In situations where people prefer to resolve disputes without going through the litigation process in court, demand letters serve as a helpful tool. These letters can facilitate easier and faster resolutions while saving time and money for both parties involved. As the aggrieved party, you or your attorney will prepare and send it to the individual responsible for taking or ceasing a specific action. This letter aims to initiate a discussion between the parties, presenting your side of the story, outlining any expenses incurred, and specifying the desired settlement amount.

This article will provide their comprehensive understanding, their purpose, and the essential components needed for an effective letter. Additionally, it will discuss potential next steps if attempts to resolve the issue outside of court prove unsuccessful.

What is a Demand Letter?

A demand letter is a formal and official document used to address unresolved issues with a party or individual.

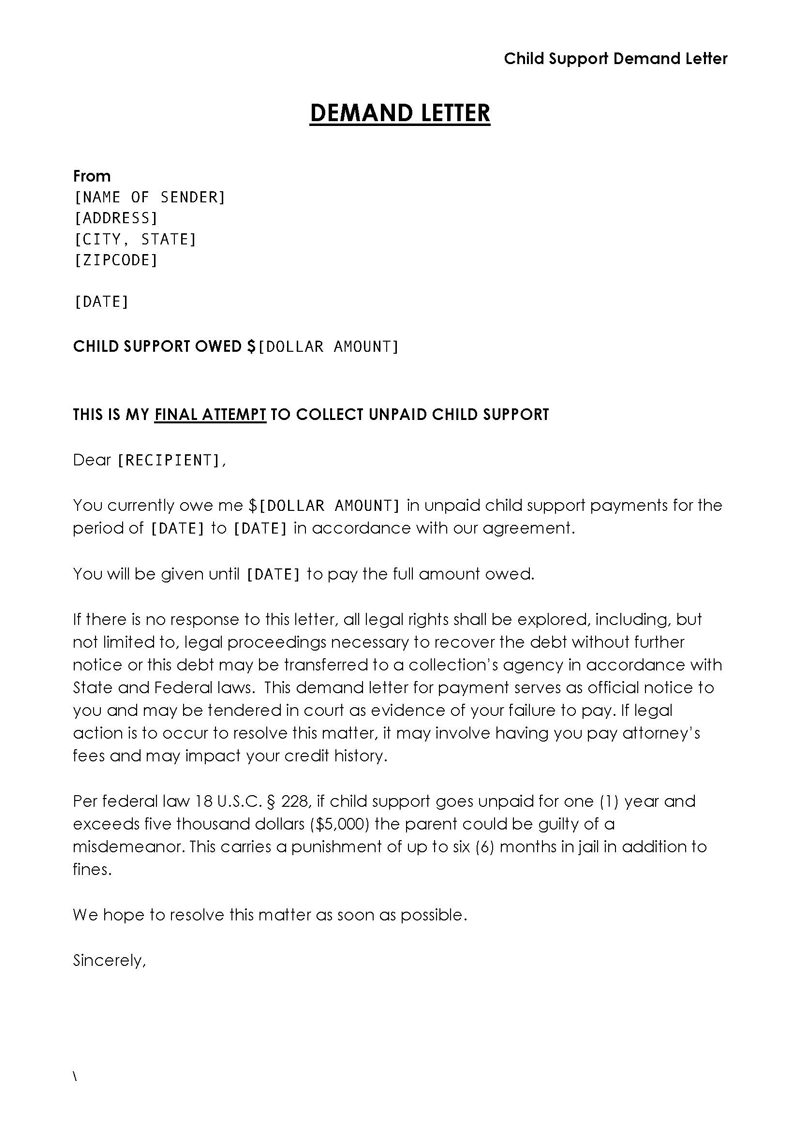

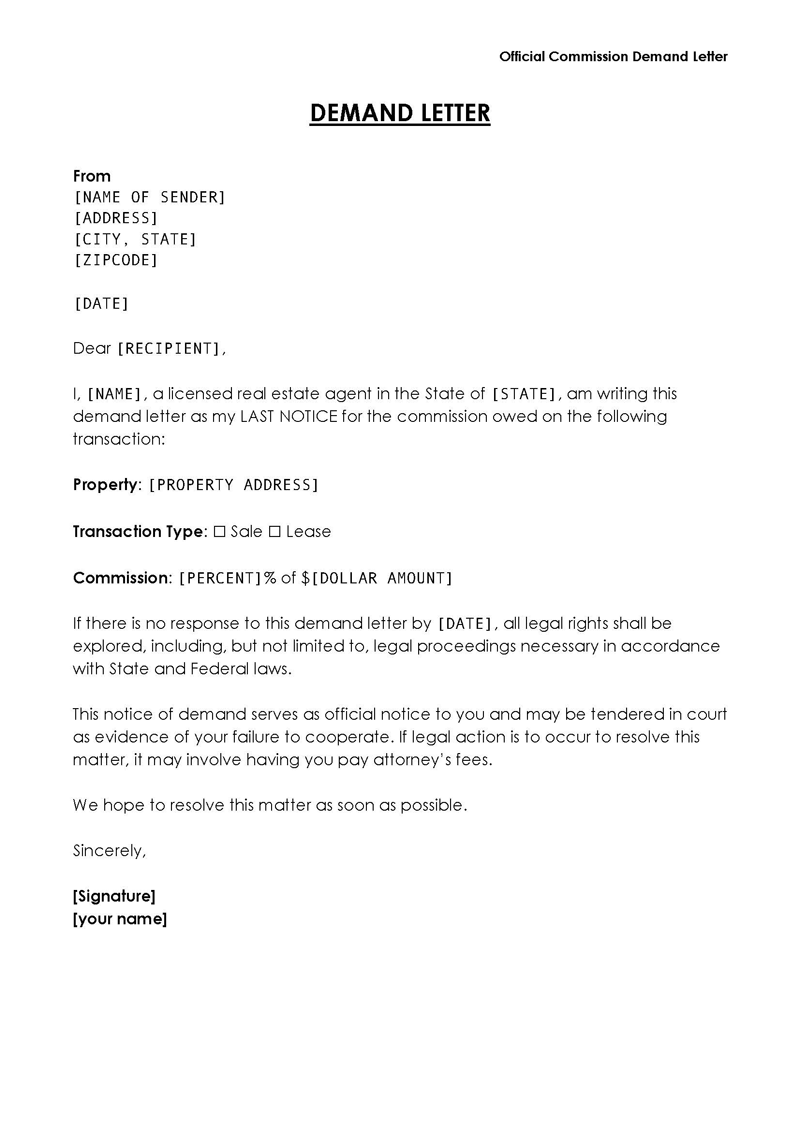

Typically, the sending party prepares it to request payment, seek settlement for a grievance, or demand corrective action for a mistake. Common reasons for sending it include breaches of contract, unpaid loans, or unfulfilled obligations. It is advisable to involve a lawyer when writing the letter, as an effectively written document can serve as a crucial first step in resolving disputes with the recipient.

Purpose of the letter

The primary objective is to formally notify the recipient of their obligation to either make a payment or undertake a specific action to address an outstanding issue. This letter serves as a clear indication of the sender’s seriousness and determination to pursue legal recourse, including filing a lawsuit, should the recipient fail to comply with the stated demands.

