When it comes to financial transactions, accuracy and transparency are key. Whether you’re a business owner making a deposit to your bank account or an individual paying a security deposit on an apartment, having a clear record of the transaction is essential. This is where a deposit receipt comes in.

A deposit receipt is a document that serves as proof of a deposit made into a bank account or other financial institution. It contains important details such as the date and amount of the deposit, the account number of the payer and recipient, and any associated fees or charges. In this article, we will explore the importance of deposit receipts and how to ensure they are accurate and reliable.

What is a Deposit Receipt?

A deposit receipt is a document that serves as proof of a deposit made into a bank account or other financial institution.

It is typically issued by the bank or credit union receiving the deposit and serves as a record of the transaction for both the payer and the recipient. These are commonly used in a variety of financial transactions, such as security deposits for rentals, down payments for real estate purchases, and deposits for services or products.

The main purpose of a deposit receipt is to provide evidence that the deposit was made and to document the terms of the transaction. It typically includes details such as the date of the deposit, the name and account number of the payer and the recipient, and the amount of the deposit. Additional information may also be included, such as the type of deposit, the source of funds, and any fees or charges associated with the transaction.

Having a receipt is important for both parties involved in the transaction. For the payer, it serves as proof that the deposit was made and provides a record of the transaction for their own records. For the recipient, it serves as proof of ownership and provides a clear record of deposits made into their account.

What is a Deposit Receipt Template?

A deposit receipt template is a pre designed document that is used to create deposit receipts quickly and easily.

It is a time-saving tool for businesses and individuals who make regular deposits and want to ensure that their receipts are accurate and complete. Deposit receipt templates can be customized to include all the necessary details for a particular transaction, such as the date of the deposit, the name and account number of the payer and recipient, and the amount of the deposit.

Using a template has several benefits.

- First, it saves time and effort by eliminating the need to create a new receipt from scratch for each deposit.

- Second, it helps ensure that all the necessary information is included and organized in a clear and consistent format.

- Third, it can be customized to meet the specific needs of different types of deposits or transactions.

When Do You Need a Deposit Receipt Template?

The templates are an essential tool for businesses and individuals who regularly make deposits. They serve as a record of transactions and provide proof of ownership.

Here are some specific instances when a deposit receipt template is especially important:

- Security deposits: When renting a property, landlords often require a security deposit to cover any damages or unpaid rent. A template can be used to document the amount of the deposit, the terms of the lease agreement, and the condition of the property at the time of move-in.

- Real estate transactions: When buying or selling a property, a deposit is often required as part of the purchase agreement. A template can be used to document the amount of the deposit, the terms of the agreement, and any contingencies or conditions.

- Service or product deposits: Businesses that require a deposit for services or products can use a template to document the transaction. This can include deposits for custom orders, special services, or large purchases.

- Down payments: When financing a large purchase, such as a car or home, a down payment is often required. A template can be used to document the amount of the down payment, the terms of the financing agreement, and any contingencies or conditions.

- Banking transactions: When making a deposit into a bank account, a receipt can serve as proof of ownership. A deposit receipt template can be used to ensure that all necessary information is included, such as the date of the deposit, the account number, and the amount.

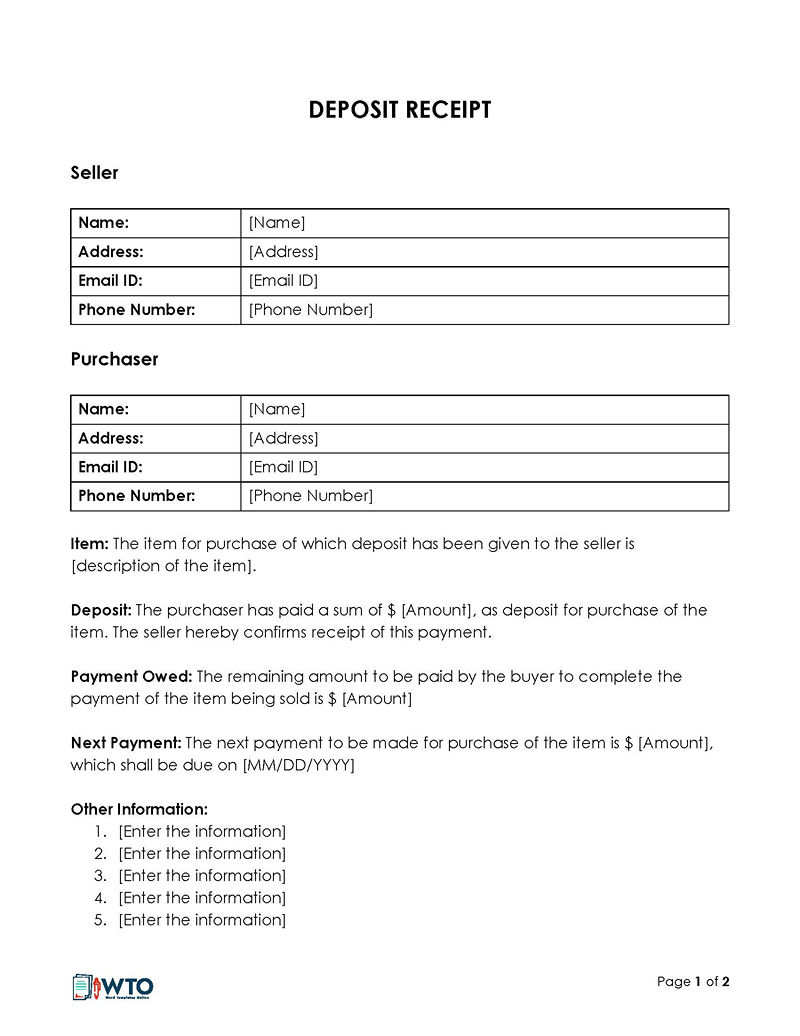

Components of a Deposit Receipt Template

A deposit receipt template is a valuable tool for documenting financial transactions. When creating a template, it is important to include all necessary elements to ensure accuracy and completeness.

