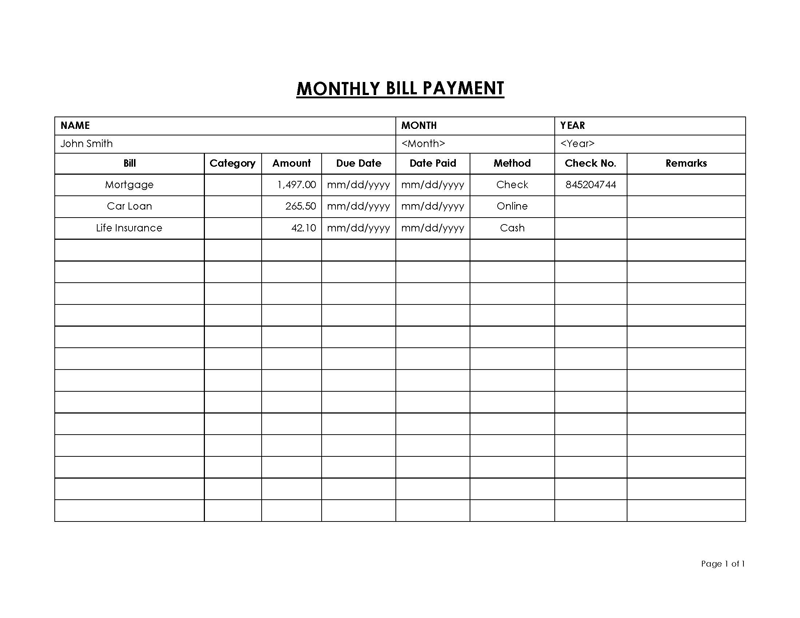

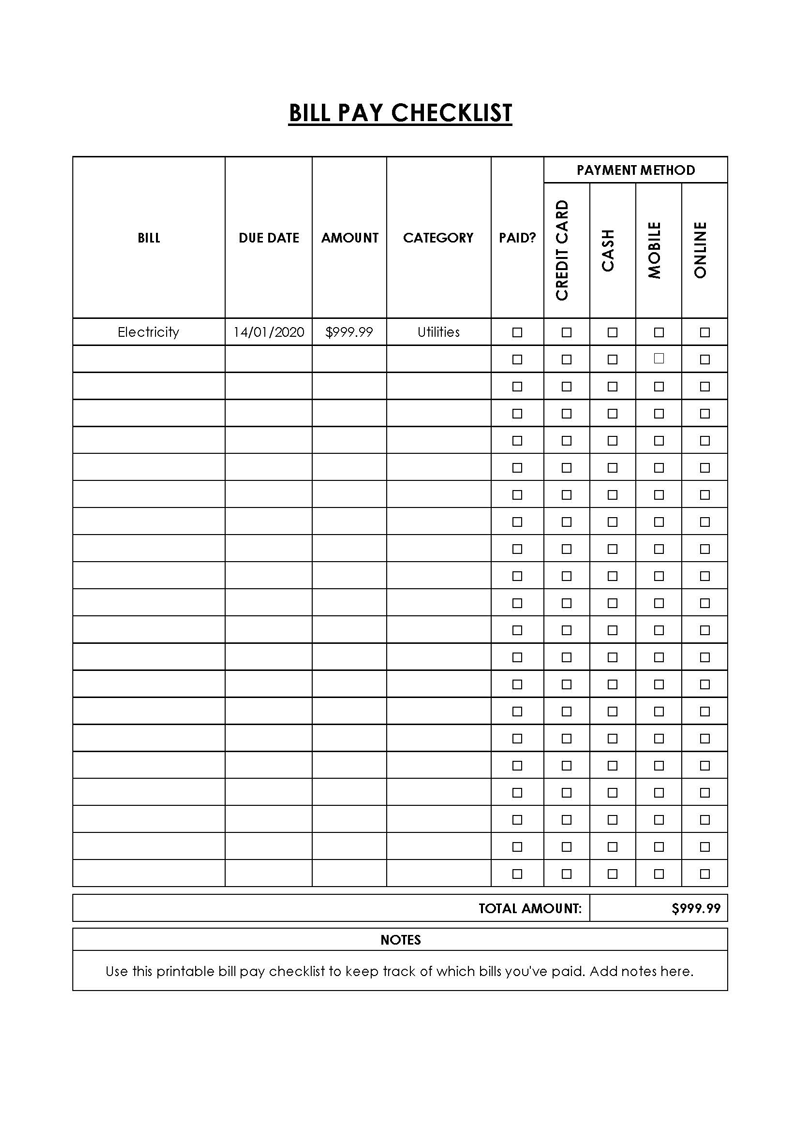

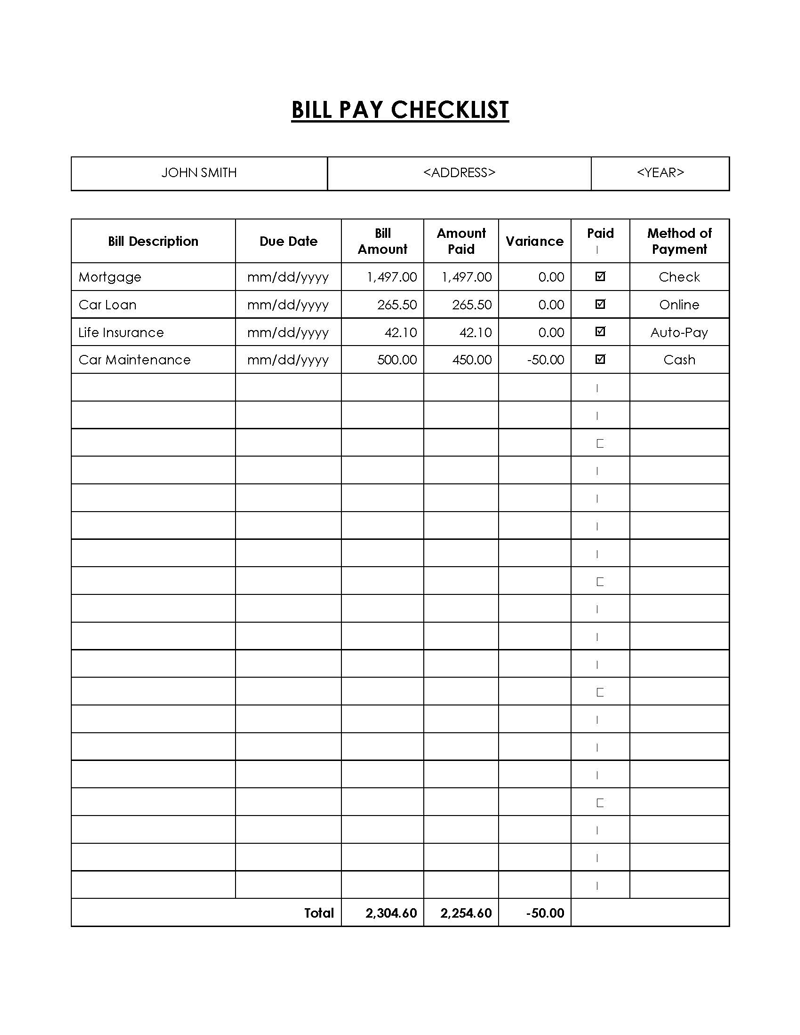

A bill pay checklist or a bill calendar is a planning sheet that helps you keep track of recurring bills such as utility, credit card, mortgage, insurance, and car payments.

A good financing strategy that ensures you do not miss any payment deadlines is to plan to settle bills on time. While most people are aware that a bill is simply a lump sum of money owed for goods or services, the problem arises when keeping track of payments that are due at different times of the month. The use of a checklist is helpful to keep track of all bill payments and stay organized.

You can use a monthly bill checklist template to carry out this purpose. The document highlights the different kinds of checklists for various types of bills and expenses. It assures you by explicitly indicating when any payment is due and when any bill payments should not be delayed.

This article explains why this type of planning document is so important, how it works, and what its components are. It also provides free templates that you can use multiple times.

