A sales receipt is a vital document provided to customers when they purchase goods or services from your business.

They serve multiple purposes, such as tax filing, income tracking, and personal bookkeeping. They offer a record of the transaction, confirming that the seller provided the goods or services to the buyer.

Various types exist, and your organization should utilize those most appropriate for the specific sales environment. It provides essential documentation for both your company’s records and the customer’s proof of payment.

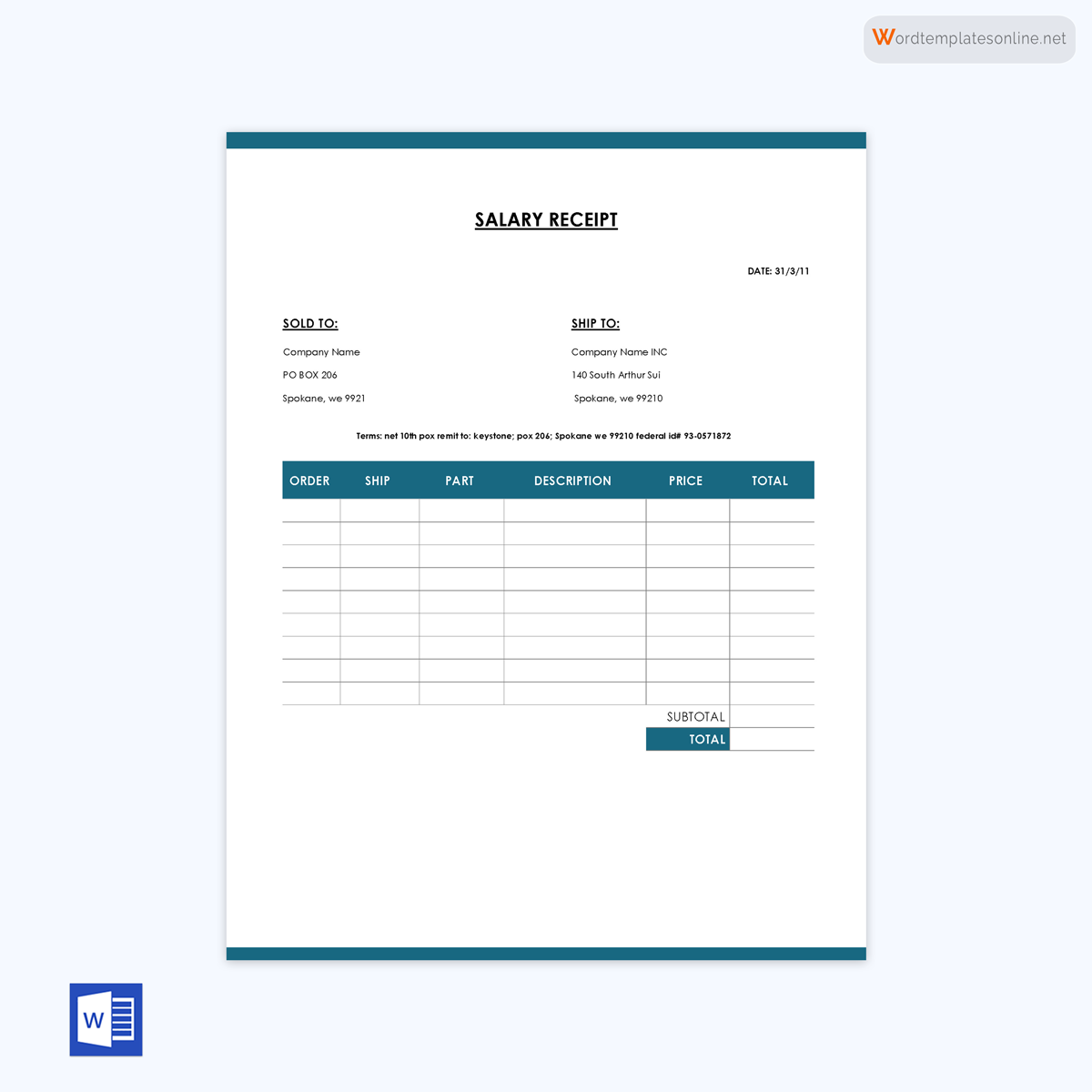

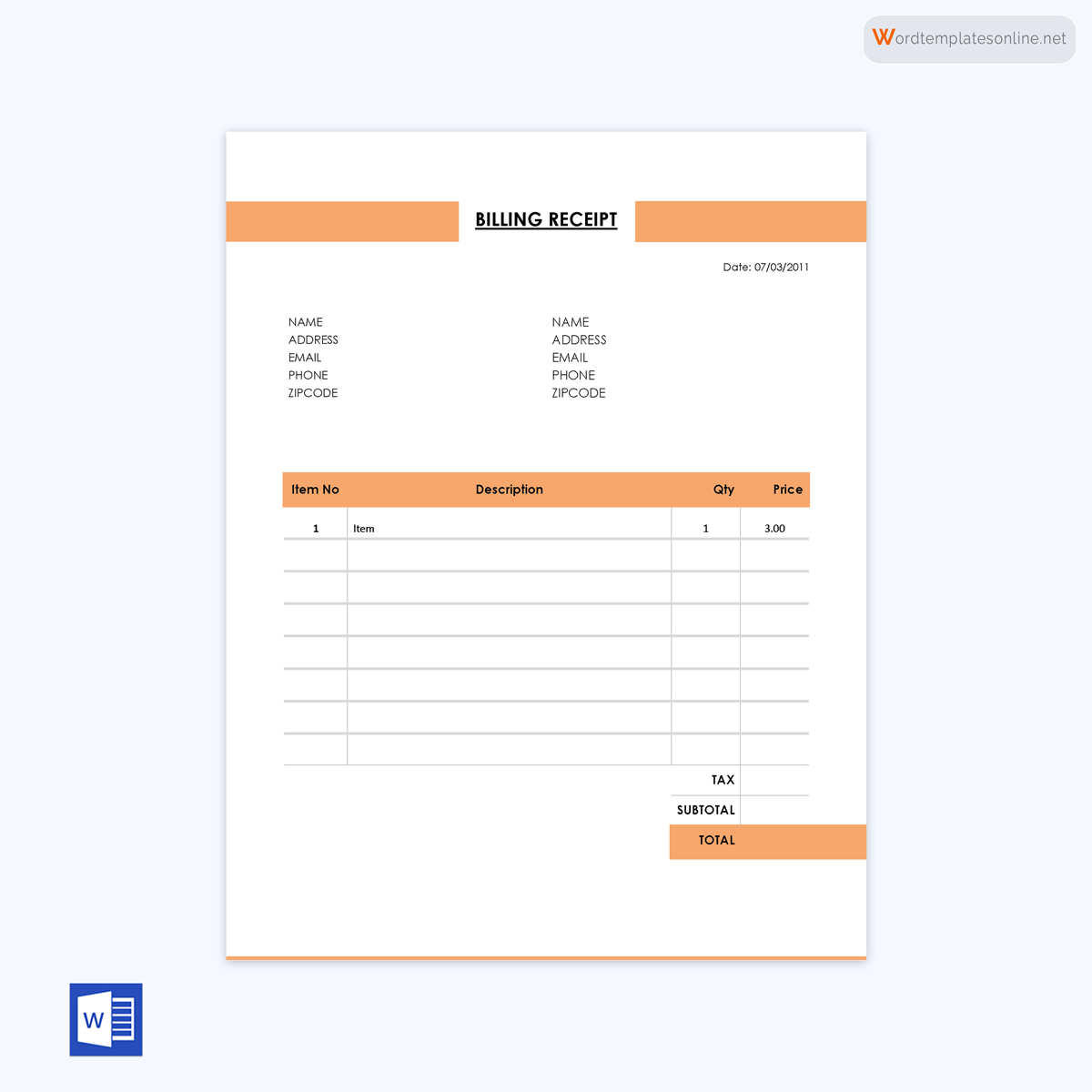

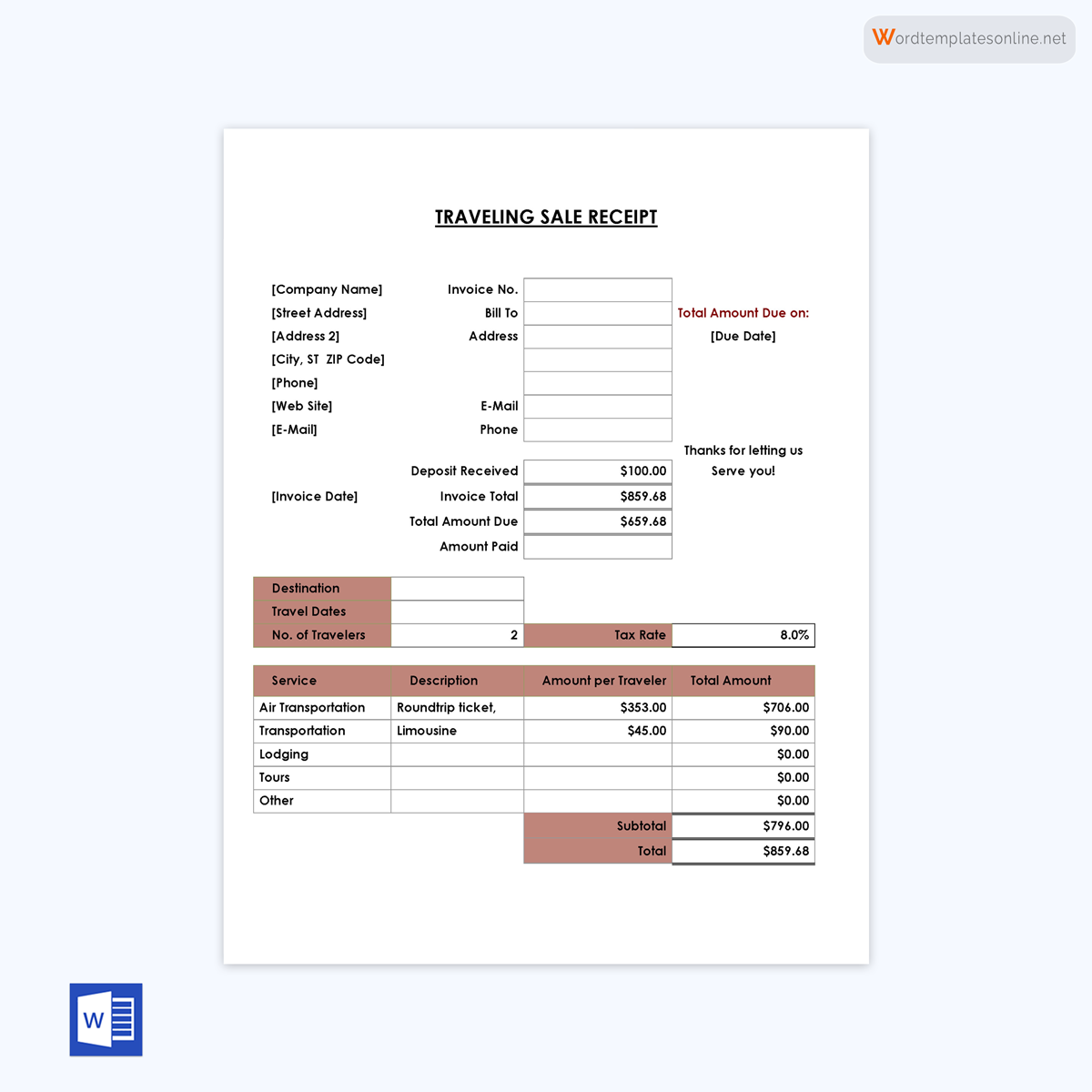

Sales Receipt Templates

What is a Sales Receipt?

A sales receipt is an official document provided to customers, recording the details of a completed sale. This document includes information about the product or service sold, the amount paid, the customer’s name, address, and other essential transaction data. For online purchases, this may be an email sent to the customer or printed from a cash register.

These templates may or may not include taxes, such as VAT or sales tax, depending on the location and nature of the transaction. Receipts may also feature marketing information like discount codes, QR codes, or the salesperson’s name.

Reasons to Use Sales Receipts

Following are the several reasons to use them:

Legal purposes

Sales receipts prove that you sold goods or services to a customer at a specific date and time. Therefore, they protect a seller from any legal issues.

EXAMPLE

A customer may suggest that they did not buy certain goods at a given price. The receipt will prove the buyer wrong, containing the goods’ date, time, and price.

