A debt validation letter highlights the amount of debt that a person owes and has to pay. However, if the person thinks that they do not owe this debt, then they can challenge it with a verification letter. It is important to make sure that the debt belongs to the person before they give it to the debt collector.

The debt collector has to send the debt collection letter, which highlights how much debt an individual owns and other information. The individual who owns the debt in this scenario can send the verification letter to find out more information from the debt collector.

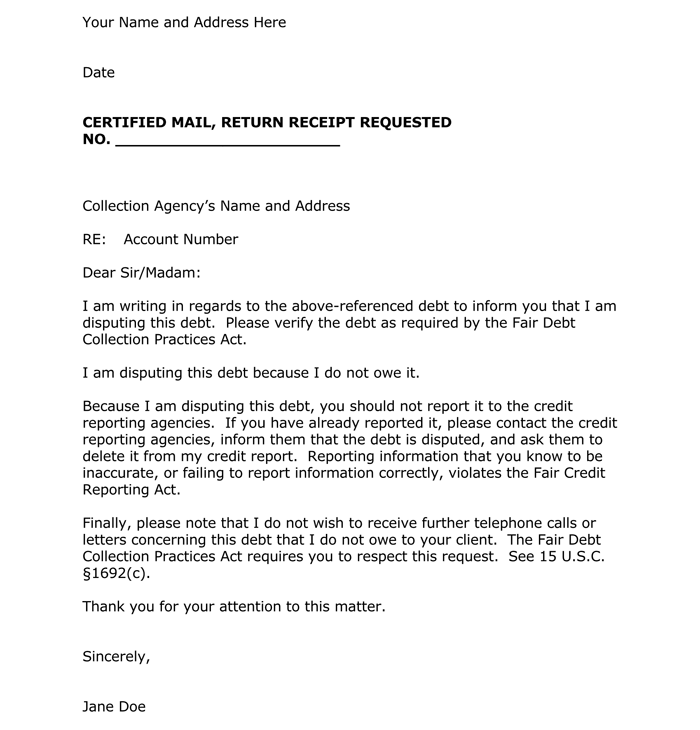

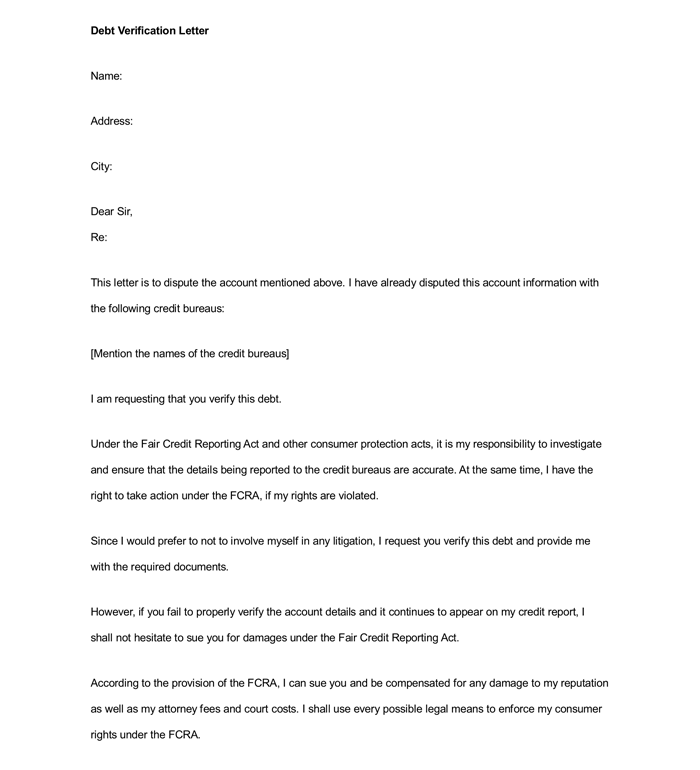

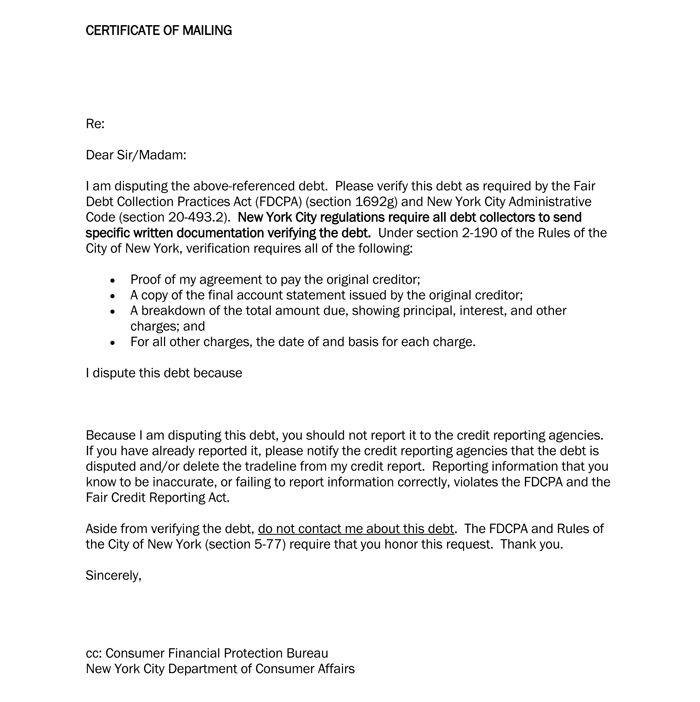

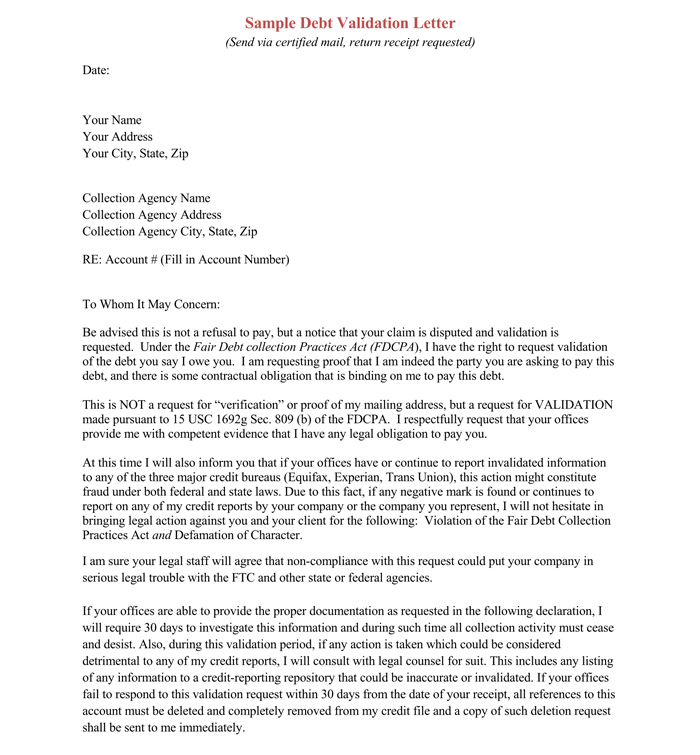

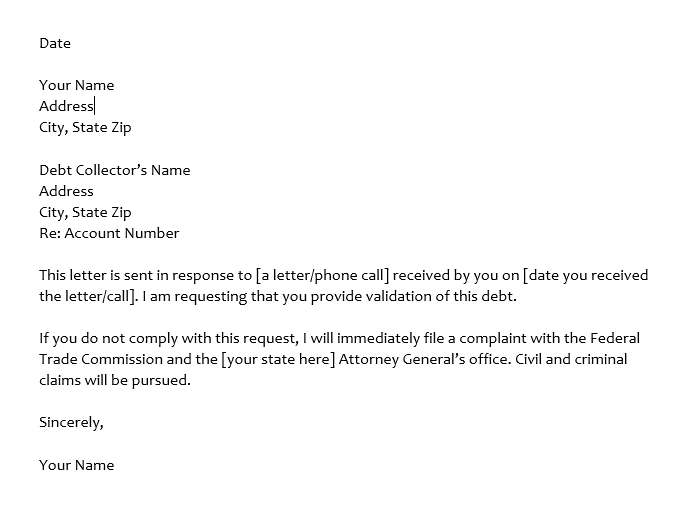

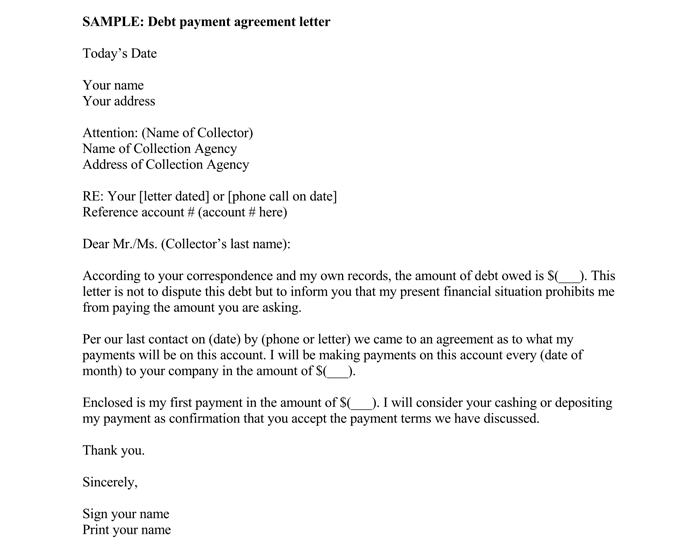

Sample Debt Validation Letters

In this section, we provide sample debt validation letters as a helpful guide. These samples serve as templates that you can adapt to your specific situation. Study the structure, tone, and content to craft an effective letter.

Your Right to Request Validation

The debt collector who is trying to contact a person doesn’t need to be trying to collect a legitimate debt, as there are chances of fraud. Therefore, it is extremely important to make sure that the debt is real. Sometimes a debt collector is asked to pay a debt that is already paid, and therefore, it is important to find detailed information on the debt.

