An individual may write a demand letter, which is an out-of-court conflict resolution document, asking that specific demands—like money payments or action taken—be fulfilled in order to make amends for wrongdoings that occurred outside of court.

This letter marks the last attempt to resolve a dispute before legal action.

The letter has to be signed to be legally enforceable. Also, it is recommended that you send it using certified mail to obtain proof/evidence of receipt once the at-fault party receives the letter. The subsequent actions of using such a letter vary from one case to another. Therefore, you should expect the recipient to oblige to the notice and perform the actions required, a counteroffer or no response. If the recipient fails to respond, you can proceed to take legal action against them.

This article will guide you in writing a strong demand letter that effectively conveys your intentions when resolving a dispute out of court. Sample letters and templates are also provided so that you can use them to write your letter.

A demand letter has other alternative names, including:

- Letter of Demand (LOD)

- Debt Collection Letter

- Demand Letter for Payment

- Demand Letter for Money Owed

- Collection Letter

- Collection Dispute Letter

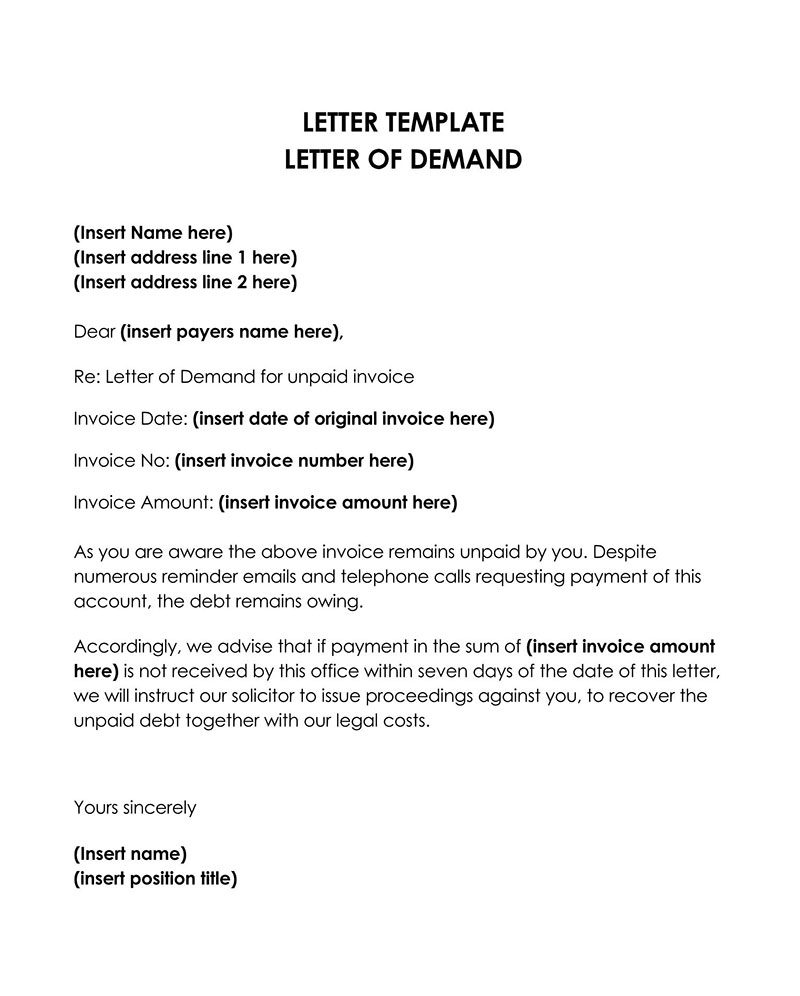

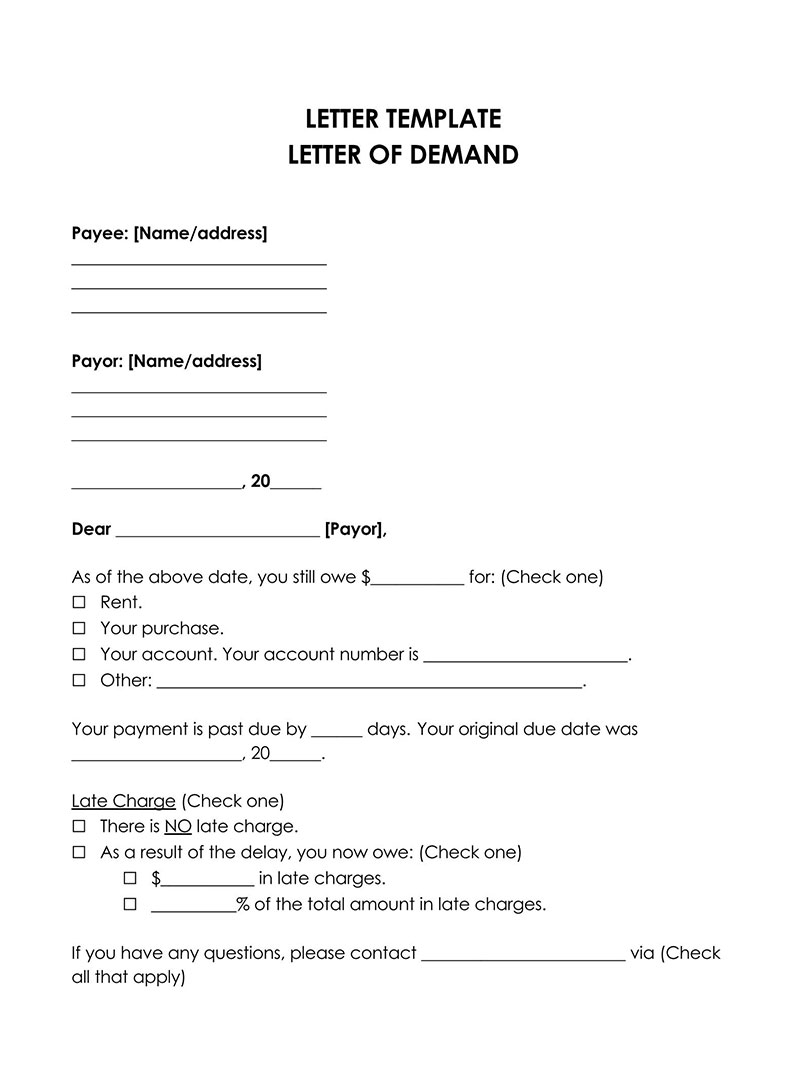

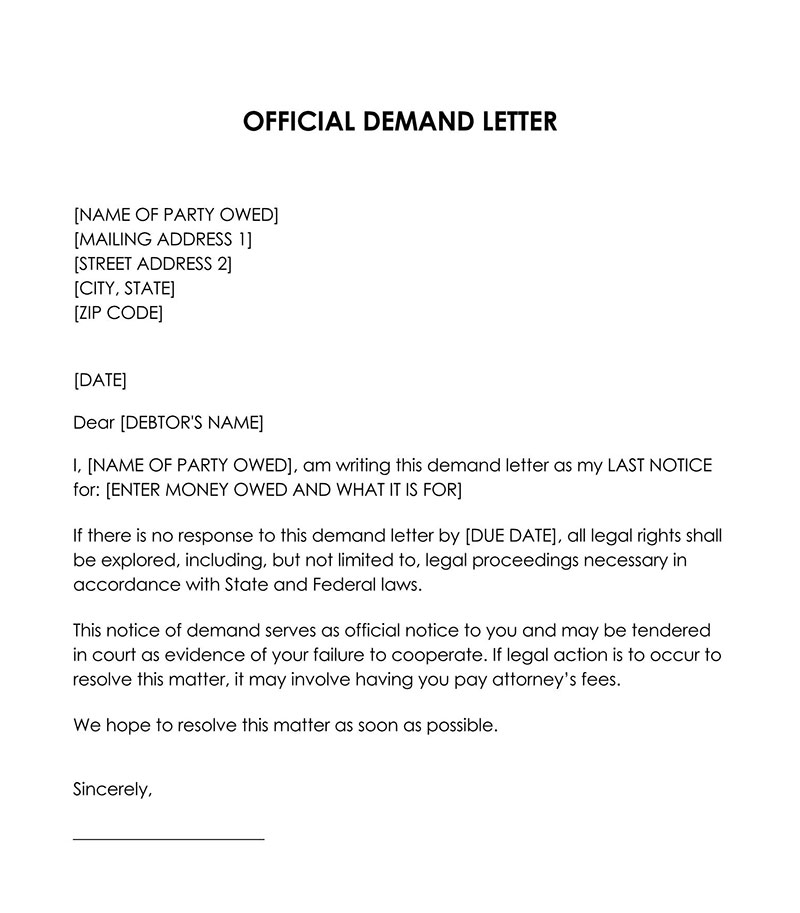

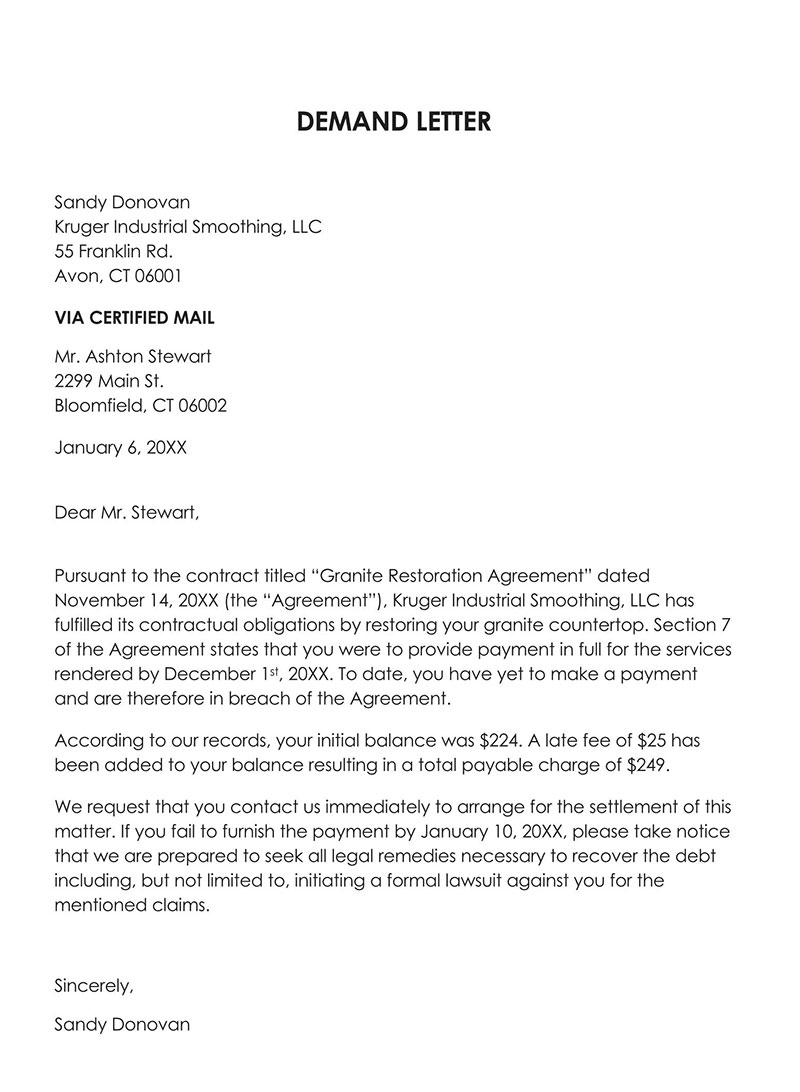

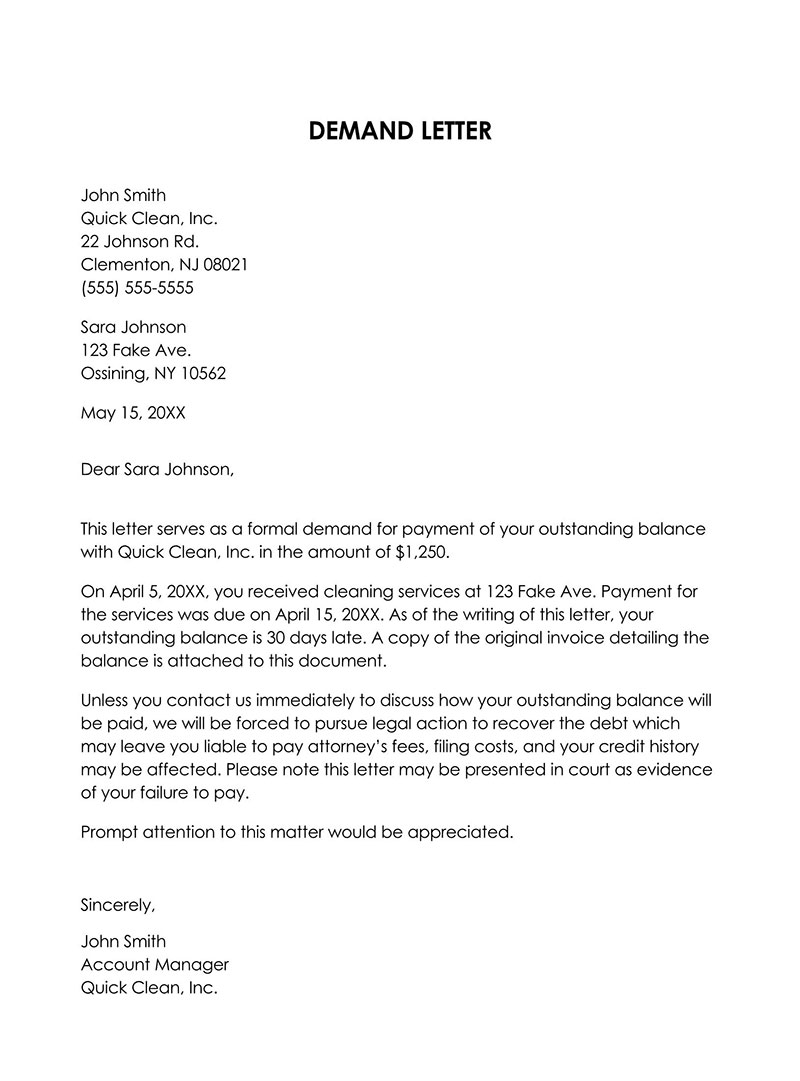

Demand Letter Templates

These templates are fillable guides that can be used to prepare these letters quickly and easily. While using a template, you do not have to spend a lot of time brainstorming which aspects of the dispute to include in the letter, as the essential sections are provided as blank spaces.

Why Do You Need a Demand Letter?

