A Yearly Budget is a financial plan that enables a business person to allocate future personal income annually towards expenses, savings, and debt repayments after considering past spending and personal debt.

Free Templates

Importance of Yearly Budget

This budget provides a person in business with a clear understanding of the expenses and revenue generated by the business. The budget can break down and distribute money to improve the financial state of a business.

The following are reasons why a business person should consider having an annual budget:

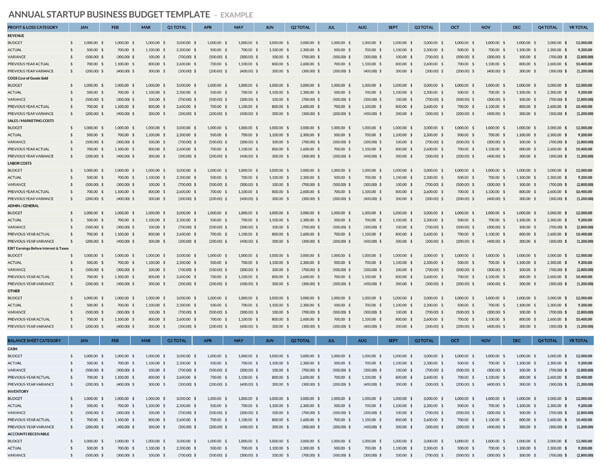

- Provides financial picture: A yearly budget provides a pre-set list of the projected and actual expenditure and revenue and their difference. The information is then used to allocate money for adequate use in the business.

- Evaluates annual revenue vs expenditure: This budget evaluates the use of revenue and expenditure in a business and enables a business person to compare it to the previous year. The evaluation and comparison help keep track of the increase in revenue and expenditure, which affects the business’s operational costs and helps create a sound financial plan.

- Enables a businessman to calculate variances: Variances are the differences between actual and projected costs. A yearly budget can help a business person to calculate the expense variances, which can either positively or negatively impact the business.

- Increases profit: Creating a budget increases profit in a business by allocating finances in areas that are likely to increase revenue.

Basic Elements (What to Include?)

A yearly budget can help steer a business in the right financial direction and stimulate growth. Therefore, a person in a business should consider using the yearly budget to identify any areas of unnecessary expenditure by providing a detailed list of expenses and income. This budget must therefore contain all the necessary elements which will ensure its usability and effectiveness.

A business person should hence include the following information in the yearly budget:

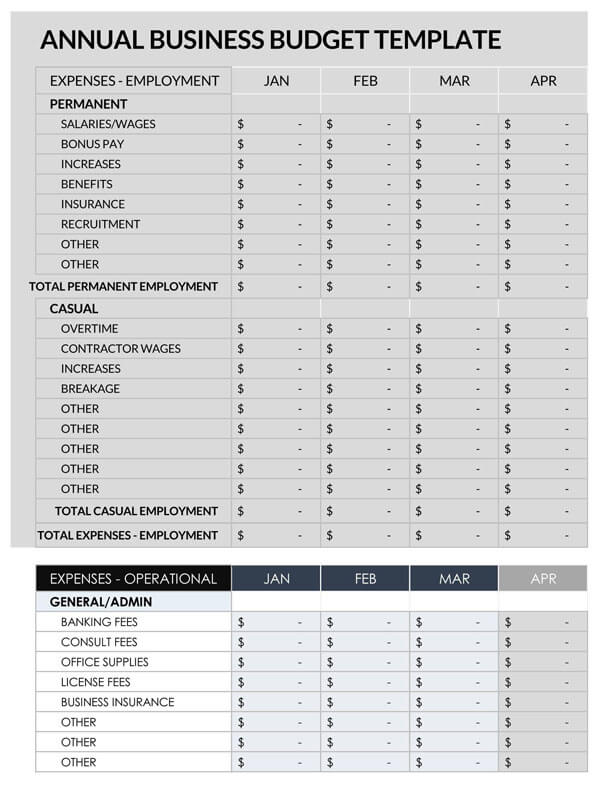

Employee costs

Employee costs are the total costs of employing individuals that a businessman incurs, such as salaries, benefits bonuses, insurance, etc. The yearly budget should contain both the actual and projected employee labor-related cost. A businessman can calculate the employee’s labor cost by adding their gross wages to the total cost of related expenses.

