An income statement is a financial document that shows the profit and loss account of a company or a business during a specific period by calculating and summing the profit calculated from gross revenue and expenses.

The document can be used to examine the financial health and profitability of a business over a period of time. It can be used for both internal and external purposes.

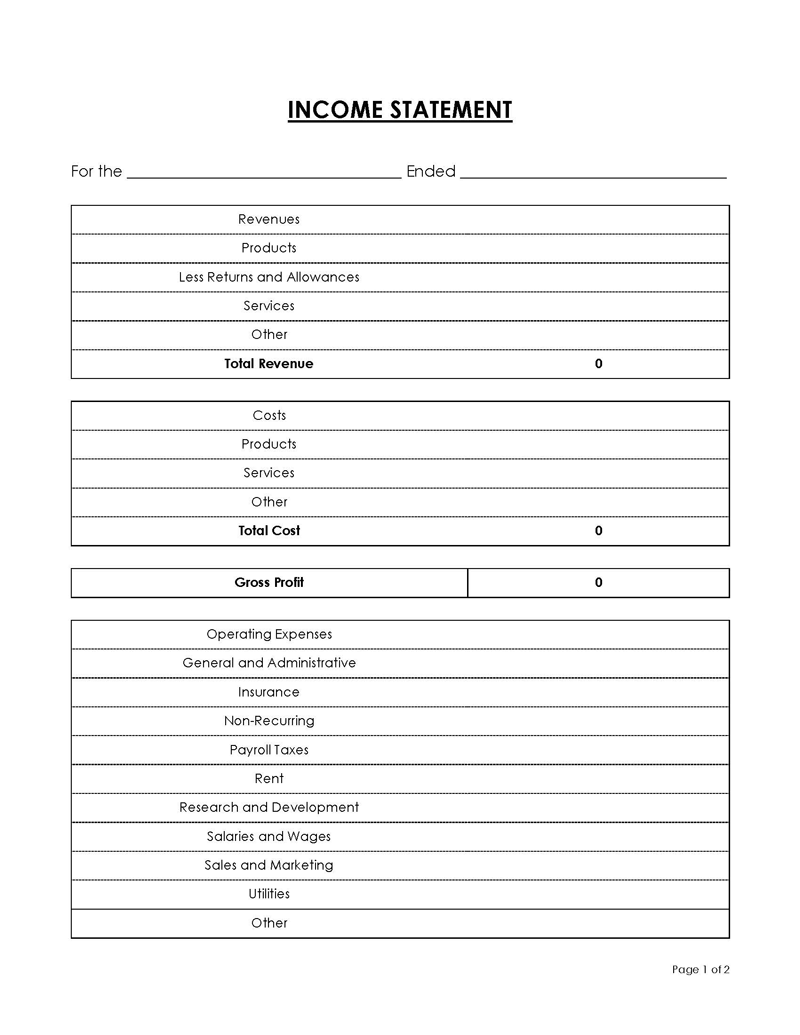

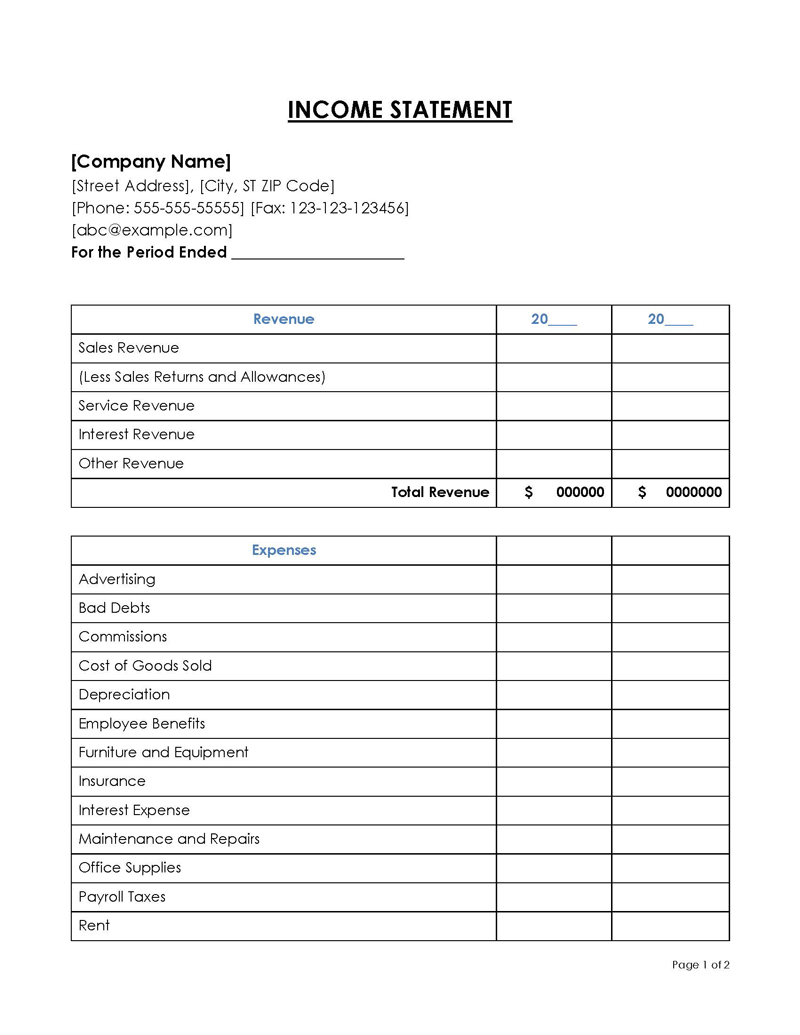

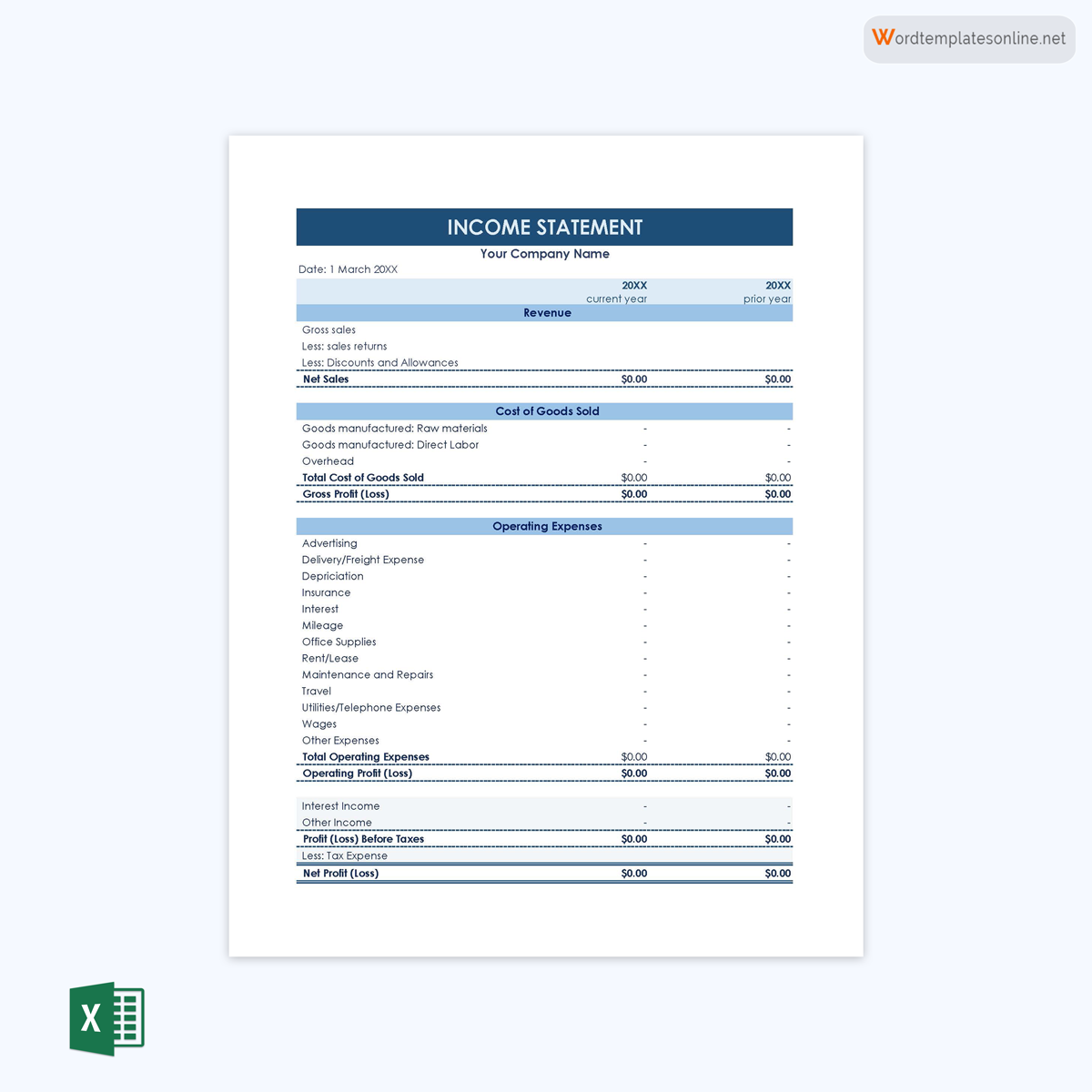

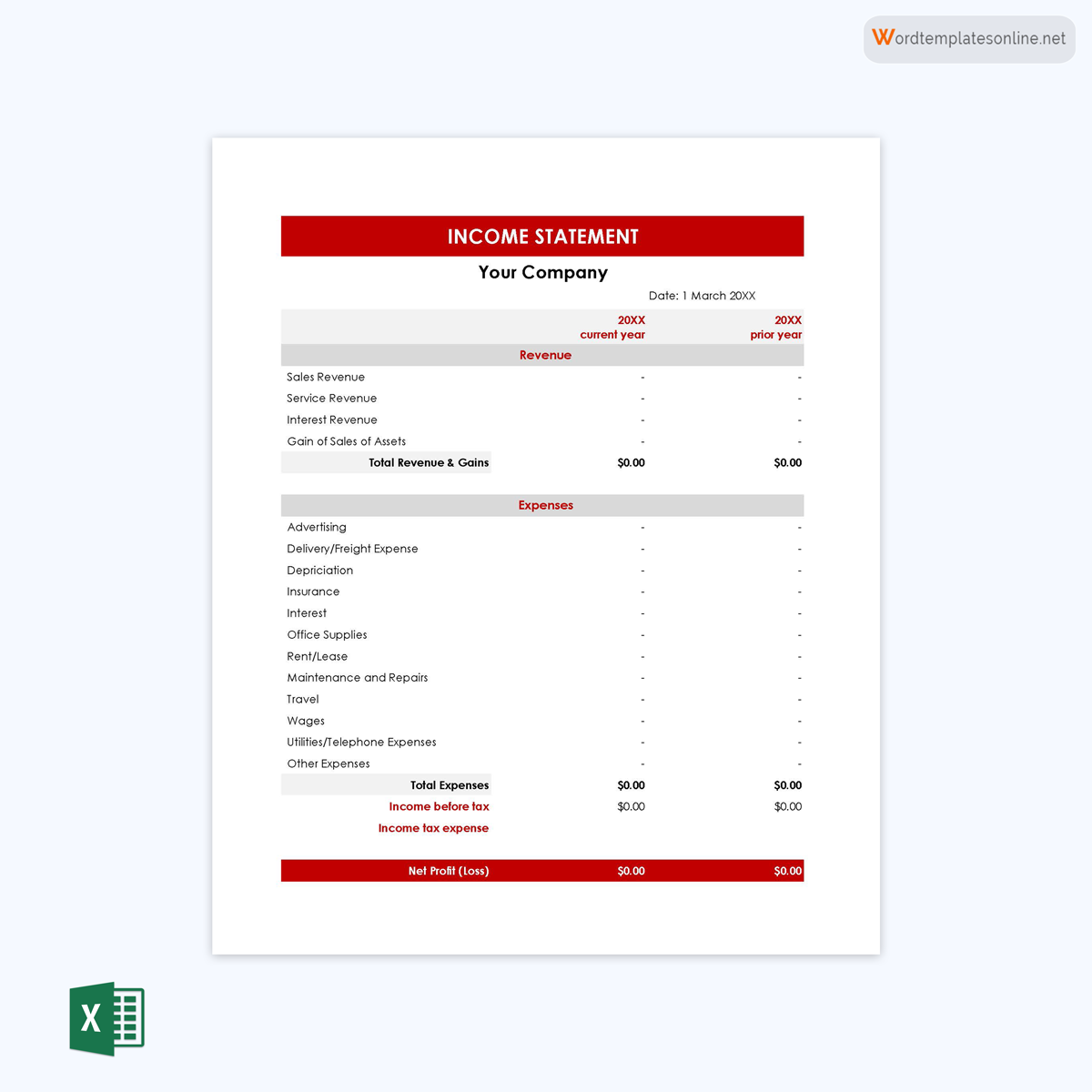

The basic elements of an income statement are gross revenue, cost of goods sold, expenses (operating, taxes), net income, company details, and the reporting period. These statements can be created from templates for income statements.

In combination with other financial documents such as cash flow statements and balance sheets, an income statement is used to analyse overall business operations and inform decision-making on important operational issues. When produced regularly, such as monthly or quarterly, they can also be used to monitor a company’s profitability, in contrast to the majority of financial documents that are created annually.

Income statements can also be used as budget management tools to pinpoint areas where spending is excessive or too low. This ensures budget allocations are optimally utilised. This statement also has external uses as it can be presented to financiers and investors when applying for funding. External parties can analyse the document and determine a company’s profitability and whether it is worth investing in. Other names for an income statement are the net income statement, statement of earnings, or profit and loss statement.

