For some, the pure mention of a legal document is enough to give them chills, especially when you are trying to get out of your legal obligation to a lease. You want to make sure that you are doing everything correctly, but what exactly is a Release from Personal Guarantee Form?

Though the name sounds scary, the form is actually quite straight forward. The release of the guarantee form allows a guarantor (or, the person that is seeking release) to be freed from being legally bound by a loan contract. This is a common form that generally gets signed if a cosigner is trying to be released from any obligation if a lessee cannot pay a loan or agreement.

Who Are The Parties Involved?

- Releasor: The party giving the release

- Guarantor: The party seeking the release

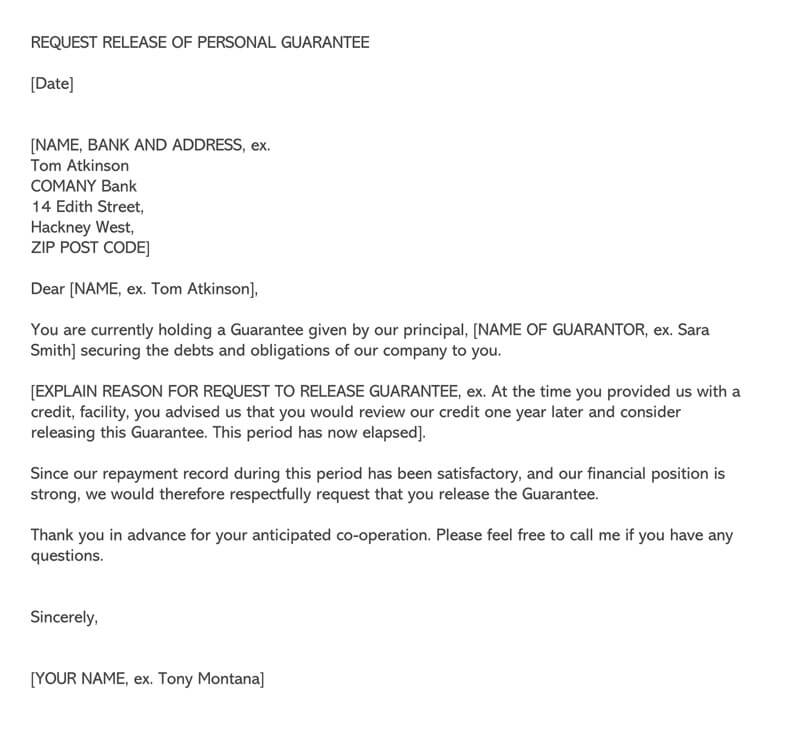

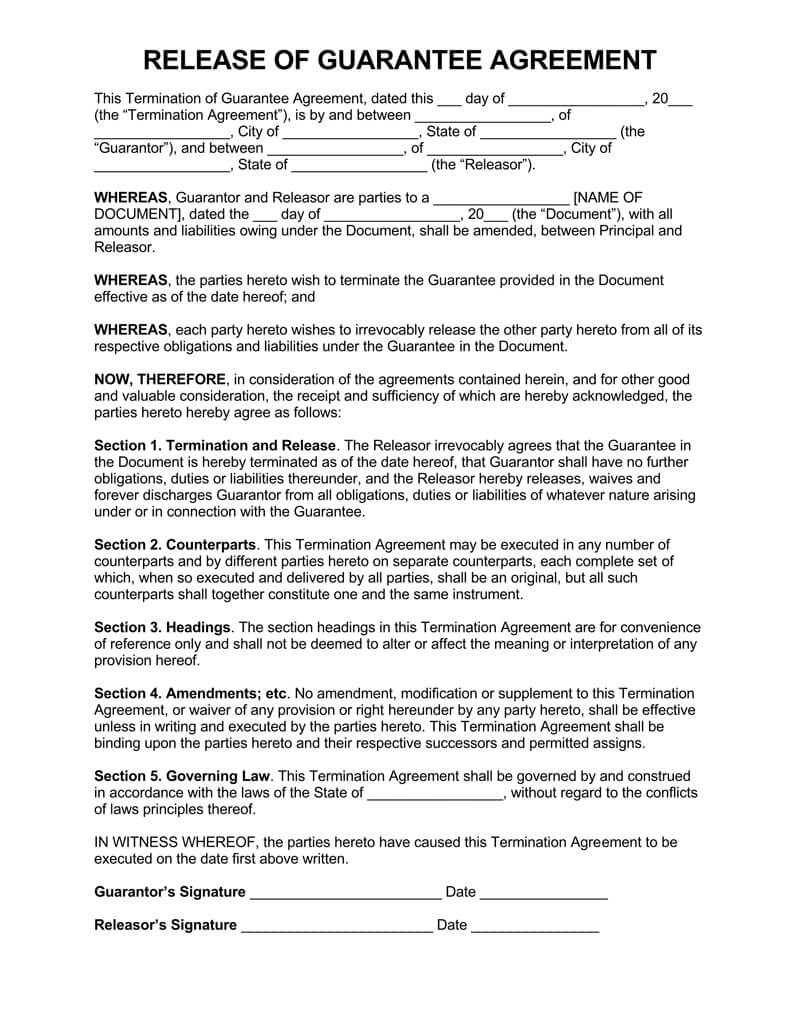

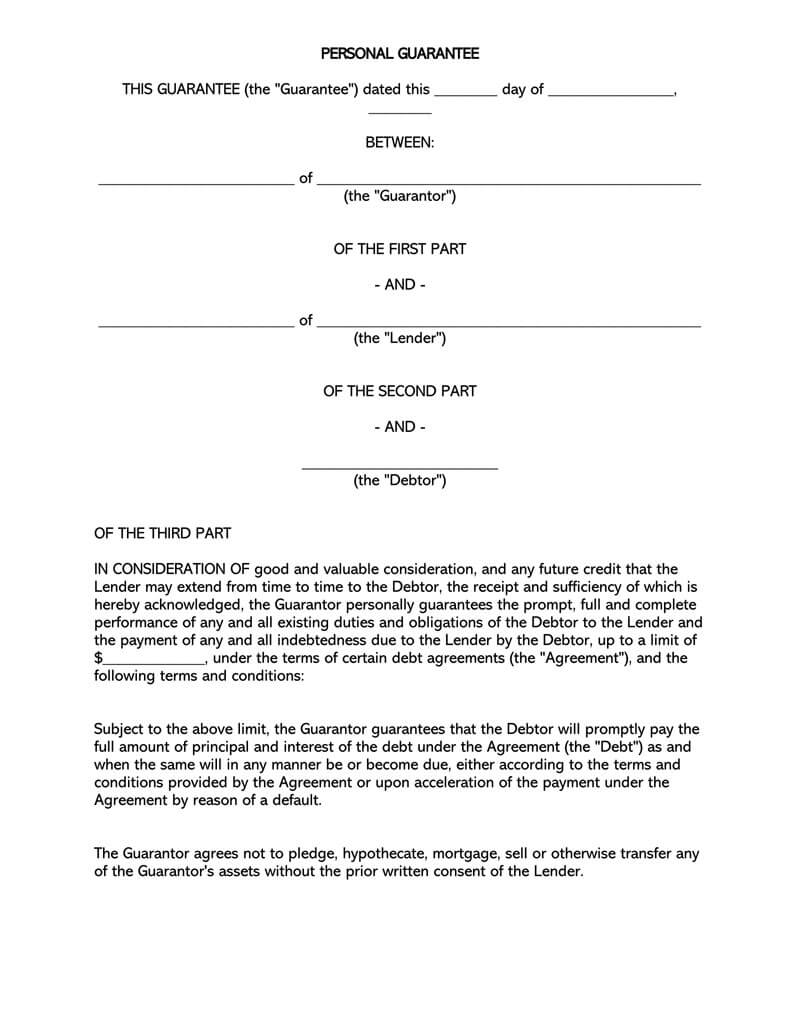

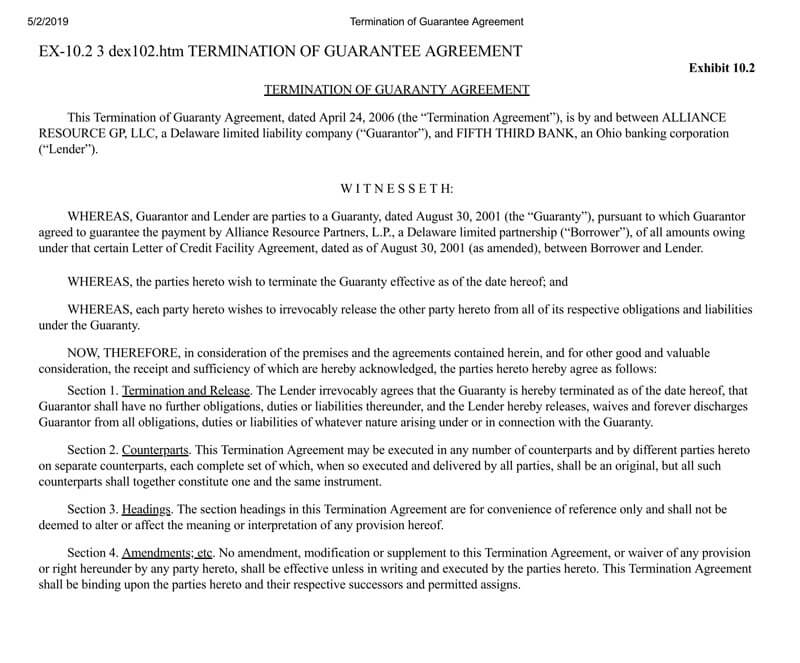

Sample Release of Guarantee Forms & Agreements

How Release of Personal Guarantee Form Works?

The release of the form takes away your legal obligation to anything you would typically be bound to.

For instance

