A Credit Application Form is a standardized document used by financial businesses such as lenders and banks to determine if a borrower should be given a loan or line of credit.

The details provided in the credit application form helps lenders determine if a borrower can repay the loan. It can be used in the case of both personal and commercial loans. A credit application can be conducted in either written or verbal form.

A credit application form gives the lender the power to control whether or not a borrower receives a loan. It also enables the lender to gather the information that borrowers would otherwise not provide if they obtain the loan before giving their details. Financial businesses use credit applications to establish contractual relationships which legally bind the borrower and lenders to the terms and conditions it stipulates.

The emergence of new financial technology systems enables lenders in the credit market to offer borrowers various credit applications. These credit applications allow borrowers to fill them in person or individually.

New financial technology has also provided other benefits, which include:

- Enabling borrowers to complete the information required on their own using online application forms

- Decreasing the waiting period for loan approval

- Enable lenders to provide a wide range of online lending options

- Enabling banks to add a variety of new lending services to borrowers

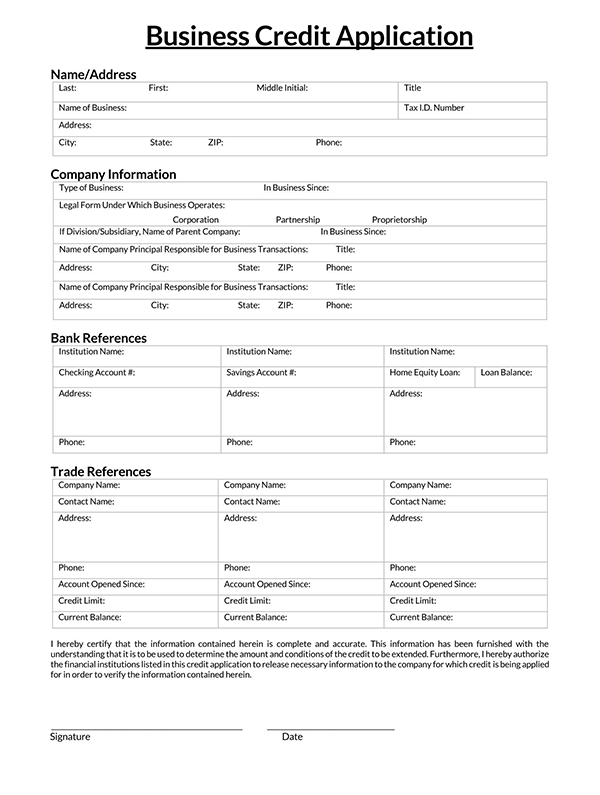

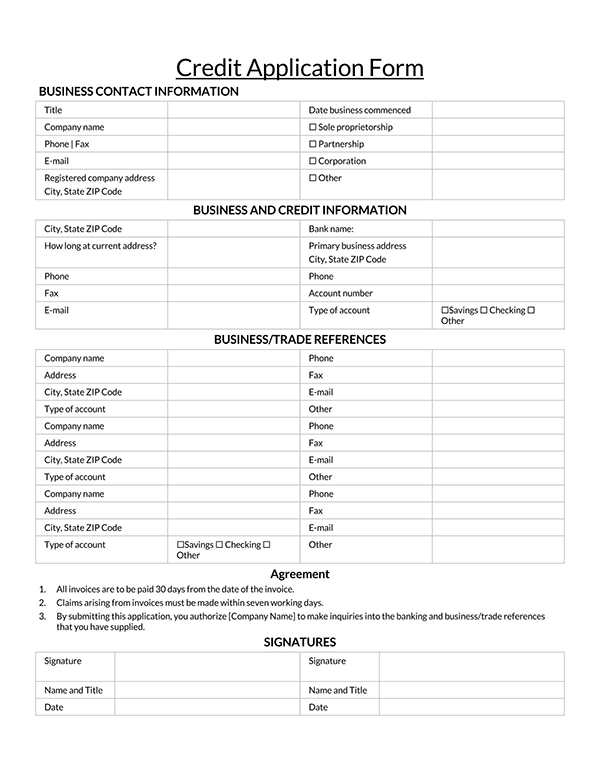

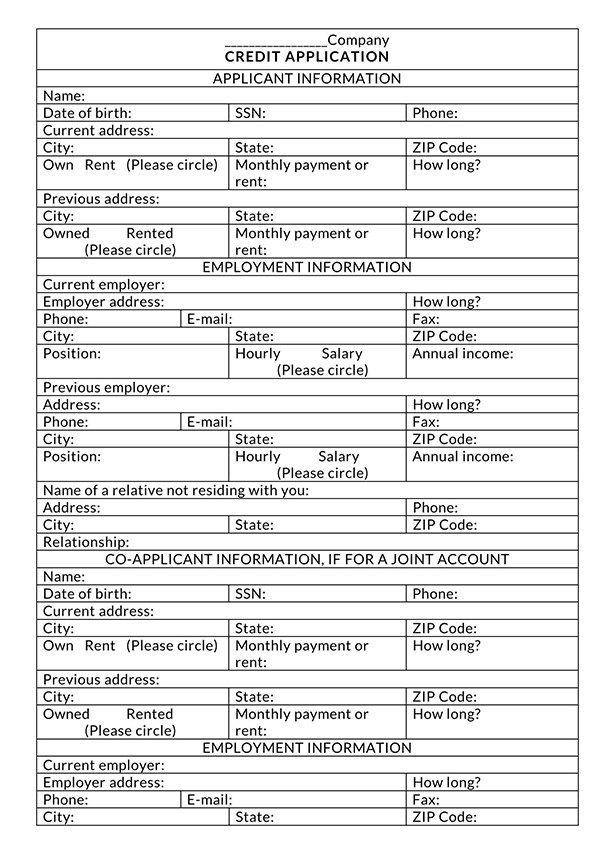

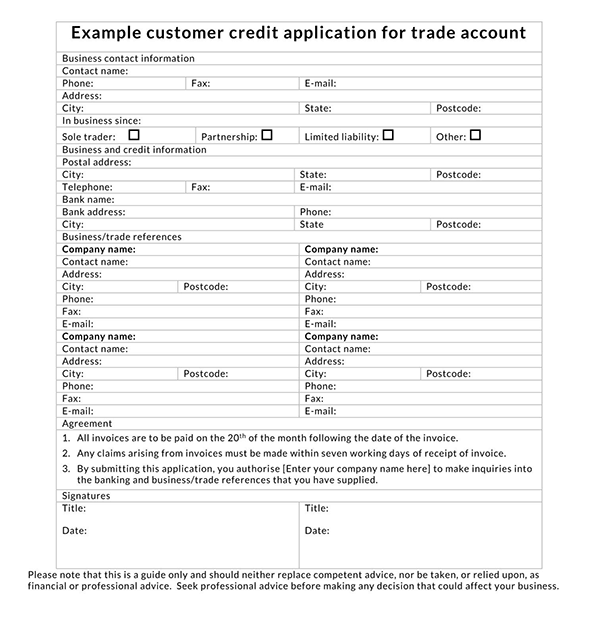

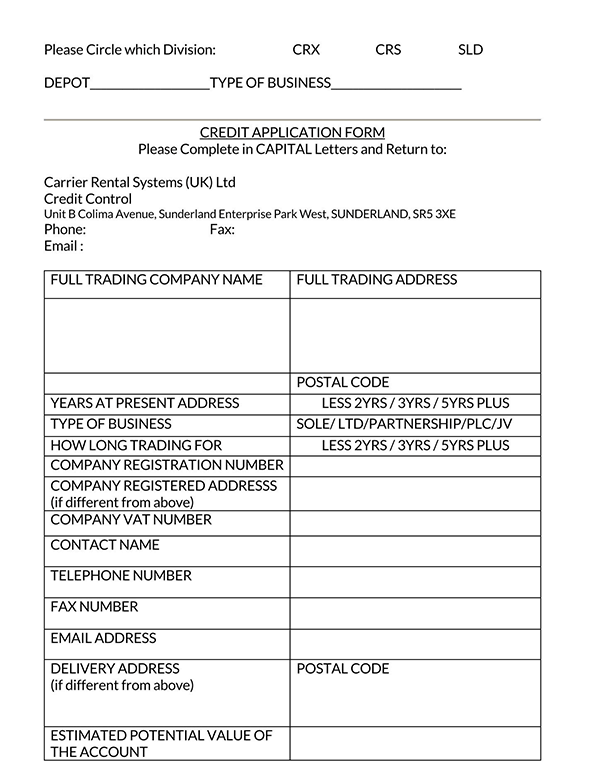

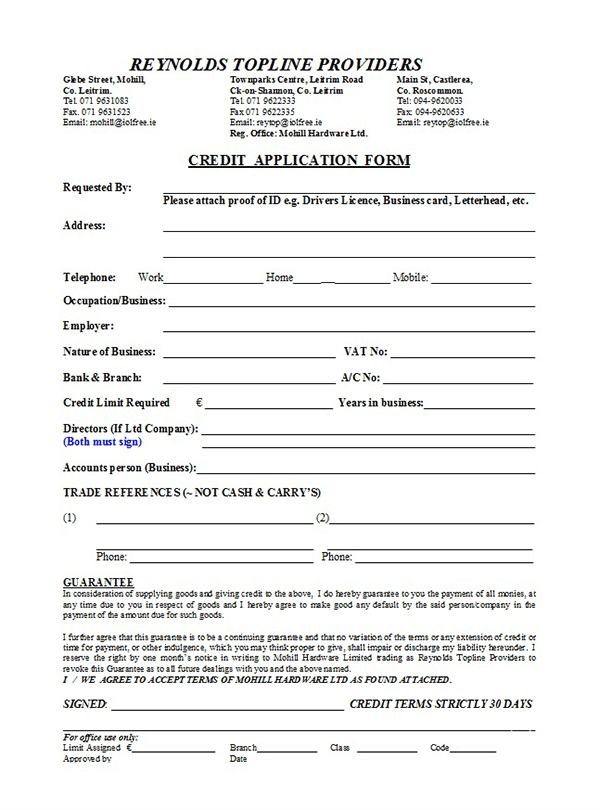

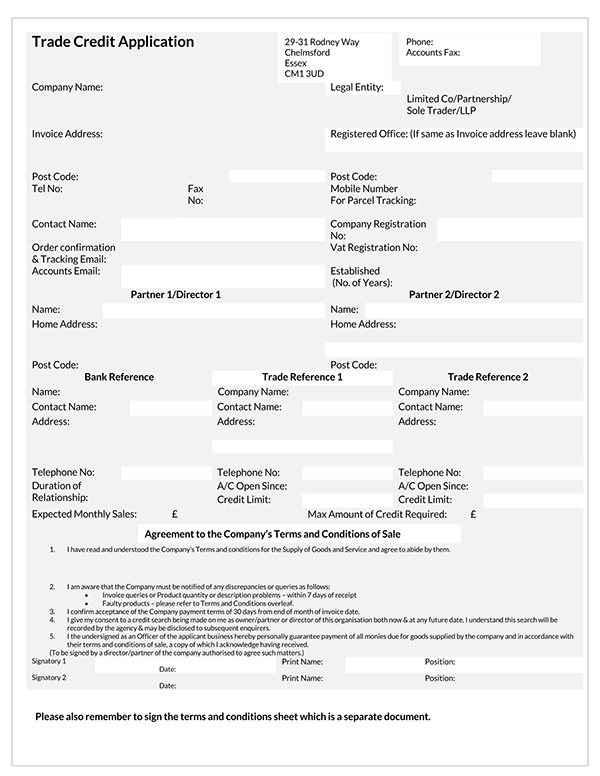

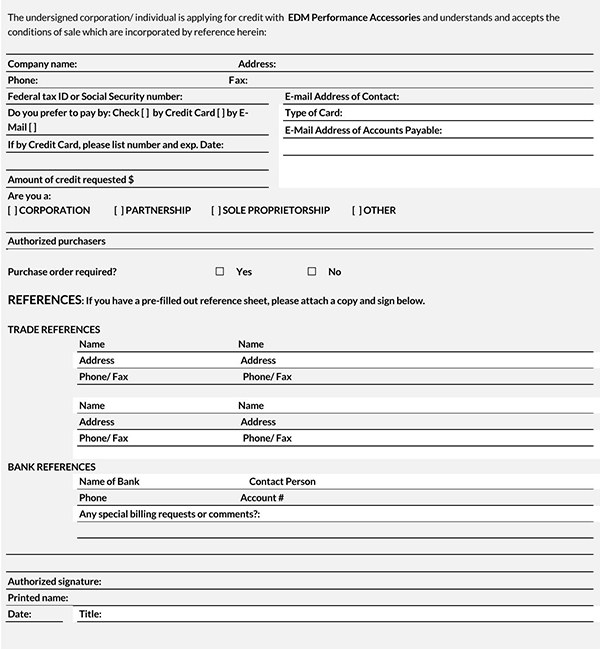

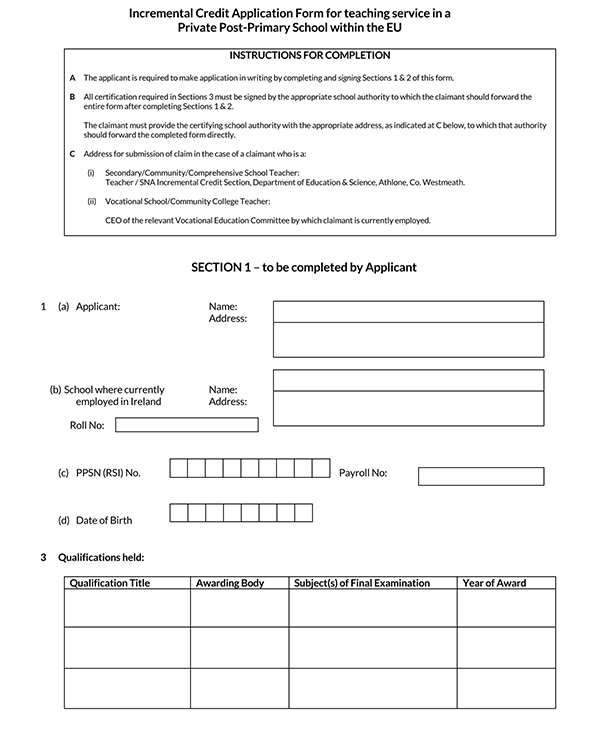

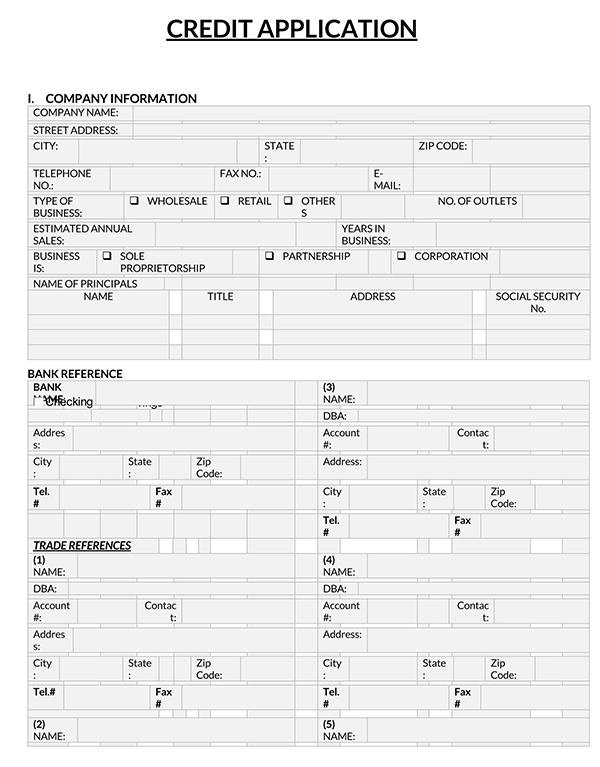

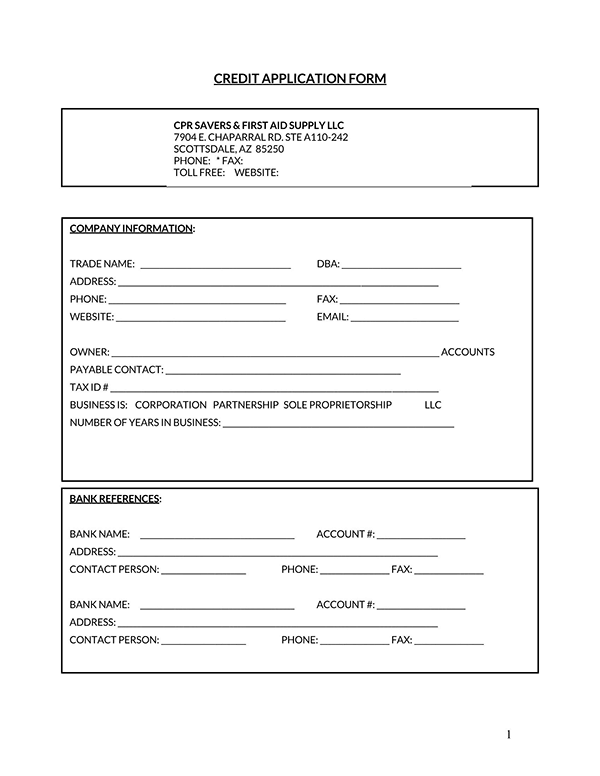

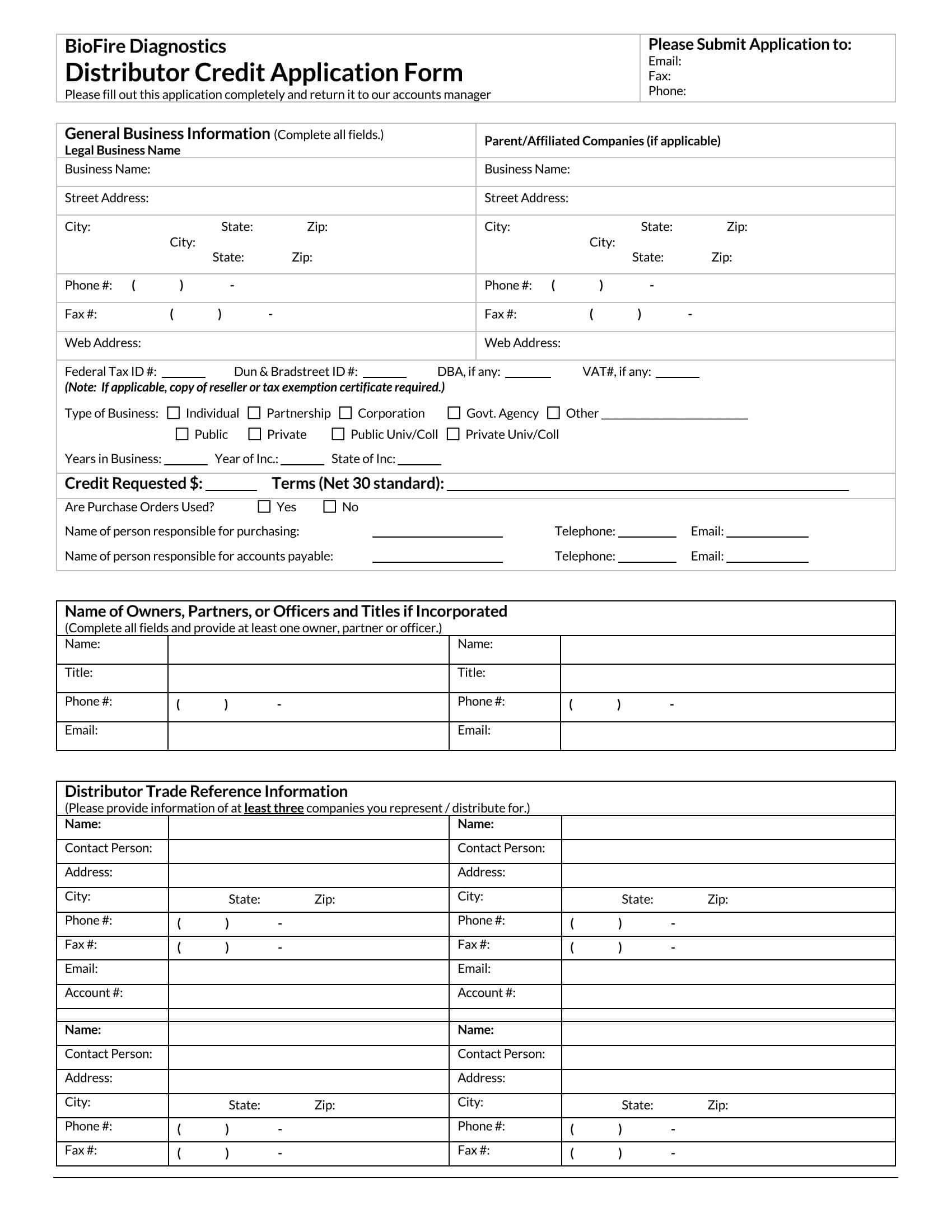

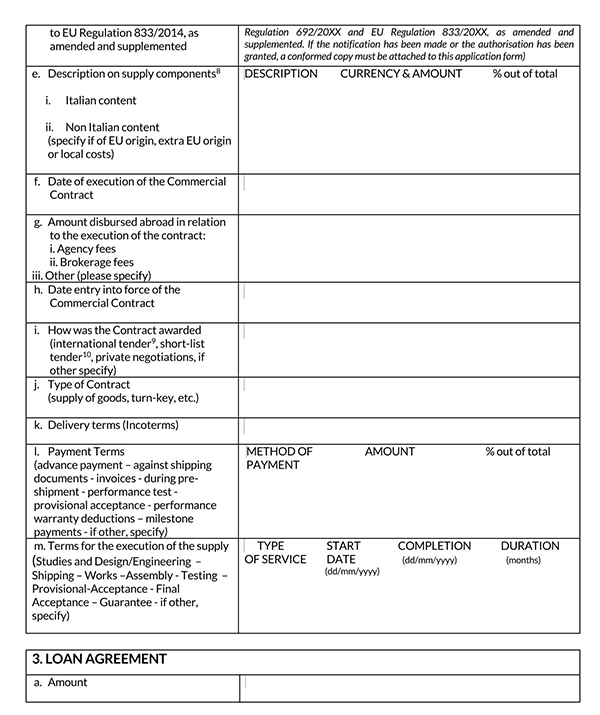

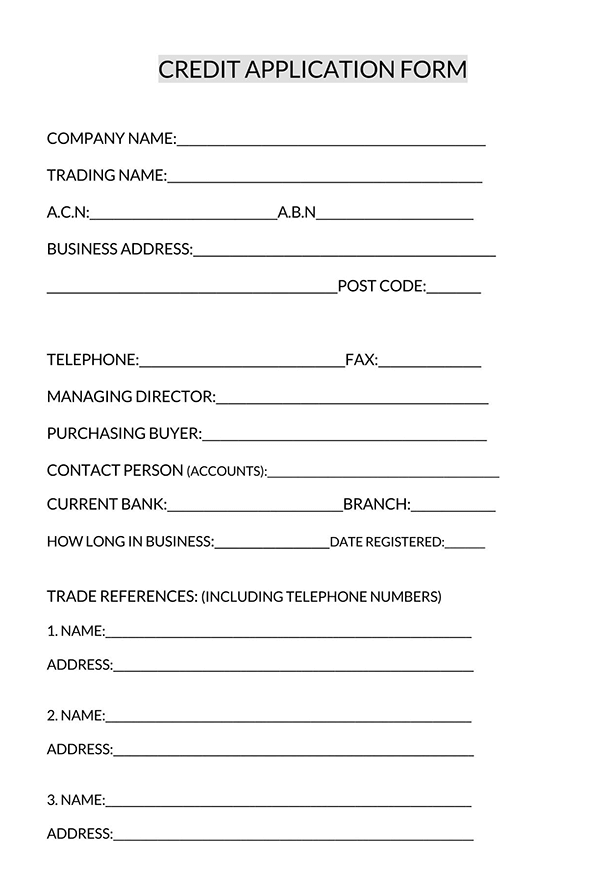

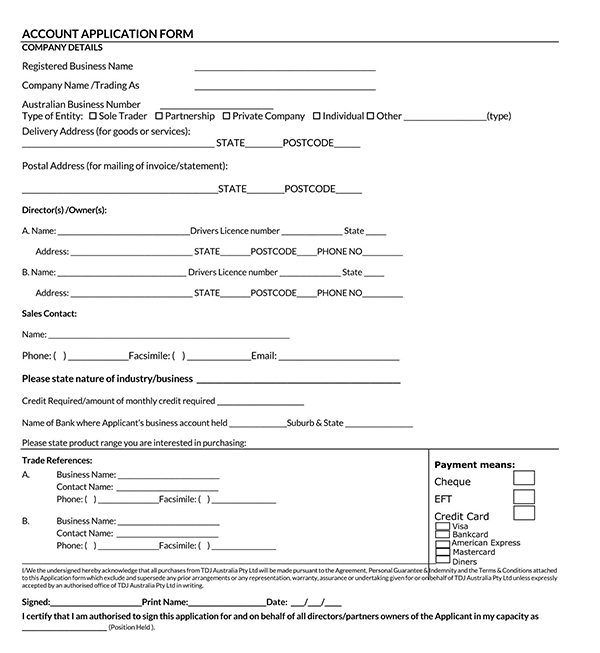