A demand letter can be used by any two conflicting individuals or entities that opt to resolve their issues out of court. Frequently, it is used by creditors to collect money owed or when seeking compensation for damages or injuries. It outlines a demand statement, a declaration of the other party’s fault, claims or debt owed, corrective actions, the deadline for compliance, and consequences of non-compliance. The letter is also used for insurance claims.

A demand letter may not be used every time two parties conflict. Instead, the letter resorts to once informal mediation attempts haven’t borne any fruit – this is before you sue the other party. Now, how does it help you in your pursuit to resolve the dispute? Firstly, the letter can speed up the settlement process if the recipient agrees to meet the demands. This process becomes shorter than the lengthy court process and saves you the money required to file a lawsuit in a civil court.

Such letters are valuable evidence materials should the case proceed to court. They provide the paper trail needed to show the accounts of a conflict and your attempt to resolve the conflict before taking it to court. These facts can be used as a foundation for your case. Also, laying out all the facts in writing ensures you are prepared to defend your claims, and the defendant cannot claim they were not aware of their case.

How it Works

Using a demand letter to resolve a dispute is a straightforward process. However, it requires adequate planning to ensure you capture all information accurately and are persuasive enough to get the at-fault party to comply.

The steps illustrated below can be followed to ensure the letter is effective:

Step 1: Decide what to demand

Firstly, you should determine what you are demanding from the other party. Decide if you will ask for compensation/settlement or an action. If the demand is a settlement, you should consult state laws to determine if the amount is within the small claims limits.

Step 2: Calculate the offense

Secondly, you should review the applicable documents, such as contracts, police reports, pictures, receipts, or any other relevant documents that can support your claim. This involves gathering facts about the disputes. Documents provide written proof that the at-fault party committed an offense. Once you have all the relevant information, you can formulate your strongest arguments and note them down.

Step 3: Decide settlement terms

Thirdly, you should determine the settlement terms you want to outline in the template for the demand letter. Settlement terms will often cover the deadline to carry out the demands and alternative solutions that would equally resolve the dispute. A deadline of two to 6 weeks is commonly used; this leaves enough time for the recipient to agree and fulfill the demands.

Step 4: Write and send the demand letter

This letter should be written once all the details that will be included are determined. You can also consult a sample when writing your letter. Another option is to use a customized template for a demand letter that suits your purpose. Ensure that it covers all the pertinent information so that your cause is airtight and the recipient doesn’t identify weak points in your argument.

The letter should then be sent via certified mail with a return receipt, as earlier mentioned – the return receipt serves as proof that the recipient received the letter. It is advisable to send a physical and digital (email) copy to get the recipient’s attention.

Step 5: File a lawsuit

Once the letter has been sent, wait for a response from the recipient. If the awarded deadline expires or their response is unsatisfactory, and they are unwilling to meet your terms, you can file a lawsuit against the recipient without going back and forth. If the demanded amount exceeds the state’s small claims limits, usually less than $ 10,000, file the lawsuit at the County Circuit Court.

Step 6: Collect and receive payment

Lastly, you can collect the respective payments if the recipient agrees to the terms. If the case is taken to court, wait for the judgment. In some cases, the at-fault party may be responsible for attorney’s fees.

Types of Demand Letters

Different types of demand letters suit specific conflicts/demands that you can use. You can also use samples to guide you when writing your letter.

Types of demand letters include the following;

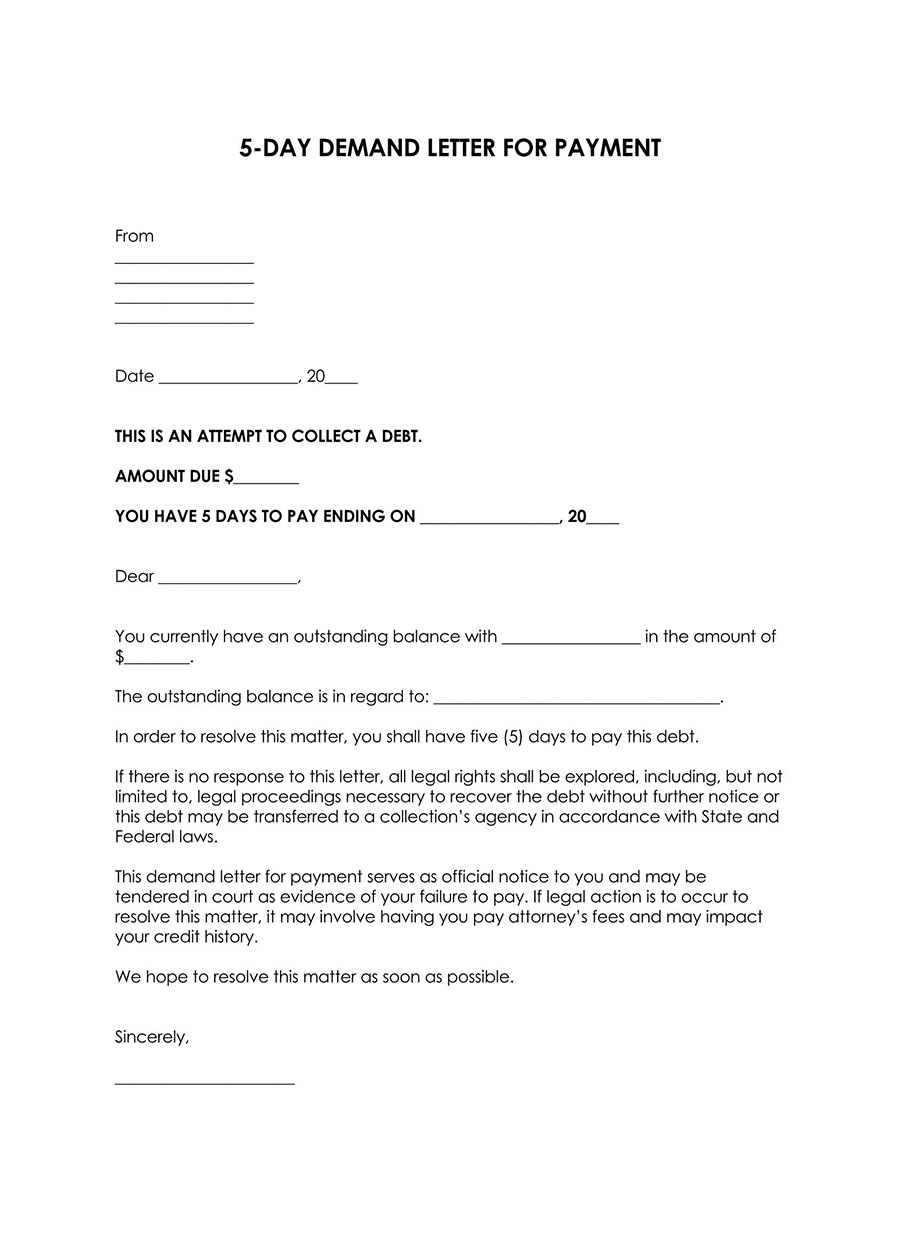

5-Day

A 5-day demand letter is issued when giving the recipient a short amount of time to fulfill certain demands. It is often used as the final reminder when multiple reminders have been issued before without a response.

Download: Microsoft Word (.docx)

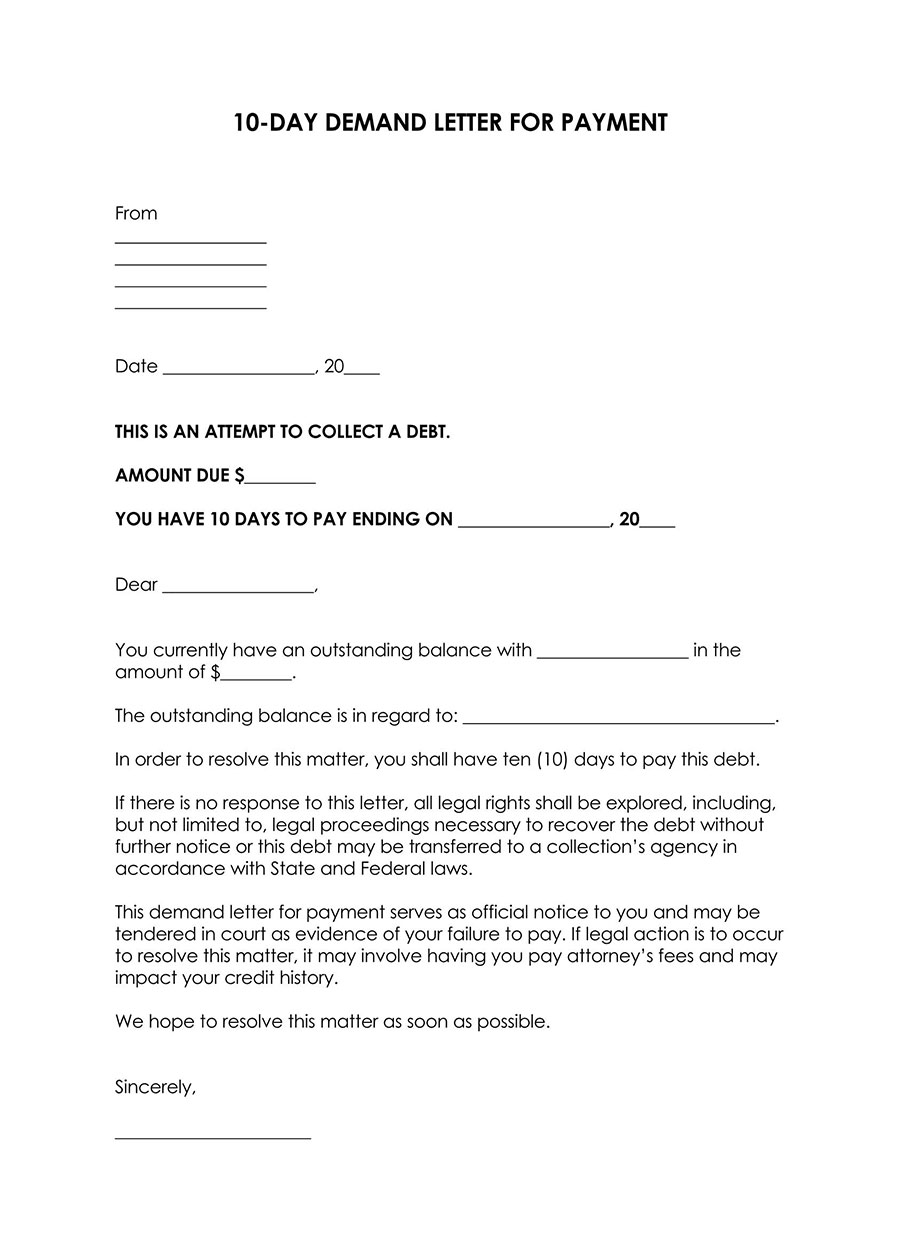

10-Day

10-day demand letters are issued when to give the at-fault party 10 days to correct a violation or wrongdoing. Since ten days is often short notice, it can be used when other resolution methods have failed.

Download: Microsoft Word (.docx)

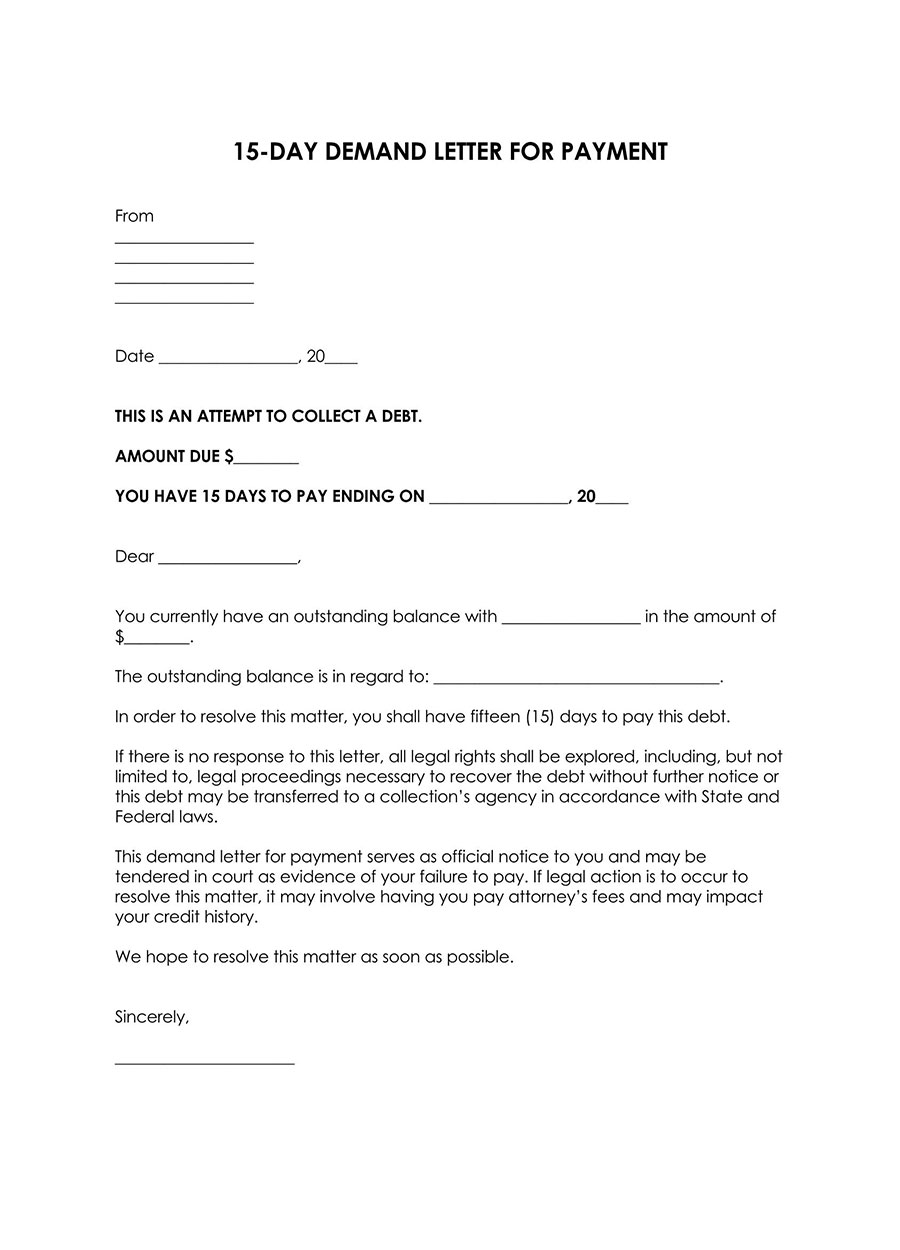

15-Day

15-day letters of demand are sent when there is a sense of urgency to resolve a dispute before fifteen days. This type of demand letter can be used for debt collection or when asking for a refund.