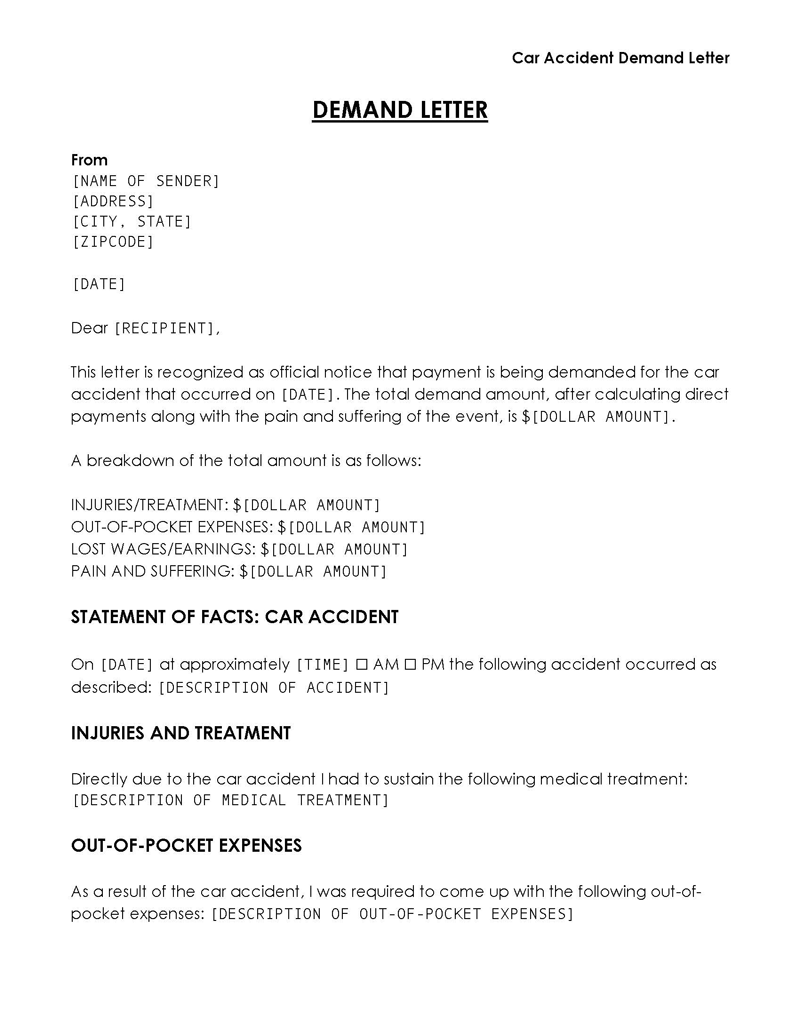

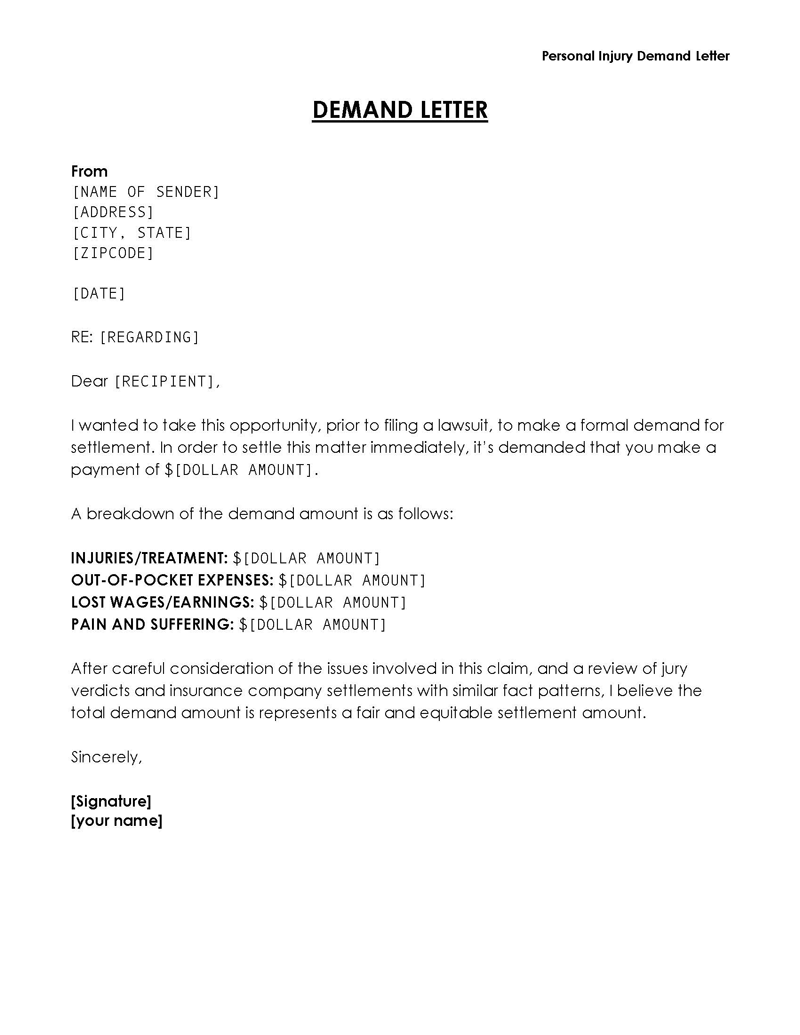

In Personal Injury Cases

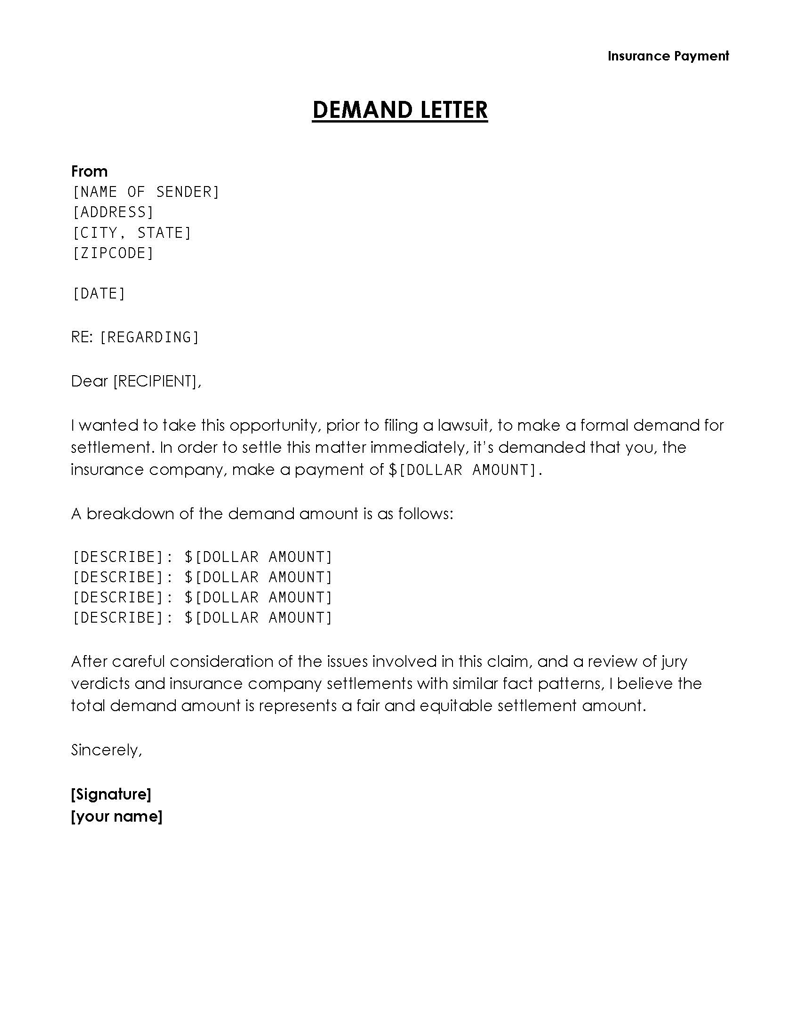

In personal injury claims, initiating the settlement negotiation process often involves sending it to the responsible party’s insurance company. As the aggrieved party or victim, your objective is to present the facts surrounding the incident that caused your injury and request appropriate compensation.

Consequently, the letter should detail the accident, address liability, enumerate personal injuries, outline medical treatments, provide an itemized list of medical bills and lost income statements, and specify the desired settlement amount for the injury.

Reasons to Use It

Here are three primary reasons to utilize the letter:

