The last will and testament in Maryland is a legal document that allows the testator to ascertain how they wish to proceed with their belongings and estate after their death, including:

- Digital property;

- Life insurance policies;

- Fiduciary assets;

- Bank accounts;

- Real estate and other property;

- Savings;

- Precious possessions such as art, jewelry, etc.

This last will and testament not only specifies who can use your possessions, but it also protects your assets and property over time. More importantly, this document enables you to choose the people who will inherit all or a portion of your possessions, estate, and assets. The beneficiaries commonly include family members (children and spouses), friends, various organizations, etc.

A will document is only legitimate and legally binding if it is properly registered with the state’s registry for last wills and testaments and is accompanied by a Proof of Execution form. A testament also requires the testator’s signature in the presence of two witnesses and their signatures.

This guide will provide all the information you require to write a will in Maryland if you want to create a document that details your final wishes. Understanding all the requirements for writing a will is essential because it enables you to specify how your heirs will use your possessions, belongings, and property in the event of your passing.

This article will also inform you of what you can expect to happen if you do not make a will in Maryland.

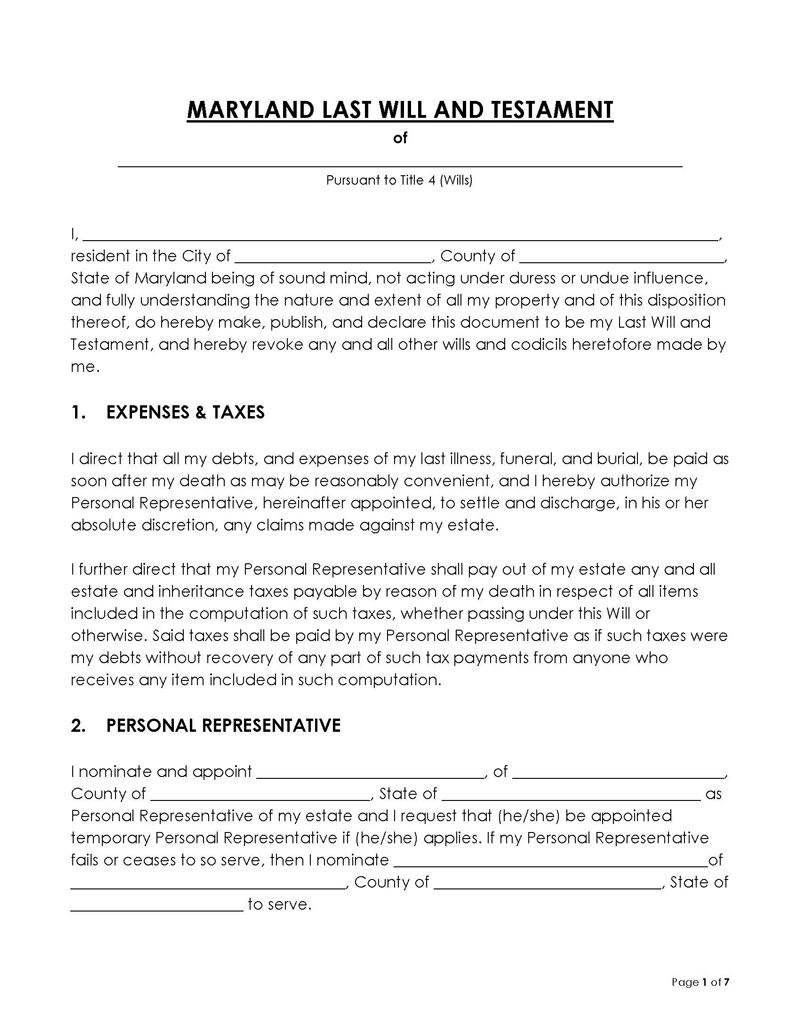

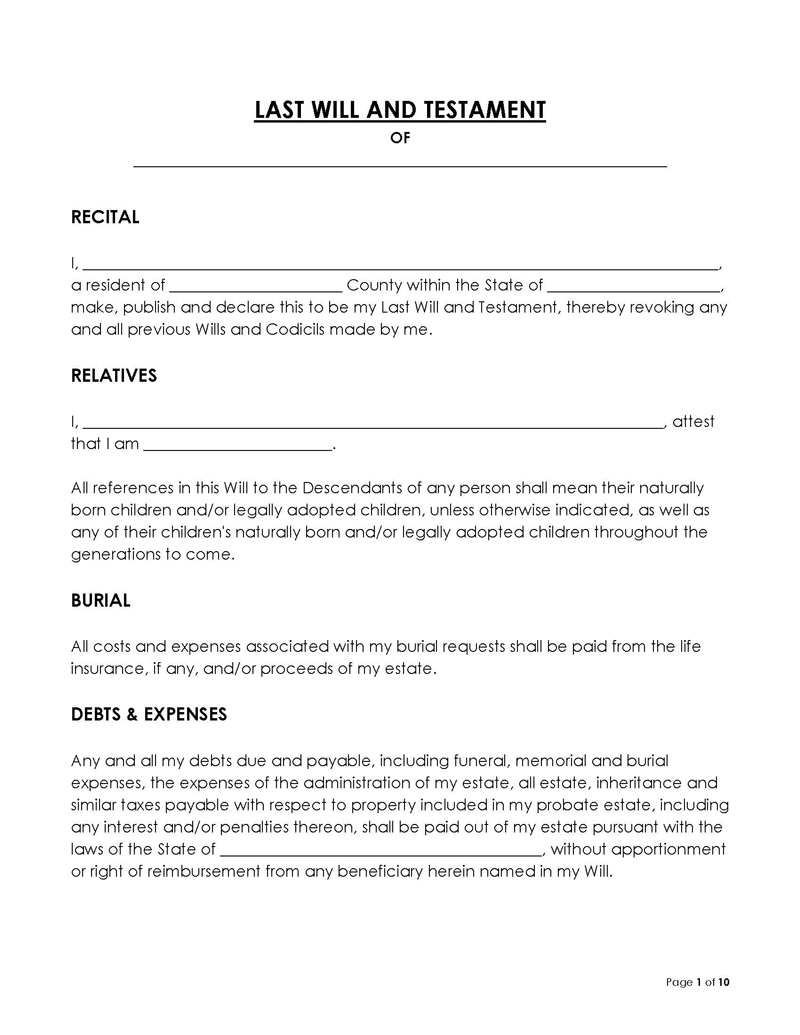

Instead of investing time and resources in creating such an important document on your own, there are professional and legal templates for a Maryland will that you can download for free, fully customize, and personalize to better meet your specific needs.

Free Templates

Why is a Will Required in Maryland?

Each state has its own unique requirements regarding the last will, and the state of Maryland is no different. The management of the distribution of your real estate, possessions, vehicles, assets, and other items after death requires last wills and testaments, even though they are not a fundamental legal requirement in Maryland. It is a vital step in the estate planning process. Without a last will and testament, Maryland is free to distribute your possessions per the state’s intestacy laws.

You should write a will to appoint beneficiaries and determine what happens to your real estate, assets, and minor children.

As a legal document, it empowers you to do the following things:

- Determine the people or organization entitled to use your property;

