If you ever find yourself in a situation where you need someone you trust to handle certain affairs on your behalf, this authorization letter can be an invaluable legal document. It ensures that important matters are managed smoothly, even when you are unable to do so yourself. This article aims to delve into the intricacies of this letter and elucidate how you can harness its potential to your advantage.

By definition,

A letter of power of attorney (POA) authorization is a legal document that gives one person (the “agent” or “attorney-in-fact”) the capacity or permission to take action on behalf of another person (the “principal”) in specific matters or in general. It can be used when the need arises to delegate responsibilities or when you cannot carry out certain functions due to various reasons.

The Scope of Powers Granted

You can grant different powers to your chosen agent, depending on the nature of your requirements. The authorization letter allows for the delegation of authority over specific areas regarding your health or broader aspects related to your professional responsibilities.

Some of the areas in which you can donate your authority include:

Financial matters

You can give your agent the power to manage your finances, handle tax filings, execute withdrawals from your accounts, and pay bills on your behalf. Your designated agent can present the letter of authority to the bank to demonstrate their capacity to undertake financial transactions on your behalf.

Property and real estate transactions

You can also donate your authority to an agent if you are a property manager and would like your agent to oversee other property-related dealings on your behalf.

Healthcare decisions

This POA allows your agent to engage with your healthcare providers concerning your preferences when you are incapacitated.

EXAMPLE

If you go into a coma, your agent can make medical decisions on the type of care you should be given and offer insight on whether you would like to be resuscitated.

Legal decisions

Legal authority can be given where you might feel hesitant about making significant legal decisions that concern you or your well-being. In these circumstances, your agent may be more knowledgeable in legal matters and can, therefore, make well-informed decisions on your behalf.

When you entrust your authority to another person, you are essentially allowing them to make decisions that will impact your life. Additionally, any consequences arising from the decisions will be considered your own. Therefore, it’s crucial to ensure that your letter of authority is meticulously crafted and that you thoroughly understand its implications.

The following is the procedure for preparing a comprehensive POA letter:

Step 1: Introduce yourself and the recipient

You should begin your letter by providing your full legal name and contact details, including your physical address. Subsequently, identify yourself as the principal and specify that you intend to delegate your authority to another individual.

EXAMPLE

Dear [Recipient’s name],

I hope this finds you well. I am [legal name], and I am writing this letter to inform you of some changes in my personal affairs.

Step 2: Identify the authorized individual or entity

Once you identify yourself, proceed to identify the person you intend to appoint as your agent by mentioning their full legal name and address. You should also add the agent’s contact information. If applicable, indicate how you are related to your agent, whether they are a friend, neighbor, or legal advisor. This information will help the recipient verify the agent’s identity.

EXAMPLE

I hereby grant [Agent’s Name] of [Agent’s City, State, and Zip Code] the authority to act as my agent in matters pertaining to property management.

Step 3: Explain the purpose of the letter

After introducing the involved parties, you should accurately describe why you are writing the letter. You need to emphasize that the letter is to inform the recipient that you have authorized the agent in the letter to act on your behalf.

EXAMPLE

I have written this letter to inform you that, henceforth, [Agent’s Name] is authorized to perform financial transactions on my behalf.

Step 4: Specify the type of power of attorney

Since the scope of authority can vary, it is essential to specify the exact nature of authority you are conferring. Clearly defining the type of POA ensures that both you and your agent are aware of the extent of their responsibilities. The different aspects of authority that can be donated include legal matters, property management, or financial transactions.

EXAMPLE

If you are granting authority pertaining to financial transactions, you could say as follows:

The power of attorney granted to [Agent’s Name] is specific to transactions relating to my two bank accounts; [Indicate the Bank Account Numbers].

Step 5: Outline the powers granted

Once you have indicated the scope of authority, proceed to outline the specific tasks that your agent is empowered to do on your behalf. Ensure your language is clear and comprehensive to avoid any miscommunication or confusion.

EXAMPLE

If you want the agent to manage monthly bills on your behalf, you may indicate the types of bills they are authorized to handle, which may include the rent, water, gas, and insurance bills.

note

Please note that [Agent’s Name] is permitted to withdraw from and deposit money into my bank account. He is also allowed to conduct financial transactions of any kind between my account and all other related bank accounts, including buying and selling using the money in the account. Additionally, he is permitted to deal with the management of my real estate property.

