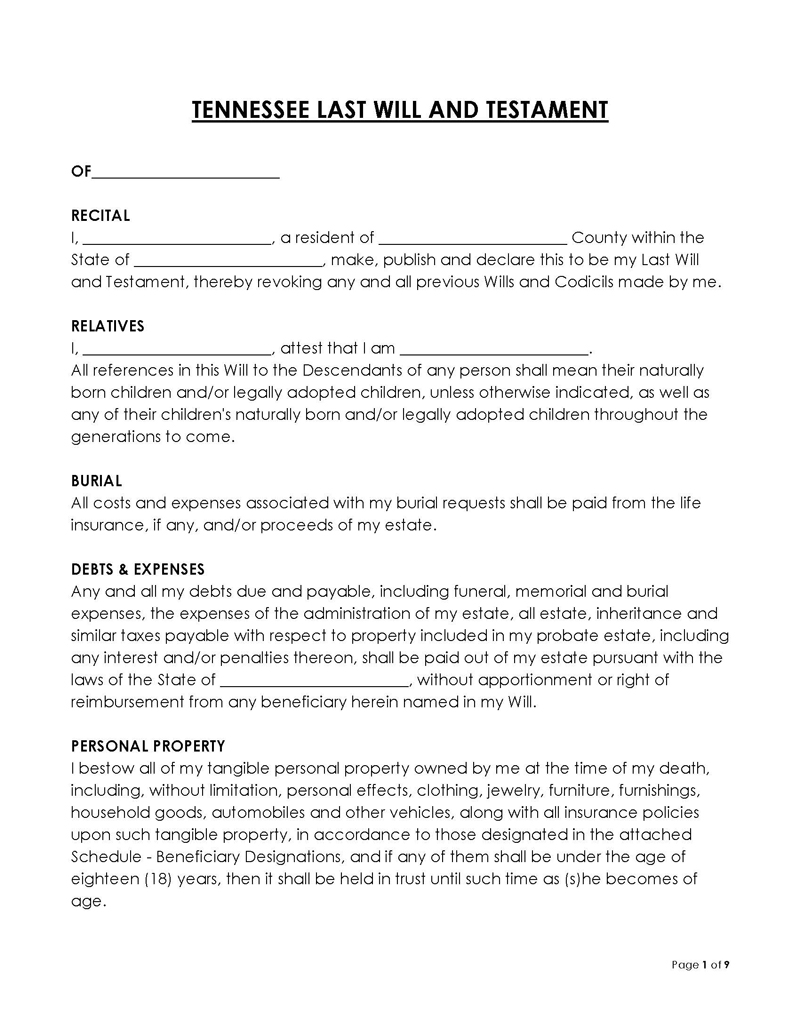

In Tennessee, a last will and testament is required to ensure that one’s property is distributed according to their wishes after their demise. The writer of the last will is known as the testator. Without the last will in place, your estate will be distributed according to the intestacy laws of the State of Tennessee, and some family members may get excluded from the inheritance due to that.

A last will is a legal document that allows you to plan the distribution of your estate. You can specify how you want your assets distributed, including your home, retirement benefits, life insurance policy, and any other assets you own. This document also contains information on the guardianship of any children if you and your spouse pass away at the same time.

A testator can list out their beneficiaries in any manner they choose in their last will. If you have specific items you would like to give to other friends or family, you can also choose to do so in this document.

It is legal in Tennessee if signed in front of two witnesses. You can keep a copy with yourself and one with your lawyer in case it gets misplaced. This document remains until you make a new one and revoke the previous one.