- Name a personal guardian who will care for your children until they come of age;

- Name a beneficiary for managing the property until minor children come of age;

- Appoint a person who will ensure your wishes are carried out;

- Choose a pet trust to take care of your pets.

In Maryland, unless the estate owner has named another beneficiary in their will, a spouse automatically inherits the entirety of an estate. If you have both minor children and a spouse, the entire estate splits between them accordingly. If there are no minor children, the spouse gets half of the total amount of the estate, along with the first $15,000. Children above 18 are entitled to the remainder of the estate and assets.

Your parents can also receive their share of the estate, but only if there are no other descendants aside from a spouse. If there are no children or spouses, Maryland leaves it to the courts to decide who will inherit the estate and how. If a testator has no relatives, the state of Maryland will take the estate. Therefore, you must make your last will in time and ensure the distribution of your property according to your wishes.

Laws and Requirements for Making a Will in Maryland

You must adhere to particular Maryland laws and requirements before creating your last will and testament. Read on to find out what is necessary for making a will in Maryland.

Statute and definitions

When it comes to the laws for making a will in Maryland, you can find all the information you need in the Code of Maryland Article – Estates and Trusts Title 4 Wills.

According to MD Est & Trusts Code § 4-101, a Maryland will is a written document or instrument that can only be executed by following the exact form prescribed by § 4-102 through 4-104, but only if § 4-105 has not revoked it. Such an instrument must include a codicil.

Here is a list of statutes and definitions:

- Statutes – MD Est & Trust Code, Title 4 (Wills) (MD Est & Trusts Code 4-101) – This regulation defines a Maryland will and the form it must follow.

- Definitions – § 4-101 – any written document that follows the exact form prescribed by § 4-102 through 4-104 is considered a valid will in Maryland.

- Laws: Title 4: Wills – a Maryland law that defines what a will is and what form it must follow.

- Registry – A testator must register a signed will with the state’s registry. The filing fee is $5.

Any will should come with the Proof of Execution form (Form RW1102). The RW1102 form is necessary for submission upon registration of every will in Maryland. The form stands as the only legal and valid proof of execution of the will in the state of Maryland.

