In North Carolina, a last will and testament is a legal document that specifies how the testator’s estate and possessions will be distributed after his or her passing. This document is also known as the last will and testament. The most common use for this type of agreement is to ensure that the decedent’s true wishes are carried out after their death. It helps avoid conflict over the inheritance of property or assets.

Typically, you are required to make a last will and testament in North Carolina when doing estate planning. If someone dies intestate (without a will), then by default, upon death, North Carolina’s intestacy laws set out who receives and owns any property that is left behind. These laws may not follow the order you would want for distribution or may be contrary to some other wish of yours. Although intestacy has some limitations, it can offer some degree of distribution certainty. Intestacy laws only apply to “probate” property, defined as “assets and accounts held in your name or under your control.” Intestacy laws do not apply to property held in joint tenancy, payable on death bank accounts, life insurance policies, etc.

In North Carolina, your last will and testament may contain any provisions you choose. This awards the testator a high degree of flexibility in how their estate should be distributed. In this article, you will learn how to write a last will that is legally valid in the state of North Carolina.

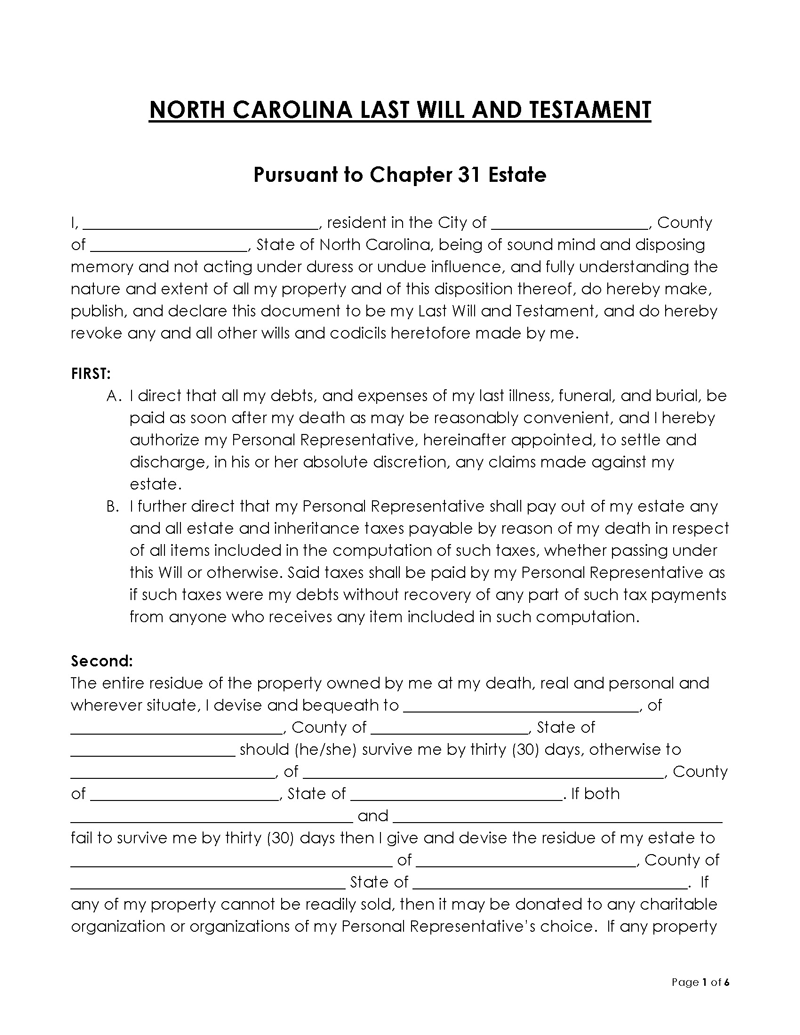

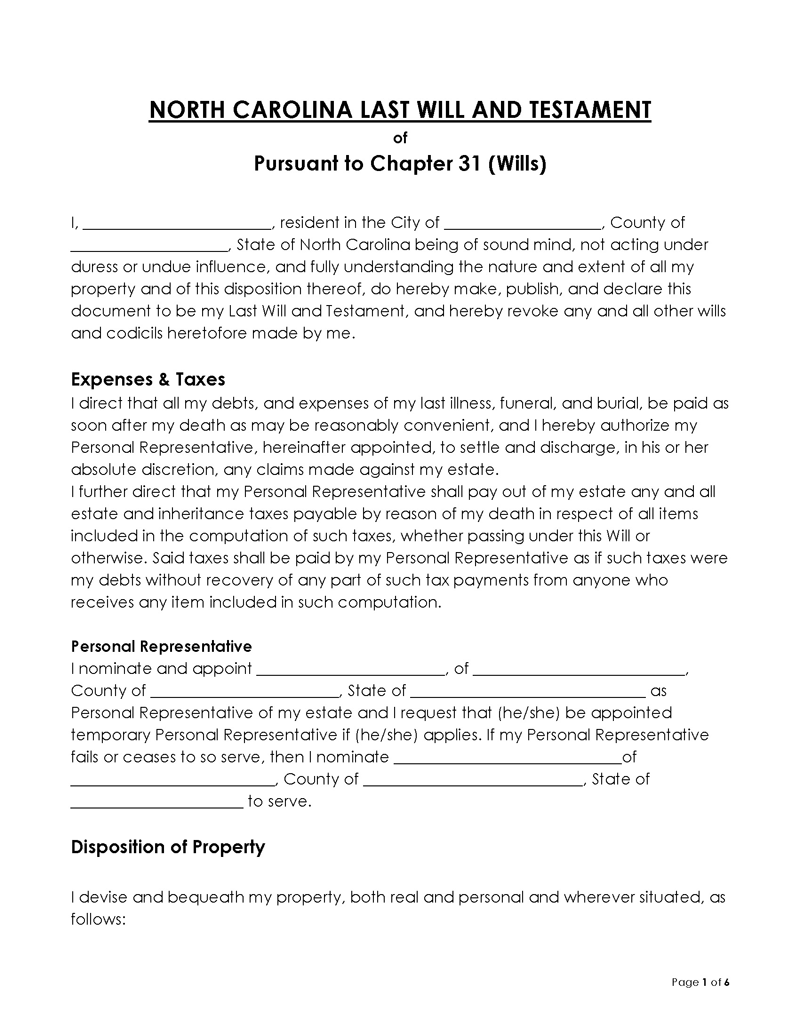

Free Templates

Why is a Last Will and Testament Required in North Carolina

To guarantee that your wishes are honored, you should create and maintain a last will and testament in North Carolina. They are also useful legal documents in their own right. In North Carolina, if you have such a will with detailed provisions concerning the distribution of assets, then it can become less likely that the document will ever be contested.

Benefits

The benefits of preparing such a will are as follows:

- A last will and testament give you the opportunity to distribute your property as you wish. You can decide the order in which your assets should be distributed, and specify to whom property should be given. The will and last testament can be changed anytime.