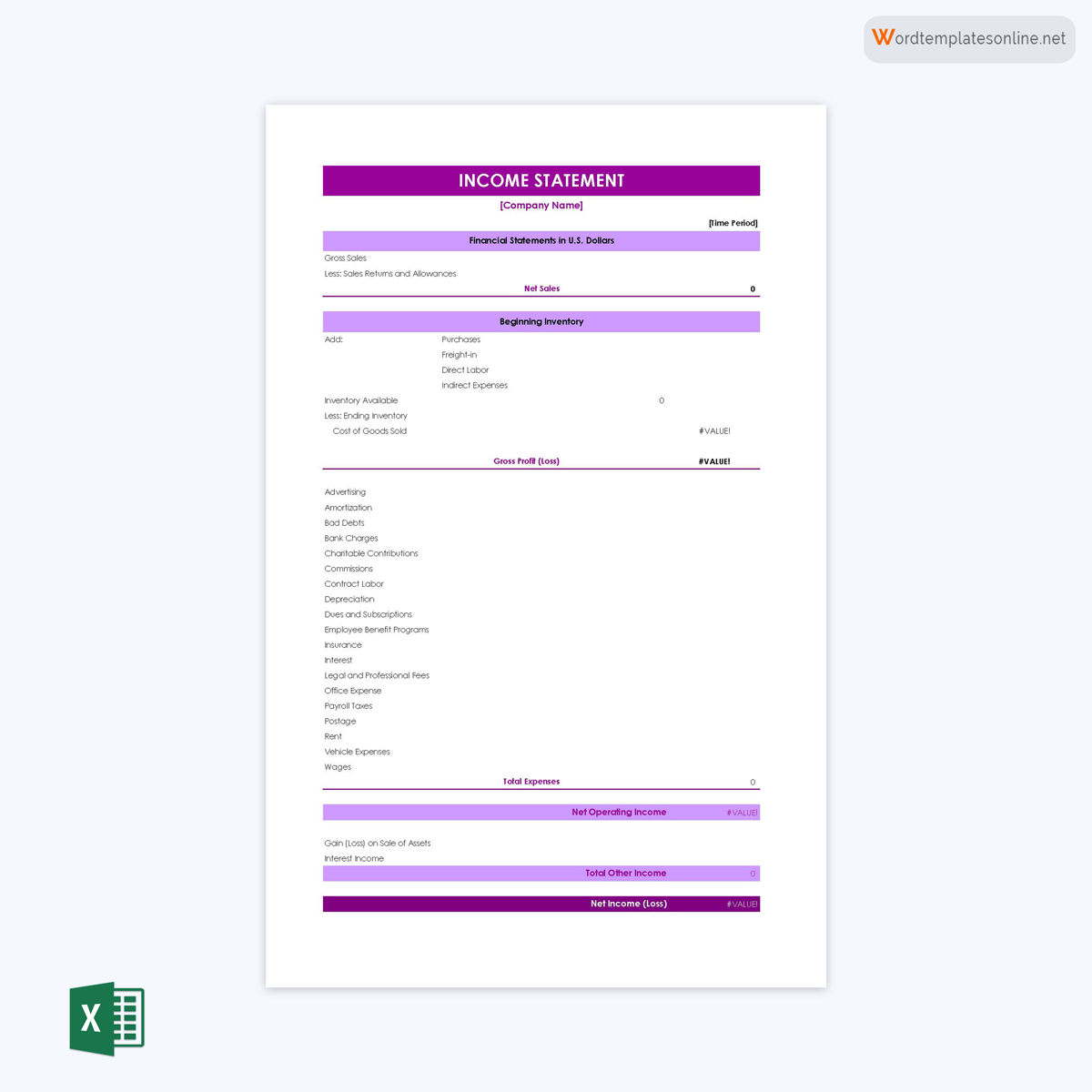

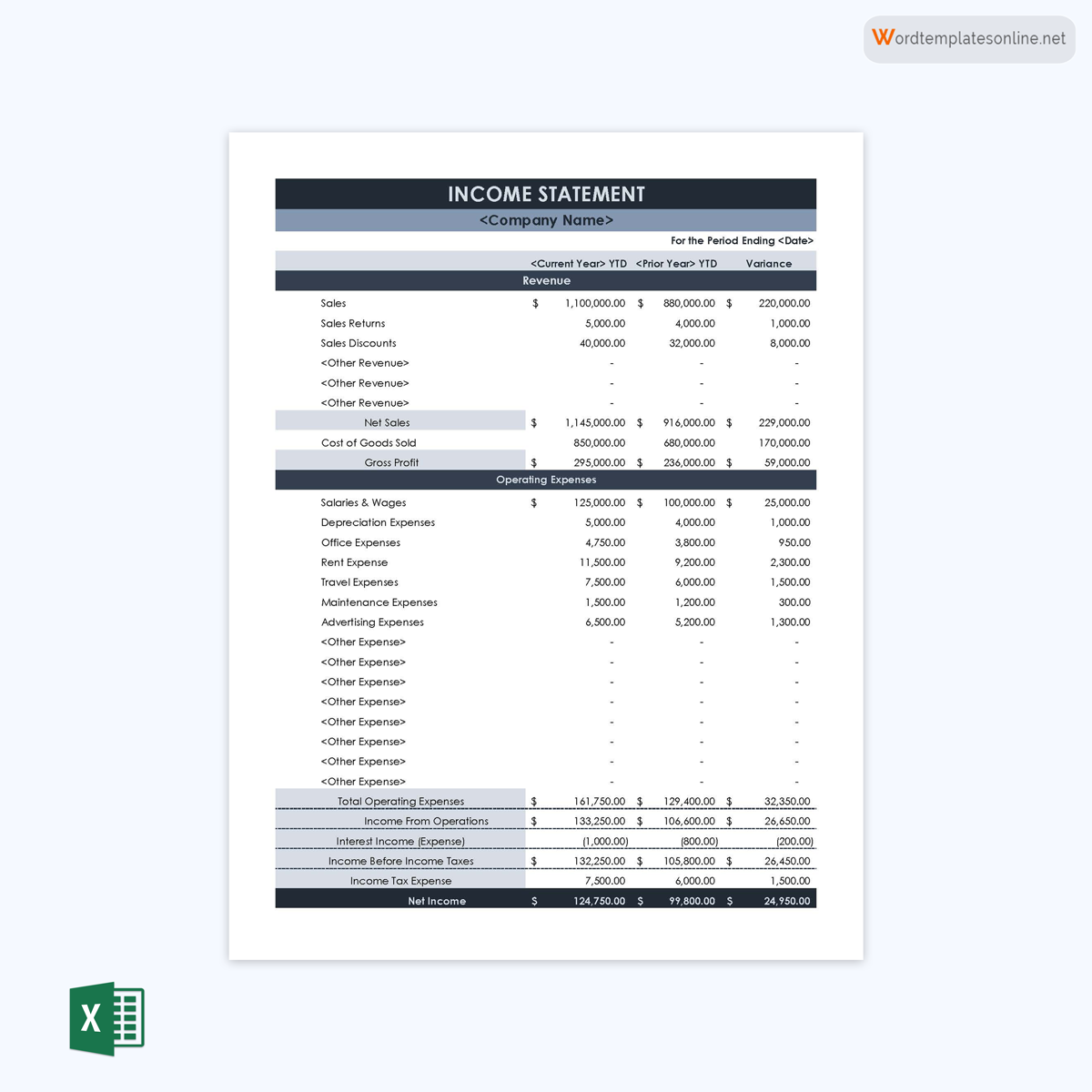

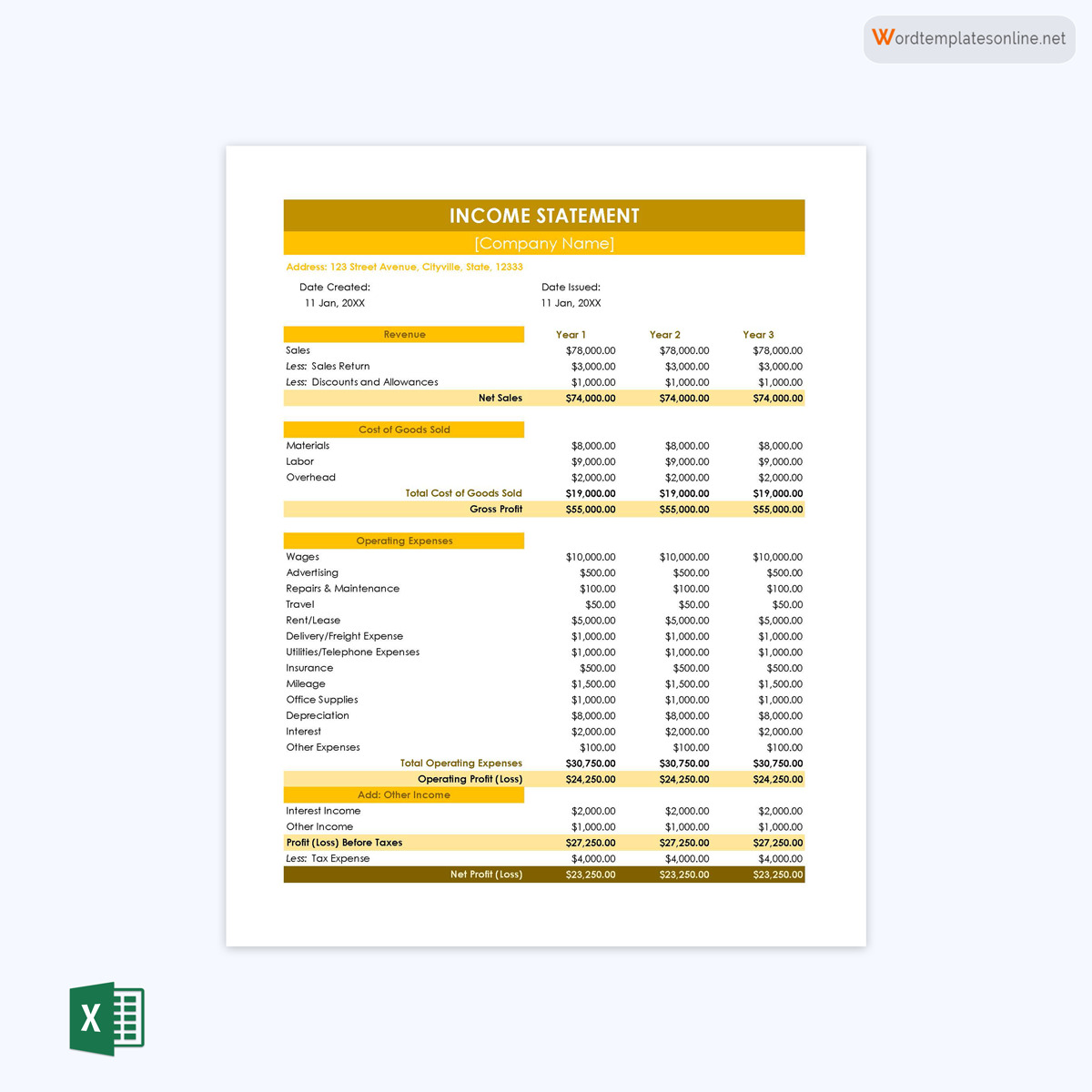

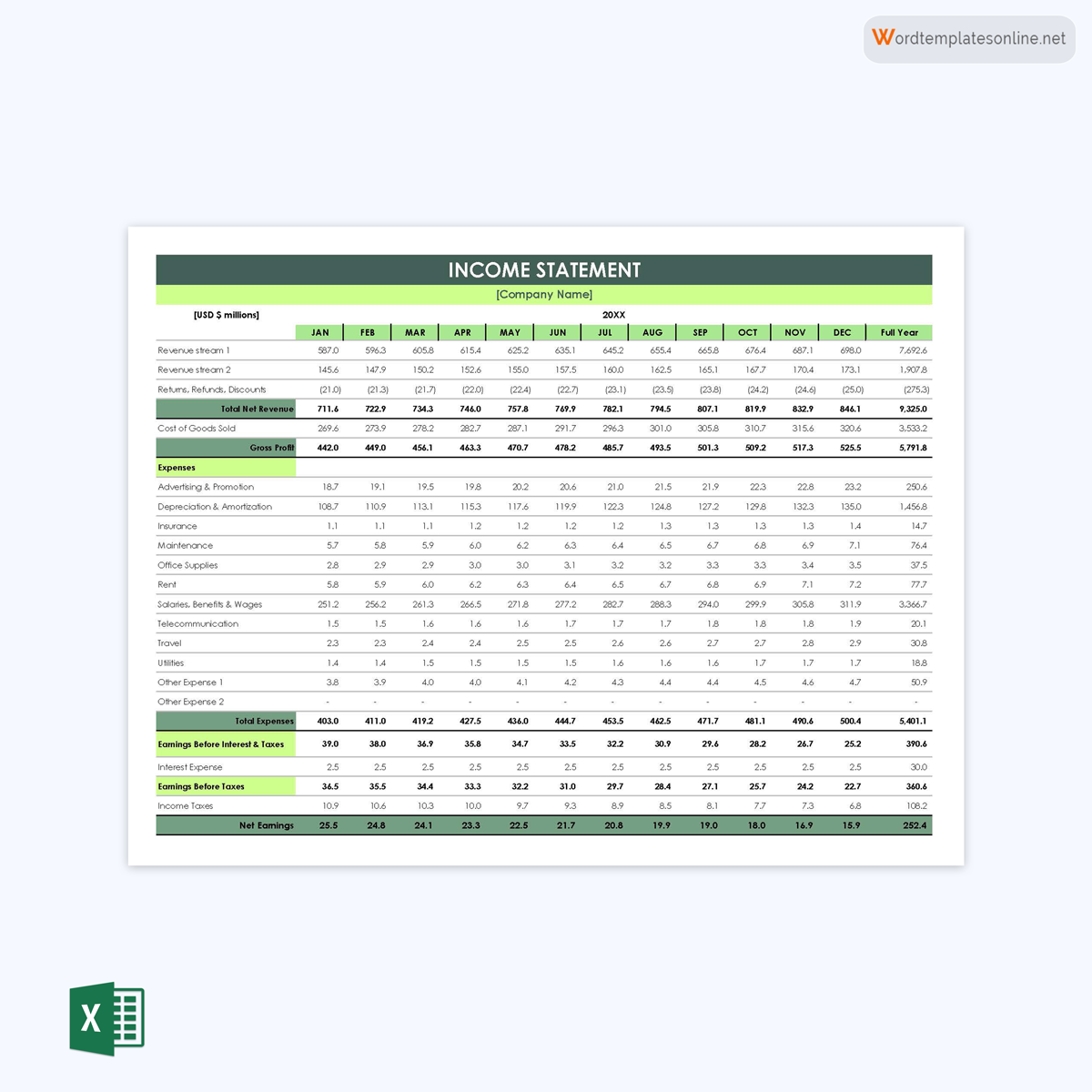

Free Templates

Preparing an Income Statement (Step-by step)

An income statement discusses all aspects of a business that directly influence its profitability. Each statement will always be unique to its associated company; however, basic components will be consistent among different statements.

Below is a procedure for preparing an income statement template:

1. Select the reporting period

First, select the reporting period for which the statement will be generated. This can be monthly, quarterly, or annual. Small businesses will typically prepare monthly income statements, whereas publicly traded companies typically have a quarterly reporting period. Monthly statements are known to be more advantageous in that they can be used to track profits and expenses, thus helping businesses identify alarming cash flow trends early and take necessary precautionary actions.

