The Pennsylvania Power of Attorney Form is a legal document that allows a state resident to assign powers to an agent to act on their behalf concerning medical treatment, finances, property, and other issues.

According to Pennsylvania Law, this form can be used if the principal becomes incapacitated or disabled. The principal decides how much power to assign to the agent and for what period. The document becomes effective immediately upon signing by both parties. It ends in the event of the principal’s incapacitation unless it is a “durable” power of attorney, which remains in effect even in the event of incapacitation. It may also come into effect upon the principal’s incapacitation, in which case is referred to as a ‘springing’ power of attorney. A spring power of attorney is also durable in nature.

Customizable Forms

Types of POA

There are various forms in Pennsylvania that can be used. They can be defined by the tasks the principal wants to assign to the agent. Understanding them will help ensure that the correct details are included in the attorney document.

They include the following:

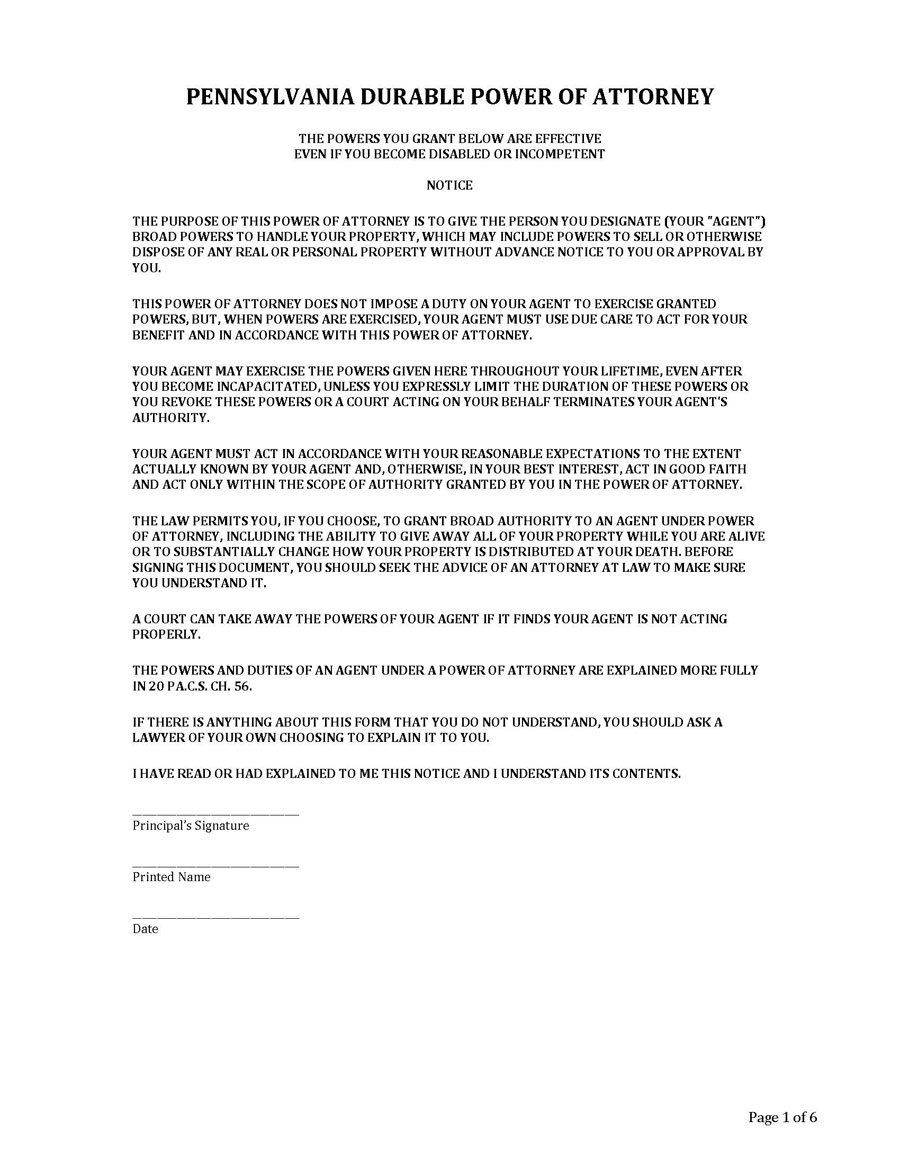

Durable (Financial) Power of Attorney

A durable (financial) power of attorney form in Pennsylvania allows the principal to transfer financial authority to the agent. Therefore, the agent can handle financial matters such as paying bills on the principal's behalf. Title 20, Chapter 56 (Power of Attorney) provides comprehensive details about the Pennsylvania state laws regarding power of attorney. According to §5604(a), the term 'durable' means that the powers assigned to the agent will not be affected should the principal becomes incapacitated. It also outlines that the principal may specify a future time when a power of attorney comes into effect or upon the occurrence of a specific event such as incapacitation. The tasks the agent is expected to perform and those that the principal can assign can be found in § 5601.4. According to§ 5601(b)(3), the principal's signature must be indicated in the presence of a notary public and two witnesses. Unless specifically indicated in the document, all powers shall be durable as outlined in § 5601.1. Rather than a statutory form, § 5602 provides suggestions for the drafting language that can be used.