Step 6: Include any limitations

Since the powers granted to the agent are limited to specific acts, it is essential to indicate clearly whether there are any limitations regarding the authority the agent has. In most cases, the agent’s authority should align strictly with the tasks granted to them. For example, an agent who can make financial decisions may be restricted from making healthcare choices.

Example limitation statement

This does not extend the authorization for any financial transactions related to healthcare on my behalf.

Step 7: Mention the effective date

These letters should be as specific as possible on the timelines within which they will be effective. In most cases, they should state the date this power shall be donated to the agent and when the power reverts to the principal. This is especially relevant if the letter takes effect after an event such as sickness or incapacitation.

Example

This power of attorney is effective as of [date the letter takes effect].

Step 8: Express your trust and confidence

Before you conclude your letter, you should mention that you are confident in your agent’s ability to fulfill the assigned tasks. This part of the letter is a simple paragraph that should be clear and concise.

EXAMPLE

I trust that [Agent’s Name] is more than capable of handling the matters assigned herein dutifully and to the best of his ability.

Step 9: Provide contact information

It is vital to include your contact information so the recipient can reach you if they require clarification. This includes your current phone number and email address so any communication is prompt and you can be reached conveniently.

EXAMPLE

If you require any clarification, please feel free to contact me at [Your Phone Number] and [Your Email Address].

Step 10: Close the letter

Like any other letter, you need to sign off your power of authority with a closing statement thanking the recipient for their cooperation. You can then add a salutation, your signature, and your full legal name.

EXAMPLE

I appreciate your cooperation in this matter and hope it clarifies any issues regarding the power of attorney.

Sincerely,

[Your Full Legal Name]

[Your Address]

