Lending money is a practice that is often faced with uncertainties. Lenders will therefore go to great lengths to protect themselves from losing their money. This includes asking borrowers to name a guarantor as an extra layer of protection. A loan guarantee form ensures that the guarantor legally accepts the obligation to pay the loan back if the borrower fails to do so.

Adding guarantors as a loan requirement increases the lending options because the added security allows borrowers with low financial capabilities to consider borrowing as a financing option. Since the agreement is legally binding. It reassures lenders that their money will be recouped from a third party should unprecedented circumstances hinder the borrower from paying it back. This article will look into who can use a personal guarantee form for a loan and the critical components of the document.

What is It?

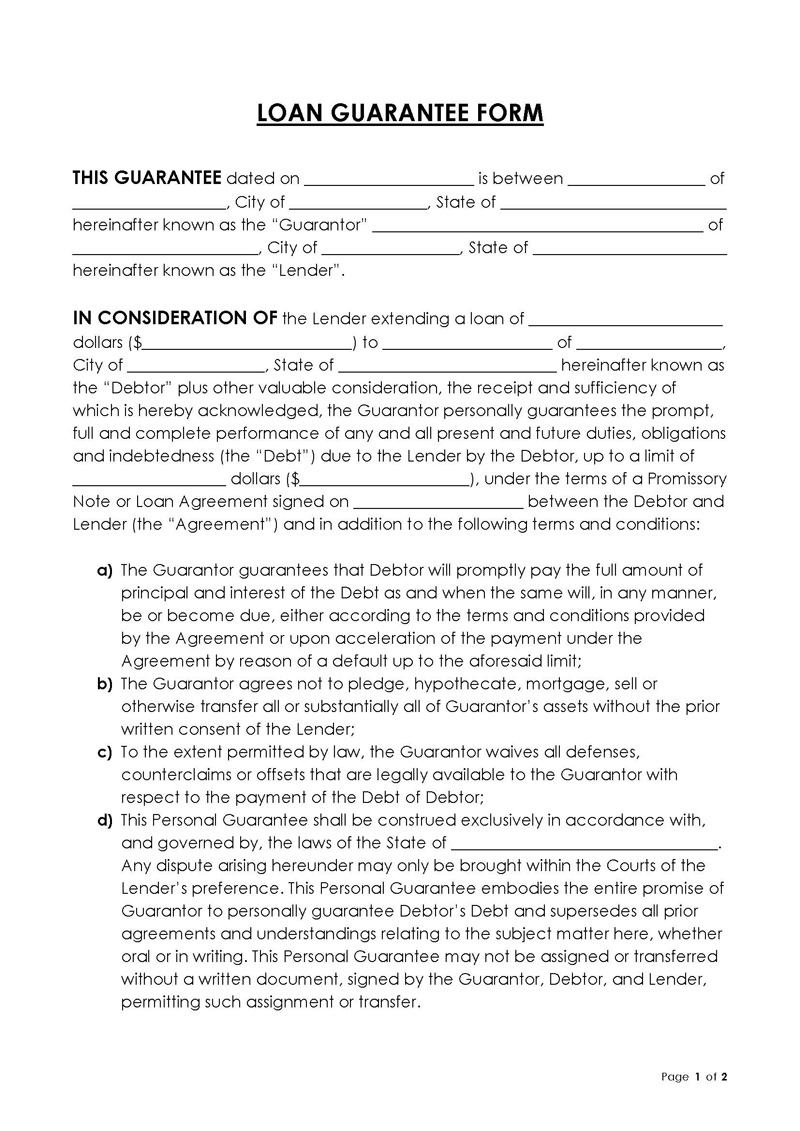

A loan guarantee form is a legal document used to appoint a third party, the guarantor, who is obligated to pay back a loan if the borrower defaults.

The agreement declares the appointed guarantor, loan amount, and applicable loan terms. In addition, it must be signed by all parties involved in the transaction and should be witnessed, preferably by the notary public in its respective jurisdiction. The guarantee is then added to loan agreements.

Who Can Use it?

The form can be applied in multiple scenarios and industries. Ordinarily, the document is used when one party needs a guarantee against losing finances.

Ordinary individuals and entities who use a personal guarantee form include:

Trading companies

The form is used between trading companies to guarantee that the company assigned duties and work will fulfill its contractual obligations as indicated in the initial transaction agreement. In such a situation, the form is used as a sign of goodwill from the client company. In addition, the form should outline the applicable state laws governing the agreement’s implementation in place for trading transactions.