Office costs

Office costs can include water, electricity, internet, rent, security, and any additional operational costs incurred by a businessman. The yearly budget must include the actual and projected office costs to ensure its reliability.

Including the office, costs can help a businessman usefully allocate money to necessary expenditures.

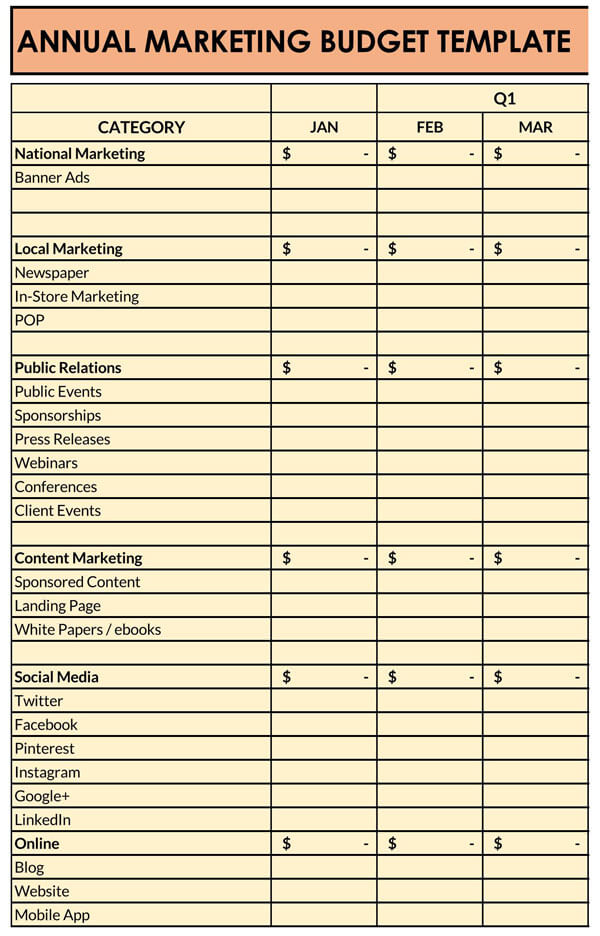

Marketing costs

Marketing costs can be defined as all the expenses that a business incurs to market, sell, develop and promote its products and brand. Marketing costs include trade shows, website hosting, advertising, etc.

Marketing costs are of two categories:

- Fixed costs: Fixed marketing costs include advertising campaigns, sales forces expenses, sales promotion, and distribution costs, salaries for salespersons, etc. These fixed costs are monthly. The results of fixed marketing are often only visible in the long term, making them difficult to evaluate.

- Variable costs:Variable marketing costs include sales commission, distribution costs etc. Variable marketing costs are less risky as opposed to fixed marketing costs

A businessman should include both the actual and projected marketing costs in the yearly budget to identify which marketing avenues should receive a larger financial allocation.

Travel costs

Travel costs include expenses such as transportation, lodging, and subsistence that a businessman incurs from the official business travel of employees. Travel costs are included in the budget to identify exactly how much money the businessman can use for official movement and what affordable option should be considered

EXAMPLE

Movement by air or road.

In-house income

In-house income includes the revenue streams that a business has, such as sales, commissions, service charges. The amount of money that a business generates should be included in the budget for proper allocation.

Investment income

Investment income is revenue generated from increased investment value such as dividends, capital gain, investor contributions, loans, and interest. A business person can effectively allocate a reasonable percentage of money on the yearly budget to investments that are likely to generate income.

Expense variance

Expense variance is the difference between the projected and actual expenses of a business. The expense variance can either be positive or negative. An expense variance is positive when the expense is less than budgeted. The variant is negative when the expense is more than budgeted. A positive expense variance projected in the budget enables a business to save money which can be added in as profit or allocated to another sector of operations.