2. Generate a trial balance report

Secondly, prepare a general ledger report for each business account. The report shows the closing balances (balance sheets) of the accounts in the general ledger during the specified reporting period. The trial balance report is used as a data source to be input into the income statement template.

3. Prepare the income statement header

As the third step, create a header for the income statement template. The header can be made to outline the title “Income Statement,” company details, and date. The company details include the business logo, name, address (city, state, ZIP code), phone number, and email address.

4. Calculate your revenue or sales

After the header, enter all revenue and sales from the company’s primary activities from the trial balance report under the “Revenue” category. What is considered revenue will vary from one business to another; some businesses use cash accounting, whereas others use accrual accounting. Indicate the source of the revenue and the exact amount generated from that source.

Revenue includes operating revenue, non-operating revenue, and all “accounts receivable.” Operating income is generated from primary business activities such as sales of products or services, while non-operating income is derived from secondary activities such as O&M (operation and maintenance) of systems, installations, registration fees, etc. Make a total and record it on the income statement.

5. Determine the cost of goods sold

The next category is the cost of good production and service delivery. Determine all the expenses from the trial report and add the information under “Cost of Goods Sold (COGS).” These are direct costs, such as expenses on raw materials and labour, for the goods and services sold in the period and typically don’t account for overhead costs such as rent and utilities. Calculate the total and note it down on the template.

6. Calculate gross margin

Once the revenue (money generated from net sales) and costs of goods sold (COGS) have been determined, subtract the latter from the former to obtain the gross margin or profit and note it down on the income statement template. The gross margins or profits indicate the profitability of a business before taking into account administrative and support service expenses, otherwise known as overhead expenses.

7. Calculate general expenses

The next section or item in the income statement template is the “general expenses” category. It includes all expenses incurred aside from the production of goods and services sold. General expenses are in some cases referred to as operating expenses, and they include rent, bank and ATM fees, equipment maintenance fees, and the following selling and administrative expenses.

8. Include interest expense

Interest expense is money paid as interest on any loans or credit payments the business must make per month.

9. Add advertising expenses

Advertising expenses are typically indirect costs used to market the products or services and increase market share. They include the costs of ad campaigns, billboards, online marketing, etc.

10. Include administrative expenses

Administrative expenses include costs of rent, salaries, office supplies, office utilities, travel expenses, etc. Administrative expenses are incurred by the business as a whole and are used to support internal operations. Therefore, administrative expenses are independent of sales.

Note down the total figure of all these accounts, to sum up, the “general expenses” category.

11. Calculate operating earning

Record the operating income/profit earned for the specific period on the statement template. This figure represents the earnings generated for the reporting period, less the internal costs. Operating income does not consider external costs such as taxes, loan interest, etc.

12. Include gains

The income statement template should then record any gains made within the reporting period. A gain is any money generated from one-off or rare business activities such as the sale of a company’s fixed assets.

13. Calculate earnings before tax (EBT)

Once all expenses have been identified, subtract the total expenses identified in the previous step from the gross margin or profit. The product is the business’s earnings before tax (EBT). Indicate the EBT on the income statement. This figure represents a company’s financial performance for that reporting period.

14. Calculate your income

Subtract the administrative and selling expenses from the previously determined gross margin to arrive at the pre-tax income for the specific reporting period. This figure should be noted on the income statement template.

15. Include income taxes

Income tax is the tax levied on earned income for a specific period minus any applicable deductions. This figure can be determined by multiplying the earnings before tax (EBT) by the applicable state tax rate. It is important to note that different types of businesses have different tax rates.

16. Include depreciation

The next step in creating an income statement is calculating the depreciation of all assets in the company and distributing it over their expected lives. As a result of the loss in value, depreciation becomes a cost in the income statement. Record this figure on the template.

17. Determine your net income

The net income is the total money earned after all expenses (direct and indirect) have been subtracted. Subtract depreciation and note down the final figure. A positive figure implies profit, and a negative figure implies loss.

18. Finalize the income statement

Lastly, review the document and edit where necessary. Go through the figures to ensure correct calculations were made. If the income statement is satisfactory, it can be saved as a template and shared with relevant people in the company.

Types of Income Statement

Income statement templates come in different formats depending on the needs of the user and the utilisation of the document. Before creating templates for personal use, small businesses and large corporations should be aware of the various types of income statements listed below:

Single-step income statement

A single-step type is a simplistic income statement that showcases four primary components: gross income, expenses, gains, losses, and net profit/loss. All the operating and non-operating expenses are summarized under “expenses,” resulting in a more straightforward profit and loss statement. Single-step statements are more suited for small businesses.

Multiple-step income statement

A multi-step type is a more thorough breakdown of a business’s finances and typically has more categories than a single-step statement. It contains the following components: sales or revenue, cost of goods sold, gross margin, operating expenses, operating income, other income and expenses, income before tax, income tax, and net income.

