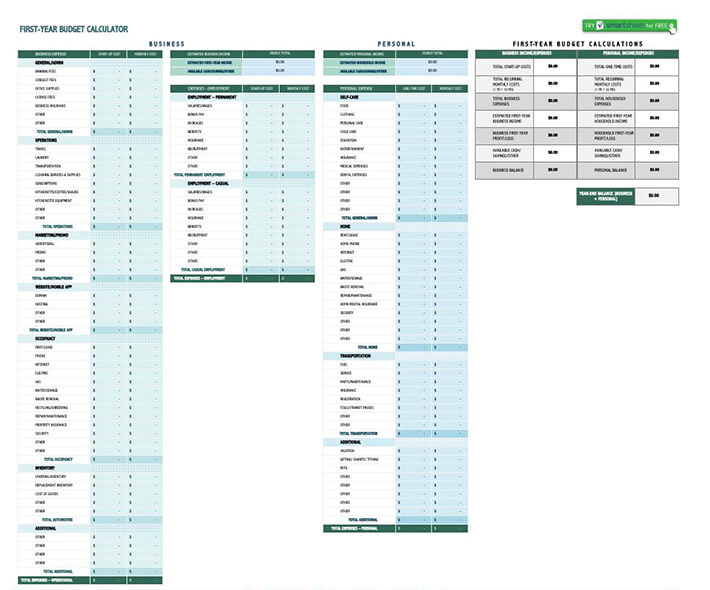

Whether you are running a small business or a large one, creating a budget template helps you achieve effective financial management and goals. Failure to a budget can affect the normal operations of your business or even jeopardize its success. Therefore, if you have a business budget template, you stand a better position of controlling your costs, avoid over-expenditure.

More importantly, it helps you plan effectively to meet your financial goals. For those starting business or thinking of starting a small and successful business, you might be interested in having a business template.