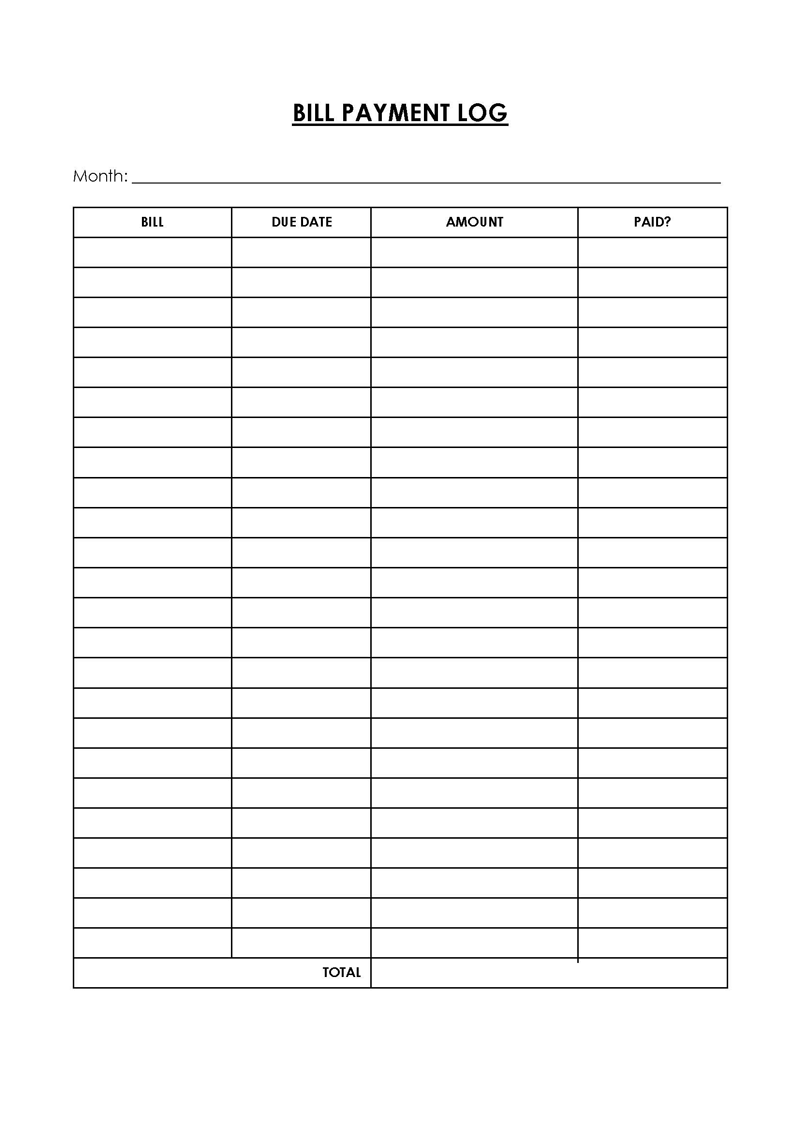

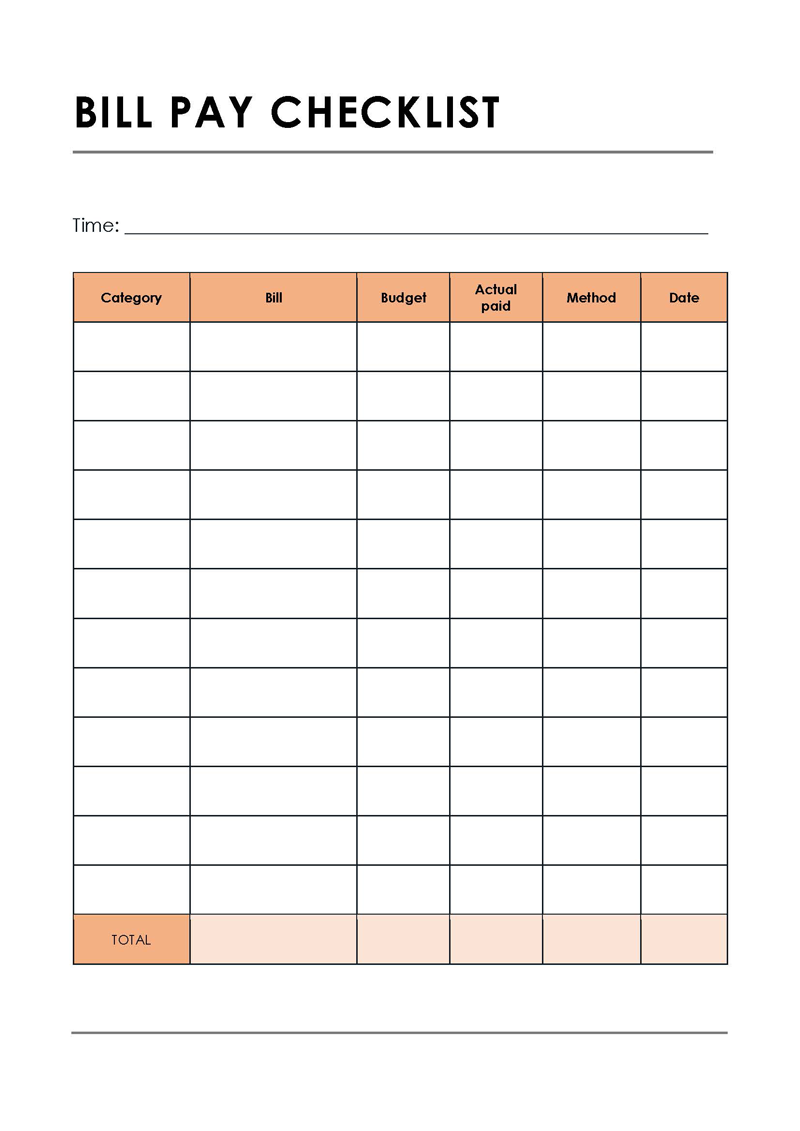

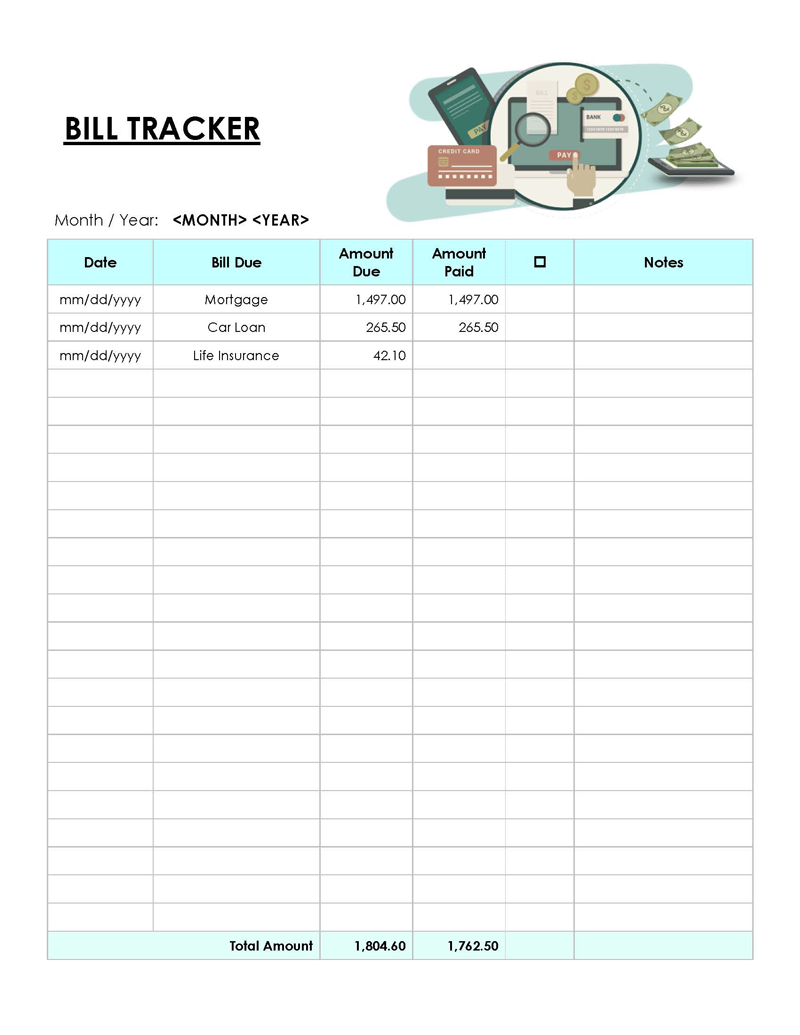

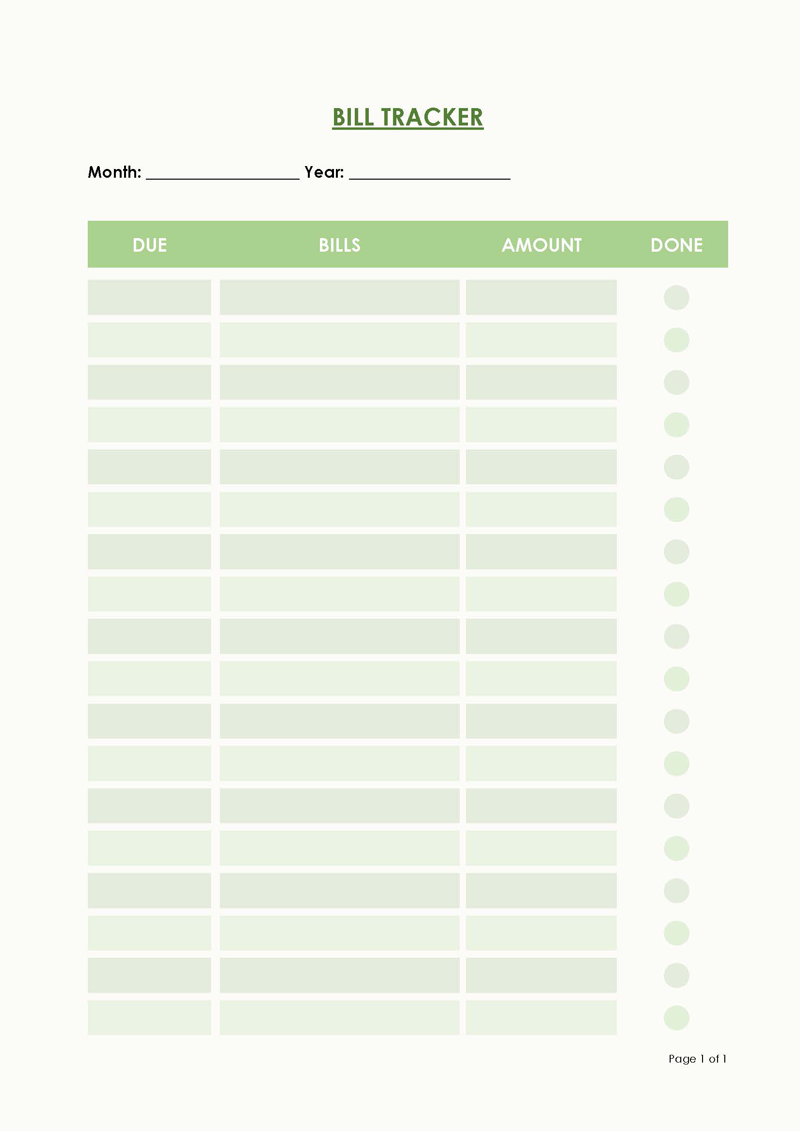

Free Templates

The Purpose of a Monthly Bill Pay Checklist

The primary purpose of a monthly checklist or bill calendar is to track your must-do expenses. It allows you to record each expense and cost for a given period. Some of the expenses covered in a bill pay checklist are rent, gas, car insurance, food, groceries, utility bills, childcare, pet food and care, clothing, etc.

Typically, the document tracks all recurring bills. After recording the expenses in the checklist, you can go ahead and calculate how much you are required to set aside for each financial period. This document can be used as a practical tool to plan how to meet all of your financial obligations and make sure you do not miss any payment.

With proper budgeting and a bill calendar, you can also develop saving habits. Furthermore, writing down your bills in a checklist is more reliable than memorizing that information. Finally, this document can also be used for tax purposes.

The Process: 7 Simple Steps

To understand how a monthly bill checklist works, you need to know how to create one. Below is a comprehensive guide to the steps involved in creating a checklist:

Step 1: Determine your income

Firstly, you should establish how much income you have to cover your monthly expenses. This will typically be the money you make in a month, less any applicable deductions such as tax deductions, etc., for that month. You should also remember that you are not allowed to include any money that you get from other sources, like gifts or inheritance, during the month.

