A receipt is a document that acknowledges payment for the sale or transfer of goods or provision of other services between two or more parties.

A receipt issued by a merchant/trader should contain vital information concerning the transaction that must include the date of payment, the amount received, the type of payment, a description of the goods or service, and the name of the individual that accepted payment. A receipt is considered a support document because it acts as proof of payment; it must be kept for at least three years. However, businesses that claim loss of tax for any year must keep their receipts for seven years. While a receipt is a document confirming payment of goods or services by a customer, an invoice is a document issued to request compensation for goods or services. Therefore, invoices are issued before payment for goods or services is made, while receipts are issued after payment of goods or services.

Free Templates

What is a Receipt Template?

Receipt templates are documents that enforce a standard layout when creating receipts used to meet the different needs of a business.

Receipt templates will save writing time for the issuing party and enable them to issue multiple receipts. Receipt templates also break down the content, making it easy for customers or clients to read the information contained in them. The standard format of receipt templates should enable issuing parties to convey all relevant information concerning the transaction. It is therefore critical that receipt templates consist of the following information:

- Names, addresses, and contact information of the transacting parties

- The payment amount

- The date of payment

- Receipt number

- The method of payment, e.g., cash or check

- Item or service description

- The payment recipient’s signature

Types of Receipts

Businesses, companies, and individuals use different types of receipts to meet different needs. The following are the different types of receipts issuing parties may use:

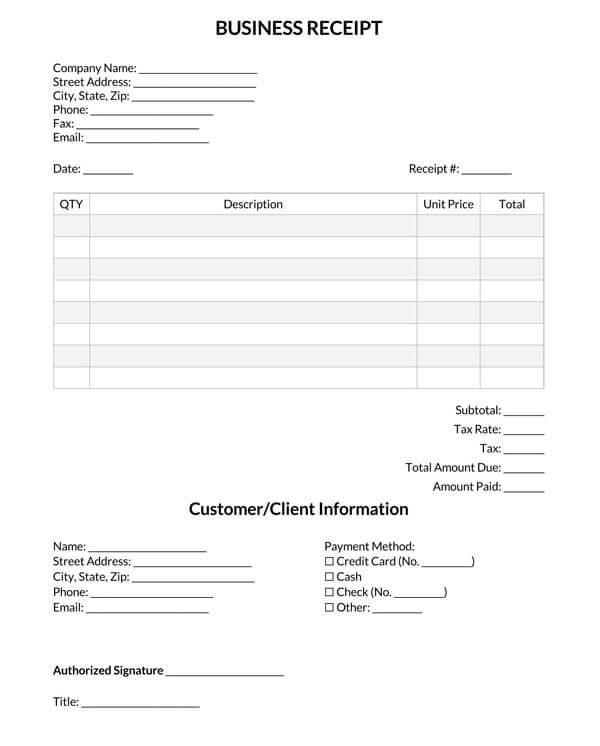

Business Receipt Template

Traders use a business receipt to record payment transactions for products or services. Business receipts must contain detailed descriptions of each transaction for proper record keeping.

Download: Microsoft Word (.docx)

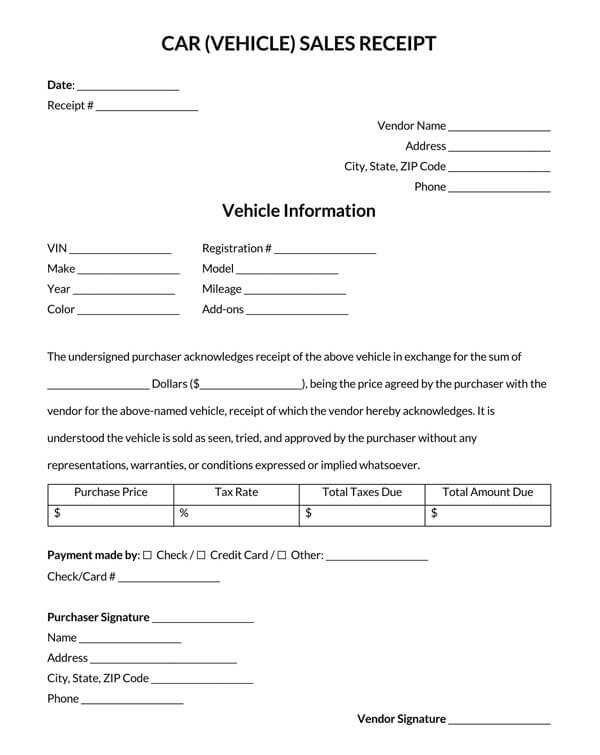

Car Vehicle Sales Receipt Template

A car (vehicle) receipt is used as proof of sale, lease, or service provided to a vehicle. It contains information concerning the vehicle, including its make, model, color, year, and odometer readings.

Download: Microsoft Word (.docx)