Income variance

Income variance is the difference between the projected and actual expenses. Income variable is the amount of money a business does or does not earn monthly.

Summary

The summary will highlight essential information, including variances of projected and actual expenses and income sources of a business. The summary of a yearly budget should also include the businessman’s financial goals.

Making and Planning a Yearly Budget

Making this budget grants a businessman financial control over the business. The ability to pre-allocate finances ensures that a business is on a stable trajectory. A yearly budget enables saving of money and discourages unnecessary expenditure. It also ensures that a business person can keep the financial health of the business.

The following procedure can enable a business person to create a helpful and reliable budget:

Note the net income

The net income is the amount of money left after a businessman subtracts taxes and other deductibles such as expenses and costs from gross income.

The first step of creating a yearly budget is noting down the actual net income. The businessman should not overestimate the figure as this would seriously distort the budget. If the amount the businessman notes is too high, then creating an expensive yearly budget is a risk. If the amount noted is too low, the businessman runs a risk of creating a budget that insufficiently supports the business.

Track the expenditures

The second step of creating a yearly budget is tracking the businessman’s spending. Tracking of expenditure can help identify major unnecessary spending which is financially crippling the business.

A business person can track spending by doing the following:

- Checking account statements: A person in a business can obtain bank statements to help identify where the money coming into the business is going.

- Categorizing expenses: A business person should categorize the expenses in a digestible and informative manner, such as fixed and variable expenses.

Set the goals

Next, the businessman should set realistic and attainable goals for both the business’s short and long-term lifespan. The businessman’s vision for the business can help provide clarity on where to start setting goals. A businessman’s goals should always be quantifiable, flexible, and specific to help identify whether they have been reached. The set goals will determine where the money goes in the yearly budget.

Make a plan

Then, they should use the compiled variables and expenditures to make a realistic plan.

EXAMPLE

A businessman can decide to downsize the workforce or forego other expenditures for a more manageable budget. Plans will also help the businessman predict the likely financial future of the business.

The yearly budget will reflect the results of the plans made by the businessman in a quantifiable way.

Adjust the habits- if needed

Afterward, a business person should, if needed, adjust the business habits to align with the goals and plans made early on in the process of budgeting. Making small adjustments in a business can increase the profit made by a businessman.

EXAMPLE

Adjustments such as a reduction in travel and the use of online media for business negotiation can help save money. The adjustments made can therefore add or subtract the expenditure to be included in the budget.

Keep track

Finally, a business person should keep track of the financial progress of the business by comparing it to the yearly budget earlier made. Keeping track will help identify an increase in expenditure or revenue and improper allocation of money.

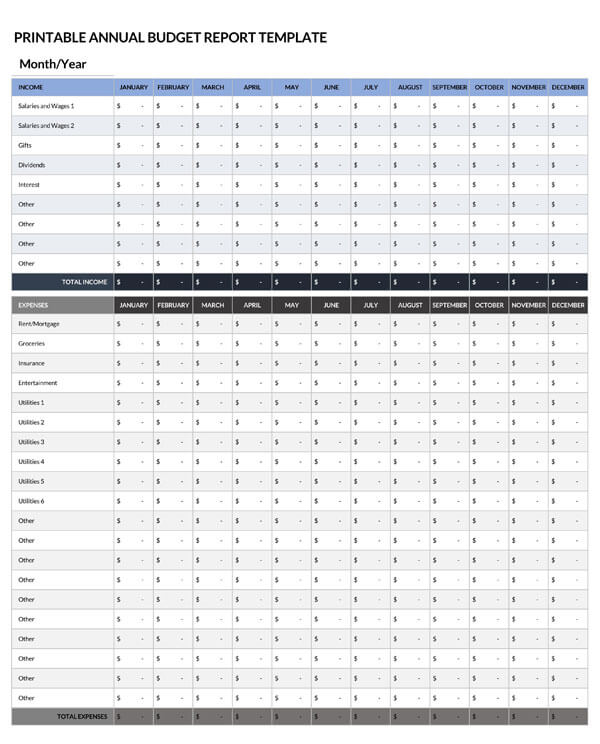

Yearly Budget Templates

Following are the templates that are available in Excel format and are free to download:

