Receipts are part of good financial habits, record keeping, and accounting. They are issued once customers make payments for goods or services offered, marking the end of a transaction. Businesses may struggle to create financial statements without receipts, which are essential in tracking progress and filing tax returns.

In addition, businesses receive receipts when they purchase different consumables, assets, inventory, etc., for operation purposes. Therefore, these receipts can be received from vendors, and suppliers and issued to customers. In addition, business-to-business transactions such as stock market transactions also involve the issuance and receiving of receipts.

A Business Receipt is a financial document issued to customers as proof of payment for goods or services purchased after receiving payments.

These receipts are used to back up business tax deductions when filing tax returns. They are also part of the auditing process to justify tax write-offs.

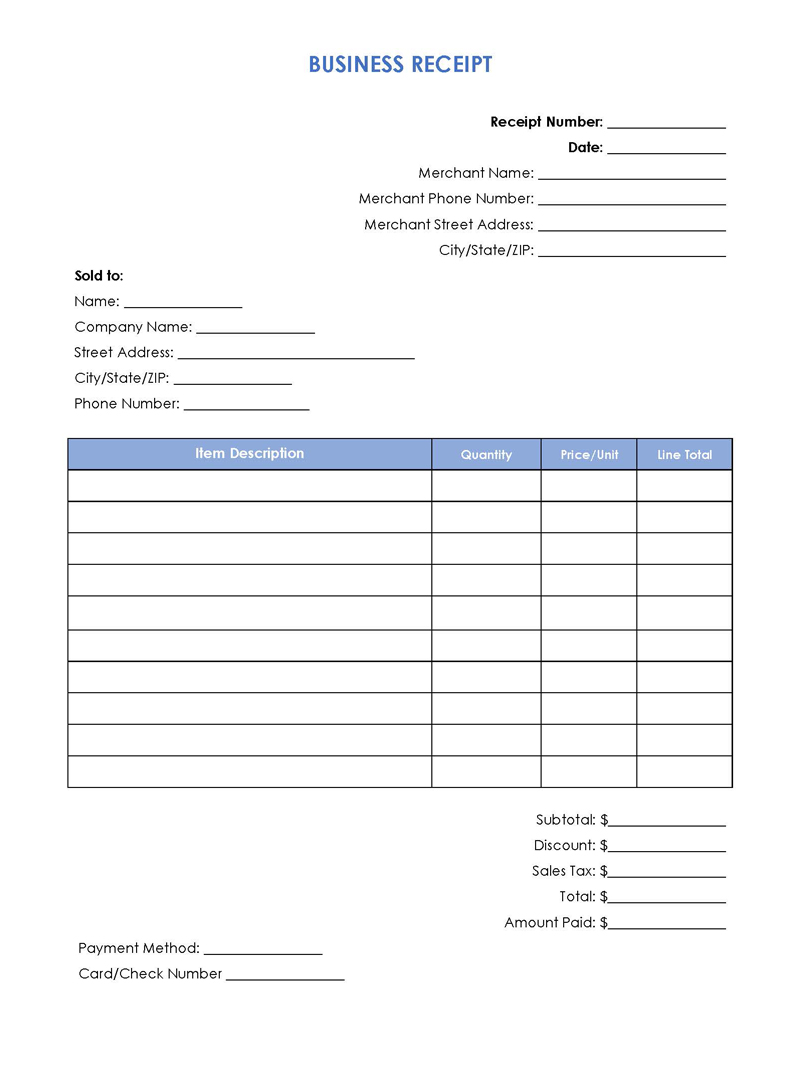

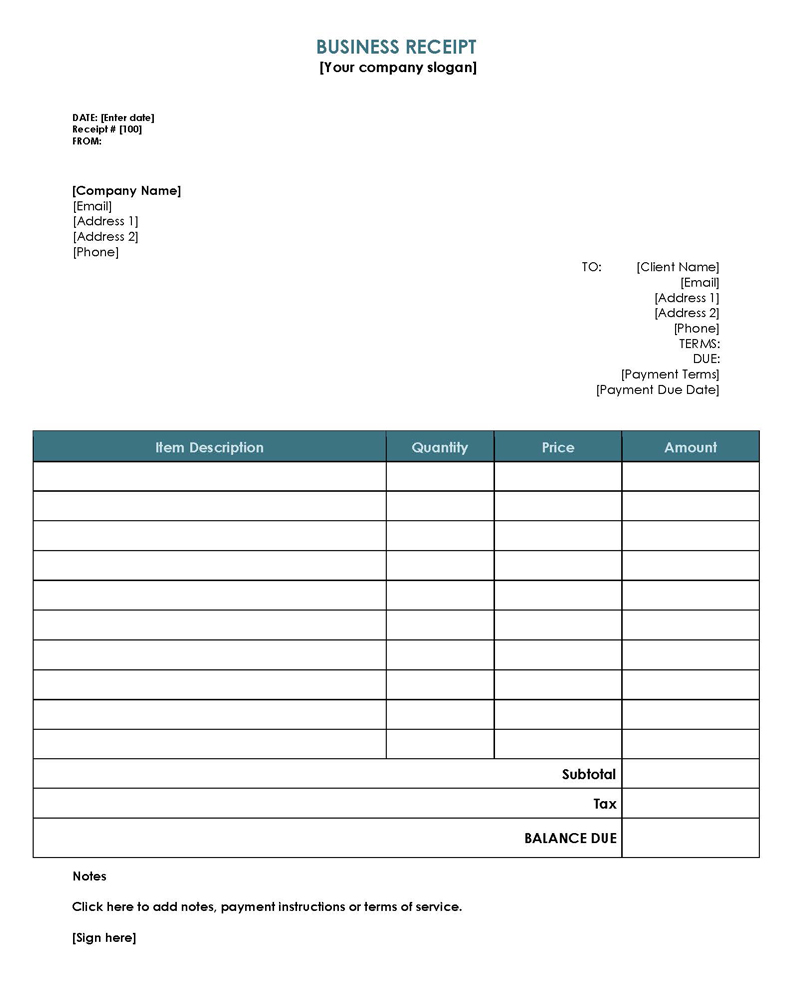

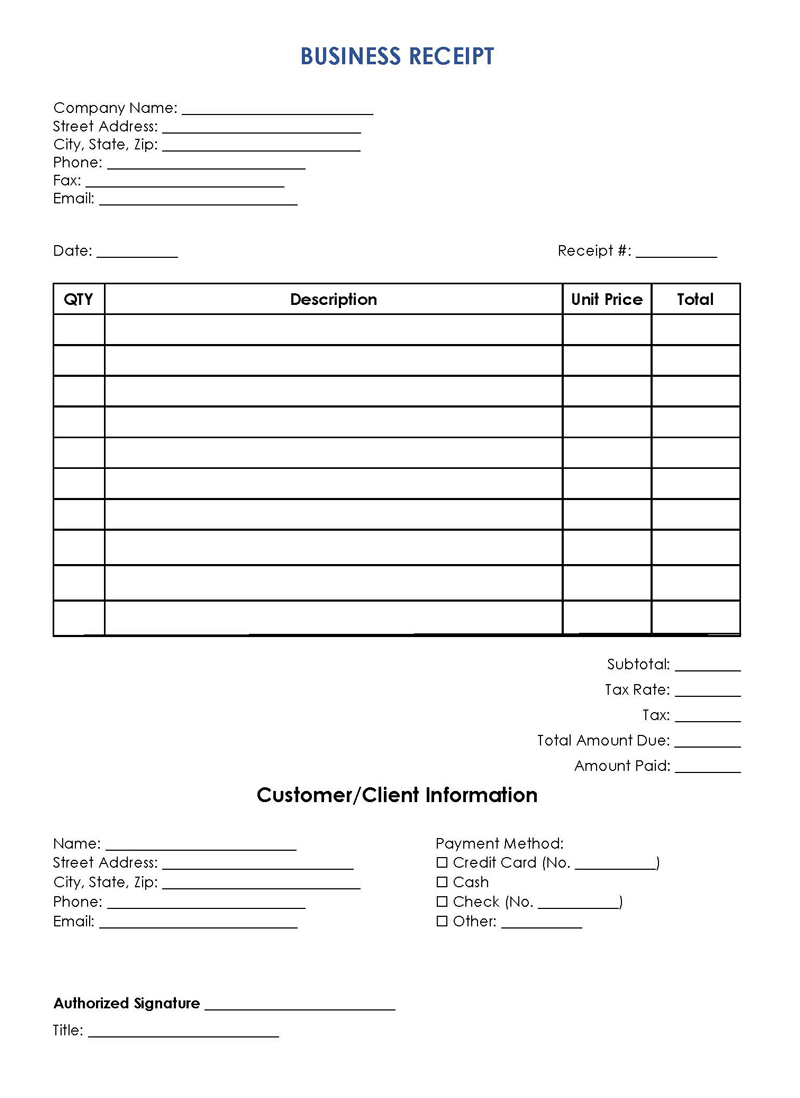

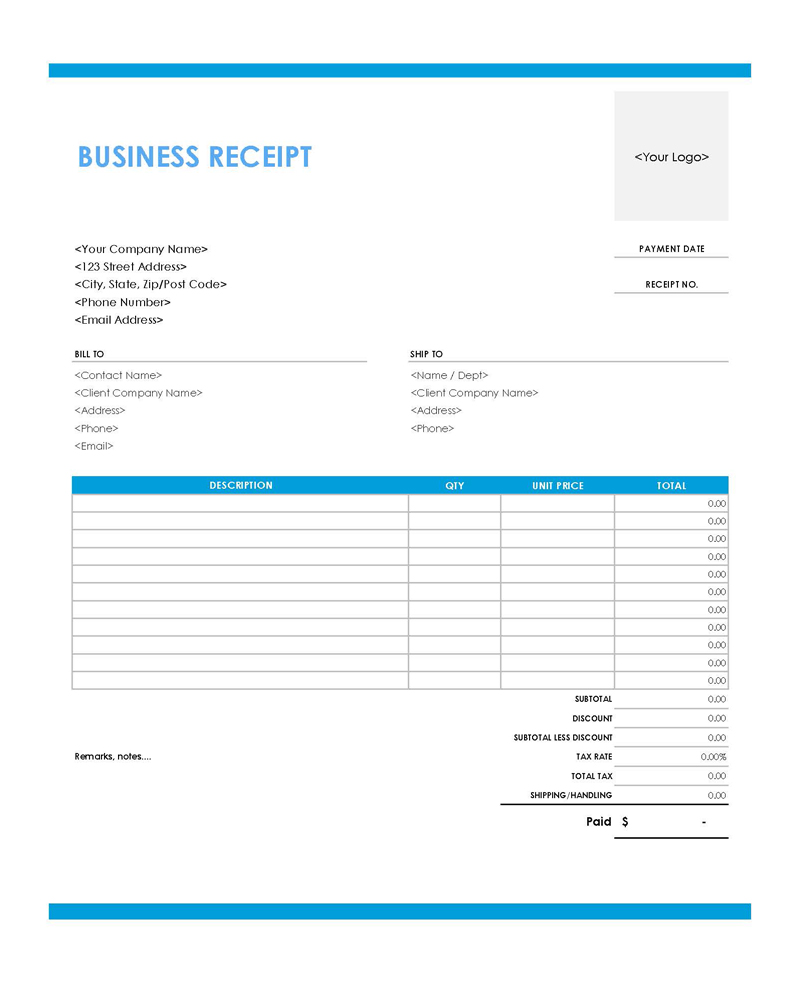

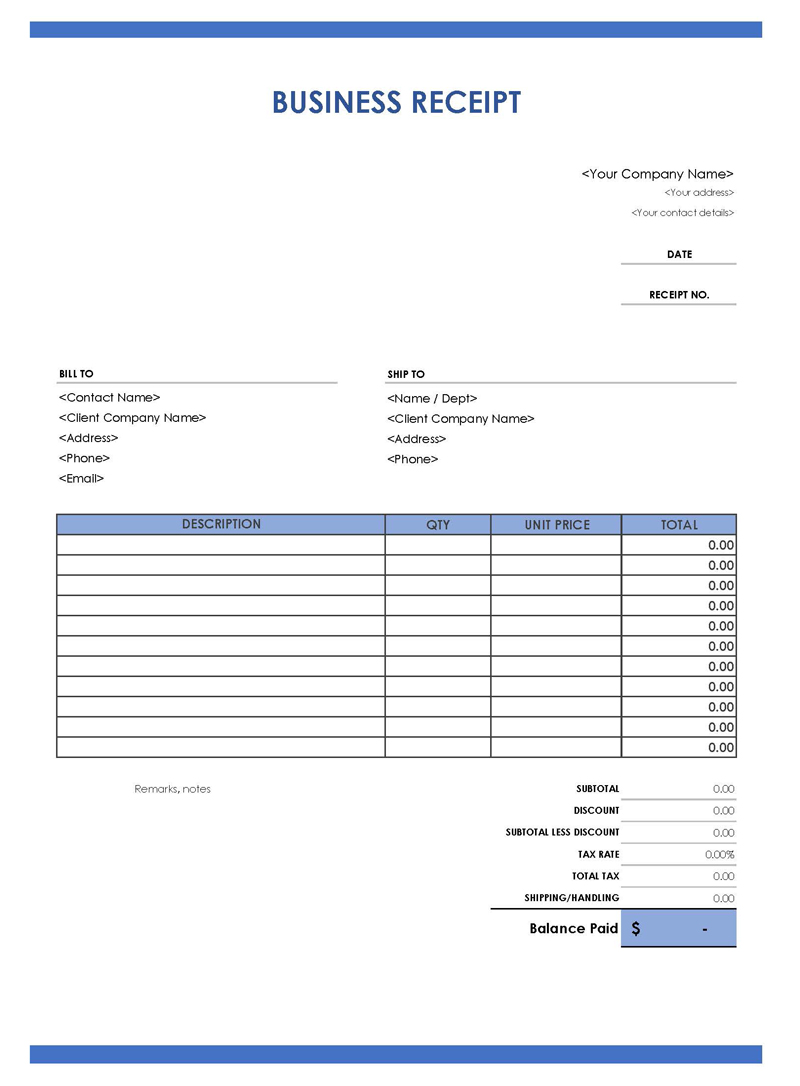

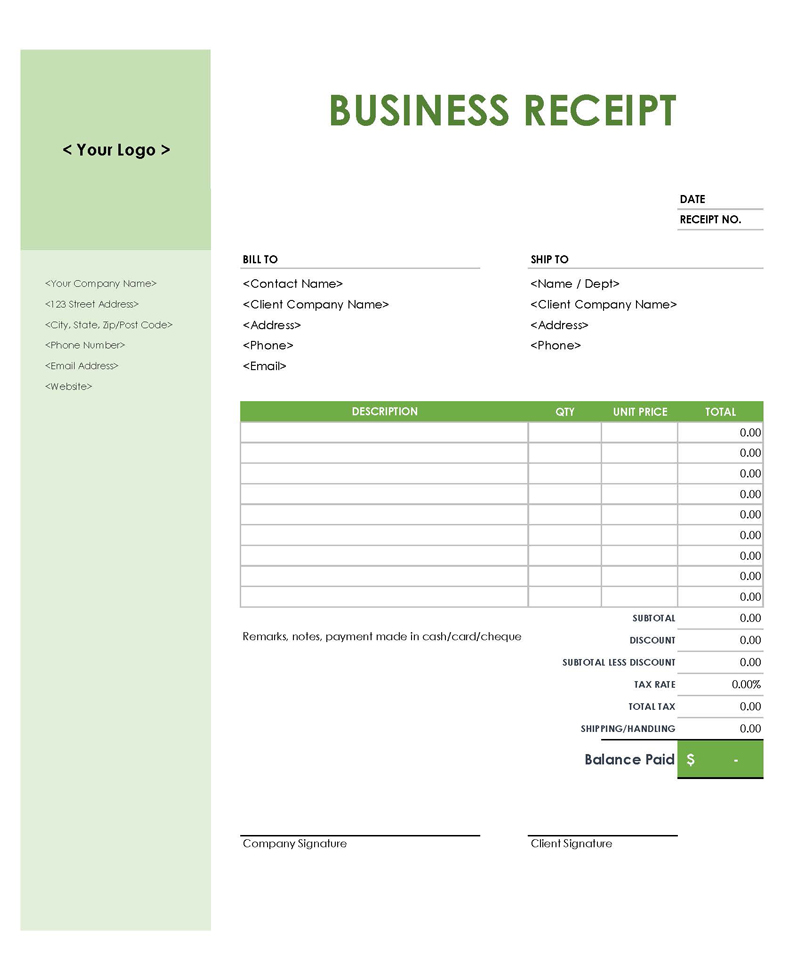

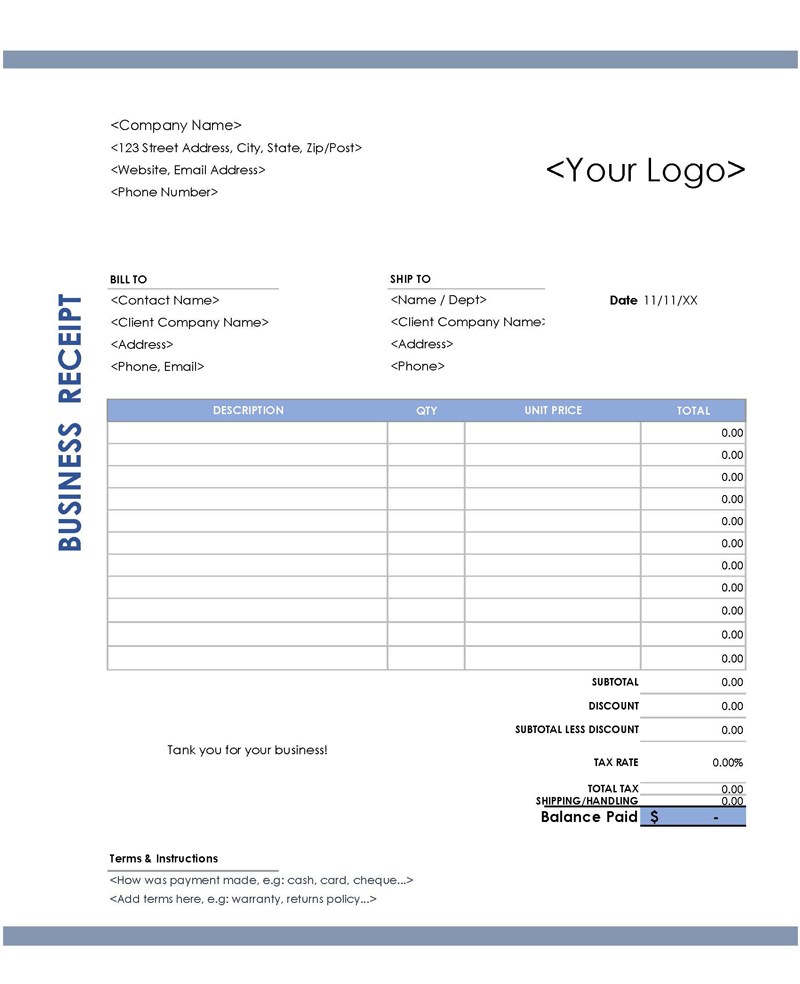

