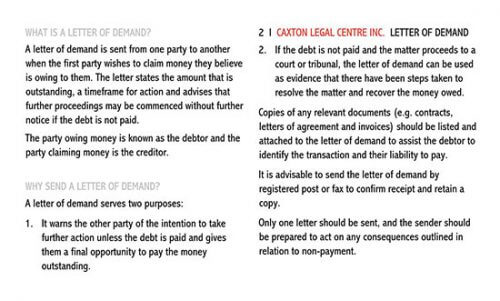

A demand letter for payment is generally a formal, written document detailing how debt should be paid before going to court to open a dispute. It notifies an individual/company that you are considering legal action against them. This letter can be viewed as an initial, non-confrontational approach to recovering a debt.

The best outcome is that once the individual/company is put on notice, they will simply clear off the debt or discuss the terms, and you won’t be forced to escalate the matter to court.

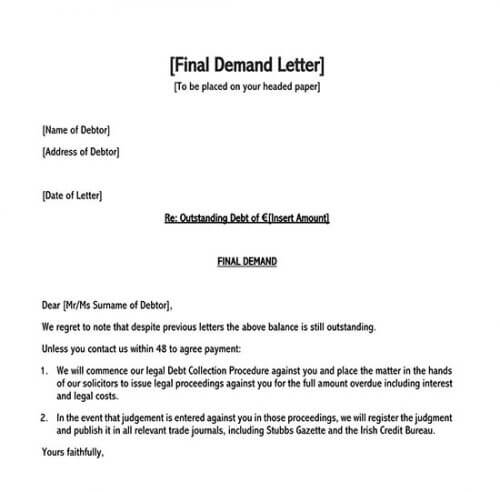

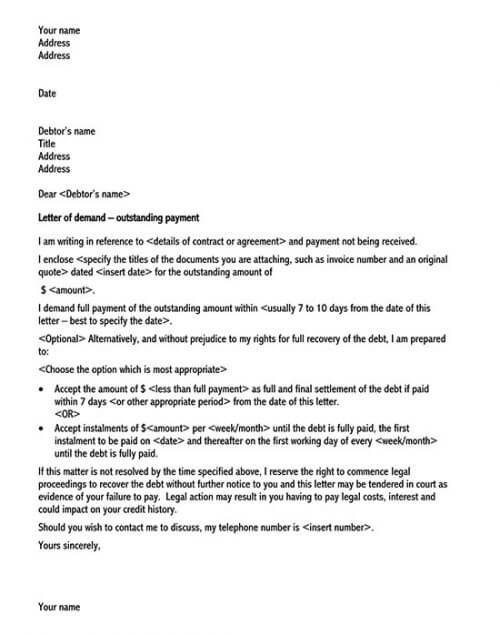

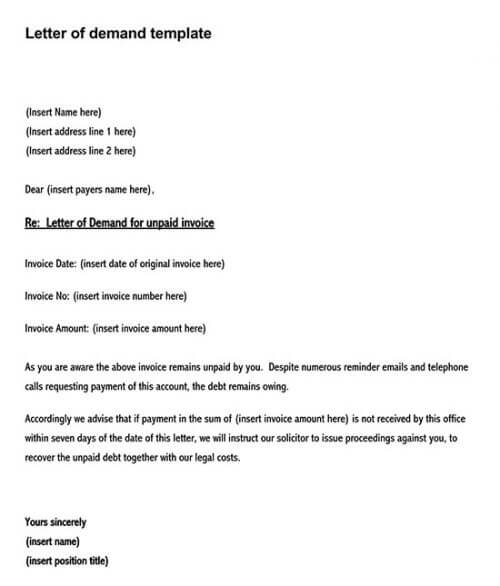

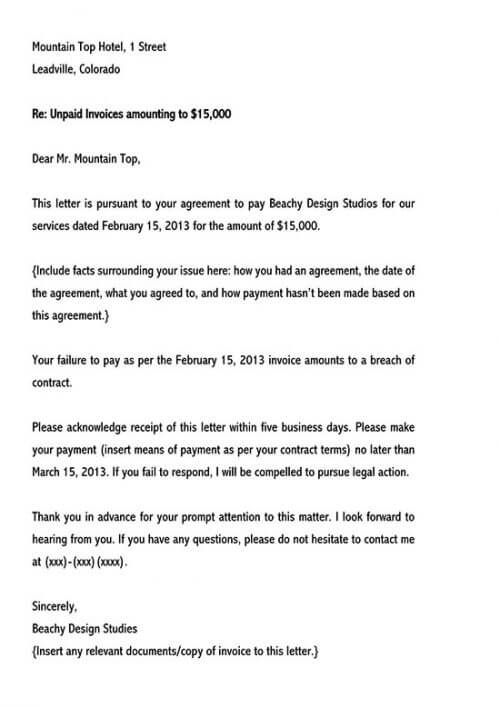

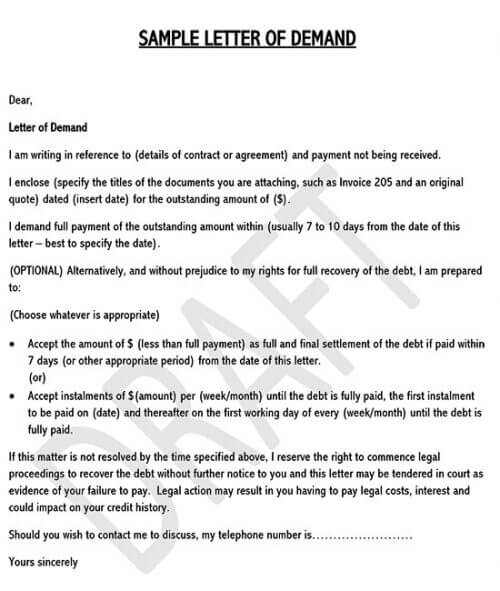

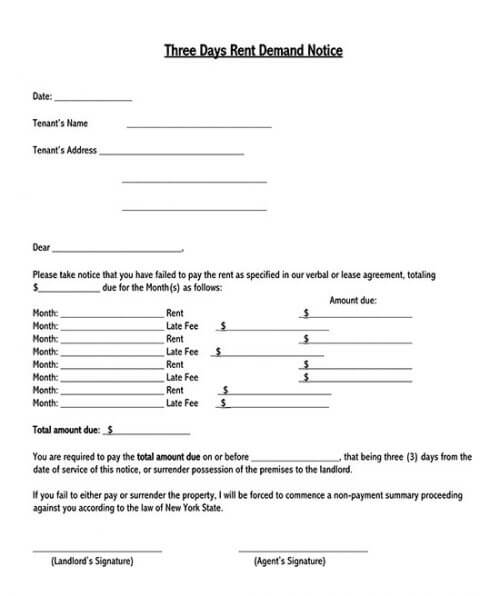

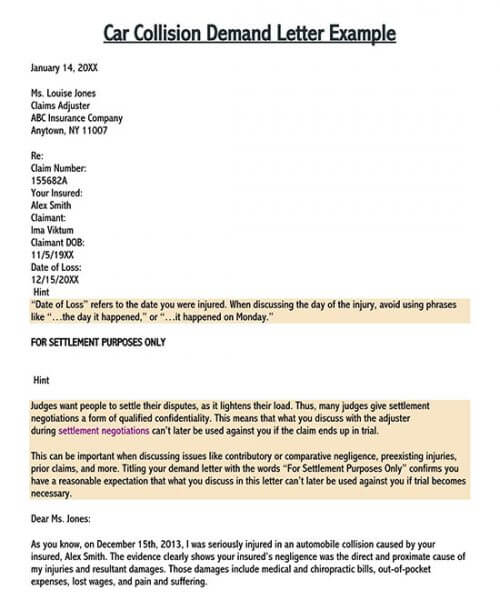

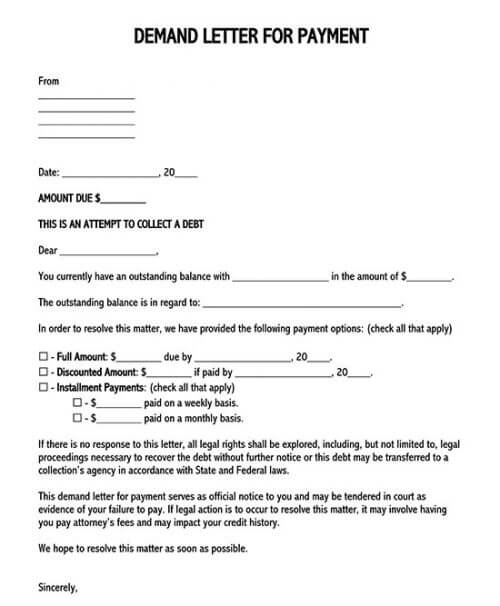

Free Templates

What is Included in It for Payment?