Download: Microsoft Word (.docx)

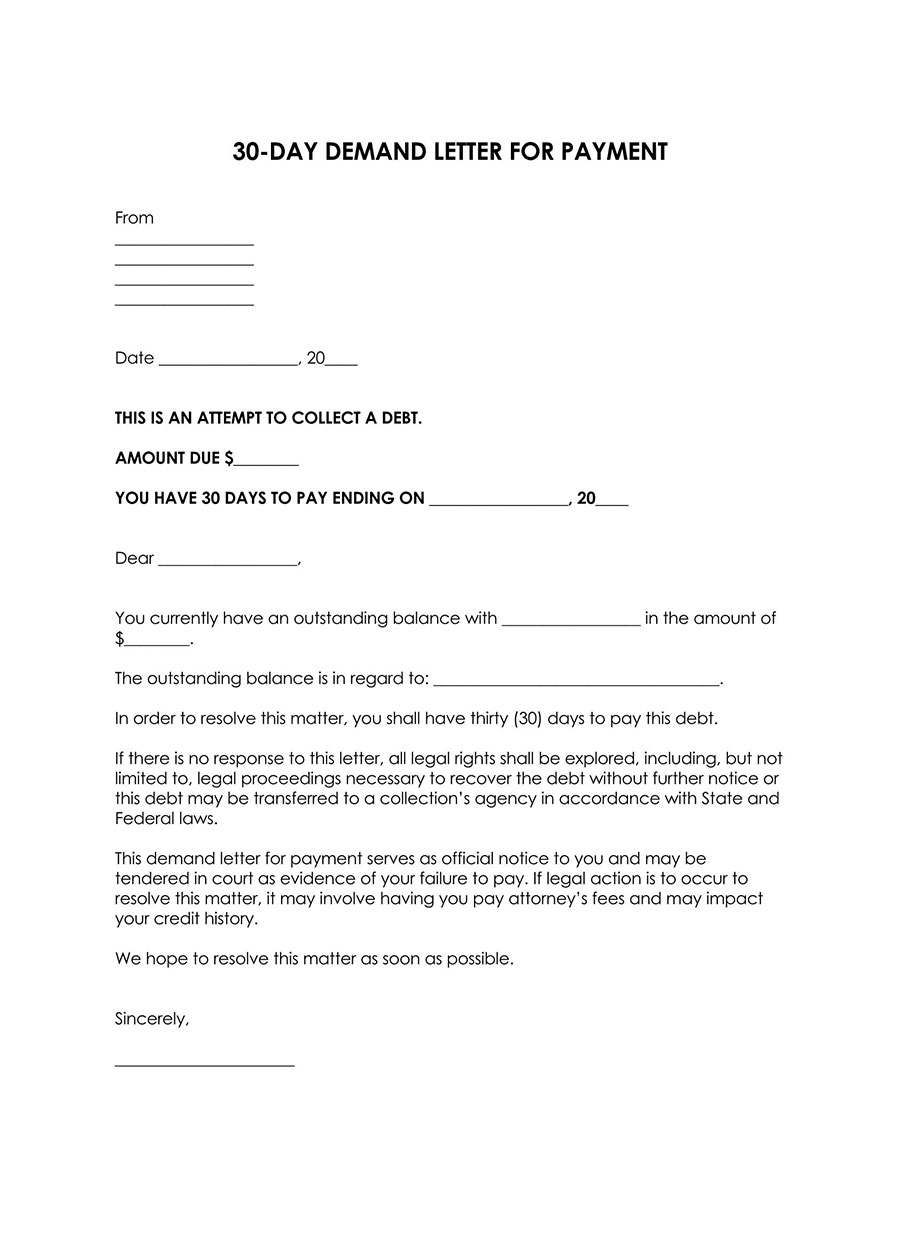

30-Day

30-day demand letters are among the most common types of demand letters. The demand letter can be used to collect a debt, terminate a lease, or ask for a refund.

Download: Microsoft Word (.docx)

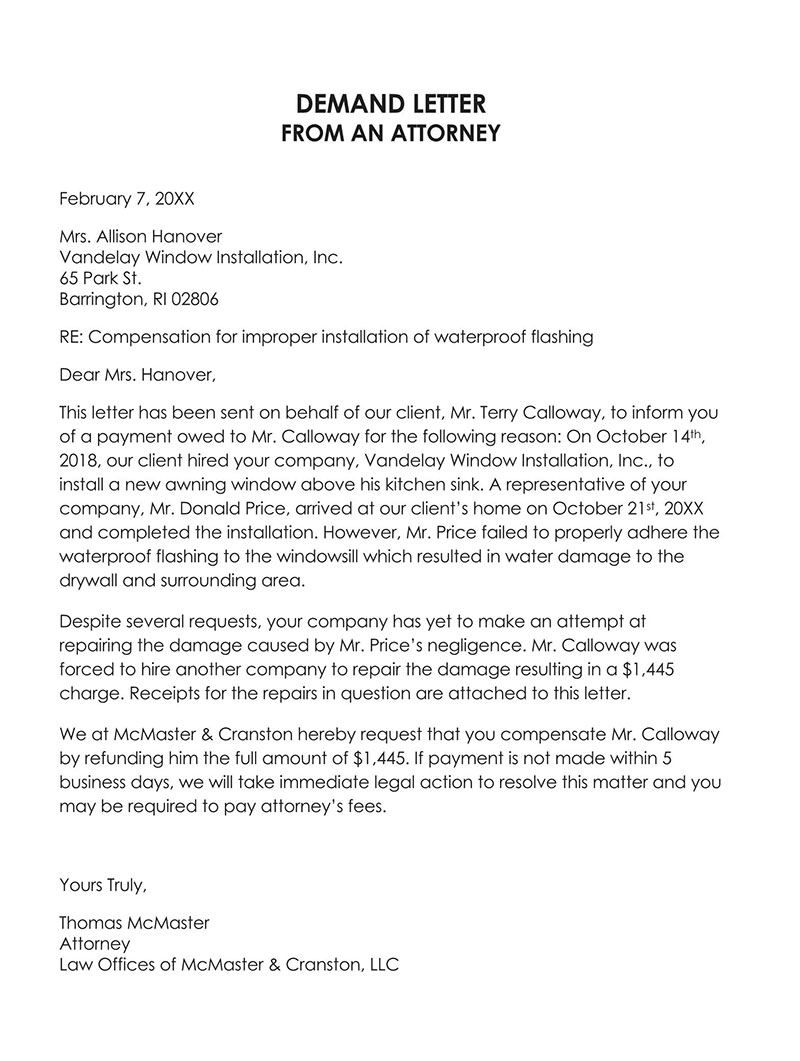

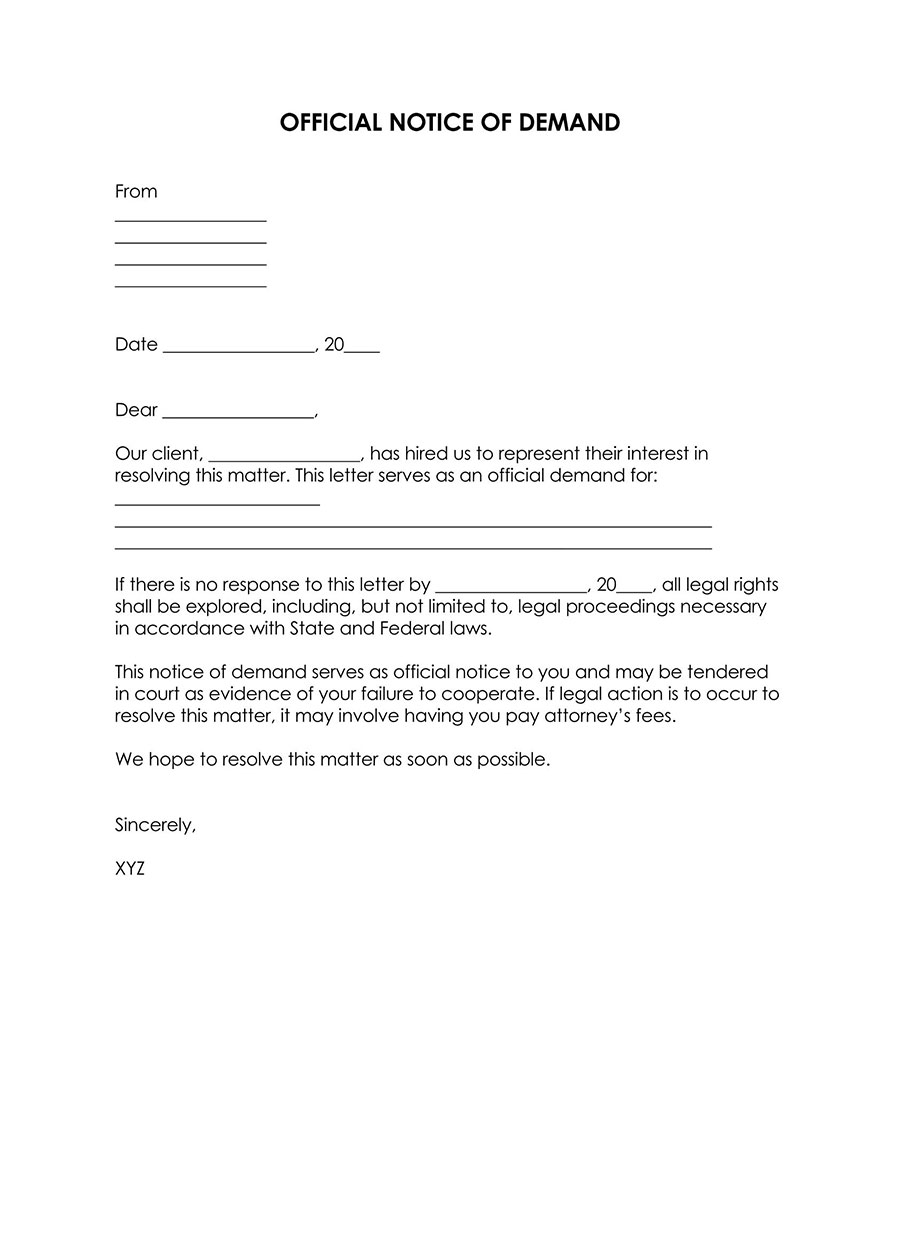

Attorney

In some instances, you can hire an attorney to write and send the demand letter. A template for a demand letter from an attorney outlines the law firm, recipient’s details, accounts of the dispute, demands, compliance deadline, name of the attorney, and a signature.

Download: Microsoft Word (.docx)

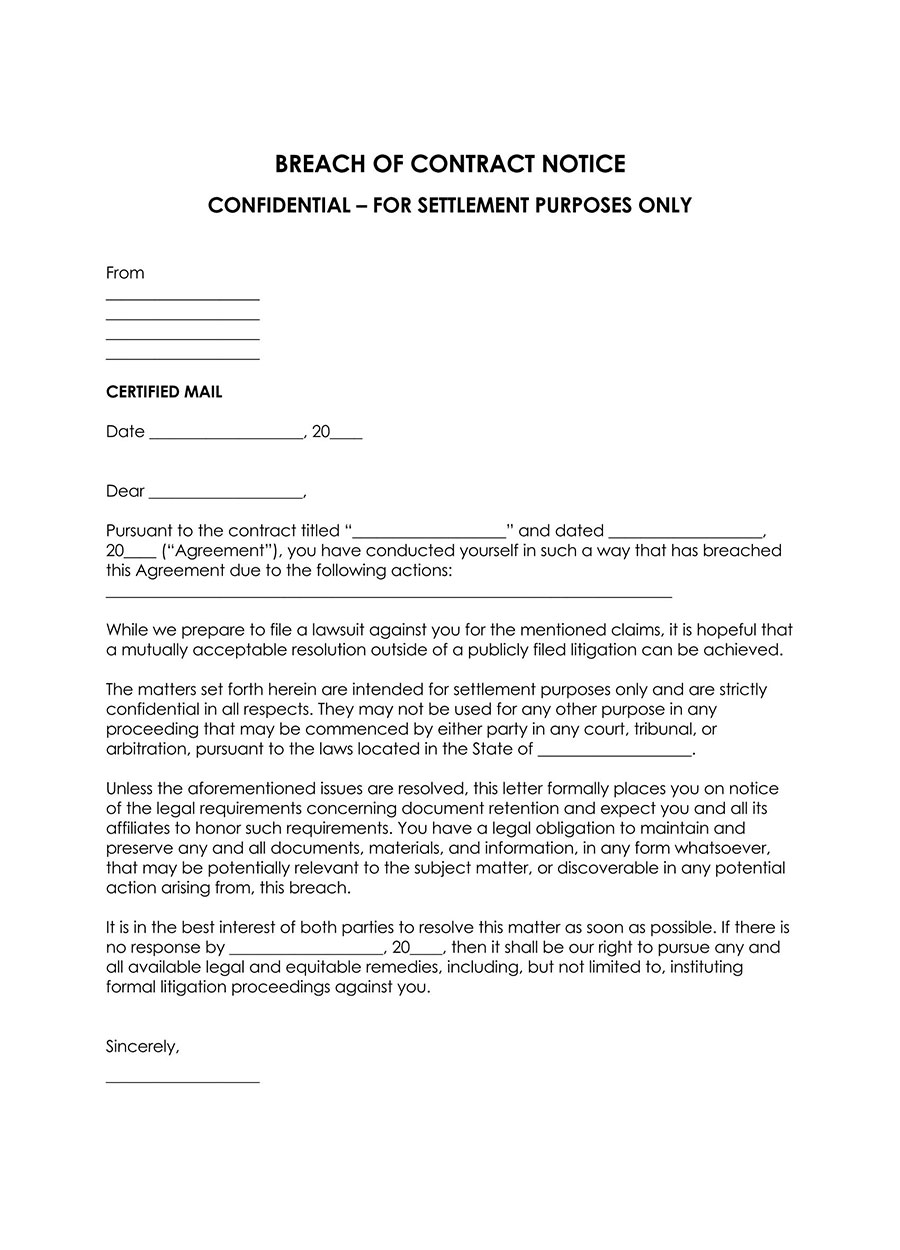

Breach of Contract

When one party of an agreement violates the contractual terms and refuses to take corrective actions despite informal mediation attempts. A breach of contract demand letter template can be issued as the last warning before the matter is taken to court. Such a template outlines the contract’s name/type/reference number, the breached terms, the demands, compliance deadline, and applicable ramifications.