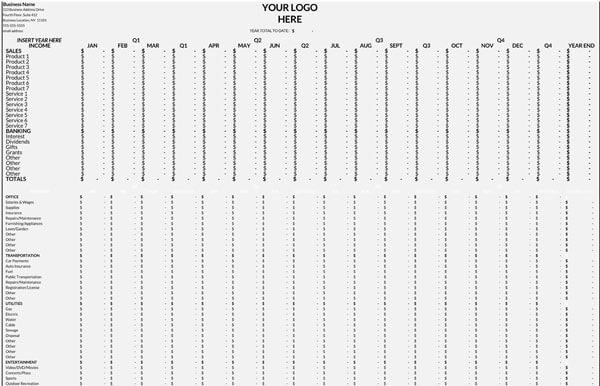

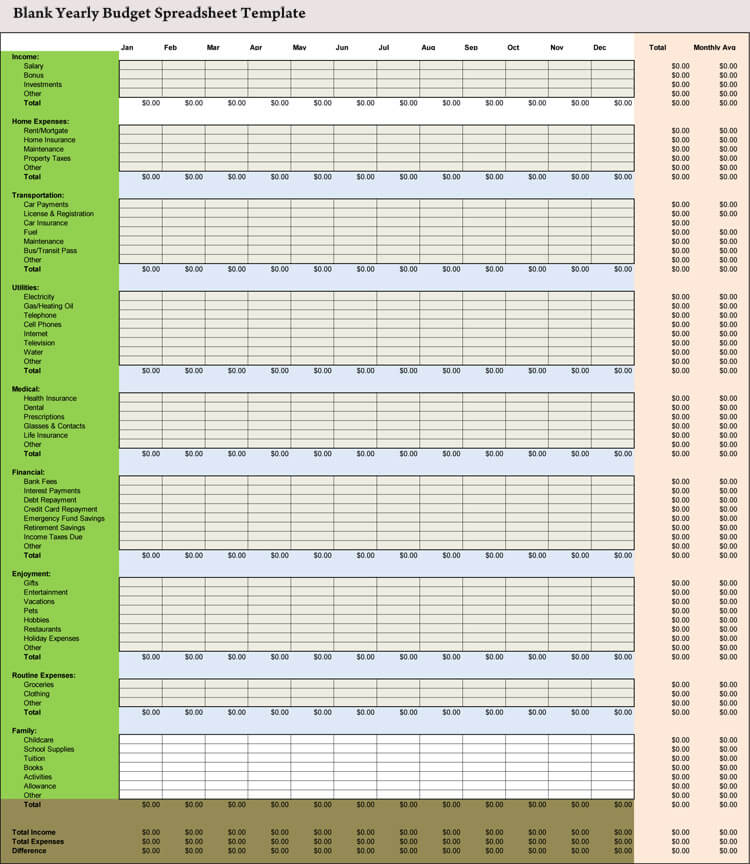

Template 1:

This particular template gives information on income, home expenses, transportation, and utilities. There are sub-categories and spaces for entering the relevant amount.