Bookkeeping

Bookkeeping is a form of accounting. Bookkeeping is a permanent record of financial transactions that must be kept for purposes such as taxation, conducting business, or auditing prior years’ records.

EXAMPLE

Every receipt, whether provided in person or online, should be kept in a file system. Accounting software automatically stores this data for you for future use in financial records and cash flow reports.

Tax Preparation

Additionally, they are important for filing tax returns since they provide a complete written record of corporate revenue. Therefore, it is advisable that you also keep your receipts for business expenses.

Inventory management

Finally, issuing and storing receipts can assist with inventory management. They serve as a record of transactional data, allowing you to analyze which products are selling and when. This information helps in predicting future demand and assessing product trends.

Types of Sales Receipts

Various types of sales receipts are used for different types of purchases. Some of these include:

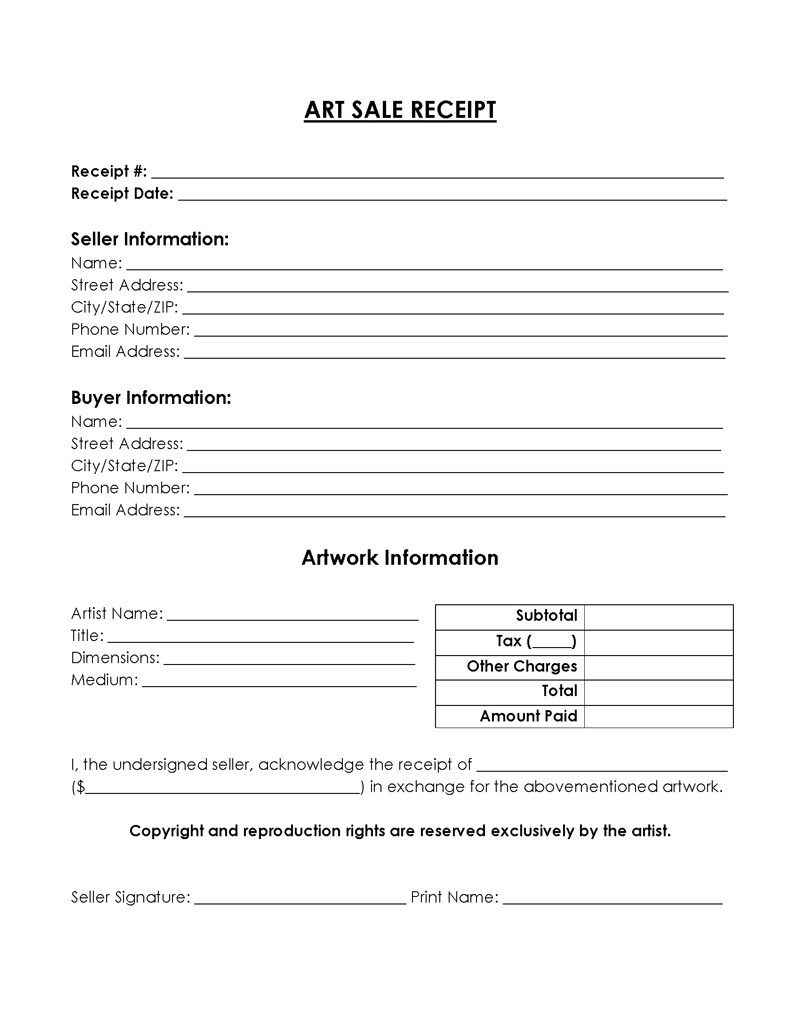

Art sales receipt

An art sales receipt is a document provided to the buyer for the artwork after payment is made. It includes:

- Artist’s name and contact information

- Buyer’s name and contact information

- Title of the artwork

- Medium and dimensions

- Price of the artwork

- Date of the transaction

- Method of payment

- Artwork’s provenance (if applicable)

- Copyright and reproduction rights information

- Return and refund policy

Additionally, the receipt should specify the ownership copyrights and reproduction rights.

