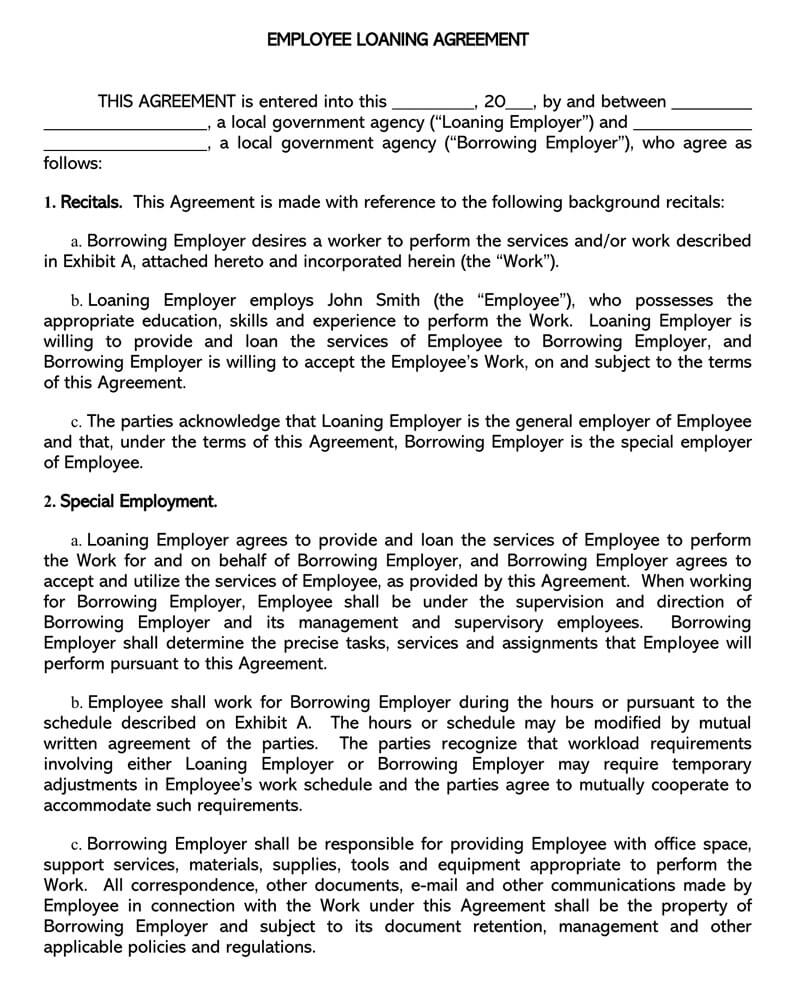

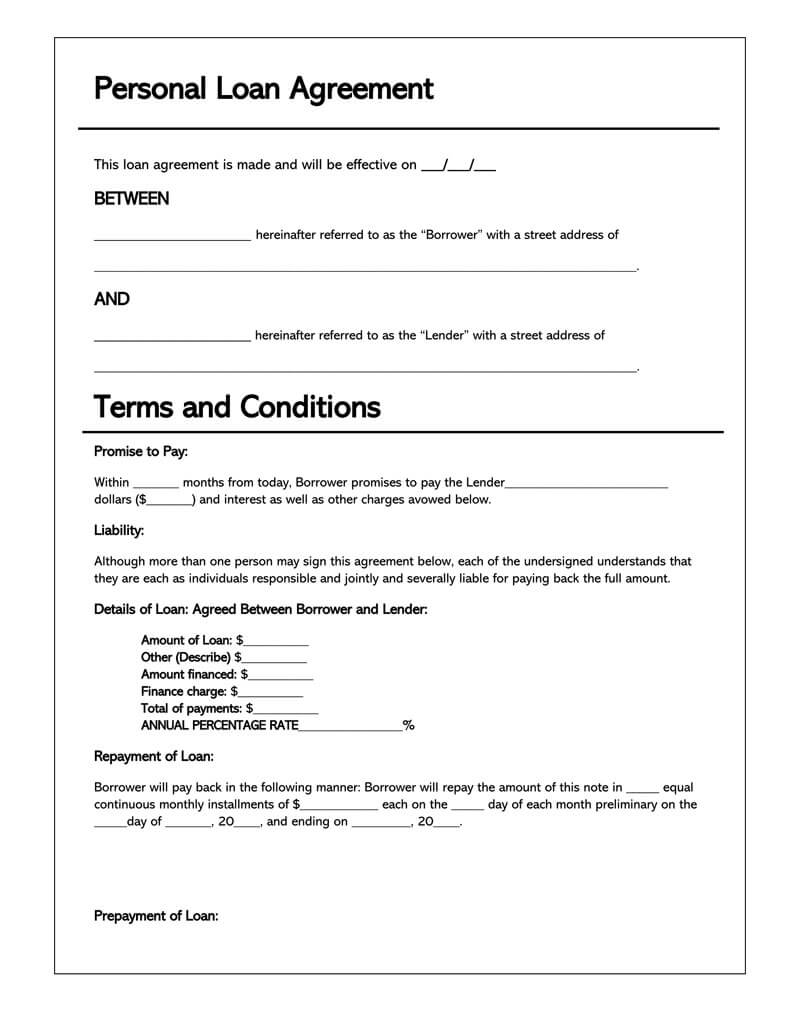

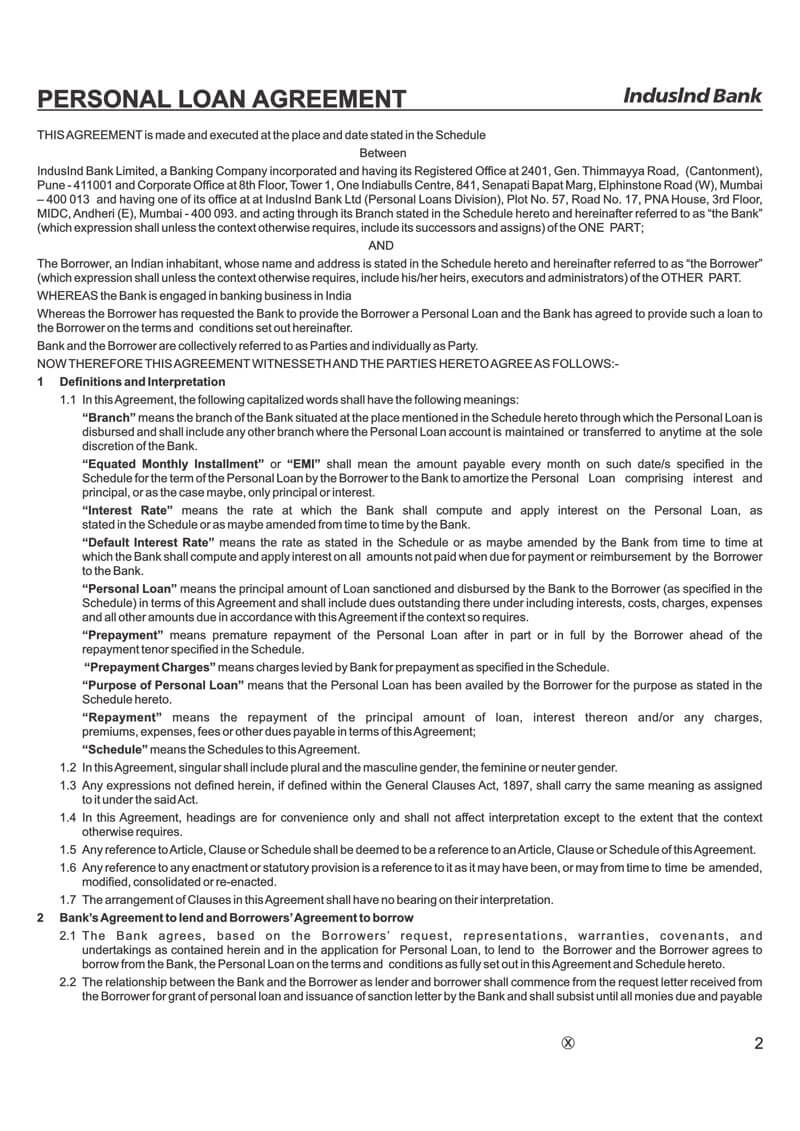

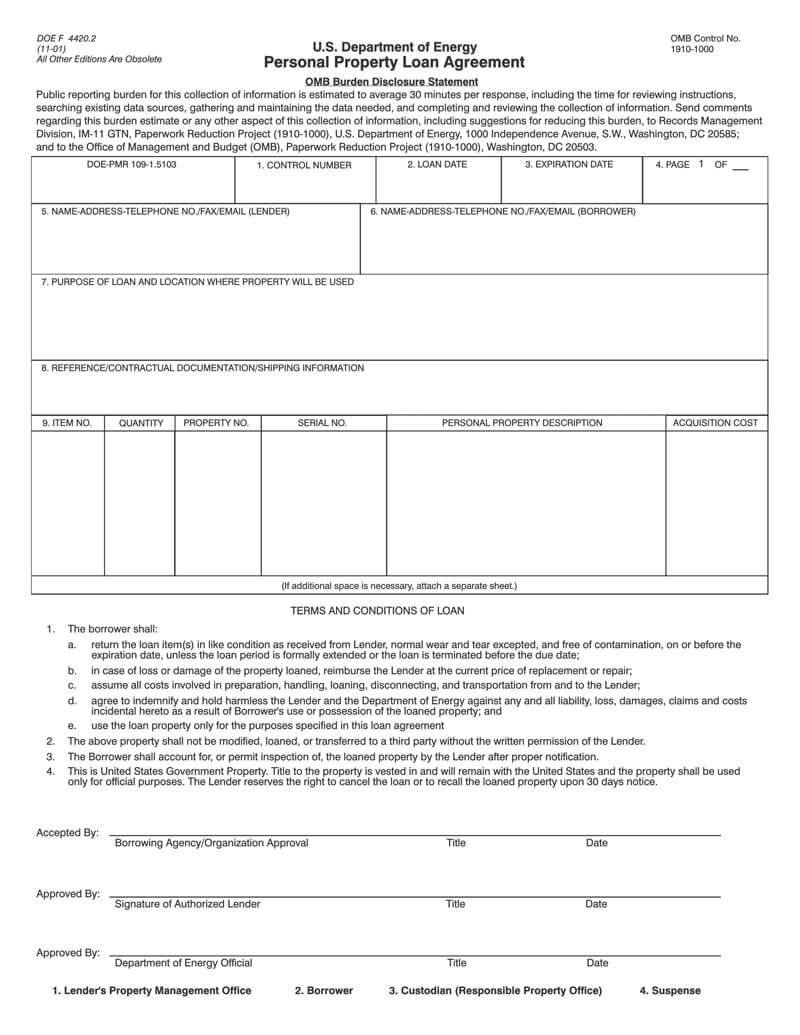

A personal loan agreement is a legally binding contract between a lender and a borrower that describes various aspects of a personal loan transaction including loan amount, repayment options and the rights of the lender in case of a default. A personal loan is meant to meet the borrower’s current financial needs.

Personal Loan Agreement Templates & Samples

Why Should You Write an Agreement?

A loan agreement protects you as the lender as it legally enforces the borrower’s pledge to repay the loan in regular payment or a lump sum. A loan agreement is also important to the borrower as it clearly spells out the details of the loan for their records and is handy for keeping track of the payments made.

When Should you Consider Getting a Personal Loan?

If you need to borrow some money for general use, getting a personal loan is a much better decision than getting a standard loan. Personal loans are ideal for situations where borrowing is for personal use.

If you are unable or unwilling to get collateral for a standard loan, a personal loan may be a viable option since personal loans may be provided without security.

