A hardship letter helps address the lender with an earnest plea for special consideration in the event of your defaulting on your debt. It typically includes three essential points – describing your circumstances, explaining your efforts to overcome financial difficulties, and requesting special consideration.

Some key features of a hardship letter include the following:

- It should help you clarify your specific financial situation and justify defaulting on your debt. For instance, you can send a hardship letter to your lender explaining why you cannot meet your financial obligations as a mortgage holder. Another frequent example is addressing your bank with a special request to extend your credit terms due to unforeseen circumstances.

- It should include details such as when and why your financial difficulties have ensued and when you expect them to end.

- Ideally, this letter should help you convey your struggles in a way that secures a certain form of relief.

- It should specify the solution to your problem and ask the lender to be lenient.

Some common types of leniency requests are:

- Lowering the amount you are expected to pay;

- Not paying your debt in full;

- Waiving late fees;

- Extending your payment terms;

- Obtaining a reduced interest rate;

- Temporarily pausing your payments.

One example of a plea for leniency is: “A three-month extension on my payment terms would help me to avoid default and give me the time I need to recuperate from my surgery. After three months, I will start receiving my full salary again and will be able to make my regular payments again.”

This letter should not be used to express frustration or to try to negotiate better payment terms. Likewise, it must not be used as a channel for conveying political messages.

What Qualifies as a Hardship?

By definition, hardship is a condition that causes difficulty or suffering. In the context of financial circumstances, experiencing hardship means having financial difficulties that were caused by circumstances beyond one’s control.

Common circumstances that qualify as a hardship are the following:

- Termination of employment

- Reduced salary or decreased work hours

- Long-distance job transfer

- Chronic illness or disability

- Severe illness or injury

- Medical expenses for a family member

- Termination of marriage or separation

- Death of someone you rely on

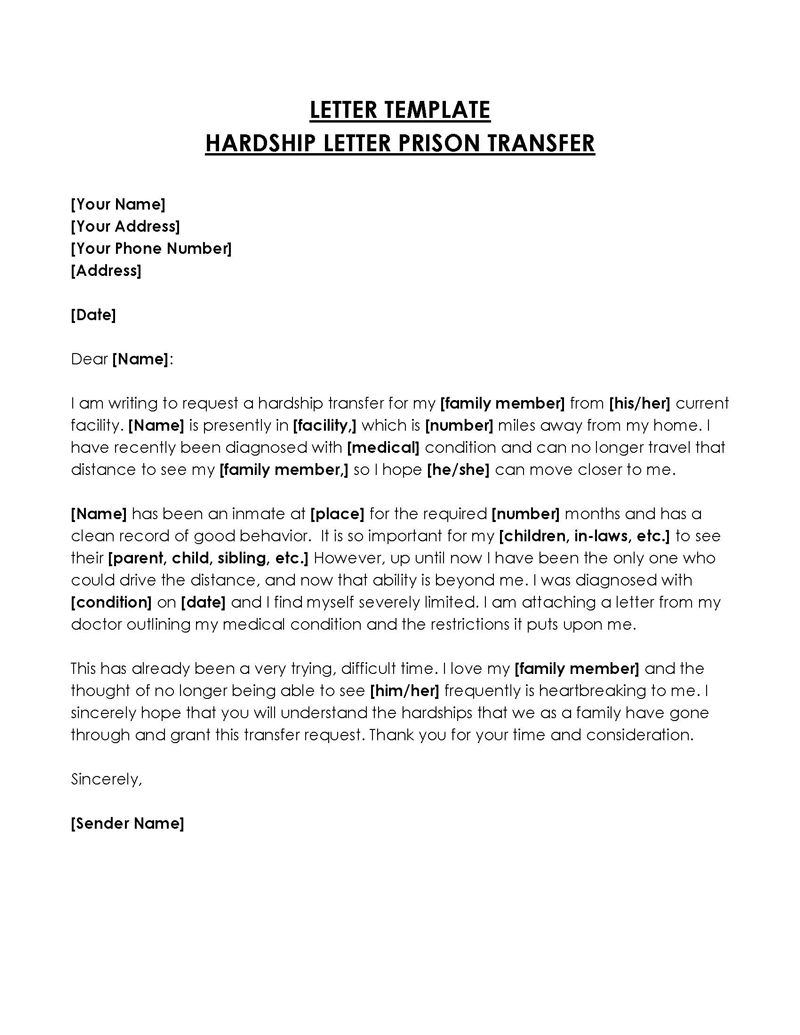

- Incarceration

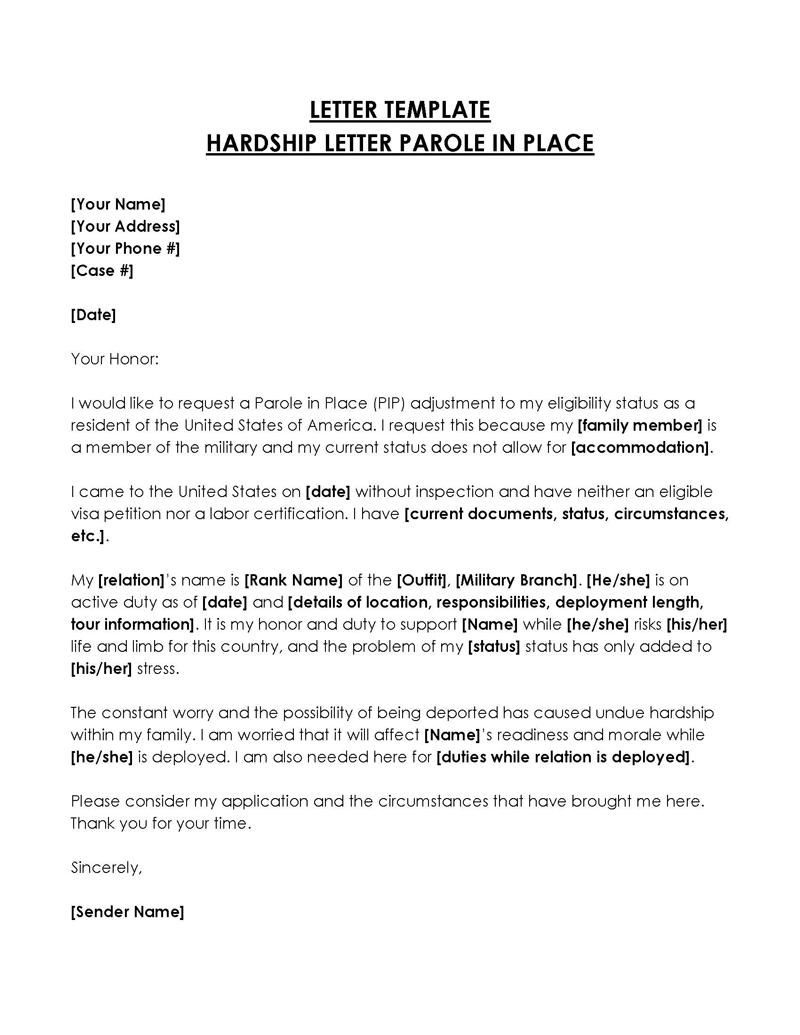

- Military mobilization

- Natural or man-made disaster

- Major, expensive, and necessary home renovations

- An extreme change in payment terms

- A sudden increase in expenses

- Excessive debts

You should not expect any form of relief in the event of the following:

- Property value decline or underwater mortgage

- Expenses and debt that cannot be justified as essential

- Any financial loss that can be covered with liquid assets

- Increased interest rate on the home equity line of credit

- Increased interest rate on an adjustable-rate mortgage

Mortgage default is one of the most frequent reasons for writing a letter of hardship. Even though many mortgage-related circumstances qualify for relief, it is important to note that an “underwater” mortgage does not qualify as a hardship.

These arguments are typically misused by borrowers asking for a change in loan payment terms after their property value has decreased, so lenders rarely consider granting any relief. Mortgage holders often file such letters due to general dissatisfaction with the property value or the terms of the loan. Without a proper reason for financial relief, such requests could be seen as an attempt at fraud, which is punishable by law. It is crucial to assess one’s situation honestly when pleading for a change in financial obligations. Only then should one request leniency.

In addition to mortgage loans, such letters can also help with credit card debt, medical bills, and school tuition. In any case, before submitting a hardship letter, the writer must carefully consider their financial situations, obligations, and practical alternative payment options.

When composing a leniency request letter, it can be very helpful to be aware of how lenders view requests for concessions. Lenders are more interested in knowing what is exactly requested in the letter than the unnecessary details of the borrowers’ financial difficulties. Therefore, the letters must address that by highlighting the ways lenders could benefit from changing the payment terms.

