A Wisconsin last will allow you to plan out your estate and determine who will get what from your property and assets after your death.

Without this document in place, the courts in Wisconsin will use current law to determine how to divide up everything and even who will be the guardian of your children. In addition, you can choose to make changes or revoke your current last will or change the beneficiaries or any assets at any time.

Making a plan for your estate allows you to make important decisions about how things will be handled when you pass on. You can list out the executor who will help satisfy your final wishes and the beneficiaries who will receive parts of your estate. Even if you are young and have a small estate in Wisconsin, the last will is suitable to fill out.

To make the will legal, you must sign it in front of two witnesses. You can choose whomever you would like as a witness but choosing someone with no interest in the will is often the best choice. Once the details of the last will have been decided and you and your witnesses have signed the document, you should keep it in a safe location until it is time to make changes or the executor needs it.

Associated Laws

You should be aware of all the associated laws that come with creating your will and testament in the state of Wisconsin. These laws need to be followed for the will to be considered legal. The exact laws that help govern the will are Chapter 853 (Wills).

To sign a will in Wisconsin, you must be at least 18 years old and considered to be of sound mind. The exact definition of “sound mind” is found in Wisconsin Statutes 853.01. When you create the will, you can use it to help dispose of any property you currently own or acquire between that time and your death. Wisconsin requires that your will is done in a hard copy or on actual paper. You will not be able to use any type of digital file, video, or audio version of the will.

Once you have sat down and divided up all of your assets and property, you will need to finalize the will. You must acknowledge and sign the will in the presence of two witnesses, and those two witnesses need to sign the will within a reasonable time after you sign it before the document is valid. When choosing your witnesses, go with individuals who will not be affected by the will and its contents.

As the testator, you can choose anyone to be your beneficiary within the Wisconsin will. Many will choose their spouse and any children as a result of that marriage. You may also choose to give individual items to other family members based on your wishes.

However, a few exceptions may limit your ability to make choices on beneficiaries and the distribution of property within your Wisconsin will. Some of these include assets that are placed inside a revocable living trust, retirement accounts and life insurance policies that already list out a beneficiary on them, the survivorship marital property, and the property owned in joint tenancy with the right of survivorship.

In Wisconsin, it is not necessary for you to notarize your will. Choosing two witnesses to watch you sign and then sign the document with you will be enough. You may choose to create a self-proving will to save time in probate when you pass on. To create a self-proving will, you as well as your witnesses must sign affidavits concerning your identities and that each one knew they were signing a will in front of a notary. This is pursuant of the Wisconsin Statutes 853.04.

What Makes the Last Will Valid?

Following the rules above will help make your will valid. You need to be 18 years old and of sound mind while having two witnesses who will verify your signature and add their own to the document. You should then keep the last will in a safe spot that is easy to find when you pass on, such as in a safety deposit box or with your lawyer.

After your death, the individual you named as an executor will be able to begin the process of dividing up your property and assets based on your final wishes. The will must go through probate court first, which will help validate the will before any property is handed out to the beneficiaries. If you meet the minimum requirements of creating a legal will, then this process should not take too long.

In Wisconsin, you can go through several types of probate based on the amount of your estate. Formal probate is the most in-depth and will require the court to monitor the distribution of assets, and informal may just allow the executor to do all of the work. You could also qualify for special probate, which will be used for smaller estates that are less than $50,000.

What Happens if You Die Without Last Will and Testament in Wisconsin?

When you create a last will in Wisconsin, you will determine who your beneficiary is and how you would like to divide up all of your assets. But many individuals decide not to write a will or who never get around to writing one in the first place.

They may assume that their assets and property are too small to write out a will and do not want to deal with it. But dying without a will can bring up a number of problems for your estate and may divide the assets and determine guardianship in a way you would not like.

When you pass on without a will, you will invoke the laws of intestacy. In this case, your surviving spouse will be the beneficiary, and they will get all of your estates, even if you have children with your spouse.

However, if you have at least one child who is not shared with your surviving spouse, then half of the estate will go to your spouse, and the children will be able to inherit the community property as well as the remainder of the separate property.