Download: Microsoft Word (.docx)

General (Financial) Power of Attorney

A general (financial) power of attorney also allows the principal to authorize an agent to handle financial affairs on their behalf. However, this type of power of attorney form from Pennsylvania is non-durable, which means that the powers will no longer be in effect once the principal is incapacitated. Chapter 56: Power of Attorney outlines Pennsylvania's statutory laws regarding the general power of attorney. It includes 20 Pa. C.S.A § 5601.4 on the authority that the agent can exercise. It states that the agreement dictates the agent's powers. The signing of the form should take place in the presence of two witnesses and a notary public as indicated in 20 Pa C.S. A. § 5601.

Download: Microsoft Word (.docx)

Limited Power of Attorney

A limited power of attorney is a type of attorney in Pennsylvania that allows a principal to grant the agent time-limited powers. Once the task is complete, the document expires. The principal can also opt to set a termination date for the form. The agent will be expected to carry out tasks per the principal's conditions as outlined in 20. Pa C.S.A § 5601.4 of the statutory law. This type of power of attorney form in Pennsylvania becomes void upon incapacitation or death of the principal. It should be signed in the presence of two witnesses and a notary public as indicated in 20 Pa C.S. A. § 5601.

Download: Microsoft Word (.docx)

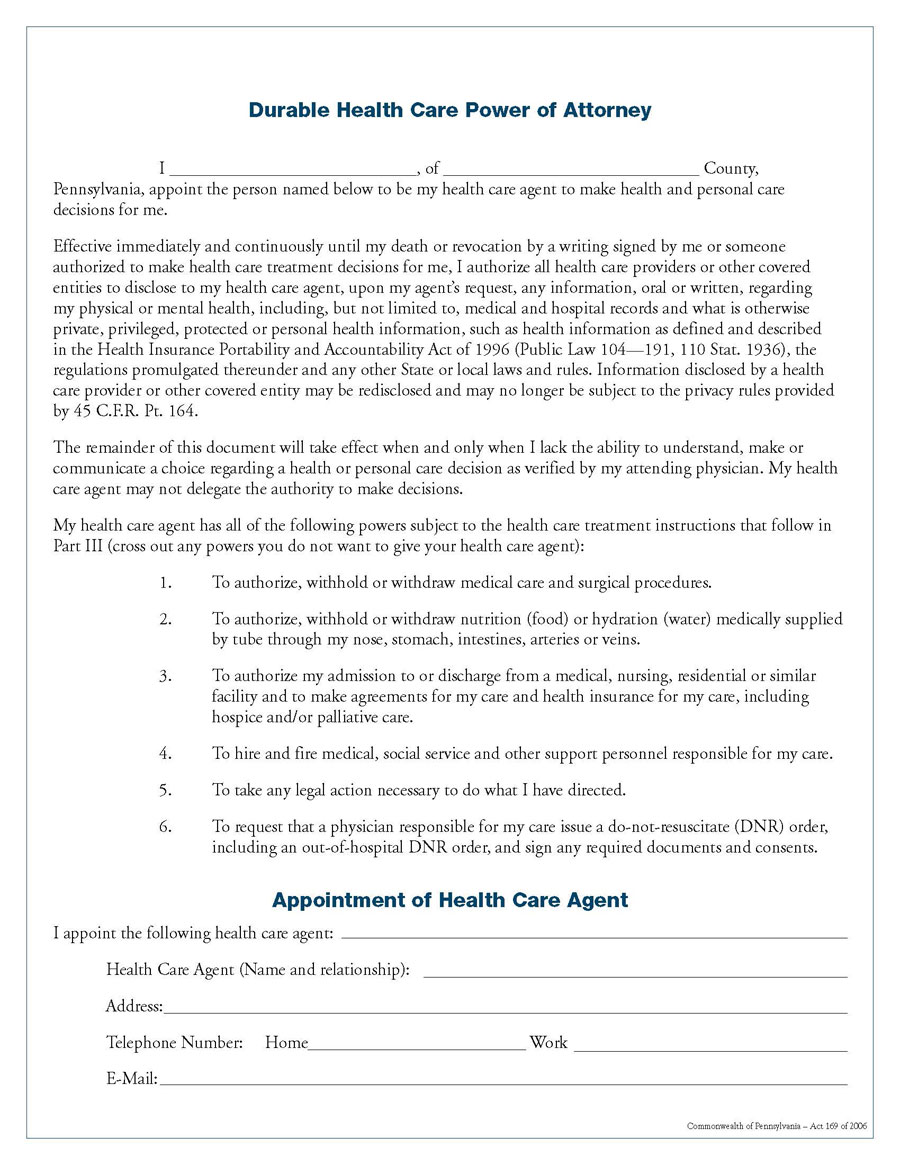

Medical Power of Attorney

A medical power of attorney allows a principal to appoint a health care proxy or agent as indicated in § 5422. The agent is tasked with ensuring that the principal's health care preferences are relayed if they are unable to do so themselves. An individual at least 18 years of age can create a medical power of attorney. Individuals can also create it under 18 so long as they have graduated high school, married, and legally emancipated. This type of power of attorney form in Pennsylvania must be signed and dated in the presence of two witnesses that must be at least 18 years of age. The agent and health care provider cannot be witnesses, nor can the health care provider act as an agent. Pennsylvania does not provide a statutory form; however, it allows a generic form to be created. A form from another state can also be adapted. Section 5451, a subchapter Chapter of Title 20 of the Statutes of Pennsylvania Consolidated Statutes, should be reviewed when creating a medical power of attorney.

Download: Microsoft Word (.docx)