Four levels of profitability characterize this type of statement: gross, operating, EBT, and net income (post-tax). Multi-step income statements are common among large corporations or businesses that require a complex or in-depth analysis of their finances.

Simple or basic income statement

Simple income statements are divided into income, expenses, and net income. They have a simple design that provides quick reporting and is often only for internal use.

Pro forma income statement

Pro forma income statements forecast changes in a business’s revenue and expenses that are expected to occur should a particular event occur. Therefore, figures in pro forma statements are only projections.

Common size income statement

It is a financial document that analyzes each item on an income statement and how it affects the profit and loss margins of the company separately. Each item is discussed as a percentage of the total revenue, not as a total revenue item.

Contribution margin income statement

It is meant to determine how much income is generated from each item (product or service) such that it can be used to contribute to the company’s fixed expenses. A product’s or service’s contribution is determined by subtracting all associated variable expenses per unit from its selling price. Contribution income statement templates are commonly meant for internal use, such as determining break-even.

Absorption costing income statement

This statement is a GAAP-recommended standard type of income statement and is ordinarily meant for external use. This type of statement factors in all expenses when analyzing COGS.

Variable costing income statement

These statements only consider indirect costs such as labor, raw materials, and overhead variances as part of the COGS when determining net income. Other overhead expenses are deducted from the company’s gross margin for that reporting period.

Partial income statement

Businesses will often have to prepare multiple financial documents within a given financial period. Partial income statements are statements used to report revenue and expenses for part of the financial period; they are in-between income statements.

CVP income statement

CVP is an abbreviation for cost-volume-profit. It focuses on the following four basic elements: revenue, fixed expenses, variable expenses, and contribution margins, and is used to analyze the profitability of a specific production scenario. Therefore, one company can have multiple CVP income statement templates.

Segmented income statement

Companies can have several production lines (segments) or departments producing different products or services. Each production line can prepare its own income statement, which is referred to as a “segmented income statement.” These templates are used to determine the profitability of each segment and, hence, which ones to prioritise.

Comparative income statement

This statement is a collection of earnings statements from multiple fiscal periods intended to provide a comprehensive financial analysis of the company.

Projected income statement

As the name suggests, a “projected income statement” is a statement that uses projected figures to estimate the financial position of a company at a particular point in the future, provided operations continue as usual. Projected income statements are common for budgetary purposes.

Consolidated income statement

Large companies can have different subsidiaries or branches operating at different locations, meaning each branch will have its own income statement. The business can use a consolidated income statement to assess the parent company’s overall financial situation. A consolidated statement of income will factor in revenue and expenses from the parent company and all its subsidiaries.

Frequently Asked Questions

Cost of Goods Sold is the total expense for goods or services sold within a specific financial period. It is determined using the following formula:

COGS = [Opening inventory for a given period] + [additional inventory purchased during the same period] – [closing inventory for the period]

The position where depreciation is placed on the income statement template will depend on whether a single-step or multi-step income is being used. It is mentioned under “expenses” in single-step statements and under “operating expenses” in multi-step statements.

Interest expense is any interest a business is expected to pay on outstanding loans. This is always accounted for in every financial period.

The formula for calculating the interest expense is:

Interest expense = [Principal outstanding on the loan] x [Annual interest rate] x [Time period]

There are no constraints regarding the time period an income statement can cover. Businesses can prepare profit and loss statements for whichever financial period they deem necessary: daily, monthly, weekly, quarterly, or even yearly.

A balance sheet is used to show the financial health of a business by highlighting its assets, liabilities, and equity (assets-liabilities) at a specific point in its life cycle. On the other hand, income statements are meant to show the profitability (revenue minus expenses) of a business during a particular financial period.

A profit and loss statement is similar to an income statement. However, the term is often used when the document is used for internal purposes.

The difference between a variable and absorption costing income statement is that absorption costing type covers all manufacturing expenses as part of the costs of products sold. A variable costing income statement type factors in only direct costs of labour, material, and overhead variances in the product costs. As a result, product costs in an absorption costing type will be higher than in a variable costing type.

Also, overhead manufacturing expenses are subtracted from a product’s selling price in an absorption income statement while they are deducted from gross margin in a variable costing statement. Absorption income statements are GAAP compliance documents, whereas variable costing statements are primarily meant for internal use.

A cash flow statement is a summary of all accounts receivable and accounts payable for a given period, which gives the current liquid assets of a business at that particular time. An income statement summarises the profitability of a business for a particular period based on revenue and expenses. A cash flow statement represents a stationary (single) point in time, while this statement can cover multiple points in time.

A single-step income statement and a multiple-step are structured differently. A single-step income statement comprises three elements: revenues, expenses, and net income, which is used to determine the business’s profitability. In contrast, a multi-step statement breaks down revenue and expenses into sales and revenue, operating expenses, operating income, non-operating and other expenses, and net income to determine profitability.