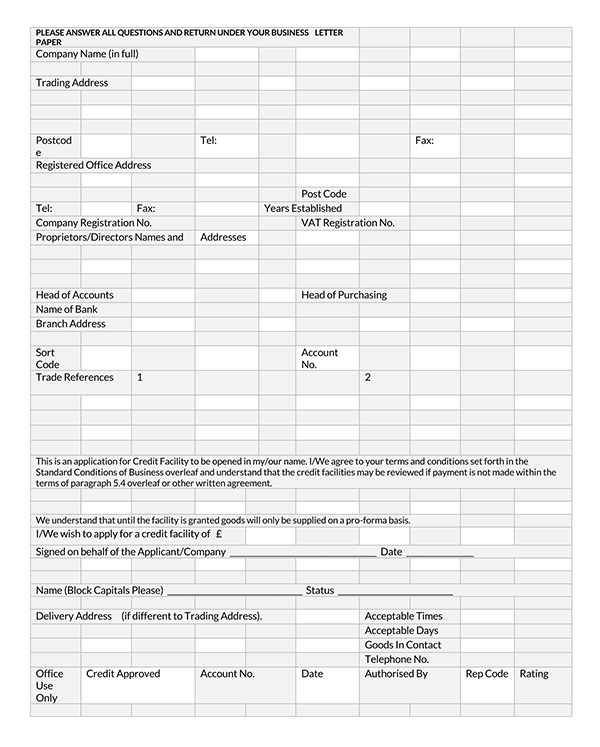

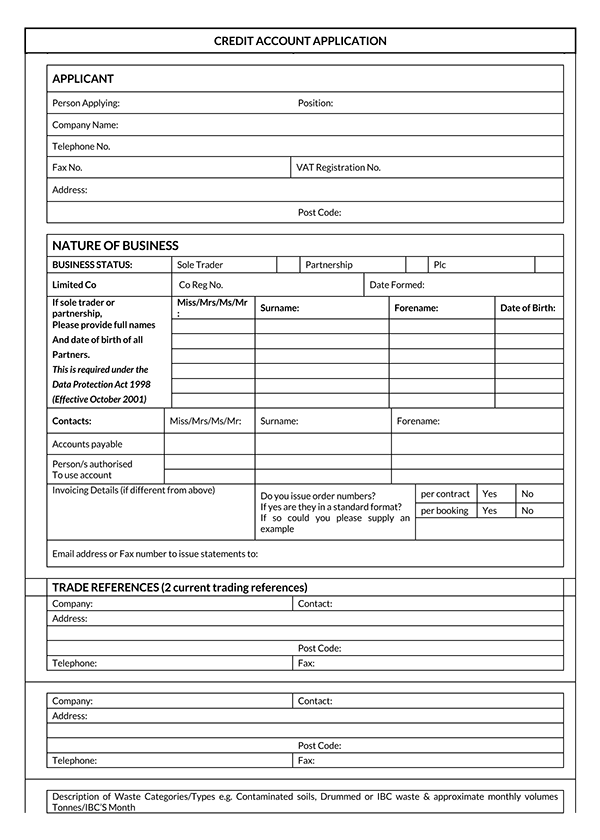

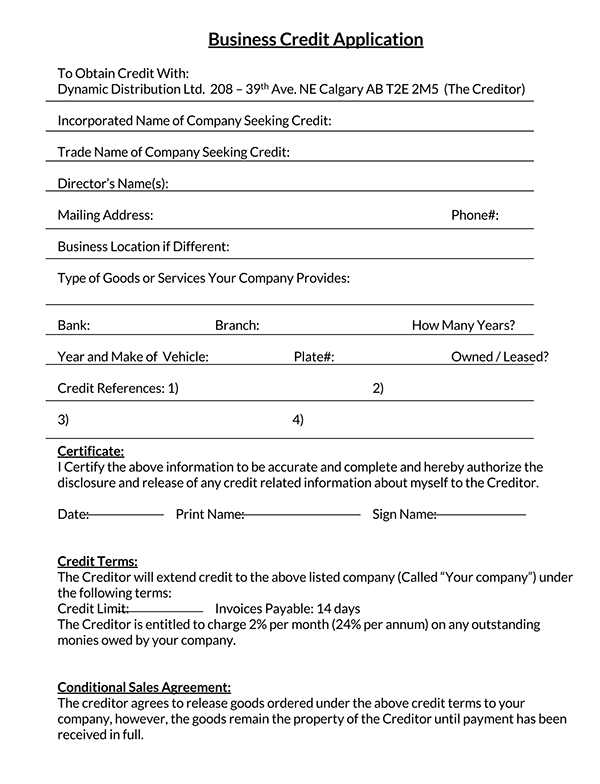

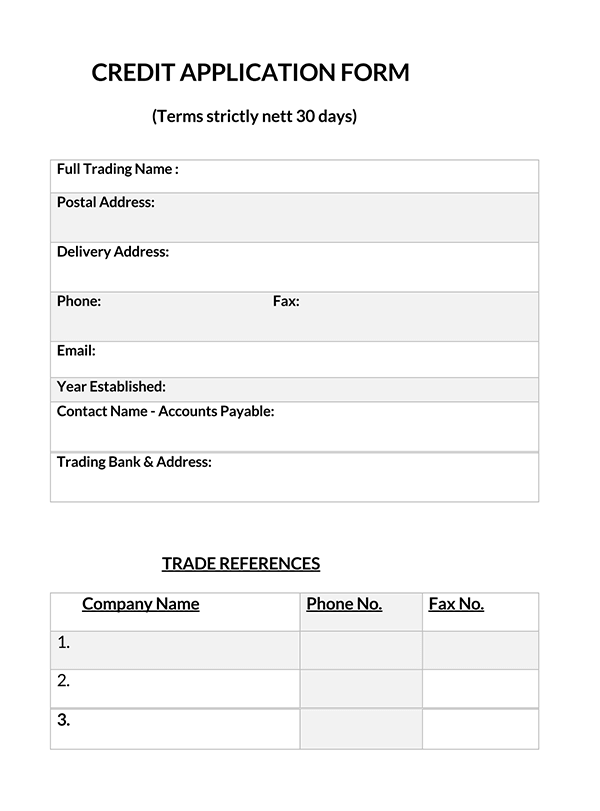

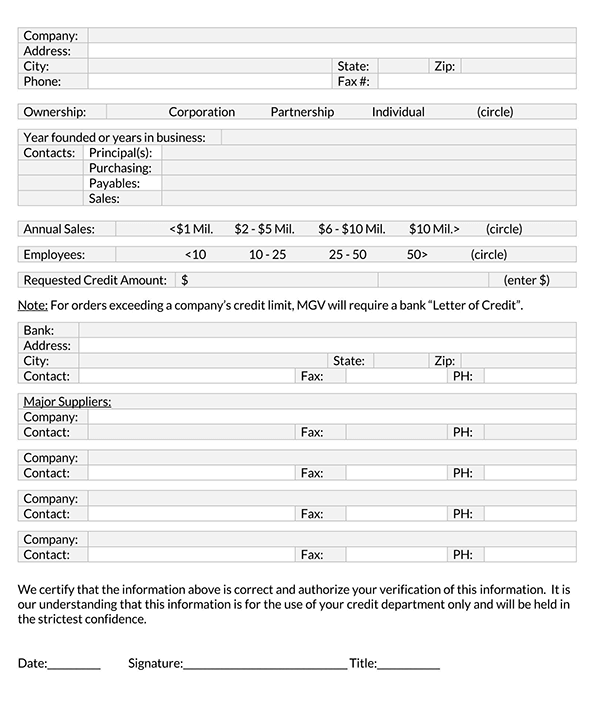

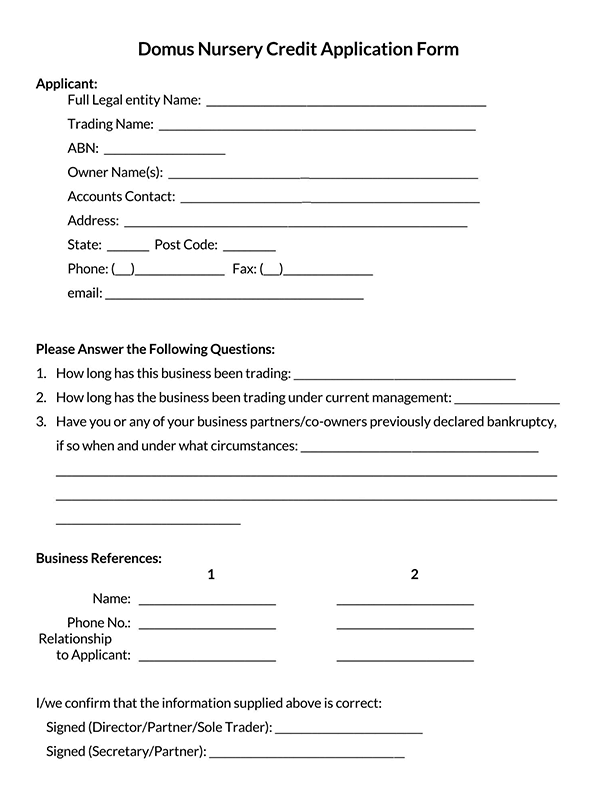

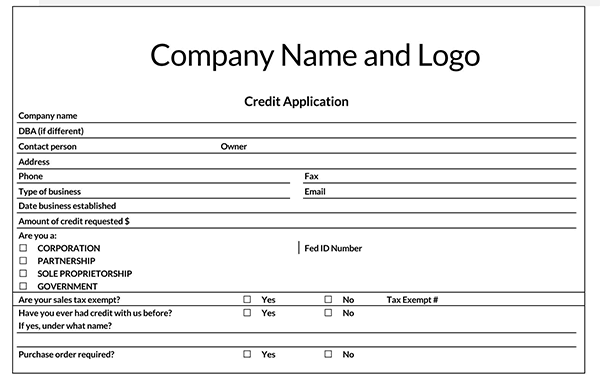

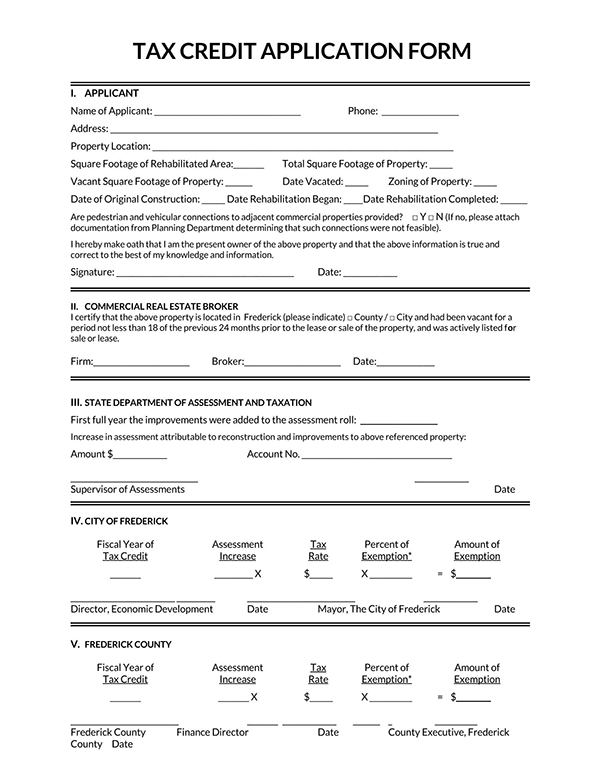

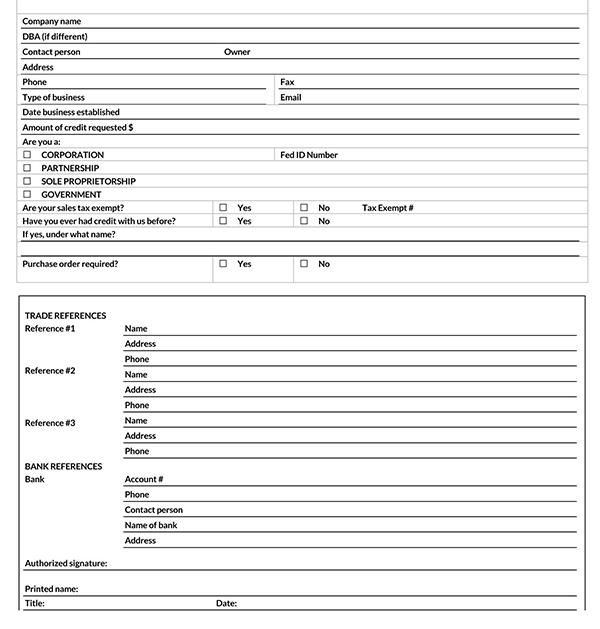

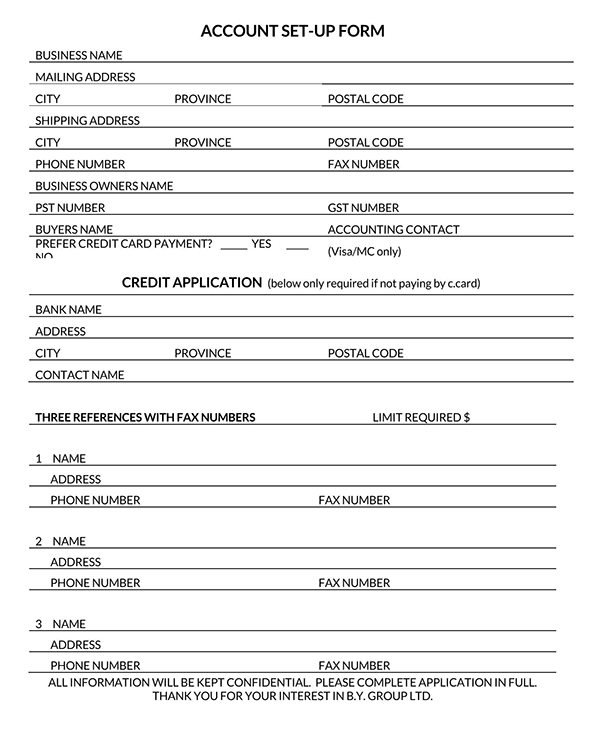

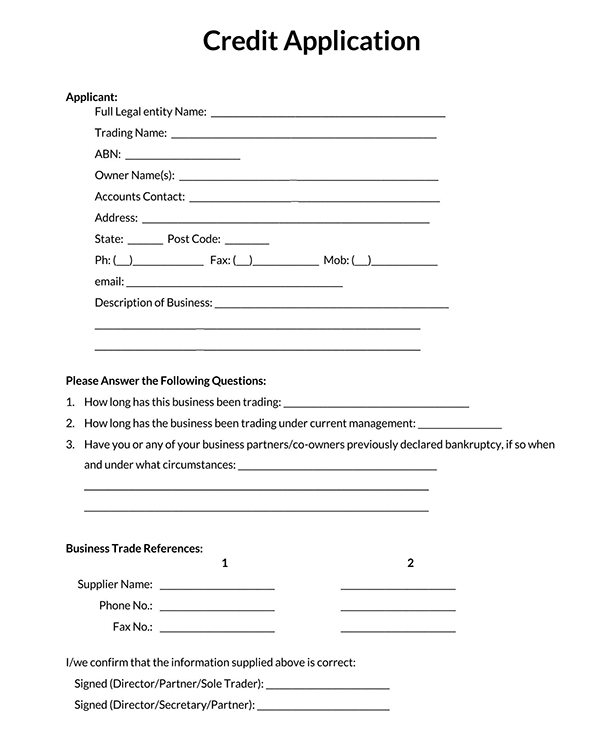

Credit Application Templates

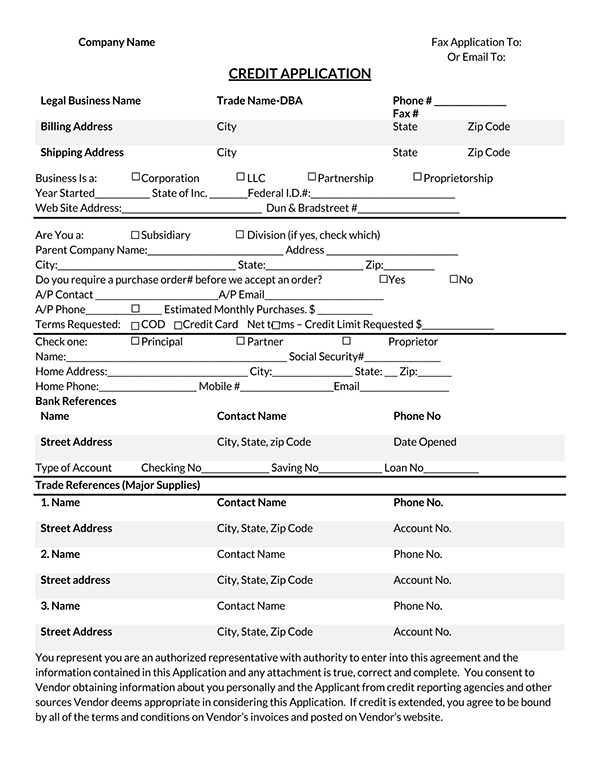

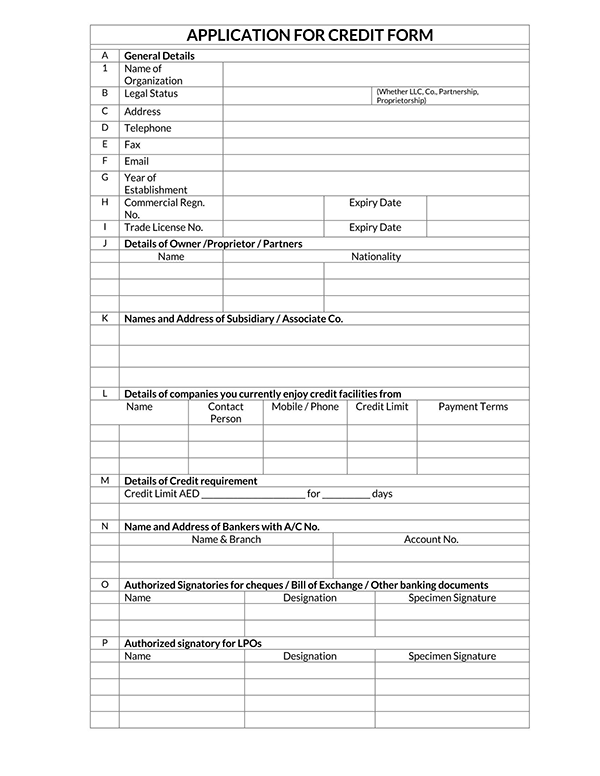

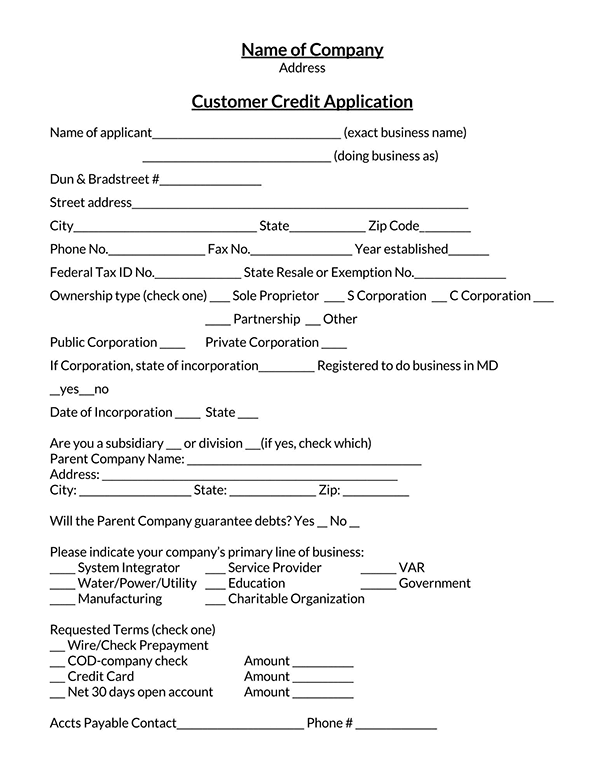

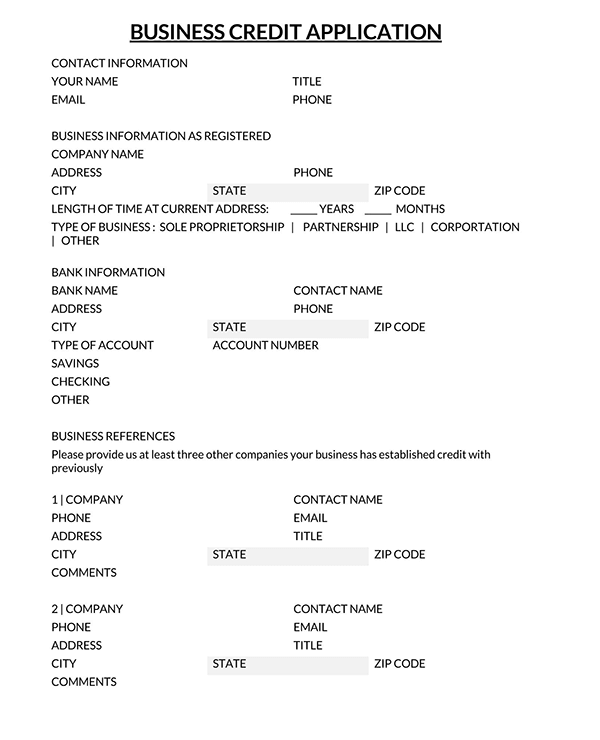

