It may not always be that a debt owed is repaid strictly in time. Some lenders often also take advantage to delay remitting the payments. In either case, you will usually have to draft a letter of demand for payment. This is a letter that, in its basic form, requests a lender to settle the associated dues.

Other than asking the recipient to settle some dues, the letter also specifies the courses of action that may be taken in the event of a complete default. It is drafted by a creditor and addressed to a debtor.

It also goes by other names like:

- Final demand for payment

- Demand letter of payment

- Demand letter

- Letter of demand

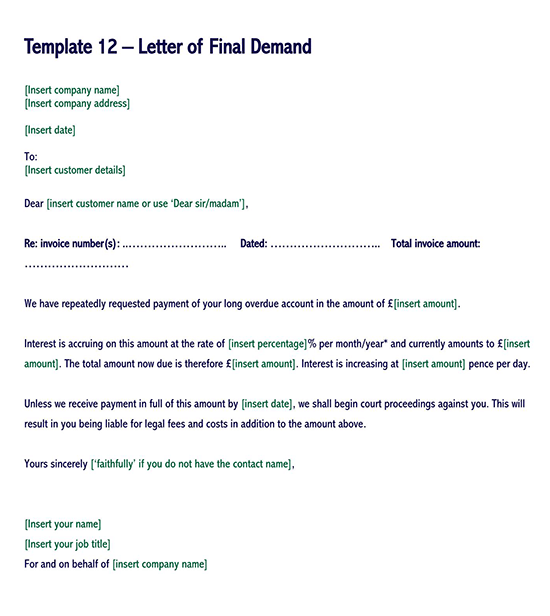

Sample Letters & Templates

When is a Demand Letter for Payment Required?

Not every situation requires one. Some payment issues may easily be rectified by simple phone calls, invoices, or ordinary letters of correspondence. Only those critical issues that are not able to be handled normally demand this letter.

They are:

Delayed payment

If the debtor does not refund the money owed within the stipulated timeframe, you may draft this letter principally as a reminder. In this role, it also serves to explain the various courses of action that may be taken if the debtor does not honor the obligation.

Complete defaults

Yet again, if the debtor completely defaults on making the stipulated payments, he may have to be summoned and asked to do the same via this letter. It is mainly used to sound a threat of action that was agreed upon before the contraction of that debt obligation.

Zero communications

As we said earlier, it is never used in all circumstances of debt repayment. It is particularly useful when the lender is forced to make difficult decisions. One such is the existence of zero communications from the debtor, even after drafting numerous reminders.

Errors in accounting

Under some special circumstances, it could be that the lender repays every amount owed. However, the amount had some errors and issues and was hence inaccurate. This may call for the drafting of this letter, principally to rectify the accounting issue. It lacks any threat when used to fulfill this particular role.

Need for refund

The opposite could be true. It could be that you are the one who owes money but paid out more than what you were supposed to pay. In this case, you send it to the creditor and ask him to refund you the extra amount of money you paid.