- As legal instruments, the last will can be useful if you are looking for a legal way to transfer your property in North Carolina or settle other matters between parties. They play a large part in the process of probate and are also referred to as estate planning documents. As a result, beneficiaries are spared the cumbersome procedure of waiting for the probate court to settle the distribution of assets. That process is time-consuming and costly.

- The document allows you to name a trusted executor of your estate to take over the responsibility to distribute property upon your passing.

- In a last will and testament, you can also appoint a guardian for your children and a manager to manage the assets and property you leave behind for them.

Costs of failing to make a will

Intestacy laws govern the distribution of your assets if you pass away without a will in North Carolina.

Some of the disadvantages of intestacy are:

- Distribution decisions may be contrary to your wishes.

- Intestacy laws in North Carolina have no requirement for a will to be filed with the probate court. This means that the rights of the surviving spouse may not be upheld, and property may end up passing to relatives that you did not intend to receive it.

EXAMPLE

If you have $100,000 payable on the death account in joint tenancy with your sister, the money will be removed from the intestacy laws and passed to her without any need for probate court proceedings.

It will go straight to their beneficiary and not your children or spouse.

- Unfortunately, if you do not leave a will, claims by in-laws and distant relatives can take precedence over claims by other, closer family members.

In North Carolina, if there is only a spouse and no children, they inherit the entire estate if there is no last will and testament. If there are also children, the spouse receives the first $30,000 of your estate and an equal share with the children of the remaining estate. If there is a surviving spouse and parents, the spouse is first awarded $50,000 and an equal share of the remaining estate with the parents. If there is no surviving spouse, children, or parent, the estate goes to the next closest relative. If there are not any living blood relatives left, the state inherits your estate in its entirety.