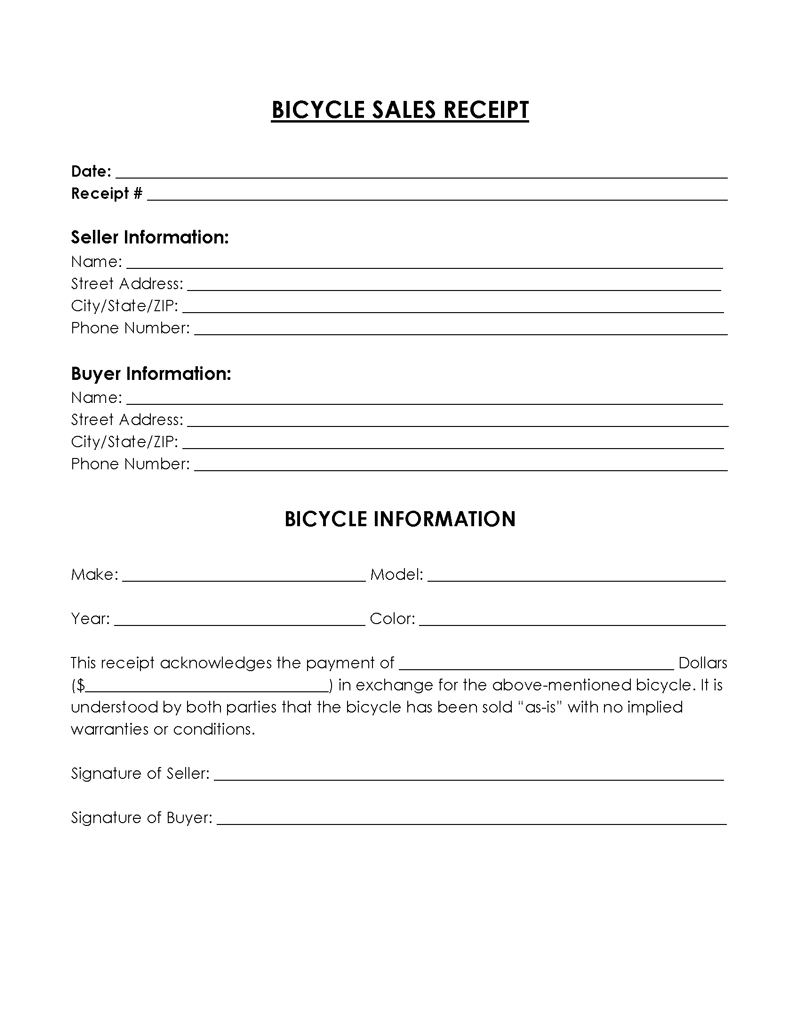

Bike sales receipt

A bike sales receipt serves as evidence of purchase for a bicycle.

It includes information such as:

- Seller’s name and contact information

- Buyer’s name and contact information

- Make, model, and year of the bicycle

- Serial number

- Price of the bicycle

- Date of the transaction

- Method of payment

- Description of any accessories included in the sale

- Warranty information (if applicable)

- Return and refund policy

The receipt also includes a declaration describing the nature of the agreement between the seller and the buyer, indicating that the bicycle is sold “as is” and without warranty. Both parties should sign the document to finalize the transaction.

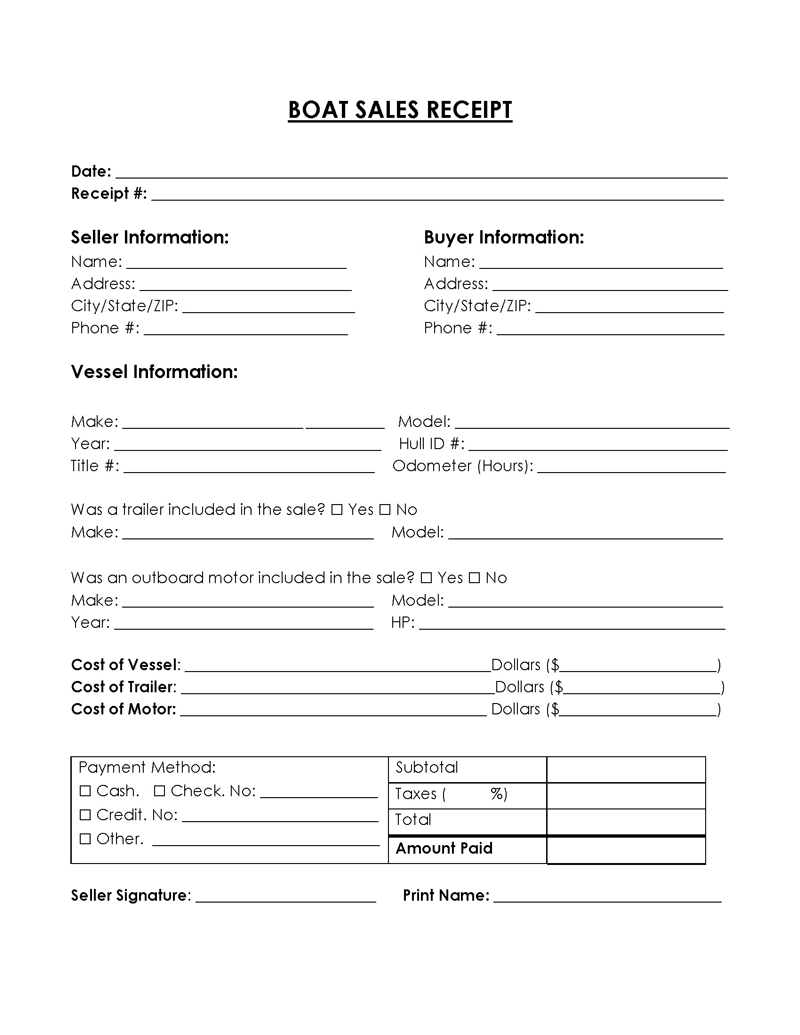

Boat sales receipt

A boat sales receipt proves that a boat’s ownership has been successfully transferred from a seller to a buyer. It confirms that the seller received the agreed-upon payment for the sale.

Boat sales receipts include information such as:

- Seller’s name and contact information

- Buyer’s name and contact information

- Make, model, and year of the boat

- Hull identification number (HIN)

- Engine make, model, and serial number (if applicable)

- Price of the boat

- Date of the transaction

- Method of payment

- Description of any additional items included in the sale (e.g., trailer, accessories)

- Warranty information (if applicable)

- Return and refund policy

If the sale involved a trailer or an outboard motor, the receipt contains the relevant sections to describe the additional items. The seller should provide their signature to authenticate the sale.

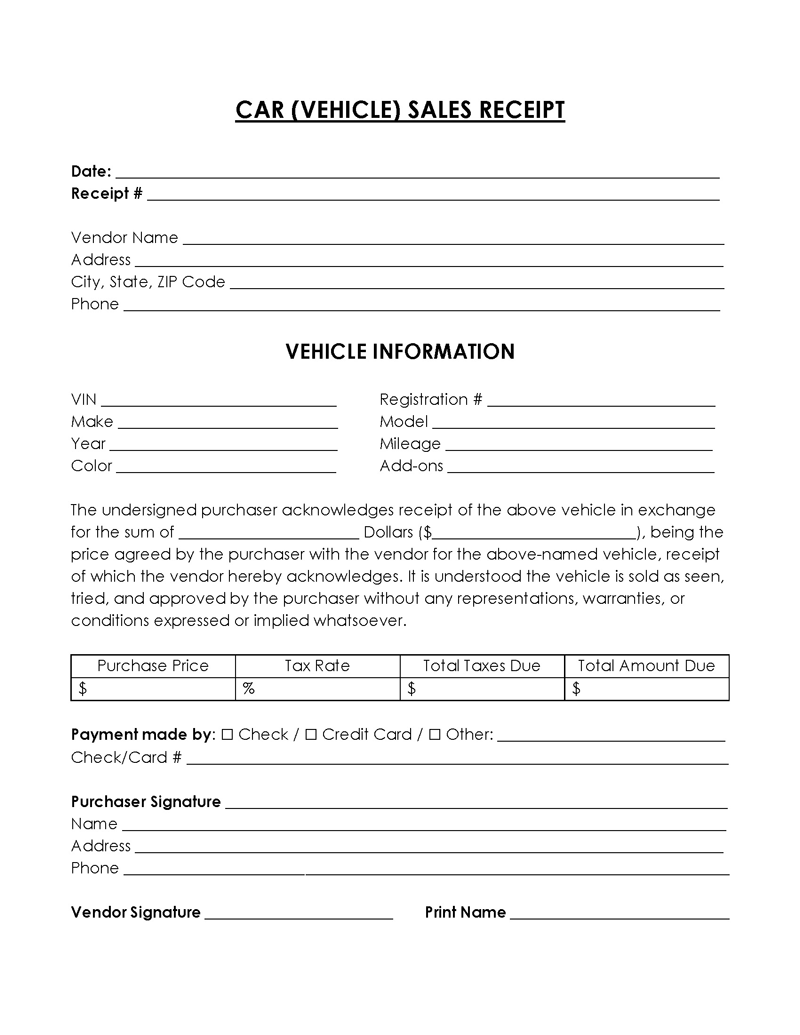

Vehicle sales receipt

A car sales receipt is used to prove the purchase of a vehicle from a dealer or private seller. The seller should issue the receipt once the money has been received.

The buyer should request the receipt and the bill of sale for registration at their local Department of Motor Vehicles office.