Here are some essential elements to consider:

- Date of the deposit: The date of the deposit is a critical piece of information that must be included in the receipt. This ensures that both the payer and the recipient have a clear record of when the transaction occurred.

- Names and account numbers: Including the names and account numbers of both the payer and the recipient ensures that the transaction is properly documented and that the funds are transferred to the correct account.

- Amount of the deposit: Including the amount of the deposit is essential for ensuring that both parties have a clear record of the amount of funds transferred.

- Type of deposit: Depending on the type of transaction, it may be important to include information about the type of deposit. This can include security deposits, down payments, or service or product deposits.

- Source of funds: If the deposit is being made from a specific source, such as a particular bank account or investment account, this should be included in the receipt.

- Fees or charges: If there are any fees or charges associated with the transaction, these should be clearly indicated on the receipt.

- Contact information: Including contact information for both the payer and the recipient can be helpful in ensuring that both parties can easily reach each other if necessary.

- Payment method: If the deposit is being made using a specific payment method, such as a check or credit card, this can be indicated on the receipt.

- Purpose of the deposit: If the deposit is being made for a specific purpose, such as a down payment on a car or a security deposit on an apartment, this can be indicated on the receipt.

- Terms and conditions: Depending on the type of transaction, it may be necessary to include terms and conditions that both parties agree to. For example, if it is a rental security deposit, the terms of the lease agreement may be included.

- Signatures: If the transaction requires signatures from both the payer and the recipient, these can be included on the receipt.

- Reference number: Including a reference number can be helpful in ensuring that the transaction is properly documented and can be easily referenced in the future.

These essential elements in a template can help to provide a clear and detailed record of the transaction, which can be helpful in resolving any disputes that may arise. It is important to customize the template to meet the specific needs of each transaction.

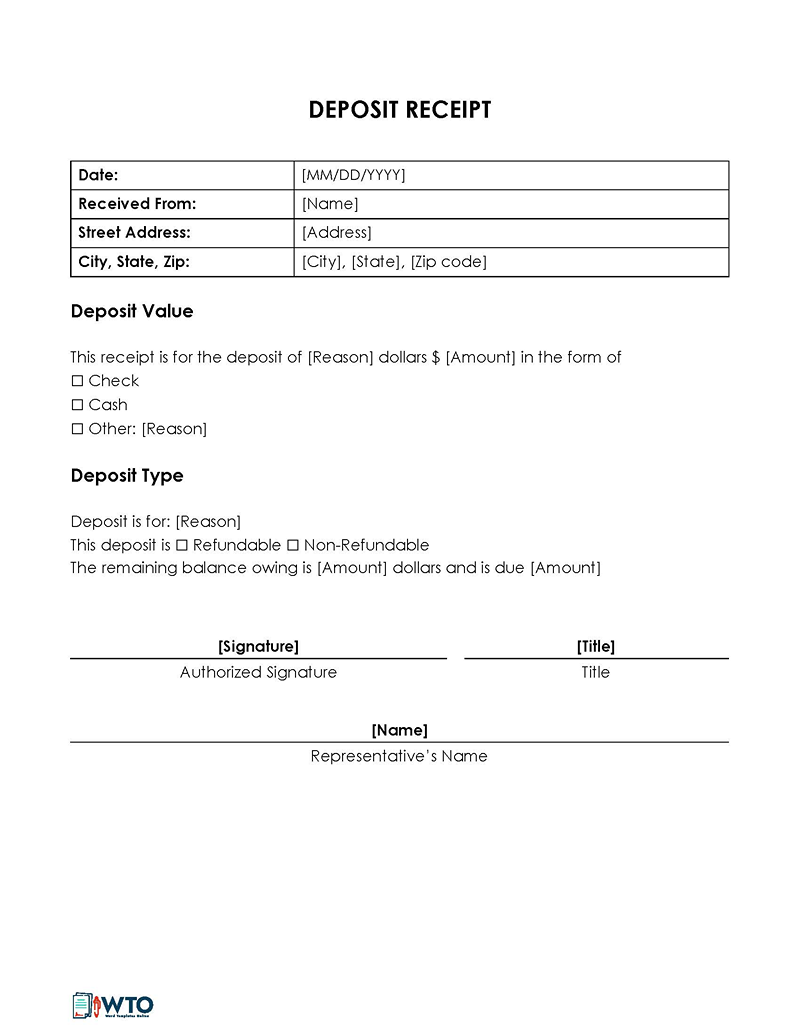

Free Templates

Following are the deposit receipt templates that you can download for free:

Free Receipt Templates

A deposit receipt is not confined to banks or landlords, and tenants. There are many instances where it is used.

They are:

General receipts

General receipts are issued to show that your deposit has been made and provide you with helpful information. General receipts may also be used when making deposits.