Step 2: Compile a list of all of your monthly expenses

The next thing you need to do is make a list of every expense you will have for that month. These expenses can include utility bills, phone and internet bills, expenses for clothing and toiletries, housekeeper wages, car loan payments, mortgage payments, credit card payments; and other recurring obligations. In addition, you can make a note of any other significant monthly bills like insurance premiums, subscriptions such as gym membership fees, and childcare costs if applicable.

Some of these expenses will be fixed, while others can vary from one month to the next. It is important to categorize them on that basis. Reviewing your previous monthly expenditures is an effective way of determining your expenses.

Step 3: Consider your cash flow

Following the cash flow, you should concentrate on understanding your income, such as how frequently you receive paychecks. You could be generating income on a weekly, biweekly, monthly, or irregular basis. This aspect of your income influences how you plan to cover your expenses to a great extent. For example, if you receive your salary every two weeks, you need to plan how these paychecks will seamlessly cover the entire month’s expenses. Prioritize by paying the most important bills first, or split the bills in half so that the first check covers one-half of the expenses and the second check covers the other half.

Also, you determine how your income compares to your expenses by subtracting the total sum of your expenses from your income. If your income exceeds your expenses, you can focus on ensuring this remains the case as you try to save some money or invest. If your expenses are higher than your income, it may be time to try some cost-saving measures, such as cutting back on luxuries like dining out.

Step 4: Prioritize your bills

Now that you have made a list of all the expenses you have, it is time to prioritize them. There are varying degrees of importance for each of your bills. For instance, one of the necessary costs in any home or business establishment is utilities. They are considered a necessity. As a result, you should give these bills the highest priority on your monthly bill pay checklist or bill calendar to lessen the financial burden on other activities like saving and investing.

The most effective way to prioritize bills in a checklist is to classify them as needs and wants. Needs are the expenses that cannot be avoided, such as mortgage payments, health insurance fees, utility bills, garbage collection payments, etc. Wants are expenses that can be avoided, such as dining out, travel expenses, cable or streaming subscriptions, jewelry, and so on. You can decide to adopt a 50/30/20 budget – 50% needs, 30% wants, and 20% savings.

Step 5: Schedule your bills

The next step in using a bill calendar is scheduling when to pay your bills. The schedule will be based on when you get paid and when each bill is due. You can start by listing the bills in order of pay dates, and then group them into sets of similar dates. If you discover that your bill due dates do not align with your paycheck dates, contact the associated organizations and request an adjustment to your due dates. Attempt to schedule everything so that the bills are all due on the same day.