Vehicle sales receipts include information on:

- Seller’s name and contact information

- Buyer’s name and contact information

- Make, model, and year of the vehicle

- Vehicle identification number (VIN)

- Odometer reading

- Price of the vehicle

- Date of the transaction

- Method of payment

- Description of any additional items or services included in the sale

- Warranty information (if applicable)

- Return and refund policy

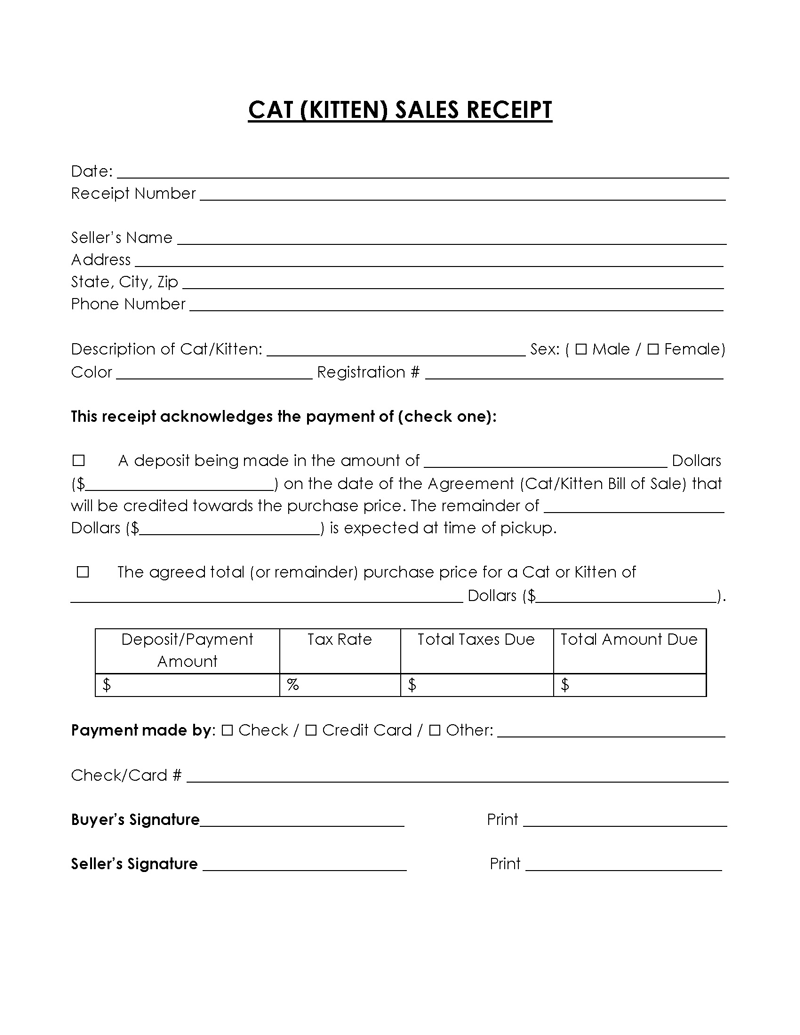

Cat (kitten) sales receipt

A cat sales receipt records a buyer’s payment for purchasing a cat or kitten from a cat breeder/owner.

For the buyer’s security, the buyer and seller should complete a written sales agreement (Cat Bill of Sale) before making any payment.

If the sales receipt is for a deposit towards the total buying price of the cat, the buyer must pay the balance by the pet’s specified pickup time.

A cat sales receipt has information on:

- Seller’s (breeder’s) name and contact information

- Buyer’s name and contact information

- Name, breed, age, and sex of the cat

- Registration or pedigree information (if applicable)

- Price of the cat

- Date of the transaction

- Method of payment

- Health information, including vaccinations and any known health issues

- Warranty information (if applicable)

- Return and refund policy

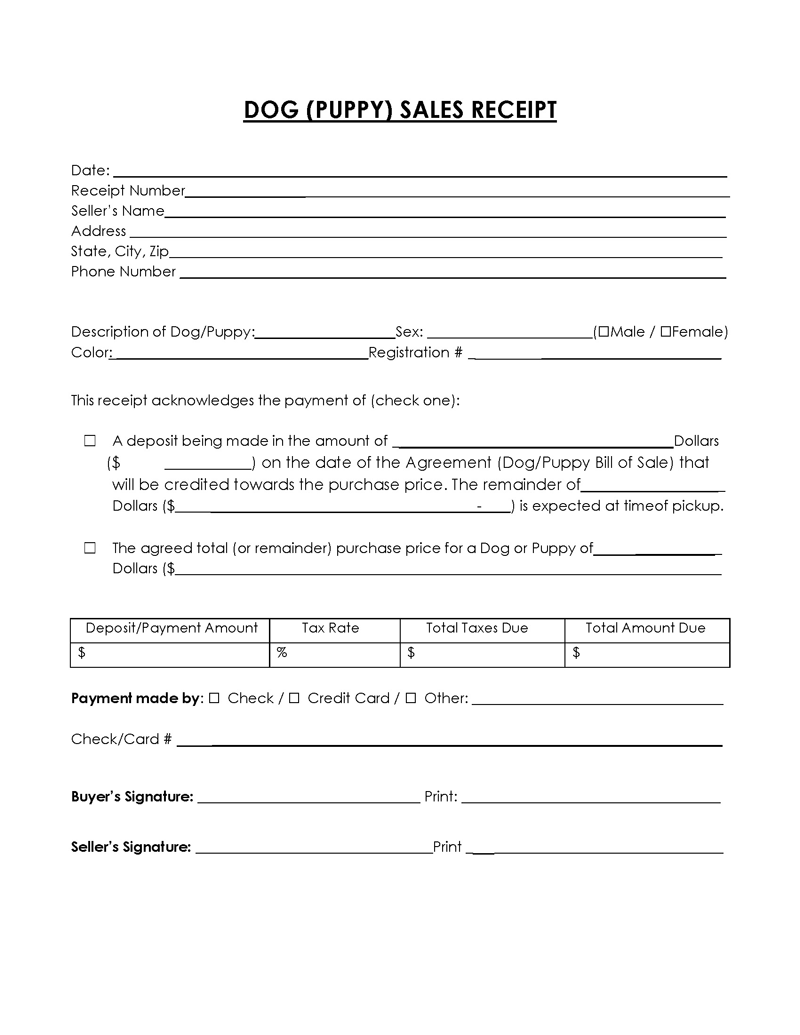

Dog (puppy) sales receipt

A dog sales receipt is used to confirm full payment or a deposit for purchasing a dog or puppy.

If the buyer only makes a deposit, it will be applied to the total price they must pay when they pick up their dog. A dog sales receipt has similar details as a cat sales receipt.

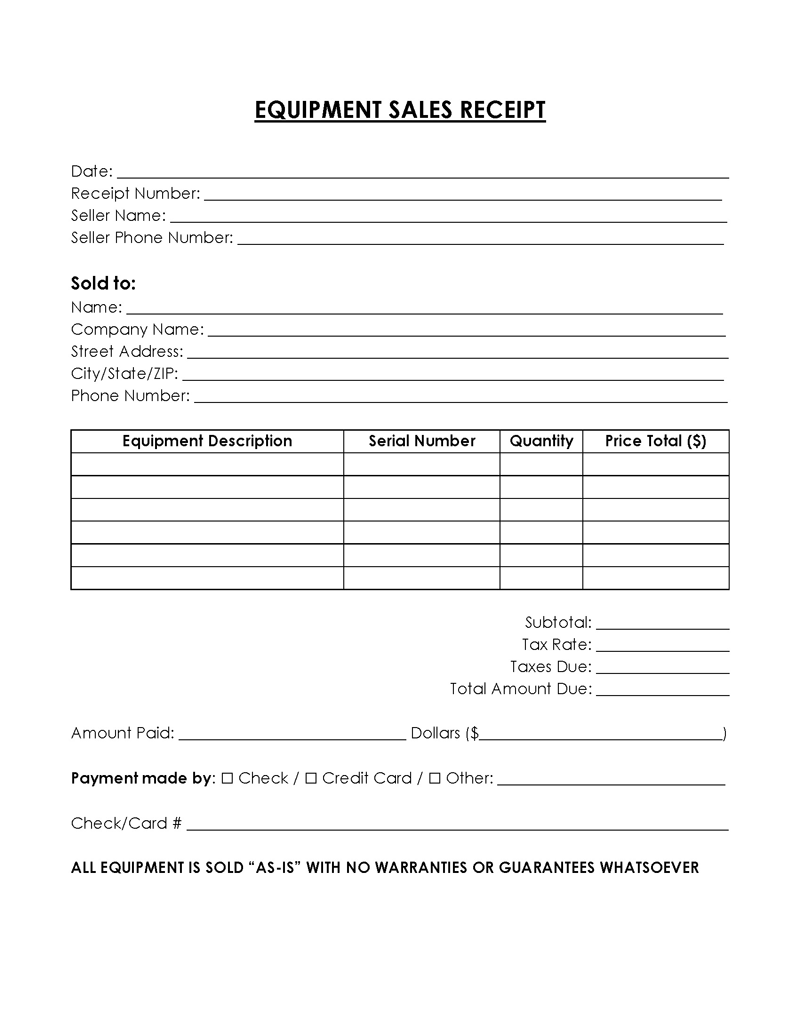

Equipment

An equipment sales receipt is a document that acts as proof of equipment purchase between the seller and buyer.