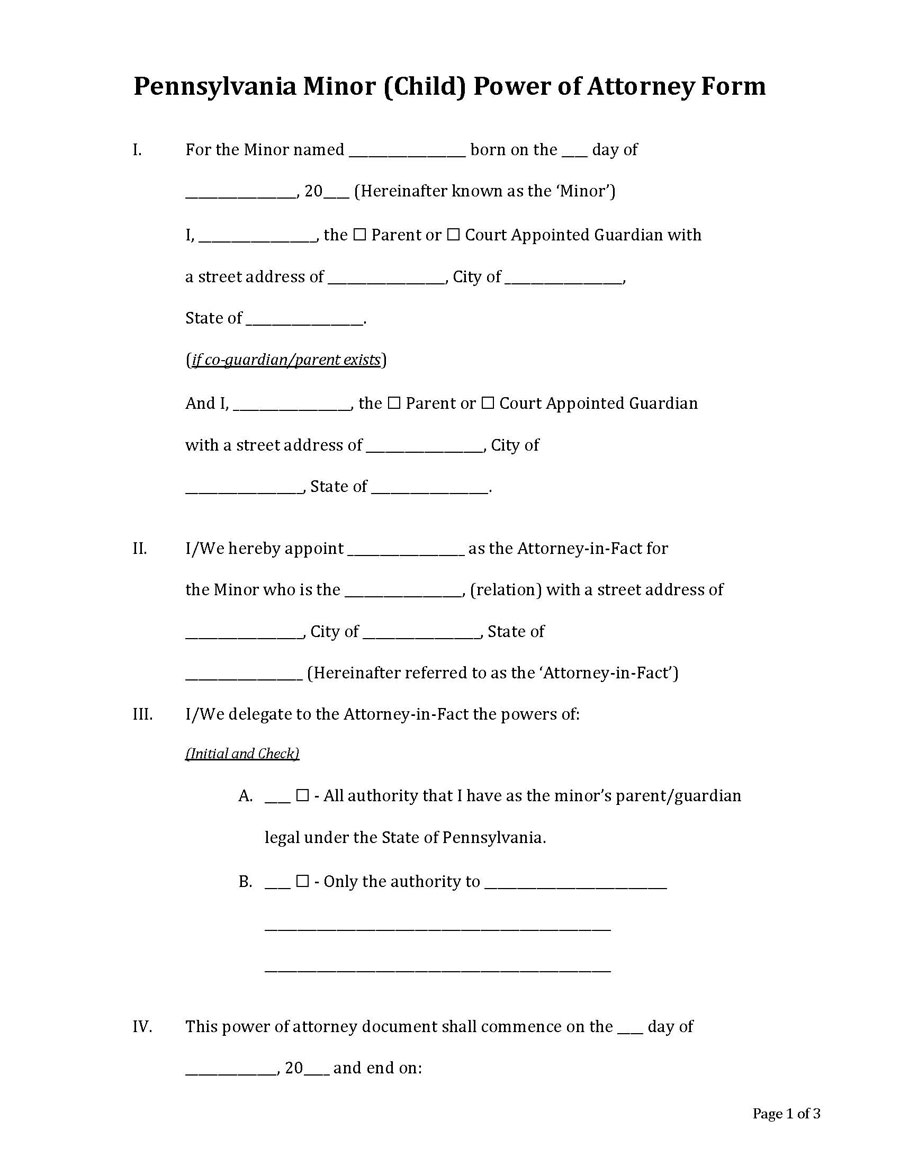

Minor (Child) Power of Attorney

A minor/child power of attorney allows a principal to appoint an agent to act as a temporary guardian for their children. The agent will temporarily be responsible for the children's education and other matters related to their care. The principal must select individuals they trust. Again, the state outlines no statute laws.

Download: Microsoft Word (.docx)

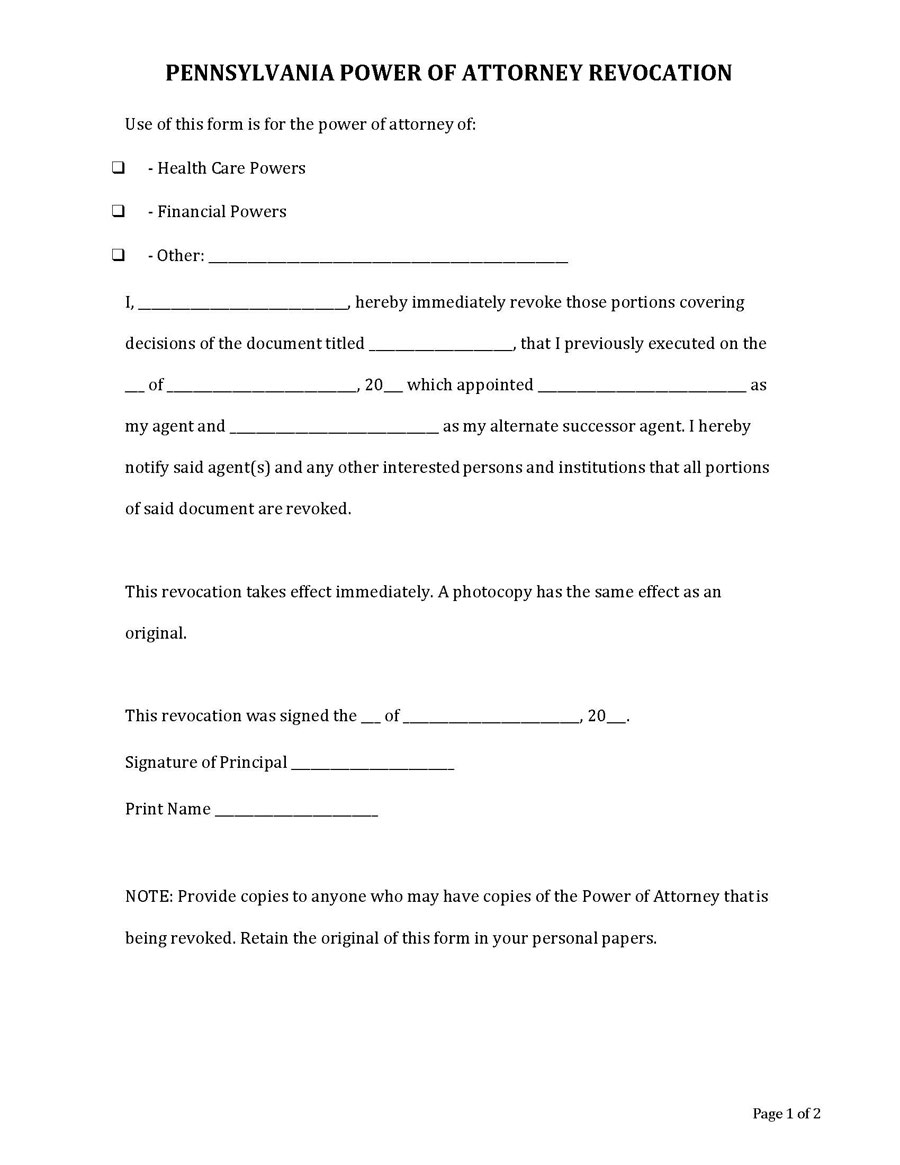

Revocation of Power of Attorney

Revocation of power of attorney is used to cancel and void powers that the principal had previously given the agent. The agent and any backup agents with the revoked powers and institutions that use the principal's power of attorney should have a copy of this document. The principal does not need the agent's approval to fill and sign this type of Pennsylvania power of attorney form. The Pennsylvania power of attorney should adhere to the statutory laws outlined in § 5606.

