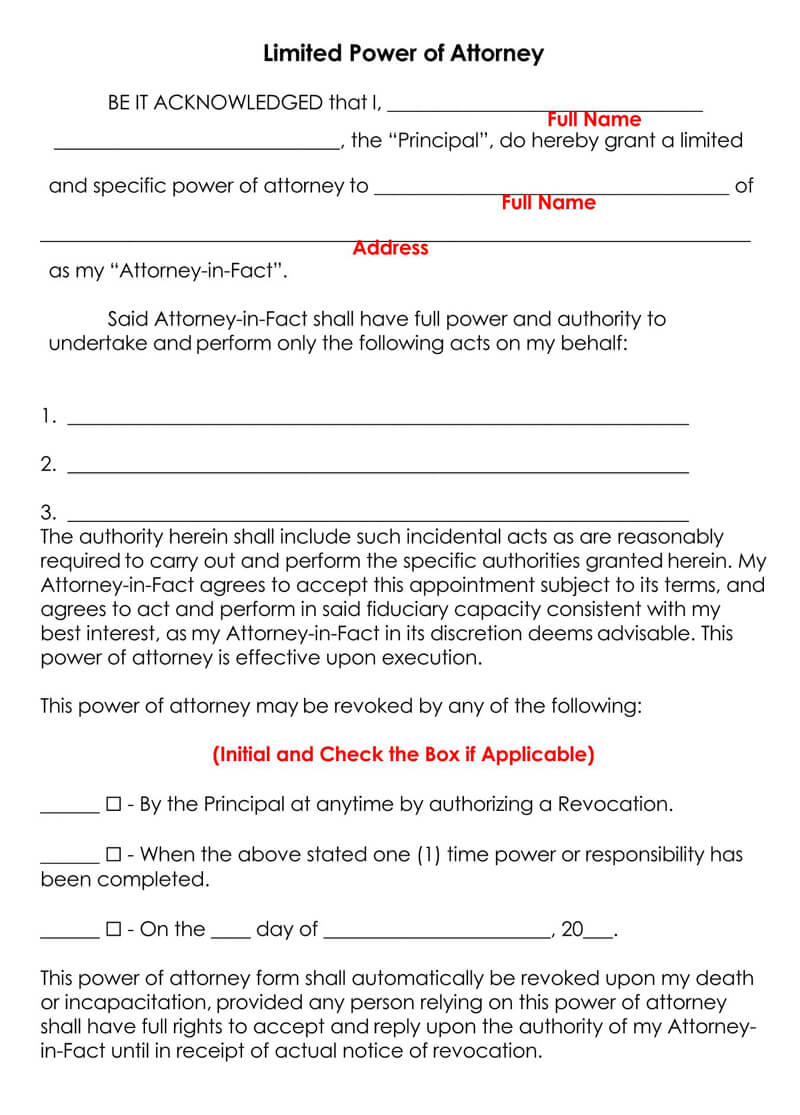

It is a formal instrument that a person uses to delegate some other person to act on his behalf on certain issues. Limited POA is limited in the sense that it stays in force for a specified duration of time, unlike the general power of attorney that holds on until it is revoked or the principal passes on.

Limited POA Forms (by State)

Free Power of Attorney Form

Limited Power of Attorney(LPOA) Form- An Overview

It is a type of document that is used to confer this power to an agent officially.

Limited POA is generally drafted by a principal or may be downloaded from the relevant state site and then filled out and sent to the various parties concerned.

This document goes by many other names. Below are the alternative core names in use:

- A specific POA

- Limited POA

- Special POA

An LPOA can be used in a variety of situations. To illustrate such uses, below are some of the examples:

- When a person (principal) cannot attend to specified duties such as financial or real estate management, signing and obtaining documentation due to illness or absence, and they wish the transactions to proceed in the absence.

- In some cases, such as signing and obtaining documents such as IRS and Social Security Administration documents, additional documents may be a requirement.

- An LPOA is also used when one wishes to transfer some personal or business responsibilities to an agent for a period of time.

Types of Limited POA

There are two main kinds of ‘limited POA. These are explained below:

- Durable and Non-durable- The ‘durable limited power of attorney’ is so-called because it stays in force until the death of the principal. It hence gives the agent unlimited leeway to carry out several transactions on behalf of the principal. The non-durable stays in force only as long as the specified durations and timelines have not elapsed.

- Springing Powers- It is enforceable if and only if certain predefined events arise or happen. Simply put: It cannot be triggered if the principal is still alive, of sound mind, and is largely capable of handling how own issues single-handedly.

Limited Power of Attorney Vs. Durable Power of Attorney

The primary difference between a Limited POA and a Durable POA is, with an LPOA, the agent is given limited or specified authority and can only act within the set limits; however, with a Durable POA, the agent/manager has the authority to make decisions even if the principal becomes incapacitated or dies.

