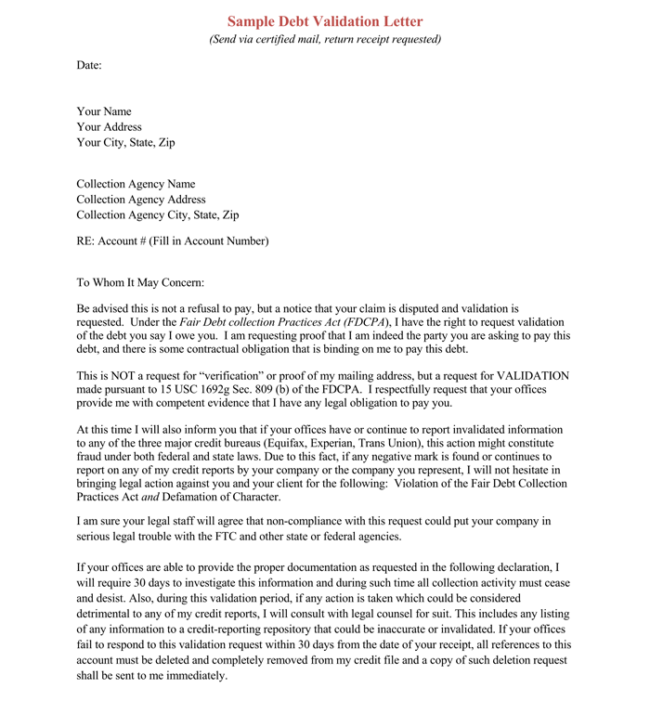

Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. This letter is always written when the receiver of a loan fails to pay his/her loan on time on time despite the reminders sent to him/her. The government allows lenders to send such letters to their debtors who have become defaulters. No harsh loan recovery measures can be taken before sending a demand letter to the loan defaulter. Debt refers to the sum of money that is due or owed. If you are collecting a debt as an agency, you may receive a debt verification letter from a creditor and you will need to validate it within 30 days.

Other names for this type of letter are:

- Demand Letter for Payment

- Collection Letter

- Debt Collection Letter

- Letter of Demand or LOD

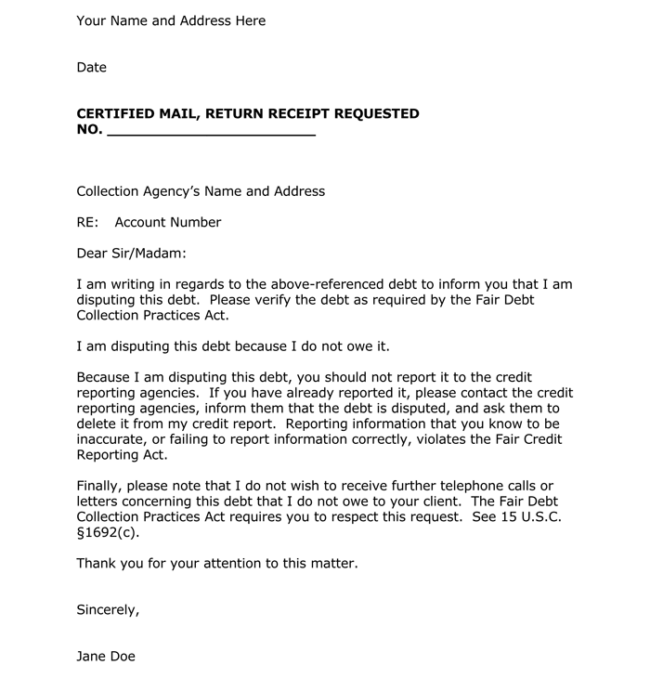

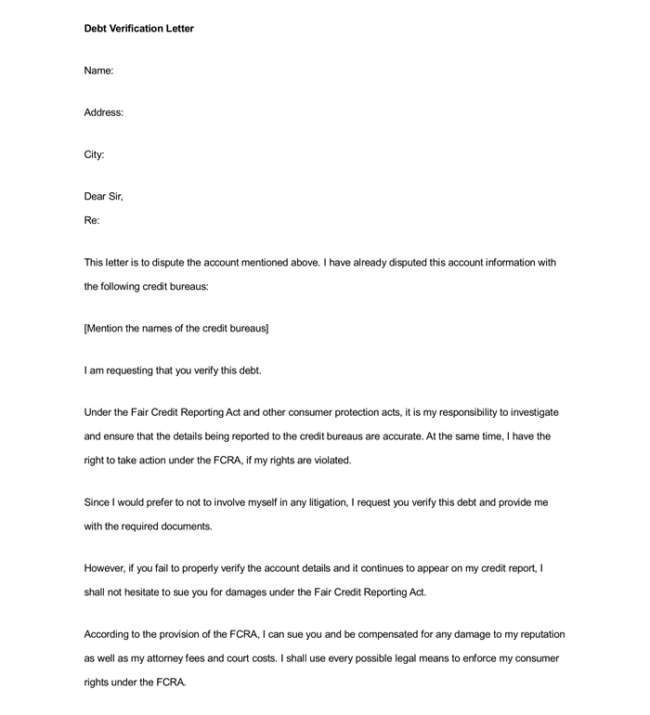

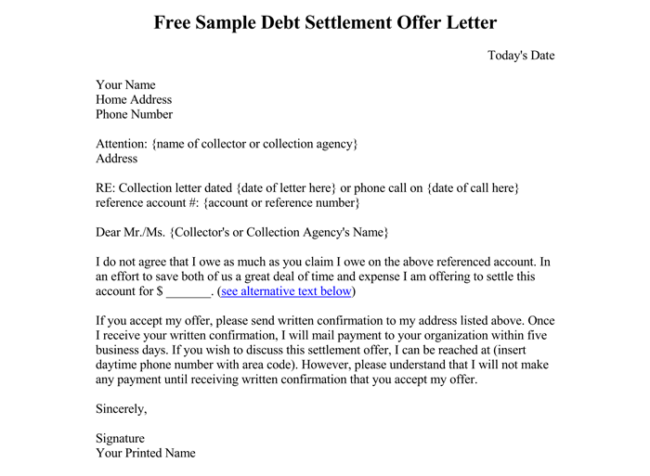

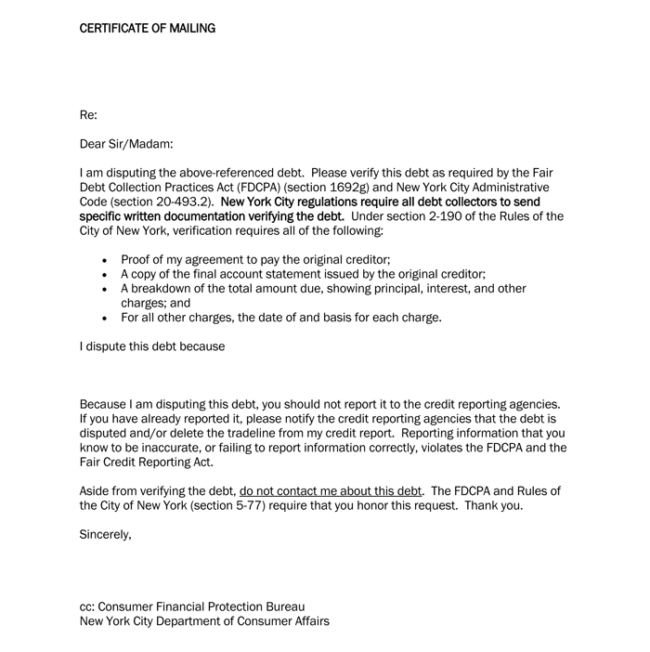

Free Templates

Purpose of a Debt Collection Letter

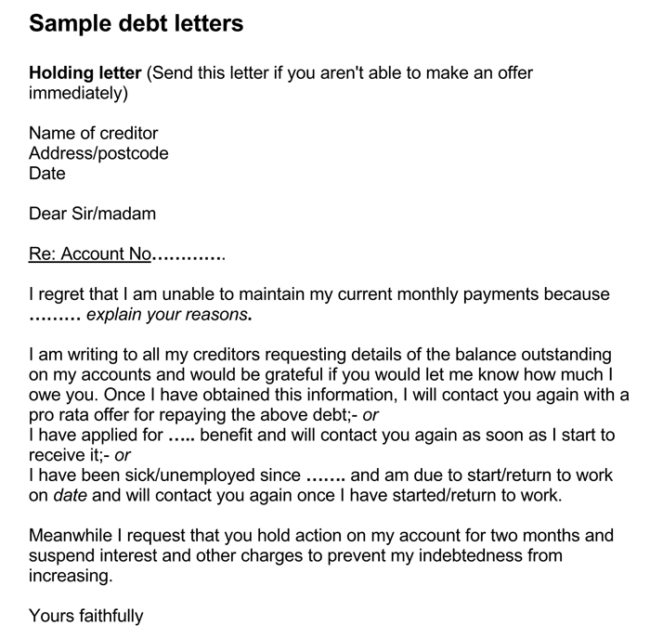

- To inform the loaned about his outstanding debt: It is a formal way of informing the loan defaulter that his loan is due, and he has to make payments before legal measures are taken. The letter also specifies the actual date when the credit was due.