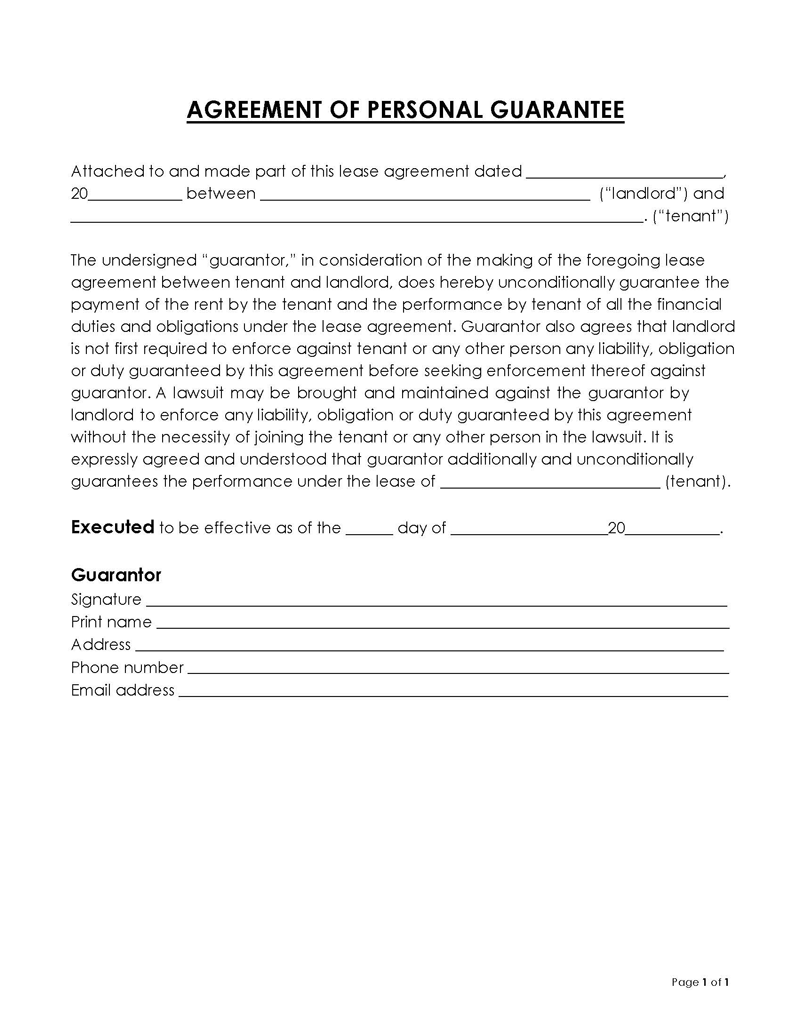

Landlord and lease property dealers

The forms are also common among lease agreements. Property owners and landlords use the forms when they want their tenants to guarantee that a third party will be taking up their lease obligations, such as rent payments if they default. Such a form should have a forwarding address that landlords can use for correspondence, such as notices if the tenant defaults or fails to make periodic rental payments.

Hiring managers

Hiring managers are also frequent users of the forms. Hiring managers ask for the form during the recruitment process to verify claims made by an applicant in their application. Such a guarantee form outlines the applicant’s details, guarantor’s details, previous employment, and an objective evaluation of the applicant’s competencies and suitability for a job. The form also serves as a recommendation. It is recorded with the applicant’s files once they are selected for the job.

Insurance providers

They are used in the insurance industry. Insurance providers use the forms to document details about the insurance applicant, the guarantor(s), and applicable terms and conditions. If the applicant fails to cover the payments, the guarantor is bound to assume any financial obligations under the insurance policy. Insurance providers can allow the applicant to include more than one guarantor.