A general receipt template will contain the following information:

- Your name, address, and the amount of your transaction

- The date on which the transaction was made

- The date on which your money will be available for withdrawal

- The type of transaction (for example, ‘deposit’)

- A reference number (which may also be given as an invoice number).

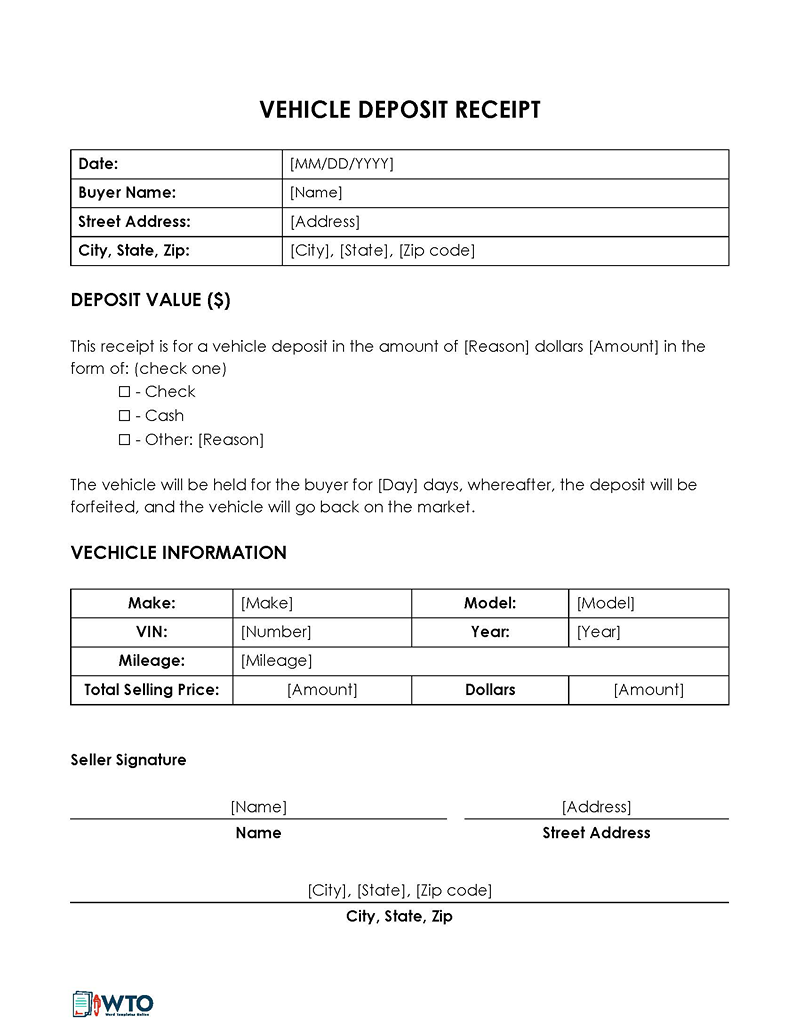

Car (vehicle down payment)

A down payment receipt for a car is a written record of the initial fee made by a buyer to a seller toward the purchase of a vehicle. A down payment is a percentage of the vehicle’s total cost and is only made after a purchase agreement is signed.

A car down payment receipt template is similar to a general deposit receipt but is suitable for down payments on cars, vans, or motorcycles. This deposit will usually be made when leasing, registering, financing, or buying a vehicle.

The contents of a car down payment receipt template are:

- Date

- Buyer’s information (name, address, city, state, zip)

- Down payment value

- Methods of payment (cash, check, other)

- Vehicle details (make, year, model, etc.)

- Seller’s information (name, address, city, state, ZIP)

