A California last will is a legal document used to distribute an individual’s property, which could be personal or real, after their death to those they chose as their beneficiaries.

The will’s maker, known as the testator, can use it to make sure their loved ones receive the share of the estate that is designated for them.

The creation of a will requires the presence of at least two trustworthy witnesses who must be present when the will is signed. A family lawyer or several family members must maintain possession of the will document to prevent tampering.

In California, the last will is crucial for distributing real and personal property upon the owner’s death. It allows the testator to leave assets and properties to partners, children, spouses, relatives, and others.

It is important to remember that a living will and the last will are two completely different documents. A living will only give instructions if the owner becomes ill or unable to make decisions for themselves. A living will takes place when a person is still alive, while the last will becomes effective upon the person’s death.

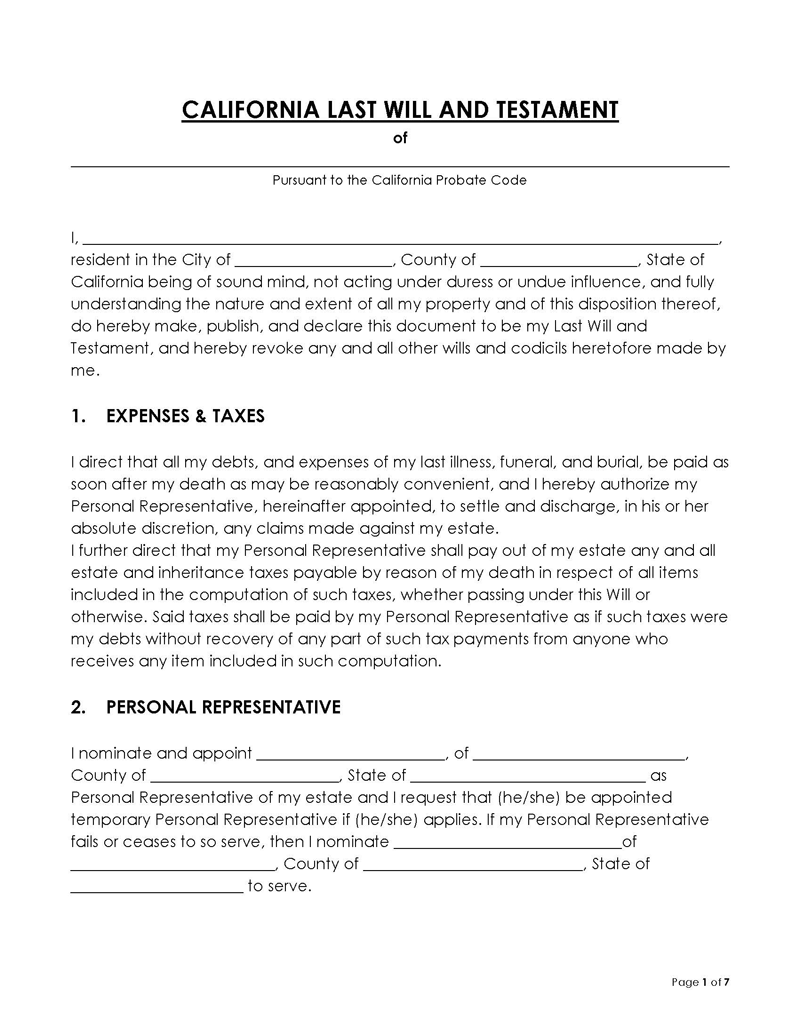

Free Template

The Importance of Using a Will in California

Numerous advantages and benefits come with the last will. One of these advantages is that it provides the testator with the assurance that his assets will be distributed following his wishes upon his death.

A will also allows the testator to name the executor of the estate, who is in charge of carrying out the bequests in the will. Last but not least, a will in California enables one to designate a person to act as the legal guardian of their children and manage any property left to them.

Do I Require Legal Counsel to Draft a Will in California?

You do not need an attorney to make a will in California. An attorney will carry out the same task as an application or piece of software does for most people. Still, in some cases where you have a child with special needs, your net worth is extremely high, or you are worried about federal estate taxes, it is essential to seek advice from an attorney.

Essential Requirements for a California Will

California’s basic requirements for the last will and testament are listed below:

Testator requirements

Regarding the testator, the law says that an individual over 18 years of age with a sound mind can make a will (Cal. Prob. Code § 6100). In general, having a sound mind simply means that you are conscious of your actions when forming your will.

To be more precise, it denotes that the person had full knowledge of what they were doing, understood why they were making a will, the type of property they were transferring, and to whom they were transferring it. In addition, the testator must not have a mental health illness that might result in a delusion, affecting what they might do with your properties (Cal. Prob Code 6100 ) If there are doubts about a person’s mental state when creating the will and at the time of signing, a letter from a doctor attesting to this can be included in the will.