Involved Parties

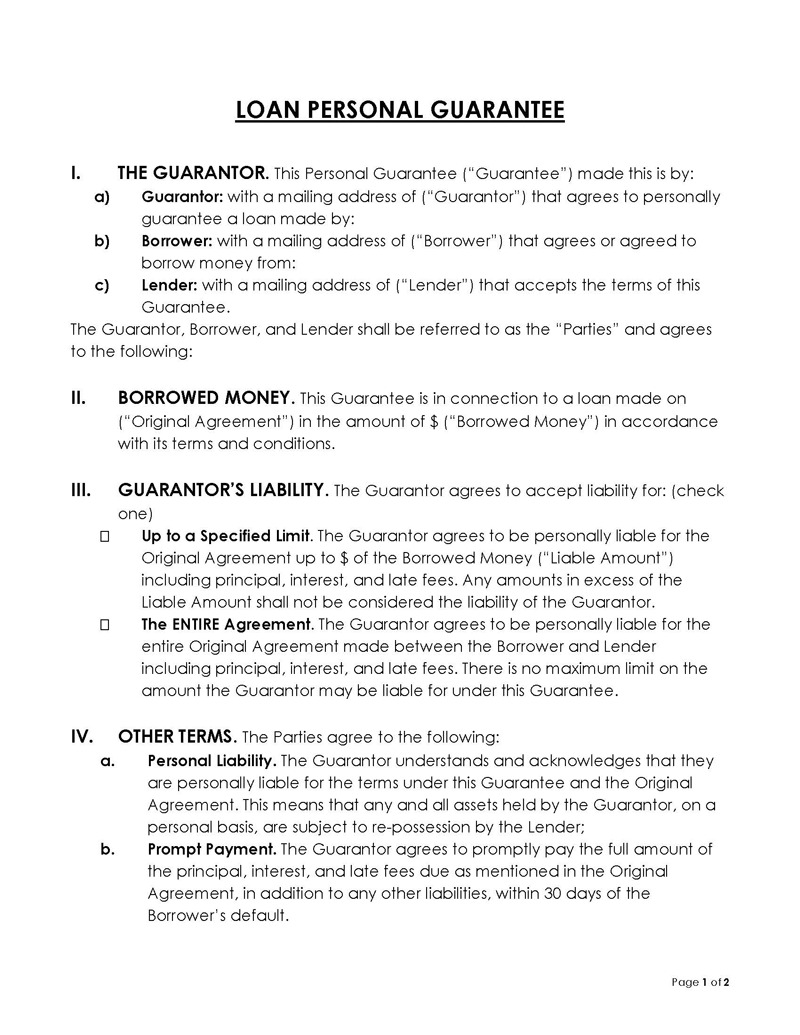

Typically, three parties are involved in executing the form. These parties include the following:

- Debtor: The debtor is the person or entity that borrows the loan. They are primarily responsible for the loan agreement’s financial obligations (paying back the loan).

- Guarantor: The guarantor is the party (person or entity) to whom the debtor’s obligations will be transferred if they fail to fulfill them. In a loan agreement, they take up the responsibility to make loan payments once the debtor defaults.

- The lender: The lender is the party to whom the debtor owes the amount indicated in the form. Consequently, they are owed by the guarantor once the debtor defaults.

Types of Personal Loan Guarantees

For credit issuers, having a guarantor sign the form provides them the assurance that they will be paid their debt.

There are two major types of personal loan guarantees as follows:

Limited guarantee

It allows creditors to collect either a definite monetary amount or a specified percentage of the principal’s remaining balance or the business owner. The limited guarantee applies when numerous principals pay parts of the loan or debt.