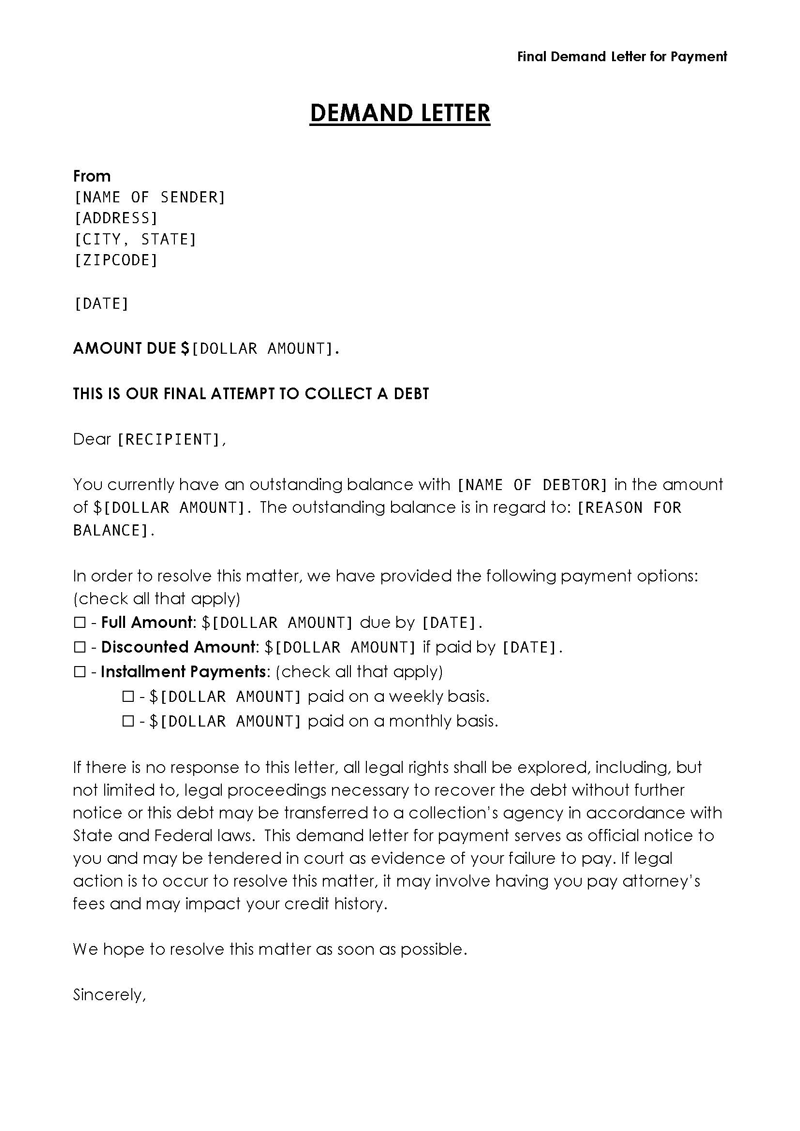

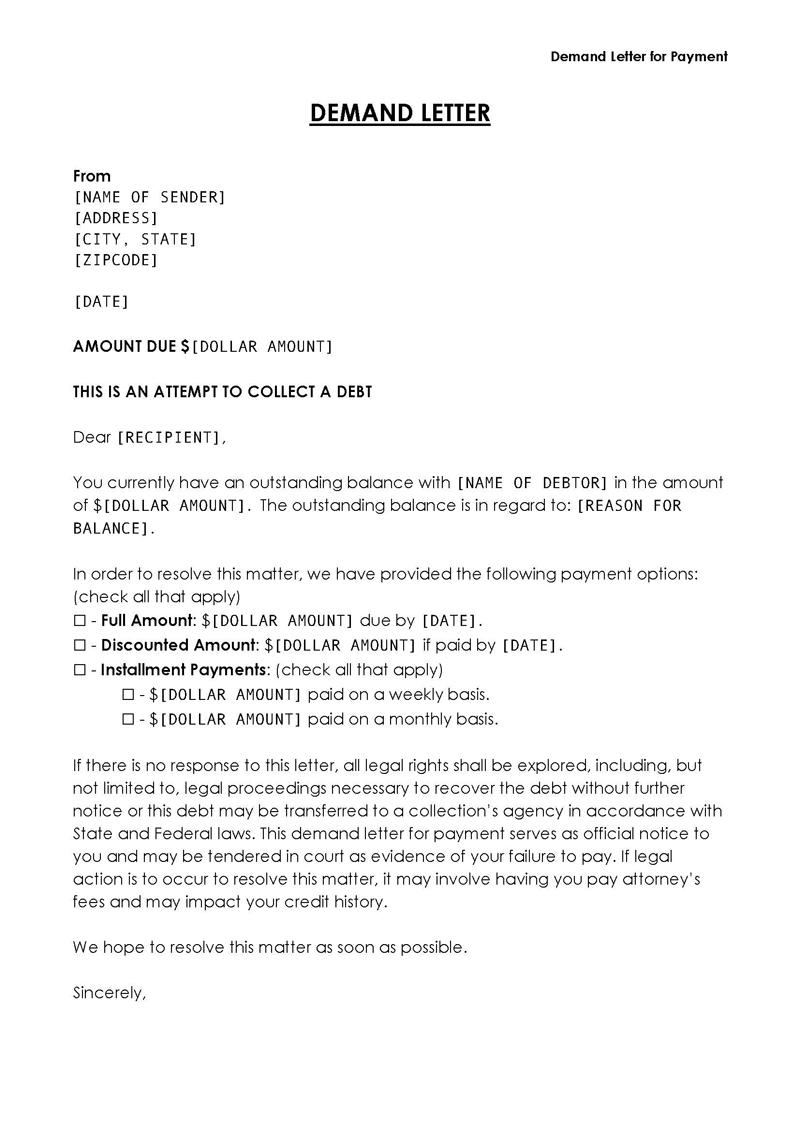

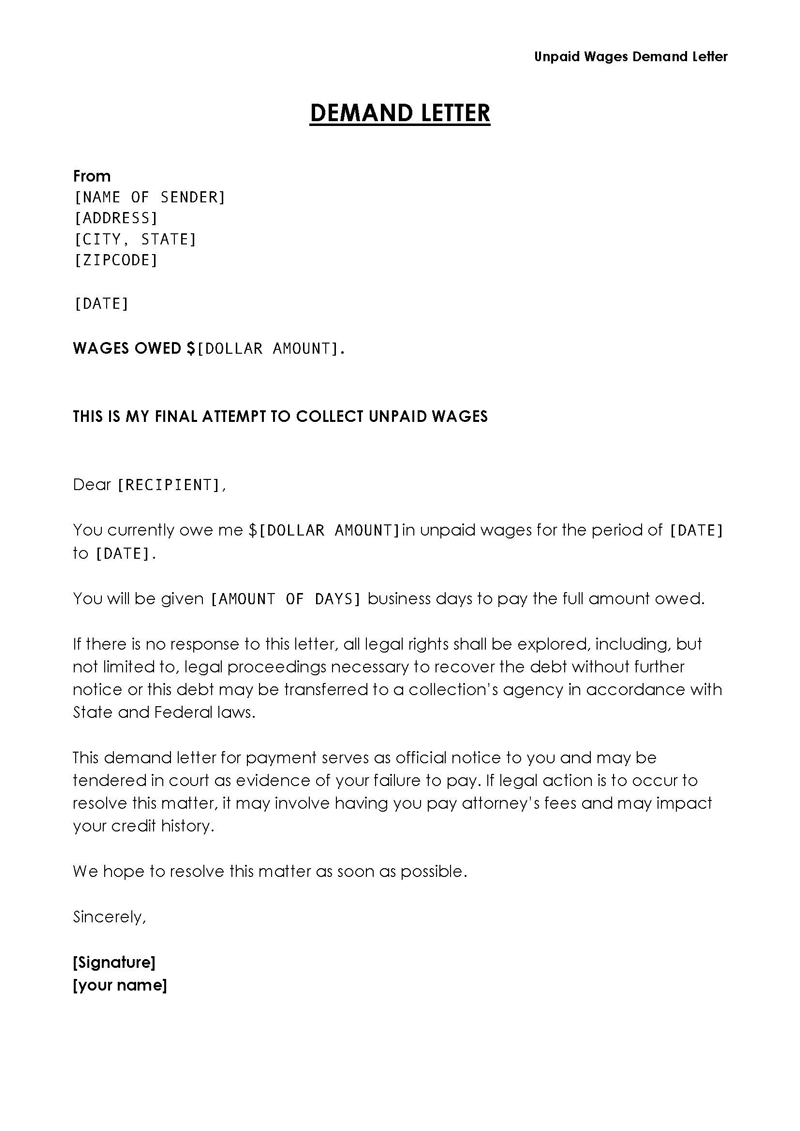

Unpaid debts

If someone owes you money and has not fulfilled their contractual obligation to repay you within the agreed-upon timeframe, it can serve as an initial step toward resolution. This approach can also be applied if the recipient engages in illicit activities that result in financial loss. In both cases, the letter can be used to demand repayment.

Insurance claims for personal injuries

In personal injury cases, these can be employed to request compensation from insurance companies. As the injured party, you initiate settlement negotiations by presenting the case’s facts, outlining the damages incurred, and specifying the compensation sought.

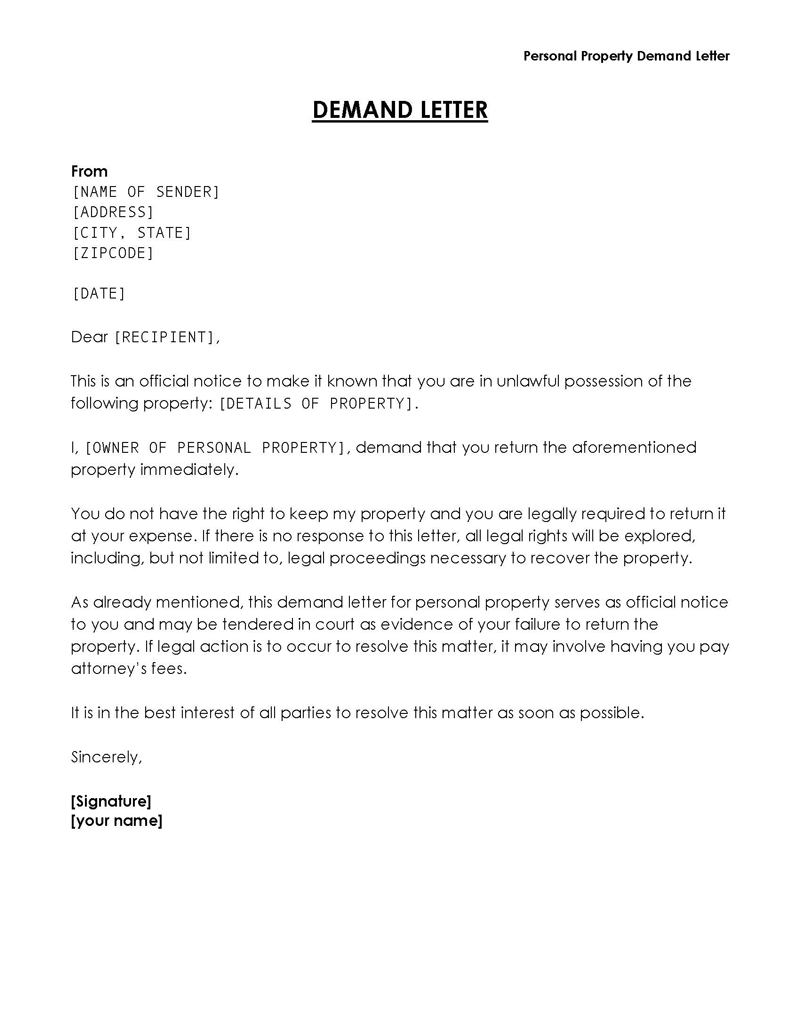

Unfulfilled obligations

If a party has agreed to complete a certain obligation but fails to do so, it can be used to compel them to fulfill their commitment. For example, if an electrical engineer does not finish wiring your house as agreed, a letter can be sent to enforce the completion of the task.

Benefits

Utilizing the letter before resorting to litigation offers several advantages. Here are some key benefits:

Encourages settlement

These can increase the likelihood of successful case settlements, reducing the need for small claims court appearances. Providing sufficient information allows the other party to understand the necessity of complying with your requests and the potential legal repercussions of not doing so. This approach promotes negotiation and settlement, increasing the chances of resolving the case amicably.

Case organization

It helps organize your case in preparation for potential court proceedings. Assembling facts and evidence strengthens your case and prepares you for litigation. The process of writing the letter ensures that all aspects of the case, including facts, laws, and evidence, are in order.

Saves time and money

They can save both time and money compared to litigation, which is generally more expensive and time-consuming. Although attorney fees may be incurred when drafting the letter, they are typically lower than the costs associated with court proceedings.

Demonstrates seriousness

When previous attempts at resolution through phone calls and emails have failed, sending it signals your seriousness and determination. This may prompt the other party to take the necessary actions to avoid potential legal consequences.

Acts as a sign of good faith

Sending the letter before resorting to litigation can be viewed as a sign of good faith by the court. This demonstrates your willingness to resolve the issue without burdening the court system. Sending the letter via certified mail provides evidence of your efforts, which may prove useful in court.

Caution

Demand Letter content can be used against you. In the event that your case goes to court, it may be read by the judge. It is essential to avoid using insults or threatening language and to refrain from making unreasonable compensation demands. Since the letter’s content can be used against you in court, consulting an attorney when drafting the letter is advisable to ensure you do not waive your rights or include unreasonable demands.

How does It Work?

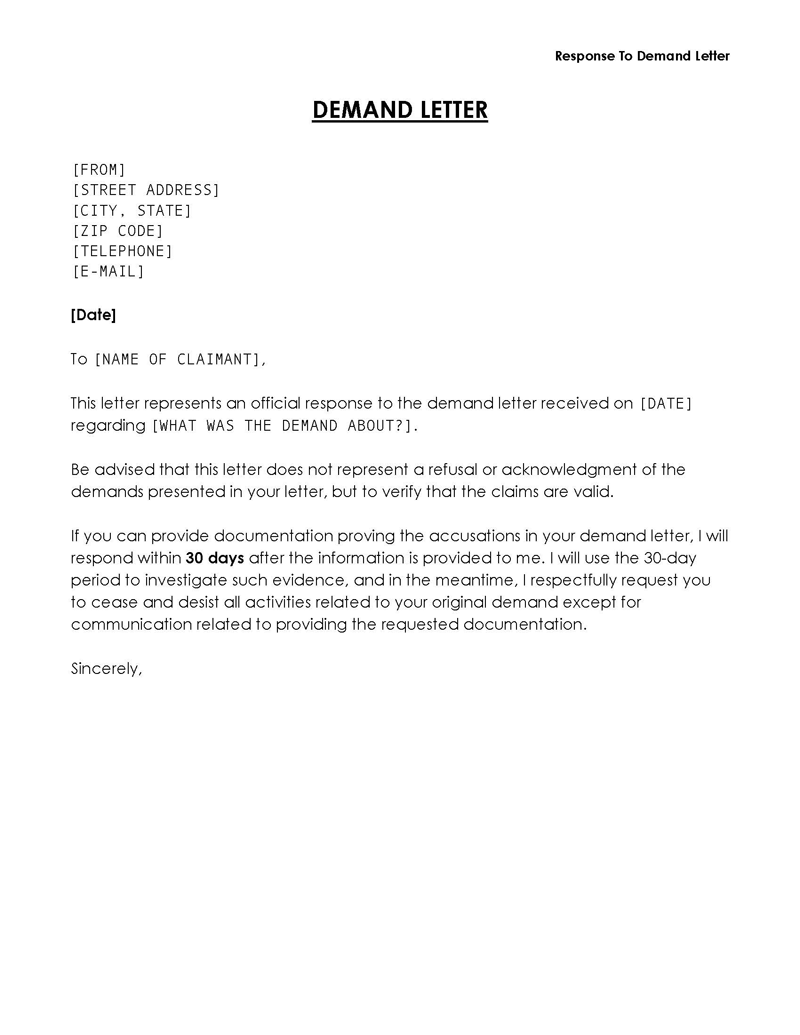

When initial attempts to resolve an issue through direct communication are unsuccessful, sending it serves as the next step before pursuing legal action. The letter informs the recipient of the issue and gives them the opportunity to address it before escalating to court proceedings.

Whether drafted by yourself or with the assistance of a lawyer, the letter serves as a reminder of the recipient’s obligations. The letter should be sent via certified mail, include instructions for resolving the issue, and specify a deadline. In response, the recipient may either comply with the demands, deny the claims, or ignore the letter.

If the recipient denies the claims or fails to respond, you, as the aggrieved party, may proceed with legal action to resolve the issue.

note

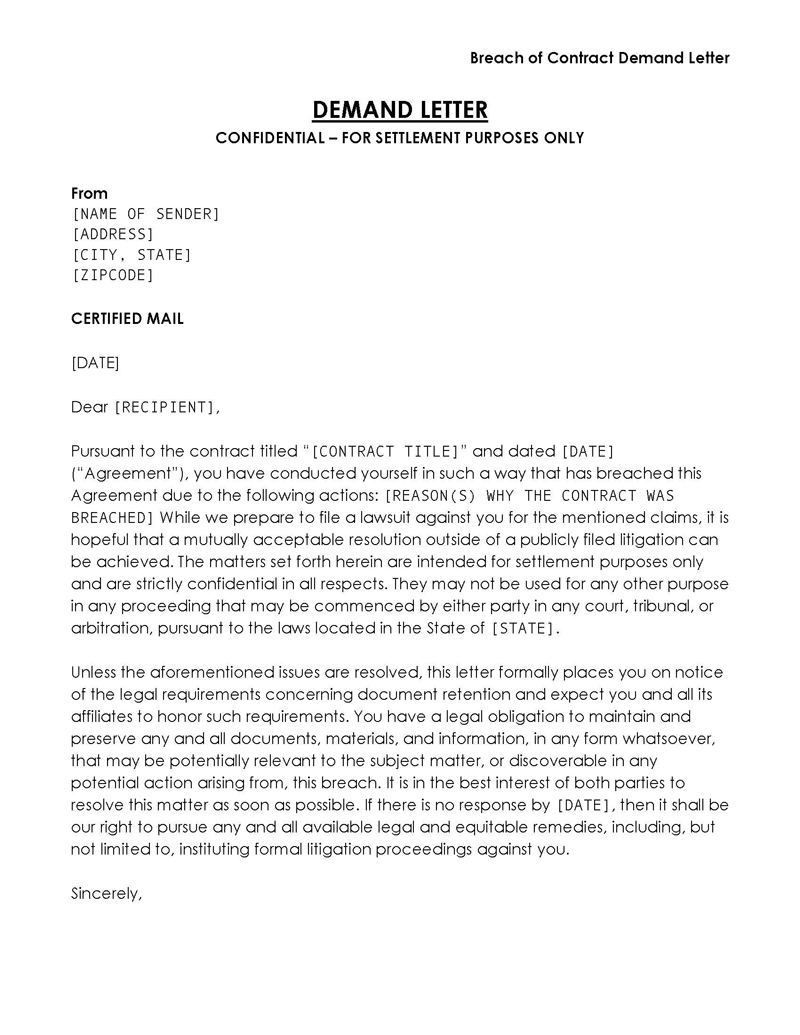

Money Owed vs. Breach of Contract. Demand letters for money owed are designed to request payment of debts or outstanding balances. They should detail the amount due, and any accrued penalties or interest, and accept payment plans if applicable. Conversely, breach of contract letters are sent when a party has violated the terms and conditions of an agreement. In this case, the letter should outline how the other party breached the contract and the actions required to rectify the situation or face potential consequences.