There are also times when you may pass on and have no surviving spouse or children. In this case, parents, siblings, and other relatives may be able to lay claim on your assets and estate. The rules governing this can be difficult, and many family members will get into heavy legal battles to figure it out. Nevertheless, intestacy is often a long, drawn-out, and expensive process that can be avoided when you create your last will.

How to Write Last Will and Testament in Wisconsin?

There are a few components of the last will that you need to keep in mind when writing the document.

A few of the steps that you should follow when creating a last will in Wisconsin include:

Identify the beneficiaries

Your will needs to list out your beneficiaries or who will receive different parts of your estate when you pass on. You can technically choose anyone to be a beneficiary, though most will put their spouse and any children down as the main beneficiaries.

You also have the option to leave most of the estate to a spouse or to your children and give a few individual items to someone else, such as a friend or another family member.

Charities are often listed out within the Wisconsin will too. You can list out a certain amount you would like to give to the charity and then divide the rest of the estate between your family. You may also choose a guardian for any children, set up a trust, or determine other ways for your assets to get set up.

Prepare an inventory of assets

As you write up your last will, you will need to prepare an inventory of assets to include in the will. This will help you figure out how to divide the assets and who should get each part of your estate. Your estate planning lawyer can help you list out all of the assets and determine who would legally get them as well.

Keep in mind that you are not able to distribute all of your assets through the will. If you own property with your spouse or they are listed as joint tenancy with the right of survivorship, they will automatically receive the property, even if their name is not on the deed.

There is also survivorship marital property that automatically goes to the surviving spouse, regardless of what you place in your last will. If you have assets within a revocable living trust or a retirement or life insurance policy, these can’t be divided up in your will.

Name an executor

While writing your will, you need to name someone as the executor of your last will. This individual will be your personal representative when you are not here and is responsible for carrying out all of the provisions within your will.

An executor will need to help divide up the assets, pay off debts that you left behind, and handle any problems that come up during the process of probate or distribution of the estate.

It is important for you to choose someone responsible and someone you can trust for this important role. If you do not choose anyone to be your executor, then the courts will choose this individual.