Download: Microsoft Word (.docx)

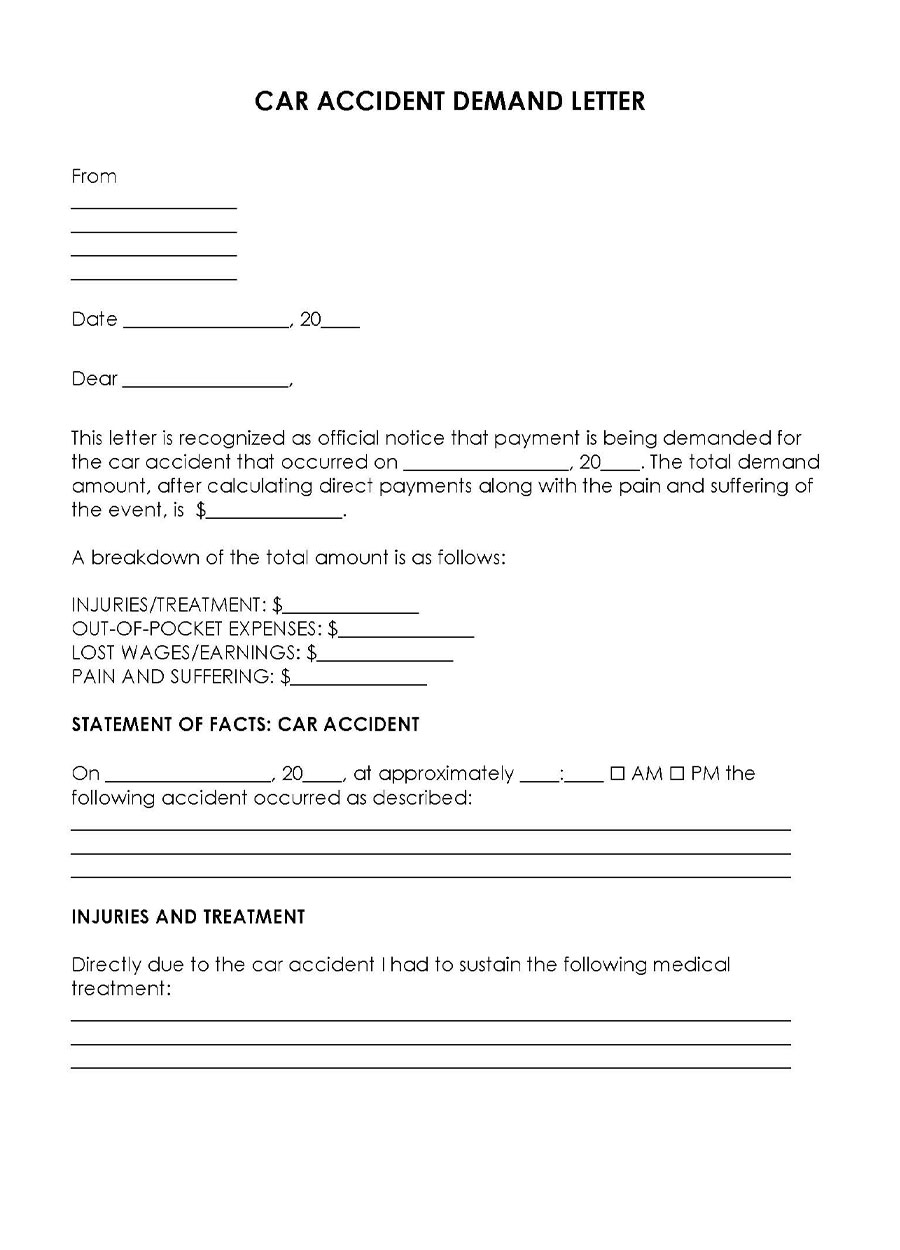

Car Accident

A car accident type of template is used to ask for compensation for damages incurred in an accident from the at-fault party. It can state the type of car, accident location, time, type of damages, cost of damages, etc.

Download: Microsoft Word (.docx)

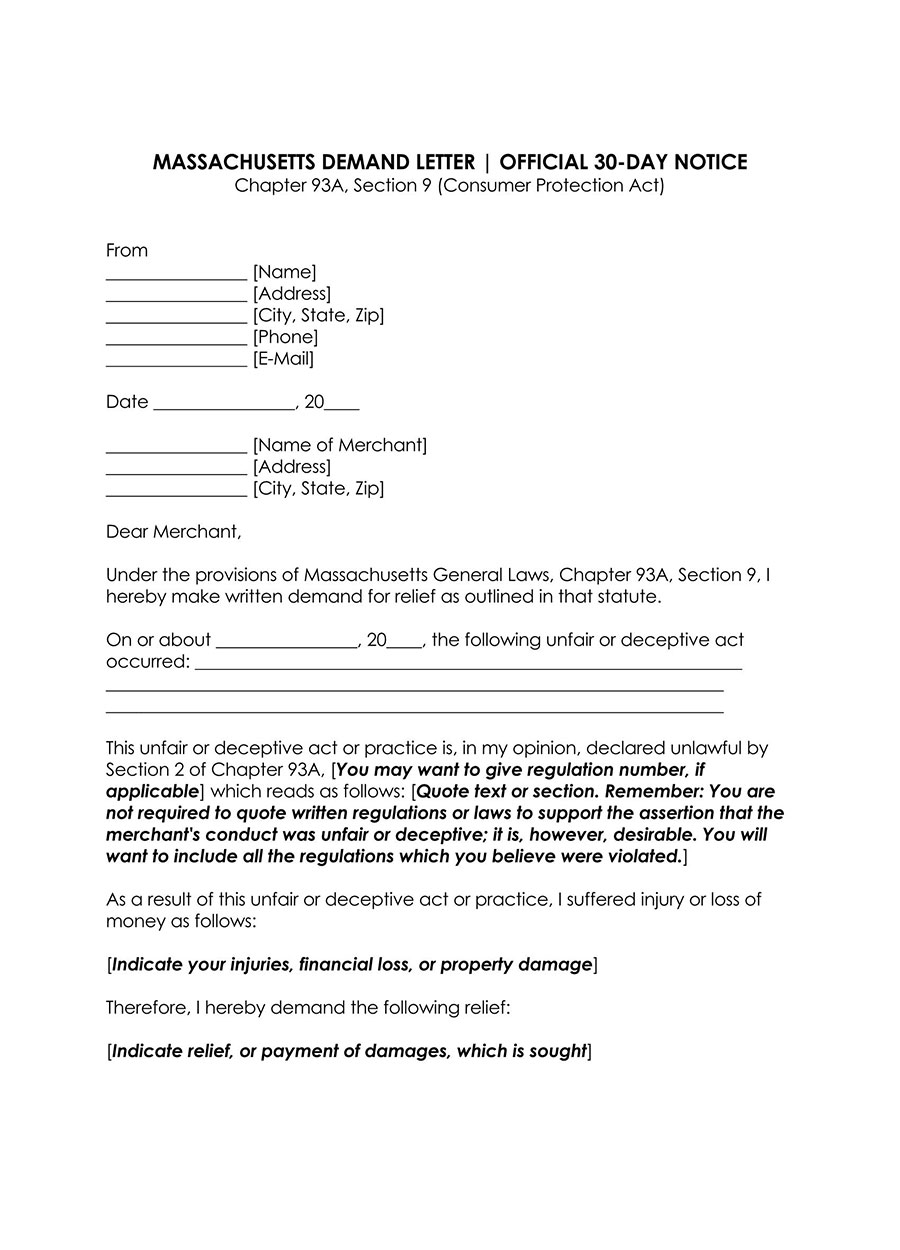

Chapter 93A

Demand letter for Chapter 93A is issued in accordance with chapter 93A: Regulation of Business Practices for Consumers Protection to demand a business to correct wrongdoing within 30 days before the claimant/consumer files a lawsuit. The letter is sent when a company engages in inappropriate business practices such as selling defective commodities, failing to refund, etc.

Download: Microsoft Word (.docx)

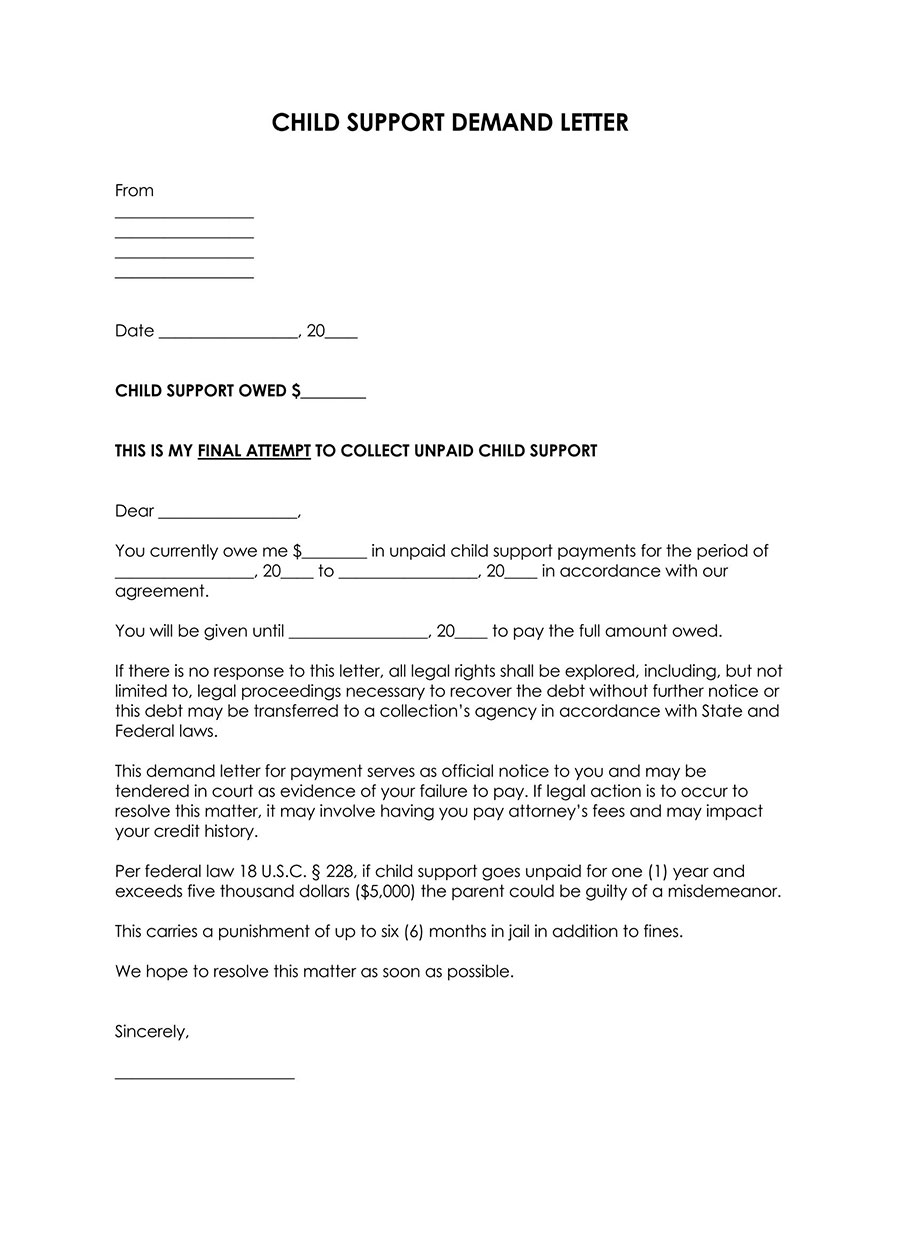

Child Support

A child support demand letter is issued to demand that the recipient fulfill their child support payment obligations as directed by the court or face a lawsuit. The letter should indicate the defendant’s details, the amount owed, etc.

Download: Microsoft Word (.docx)

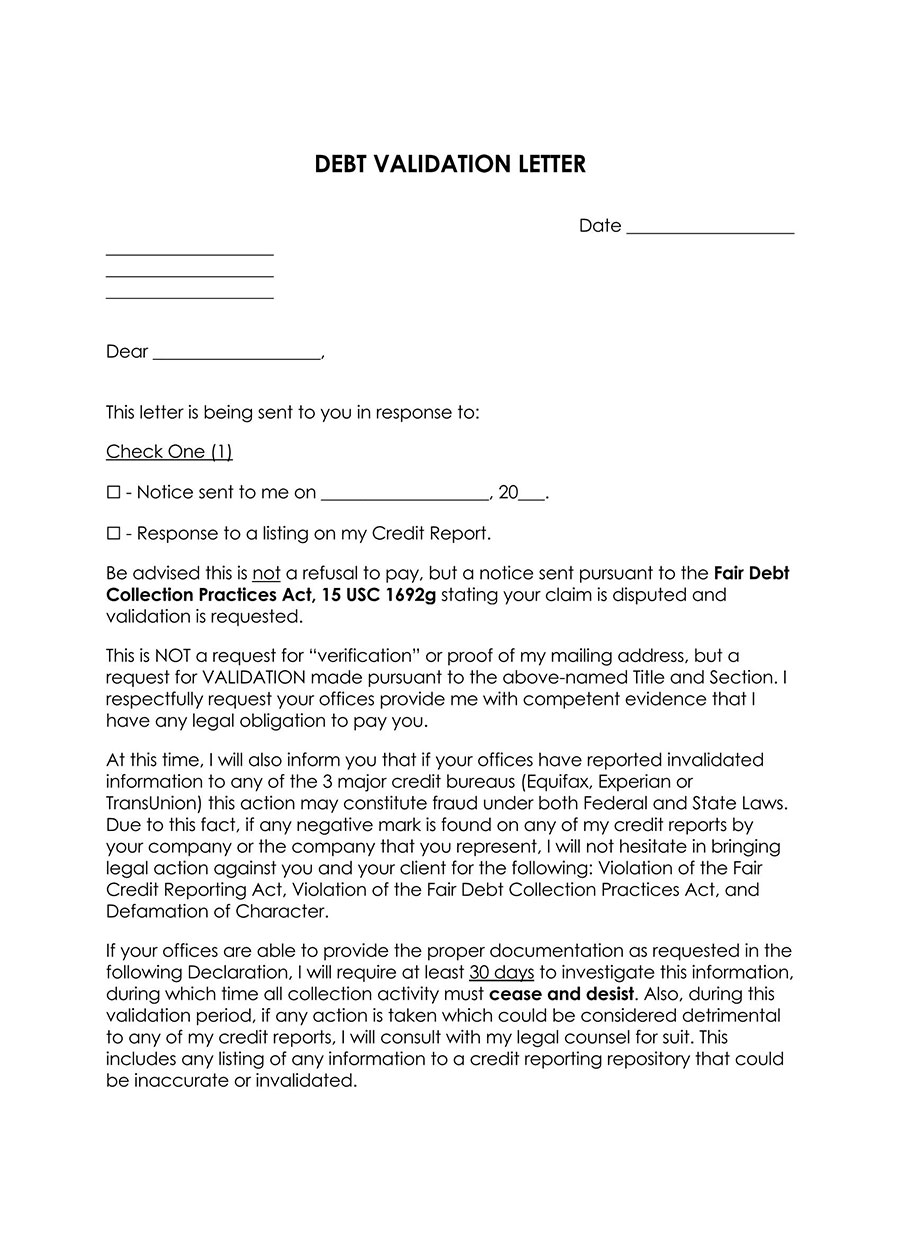

Fair Debt Practices

Consumers can send a letter seeking verification of how debt was incurred and acknowledging receipt of a notice of an attempt to collect from a creditor. This letter is sent in accordance with the Fair Debt Collection Practices Act and must be sent within 30 days after receiving the notice.