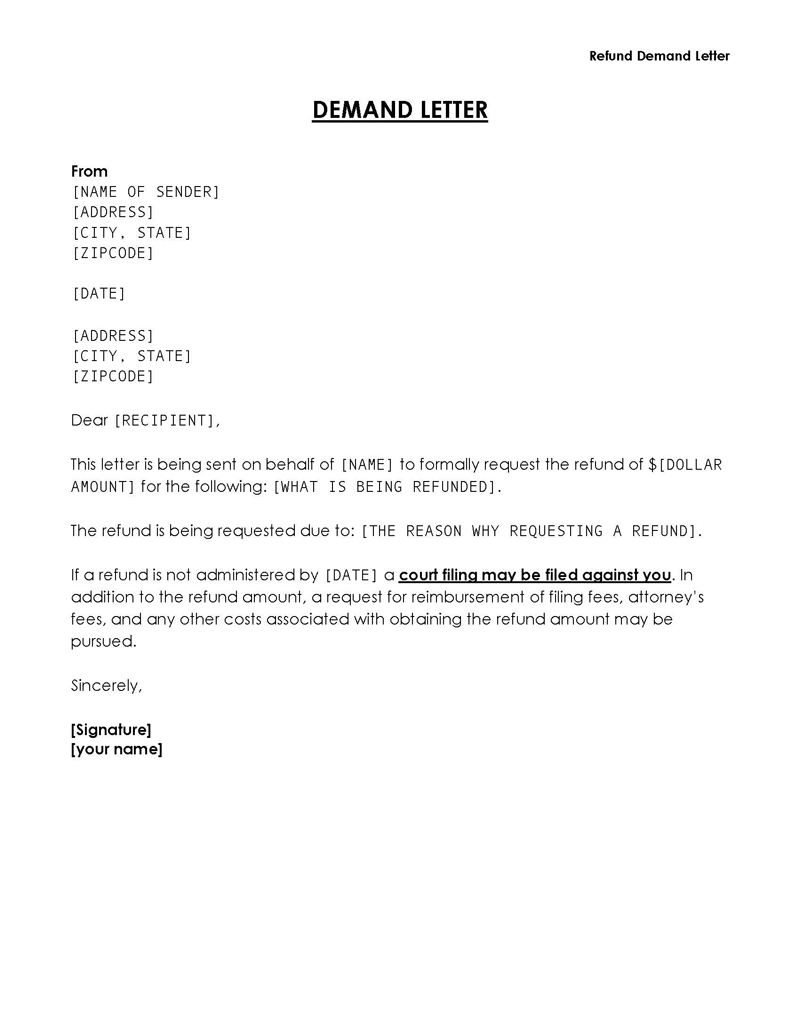

How to Write

To write an effective letter that improves the likelihood of achieving your desired outcome, follow these steps:

- State the purpose of the letter: Clearly state your intent in the opening paragraph. For example, “I am writing this letter to request payment of the outstanding balance of $2,000 for services rendered on [date].”

- Identify the parties involved: Include your name and contact information, as well as the recipient’s name and address.

- Specify the date and time of the grievance: Mention the date and time when the issue occurred, providing a brief explanation. For example, “On [date], the agreed-upon deadline for payment passed without any communication from you.”

- Describe damages: Detail any damages you have incurred due to the grievance, using specific figures and evidence where possible. For example, “As a result of your late payment, I have incurred a $100 late fee from my bank.”

- Present the facts: Outline the facts of the case, including any prior attempts to resolve the issue, unanswered communication, and any inappropriate behavior by the opponent.

- Make your demand: Clearly state your demand, support it with evidence, and keep it reasonable. For example, “I am requesting payment of the outstanding balance of $2,000, plus the $100 late fee, for a total of $2,100.”

- Set a deadline: Provide a specific deadline for the recipient’s response, typically one to two weeks. For example, “I expect to receive payment no later than [date].”

- Express your willingness to negotiate: Indicate that you are open to negotiation and settlement to resolve the issue amicably, avoiding court fees, attorney fees, and time loss. For example, “I am willing to discuss a reasonable payment plan or other solutions to resolve this matter without resorting to legal action.”

- Outline the consequences of non-compliance: State the potential consequences if the recipient fails to meet your demands, emphasizing your readiness to take legal action if necessary. For example, “If I do not receive payment by the specified deadline, I will have no choice but to pursue legal remedies to recover the amount owed.”

