In Illinois, the last will and testament is a legally-binding document that testators use to specify how their funds, real estate, possessions, or digital assets will be distributed among beneficiaries after their passing.

It is not the same as a living will. If you are unable to make these decisions while still alive, a living will specify how your property and health should be managed. On the other hand, the last will and testament are in effect only after the testator has died.

You, the testator, can guarantee that your loved ones receive a specific portion of your estate by using this legal document. If you do not create a will in Illinois, the succession laws take over the process of sharing the property. You can ensure that your children, partners, pets, and other good friends are taken care of after your death through a last will. It is also possible to give all your belongings to charity or as gifts to some organizations.

It also names the people, referred to as “executors,” who will oversee the inheritance process. In the state of Illinois, the testator needs two witnesses to sign the document for it to be valid. The document may also be notarized.

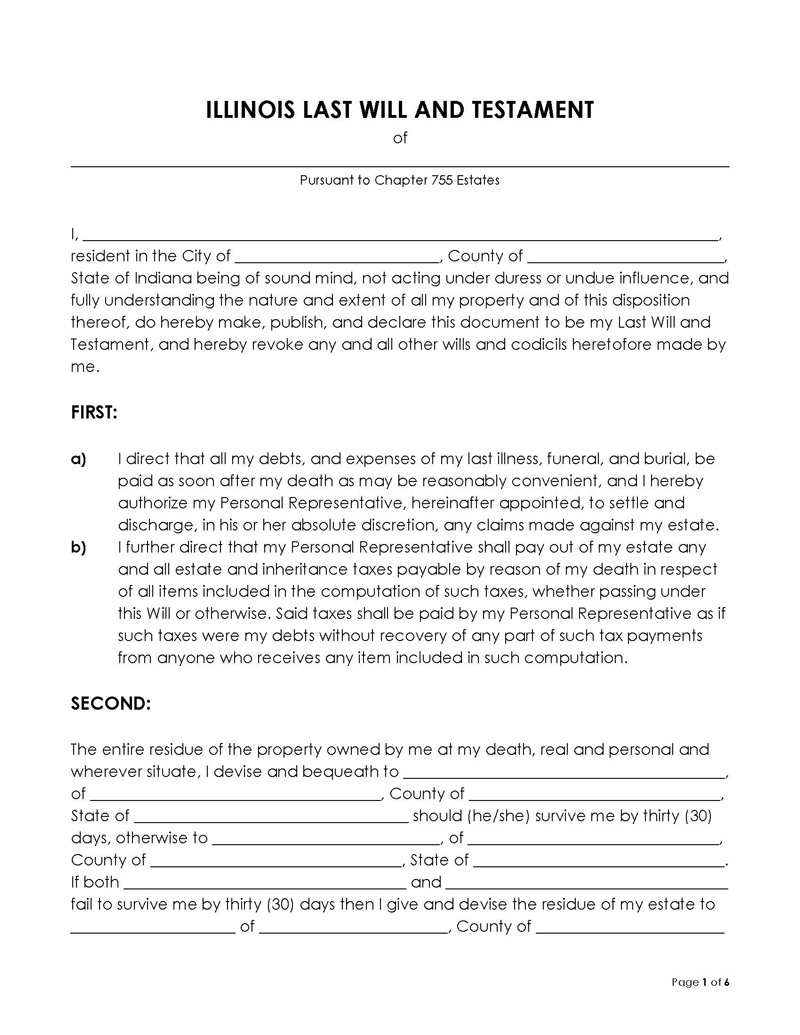

Free Templates

Associated Laws

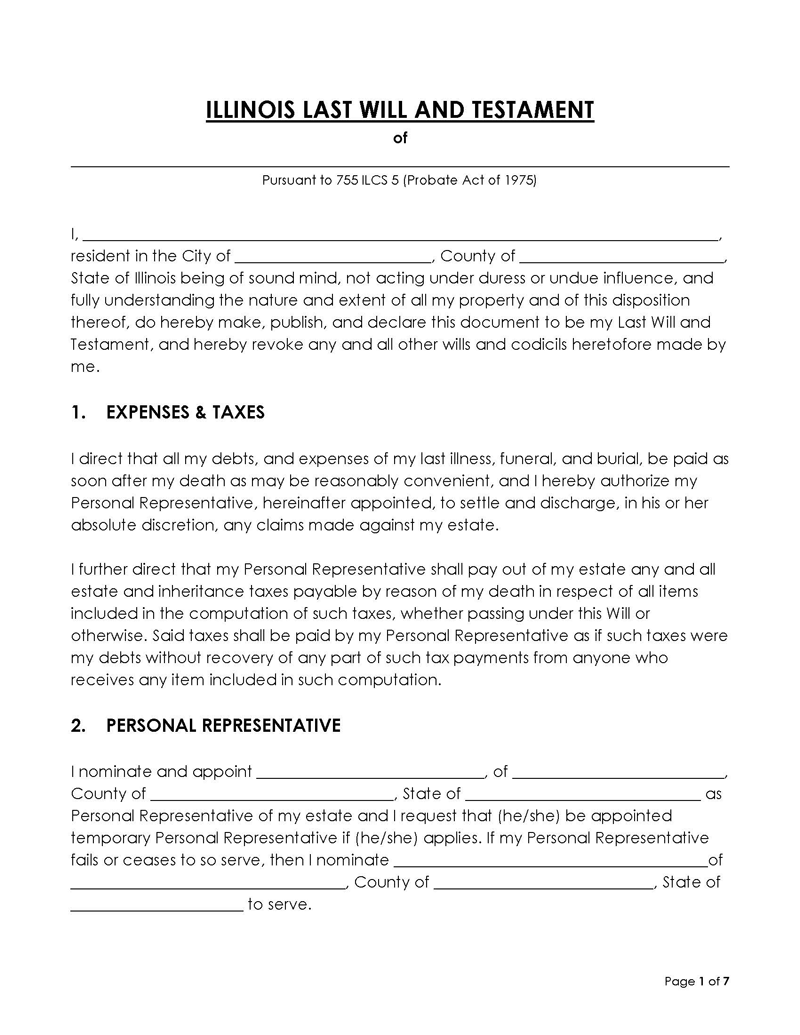

Creating a last will and testament in Illinois is closely monitored and guided by several important laws. All the actions regarding it in Illinois are regulated and legislated by the Probate Act of 1975 (755 ILCS 5).

Here are some of the most critical sections that give further information about this issue:

- 755 ILCS 5/1-2.18: This section of the law gives a legal definition of wills.

- 755 ILCS 5/4-3: This section says that testators need two witnesses present when signing a document.

- 755 ILCS 5/4-7: This section describes how a will can be revoked or changed legally and under what circumstances.

Basic Requirements

As a potential testator, you are probably interested in learning the requirements to make your will in Illinois. All these requirements are outlined in Article 4 of the Probate Act.

These include:

- To become a testator, a person needs to be 18 or older;

- Testators cannot have mental issues or difficulties with memory and decision-making;

- Testators need to sign the document or by someone else in their name while they are present;

- Last will and testament in Illinois require signatures of two witnesses 755 ILCS 5/4-3 who cannot be beneficiaries 755 ILCS 5/4-6;

- All these documents must be in writing to be valid;

- Testators can choose any person to be their beneficiary just as long as that individual is not a witness to the process.

As a testator, you need to have a sound mind when making a will and be completely aware of your actions. People with Alzheimer’s disease or dementia might also be able to make a will if they can prove that they are lucid when signing the legal document.

Wills can also be handwritten in the presence of a lawyer or other professionals who provide these kinds of legal services. Even though the law says that these kinds of will can be permitted, there are many ways that they can be disputed later. Finally, you cannot change the terms of your last will unless you have your attorney and witnesses present. In other words, if you change your mind, you cannot make handwritten changes to your document.

Notarizing your will

Some states require wills to be notarized to make them legal, but this is not the case in Illinois. However, notarizing the document will only serve to make sure it cannot be contested. You will not have any problems as long as you properly sign the document in the presence of witnesses.

Some states allow the testator to write “self-proving” wills that are accepted by probate courts without contacting the witnesses. In Illinois, the will can be self-proved as long as the witnessing and signage are done correctly.