If you cosign on your cousin’s student loans or mortgage, but you no longer wish to be responsible if they suddenly can’t pay, this may be the right move for you.

This release must be approved by whoever provided the loan or whoever the third party is leasing an item from. While this is most commonly signed after a loan has been fully paid, if someone sells the asset or has another party take over the asset, you can sign one of these to remove your obligation to the loan or lease.

Why Should You Obtain a Release?

It is important to have a release of a personal guarantee form as you can be held financially responsible for any future debt that might be incurred under the account if you do not. A release of the form states that you have fully ended all obligations to the account which you were originally tied to as collateral. If someone were to try and come after you for unpaid debts on a loan or lease, you have proof that you have ended the terms of the original agreement. In the case of a company, if you own a company, you cannot be held liable for any debts incurred after the date of the form.

Situations Where Personal Guarantees are Required

When securing:

- Property loans

- Invoice finance

- Commercial rents

- Bank overdrafts

- Property loans

- Leasing agreements

- Trade credit

- Unsecured business loans

The following are the key purposes of the release form:

- Releases financial obligations: The prime benefit of the form is the fact that it frees or releases the guarantor from their financial obligations. As soon as the for is signed by both parties, the guarantor ceases to be responsible for any issues that may arise in the process.

- May be used as evidence in court cases: Should there arise any issues/disputes surrounding the loan spillovers to the court, the form may be used as evidence in the case. In this sense, it may be used as evidence to show that the guarantor was released from all financial obligations that were tied to them.

- The form may serve as a reference: The release form may also serve as a reference for any disputes or misunderstandings that may arise in the future. For instance, if the borrower is no longer in the position to service their loan. Many lenders often resort to demanding that the guarantors step in for them. The form, in this case, serves as a reference for any freed financial obligations.