Making a Last Will and Testament

There are specific guidelines that must be followed when writing a will. A will should be written on paper that is easy to read.

The steps below can assist you in creating a will for your assets in North Carolina.

Step 1: Check all requirements

The first step before writing a will is to ensure that you meet all of the requirements for doing so.

Here are some suggestions for making sure that your last will and testament comply with North Carolina law:

- You must be 18 years old or older.

- The will must be written in ink, signed, and dated. A minimum of two witnesses should witness it.

- Your signature should not be written by another person, an envelope flap, or any kind of stamp.

- The testator should be of sound mind when they prepare the document.

- Your will must be written using a pen or typewriter. Audio, video or other types of digital files are not a viable last will. The last will and testament can, however, be handwritten according (to N.C. Gen. Stat. § 31-3.4), although they are not recommended.

- An oral last will and testament is acceptable in North Carolina if the testator is on the verge of passing on. This type of will must, however, be in front of two witnesses specifically selected by the testator (N.C. Gen. Stat. § 31-3.5). Note that oral last wills can only be used to distribute personal property (N.C. Gen. Stat. § 31-3.2).

Step 2: Consult with state laws

Next, you should review applicable North Carolina state laws and establish whether your will follows the state’s requirements. The state laws that govern the last will and testament can be found by going to the General Assembly’s website, North Carolina General Statutes Chapter 31 Wills Article 1 Execution of Wills. Determine whether your document fits the definition provided by the state and meets the signing requirements.

Step 3: Self-prove your will

In North Carolina, an attested will needs to be self-proved. This means that you need to have your will notarized. This increases the enforceability of the document. You can do this by taking this will to a notary public, presenting it in person, and signing it. The notary will then witness the document and sign it, thereby certifying its truth, accuracy, and validity under penalty of perjury (N.C. Gen. Stat. § 31-11.6). Though notarizing your last will is not required by the state.

Step 4: Review all signature requirements.

It should also be signed in the presence of two witnesses. The witnesses must also sign the document in front of you. Both of these witnesses should be present at the same time, and they must not be beneficiaries of the will (referred to as “disinterested” witnesses). “Interested persons, like your spouse, stand to lose their share if they witness a last will in which they are beneficiaries’ ‘ (N.C. Gen. Stat. 31-10). Holographic last wills do not have to be witnessed but ought to be in the testator’s handwriting (N.C. Gen. Stat. § 31-3.4).

note

An important aspect that one needs to remember is that individuals who have children under the age of 18 cannot leave them their property, according to North Carolina law. They have to appoint a guardian to manage the property.

How to Revoke a Will in North Carolina

In North Carolina, individuals have the right to revoke a will. This can be done in the following ways:

- The will can be revoked in writing by the testator. The revocation must state that it revokes the old will.

- A testator can also create a newly dated last will and testament in North Carolina and follow the state’s mandated formalities.

- The will can be revoked orally by the testator in front of two witnesses. Note that this must happen while the testator is competent and of sound mind.

- The testator of the will can revoke his or her will by destroying it. This can be through burning, tearing, obliterating, canceling, defacing, or erasing the will.

- The testator can also revoke his or her will by distributing his or her estate in a way that no longer meets the terms of the old will.

- The witnesses can also testify that the testator intended to annul his will. This testimony should be documented and provided before the testator’s death.

note

It is important to note that, upon divorce, state laws nullify any provision in your will that names your spouse as a beneficiary or executor of your estate.

However, this state law does not apply if the will specifically states that a divorce will not affect the provisions. Thus, creating a new last will and testament in North Carolina is the most straightforward method of revoking the previous last will.

Frequently Asked Question

You do not need a lawyer to make a last will and testament, but having one could make things easier. If you are doing it yourself, it is best to have a third party review the document and affix their signature before determining whether the will is valid.

Yes, you should name an executor in your last will and testament. This person will take care of the distribution of your assets after your death. The court will have to appoint an executor if you do not name one, which will cause the probate process to take longer.

You can make a digital last will and testament. However, this type of will is not accepted in all states because it is difficult to authenticate. Consult a North Carolina attorney before creating your digital last will and testament to make sure you do it properly.