The seller can use the sales receipt to sell any office, home, professional, or outdoor equipment. However, since the equipment is frequently sold as-is, a sales receipt is generally only helpful as proof of payment if the buyer intends to claim the purchase as a tax-deductible expense.

The sales receipt has information on:

- Seller’s name and contact information

- Buyer’s name and contact information

- Make, model, and description of the equipment

- Serial number (if applicable)

- Price of the equipment

- Date of the transaction

- Method of payment

- Warranty information (if applicable)

- Return and refund policy

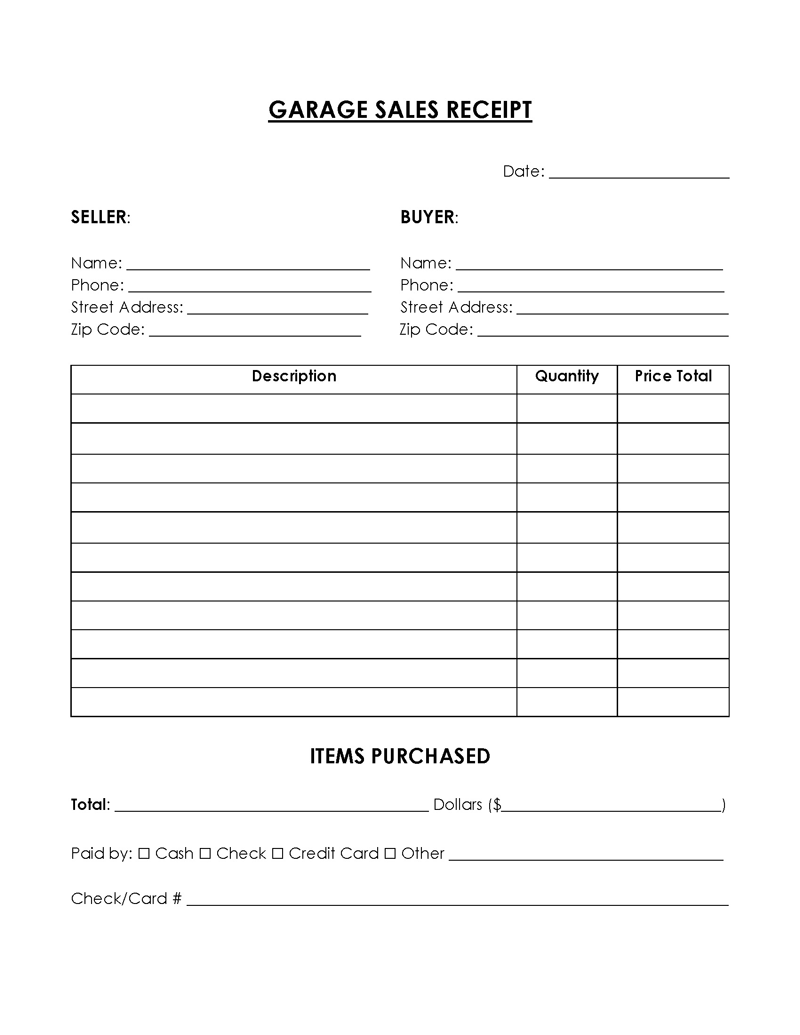

Garage sale

A garage sale receipt is used by sellers holding a garage sale to provide customers with a transaction record. Some people prefer to track how much money they spend on each item.

EXAMPLE

If a buyer intends to resell their products or use them for business purposes, they may require a receipt for tax considerations.

The receipt provides information about the buyer and seller, each item’s selling price, and the payment mode.

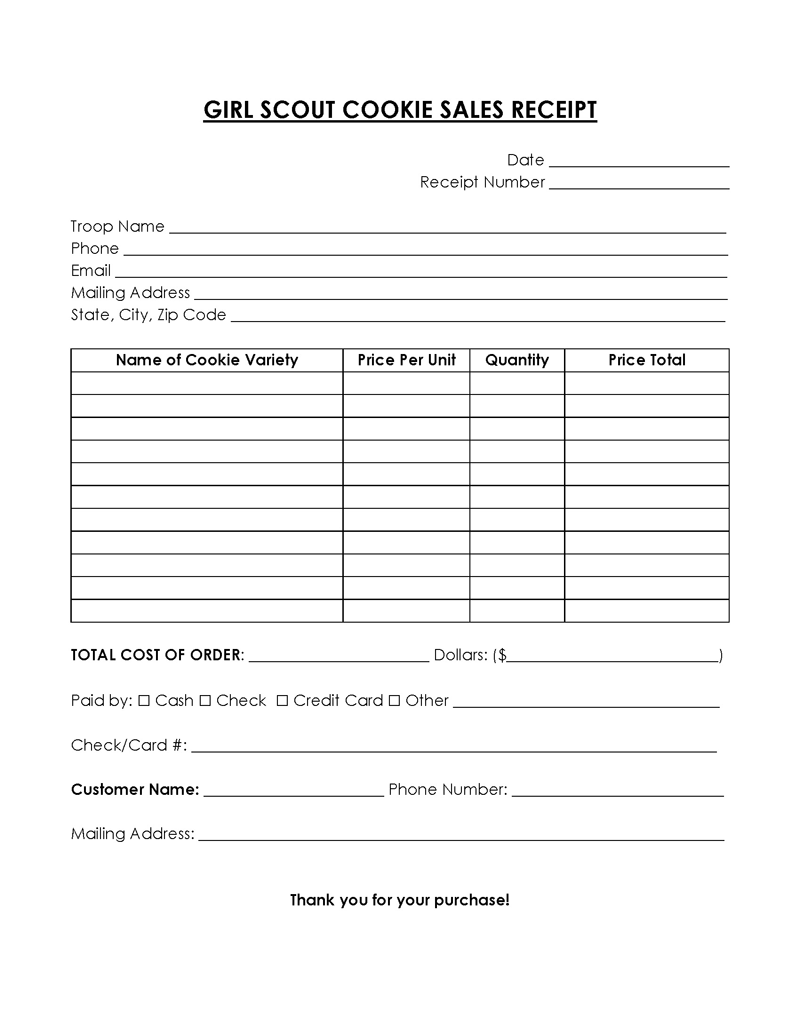

Girl scout cookie

A girl scout cookie sales receipt provides consumers with documentation of their purchase.

Girl scout sales receipts include the following information:

- Name and contact information of the scout group

- Buyer’s name and contact information (optional)

- Description of cookie products sold

- Price per box of cookies

- Total price of the sale

- Date of the transaction

- Method of payment

Girl Scout cookies are not taxed since they are sold at a fair market price, just as charitable giving.

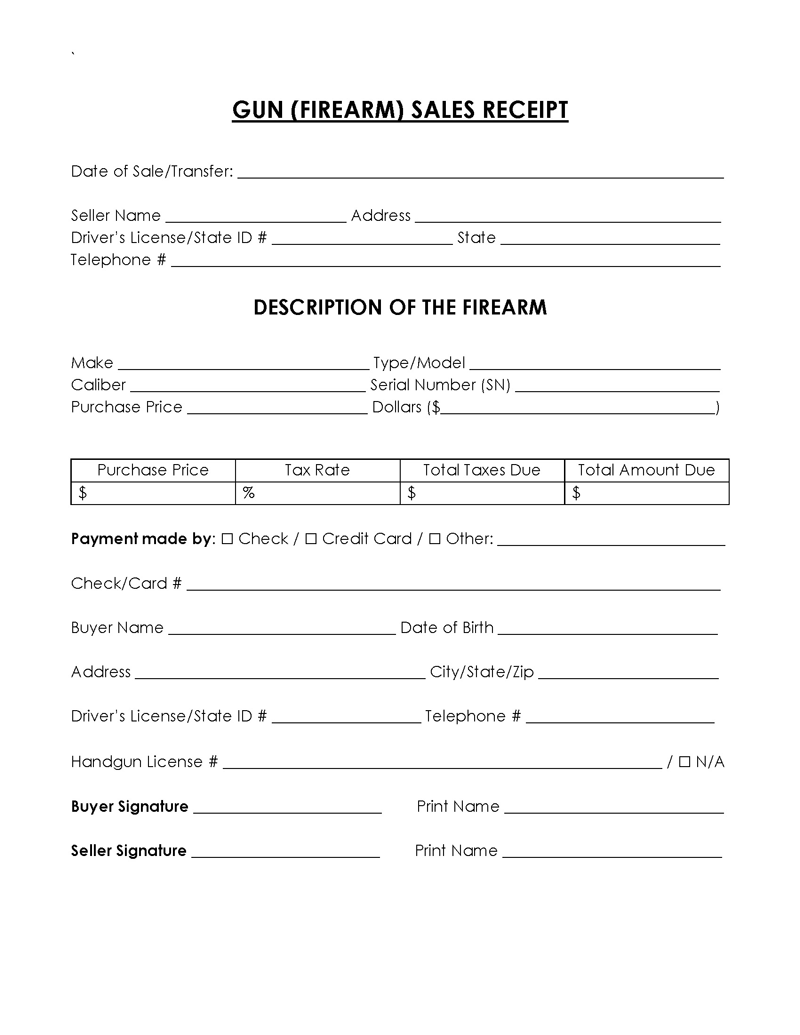

Gun (firearm)

A firearm sales receipt is used by sellers to give buyers proof of a firearm or handgun purchase.