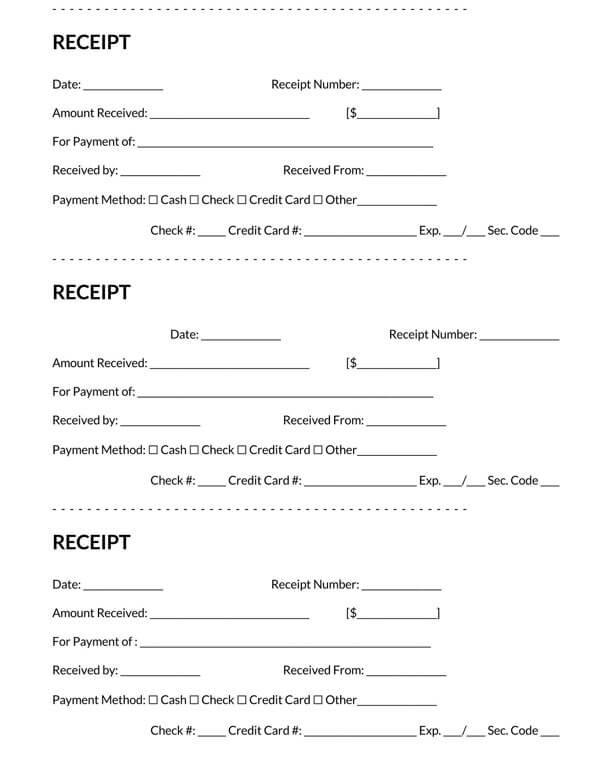

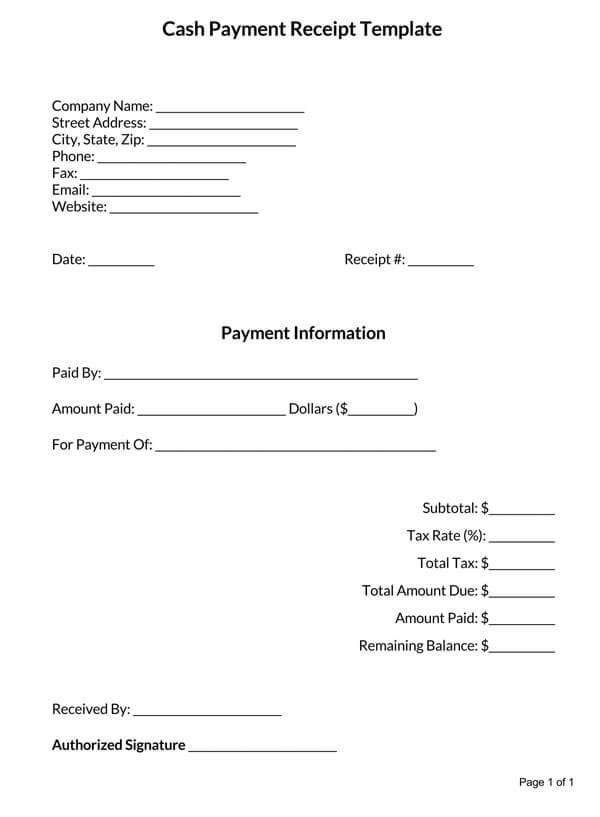

Cash Payment Receipt Template

A cash payment receipt is evidence of physical payment in terms of cash for products or services. Therefore, the business should retain a copy of a cash payment receipt upon issuance to a customer.

Download: Microsoft Word (.docx)

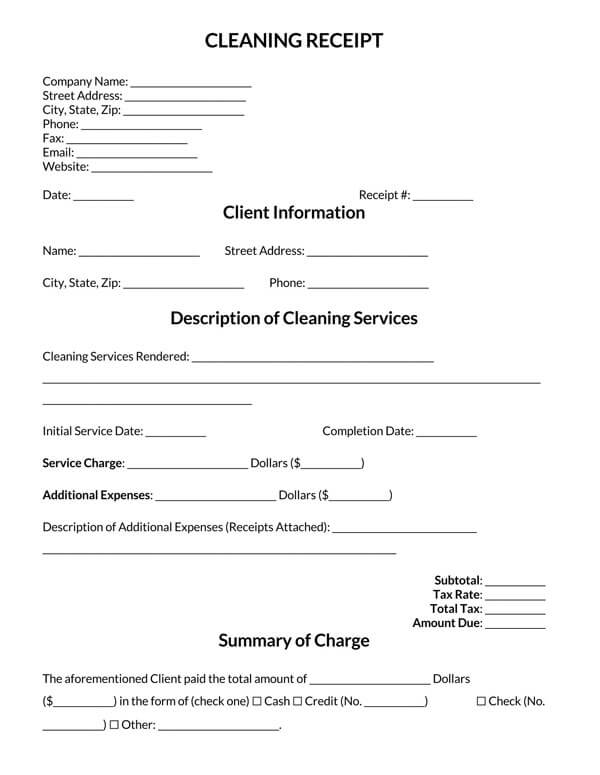

Cleaning Receipt Template

A cleaning receipt is issued upon the provision of cleaning services to a client. It should contain information which includes a detailed description of the cleaning service provided and charges for the service rendered.

Download: Microsoft Word (.docx)

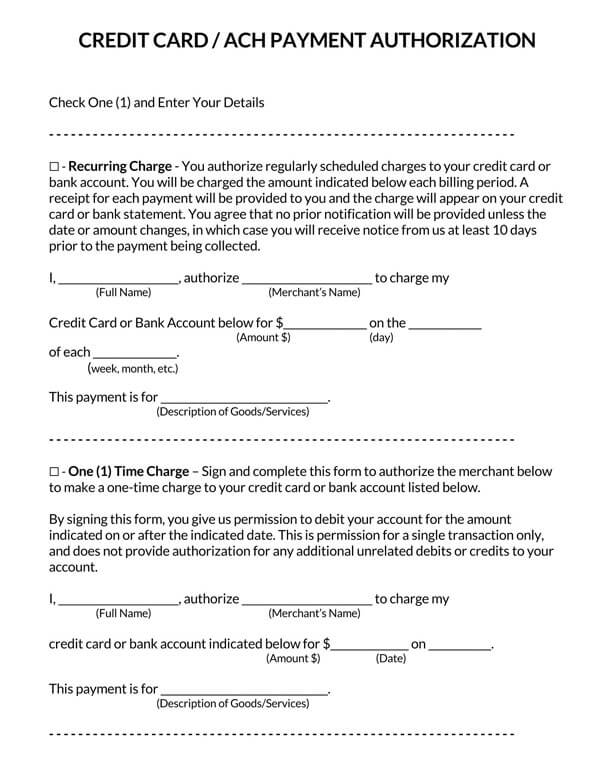

Credit Card ACH Payment Authorization Form

A credit card receipt is only issued upon authorization of credit card charges. The charges indicated in the receipt will appear on the client’s/customer’s credit card.

Download: Microsoft Word (.docx)

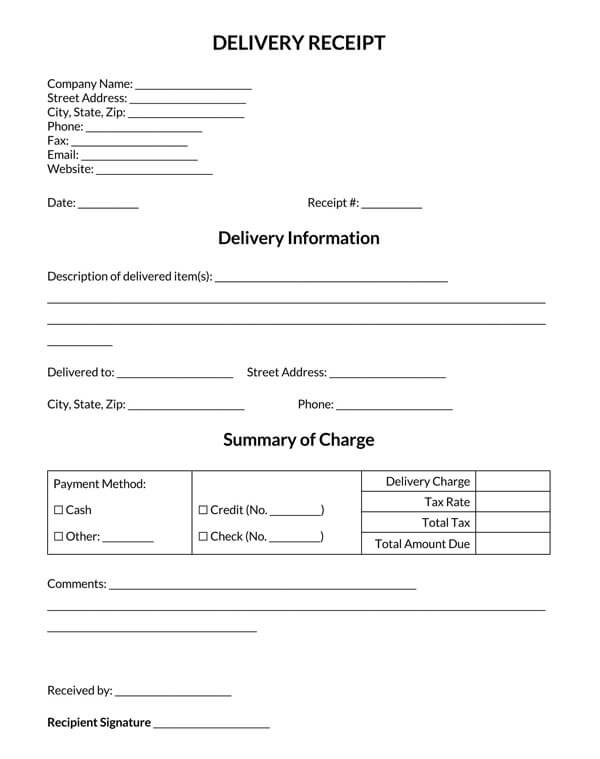

Delivery Receipt Template

A delivery receipt is issued after the successful delivery of goods to a client’s /customer’s destination. It must contain details of the delivery and the charges. It is only issued upon payment of the delivered goods.