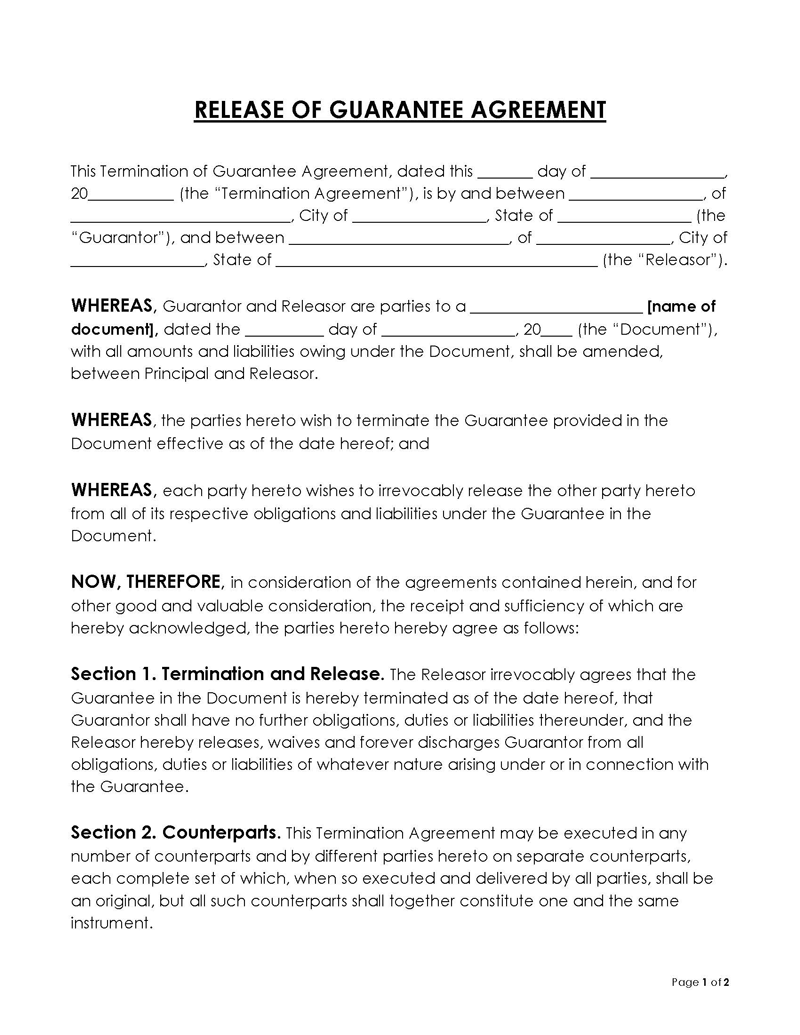

Unlimited guarantee

This requires that the principal receive liability for the remaining balance. Personal guarantees required by the SBA fall under an unlimited guarantee. If a debtor, may it be a business or person, is unable to fulfill their commitments on loan with an unlimited guarantee, then the lender can reach out to the principal to get the remaining balance.

Free Forms

What to Include?

Personal guarantee forms for a loan will vary from one transaction to another. However, some standard components ought to appear in the form to ensure all the involved parties are aware of the terms involved in the transaction.

These components include:

Identify the involved parties and their addresses

The form should identify all the parties involved in the transaction – lender, debtor, and guarantor. In addition, each party should provide their official names and addresses. The identification provided in the form must match that outlined in the loan agreement. Additional information specific to the party, such as phone numbers, can also be added for communication purposes.

Specify the loan amount

The form for the loan must also indicate the loan amount owed by the debtor. The form should state the total loan amount and balance if the debtor has paid a portion of the initial loan. Additionally, the form can indicate the origin of the loan, which is the region where the loan was borrowed.

EXAMPLE

State; this is because different states will have different legal stipulations regarding loan terms, interests, etc.

Loan terms and guarantor’s obligations

Each loan will have its distinctive terms and, consequently, the guarantor’s obligations. Therefore, the form should include the loan terms such as the loan limit imposed on the guarantor, due date, payment installments, etc., if the debtor defaults. However, the outlined terms are ineffective until a predetermined condition such as missed payment or defaulting occurs. The form can also outline the payment methods available to the guarantor, for example, cash, cheque, or direct deposit.

Notarize the document and sign

A legally enforceable form should be notarized and signed. Specific state notarization guidelines should be observed. However, ordinarily, it has to be witnessed by two witnesses during notarization. The lender, debtor, and guarantor should sign the document in the notary public’s presence to signify they have read and understood the document’s stipulations and are willing to assume respective obligations.

note

Once the debtor defaults on loan, the lender should confiscate the collateral listed in the loan agreement and then proceed to demand payment, whether the total amount or a balance, from the named guarantor. In such a case, the guarantor also assumes responsibility for any interest, late fees, and missed payment accrued when the lender deems the loan as default. As a result, the guarantor is deemed to be in default. Consequently, this financial liability reflects on the guarantor’s credit score. Therefore, to avoid escalating a situation to such heights, lenders should ensure that any named guarantors are financially capable of settling the loan.

Effective Practices

Lending money is a sensitive transaction. Therefore, lenders should make it as practical and straightforward as possible. The form is one tool that ensures seamless lending of money is achieved.

Below are techniques that lenders should consider to avoid misunderstandings between the involved parties during and after the transaction:

Simplicity

Always keep the form for loan design simple. This ensures the signatories can read and understand every detail outlined in the document. This way, they can decide whether to sign or not sign the form. Simplicity also gives the document a more formal look.

Include all necessities

Each lender requires different information to be included in the form. The chosen form for the loan template should have all the necessary details. If not, the template can be personalized to include any missing items. The items should also be ordered depending on relevance and relativity to each other.

Frequently Asked Questions

A personal guarantee is fundamentally a contract between the lender and the guarantor. However, it becomes legally binding as long as there’s a consideration from one party (lender) to the other (debtor) who has appointed the guarantor to assume their financial responsibilities upon defaulting.

Government-guaranteed debt is debt securities issued to investors in the US and whose sale finances the federal debt (raises funds for the federal government). The securities are deemed risk-free as the government guarantees them.

SBA stands for Small Business administration. SBA loans are debts issued to small businesses with the government as guarantors. The government guarantees 85% of $150 000 and below SBA loans and 75% of SBA loans worth $150 000.

The value of the guaranteed loan is determined by discounting the expected cash flow, which includes the principal amount and coupon payments under the risky rate to the guaranteed rate.