- Seller’s signature

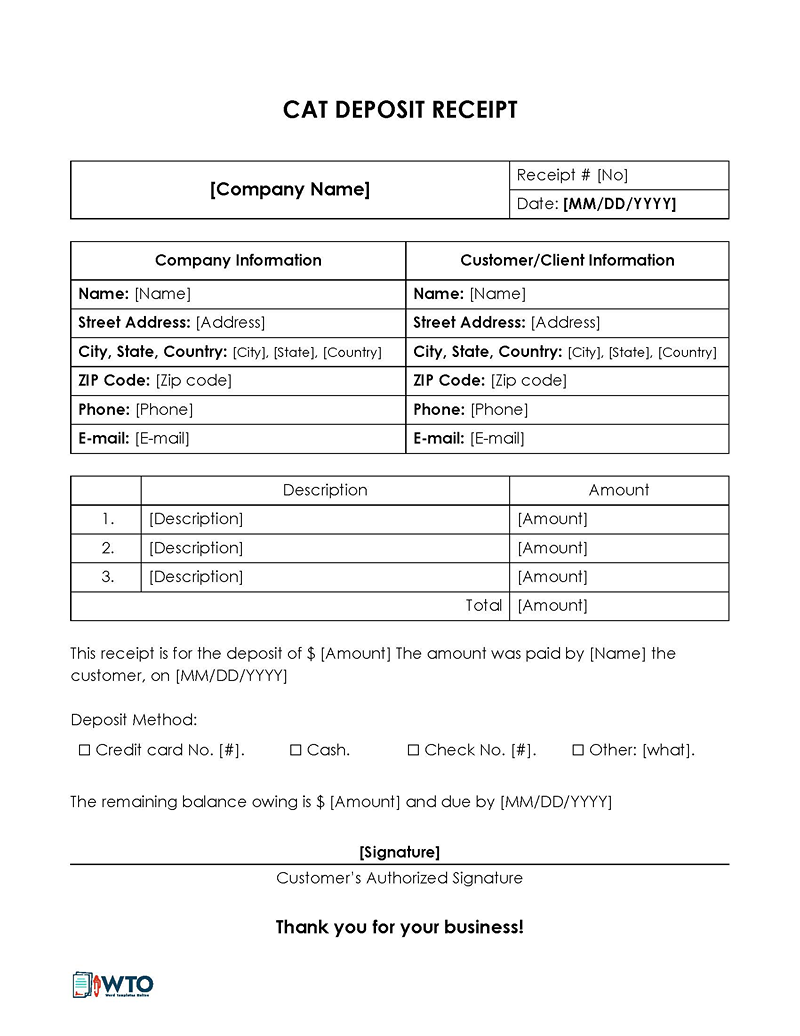

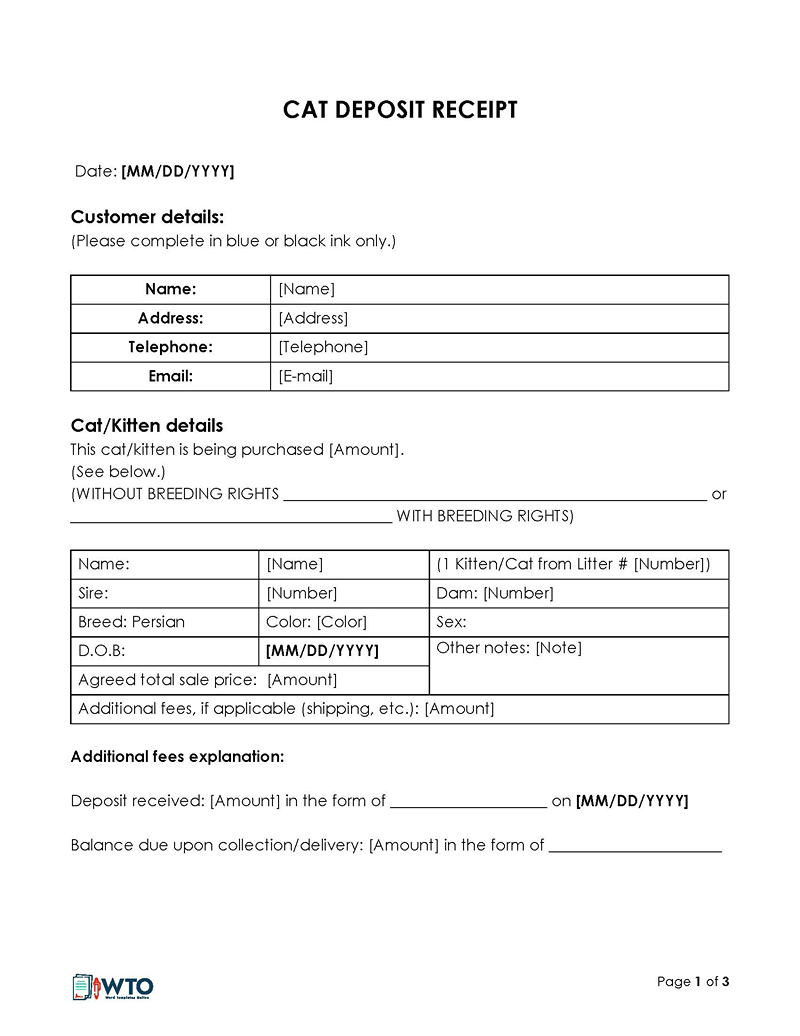

Cat (kitten) purchase deposit receipt

A kitten deposit receipt is used to pay the first installment on kittens or cats. These can be issued when you adopt or take in unwanted animals and then find new homes. The deposit creates trust between the buyer and seller.

The elements of a cat/kitten receipt template are:

- Date

- Deposit amount

- Total selling price

- Buyer’s information (name, address, city, state, ZIP)

- Seller’s information (name, address, city, state, ZIP)

- Cat/kitten information (color, health, etc.)

