A profit and loss statement (P&L) is a document used by a business to summarise its financial standings to determine its financial health, or lack of, for a particular time period, a month, a quarter, or a year.

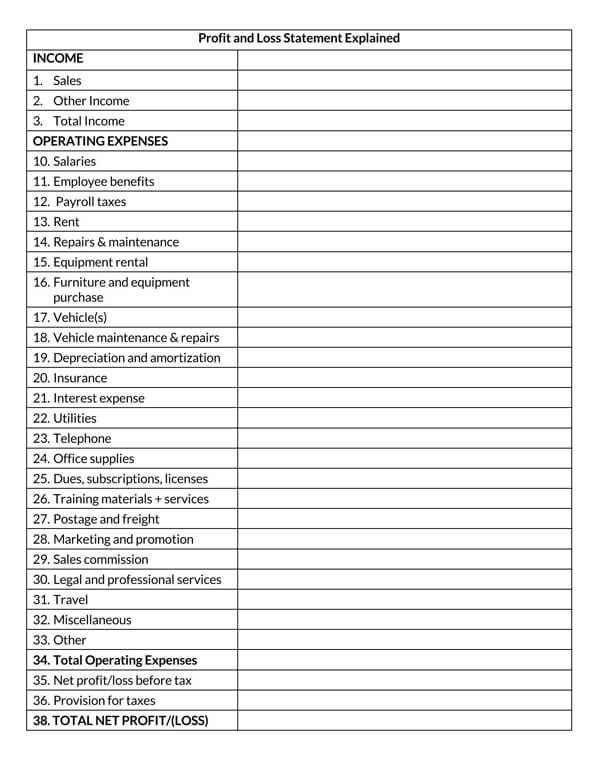

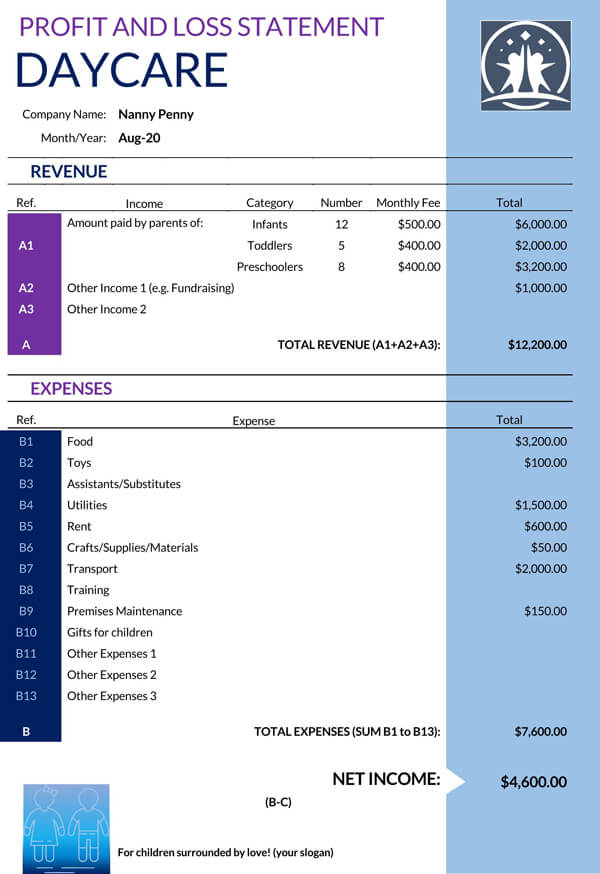

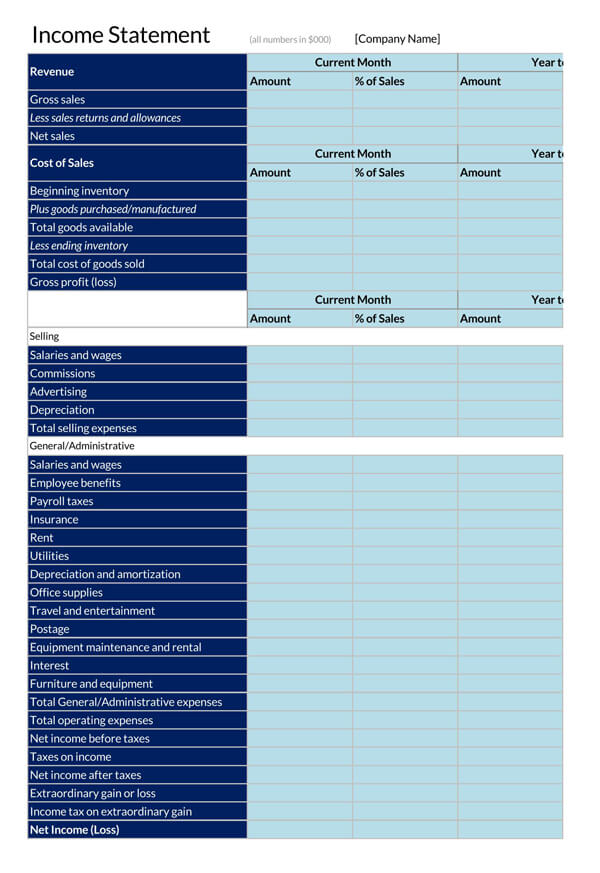

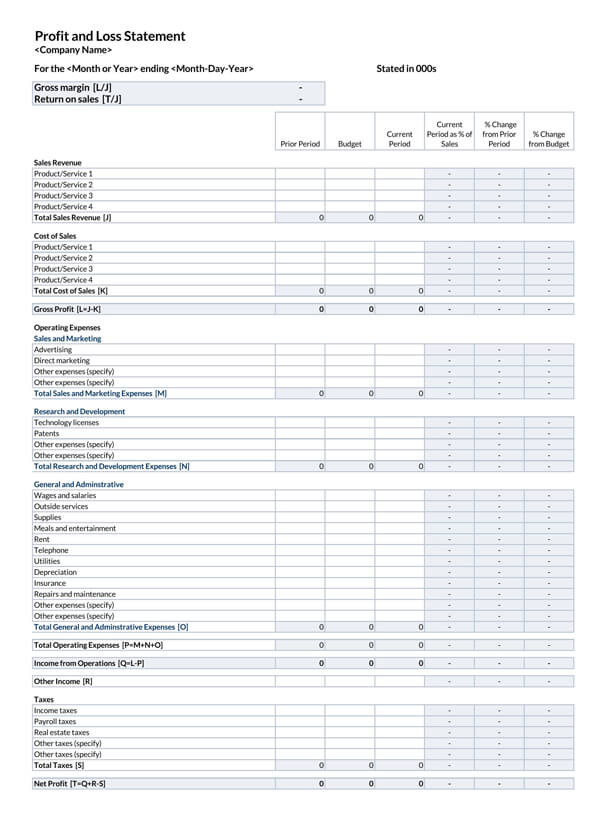

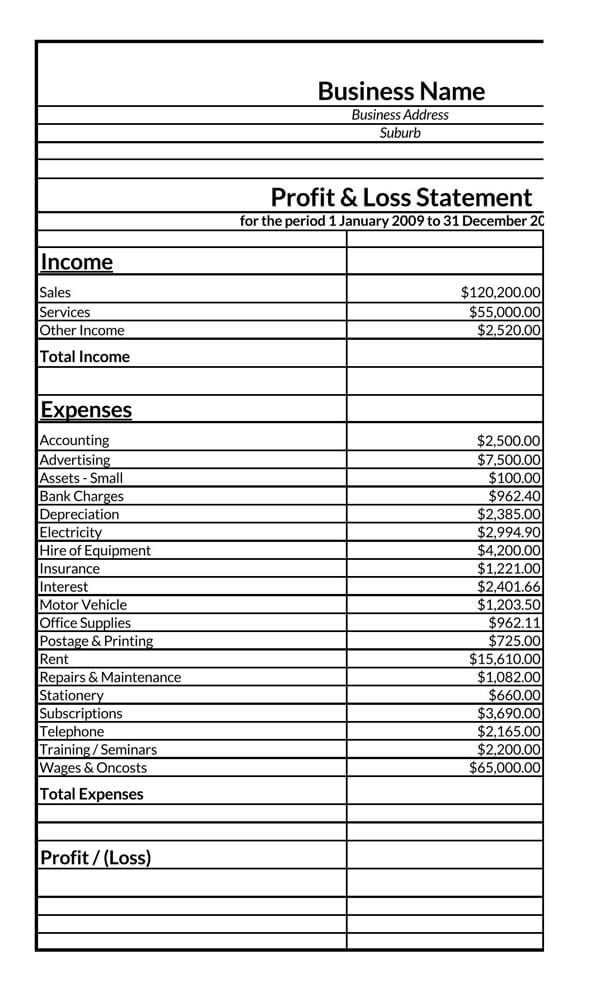

It mainly includes an expenses section, revenue column, and net income section. This financial statement is meant to help a business owner determine if their business or corporation is making profits or not in a certain financial year.

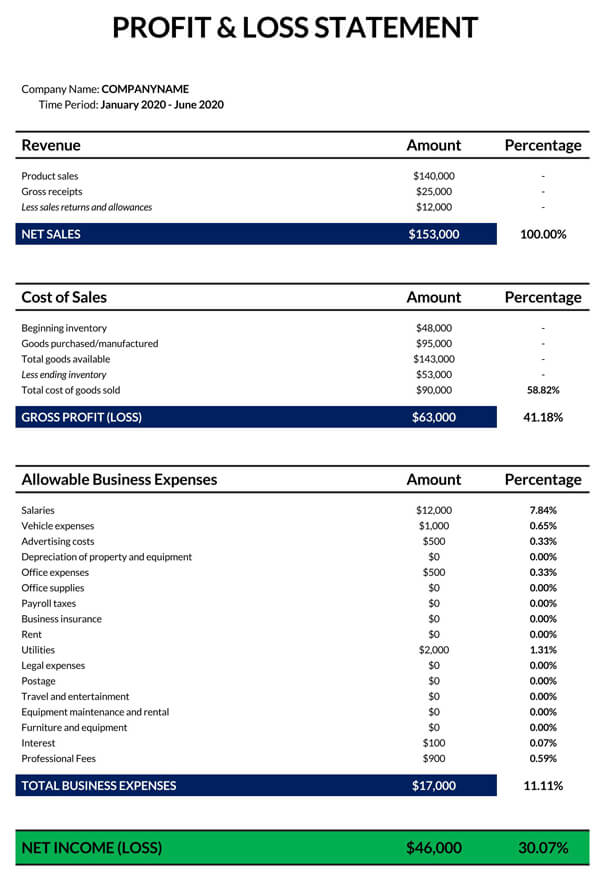

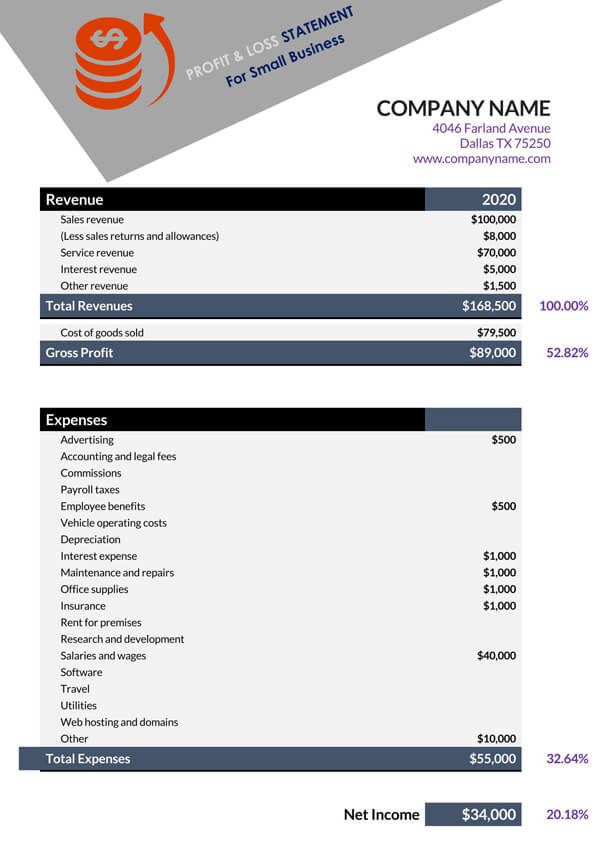

To know how to prepare and understand a P&L statement, you must know the difference between the three main sections usually found in this statement. Your revenue is the money that is coming into your business from your customers. Your expenses are the costs you incur in the course of handling your business. The net income is the difference between your revenue and expenses. A positive result from these calculations means that your business is making a profit.

For any business owner, knowing whether their business is making profits is an important part of the business. A business owner requires a P&L statement to aid them in displaying their business plan to potential investors, since the profit or loss generated is well-indicated. It also helps businesses in budget creation and calculating the working capital of the business.

The P&L statement helps track the business’s expenses, net income, revenue, and other incidentals incurred in a given financial year. With this statement, a business owner can establish if the revenue they are getting is higher than the expenses to determine the profits of the business. Alongside the balance sheet and cash flow statement, a business with the P&L statement can clearly understand its expenditures and revenues over time.

The profit and loss statement is also known as:

- Statement of financial results or income

- Earnings statement

- Income statement

- Statement of operations

- Expense statement

- Statement of profit and loss

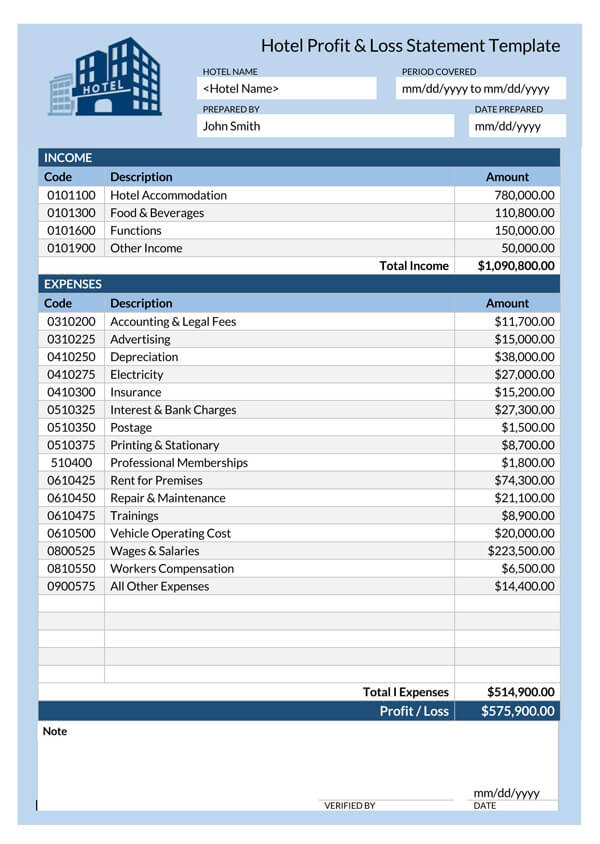

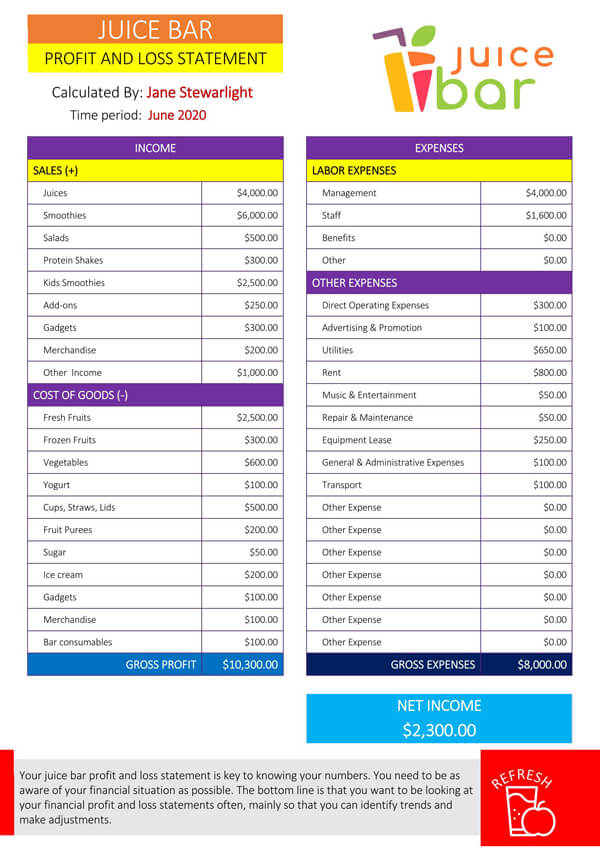

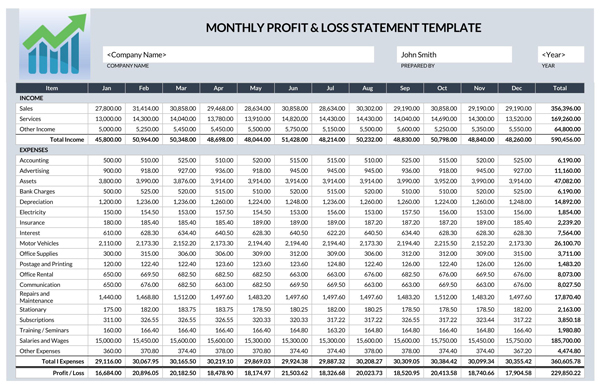

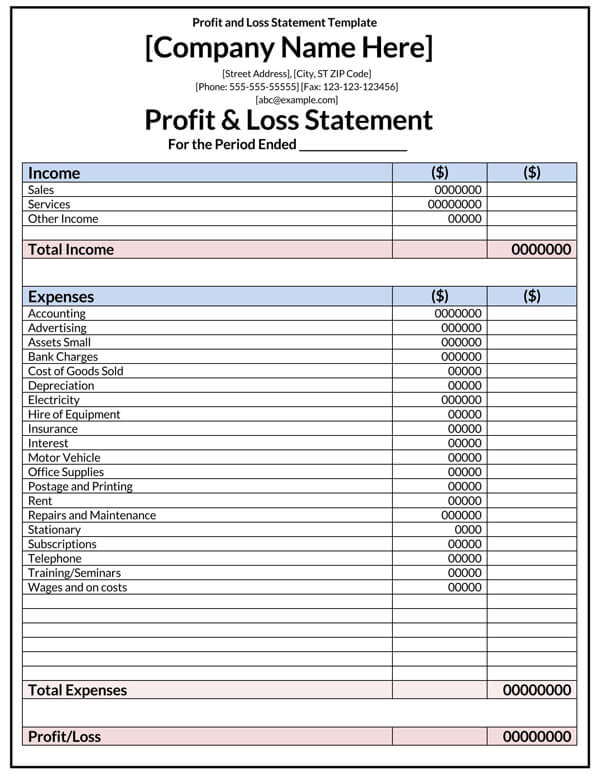

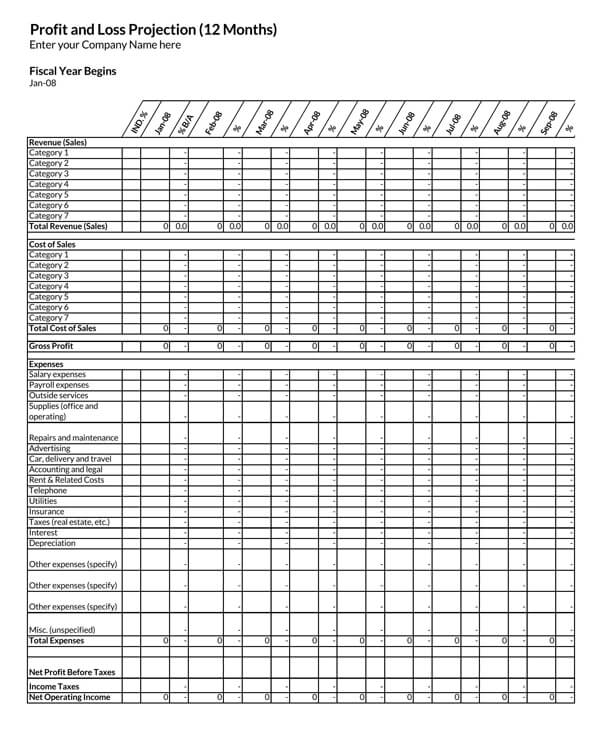

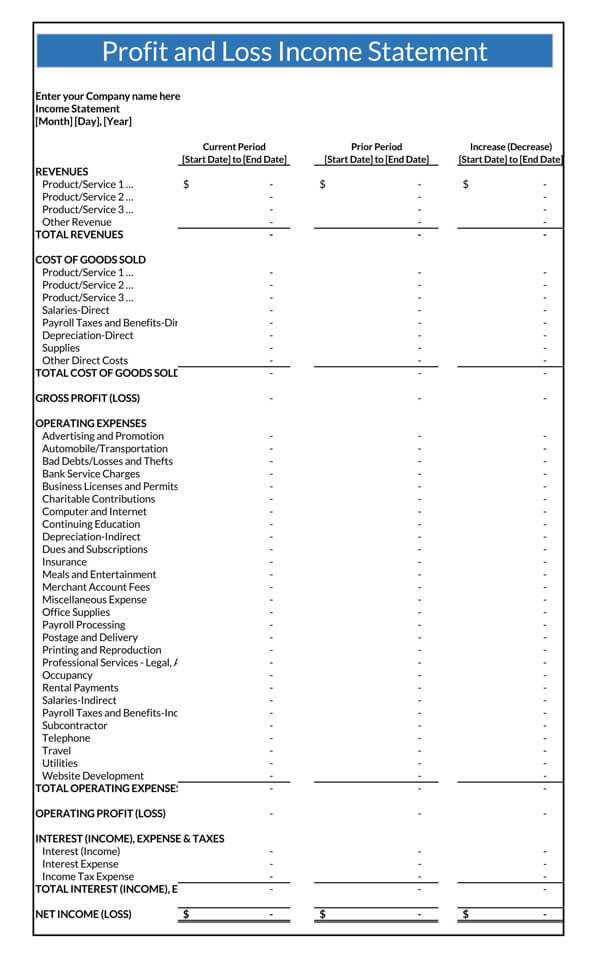

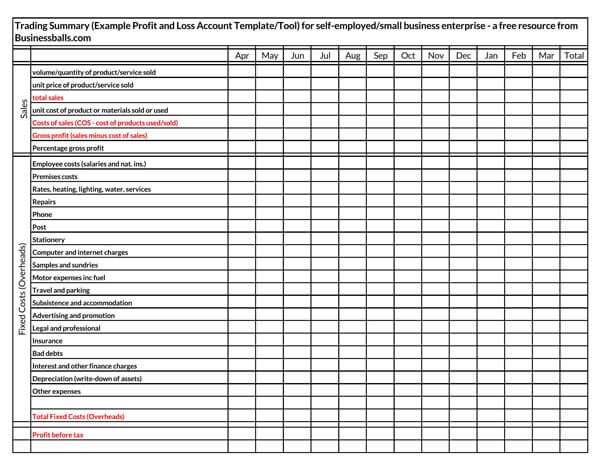

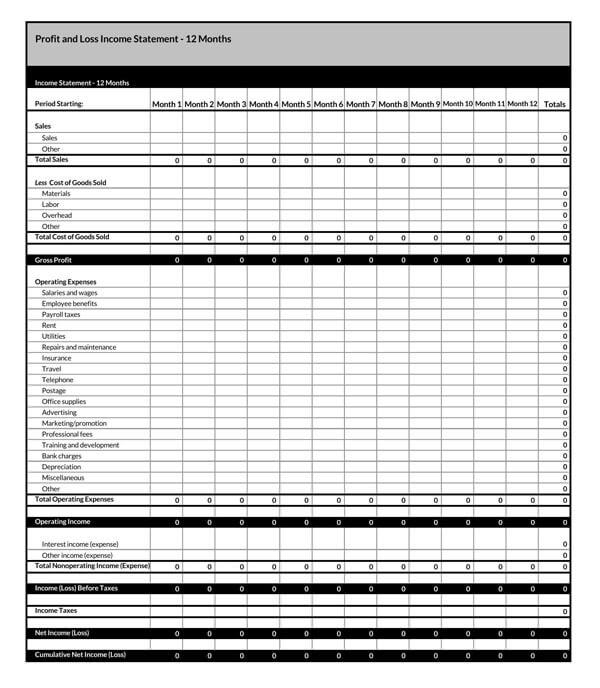

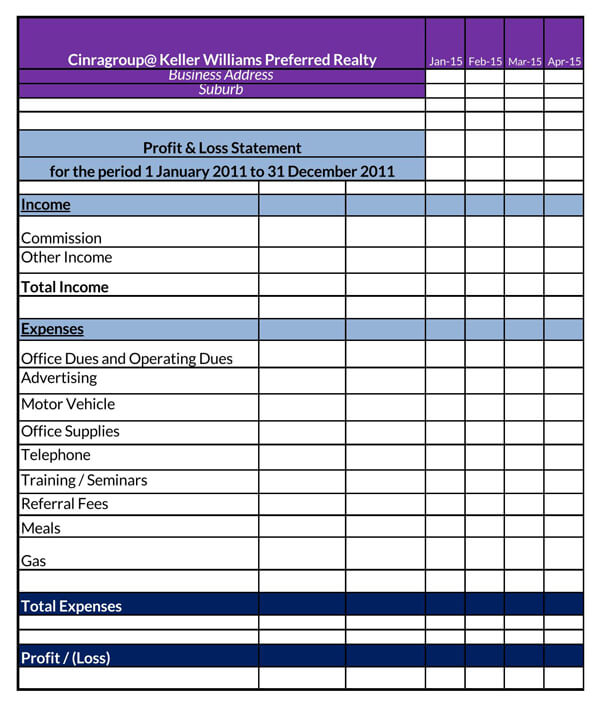

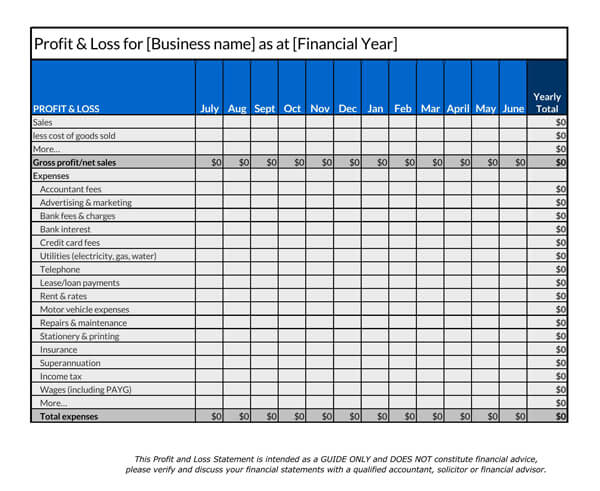