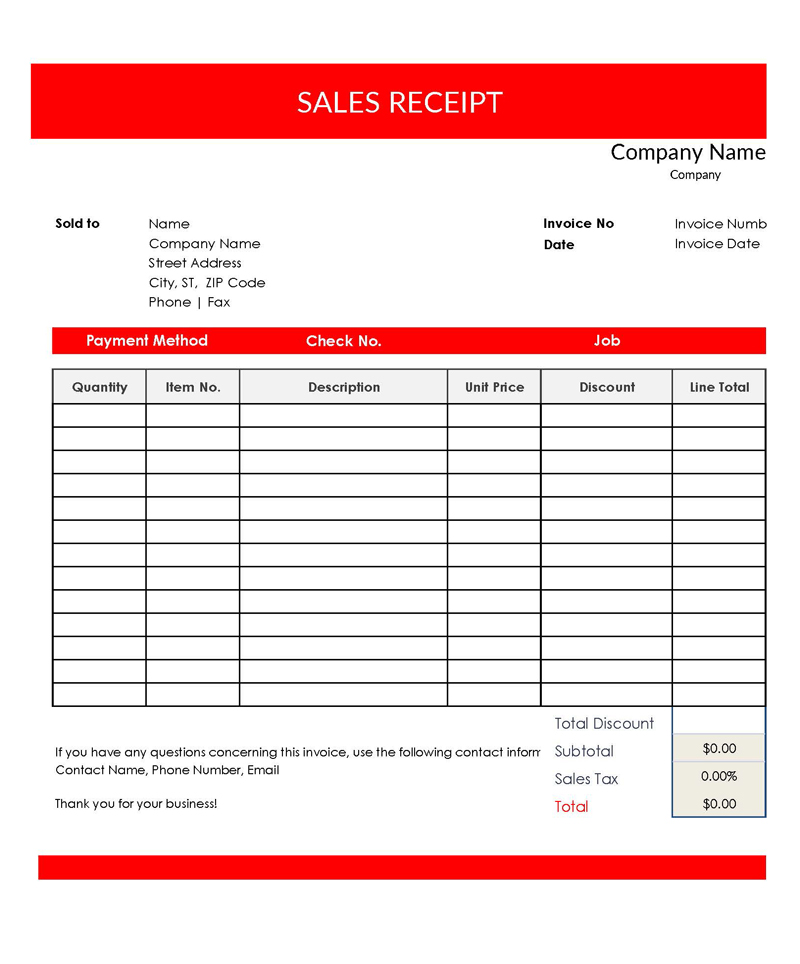

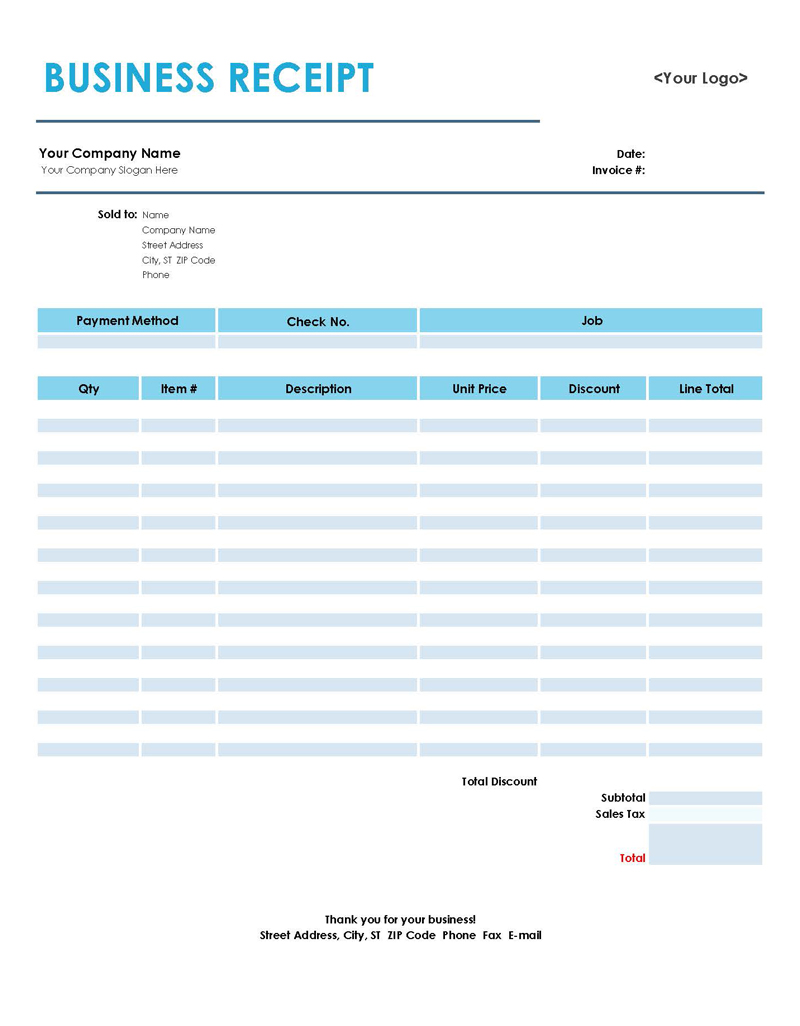

Business Receipt Templates

For How Long Receipt Must be Kept?

Since Receipts for business are used for tax filing purposes, the IRS has specific guidelines for how long a business should safely keep its receipts. All profitable businesses are required to keep their receipts for a minimum of 3 years from the date of filing tax returns. Businesses that reported a loss must keep their receipts for seven years at least. The IRS has outlined different circumstances and how they affect the duration of which receipts should be kept.

Why are Receipts Necessary?