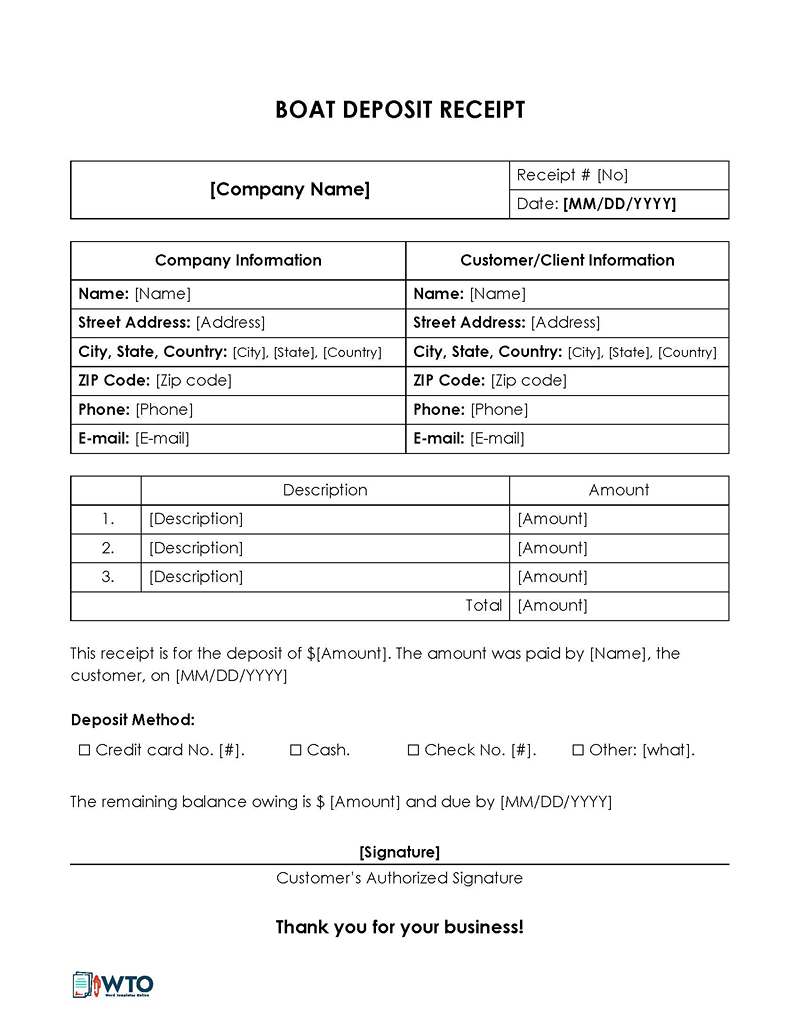

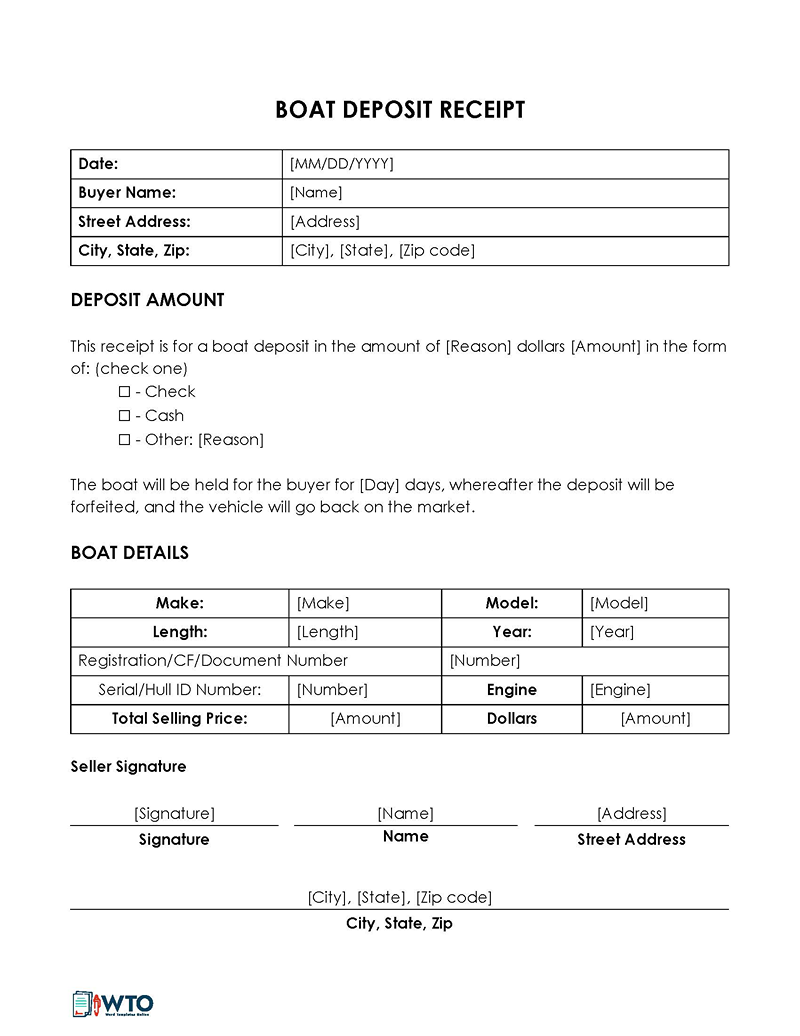

Boat deposit

It is used to pay the first installment on boats, cruisers, or yachts. These first payments are sometimes called ‘option payments’ or ‘first payments.’ If a buyer expresses interest in a boat for sale, the seller agrees not to sell the boat to another person in exchange for a deposit. The deposit will reflect on the total sale price of the vessel, but the buyer must return within an agreed-upon number of days, or the seller will retain the deposit.

The elements of a boat deposit receipt template are:

- Date

- Buyer’s information (name, address, city, state, ZIP)

- Seller’s information (city, state, ZIP)

- Boat information ( make, condition, etc.)