Download: Microsoft Word (.docx)

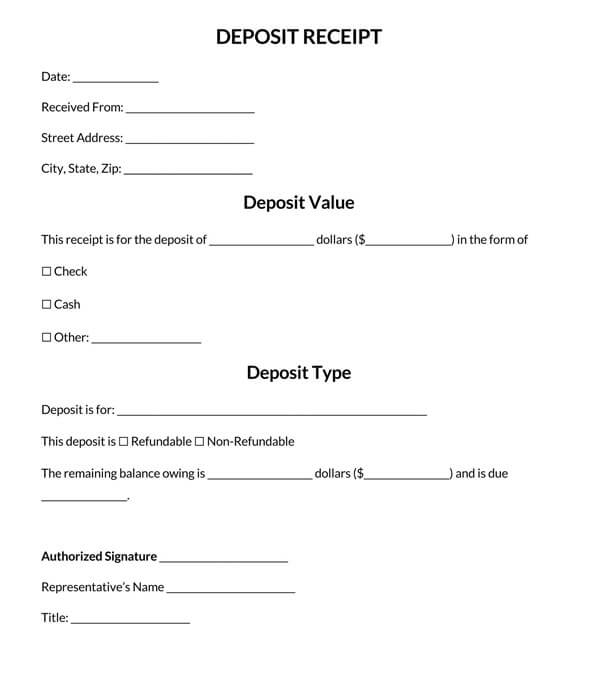

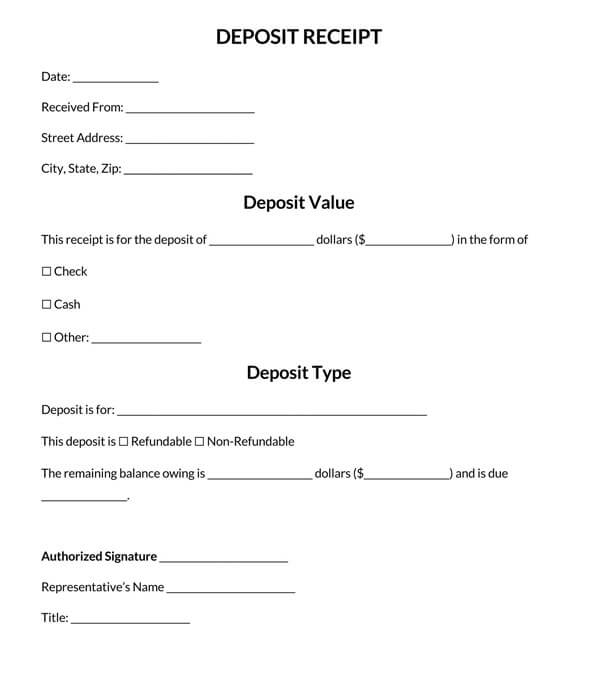

Deposit Receipt Template

A deposit receipt is issued upon partial payment for goods or services, with the rest of the payment to be made at a later agreed date. Deposit receipts must include the balance owed to the payment recipient or business.

Download: Microsoft Word (.docx)

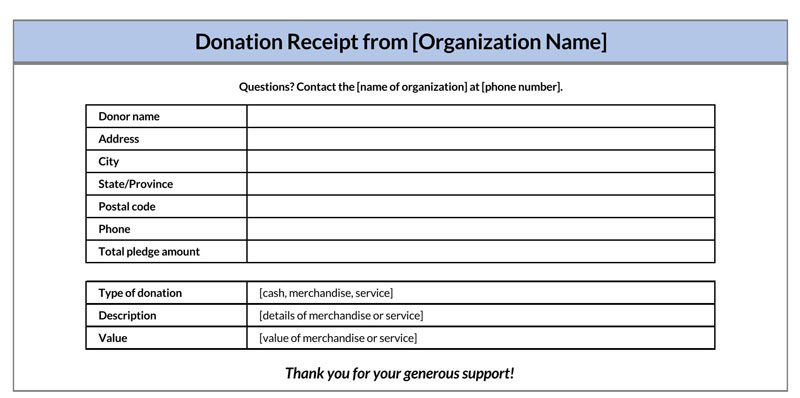

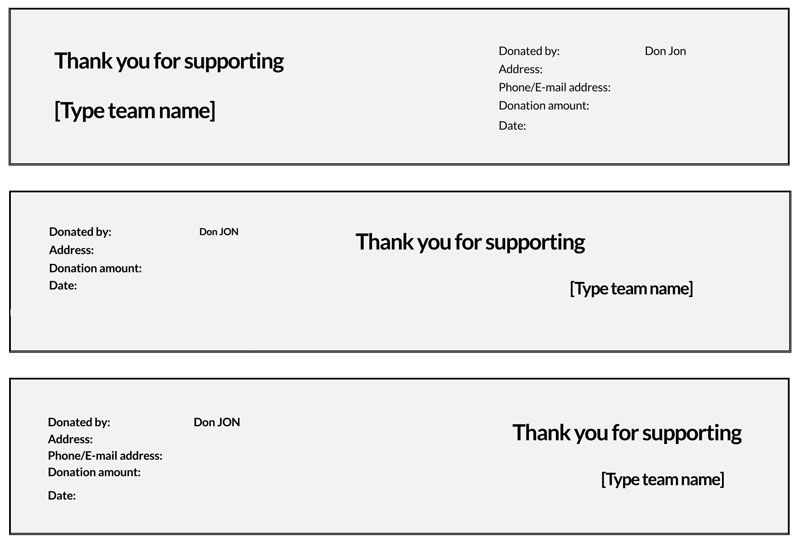

Donation Receipt Template

A donation receipt is issued to an individual who contributes $250 and more, personal property or vehicle donation. It should contain a total annual contribution for all the donations made during the year.