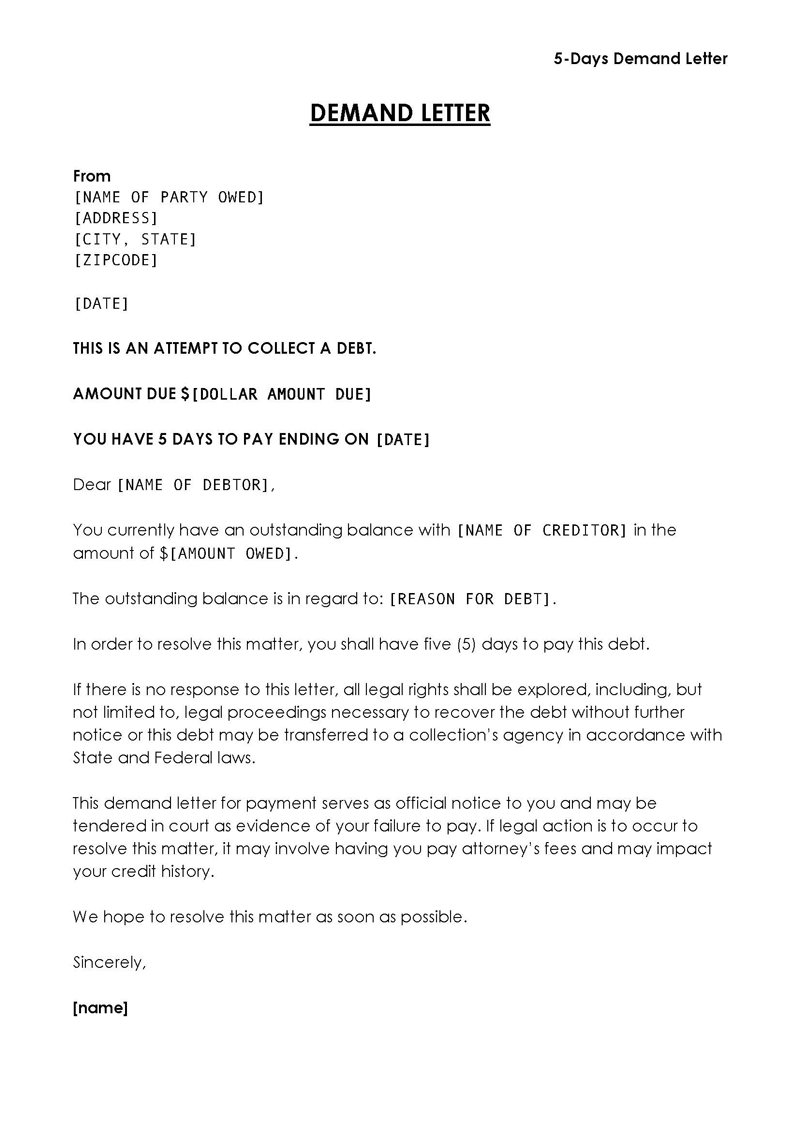

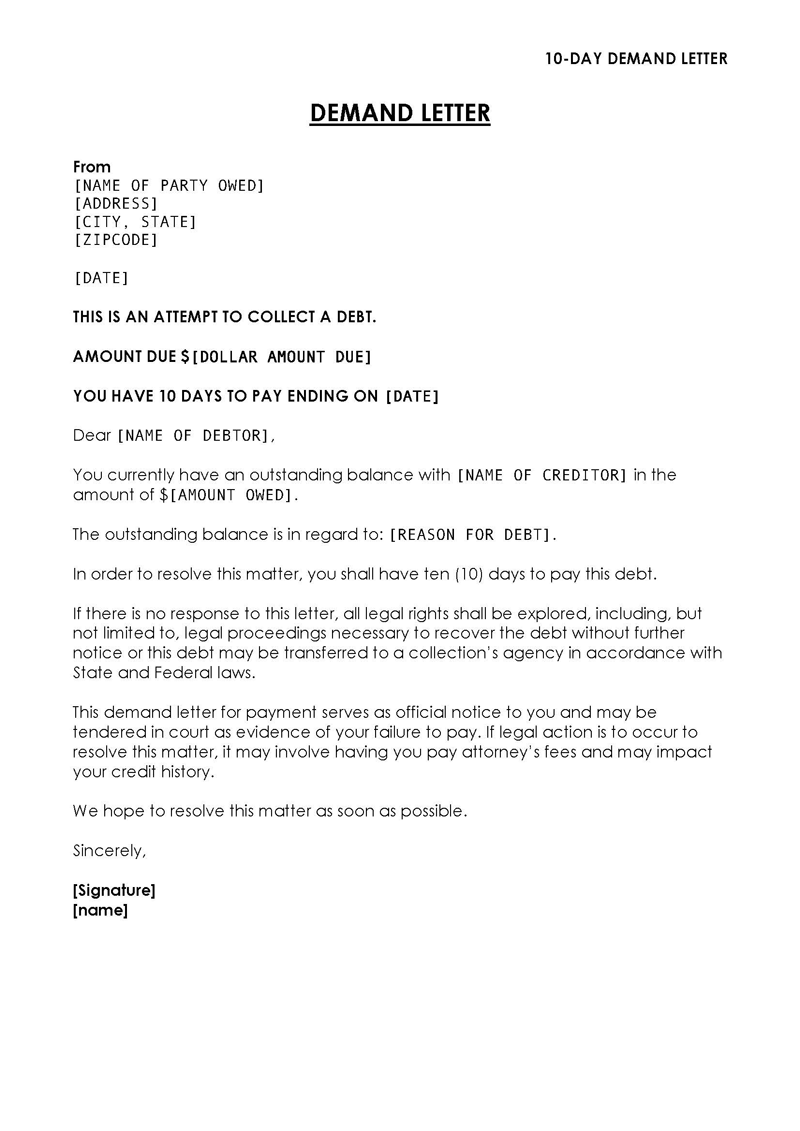

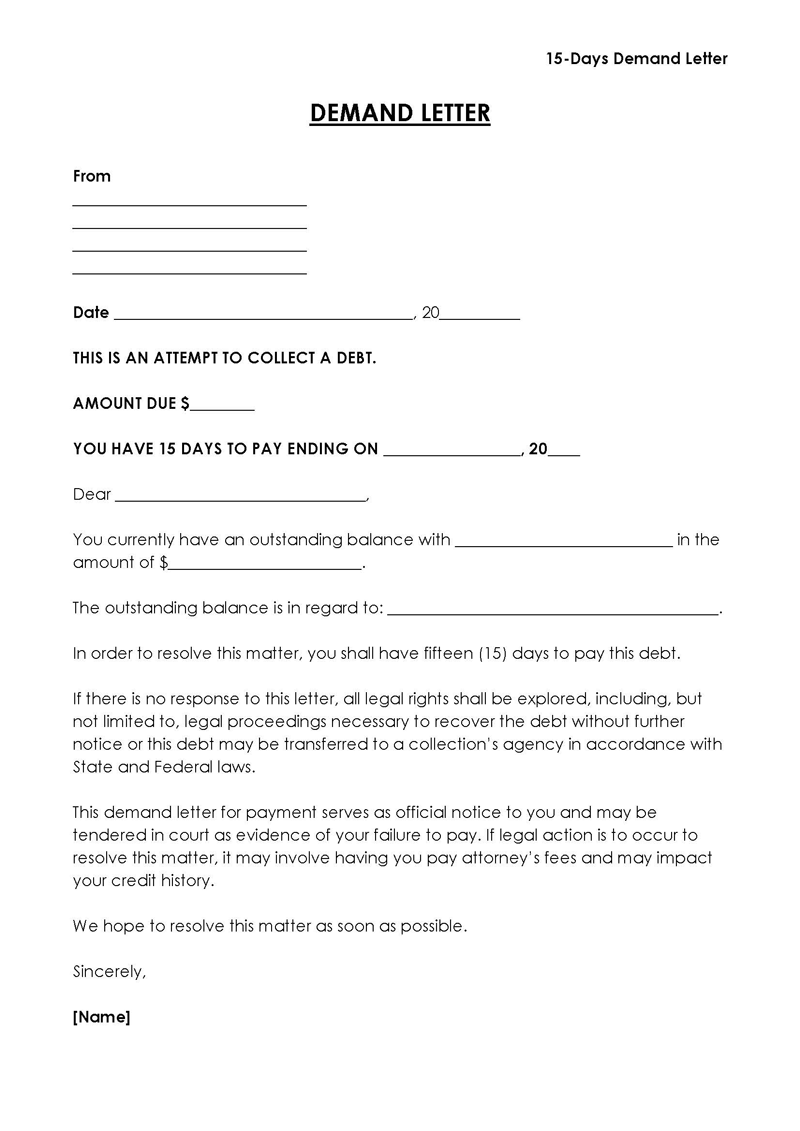

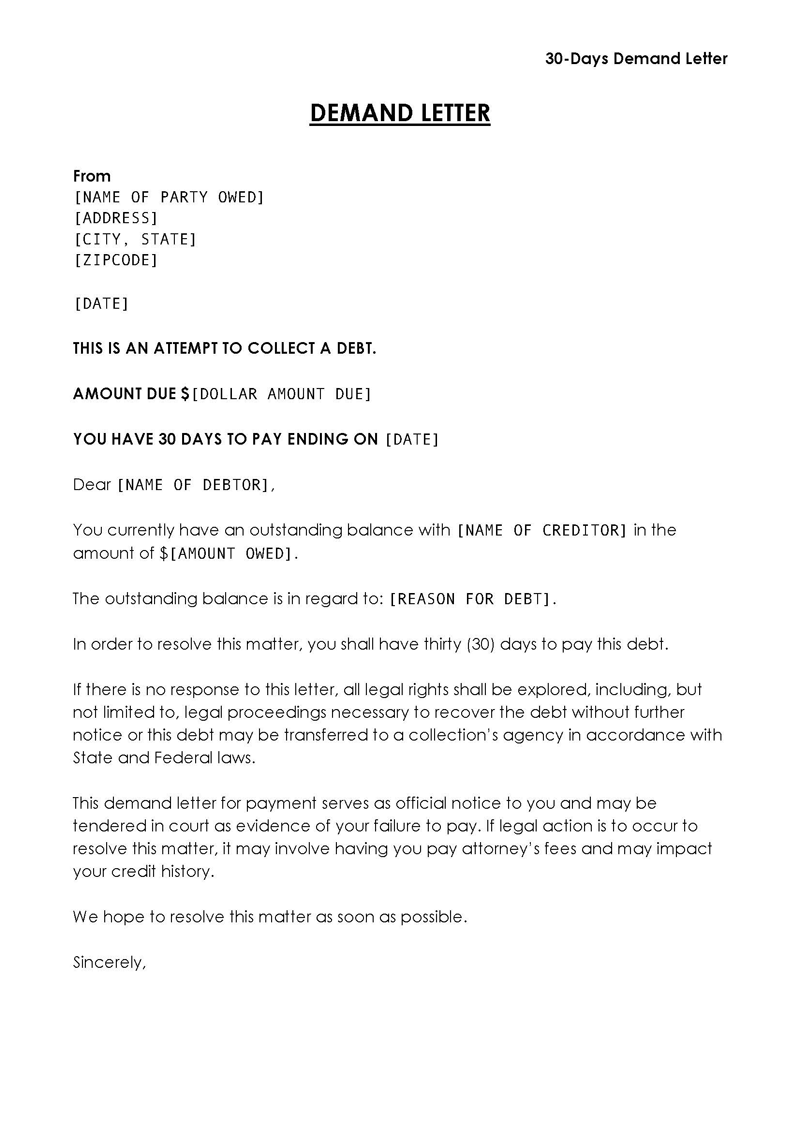

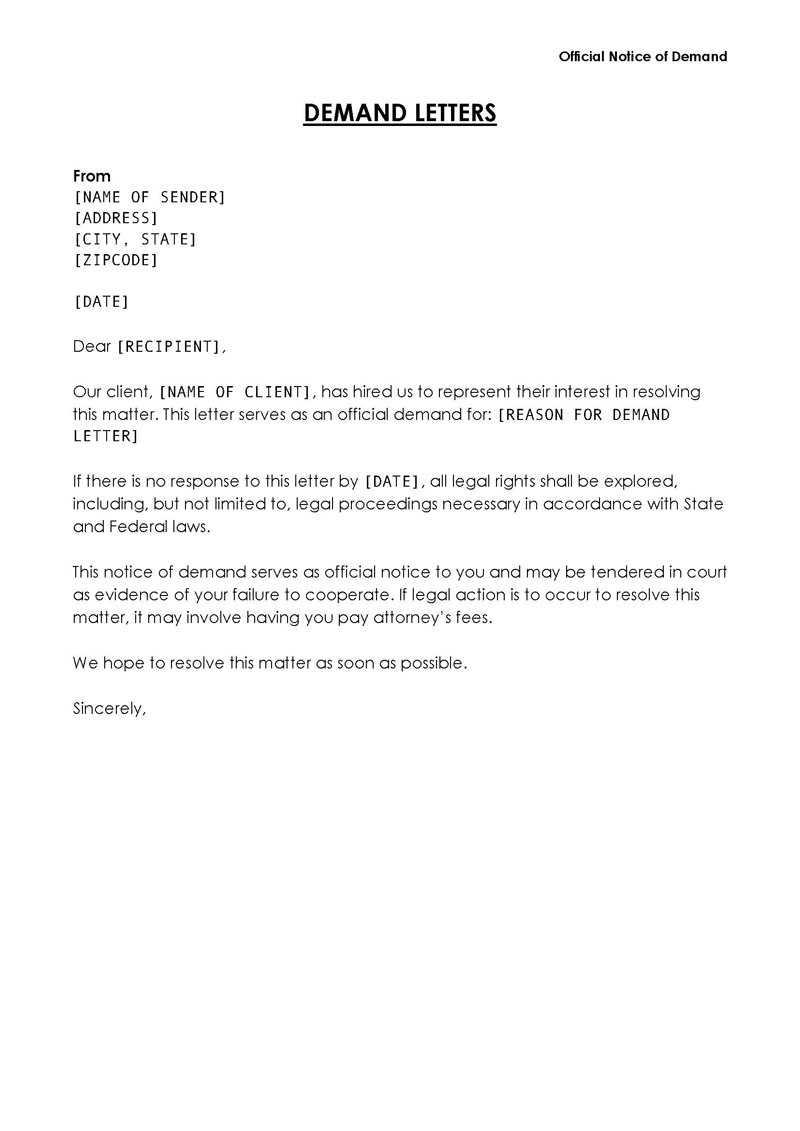

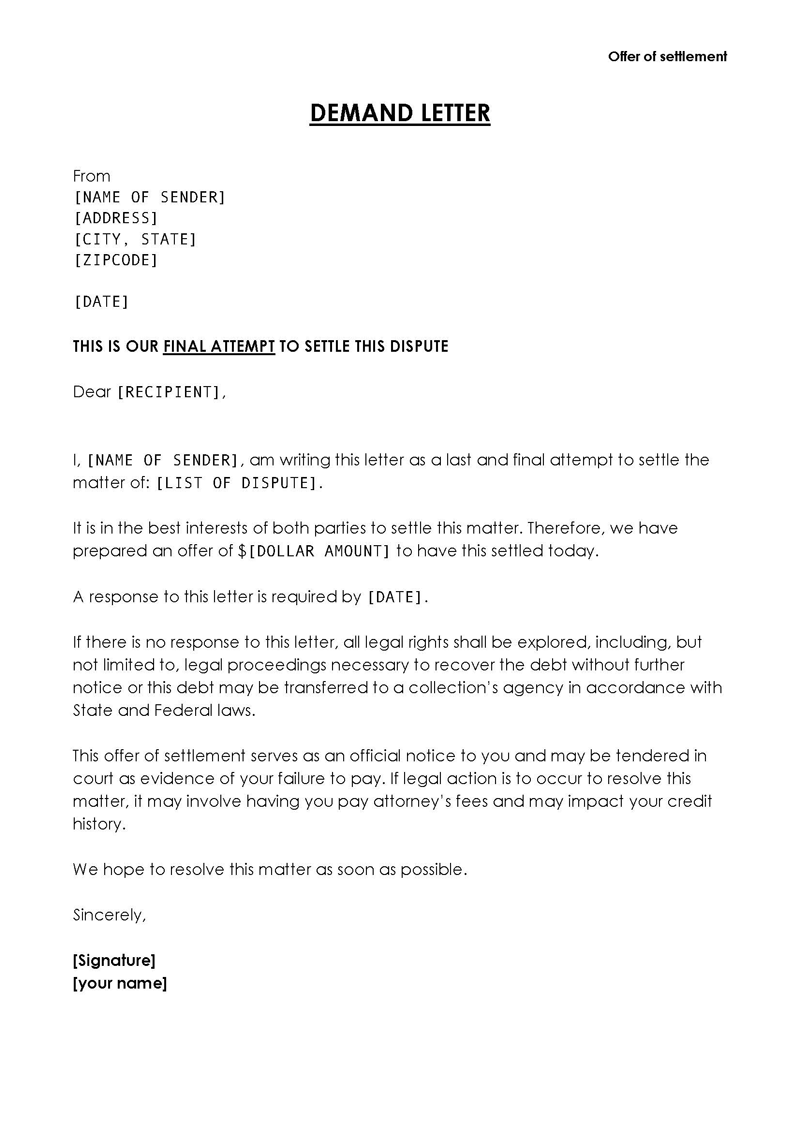

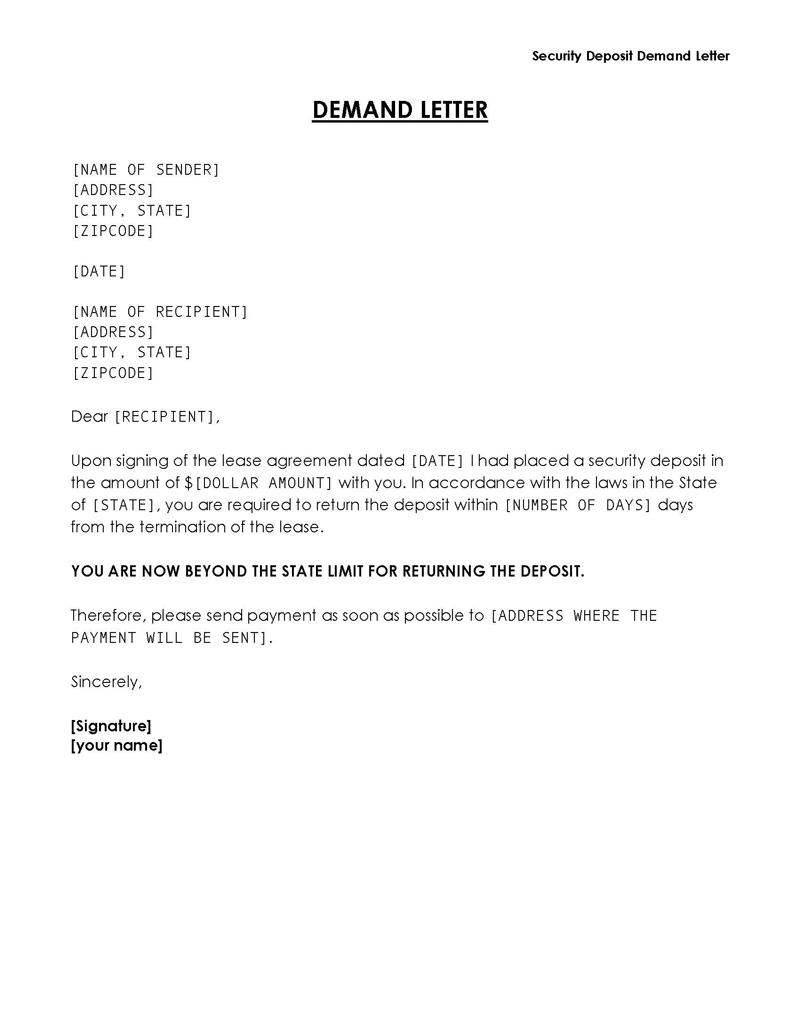

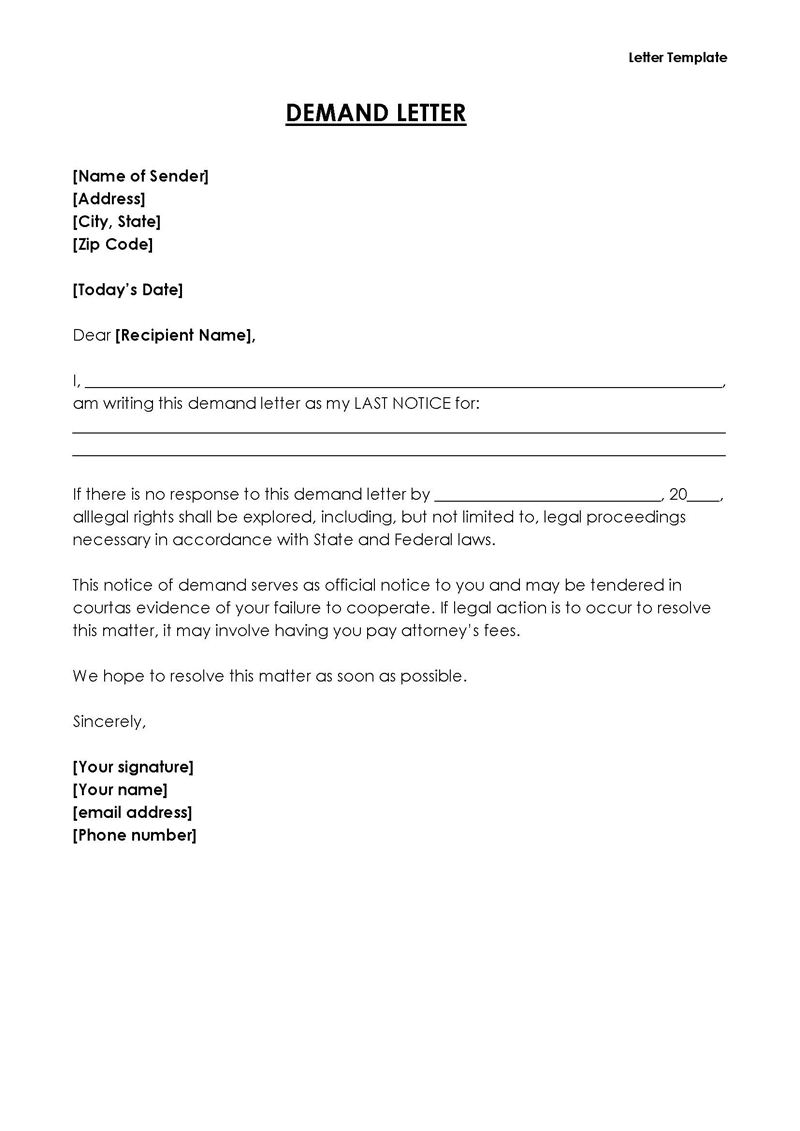

Letter Template

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Address]

[City, State, Zip Code]

Dear [Recipient’s Name],

Subject: Demand for [Specify the Demand, e.g., Payment of Unpaid Debt, Compensation for Damages]

I am writing to formally demand [specific action, e.g., the immediate payment of the unpaid debt, compensation for damages incurred]. Despite previous attempts to resolve this matter amicably, I have yet to receive [payment/a satisfactory response/compensation] for [briefly describe the issue, e.g., services rendered on date, damages from an incident].

As per our agreement [mention any relevant contract, invoice, or verbal agreement and the date], it was clearly stated that [briefly outline the terms that have been breached or not fulfilled]. To date, this obligation has not been met, which has resulted in [describe the impact, e.g., financial loss, personal inconvenience, damage to property].

I have attached copies of [list any relevant documents, e.g., contracts, invoices, previous correspondence] to this letter as evidence of the aforementioned claims and to remind you of the commitment that was made.

To avoid further action, I require [specify the demand, e.g., full payment of the outstanding amount of $X, compensation for the specified damages] to be made by [specific deadline, typically 15-30 days from the date of the letter]. Payment should be made [specify the preferred method of payment, e.g., by check, bank transfer] to the following [account/details].

Please understand that this letter serves as a final demand, and failure to comply with the terms outlined above will leave me with no choice but to pursue all available legal remedies, including filing a lawsuit to recover the amount due, plus any additional damages and legal fees incurred.

I hope to resolve this matter swiftly and amicably, without the need for further legal action. Please contact me directly at [Your Phone Number] or [Your Email Address] to confirm receipt of this letter and to discuss the steps you will take to resolve this issue.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Signature, if sending a hard copy]

[Your Title/Position, if applicable]

Letter Sample