You may also consider getting a personal loan if you prefer to have more flexibility on how to use the loan proceeds; that is if in the future you might change how you plan to use the proceeds.

Difference Between Standard And Personal Loan Agreement

A standard loan agreement prescribes how the proceeds of the loan may be spent. Examples of standard loan agreements are mortgage agreements that specify the money may only be spent to buy a house and student loan agreements that prescribe that the funds may only be spent on paying school fees. Standard loan agreements are generally relatively rigid compared to personal loan agreements.

A personal loan agreement does not specify how the loan proceeds may be spent. These loan agreements, therefore, allow the borrower the freedom to use the money in any way they deem fit.These agreements also offer flexibility.

Standard loan agreements often specify collateral for the debt. Collateral is an asset that can be forfeited should the borrower defaults in paying the loan.

Personal loan agreements generally don’t specify collateral. This is because personal loans are often unsecured; that is they are provided without collateral.

Difference Between a Loan And a Promissory Note

Although a bit similar, a Loan agreement tends to include a more comprehensive payment schedule, while a Promissory note is often used for simple loan terms.

Basically, a promissory note only requires the signature of the borrower, whereas a loan agreement requires a signature from both parties.

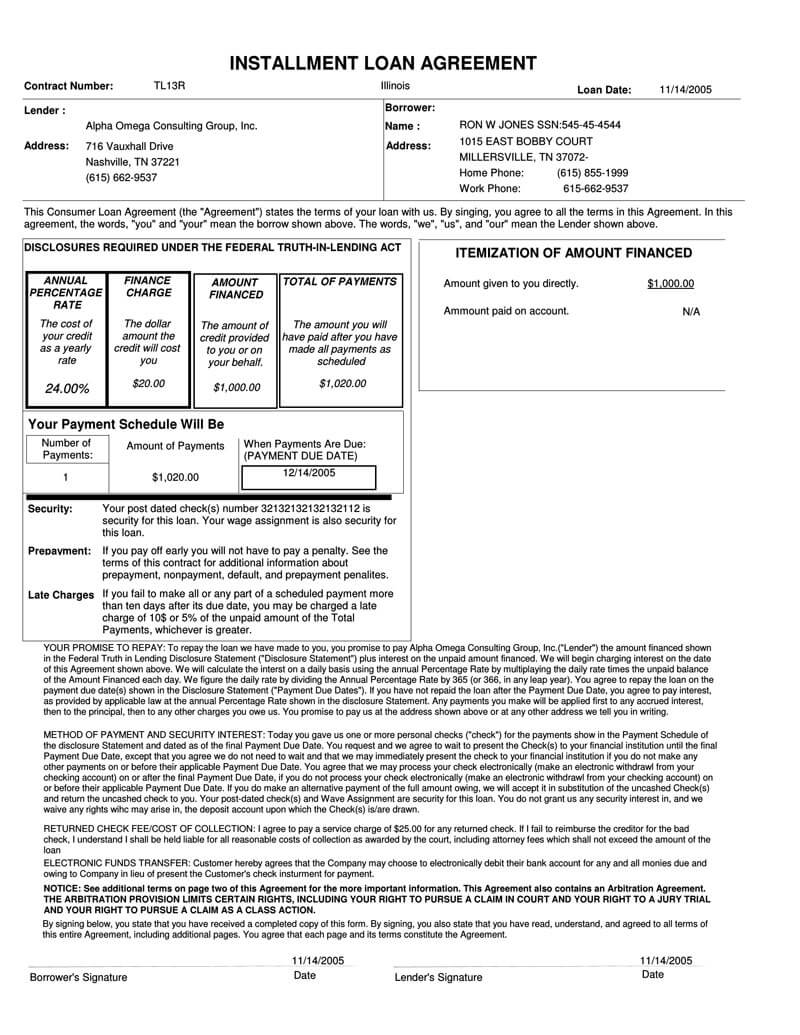

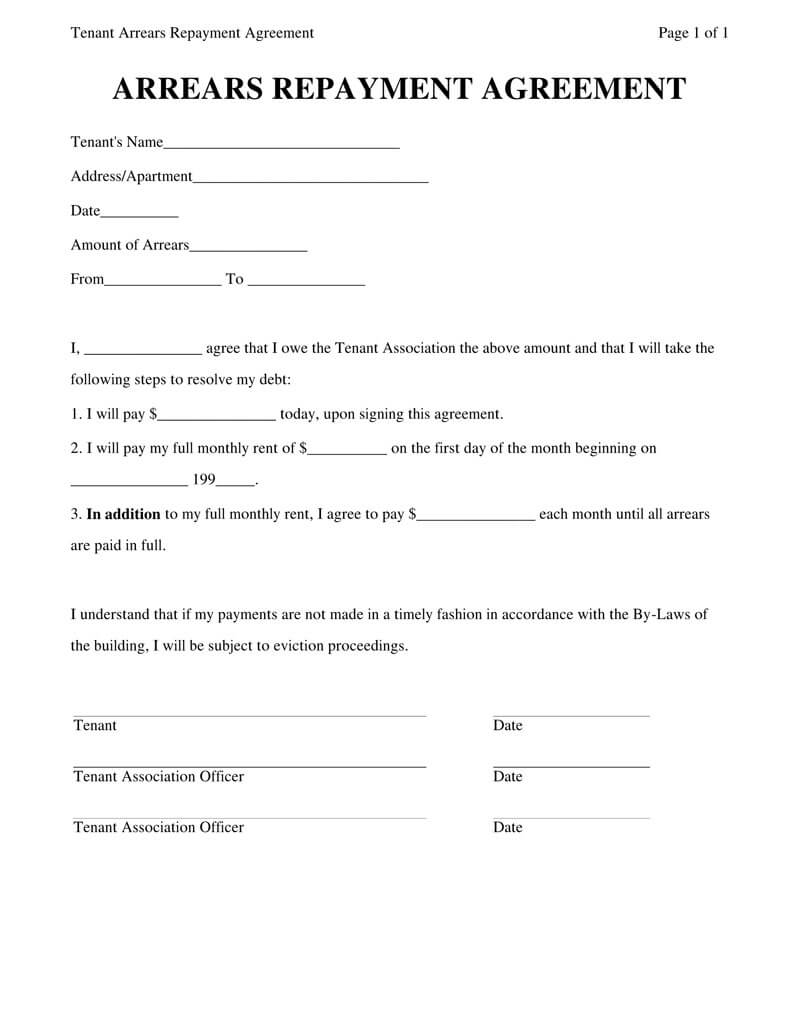

Basic Contents of a Personal Loan Agreement

- Personal and contact information – the agreement should contain the names and addresses of both parties (the borrower and the lender)

- Date – the date at which the agreement was made should be indicated.

