As a contractor, laborer, or supplier, you may run into situations where a customer has not paid for the work you have done on their property. In order to be paid, you may need to file a lien on the property. As the person having to pay the bill, the lien won’t be removed until you have paid in full and requested a Contractor’s Lien Release.

Free Forms

What is a Contractor’s (Mechanic’s) Lien?

This is something that a contractor will have placed when you have not paid for the work, services, or supplies they have provided. This usually occurs when a bill has not been paid for quite some time by the owner of the property.

What is a Contractor’s (Mechanic’s) Lien Release Form?

This is a form the bill payer uses, requesting that documentation be given to show the release of the lien placed on the property and that the bill has been paid in full. The Lien Release must then be signed and filed with the County Registry of Deeds.

What Should be Included?

Details of all involved parties

The first thing that your form should contain is the details of all of the parties involved.

EXAMPLE

Paying a contractor in full may not stop a subcontractor from making a claim as well.

Be sure to include the contractor, any subcontractors, consultants, and professionals in the document and have them sign the lien release form. This means all rights are waived for the work done.

Include terms and conditions

You will need to state if this is a conditional or unconditional lien release. Be sure to mention any terms and conditions as clearly and explicitly as possible. This is especially important if you choose to waive only some rights and not all of them.

Details of all work and entire project

Your next section should include the nature of the project or the work that has been done. Give as much detail as possible regarding who did what work, as this will help determine what work any parties involved cannot lay claim to. Also, be sure to state that parties can not lay a lien claim on equipment delivered or materials used.

Exceptions

Contractors and subcontractors alike don’t always stipulate what claims they want to retain. This means, if they are not mentioned, they forfeit valid claims, such as rights or intellectual property and construction design. In this section, you will need to state all claims that you want to reserve.

Seal and sign

Your release form needs to be stamped and signed. Having a seal stamped by a registered or authorized form will give the form authenticity. In some states and jurisdictions, you will need notarization and affidavits. If the nature of the project is large and of significant value, you may also need witnesses to view and sign the release form. Be sure to include the date the release was signed.

Different Types of Lien Release Forms

There are two types of forms that can be used:

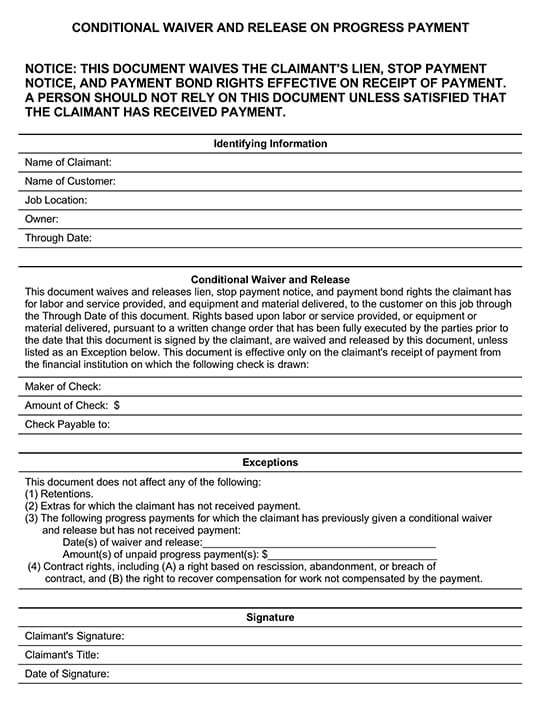

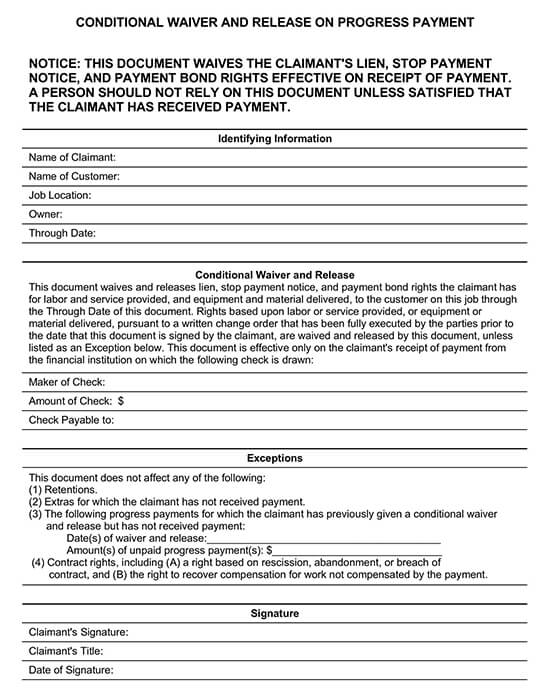

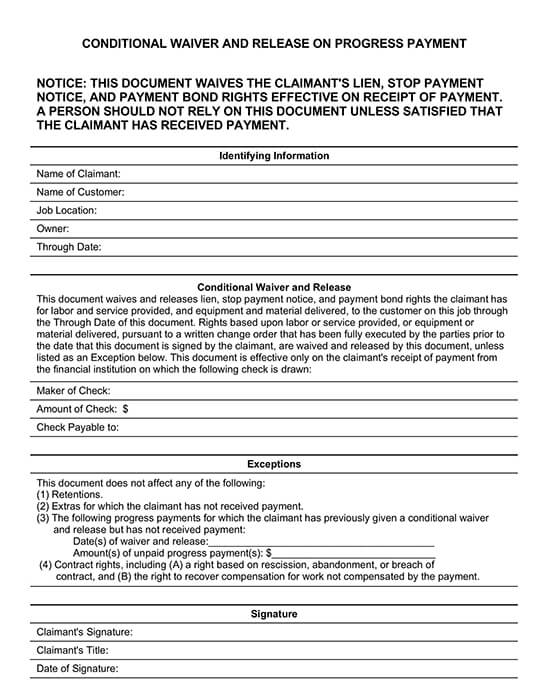

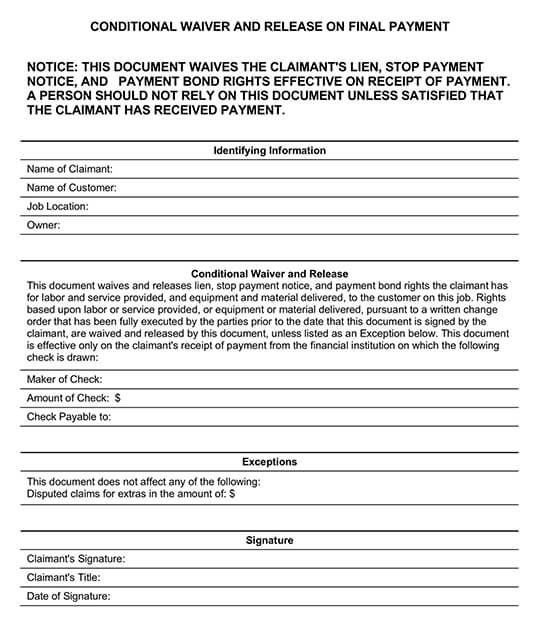

- Conditional – this is an agreement by both the unpaid party and the owner of the property stating an intent to pay the bill, such as through a payment agreement. The form is only valid if the bill payer keeps making the agreed payments until the debt is settled in full.

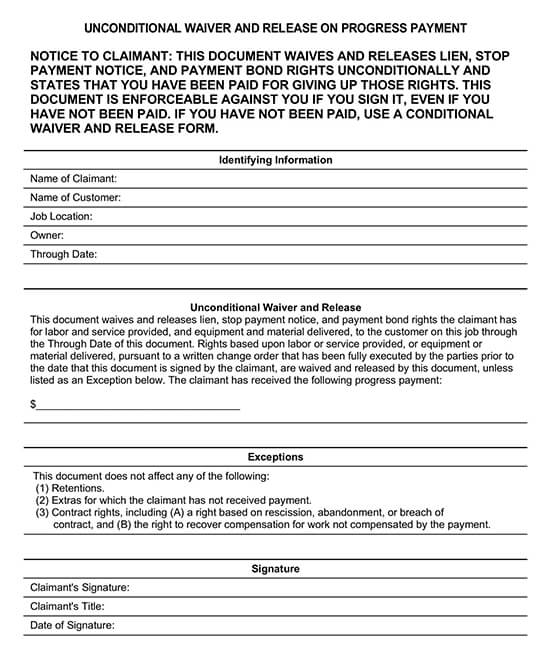

- Unconditional – this is the most common form of lien release and is only valid when both the property owner and the bill collector has been paid.