People who owe a debt have permission from the federal law to ask the debt collector about proof that they owe the debt. It would be the best way to find out whether the person owes the debt or whether it is just a fraud. However, it is very important to keep in mind that the request validation for the debt would be time-sensitive.

The person who owes the debt has to contact the debt collector within 30 days of their initial contact with the debt collector. However, for an individual who is waiting for more than 30 days, their validation is unlikely likely considerable under the debt collection law.

The rights of an individual would not be protected if they were making the debt validation request over the phone.

Once the debt collector is asked for proof, they cannot send the person who owes the debt any letter, call, or list any debt on their credit report of this person. It is very important to be aware of all the rights, and it would be advisable to take the recommendation or ask for legal advice from someone knowledgeable. Usually, people do not have enough information, and they try to search for it online. Even though there is tons of information available online, it is wise to take someone’s opinion as well who is knowledgeable.

Things You Should Do When a Debt Collector Calls

It is important to keep a few things in mind, such as:

- Keeping information about the collection log would be useful. It would be a written record, which would mention the date, time, and employee a person has spoken to and a note on what the debt collector has said. This particular information can be noted on a simple piece of paper or a notepad. With the help of the collection log, the person who owes the debt would keep track of the collector’s call and would get an idea of what they have been talking about each time and whether there is a change in information. It would be wise to keep track under such circumstances.

- Federal Fair Debt Collection Practice Act allows the person who owes the debt to request the debt collector in writing not to contact the person. However, there are a few exceptions. It is extremely important to give this matter careful thought before giving it final consideration. The collector can contact the person to file a lawsuit. It is important to consider whether or not allowing the debt collector to contact is in the best interest of the individual who owes the debt or not.

- It is important to make the collector aware of the fact that an individual who owes the debt has no idea whether they owe that particular debt or not. Sometimes even the collectors have no idea and making them aware of the situation can resolve the matter in some cases. The person who owes the debt can request the debt collector in writing to validate the date. He/she can ask for more information on the debt. There is also a possibility, according to some consumer lawyers, that the debt collector might not provide enough information in response to these requests.

- It would be wise to let the collector know if the person who owes the debt cannot afford to pay. It would be best to let the collector know about the financial situation.

- It would be illegal for the collector to contact friends or employers to get the address of the person who owes the debt if they were aware of their current address. Therefore, it would be wise to let the debt collector know the current address rather than hiding.

