Debt Release Letter is an official letter sent by the creditor to the debtor along with any third party, after a debt has been paid, to inform them that there is no longer any financial obligations between the creditor and the debtor.

A debt release letter is usually requested by the debtor, after making their final payment, to obtain an acknowledgment letter from the creditor to show a credit reporting agency or any other third party that the debt has been cleared and should be removed from their credit report.

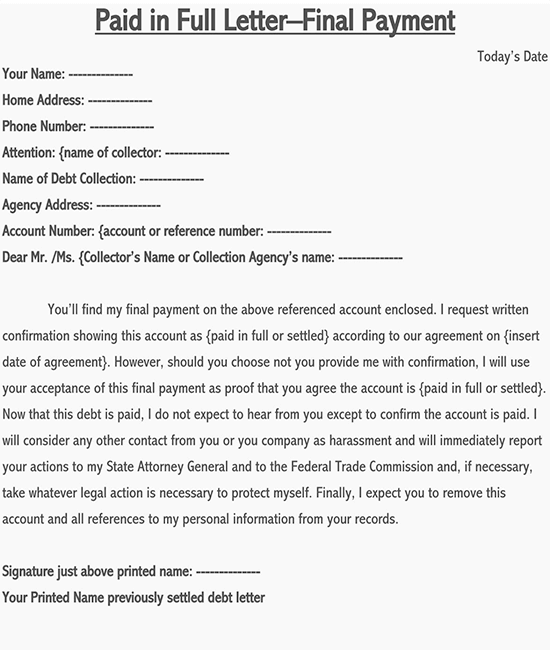

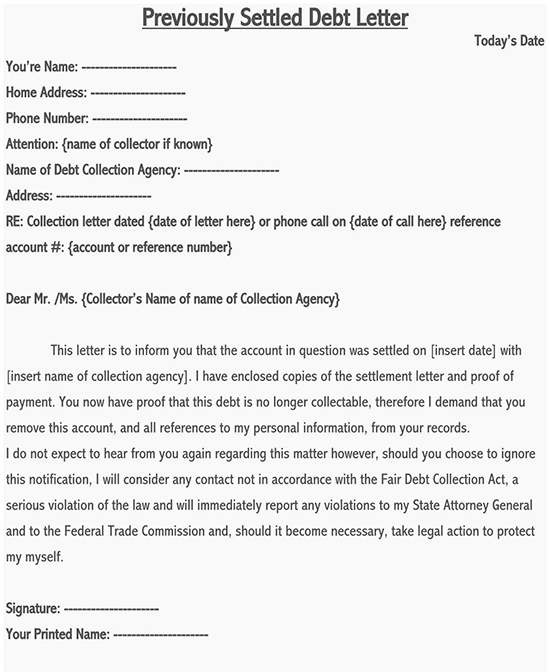

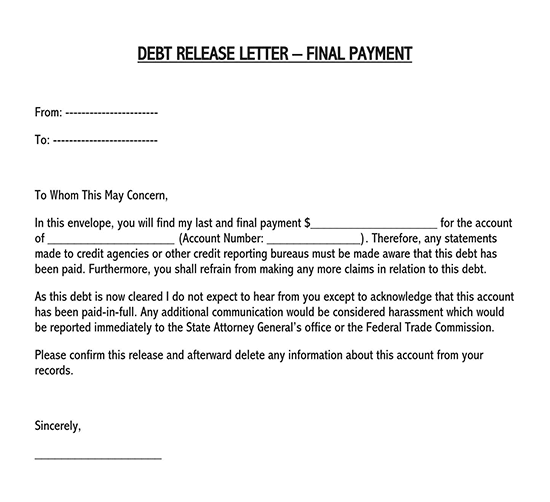

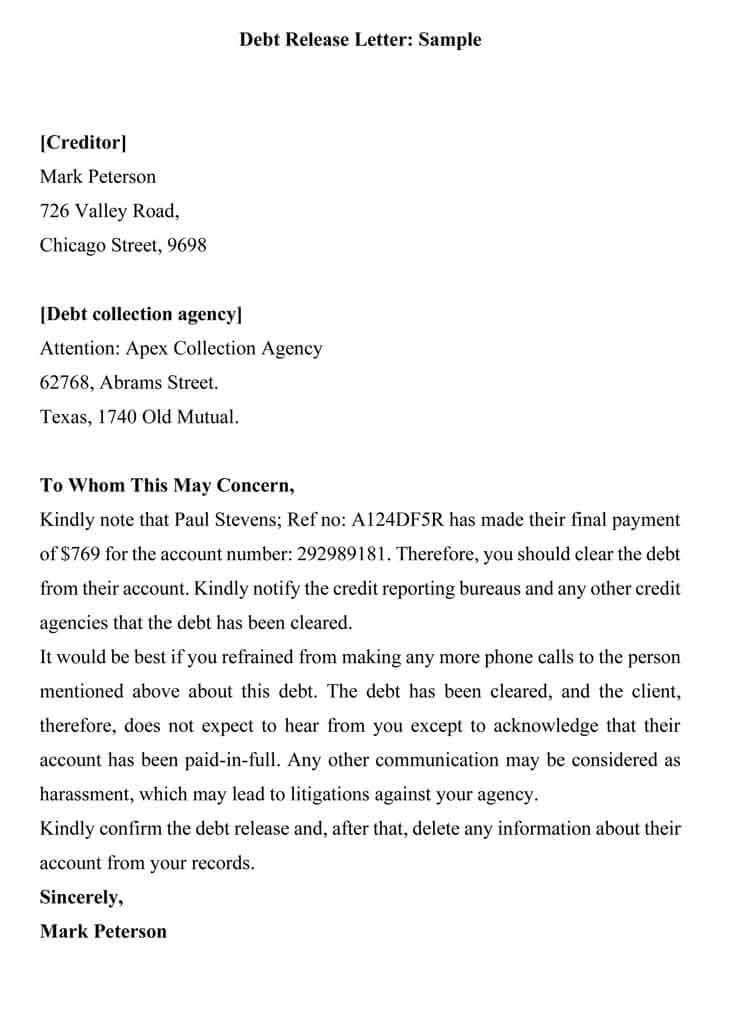

Free Templates

Why it is Necessary to Issue a Debt Release Letter

- The issuance of this letter means that there is no financial obligation between the creditor and the debtor.

- The letter acts as a future reference for the debtor, indicating that he has fully paid the owed amount.

What Should be Included in a Debt Release Letter?

The agreement that is given must include all of the following primary information:

- The creditors’ names and address

- The debtors’/any other third party’s name and address

- The loan reference number/account number

- The date on which the debt was paid

- The total amount paid: The letter should indicate the total amount paid. Note that for you to obtain a debt release letter, you must have paid the debt in full.

- A closing signature

Debt Collection laws

Although creditors are obliged to collect every debt owed by their clients, the law restricts the methods used to collect them under the Fair Debt Collection Practices Act; the laws do not relieve debtors from paying what they owe. Creditors also have a right to call the debtor, demand for the payment and sue the debtors in court when it is necessary.