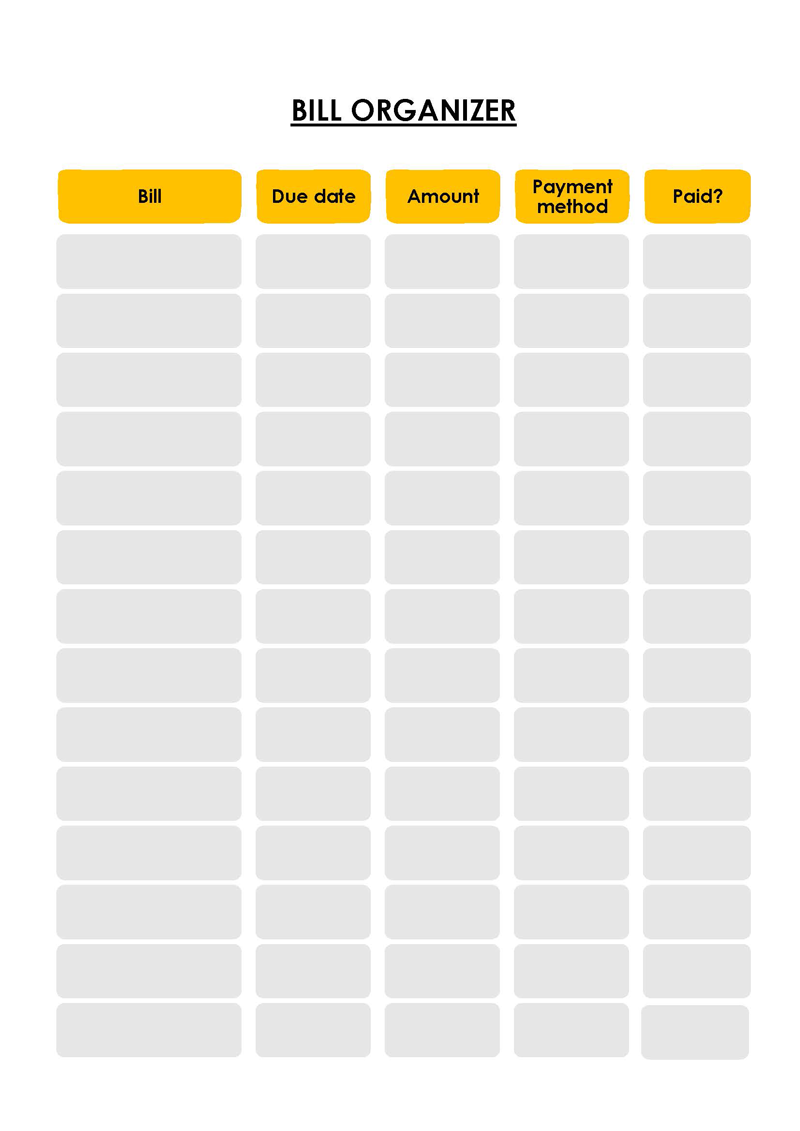

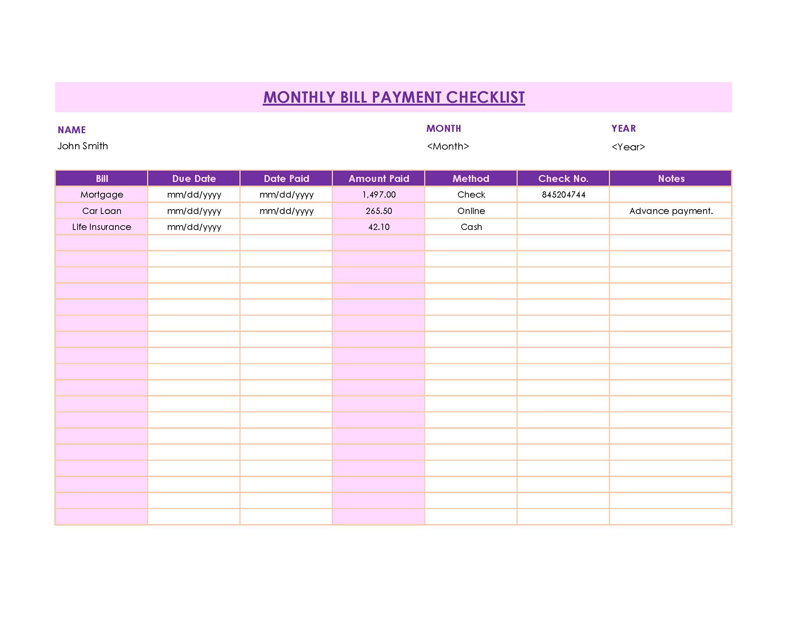

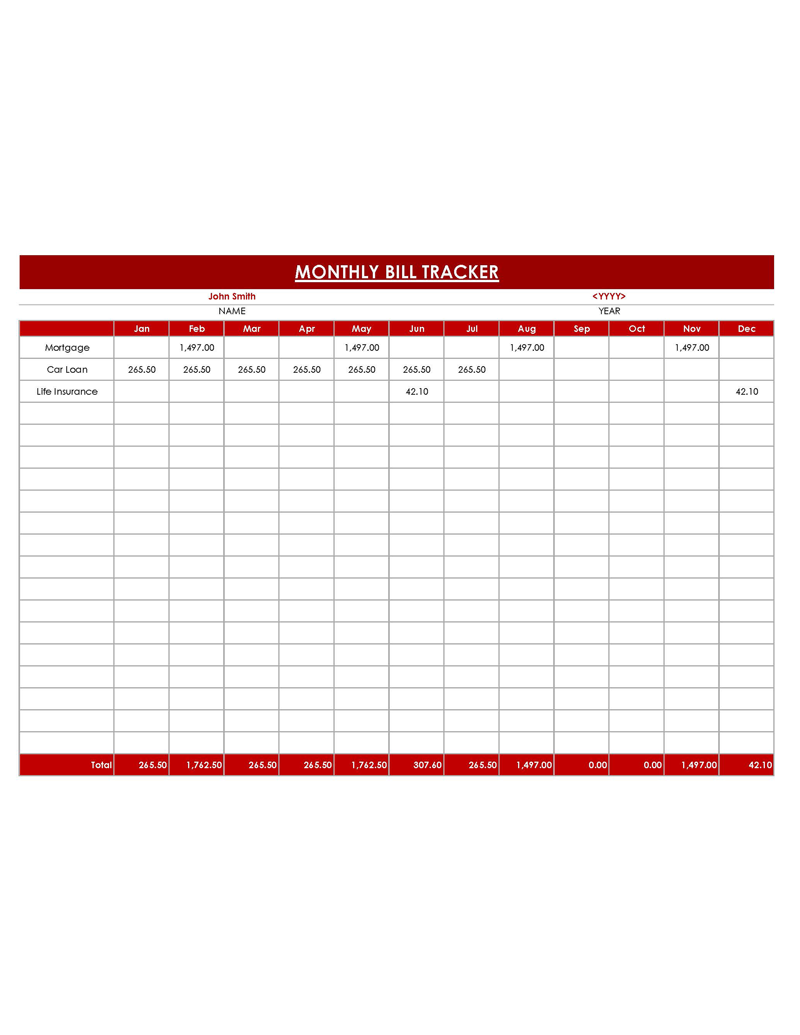

Step 6: Create a monthly bill pay checklist or use a template

Once you have all the pertinent information you need and a plan to settle your monthly bills, you can create a checklist or calendar template. The monthly bill calendar can be created using a spreadsheet or a pre-made template that just needs to be filled out with the necessary data.

Step 7: Track your budget

Lastly, you can utilize your monthly bill pay template to track your expenses. You can use a physical template where you record your bill manually or an online checklist where you can track your bills digitally. Always include your daily expenses on the bill-pay checklist since they account for the majority of your monthly costs.

Items to Include

Creating a monthly bill pay checklist can be difficult and time-consuming. Therefore, the use of templates is highly recommended to save time and effort.

The following components should be included in a template:

Expenses

There should be a section in the template where you can list every expense you make in a month. Monthly expenses will vary from one person to the next. However, expenses can be broadly categorized into the following:

- Fixed expenses Fixed expenses are essential expenses that will not change in the future. Fixed expenses include rent payments, mortgage payments, health insurance, gym memberships, subscriptions, and car insurance. In essence, you can anticipate fixed costs.

- Variable expenses: Variable expenses are those that change regularly. These include grocery and store expenses, clothing expenses, and car repairs. As a result, the percentage of these costs varies according to how frequently they are purchased.

Savings

A monthly bill template should also have a section to track savings. You need to know how much you can save before you can accurately determine your financial health. Retirement funds, emergency funds, and other types of savings, like savings for vacations, can all be categorized as savings.

Debt repayment