- Total selling price

- Seller’s signature

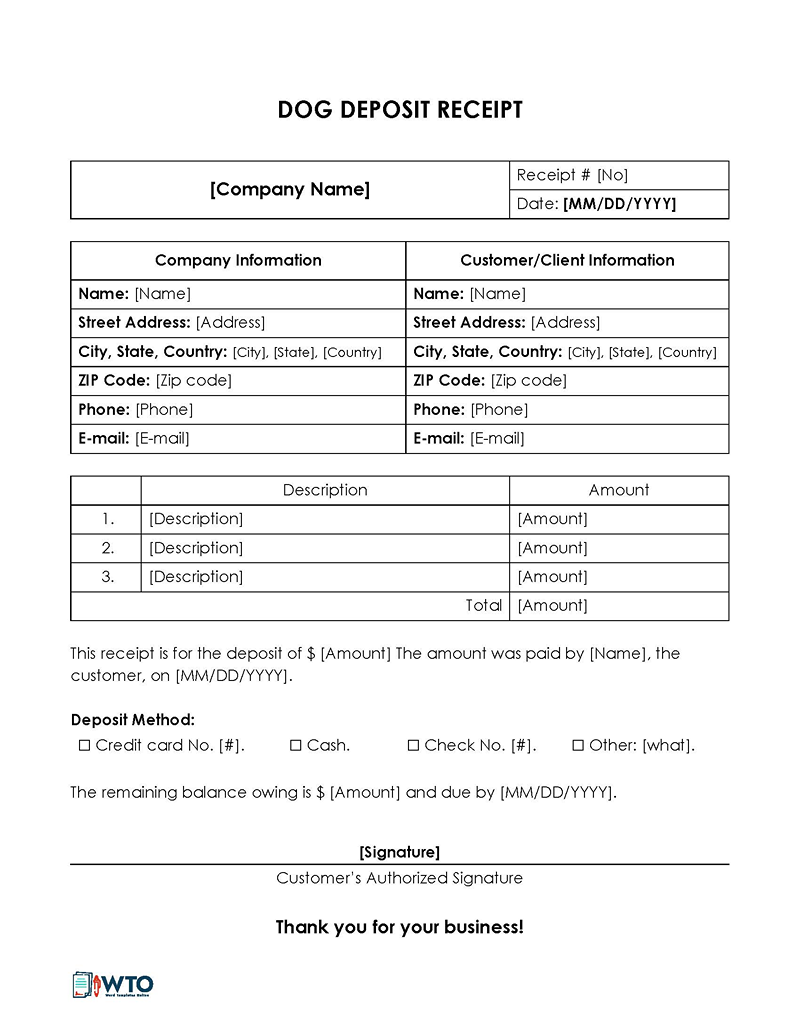

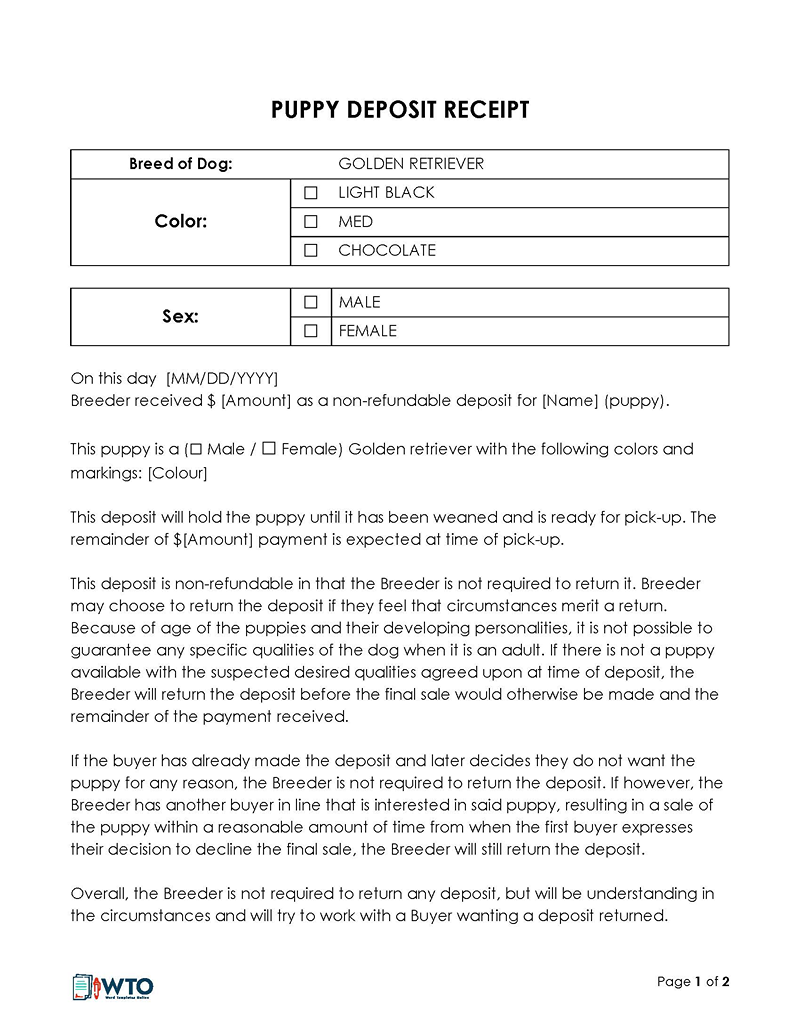

Dog (puppy) purchase deposit receipt

A dog deposit receipt describes a transaction between a dog owner and a potential buyer. A deposit creates a temporary agreement between the buyer and seller; the buyer pays cash to show that they are serious about purchasing a dog, and the seller agrees not to sell the dog to anyone else while the potential buyer comes up with the remaining funds. In addition, the seller will only hold the dog for a few days before reselling it, which should be specified on the receipt.

The elements of a dog deposit receipt template are:

- Date

- Buyer’s information (name, address, city, state, ZIP)

- Seller’s information (name, address, city, state, ZIP)

- Dog information (type, color, etc.)