General Power of Attorney Vs. Limited Power of Attorney

These two documents differ in four main regards, which are outlined and explained below:

Powers

The ‘general power of attorney’ gives out a wider set of powers to an agent compared to the ‘limited power of attorney.’ It hence gives the agent a broader leeway and freedom to act. Moreover, it stays in force for a longer duration of time too!

Specificity

A ‘general POA’ generally spells out the duties to be performed by an agent on behalf of a principal. It leaves out the finer details to the discretion of the agent himself. The ‘limited POA,’ on the other hand goes deeper to stipulate the exact duties and responsibilities as well as how to perform them.

Expiration

As hinted above, the ‘general POA’ stays in force from the time it is drafted to the time the principal becomes incapacitated, terminally ill, or dead. The ‘limited POA,’ on the other hand has some strict dates within which it may operate or stay in force, after which it expires.

Activation Event

As soon as a ‘general power of attorney’ is drafted, it commences operations and remains in force till it is revoked or the principal passes on. The ‘limited POA,’ on the other hand has to be triggered to operate. Many times, the trigger is the event which it is intended to oversee or the specified timelines.

Understanding Limited POA

With the increasing preference for the use of registered investment advisors or boutique money management firms over traditional brokerage firms, LPOAs are becoming more common in today’s investment field. Also, with today’s 24-hr economy, people find themselves with busy schedules and have to offload some of their responsibilities to other people to keep up, therefore, needing POAs.

How limited POA works

For a start, the document spells out specific things you want your agent to carry out on your behalf. For it to come to force, you have to assign an agent to carry out the transactions on your behalf. It also provides further details, regulations, and guidelines on how these transactions ought to be carried out.

As stated above, this one differs from the ‘general POA’ in that it runs for a specified duration of time and is limited to specific tasks. Thus, it becomes obsolete after the expiration of the stated terms and durations. The form is triggered by the emergence of the issue that it is crafted to handle.

The document also becomes null and void under some unique circumstances. These include premature death, divorce, separation, mental, and physical incapacitation. Like any other form, it may also be revoked.

Who needs LPOA

A Limited POA can be used by investors, businesspeople, or individuals who wish to transfer some of their official responsibilities to another party for whatever reason(s) they may have. Also, these individuals must be 18 years or older. An LPOA can also be used by someone who anticipates being incapacitated or in a position where they might be physically or mentally unable to make decisions for themselves. An example is a military personnel going overseas and intends to leave some of his or her legal obligations to someone back home.

Timeframe

Ordinarily, with a Limited POA, the starting and ending date of the agreement’s validity is predetermined. For example, for the two weeks, the principal will be out of the country.

In other cases, its duration may be dependent on a specified triggering event(s) whose occurrence activates or terminates the POA’s validity. For example, it may be terminated upon the principal’s death.

Where the attorney/agent is the principal’s spouse, divorce should prompt revocation of the LPOA.

Contents of Limited POA

Even though LPOAs vary from one situation to another, several items are present in a standard LPOA. Including these components ensure that all the relevant dynamics of an LPOA are addressed.

They include:

- The term/timeframe- This is the duration in which the Limited POA is expected to be active. The term could range from a day, week, and month or last for years.

- The number and frequency of activities/actions- This outlines the number of times the agent is expected to intervene. It could be a one-time agreement or a weekly etc., requirement.

- Specific details of the attorney’s authority- A description of the duties/actions the agent is responsible for. It should be detailed, and where there are exceptions, they should be stated.

These components are enough proof to third parties that, indeed, the attorney is permitted/authorized to make decisions to make on the outlined matter(s).

Making a Limited Power of Attorney

When Coming up with a Limited POA, you want to make sure that you capture all the essential details; remember, it is a legal document. Specificity is key as both parties’ have a certain liability which will be dependent on what is outlined in the LPOA.

Below are the procedural steps of preparing an LPOA.

- Determine the powers- Commence the exercise by determining the powers to grant to a third party. While at it, including the start and the end dates as well as the mandates which the agent is to exercise on your behalf. Be exhaustive to ensure that you leave no room for any ambiguities in the process.

- Choose the limited POA- LPOAs vary from one state to the other. Therefore, the first step should be selecting the appropriate LPOA within your state. This ensures the document satisfies the legal requirements as governed by the state laws.

- Download the form- Once you have ascertained that the LPOA chosen is the correct one for your state of residency, you can proceed to download it.

- Input personal information- The next step is filling in personal information. Both parties are expected to provide their names and addresses, including the city, state, zip code, and phone number or email address. Additional information that can be used to validate one’s identity can be included.

- Explain the attorney’s powers- After filling in personal information, the powers of the agent should be explicitly and clearly stated. This is important as this defines the ‘limited’ authority given to the attorney. The agent’s responsibilities are listed and how frequently they should be undertaken. The principal may be required to provide additional information such as the Social Security Number or Employer’s Identification Number if the duties being transferred require the identity of both parties to be verified. Specific transactions the attorney is not authorized to conduct on the principal’s behalf can be stated.

