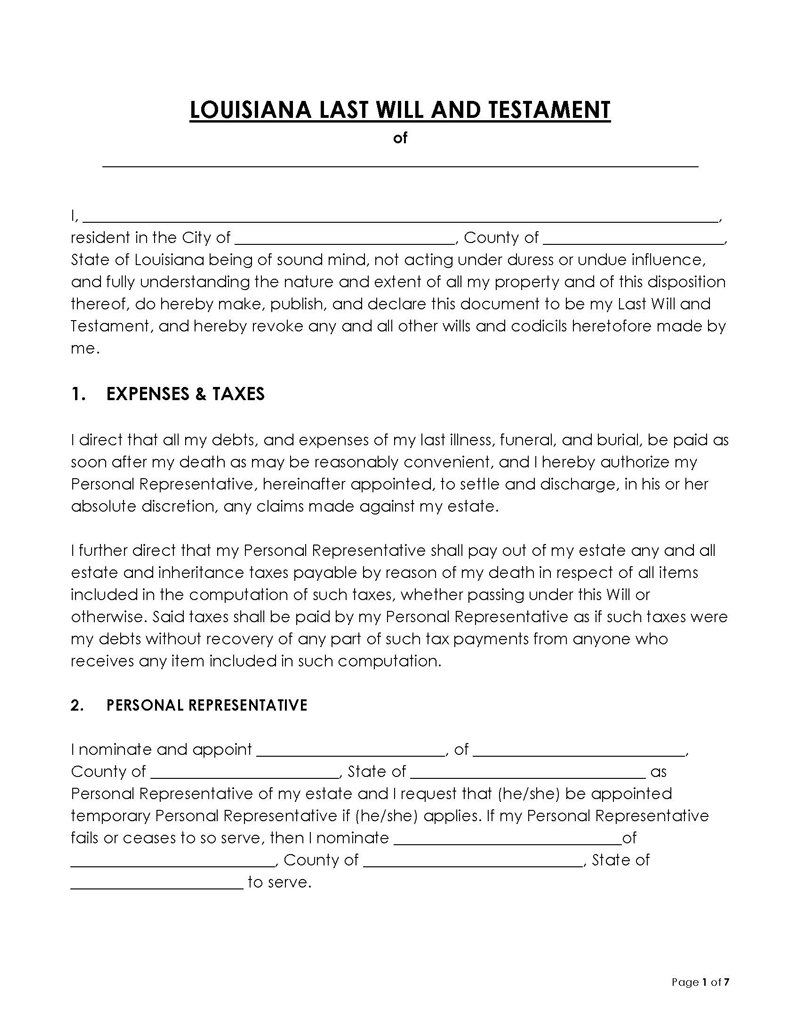

A person’s final wishes are recorded in their last will, which is a legal document. This person is known legally as a testator. What happens to the estate is specified in the will, along with the assets you, the testator, are leaving behind and the intended beneficiaries. The last will and testament can be made by any person in Louisiana and should be kept up to date as circumstances change. You, as the testator, are in control of what happens with your property.

The state of Louisiana will name the beneficiaries of your property, who can be an individual or an entity. The will should include specifics about what type of property is left behind, such as personal items, real estate, fiduciary assets, life insurance, or money. It needs to specify whether the property goes to one person or many people in different amounts. A will also identifies the executor, who is responsible for seeing that the instructions in the will are carried out.

A will must be written because it avoids disputes among family members. If you do not make a will, there is no guarantee that your inheritance will go to the appropriate beneficiaries. You must be of sound mind to have clear instructions. To be legally enforceable, the will must be written according to Louisiana state law. The requirements for a will, how to create a will, and other crucial information will be covered in this article.

Free Template

Associated Laws

The testator must sign their name in the presence of two witnesses who are authorized to do so under Article 1577. The will cannot become effective until both signatories have signed it in front of a notary public who can attest to both signatures. Each page of the will should be signed.

Making Last Will and Testament in Louisiana

After you have completed all of the requirements for making a will, you can begin the process by writing your will. Louisiana will need to be written in clear and understandable legal language. The will’s content should not be ambiguous, this can lead to different interpretations by different people. In Louisiana, you can draft your last wills, and a lawyer is not required for this process, but it may help to utilize their knowledge of the state’s laws.

The steps for creating a legally enforceable will in Louisiana are as follows:

Step 1: Check eligibility

You, as the testator, should know whether you are legally eligible to make a will in the first place. You must also be of sound mind and not be under any type of pressure while making the will. It is also important that you understand the implications of your decisions and can reasonably carry them out without being influenced by external factors. In other words, you must be acting freely and not under the influence of others.