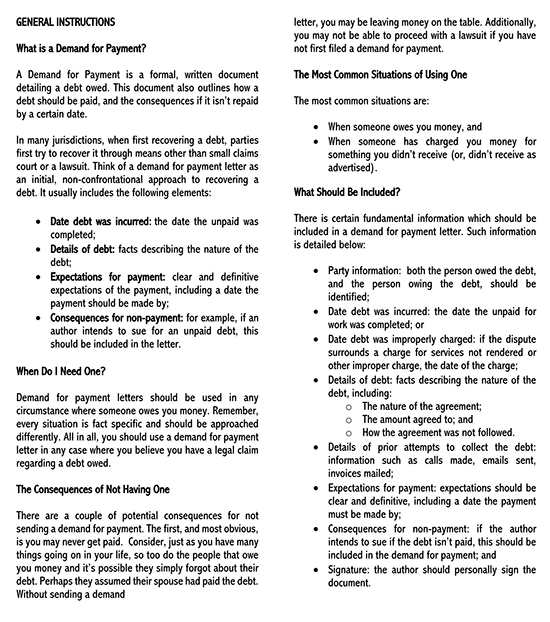

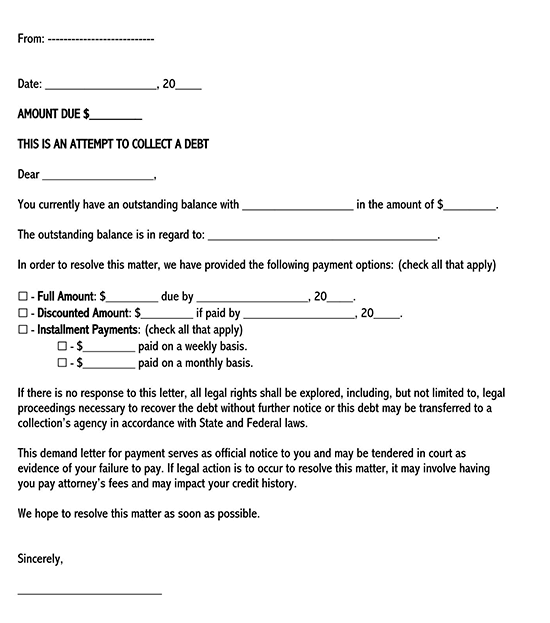

What is Included in a Payment Demand Letter?

Regardless of the amounts of money owed, and the circumstances under which these letters are used, some standard pieces of information have to be included in them.

Here below, we look into some of these issues and why they have to be incorporated in the letter:

Party information

The parties here refer to the people who were involved in the debt obligation. They include the person owed, the lender, and any witness who was involved in the process of procuring the debt.

Date when the debt was incurred

It is the date when the debt was officially incurred. It includes that day when the work for which the amount is demanded was officially completed or the goods were officially supplied to the customer.

Date when the debt was improperly charged

In cases where the dispute revolves around an overcharge for a good or service, the date when the same happened is assumed to be the official date when the debt was incurred.

Precise details of the debt

Every debt instrument has a structure that is a breakdown of the finer details of the said debt. These include details such as the amount borrowed, the grace period, the interest and the periodic installments, and the repayment periods.

Details of any attempts to collect the debt

If any attempts have been made previously to collect the debt, the same has to be expressed in the letter. They have to be accompanied by relevant documents and other references that vouch for them. These references include such things as previous emails, phone calls, emails, invoices, and general inquiries.

Expectations for the payments

The term ‘expectations’ here refers to what exactly you are looking up to going forward. It could include renegotiation of the terms of the debt, the settlement of the debt obligation within a stipulated timeframe, the reduction of the interest rates, and so on.

Consequences for non-payment

Here, you have to state what you plan to do in case the lender does not honor the obligation within the required timeframe. They could be surcharges, listings in the credit reference bureaus, or the referral of the matter to the debt collection agencies.

Relevant signatures

After concluding the letter, the writer has to append his signature. The witness statements and the statements of any other parties involved in the debt instrument contracting must be submitted with this.

Demand Letter for Outstanding Payment Template

[Your Name or Your Company’s Name]

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Recipient’s Name or Company’s Name]

[Recipient’s Address]

[City, State, Zip Code]

Dear [Recipient’s Name or Company’s Name],

I am writing this letter in reference to our previous communications and agreements regarding the services provided by [Your Name/Your Company’s Name] to [Recipient’s Name/Company’s Name] on [Date of Service]. As per our agreement, the payment of [Amount Due] was due on [Due Date]. As of today, [Date], the payment has not been received, and no communication has been made by your side to explain the delay or propose a payment plan.

Despite multiple attempts to contact you and resolve this matter amicably, I have received no response. Therefore, I must insist on the immediate payment of the outstanding amount of [Amount Due], including any applicable late fees as outlined in our agreement.

Please be advised that this letter serves as a formal demand for payment. Failure to respond or settle the outstanding amount within [Number of Days, e.g., 15 days] from the date of this letter will compel me to take further action to recover the debt. This may include, but is not limited to, legal proceedings, which could result in additional costs for which you may be liable.