- To start the process of negotiation: The letter also informs the loan defaulter on how to begin the negotiation process and come up with new payment plans that will be rational.

- To initiate the legal process: The letter serves as tangible evidence that the loan defaulter was informed of his /her debt and still did not make payments. It, therefore, becomes easy for the debtor to start legal processes.

How to Write a Debt Collection Letter

Writing a debt collection is different from writing other letters as it assumes a unique format. When writing the letter, it is crucial to use a simple and professional language. Do not be harsh or threat the debtor in your letter as it can turn the tables against you. The letter should be addressed to the debtor’s home address or any other address that the debtor has provided before.

What to Include?

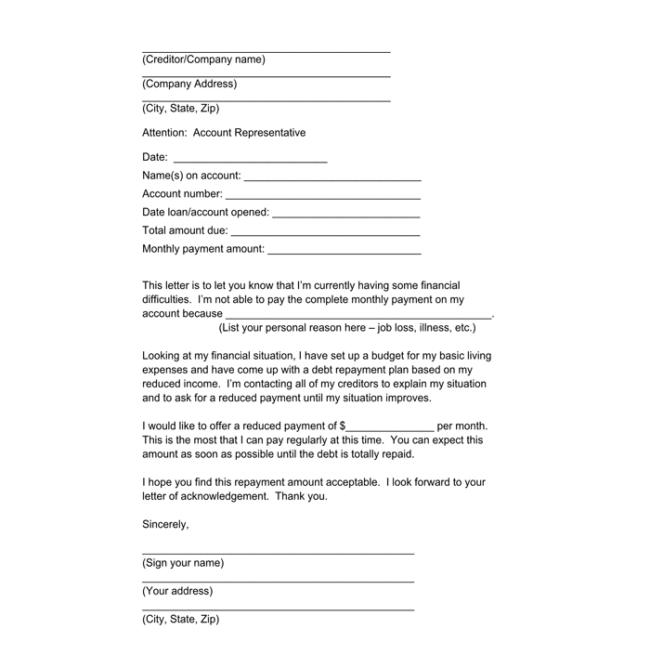

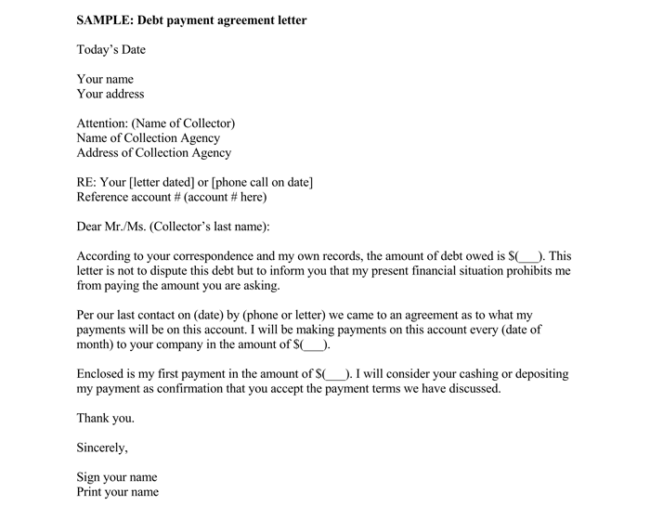

Your letter should be compliant with the debt collection practices put in place by the government. You should attach credit agreements, contracts, or other relevant records for reference. The contents can vary depending on your situation, but your debt collection letter should contain the following:

- Debt Reference: It is the reference to the original contract, agreement, or any document that proves the debt.

- Debt Amount: Typically, this includes the amount owed, the amount in arrears, and the original due date.

- Action Required: This describes the minimum or full amount to be paid by the debtor, before the due date, along with any interests or fines. This section also depends on the “payment terms” of the original contract. This is a description of the amount to be paid or action to be taken. In some cases, the creditor might enter an acceptable lower amount to settle the entire debt and include the payment terms or “terms of the settlement”.

- Deadline: This is the date that a response to the letter is expected, or otherwise, it will be assumed valid by the creditor. This period usually consists of 30 days.

- Consequences: This explains the legal action that may be taken by the creditor and the effect that such action could have on the debtor’s credit if the letter is not responded to or debt not paid before the deadline.