Download: Microsoft Word (.docx)

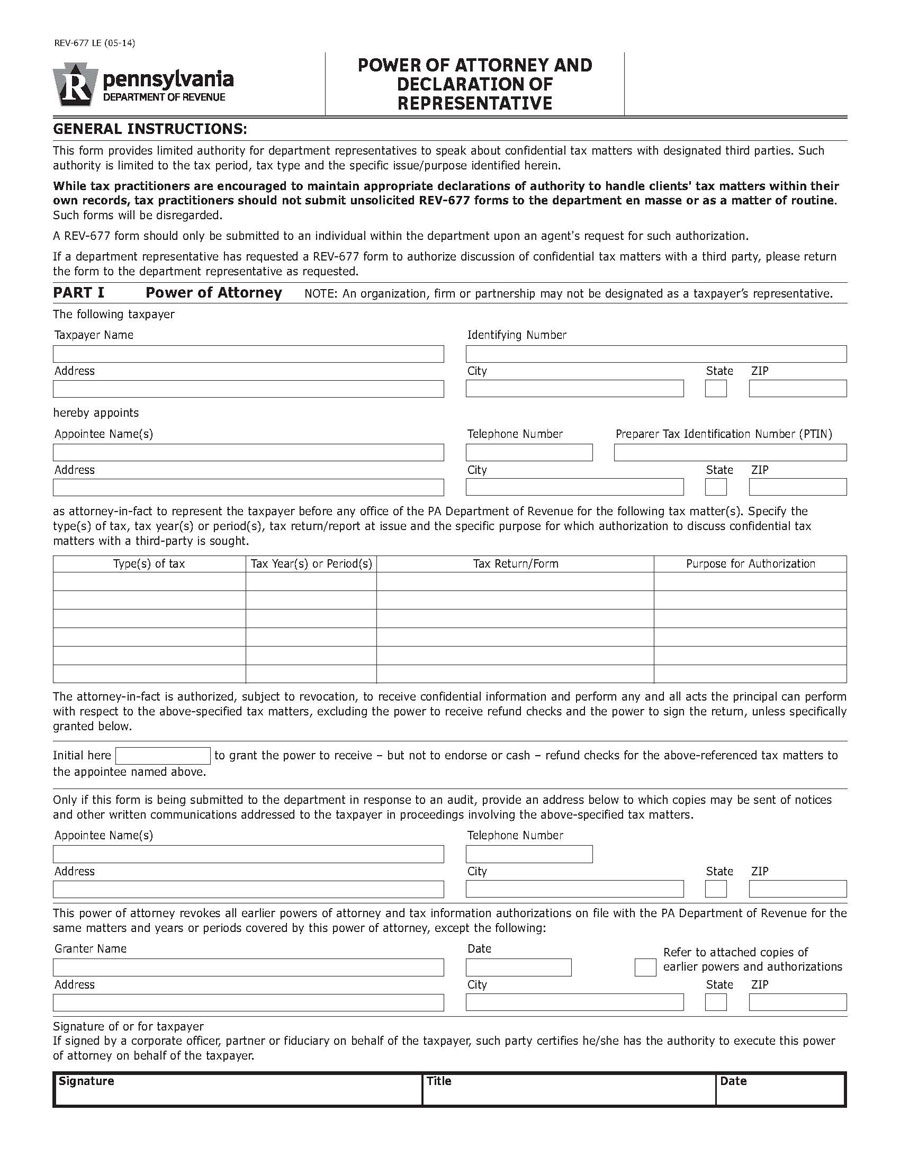

Tax Power of Attorney (Form REV 677)

A tax power of attorney is also known as REV 677 or the Department of Revenue Power of attorney and Declaration of Representative. This type of power of attorney form in Pennsylvania allows the principal to appoint a representative to act on their behalf concerning tax-related matters. It is usually advisable to appoint an experienced individual such as a certified accountant. The principal must ensure that the document is clear on who the agent is, which tax issues and forms they will handle, how long, and how their powers will interact with other documents.