A gun sales receipt generally includes the following information:

- Seller’s name and contact information

- Buyer’s name and contact information

- Make, model, and caliber of the firearm

- Serial number

- Price of the firearm

- Date of the transaction

- Method of payment

- Buyer’s identification (e.g., driver’s license number)

- Warranty information (if applicable)

- Return and refund policy

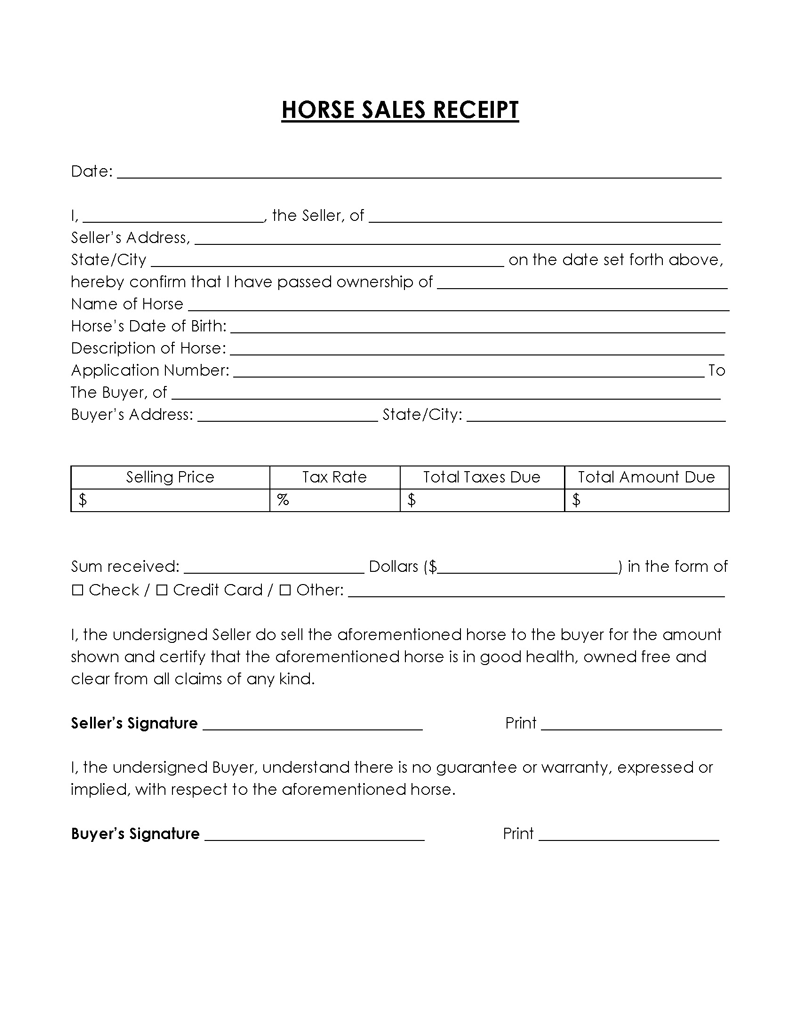

Horse

A horse sales receipt is used by sellers to verify payment to a horse buyer.

The horse sales receipt includes:

- Seller’s name and contact information

- Buyer’s name and contact information

- Name, breed, age, sex, and color of the horse

- Registration or pedigree information (if applicable)

- Price of the horse

- Date of the transaction

- Method of payment

- Health information, including vaccinations and any known health issues

- Warranty information (if applicable)

- Return and refund policy

- Terms of any boarding or training agreement (if applicable)

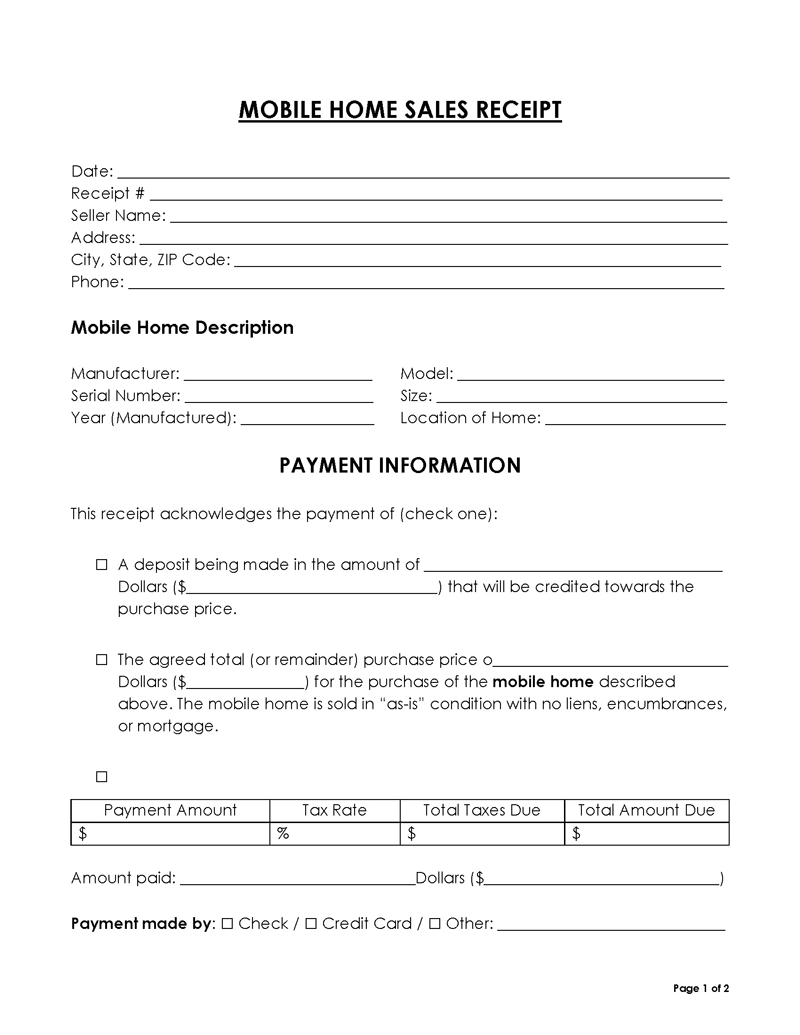

Mobile home

A mobile home sales receipt serves as evidence of full payment or a deposit on a mobile home. If a buyer is only making a deposit, they must pay the entire agreed-upon sum before the seller transfers ownership of the home.

After making a deposit, the buyer can request a professional inspection of the mobile home before finalizing the sale.

After the complete payment, the seller transfers home ownership to the buyer and should register the mobile home with the DMV.

The mobile home sales receipt includes:

- Seller’s name and contact information

- Buyer’s name and contact information

- Description of the mobile home, including make, model, size, and year

- Serial number and vehicle identification number (VIN)

- Location of the mobile home

- Price of the mobile home

- Date of the transaction

- Method of payment

- Warranty information (if applicable)

- Return and refund policy

- Terms of any financing or lease agreement (if applicable)