Primarily, business receipts are used for accounting and tax filing purposes. Accounting documents are used to track sales and develop cash flows for a business, which are critical steps in preparing financial documents such as cash flows, balance sheets, financial statements, etc. As tax-filing documentation, receipts are used as backup documentation to support business tax deductions.

The receipts are part of a business’s record-keeping culture essential in various aspects of the business, such as evaluating quarterly and annual sales, making revenue projections, etc.

Receipts are also used to prevent disputes after a transaction. They highlight all the essential information about a transaction. In case of any complaints such as return items, wrong payments, or any other claims by the customer, they can be consulted to provide factual information about what was purchased and how much was paid. In addition, these receipts can be made to include terms, conditions, and return policies to protect the business and its customers further.

Receipts are traceable records of business expenses for a given period and are therefore tools that can be used to prepare informed budgets. For example, receipts from the previous year can show a company’s overall expenses, which form a baseline for predicting the current year’s expenditure.

Business receipts help in tracking a business’s overhead expenses. Overhead expenses are expenses indirectly involved in the company’s operations. They include rent, insurance, depreciation of assets, etc. Through receipts, a business can identify areas taking up overhead expenses and design cost-cutting solutions to foster profitability.

Monitoring staff expenses is crucial in a business. For example, staff members can be prompted to present expenses for office supplies, networking, entertainment, etc. By having formal records of these expenses, staff expenditures can be monitored and controlled.

Which Receipts Should be Kept?

In any business, different receipts are part of record-keeping. Therefore, keeping the proper record is essential in ensuring enough information is stored for tax purposes and decision-making.

The following receipts are some of the essential documents a business should aim to have in its records:

Inventories

Businesses require inventory or raw materials to produce and sell goods or services. Therefore, receipts for any purchases made to produce goods or deliver services should be saved as proof of funds flowing out of business. In the absence of a receipt, an invoice or canceled check for the purchase can be stored.

Assets

Assets are an integral part of a business. Assets cost money that is not directly related to production or service delivery costs. Receipts for purchasing assets such as land, machinery, furniture, etc., must be kept as the associated costs must be considered when filing taxes.

Other expenses

Other operational and management expenses will always be incurred to run a business. For example, cash outflows will typically have to be written off on the business’s taxes, and receipts must be produced as proof of these expenses.

Here are various expenses whose receipts are essential records to a business:

- Car/truck expenses in the business: Vehicles for business transactions will typically come at a cost. These costs are associated with fuel, maintenance, and servicing. Receipts for these purchases/expenses must be saved if they are to be written off on tax returns.

- Entertainment: The IRS has provided businesses with different entertainment tax deductions for business. Entertainment expenses are any entertainment expenses incurred for business-related activities such as meetings with clients, gifts to clients, or any other incentives. Entertainment receipts must be kept as they are usually tax-deductible.

- Advertising expenses: Advertising is a significant component of business operations and usually comes at a cost. Therefore, proof of any associated expenses should be kept for tax return filing. Examples of advertising costs include business cards, ad campaigns, billboards, web hosting, online ads, etc.

- Travel expenses: Traveling is a significant part of the business. Associated expenses include costs of plane tickets, hotel bookings, etc. Receipts for such expenses must be kept as they may be fully or partially tax-deductible.

- Other business services: Businesses will ordinarily have to spend money on support services such as legal counsel, contractors, freelancers, consultants, and such. Therefore, receipts for such expenses should be kept.

- Office supplies expenses: Office supplies such as print paper, ink, paper clips, and pens are essential for the day-to-day operations of a business. However, these items come at a cost. Therefore, receipts for office supplies should be saved as they can be tax-deductible.

- Networking: Networking is essential in a business setting. Networking may come at a cost for activities such as buying tickets to a conference, booking a table in an event, entrance fees, or participant’s fee in a tradeshow. Receipts for such expenses must be kept.

- Education expenses: Occasionally, a business might spend money retraining its staff or furthering the education of critical employees. Receipts for such educational expenses should be kept as they qualify as tax write-offs.

How to Write a Business Receipt?

These receipts will differ from one business or transaction to another. Some businesses will have a standard format for their transactions. However, the specifics of the receipt will generally be specific to the transaction in question.