You can include a section on your checklist that details how much cash you will be setting aside each month for debt repayment. This can include payment of student loans, credit card payments, additional mortgage repayments, etc.

Monthly net income

The checklist should have a section to record your monthly net income. Net income is calculated by deducting your expenses from your gross employment income. The net income will help you determine how much money you have for savings or investments.

You can download free printable monthly bill templates or checklist or bill calendars that you can customize based on your specific financial situation. However, you will have to fill in the individual fields on this document before using it. Once you have downloaded the template, simply open it in your word-processing program and start entering your information.

There are different ways to create a checklist. This is because there are plenty of tools available for you to use for this process. The use of a spreadsheet is one of the methods that has been around for the longest time. It simply involves creating a spreadsheet, labeling the rows and columns as the appropriate categories of a checklist, and inputting the necessary information required to track your expenses. You can also download the checklists and calendar templates, which have been pre-designed to carry out the process.

Alternatively, you can use an online checklist and a calendar where you add the bill due dates and request for a notification to be sent a few days before the due dates, then the tracking will continue every month.

Final Thoughts

Personal budgeting should always be a priority for good financial management. Using a bill pay checklist or a bill calendar is a well-known method of assisting people in keeping track of their spending habits. This is because this method enables you to record all the bills and their due dates. In addition, using a template makes the monthly bill recording process more efficient. These templates have sections for expenses, savings, paying off debt, net income, and other typical personal financial requirements. This is unquestionably worth considering if you want to ensure that you can keep track of your expenses.