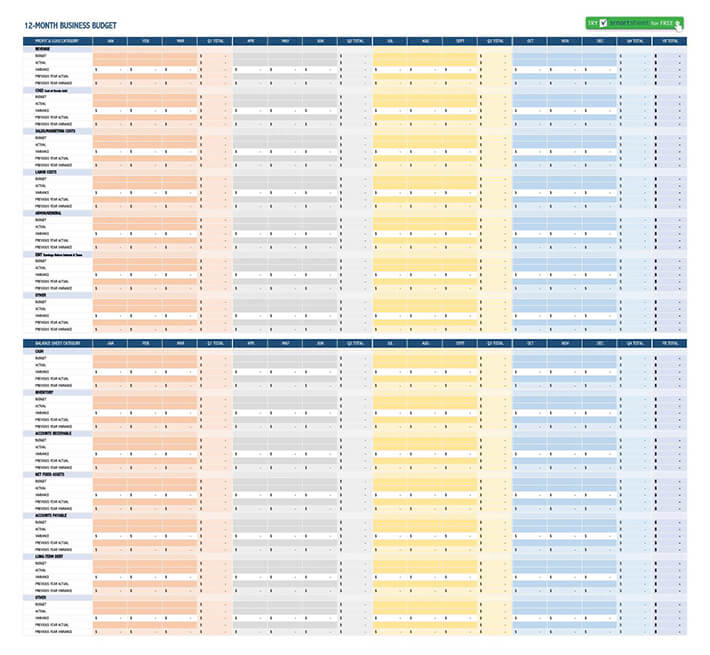

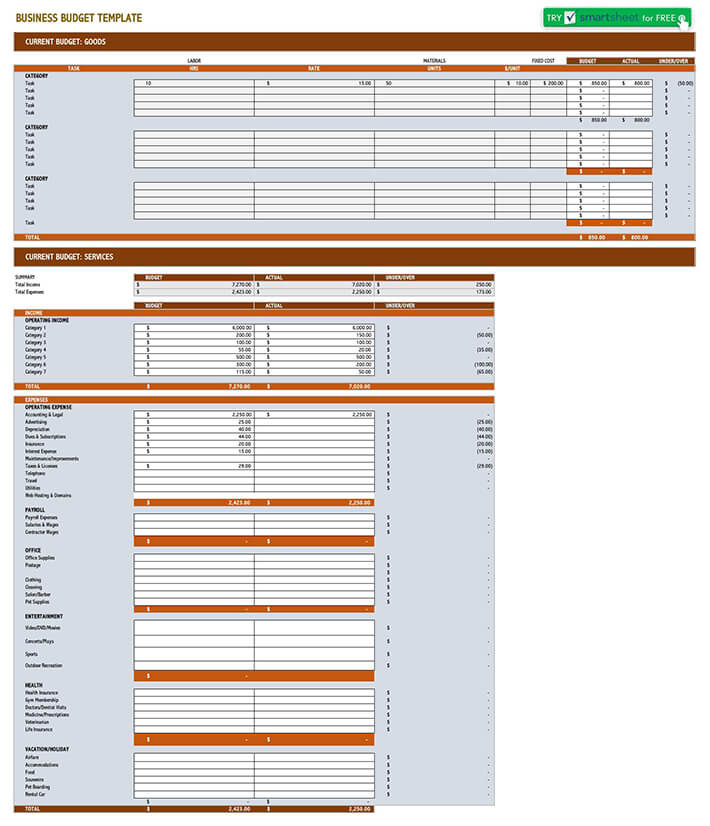

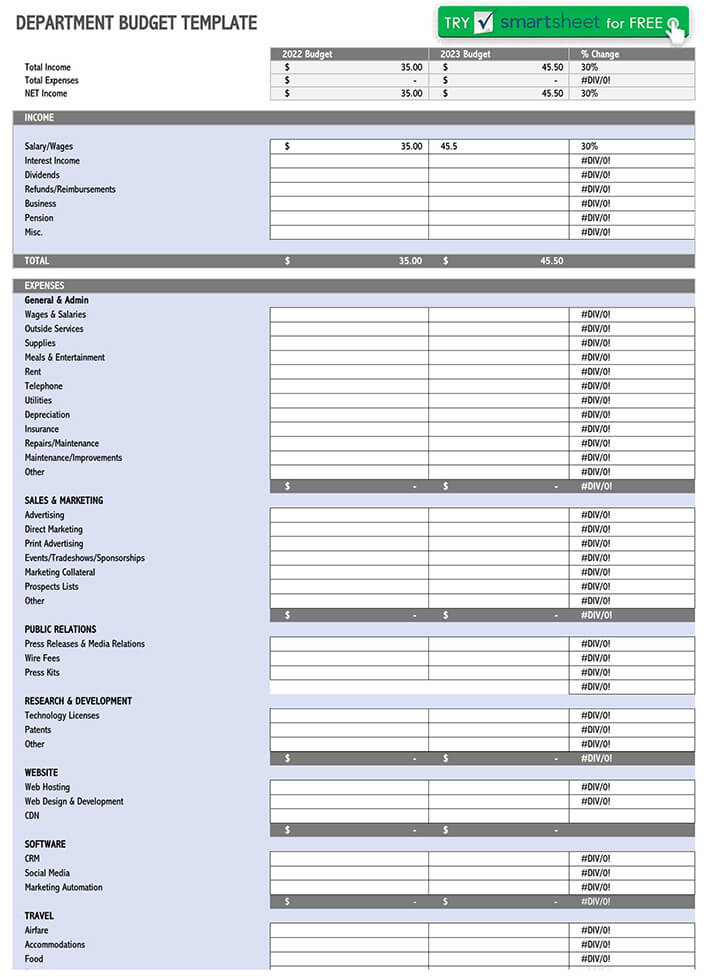

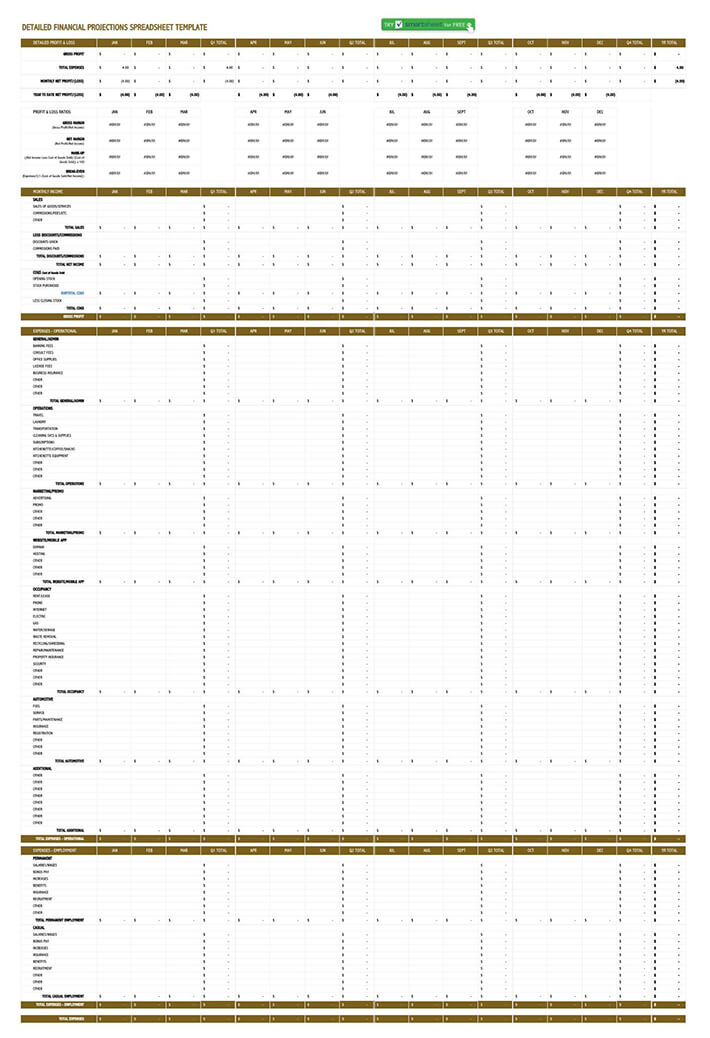

Free Templates

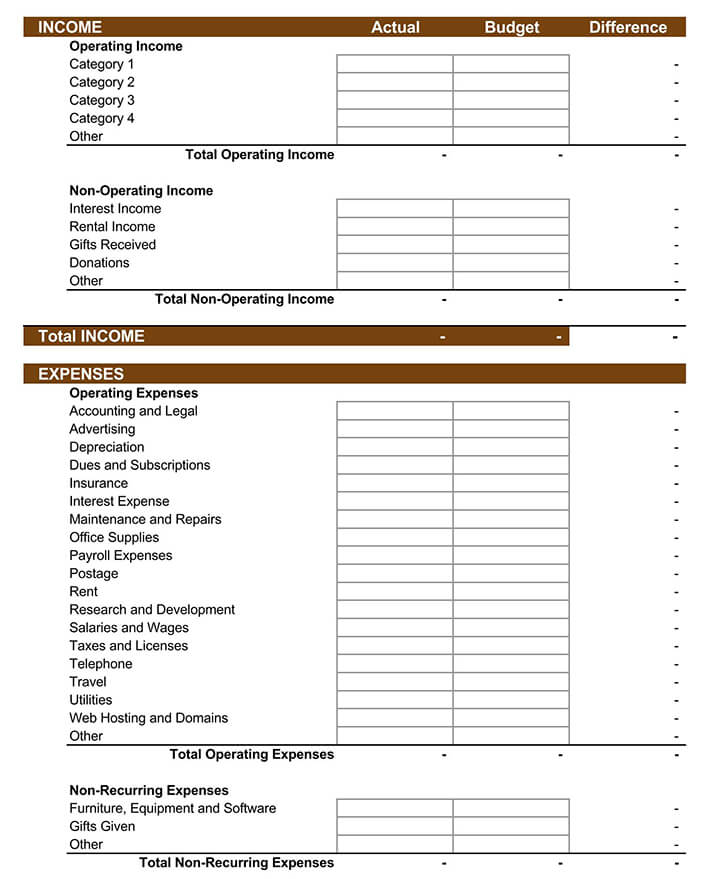

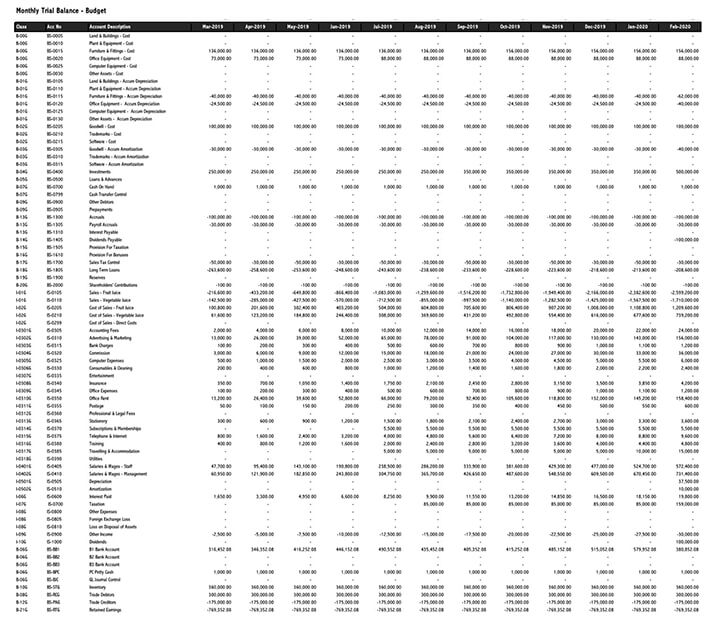

