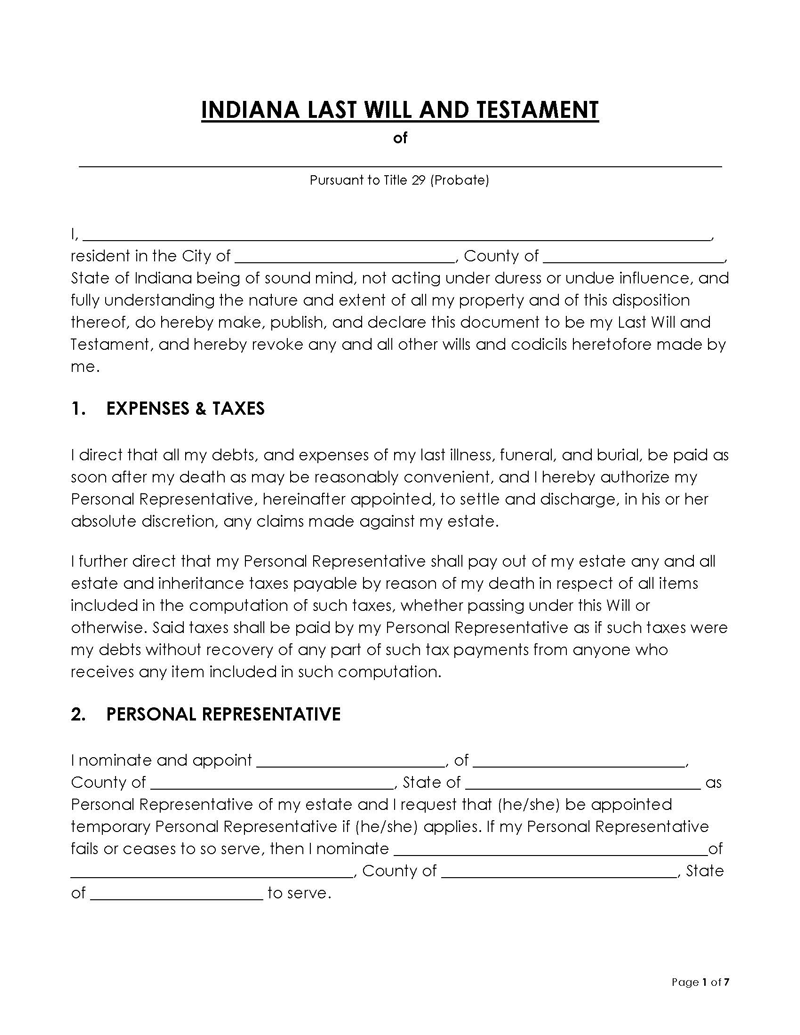

A last will and testament in Indiana is a legal document that allows individuals to hand over their assets, whether real estate, digital properties, or any other belongings, to their spouse, children, friends, or even pets.

The individual who writes this will and testament is called the testator, and the essence of the document is to ensure that their heirs can receive the estate after their death. To ensure the legitimacy of the legally binding document, the testator must sign it in the presence of two witnesses who will also sign. Furthermore, the document may be notarized by the testator. Additionally, the testator has the option to designate charitable organizations as recipients of gifts or assets under Indiana’s last will and testament.

As a result, a living will and a last will have some important distinctions that should not be overlooked. A living will is a legal document that details instructions on how the testator will be taken care of in the eventuality of medical complications. To put it another way, the living will in Indiana takes effect while the testator is still alive, whereas the last testament in Indiana only begins to take effect after the testator dies.

The various components of a last will and testament used in Indiana will be examined in this article.

Free Form

Importance of Drafting a Will in Indiana

Making a will in Indiana is important as you can properly document how you want your properties to be settled among your heirs, charity organizations, pets, and any other beneficiaries in your life.

It will save the testator’s heirs from having to go through lengthy and costly legal procedures to inherit the decedent’s estate.

Furthermore, the testator in Indiana has the option of naming an executor, who is responsible for carrying out all of the instructions contained in the will. Without an executor, the court will step in to execute the instructions.

Another reason why the last will and testament is important for a testator is that without it, the state will lay claims and distribute the deceased’s assets and properties in a way that may be contrary to the decedent’s wishes. Furthermore, the testator can use the will to appoint a legal guardian for their children.

The state of Indiana’s last will and testament rules allow for “Pet Trusts,” which allow the pets to be taken care of after the testator’s demise. Testament trusts, on the other hand, are set up to protect the testator’s beneficiaries. You can also use the will to appoint someone to manage the estate and properties you leave behind for minor children until they reach a certain age.

According to Indiana law, if the testator’s estate is worth less than $50,000, the will can be quickly processed if the executor distributes the properties and then files a closing argument. Furthermore, the will can be accelerated if one of the beneficiaries files an affidavit stating their interest in a specific institution left by the testator. The institution must accept the affidavit before the will can be carried out.

Implications of Not Having a Will in Indiana

In Indiana, to properly distribute the property of a deceased person who does not have a will, there is a provision called an “intestacy” law. According to Indiana’s intestacy laws, if someone passes away without a will, their property is distributed to their close relatives by the state.