Download: Microsoft Word (.docx)

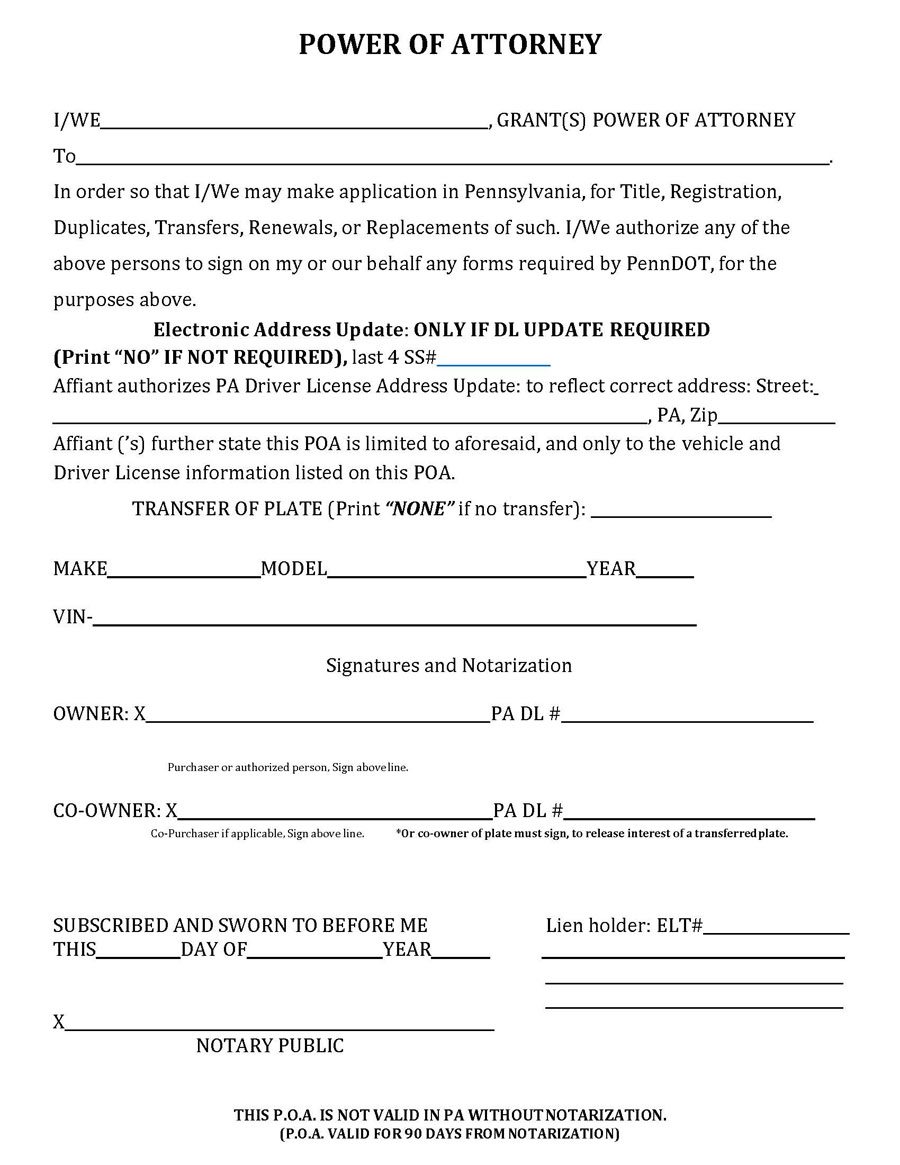

Vehicle Power of Attorney

A vehicle power of attorney is used to appoint a representative to act on behalf of the principal about their vehicle when dealing with the Department of Transportation in Pennsylvania. It is used as proof that the principal has authorized the agent to handle the specific matters indicated in the document. The vehicle power of attorney form in Pennsylvania has certain security features, making it a 'secure' document. State agencies in Pennsylvania, such as insurance companies and vehicle dealers, are the sole distributors of this type of power of attorney form in Pennsylvania.

Download: Microsoft Word (.docx)