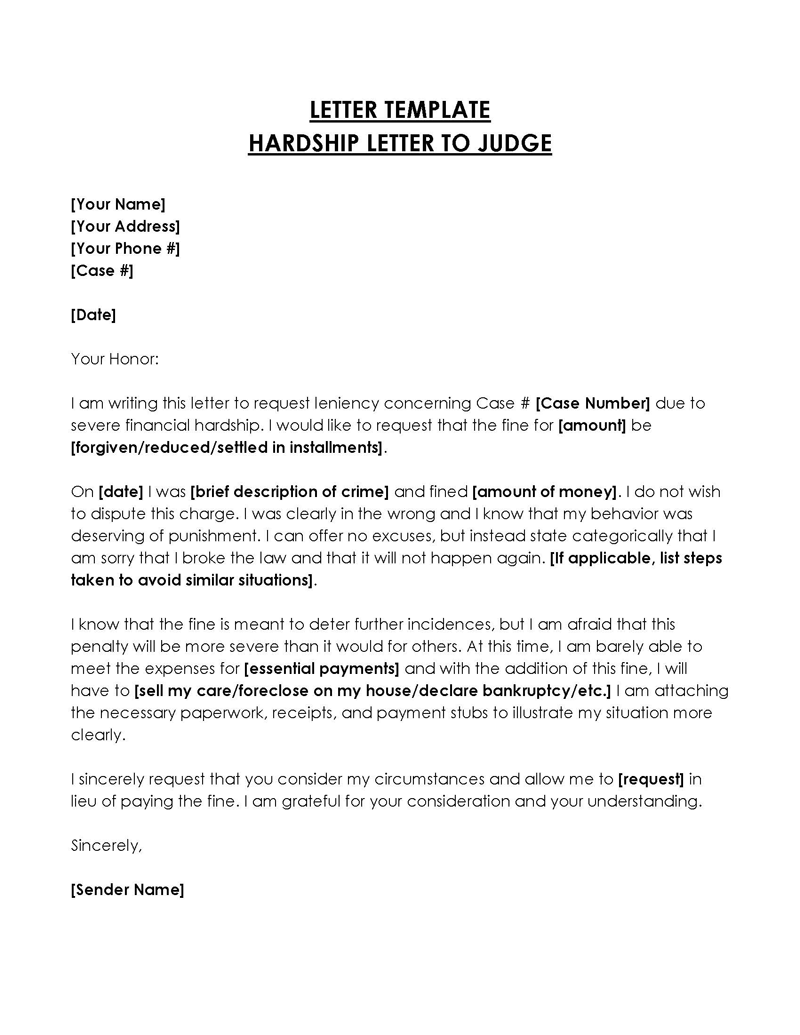

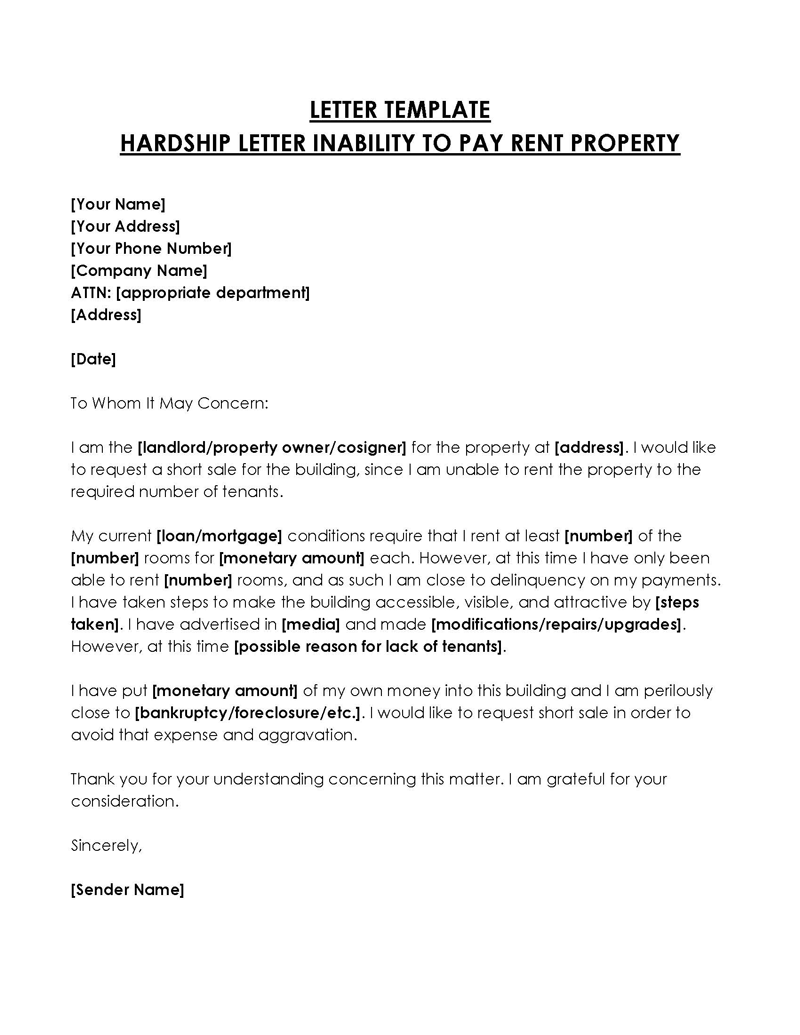

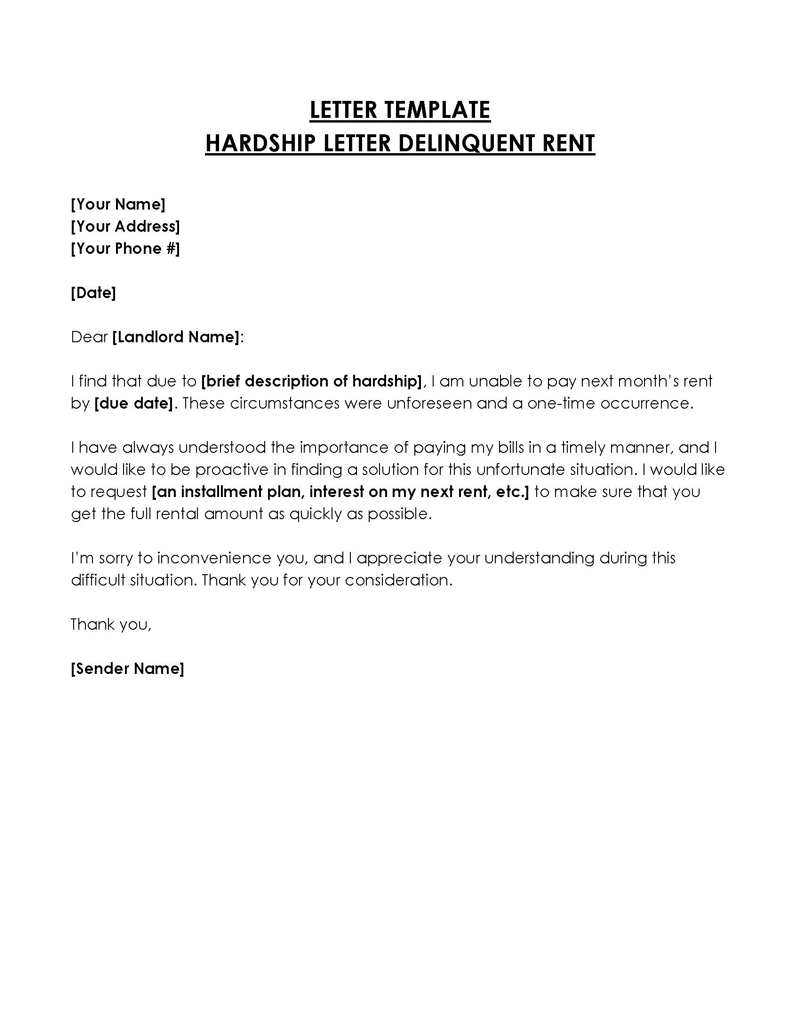

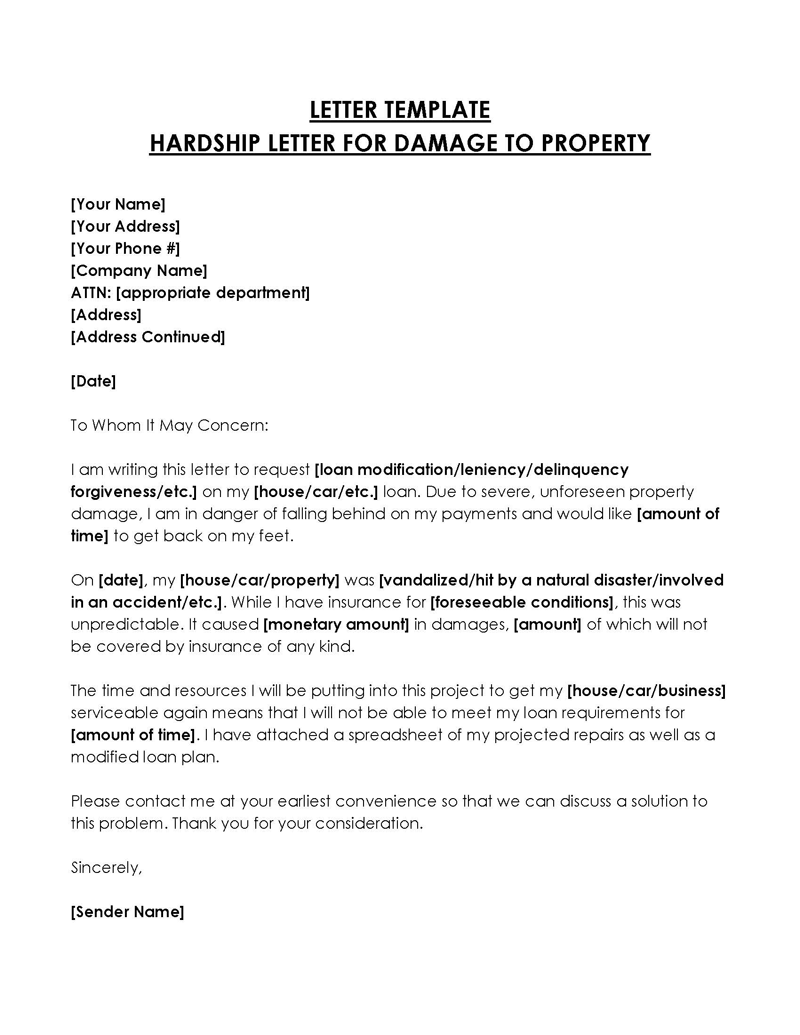

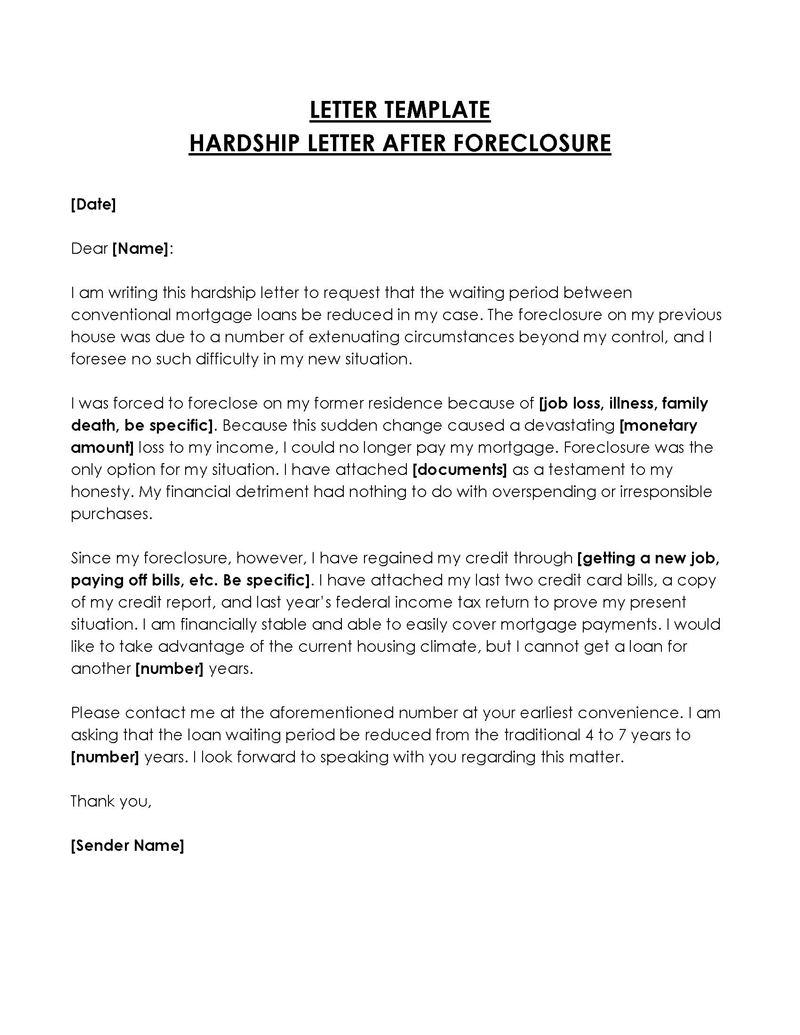

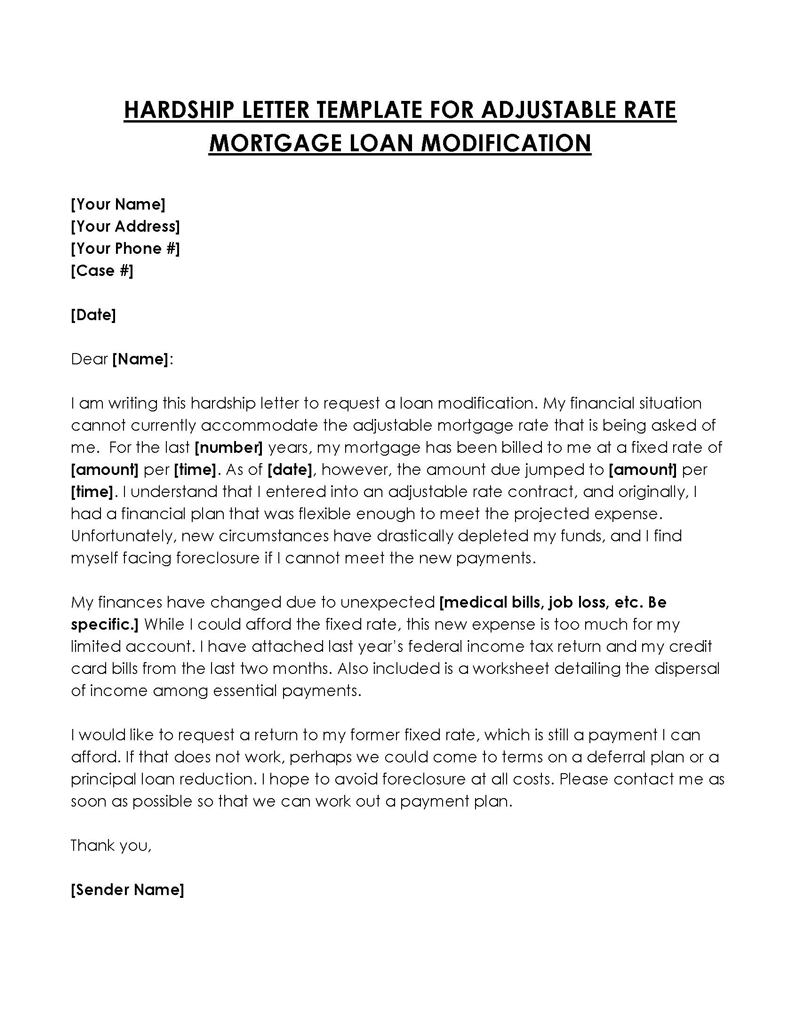