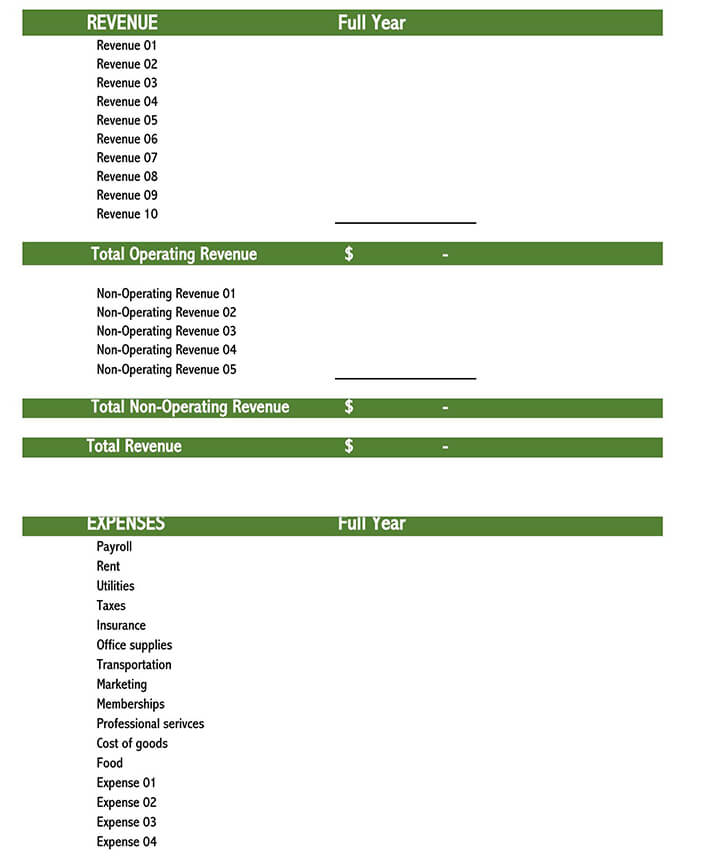

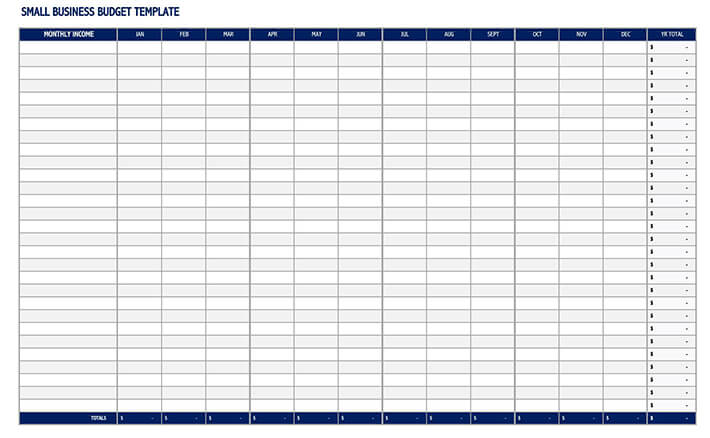

What to Include in a Small Business Budget Template

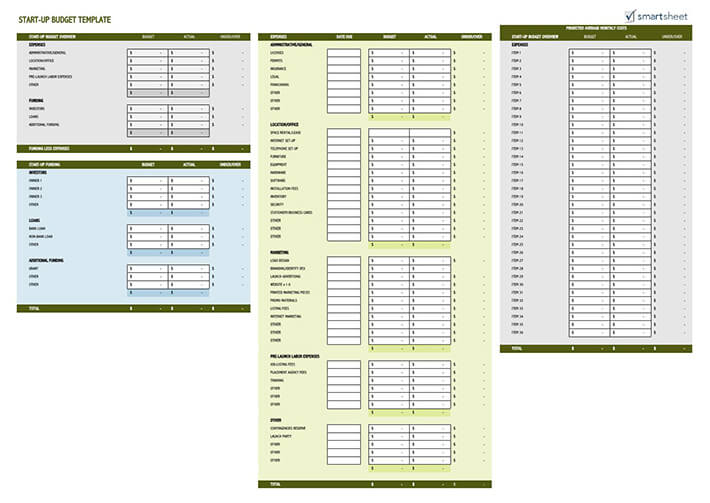

The United States Small Business Administration recommends a business template to contain the following information:

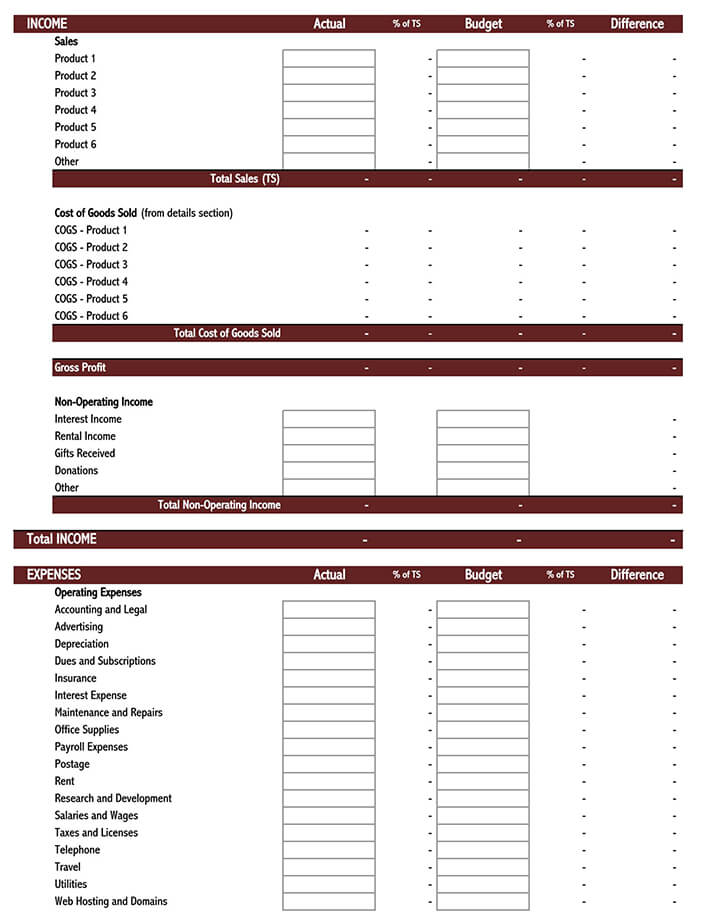

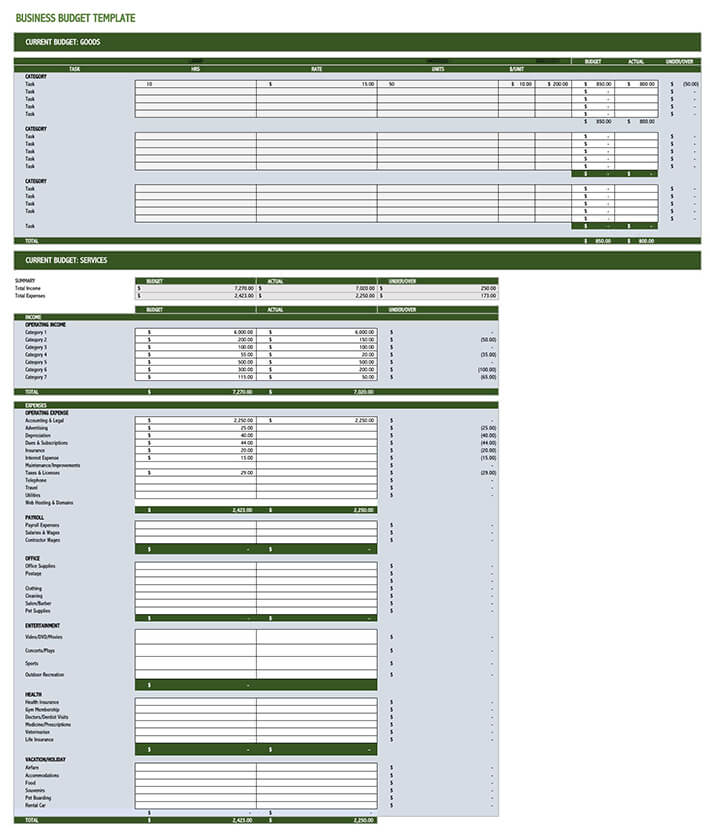

- The projected sales and revenues within a specific duration

- Fixed costs, i.e., costs that are constant and don’t depend on business sales. They include rent, licenses, and other fees.