Following are some free downloadable templates for you:

What to Include in a Credit Application Form

The components of the credit application form enable lenders to determine the creditworthiness of borrowers. Lenders can also revisit the application when disputes arise over the borrower’s failure to adhere to the terms and conditions stated.

The following information should be included in a credit application:

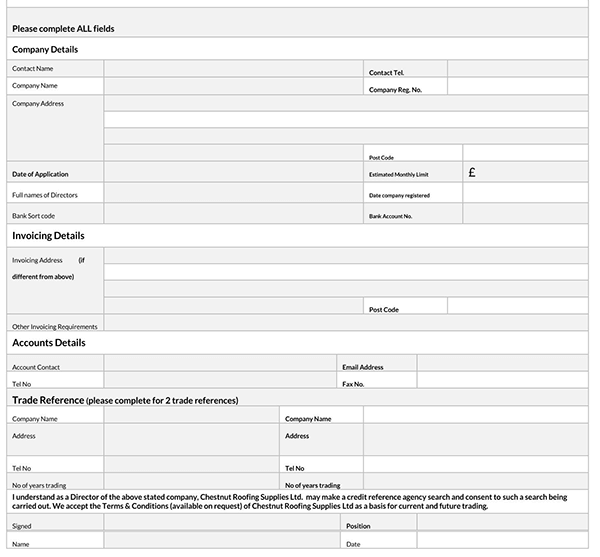

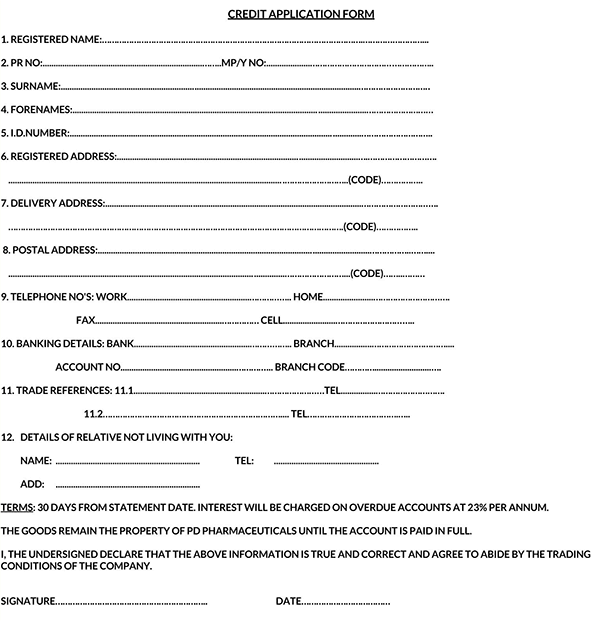

Customer’s information

The credit application form is the lender’s information gathering tool; therefore, a vital component of the document is the customer’s information. The information the creditor requests from the customer should be adequate to enable an informed assessment to be carried out.