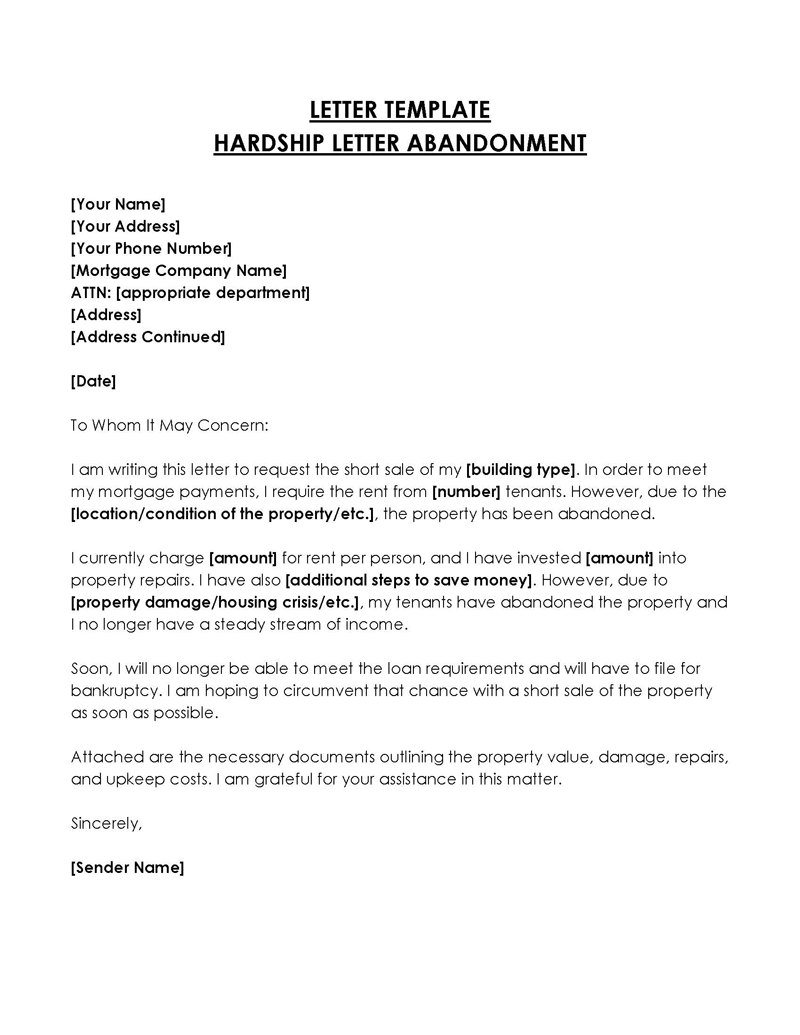

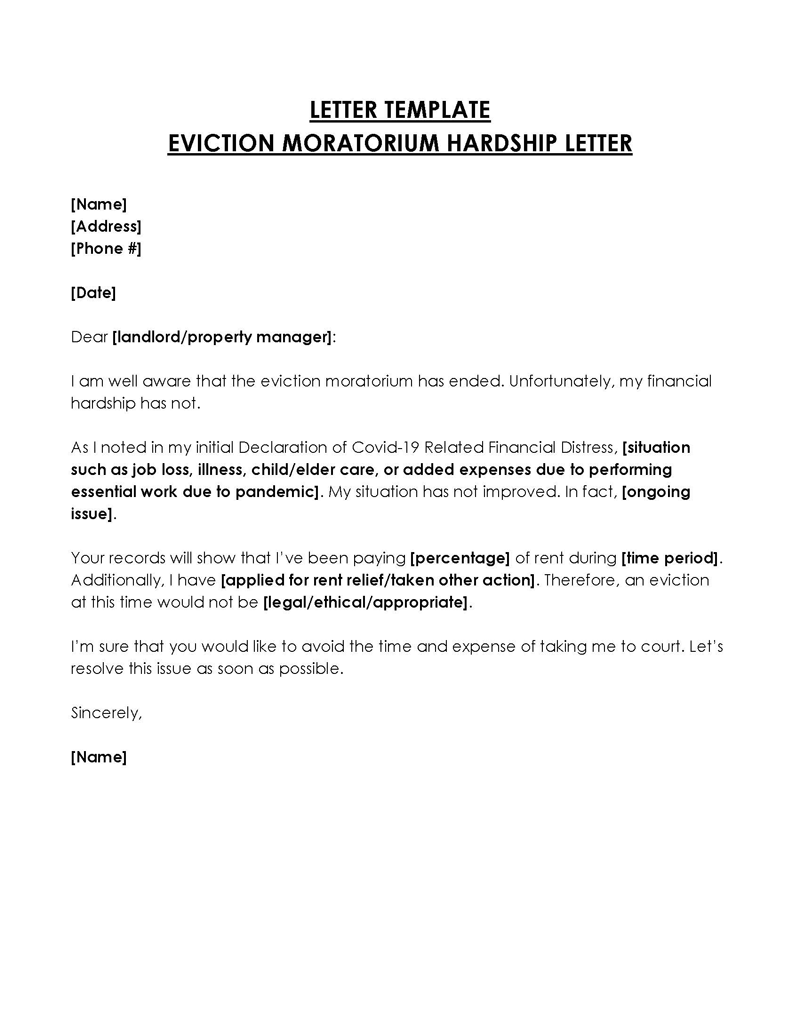

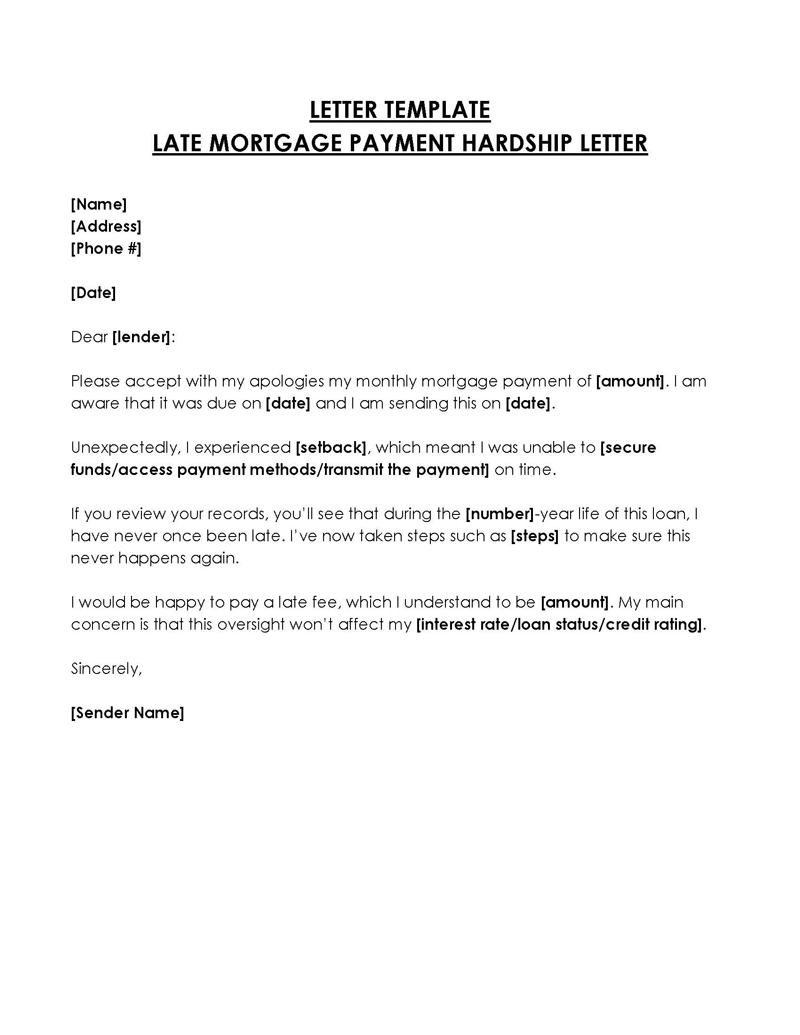

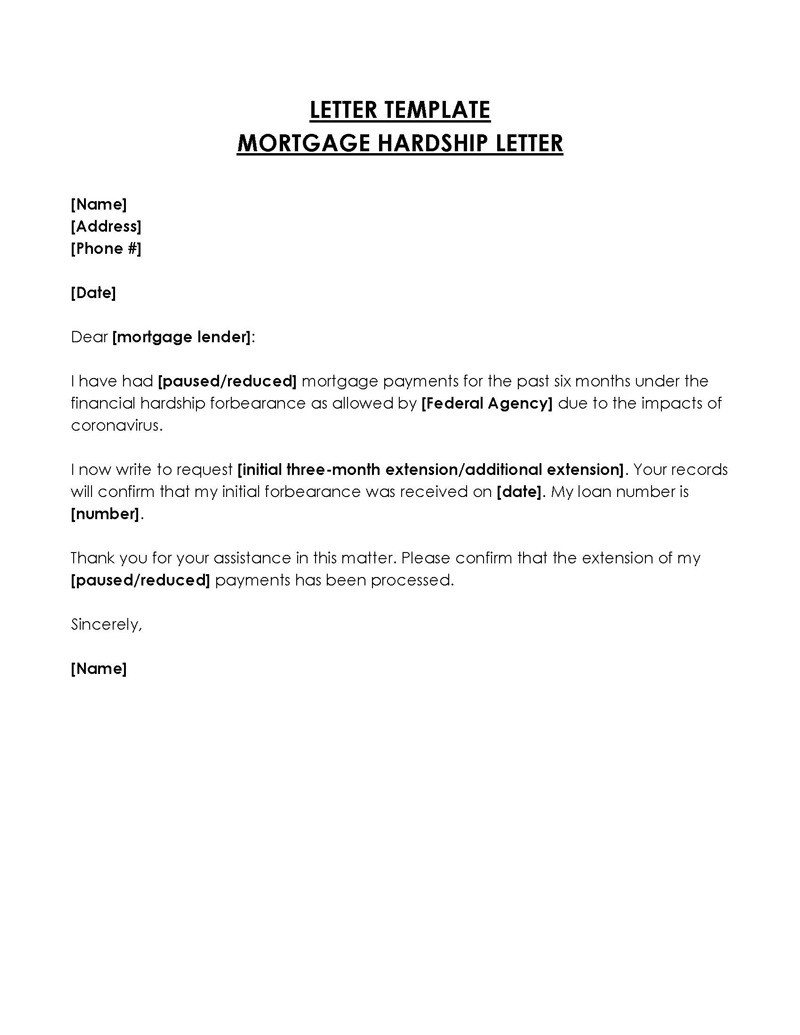

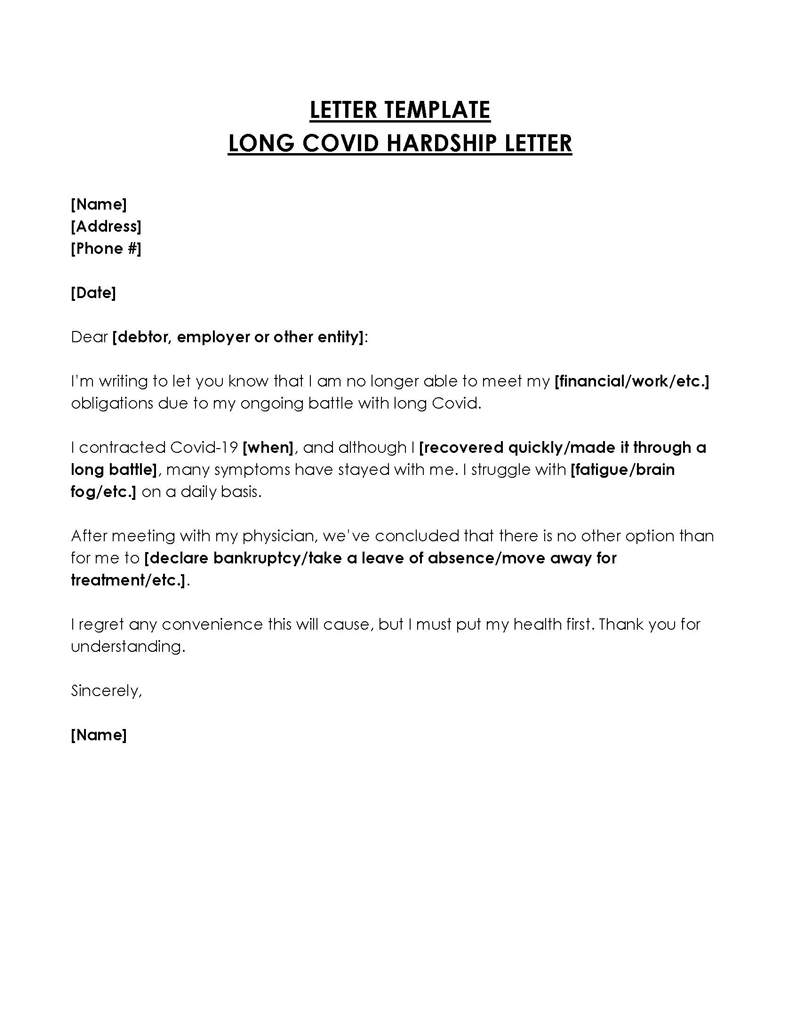

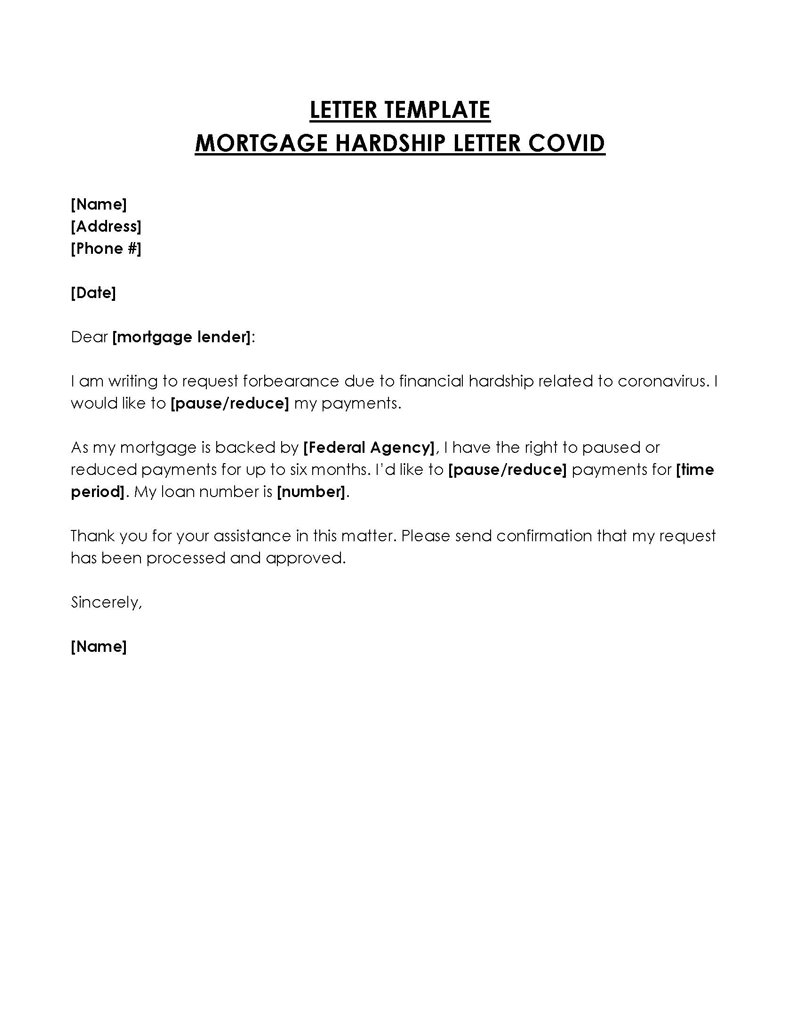