- Variable costs, i.e., cost that change as the quantity of production/sales changes. They include raw materials and other labor indirectly involved in the business, among others.

- Semi-variable costs. These are costs that contain a mixture of fixed and variable costs. They include telephone charges, fuel, wages, and power.

- The estimated profits after deducting all costs.

Note that the points, as mentioned earlier, are just but essential things to include in your small business budget template. You can, therefore, decide to all or subtract the points depending on your business size, type, and financial information. For instance, if you are running a cyber café, you would want to include the cost of Wi-Fi coverage to match your business type.

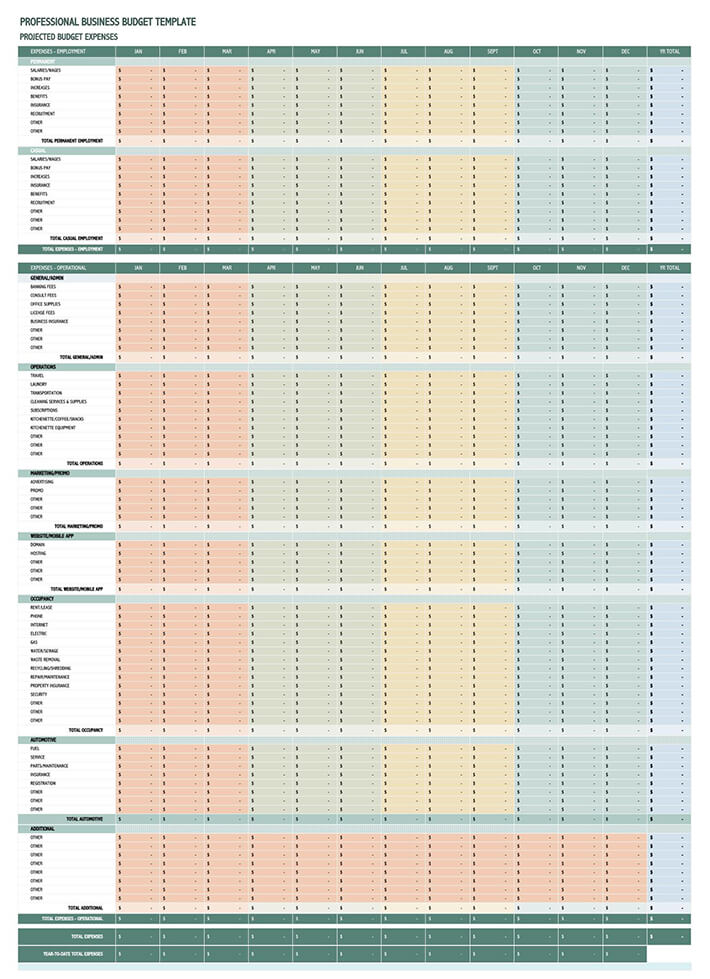

Tips for Creating a Successful Small Business Budget Template

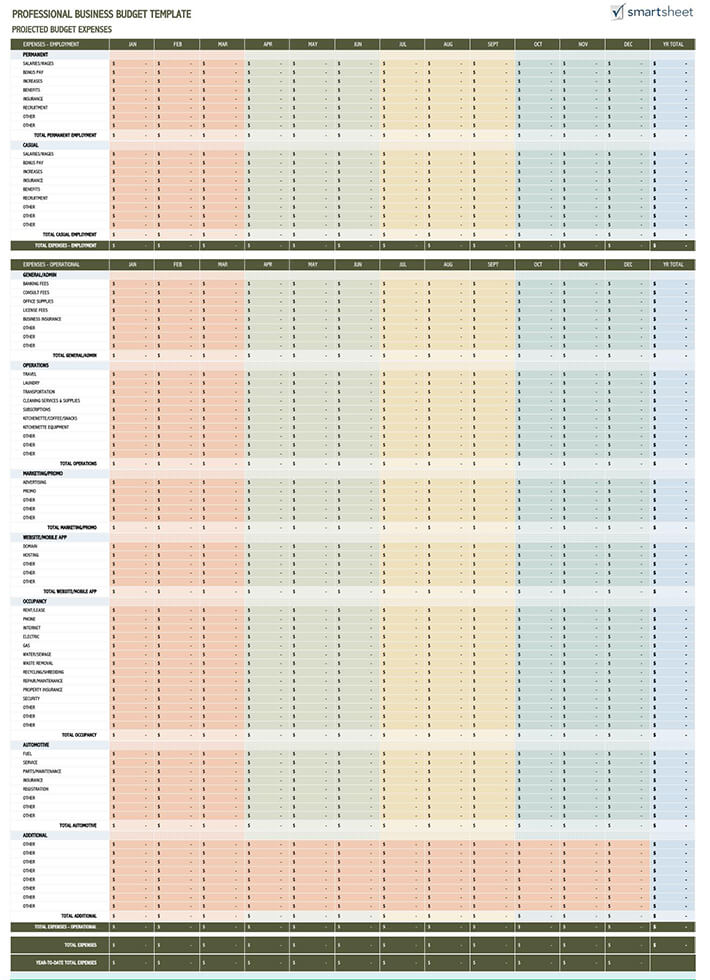