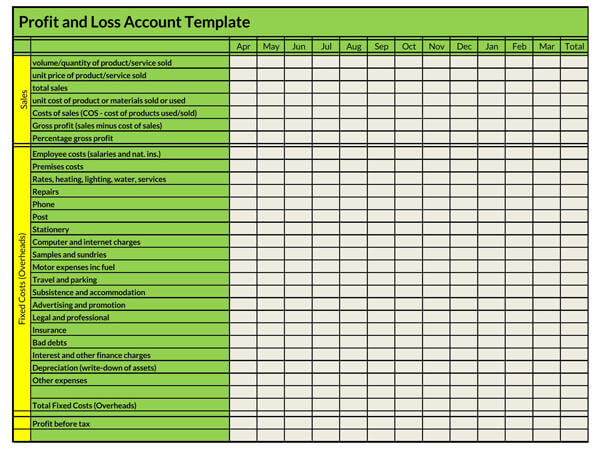

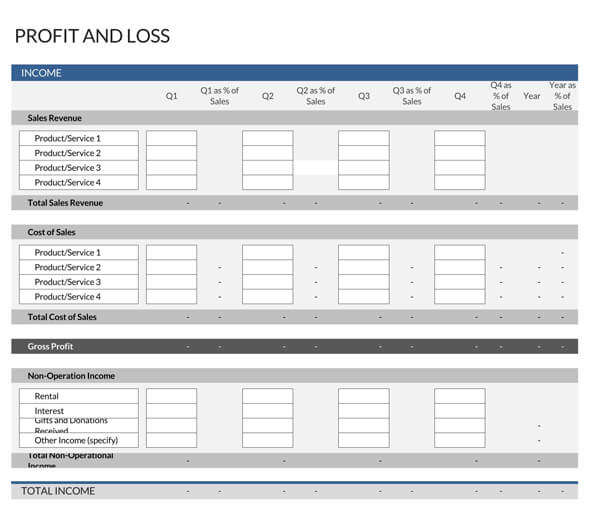

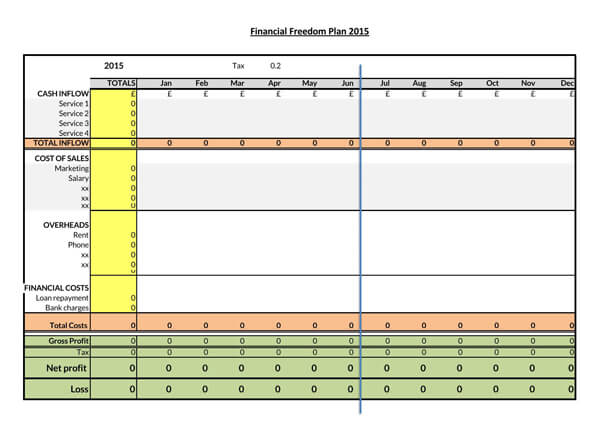

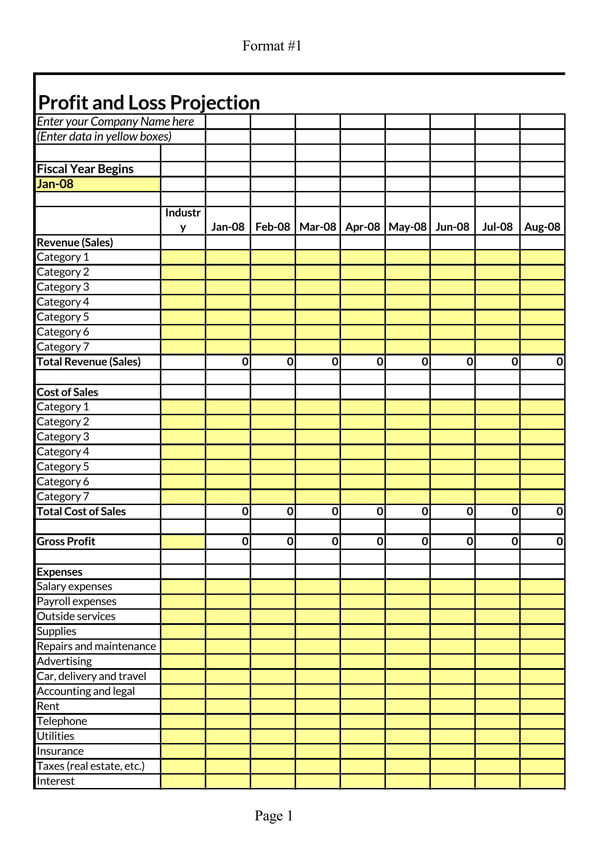

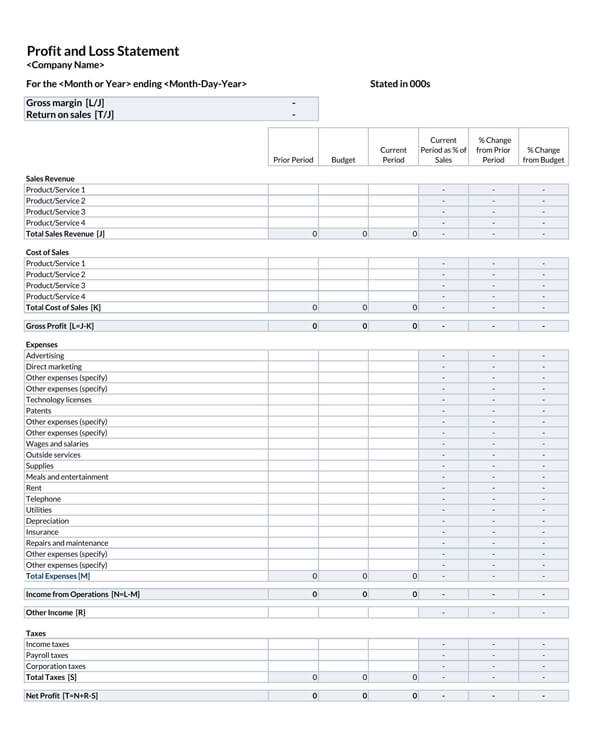

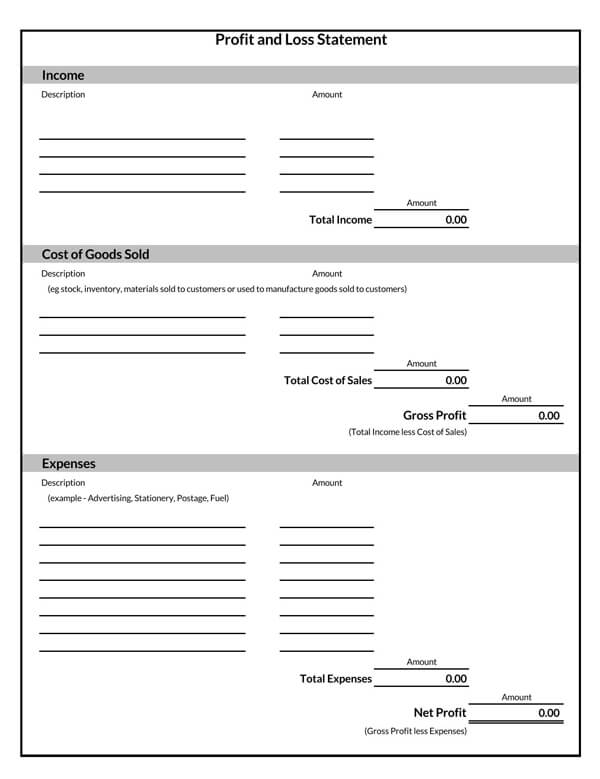

Profit and Loss Statement Templates

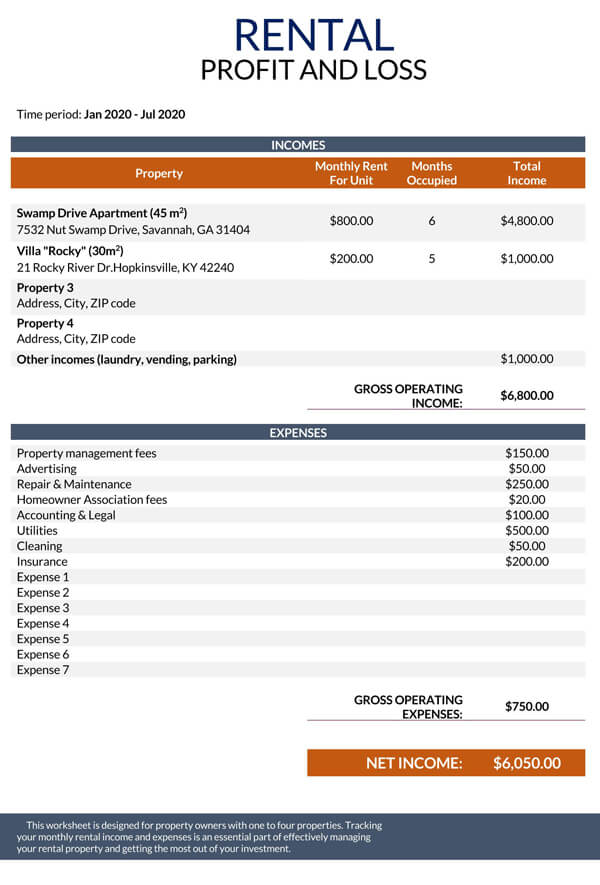

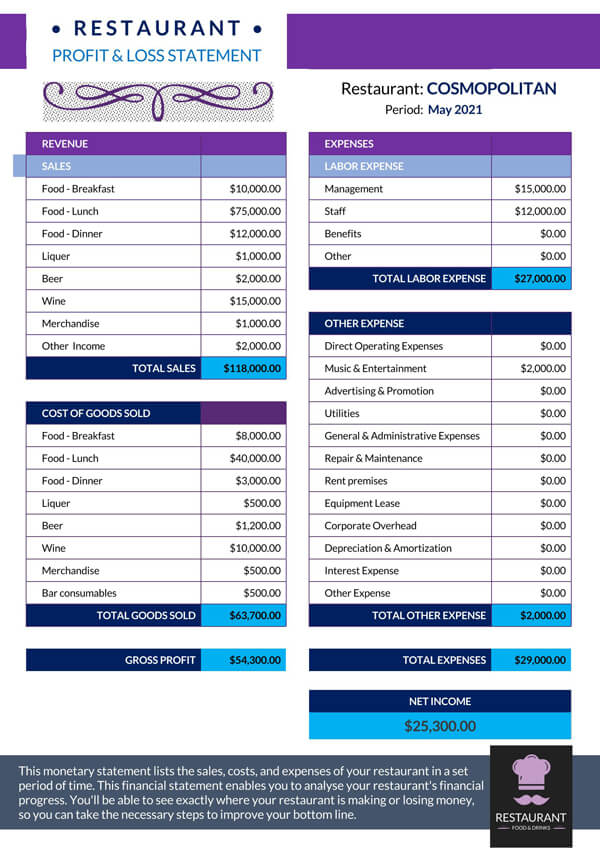

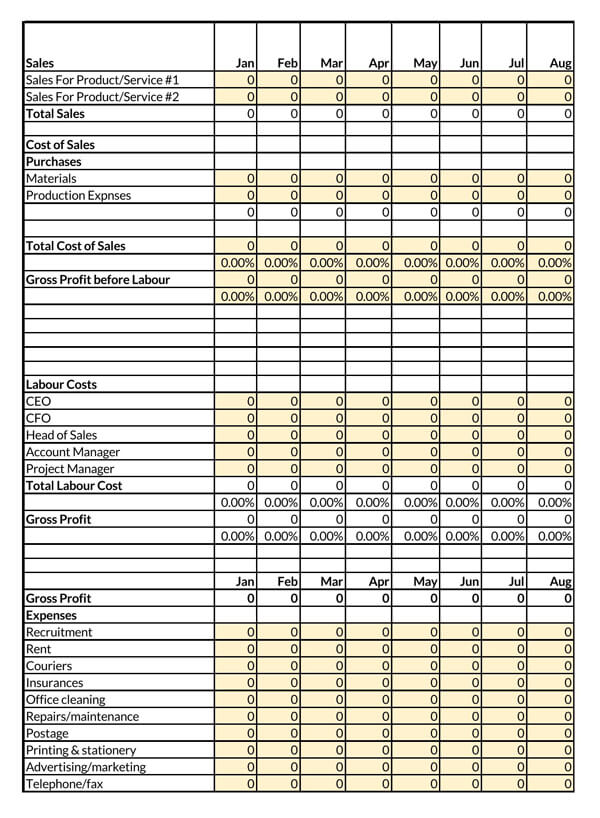

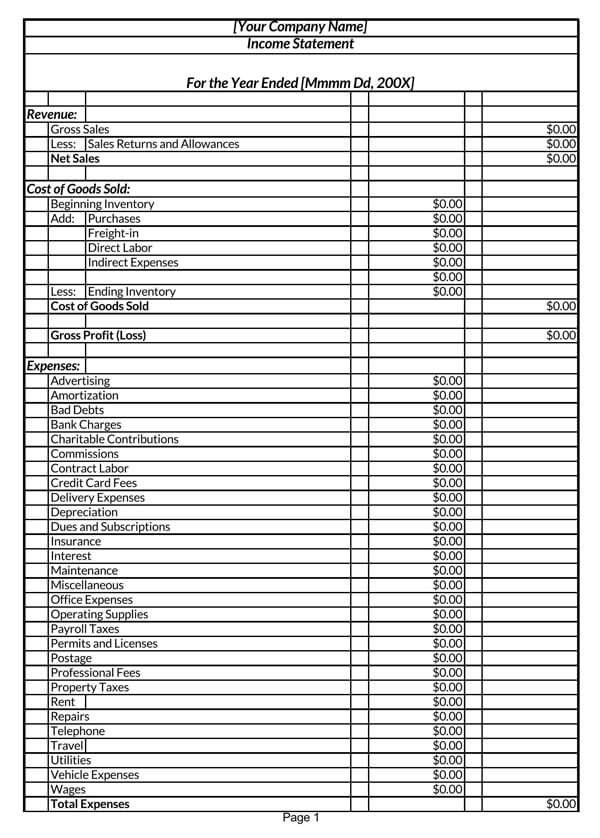

For easier preparation of a profit and loss statement, a business owner should use its template. This is an already prepared and printable form that can be used to account for expenditures and revenues faster and easily. With a template, a business owner will have a form that is already divided into sections to make the preparation work easier.

Templates in Word format

Templates in Excel format

Ways to Prepare

Whether you are preparing a personal or business statement, you can use either of the following two ways:

Cash method

With the cash method, a business owner can have records of cash transactions in and out of the business. This method is also called the cash accounting method. For any cash a business owner receives, they will indicate it as revenues, and for any cash that leaves, it will be indicated as liabilities.

Business owners with smaller businesses or companies mainly prefer this method of preparing a P&L statement. It is simple and is also the best for personal P&L statements to manage personal finances.

Accrual method

For the accrual method, business owners take records of revenues and liabilities that are yet to be received or paid for. The P&L statement created using this method takes account of all revenues and liabilities even before they are actualized to provide a financial statement for the future of the business.