Generally, it must state the purpose for writing the letter, request payment or action by a specific date, and the legal actions that shall be taken if they fail to respond to the letter.

The contents differ depending on the reasons for writing the letter.

The primary things to include are:

- Party Information: You must include your name and the name of the person/company that owes you

- Date: The date on which the debt was incurred

- Debt Owed: It must outline the reason for the debt, the total amount, and the date on which the amount was to be paid.

- Action Required: It should include a description of the action being requested. Provide a clear and definitive expectation of the payment. This consists of a date on which the payment should be made.

- Details of the debt: Provide a brief description of the nature of the debt, including:

- The nature of the agreement

- The amount agreed to and

- How the agreement has not been followed

- Consequences for non-payment: The letter should notify the individual/company of the next step you will take to have the issue resolved.

- Signature: The author should personally sign the document

When Do I Need to Write it?

This letter is used in any situation where someone owes you money and is not paying it back as per the agreement terms. Keep in mind that every case is not the same and should be approached differently.

EXAMPLE

If you are hired and assigned a specific task to do and you have completed the work as agreed, you shouldn’t send it immediately after completing the work. In this case, a professional invoice will suffice.

However, if the payment is not made on the date agreed upon in the agreement and, after making follow-ups, you still haven’t been paid, then the letter is appropriate.

Similarly, it would be appropriate to charge for services not rendered or products not delivered. However, before sending this letter, you should try reaching out to the other party either by email, phone, or any other means available at your disposal.

You can also use it when you believe a company is intentionally refusing to credit your account after making several attempts to contact them and explain your situation to them.

What If You Have No Contract But Have a Verbal Agreement?

Verbal agreements are honored by the court, provided the “statute of frauds” does not apply to that particular transaction. However, an oral agreement may be hard to prove. A court will look at the transactions and the performance leading to the dispute and award a remedy accordingly.

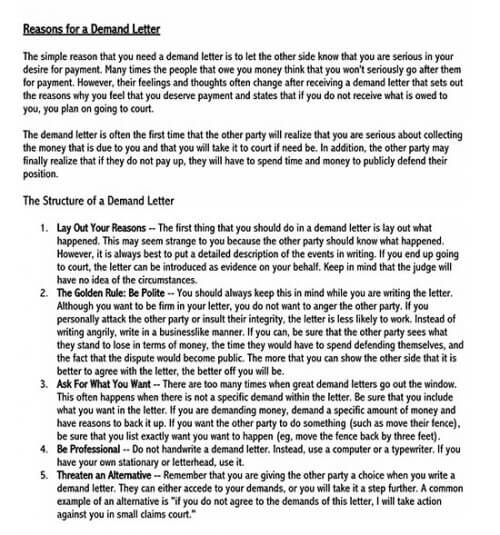

The Consequences of Not Sending it

The most common consequence is that you may never get paid. Remember, just as you have many things going on in your life, so too does the individual/company that owes you money, and there is a chance that they may have forgotten about their debt.

They may also have assumed that they have already paid you, or there might be a mix-up of your payment information, and the payment was never processed. Without sending a demand letter, you may be leaving money on the table.

How to Present It

- Be professional: When writing a demand letter, you should maintain professionalism. Use correct grammar and spelling. Avoid any unnecessary details and go straight to the point. Make sure to include your legal name, and address along with the full name, address of the recipient (individual/company), and the date on which the letter was written.

You can download our preformatted templates to make it easier for you when writing. The templates will also help you make sure that you have provided all the necessary details required in the letter.

- Read it through the recipient’s eyes: After drafting the letter, make sure to go through it from the recipient’s perspective. Ensure that you have used polite language. Try to be as compelling as possible, making sure that there is no room for doubt.

- Send by certified mail: Using certified mail with a return receipt is probably the most effective way of sending the letter, as it guarantees that it was received. Should the person claim not to have received the letter, then you shall have evidence against such claims.

What Happens After It is Sent?