Download: Microsoft Word (.docx)

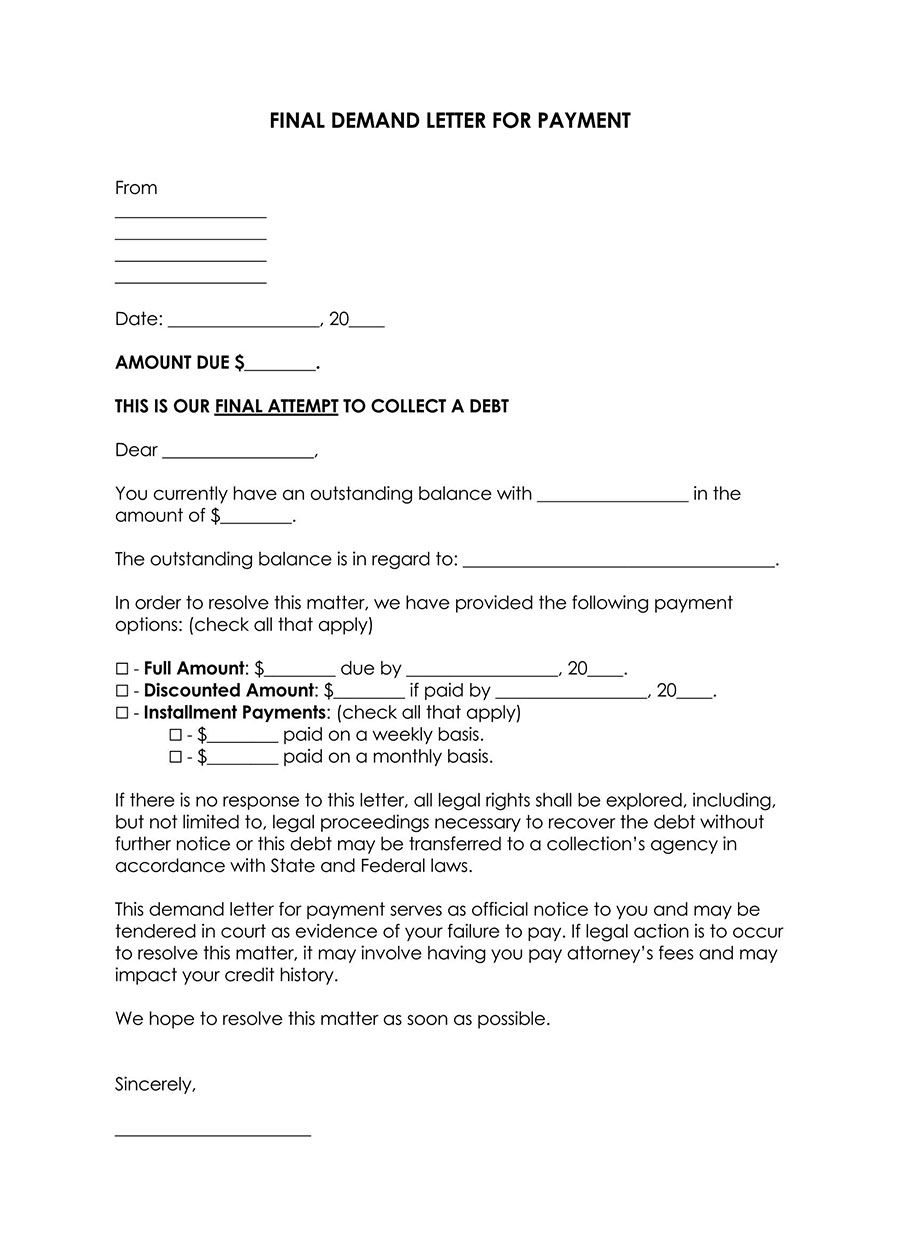

Final (Last) Notice

This type of demand letter is sent when one party wants to issue a general last warning to another party before taking legal action against them. The letter can be used for debt collection, breach of contract, personal disputes, etc.

Download: Microsoft Word (.docx)

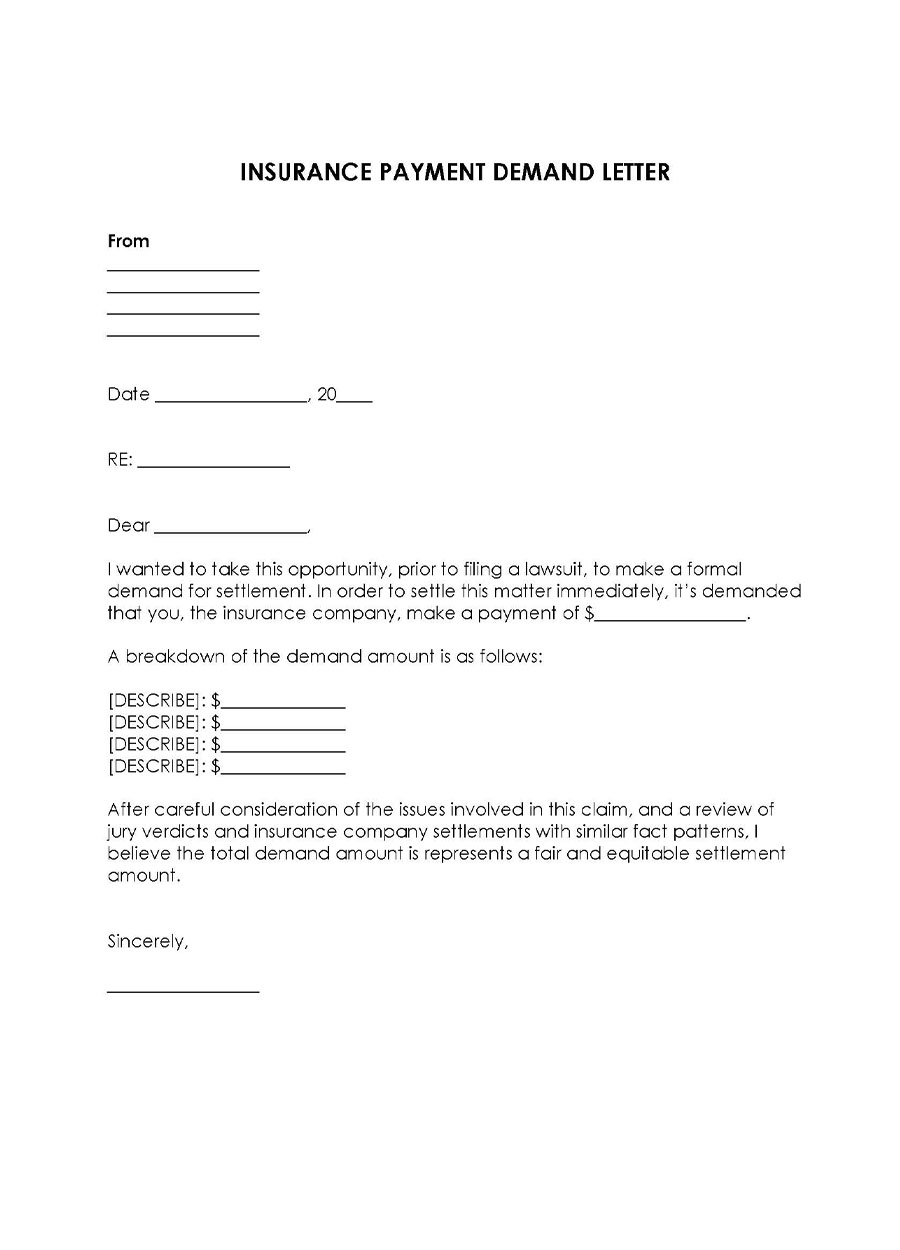

Insurance Company

Insurance policyholders can write demand letters to insurance companies seeking compensation for property damage or personal injury. The letter should indicate the claim, incident, explanation, compensation demanded the deadline for compensation, and other pertinent details such as a history of attempts to resolve the issue.

Download: Microsoft Word (.docx)

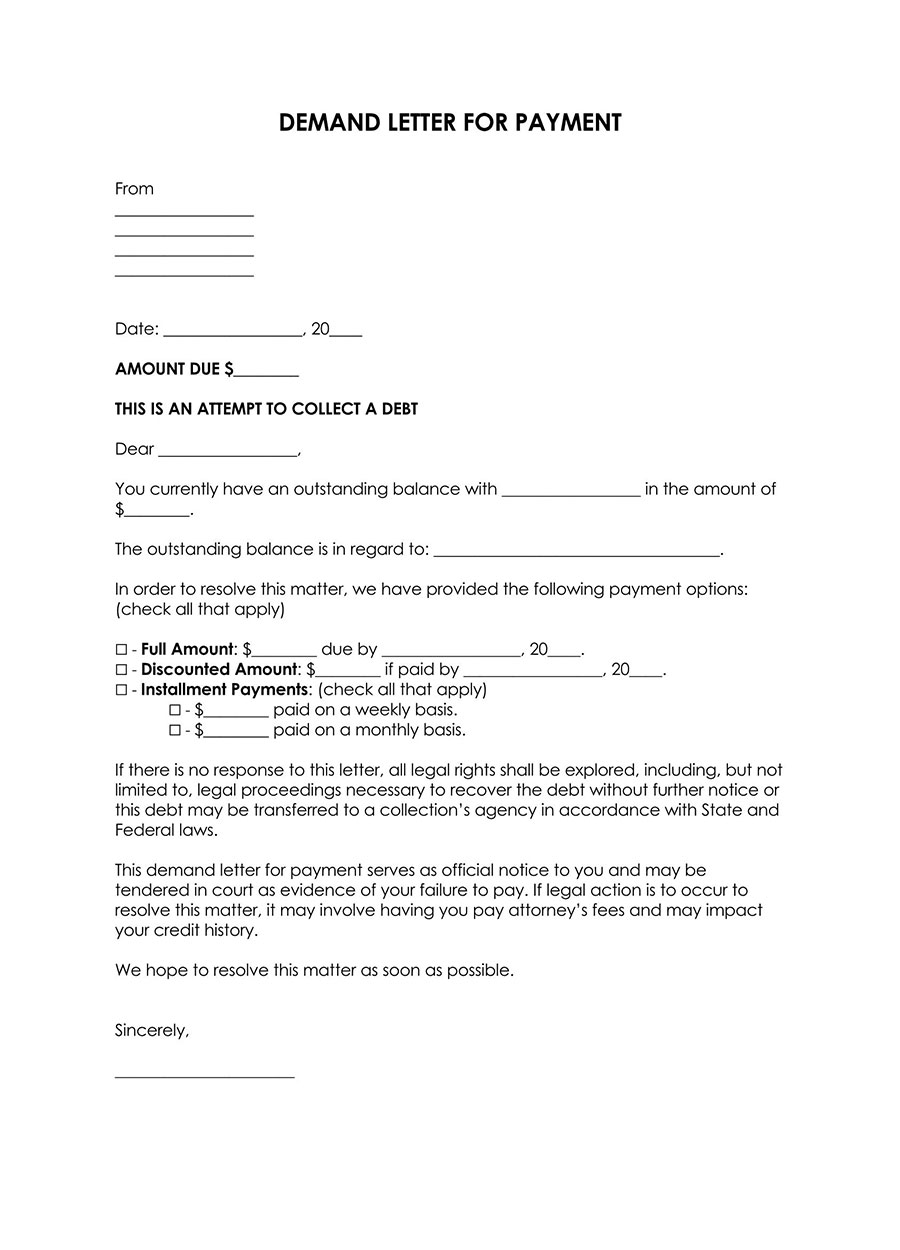

Payment

Such a letter is written when one party demands payment from another. The demand letter template for payment indicates the amount, initial due date, applicable late fees, and compliance deadline.

Download: Microsoft Word (.docx)

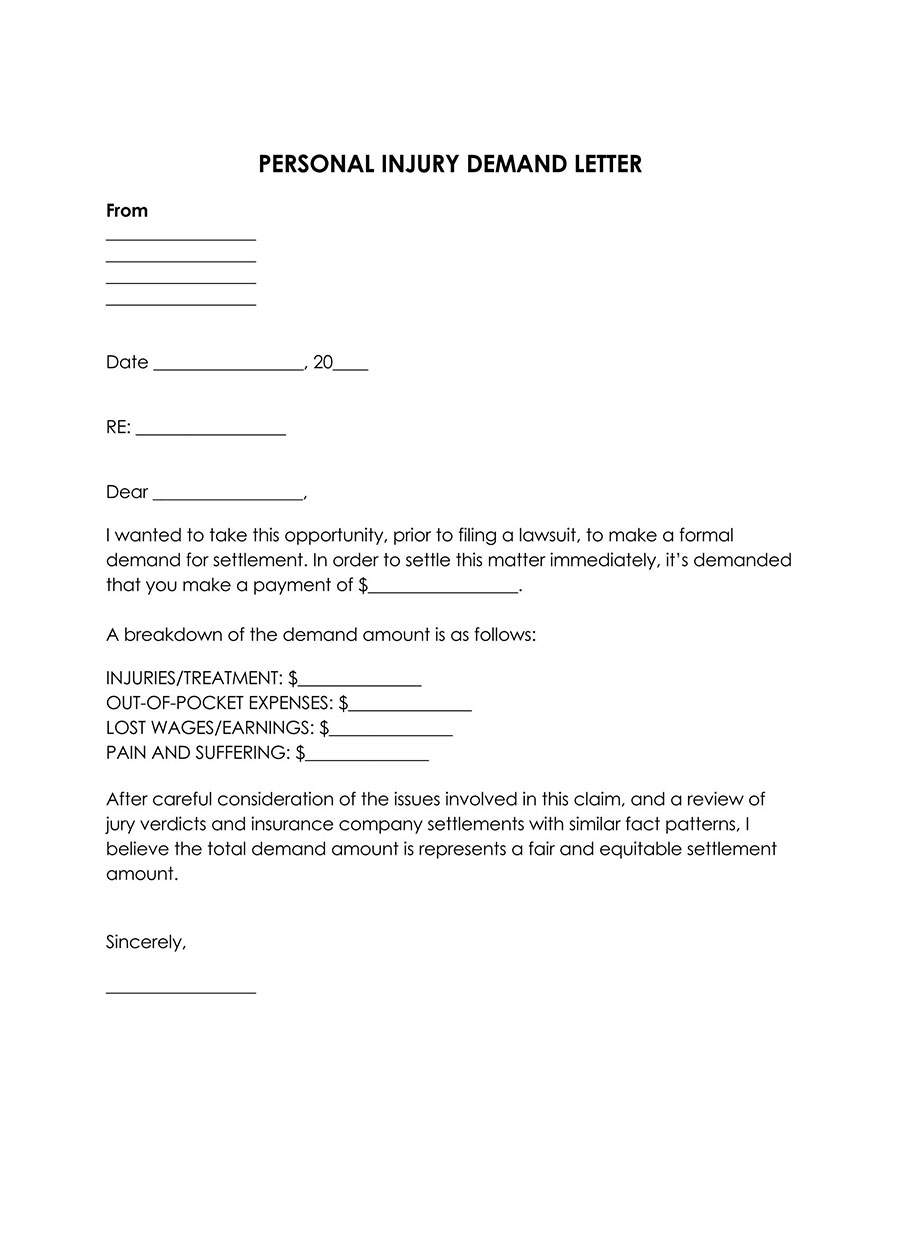

Personal Injury

A personal injury type of demand letter is written to demand compensation for personal injury. This can be written to an insurance company or employer.