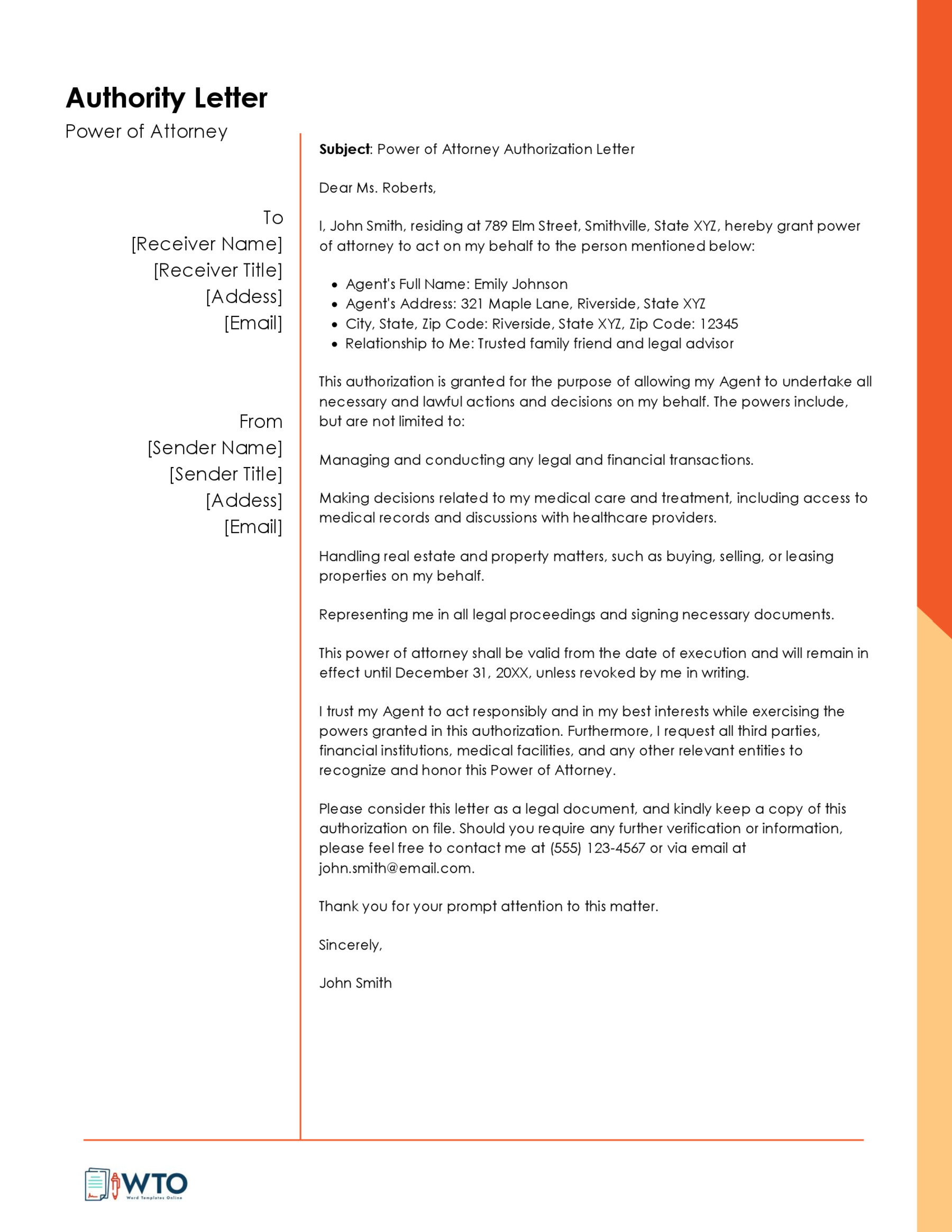

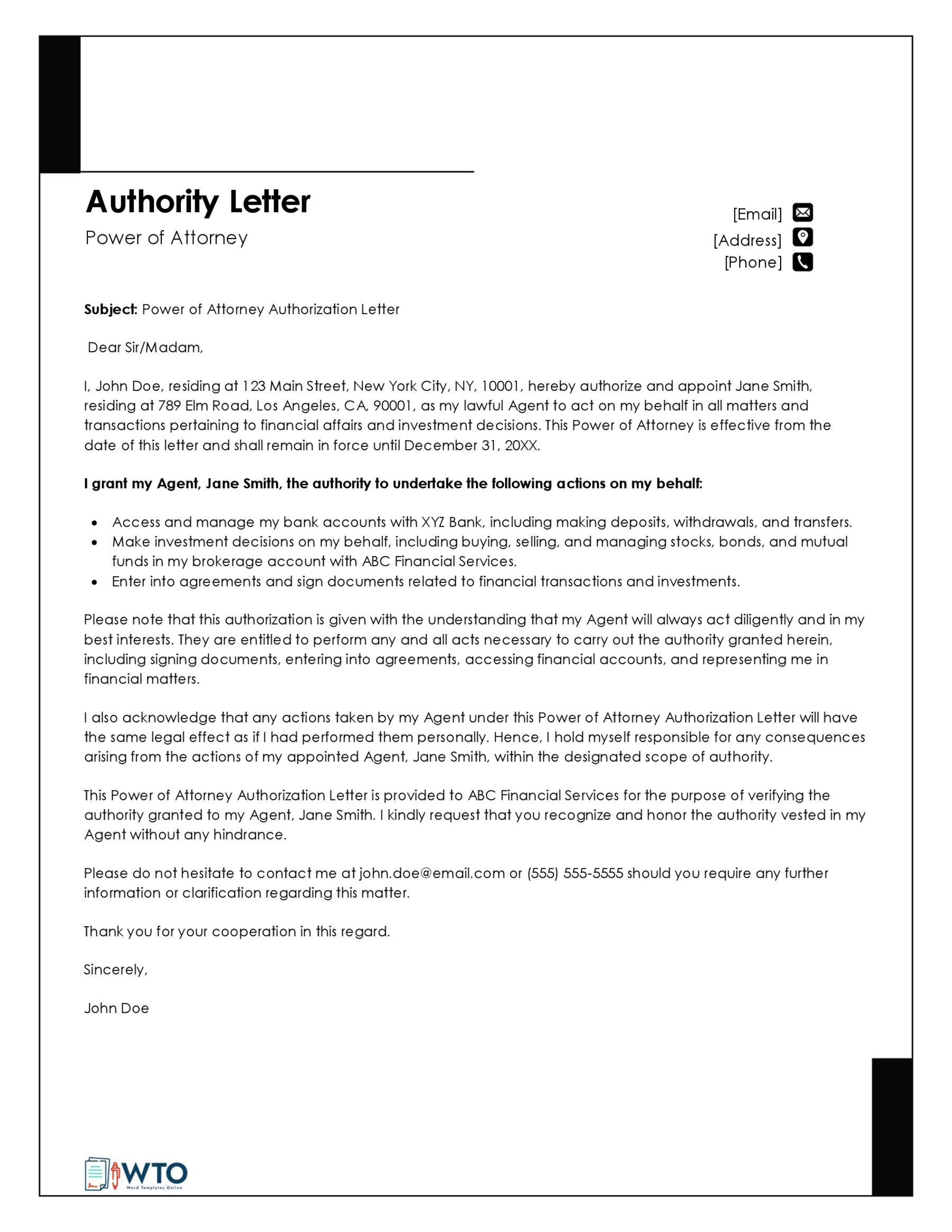

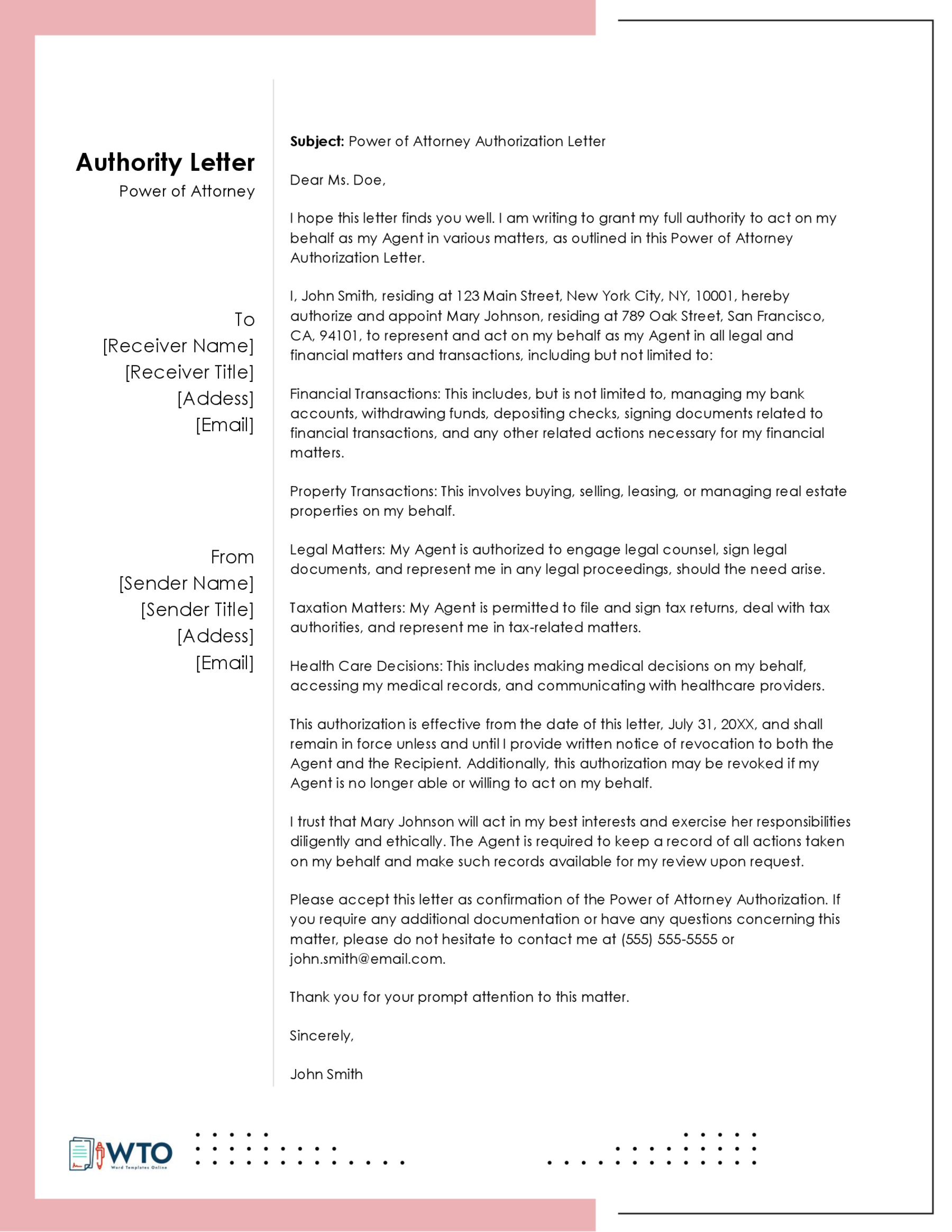

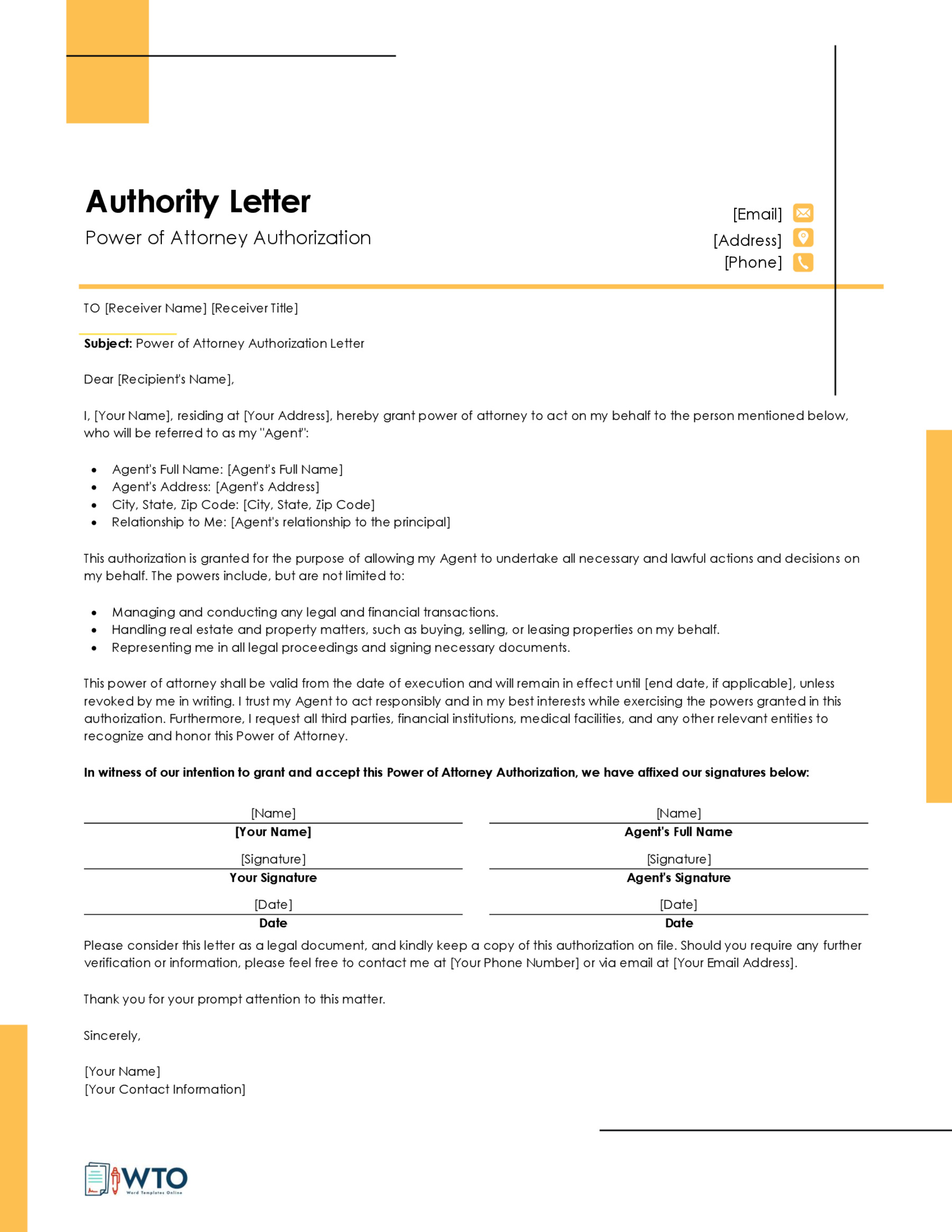

Sample Letters

Letter Templates

important note

A power of attorney is a legally binding document with full implications. However, to avoid the recipient having doubts about its authenticity, you can have it notarized by a notary public. Additionally, the letter should comply with any laws of the jurisdiction in which it will apply. Before writing one, you should check your local and state laws to ensure you are not violating any laws that could invalidate the power of attorney.

Do’s and Don’ts for Writing a Power of Attorney Letter

Since this authorization letter has legal implications, it is vital to understand the best practices to prepare a comprehensive power of attorney, accompanied by an awareness of potential pitfalls.

Some recommendations and cautions to keep in mind include:

Do’s

- You should use clear and concise language when indicating details like the effective date, specific powers granted to the agent, and limitations of these powers you have granted.