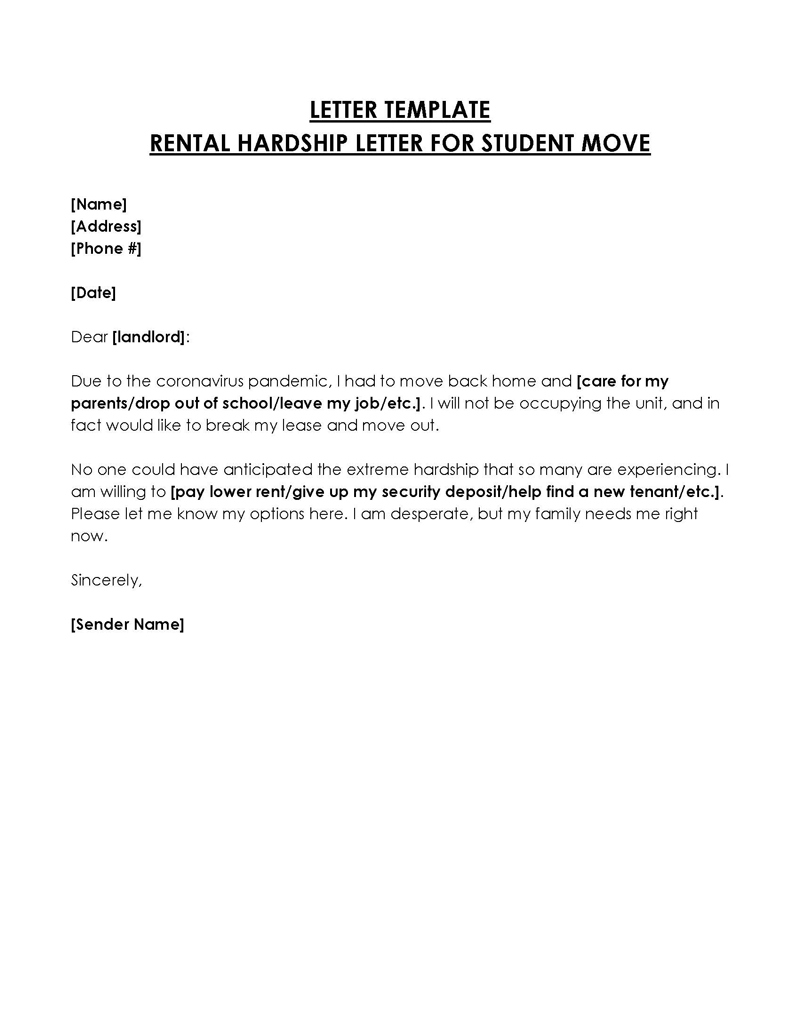

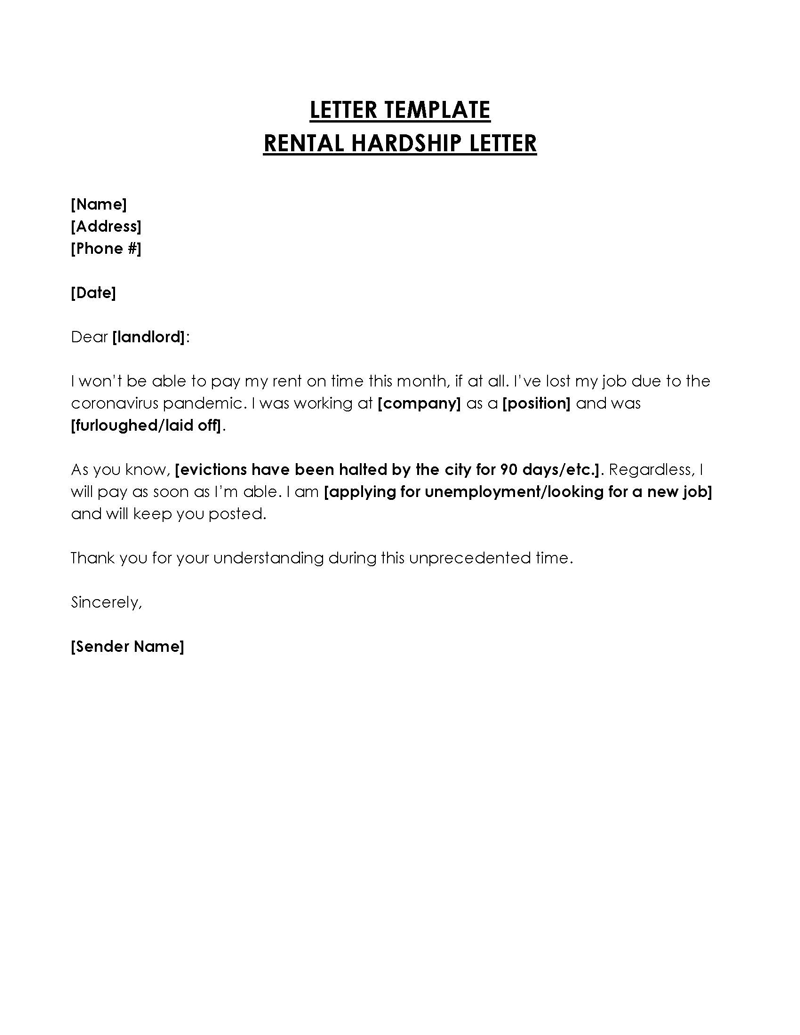

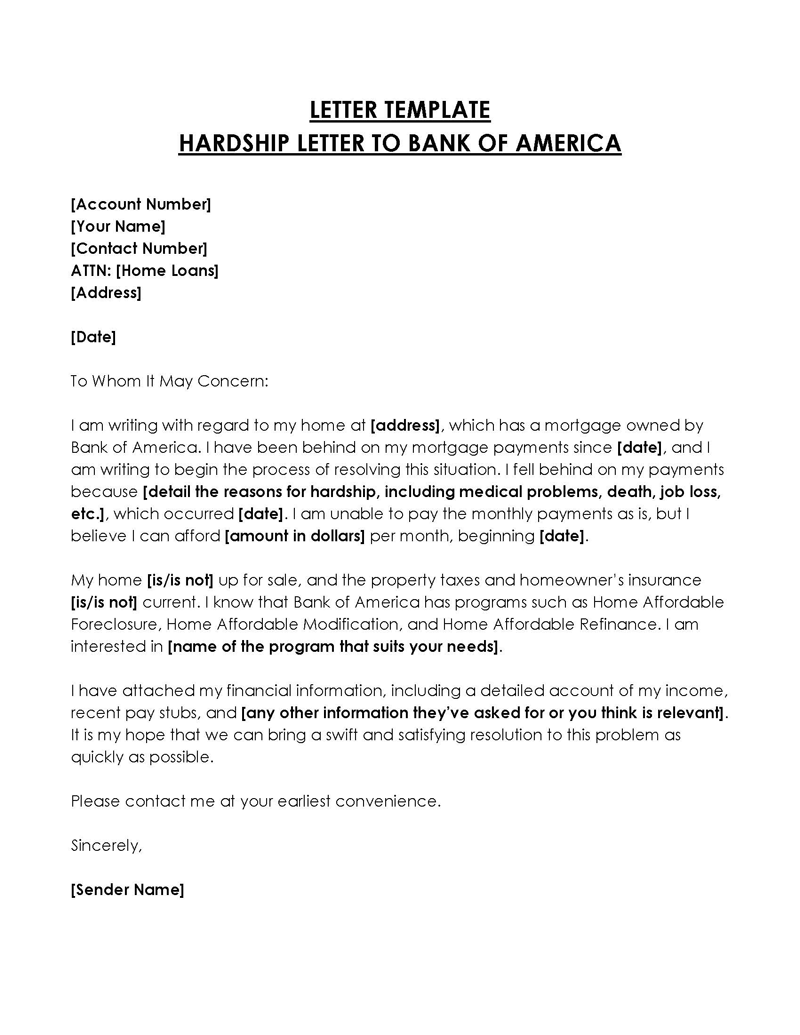

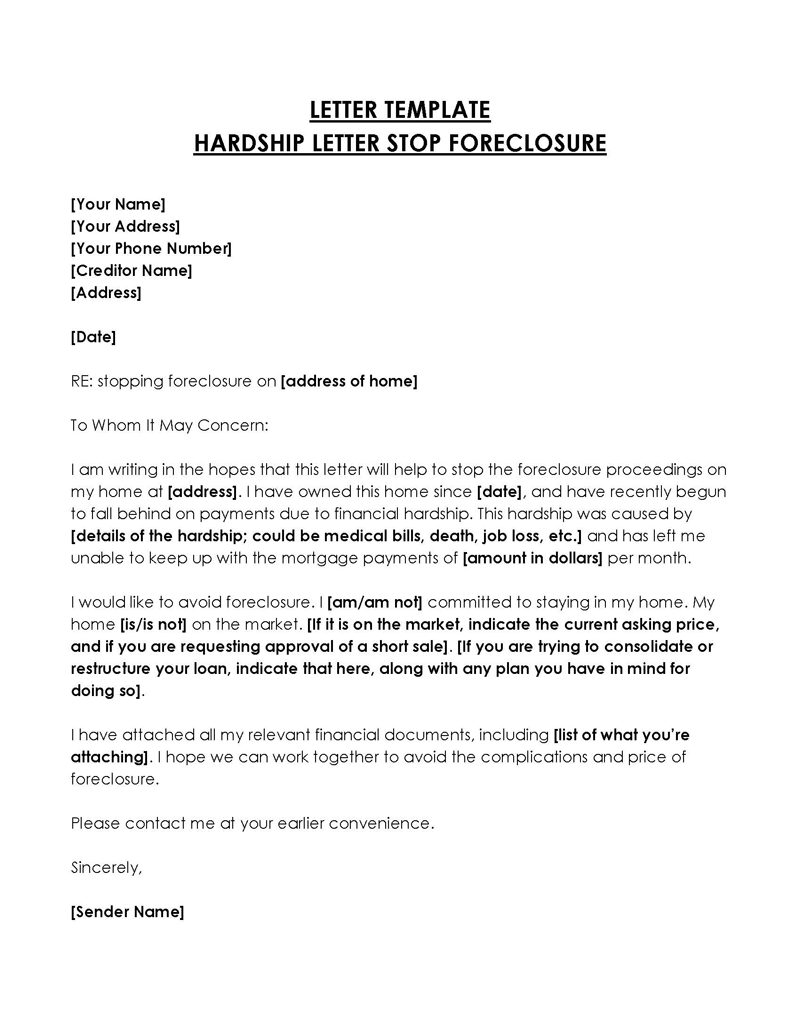

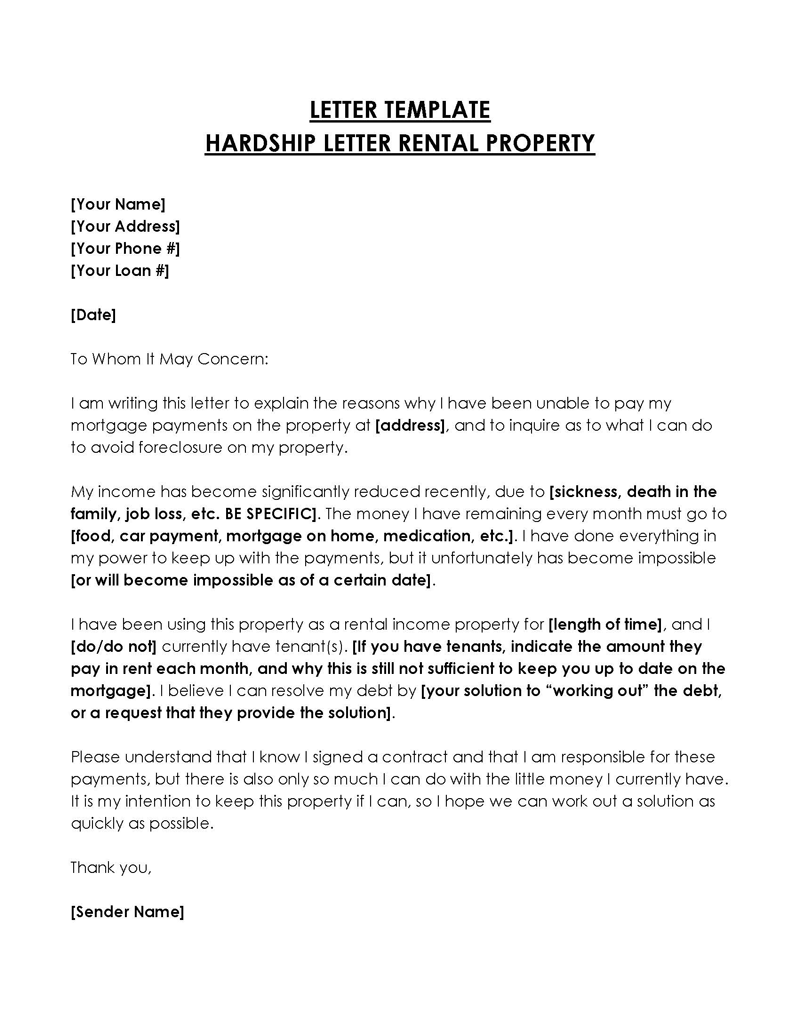