Exceptions to the ability to distribute property

It is only possible to transfer property through a will if it was registered in the testator’s name at the time of death. The terms of a will do not apply to any property that is jointly owned, community property with the right of survivorship, or owned by a registered domestic partner.

The designated beneficiary receives the proceeds of a life insurance policy. Assets from 401(k) or IRA retirement plans go to the designated beneficiary. The designated beneficiary on some securities and brokerage accounts, such as “transfer on death” or “pay on death” accounts, receives the assets in the account. Assets that are in living trusts are distributed per the terms of the trust with the help of the designated successor, irrespective of the will provisions.

State laws

According to Probate Code § 88, a will consists of a codicil and all other testamentary instruments that simply appoint an executor or revoke another will.

Two (2) or more witnesses must be present when a document is signed according to Probate Code § 6110. If you have an old will in place, you can cancel it by creating a new one. Most often, the last will specifies that it nullifies any prior will. Also, according to California law, you can cancel a will by destroying it physically. (California Probate Code § 6120). All the statutes of California can be found in Statutes Probate Code Division 6, Part I (Wills).

Beneficiaries

Property can be distributed to businesses, people, societies, associations, and a lot more under California law. Generally, you can leave your property the way you want it. Married people should be aware that California is a community property state, which simply means that assets acquired during a marriage belong to both spouses equally.

As a result, after the death of one spouse, the other spouse continues to own their respective share of the assets. The will of the deceased only affects half of the property owned by the deceased. Apart from this, you can leave your assets the way you want them to be.

Executor

In California, it is necessary to use a will to designate an executor who will be tasked with seeing that the terms of the testator’s will are carried out after his or her passing.

Witnesses and Signature

To finalize the will, it must be signed in front of two witnesses, and neither of the witnesses should be a beneficiary of the will (Cal. Prob. Code § 6110.) California law presumes that any gift made to a witness of the will under duress could cause the witness to lose the gift. You should note that holographic or handwritten will does not require witnesses ( Cal. Prob. § Code 6111.)

Writing

Your last will should be in written form in the state of California. In some states, creating a legal will digitally is permitted, allowing you to create it, sign it, and have it witnessed without having to print it. Although this is acceptable in a few states, many other states are also considering legalizing it.

File the will with the court

According to California law, a will has to be filed with the court within 30 days after the demise of the testator. Upon which, the will has to be filed in the local probate court by the executor, which would serve as the inception of the legal process called probate.

How to Modify or Revoke a Will

To revoke or change your will in California, you must burn, tear, cancel, and destroy it, or create a new will clearly stating that you have revoked the previous one (Cal.Prob.Code § 6120.)

If you need to revoke your will, you should first nullify it and then create a new one. However, if you need to make a few changes to your will, you can add a codicil to your existing will.

If a husband and wife divorce or annul their marriage, the gifts given to the wife in the will and all other provisions that are in the wife’s name will be automatically revoked unless the will explicitly says otherwise (Cal. Prob code § 6122. )

Probate and Laws of Intestacy

The last will and testament aid the estate by minimizing or avoiding probate. The process of administering a decedent’s estate under court supervision is called probate. It starts when a petition is filed in court, usually by the executor named in the will.

In California, there is a special procedure that allows assets to pass to surviving spouses and registered domestic partners without going through a full probate process. If it is stated in a will that assets should be passed to the surviving spouse or domestic partners, the spouse or partner can file a spousal or domestic partner property petition and avoid a complicated probate process. Another circumstance where probate might be avoided is when the decedent left $150,000 or less in assets.

A person who dies without writing a will is called intestate, and the laws of intestacy are invoked. In California, when inheritance occurs, the property is distributed to the spouse first, followed by the children, parents, siblings, grandparents, and others; if the deceased has no relatives, the assets are transferred over to the state.

It is important to have a will if you would like to have the distribution of your estate under your control and avoid the laws of intestacy.

Does my will need to be notarized?

You do not need to have your will notarized in California to make it legal. In some states, you can make your will self-proving by simply signing a special affidavit that goes with it in front of a notary public. As long as you sign and witness your will appropriately, the will does not need to be proved at the probate court, and there is no need for a self-approving affidavit (Cal. Prob. Code 6113.)

Final Thoughts

Your will and testament are important documents that determine how your assets and properties will be distributed after your death. The California probate codes govern the distribution of the decedent’s property. Also noteworthy is the requirement that your will is in writing in California, though you are entirely free to complete the process without printing it out. It is wise to have a written last will and testament to avoid intestacy.