- It is important to be aware of what the debt collector can or cannot do under the federal Fair Debt Collection Practices Act.

EXAMPLE

The debt collector cannot use harassing tactics on the person who owes the debt and similarly, they cannot be abusive.

It would be wise to make oneself aware of all the rules by visiting the official websites and reading as much information as possible.

Things to Look for in a Debt Validation Notice

The debt validation notice should include the following information:

- Look for the debt amount in the debt validation notice.

- Look for the name of the creditor.

- Look out for the assumption, keeping in mind that the debt will be valid until the person who owes the debt disputes it within 30 days.

- It would be wise to look for a notification that the person who owes the debt can ask for the verification of the debt within 30 days.

- It would also be wise to look for the notification to ask for the address and name of the original creditor within the first 30 days.

Should You Request the Validation of a Debt Letter?

It would be wise to write the request for validation of the debt letter for the following reasons:

- If the person who owes the debt in this scenario feels that there is a reporting error, which is aligning someone else’s debt to the name of this person.

- There is a possibility of fraud as a person can put down the Social Security Number or the name of the person to claim the debt in their name.

- It would be wise because there are chances that the collector will attempt to collect the debt that has exceeded the statute of limitations or it could be a debt that the person has repaid years ago.

tip

It would be wise to send the letter through certified mail so there could be proof of the receipt the letter should also include the account number, the method the collector used to contact the person, the date when they contacted the person, and a statement for providing the request for the validation of the debt.

When You Might NOT Want to Request Validation of Debt

However, it is important to keep in mind that there are certain circumstances under which writing the request for validation of debt would not be favorable for the person, as explained by Strauss:

- There could be a situation where the debt collector might be able to receive more information on the person who owes the debt, and there could be chances that the debt collector might now even sue the person.

- The situation is working against the person who owes the debt, as it might give an upper hand to the debt collector.

- The situation can single out the person as someone resolving the situation; however, it could be in a manner that is likely to be adverse.

What If You Don’t Receive the Validation of Your Debt?

There is a possibility of not getting the debt validated. There are chances, according to Strauss, that the debt collector would not validate the debt as they are not likely to have enough information about the person who owes the debt; that is, they cannot prove much and would not be sure whether the person is going to repay the debt or not.

It is possible that the debt collector cannot verify the debt as well. Even though a person does not receive the validation letter, the debt will still be in their credit report. There is also a possibility that the collector would want to send it; however, for some reason, they had just decided not to send the validation of the debt. On the other hand, the collector does not have any time restriction and thus, they are not confined to a 30-day time limit.

How to Write a Debt Validation Letter

When writing a debt validation letter, it is important to ask the following things in the letter:

- Give a reference to the date of the initial contact. Do not forget to mention the method of contact.

- Provide a statement requesting the validation of the debt. By any chance, do not admit owing the debt.

- Consider the statute of limitations.

- It is important to request the identity of a debt collector, the phone number, and the address.

- Proof about the legal authority of the debt collector to collect the debt the person owes.

- The contact information of the original creditor (name, address, and phone number)

- The full amount of debt, including the interest and the relevant collection fees

- When was the debt incurred and what was the reason for the debt?

- The letter must be mailed through certified mail to get proof of delivery.

Sample Debt Validation Letter

The following section presents a sample debt validation letter, offering you an example of how to formally request information about a debt and verify its accuracy in compliance with relevant regulations.

sample

Re: Debt Validation for Account No. XYZ12345

Dear Galactic Collections Inc.,

I am writing in response to a letter received on December 1, 20XX, concerning a debt for Starlight Technologies. Please understand that this is not a refusal to pay but a formal dispute over the claim and a request for its validation.

In accordance with the Fair Debt Collection Practices Act, I request the provision of the following information:

1. The precise amount of the alleged debt.

2. The name and address of the current creditor, if different from Starlight Technologies.

3. A copy of the agreement that grants your agency the authority to collect this debt.

4. Detailed documentation showing the original debt amount and a breakdown of any additional fees or charges.

5. Confirmation that the statute of limitations for collecting this debt has not expired.

Until the above information is furnished, I consider this debt to be in dispute. All collection activities should cease during this dispute period, as mandated by the Fair Debt Collection Practices Act. Also, I request that all communications be made in writing to the address listed above.