Conditional lien release forms

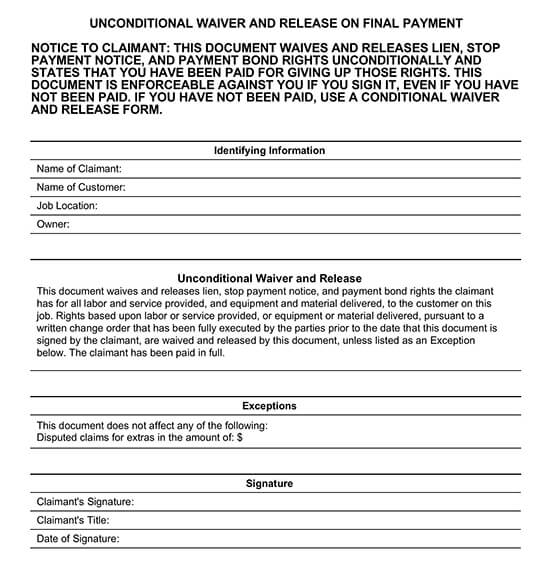

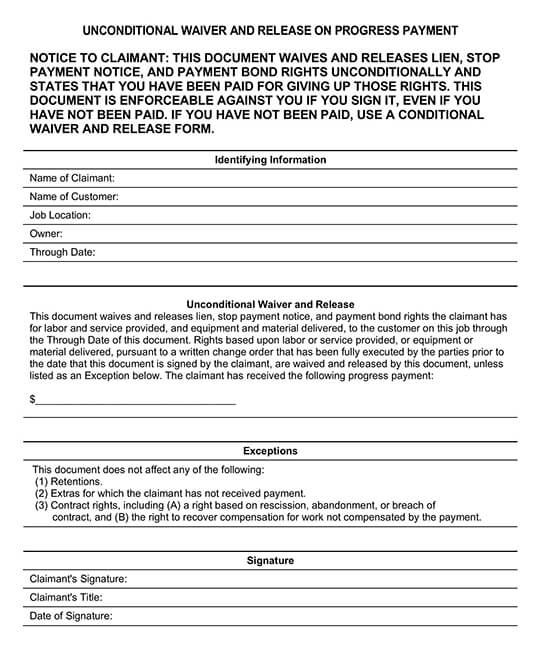

Unconditional lien release forms

Release upon progress payments

A conditional lien release is used when the person owing the money has agreed to make payments, and the claimant agrees to remove the lien release. This type of release form is only effective if the person paying actually makes the set-out payments. It also doesn’t cover all items.

An unconditional lien release is used when the claimant has received the progress payments set out between both parties. This type of release doesn’t cover all items.

Release upon final payment

A conditional release is used when the claimant has not yet been paid a final payment, but the payee has agreed to make one, and the claimant has released the lien. It can only be considered binding if payment has been made and written acknowledgment must be given.

An unconditional release is used when the final payment has been received, and the claimant releases the lien. Proof of payment must be given in writing.

Steps for Removing a Lien

Your first step is to check the validity of any preliminary notices, which is a document needed from the unpaid party that shows there is the potential for a lien to be filed by them, for them to serve a stop notice, or to make a payment bond claim against the property.

A legitimate preliminary notice should include the following:

- Property owners name and address

- Direct contractors name and address

- If applicable, the construction investors name and address

- What the relationship is between the parties serving the preliminary notice (for example, from the subcontractor to the direct contractor

- Project location

- The name and address of the individual who will be, or is receiving the service or work

- How the Preliminary Notice has been served, for example, certified mail or personal delivery.

- All of the estimated costs that are associated with any work that has been done already or that will be done

A Preliminary Notice must be served within the notification requirements set out by the state you are in. You can get more details from your Department of Consumer Affairs. In some states, a county recorder is not needed for the preliminary notice to be valid. Time frames can begin from the date that the services or work was completed.

Once you have determined that a lien has been put in place and has not expired, you should make payment to the party that filed the lien as soon as possible.

Preventing a Contractor’s (Mechanic’s) Lien

As a way to protect yourself, as the one hiring contractors to do work, make sure that you only use licensed professionals and validate those licenses and the business. Refer to your state’s local Department of Consumer Affairs to check if there are any complaints registered against the businesses that you use. Also, make sure your contractor is only using licensed and reputable sub-contractors.

A contractor should remit payments in a timely manner to subcontractors if you want to avoid any completion delays with the work being done. Make sure to get a list of all of the suppliers and contractors that the main contractor will be using. You also have the option of directly paying suppliers and subcontractors to avoid any issues that can arise from the main contractor, not making timely payments.

Payment schedules

Be sure there is a detailed payment schedule in your contract, including any phases and the dates they should begin and be completed. This should also include the amount for each phase or segment, along with any materials being used and their costs.

Lien waivers

One way to avoid a Contractor’s Lien is to file a Lien Waiver, which holds the contractor, suppliers, and sub-contractors responsible for providing you with a waiver that shows payments have been received and that they are waiving their rights for filing a future lien.

Frequently Asked Questions

A lien release typically needs to be signed by the claimant or their agent. For situations where it’s just an individual claimant, the individual is allowed to sign their own lien waiver.

Generally,it should be sent to you by the contractor upon the final payment. If you do not receive one, you can submit a request to the claimant asking for proof that the bill has been satisfied.

It typically takes 30 days for the lien release to be sent to the bill payer after the final payment has been made.

Liens are made accessible by public records once they have been recorded. You can find this information by searching the county clerk, recorder, or assessor online. You just need the property owner’s name and address. If you are unable to find information, you can visit the above offices in person. You can also contact the title company.