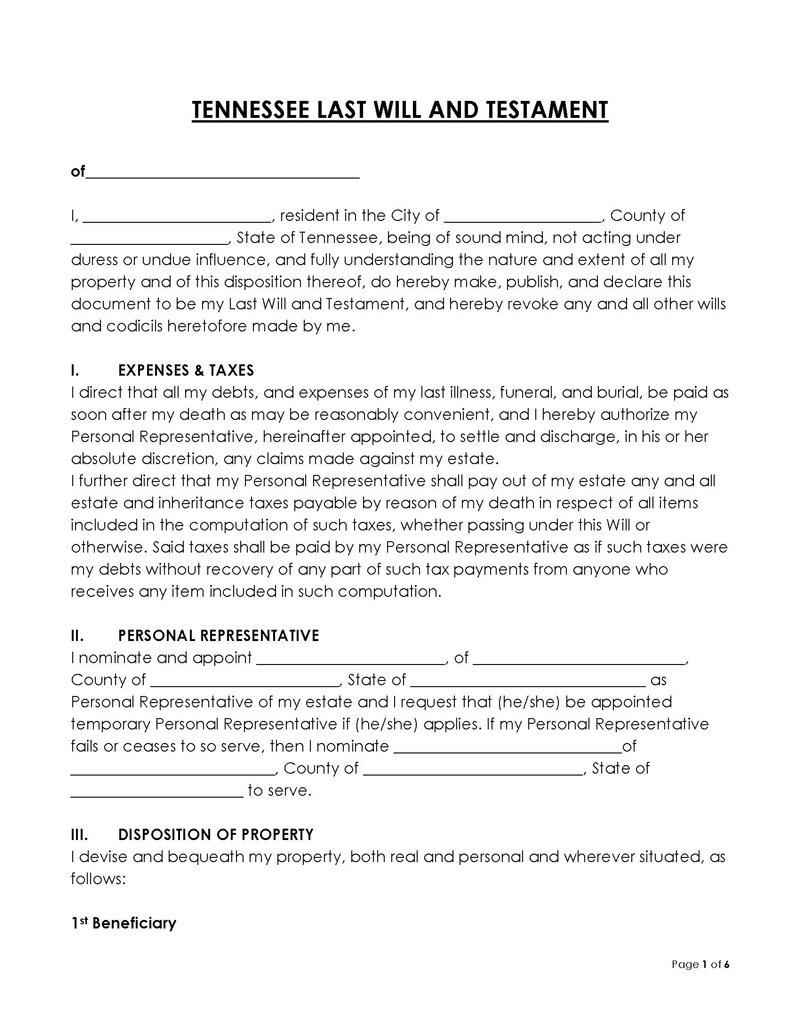

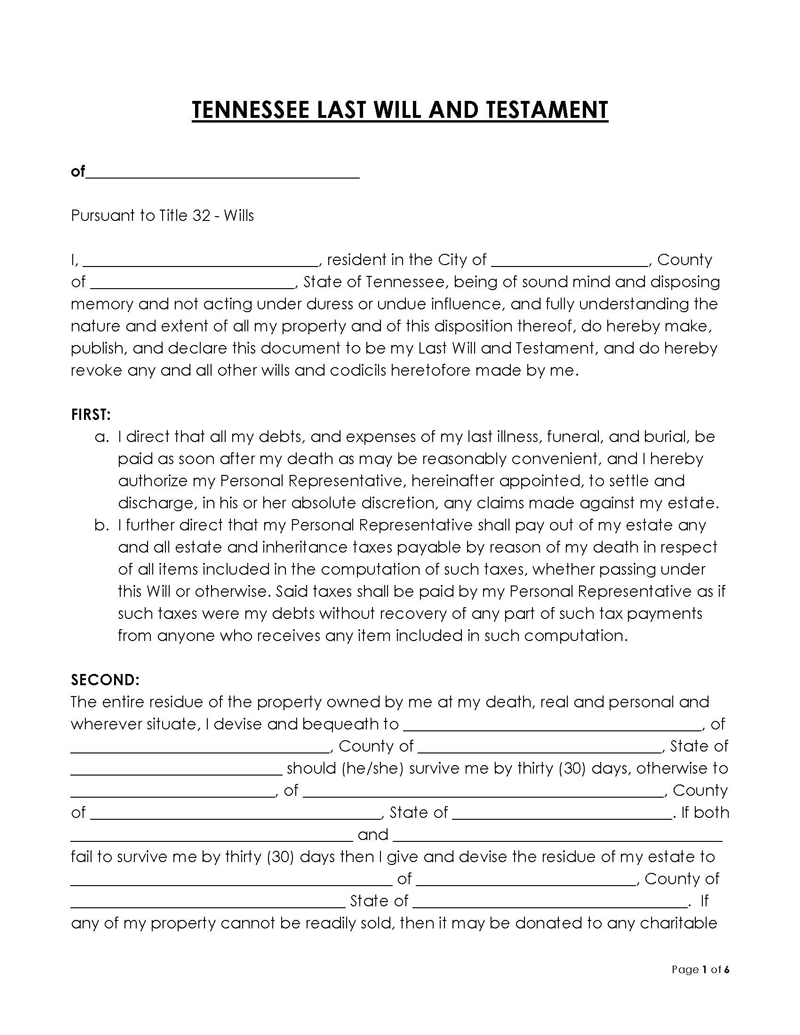

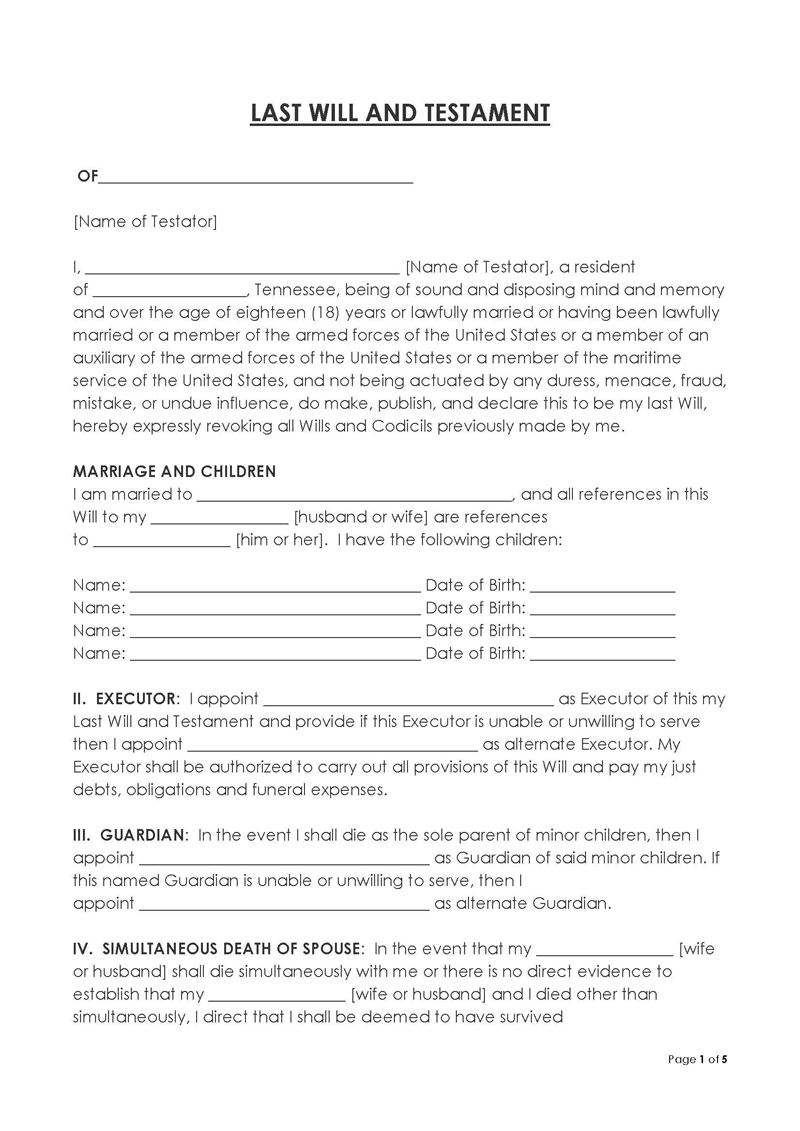

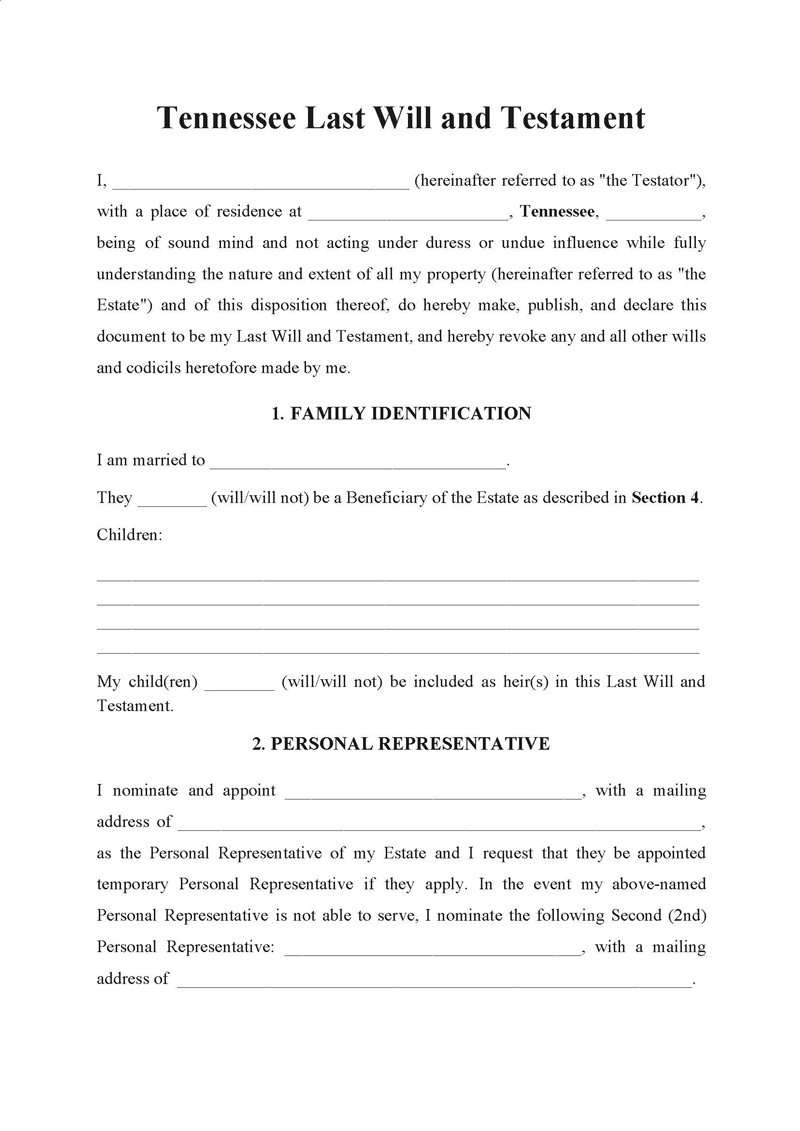

Free Last Will Templates

Importance of Making a Will in Tennessee

You are not legally required to make a last will and testament in Tennessee. If you choose not to create one or do any sort of estate planning, then the state of Tennessee will take over and distribute your assets after your death. They can determine who receives the house, your retirement plan, and any money in savings. They will also get to choose the guardianship of their children.

Sometimes, the state will distribute the assets and give guardianship in the same way that you would have wanted. But there is no assurance that the distribution of the assets will be according to what the decedent would have wanted, which can cost the heirs more money and distress. Therefore, writing a last will is the best option.

The size of your estate does not matter when writing this document. The document can help you with the following:

- Name someone to be the guardian of your children if you and your spouse pass away.

- Choose beneficiaries for your estate. You can choose to split property between more than one person or give it all to one person.

- Prepare a plan for any pets who are left behind.

- Choose someone to be the executor of the will. This can be time-consuming, so choose someone who is trustworthy and will follow your wishes.

Your last will will make sure that your final wishes are honored when you pass on. It can also expedite the probate process. In the absence of this document, the probate process may take many years and be very expensive, particularly if family members have disagreements over assets and guardianship. Thus, it saves money and time.

Associated Laws

You should work with an estate planning lawyer to help you create your last will in Tennessee. This will help you follow all applicable Tennessee laws concerning your estate and make sure that it is legally valid. The specific laws concerning the last will t can be found in § 32-1-101 and Title 32 (Wills).

Basic Requirements

Tennessee’s laws concerning a last will are relatively easy, saving the hassle for those who need to create an estate plan. The main rules surrounding writing this document in Tennessee include the following:

- The testator needs to be a minimum of 18 years old.

- The document must be signed in front of two witnesses.

- The testator must be of sound mind.

The rules about oral wills

Some Tennessee courts will accept oral wills, but it is better to have a written copy because it can be difficult to prove that these are the testator’s final wishes. The testator must be in imminent danger of passing away and then pass away as a result of that danger for the oral will to be deemed valid.

Two impartial witnesses must attest to the will, and those witnesses must put their statements in writing within 30 days. There are limitations of up to $1000 for individuals and $10,000 for military personnel on how much can be distributed in an oral will. Also, this will cannot be used in place of any other last will and testament the testator wrote.