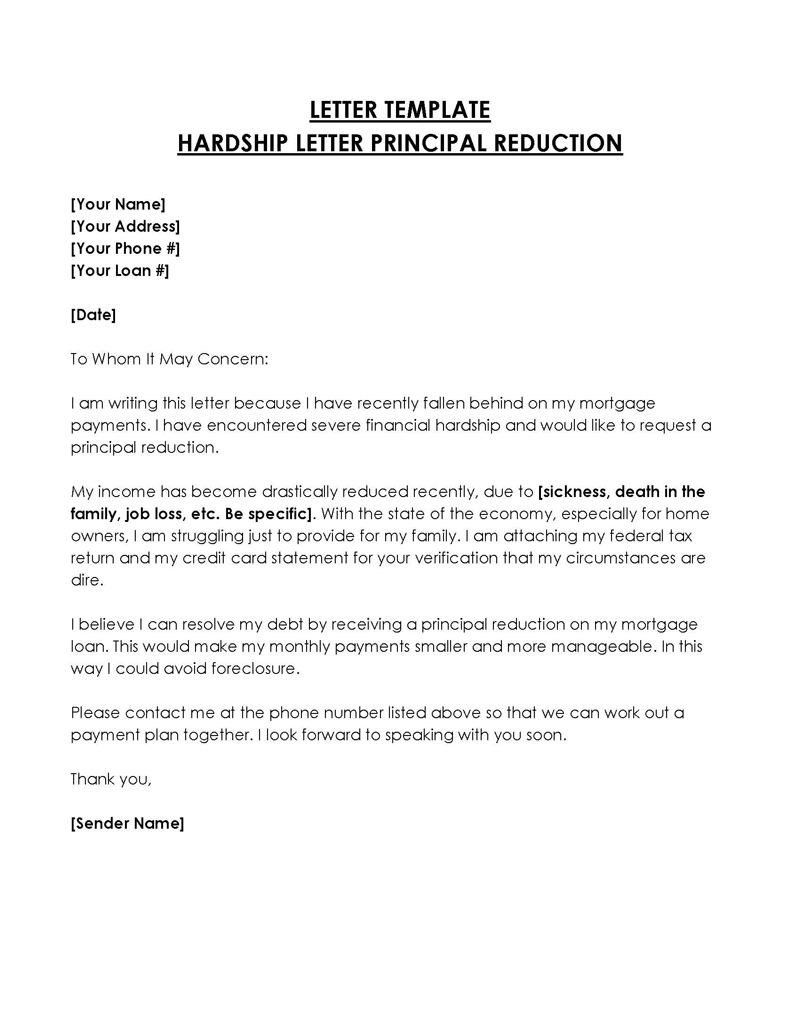

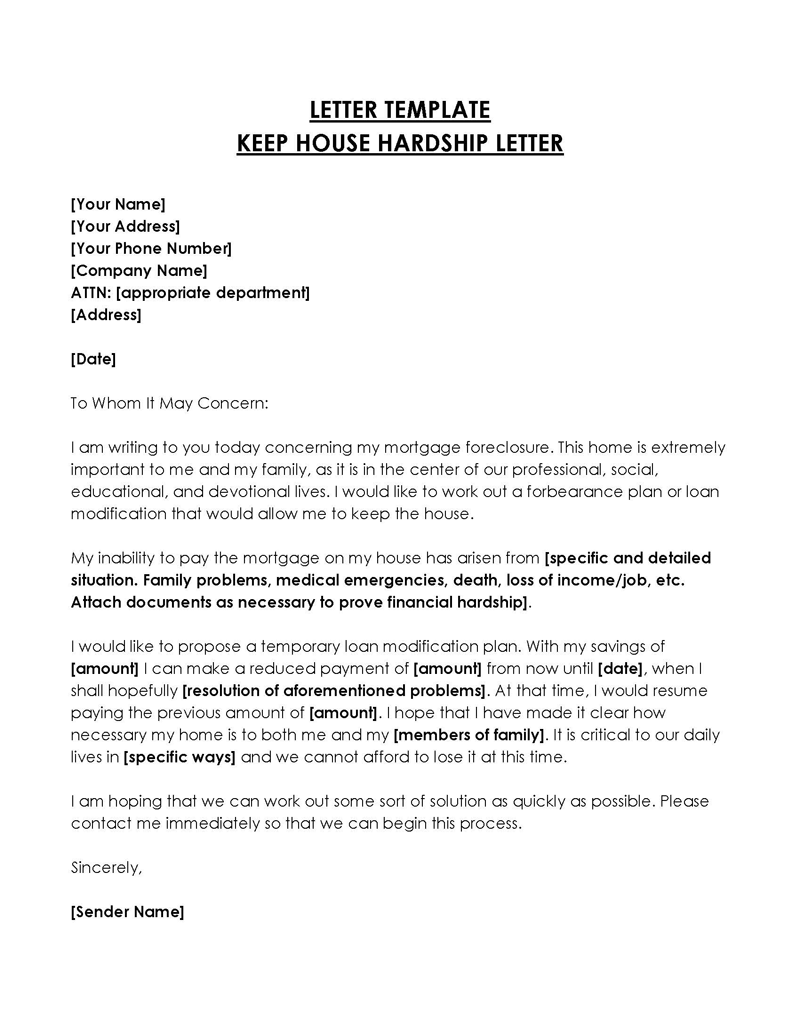

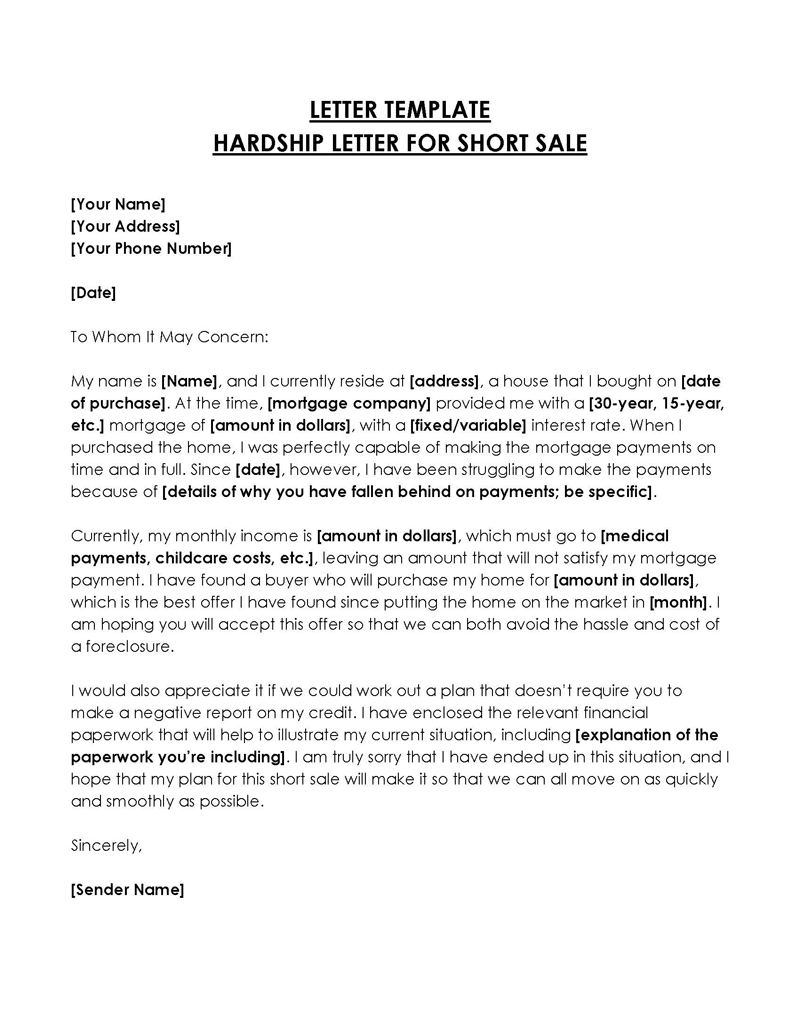

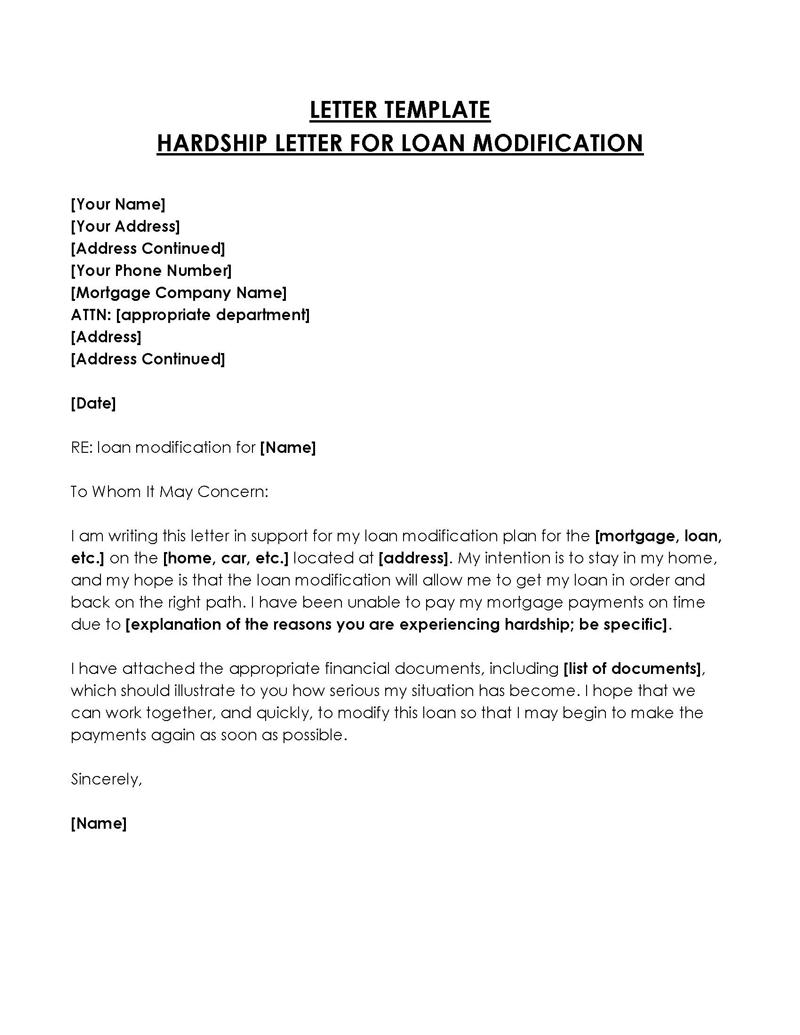

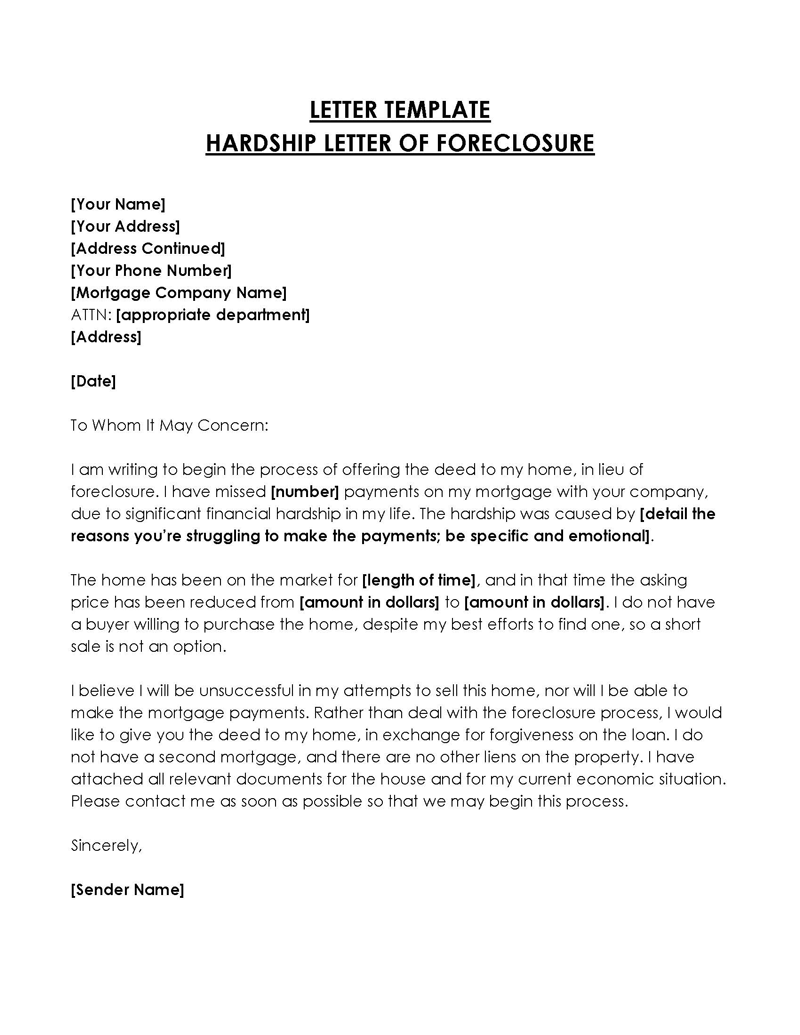

Free Templates and Samples

When writing a hardship letter, you must adhere to a specific format and a set of guidelines in order to make your request as convincing as possible. That is no easy task, particularly when you are already facing a personal and financial crisis. You might lack the time, resources, or tenacity to handle another challenge. If this is the case, a template for such a letter can assist you in selecting the best approach to addressing your lenders without requiring you to invest time, energy, and effort.