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Address]

[City, State, ZIP Code]

Re: Demand for Payment of Outstanding Balance

Dear [Recipient’s Name],

I am writing this letter to formally request payment for the outstanding balance of $2,000 related to the services I provided on [date]. As per our agreement, the payment was due within 30 days after the completion of the project, which was on [date]. Despite multiple attempts to contact you via phone and email, I have received no response.

As a result of your late payment, I have incurred a $100 late fee from my bank, in addition to the loss of income that has negatively impacted my ability to meet my financial obligations. The total amount due, including the late fee, is $2,100.

To date, I have made three phone calls and sent two emails requesting payment, with no response from you. This lack of communication is not only unprofessional but also in breach of our contract. I have documented all my attempts to contact you, which I am prepared to present in court if necessary.

I kindly request payment of the outstanding balance of $2,100 no later than [deadline date]. I am willing to discuss a reasonable payment plan or other solutions to resolve this matter amicably and avoid resorting to legal action. However, if I do not receive payment by the specified deadline, I will have no choice but to pursue legal remedies to recover the amount owed.

Please understand that my preference is to resolve this issue outside of court through negotiation and settlement. I believe that reaching an agreement will save both of us the time, expense, and stress associated with litigation. However, I am fully prepared to take legal action if necessary to protect my interests and recover the money owed to me.

If you have any questions or concerns, please do not hesitate to contact me at [your phone number] or [your email address] so we can discuss the matter and work towards a resolution. I hope that we can resolve this issue promptly and amicably, allowing us to move forward in a professional manner.

Please note that this letter serves as a formal demand for payment and should be treated as such. I kindly request that you confirm receipt of this letter and your intentions regarding the payment by [date], so we can avoid further escalation of this matter.

Thank you for your attention to this matter, and I look forward to your prompt response.

Sincerely,

[Your Name]

Enclosures: [List any relevant documents enclosed, such as a copy of the contract, invoices, or records of previous attempts to collect payment.

