A business transaction usually requires a money transfer from the buyer to the seller to receive goods or services. Therefore, as a seller, you must write a receipt that suits your business correctly and serve as legal proof of payment after rendering a service or selling goods to a consumer. It is a document that records the client’s payments and the goods and services you have provided. Hence, there is a need to learn various aspects of a receipt book and use it effectively in your business.

A Receipt Book is an essential tool for payment and business transactions and is a small book that contains multiple receipts that are usually detachable.

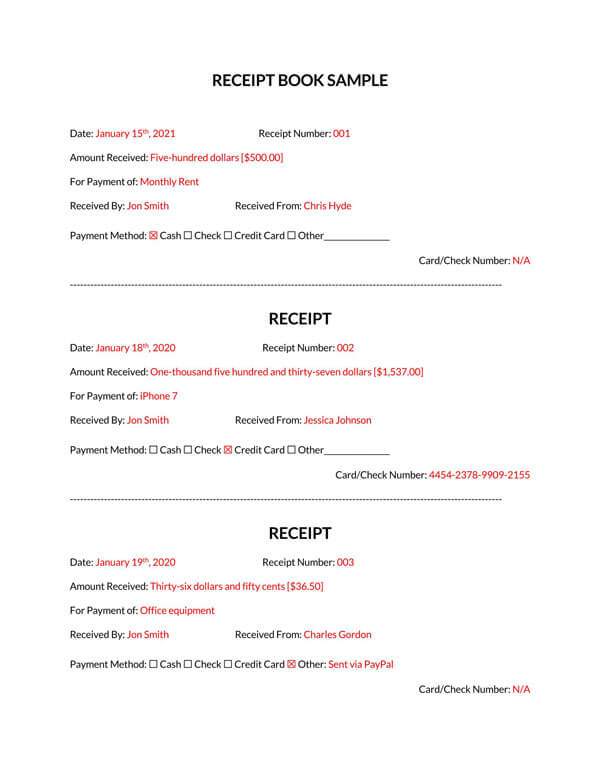

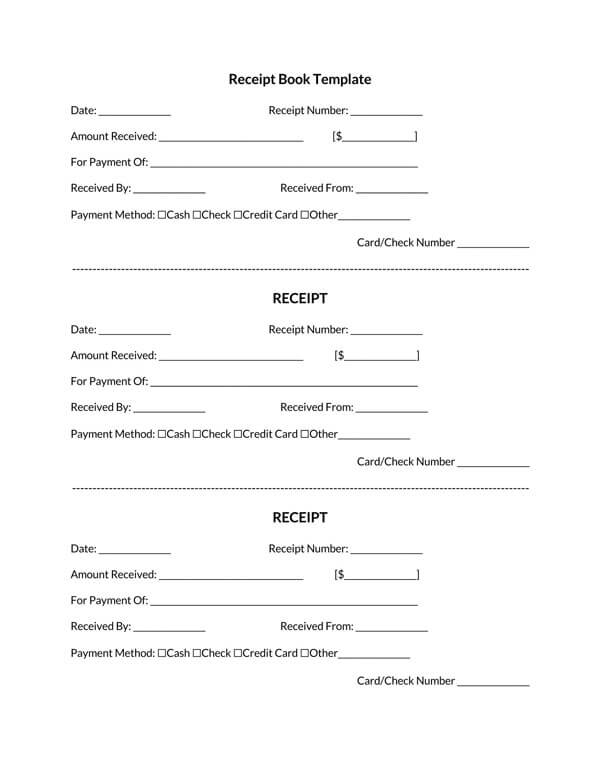