After properly drafting and sending it, expect any of the following responses from the recipient:

- Acknowledge the issue and comply with your request: The recipient may acknowledge their mistake in the matter and make thepaymentt.

- Reply with a counteroffer: The recipient may respond with a counteroffer. A counteroffer may be a quick way to solve the issue. You must, however, check to ascertain that the terms set for the counteroffer are beneficial to you; otherwise, you can refuse and continue with the negotiation process.

- Reply with a debt verification letter: The recipient may send you a debt verification letter to ask you to verify and provide proof of your claimed debt.

- Ignore your letter: The recipient may decide to ignore your letter. If you don’t get any response in two weeks, then the best option would be to either try and contact them again or commence legal proceedings with the help of your attorney if they are unreachable.

Will This Letter be Used in Court?

If the recipient fails to heed the demands stipulated in the letter, then you can opt to take the matter to a court of law. You can present it to the judge as proof to show that you tried resolving the matter out of court.

Benefits of Sending this Letter

- It summarizes your case by providing a detailed description of the job and the facts at issue in your case.

- It is usually a show of good faith. And can be used in a court of law as proof that you tried settling the case out of court. And may qualify you for other remedies; for instance, the court may rule that you be compensated for the attorney fees or collect penalties.

- It promotes settlement and gives the party in breach a final opportunity to make things right without litigation.

Can I Send it Without a Lawyer?

Even though you can send a demand letter on your own, having an attorney send your letter has its advantages, including:

- A letter from an attorney carries more weight than a formal letter.

- Having your attorney send the letter makes it clear to the breaching Party that you are ready to pursue legal actions against them should they fail to heed to your demands.

- An attorney can write the letter in a way that takes advantage of laws providing for the collection of other remedies.

- A letter from an attorney is likely to be taken more seriously compared to a formal letter.

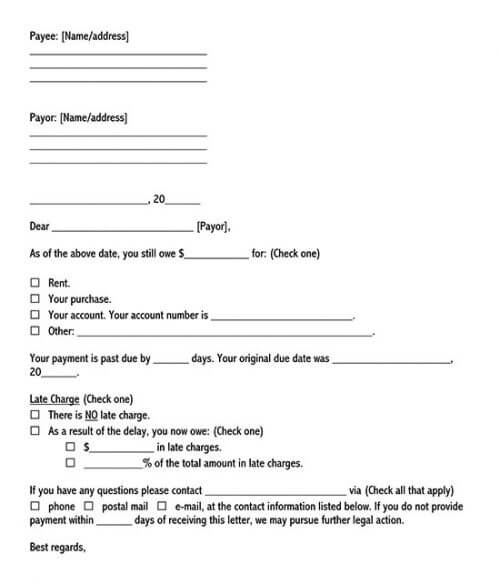

template

[Your Name]

[Address]

[City, State, Zip code]

[Email]

Date:

[Name of the Breaching Party]

[Address]

[City, State, Zip code]

Dear: __ [Name of Breaching Party]

This demand letter is in line with the loan that I gave you on the [Date] in the amount of _ [include dollar amount of the loan] for the down payment of your new home. At that time, we agreed that the loan was to be repaid on or before_____________ [Date].

You have failed to make any payments towards this loan. It has been [no of months/years] since the loan was to be repaid in full. I request that upon receiving this letter, you make the full payment of the amount.

Failure to make the payments in full before [Period], I reserve the right to take further legal action against you to recover the debt without offering any other notice to you.

This letter shall be provided as evidence in court should you fail to pay with the demands made. If this matter escalates to court, you shall be required to pay all the applicable interest, filing, and attorney’s fees, any other related expenses.

Your immediate response to this letter will be appreciated.