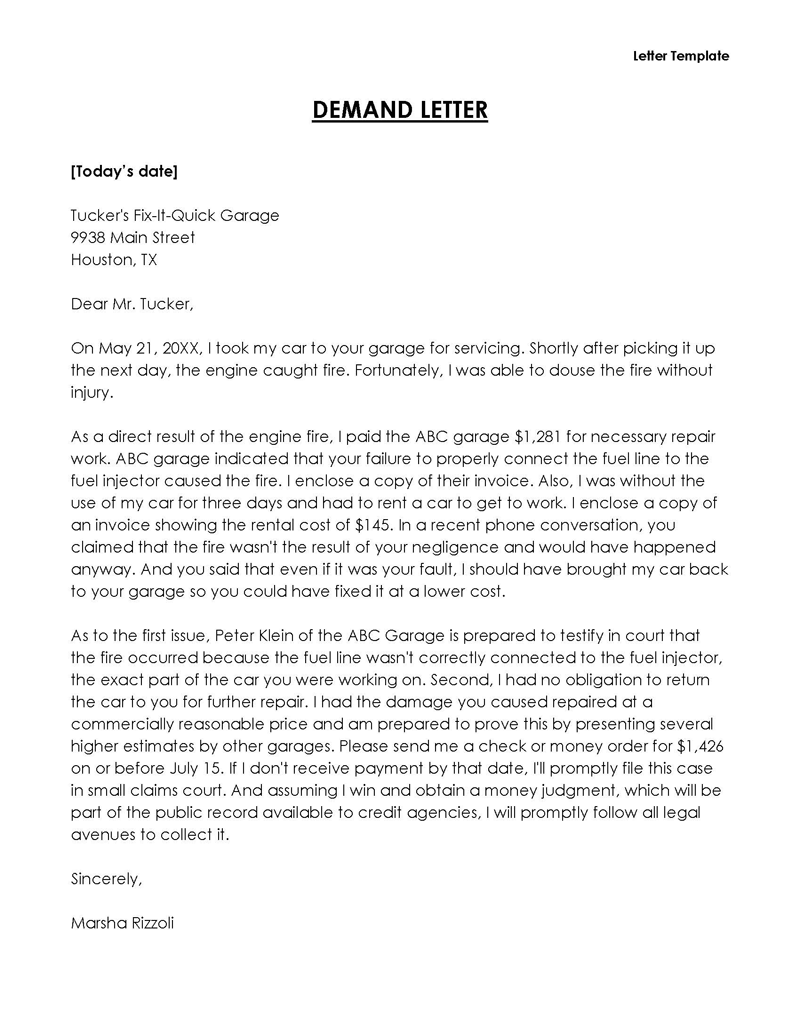

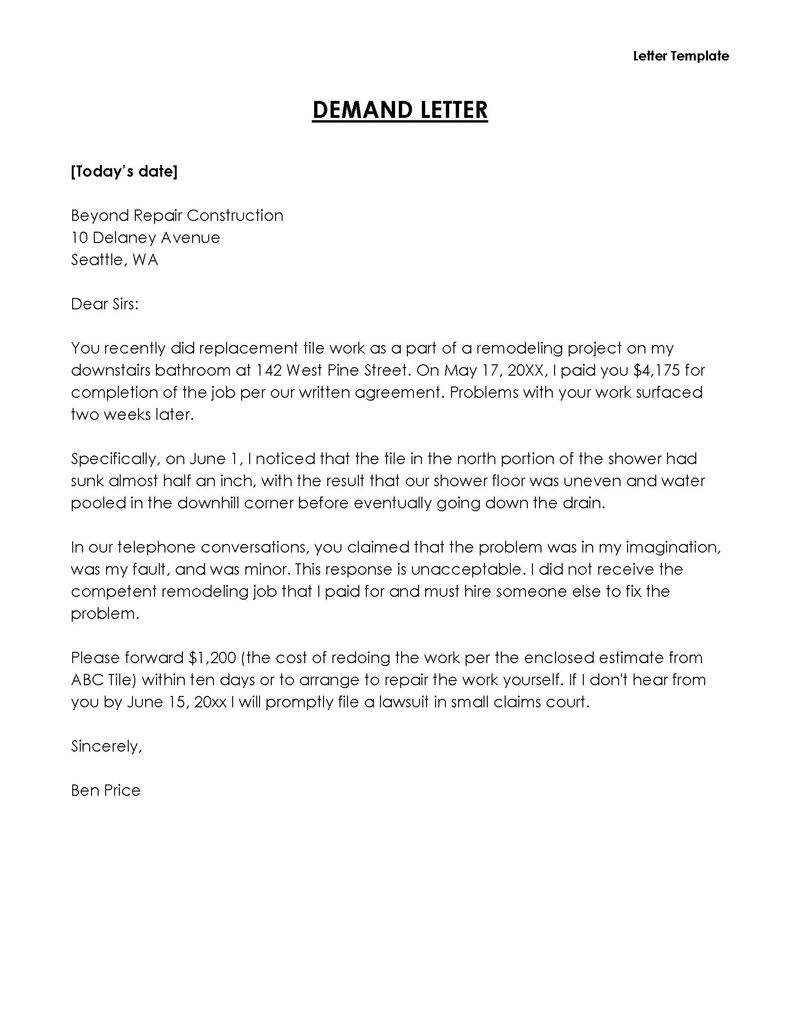

Sample Demand Letter

Dear Mr. Thompson,

Subject: Demand for Payment of Unpaid Invoice #12345

I hope this letter finds you well. I am writing to address an unresolved issue regarding invoice #12345, dated August 15, 20XX, for graphic design services rendered to Innovative Designs Inc. Despite multiple email reminders and phone calls, the outstanding payment of $2,500 remains unpaid, which is now 45 days overdue.

As per our signed contract dated July 1, 20XX, it was agreed that payment for completed projects would be made within 30 days of invoice submission. The services, which included the design of your fall marketing campaign materials, were delivered on time and approved by your team on August 14, 20XX. I have attached a copy of the signed contract and the invoice in question for your reference.

The delay in payment has placed me in a difficult financial position, as I rely on timely payments to manage my business expenses and personal obligations. I value our professional relationship and would prefer to resolve this matter amicably without resorting to legal action.

Therefore, I kindly request that the full payment of $2,500 be made by October 15, 20XX. Payment can be made via bank transfer to the account details provided on the invoice, or a check can be mailed to the address listed above.

Please consider this letter as a final reminder to settle the outstanding payment. Failure to address this payment by the specified deadline may compel me to take further action, including but not limited to legal proceedings to recover the debt, along with any additional costs and interest incurred due to the delay.

I am hopeful that we can resolve this matter promptly and continue our business relationship on positive terms. Please do not hesitate to contact me directly at 555-234-5678 or via email at jordan.lee@email.com to discuss this matter further or to confirm the payment has been processed.

Thank you for your immediate attention to this issue. I look forward to your swift response and resolution of this matter.

Sincerely,

Jordan Lee

Freelance Graphic Designer

Key Takeaways

This demand for payment letter is effective due to several key attributes:

Clear Subject and Purpose: The letter immediately specifies its purpose with a clear subject line about the demand for payment related to an unpaid invoice. This direct approach ensures the recipient understands the issue at hand from the outset.

Professional Tone: Despite the underlying frustration due to delayed payment, the letter maintains a respectful and professional tone throughout. This strategy encourages a constructive response and preserves the potential for future professional interactions.

Contractual Reference: Citing the signed contract and agreed payment terms lends authority to the demand. The mention of the service delivery and approval date provides evidence of fulfilled obligations, strengthening the position of the sender.

Documentation and Evidence: Including attachments of the contract and invoice serves to substantiate the claim and provides the recipient with all necessary details to verify and process the payment, streamlining resolution.

Specific Call to Action: The letter clearly outlines the desired outcome (payment by a specific date) and details the methods by which the payment can be made. This guidance removes any ambiguity about how the recipient can resolve the issue.

Balance of Amicability and Firmness: Expressing a preference for an amicable resolution while simultaneously warning of potential legal action strikes a balance between diplomacy and assertiveness. This dual approach underscores the seriousness of the situation while leaving room for a positive resolution.

Open Lines of Communication: Offering direct contact information and inviting further discussion demonstrates openness to dialogue, which can facilitate a swift and amicable resolution to the payment issue.

Overall, the letter’s effectiveness is rooted in its combination of clarity, professionalism, and the strategic balance between seeking a cooperative resolution and clearly outlining the consequences of non-compliance, making it a compelling communication tool in a situation of overdue payment.

Free Downloads

Tips for You

Here are some tips to keep in mind while writing it:

Be polite

Ensure that you maintain a polite tone in your letter. Avoid using angry words or threatening language, as this can hinder the resolution process. Staying calm and polite will make you appear more confident in your position.

Type your letter

Use a computer to type your letter, as this will make it appear more professional and neat. If you don’t have a computer, consider using one at a public library.

Make and keep copies

Before sending the letter, make and keep copies for your records. If you use certified mail, request a return receipt. In case you use email, ensure that you don’t delete it. Having a copy of the letter is essential for future reference or as evidence if needed.

Be reasonable

When making your demands, ensure that they are realistic and reasonable. Reasonable demands backed up by honest facts are more likely to be resolved quickly compared to unreasonable requests.

Use certified mail

Send by using certified mail with a return receipt. This will provide proof that the recipient received the letter, which can be useful if the matter ends up in small claims court. If you use email for communication, ensure that you receive a response from the recipient; otherwise, it is better to use certified mail.

Maintain a serious tone

While it is essential to remain polite, also maintain a serious tone in your letter. Make it clear that you are considering taking legal action if the recipient does not meet your demands. However, avoid making threats. Being professional will effectively convey your message and demonstrate the seriousness of the matter.

Provide clear evidence and documentation

When stating the facts and presenting your demands, provide clear evidence and documentation to support your claims. This can include invoices, contracts, or other relevant documents. Providing solid evidence will make your case stronger and more likely to be resolved in your favor.

Offer a solution or compromise

While stating your demands, also offer a solution or compromise that could resolve the issue amicably. This shows your willingness to work together to reach a mutually beneficial resolution.

Proofread your letter

Before sending, proofread it carefully for any errors or inconsistencies. A well-written, error-free letter will appear more professional and enhance the credibility of your claims.

Consult an attorney if necessary

If you are uncertain about the content or the legal implications of your case, consult an attorney for guidance. They can help you draft an effective letter and provide valuable legal advice on how to proceed with your case.

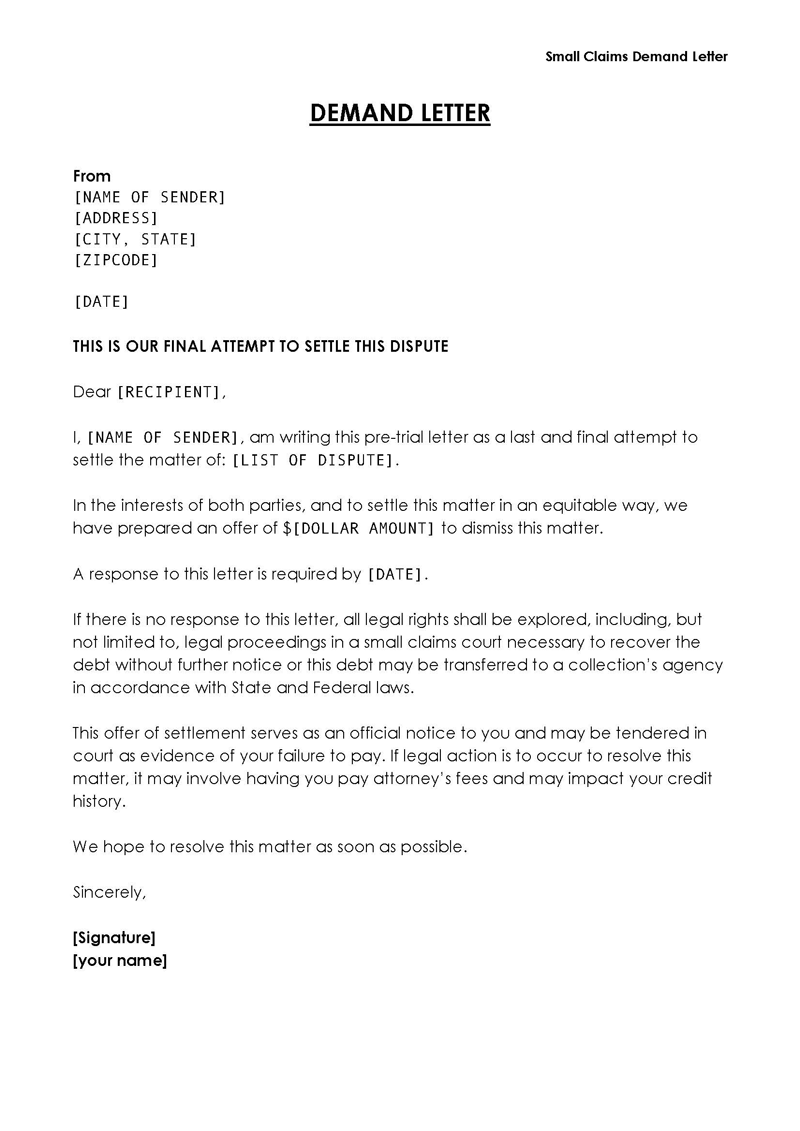

Small Claim Limits

Small claim limits ($) refer to the amount owed that is less than the State minimum, usually $5,000 to $10,000. If this is the case, you will likely go through the small claims court to resolve the issue and get your money back. Another way to get your payment is to place a lien or levy on the assets of the individual who owes you money. This means that you can seize their property if they fail to pay.