If your office has reported this disputed debt to any credit bureaus (Equinox Credit, Sirius Reporting Agency, or Orion Credit Services), I urge you to rectify this by providing them with the current status of the dispute. Additionally, I would appreciate the contact details of each credit bureau you have communicated with regarding this account.

Non-compliance with this validation request will be taken as a failure to substantiate the debt and may lead to legal repercussions, including complaints to the Federal Trade Commission and the Cosmos State Attorney General.

I await your response with the necessary information within 30 days of your receipt of this letter.

Sincerely,

Samantha Goldberg

Managing Director,

Starlight Technologies

Key Takeaways

This letter is a useful example of writing a debt validation request under the Fair Debt Collection Practices Act (FDCPA).

Its strengths include:

- The letter directly communicates the intent to dispute and request debt validation, setting a serious yet respectful tone.

- The letter mentions the FDCPA, showing the writer’s awareness of their legal rights.

- Outlines precise details needed for debt validation, including amount, creditor details, agency authority, fee breakdown, and statute of limitations status.

- The writer requests all communications in writing for record-keeping and asserts a halt on collection activities during the dispute, as per FDCPA.

- The writer addresses credit reporting issues, asking for rectification and details of contacted credit bureaus. Warns of legal actions and complaints to regulatory authorities if non-compliant.

- The writer has set a 30-day deadline for a response, adding urgency and a clear timeframe.

This letter serves as a comprehensive guide for assertive yet respectful legal communication, especially in debt-related disputes.