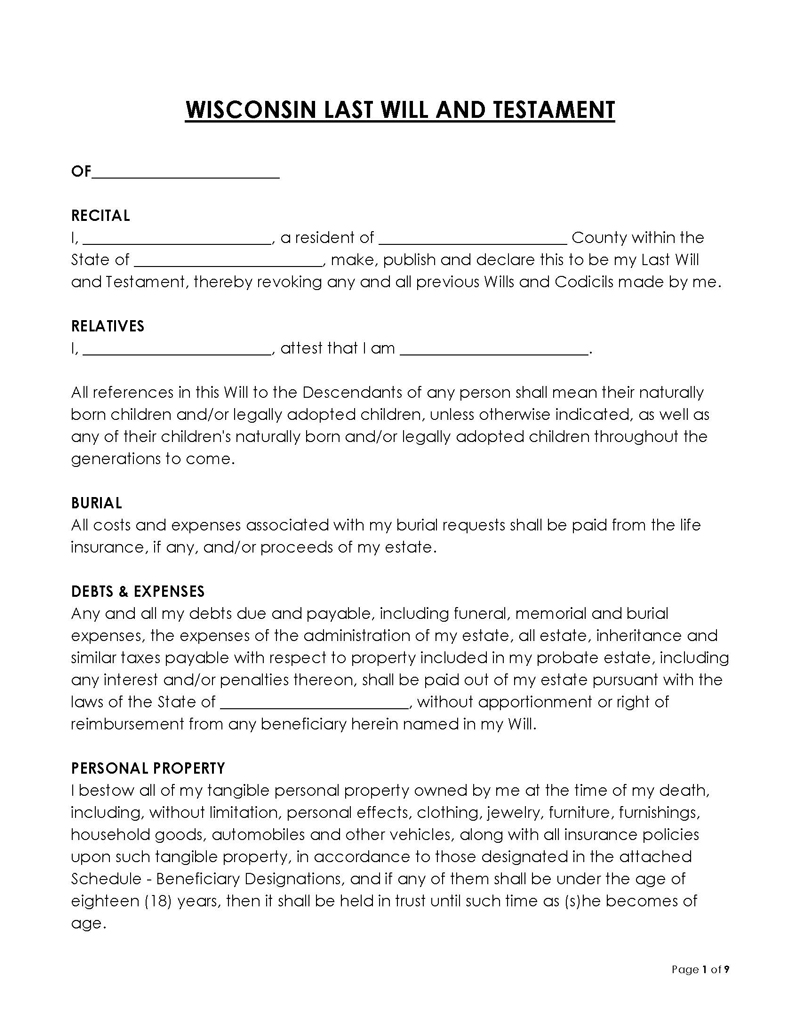

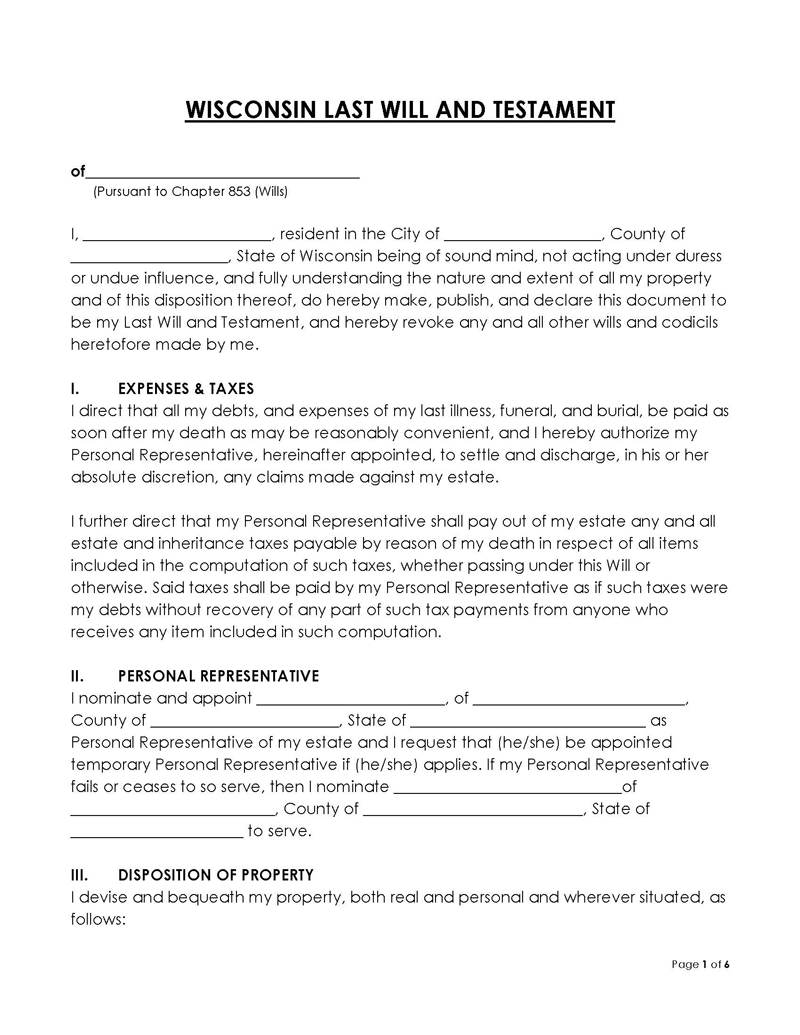

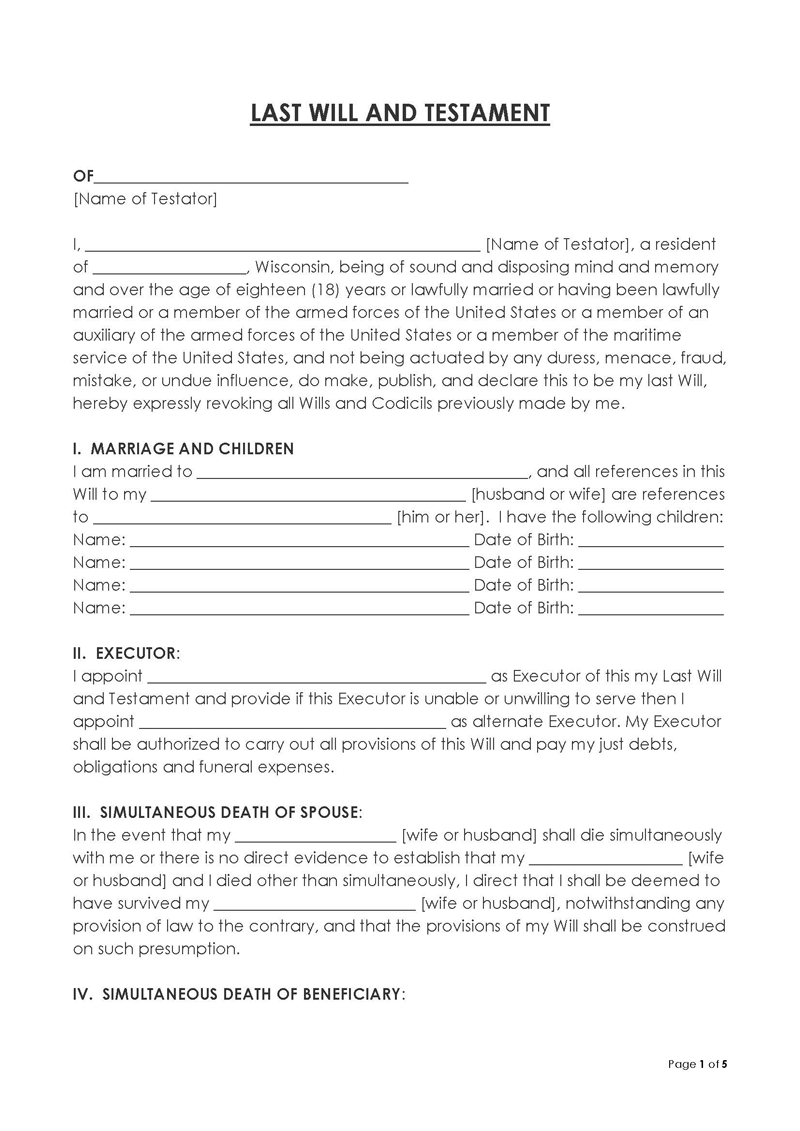

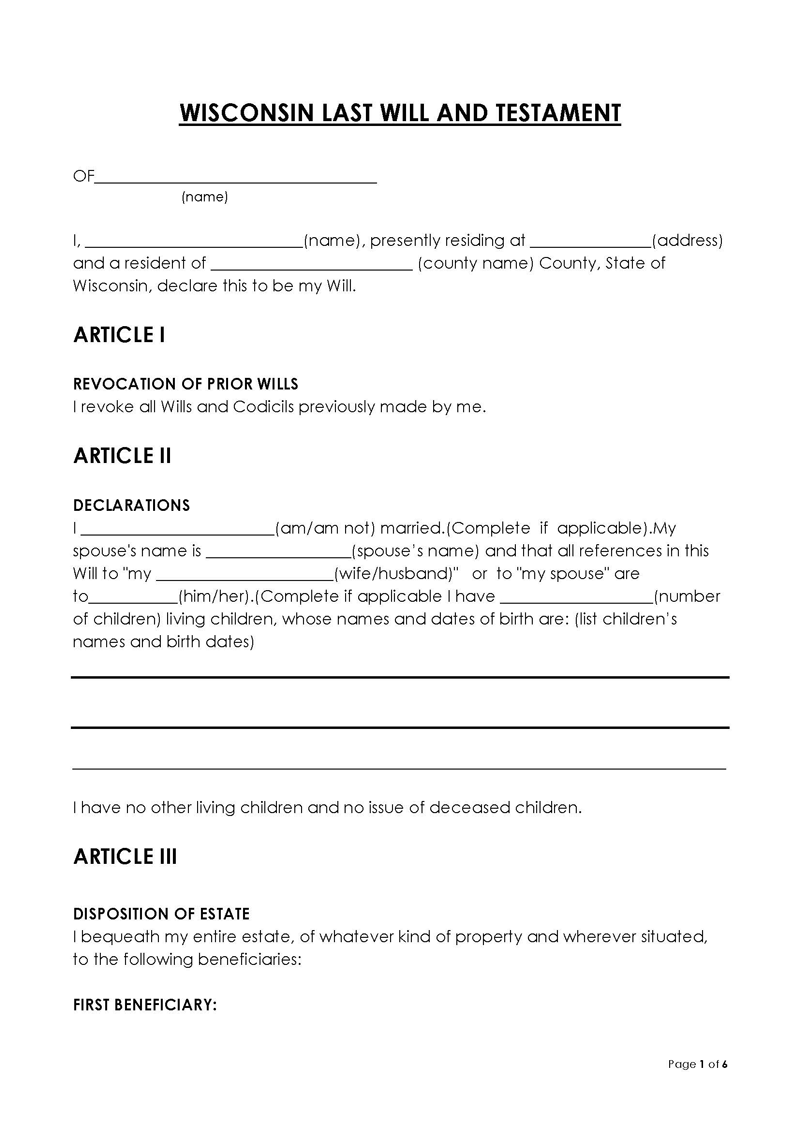

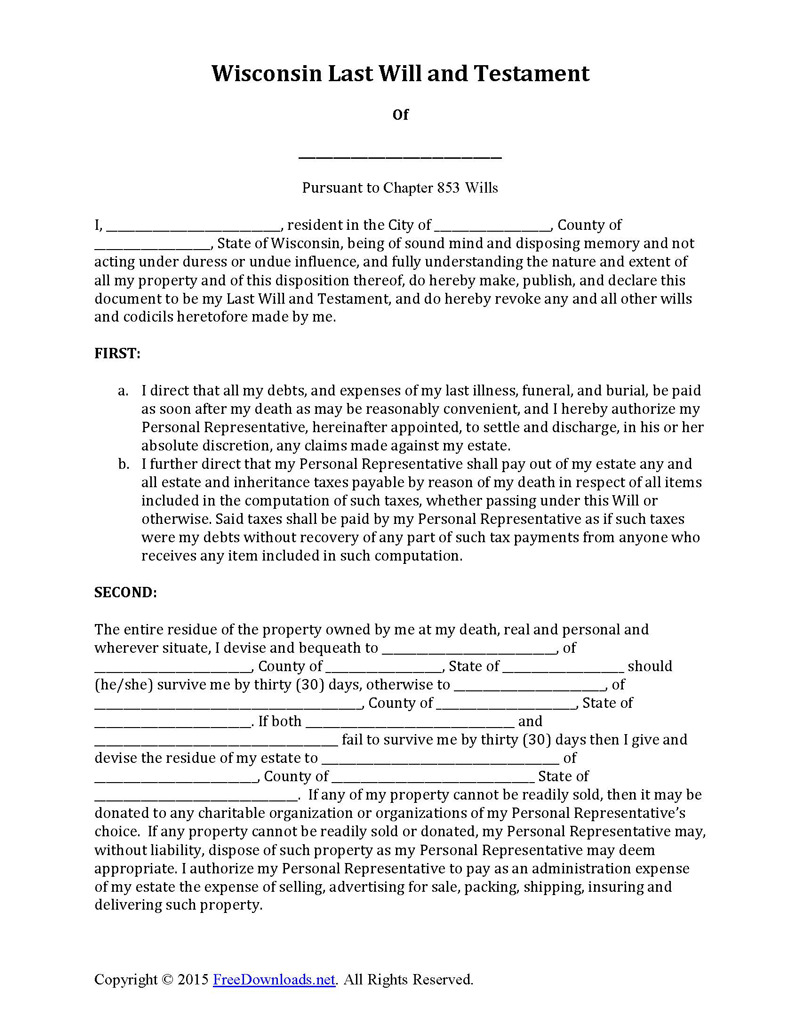

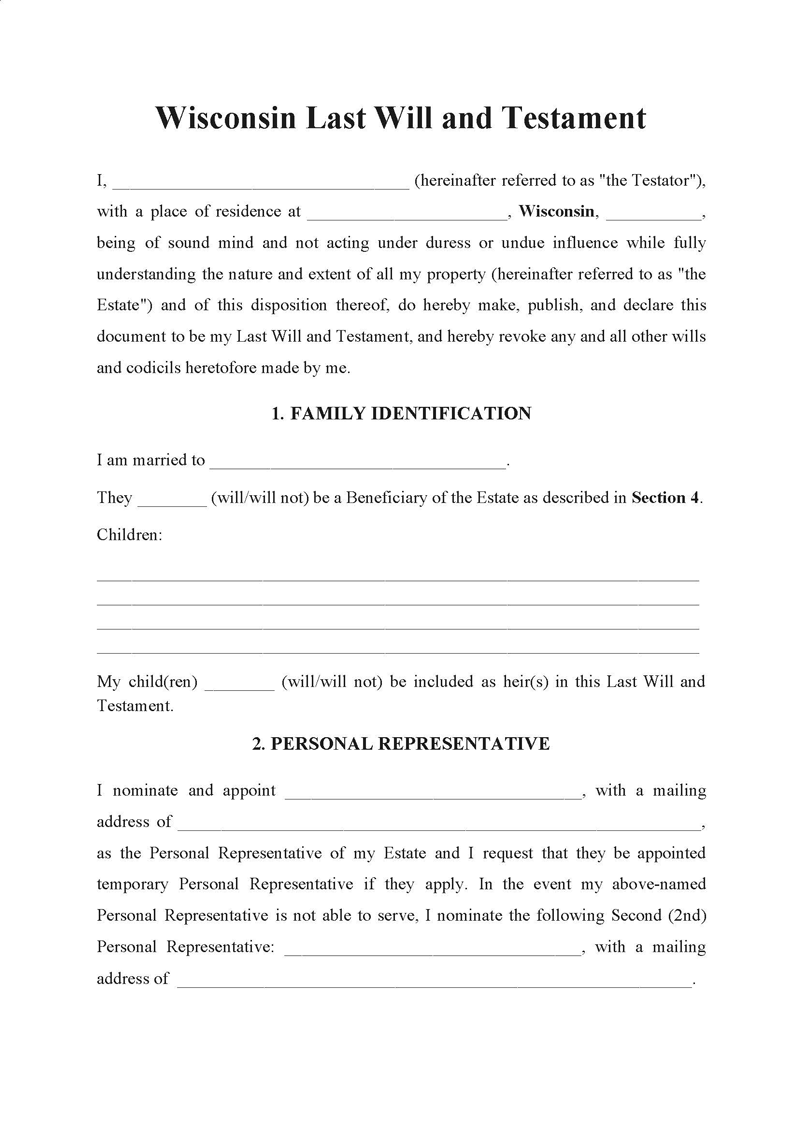

Draft the final will

Once you have gathered all of the necessary information, including the list of assets, the beneficiaries, and the name of the executor, you can draft the final will. Working with an estate planning lawyer can be useful because they will take care of the wording to ensure the will is legally binding until the time you make another one. There are also pre-made templates online that will help you create a last will on your own.

Download Free Templates

Can I Revoke or Change My Will?