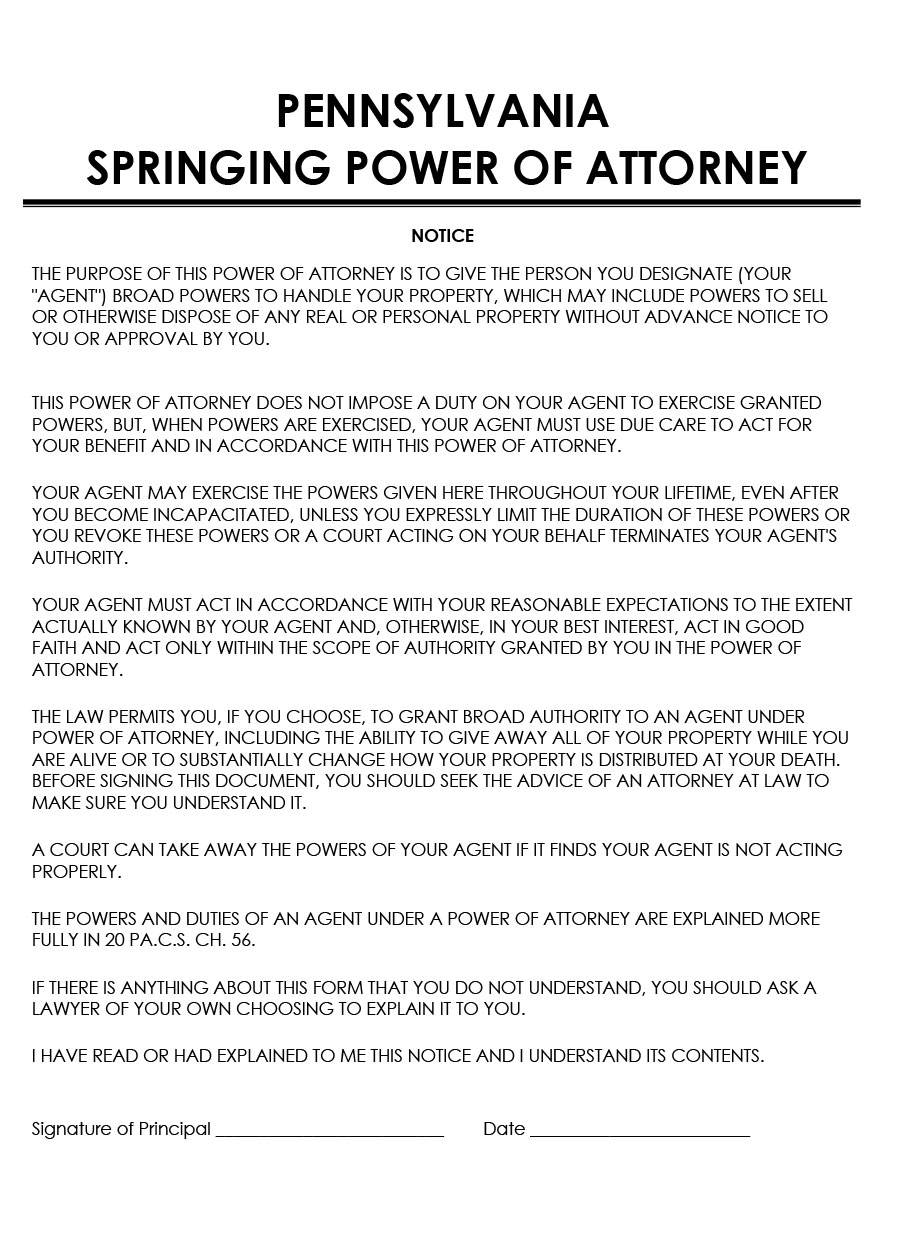

Springing Power of Attorney

A springing P.O.A. allows a principal to appoint an agent to act on their behalf for a specified time in the future after signing. It may also come into effect when the principal becomes incapacitated. If the spring power of attorney is 'durable,' the powers of attorney continue even when the principal can no longer make decisions for themselves. The document may stipulate that they end up on the principal's incapacitation.

Download: Microsoft Word (.docx)

Real Estate Power of Attorney

The real estate Pennsylvania power of attorney form allows the principal's agent to act on their behalf when handling real estate matters such as the purchase or sale of their property. The agent is strictly limited to real estate affairs. The principal should only sign against the real estate matters the agent will be expected to handle.

Download: Microsoft Word (.docx)