To avoid any further action and additional costs, I urge you to settle the outstanding amount in full by [Deadline for Payment]. Payment can be made via [Preferred Payment Method, e.g., bank transfer, check], to the following details: [Payment Details].

I would like to resolve this matter without the need for further legal action. Therefore, I kindly request your immediate attention to this issue. Please contact me directly at [Your Phone Number] or [Your Email Address] to confirm receipt of this letter and to discuss any payment arrangements you may wish to propose.

Thank you for your prompt attention to this matter. I look forward to resolving this issue amicably and continuing our professional relationship.

Sincerely,

[Your Name]

[Your Position, if applicable]

[Your Company’s Name, if applicable]

[Your Contact Information]

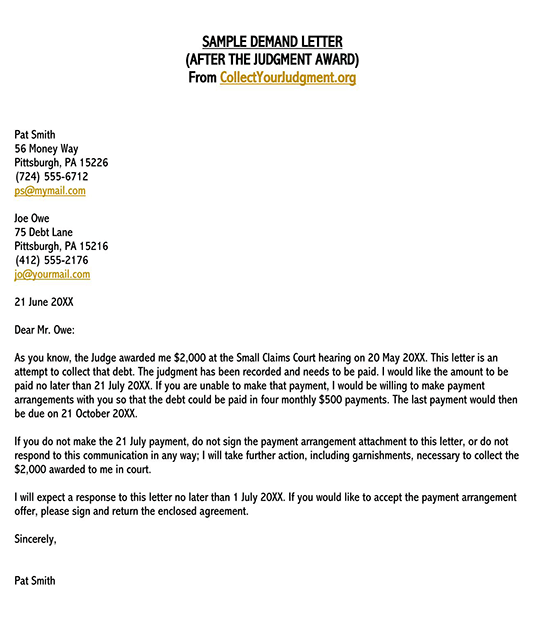

Sample Letter

Dear Mr. Martin,

I am writing to you on behalf of Robinson Consulting Services regarding the outstanding payment for the consulting services we provided to Innovative Solutions Inc. Despite our repeated invoices and reminders, we have yet to receive payment for the invoice dated January 15, 20XX, amounting to $15,000.

As per our agreement dated December 1, 20XX, payment for services rendered was due within 30 days of invoice issuance. It is now well past this due date, and this delay in payment has placed a considerable strain on our operational capabilities.

We have always valued our business relationship and have been proud to support Innovative Solutions Inc. with our consulting services. Therefore, it is with regret that we find ourselves in this situation. However, to maintain our quality of service and fulfill our obligations to our other clients, we must insist on the immediate settlement of this outstanding amount.

Please find attached a detailed statement of your account for your reference. We kindly request that you expedite the payment of $15,000 by no later than March 15, 20XX. If this payment has already been processed, please disregard this letter and accept our thanks.

Should there be any issues or concerns regarding this payment, or if you require further clarification or documentation, please do not hesitate to contact me directly at (555) 321-9876 or via email at taylor.robinson@rcs.com. We are willing to work with you to resolve this matter promptly.

We hope to resolve this issue amicably and continue our business relationship without further complications. Thank you for your immediate attention to this matter.

Sincerely,

Taylor Robinson

Owner

Robinson Consulting Services

Examples of the Breakdowns of Contents

| Party Information | From: Cecil Credits to J.T Emerson |

| The date the debt was incurred | Soft Loan worth $1,500 that was advanced on February 6th, 20XX |

| Details of Debt | As per our agreement, you were to have a grace period of only one month, after which you were to start repaying the date thereafter. The last installment was to be paid within two months. Today marks the end of the two-month period we had initially agreed upon. |

| Details of Prior Attempts to collect the debt | I drafted you a communique exactly one month after we signed the contract. You, however, did not respond in any shape or form. I sent out another one last week (check your records) yet again without any ensuing rejoinder. |

| Expectations of Payment | In line with our agreement, you are supposed to pay me back the full amount by close of business today. Since that is not forthcoming, I will have to refer you to the credit reference bureau and bring in some debt collectors. |

| Consequences | I will not hear from you within a week, and I will have no choice but to bring in the law enforcement officers to help me out. |

How to send a Demand Letter

Drafting the letter in and of itself is not enough. You no doubt have to send it out to the intended destination for it to be acted upon.