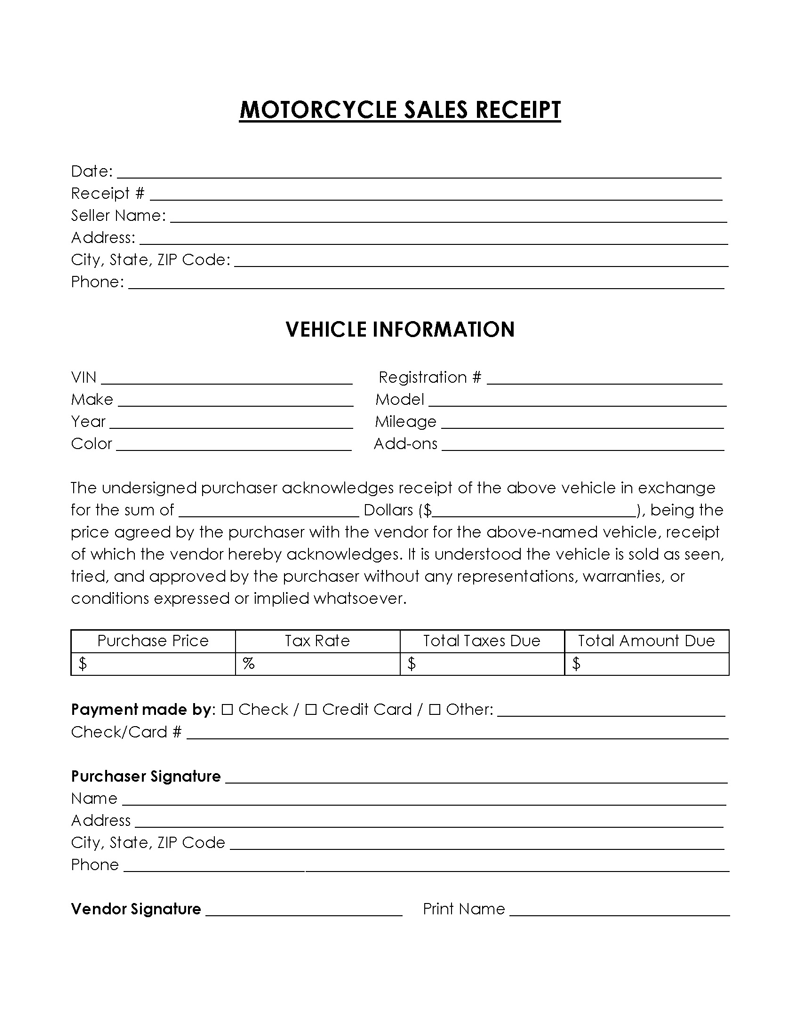

Motorcycle

A motorcycle sales receipt is used by sellers to provide proof of purchase to a consumer.

A motorcycle sales receipt contains information on:

- Seller’s name and contact information

- Buyer’s name and contact information

- Make, model, and year of the motorcycle

- Vehicle identification number (VIN)

- Odometer reading

- Price of the motorcycle

- Date of the transaction

- Method of payment

- Description of any additional items or services included in the sale

- Warranty information (if applicable)

- Return and refund policy

Receipt vs Invoice

Concepts of receipt, invoice and their differences are given below:

Receipt

A receipt is a document issued after a sale to confirm that the payment has been received for the products or services rendered. It serves as proof of purchase and shows that the transaction has been completed.

Receipts should include:

- Information about your company (name, address, contact details)

- Original invoice number (if applicable)

- Payment date

- Amount paid

- Any outstanding balance

- Method of payment

Receipts should be issued whenever a payment is received from a customer, as they provide a record of the completed transaction.

Invoice

An invoice, on the other hand, is generated after the products or services have been delivered but before payment is received. It is an official payment request that also serves as evidence of the sale by your business.

Invoices typically include:

- Information about your company (name, address, contact details)

- Invoice number and date

- Buyer’s information (name, address, contact details)

- A detailed list of products or services provided

- The price for each item or service

- Any applicable taxes or discounts

- Payment terms and due date

- Total amount due

A seller issues an invoice to a customer when it is time for them to pay for the goods or services. The invoice shows the buyer the amount they are supposed to pay and any payment terms agreed upon.

Key Differences

The main difference between a receipt and an invoice is their purpose and the stage of the transaction at which they are issued. A receipt is provided after payment has been made and serves as proof of the completed transaction. In contrast, an invoice is issued before payment is received, acting as an official payment request and evidence of the sale by your business.

Both invoices and receipts are essential business records, as they provide proof of the exchange of goods or services between a buyer and a seller. They should be kept carefully to avoid future problems, such as inaccurate records of transactions for tax purposes.

By maintaining accurate and organized records of invoices and receipts, businesses can ensure smooth financial management and reduce the risk of disputes or misunderstandings.