- The law does not allow the collection agency to discuss the amount of debt you owe with your employers, family, and friends.

- The law prohibits using abusive words, threats, slurs, insults, or even profane language when collecting debts. The debtor can always file a complaint in court if there is any evidence of harassment.

- Debtors always have the right to pay the debt slowly. They can request the creditor for a breakdown of the amount owed and its interest rates, which they can easily manage

- The debtor should not completely ignore the creditor or the collector. He or she should indicate when it is appropriate to be called.

- The debt collectors should always introduce themselves to their first contact with the debtor. The debtor has the right to know who they are, the agency or creditor they are representing, your outstanding balance, and also provide contact information on how you will get in touch with them.

- Always request a written document in cases where the negotiation is done over the phone for future reference. it may include the owed debt and where or whom you should be making your payments to.

What are the Benefits of Obtaining a Debt Release Letter?

According to someone or a company, a debt ties up all your capital so that you won’t be able to do the things you want to do. The effects can be more than financial; pressure to pay debts can sometimes damage your relationships with others, your health, and also your work.

There are several benefits to paying off your debts and having a debt release letter.

These benefits include:

- Better Credit Score: Your credit score may improve significantly after paying off your debts, thereby increasing your chances of getting another loan. You can also use the debt release letter to inform any credit reporting agencies to remove any negative listings from your credit report.