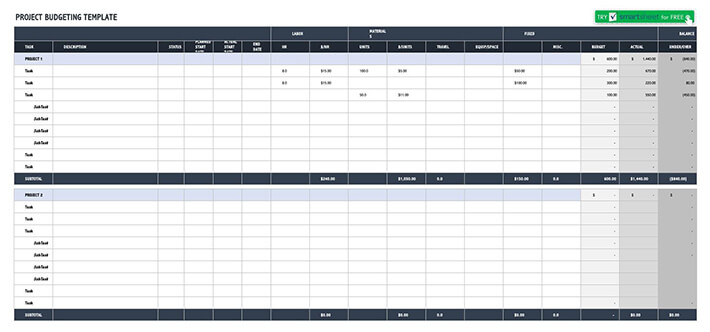

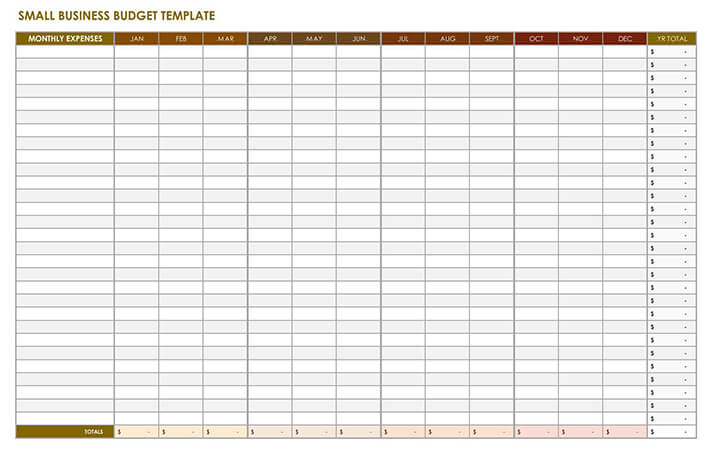

When creating a budget for your small scale business, it is always recommended to use a template to create a detailed budget plan. Therefore, the following are necessary steps that can help you create a comprehensive business budget template:

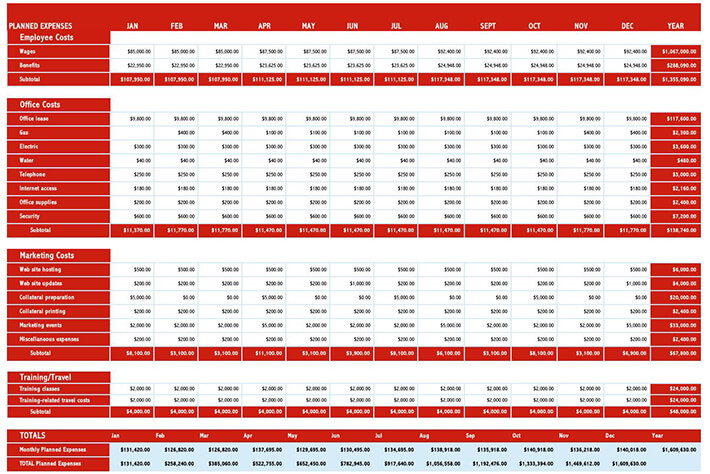

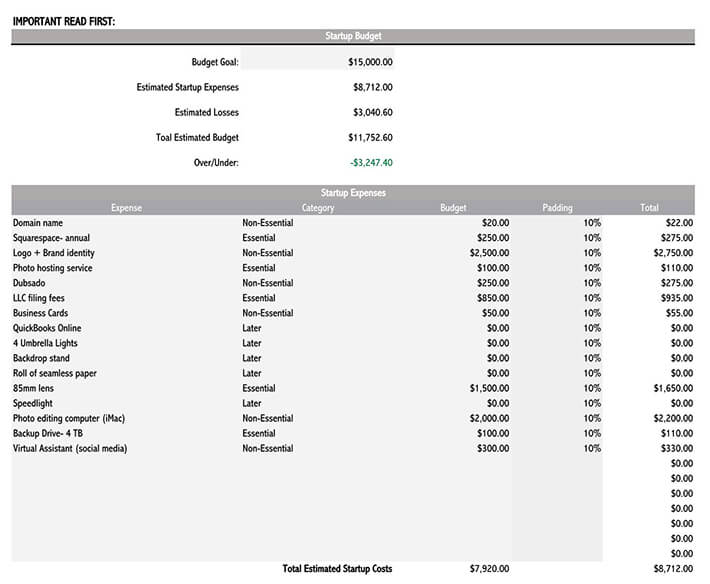

- Collect historical information: Firstly, you need to gather every available data relating to your small business. Once you’ve understood how your company operates, you now need to set your business goals. Plus, you should identify other operational costs such as salaries, rentals, etcetera, as well as sales and revenues that would be collected over time. You can benchmark from a business that is similar to the one you are opening or aspiring to open.