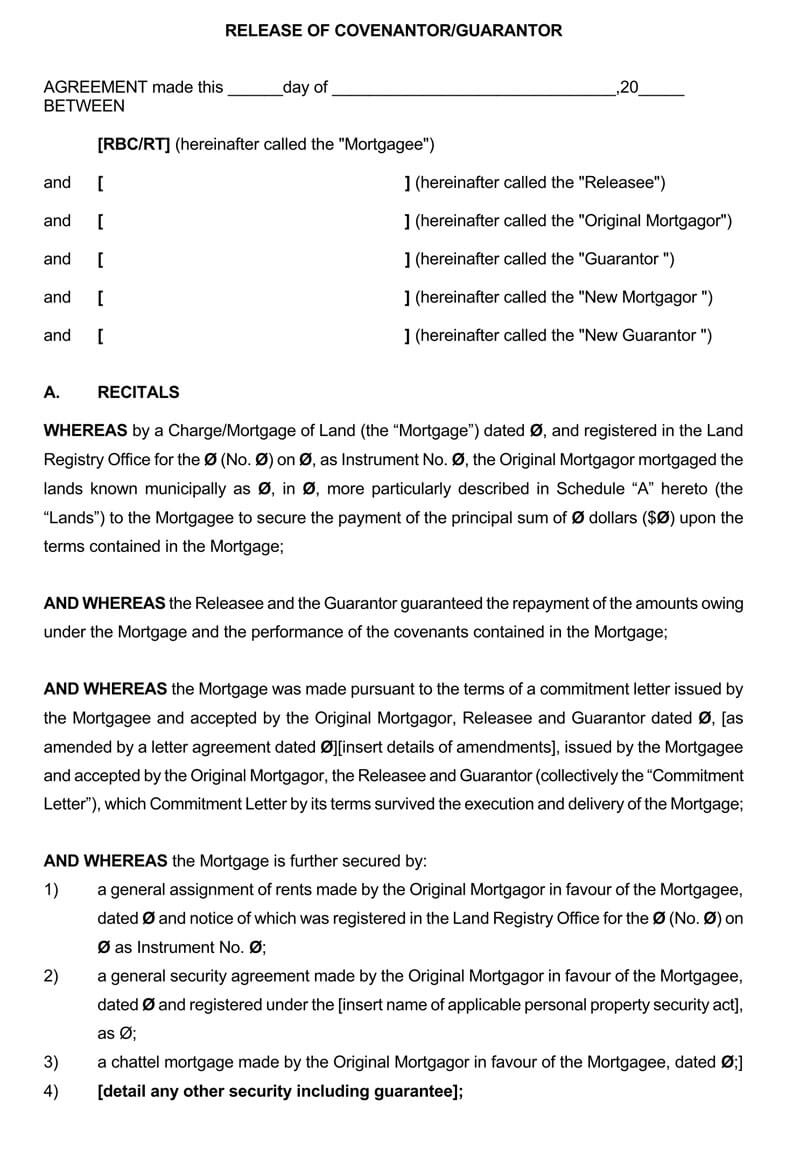

Basic Contents of Release Form

- Date, Identification, and physical address: First, your introduction should have several things defined. You must have the document dated. The guarantor should be the first party that is reported within the document. They should also have identification, such as their physical street address. This normally is yourself.

- The name of the person/institution releasing the guarantor: The next thing that should be defined within your release of the form is the releasor or the person or institution that is releasing the guarantor from the responsibility of the previous contract. This should be identified in the same way as the guarantor.

- What the guarantor is being released from: The most important thing that should be defined is what the guarantor is being released from. This will typically be a document – such as a lease agreement – and should include the date of the agreement, as well. For instance, you might have it worded “whereas, guarantor and releasor are parties to a vehicle lease agreement, dated the 4th day of May 2018, with all amount and liabilities owing under the document, shall be amended, between principal and releasor.” this clause helps validate the document, should you ever have to take it to court. It allows a judge to see what you are released from.

- Signature to officiate the document: Lastly, there should be a space for the signature of both yourself and the releasor…as well as the signature of a notary. You should also include a second page, which is a notary acknowledgment.

Release Forms (by State)

Frequently Asked Questions

As a director, you cannot get out of a personal guarantee if the business is insolvent. The only thing you can do is to either renegotiate the agreement so that your lender no longer insists on a PG. If it is called in, then you may decide to;

• Pay it,

• Agree on how to pay it

• Declare bankruptcy

The guarantor’s liability is “coextensive” with the debtor. The guarantor is liable to whatever is liable to the creditor. If the debtor’s liability is released, so is the liability of the guarantor.

Having a notary backing this document deters fraud and identity theft. It also is self-authenticating, meaning that, should you ever be called into court over the agreement of the previous lease, you will not have to testify in court that your signature is authentic. The notary will have already done that job. If ever the agreement is called into question, having the document notarized can end disputes much more quickly.