Download: Microsoft Word (.docx)

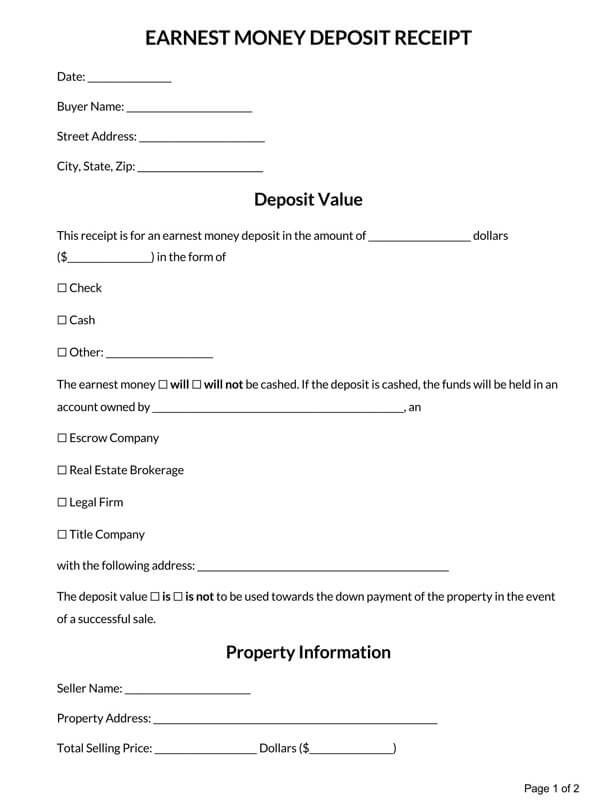

Earnest Money Deposit Receipt Template

An earnest money deposit receipt is issued to a real estate buyer for the deposit paid for the property upon entering into a purchasing agreement with the seller. It must contain the property address and names of the parties involved in the transaction.

Download: Microsoft Word (.docx)

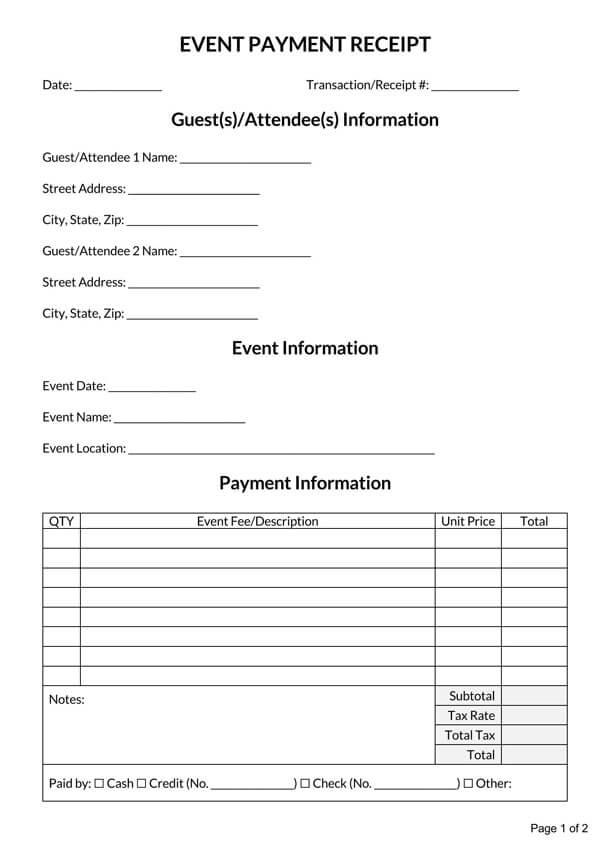

Event Payment Receipt Template

An event payment receipt is issued to attendees of an event after tickets are sold to them and any other fees or services provided to them. This receipt must contain the event name, date, location, the fee charged, and the total amount paid by the attendee.

Download: Microsoft Word (.docx)

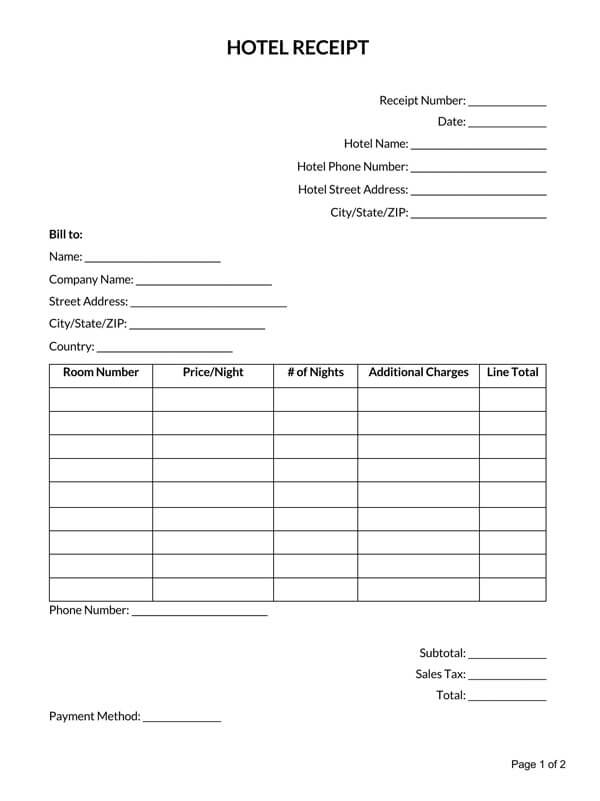

Hotel Receipt Template

A hotel receipt is issued after payment is made by guests for the cost of their stay. It contains the room rate cost, any extra amenities provided, and other charges by the hotel.

Download: Microsoft Word (.docx)