The lender should request the following customer information:

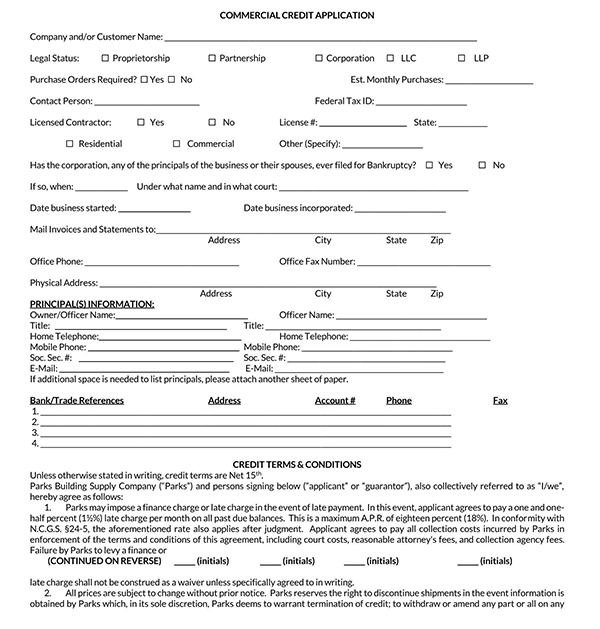

Name

The customer’s legal name must be provided in the credit application form. If the customer is a company or corporation, it must provide its corporate name, which appears in its state and federal documents. It should provide an option that seeks information on whether the customer is a corporate, partnership sole proprietorship, LLP or LLC, or others. The lender can also ask the customer to list the domain name of the company or organization, that is if it has a website.

Address

The credit application form should request the customer’s physical and mailing address. The customer’s address information can be used later by the lender to send notices and other loan repayment correspondences to the borrower. The addresses also help the lender establish whether or not the borrower has a stable residence.

Telephone number

The customer’s primary and secondary telephone numbers should be indicated in the credit application. The contact information will ease the lender’s ability to get in touch with the borrower in the future. It will also help ensure that the lender can use other communication means separate from formal letters and written notices.