Below is a guide on how to write a standard receipt incorporating all the essential components:

Write company details

Firstly, details about the company (seller) must be provided as the issuing party (who received the payment). This section outlines the company name, street address, location (city, state, and ZIP code), and contact information (phone number, fax, and email address).

Mention the date of receiving payment

Afterward, write the date when the payment was received. The payment date must be a matter of record to prevent any claims of payments from being made. The date must clearly show the day, month, and year.

Note the receipt number

Following the date of payment should be the receipt number. Each business awards a unique number to every one of its receipts as a means for tracking documentation and organizing records.

Describe the thing which was ordered

After writing down the receipt number, details about the purchase should be provided. This description includes a breakdown of all products or services purchased. In addition, details about the quantity, unit price, total purchase price, and a precise description of the product/services must be provided.

Write subtotal as well

Next, indicate the subtotal money that the customer owed as a result of the purchase. A breakdown of this amount should be given, indicating applicable discounts and taxes. The amount should be given in figures showing the monetary units used.

Note the paid amount

The receipt must then show the total amount of payment received from the customer. The amount can be a partial or complete payment of the money due. The amount received should be given in figures and assigned the appropriate monetary units (dollars, euros, etc.).

Specify remaining amount

In case the payment was partial, the receipt must declare it and indicate the remaining balance. This will be the subtotal amount less the amount paid. The balance should also be given in figures and the correct monetary units.

Write client information

The next item that should be noted down on the receipt is the customer information. A receipt needs to show who made the purchase and payment. Information such as the customer’s name, street address, city, state, and zip, as well as contact information like a phone number or email address, should be given.

Mention payment method

The subsequent section should outline the payment method used by the customer. Typically, invoices will offer customers different payment methods to choose from. These methods must also be declared in a receipt, and the method used must be indicated.

Signatures of both

Lastly, the receipt should be signed. The receipt can be signed by both parties or the authorized company representative. Simple transactions will often require the representative’s signature only, while most business-to-business receipts will have the signatures of both parties. The title of the signing party must also be stated. Once signed, the receipt can be given to the customer, and the seller can keep a copy of the same.

How Do You Store the Receipts?

To ensure receipts are correctly stored, businesses can constantly develop a system that effectively serves their record-keeping requirements. Proper receipt management reduces the workload at the end of the year when filing taxes.

The different ways businesses are known to store their receipts include:

Store them online

Virtually storing receipts is a proven effective method of saving business receipts. Physical receipts can be a lot to work with and are likely to get lost in the records or get damaged over time. Virtual storage reduces the probability of these two events occurring. Digital receipts are equally as viable as physical receipts. They can be stored in a computer folder and uploaded to the cloud to be retrieved anytime.

Physical receipts can be converted to virtual receipts by simply taking a photo of the receipts and saving it to the cloud folder or sending it to the computer and saving it to the appropriate folder. Physical receipts can also be scanned for this process.

Other alternatives for virtually storing receipts are the use of accounting applications and software.

Categorization helps

Receipts can be stored based on their nature to increase the efficiency of a receipt management system. Different folders representing different categories of expenses can be opened, for example, folders for assets, inventory, travel expenses, advertising, etc. These folders make it easier to locate receipts for different expenses within a business.

Keep in chronological order

The receipts of buisness can also be arranged in chronological order to simplify tracking in the future. Different chronological orders can be used. For example, receipts can be arranged based on months and then years or simply by dates. Dates must be used in ascending order, from the most recent date to the oldest.

Always backup

Always have backups for all receipts. The backup for physical receipts is digital receipts, and digital receipts can be backed up in a cloud storage system. Cloud guarantees that receipts are always safe and can be accessed from anywhere at any time. Dropbox and Google Drive are two (2) popular cloud storage applications that businesses can use.

Frequently Asked Questions

Smart receipts are equally as effective and viable as physical receipts. They are better to use because they are not prone to wear and tear and are easy to store, unlike physical receipts, which take up a lot of space and time to record and reference. In addition, smart receipts outline the same essential information about a transaction and, therefore, reliable records of business transactions.

Businesses should keep any receipts that help them prepare financial statements, track business expenditures, identify revenue sources, track deductible expenses, prepare tax returns and support any financial and operational decisions of the business. Examples of receipts that should be stored are receipts inventory, raw materials, office supplies, advertising, assets, consultations, contractors, travel expenses, and any others.