Download: Microsoft Word (.docx)

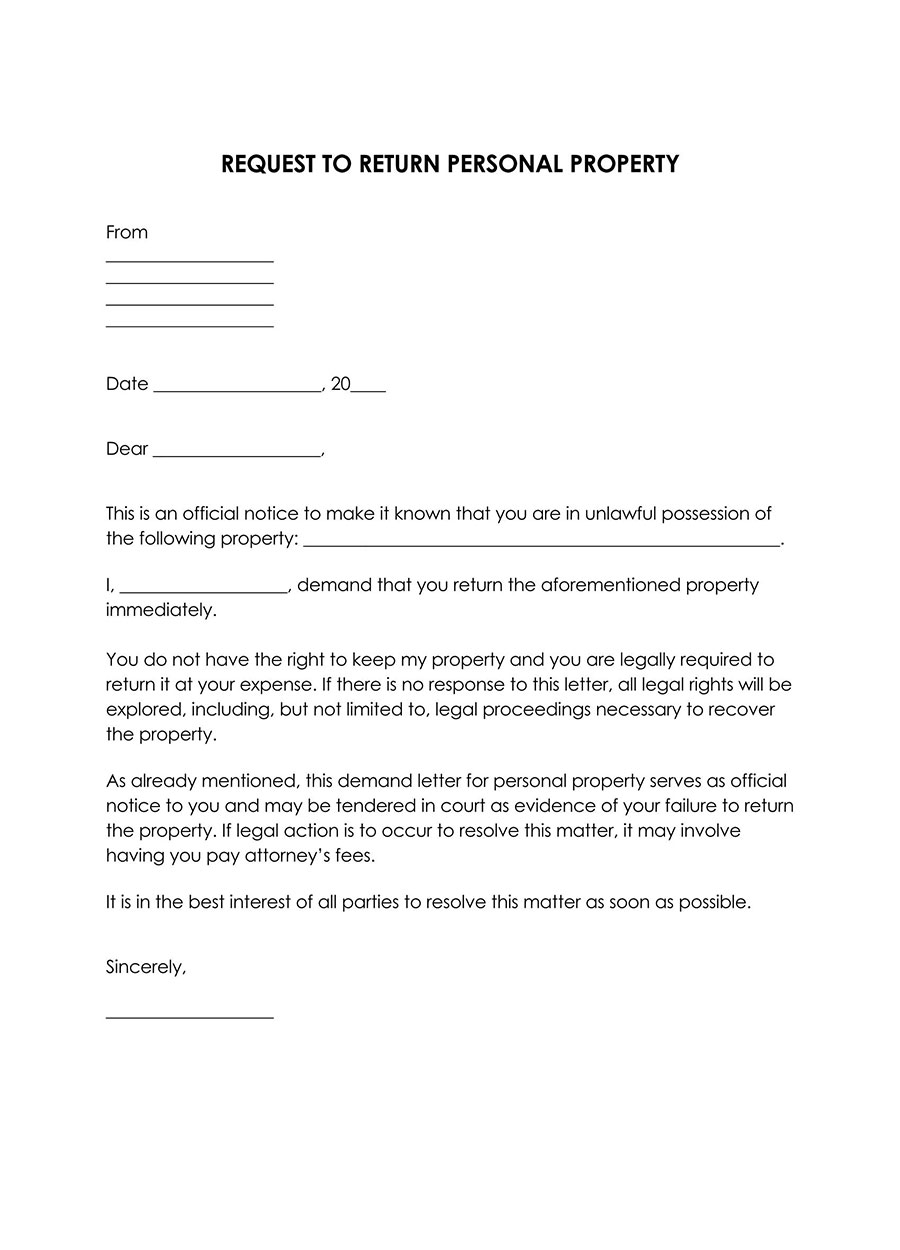

Personal Property

Individuals and entities can use a demand letter to demand the return of personal property that is in the hands of another party. The letter should indicate the type of property and return date.

Download: Microsoft Word (.docx)

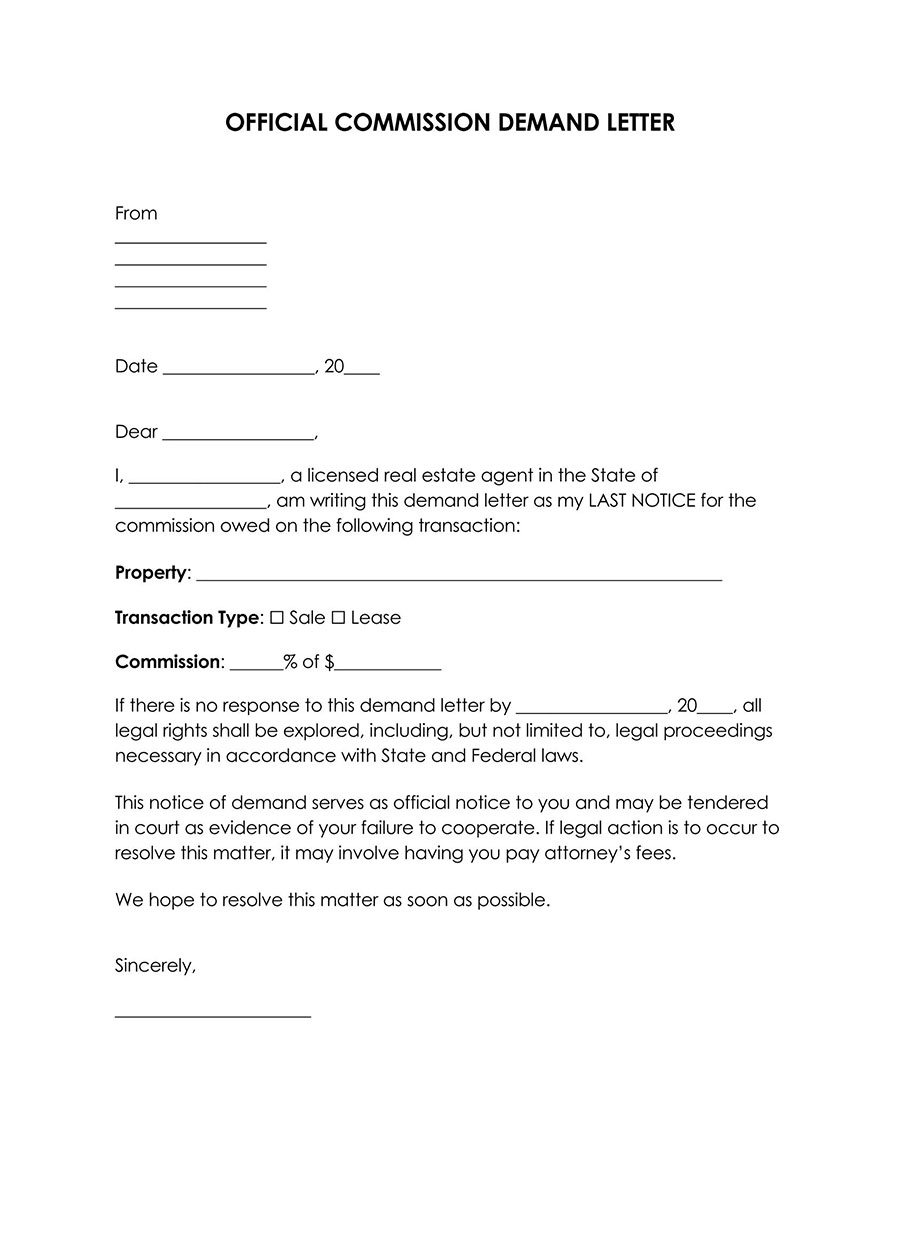

Real Estate Commission

Real estate agents (broker) use this type of demand letter to demand payment of an unpaid real estate commission from a client. The letter can be sent to the property buyer, seller, tenant, or landlord, depending on who was obligated to pay the commission.

Download: Microsoft Word (.docx)

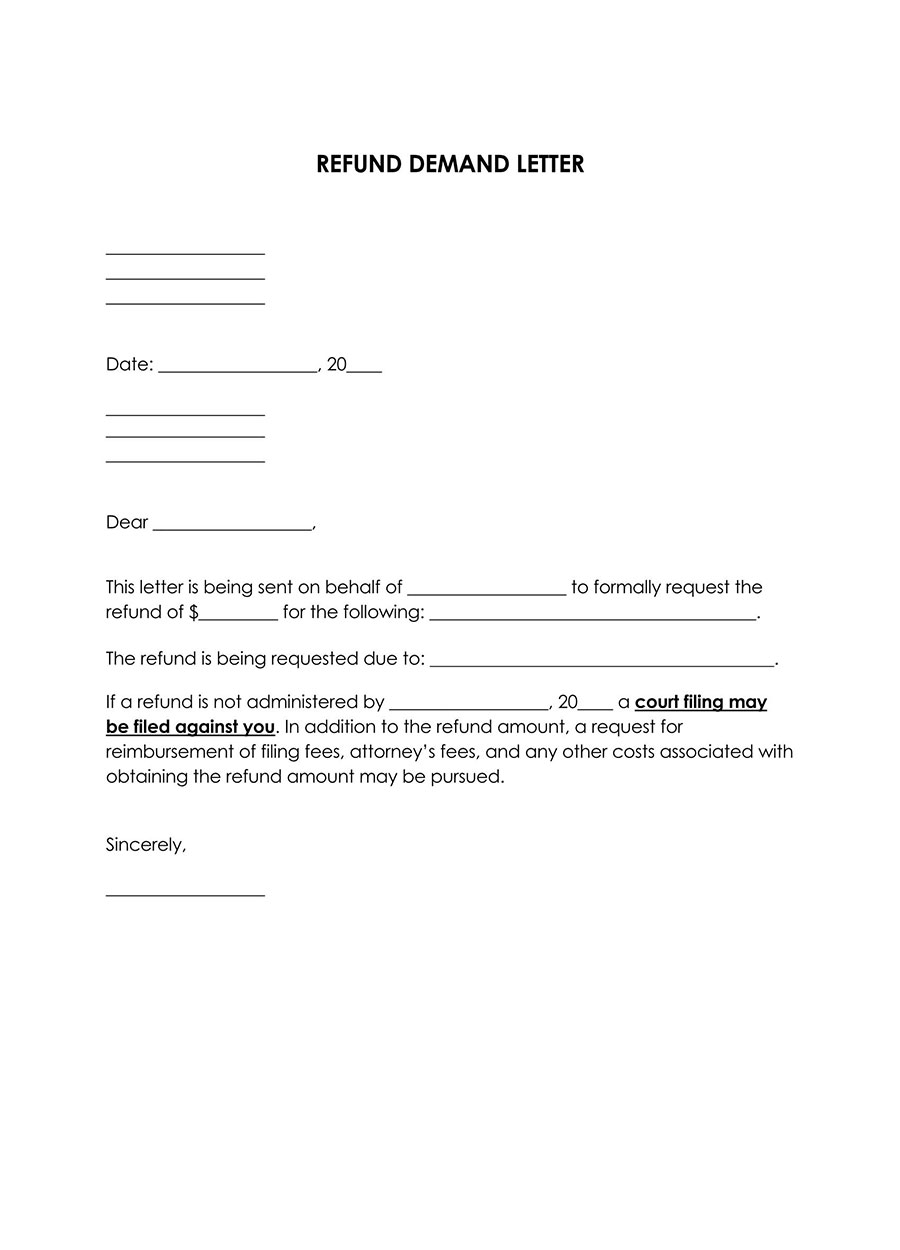

Refund Demand Letter

Customers can send a demand letter to businesses to ask for a refund when they are sold defective goods, or the seller breaks the terms of sale. The letter should indicate the type of service/good, the amount paid, the amount being asked as a refund, the date of transaction, etc.