- Total selling price

- Seller’s signature

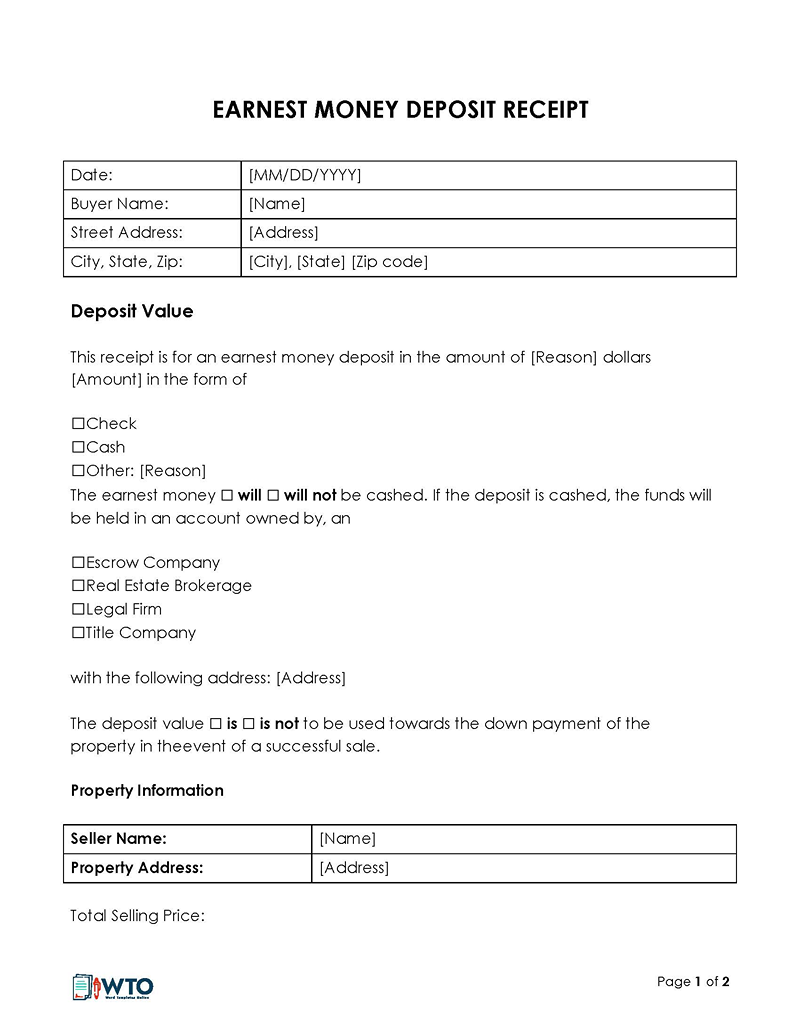

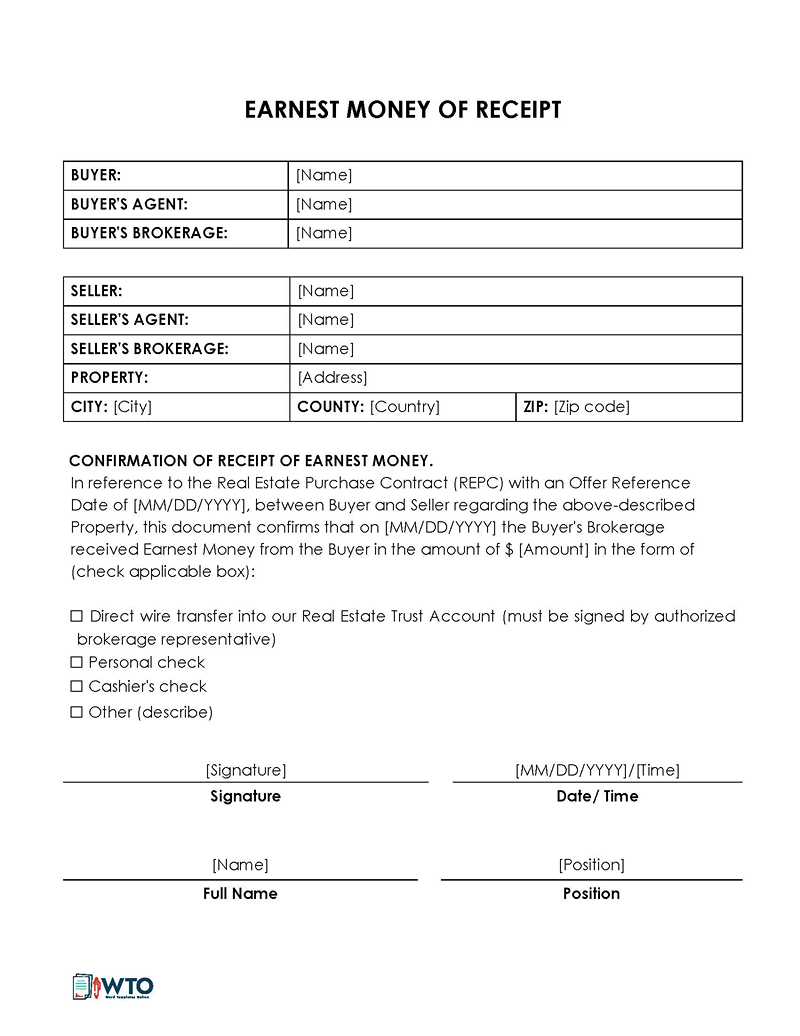

Earnest money deposit

A seller gives an earnest money deposit receipt to a buyer who has expressed interest in a property by depositing money as a sign of good faith. The earnest money is then made payable to a trustworthy third party, such as a reliable property estate agent, legal firm, etc. A refund policy section is usually included in the receipt, which clarifies when the seller is allowed to keep the deposit and when the buyer’s deposit will be refunded.

