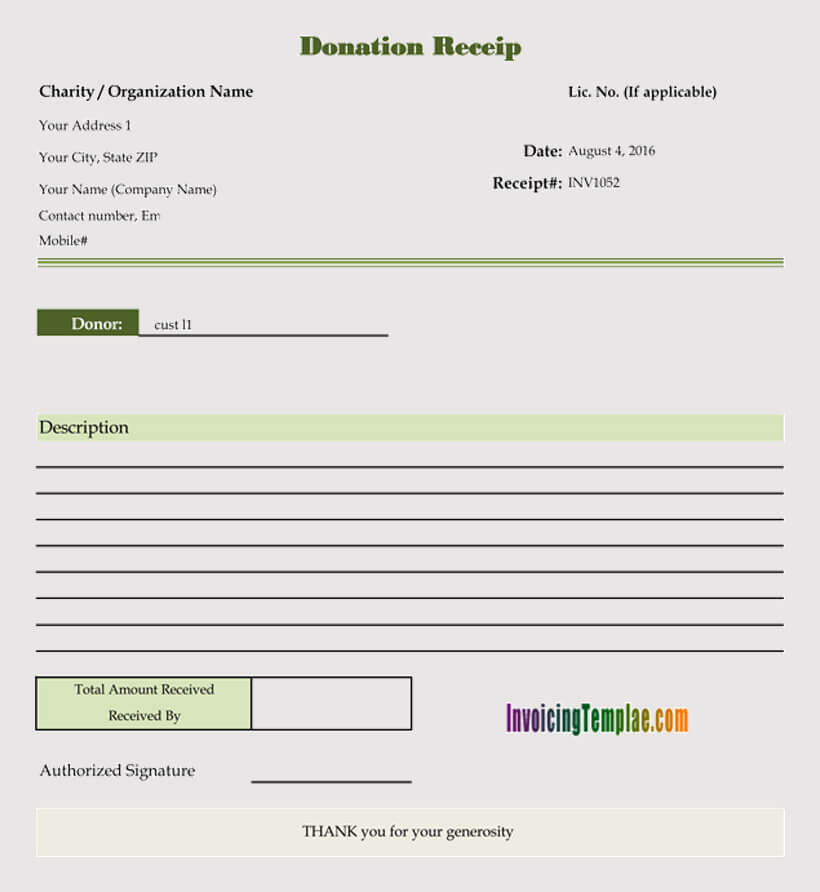

Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. There are various types of receipts including the following:

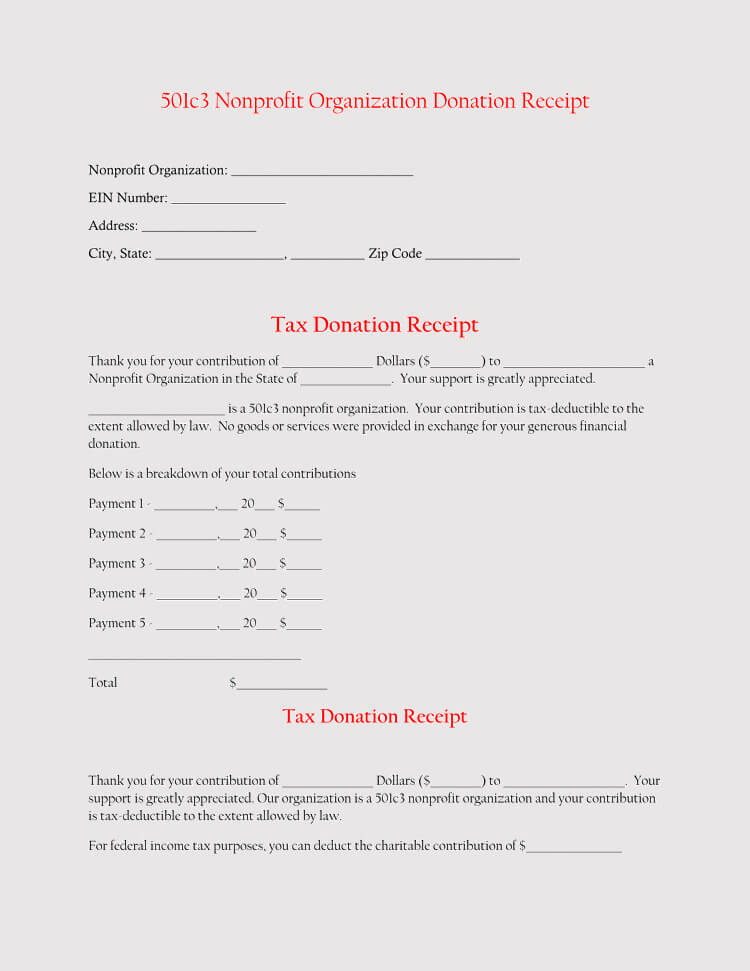

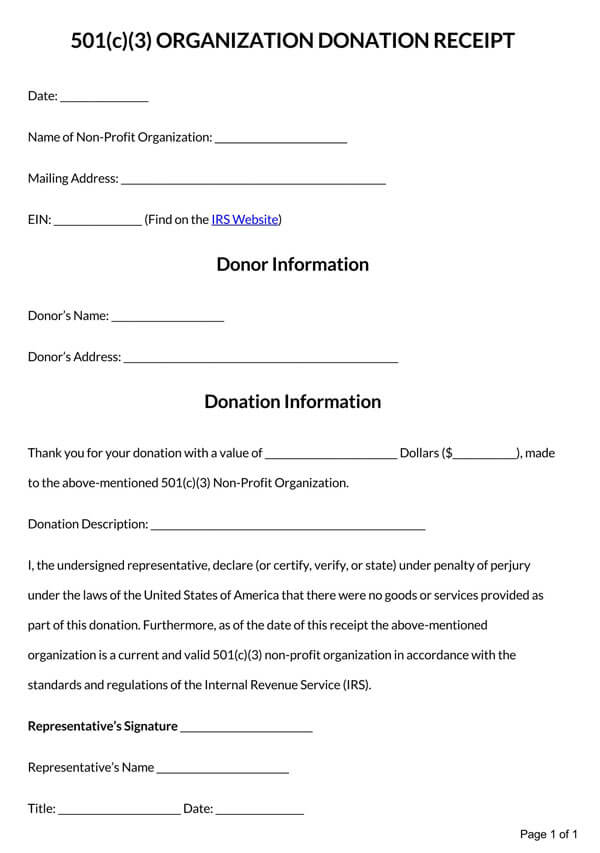

501c3 Donation Receipt Template

Download: Microsoft Word (.docx)

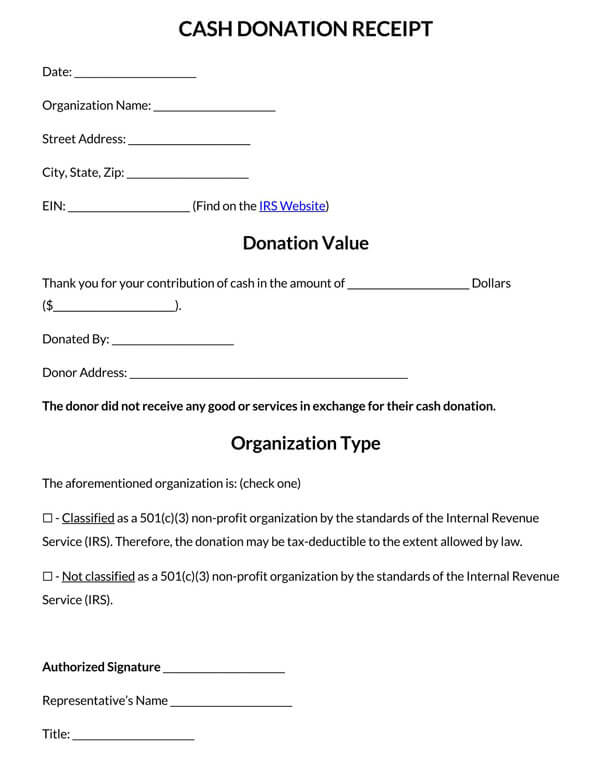

Cash Donation Receipt Template

Download: Microsoft Word (.docx)