Template for Hardship Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Phone Number]

[Date]

[Loan Number]

Dear [Lender’s Name],

I am writing this letter to explain my current financial difficulties and to request your assistance in finding a solution. My name is [Your Name], and I am a holder of the loan referenced above. Despite my best efforts to stay financially stable, I am facing significant challenges that have put me on the brink of financial hardship.

The primary cause of my financial distress is [specific reasons such as job loss, medical emergency, unexpected major expenses, etc.]. Despite taking several measures like [applying for unemployment benefits, cutting down expenses, seeking additional work, etc.], the situation remains beyond my control.

To address this hardship, I have taken several steps. I have [list specific actions you have taken to mitigate the financial impact]. Unfortunately, these efforts have been insufficient to overcome the financial burden. Attached are relevant documents, including [bank statements, medical bills, repair bills, etc.], that corroborate my situation.

Given these circumstances, I am requesting [specific request such as loan modification, extended payment deadlines, reduced interest rates, etc.]. My plan to manage future payments includes [specific steps you intend to take to ensure repayment]. I believe that with [specific concessions requested], I will be able to overcome the current challenges and resume normal payments by [expected timeframe].

I am committed to resolving this situation and am hopeful for your understanding and assistance. Thank you for considering my request. I am looking forward to a positive response.

Sincerely,

[Your Name]

Sample Hardship Letter

This section features a sample hardship letter, offering an example to guide you when facing challenging circumstances in conveying your situation effectively when writing a similar letter.

Dear Mr. Johnathan Harrow,

I am writing to inform you of my current financial hardship and to earnestly request your assistance in finding a feasible solution. My name is Eleanor Matthews, and I am the holder of the Loan Number: 987654321. Despite my persistent efforts to maintain financial stability, unforeseen challenges have led me into a state of financial distress.

The root of my hardship stems from a series of unfortunate events, beginning with the unexpected closure of the company I worked for, “DreamTech Innovations,” due to market downturns. This was closely followed by a medical emergency involving my daughter, Amelia, which resulted in substantial medical expenses not fully covered by insurance.

In response to these challenges, I have actively sought employment and have been working part-time at a local bookstore, “Mystic Reads.” Additionally, I have minimized all non-essential expenses and have been diligently searching for more stable employment. Unfortunately, these measures have been insufficient to fully address the financial burden. Enclosed, please find documents that substantiate my situation, including recent bank statements, medical bills from Springfield General Hospital, and a termination notice from DreamTech Innovations.

Given these circumstances, I am requesting a temporary modification of my loan terms. Specifically, I seek a reduced interest rate and an extension of the payment deadline. I have formulated a plan to manage future payments, which includes securing full-time employment within the next three months and reallocating funds from my reduced expenses towards loan repayment. I am confident that with these adjustments, I will be able to resume normal payment schedules by June 20XX.

I am fully committed to resolving this situation and am hopeful for your understanding and support. Thank you for considering my request, and I look forward to a favorable response from your end.

Sincerely,

Eleanor Matthews

Analysis

The letter provided is a useful and persuasive sample for composing a request for financial assistance. The writer introduces herself concisely, mentions her loan number, and vividly describes her financial hardship due to unexpected job loss and a critical family medical emergency. She exhibits a proactive and responsible approach, detailing her efforts to manage the crisis, such as obtaining part-time work, minimizing unnecessary expenses, and supplying corroborating documents like bank statements and medical bills to enhance the credibility of her claims.

Her plea for a loan modification is clear, specific, and well-founded, requesting a reduced interest rate and an extended payment deadline. She presents a realistic strategy to secure full-time employment and reallocate funds for loan repayment. The letter adeptly combines emotional appeal with practical details, illustrating the writer’s dedication to resolving her financial difficulties.

This makes it an effective example for individuals in a similar situation who need to request leniency or assistance due to financial hardships, emphasizing the importance of transparency, detailed explanations, and a clear plan for future actions.

How to Write a Hardship Letter

You probably do not have the time or energy to research the rules of formal writing when you are in a situation where you must address your lender with a request for some financial relief. To assist you, we have created a set of guidelines for drafting the letter:

Step 1: Introduce yourself

Writing formal letters is never easy because they require a certain balance between form and authenticity. In terms of an introductory paragraph, that may not be the case. It is purely a practical section of the letter where you should introduce yourself, give brief details of your case, and provide your contact information.

An introductory paragraph in a hardship letter should include the following:

- Name

- Address

- Phone number

- Date

- Loan number

- A brief summary of why you are writing

It is helpful to use this part of the letter to establish yourself as an informed individual who does not intend to waste anyone’s time. Consequently, a succinct summary should, in no more than two or three simple and direct sentences, clearly state your reasons for addressing the lender.

Step 2: Explain the cause of your hardship

This is the part where you should explain, in a straightforward way and precisely, the unique circumstances or a series of unfortunate events that have led you to the edge of financial ruin.

Be objective in determining what your lender should know and what is irrelevant (or potentially harmful) to your case. As much as it brings you pain or shame, include every problem, incident, and misfortune that might be important for understanding your position.

Step 3: State your response to the hardship

Explaining the cause and effect of the financial challenges that you are facing is not enough to make a case for leniency. You must also mention and describe the measures you have taken to overcome those challenges. Unfortunately, most lenders will not consider providing financial relief unless you describe what you have done and how you have failed to improve the situation.

In other words, you must demonstrate that despite your best efforts to make your payments, the outside circumstances are simply beyond your control. For instance, after losing a job, a mortgage holder would be expected to seek unemployment benefits, apply for jobs, attend interviews, limit day-to-day spending, and eliminate all non-essential expenses.

Only when all available alternatives have failed to provide the necessary financial means for paying your debt on time would you be eligible for leniency from a lender’s perspective.

To further support your hardship claims, your letter should provide some proof in the form of official records. If possible, include the following documents:

- Bank statements, tax returns, and/or profit-and-loss papers

- Official documents from your employer showing your income

- Medical identification cards and bills in the event of illness or surgery

- Police reports and damage bills in the event of an accident

- Legal documentation detailing your divorce/separation/alimony

- Repair bills

- Proof of disability

- Death certificate

- Military orders

- Incarceration papers

Step 4: State your request

You are writing a letter to request leniency from the lender because you need help. The request should be made explicitly. You must have a specific solution in mind after thoroughly considering all possible solutions to your issue. For example, do you want to be considered for foreclosure prevention, loan modification, or leniency? And how?

When stating your request, the most effective approach is to propose a step-by-step plan that should help you overcome your challenges. For example, explain how you plan to make future payments and when you expect your current situation to end. Would your plan benefit from having a lower interest rate, extended deadlines, or something else? Make a convincing proposition.

Step 5: Restate your intent

Similar to the introductory paragraph, the conclusion is where you need to summarize the content and purpose of your letter and restate your intent. Once again, do that in two or three sentences. The purpose of the conclusion is to provide a convincing closing statement.

Do’s and Don’ts

We’ve compiled a list of some dos and don’ts that can be used as writing tips in addition to formal guidelines for hardship letters.

The following practices distinguish a convincing letter from a poorly written one:

- Be concise: To be respected for their time by others is important to every professional. Keep your letter short and relevant to show respect for your lender. Include everything that might be relevant to your case, but do not over-explain your reasons or get emotional. If you have several points to cover, divide them into short sections. The letter should not be more than one page long.

- Be original: You should write everything else in your own words and from your personal experience. Avoid cliched phrasing, and never copy any text. Lenders read enough of these letters to know when someone is not sincere or authentic.

- Be honest: Honesty is the best approach when you are asking for help. Nobody wants to waste their time and resources on people who disrespect their kindness by lying to them. Also, some lenders conduct background checks on their clients. If you are not honest about your intentions or deliberately omit the truth, the lender will not accept your request for leniency.

- Seek professional help for writing: If you are having difficulties with writing or are not sure what would count as relevant, you can consult a professional. Non-profit debt counselors can review your draft and help you edit it. You can also seek the assistance of a financial coach or a housing counselor in developing a viable financial plan for debt repayment or mortgage settlement.

- Include enclosures: If you have any, you should also provide factual proof of financial challenges, such as an employment termination letter and bank statements proving your liquidity position. In the event of death, provide a death certificate. If you are reporting health-related expenses, including medical cards and bills. Assert your need for financial leniency to pay off your debt using all the evidence you can find.

Some common mistakes that you should avoid are detailed below:

- Don’t criticize or blame your lender: Something you should never do when filing a formal request for financial relief is to be critical of the lender. Never insinuate that they have wronged you or that they are responsible for your current situation. Making excuses and blaming others is seen as irresponsible.

- Don’t be optimistic: You should not make any promises to your lender unless you are absolutely certain that you will be able to keep them. Even if you are expecting a positive outcome, your letter should not appear overly optimistic, as lenders typically grant financial relief only to individuals in dire situations.

- Avoid jargon: Just as you would not use the same language to text a friend and write a school essay, the letter requesting leniency from a lender necessitates a specific way of expressing your thoughts and demands. You should never use jargon, be overly descriptive, or use emotional language and arguments.

Conclusion

When you do not have the resources to pay back your lenders, a hardship letter can help you overcome financial challenges. Reexamine your situation and determine whether it meets the criteria for hardship to improve your chances of receiving financial assistance. A properly written letter should be brief, relevant, and follow a specific format. Most importantly, it must highlight the fact that your financial situation is such that you will default on your payments if the lender does not grant you leniency, as well as your willingness to cooperate in any way you can.