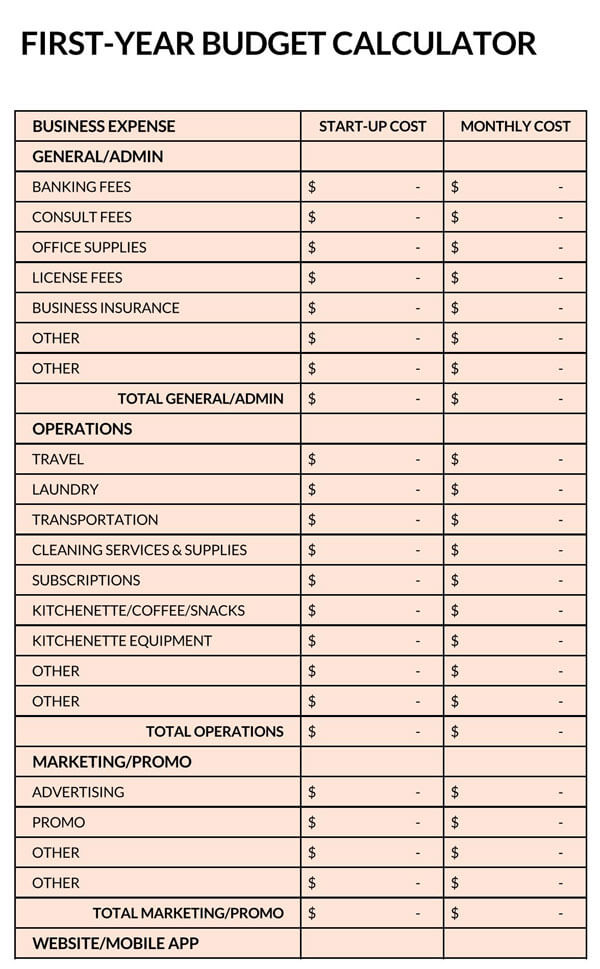

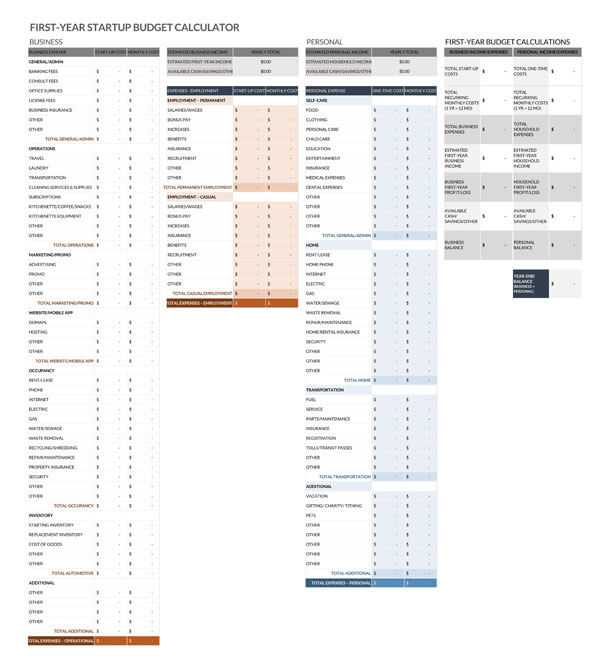

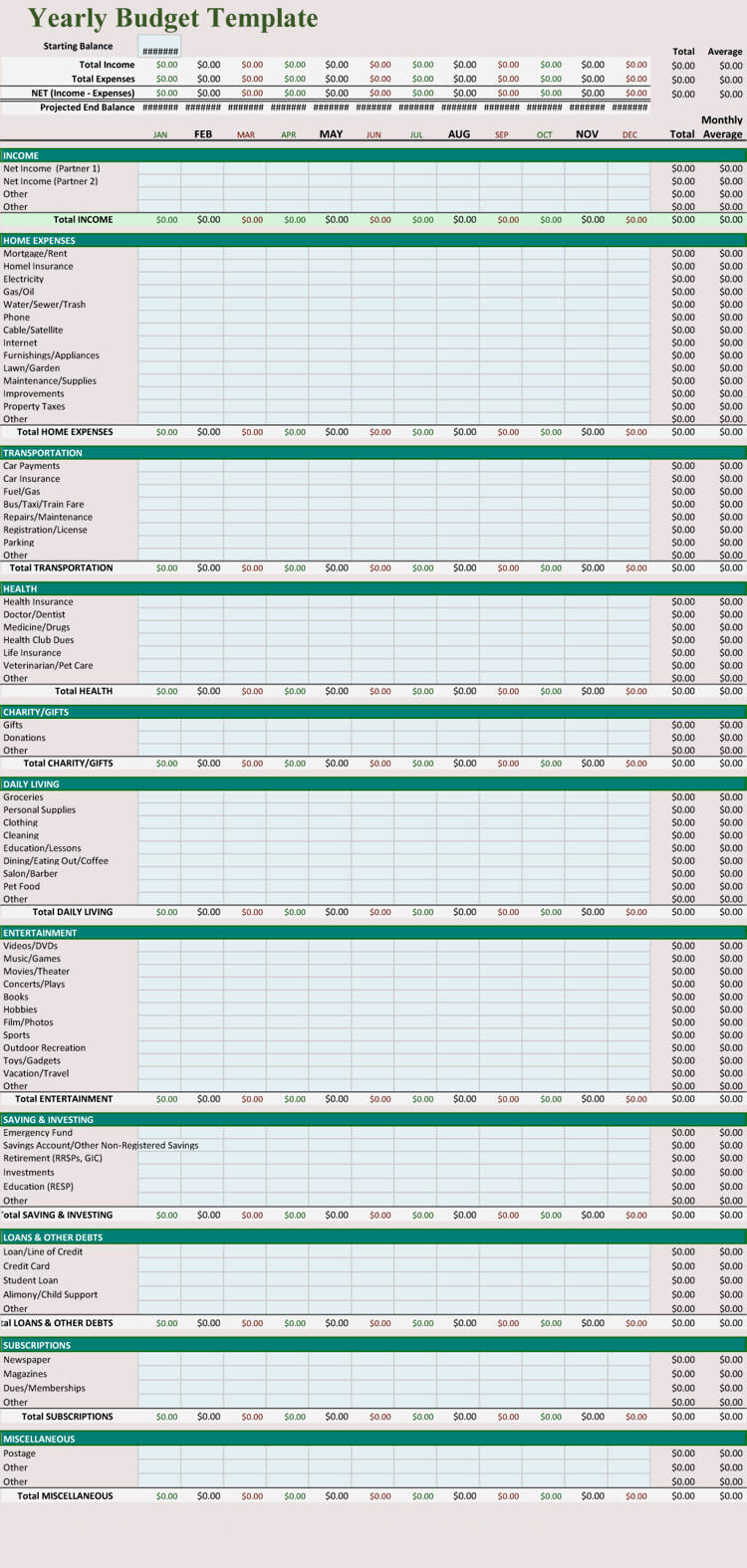

Template 2:

This particular template depicts information about starting balance, which states the total income and total expenses. An individual, by using this particular sheet, would get an idea about the projected end balance. It considers categories for income if there is more than one earning member in the family. It also provides information on the home expenses as well, which depicts sub-categories and blank spaces against each category to present the financial information.