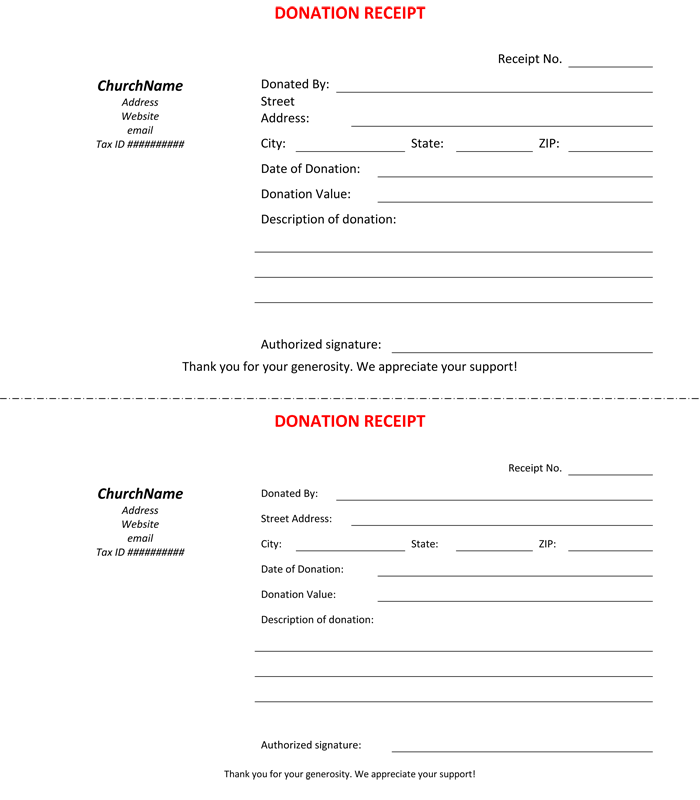

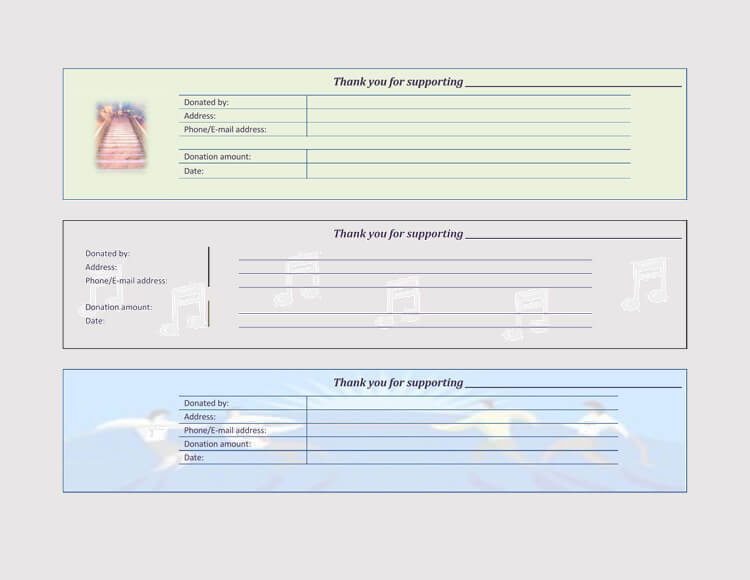

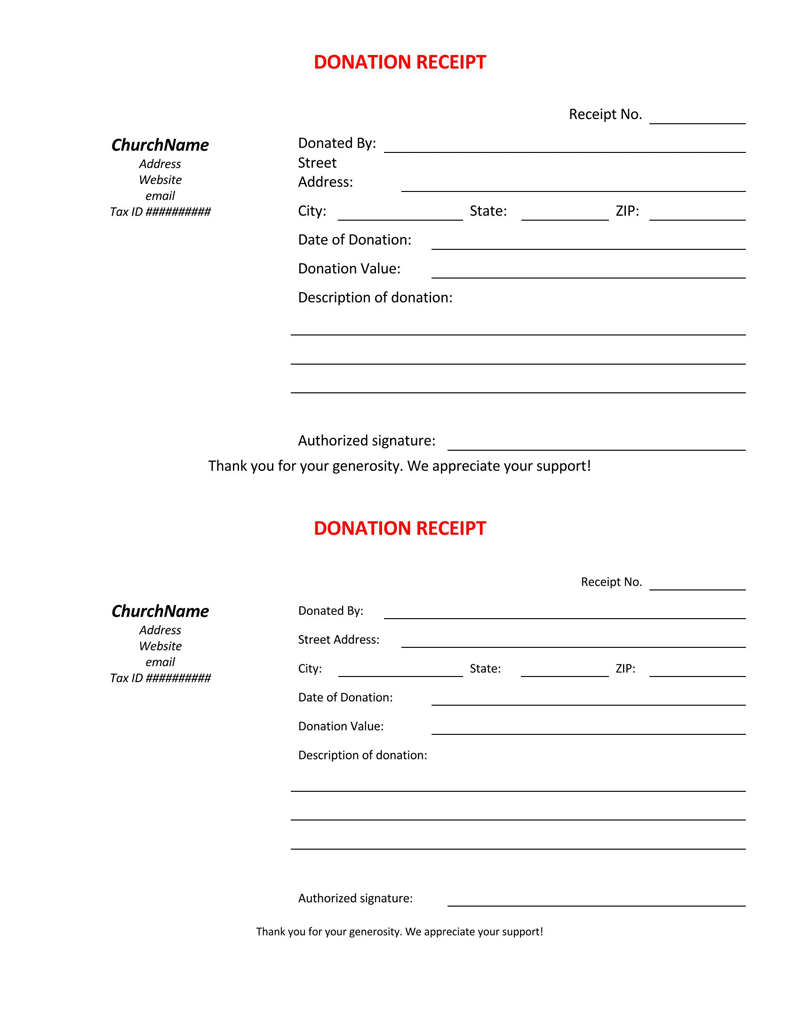

Church Donation Receipt Template

Download: Microsoft Word (.docx)

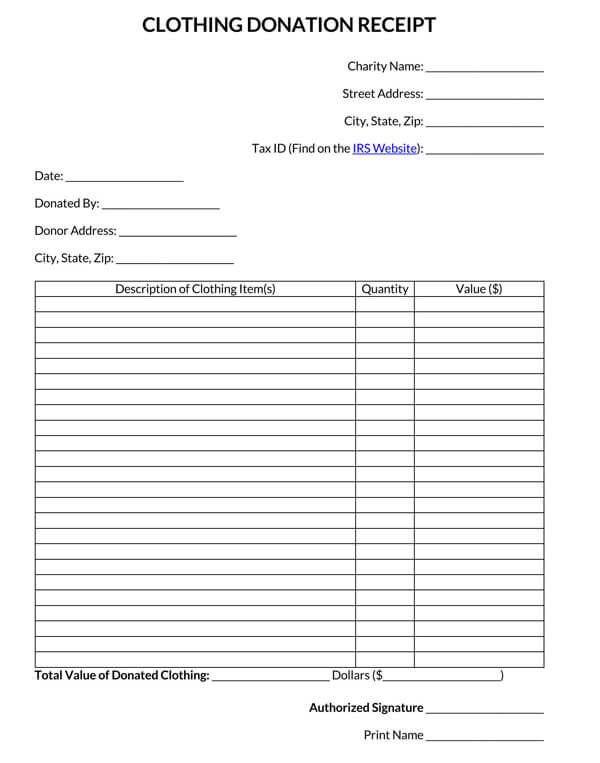

Clothing Donation Receipt Template

Download: Microsoft Word (.docx)

Food Donation Receipt Template

Download: Microsoft Word (.docx)

In Kind Donation Receipt Template

Download: Microsoft Word (.docx)