How to Create

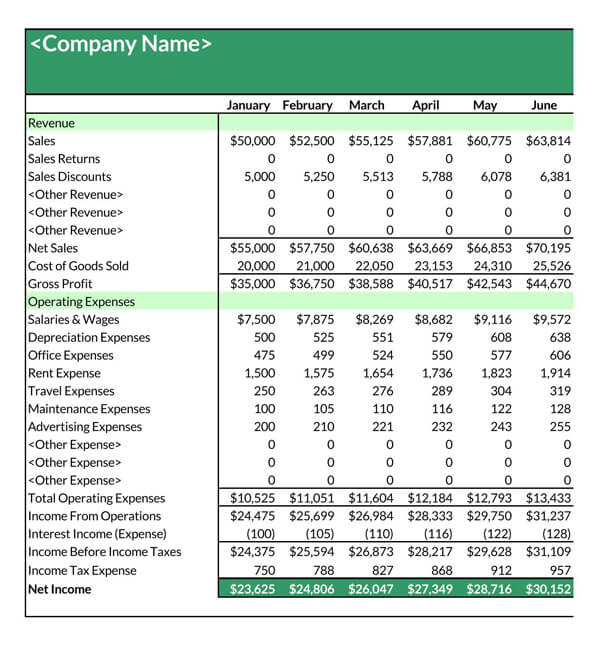

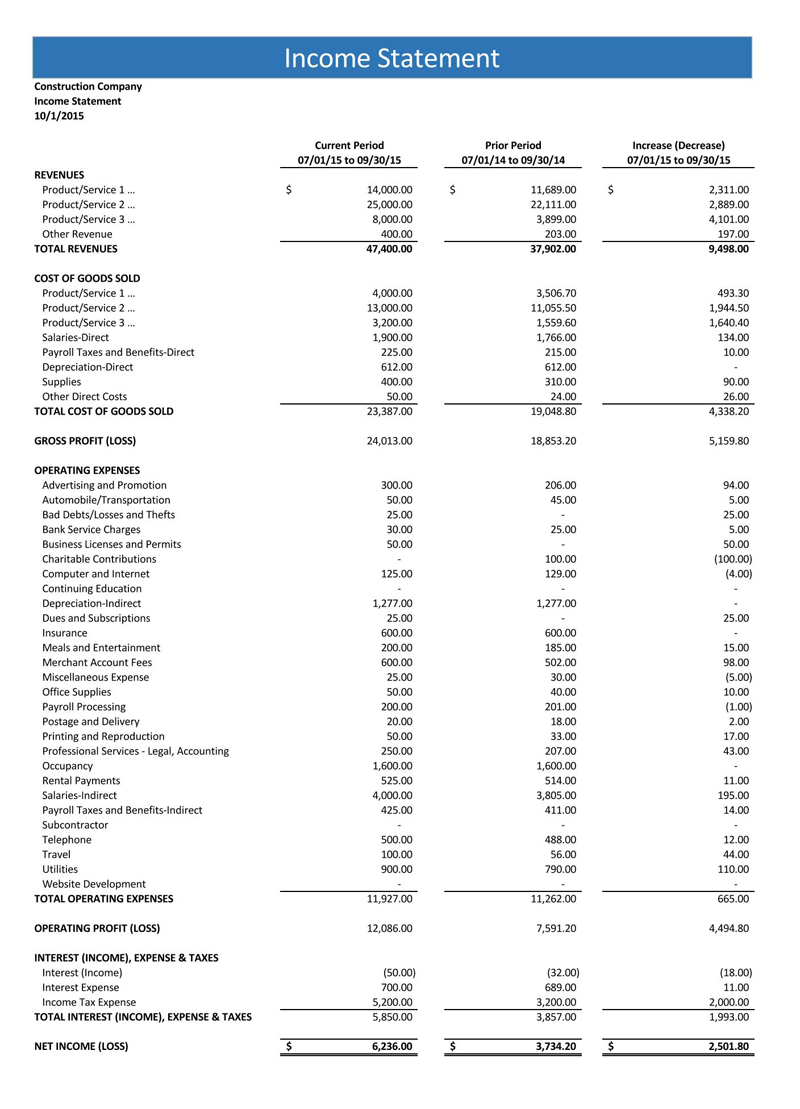

There are six basic steps that a business owner should observe when preparing a profit and loss statement. Below is an example of such a statement containing all the components created in the different steps.

Profit & Loss ABC Company 1st March to 30th July

| Revenue | Month 1 | Month 2 | Month 3 |

| Sales | Amount | Amount | Amount |

| Less: Discounts | Amount | Amount | Amount |

| Total Revenue | |||

| Costs of goods sold | Month 1 | Month 2 | Month 3 |

| Labor | Amount | Amount | Amount |

| Raw materials | Amount | Amount | Amount |

| Total Costs of goods sold | Amount | Amount | Amount |

| Expenses | Month 1 | Month 2 | Month 3 |

| Payrolls | Amount | Amount | Amount |

| Electricity bills | Amount | Amount | Amount |

| Water bills | Amount | Amount | Amount |

| Rent | Amount | Amount | Amount |

| Other expenses | Amount | Amount | Amount |

| Total expenses | Amount | Amount | Amount |

| Net income (Revenue- Expenses) | Amount | Amount | Amount |

| Profitability or Loss | Month 1 | Month 2 | Month 3 |

| Gross profit (revenue-total costs of goods) | Amount | Amount | Amount |

| Operating profit (total revenue-total expenses) | Amount | Amount | Amount |

| Net profit (after taxes) | Amount | Amount | Amount |

The components shown in the statement above, that is, the revenue, cost of goods sold, the expenses incurred, the net income, and the profit (or loss made), are the main components that are found in a P&L statement.

Step 1: Choose a format

You need to first choose the format that you will use to prepare your P&L statement. Since you can use either the cash method or the accrual method, you will have to pick a format that suits your records. That means you either need to have your cash transaction records or your liabilities and asset records to prepare the right format for the statement.

A P&L statement may mainly be formatted in two main ways. These are:

Single-step income statement

This format bundles up all the expenses, and the revenues save for the income tax expenses. It is simpler and quicker to make. Nonetheless, it may not always yield the proper and in-depth guidance that a statement of this kind is ordinarily supposed to give off. Then, it is also limited to small businesses only.

Multi-step income statements

In this kind of format, the expenses are broken down to their finest levels. In particular, the operating income and gross profits are handled separately in different lines.

To do this, it subtracts the ‘Cost of Goods Sold’ from the ‘Net Sales’ to arrive at the ‘Gross Profit.’ It proceeds to calculate the ‘Operating Income’, after which it adjusts for the interest expenses and the income tax to generate the ‘Income from Continuing Operations.’

Step 2: Enter revenue

The revenue is the amount of money your business has received over a particular financial period. It is the first component that must be entered into the P&L statement. It includes all that has been received from selling products and services or any part of your business like a photocopying machine.

For a business owner, you need to include all the business revenue. In the case of a monthly P&L statement, a business owner will include both the business revenue that has been collected and the one that has not been collected.

You can start by getting information about your current account balances from your business ledger. The current account balances might include cash and all the current accounts receivable (AR) balances. A quarterly statement will require a business owner to include all the revenue gathered during the three-month period.

Step 4: Calculate cost of goods sold

The cost of goods may vary from business to business, but must be included in the P&L statement. For some business owners, the cost of goods is the amount of money they spend buying goods from their manufacturers or suppliers. For others, it is the price they paid to manufacture their goods, for instance, accessing the raw material and paying for labour.

Step 5: Enter expenses

These are the costs that a business owner incurs when operating a business. Expenses in a business may include rent, the amount used to pay employees, money spent on equipment, travel, and utilities like electricity and water bills.

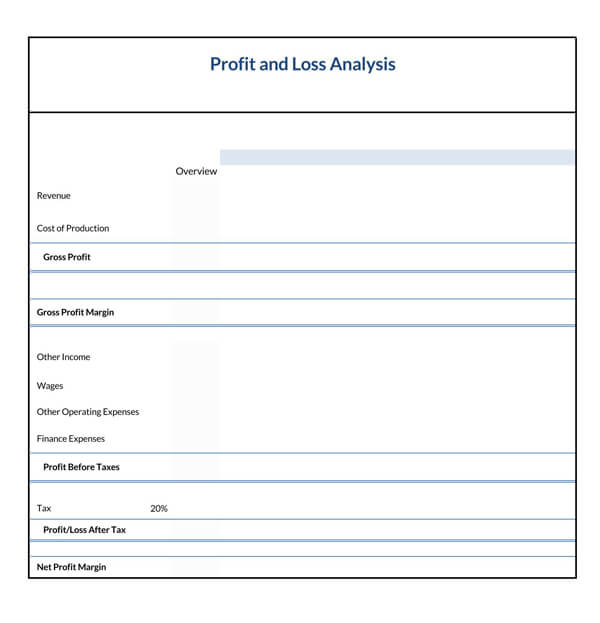

Step 6: Calculate net income

The net income is also known as the profit your business has made for that financial period. It is calculated by subtracting your business expenses from your revenue. You will be able to obtain the total operating profit of the business.