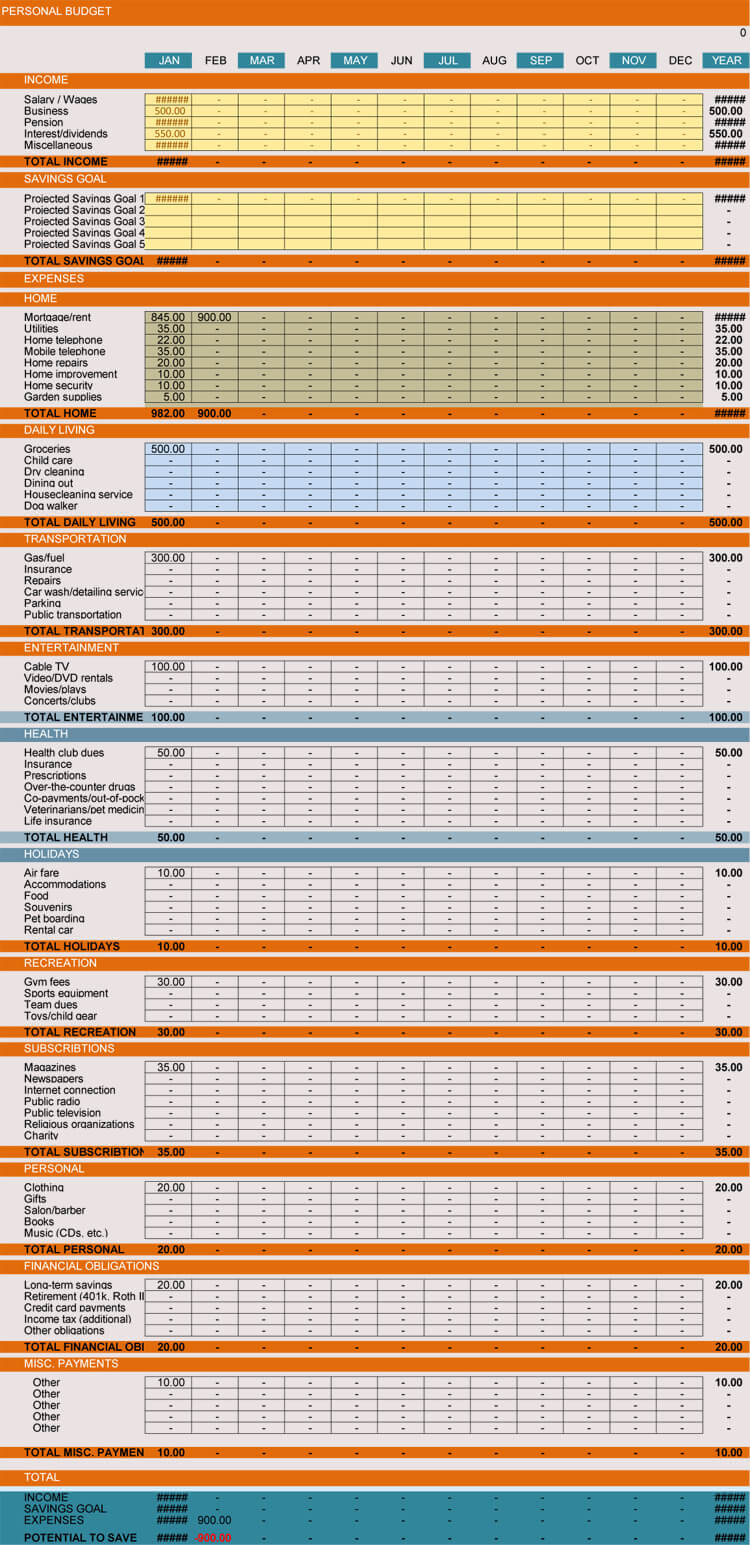

Template 3:

This template provides information on the income and takes into consideration the savings goals. It takes into account the relevant expenses. It is amazing how some people might have no idea about how finance works, but they would still be able to extract the relevant information by inserting the required information in the templates.