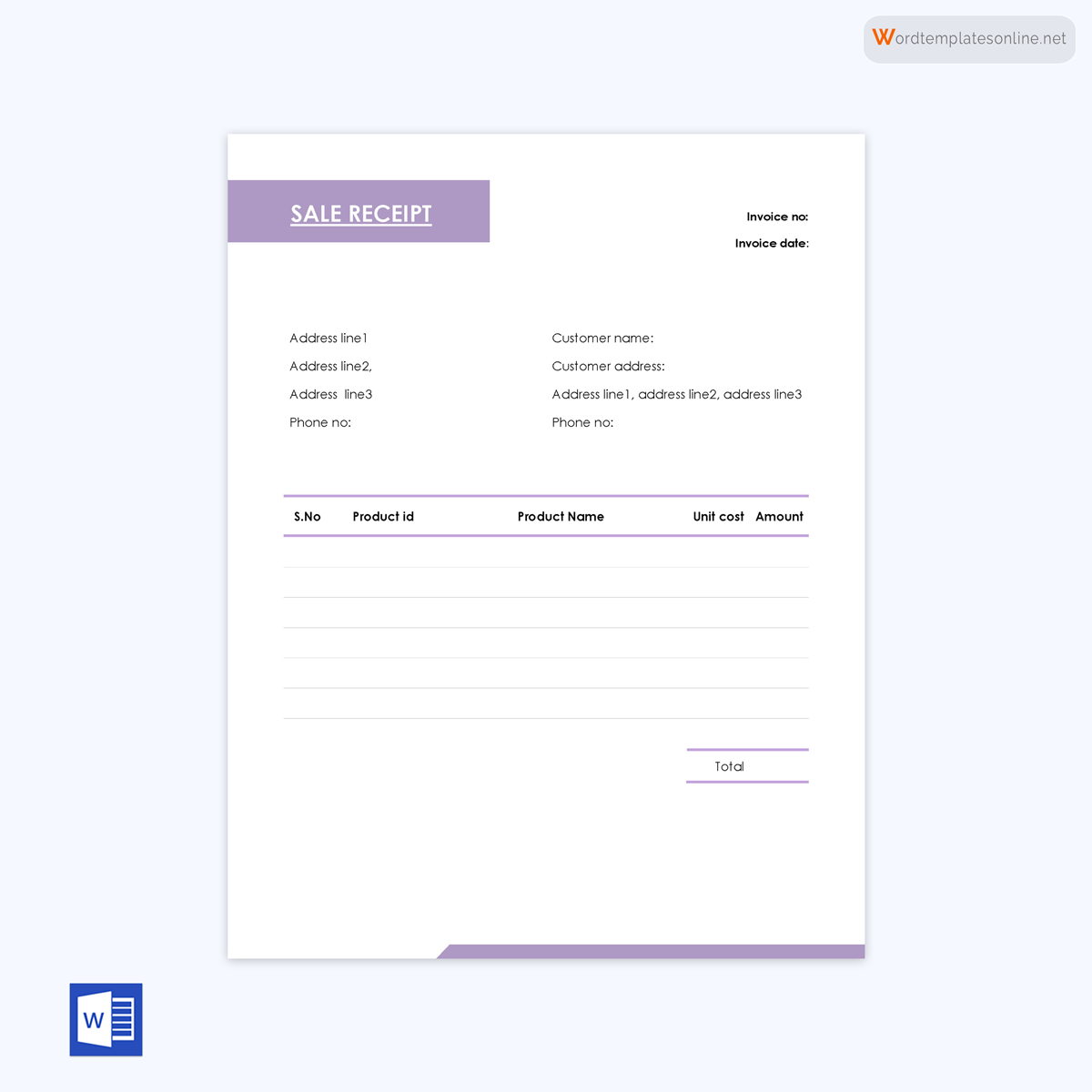

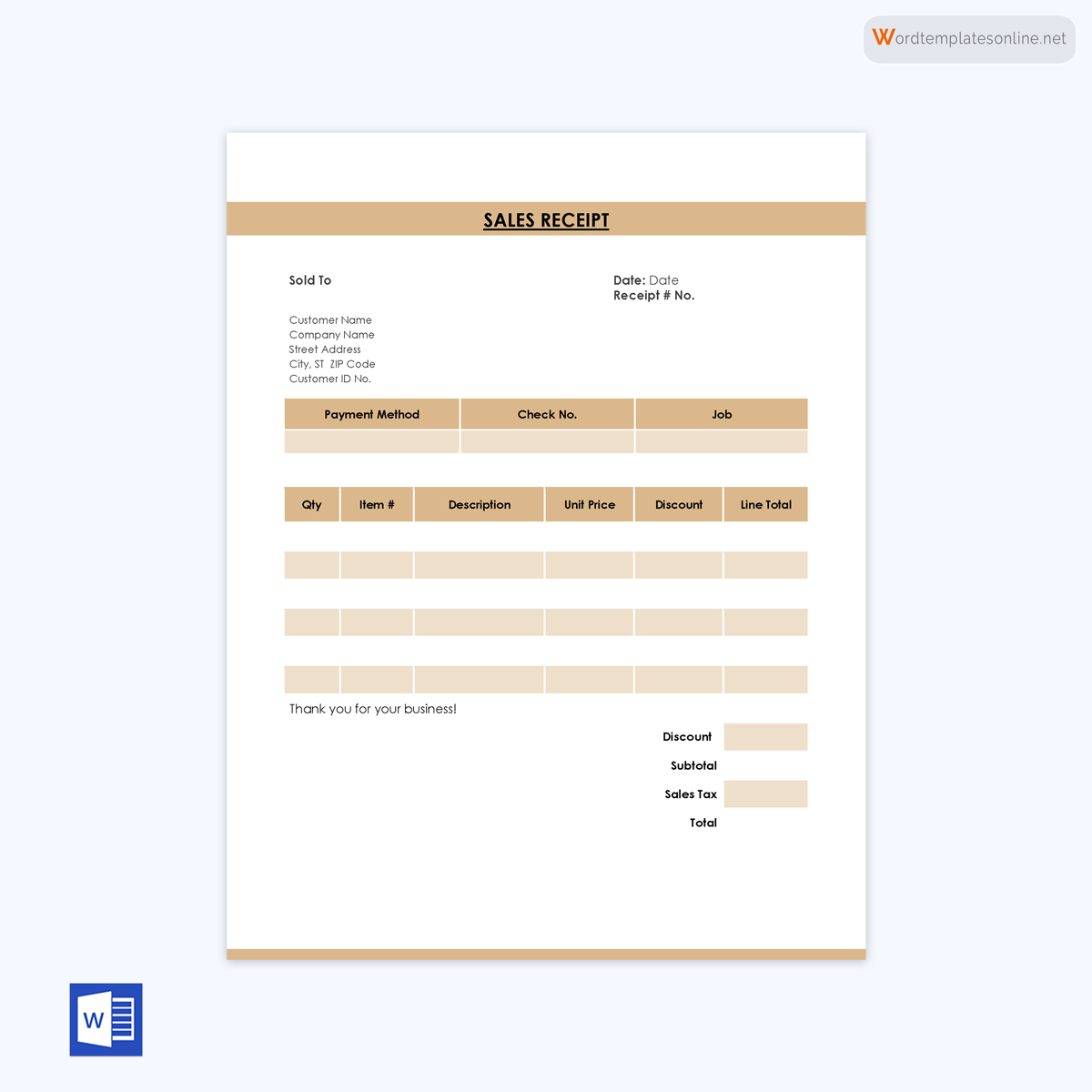

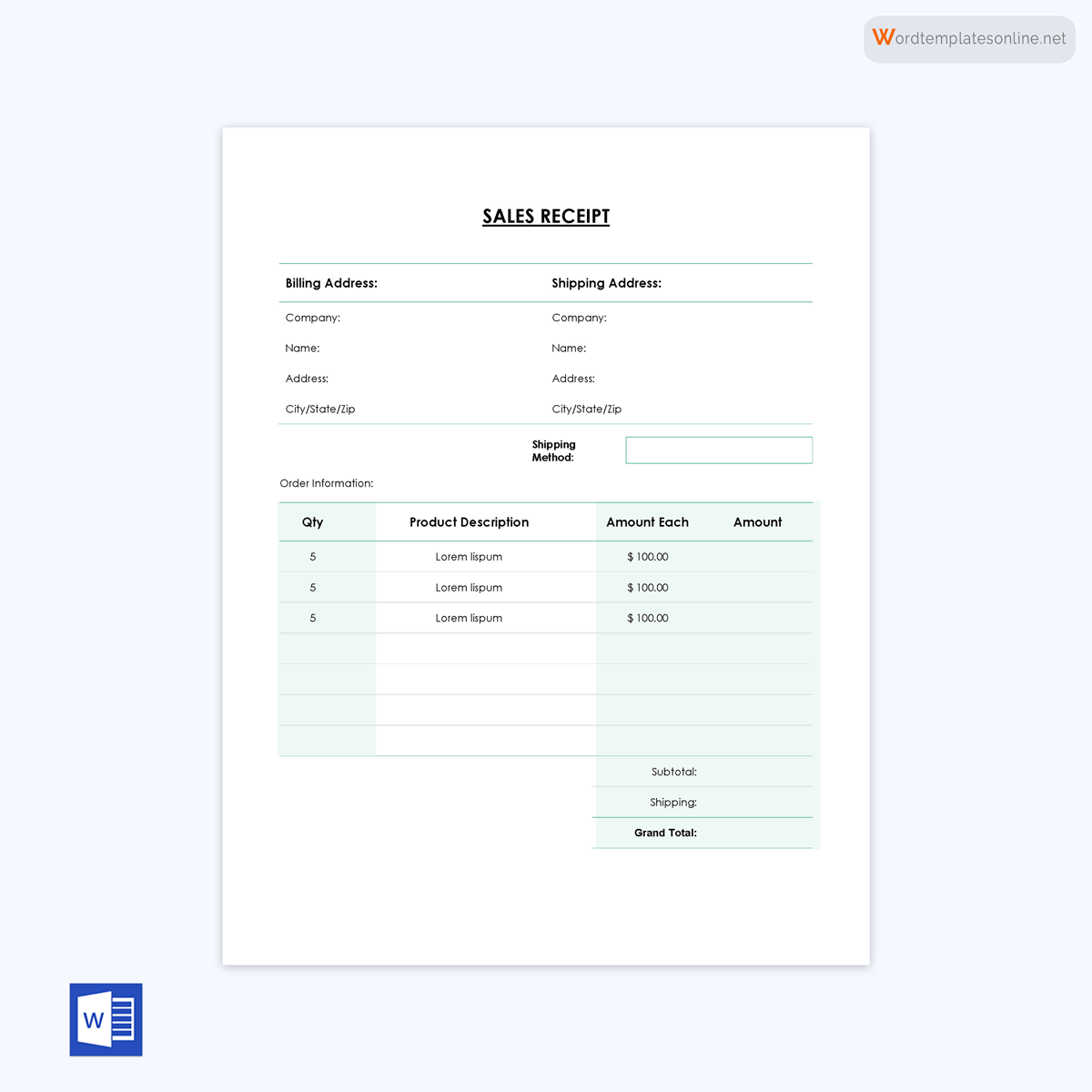

Information to Include in Sales Receipt

A sales receipt documents the details of a transaction, including the purchased item(s), associated costs, and payment information.

The following information should be included in a sales receipt:

1. Receipt Number

A receipt number is a unique identifier used to track a business’s sales. Place the receipt number at the top right corner of the receipt.

EXAMPLE

Receipt Number: _____________

2. Date of Sale

Indicate the date the sale was completed and the payment was made. Write this information below the receipt number.

EXAMPLE

Date: _____________

3. Merchant’s Information

Include the seller’s name, phone number, and address. Write this information below the date.

EXAMPLE

Merchant Name: _________________

Merchant Phone Number: ___________________

Merchant Street Address: ___________________

City, State, ZIP: ___________________

4. Customer’s Information

Include the buyer’s name, company name (if applicable), street address, ZIP code, and phone number.

EXAMPLE

Sold to:

Name: ___________________________

Company Name: ________________________

Street Address: _________________________

City, State, ZIP: _________________________

Phone Number: _________________________

5. List of Items Purchased

Create a table with columns for description, quantity, price per unit, and line total. For each item, list the quantity sold, the price per unit, and the total.

EXAMPLE

| Description | Quantity | Price/unit | Line Total |

| Samsung S20 | 1 | $950 | $950 |

| iPhone 13 Pro | 1 | $995 | $995 |

6. Payment Details

Include a breakdown of the costs and payments, such as subtotal, discount, sales tax, total, amount paid, payment method, and card/check number (if applicable).

EXAMPLE

Subtotal: $1945

Discount: $0

Sales Tax: $0

Total: $1945

Amount Paid: $1950

Payment Method: Cash [ ], Check [ ], Card [ ]

Card/Check Number: ____________________

7. Merchant and Buyer’s Signatures

Finally, both the seller and the buyer should sign the receipt as a formal agreement that a purchase was made.

EXAMPLE

Merchant Signature: _______________

Buyer Signature: _______________

Bottom Line

A sales receipt is significant to a seller in any business. Sellers need sales receipts to help them know what they have sold, how much taxes they should pay, the date and time a sale took place, customers’ information, etc. This information is crucial in case of legal issues, for example, a customer claiming they did not receive any goods they paid for. A seller can avoid this situation by providing a sales receipt as evidence that goods were sold to a particular customer at a specific time.

It is essential to note that a good sales receipt contains every detail of a particular sale. These details include the receipt number, date and time of the sale, the seller and customer’s information, i.e., name, address, and phone number, list of the items sold, quantity, price, and payment details. Without any of the listed details, a seller could encounter problems in the future with customers.