Pennsylvania POA Requirements

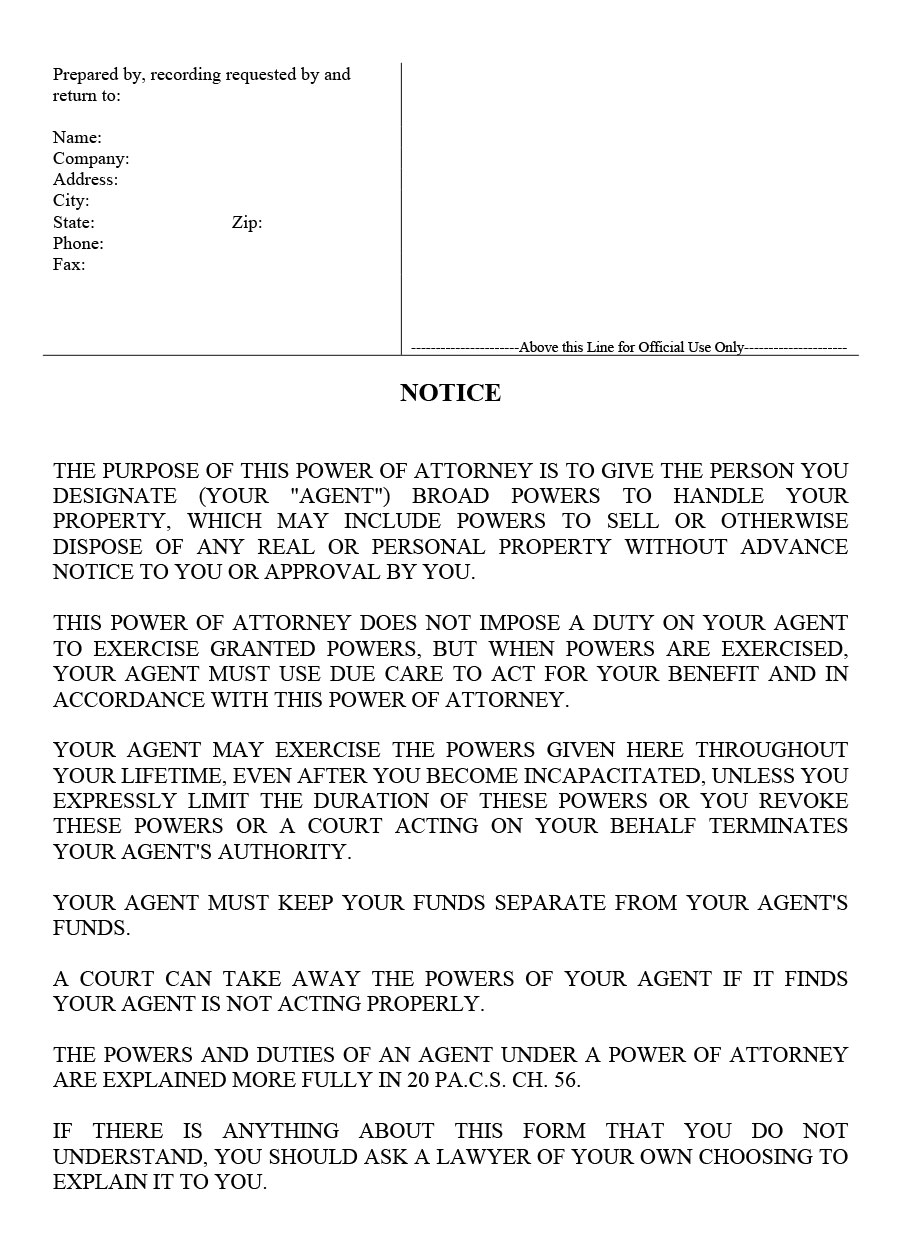

When creating this form in Pennsylvania, it is crucial to consider the requirement to ensure that the document adheres to state laws. Other than ensuring that the powers are outlined in writing, the form must contain details such as the name and addresses of both the principal and the agent. The powers being granted should also be clearly outlined. The state laws indicated in §5602 and §5603 should be consulted to help identify the language used to describe the powers being granted.

Once completed, it may be filed in the clerk of the orphans’ court division where the principal resides. For a real estate power of attorney that has been notarized, the document should be recorded in the office for the recorded deed where the principal resides along with the counties where the transaction may have taken place. The document should also contain a signed and dated ‘NOTICE’ as indicated in § 5601-C along with a signed and dated section outlining ‘Acknowledgment executed by the agent’ as indicated in 5601-D. It should also adhere to the appropriate signing requirements.

They include the following:

Signing and witness requirements

It should contain the signatures of both the principal and the agent. The principal’s signature should be indicated in the presence of two witnesses who must be at least 18 years of age and a notary public. A mark such as X can be used in place of a signature if the principal cannot write. A representative of the principal may also sign this form on their behalf in the presence of witnesses. The witnesses must not be the agent or the representative tasked with signing it on the principal’s behalf.

How to Get Power of Attorney in Pennsylvania?

A power of attorney form can be created with the help of Chapter 56 of the Pennsylvania Consolidated Statutes. The document must adhere to the regulations dictated by this chapter to ensure it complies with state laws. Both the principal and agent must fill out and sign the document.

Key Takeaways

- Creating a power of attorney form in Pennsylvania enables an individual to legally authorize another person to handle specific tasks on their behalf. The powers are assigned at a specific time in the future or upon the occurrence of an event such as incapacitation.

- The different forms help the principal distinguish what powers they want to grant the agent. The principal may need the agent to hand over affairs such as their finances, medical decisions, real estate, and care for their children, among others.

- It must adhere to the Chapter 56 Pennsylvania Consolidated Statutes to ensure that it complies with state laws. In addition, it will help identify the document’s requirements, such as the appropriate signing requirements.

- Though the state of Pennsylvania does not provide a standard form, it does provide language that can be used to describe the powers that have been granted to the agent.