In Wisconsin, it is possible to change or revoke your will at any time. Once a last will and testament is created, it will stay valid until your death and your estate is dispersed, unless you make changes or choose to revoke the will.

The easiest way to change or revoke your will is to simply execute a new will. You can create a new will, following the same steps with witnesses as listed above, and change the terms of the original will to fit your new wishes. This could be done when you divorce or when all of the children move out of the home and no longer need a guardian to take care of them.

The creation of a new will is often enough to revoke the original will and put the new one in place. There are rules in Wisconsin that are utilized if you have more than one will, and it is unclear whether the original will was revoked or not. If the new will adequately handles all of your estate, then it is deemed the one the executor should follow, and the older will is ignored.

However, if some parts of the estate are not disposed of in the new will, then the courts in Wisconsin will assume that you want the wishes of both carried out at the time of your passing, and the executor will need to follow the instructions of both. If there are any terms within the two wills that contradict one another, the executor is instructed to follow the terms in the newer will rather than the old one.

You can also choose to physically destroy a will to revoke it. This can be done by canceling, tearing, or burning the will or any part of the document. You can also give permission to someone else, such as your lawyer, to do these actions to dispose of the first will before creating a new one.

Final Thoughts

A last will and testament allows you to list out how your estate in Wisconsin should be divided up when you die, providing the beneficiaries with the support they need at that time. You can choose how to split up the estate, outside of certain elements that will automatically go to your spouse or to someone else who has a stake in them. Without the will, your wishes may not be met, and the courts will be able to divide the estate and handle guardianship issues without your consent. Take the time to create your own last will to control what happens to your estate in Wisconsin when you are gone.