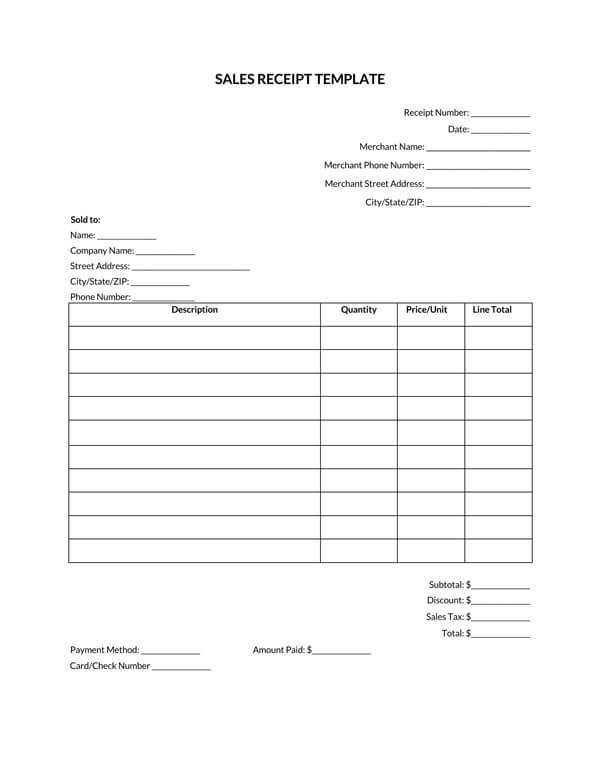

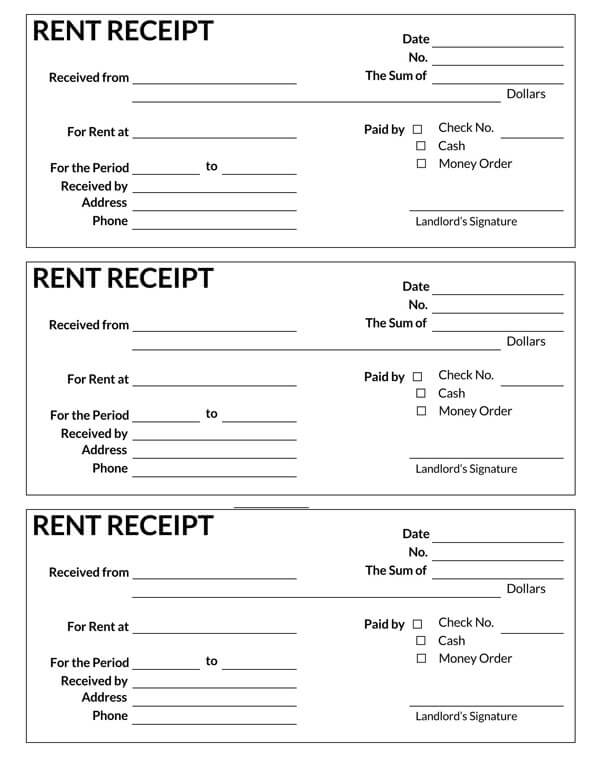

Therefore, the book template must have at least three types of receipts: cash payment receipts, business receipts, and sales receipts, and retain a copy of any receipt that you have detached as a form of record of sales and payment. When such a book is customized, you must combine all the single sheets into a binder and use a standard “hole puncher” to create holes before binding.

Templates

We realize that the process of creating a template may be complex, so there is already a created array of templates on this website to fit into your every receipt desire. These are accessible and downloadable, and you can mold any of these templates to best suit your business.

Some examples are:

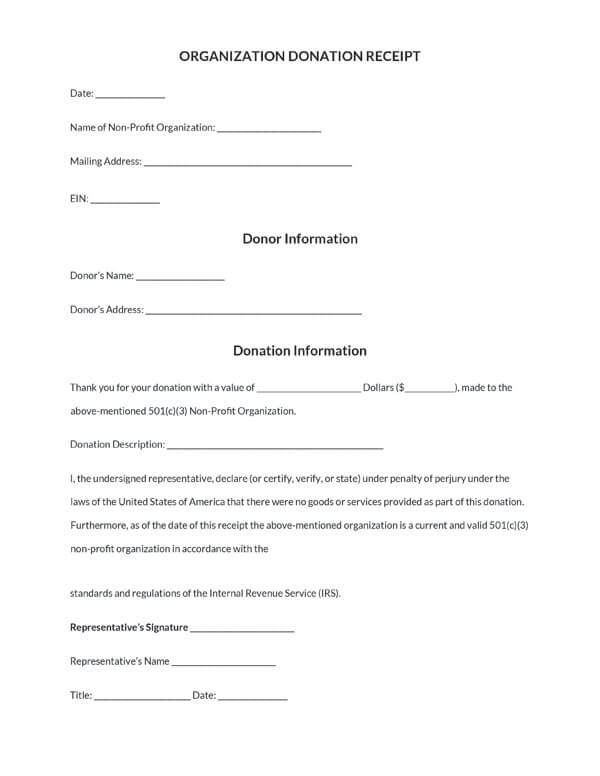

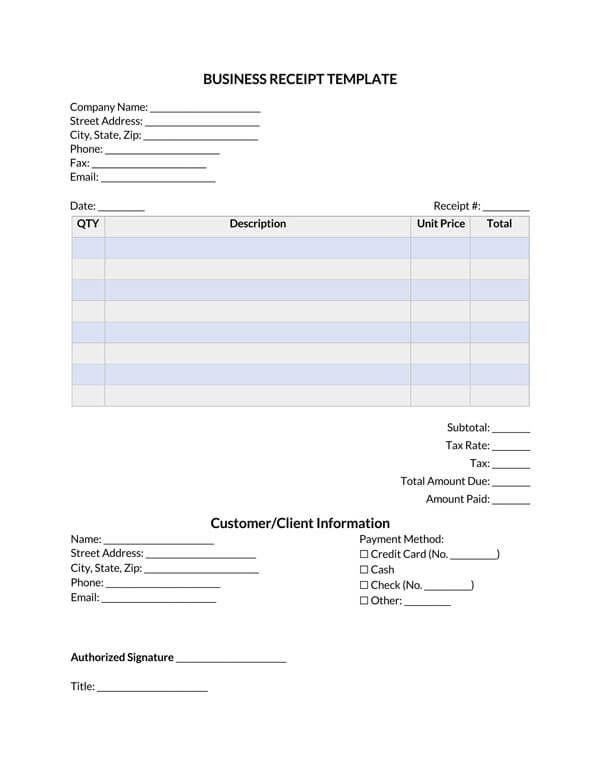

- Business receipt: A business receipt serves as proof of payment of goods or services. Business to business transactions make use of the receipts, and the issuing business can approve a refund if the receiving business makes a complaint against goods and services. You can also use it to verify the correctness of the purchase for tax.

- Cash receipt: The cash receipt is the one you fill for a customer who pays you by hand on the spot. It serves as a record of payment in a transaction and is helpful in cash transactions where there is no means of an electronic record of this payment.

Different templates for these types of receipts are as:

Why Should You Have One?

Business is easier for both buyers and sellers of goods and services when transactions are simple and less stressful in transaction records and documentation. In addition, in every organization, it is essential to monitor sales and income.

Therefore, receipt books improve business organization in the following ways:

Branding

In business, you are always in competition with others who provide the same services as you, and therefore branding is essential, even for your small business. Each receipt contains your business details, such as company name, email address, and phone number. That lends your business a unique and exotic feature that has the customers hooked on the services and goods that you provide. These details look engaging and capture the customer’s attention at first glance.

Summarizes transaction records

A sure and easy way to collate your transaction data is to get a custom receipt that has carbon copies. That helps you to meticulously organize and store details about your transactions and observe the profit or loss.

Portable

Your business may require that you are mobile to engage your clientele. In such cases, you may need to work with portable documents, and so you may require a custom receipt book, which makes transactions easier and tidy, without loose ends. This book summarizes all essential transactions and comes in handy when you need quick information about a transaction. In addition, because it is a small booklet, you can easily take it around with you for interaction with the clients.

Easy cash write-ups

Such a book lets you give the customer their receipt on the spot and record the transaction. This keeps your transaction records detailed and concise and is incredibly beneficial if your clients are more cash-oriented.

The right type

There are several types, which are available for business owners. Therefore, you should never limit all your transactions to one receipt type but get books that cater to every kind of service or goods that you offer. For example, you can have two separate receipts for delivery and sales. That helps to organize your work.