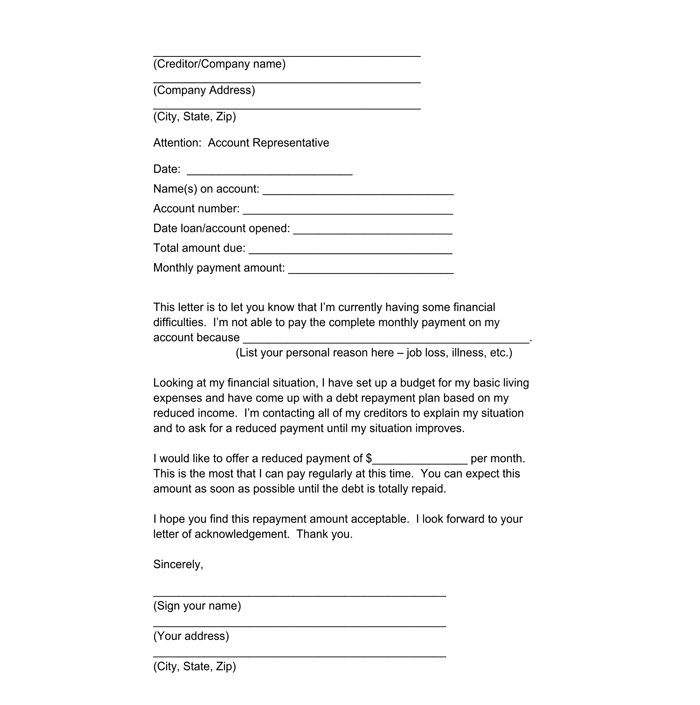

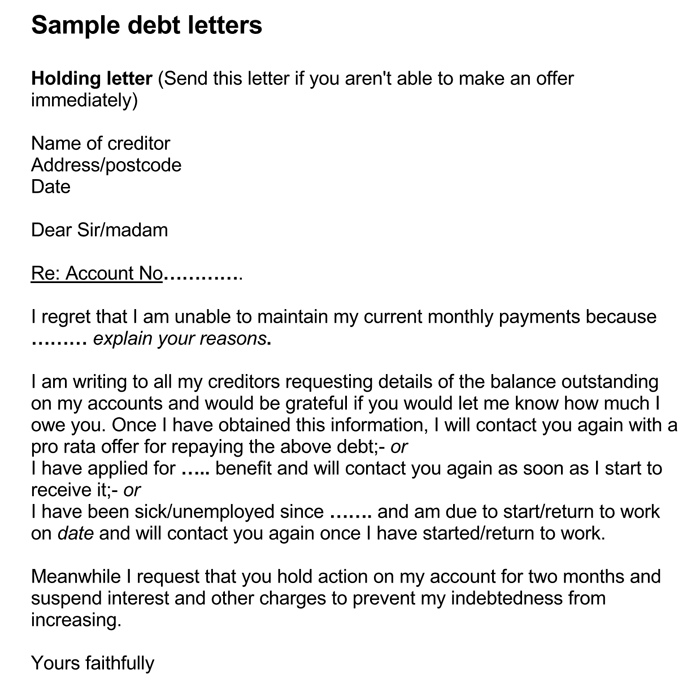

Sample Letters to Creditor (When You Are Unable to Pay)

What to Do if the Debt in Question is Not Yours?

When a person owes a debt, that is quite a serious situation; however, when they do not owe the debt but still receive the notice from the debt collector, now the question is what to do if the debt does not belong to them.

There are different tactics that debt collectors would use to collect the debt from the people who owe them.

EXAMPLE

They could send letters to the person, call the person, list the debt on a credit report, or even sue the person who owes the debt.

There could be an issue of inaccurate debt collection when there is someone who opens the account in the name of the person who gets the notice (the person who owes a debt here) and the individual who originally opened the account in someone else’s name fails to pay the bill.

There could be a possibility of fraud and thus, it is extremely important to be cautious and aware of such situations.

Following the right steps becomes extremely important under these circumstances, such as:

- It is extremely important to determine whether the debt belongs to you or not. Be very accurate about it and try to remember all the details. Sometimes there are chances that an individual might forget the information.

- Be aware of the credit reporting time period as well. The action that the debt collector can take against the person depends on the credit reporting time period. Keep in view the statute of limitation as well, which is the legally enforceable time for the debt.

- Send a debt validation letter to the debt collector if you believe you don’t owe the debt and the debt collector has to provide proof.

- Be sure to check whether there is an impact on the credit report, as there are chances that the debt might affect the credit report.

- It is not wise to ignore the debt. Instead, it would be wise to do all in your power to get information about it.

- It is possible to complain against the debt collector if they have been misbehaving and contacting even after they received the debt validation letter. However, it would be wise to get as much information as possible before making any final decision.

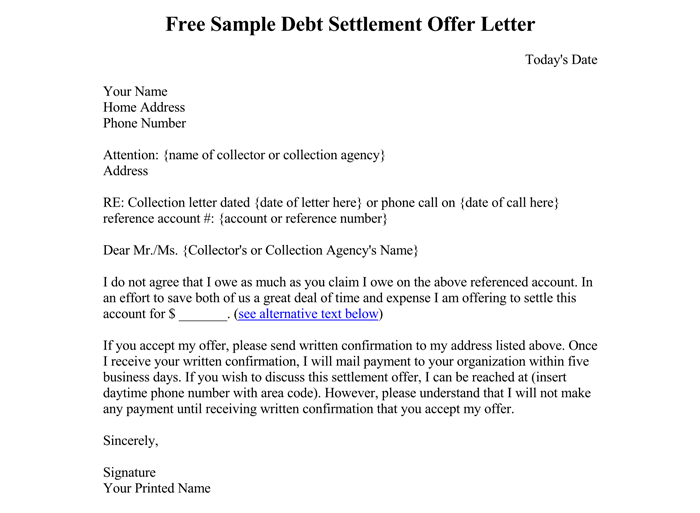

What to Do If the Debt in Question is Yours?

On the other hand, if the debt in question belongs to you and there is enough verification from the collector as well, check for the statute of limitations and credit reporting time limit and find out the relevant options. Try to settle with the debt collector a percentage or agreement and pay for the deleted agreement, especially if the account is listed on the credit report.

The ideal situation would be to negotiate with the debt collector and get the debt removed with a settlement amount. It is possible to get the debt removed with the full settlement as well. If the collector is not ready to delete the entry from the credit report, ask them for payment in a full update, or at the very least payment. Settle. It is wise to take such actions to boost the credit score; however, there is usually a seven-year mark to it after which negative reporting might fall off depending on the scenario. It would be wise to check the official websites of the relevant states to get updated information.