Witnessing and signature requirements

A last will need to be signed by the testator before they are valid. You must do this in the presence of two or more witnesses at the time. The witnesses will also need to sign the document in front of one another and in front of you before the document is considered legal. You must declare that this document is your will before anyone signs in front of the witnesses. It is important to choose at least one person as a witness who has nothing to gain or lose from the results of the will.

Requirement for notarization

The will does not need a notary to sign it to make it valid. The two witnesses that you choose will be enough for the will to be legally acceptable and valid. However, the witnesses would have to testify in court about the authenticity of the document. To avoid this, wills can be “self-proved”. During this process, the testator and the witnesses can sign an affidavit confirming who they are as they sign the will.

The probate process

Before your executor can administer the last will and testament in Tennessee, the will needs to be filed with a probate court. Following this, the executor will be in charge of finalizing the details of the estate, including paying off debts, handling guardianship issues, and distributing the property to the heirs. Some estates that are smaller than $25,000 may be able to go through a simplified probate process in Tennessee, which can begin 45 days after the death of the testator.

Revoking or Making Changes to the Last Will

You may want to make changes or revoke your last will. Revoking or changing the will can happen especially in cases of major life events like the birth of a child, divorce, death of the spouse or any beneficiary initially named in the will, etc.

You can change any part of your last will at any time using a codicil. However, you will have to follow the same steps you did when initially creating the document.

There are a few ways that you can do this. If you write a new will, that will effectively make the old one null and void. If you cancel, destroy, tear, or burn the document, or if you allow someone else to do so with your permission and in your presence, this will also be considered a revocation of the will.

Divorce can also affect the will. For example, if the courts determine that your marriage was invalid or that you divorced your spouse but they are still named as executor or beneficiary, the court will revoke that designation. The only exception is if you explicitly mention in the document that divorce will not affect any of the provisions in the will.

The will is also nullified by the testator’s subsequent marriage or childbirth. Both the marriage and the birth of the child must occur after the execution of the will. Following the execution of the will, the occurrence of just one event is insufficient to invoke the statute’s application. So, for example, a will executed after the testator’s marriage but before the birth of his child would remain valid, subject to the pretermitted child statute.

Joint Tenancy

In Tennessee, most of the information you add to your last will will be followed by the courts, and all the estate will be distributed based on your wishes. However, some exceptions can be made, regardless of what you have mentioned in your will. Some types of property, like a home, will be in joint tenancy with the right of survivorship. Such assets are automatically transferred to the surviving spouse and do not go through the probate process.

What Happens When There is No Will?

When you die without a will, the state of Tennessee will distribute the assets according to intestacy laws. According to Tennessee intestacy laws, if there is only one surviving spouse, they automatically inherit the entire estate. If you have children with your spouse, then the spouse will need to share the estate equally with the children. The courts do require that the share the surviving spouse receives be at least 1/3 of the total estate. If there is no surviving spouse, then the estate will be equally divided among the children.

In some cases, the decedent will have no children and no surviving spouse. When this happens, other family members will be next in line to inherit from the estate. This can include siblings, parents, uncles, and aunts. These legal procedures can be expensive and time-consuming especially if the deceased has a large estate.

Digital Wills in Tennessee

A digital or electronic will is one that is entirely created online, from start to finish. It employs electronic signatures rather than wet signatures, obviating the need for a hard copy. It can be stored and transmitted electronically because it is created digitally. Currently, the state of Tennessee has not passed any rules about the creation of an electronic will, and there are no forms that allow this to be done yet.

Wills Created in Other States

According to Tennessee Code Ann. 32-1-107, the State of Tennessee will recognize a last will written in another state so long as it complies with all the state’s legal requirements for a will.

Conclusion

In Tennessee, a last will and testament allows the testator to decide about the distribution of his assets in the event of his death. You can choose to change your last will as often as you need, as long as you follow the Tennessee laws and have two witnesses verify that you are of sound mind and of the right age. If a person dies intestate, i.e., without a will, then the laws of intestacy are used to determine the distribution of the decedent’s assets. It protects one’s heirs from the costs and stress of legal proceedings under intestacy laws, in addition to ensuring that their inheritance is distributed in accordance with their wishes.