Employment and income information

The lender should ensure the credit application requests the customer’s employment and income information. The employment information requested should include the name, address, and phone number of the customer’s employer. The customer’s annual salary should also be indicated. Other employment information that should be requested includes:

Employer identification number (EIN)

Customers that are business entities should be requested to provide their Employer Identification Number in the credit application form. The EIN is a unique nine-digit number provided by the IRS to help identify businesses operating in the US. When used for employment tax reporting, the EIN can be referred to as a Taxable Identification Number(TIN). The credit application should contain both the ‘EIN and TIN’ options to ensure that customers can identify the information being requested.

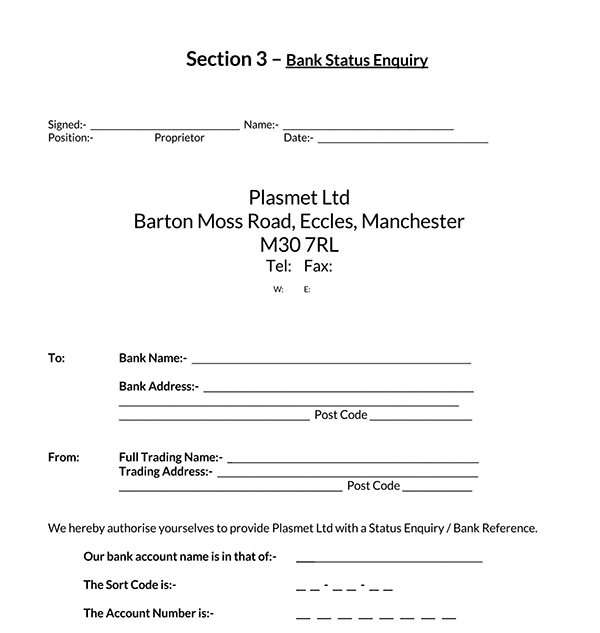

Bank information and credit references

The credit application should request information on all the banks where the customer has opened an account. Each bank’s name and address, coupled with the customer’s account numbers, should be indicated. The customer should also list a minimum of three credit references. Each credit reference’s name, address, and phone number should be provided. The lender may also request customers to provide details of credit references that can be contacted for inquiries.

Residential status

Lenders should ensure that foreign nationals indicate their residential status in the credit application form. The indication of the customer’s residential status can help the lender decide whether or not to provide the loan. Therefore, the lender should confirm the residential status indicated by the customer.

Checking and savings account

The credit application form should request information on whether or not a customer has a checking and savings account. The lender can use the information provided to establish whether the customer is financially stable. The customer’s checking and savings account are among the most important parts of the credit application form.

Investment portfolio

A list of the customer’s financial investments, such as stocks, bonds, or commodities, among other financial assets, should be indicated in the credit application form. The lender can use the investment portfolio to establish the borrower’s financial assets. It helps inform the lender how the customer generates returns in the short or long term. The lender can use this information to discern whether a customer is capable of paying back the loan.

Income tax statements

The credit application should contain the customer’s income tax statement. The customer’s income tax statement is often demanded when the loan requested is high. It helps the lender identify the customer’s tax liability.

Credit information

Customers should provide information on debts owed to other financial businesses. The customer’s credit information shows the lender whether the customer is capable of repaying debts. The lender should confirm the customer’s credit information by checking the records held by customer credit agencies.

Guarantor’s information

The credit application form should contain information about the customer’s guarantor. The guarantor is the individual or entity that promises to pay a customer’s loan in the event of a borrower’s default in payment.

The following information about the guarantor should be provided:

Name

The full name of the customer’s guarantor should be provided in the credit application form. The full name should include the guarantor’s first, middle, and last name. For example, If the guarantor is a corporate, then the corporate name should be indicated.

Address

The guarantor’s home and business address should be provided. The lender can use the addresses to send correspondences about the customer’s loan. The guarantor’s address information should include the city, state, and zip code.

Telephone

The guarantor’s telephone number should also be indicated in the credit application form. The guarantor’s telephone number should include the primary and secondary numbers. The telephone information will help the lender get in touch with the grantor in the future.

Email address

The credit application should contain the grantor’s email. The email will provide a faster means by which the lender can contact the grantor as opposed to using the mailing address. It also provides alternative means to contact the grantor when all other means like the telephone are not working.

Social security number (SSN)

The social security number of the guarantor will help the lender obtains the grantor’s credit history. Information obtained from using the SSN helps the lender determine if the grantor is acceptable. It also helps the lender to check the guarantor’s credit score.

Driver’s license number

The guarantors’ driving license should also be provided in the credit application. The driving license number provides more proof that the grantors are who they say they are. It ensures that there is no mismatch of the grantor’s information.

Position in the company

The credit application should also contain information on positions grantors’ occupy in their occupation. The name of the company should also be indicated in the credit application form. The information on the position occupied by the grantor helps demonstrate responsibility.

Business loan questions

The credit application form should contain business loan questions that the lender is interested in knowing. The questions may include the amount of money the customer wants, how the funds will be used and how the customer plans to repay the loan. The business loan questions help the lender understand the customer’s financial situation.

Signature line

The credit application should contain signature lines appropriate to the types of businesses that may submit loan applications. Indicating various signature lines ensures that the application enables the customer’s signatory parties to be included in the document, for instance, individuals signing on the customer’s behalf. A date should be on each type of signature line provided in the credit application.

Interest and attorney’s fees

A statement should be included in the credit application form that indicates that the lender will collect interest and attorney fees if the customer defaults on making full or timely payments. The percentage or amount charged for the attorney’s fees doesn’t have to be mentioned. However, the amount of interest that will be charged should be indicated by the lender.

How to Review a Credit Application

Once the customer completes the credit application, the lender should review the document. The review should be carried out in a well-outlined step-by-step process. The process ensures that the lender carries out a thorough review.

The following process should be followed when reviewing a credit application:

Confirm customer’s identity

First, the lender should confirm who the customer is. The customer’s identity enables the lender to determine if a borrower can conduct a transaction within the state. In addition, confirmation of the customer’s identity ensures the lender is not defrauded.

Check UCC filing information

Secondly, the Uniform Commercial Code filing information should be checked. The UCC filing information allows the lender to determine if customers have secured loans by other creditors using their personal property such as their accounts, equipment, inventory, or anything other than their real estate. If this is the case, then lenders should follow up with the other creditors before deciding to loan money to the customer.

Google their name and address

Thirdly the lender should carry out a google search to confirm the name indicated in the application. The customer’s city of residence should also be confirmed. A google search of the customer’s details will help the lender find information that may not have been included in the credit application, such as another phone number that the customer didn’t indicate in the document. Finally, in instances where the customer is a corporation, a google search helps the lender obtain information from business reviews. The business reviews will help determine if the customer repays loans to creditors.

Follow up with credit references

Next, the lender should follow up with the list of credit references. The credit references will provide the lenders with the customer’s business and loan payment history. The lender should also investigate any information uncovered during the review.

Correct the errors

Finally, the lender should correct any errors in the credit application. Correcting the credit application ensures that the lender remains in a position of strength. It also ensures that the lender has complete, accurate information on the customer’s financial status.

Download Free Samples

Frequently Asked Questions

Regulation Z is a federal law that requires lenders to disclose borrowing costs to the customer. Therefore it is a consumer protection law. It is also referred to as the Truth in Lending Act. It helps protect customers from misleading practices that may be found in the lending industry.

Banks provide customer services that help borrowers with the lending process. They also offer telecommunication services where bank representatives guide customers through obtaining a loan and completing the credit application form over the phone. Both of these services enable a more personal interaction between customers and their banks.

Banks offer lines of credit, mortgage loans, and home equity loans in the credit application form. The components of credit application forms for each of the loan types differ. The type of loan the customer requests will determine the type of credit application form availed by the lender.