Regards,

__ [Your Name]

__ [Phone Number]

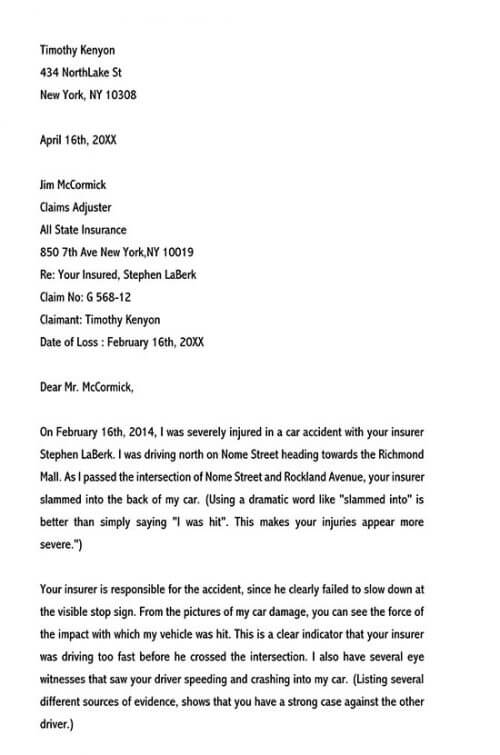

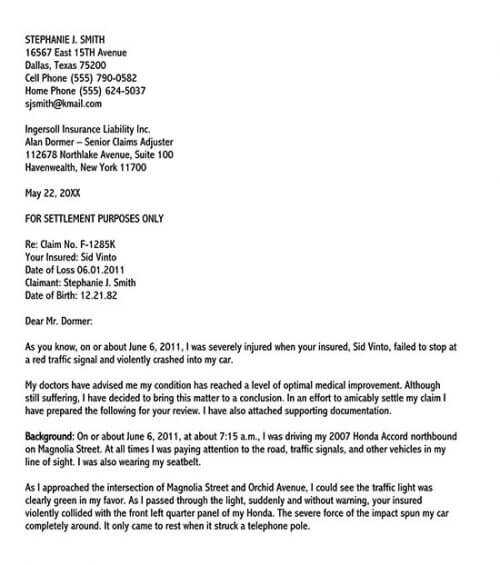

Sample Letter

In this section, a sample demand letter for outstanding payments is provided, serving as a practical template for you when seeking to address overdue payments professionally.

sample

Subject: Demand for Payment

Dear Mr. Johnson,

I am writing to formally request the immediate payment of an outstanding debt incurred by BlueTech Innovations Inc. under your management. This debt, amounting to $15,000, stems from a contractual agreement dated April 15, 20XX, wherein I provided specialized software development services for your company’s latest project.

Our agreement, which is enclosed for your reference, clearly stipulates a payment of $15,000 for these services, with the full amount due by July 1, 20XX. To date, this payment has not been received, leading to an unsettled debt that impacts my financial obligations.

Given the lapse in the agreed payment schedule, I now require the total amount of $15,000 to be paid by January 15, 20XX. Payment can be made via bank transfer or a certified check to ensure a swift and secure transaction.

Please be advised that failure to comply with this demand may compel me to initiate legal proceedings to recover the debt. Such actions will likely result in additional costs, for which your company will be held responsible.

I trust that we can resolve this matter amicably and without the need for further legal action. Should you wish to discuss this matter further or propose an alternative payment arrangement, please contact me at (555) 123-4567.

Your prompt attention to this matter is highly appreciated.

Sincerely,

[Handwritten Signature]

Alice Smith

Key Takeaways

This letter serves as a formal demand for payment, and it is well-structured and professionally written, making it a good guide for someone in a similar situation.

Here are the key aspects of the letter that contribute to its effectiveness:

- The subject line “Demand for Payment” is straightforward and immediately informs the recipient about the purpose of the letter.

- The tone of the letter is formal and respectful, which is crucial in maintaining professionalism, especially in potentially contentious situations.

- The letter includes specific details such as the amount owed, the origin of the debt (contractual agreement for software development services), and the date of the agreement. This clarity leaves no room for ambiguity.

- Including a reference to the enclosed agreement strengthens the writer’s position by reminding the recipient of the contractual obligations.

- Setting a new, specific deadline for the payment provides a clear timeframe for the recipient to act.

- Offering multiple methods of payment (bank transfer or certified check) makes it easier for the debtor to comply.

- The warning about potential legal proceedings is a necessary step in escalation but is presented as a last resort, which is appropriate for maintaining a professional demeanor.

- The invitation to discuss the matter or propose alternative payment arrangements shows flexibility and a willingness to negotiate, which is often effective in resolving disputes amicably.

- Providing contact details makes it easy for the recipient to reach out and discuss the matter.

- The closing remarks express hope for an amicable resolution and appreciation for prompt attention, which helps to keep the interaction positive.

For someone in a similar situation, this letter serves as a template for how to communicate a demand for payment firmly but respectfully.