Debt Collection Letter Samples & Examples

Sample Letter

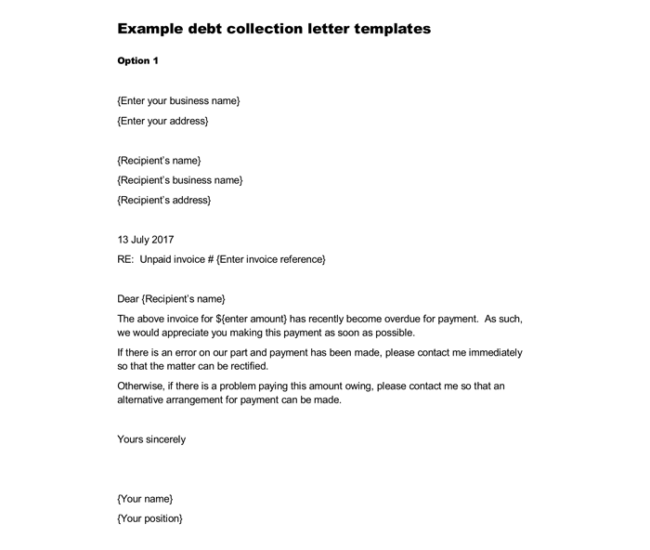

DEBT COLLECTION LETTER

Monroe Microfinance and Banking Limited,

9523 Henry Smith Drive,

Redondo Beach, CA 90278.

+1-111-111-1111

Date: 29/04/20XX

Dear Steven Charles,

RE: PLEASE SOLVE THIS ISSUE IMMEDIATELY

We have sent you frequent reminders concerning the settlement of your debt, and up to date, the debt remains unpaid. We humbly request you to make your payments as soon as possible.

AMOUNT DUE: $589

PLEASE MAKE PAYMENT TO [Company Name]

ACCOUNT NUMBER: XXXXXXXXXXXX

We advise you to make your payment before 29/05/20XX; otherwise, your details will be submitted to our external debt collectors, and from there legal procedures pertaining to our loan recovery will be taken against you. This move could affect your credit history seriously. Therefore, we ask you to make communication with us to make payments or arrange alternatives before the mentioned date.

You have the right to dispute this letter by responding to it within thirty days of receiving it. If you do not dispute this letter within the allocated time frame ( 30 days), then the debt collection will be considered approved by the debtor(you).

Sincerely,

Md. Jane raised Jefferson

Legal Considerations

Fair Debt Collection Practices Act (FADCPA) allows the creditor to take either self –help remedies or court-based remedies in collecting their debts from their debtors. However, the creditor must first send a debt collection letter that follows FADCPA guidelines. The letter will be assumed to be valid unless the debtor disputes its validity within thirty days after receiving the letter.

It’s important to understand the requirements of the state that has legal jurisdiction over your situation. Usually, this is the state where you live.

However, if the contract was agreed to (entered into) in another state, then the other state is the state with legal jurisdiction. You will need to understand what evidence the other state requires as acceptable proof of delivery.

Tips for Writing a Debt Letter

The idea of writing a debt letter shows a professional technique of negotiating with the creditors. The procedure of writing a debt letter involves a good understanding of the best tips for the letter.

Understand the conditions of the debt: Before drafting a debt letter, you should evaluate the fees, tax surcharges and any interest rates that have been agreed upon.

Calculate the right amount: You should note the amount you require to be paid. The amount should include any extra charges that might have been incurred during the process of repayment. The amount indicated should be the correct amount that is due and should not include any extra charges outside the agreement.

Consult with Lawyer: It is wise to hire a debt negotiation professional or a lawyer to cross-check the letter. The professionals ensure the letter lacks unnecessary items and inconsistencies.

Avoid threats: As you write the debt letter avoid any threat to the creditor. Additionally, it never indicates filing of bankruptcy upon anyone. Such information may be unlawful with regard to the company you are dealing with and also the agreement of the contract.

FAQs

If you decided to get help from a collection agency or to the court, you might be required to prove that the collection letter was delivered to the creditor for the validity of the debt and with the warnings of consequences. To comply with the law, you should consider using the following options to deliver the letter:

Deliver the letter personally: Deliver the letter to the creditor personally by hand and get a signature on a receipt that should state that the letters have been received by the creditor on this date.

Ask someone you trust to deliver the letter: This person will act as a witness in the court, stating that the letter was delivered. It is recommended to get a receipt signed upon delivery.

Hire a lawyer: Your lawyer will handle the delivery of letters as per the state laws.

Hire a process server or similar legal support provider.

Send the letter via registered mail: Using registered mail will give you a tracking number as well as a reference number for the delivery of a letter. This reference number will be used in the count for the validity of delivery.

You should only deliver this letter to the debtor’s home address and any address that debtor motioned in the agreement. Moreover, it is advised to deliver the letter via registered mail.