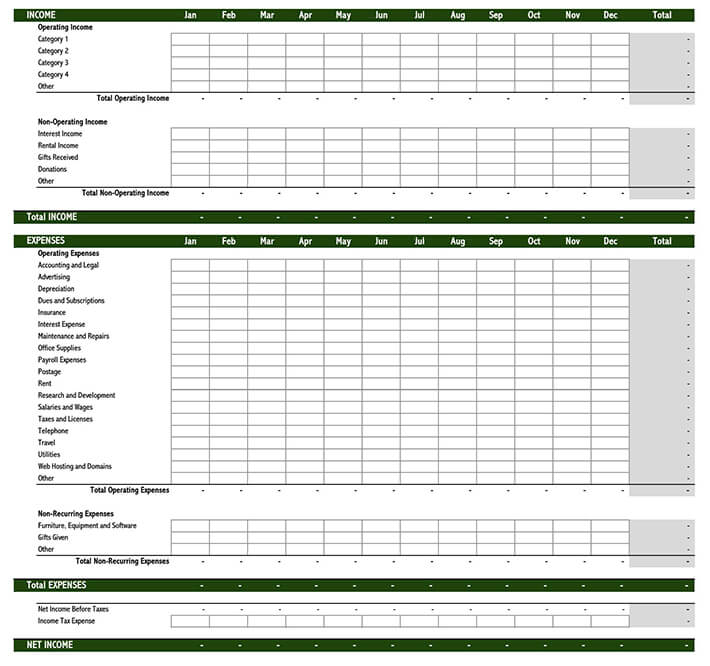

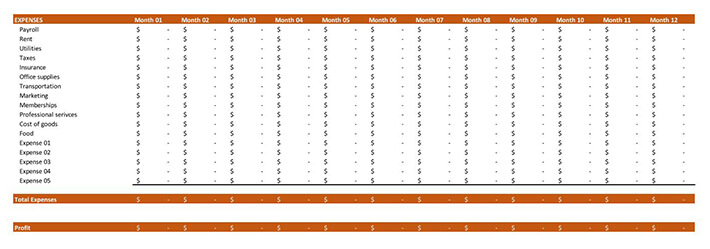

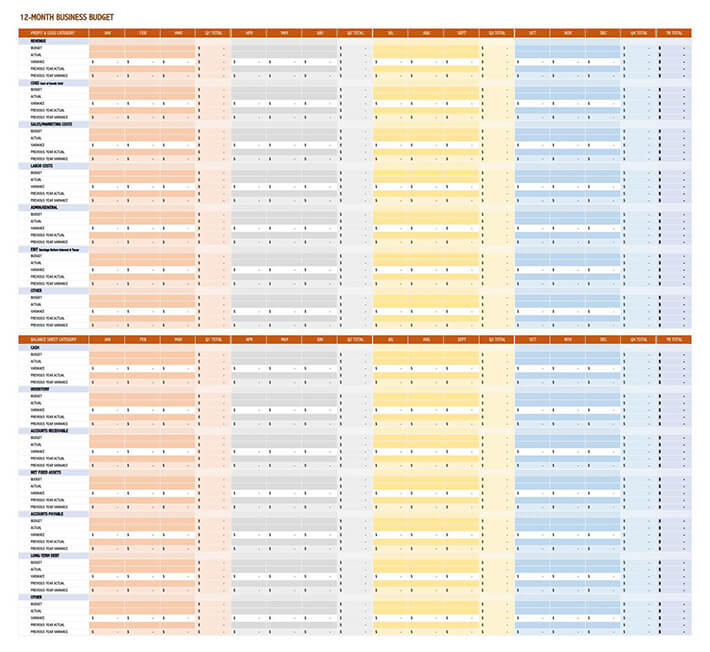

- Project the sales and budget goals: Here, you need to set your budget goals. These goals will help you establish clear spending boundaries right from the start. Remember to set realistic, simple, and attainable goals. After that, you should calculate all the sales and revenues you project to collect during different times of the year. While making your calculations, make sure you put holidays, office closures, and leaves into consideration.

- Estimate the fixed and variable costs: Here, you need to project the total amount of fixed costs that will be involved in your business operation. This will include rental expenses, business licenses, and insurance, to mention a few. At the same time, you also need to calculate the total amount of variable costs. These include the cost of acquiring raw materials, labor costs, salaries, workers benefits and bonuses, travel, and training expenses, among others.

- Determine your profit margin: To calculate the profit you expect to get from your business after a specific period, you need minus your total expenses from the prospect revenues and sales. Also, ensure you include other hidden costs such as shipping costs.

- Review and update your budget: Last but not least, you should always update your budget template continuously. It helps you compare and contrast your estimates against the actual expenses and sales. For this reason, if you aren’t making any profit, you’ll review the budget and assess areas that need reduced spending. Therefore, you’ll try to reduce overhead costs and increase your sales to avoid losses. Also, the other move you could make to prevent injuries is removing non-essential items from your expenses. In case you still can’t find your budget balance, you should then reassess your essential costs.