Custom fields

This happens to be one of the most incredible benefits of using book receipts, especially customized ones. You can get a format that has custom fields that suit your business and transactions. You can include everything from the client’s details to items purchased and the service that you rendered.

But, How to Get a Receipt Book?

Receipts are essential for the smooth running of any business enterprise. However, obtaining the right book for your company or business may be a challenge.

So, it should be great news to know that depending on your business specifications, you have the following options:

Purchase a receipt book

Online vendors and office sales stores have carbonless two-part receipt books, and you can purchase these from them. It is easy to use because it comes pre-numbered and has headings on each sheet. In choosing a book, always go for one that has a copy to help you keep your records straight and easy.

When using such a book, never forget to insert a carbon sheet between the original and a copy of the receipt. This helps the details to appear on the copy that serves as your record of that transaction.

Download a receipt form template for digital use

As a business owner in today’s world, you may have to provide a client with an online receipt. When this happens, it is best to write it on a computer. To create your own, search online for the templates that will help create a receipt that suits the transaction you are performing.

Then, you should fill in all the fields that the transaction needs with the help of a word processor and send a copy to the customer. Always write the transaction date on your receipts and download your templates from only reputable sources.

What Should a Basic Book Include?

A receipt can serve as a legal document, which helps a business owner keep adequate records of goods and services exchanged in a transaction.

Therefore, regardless of your business receipt style, you must include these components in the template:

Date

Including dates on the book helps you track the receipts and have accurate records of transactions you have made. You should always fix the date at the top right of the receipt and ensure it is bold and clear.

Receipt number

The receipt number always goes with the date at the top right of your document, and you can use the date and number to keep track of all transactions you have made in a day. You should start each new day with a new number. Then, there will be no confusion since it tallies with each new date. In this way, you will organize your records and make tracking transactions a lot easier.

Receiver’s name

The payment recipient should be the company or business owner. Therefore, write the company’s name and then follow with the company’s address and phone number. Here, you may also choose to include other information such as your company’s social media handles and operating hours to help the customer reach you if they need to.

Purchased items and their cost

Write out each item the client purchased on the left side of the book and fill the costs on the right side of the pass against each item.

Subtotal

If you have sold more than one item, you will need to take the subtotal of each group of items. Subtotal simplifies the entire process of tallying the purchases and makes the book tidy and orderly.

Additional taxes

You will need to clearly state the additional taxes on the purchase on the left side of the book and then include the monetary implications before summing all costs to get the total cost of goods that the client must pay.

Amount received

You must write out the cost of the purchase in both words and numbers for the sake of clarity. That is important to reduce errors in drawing up the cost of purchase.

Payment method

The standard payment methods are cash, use of credit cards, or cheques. You must clearly state the payment method in the receipt book, just below the total cost on the left side.

Card or cheque number (if needed)

This is necessary if your customer makes payment via credit card or cheques. Input the card number or cheque number below the payment method to track the client if there are problems in transactions.

Name of client and their signature

This is a legal document, and so the client should write their full name and sign on the last line of the receipt. You can then hand over the original one to the client and keep the copy in your file for record purposes.

In running a business or company, you must find ways to make transactions straightforward and orderly. One of such ways is using a book to make receipts for clients and have a personal record. With a two-way carbonless book, the recording becomes easier for you, and you can purchase these at several office outlets or online stores, along with reusable carbon sheets for writing out receipts.

tip

Remember to use good pens to write out receipts and apply slight pressure while writing to ensure that the details appear on the copy. It is also essential to place the carbon sheet between the original and a copy before filling in the transaction details.

Business involves impressing your client throughout your transaction, and the nature of your receipt plays a significant role in selling your business brand. Hence, the template should be perfect and fit the needs of your clients, as well as suit your brand.

Frequently Asked Questions

Yes, sure. It will significantly help record and proper documentation if your money order matches the receipt date.

The customer (client) always gets the original copy of the receipt, and the company keeps the copy or duplicate for record purposes.

When writing a receipt, the payee gets the yellow slip, and the original or white slip goes to the buyer (payer).

Ideally, you must write all the services you rendered on the left side of the receipt and the monetary implication on the right side. However, you may also want to record your services in an invoice for easier tracking.