- Less Stress: Paying off debt feels like lifting a huge weight off your chest. One can sleep more comfortably after obtaining a debt release letter stating that they have been cleared of any financial obligations.

- Fewer Risks: Being indebted means one does not have savings to fall back on. Bad debts may also lead to losing your assets, such as your home and car, and may eventually lead to bankruptcy.

- Higher Self-Esteem: Paying off debts boosts your confidence around people. Paying off your debt removes one financial burden and relieves the burden of calls or even letters from the collecting agency. You can always refer to your debt release letter should there arise any issue with the creditor or the credit reporting agencies thereafter.

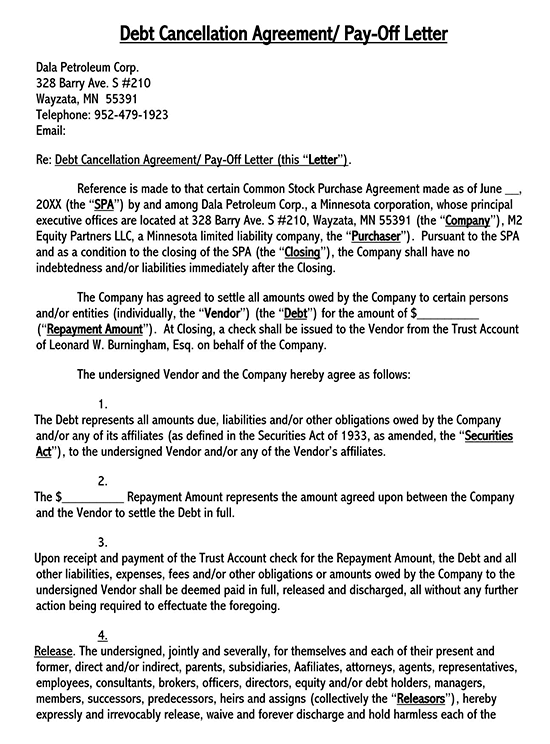

Sample Debt Release Letter

Presented below is a sample letter for you that will help you understand the key elements and format of a debt release letter.

SAMPLE

Dear Mr. Johnson,

Subject: Debt Release Confirmation

I hope this letter finds you in good health and high spirits. I am writing to officially confirm the release of any outstanding debts that you may have had with Mitchell Financial Services. We acknowledge receipt of the full and final payment on January 1, 20XX, and as a result, your account has been settled in its entirety.

The details of the settled account are as follows:

Debtor’s Name: Robert Johnson

Account Number: MJ789012345

Original Amount: $5,000

Payment Amount: $5,000

Payment Method: Bank Transfer

Date of Final Payment: January 1, 20XX

We want to express our appreciation for your commitment to fulfilling your financial obligations. Your cooperation in settling this debt is commendable, and we trust that this resolution will bring a positive conclusion to our financial interactions.

Please consider this letter as official confirmation that your outstanding debt with Mitchell Financial Services has been completely satisfied. No further action is required on your part regarding this matter.

Should you require any additional documentation or have further inquiries, please do not hesitate to contact us at sandra.mitchell@email.com or (555) 123-4567.

Once again, we thank you for your prompt attention to this matter, and we wish you continued success in all your endeavors.

Sincerely,

Sandra Mitchell

Mitchell Financial Services

[Enclosures: Any relevant documents, such as payment receipts or settlement agreements]

Points to Consider

Let us now explore why this is a useful sample letter for you.

- The details of the settled account are presented clearly, including the debtor’s name, account number, original and payment amounts, payment method, and the date of the final payment. This clarity helps in avoiding any potential confusion.

- The letter expresses gratitude for the recipient’s commitment to settling the debt, creates a positive tone, and acknowledges the recipient’s cooperation.

- The letter clearly states that no further action is required from the recipient, providing reassurance and clarity on the resolution of the debt.

- The letter includes contact information, both email and phone, for any further inquiries or documentation needs, demonstrating openness and accessibility.

- The letter maintains a polite and professional tone throughout, ensuring a positive and respectful communication style.

Overall, the letter is well-structured, conveying necessary information while maintaining a professional and appreciative tone.

Details

File Format

- MS Word