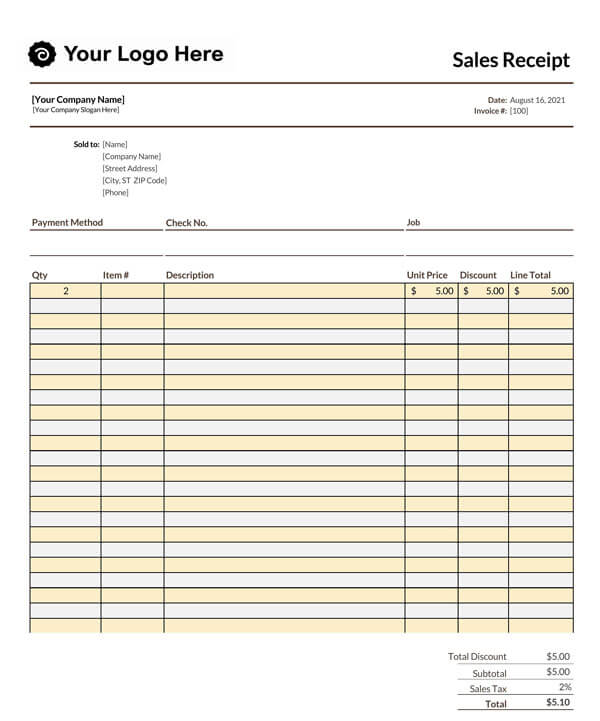

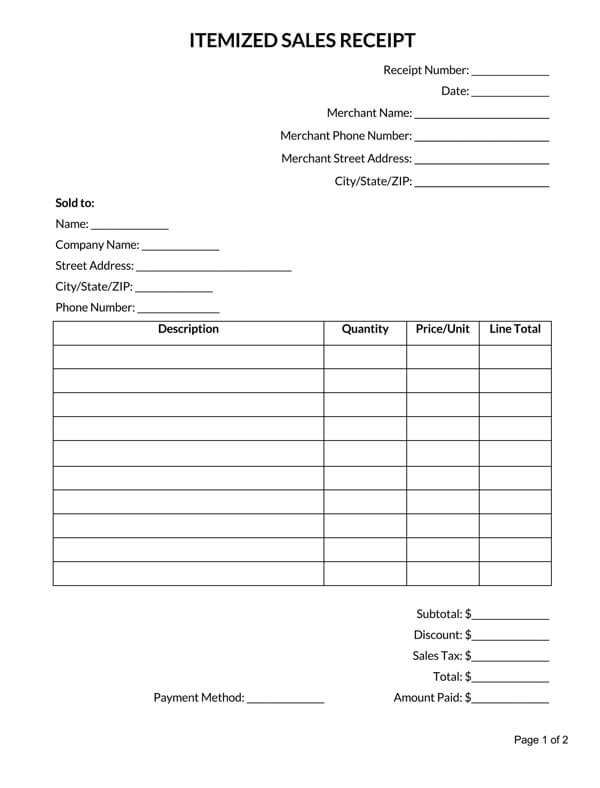

Itemized Sales Receipt Template

An itemized receipt is issued to customers by a merchant for the list of items they purchase. It contains a list describing each unit sold and the names of the parties involved.

Download: Microsoft Word (.docx)

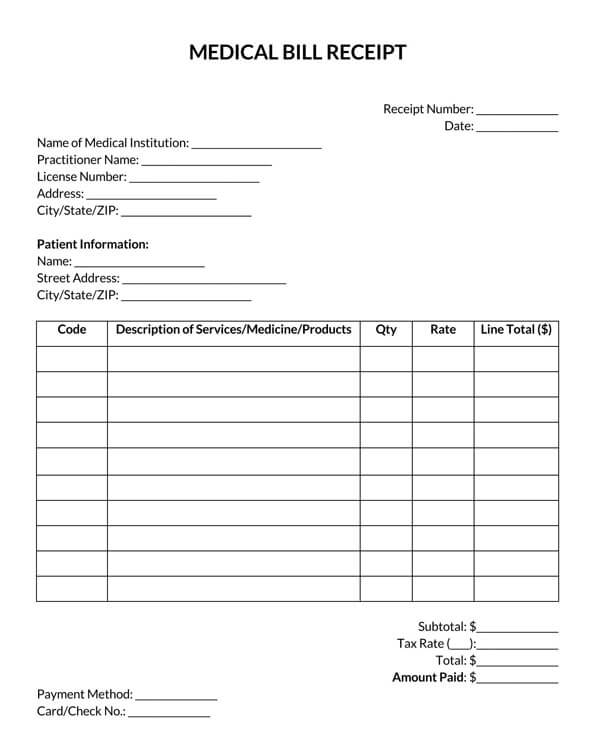

Medical Bill Receipt Template

A medical bill receipt contains a breakdown of the services provided to patients, such as an ultrasound, medication administered, and products used for the treatment that must be paid.

Download: Microsoft Word (.docx)

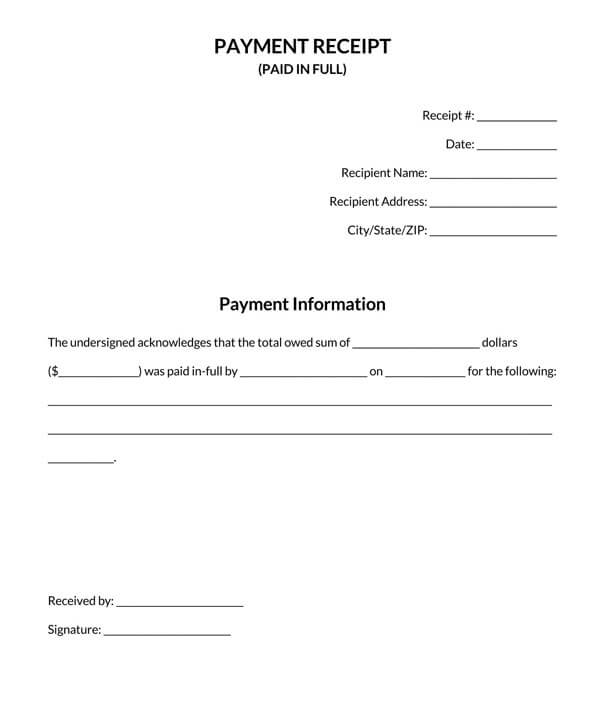

Paid In Full Receipt Template

A paid-in the full receipt is issued to record successful payment of money owed with no balance due to the issuing party. In addition, this receipt verifies that customers have fully settled their debts with sellers.

Download: Microsoft Word (.docx)