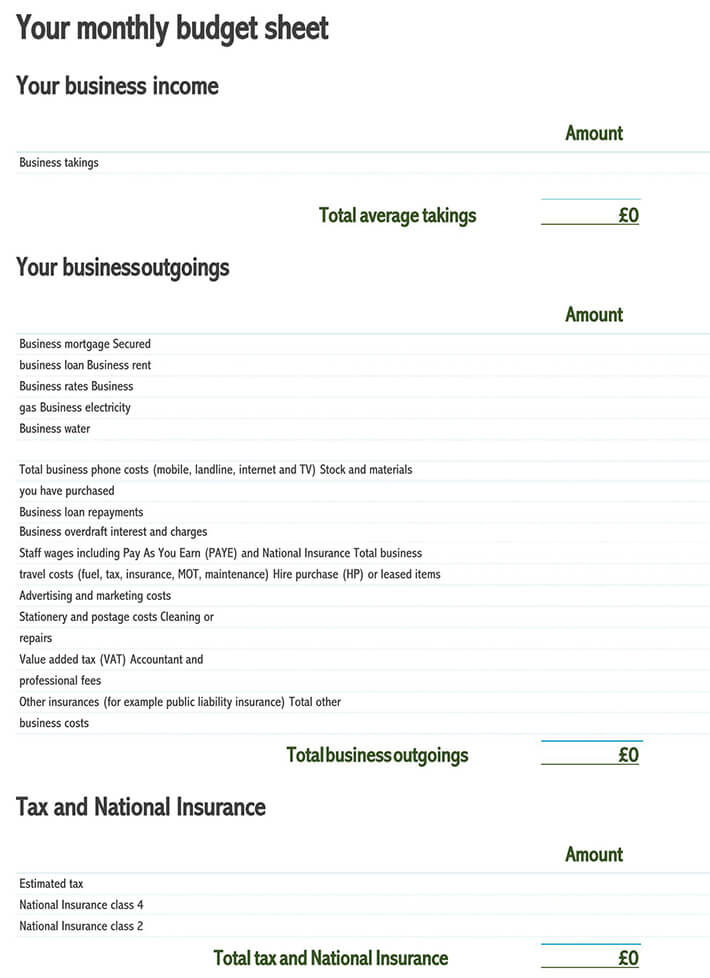

Reasons Why You Need a Small Business Budget Template

In most cases, small business owners tend to think that budget templates are only for large, established businesses. After all, the thing that since their business is low, they can easily project their cash flow and expenses. However, the reality is that for every business to avoid running into financial problems; they need to have a budget template.

Therefore, it helps you to:

- Prepare for the fluctuating business slowdowns

- Track and monitor financial flows including expenses and revenues

- Plan for your business investments and purchases

- Estimate the cost of starting and running the enterprise.

- Allocate those areas that need most capital.

Put into one context, a small business budget template acts as a health scorecard for your business.

How to Use Your Budget Template

Creating a small business budget template is one thing. But implementing it is another. Nonetheless, one key secret of using the budget template is to update it every month. It will help you reach your financial goals nicely and quickly.

Secondly, you should visit or benchmark other businesses that operate similarly to yours. It will help you adjust your budget and financial expectations as you maneuver your way through. Last but not least, always endeavor to use your template as a guide towards your business’ financial stability.

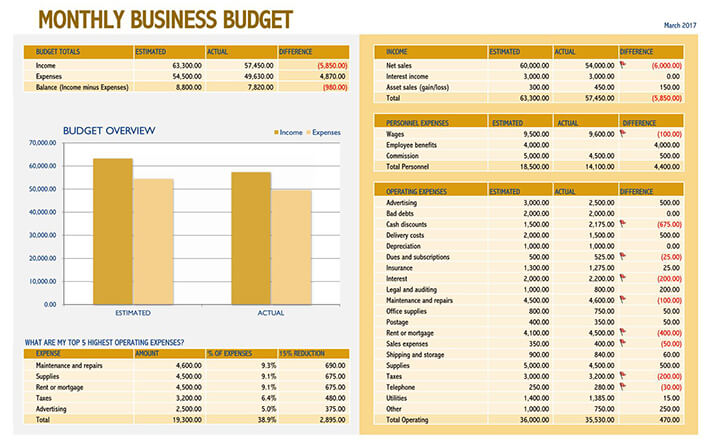

| Summary | Actual | Budgeted | Over budget | Under budget | Comment |

| Total income | 3,500,000 | 3,000,000 | 500,000 | ||

| Total expenses | 400,000 | 350,000 | 50,000 | ||

| Income less expenses | 3100000 | 2650000 | 450,000 | ||

| INCOME DETAILS | Actual budget | Budgeted | Over budget | Under budget | |

| Sales | 1,500,000 | 1,000,000 | 500,000 | Increase monthly sales | |

| Revenues | 500,000 | 400,000 | 100,000 | ||

| Royalties | 500,000 | 500,000 | 0 | ||

| Other | 1,000,000 | 1,100,000 | -100,000 | ||

| Total income | 3,500,000 | 3,000,000 | 500,000 | ||

| Expense details | Actual budget | Budgeted | Over budget | Under budget | |

| salaries and wages | 100,000 | 150,000 | -50,000 | Reduce travelling cost | |

| shipping costs | 50,000 | 100,000 | -50,000 | ||

| travel costs | 50,000 | 100,000 | -50,000 | ||

| Rent | 120,000 | 100,000 | 20,000 | ||

| Other | 80,000 | 50,000 | 30,000 | ||

| Total expenses | 400,000 | 500,000 | -100,000 |

Final Thoughts

For any kind of business, the budgeting process plays a crucial role in ensuring its success. The good thing is that there is a wide range of business budget templates from which business owners can choose to help in their financial management. However, if you can’t find a template that meets your needs, you can still customize one using excel spreadsheets. All you need to do is follow the above-mentioned guidelines.