Download: Microsoft Word (.docx)

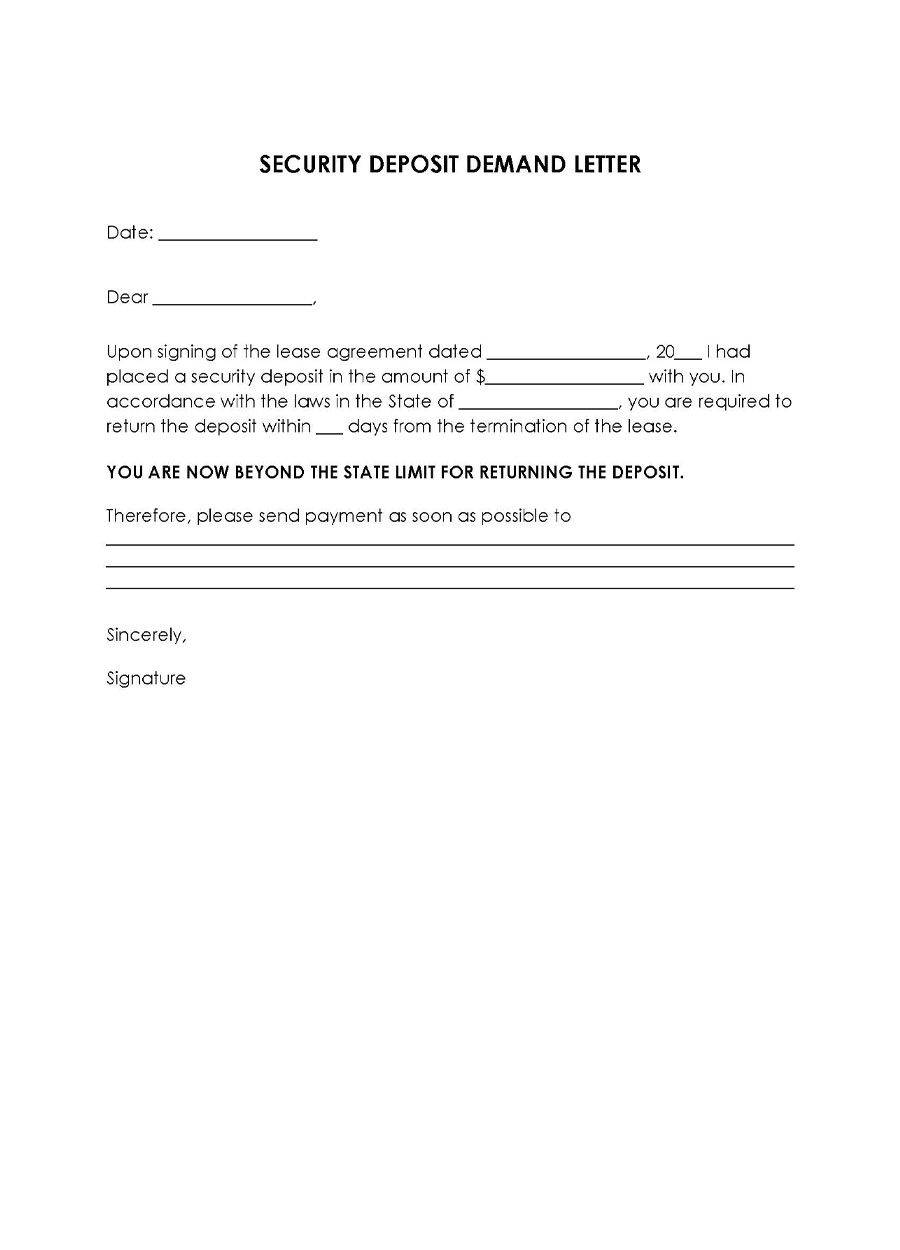

Security Deposit Demand Letter

Tenants can send a letter to demand reimbursement of their security deposit after moving out. The letter should be written after other informal interventions have been made to no avail.

Download: Microsoft Word (.docx)

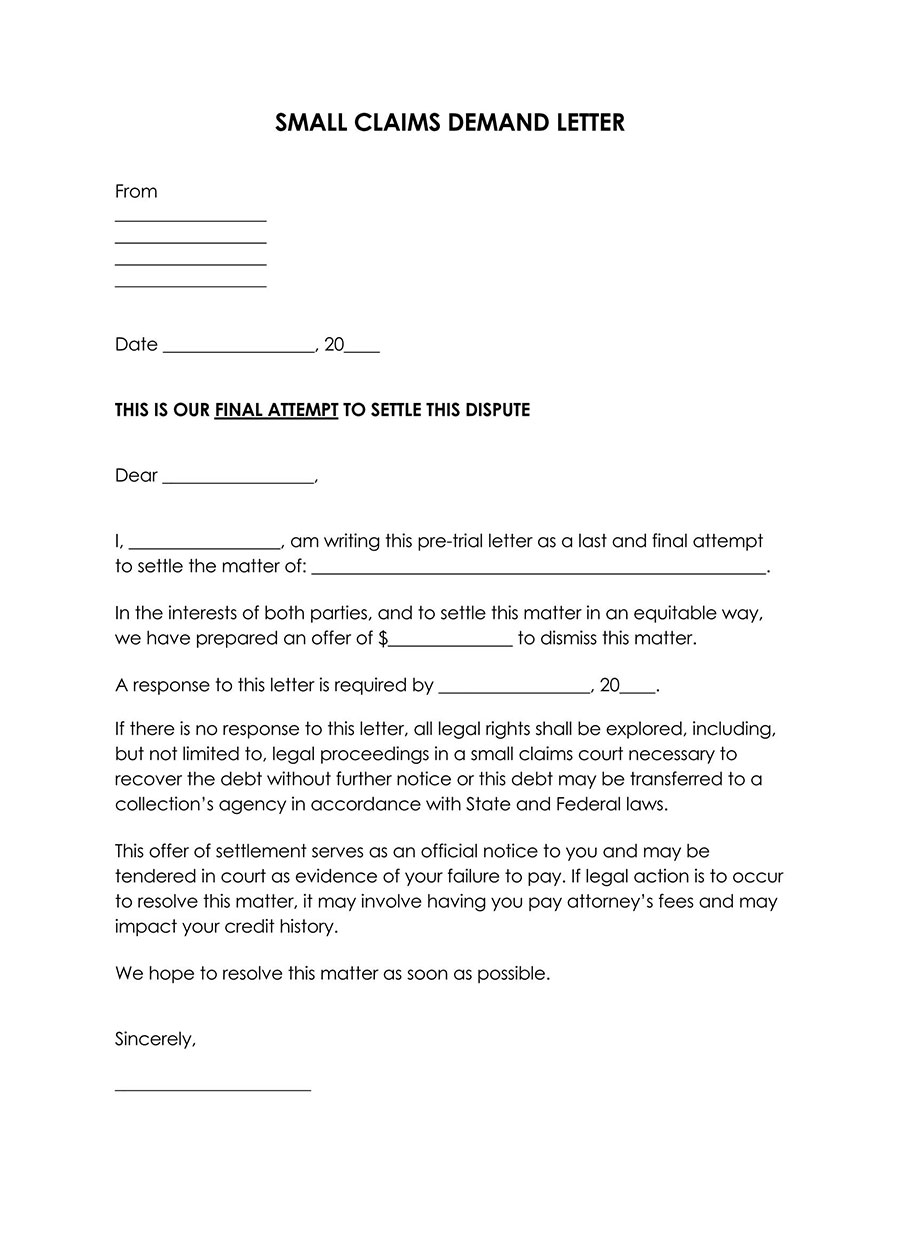

Small Claims Demand Letter

A small claims demand letter is sent to demand payment of personal loans or debts deemed as small claims in the respective jurisdiction. The letter ought to be sent before the creditor takes the case to court.

Download: Microsoft Word (.docx)

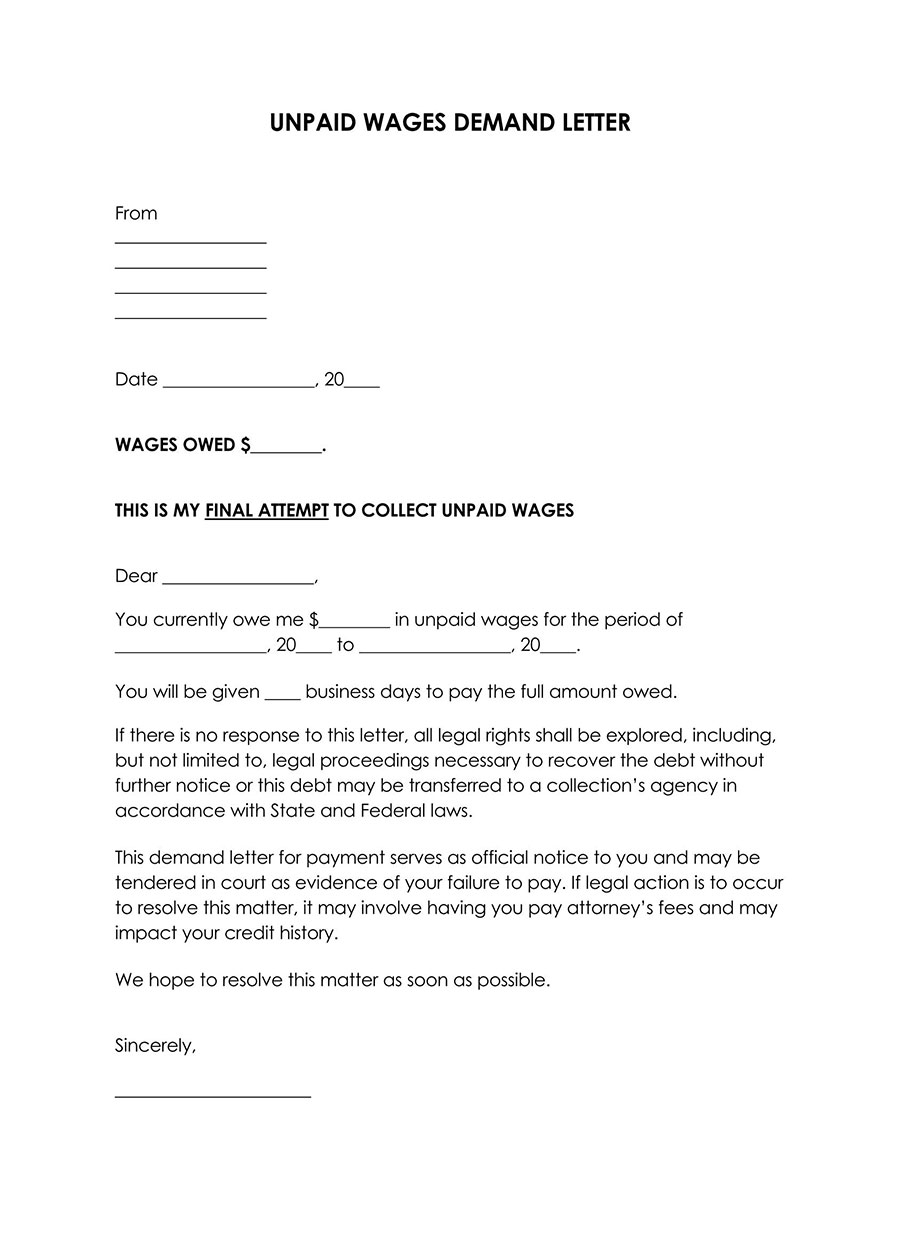

Unpaid Wages

An employee or hired contractor can send a demand letter asking their employer to pay them money owed for services rendered. Such a demand letter is common between employees and former employers to demand the last payment or in cases involving overtime pay.

Download: Microsoft Word (.docx)

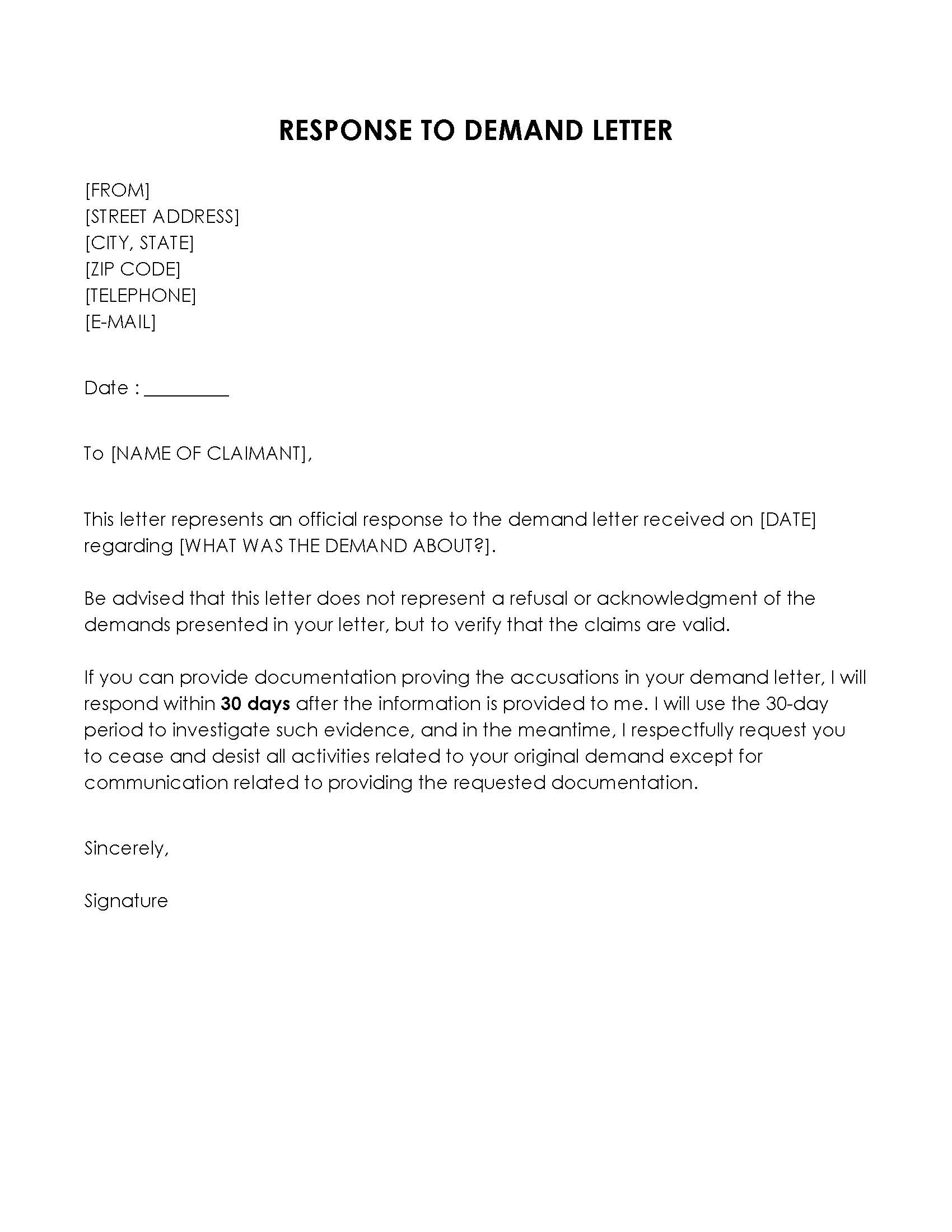

Response to Demand

A response to demand letter is sent by the recipient of a demand letter to acknowledge receipt of the letter. It can state acceptance of demands, a counteroffer, or rejection of the claims.