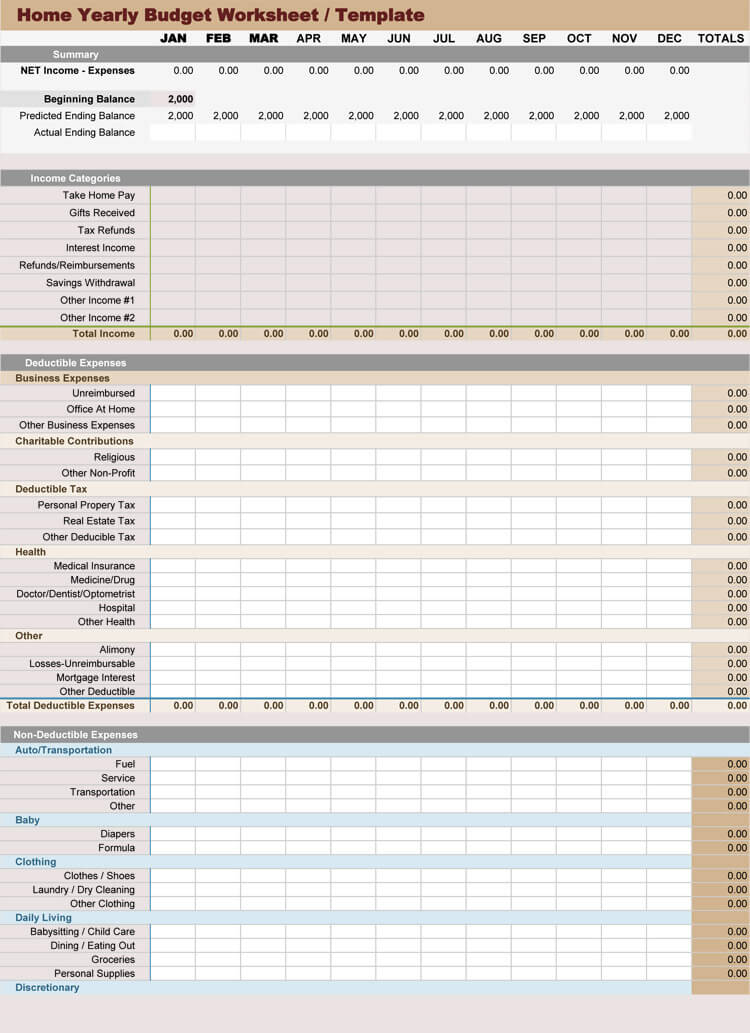

Template 4:

This template takes into account net income, expenses, and other relevant information. There is interesting information to include, like take-home pay, gifts received, and so much more.

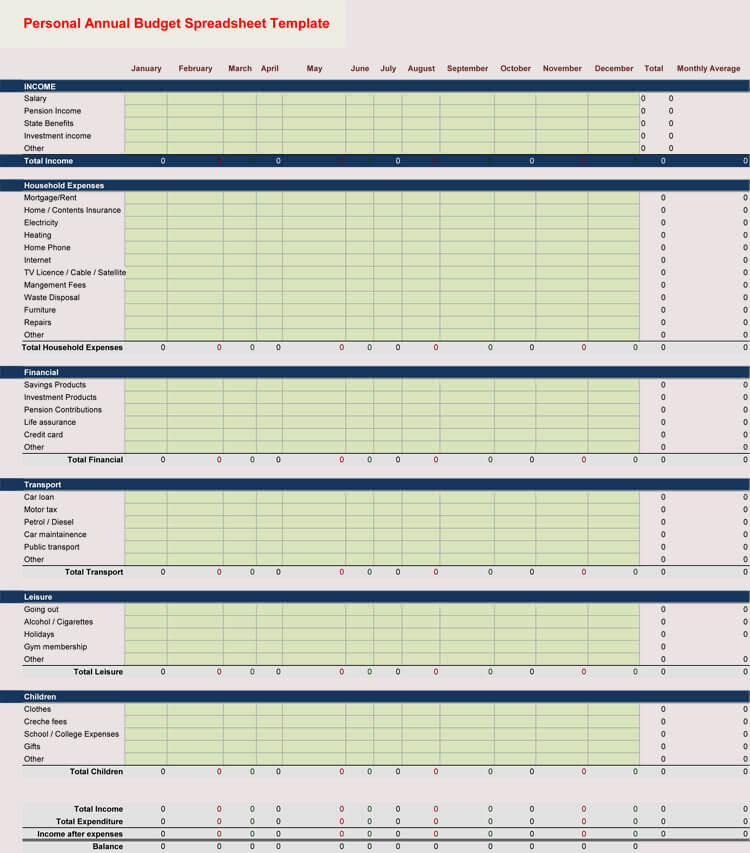

Template 5:

This particular template gives information about income, which includes salary, pension income, state benefits, investment income, other, and a total of these values. It gives information on the household expenses and finances as well.

Final Thoughts

A yearly budget can help a businessman effectively spread out and use the money to conduct business. The personal yearly budget provides a business with an organized and stable way of managing its finances by preventing overspending. A business can use the budget to filter out unnecessary expenses affecting its profitability, growth, and success.

The information contained in the personal yearly budget will guide a business to achieving the businessman’s goals. The budget will also help keep a business person focused on the financial goals set early in the year.