In the absence of a will, the spouse and children will automatically inherit the estate. However, if there are cases where the decedent does not have a spouse or children, then the properties will go to the parents or grandparents. In rare cases, the state might not be able to locate both parents and grandparents; then, the properties will be distributed to other relatives, such as cousins, aunts, uncles, nephews, and nieces. If no relative is found, there is also the chance that the state will receive the properties.

If the deceased has a spouse, that person will receive half of the intestate property and then a quarter of the market value of any real estate that was left by the deceased. Furthermore, the other relatives will share the remaining parts of the properties. If the deceased had no children, the parents would get the remaining quarter of the estate and the spouse would get the other third.

Basic Guidelines and Conditions

You must be aware of a few nuances when making a will in Indiana if you want to make sure that your assets are distributed properly among your heirs. An appropriate last will and testament can be prepared when the laws and procedures for drafting such a document in Indiana are fully understood. Without adequate information on these matters, the heirs may not have a smooth succession to the property, rendering the entire exercise futile.

Some rules and regulations are presented below for a better understanding of the process:

Exceptions to the ability to distribute property

Some properties cannot be distributed through an Indiana will and testament. In Indiana, assets with rights to survivorship, such as joint tenancies, cannot be distributed by a will. Also, benefits from a life insurance policy will be directly given to the beneficiary.

State laws

According to the Title 29 statute (IC-29-1-1-3(27), the term “Will” is classified as testaments, wills, and codicils. The state laws require that the testator appoint an executor responsible for distributing the properties to the beneficiaries or provide a position through which it can be revoked or another will can be created. Click here for more information on the Indiana State Laws for this Will and Testament.

Testator’s eligibility

For the will in Indiana to be considered credible, the testator has to be someone who can think properly and has to be at least 18 years of age. This is only exempt if the testator is a member of the armed forces, the United States Merchant Marines, or allies.

Requirements for signing

The statute governing the creation of wills in Indiana requires two witnesses to sign the document alongside the testator. One thing to remember is that the witnesses cannot be beneficiaries of the properties and assets mentioned in the last will. All witnesses must be present in person to attest to the validity of the will, even if it is electronic, according to Indiana State Law for Last Will and Testament.

Probate

For a will to be considered credible in Indiana, it must be proven valid in a probate court. The procedure for distributing assets and properties will be displayed in this court. The executor will then take a look at the debts that the properties accrued and successfully pay them off. The executor will proceed to distribute the assets as necessary after the debts have been paid.

The state of Indiana offers two straightforward procedures for determining a will’s legitimacy. The executor will distribute the assets first if the estate has less than $50,000 in it, and after that, they will submit a closing statement to the probate court. The second process is a bit more complex than the first; if anyone is looking to inherit any property aside from real estate, that person will need to provide an affidavit regarding their entitlement to the property. The institution or individual will transfer the property to the beneficiary after the entitlement claim has been examined and found to be legitimate.

If both options are absent, the executor will have to file a “petition for probate,” where the court will demand testamentary letters for the people’s benefit. After that, the executor will then proceed to distribute the properties accordingly.

Laws of intestacy

This law only applies to an individual who dies without creating a will. If the deceased did not specify how he or she wants the properties distributed, close family members will be the beneficiaries.

However, according to the law of intestacy in Indiana, there are different portions of the property that the state will give the heirs depending on the people that can be traced. For example, if the deceased has a spouse, that person will receive half of the intestate property and then a quarter of the market value of any real estate that was left by the deceased.

Furthermore, the other relatives will share the remaining parts of the properties. Another scenario can be if the deceased had a spouse and parents but no kids; the spouse will have three-quarters of the estate, and the parents will inherit the rest.

Self-proving will

One of the ways through which a will can be expedited is through a self-proving will. This means that you do not need to have the will notarized before it is considered legal. The court can recognize the legality of your document even without the witnesses who signed it.

For the will to be self-proving, both you and your witnesses must have met the requirements that we have examined above. Furthermore, you and your witnesses must have signed the document freely, without being under any compulsion. The probate court will see the document as self-proving if a self-proving affidavit is attached to the will.

Wills must be in writing

Indiana does not permit you to have an oral will; it must be in writing. More importantly, the writing has to be clear and concise, without any form of ambiguity. However, according to this code, you can videotape your will, but you will still need to put it in writing for posterity’s sake. Although electronic or digital wills are fairly new in some states, they are widely accepted in Indiana. Note that holographic forms of will, that is, handwritten wills, are not acceptable in Indiana.

Revoking a will or making changes

In Indiana, you have the right to revoke and change your will at any time. One of the most popular ways to revoke and modify your will is to destroy the document with the intention of canceling it. A divorce automatically revokes any portions of a will that relate to your ex-spouse.

If you do not want to destroy the document, you can simply make a new will. The link to this code shows all the requirements for creating a new will.

Final Thoughts

Understanding the ideas that have been covered in this article is necessary if you want to create a will and testament in Indiana. A will and testament is important, as it is best to have a solid plan to distribute your assets and properties among your loved ones. You should be familiar with the legal requirements for creating a will to make sure it is valid. The will must be written clearly and adhere to all legal requirements as set forth by Indiana law.