Step 7: Determine profitability

To determine the business’s profit, a business owner should learn how to calculate these different types of profits:

- Gross profit: This is the profit you make after subtracting the costs of all the goods sold from your revenue.

- Operating profit: The operating profit is the profit you realise from subtracting the total expenses from the gross profit.

- Net profit: This is the profit you realise after paying your taxes.

Periodic vs. Pro Forma

There are two types of P&L statements that you may choose to prepare depending on your business. These two types of P&L statements include:

Periodic profit and loss statement

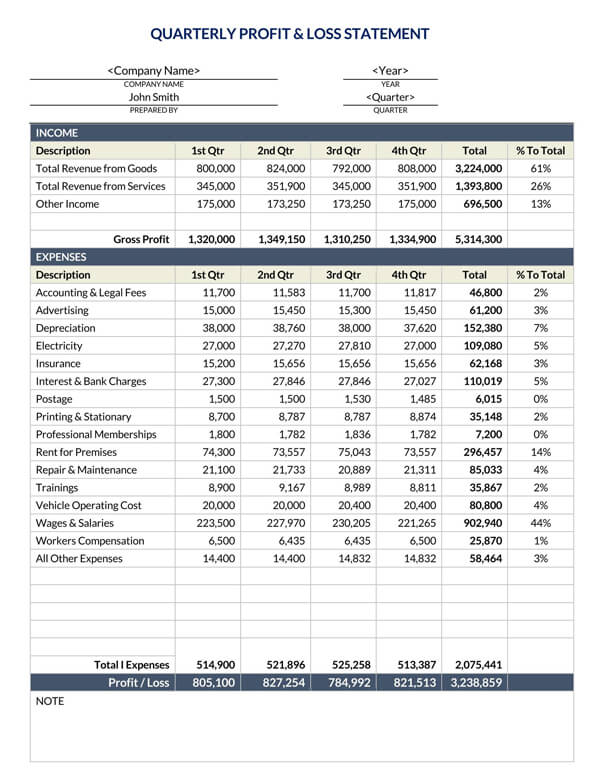

This financial statement is used by a business owner who wishes to prepare and evaluate their profits and losses after a set period of time, usually quarterly. With this statement, a business owner can make informed decisions about tax returns. Information from the statement will help such a business owner to calculate their net income so as to determine the expected tax returns from the business.

To prepare a periodic P&L statement, you need to have a section that shows the quarterly amount and another that shows the total yearly amount. Start by indicating your net income or sales on a quarterly basis, and then create a section for expenses.

Continue by creating another section that indicates the difference between sales made and the expenses, and then indicating the interest released from the business debts. Finally, indicate the taxes from the sales made and subtract before you indicate the total depreciation of that year.

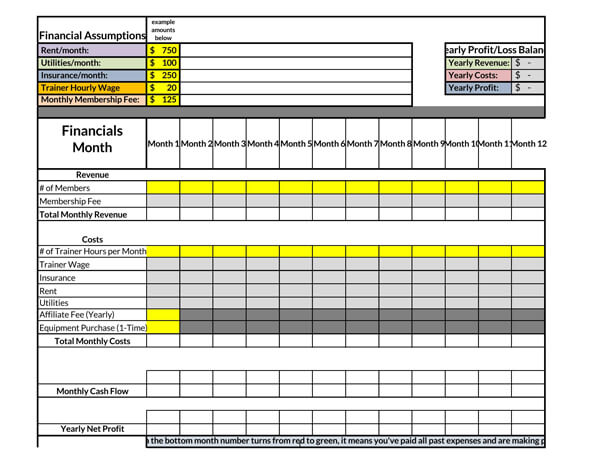

Pro Forma profit and loss statement

It is meant for new businesses that are just starting up and are looking to project the profits and losses. They are also used by business owners when looking for potential investors to fund any business project. To prepare this statement, you need to list all the expenses by over-estimating the amount, provide an estimate of sales (net income) for each month, and finally, have a section of the difference between the two (sales and expenses). A negative amount will indicate the amount of money a business owner should request for funding.

More Free Templates

Frequently Asked Questions

The two do not have much difference except for the name. They are both used for tracking and reporting expenditures and revenues to determine profit or loss in a business.

While a P&L statement indicates the business’ income, expenses, and revenue, the balance sheet indicates the business’ assets and liabilities. Also, the P&L statement has records for a particular period of time, while a balance sheet has up-to-date records of the business.

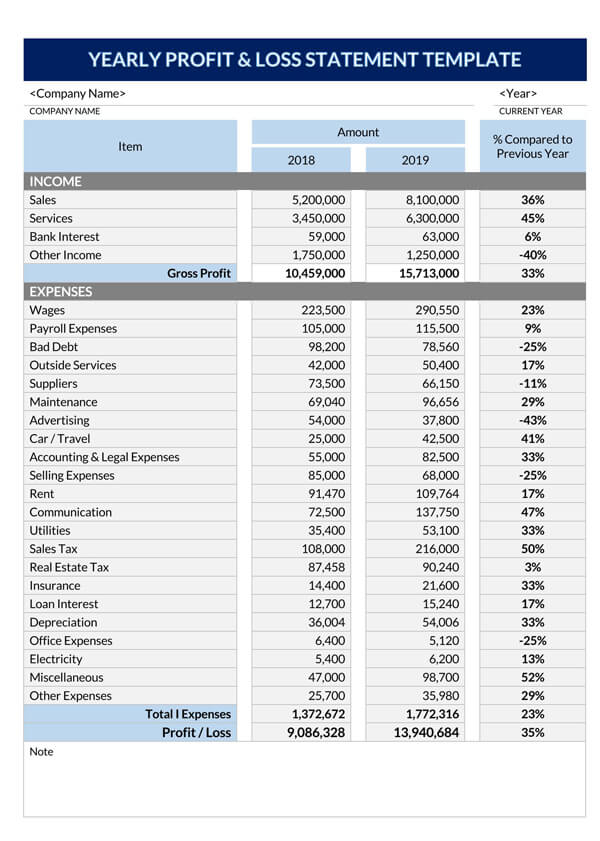

Most business owners prefer to generate their statements on a monthly, quarterly or yearly basis.

Usually, private companies are not required to prepare a P&L statement. However, for public companies, business owners must prepare this financial statement and file it with the Securities and Exchange Commission. With that in place, investors and company regulators can review the financial status of the business.

All GAAP (Generally Accepted Accounting Principles) guidelines must be observed as a public business owner prepares a P&L statement.

To find the net revenue amount in the profit and loss statement, you need to subtract all the expenses incurred from the net income or sales made. For a positive answer, the business is making profits, while a negative answer means that the business is making losses.

This financial statement is usually accompanied by other financial statements like balance sheet and cash flow statement. However, these documents are not necessary for a monthly P&L statement due to the little period of time.

A monthly statement is due at the end or beginning of every month after the reporting period is complete.

After preparing and signing the statement, you need to send it to the required party who is most likely a money lender. It is best to always have a copy of the P&L statement.