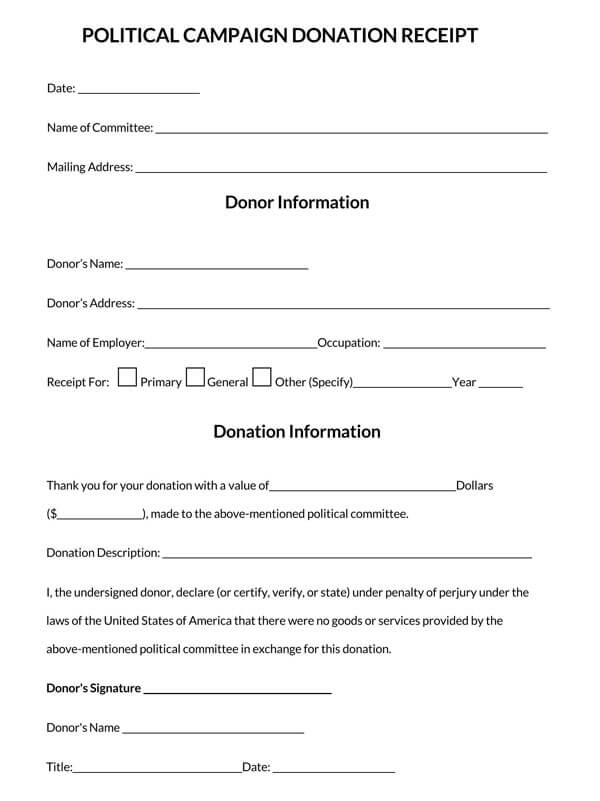

Political Campaign Donation Receipt

Download: Microsoft Word (.docx)

Vehicle Donation Receipt Template

Download: Microsoft Word (.docx)

Requirements of a Receipt According to IRS

The IRS gives clear guidelines on what should be included in the receipt. Some of these essential features include; the name of both charity and donor, the date of the contribution, detailed description of the property donated, amount of contribution among other features.

Name of charity and donor

The receipt is required to have the name of the donor, who is the person making contributions to the charity. It should also state the name of the charity organization as well as the address or location of the charity organization.

Date of contribution

The date the donor made his contributions to the charity organization is important and should be captured on the receipt. The dates inform the IRS when contributions were made to allow tax-deductions for the donations made during that fiscal year.

Detailed description

In cases where the donations are made in cash, the cash is recorded on the receipt as soon as it is received, where they are not cash-based, a clear description is recorded on the donation receipt. Some donations could be in the form of land, and in this case, the location is stated on the receipt.

Amount of contribution

The amount of contribution in cash should be recorded on the receipt. However, for non-cash donations, the charity organization should not value these contributions and thus the value cannot be recorded. The role of valuing such contributions remains solely the donor.

Statement regarding exchange for contributions

The IRS expects a statement regarding exchange for contributions in the receipt. The charity should simply state and admit to some of the benefits acquired from the contribution and not necessarily describe such benefits. For example, in the case of an educational institution, this could be stated; nothing was given in exchange for the benefits enjoyed.

The value of goods provided by charity to the donor

In some cases, the charity organizations may provide some goods or services to donors in exchange for the donations. Information regarding such goods and services should be disclosed. It is assumed that donations exceeding $75 from the donor should be included and those below this amount should not necessarily be recorded in it.

Failed Receipts

For various reasons the transactions from donors to the charity may be unsuccessful, if this happens, the charity must inform the donor. The charity may miss out on some information required when informing the donor.

For this, the information required is listed as:

- Charities should mention the reason behind the unsuccessful transaction in the failed receipt explaining to the donor why the transaction was nullified.

- The dates when a failed transaction had been initiated should be provided to the donor by the charity organization.

- A failed receipt should provide a link for the donor to update their billing information.

- Credit card information of the charity should be provided in it.

- An email address of the charity organization is provided to allow the donor to find out more details about the failed transaction.

- The name of the person that initiated the failed transaction should be provided by the charity organization.

- The charity should state the name of the person or organization that was intended to receive the contribution from the donor.

- Charities should also mention the amount that was involved in the failed transaction when filling the receipt sent to donors for evaluation.

Conclusion

Donation receipts are very vital for donors and charity as it gives a clear record of what the donors have contributed to the charity over time and the benefits being enjoyed by the charity from such contributions. The use of templates to come up with this document could go a long way in minimizing the chances of missing out on some important details in the construction of the document. Part of maintaining transparent and good relations with donors requires sending them receipts for every donation they make.