Age of testator

According to § 4-102 state law, a testator must be 18 or older to make a last will in Maryland. The will’s creator must be 18 or older to be legally competent (Md. Code Ann., Est. & Trusts § 4-101).

Legal competence and requirements mean that the testator:

- Understands the context of making a will.

- Acknowledges and understands what property they possess.

- Understands who will inherit their property after their demise.

- Agrees with the claims of dependents, relatives, friends, and family who may have rights to their property.

Age of witnesses

According to the Maryland Office of the Register of Wills, a testator must have witnesses who will sign the will in their presence. In addition, the witnesses must be 18 or older to have the right to participate in making a will.

Self-proving will

A person has the right to contest a will if it contains irregularities. According to Maryland law, you have the right to make a will self-proving to expedite probate without the physical presence of the witnesses. Unless there is a need to contest a will, witnesses do not need to appear in court during the probate process. However, the state of Maryland does require you and your witnesses to sign an affidavit at the notary to make a will self-proving. According to Md. Code Ann. [Est. and Trusts] § 4-606, an affidavit is proof of both the testator’s and witnesses’ acknowledgment of their actions regarding putting their signature on the will.

Electronic will

The participants mentioned in a will can witness its execution remotely.

However, there are specific requirements for executing electronic wills:

- Witnesses must be in the presence of the testator.

- At the time the will is executed, they must be residents of Maryland and have a US address.

- There must be a supervising attorney physically present at the execution.

- The testator and witnesses must either affix electronic signatures to the electronic will or sign the counterparts of the original document.

Oral will

Also referred to as a deathbed or nuncupative will, an oral will is the verbal form of the last wishes of the dying. The state of Maryland does not recognize oral wills.

Holographic will

According to the § 4-103 law on holographic wills, this type of last will is valid but only under specific conditions, e.g., if a testator is serving in the US armed services and is outside of the US. It requires a hard copy on actual paper, not digital files. A handwritten last will is valid for one year after the discharge from the military. The only exception is the death of a testator before the expiration of the year or if he does not have the testamentary capability then.

Signing requirements

According to Section 4-102, the last will signing requirements in Maryland include producing two or more credible witnesses who will sign the document in the testator’s presence. Therefore, you must sign a will in the presence of two or more witnesses, and vice versa, to finalize the last will in Maryland. Witnesses must be adults aged 18 or older and cannot be beneficiaries. Testators and witnesses must fill out the will correctly, including their names, addresses, and signatures.

How to Revoke or Change a Will in Maryland

There are also situations where you, as a testator, may want to make simple changes. Fortunately, it’s possible to add amendments (codicil) to an existing will. The state of Maryland allows you to change or revoke your will according to your current needs.

You have a range of options for revoking a will, such as:

- It is best to have a new last will and testament rather than make changes in the document to avoid all the complications. Obliterate, tear, cancel, or burn the will by yourself or hire someone else to do it for you.

- Creating a new document that revokes your old will or includes contradictory terms to the old one.

- Reviving an existing old will that you previously revoked.

- There are situations where testators remarry and adopt a child. In such scenarios, the state of Maryland automatically revokes your old will, meaning that you have to make a new and valid one. According to Md. Code Ann. [Est. and Trusts] § 4-105, if you and your spouse go through a divorce after you create a new document or your marriage becomes illegal in the eyes of the court, the state of Maryland will revoke certain items in your will, such as the property and assets you left to your spouse. Thus, if there is a need to alter your will in any way, we recommend revoking the old one and making a new one.

Frequently Asked Questions

Making a Maryland will does not require hiring a lawyer. There are readily available, free premade will templates that can be used to make a will by yourself.

Maryland allows for the designation of an executor in the last will and testament, who is responsible for carrying out the terms of the will and directing the distribution of the estate’s assets in accordance with the decedent’s wishes. If none is specified in the will, the court will name one.

There are a handful of states, including Maryland, that allow e-wills. To make sure you have all the necessary information, however, research the requirements as they may differ.

You do not have to notarize your last will in Maryland for it to be legal. However, both you and the witnesses will need to go to the notary to sign an affidavit to make a will self-proving. You will also need to attach the RW1102 form to your will.

A testator is testamentary capable if they are mentally capable of clearly expressing their asset distribution wishes, outlining their beneficiaries and family members, and recognizing the property and assets they own.

In Maryland, it is not possible to disinherit your spouse because spouses have the legal right to an elective share within nine months of their spouse’s death.

A Maryland last will can only be changed if the testator is unable to sign it. Otherwise, no one can change your last will.

You can submit a request to admit a copy of the original will if you misplace or damage it. However, you will need to present proof that you did not plan to revoke the will by losing it.