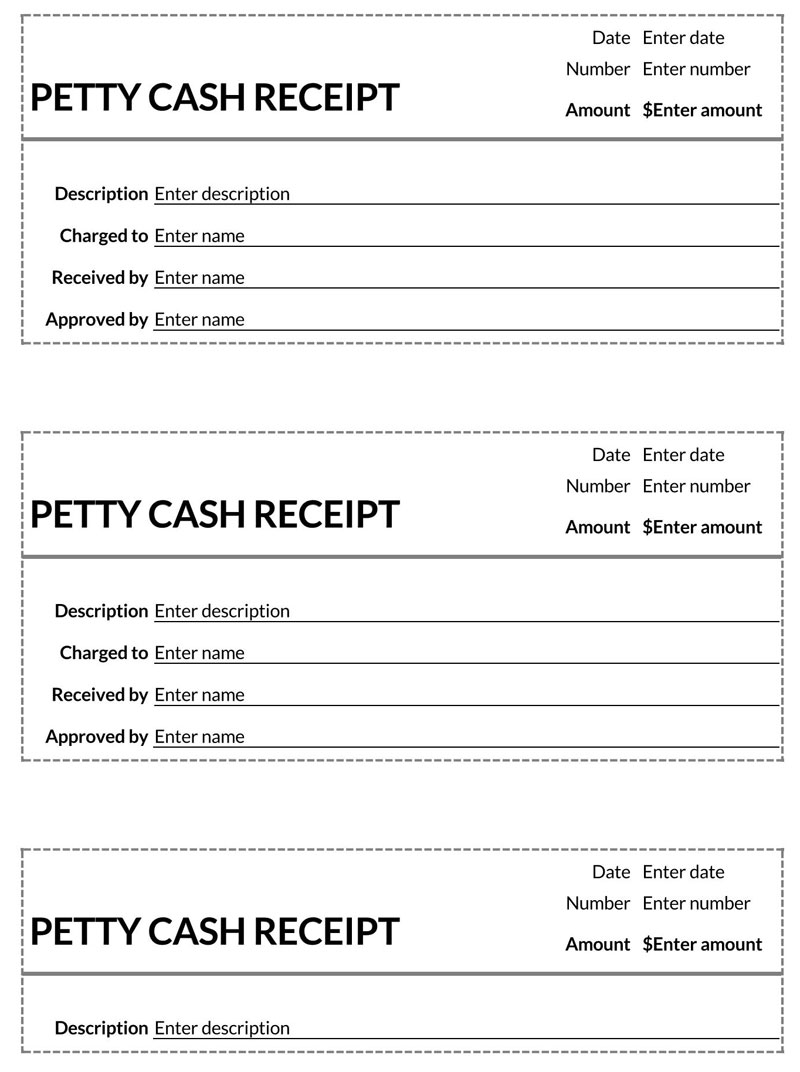

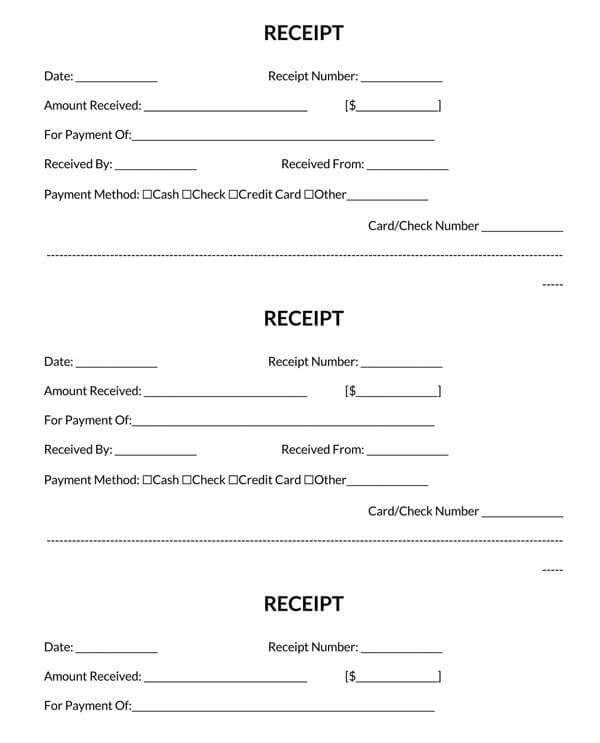

Receipt Book Template

A receipt book contains forms used in issuing receipts for payments made by a customer or client. An issuing party must retain a copy of the receipt issued by noting transactions in a booklet or using carbon copy receipts.

Download: Microsoft Word (.docx)