- You should ensure your language remains formal throughout the letter. This formality is particularly crucial when defining the letter’s purpose, limitations, and scope of authority. You also maintain formality by using the proper titles and full legal names of your agent and its recipient.

- Once you finish writing the letter, you should review it and check for spelling and grammatical errors. This ensures you do not make any mistakes that might confuse the recipient.

Don’ts

- While a POA letter is a legal document, you should ensure you use simple language. Avoid using technical legal terms, especially because they may make it difficult for the recipient to understand and help your agent fulfill their duties.

- Do not overlook essential information like the agent’s full legal name and the letter’s effective date. If you fail to include this information, your letter may be rendered invalid or be too ambiguous for the recipient to act upon.

- Do not ignore legal limitations and requirements. Before writing your letter, you should understand the laws and jurisdiction within which your authorization will fall and ensure you have complied with all the requirements.

Types of Power of Attorney

There are several different types of power of attorney, depending on your situation,that are specifically designed to help you. The different forms of POA give people the flexibility to know that their affairs are being looked after by someone they can completely trust. The following are the different types of POA that you can choose from depending on the requirements of your current situation.

A non-durable power of attorney

This form is used only for a given period and is often used for a certain transaction in which you give your agent the authority to act on your behalf. The transaction is immediately completed, or if the principal becomes incapacitated during this period, a POA ceases.

A durable power of attorney

It is used to grant another person the authority to make important decisions and take action on your behalf. It is more comprehensive compared to the non-durable power of attorney.

The decisions that the authorized person may resolve include financial, business, and real estate affairs. A durable power of attorney doesn’t cease upon the death of the principal and does not expire after a given period. It actually becomes effective immediately upon the incapacitation of the principal.

Special or limited power of attorney

Special/limited power of attorney is usually used on a limited basis, such as for one-time banking or financial transactions to sell a given property. In most cases, a limited POA is used when the principal is incapacitated or is unable to complete the transactions due to his/her prior commitments or illness and wishes to appoint a trusted individual to act on his or her behalf. The agent only has the authority to act on behalf of the principal over what is assigned to them and no other matters, as this is the only scope and limitation of the stipulation.

Springing power of attorney

This can be durable or non-durable. Springing POA encompasses any number of affairs that the principal wishes to assign to their trusted agent. Springing POA becomes operative at a future time after the occurrence of specific events.

These events include the incapacitation of the principal, when the principal is out of the country, or when the principal is unable to act upon it. Therefore, this will only take effect (spring out) upon the occurrence of certain events that must be specified in the professional letter. This should be detailed to avoid confusion and misunderstanding between the parties involved.