Download: Microsoft Word (.docx)

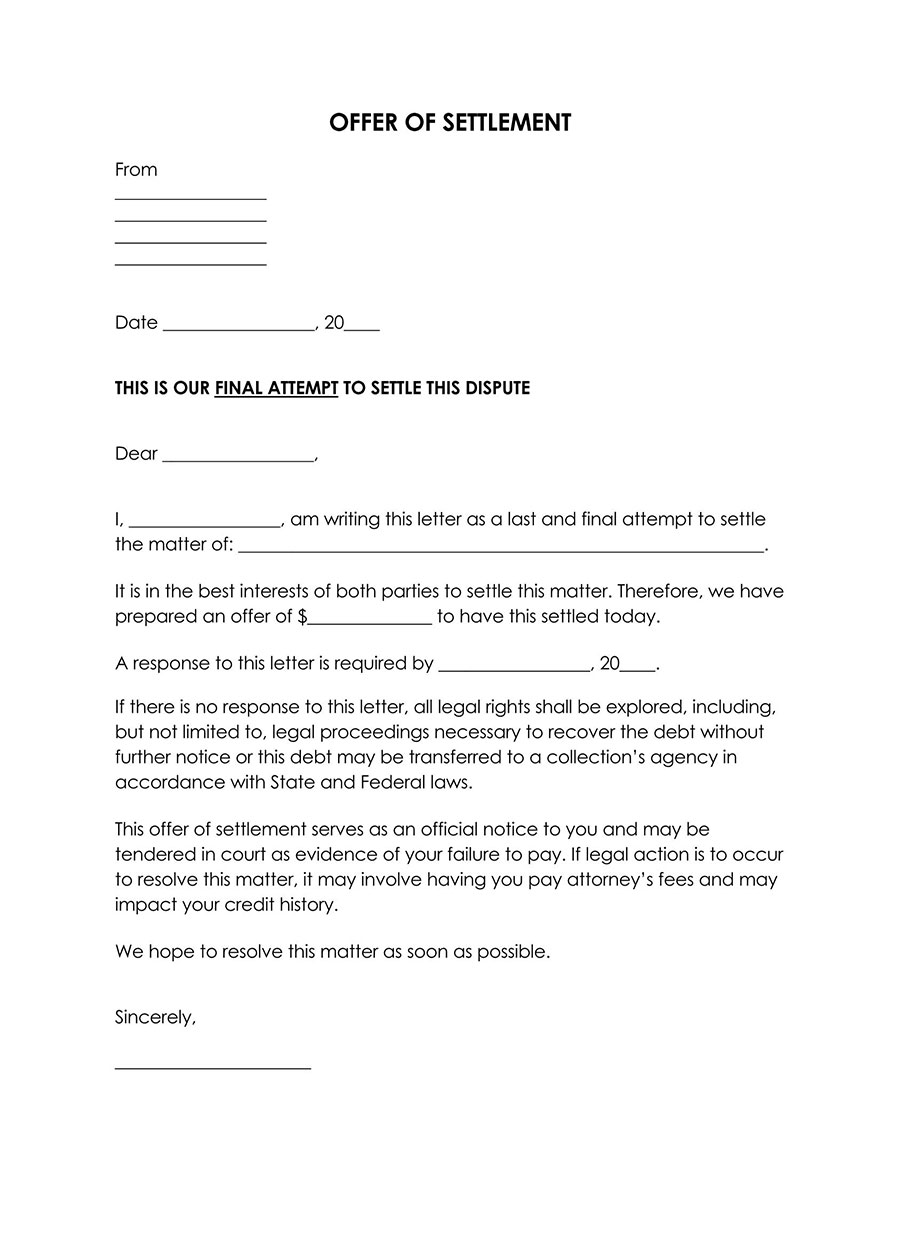

Settlement

After a defendant sends a response to a demand letter making a counteroffer, a settlement letter can be sent accepting the counteroffer or including more favorable terms to avoid taking the dispute to court.

Download: Microsoft Word (.docx)

What to Include in a Demand Letter

Knowing how to structure a demand letter is necessary to ensure it serves its intended purpose. The letter should adopt a business letter format. The specifics of a demand letter differ depending on the details of the conflict in question. However, you can use a standard template that can be used multiple times and for various purposes.

The demand letter template you choose to use should have the following items:

Return address

The letter should have a return address—which is your address—that the recipient can use for correspondence. The address should contain your name or that of the person assigned to receive the demand letter’s response, the name of the organization (if applicable), the street address, the city, state, and ZIP code.

Date

A date should also be supplied in the letter. This is the date the letter was written. It must specify the day, month, and year. Dates are important should the case go to court.

Salutation

The template should also have a salutation after the date. The salutation can be formatted: “Dear,” followed by the recipient’s name. The recipient of the letter can be the owner, officer-in-charge operations manager, or any other person obligated to handle the issue at hand. Ensure the name appears in the letter, as it is provided in other documents that can be used to support your case.

Your details

After the salutation, the next section in the demand letter should provide your details. You can introduce yourself by providing your official name.

Demand statement

A demand statement should then be supplied to declare the violation or wrongdoing and demands you want the recipient to fulfill. The demand should be direct and specific. The statement must also declare that the letter will be the last warning issued to the recipient. Additional supporting information can also be written down. If supporting documents are attached, they should be declared/mentioned in this section.

Amount of debt owed, if applicable

If you are seeking monetary compensation or settlement from the recipient, you should indicate the amount owed. This section is mandatory for demand letter templates for debt repayment. You should indicate the cause of the debt, the amount owed, the initial due date, and the settlement terms.

Deadline for compliance

The deadline for compliance should then be stated. Make sure to write down the day, month, and year for clarity. The consequences of non-compliance should also be provided in this section. It is important to inform the recipient that legal solutions shall be explored if they don’t heed the demands.

Action required

If you are seeking corrective action, the letter should have a description of the specific action the recipient should take. If there are multiple actions to be taken, they should be listed.

Insurance claim, if applicable

If the demand letter is being used for insurance claims, details about the claim should be outlined in the template. Details such as the claim number, date of incident, amount requested, type of claim, etc., can be included.

NSF check, if applicable

A demand letter notifying a debtor of a non-sufficient funds check should provide details about the NSF check. Such details include the check number, amount, bank name, and purpose of the check. You can also request reimbursement of postage and bank fees in such a case.

Stop payment, if applicable

If the demand letter is meant to ask for payment after a debtor imposes a stop payment on a check, it should outline details about the check and ask for payment to be made as agreed upon. Such a template for a demand letter can indicate the check number, bank name, amount owed, and the date when the check was issued.

Signatures

Lastly, you should sign the letter. A signature authenticates the document. By authenticating the document, it becomes admissible in court.

Template Demand Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Address]

[City, State, Zip Code]

Subject: Demand for [Brief Description of Demand]

Dear [Recipient’s Name],

I am writing to formally address [describe the issue or situation, e.g., “the outstanding payment for services rendered,” “the breach of our contract dated XYZ,” “the damages incurred due to your negligence,” etc.]. Despite previous attempts to resolve this matter [describe any previous communication or efforts to resolve the issue], I have yet to receive a satisfactory response/action.

As you are aware, [provide a brief explanation of the agreement, expectation, or legal obligation, including any relevant dates or details]. To date, this has resulted in [describe the impact or damages, e.g., financial loss, personal injury, property damage, etc.]. [If applicable, mention any documents or evidence you are attaching, such as contracts, invoices, photographs, or correspondence.]

Therefore, I am writing to demand [specify your demand, e.g., “immediate payment of $X,” “repair or replacement of the damaged property,” “compensation for medical expenses,” etc.]. I expect this matter to be resolved by [provide a specific deadline, typically 15-30 days from the date of the letter], which I believe provides ample time for a resolution.

Please be advised that failure to meet this demand within the specified timeframe will leave me with no choice but to pursue all available legal remedies, including [mention any specific actions you are prepared to take, such as “filing a lawsuit,” “reporting to a credit bureau,” “seeking arbitration,” etc.]. I hope to resolve this matter amicably and without the need for further legal action.

I urge you to take this demand seriously and respond by [repeat the deadline] to avoid any further complications or legal proceedings. Should you have any questions or require further clarification, please do not hesitate to contact me directly at [Your Phone Number] or via email at [Your Email Address].

Thank you for your prompt attention to this matter. I look forward to your cooperation in resolving this issue as swiftly and amicably as possible.

Sincerely,

[Your Name]

[Your Signature, if sending a hard copy]

Sample Letter

Subject: Demand for Payment of Outstanding Debt

Dear Chris Robinson,

I hope this letter finds you well. I am writing to remind you of the unpaid debt that you owe me in the amount of $2,500, which was loaned to you on June 15, 20XX. As per our agreement, this amount was expected to be repaid in full by August 15, 20XX. To date, I have not received any payment nor any communication from you regarding an intention to repay this debt.

I have always valued our relationship and have been patient in awaiting your repayment. However, the lack of communication and failure to meet the agreed repayment deadline have compelled me to formally demand the immediate payment of the full amount owed.

Please consider this letter a final reminder to settle the outstanding debt of $2,500 by no later than October 20, 20XX. Payment can be made via bank transfer, check, or any other method we agree upon. I am willing to discuss a payment plan if you are unable to repay the full amount by the specified date. However, it is imperative that you contact me immediately to discuss this matter and confirm your plan for repayment.

Failure to comply with this demand within the specified timeframe will leave me with no choice but to take further action to recover the debt. This may include legal proceedings to ensure the debt is repaid, along with any additional costs and interest incurred due to the delay. I sincerely hope that we can resolve this matter without the need for such actions.

I urge you to take this matter seriously and to respond promptly. You can reach me directly at 555-678-9100 or via email at jordan.matthews@email.com. I am hopeful that we can come to a satisfactory resolution and move past this issue.

Thank you for your immediate attention to this matter. I look forward to your swift response and resolution of this debt.

Sincerely,

Jordan Matthews

Key Takeaways

The demand for payment letter is effective due to several key components that ensure its clarity, firmness, and professionalism:

Direct and Clear Statement of Issue: The letter immediately identifies the core issue—the unpaid debt of $2,500, including the specific dates of loan issuance and the missed repayment deadline. This direct approach leaves no ambiguity about the purpose of the communication.

Reference to Agreement: Highlighting the agreement made between the parties regarding the loan and its repayment terms reinforces the legitimacy of the demand. It reminds the recipient of their commitment and the expectation of repayment, grounding the request in a mutual understanding.

Expression of Goodwill: Mentioning the value placed on the relationship and the patience shown thus far serves to soften the demand, indicating a preference for amicable resolution. This tactful balance between firmness and concern for the relationship helps maintain a respectful tone.

Final Reminder and Call to Action: Declaring the letter as a final reminder introduces a sense of urgency. The clear demand for payment by a specific date and the openness to discuss a payment plan if necessary offer a path forward for resolving the issue. This approach demonstrates flexibility while emphasizing the seriousness of the situation.

Warning of Further Action: The letter warns of potential legal actions to recover the debt if the demand is not met within the given timeframe. This warning is crucial for highlighting the consequences of non-payment and underscores the determination to resolve the matter.

Contact Information and Urgency for Response: Providing contact details and urging a prompt response facilitate communication and signal the importance of quick resolution. It shows readiness to engage and solve the problem while emphasizing the urgency of the matter.

Professional Tone Throughout: Maintaining a professional tone despite the potentially sensitive nature of the subject matter ensures that the letter is taken seriously. It reflects respect for the recipient while clearly stating the demand and possible consequences of inaction.

Overall, the letter’s effectiveness lies in its structured presentation of the problem, the balance between firmness and respect for the relationship, and the clear outline of expected actions and potential consequences. This approach maximizes the chance of a positive outcome while preparing for necessary escalation if the issue remains unresolved.

Must-to-Follow Advices

A comprehensive demand letter is crucial in getting the recipient to understand and comply with your request.

Therefore, to improve the efficiency of your letter, you can incorporate the following writing tips:

Type your letter

Always type your letter. Typed letters are more legible than handwritten letters and reduce the chances of words being misunderstood, especially if the handwriting is not as clear. Typing is also faster and easier to edit.

Include the facts

The demand letter template outlines factual information regarding the conflict in question. Information provided in the letter should exhibit neutrality since the letter can be used in court. You can also include details about events such as unanswered calls that led up to the demand letter as a last resort.

Be polite

Regardless of the extent of the dispute, you should remain polite throughout the letter. The letter should not be an attack on the at-fault party but the last warning. Politeness can sometimes invite a similar response which ends up expediting the process.

Be clear with your demand

From the onset of the letter, go straight to the point. Always be specific with your demands. If you are asking for a settlement, ask for an exact figure, not a range. Also, do not include unnecessary information. However, you can include details that support how you arrived at figures when asking for a settlement.

Set a deadline

Always impose a deadline on your demands. This is an effective way of illustrating the urgency of the issue and motivates them to respond to avoid a lawsuit. Specify the deadline by indicating the actual date.

Use professional language

This letter should be kept professional regarding formatting, language, and tone. Therefore, you should avoid using inappropriate language, and the language should not imply extortion.

Be honest and accurate

You should be truthful and accurate in your demand letter. To ensure you achieve this, you can review past notes, reports, agreements, and receipts to ensure that the details you include in your letter are accurate and truthful.

Make and keep copies

Before sending this letter, always make more than one copy for safekeeping. Therefore, should the recipient dispose of their copy, you will still have a copy to present in court. Also, keep the return receipt from the post office and correspondence from the defendant.

Proofread

Always proofread the letter before sending it. Ensure to correct any errors in grammar, typing, and spelling. An error-free letter reduces the chances of misinterpretation.

Use a sample or a template

You can use demand letter samples and templates available online to guide you through the writing process to ensure you include all the required details in your letter. Using a template for your demand letter saves you the time and effort of creating the letter from scratch. Reviewing samples helps you gain insight into what you should include and how to structure the letter.

Frequently Asked Questions

There are three likely scenarios after you send a demand letter. They include; the demand is met, a counteroffer is made, or the demand is refused. The two scenarios that need more attention are the last two.

A counteroffer does not imply they are unwilling to pay. It simply shows they might not agree to the demands or accounts and are willing to negotiate. You can choose to accept or make a counteroffer. However, you are not obligated to accept the counteroffer. If the demand is not met, you can proceed to file the case in court.

If the recipient doesn’t respond to your letter, you should follow through with the consequences of non-compliance outlined in the letter. In most instances, this involves filing a lawsuit against them.

An eviction notice is a demand letter that landlords use to ask their tenants to fulfill their lease agreement terms or else get evicted. An eviction letter can demand the tenant make a payment or move out depending on the gravity of the breach of contract.

A creditor writes a money-owed demand letter to a debtor demanding that they pay back the money owed or face legal action. Alternatively, a breach of a contract demand letter is written to warn an individual or entity who has violated the terms of an agreement.