This entails the following three main procedures:

Step I: Gather the necessary pieces of information

You have to start by gathering the necessary pieces of information. These pieces of information are those that vouch for the existence of the debt instrument and the need for the same to be settled.

Some of the must-have exhibits are the debt contract itself or the receipts for the amounts owed. You have to preferably attach them to the body of the letter that you eventually draft.

Step II: Draft the letter of demand for payment

Now get to the core of the business. It is at this stage that you piece every bit of evidence together to create a unifying narrative. The best course of action is to use a polite tone while making some subtle threats.

The ‘threat’ may be available in the following ways and means:

- Use of a debt collection agency. Tell them that you will use a debt collection agency to recover your loan if they default. Responsible individuals and corporate entities that care for their reputations will do whatever they can to avoid being referred to these institutions.

- Hot discounts. Offer some hot discounts to the debtors. Tell them that if they repay the whole amount by a certain deadline, you will grant them some discounts. This is to entice them to make some effort, at least.

- Renegotiate the installment payments. You may also offer to renegotiate the installments and the amount of money they have to pay at that time. This, again, will ease the burden and let them repay the debt comfortably.

- Suggest referral to the Small Claims Court. Like the debt collection agencies, the Small Claims Courts will also usually come in to help with recovering your money. Many responsible firms and individuals will also fear being referred to there. That threat will also serve to awaken them to act.

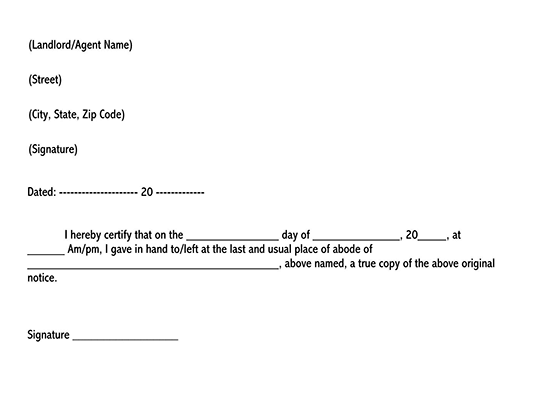

Step III: Send the letter

Having drafted the letter, you now have to send it out to the intended recipient. The use of certified mail is by far the most recommended for this job. That is because it provides electronic verification that the letter was indeed delivered to the intended recipient.

If the recipient does not receive it for whatever reason, the same is returned to the sender at no extra cost. To add to these, the means of delivery itself is safer and less prone to the risks of parcel loss and other issues that arise in the course of making a delivery.

The Tone of the Demand Letter for Payment

Even though you have every reason to get wild, you shouldn’t express these emotions in this letter. You should always see to it that you maintain your claim. The language you use, as well as the tone thereof, has to be polite, respectful, and devoid of direct threats.

Frequently Asked Questions

As we have already explained above, the tone of the letter need not necessarily be forceful and rude, even though you have every right to be wild. Instead, it should be less assertive, polite, and kind. As part of making this possible, you also have to state the exact reasons and references for demanding the payment be processed.

A ‘payment demand letter’ need not necessarily be notarized. Nonetheless, if you intend to file a claim in a court of law, you may have to notarize it as proof of the contents that are indicated therein. Furthermore, the process of notarization also vouches for the facts that are stipulated therein.

Conclusion

You now know how to go about the issue of drafting a demand letter for payment, don’t you? Well, we have no other issues to explain or spell out. All we are left to do now is to pass the ball on your court. Take advantage and make use of the pieces of information we have furnished to demand your payments effectively going forward.