What Happens if I Do Not Make a Will?

Intestate succession laws govern how assets are distributed and who is entitled to them when an Illinois resident passes away without leaving a last will and testament. Every state has different intestacy laws, and in Illinois, all the estate and financial decisions regarding the deceased’s estate are transferred to the closest relatives.

Intestacy laws in Illinois cover retirement savings, bank accounts, and properties you own without co-ownership. All the assets co-owned by you, like joint ownership properties or properties with beneficiaries, are non-probate and outside of intestacy laws.

If someone passes away without leaving a will, the Illinois Probate Act outlines how assets are distributed. Children and spouses are the first to inherit all of the assets. If neither a spouse nor children are present, the assets are given to grandparents or parents.

If no close relatives are present, the rights are transferred to more distant relatives. The state will seize all the property if no living relatives can be found through marriage or bloodlines.

How an Illinois Will may be Amended or Revoked

As a resident of Illinois, you can change or revoke your will whenever you see fit. A will can be revoked by:

- Writing a legal document where you officially revoke the previous will using the same approach and formalities as in the will.

- Writing a new will that is different from the old will.

- Writing a new will that expressly states that the previous version is revoked.

- Telling someone to destroy the will while you are present by tearing, canceling, or burning it.

- Destroying the will on your own.

In case you divorce your spouse or your marriage is declared illegal for any reason, the state of Illinois will automatically revoke all the clauses in the will where you leave assets to your spouse. If you have named your spouse as the executor, this will also be revoked.

The best way to change your will is to make a new one and revoke the old one in one of the ways mentioned above. As previously stated, you can change your will by adding new points, but only under the same conditions under which you made the will.

Benefits of Making a Will in Illinois

Having a will in Illinois is not required by law, but without one, the intestacy laws will distribute your assets, which is rarely a good thing. As it is likely that such a distribution will not align with your wishes, it is generally a good idea to write your own last will and testament.

Apart from this, there are other benefits as well:

The government would not seize your property

If the government cannot trace your relatives and you have no spouse or descendants, it will absorb all of your assets. Many people have partners outside of legal marriage or want to leave property to close friends.

You can create a trust for pets and beneficiaries

You can create a testamentary trust in Illinois that your beneficiaries can use if they look after your pets. These trusts are terminated when there are no living pets covered. In other words, you can use your Illinois will to ensure your pets are taken care of as well.

Assign a legal guardian to your children

As the testator, you can name guardians for your children in your Illinois will and designate the person who will look after them. You can also specify their responsibilities.

Conclusion

In Illinois, the last will and testament are legal documents that can be used to ensure that the estate is distributed according to the decedent’s wishes. The article discussed Illinois state laws, legal requirements for preparing a will, notarizing your will, the consequences of not having one, changing/revoking wills, the benefits of having one, and how to find the right template for your needs.