The elements of an earnest money deposit receipt template are:

- Date

- Buyer’s information (name, address, city, state, ZIP)

- Seller’s information (name, address, city, state, ZIP)

- Deposit amount

- Deposit account/account holder Property address

Real estate down payment

A real estate down payment receipt template is issued for the first installment on purchasing a property or a home. Real estate down payments usually takes place by check, cash, or credit card. This transaction is generally between a buyer and seller. A down payment is a deposit of the total sale cost of the home and should be paid at the time of closing. A sales agreement will contain the most critical information about the sale, but a down payment receipt is a valuable document for the buyer to preserve their records.

The elements of a real estate deposit receipt template are:

- Date

- Buyer’s information (name, address, city, state, ZIP)

- Seller’s information (name, address, city, state, ZIP)

- Down payment amount

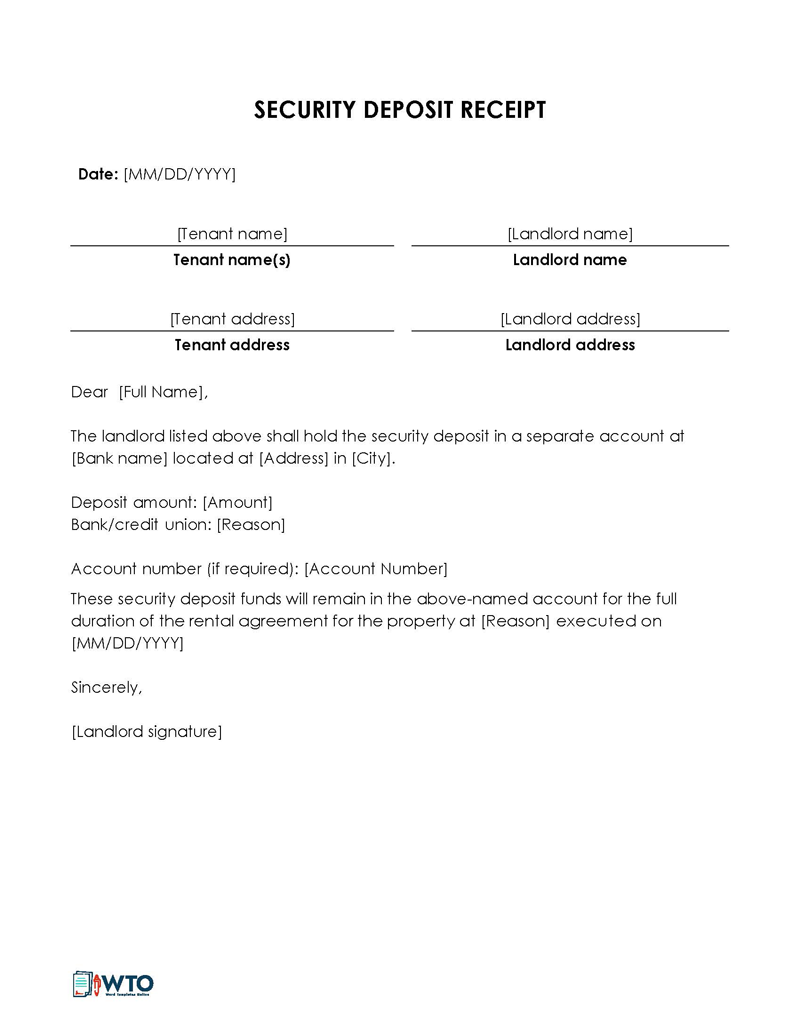

Security deposit (tenant)

A security deposit receipt is issued to tenants to mitigate the risk of fraud. It ensures that the tenant will leave the property (and all its contents) without incurring any damage or inconvenience at the end of their tenancy. Security deposits are usually made as a percentage of the stated rental amount (though this is not always the case). This percentage will depend on several factors, including average rental values, lease periods, and maximum rental amounts allowed.

The elements of a security deposit receipt template are:

- Date

- Landlord’s information (name, address, city, state, ZIP)

- Tenant’s information (name, address, city, state, ZIP)

- Bank information (name, address, city, state, ZIP). This is where the deposit will be held until termination

- Deposit amount and account

- Landlord’s signature and printed name

- Signature and date

Frequently Asked Questions

Yes, deposit receipt templates can be customized to meet the specific needs of each transaction. You can add or remove elements depending on the type of transaction.

If the transaction requires signatures from both the payer and the recipient, then signatures should be included on the receipt. However, not all transactions require signatures.

The templates serve as a record of financial transactions and can be used as evidence in legal disputes. However, they do not have any legal standing on their own and are not considered legal documents.

Yes, the templates can be used for both personal and business transactions. They are a useful tool for documenting any type of deposit, such as security deposits, down payments, or service or product deposits.

Including contact information for both the payer and the recipient can be helpful in ensuring that both parties can easily reach each other if necessary. However, it is not always necessary to include contact information.