The table below highlights the applicable statute for each state:

| States | States |

| Alabama (§ 12-12-31) | Nebraska (§ 25-2802, Small Claims) |

| Alaska (§ 22.15.040) | Nevada (§ 73.010) |

| Arizona (§ 22-503) | New Hampshire (§ 503-1) |

| Arkansas (“Guide to Small Claims Court”) | New Jersey (New Jersey Judiciary Small Claims”) |

| California (§ 116.210-116.270) | New Mexico (§ 34-8a-3) |

| Colorado (§ 13-6-403) | New York (NY Small Claims) |

| Connecticut (§ 51-15(d)) | North Carolina (§ 7A-210) |

| Delaware (§ 9301) | North Dakota (§ 27-08.1-01) |

| Florida (Rule 7.010(b)) | Ohio (§ 1925.02(A)(1)) |

| Georgia (§ 15-10-2) | Oklahoma (§ 1751) |

| Hawaii (§ 633-27, “Your Guide to Small Claims Court”) | Oregon (§ 55.011-55.140) |

| Idaho (§ 1-2208(1)(a)) | Pennsylvania (“Bringing Suit Before a Magisterial District Judge”) |

| Illinois (Rule 281) | Rhode Island (§ 10-16-1) |

| Indiana (Rule 8(c), Small Claims Manual (2022)) | South Carolina (§ 22-3-10) |

| Iowa (§ 631.1) | South Dakota (§ 15-39-45.1) |

| Kansas (§ 61-2703(a)) | Tennessee (§ 16-15-501(d)) |

| Kentucky (§ 24A.230) | Texas (§ 26.042) |

| Louisiana (§ 5202) | Utah (§ 78A-8-102) |

| Maine (§ 7482) | Vermont (“A Guide to Small Claims Proceedings in Vermont”) |

| Maryland (§ 4-405) | Virginia (§ 16.1-122.2) |

| Massachusetts (§ 218-21) | Washington (§ 12.40.010) |

| Michigan (§ 600.8401) | Washington D.C. (§ 11–1321) |

| Minnesota (§ 491A.01) | West Virginia (§ 50-2-1) |

| Mississippi (§ 9-11-9) | Wisconsin (§ 799.01(d)) |

| Missouri (Missouri Small Claims Court Handbook”) | Wyoming (§ 1-21-201) |

| Montana (§ 25-35-502) |

Legal Considerations

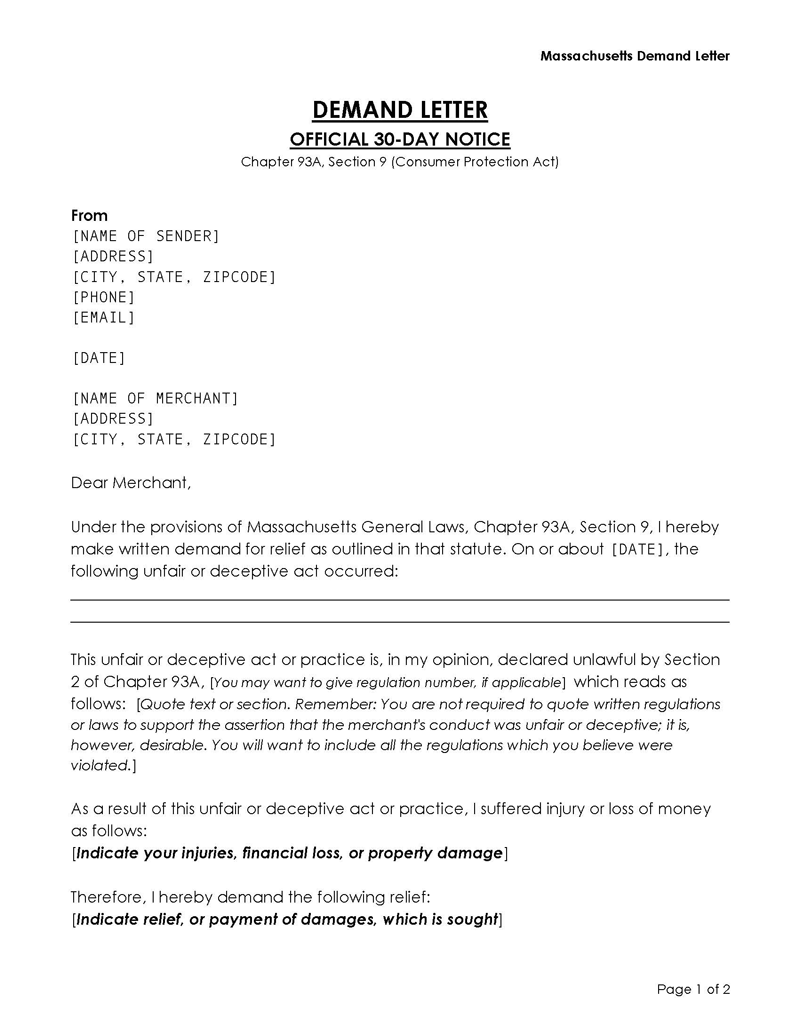

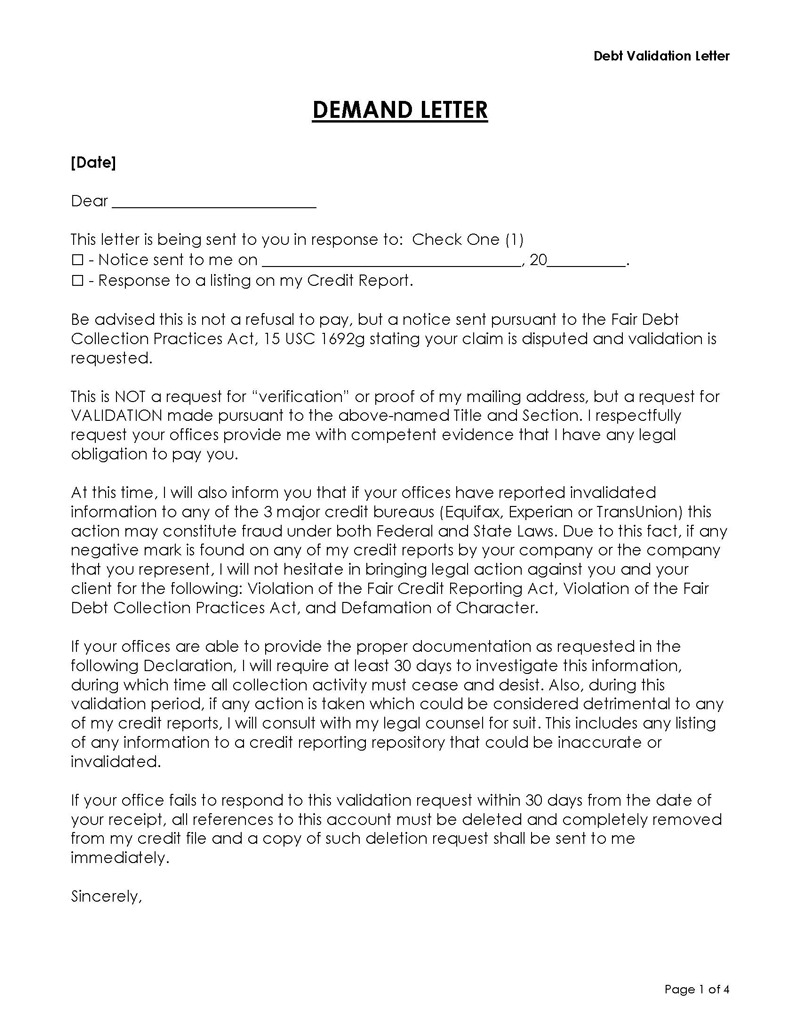

When it comes to legal considerations, these letters may fall under the Fair Debt Collection Practices Act (FDCPA), while others may be subject to specific state laws in the United States. The FDCPA governs the conduct of third-party debt collectors, setting guidelines and limitations on their behavior to protect consumers from harassment, threats, and other inappropriate collection tactics.

State laws also play a role in debt collection practices, allowing debtors (parties that owe money) to file for damages if the debt collection rules are not observed. Legal counsel should be involved when creditors attempt to collect overdue debts, particularly if the debtor is uncooperative or the debt is disputed.

It is important to note that dishonest collection agencies may use schemes that demand immediate payment, even if they are not legally authorized to do so. State laws protect unsuspecting debtors from such scams, ensuring they are not coerced into sending payments in error. As a result, it is crucial to consult with an attorney to ensure that it complies with both the FDCPA and any relevant state laws. Doing so will help you avoid legal pitfalls and increase the likelihood of successfully resolving the issue at hand.

What’s Next After Sending the Letter?

After you have sent these, there are three possible outcomes to expect:

The demand is fulfilled

The opposing party may decide to meet or fulfill your demands, accepting all your requests and taking the required action or making the payment specified in the letter.

A counter-offer is proposed

The recipient might make a counteroffer, indicating that they do not agree with all your demands but are willing to fulfill some of them while negotiating others. As the aggrieved party, you have the option to accept or refuse the counteroffer. You may also choose to send a counteroffer in response to their proposal until both parties reach a mutually satisfactory agreement.

The demand is rejected

In the worst-case scenario, it may be entirely rejected. The recipient may refuse to meet any of your requests, leaving you with no choice but to file a lawsuit to resolve the matter.

It’s essential to remain patient and be prepared for any of these outcomes. If negotiations are unsuccessful, consult with an attorney to discuss your legal options and determine the best course of action moving forward.

Frequently Asked Questions

A poorly written or inappropriate letter can hurt your case if the issue goes to court. If the letter contains threats, insults, or unreasonable demands, it could negatively impact your case. To avoid this, always consult with an attorney to ensure that it is professionally written and presents your case in the best possible light.

Demand letters, while not legally binding, carry significant weight in the dispute resolution process. They serve as a formal, written notice of your demands and your intent to take legal action if the recipient fails to fulfill them. Sending it can demonstrate to the court that you made a good-faith effort to resolve the issue before pursuing legal action.

There isn’t a strict format, but they should be clear, concise, and professional. The letter should include the purpose of the letter, the parties involved, the date and time of the grievance, a description of damages, facts supporting your claim, your specific demands, a deadline for the recipient to respond, and the consequences if the recipient fails to comply. Including all this information in a well-structured manner will make it more effective.

While it can be sent via email, it is generally recommended to send it via certified mail with a return receipt. This provides a more official means of communication and ensures that you have proof that the recipient received the letter. In some cases, sending via email might be appropriate, but you should always ensure you receive a response from the recipient, confirming they have received and read the letter. If you choose to send it via email, it is still a good idea to follow up with a hard copy sent by certified mail to reinforce the seriousness of the matter.

While it can be handwritten, it is generally not recommended. A typed letter is more professional, neater, and easier to read. Handwritten letters may appear less formal and less persuasive to the recipient. Typing your letter ensures that it looks professional and is more likely to be taken seriously by the recipient.

A demand letter is successful if it achieves the desired outcome, such as the recipient fulfilling your demands, proposing a reasonable counteroffer, or engaging in a negotiation to reach a settlement. The response you receive from the recipient will determine its success. If you do not receive a response within the given deadline or the recipient rejects your demands, you may need to consider further legal action.