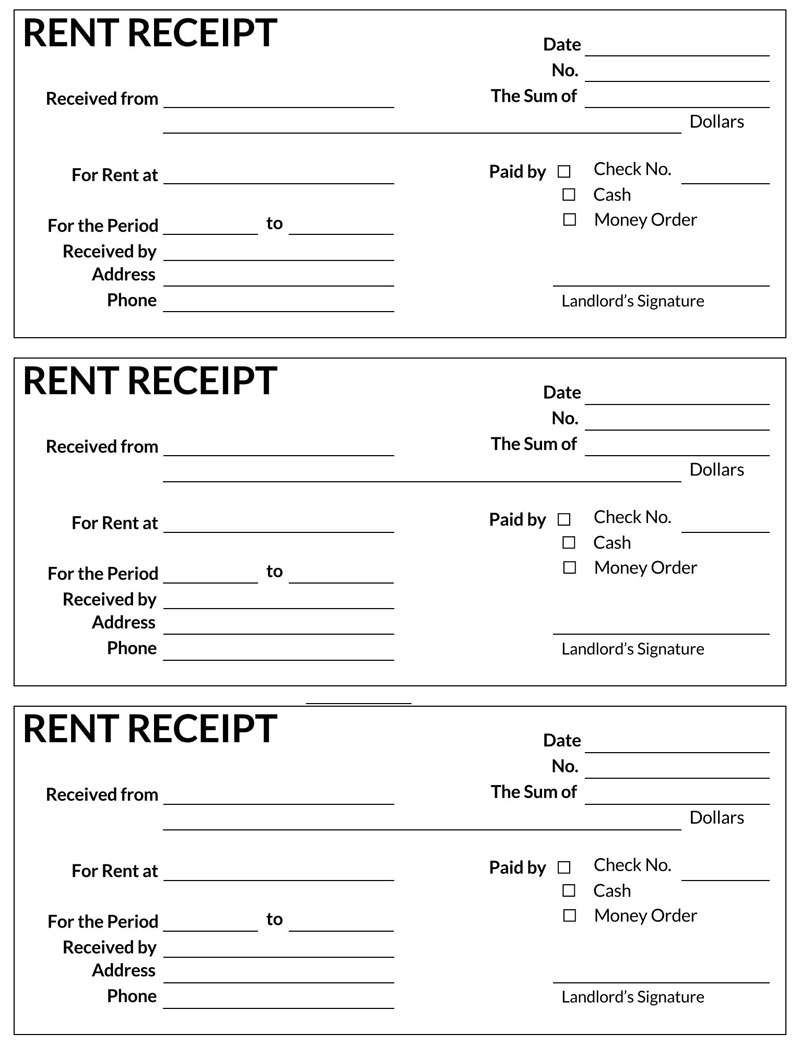

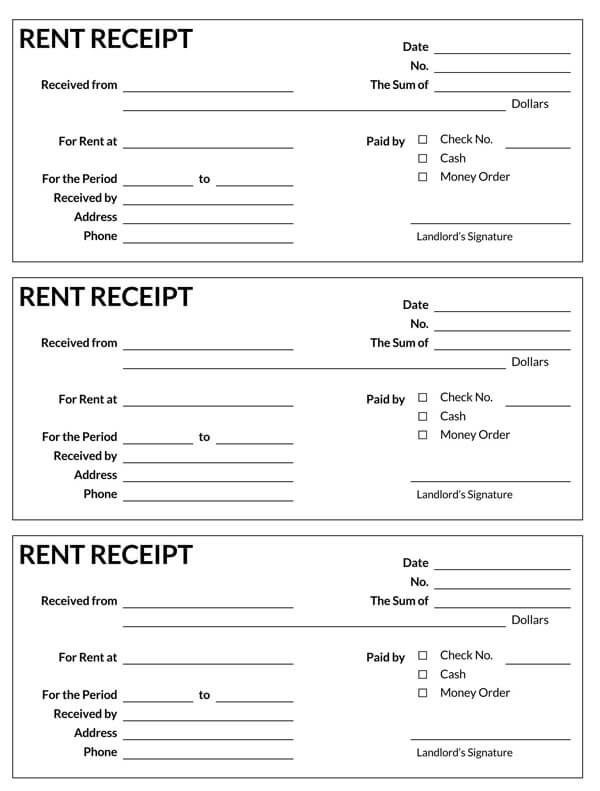

Rent Receipt

A landlord issues a rent receipt to a tenant as proof of payment of monthly rent. The landlord and tenant must keep a copy of the rent receipt for proper record keeping.

Download: Microsoft Word (.docx)