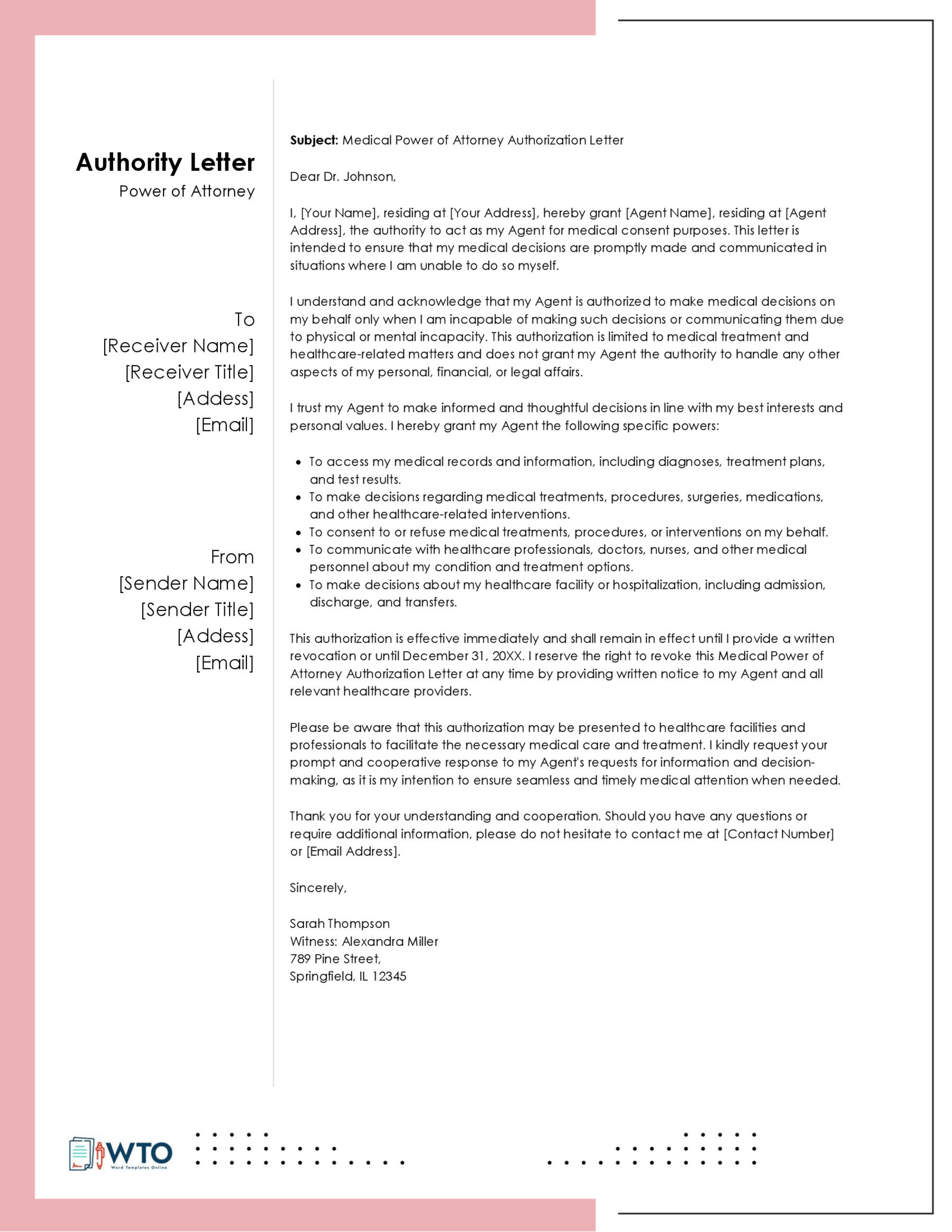

A medical power of attorney

It bestows authority on the agent to take definite control over the health care decisions of the primary whenever they are unable or are incapacitated to do so.

The medical POA typically takes effect with the consent of the presiding physician. It permits the agent to authorize all the medical decisions with regard to the principal. All these details must be clearly stated in the letter of authorization to avoid misunderstandings and confusion between the involved parties or the general contractor.

Key Takeaways

- A letter of power of attorney authorization is an essential tool for when you are either incapacitated or unable to make crucial decisions in your life.

- An authorization letter allows you to delegate authority to another person to make decisions on your behalf.

- Your letter should be addressed to the intended recipient and explicitly state its purpose.

- When providing specific details, such as the recipient’s name, it is vital to provide the most accurate information on their contacts and physical addresses.

- The letter should be written in simple but formal language so it is easy for the recipient to understand and enforce.