Step 2: Check all rules and requirements

The person making the will must know all the Louisiana laws that relate to making a will to ensure that they do not violate any of these laws while making the will. This includes learning about their legal rights, responsibilities, and obligations toward their heirs. A Louisiana will should be witnessed by two witnesses and notarized. Furthermore, as the testator, you must determine whether the property specified in the will is eligible for distribution. For example, property owned by you under the joint tenancy with a right of survivorship automatically goes to the joint account owner.

In addition, community property goes to the surviving spouse. Property is also distributed in Louisiana under “forced heirship,” which provides that forced heirs are entitled to a portion of the property. Forced heirs include descendants of the first-degree aged 23 years and below or first-degree descendants of any age who cannot take care of their persons or manage their estate due to mental or physical incapacity at the time of the testator’s death.

Step 3: Describe marital status and select beneficiaries

Following that, your marital status and beneficiaries should be highlighted in your last will. You are legally allowed to make a will for yourself; this means that if you are married, you can still make a will without your spouse’s consent.

Remember, though, that if you outlived your spouse and they inherited from your estate, they would do so with twice the legal amount of inheritance. Your adopted and natural descendants should be listed in the will. The children should be declared even if they are not being awarded any part of the estate. Last but not least, all other beneficiaries who will receive a share of the estate must be listed in this section.

Step 4: Appoint an executor

The testament must name an executor after naming all beneficiaries. The will must state who will be taking responsibility for the estate after your death. The executor must be a person or an entity that can take care of all legal matters regarding the estate.

Step 5: Implement intestacy laws as necessary

The will can also reference intestacy laws. If you pass away without a will, intestacy laws will determine who gets what. According to these laws, community property (property shared with the spouse) must be distributed to the spouse and any shared descendants. The spouse can occupy the property for life while the children inherit your portion.

The children should inherit a separate property of yours. If you leave behind a spouse and no children but surviving parents, the community property goes to the spouse and the separate property goes to the parents. Siblings should come first if there are still living ones, rather than parents. Siblings inherit the separate property, and parents the community property if there is no spouse, descendant, or children.

Step 6: Probate your will

The local probate court must then receive an executed and witnessed Louisiana will. The will is validated by filing a Petition for Probate of the Testament. The court decides if it is “notarial,” or adheres to Louisiana law, rather than being handwritten and self-proven (notarized). The court can then make the executor of the will responsible for the estate and hold them accountable for all legal actions taken in the process. Louisiana wills that are handwritten (holographic) must be accompanied by supporting documentation for the court to accept them.

How a Will Can Be Legally Revocated

A will can be revoked in Louisiana if you make a mistaken statement or change your mind about some instructions left in the original will for beneficiaries. The will may be revoked by making a new one that expressly declares that all prior ones are null and void, by sending a text message formally stating your intention to do so, by burning, tearing, shredding, or in any other manner that will cause it to be irrevocably destroyed. Note that unless the will specifically provides a contingency for such circumstances, a Louisiana will is also nullified upon the birth or adoption of a child.

Benefits of a Will in Louisiana

Having a will helps in numerous ways, especially when it comes to succession planning. Primarily, the last will provide legal documentation for the distribution of property after death. The last will can help eliminate uncertainties or questions about what to do with your estate after you die, how to pay all of your debts, and how to distribute any remaining assets.

As a testator, you may want to decide what happens to your property, who benefits from it, or who takes care of your minor children after your death, which is why many individuals make a last will. A will also allows testators to appoint an executor and a manager of their property (especially if they are going to leave property to minors).

The most important reason someone would want a will is to avoid probate court. Many individuals create a will because they want their assets distributed as quickly and inexpensively as possible after they pass away. This lessens the frustration associated with the lengthy probate process. Additionally, you can use your will to give gifts and donations to people and organizations in Louisiana. Wills also let people name caregivers and set up funds for their pets.

Final Thoughts

The last will is a crucial component of estate planning. Even though it is not required, making a will in Louisiana can have a lot of advantages for both the testator and their family. A will can give you a sense of closure and put an end to disagreements about property and estate in the future. It allows you the opportunity to express your wishes concerning your estate and beneficiaries. To have one, you have to make sure that you have followed all of the guidelines stipulated by law.

You can prepare your own will or hire an attorney to do it for you. There is no limit on the number of wills that can be made or revoked. The probate laws of the state in which a person resides frequently take precedence over laws of the state in which a person died when it comes to interstate estate planning issues. This means that when a person moves to another state, a will that was made in Louisiana may not always be used to distribute assets.