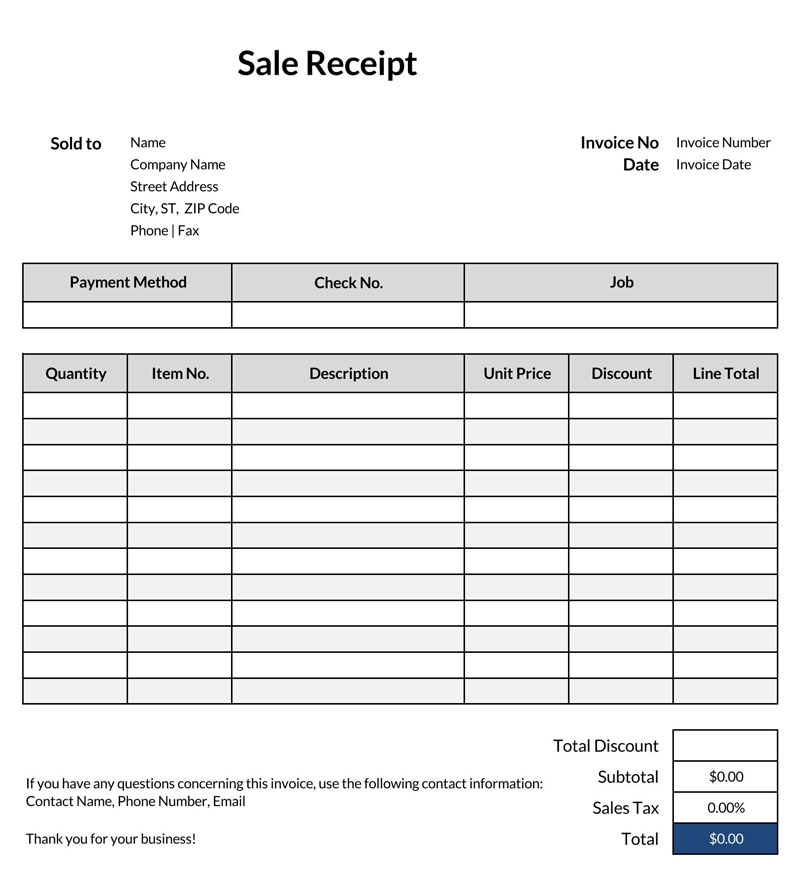

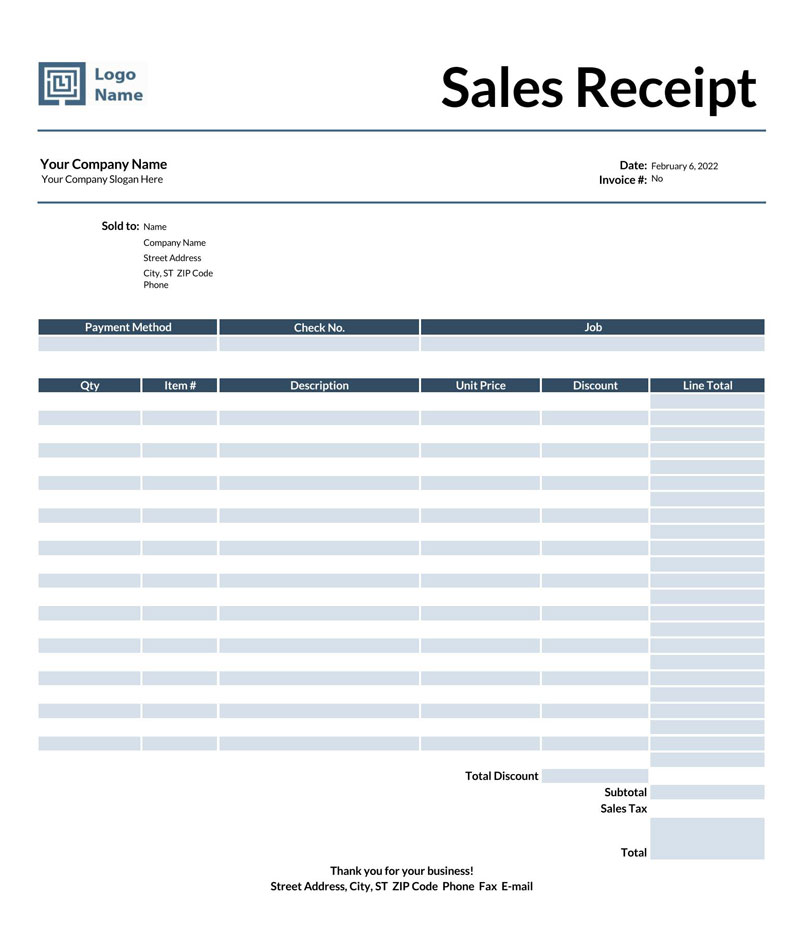

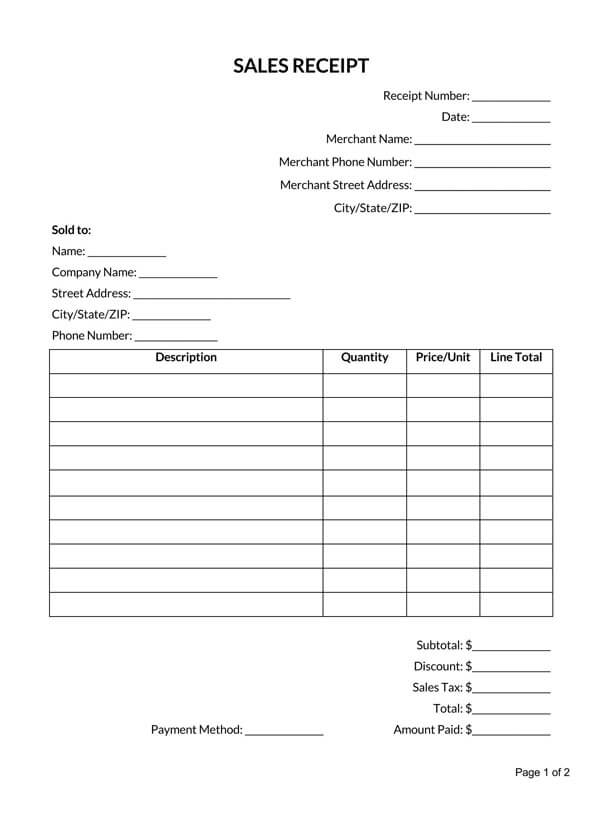

Sales Receipt

A sales receipt is issued after the sale of products from a vendor to a customer. It is used to break down the number of items sold multiplied by the price of each unit with a total estimate indicated.

Download: Microsoft Word (.docx)

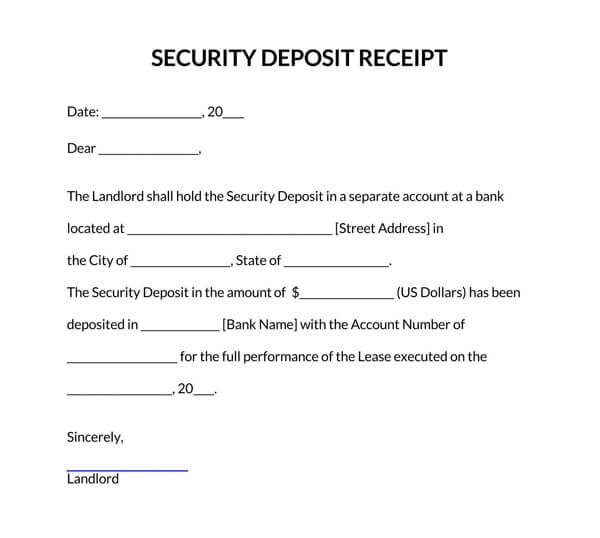

Security Deposit

A security deposit receipt is issued to a tenant after successfully paying the security deposit to the landlord. The security deposit amount paid is reliant on the state of residence of the issuing party.

Download: Microsoft Word (.docx)

How to Make a Receipt

A receipt helps the issuing parties to break down transaction information into different sections. The standard format of a receipt also ensures uniformity of the content demanded. It is therefore essential that an issuing party adheres to the following step by step process when making a receipt:

Enter the date

When writing a receipt, the issuing parties should first ensure that they write the full date of the sale. Entering the date of sale ensures that the issuing party can identify when a sale was made to a client.

For example:

Date: April 5th,2020

Create a unique receipt number

Secondly, the issuing parties must ensure that they create unique receipt numbers in their receipt templates. A unique receipt number ensures that the issuing party can keep track of each sale of the day.

For example:

Receipt number: 04235

Add business details

Thirdly an issuing party must ensure that the receipt contains vital business details. This information is proof that the issuing party made the sale, and it will help the clients contact them should they need to. The business details should include the business name and address (City, State, Zip Code). A phone number or email address that clients can use to contact them must also be included.

For example:

Telco Company Inc.

1246 Main St,

Fresno, CA 950032

(555) 246-146

Telcocompany@email.com

Enter the amount of money paid

The Issuing party’s fourth step in making a receipt should be to enter the payment amount in both words and figures.

For example:

Amount Received: Six hundred and seventy dollars $670

State the product or service rendered

The fifth step the issuing party must take is to state the product or service rendered. This helps the issuing party identify the product sold or services rendered to the client.

For example:

For Payment of: Sale of Record Player

Payment method

Next, the issuing party must ensure the method of payment used is indicated in the receipt. The issuing party can receive payment in cash, check, or credit card or through other methods, for example:

Payment method: Cash: Check: Check Credit Card: Other:

Check number (if applicable)

If payment has been made via check, the issuing party must ensure that the check number is indicated.

For example:

Check number: 10010012356

Credit card details

Suppose payment was made via credit card, then the issuing party should include the necessary credit card details,

For example:

Credit card Number: 1234 5678 9312 3476

Enter names of the seller and the buyer

The issuing party must then enter the names of the seller and buyer. This ensures that the receipt contains the names of the parties involved in the transaction,

For example:

Payment made to: Telco company Inc Payment made from: Ann Mathews.

Add signatures

Finally, the buyer and the seller must indicate their signatures in the receipt. This certifies that the parties have taken part in the transaction.

Receipt Template

Receipt Template

<Business name> Receipt number:_______________________

<Street Address> Date:_______________________

<City, state, Zip code>

<Phone number>

<Email Address>

Amount received: <amount in words> <amount in figures>

For Payment of: <product or service provided>

Payment method: Cash____ Check____ Check Credit Card____ Other____

Check number:_____________________ Credit card Number: ____________________________

Payment made to:___________________________ Payment made from:_________________________

Signature:____________________________ Signature:______________________________

Sample Receipt

CBI Limited Receipt number: 005432

39Main street, Date: March 12th ,2020

Townville, NH, 030360

Phone number

(123)564-88754

Email address

CBI@email.com

The amount received: Two hundred and 50 dollars $250

For Payment of: Sale of Sneakers

Payment method: Cash____ Check____ Credit Card____ Other_____

Check number: 456765 Credit card Number: 6344-5353-5892-4503

Payment made to: CBI limited Payment made from: James Simons

Signature: __Bradley_ Signature: __James Simons

Frequently Asked Questions

No, writing a fake receipt makes it harder to track sold goods and collect sales tax. Fake receipts also allow individuals to make fraudulent purchases which is illegal.

Yes, it is legal to issue a handwritten receipt as it is considered legally binding. However, the issuing party must ensure that the receipt contains all the relevant information concerning the transaction.