- Include expiry and revocation- The next step is declaring how the document will be terminated or can be revoked. Customarily, an LPOA will have its commencement and expiry date scheduled. This means that once that term ends, the document expires. Another scenario is having the agreement expire once the set-out actions or actions have been completed. An LPOA also includes a revocation provision, the principal is allowed to end the arrangement prior to its expiration, or certain events such as death or divorce can render the agreement invalid.

- List the state- As earlier mentioned, LPOAs vary with state. Therefore, it is important to declare the state whose laws govern the LPOA’s preparation and execution. Ordinarily, this will be the principal’s state of residency.

- Acceptance of appointment clause- The next step is to include an acceptance clause. It is included after the principal’s signature. It is in the form of an acceptance statement for the outlined responsibilities. The agent agrees to this by signing.

- Execute according to your state laws- The final step is implementing the LPOA in accordance with the state laws. Some states require that the document be signed dated in the presence of witnesses or a notary public. Even though notarizing is not a requirement in your state, it is important to notarize it.

Scope and Limitations

A Limited POA will often be applied to a single area of activity(ies), for example, handling investments. Under an LPOA, an investment manager, appointed as the attorney-in-fact can be given authority to:

- Trade funds in a client/principal’s account

- Disburse funds in an investment account

- Make fee payments

- Issue instructions to brokers

In this case, the agent is only limited to making decisions within the outlined areas. Other decisions about the account, such as withdrawal and deposits, may be handed to another agent, or the principal may choose to remain the sole authority in charge of those decisions.

The LPOA may also be limited in terms of:

- Schedules and timeframes– This is defined by the principal. The authority of the agent may be limited to certain days such as holidays, during business trips, or sickness. These schedules are part of the document’s limiting nature.

- Documentation– Sometimes, the agent can be limited to access certain files; where this is the case, it should be declared. Therefore, relevant paperwork, accounts, and any other information that is part of their authority should be declared and issued as applicable.

- Power to revoke– This is limited to the principal. A revocation clause that outlines how revocation should be actualized is included in the LPOA. It is effected once the principal signs and dates the clause.

Revoking Limited POA

Revocation will often be necessary for the event of death, incapacitation, or any other stated reason. There are three distinct ways a limited POA can be revoked.

- One is by the principal entering a revocation date or a date in the revocation clause. Once this specified date has arrived, the document ceases to be valid, and the attorney is relieved of their duties.

- Secondly, some LPOAs dictate that the document becomes void once the outlined action or action has been completed.

- Thirdly, the principal can fill out a Revocation of POA Form as they see fit, and the POA automatically becomes invalid.

The steps involved in revoking LPOA are as follow:

- Draft your revocation document- Start off by drafting your revocation document. In case you reside in a state in which this document is issued officially, do not hesitate to take advantage of the same. You definitely want yours to be widely accepted and be devoid of any ambiguities, don’t you?

- Fill it out- Move on to fill the document out. While at it, you have to expressly identify yourself and state that you want to revoke an earlier power of attorney you had already granted. Be sure to incorporate the date as well.

- Furnish the form to some witnesses- After completing the form, take the same to some witnesses to vouch for its accuracy. Many states require that you also furnish the photo identification of the witnesses and the accompanying signatures. Finish this step by appending your signatures to the forms.

- Include the word ‘REVOKED’- To further make it plain that you wish to revoke your original power attorney, include the word ‘REVOKED’ in letters that are bold, capitalized, and darkened. Attach this to the original copies of the power attorney forms you had drafted earlier.

- Notify each party of your revocation- After being through with the revocation, notify each party of your own intention to revoke an earlier agreement. Simply produce multiple copies of the same and furnish each of your clients or party to the signatory of your intention.

Frequently Asked Questions

This requirement varies from state to state. Many states require that the form be notarized before use. Even if your state does not pose this requirement, you are still highly advised to do so. This is to make it official and instil some confidence in the parties that use it.

The ‘general POA’ gives out a wider set of powers to an agent compared to the ‘LPOA.’ It hence gives the agent a broader leeway and freedom to act.

Moreover, a GPOA’ generally spells out the duties to be performed by an agent on behalf of a principal. It leaves out the finer details to the discretion of the agent himself. The ‘LPOA’ on the other hand goes deeper to stipulate the exact duties and responsibilities as well as how to perform them.

Key Takeaways

A Limited POA gives an agent the authority to conduct official transactions on behalf of a principal. The transferred responsibilities are outlined, and the attorney is not permitted to act outside these duties. An LPOA is convenient for people with busy schedules, business people on trips, some professions like military, etc.

It ensures decisions are still made even when the principal is away. An LPOA will often include the identity of both parties, term/time frame, detailed actions, revocation clause, and the parties’ signatures. Laws that govern the preparation and execution of LPOAs will vary from one state to the other; it is important to familiarize oneself with the laws in their state of residency. An LPOA is a legally binding document; therefore, where something is not clear, legal counsel should be sought after.