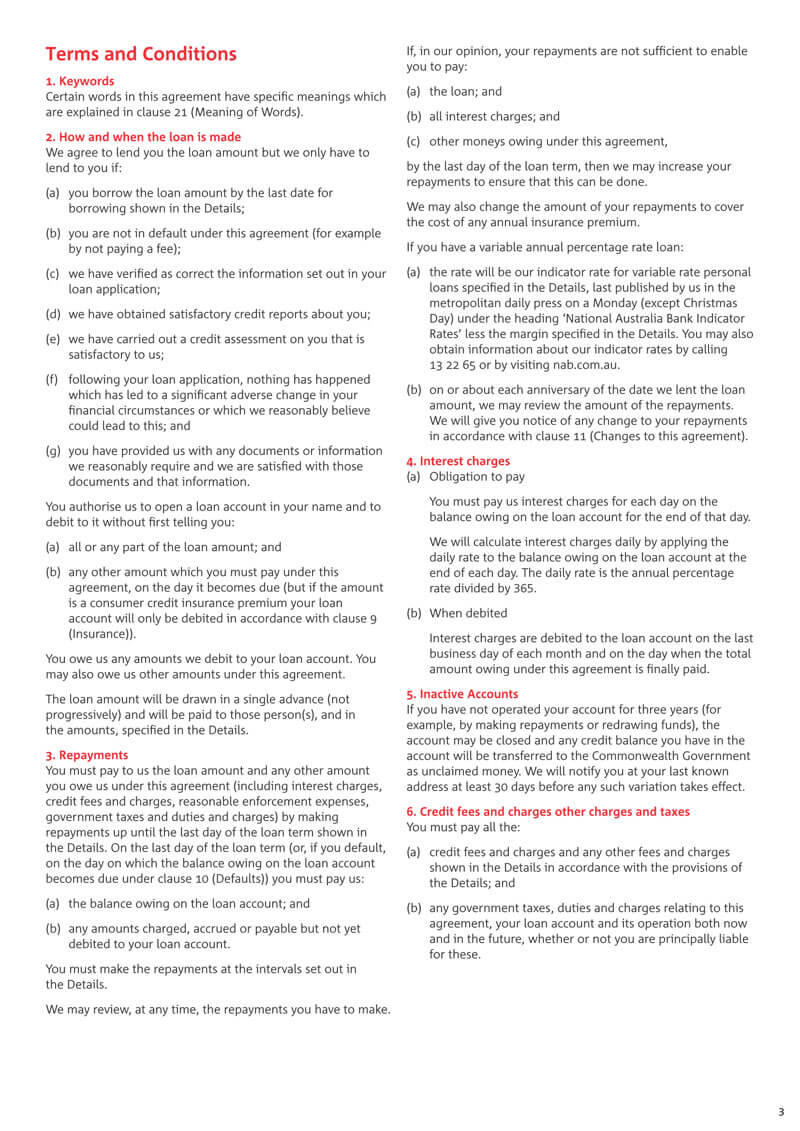

- Loan amount – the total amount being loaned out to the borrower has to be disclosed.

- Repayment options – the agreement describes whether repayments will be a lump sum or periodic.

- Interest – the interest rate on loan, if any.

- Late payments and defaulting consequences – the agreement should specify when loan repayments will be considered late and the implications of late payments. For instance, late payments may attract late fees. The amount of such fees should be disclosed. The agreement also describes what happens if the borrower violates any other terms.

- Details of a guarantor – the agreement may require the signature of a guarantor. The guarantor is the party required to repay the loan should the primary borrower default. It is not mandatory for a personal loan agreement to have a guarantor.

Things to do Before Signing a Loan Agreement

As the lender, it is your responsibility to determine the creditworthiness of the borrower. The borrower’s trustworthiness is normally evaluated through credit reports and references. The borrower might also consider things like the duration you have known the borrower or how long they’ve lived somewhere.

As a lender, you should also read over the loan agreement draft and make sure that all the provisions and writings are accurate. Once you sign the document, it will show that you read the document and understood it, and certify that the information contained in it is accurate.

The borrower should also go through the entire agreement. The borrowers’ responsibility is to ensure that they clearly understand what is written in the document and question the document for clarification before signing.

Frequently Asked Questions

You can charge interest on a personal loan if you wish to. In many cases, small personal loans to friends and relatives are extended with no interest charges. Bigger personal loans, such as loans for purchasing homes, often have some interest charges. Personal loans from financial institutions such as banks usually have interest charges.

A personal loan agreement can specify that regular repayments go towards the interest-only or towards the interest and a part of the principal amount. An amortization schedule shows how the repayments are allocated between the principal amount and the interest.

The payment schedule should be manageable by the borrower. It should be structured in a manner that is consistent with the borrower’s earnings. This reduces the default risk.

This agreement does not need to be notarized for it to be legally binding. However, having the agreement notarized is good practice.

A personal loan agreement does not have to be witnessed for it to be legally enforceable. However, having a third-party witness can be very helpful in case you need to enforce the repayment of the personal loan.